Exhibit 96.1

S-K 1300 Technical Report Summary

Prepared for

International CuMo Mining Corp.

Prepared by

Geologic Systems Ltd.

November 2022

S-K 1300 Technical Report Summary

November 2022

| | Prepared for | Prepared by |

| | | |

| | International CuMo Mining Corp. | Geologic Systems Ltd. |

| | Suite #2300–550 Burrard Street | 514 East Columbia St |

| | Vancouver, BC V6C 2B5 | New Westminster, BC V3L 3X7 |

| | Canada | Canada |

Tel: +1 604 689 7902

Web: www.cumoco.com

Authored By:

| | Shaun M Dykes, M. Sc. (Eng), P.Geo. | Geologic Systems Ltd.. |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page i |

Acronyms and Abbreviations

| Distance | | | NaCN | sodium cyanide |

| µm | micron (micrometre) | | Other | |

| mm | millimetre | | °F | degrees Fahrenheit |

| cm | centimetre | | °C | degrees Celsius |

| m | metre | | cfm | cubic feet per minute |

| km | km | | elev | elevation |

| in | inch | | m AMSL | metres elev. above mean sea level |

| ft | foot | | hp | horsepower |

| Area | | | hr | hour |

| m2 | square metre | | s | second (unit of time) |

| km2 | square km | | kW | kilowatt |

| ac | acre | | kWh | kilowatt hour |

| Ha | hectare | | M | Million or mega |

| Volume | | | mph | miles per hour |

| L | litre | | ppb | parts per billion |

| m3 | cubic metre | | ppm | parts per million |

| ft3 | cubic foot | | s.g. or SG | specific gravity |

| bcm | bank cubic metres | | V | volt |

| Mbcm | million bcm | | W | watt |

| bcy | bank cubic yards | | $k | thousand US dollars |

| Mbcy | million bcy | | $M | million US dollars |

| Mass | | | $Bn | billion US dollars |

| kg | kilogram | | tph or stph | short tons per hour |

| g | gram | | tpd or stpd | short tons per day |

| g/t | g/ metric tonne | | mtpa or mstpa | million short tons per annum |

| t or st | short ton | | Ø | diameter |

| kst | thousand short tons | | Acronyms | |

| Mst | million short tons | | SRK | SRK Consulting (Canada) Inc. |

| Bst | billion short tons | | CIM | Canadian Institute of Mining |

| lb | pounds | | NI 43-101 | National Instrument 43-101 |

| mmlbs | millions of lbs | | ABA | Acid- base accounting |

| oz | troy ounce | | LOM | life of mine |

| wmt | wet metric tonne | | AP | Acid potential |

| dmt | dry metric tonne | | NP | Neutralization potential |

| Pressure | | | ML/ARD | Metal leaching/ acid rock drainage |

| psi | pounds per square inch | | PAG | Potentially acid generating |

| Pa | pascal | | non-PAG | Non-potentially acid generating |

| kPa | kilopascal | | RC | reverse circulation |

| MPa | megapascal | | IP | induced polarization |

| Elements and Compounds | | | COG | cut-off grade |

| Mo | molybdenum | | NSR | net smelter return |

| MoS2 | molybdenite | | NPV | net present value |

| Cu | copper | | | |

| Au | gold | | Conversion Factors | |

| Ag | silver | | 1 ton | 2,000 lb |

| S | sulfur | | 1 tonne | 2,204.62 lb |

| CN | cyanide | | 1 troy oz | 31.10348 g |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page ii |

Table of Contents

| 1 | Executive Summary | 1 |

| | 1.1 | Introduction | 1 |

| | 1.2 | Property Description, History, and Ownership | 2 |

| | 1.3 | Exploration | 2 |

| | 1.4 | Geology and Mineralization | 2 |

| | 1.5 | Mineral Resource Estimate | 3 |

| | 1.6 | Project Development and Operations | 6 |

| | 1.7 | Social and Environmental | 7 |

| | 1.8 | Project Costs | 8 |

| | 1.9 | Project Economics | 8 |

| | | 1.9.1 | Cautionary Statements | 8 |

| | | 1.9.2 | Economic Summary | 8 |

| | 1.10 | Project Risks | 11 |

| | | 1.10.1 | Mineral Resource | 11 |

| | | 1.10.2 | Mining | 11 |

| | | 1.10.3 | Mineral Sorting | 11 |

| | | 1.10.4 | Processing | 11 |

| | | 1.10.5 | Project Infrastructure | 12 |

| | | 1.10.6 | Permitting | 12 |

| | | 1.10.7 | Economic Risks | 12 |

| | 1.11 | Project Opportunities | 13 |

| | | 1.11.1 | Mineral Resource | 13 |

| | | 1.11.2 | Mining | 14 |

| | | 1.11.3 | Mineral Sorting | 14 |

| | | 1.11.4 | Processing | 14 |

| | | 1.11.5 | Project Infrastructure | 14 |

| | | 1.11.6 | Economic Opportunities | 15 |

| | 1.12 | Conclusions and Recommendations | 16 |

| | | 1.12.1 | Mineral Resources | 16 |

| | | 1.12.2 | Pit Geotechnical | 16 |

| | | 1.12.3 | Mining | 17 |

| | | 1.12.4 | Mineral Sorting | 17 |

| | | 1.12.5 | Processing | 17 |

| | | 1.12.6 | Tailings Management | 18 |

| | | 1.12.7 | Permitting | 18 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page iii |

| | | 1.12.8 | Plan and Budget for Additional Work | 18 |

| 2 | Introduction and Terms of Reference | 20 |

| | 2.1 | Issuer | 20 |

| | 2.2 | Terms of Reference | 20 |

| | 2.3 | Responsibility | 20 |

| | 2.3 | Sources of Information | 20 |

| | 2.4 | Site Visit | 20 |

| | 2.5 | Previous Reports | 20 |

| 3 | Property Description and Location | 21 |

| | 3.1 | General | 21 |

| | 3.2 | Mineral Tenure | 21 |

| | 3.3 | Ownership Agreements | 21 |

| | 3.4 | Environmental | 26 |

| | | 3.4.1 | Environmental Regulations | 26 |

| | | 3.4.2 | Environmental Liabilities | 26 |

| | | 3.4.3 | Other Significant Factors and Risks | 26 |

| | 3.5 | Permits | 27 |

| 4 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 29 |

| 5 | History | 30 |

| | 5.1 | Exploration | 30 |

| | 5.2 | Historical Resource Estimate | |

| 6 | Geological Setting and Mineralization | 33 |

| | 6.1 | Regional Geology | 33 |

| | 6.2 | Local Geology | 36 |

| | 6.3 | Property Geology | 38 |

| | 6.4 | Mineralization | 41 |

| | | 6.4.1 | Description of Mineralized Zones | 41 |

| | | 6.4.2 | Property Mineralization | 41 |

| 7 | Exploration And Drilling | 47 |

| | 7.1 | Drilling and Trenching | 48 |

| | 7.2 | Sampling and True Thickness Adjustments | 48 |

| | 7.3 | 2006 Drill Program | 48 |

| | 7.4 | 2007 to 2011 Drill Program | 48 |

| | 7.5 | 2012 Drill Program | 56 |

| | 7.6 | Metal Equivalent Calculations | 58 |

| 8 | Sample Preparation, Analyses, and Security | 60 |

| | 8.1 | General sampling | 60 |

| | 8.2 | Density Determinations | 61 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page iv |

