1934 Act Registration No. 000-50631

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of April 2005

TOM Online Inc.

(Translation of registrant’s name into English)

8th Floor, Tower W3, Oriental Plaza

No. 1 Dong Chang An Avenue

Beijing, China 100738

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): )

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): )

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .)

EXHIBITS

| | | | |

Exhibit

Number

| | | | Page

|

| 1.1 | | Announcement dated April 29, 2005 | | |

FORWARD-LOOKING STATEMENTS

The Announcement dated April 29, 2005 of TOM Online Inc. (the “Company”), constituting Exhibit 1.1 to this Form 6-K, contains statements that may be viewed as “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are, by their nature, subject to significant risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Such forward-looking statements include, without limitation, statements that are not historical fact relating to the financial performance and business operations of the Company, the expected benefit of any acquisition, the future prospects of and our ability to integrate the acquired business, the continued growth of the telecommunications industry in China, the development of the regulatory environment and the Company’s latest product offerings, and the Company’s ability to successfully execute its business strategies and plans, including its ability to expand its market share and revenue through acquisitions.

Such forward-looking statements reflect the current views of the Company with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, any changes in our relationships with telecommunication operators in China, the effect of competition on the demand for the price of our services, changes in customer demand and usage preference for our products and services, changes in the regulatory policies of the Ministry of Information Industry and other relevant government authorities, any changes in telecommunications and related technology and applications based on such technology, and changes in political, economic, legal and social conditions in China, including the Chinese government’s policies with respect to economic growth, foreign exchange, foreign investment and entry by foreign companies into China’s telecommunications market. Please also see the “Risk Factors” section of the Company’s registration statement on Form F-1 (File No. 333-112800), as filed with the Securities and Exchange Commission.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | TOM ONLINE INC. |

| | |

| Date: April 29, 2005 | | By: | | /s/ Peter Schloss

|

| | | Name: | | Peter Schloss |

| | | Title: | | Chief Financial Officer |

3

This announcement appears for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities.

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

(Stock Code: 8282)

SHARE TRANSACTION

ANNOUNCEMENT

Proposed subscription of shares in Indiagames Limited by

Cisco Systems, Inc. and Macromedia, Inc.

The Board is pleased to announce that:

| 1. | Cisco will subscribe for the Cisco Subscription Shares, being 61,976 Indiagames Shares (representing approximately 10% of the issued share capital of Indiagames (as enlarged by the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing); and |

| 2. | Macromedia will subscribe for the Macromedia Subscription Shares, being 50,707 Indiagames Shares (representing approximately 8.18% of the issued share capital of Indiagames (as enlarged by the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing), |

upon the terms and subject to the conditions set out in the Subscription and Shareholders Agreement.

Reference is made to the Joint Announcement and the Circular. In the light of the investment in Indiagames by Cisco and Macromedia as disclosed in this announcement, Indiagames and TOM Online Games have agreed that TOM Online Games will not subscribe for the Subscription Shares (as defined in the Joint Announcement and the Circular) as disclosed in the Joint Announcement and the Circular.

As the Transactions involve the possible issue and allotment of the TOM Online Shares under the Subscription and Shareholders Agreement, the Transactions constitute a share transaction of TOM Online under Chapter 19 of the GEM Listing Rules. If the Investors exercise the Investor Put Options, they agree that, and TOM and TOM Online will comply with the relevant requirements under the Listing Rules and the GEM Listing Rules, respectively.

1

Reference is made to the Joint Announcement and the Circular. The Sale Completion took place on 24 February 2005, TOM Online Games has successfully acquired approximately 76.29% of the issued share capital of Indiagames.

Pursuant to the Sale and Subscription Agreement, TOM Online Games has agreed to subscribe for the Subscription Shares (which, together with the existing shares of Indiagames held by TOM Online Games, represent approximately 80.6% of the issued and paid-up share capital of Indiagames (as enlarged by the issue of the Subscription Shares) as at the Subscription Completion.

The Board announces that TOM Online Games will not subscribe for the Subscription Shares and the Subscription Completion will not take place accordingly.

Cisco and Macromedia will replace TOM Online Games to subscribe for shares in Indiagames (equal to the number of the Subscription Shares). In this connection, the parties to the Original Shareholders Agreement have entered into the Subscription and Shareholders Agreement, details of which are set out below.

THE SUBSCRIPTION AND SHAREHOLDERS AGREEMENT

Date

29 April 2005

Parties

| | | | |

| Subscribers: | | 1. | | Cisco |

| | | 2. | | Macromedia |

| |

| Issuer: | | Indiagames |

| | |

| Other parties: | | 1. | | TOM Online Games |

| | | 2. | | The Founder |

| | | 3. | | Mr. Prannath GONDAL |

| | | 4. | | Ms. Shashi GONDAL |

| | | 5. | | Mr. Deepak Chandappa AIL |

| | | 6. | | Ms. Harpreet Vishal GONDAL |

| | | 7. | | Mr. Kiran Jagannath NAYAK |

| | | 8. | | Mr. Mahendra Vasudeo PATEL |

| | | 9. | | Mr. Cyril FERRY |

Subscription shares

| 1. | The Cisco Subscription Shares (representing approximately 10% of the issued share capital of Indiagames (as enlarged by the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing). |

2

| 2. | The Macromedia Subscription Shares (representing approximately 8.18% of the issued share capital of Indiagames (as enlarged by the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing). |

Reference is made to the Joint Announcement and the Circular. In the light of the investment in Indiagames by Cisco and Macromedia as disclosed in this announcement, Indiagames and TOM Online Games have agreed that TOM Online Games will not subscribe for the Subscription Shares (as defined in the Joint Announcement and the Circular) as disclosed in the Joint Announcement and the Circular.

