1934 Act Registration No. 000-50631

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of July 3, 2006

TOM Online Inc.

(Translation of registrant’s name into English)

8th Floor, Tower W3, Oriental Plaza

No. 1 Dong Chang An Avenue

Beijing, China 100738

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): )

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): )

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- .)

EXHIBITS

FORWARD-LOOKING STATEMENTS

The Discloseable Transaction Circular of TOM Online Inc. (the “Company”), constituting Exhibit 1.1 to this Form 6-K, contains statements that may be viewed as “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. Such forward-looking statements are, by their nature, subject to significant risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Such forward-looking statements include, without limitation, statements that are not historical fact relating to the financial performance and business operations of the Company in mainland China and in other markets, the continued growth of the telecommunications industry in China and in other markets, the development of the regulatory environment and the Company’s latest product offerings, and the Company’s ability to successfully execute its business strategies and plans.

Such forward-looking statements reflect the current views of the Company with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, any changes in our relationships with telecommunication operators in China and elsewhere, the effect of competition on the demand for the price of our services, changes in customer demand and usage preference for our products and services, changes in the regulatory policies by relevant government authorities, any changes in telecommunications and related technology and applications based on such technology, and changes in political, economic, legal and social conditions in China, India and other countries where the Company conducts business operations, including, without limitation, the Chinese government’s policies with respect to economic growth, foreign exchange, foreign investment and entry by foreign companies into China’s telecommunications market. Please also see “Item 3 – Key Information – Risk Factors” section of the Company’s 2005 annual report on Form 20-F as filed with the United States Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | TOM ONLINE INC. |

| | |

| Date: July 3, 2006 | | By: | | /s/ Peter Schloss |

| | Name: | | Peter Schloss |

| | Title: | | Chief Legal Officer |

Exhibit 1.1

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser.

If you have sold or transferred all your shares inTOM Online Inc., you should at once hand this circular to the purchaser or the transferee or to the bank, stockbroker or other agent through whom the sale was effected for transmission to the purchaser or the transferee.

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular.

(Stock Code: 8282)

DISCLOSEABLE TRANSACTION

Proposed acquisition of the entire issued share capital of

Gainfirst Asia Limited

This circular will remain on the GEM website at www.hkgem.com on the “Latest Company Announcements” page for at least 7 days from the date of its posting and on the website of TOM Online Inc. at www.tom.com.

3 July 2006

| * | for identification purpose |

1

CHARACTERISTICS OF GEM

GEM has been established as a market designed to accommodate companies to which a high investment risk may be attached. In particular, companies may list on GEM with neither a track record of profitability nor any obligation to forecast future profitability. Furthermore, there may be risks arising out of the emerging nature of companies listed on GEM and the business sectors or countries in which the companies operate. Prospective investors should be aware of the potential risks of investing in such companies and should make the decision to invest only after due and careful consideration. The greater risk profile and other characteristics of GEM mean that it is a market more suited to professional and other sophisticated investors.

Given the emerging nature of companies listed on GEM, there is a risk that securities traded on GEM may be more susceptible to high market volatility than securities traded on the main board of the Stock Exchange and no assurance is given that there will be a liquid market in the securities traded on GEM.

The principal means of information dissemination on GEM is publication on the Internet website operated by the Stock Exchange. Listed companies are not generally required to issue paid announcements in gazetted newspapers. Accordingly, prospective investors should note that they need to have access to the GEM website in order to obtain up-to-date information on GEM-listed issuers.

i

CONTENTS

ii

DEFINITIONS

In this circular, unless the context otherwise requires, the following expressions have the following meanings:

| | |

| “Acquisition” | | the proposed acquisition by TOM Online Media of the entire issued share capital of Gainfirst from the Vendors in accordance with the terms and conditions of the Agreement |

| |

| “Agreement” | | a conditional sale and purchase agreement entered into on 12 June 2006 between TOM Online Media, the Vendors, Ms. Sun and Mr. Wang in respect of the Acquisition |

| |

| “associates” | | has the same meaning as ascribed to it under the GEM Listing Rules |

| |

| “Beijing Infomax” | |  (Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of the Agreement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively (Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of the Agreement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively |

| |

| “Board” | | the board of directors of the Company |

| |

| “Business Day” | | a day (excluding Saturday) on which banks are generally open for business in the PRC |

| |

| “BVI” | | the British Virgin Islands |

| |

| “Company” | | TOM Online Inc., a company incorporated in the Cayman Islands with limited liability and whose shares are listed on GEM |

| |

| “Completion” | | completion of the Acquisition upon the terms and subject to the conditions set out in the Agreement |

| |

| “Consideration” | | the consideration for the Acquisition |

| |

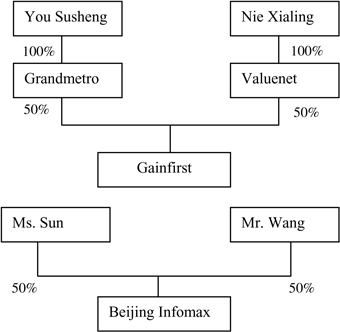

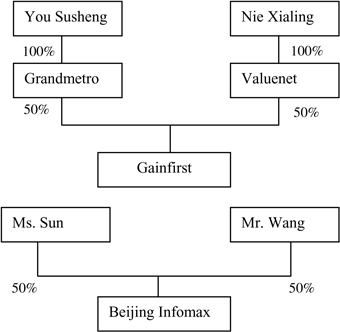

| “Gainfirst” | | Gainfirst Asia Limited, a company incorporated in the BVI with limited liability and whose principal business is investment holding, which is independent from the Directors, chief executive, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company. As at the date of the Agreement, Gainfirst is owned as to 50% by Grandmetro and 50% by Valuenet |

1

DEFINITIONS

| | |

| “Gainfirst Group” | | Gainfirst, WFOE and Beijing Infomax |

| |

| “GEM” | | the Growth Enterprise Market of the Stock Exchange |

| |

| “GEM Listing Rules” | | the Rules Governing the Listing of Securities on GEM |

| |

| “Grandmetro” | | Grandmetro Group Limited, a company incorporated in the BVI with limited liability and is wholly-owned by You Susheng , whose principal business is investment holding. Grandmetro and You Susheng , whose principal business is investment holding. Grandmetro and You Susheng are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “Group” | | the Company and its subsidiaries |

| |

| “HK$” | | Hong Kong dollars |

| |

| “Latest Practicable Date” | | 26 June 2006, being the latest practicable date prior to the printing of this circular for ascertaining certain information contained herein |

| |

| “Mr. Wang” | | Wang Yutian , who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “Ms. Sun” | | Sun Weijing , who holds 50% of the equity interest in Beijing Infomax. Ms. Sun is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , who holds 50% of the equity interest in Beijing Infomax. Ms. Sun is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “PRC” | | the People’s Republic of China |