| | 8.3 | Assay Techniques | 62 |

| | 8.4 | Security | 63 |

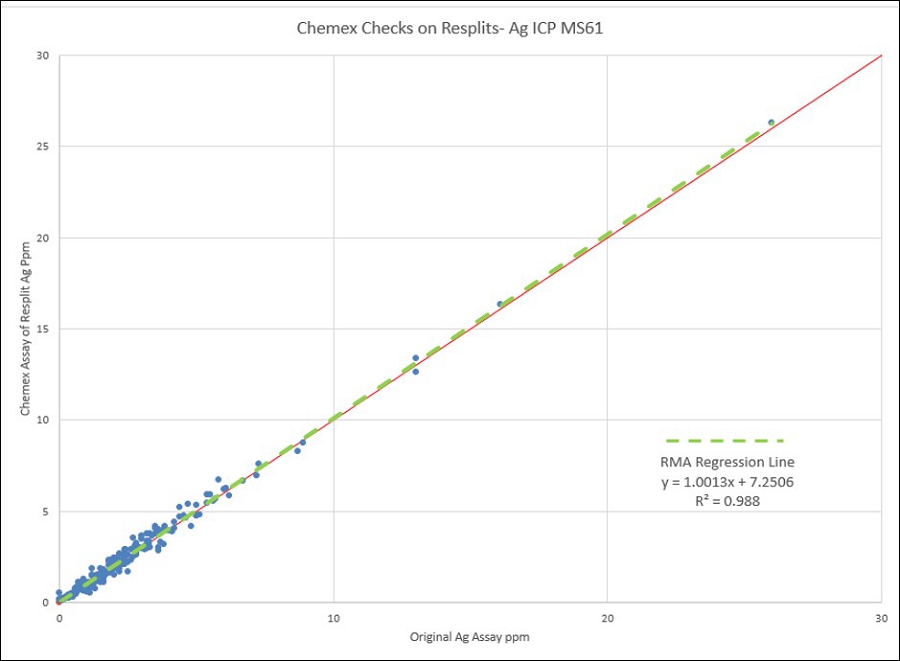

| | 8.5 | QA/QC Programs | 63 |

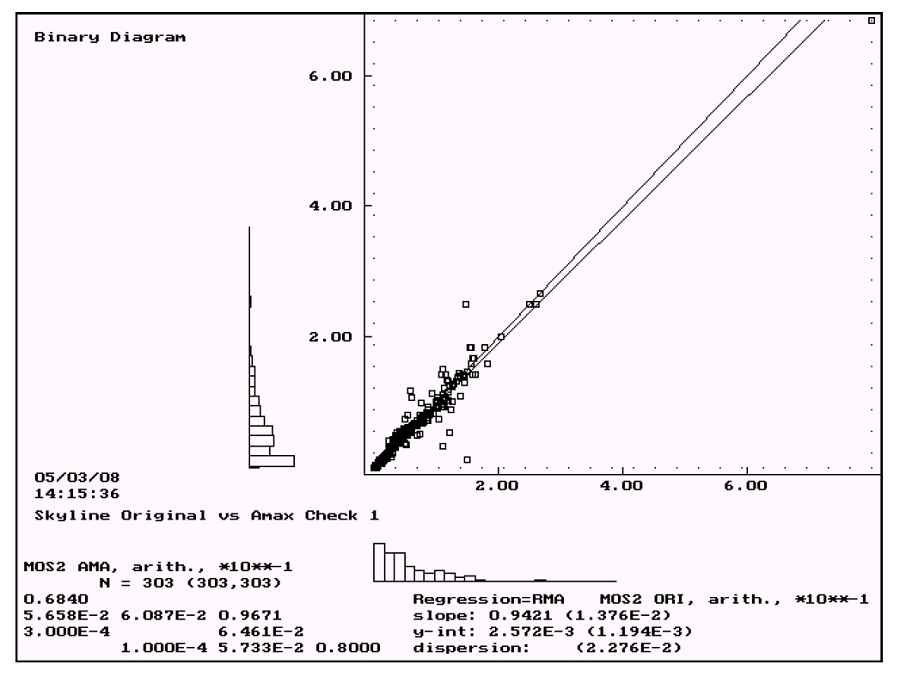

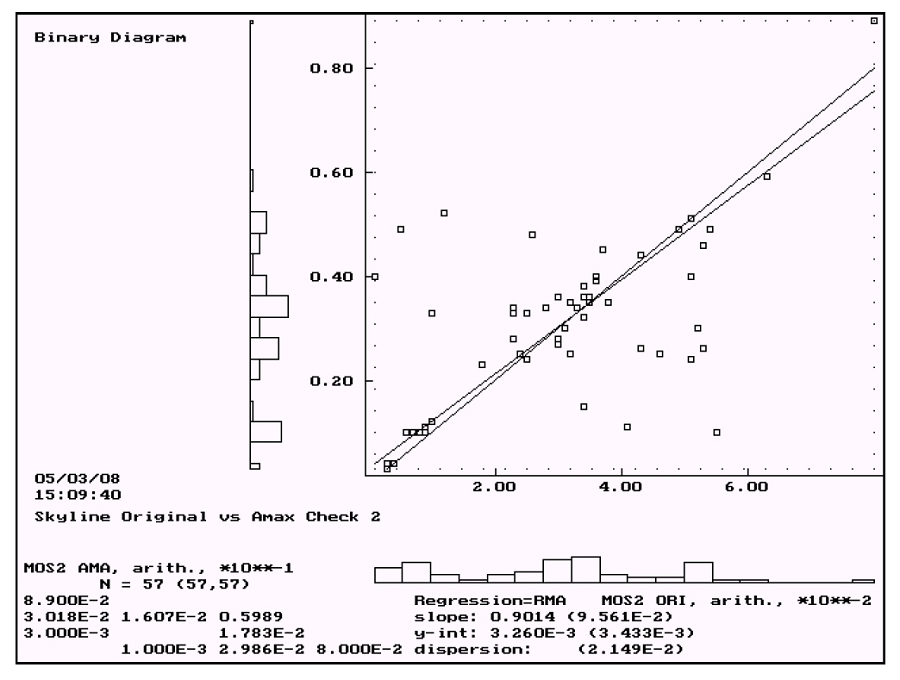

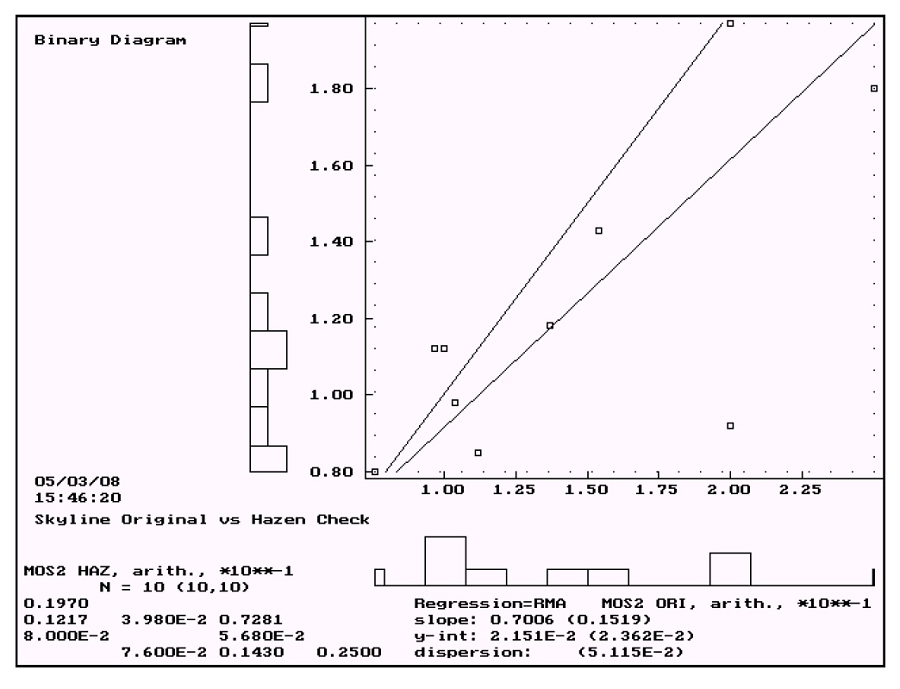