Subscription consideration

| 1. | The Cisco Subscription Price, being US$2.2 million. |

| 2. | The Macromedia Subscription Price, being US$1.8 million. |

The Cisco Subscription Price and the Macromedia Subscription Price are based on the same valuation of Indiagames at which TOM Online Games acquired the Sale Shares (as defined in the Joint Announcement and the Circular) under the Sale and Subscription Agreement (as defined in the Joint Announcement and the Circular). The Cisco Subscription Price and the Macromedia Subscription Price were arrived at after arm’s length negotiations between Indiagames, and Cisco and Macromedia and being a price acceptable to them with reference to the historical multiple of earnings, present and future performance and the strategic value of the Indiagames Group (as mentioned in the section headed “Reasons for entering into the Subscription and Shareholders Agreement” below).

Payment terms

The Cisco Subscription Price and the Macromedia Subscription Price are payable on or before the Subscription Closing Date.

Conditions precedent

The Subscription and Shareholders Agreement is conditional upon, among other things, the following conditions (“Conditions”) having been fulfilled on or before 30 April 2005:

| 1. | to the extent required under the Listing Rules, the transactions contemplated under the Subscription and Shareholders Agreement having been approved by the shareholders of TOM; |

| 2. | to the extent required under the GEM Listing Rules, the transactions contemplated under the Subscription and Shareholders Agreement having been approved by the shareholders of TOM Online; and |

| 3. | to the extent required under the laws of India and/or the articles of association of Indiagames, the transactions contemplated under the Subscription and Shareholders Agreement (including, without limitation, the issue and allotment of the Cisco Subscription Shares and the Macromedia Subscription Shares) having been approved by the Indiagames Directors and, if required, the Indiagames Shareholders. |

3

Subscription Closing

The Subscription Closing will take place on the date on which the last of the Conditions is fulfilled and if that date is not a Business Day, the first Business Day immediately following that date (or such other date as Cisco, Macromedia, TOM Online Games and Indiagames may agree in writing).

Upon the Subscription Closing, the Original Shareholders Agreement will be terminated.

Upon the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares, Indiagames will be owned as follows:

| | | | | |

Name

| | Number of

Indiagames Shares

| | Percentage of issued

share capital of Indiagames

| |

The Founder | | 100,080 | | 16.15 | % |

Mr. Prannath GONDAL | | 80 | | 0.01 | % |

Ms. Shashi GONDAL | | 80 | | 0.01 | % |

Mr. Deepak Chandappa AIL | | 4,000 | | 0.65 | % |

Ms. Harpreet Vishal GONDAL | | 4,000 | | 0.65 | % |

Mr. Kiran Jagannath NAYAK | | 4,000 | | 0.65 | % |

Mr. Mahendra Vasudeo PATEL | | 4,000 | | 0.65 | % |

Mr. Cyril Ferry | | 4,000 | | 0.65 | % |

Cisco | | 61,976 | | 10.00 | % |

Macromedia | | 50,707 | | 8.18 | % |

TOM Online Games | | 386,833 | | 62.42 | % |

| | |

| |

|

|

Total: | | 619,756 | | 100.00 | % |

4

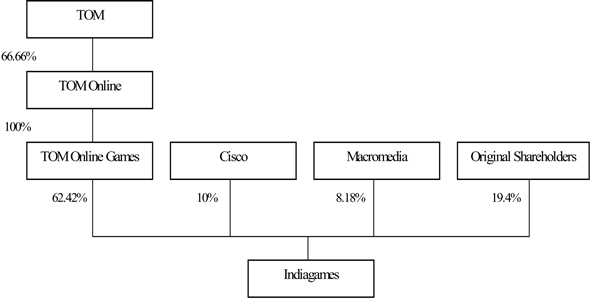

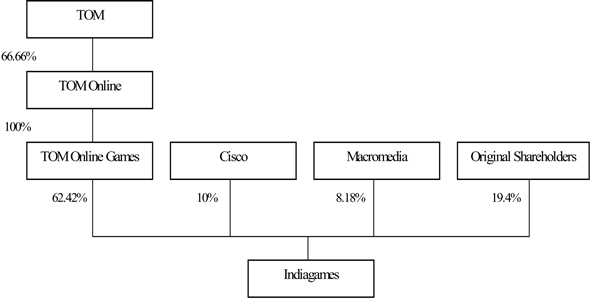

Simplified corporate chart of Indiagames upon the allotment and issue of the Cisco Subscription Shares and the Macromedia Subscription Shares

Board of Indiagames

| 1. | The Indiagames Board will initially comprise 5 members, of which 4 will be nominated by TOM Online Games and 1 will be nominated by the Founder, provided that he owns at least 8% of the issued and paid-up share capital of Indiagames. |

| 2. | If Indiagames is required under applicable laws, rules or regulations to have more than 5 directors, the number of directors of Indiagames will be increased such that the total number of directors of Indiagames will be an odd number, more than half of which will be directors nominated by TOM Online Games. |

Observation rights

Indiagames shall permit a representative of each of the Investors to attend all meetings of the Indiagames Board and of any committee of the Indiagames Board, which representative shall have no voting rights at any such meeting.