2

DEFINITIONS

| | |

| “Pre-IPO Share Option Plan” | | the pre-IPO share option plan adopted by the Company on 12 February 2004 |

| |

| “Registration” | | registration of the transfer of equity interest in Beijing Infomax between Ms. Sun and Mr. Wang and the Two Nominees with the competent administration for industry and commerce in the PRC |

| |

| “RMB” | | Renminbi |

| |

| “Sale Shares” | | the entire issued share capital of Gainfirst as at the date of the Agreement and as at Completion |

| |

| “SFO” | | the Securities and Futures Ordinance, Chapter 571 of the laws of Hong Kong |

| |

| “Share Option Scheme” | | the share option scheme adopted by the Company on 12 February 2004 |

| |

| “Shareholders” | | the shareholders of the Company |

| |

| “Stock Exchange” | | The Stock Exchange of Hong Kong Limited |

| |

| “TOM Group” | | TOM Group Limited, a company incorporated in the Cayman Islands with limited liability and whose shares are listed on the Main Board of the Stock Exchange |

| |

| “TOM Online Media” | | TOM Online Media Group Limited, a company incorporated in the BVI with limited liability, which is a wholly-owned subsidiary of the Company |

| |

| “TOM WFOE” | | Beijing Lahiji Technology Development Limited , an indirect wholly-owned subsidiary of the Company , an indirect wholly-owned subsidiary of the Company |

| |

| “Two Nominees” | | Zhang Yingnan and Chang Cheng and Chang Cheng , the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of the Group and not connected persons (as defined in the GEM Listing Rules) of the Company prior to Completion , the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of the Group and not connected persons (as defined in the GEM Listing Rules) of the Company prior to Completion |

| |

| “US$” | | United States dollars |

3

DEFINITIONS

| | |

| “US GAAP” | | the accounting principles generally accepted in the United States of America |

| |

| “Valuenet” | | Valuenet Holdings Limited, a company incorporated in the BVI with limited liability and is wholly-owned by Nie Xialing , whose principal business is investment holding. Valuenet and Nie Xialing , whose principal business is investment holding. Valuenet and Nie Xialing are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company |

| |

| “Vendors” | | Grandmetro and Valuenet |

| |

| “WFOE” | |  , a wholly foreign owned enterprise established by Gainfirst in Beijing, the PRC , a wholly foreign owned enterprise established by Gainfirst in Beijing, the PRC |

| |

| HK$1 = RMB1.03 | | |

| US$1 = HK$7.8 | | |

4

LETTER FROM THE BOARD

(Stock Code: 8282)

| | |

| Directors: | | Registered office: |

| Frank Sixt*(Chairman) | | P.O. Box 309GT |

| Susan Chow*(Alternate Director to Frank Sixt) | | Ugland House |

| Tommei Tong*(Vice Chairman) | | South Church Street |

| Wang Lei Lei(Chief Executive Officer) | | George Town |

| Jay Chang | | Grand Cayman |

| Peter Schloss | | Cayman Islands |

| Elaine Feng | | British West Indies |

| Fan Tai | | |

| Wu Yun | | Head office and principal |

| Gordon Kwong# | | place of business in the PRC: |

| Ma Wei Hua# | | 8th Floor, Tower W3 |

| Lo Ka Shui# | | Oriental Plaza |

| Angela Mak* | | No.1 Dong Chang An Avenue |

| | Dong Cheng District |

| | Beijing 100738 the PRC |

| # | Independent non-executive Directors |

| | |

| | 3 July 2006 |

| |

| To the Shareholders | | |

| |

| Dear Sir or Madam, | | |

DISCLOSEABLE TRANSACTION

Proposed acquisition of the entire issued share capital of

Gainfirst Asia Limited

A. INTRODUCTION

On 12 June 2006, the Company announced that TOM Online Media, the Vendors, Ms. Sun and Mr. Wang had entered into the Agreement, under which, among other things, TOM Online Media conditionally agreed to acquire the Sale Shares (representing the entire issued share capital of Gainfirst as at the date of the Agreement and as at Completion) at an aggregate consideration of not more than RMB600 million (approximately HK$582.52 million).

| * | for identification purpose |

5

LETTER FROM THE BOARD

The Acquisition constitutes a discloseable transaction of the Company under Chapter 19 of the GEM Listing Rules.

The purpose of this circular is to provide the Shareholders with further information relating to the Acquisition. This circular also contains information in compliance with the GEM Listing Rules.

B. THE AGREEMENT

Set out below is a summary of the principal terms of the Agreement.

12 June 2006

| | | | | | |

| | Purchaser: | | TOM Online Media |

| | | |

| | Vendors: | | (1) | | Grandmetro |

| | | | (2) | | Valuenet |

| | | |

| | Other parties: | | (1) | | Ms. Sun |

| | | | (2) | | Mr. Wang |

The Sale Shares, representing 100% of the issued share capital of Gainfirst as at the date of the Agreement and as at Completion.

WFOE is a wholly-owned subsidiary established by Gainfirst.

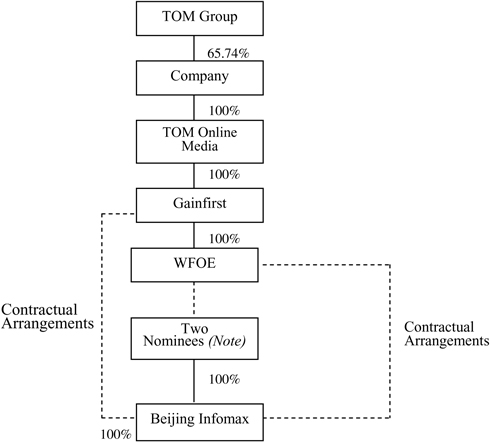

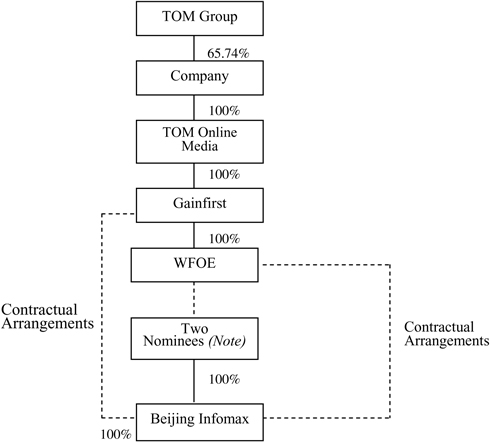

Under the Contractual Arrangements (as described below), Gainfirst and WFOE will be able to enjoy the economic interest in Beijing Infomax. Subject to confirmation by the auditors of the Company, Beijing Infomax will be accounted for as a wholly-owned subsidiary of the Company.