| | | 8.5.1 | Historical Checks | 63 |

| | | 8.5.2 | Blanks | 65 |

| | | 8.5.3 | Internal Lab Standards | 66 |

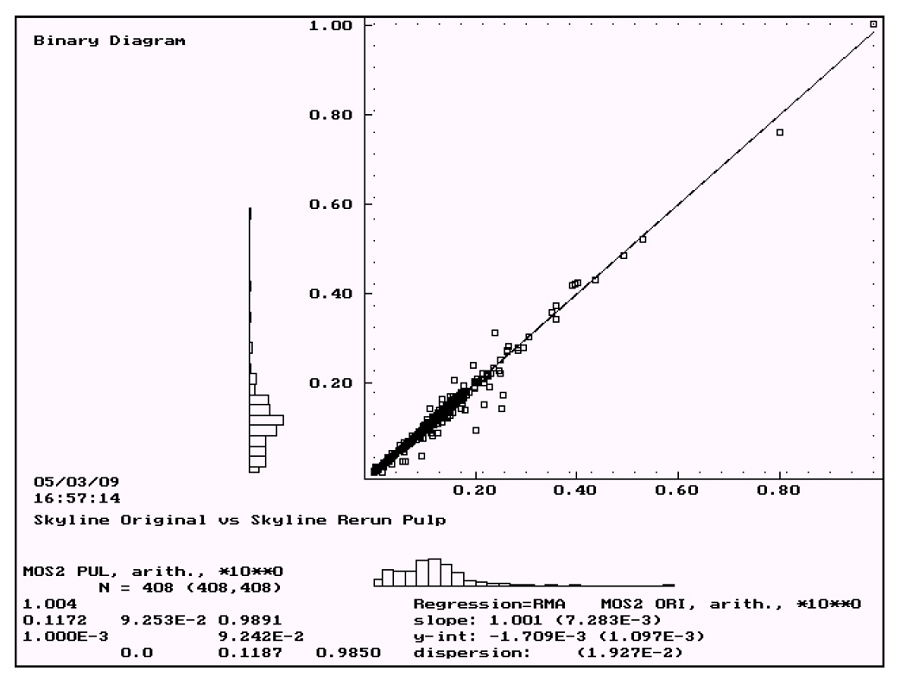

| | | 8.5.4 | Internal Pulp Checks | 66 |

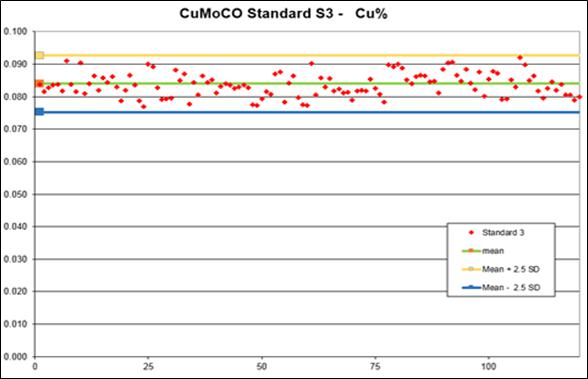

| | | 8.5.5 | CuMoCo Standards | 67 |

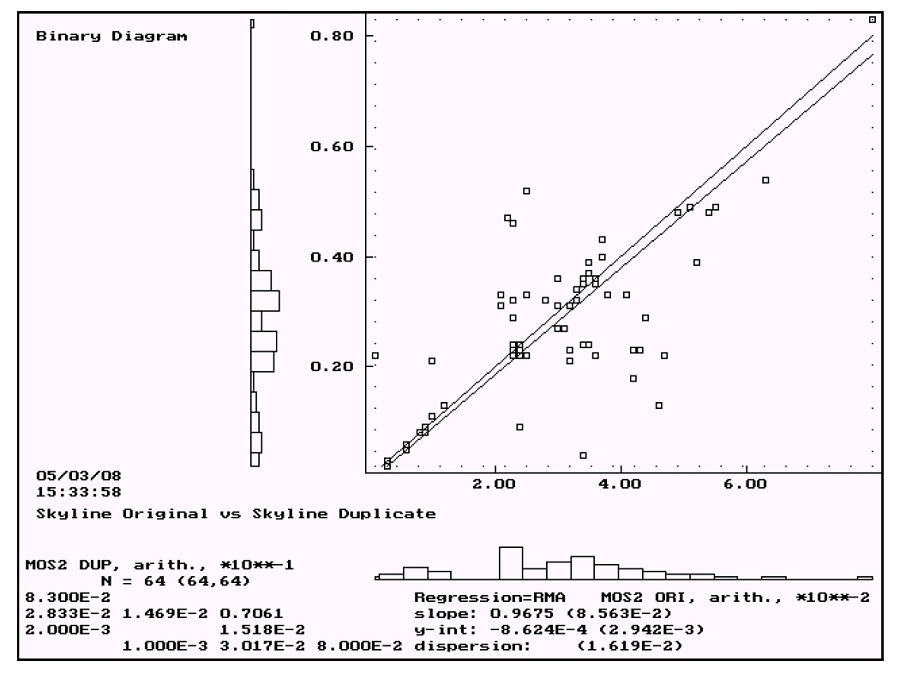