Veto rights

At any time prior to the Initial Listing:

| 1. | none of the following actions may be taken without the prior consent of the Founder, provided that the Founder owns at least 8%of the issued and paid-up share capital of Indiagames: |

| | (a) | any transfer by TOM Online Games of any its equity interests in Indiagames to any third party (other than an Affiliate of TOM Online Games which is not engaged in the business of mobile gaming) or any issue of additional securities in Indiagames; |

5

| | (b) | any decision to dissolve, liquidate or wind-up Indiagames, or dispose of, sell, license or transfer all or substantially all of the assets or the business of Indiagames; |

| | (c) | save and except in the ordinary course of business of Indiagames, transfer or disposal of any material intellectual property rights owned by Indiagames; |

| | (d) | amend the rights of any class of Indiagames Shares; |

| | (e) | amend any provision of the articles of association of Indiagames in a manner that adversely alters or changes the rights of the Indiagames Shares held by the Founder or the rights of the Founder under the Subscription and Shareholders Agreement; |

| | (f) | increase or decrease the authorised share capital of Indiagames; or |

| | (g) | any declaration of extraordinary dividends by Indiagames; and |

| 2. | the following matters shall require the prior approval of each of the Investors, provided that each of the Investors (together with its Affiliates) holds at least 7% of the issued and paid-up capital of Indiagames: |

| | (a) | liquidate, dissolve or wind up Indiagames; |

| | (b) | redeem or repurchase any security of Indiagames, other than repurchases at the original purchase price of all or any of the Indiagames Shares granted pursuant to a share option or incentive scheme approved by the Board; or |

| | (c) | sell any assets of Indiagames, the aggregate fair market value of which assets is more than US$500,000 to TOM Online Games or any Affiliate of TOM Online Games other than in an arms-length transaction. |

Registration rights

Upon any US Listing, an Investor shall have “piggy-back” registration rights (which can only be exercised if and when TOM Online Games registers its own Indiagames Shares) to include all of the Indiagames Shares held by an Investor in all primary and secondary registrations of the Indiagames Shares held by TOM Online Games or any other shareholders of Indiagames (“Registration Rights”). The Registration Rights of each Investor shall expire: (1) forthwith upon the US Listing if such Investor (together with its Affiliates) holds less than 3% of the issued and paid-up capital of Indiagames as at the date of the US Listing; or (2) the date falling 2 years after the date of the US Listing.

Winding-up priority

In the event of any winding up of Indiagames, if the total liquidation proceeds or distributions (whether in cash or as assets) received by any Investor (provided that it is still an Indiagames Shareholder) is less than the capital paid-up on the Indiagames Shares held by such Investor under the Subscription and Shareholders Agreement, the Original Shareholders and TOM

6

Online Games will pay from the amounts received by them as liquidation proceeds or distributions (pro rata amongst themselves and subject to any required regulatory approvals), an amount equal to the difference between the capital paid-up on the Indiagames Shares held by such Investor and the liquidation proceeds or distributions received by such Investor from Indiagames.

Transfer restrictions

If, at any time after the Subscription Closing, any of the Indiagames Shareholders (other than TOM Online Games) wishes to sell all or any of its, his or her Indiagames Shares, TOM Online Games has a right of first refusal to acquire such Indiagames Shares on the same terms as those offered by a bona fide third party purchaser (“Right of First Refusal”).

If, at any time after the Subscription Closing, TOM Online Games wishes to sell all of its Indiagames Shares, it may force all of the other Indiagames Shareholders to sell all of their Indiagames Shares to the same purchaser.

If, at any time after the Subscription Closing, TOM Online Games wishes to sell all or any of its Indiagames Shares, any of the Founder and the Investors may sell its or his Indiagames Shares:

| | (a) | on a pro rata basis; or |

| | (b) | if, as a result of any such proposed sale of Indiagames Shares by TOM Online Games, the total number of Indiagames Shares held by TOM Online Games will represent less than 51% of the issued and paid-up share capital of Indiagames, the Founder may sell all of his Indiagames Shares, |

on the same terms offered by the purchaser proposing to acquire all or part of TOM Online Games’s Indiagames Shares.

| Original | Shareholder Put Options |

| 1. | Subject to, among other things, the relevant requirements under the Listing Rules, the GEM Listing Rules, and any applicable laws, rules and regulations, if the Indiagames Shares are not listed on any recognised securities exchange by the 3rd anniversary of the Subscription Closing Date, each of the Original Shareholders may sell to TOM Online Games all (but not part) of his or her Indiagames Shares (“Option Shares”) at an exercise price (“Exercise Price”) equal to US$5,216,764 (equivalent to approximately HK$40,690,759) multiplied by the following fraction: |

7

where:

| | |

| A = | | the total number of Indiagames Shares held by the relevant Original Shareholder (who has exercised his or her Original Shareholder Put Option) as at the Subscription Closing Date |

| |

| B = | | the total number of Indiagames Shares held by all of the Original Shareholders as at the Subscription Closing Date |

| 2. | Each Original Shareholder may exercise his or her Original Shareholder Put Option only once at any time after the 3rd anniversary of the Subscription Closing Date and before the earlier of: (i) the 5th anniversary of the Subscription Closing Date; and (ii) the day immediately preceding the date of the initial listing of the Indiagames Shares on any recognised securities exchange (“Exercise Period”). |

| 3. | At the option of TOM Online Games, the Exercise Price may be paid in cash and/or satisfied by the allotment and issue of ADSs (rounded down to the nearest whole ADS) (“Consideration Shares”) at the Issue Price, provided that if any of the Original Shareholders is restricted or prohibited by any applicable law, rule or regulation from holding all or any of the Consideration Shares, TOM Online Games shall pay such Original Shareholder in cash an amount equal to the number of Consideration Shares so restricted or prohibited multiplied by the Issue Price. |