6

LETTER FROM THE BOARD

Gainfirst has established WFOE in Beijing, the PRC. The corporate structure of WFOE is as follows:

| | |

| (a) Registered capital: | | US$100,000 (approximately HK$780,000) |

| |

| (b) Shareholder: | | Gainfirst (100%) |

| |

| (c) Scope of business: | | research, development and sale of computer software; providing technology consultation and services in respect of computers and the sale of self-manufactured products. |

| |

| (d) Date of establishment: | | 8 June 2006 |

| 5. | Transfer of equity interest in Beijing Infomax |

Ms. Sun and Mr. Wang will transfer all of their respective equity interest in Beijing Infomax to the Two Nominees at an aggregate consideration of RMB10 million (approximately HK$9.71 million) (being part of the Consideration) no later than the fifteenth Business Day after completion of the Registration, which completion shall occur no later than the fifth Business Day after Completion.

| | 6.1. | The Consideration comprises three instalments as described below, the aggregate amount of which will not be more than RMB600 million (approximately HK$582.52 million). |

| | 6.2. | The first instalment is a sum in HK$ or US$ equivalent to RMB150 million (approximately HK$145.63 million) (the “First Instalment”), which will be paid in cash within 15 Business Days after the Registration, which Registration shall be completed no later than the fifth Business Day after the date of Completion. A sum of RMB10 million (approximately HK$9.71 million) of the First Instalment will be allocated as the consideration to be paid by the Two Nominees to Ms. Sun and Mr. Wang for the transfer of equity interest in Beijing Infomax. |

| | 6.3. | The second instalment (the “Second Instalment”) is an amount in HK$ or US$ equivalent to the amount calculated by the following formula: |

A = (B – C + D) x E1 – F

where:

| | A = | the amount of the Second Instalment (in RMB) |

| | B = | the amount of the audited combined after-tax profit (in RMB) under the US GAAP of the Gainfirst Group for the year ending 31 December 2006 |

| | C = | the amount of the balance of accounts receivable as at 31 December 2006 (in RMB) minus the amount of provision for doubtful accounts receivable as at 31 December 2006 (in RMB) (if any) |

| | D = | the amount of accounts receivable as at 31 December 2006 (in RMB) which has been collected during the period from 1 January 2007 to 30 June 2007 |

| | E1 = | 2.5 if (B – C + D) is less than RMB35 million or 3.5 if (B – C + D) is equal to or more than RMB35 million |

7

LETTER FROM THE BOARD

| | F = | the amount of the First Instalment (i.e., RMB150,000,000) |

If A is greater than 0, the Second Instalment will be paid by TOM Online Media in cash on or before 21 July 2007.

TOM Online Media will not be required to pay the Second Instalment if A is equal to or less than 0.

| 6.4. | The final instalment (the “Final Instalment”) is an amount in HK$ or US$ equivalent to the amount calculated by the following formula: |

W = (H – I + Y) x J + (B – C + X) x E2 –Z

where:

B and C have the same meanings as defined in the formula for the calculation of the Second Instalment above.

| | W = | the amount of the Final Instalment (in RMB) |

| | H = | the amount of the audited combined after-tax profit (in RMB) under the US GAAP of the Gainfirst Group for the year ending 31 December 2007 |

| | I = | the amount of the balance of accounts receivable as at 31 December 2007 (in RMB) minus the amount of provision for doubtful accounts receivable as at 31 December 2007 (in RMB) (if any) |

| | Y = | the amount of accounts receivable as at 31 December 2007 (in RMB) which has been collected during the period from 1 January 2008 to 30 June 2008 |

| | J = | 3 if (H – I) is less than RMB65 million or 4 if (H – I) is equal to or more than RMB65 million |

| | X = | the amount of accounts receivable as at 31 December 2006 (in RMB) which has been collected during the period from 1 January 2007 to 30 June 2008 |

| | E2 = | 2.5 if (B – C + X) is less than RMB35 million or 3.5 if (B – C + X) is equal to or more than RMB35 million |

| | Z = | the aggregate amount paid by TOM Online Media up to the Final Instalment, i.e., |

| | (i) | if A is equal to or greater than 0, then Z = F + A; |

| | (ii) | if A is less than 0, then Z = F. |

If W is greater than 0, the Final Instalment will be paid by TOM Online Media in cash on or before 21 July 2008.

TOM Online Media will not be required to pay the Final Instalment if W is equal to or less than 0.

The Consideration was reached at after arm’s length negotiations between the Vendors and TOM Online Media and being a price acceptable to the Vendors and TOM Online Media with reference to the past, present and future performance and the strategic value of the Gainfirst Group (as mentioned in the section headed “Reasons for entering into the Agreement” below).

The Consideration will be funded by the internal resources of the Company.

8

LETTER FROM THE BOARD

| 7. | Structure charts of Gainfirst and Beijing Infomax immediately before Completion |

| 8. | Structure chart of the Gainfirst Group immediately after Completion |

9

LETTER FROM THE BOARD

| Note: | Upon Completion, Beijing Infomax will be accounted for as a wholly-owned subsidiary of the Company (subject to confirmation by the auditors of the Company). Notwithstanding the aforesaid, each of the Two Nominees and his/her associates (which do not include Beijing Infomax) will be deemed as connected persons of the Company by virtue of his/her being a substantial shareholder of a subsidiary of the Company. Any transaction (other than the Contractual Arrangements) between any of the Two Nominees or his/her associates and any member of the Company will be deemed a connected transaction of the Company and subject to the requirements of Chapter 20 of the GEM Listing Rules. |

Completion is conditional upon, among other things, the following conditions (“Conditions”) having been fulfilled or waived on or before 7 July 2006 (or such other date as the parties to the Agreement may agree):

| | 1. | a PRC legal opinion opining on the legality of the establishment of WFOE and the transactions contemplated under the Agreement (including the Contractual Arrangements) having been issued by such PRC legal counsel approved by TOM Online Media; |

| | 2. | an employment contract in such form and substance satisfactory to TOM Online Media having been duly executed between WFOE and each member of the management team and other essential staff members (including Ms. Sun and Mr. Wang) of WFOE; |

| | 3. | the Contractual Arrangements in such form and substance satisfactory to TOM Online Media having been duly entered into by the relevant parties; |

| | 4. | the 2005 annual review of the national license for value-added services and the telecom and information services license and the telecom and information services license currently held by Beijing Infomax having been passed; currently held by Beijing Infomax having been passed; |

| | 5. | the board of directors of TOM Online Media and the board of directors and/or shareholders of the Company (if required under the GEM Listing Rules) having approved on terms of the Agreement and the transactions contemplated thereunder; |

| | 6. | the board of directors and/or the shareholders of TOM Group (if required under the Listing Rules) having approved on the terms of the Agreement and the transactions contemplated thereunder; and |

| | 7. | TOM Online Media having been satisfied with the result of the due diligence exercise carried out by it on the assets and liabilities, business and prospects of the Gainfirst Group. |

As at the Latest Practicable Date, except for Conditions (1), (4) and (7), all the above Conditions have been fulfilled.