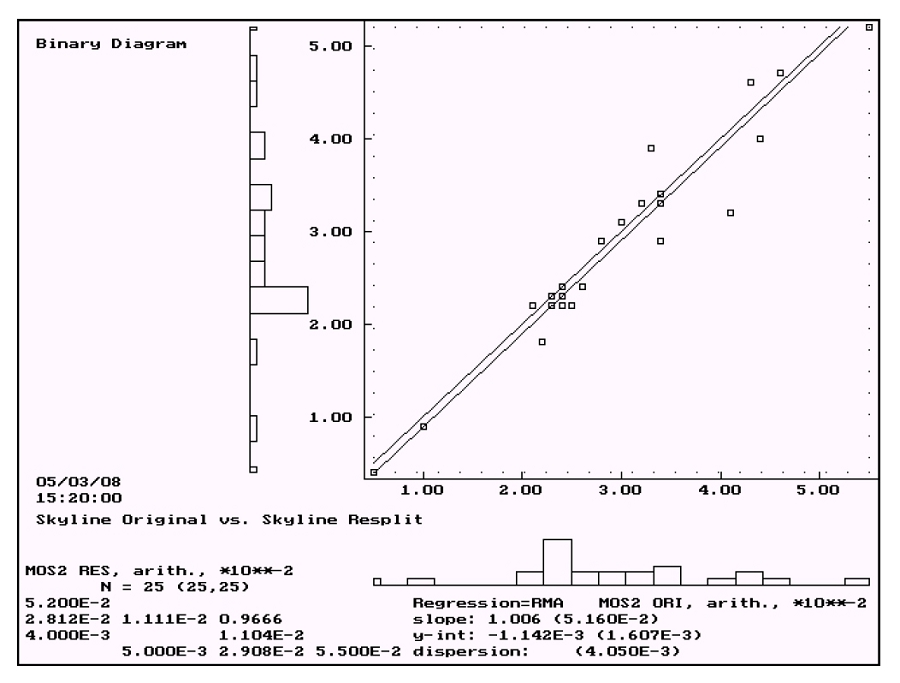

| | | 8.5.6 | Coarse Reject Duplicates | 71 |

| | 8.6 | Survey Validation | 71 |

| | 8.7 | Verification of Drilling Data | 71 |

| 9 | Data Verification | 72 |

| 10 | Mineral Processing and Metallurgical Testing | 73 |