For illustration purposes only, assuming that all of the Exercise Price will be satisfied by the allotment and issue of ADSs and based on the closing price of US$11.60 per ADS as quoted on NASDAQ on 28 April 2005, the maximum number of ADSs to be issued in satisfaction of the Exercise Price will be 449,721 ADSs (equivalent to 35,977,680 TOM Online Shares) (representing approximately 0.86% of the existing issued share capital of TOM Online as at the date of this announcement and, assuming that no further TOM Online Shares (other than the Consideration Shares) will be issued from the date of this announcement to the date of issue of all of the Consideration Shares, approximately 0.85% of the issued share capital of TOM Online (as enlarged by the issue of the Consideration Shares)).

| 4. | It is a condition to completion of the sale and purchase of the Option Shares that: |

| | (a) | each of the Original Shareholders who has exercised his or her Original Shareholder Put Option undertakes in writing that: |

| | (i) | during the first 40 days after the date of issue of the Consideration Shares issued to him or her, he or she will not transfer or otherwise deal in all or any of such Consideration Shares; |

| | (ii) | during the first 6 months after the date of issue of the Consideration Shares issued to him or her, he or she will not transfer or otherwise deal in more than 15% of such Consideration Shares; |

8

| | (iii) | during a period of 12 months after the date of issue of the Consideration Shares issued to him or her (“Lock-up Period”), he or she will not transfer or otherwise deal in more than 30% of such Consideration Shares; and |

| | (iv) | on any Trading day after the end of the Lock-up Period, he or she will not transfer or otherwise deal in more than 14% of such Consideration Shares; and |

| | (b) | such completion of the sale and purchase of the Option Shares takes place outside of the US. |

| 5. | Any Original Shareholder Put Option that is not exercised during the Exercise Period will automatically lapse upon the expiry of the Exercise Period. |

The Original Shareholder Put Options are the same put options granted to the Original Shareholders under the Original Shareholder Agreement as disclosed in the Circular.

Investor Put Options

| 1. | If the Initial Listing shall not have taken place by the 3rd anniversary of the Subscription Closing Date, then at any time thereafter but before the 5th anniversary of the Subscription Date, at the request of either of the Investors (“Exiting Investor”), one or more Approved Banks will be engaged to determine the following matters: |

| | (a) | subject to the market conditions at that time, whether Indiagames is suitable for the Initial Listing; and |

| | (b) | subject to the market conditions at that time, whether such Approved Bank will underwrite the Initial Listing in accordance with the market practice, |

(“Suitable for Listing”).

| 2. | If Indiagames is determined to be Suitable for Listing but Indiagames fails to file an application for the Initial Listing with the relevant securities exchange or Indiagames, having filed such an application for the Initial Listing, voluntarily withdraws such an application for the Initial Listing within a period of 6 months from the date of such determination, then at any time thereafter but before the 6th anniversary of the Subscription Closing Date: |

| | (a) | at the request of the Exiting Investor or TOM Online Games, one or more Approved Banks will be engaged to determine the valuation of Indiagames (“Indiagames Bank(s)”); and |

| | (b) | after the valuation of Indiagames is determined under paragraph 2(a) above, at the request of the Exiting Investor or TOM Online Games, Indiagames will instruct Indiagames Bank(s) to offer (on behalf of all of the Indiagames Shareholders) to sell the entire issued share capital of Indiagames to a third party at a price equal to the valuation of Indiagames as determined by Indiagames Bank(s) (“Trade Sale”). For the avoidance of doubt, TOM Online Games may decide not to sell its interest in Indiagames in any such Trade Sale; |

9

| | (c) | subject always to the Right of First Refusal, the Exiting Investor may offer to sell all (but not part) of the Indiagames Shares then held by it and/or its Affiliates (“Investor Shares”) to a bona fide third party purchaser (“Bona Fide Disposal”) at a price equal to the valuation of the Investor Shares as determined by Indiagames Bank(s) (“Investor Price”); |

| | (d) | if TOM Online Games refuses to dispose of its interest in Indiagames in a Trade Sale and if TOM Online Games refuses to allow the Exiting Investor to sell of the Investor Shares in a Bona Fide Disposal, then the Exiting Investor has the right to sell to TOM Online Games all (but not part) of the Investor Shares at the Investor Price by giving notice in writing to TOM Online Games (“Investor Notice”), in which event, the Exiting Investor agrees that, and the exercise of the put option by the Exiting Investor is conditional on TOM and TOM Online complying with the relevant requirements under the Listing Rules and the GEM Listing Rules, respectively; and |

| | (e) | at the option of TOM Online Games, the Investor Price may be paid in cash and/or satisfied by the allotment and issue of freely-tradable TOM Online Shares (rounded down to the nearest whole TOM Online Share) (“InvestorConsideration Shares”) at an issue price per Investor Consideration Share equal to: (i) in the event that TOM Online Shares are issued and deposited with Citibank N.A. and ADSs are issued by Citibank N.A., 1.25% or 1/80 (as each ADS representing ownership of 80 TOM Online Shares) of the average closing price of each ADS as quoted on NASDAQ; or (ii) in the event that TOM Online Shares are issued and listed on GEM, the average closing price of each TOM Online Share as quoted on GEM for the 30 consecutive Trading Days immediately preceding the date of the Investor Notice, in which event, TOM Online Games shall procure that TOM Online allots and issues the Investor Consideration Shares to the Exiting Investor. |

| 3. | If Indiagames is determined not to be Suitable for Listing, then at any time after the date of such determination but before the 6th anniversary of the Subscription Closing Date: |

| | (a) | at the request of the Exiting Investor or TOM Online Games, one or more Approved Banks will be engaged to determine the valuation of Indiagames (“Valuation Bank(s)”) ; and |

| | (b) | after the valuation of Indiagames is determined under paragraph 3(a) above, at the request of the Exiting Investor or TOM Online Games, Indiagames will instruct the Valuation Bank(s) to conduct (on behalf of all of the Indiagames Shareholders) a Trade Sale in respect of the entire issued share capital of Indiagames at a price equal to the valuation of Indiagames as determined by the Valuation Bank(s). For the avoidance of doubt, TOM Online Games may decide not to sell its interest in Indiagames in any such Trade Sale; |