10

LETTER FROM THE BOARD

Completion will take place on the date on which the last of the Conditions is fulfilled (or waived) or such other date as the parties may agree.

| 11. | Contractual Arrangements |

As PRC regulations currently restrict foreign ownership of companies engaged in the provision of the telecommunications value-added services (such as Beijing Infomax). To comply with the relevant PRC regulations, TOM Online Media will not have direct equity interest in Beijing Infomax but it will designate the Two Nominees to acquire the entire equity interest in Beijing Infomax. Prior to Completion, the following contractual arrangements (“Contractual Arrangements”) have been/will be entered into between the relevant parties:

| | (a) | an exclusive technical and consultancy services agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) and Beijing Infomax, under which TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) will provide certain technical and consultancy services to Beijing Infomax. Beijing Infomax will pay TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) service fees on a monthly basis, which fees will be an amount equal to 65% of the total number of subscribers of the month multiplied by the net average charge per subscriber for that month (after deduction of business tax). The former exclusive technical and consultancy services agreement has been entered into between TOM WFOE and Beijing Infomax on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter exclusive technical and consultancy services agreement; |

| | (b) | a business operation agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment), Beijing Infomax and the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration), under which TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) agreed to act as a guarantor for any obligations undertaken by Beijing Infomax and in return for which, Beijing Infomax will pledge to TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) their accounts receivable and assets. No consideration is payable under the aforesaid business operation agreement. The former business operation agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter business operation agreement; |

| | (c) | an exclusive option agreement to be entered into between TOM WFOE (before the establishment of WFOE) or Gainfirst (after the establishment of WFOE) and each of the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration), pursuant to which the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration) will grant an exclusive right to TOM WFOE (before the establishment of WFOE) or Gainfirst (after the establishment of WFOE) to purchase all or part of the shareholders’ equity interest in Beijing Infomax at an aggregate exercise price of RMB10,000,000. The option is exercisable at the discretion of TOM WFOE or Gainfirst. The former exclusive option agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter exclusive option agreement; |

11

LETTER FROM THE BOARD

| | (d) | an equity pledge agreement to be entered into between TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) and each of the shareholders of Beijing Infomax (before completion of the Registration, it refers to Ms. Sun and Mr. Wang; after completion of the Registration, it refers to the Two Nominees), pursuant to which the shareholders of Beijing Infomax will pledge their respective interest in Beijing Infomax to TOM WFOE (before the establishment of WFOE) or WFOE (after its establishment) for the performance of Beijing Infomax’s payment obligations under the aforesaid exclusive technical and consulting services agreement. No consideration is payable under the aforesaid equity pledge agreement. The former equity pledge agreement has been entered into between TOM WFOE, Ms. Sun and Mr. Wang on 1 June 2006 and it will lapse on the effective date (i.e., the date of completion of the Registration) of the latter equity pledge agreement; |

| | (e) | a transfer agreement of the equity interest in Beijing Infomax to be entered into between Ms. Sun, Mr. Wang and the Two Nominees whereby Ms. Sun, Mr. Wang will transfer their respective equity interest in Beijing Infomax to the Two Nominees at an aggregate consideration of RMB10 million (approximately HK$9.71 million); |

| | (f) | an irrevocable power of attorney to be entered into between the shareholders of Beijing Infomax (it refers to Ms. Sun and Mr. Wang before completion of the Registration; it refers to the Two Nominees after completion of the Registration) in favour of the two designated persons as designated by TOM WFOE before completion of the Registration or by WFOE after completion of the Registration so that the two designated persons have full power and authority to exercise all of the shareholder’s rights with respect to the shareholders’ interests in Beijing Infomax. The former irrevocable power of attorney has been executed by each of Ms. Sun and Mr. Wang on 1 June 2006 and they will lapse on the effective date (i.e., the date of completion of the Registration) of the latter irrevocable power of attorney to be executed by the Two Nominees; and |

| | (g) | a loan agreement to be entered into between Gainfirst and the Two Nominees so that loans (the aggregate amount of which will be equal to the amount of the registered capital of Beijing Infomax (i.e., RMB10 million)) will be provided by Gainfirst to the Two Nominees for the exclusive purpose of Beijing Infomax’s business operations. |

As a result of the Contractual Arrangements, the Group will be able to govern the financial and operating policies of Beijing Infomax and enjoy all of the economic benefits of the Gainfirst Group.

12

LETTER FROM THE BOARD

| C. | INFORMATION ON GAINFIRST |

Gainfirst is a company incorporated in the BVI with limited liability. As at the date of the Agreement, Gainfirst is owned as to 50% by Grandmetro and 50% by Valuenet. TOM Online Media will acquire the entire issued share capital of Gainfirst upon the terms and subject to the conditions set out in the Agreement. Pursuant to the Agreement, Gainfirst has established WFOE in Beijing, the PRC. Under the Contractual Arrangements, Gainfirst and WFOE will be able to enjoy the economic interest in Beijing Infomax. Subject to confirmation by the auditors of the Company, Beijing Infomax will be accounted for as a wholly-owned subsidiary of the Company. As Gainfirst is dormant since its incorporation, therefore no financial information for the past two years is available.

| D. | INFORMATION ON BEIJING INFOMAX |

Beijing Infomax is a domestic company established in the PRC on 27 February 2003. The amount of the current registered capital of Beijing Infomax is RMB10 million (approximately HK$9.71 million), which has been fully paid up. Beijing Infomax is primarily engaged in the telecommunication value-added services and the research and development on computer software. Before Completion and at the date of the Agreement, Beijing Infomax is held as to 50% by Ms. Sun and 50% by Mr. Wang, respectively. Ms. Sun and Mr. Wang will transfer their respective equity interest in Beijing Infomax to the Two Nominees pursuant to the Agreement.

Based on the unaudited management account prepared in accordance with US GAAP of Beijing Infomax, the unaudited profit both before and after tax of Beijing Infomax for the year ended 31 December 2004 were approximately RMB6.01 million and approximately RMB6.01 million, respectively. Based on the unaudited management account prepared in accordance with US GAAP of Beijing Infomax, the unaudited profit both before and after tax of Beijing Infomax for the year ended 31 December 2005 were approximately RMB6.9 million and approximately RMB6.9 million, respectively. The unaudited net asset of Beijing Infomax as at 31 December 2005 was approximately RMB11.57 million.

The Board does not expect the Acquisition will have any immediate material impact on either the earnings or the assets and liabilities of the Group, upon Completion.

| E. | REASONS FOR ENTERING INTO THE AGREEMENT |

Beijing Infomax is a wireless Internet service provider focusing on delivering entertainment content to users via SMS and other wireless Internet services in cooperation with major TV broadcasters in China. Beijing Infomax has an exclusive relationship with China’s national broadcaster CCTV2 for the provision of wireless Internet services. Through the Acquisition, the Company intends to further strengthen its leading market position in the wireless internet sector in terms of market share and distribution channels.

The Acquisition is expected to create significant synergies between Beijing Infomax and the Company in the coming years. The Company has a proven track record in integrating TV and wireless media to inform and entertain Chinese consumers. With the addition of Beijing Infomax’s relationships with CCTV2 and other TV broadcasters and the Company’s leading position in the wireless Internet sector, the Company believes there are significant synergies in product diversification, operational efficiency and content sharing that can be gained through the Acquisition.