| | 10.1 | Metallurgical Testing (2009, 2015) | 73 |

| | | 10.1.1 | Introduction | 73 |

| | | 10.1.2 | Sample Selection | 74 |

| | | 10.1.3 | Test-work Program | 74 |

| | | 10.1.4 | Conceptual Study Flotation Test-work | 75 |

| | | 10.1.5 | Grade and Recovery Predictions | 78 |

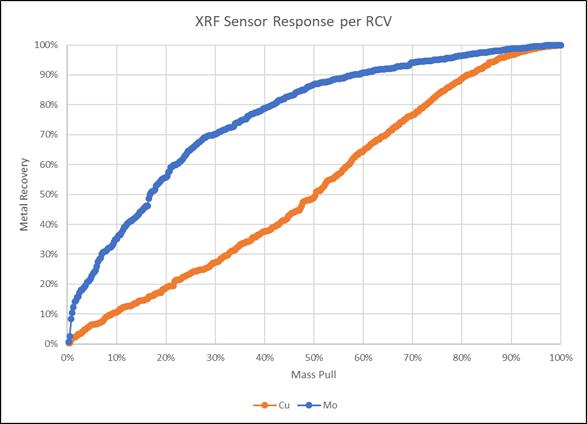

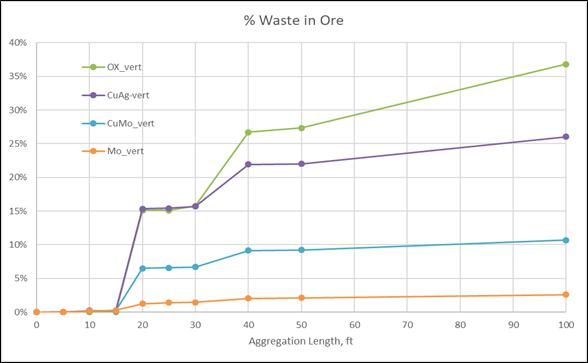

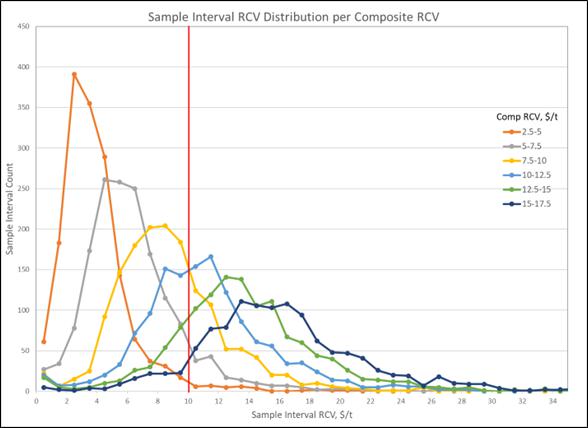

| | 10.2 | Mineral Sorting | 80 |

| | | 13.2.1 | Particle Sorting | 80 |

| | | 13.2.2 | Bulk Sorting | 81 |

| 11 | Mineral Resource Estimates | 85 |