10

| | (c) | subject always to the Right of First Refusal, the Exiting Investor may offer to sell all (but not part) of the Investor Shares in a Bona Fide Disposal at a price equal to the valuation of the Investor Shares as determined by the Valuation Bank(s); |

| | (d) | in the event that a bona fide third party purchaser identified by the Valuation Bank under a Trade Sale offers to acquire the entire issued share capital of Indiagames at a price equal to or more than US$55,000,000 (“Trade Sale Price”) but TOM Online Games refuses to dispose of its interest in Indiagames through such a Trade Sale, then the Exiting Investor has the right to sell to TOM Online Games all (but not part) of the Indiagames Shares then held by it and/or its Affiliates (“Put Shares”) at a price equal to the Trade Sale Price multiplied by the following fraction (“Put Price”) by giving notice in writing to TOM Online Games (“Put Notice”), in which event, the Exiting Investor agrees that, and the exercise of the put option by the Exiting Investor is conditional on TOM and TOM Online complying with the relevant requirements under the Listing Rules and the GEM Listing Rules, respectively: |

where:

| | |

| C = | | the total number of the Put Shares; and |

| |

| D = | | the total number of issued and paid-up Indiagames Shares as at the date of the Put Notice; and |

| | (e) | at the option of TOM Online Games, the Put Price may be paid in cash and/or satisfied by the allotment and issue of freely-tradable TOM Online Shares (rounded down to the nearest whole TOM Online Share) (“PutConsideration Shares”) at an issue price per Put Consideration Share equal to: (i) in the event that TOM Online Shares are issued and deposited with Citibank N.A. and ADSs are issued by Citibank N.A., 1.25% or 1/80 (as each ADS representing ownership of 80 TOM Online Shares) of the average closing price of each ADS as quoted on NASDAQ; or (ii) in the event that TOM Online Shares are issued and listed on GEM, the average closing price of each TOM Online Share as quoted on GEM for the 30 consecutive Trading Days immediately preceding the date of the Put Notice, in which event, TOM Online Games shall procure that TOM Online allots and issues the Put Consideration Shares to the Exiting Investor. |

| 4. | The right of each of the Investors to request the Company to engage an Approved Bank to determine the valuation of the Company under paragraph 2 or 3 above shall only be exercised once at any time before the 5th anniversary of the Subscription Closing Date. |

11

INFORMATION ON INDIAGAMES

Indiagames is a company incorporated in India with limited liability and a non wholly-owned subsidiary of TOM Online. As at the date of this announcement, Indiagames is owned as to approximately 76.29% by TOM Online Games.

Indiagames was founded by the Founder, the current CEO, in 1999 has become one of the global leaders in mobile games publishing business. With over 200 professionals based in Mumbai and an office in Hollywood, Indiagames is primarily engaged in publishing and developing games across various platforms like Internet, PC, broadband, mobile phones, PDAs, handheld gaming devices and consoles. Indiagames also has a leading edge in wireless games in various formats like Java™, BREW™, I-Mode™, Flash Lite™ and Symbian™. As the No.1 gaming developer and publisher in India, Indiagames controls a 60% share in India’s game-related wireless value-added services market.

Indiagames was the first to launch mobile games in India in February 2003. It has established partnerships with all major mobile operators in India and over 100 channel partners globally. Major global distribution channels include Vodafone, O2, T-Mobile, Orange, Verizon, Sprint, Singtel, Airtel, Tata, China Mobile, Optus, Hutch, Amena, Telefonica, O2 and Wind. Although based in India, majority of its sales this year came from Europe, Asia Pacific, United States, Middle East and South Africa.

Indiagames is among the first to obtain branded licenses for mobile products with the launch of one of its best selling mobile gameSpider-Man™ Classicin 2003. In the past 12 months Indiagames has licensed several key brands including Bruce Lee™, Predator™, Buffy The Vampire Slayer™, The Mummy™, Scorpion King™, Jurassic Park™ 1, Jurassic Park™ 2, Jurassic Park™ 3, Garfield™, The Day After Tomorrow™, Spy Kids™, Indian Idol, Singapore Idol, Malaysian Idol, Indonesian Idol and Phantom™.

Based on the management accounts of Indiagames, the unaudited net revenues of Indiagames prepared in accordance with US GAAP and HK GAAP for the years ended 31 December 2002 and 31 December 2003 and 9 months ended 30 September 2004 were approximately Rs7,283,000 (equivalent to approximately HK$1,242,000), Rs66,439,000 (equivalent to approximately HK$11,334,000) and approximately Rs95,036,000 (equivalent to approximately HK$16,213,000), respectively. The unaudited loss before and after taxation of Indiagames prepared in accordance with US GAAP and HK GAAP for the year ended 31 December 2002 were approximately Rs5,473,000 (equivalent to approximately HK$934,000) and approximately Rs3,991,000 (equivalent to approximately HK$681,000), respectively. The unaudited profit before taxation of Indiagames prepared in accordance with US GAAP and HK GAAP for the year ended 31 December 2003 and 9 months ended 30 September 2004 were approximately Rs38,851,000 (equivalent to approximately HK$6,628,000) and approximately Rs34,158,000 (equivalent to approximately HK$5,827,000), respectively. The unaudited profit after taxation of Indiagames prepared in accordance with US GAAP and HK GAAP for the year ended 31 December 2003 and 9 months ended 30 September 2004 were approximately Rs27,922,000 (equivalent to approximately HK$4,763,000) and approximately Rs29,224,000 (equivalent to approximately HK$4,986,000), respectively. As at 30 September 2004, the unaudited net assets of Indiagames prepared in accordance with US GAAP and HK GAAP was approximately Rs68,580,000 (equivalent to approximately HK$11,700,000).