13

LETTER FROM THE BOARD

The Acquisition is in line with the statement of business objectives of the Company as disclosed in its prospectus dated 2 March 2004. The Directors believe that the Acquisition will enable the Company to enlarge its market share in the wireless Internet market and increase its revenues from wireless Internet services.

The Directors consider that the Agreement is entered into on normal commercial terms in the ordinary and usual course of business of the Company and that the terms of the Agreement are fair and reasonable and in the interests of the Company so far as the Shareholders are concerned.

If there is any material change to the terms of the Agreement (including the Contractual Arrangements), the Company will re-comply with the relevant requirements of the GEM Listing Rules.

The Acquisition constitutes a discloseable transaction of the Company under Chapter 19 of the GEM Listing Rules.

The Company is an internet company in the PRC providing value-added multimedia products and services. It delivers its products and services from its Internet portal to its users both through their mobile phones and through its websites. Its primary business activities include wireless value-added services, online advertising and commercial enterprise solutions.

Your attention is drawn to the additional information set out in the Appendix to this circular.

|

| Yours faithfully, |

| By Order of the Board |

| TOM ONLINE INC. |

|

/s/ Wang Lei Lei Wang Lei Lei |

| Chief Executive Officer and |

| Executive Director |

14

| | |

| APPENDIX | | GENERAL INFORMATION |

| 1. | RESPONSIBILITY STATEMENT |

This circular, for which the Directors collectively and individually accept full responsibility, includes particulars given in compliance with the GEM Listing Rules for the purpose of giving information with regard to the Company. The Directors, having made all reasonable enquiries, confirm that, to the best of their knowledge and belief:

| | (a) | the information contained in this circular is accurate and complete in all material respects and not misleading; |

| | (b) | there are no other matters the omission of which would make any statement in this circular misleading; and |

| | (c) | all opinions expressed in this circular have been arrived at after due and careful consideration and are founded on bases and assumptions that are fair and reasonable. |

| 2. | DISCLOSURE OF INTERESTS AND SHORT POSITIONS IN SHARES, UNDERLYING SHARES AND DEBENTURES |

As at the Latest Practicable Date, the interests and short positions of the Directors and chief executive of the Company in the shares, underlying shares and debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) which were notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which they are taken or deemed to have under such provisions of the SFO), or which were required, pursuant to Section 352 of the SFO, to be entered in the register referred to therein, or which were required, pursuant to the Code of Conduct regarding Securities Transactions by Directors adopted by the Company (“Code of Conduct”), to be notified to the Company and the Stock Exchange, were as follows:

| | (a) | Long positions in the shares of the Company |

| | | | | | | | | | | | | | | |

Number of shares of the Company | |

Name of Directors | | Capacity | | Personal Interests | | Family Interests | | Corporate Interests | | Other Interests | | Total | | Approximate percentage of shareholding | |

Wu Yun | | Beneficial owner | | 40,000 | | — | | — | | — | | 40,000 | | 0.001 | % |

Lo Ka Shui | | Founder of a discretionary trust | | — | | — | | — | | 4,700,000 | | 4,700,000 | | 0.110 | % |

Angela Mak | | Beneficial owner | | 2,488 | | — | | — | | — | | 2,488 | | Below

0.001 |

% |

15

| | |

| APPENDIX | | GENERAL INFORMATION |

| | (b) | Rights to acquire shares of the Company |

Pursuant to the Pre-IPO Share Option Plan and/or Share Option Scheme, certain Directors were granted share options to subscribe for the shares of the Company. Details of which as at the Latest Practicable Date were as follows:

| | | | | | | | |

Name of Directors | | Date of grant | | Number of share options

outstanding as at the Latest Practicable Date | | Option period | | Subscription

price per share of

the Company |

| | | | | | | | | HK$ |

Wang Lei Lei | | 16/2/2004 | | 139,264,000 | | 16/2/2004-15/2/2014 | | 1.50 |

Jay Chang | | 11/5/2005 | | 18,000,000 | | 11/5/2005-10/5/2015 | | 1.204 |

Peter Schloss | | 16/2/2004 | | 10,000,000 | | 16/2/2004-15/2/2014 | | 1.50 |

Elaine Feng | | 16/2/2004 | | 3,972,000 | | 16/2/2004-15/2/2014 | | 1.50 |

Fan Tai | | 16/2/2004 | | 7,346,000 | | 16/2/2004-15/2/2014 | | 1.50 |

Wu Yun | | 16/2/2004 | | 6,030,000 | | 16/2/2004-15/2/2014 | | 1.50 |

| B. | Associated corporations (within the meaning of the SFO) |

| | (a) | Long positions in the shares of TOM Group |

| | | | | | | | | | | | | | | |

Number of shares of TOM Group | |

Name of Directors | | Capacity | | Personal Interests | | Family Interests | | Corporate Interests | | Other

Interests | | Total | | Approximate percentage of shareholding | |

Wang Lei Lei | | Beneficial owner | | 300,000 | | — | | — | | — | | 300,000 | | 0.01 | % |

Angela Mak | | Beneficial owner | | 44,000 | | — | | — | | — | | 44,000 | | Below

0.01 |

% |

16

| | |

| APPENDIX | | GENERAL INFORMATION |

| | (b) | Rights to acquire shares of TOM Group |

Pursuant to the pre-IPO share option plan and/or the share option scheme of TOM Group, certain Directors were granted share options to subscribe for the shares of TOM Group, details of which as at the Latest Practicable Date were as follows:

| | | | | | | | |

Name of Directors | | Date of grant | | Number of share options

outstanding as at the Latest Practicable Date | | Option period | | Subscription

price per share of TOM Group |

| | | | | | | | | HK$ |

Wang Lei Lei | | 11/2/2000 | | 9,080,000 | | 11/2/2000-10/2/2010 | | 1.78 |

| | 9/10/2003 | | 6,850,000 | | 9/10/2003-8/10/2013 | | 2.505 |

| | | | |

Tommei Tong | | 9/10/2003 | | 15,000,000 | | 9/10/2003-8/10/2013 | | 2.505 |

Wu Yun | | 9/10/2003 | | 200,000 | | 9/10/2003-8/10/2013 | | 2.505 |

| | | | |

Angela Mak | | 11/2/2000 | | 3,026,000 | | 11/2/2000-10/2/2010 | | 1.78 |

| | 9/10/2003 | | 6,000,000 | | 9/10/2003-8/10/2013 | | 2.505 |

| | (c) | Short positions in associated corporations |

Mr. Wang Lei Lei has, as of 12 June 2001 (as supplemented on 26 September 2003), granted an option to a wholly-owned subsidiary of the Company in respect of his 20% (RMB20,000,000) equity interest in Beijing Lei Ting Wan Jun Network Technology Limited (“Beijing Lei Ting”) whereby such wholly-owned subsidiary of the Company has the right at any time within a period of 10 years commencing from 26 September 2003 (which may be extended from another 10 years at the option of such wholly-owned subsidiary of the Company) to acquire all of Mr. Wang Lei Lei’s equity interest in Beijing Lei Ting at an exercise price of RMB20,000,000.