| | 11.1 | Introduction | 85 |

| | 11.2 | Data Analysis | 85 |

| | 11.3 | 50-Foot Composites | 90 |

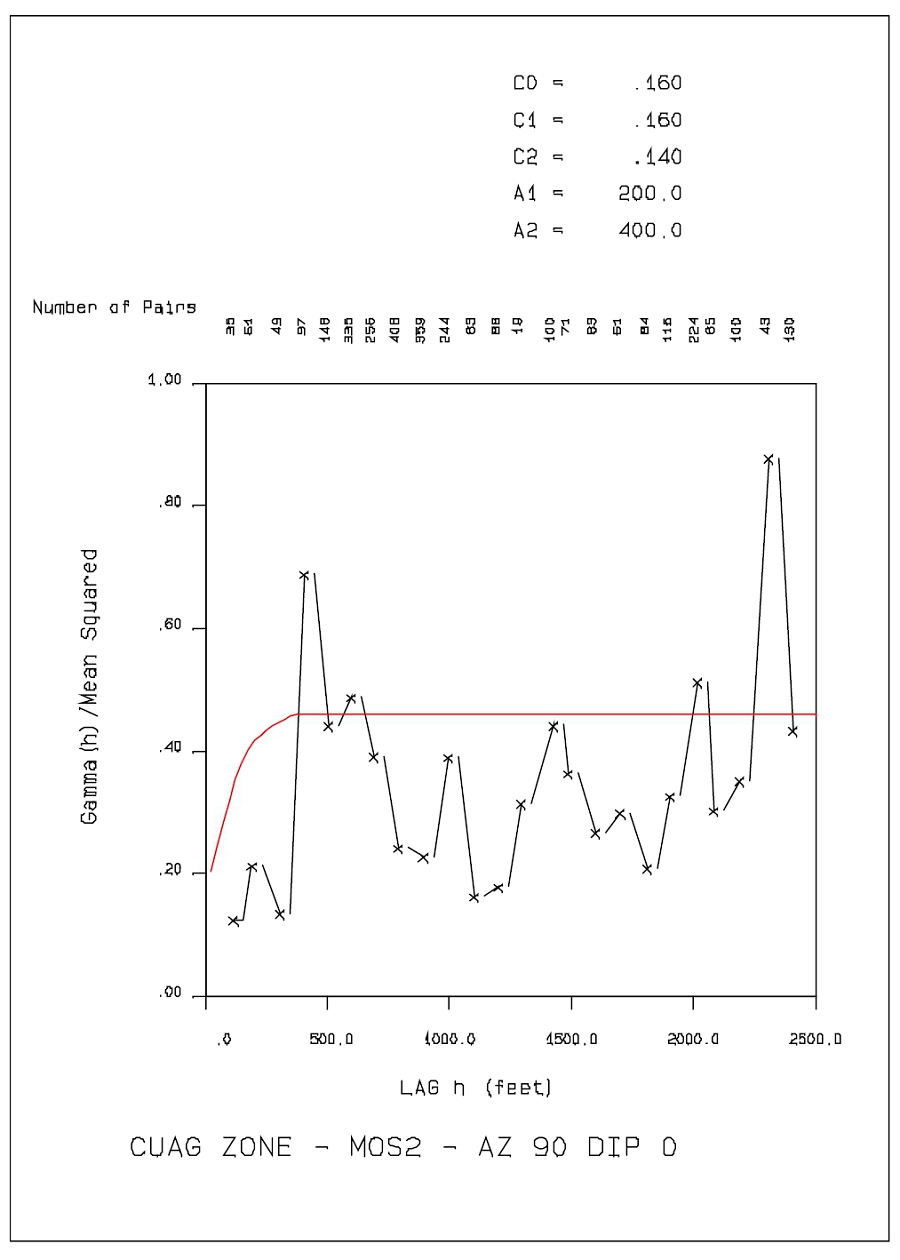

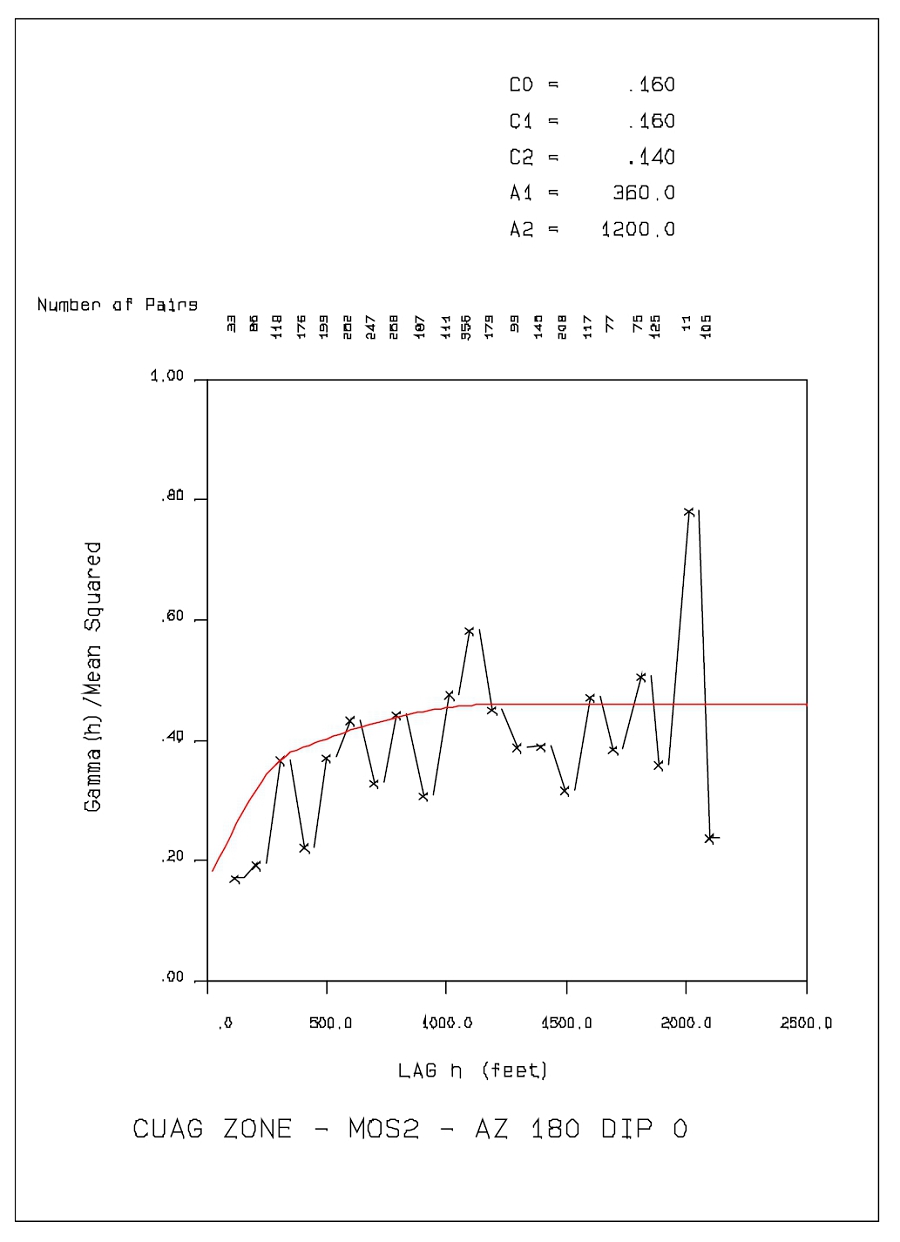

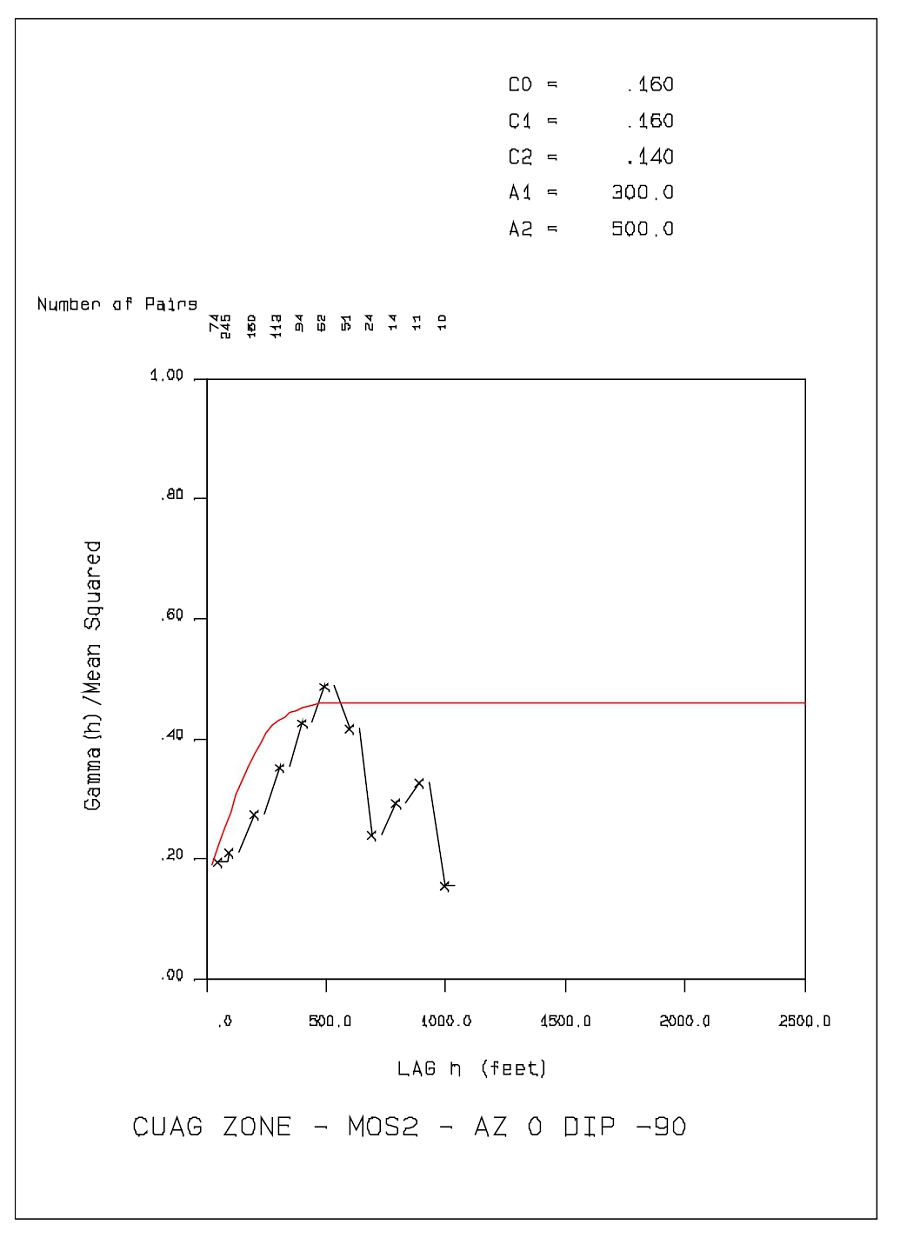

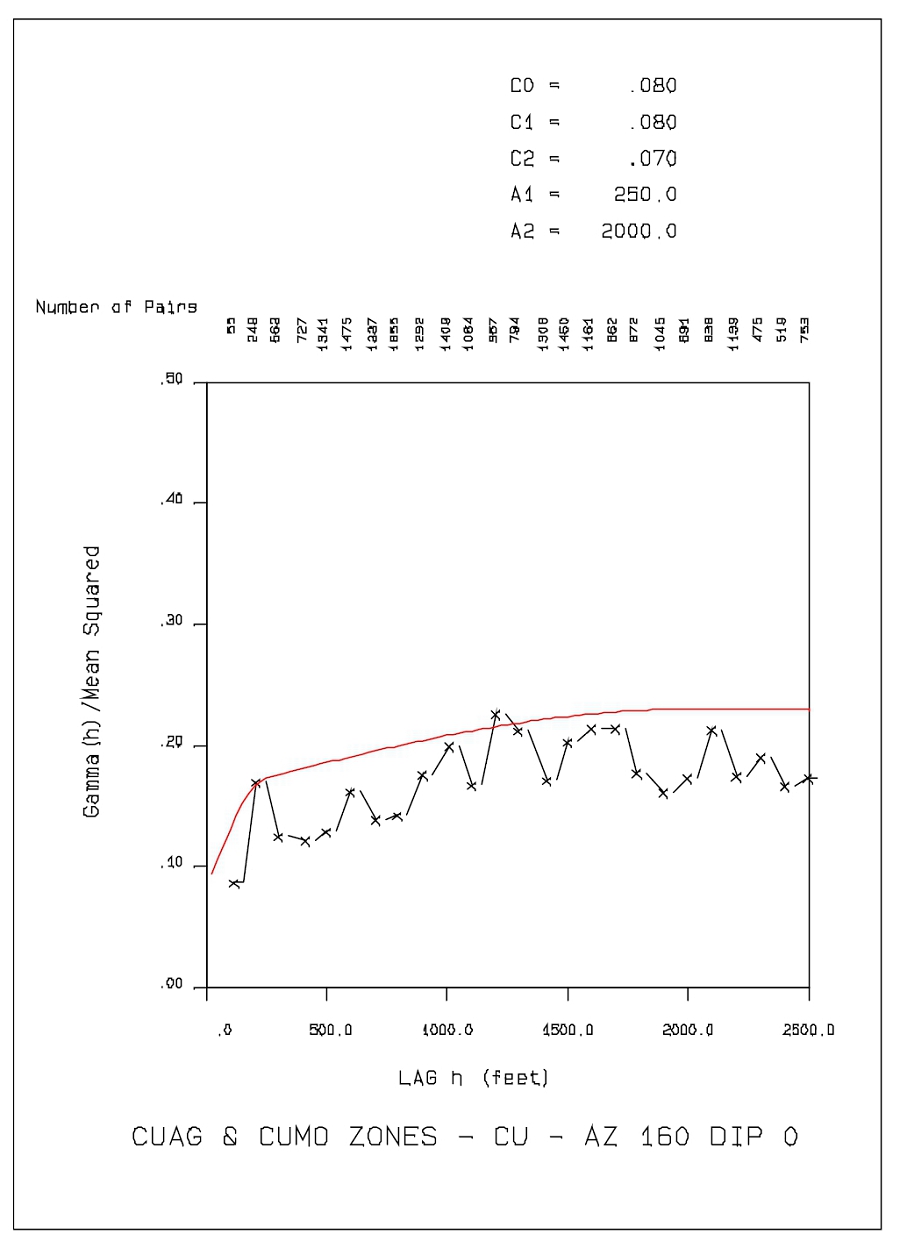