12

INFORMATION ON CISCO AND MACROMEDIA

Cisco (NASDAQ: CSCO) is a worldwide leader in networking for the Internet. Today, networks are an essential part of business, education, government and home communications, and Cisco Internet Protocol-based (IP) networking solutions are the foundation of these networks. Cisco hardware, software, and service offerings are used to create Internet solutions that allow individuals, companies, and countries to increase productivity, improve customer satisfaction and strengthen competitive advantage. The Cisco name has become synonymous with the Internet, as well as with the productivity improvements that Internet business solutions provide.

Cisco was founded in 1984 by a small group of computer scientists from Stanford University. Since the company’s inception, Cisco engineers have been leaders in the development of Internet Protocol (IP)-based networking technologies. This tradition of IP innovation continues with industry-leading products in the core areas of routing and switching, as well as advanced technologies in areas such as home networking, optical storage networking, IP telephony, network security and wireless LAN.

Today, with more than 34,000 employees worldwide, Cisco remains committed to creating networks that are smarter, thanks to built-in intelligent network services; faster, in their ability to perform at ever-increasing speeds; and more durable, with a generational approach to an evolutionary infrastructure. Information about Cisco can be found athttp://www.cisco.com.

Macromedia, Inc. (NASDAQ: MACR) is an independent software company providing software that empowers designers, developers and business users to create and deliver effective user experiences on the Internet, fixed media and wireless and digital devices. Macromedia’s integrated family of technologies enables the development of Internet solutions, including websites, rich media content and Internet applications across multiple platforms and devices. Macromedia serves three markets: the designer and developer, the business user and the consumer. Additional information about Macromedia can be found at http://www.macromedia.com.

REASONS FOR ENTERING INTO THE SUBSCRIPTION AND SHAREHOLDERS AGREEMENT

As mentioned in the section headed “Information on Indiagames” in this announcement, Indiagames is one of the largest mobile gaming companies in the world with global distribution to diversified geographical region including PRC, and, through the Transactions, TOM Online intends to further strengthen its leading market position in the wireless internet sector in terms of market share, distribution channel, such as online, television, radio or print, product portfolio and national mobile telephone short text messages numbers.

The Transactions are in line with the statement of business objectives of TOM Online as disclosed in its prospectus dated 2 March 2004. The directors of TOM Online believe that the Transactions will enable TOM Online to enlarge its market share in the wireless value added services market and increase its revenue arising from the wireless value added services segment.

13

The directors of TOM Online believe that the Investors will bring significant strategic value to Indiagames going forward given their leading position in their respective business areas. The Indiagames Directors envisage synergy may come from better visibility to future technology developments related to internet and wireless applications, the Investors’ existing client network and relationships globally, and their marketing expertise and resources.

The directors of TOM Online consider that the Subscription and Shareholders Agreement are entered into on normal commercial terms in the ordinary and usual course of business of TOM Online, and that the terms of the Subscription and Shareholders Agreement are fair and reasonable and in the interests of TOM Online so far as the shareholders of TOM Online are concerned.

SHARE TRANSACTION OF TOM ONLINE

As the Transactions involve the possible issue and allotment of the TOM Online Shares under the Subscription and Shareholders Agreement, the Transactions constitute a share transaction of TOM Online under Chapter 19 of the GEM Listing Rules. If the Investors exercise the Investor Put Options, they agree that, and TOM and TOM Online will comply with the relevant requirements under the Listing Rules and the GEM Listing Rules, respectively.

In the event that TOM Online Games decides to satisfy the Exercise Price, the Investor Price or the Put Price (as the case may be) by the issue and allotment of ADSs or TOM Online Shares as mentioned above, TOM Online will apply to the Stock Exchange for the listing of, and permission to deal in, such TOM Online Shares representing the ADSs or TOM Online Shares accordingly and TOM and TOM Online will comply with the relevant requirements of the Listing Rules and the GEM Listing Rules respectively (including shareholders’ approval for issue of such TOM Online Shares).

GENERAL

TOM Online is an internet company in the PRC providing value-added multimedia products and services. It delivers its products and services from its Internet portal to its users both through their mobile phones and through its websites. Its primary business activities include wireless value-added services, online advertising and commercial enterprise solutions.