Mr. Fan Tai has also, as of 13 December 2004, granted an option to a wholly-owned subsidiary of the Company in respect of his 20% (RMB2,000,000) equity interest in Beijing Lei Ting Wu Ji Network Technology Company Limited (“LTWJi”) whereby such wholly-owned subsidiary of the Company has the right at any time within a period of 10 years commencing from 13 December 2004 (which may be extended for another 10 years at the option of such wholly-owned subsidiary of the Company) to acquire all of Mr. Fan Tai’s equity interest in LTWJi at an exercise price of RMB2,000,000.

Save as disclosed above, none of the Directors or their associates had, as at the Latest Practicable Date, any interests or short positions in any shares, underlying shares or debentures of, the Company or any of its associated corporations (within the meaning of Part XV of the SFO) which would have to be notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests or short positions which they are taken or deemed to have under such provisions of the SFO), or which were required, pursuant to section 352 of the SFO, to be entered in the register referred to therein, or which were required, pursuant to the Code of Conduct, to be notified to Company and the Stock Exchange.

17

| | |

| APPENDIX | | GENERAL INFORMATION |

| 3. | INTERESTS AND SHORT POSITIONS OF SHAREHOLDERS |

So far as is known to any Director or chief executive of the Company, as at the Latest Practicable Date, the following persons/companies (not being a Director or chief executive of the Company) who have interests or short positions in the shares and underlying shares of the Company as recorded in the register required to be kept under Section 336 of the SFO or have otherwise notified to the Company were as follows:

| | | | | | | | |

Name | | Capacity | | No. of shares of the Company held | | | Approximate percentage of

shareholding | |

Li Ka-shing | | Founder of discretionary trusts & interest of controlled corporations | | 2,814,290,244 | (L) (Note 2) | | 66.069 | % |

| | | |

Li Ka-Shing Unity Trustee Corporation Limited (as trustee of The Li Ka-Shing Unity Discretionary Trust) | | Trustee & beneficiary of a trust | | 2,814,290,244 | (L) (Note 2) | | 66.069 | % |

| | | |

Li Ka-Shing Unity Trustcorp Limited (as trustee of another discretionary trust) | | Trustee & beneficiary of a trust | | 2,814,290,244 | (L) (Note 2) | | 66.069 | % |

| | | |

Li Ka-Shing Unity Trustee Company Limited (as trustee of The Li Ka-Shing Unity Trust) | | Trustee | | 2,814,290,244 | (L) (Note 2) | | 66.069 | % |

| | | |

Cheung Kong (Holdings) Limited | | Interest of controlled corporations | | 2,814,290,244 | (L) (Notes 1 and 2) | | 66.069 | % |

| | | |

Chau Hoi Shuen | | Interest of controlled corporations | | 425,888,453 | (L) (Note 3) | | 9.998 | % |

| | | |

Cranwood Company Limited | | Beneficial owner & interest of controlled corporations | | 212,958,118 | (L) (Note 3) | | 4.999 | % |

| | | |

TOM Group Limited | | Beneficial owner | | 2,800,000,000 | (L) | | 65.735 | % |

18

| | |

| APPENDIX | | GENERAL INFORMATION |

Notes:

| (1) | Easterhouse Limited is a wholly-owned subsidiary of Hutchison International Limited, which in turn is a wholly-owned subsidiary of Hutchison Whampoa Limited. Certain subsidiaries of Cheung Kong (Holdings) Limited in turn together hold one-third or more of the issued capital of Hutchison Whampoa Limited. |

Romefield Limited is a wholly-owned subsidiary of Sunnylink Enterprises Limited, which in turn is a wholly-owned subsidiary of Cheung Kong Holdings (China) Limited. Cheung Kong Holdings (China) Limited is a wholly-owned subsidiary of Cheung Kong Investment Company Limited, which in turn is a wholly-owned subsidiary of Cheung Kong (Holdings) Limited.

Easterhouse Limited and Romefield Limited together hold more than one-third of the issued share capital of TOM Group Limited, and therefore Cheung Kong (Holdings) Limited is entitled to exercise or control the exercise of more than one-third of the voting power at the general meetings of TOM Group Limited. By virtue of the SFO, Cheung Kong (Holdings) Limited is deemed to be interested in the 9,526,833 shares of the Company, 4,763,411 shares of the Company and 2,800,000,000 shares of the Company held by Easterhouse Limited, Romefield Limited and TOM Group Limited respectively.

| (2) | Li Ka-Shing Unity Holdings Limited, of which each of Mr. Li Ka-shing, Mr. Li Tzar Kuoi, Victor and Mr. Li Tzar Kai, Richard is interested in one-third of the entire issued share capital, owns the entire issued share capital of Li Ka-Shing Unity Trustee Company Limited. Li Ka-Shing Unity Trustee Company Limited as trustee of The Li Ka-Shing Unity Trust, together with certain companies which Li Ka-Shing Unity Trustee Company Limited as trustee of The Li Ka-Shing Unity Trust is entitled to exercise or control the exercise of more than one-third of the voting power at their general meetings, hold more than one-third of the issued share capital of Cheung Kong (Holdings) Limited. |

In addition, Li Ka-Shing Unity Holdings Limited also owns the entire issued share capital of Li Ka-Shing Unity Trustee Corporation Limited (“TDT1”) as trustee of The Li Ka-Shing Unity Discretionary Trust (“DT1”) and Li Ka-Shing Unity Trustcorp Limited (“TDT2”) as trustee of another discretionary trust (“DT2”). Each of TDT1 and TDT2 hold units in The Li Ka-Shing Unity Trust.

By virtue of the SFO, Mr. Li Ka-shing, being the settlor and may being regarded as a founder of each of DT1 and DT2 for the purpose of the SFO, Li Ka-Shing Unity Trustee Corporation Limited, Li Ka-Shing Unity Trustcorp Limited, Li Ka-Shing Unity Trustee Company Limited and Cheung Kong (Holdings) Limited are all deemed to be interested in the 9,526,833 shares of the Company, 4,763,411 shares of the Company and 2,800,000,000 shares of the Company held by Easterhouse Limited, Romefield Limited and TOM Group Limited respectively.

| (3) | Schumann International Limited and Handel International Limited are companies controlled by Cranwood Company Limited. Devine Gem Management Limited is a company controlled by Ms. Chau Hoi Shuen. Ms. Chau Hoi Shuen is entitled to exercise more than one-third of the voting power at the general meetings of Cranwood Company Limited. |

By virtue of the SFO, Cranwood Company Limited is deemed to be interested in 5,800,000 shares of the Company and 3,174,117 shares of the Company held by Schumann International Limited and Handel International Limited respectively in addition to 203,984,001 shares of the Company held by itself.

By virtue of the SFO, Ms. Chau Hoi Shuen is deemed to be interested in 203,984,001 shares of the Company, 5,800,000 shares of the Company, 3,174,117 shares of the Company and 212,930,335 shares of the Company held by Cranwood Company Limited, Schumann International Limited, Handel International Limited and Devine Gem Management Limited respectively.