DEFINITIONS

| | |

| “ADSs” | | the American depositary share(s), which are issued by Citibank N.A. and quoted on NASDAQ, each representing ownership of 80 TOM Online Shares |

| |

| “Affiliates” | | in relation to any person: (1) if that person is a company, any of its subsidiaries or holding companies and any subsidiary of such holding companies; or (2) if that person is an individual, any company which he directly or indirectly holds 30% or more of the issued share capital (or voting rights) thereof and any subsidiary of such company |

14

| | |

| “Approved Bank” | | any of Credit Suisse First Boston (CSFB), Goldman Sachs, Merrill Lynch, Morgan Stanley, JPMorgan or UBS (or such other internationally recognised investment banks as Cisco, Macromedia, TOM Online Games and Indiagames may agree) |

| |

| “associates” | | has the meaning ascribed to it in the GEM Listing Rules |

| |

| “Board” | | the board of directors of TOM Online |

| |

| “Bona Fide Disposal” | | has the meaning ascribed to it in the section headed “Investor Put Option” in this announcement |

| |

| “Business Day” | | a day (excluding Saturday) on which banks are generally open for business in India, Hong Kong and the US |

| |

| “Circular” | | the circular of TOM dated 10 January 2005 |

| |

| “Cisco” | | Cisco Systems, Inc., a company incorporated in the State of California, the US, which is a third party independent of and not connected with TOM Online or any of its associates and not a connected person (as defined in the GEM Listing Rules) of TOM Online |

| |

| “Cisco Subscription Price” | | the subscription price for the Cisco Subscription Shares, being US$2.2 million |

| |

| “Cisco Subscription Shares” | | 61,976 Indiagames Shares (representing approximately 10% of the issued and paid-up capital of Indiagames (as enlarged by the issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing) to be allotted and issued by Indiagames to Cisco upon the terms and subject to the conditions set out in the Subscription and Shareholders Agreement |

| |

| “Conditions” | | has the meaning ascribed to it in the section headed “Conditions Precedent” in this announcement |

| |

| “Consideration Shares” | | has the meaning ascribed to it in the section headed “Original Shareholder Put Options” in this announcement |

| |

| “Exercise Period” | | has the meaning ascribed to it in the section headed the section headed “Original Shareholder Put Options” in this announcement |

| |

| “Exercise Price” | | the exercise price of each Original Shareholder Put Option, being the amount calculated in the manner set out paragraph 1 of the section headed “Original Shareholder Put Options” in this announcement |

15

| | |

| “Exiting Investor” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Founder” | | Mr. Vishal GONDAL, who is the founder of Indiagames, is the legal and beneficial owner of approximately 19.74% of the issued share capital of Indiagames as at the date of this announcement and an Indiagames Director. He becomes a connected person (as defined in the GEM Listing Rules) of TOM Online after the Sale Completion on 24 February 2005 |

| |

| “GEM” | | the Growth Enterprise Market of the Stock Exchange |

| |

| “GEM Listing Rules” | | the Rules Governing the Listing of Securities on GEM |

| |

| “HK$” | | Hong Kong dollars, the lawful currency of Hong Kong |

| |

| “HK GAAP” | | the generally accepted accounting principles in Hong Kong |

| |

| “Hong Kong” | | the Hong Kong Special Administrative Region of the People’s Republic of China |

| |

| “India” | | the Republic of India |

| |

| “Indiagames” | | Indiagames Limited, a company incorporated in India and a non wholly-owned subsidiary of TOM Online |

| |

| “Indiagames Bank(s)” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Indiagames Board” | | the board of directors of Indiagames |

| |

| “Indiagames Director(s)” | | the director(s) of Indiagames |

| |

| “Indiagames Group” | | Indiagames and its subsidiaries (if any) |

| |

| “Indiagames Share(s)” | | ordinary equity share(s) of Rs10 each in the capital of Indiagames |

| |

| “Indiagames Shareholder(s)” | | the shareholder(s) of Indiagames |

| |

| “Initial Listing” | | the initial listing of the Indiagames Shares on any recognised securities exchange |

| |

| “Investor Consideration Shares” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Investor Notice” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

16

| | |

| “Investor Price” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Investor Put Options” | | the rights of the Investors to sell their Indiagames Shares to TOM Online Games in the manner described in the section headed “Investor Put Options” in this announcement |

| |

| “Investor Shares” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Investors” | | Cisco and Macromedia and “Investor” means either one of them |

| |

| “Issue Price” | | means the issue price per Consideration Share, being the average closing price of each ADS as quoted on NASDAQ for the 30 consecutive trading days immediately preceding the date of exercise of an Original Shareholder Put Option |

| |

| “Joint Announcement” | | the joint announcement of TOM and TOM Online dated 17 December 2004 |

| |

| “Listing Rules” | | the Rules Governing the Listing of Securities on the Stock Exchange |

| |

| “Lock-up Period” | | has the meaning ascribed to it in the section headed “Original Shareholder Put Options” in this announcement |

| |

| “Macromedia” | | Macromedia, Inc., a company incorporated in the State of Delaware, the US, which is a third party independent of and not connected with TOM Online or any of its associates and not a connected person (as defined in the GEM Listing Rules) of TOM Online |

| |

| “Macromedia Subscription Price” | | the subscription price for the Macromedia Subscription Shares, being US$1.8 million |

| |

| “Macromedia Subscription Shares” | | 50,707 Indiagames Shares (representing approximately 8.18% of the issued and paid-up capital of Indiagames (as enlarged by the issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing) to be allotted and issued by Indiagames to Macromedia upon the terms and subject to the conditions set out in the Subscription and Shareholders Agreement |

| |

| “Major Shareholder” | | any Indiagames Shareholder (together with its Affiliates) holding more than 5% of issued and paid-up capital of Indiagames |

| |

| “Offered Shares” | | has the meaning ascribed to it in the section headed “Right of first refusal” in this announcement |