19

| | |

| APPENDIX | | GENERAL INFORMATION |

So far as is known to any Director or chief executive of the Company, as at the Latest Practicable Date, the following company was interested in 10% of the equity interest of a subsidiary of the Company:

| | | | | | | |

Name of subsidiary | | Name of shareholder | | Number and class of shares held | | Percentage of

shareholding | |

Beijing GreaTom United Technology Company Limited | | Great Wall Technology Company Ltd. | | Registered capital RMB2,500,000 | | 10 | % |

Beijing Huan Jian Shu Meng Network Technology Limited | | Kong Yi | | Registered capital RMB22,000 | | 22 | % |

Beijing Huan Jian Shu Meng Network Technology Limited | | Zhang Wei | | Registered capital RMB18,000 | | 18 | % |

Indiagames Limited | | Vishal P. Gondal | | 104,240 ordinary shares | | 16.82 | % |

Indiagames Limited | | CSI BD (Mauritius) | | 61,976 ordinary shares | | 10 | % |

Tel-Online Limited | | Skype Communications S.á.r.l. | | 49 ordinary shares | | 49 | % |

Save as disclosed above, as at the Latest Practicable Date, the Directors are not aware of any other persons or corporation having an interest or short position in the shares and underlying shares of the Company which fall to be disclosed to the Company under the provisions of Divisions 2 and 3 of Part XV of the SFO, or who is interested in 10% or more of the nominal value of any class of share capital carrying rights to vote in all circumstances at general meetings of any other member of the Group.

Mr. Frank Sixt and Mrs. Susan Chow, the Chairman of the Company and the alternate Director to Mr. Frank Sixt respectively, are executive directors of Hutchison Whampoa Limited (“HWL”), Cheung Kong Infrastructure Holdings Limited (“CKI”) and directors of certain of their respective associates (collectively referred to as “HWL Group” and “CKI Group” respectively). In addition, Mr. Frank Sixt is a non-executive director of Cheung Kong (Holdings) Limited (“CKH”) and Hutchison Telecommunications International Limited (“HTIL”) and director of certain of their associates (collectively referred to as “CKH Group” and “HTIL Group” respectively). Mrs. Susan Chow is an alternate director of HTIL and director of certain of its associates. HWL Group is engaged in e-commerce and general information portals. Both the CKH Group and the CKI Group are engaged in information technology, e-commerce and new technology. HTIL Group is engaged in providing mobile and fixed-line telecommunications services, including broadband data services, multimedia services and mobile and fixed-line Internet services and Intranet services. The Directors believe that there is a risk that such businesses may compete with those of the Group.

20

| | |

| APPENDIX | | GENERAL INFORMATION |

Mr. Gordon Kwong, an independent non-executive Director, owns approximately 2.2% interest in ChinaHR.com Corp, which is a company in the PRC that engages in online job search. He is also an independent non-executive director of Quam Limited, which is an internet company that mainly deals with financial services. The Directors believe that there is a risk that such businesses may compete with those of the Group.

Dr. Lo Ka Shui, an independent non-executive Director, is the deputy chairman and managing director and, is interested or deemed to be interested in approximately 44.91% of the issued share capital of Great Eagle Holdings Limited (“Great Eagle”), the shares in which are listed on the Main Board of the Stock Exchange. An associated company of Great Eagle is engaged in, among other things, online job search business in the PRC. He is also an independent non-executive director of China Mobile (Hong Kong) Limited (“China Mobile”), the shares in which are listed on the Main Board of the Stock Exchange. China Mobile is engaged in telecommunications business in the PRC. The Directors believe that there is a risk that such businesses may compete with those of the Group.

| (b) | Management shareholders |

TOM Group, an initial management shareholder of the Company, and its subsidiaries are engaged in diversified businesses, which include, inter alia, the provision of certain online services ancillary to their business divisions.

Cranwood Company Limited, an initial management shareholder of the Company, has two wholly owned subsidiaries whose businesses consist of the provision of mobile content products and online services. Another wholly owned subsidiary of Cranwood Company Limited has a minority interest in a company which is engaged in internet mobile businesses. The Directors believe that there is a risk that such businesses may compete with those of the Group.

Save as disclosed above, none of the Directors or the management shareholders of the Company (as defined under the GEM Listing Rules) or their respective associates have any interests in a business, which competes or may compete with the business of the Group.

21

| | |

| APPENDIX | | GENERAL INFORMATION |

| 5. | OUTSTANDING SHARE OPTIONS |

As at the Latest Practicable Date, options to subscribe for an aggregate of 202,970,601 shares of the Company granted pursuant to the Pre-IPO Share Option Plan and Share Option Scheme were outstanding. Details of which are as follows:

| | | | | | | | |

Date of grant | | No. of share

options | | No. of employees | | Subscription

price per

share of the

Company | | Option period* (commencing from date of grant and terminating ten years thereafter) |

| | | | | | | HK$ | | |

16/2/2004 | | 184,970,601 | | 320 | | 1.50 | | 16/2/2004 –15/2/2014 |

11/5/2005 | | 18,000,000 | | 1 | | 1.204 | | 11/5/2005 –10/5/2015 |

| * | Those options that have been vested may be exercised within the option period unless they have been cancelled. Generally, the options are vested in different tranches subject to conditions set out in the offer letter. |

As updated and notified by the Company’s joint sponsors, Citigroup Global Markets Asia Limited (“Citigroup”) and Morgan Stanley Dean Witter Asia Limited (“Morgan Stanley”), their interests in the share capital of the Company as at the Latest Practicable Date are summarised below:

| | | | |

| Citigroup’s employees | | - | | none |

| (excluding directors) | | | | |

| | |

| Citigroup’s directors | | - | | none |

| | |

| Citigroup and its associates | | - | | 50,739,280 shares (represents ordinary shares |

| | | | and ordinary shares equivalents relating to ADRs) |

| | |

| Morgan Stanley’s employees | | - | | 1,265,680 shares (represents ordinary shares and |

| (excluding directors) | | | | ordinary shares equivalents relating to ADRs) |

| | |

| Morgan Stanley’s directors | | - | | none |

| | |

| Morgan Stanley and its associates | | - | | 99,760 shares (represents ordinary shares and ordinary shares equivalents relating to ADRs) |

Pursuant to the sponsorship agreement dated 1 March 2004 entered into between the Company, Citigroup and Morgan Stanley, Citigroup and Morgan Stanley have been appointed as the joint sponsors of the Company as required under the GEM Listing Rules at a fee from 11 March 2004 to 31 December 2006.

As at the Latest Practicable Date, other than disclosed above, neither Citigroup and Morgan Stanley nor their respective directors, employees or associates (as referred to in Note 3 to rule 6.35 of the GEM Listing Rules) had any interest in the securities of the Company, including options or rights to subscribe for such securities, other than the shares held by Citigroup and/or Morgan Stanley’s respective brokerage and asset management operations on behalf of customers.