17

| | |

| “Original Shareholder Put Option” | | the right of each Original Shareholder to sell to TOM Online Games all (but not part) of his or her Indiagames Shares at the Exercise Price during the period specified in paragraph 2 of the section headed “Original Shareholder Put Options” in this announcement |

| |

| “Original Shareholders” | | 1. The Founder 2. Mr. Prannath GONDAL 3. Ms. Shashi GONDAL 4. Mr. Deepak Chandappa AIL 5. Ms. Harpreet Vishal GONDAL 6. Mr. Kiran Jagannath NAYAK 7. Mr. Mahendra Vasudeo PATEL 8. Mr. Cyril FERRY |

| |

| | | each of whom (other than the Founder) is a third party independent of and not connected with TOM Online or any of its associates and not a connected person (as defined in the GEM Listing Rules) of TOM Online |

| |

| “Original Shareholders Agreement” | | the shareholders agreement dated 17 December 2004 entered into between the Original Shareholders, TOM Online Games and Indiagames |

| |

| “NASDAQ” | | the National Market of National Automated Systems Dealership and Quotation in the US |

| |

| “Option Shares” | | the Indiagames Shares to be acquired by TOM Online Games upon the exercise of the Original Shareholder Put Options by the Original Shareholders, being an aggregate of 120,238 Indiagames Shares (representing approximately 19.4% of the issued and paid-up capital of Indiagames (as enlarged by the issue of the Cisco Subscription Shares and the Macromedia Subscription Shares) as at the Subscription Closing) |

| |

| “Put Consideration Shares” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Put Notice” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Put Price” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Put Shares” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “R” | | Rupee, the lawful currency of India. For the purposes of this announcement, the conversion rate between Rupee and HK$ is R1º HK$0.1706 |

18

| | |

| “Registration Rights” | | has the meaning ascribed to it in the section headed “Registration rights” in this announcement |

| |

| “Right of First Refusal” | | has the meaning ascribed to it in the section headed “Right of first refusal” in this announcement |

| |

| “Subscription and Shareholders Agreement” | | a conditional subscription and shareholders agreement dated 29 April 2005 entered into between Cisco, Macromedia, TOM Online Games, the Original Shareholders and Indiagames |

| |

| “Subscription Closing” | | closing of the subscription, issue and allotment of the Cisco Subscription Shares and the Macromedia Subscription Shares upon the terms and subject to the conditions set out in the Subscription and Shareholders Agreement |

| |

| “Subscription Closing Date” | | the date on which the last of the Conditions is fulfilled and if that date is not a Business Day, the first Business Day immediately following that date (or such other date as Cisco, Macromedia, TOM Online Games and Indiagames may agree in writing) |

| |

| “Suitable for Listing” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Stock Exchange” | | The Stock Exchange of Hong Kong Limited |

| |

| “TOM” | | TOM Group Limited, a company incorporated in the Cayman Islands with limited liability, whose shares are listed on the Stock Exchange |

| |

| “TOM Online” | | TOM Online Inc., a company incorporated in the Cayman Islands with limited liability, whose shares are listed on GEM |

| |

| “TOM Online Games” | | TOM Online Games Limited, a company incorporated in Mauritius, which is a wholly-owned subsidiary of TOM Online |

| |

| “TOM Online Share(s)” | | ordinary share(s) of HK$0.01 each in the capital of TOM Online |

| |

| “Trading Day” | | a day on which the ADSs are quoted on NASDAQ or a day on which the TOM Online Shares are traded on GEM (as the case may be) |

| |

| “Trade Sale” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

| |

| “Trade Sale Price” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

19

| | |

| “Transactions” | | the transactions contemplated under the Subscription and Shareholders Agreement |

| |

| “US” | | the United States of America |

| |

| “US Listing” | | an Initial Listing or any secondary listing of the Indiagames Shares in the US on the New York Stock Exchange or NASDAQ |

| |

| “US$” | | US dollars, the lawful currency of the US. For the purposes of this announcement, the conversion rate between US$ and HK$ is US$1º HK$7.8 |

| |

| “US GAAP” | | the accounting principles generally accepted in the US |

| |

| “Valuation Bank(s)” | | has the meaning ascribed to it in the section headed “Investor Put Options” in this announcement |

|

By Order of the Board TOM ONLINE INC. Angela Mak Company Secretary |

Hong Kong, 29 April 2005

As at the date hereof, the directors of TOM Online are:

| | | | |

| Executive Directors: | | Non-executive Directors: | | Independent non-executive Directors: |

| | |

| Mr. Wang Lei Lei | | Mr. Frank Sixt (Chairman) | | Mr. Gordon Kwong |

| Mr. Xu Zhiming | | Mr. Sing Wang | | Mr. Ma Wei Hua |

| Mr. Peter Schloss | | (Vice Chairman) | | Dr. Lo Ka Shui |

| Ms. Elaine Feng | | Ms. Tommei Tong | | |

| Mr. Fan Tai | | | | |

| Mr. Wu Yun | | Alternate Director: | | |

| | | Mrs. Susan Chow | | |

| | | (Alternate to Mr. Frank Sixt) | | |

This announcement, for which the directors of TOM Online collectively and individually accept full responsibility, includes particulars given in compliance with the GEM Listing Rules for the purpose of giving information with regard to TOM Online. The directors of TOM Online, having made all reasonable enquiries, confirm that, to the best of their knowledge and belief: (i) the information contained in this announcement is accurate and complete in all material respects and not misleading; (ii) there are no other matters the omission of which would make any statements in this announcement misleading; and (iii) all opinions expressed in this announcement have been arrived at after due and careful consideration and are founded on bases and assumptions that are fair and reasonable.

20

This announcement will remain on the GEM website at www.hkgem.com on the “Latest Company Announcements” page for at least 7 days from the date of its posting and on the website of TOM Online at www.tom.com.

| * | for identification purpose |

21