22

| | |

| APPENDIX | | GENERAL INFORMATION |

No member of the Group is engaged in any litigation or arbitration of material importance and there is no litigation or claim of material importance known to the Directors to be pending or threatened against any member of the Group.

None of the Directors has any service contracts with any member of the Group which is not terminable by the Company within one year without payment of compensation (other than statutory compensation).

| | (a) | The registered office of the Company is at P.O. Box 309GT, Ugland House, South Church Street, George Town, Grand Cayman, Cayman Islands, British West Indies. |

| | (b) | The head office and principal place of business of the Company in the PRC are at 8th Floor, Tower W3, Oriental Plaza, No.1 Dong Chang An Avenue, Dong Cheng District, Beijing 100738, the PRC. The principal place of business of the Company in Hong Kong is at 48th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong. |

| | (c) | The share registrar and transfer office of the Company is Computershare Hong Kong Investor Services Limited at Rooms 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Hong Kong. |

| | (d) | The Compliance Officer of the Company is Mr. Peter Schloss. Mr. Schloss holds a B.A. in Political Science and a J.D. from Tulane University. He was general counsel at IBM China/Hong Kong Corporation from 1989 to 1991. From 1991 to 1996, he was general counsel of Satellite Television Asian Region Limited, or STAR TV, and was a director of that company from 1993 to 1996, as well as a director of Asia Satellite Telecommunications Company Limited from November 1991 to June 1993. He was also managing director of ING Barings and head of its Asian Media, Internet and Technology Group from 1999 to 2001 and managing director of Mediavest Limited before joining the Company in December 2003. |

| | (e) | The Qualified Accountant of the Company is Ms. Mabel Cheung. Ms. Cheung holds a Bachelor of Commerce degree from the University of New South Wales in Australia. She is a member of the Hong Kong Institute of Certified Public Accountants and the CPA Australia. |

23

| | |

| APPENDIX | | GENERAL INFORMATION |

| | (f) | The Company Secretary of the Company is Ms. Pessy Yu. Ms. Yu holds a Master of Arts degree in Jurisprudence from the Oxford University and has been admitted as a solicitor in Hong Kong, and England and Wales. |

| | (g) | The Company has established an audit committee in February 2004, in accordance with the GEM Listing Rules, which reviews the internal accounting procedures and considers and reports to the board of directors of the Company with respect to other auditing and accounting matters, including selection of independent auditors, the scope of annual audits, fees to be paid to the independent auditors and the performance of the independent auditors. The audit committee comprises three independent non-executive Directors, namely Mr. Gordon Kwong, Mr. Ma Wei Hua and Dr. Lo Ka Shui, further details of whom are set out below: |

Mr. Gordon Kwong, aged 56, has a Bachelor of Social Science degree from the University of Hong Kong and is a fellow member of the Institute of Chartered Accountants in England and Wales. Mr. Kwong has also been serving as a member of the remunerations committee and the nominations committee of the Company and the chairman of the audit committee of the Company since 12 February 2004. He is also an independent non-executive director of a number of companies listed on the Stock Exchange, namely COSCO International Holdings Limited, Tianjin Development Holdings Limited, Beijing Capital International Airport Company Limited, Frasers Property (China) Limited, NWS Holdings Limited, China Oilfield Services Limited, Concepta Investments Limited, China Chengtong Development Group Limited, Global Digital Creations Holdings Limited, Ping An Insurance (Group) Company of China, Limited, Quam Limited, China Power International Development Limited, New World Mobile Holdings Limited, Henderson Land Development Company Limited, Henderson Investment Limited and Agile Property Holdings Limited. From 1984 to 1998, Mr. Kwong was a partner of Pricewaterhouse and was a council member of the Stock Exchange from 1992-1997. Mr. Kwong previously served as a non-executive director of COSCO Pacific Limited until his resignation in January 2006 and was an independent non-executive director of Henderson China Holdings Limited which was privatized in July 2005.

Mr. Ma Wei Hua, aged 58, obtained a Ph.D in Economics from Southwestern Finance and Economics University in 1998. Mr. Ma has also been a member of the remunerations committee and the nominations committee of the Company since 12 February 2004. He is also the president and chief executive officer of China Merchants Bank.

24

| | |

| APPENDIX | | GENERAL INFORMATION |

Dr. Lo Ka Shui, aged 59, graduated with Bachelor of Science degree from McGill University and a M.D. from Cornell University. He was certified in cardiology from University of Michigan Hospital. Dr. Lo has also been a member of the remunerations committee and nominations committee of the Company since 30 September 2004. He is deputy chairman and managing director of Great Eagle Holdings Limited. He is also a non-executive director of The Hongkong and Shanghai Banking Corporation Limited, Shanghai Industrial Holdings Limited, Phoenix Satellite Television Holdings Limited, China Mobile (Hong Kong) Limited and some other listed public companies in Hong Kong. He is also a director of Hong Kong Exchanges and Clearing Limited, a vice president of the Real Estate Developers Association of Hong Kong, a Trustee of the Hong Kong Centre for Economic Research and a Board Member of the Airport Authority. Dr. Lo has more than 26 years’ experience in property and hotel development and investment both in Hong Kong and overseas.

| | (h) | The English text of this circular shall prevail over the Chinese text. |

25

(Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of the Agreement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively

(Beijing Bo Xun Rong Tong Information Technology Company Limited), a domestic company established in Beijing, the PRC. As at the date of the Agreement, Ms. Sun and Mr. Wang beneficially own 50% and 50% of the equity interest in Beijing Infomax, respectively , whose principal business is investment holding. Grandmetro and You Susheng

, whose principal business is investment holding. Grandmetro and You Susheng are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

, who holds 50% of the equity interest in Beijing Infomax. Mr. Wang is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , who holds 50% of the equity interest in Beijing Infomax. Ms. Sun is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

, who holds 50% of the equity interest in Beijing Infomax. Ms. Sun is independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , an indirect wholly-owned subsidiary of the Company

, an indirect wholly-owned subsidiary of the Company and Chang Cheng

and Chang Cheng , the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of the Group and not connected persons (as defined in the GEM Listing Rules) of the Company prior to Completion

, the individual nominees to be designated by TOM Online Media to acquire the entire equity interest in Beijing Infomax from Ms. Sun and Mr. Wang. Ms. Zhang and Mr. Chang are employees of the Group and not connected persons (as defined in the GEM Listing Rules) of the Company prior to Completion , whose principal business is investment holding. Valuenet and Nie Xialing

, whose principal business is investment holding. Valuenet and Nie Xialing are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company

are independent of and not connected with any of the Directors, chief executives, substantial shareholders or management shareholders of the Company or any of their respective associates and not a connected person (as defined in the GEM Listing Rules) of the Company , a wholly foreign owned enterprise established by Gainfirst in Beijing, the PRC

, a wholly foreign owned enterprise established by Gainfirst in Beijing, the PRC

and the telecom and information services license

and the telecom and information services license currently held by Beijing Infomax having been passed;

currently held by Beijing Infomax having been passed;