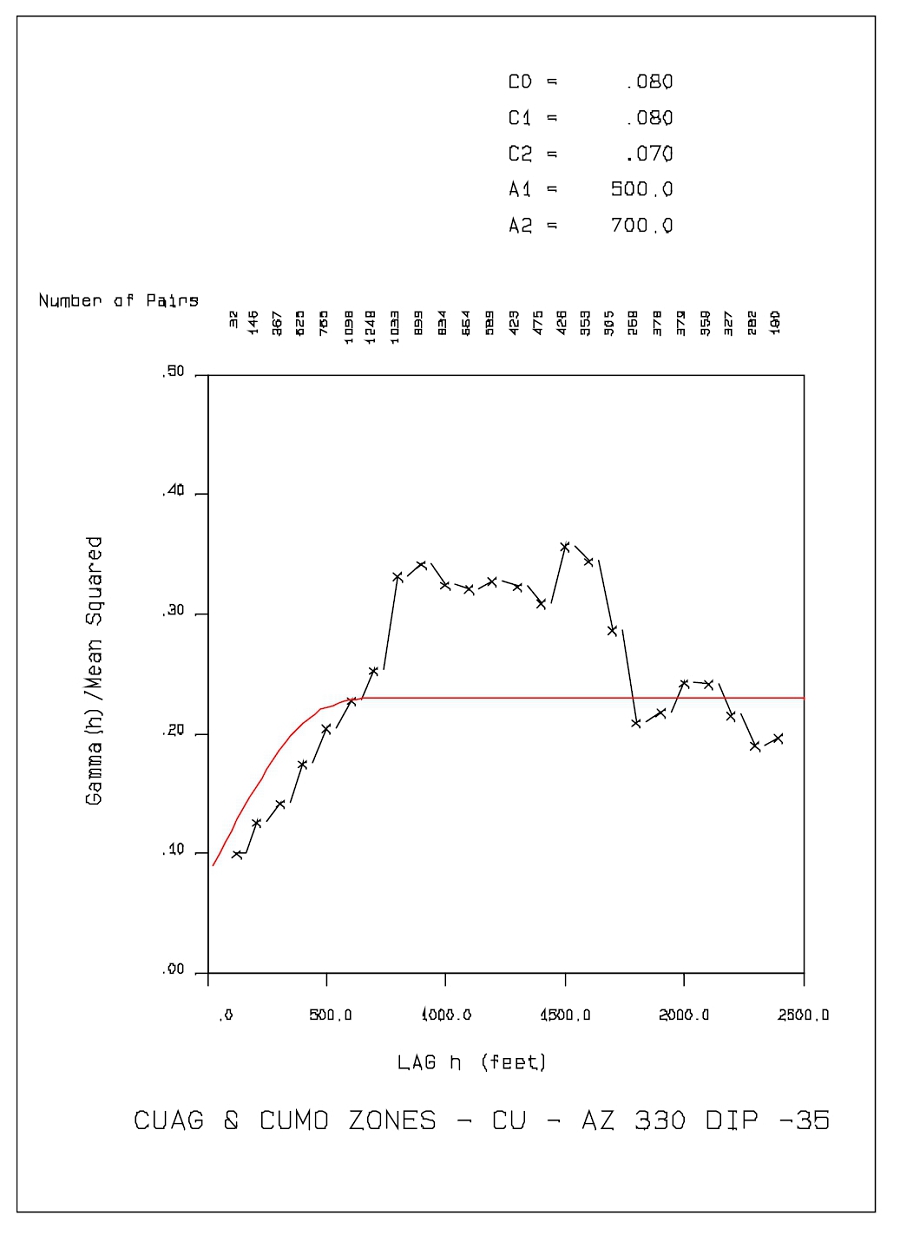

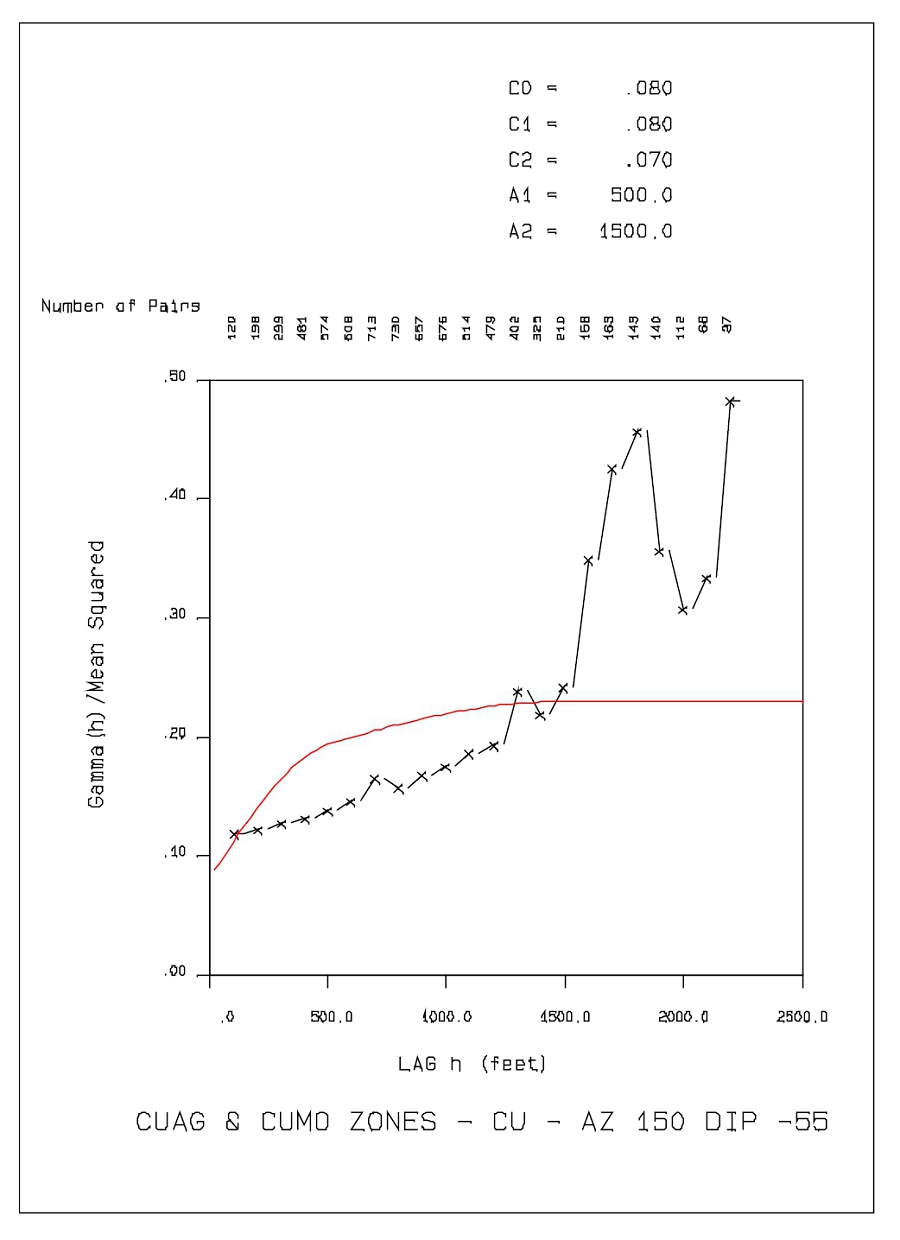

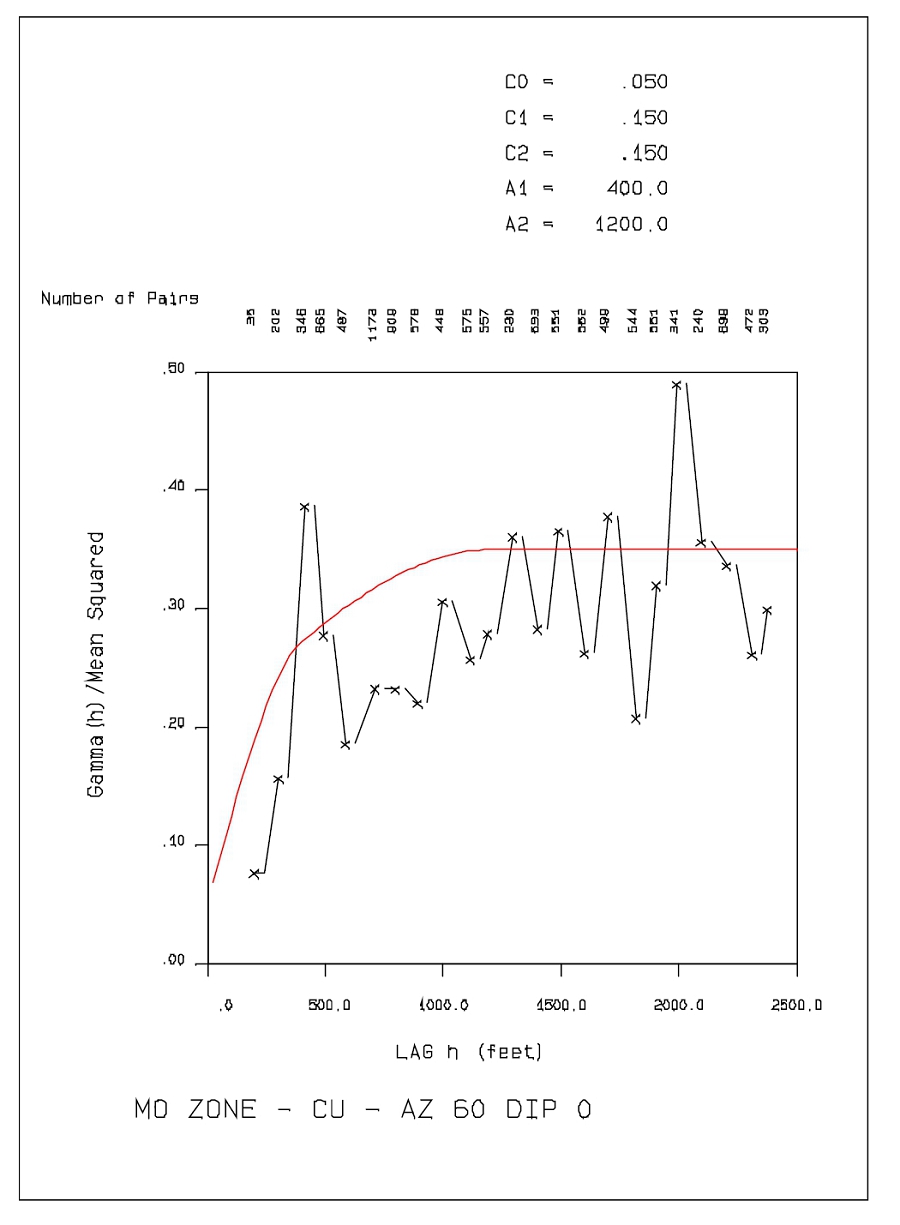

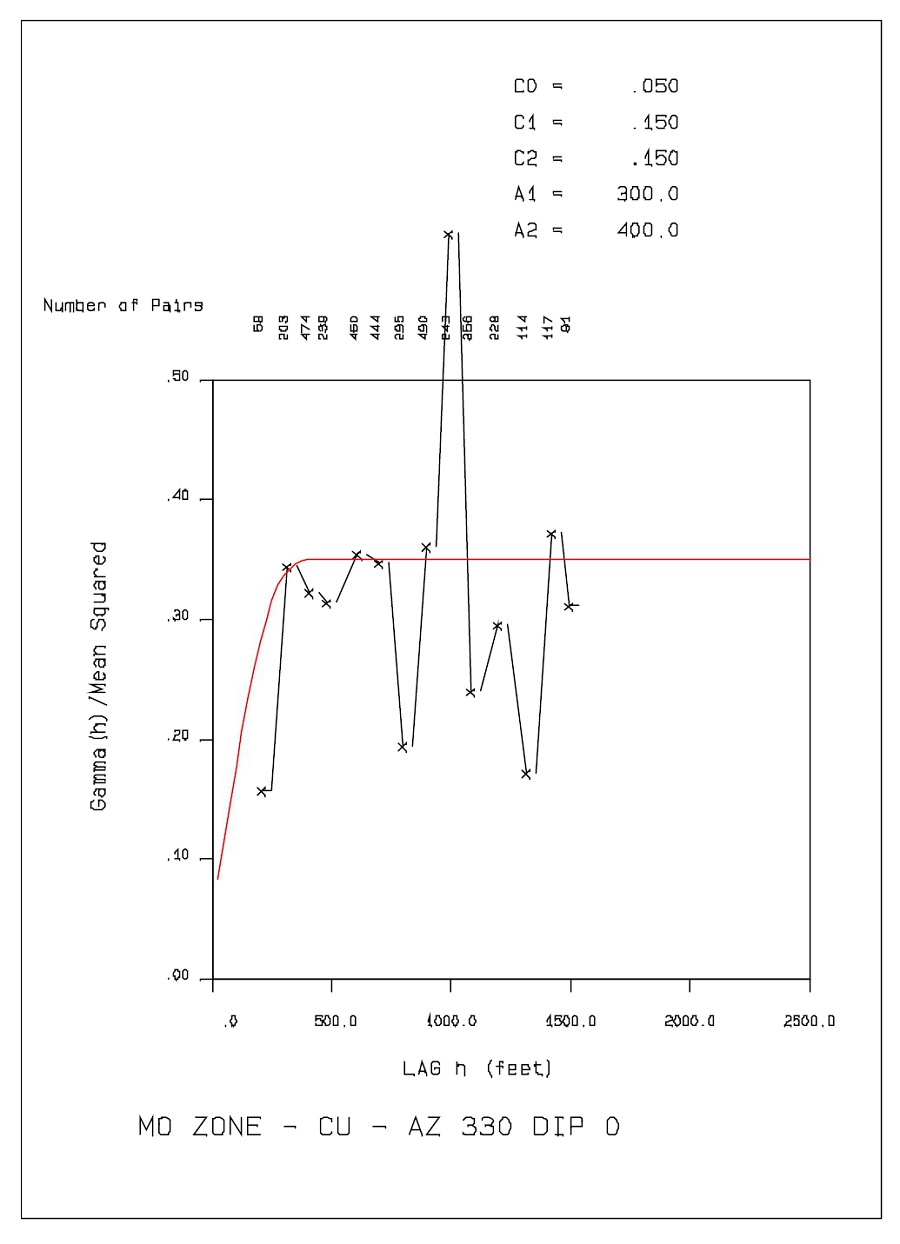

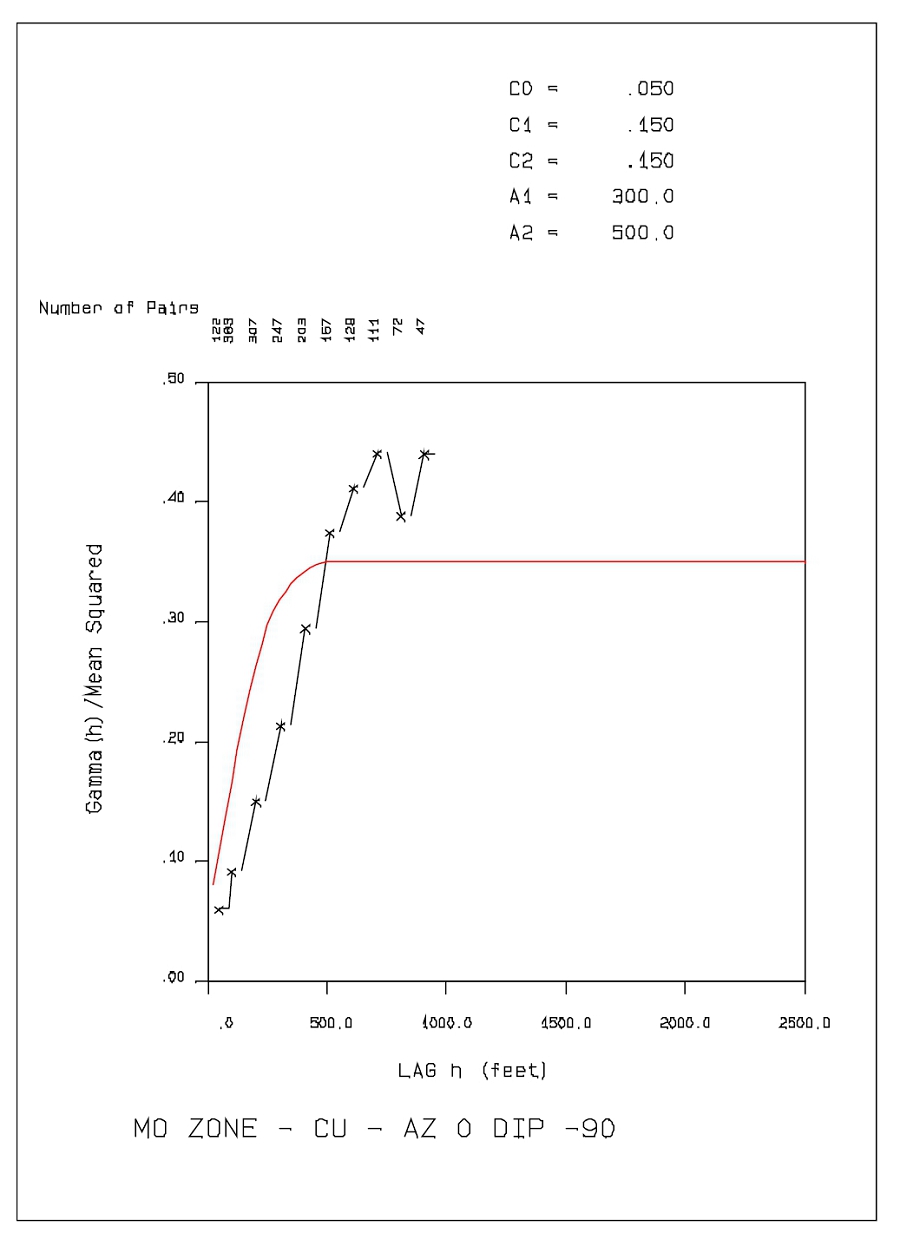

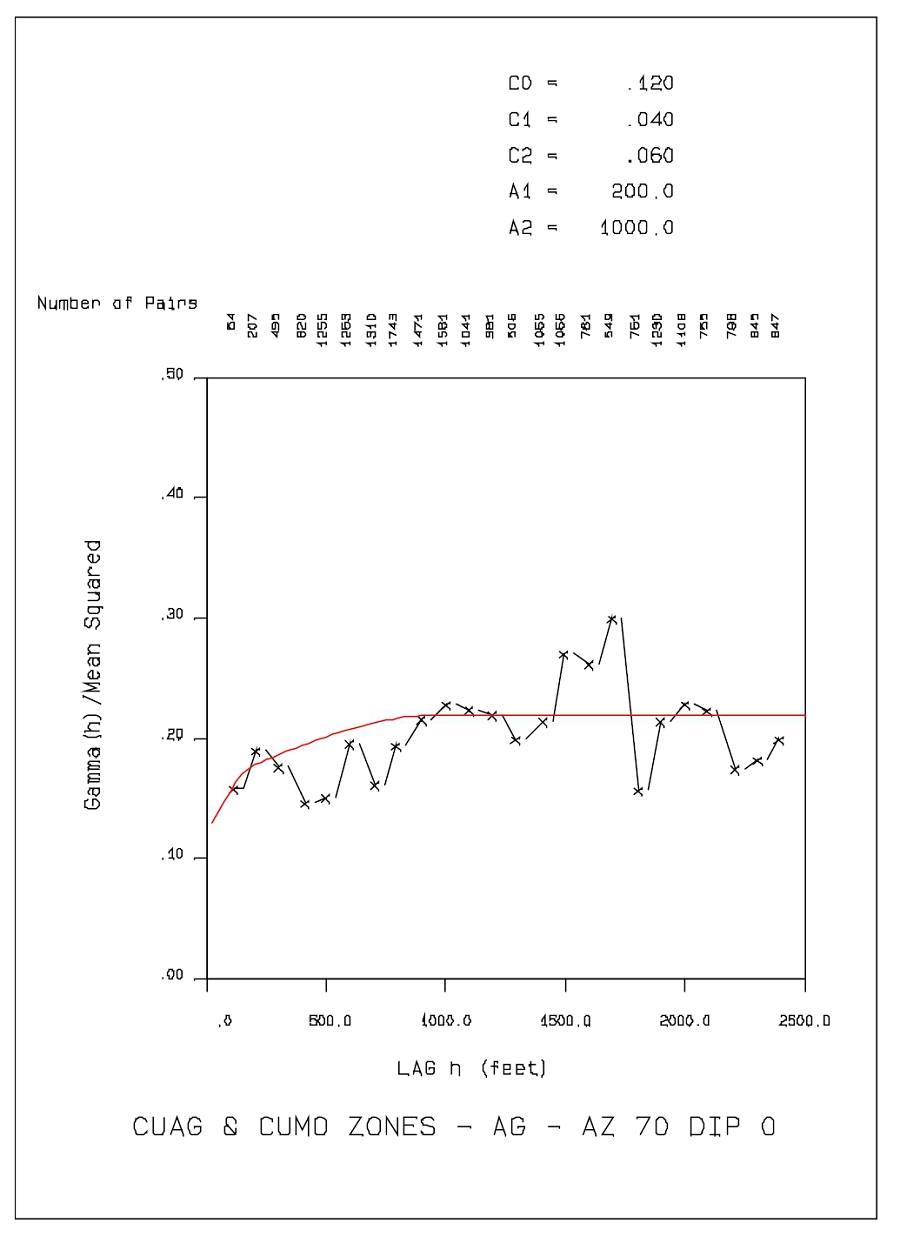

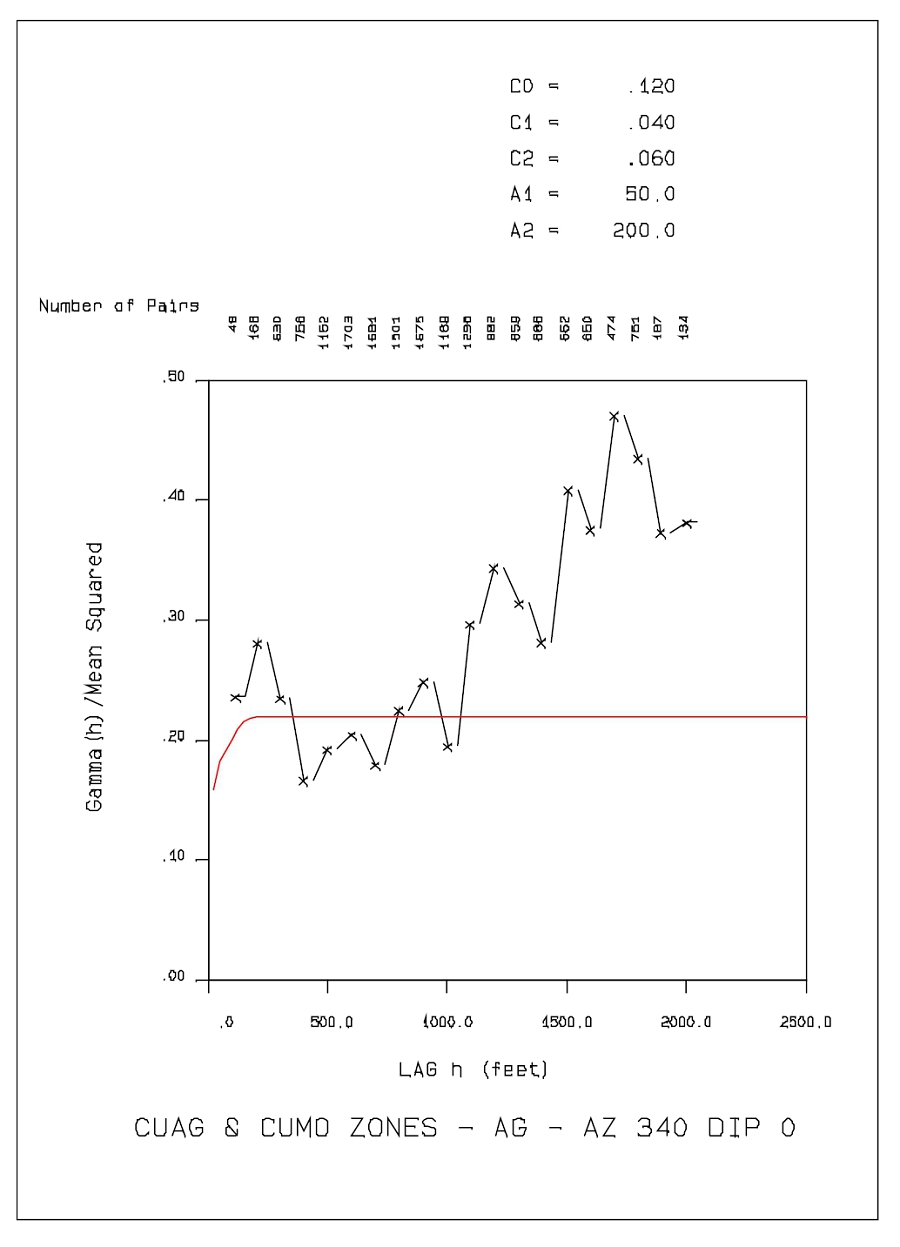

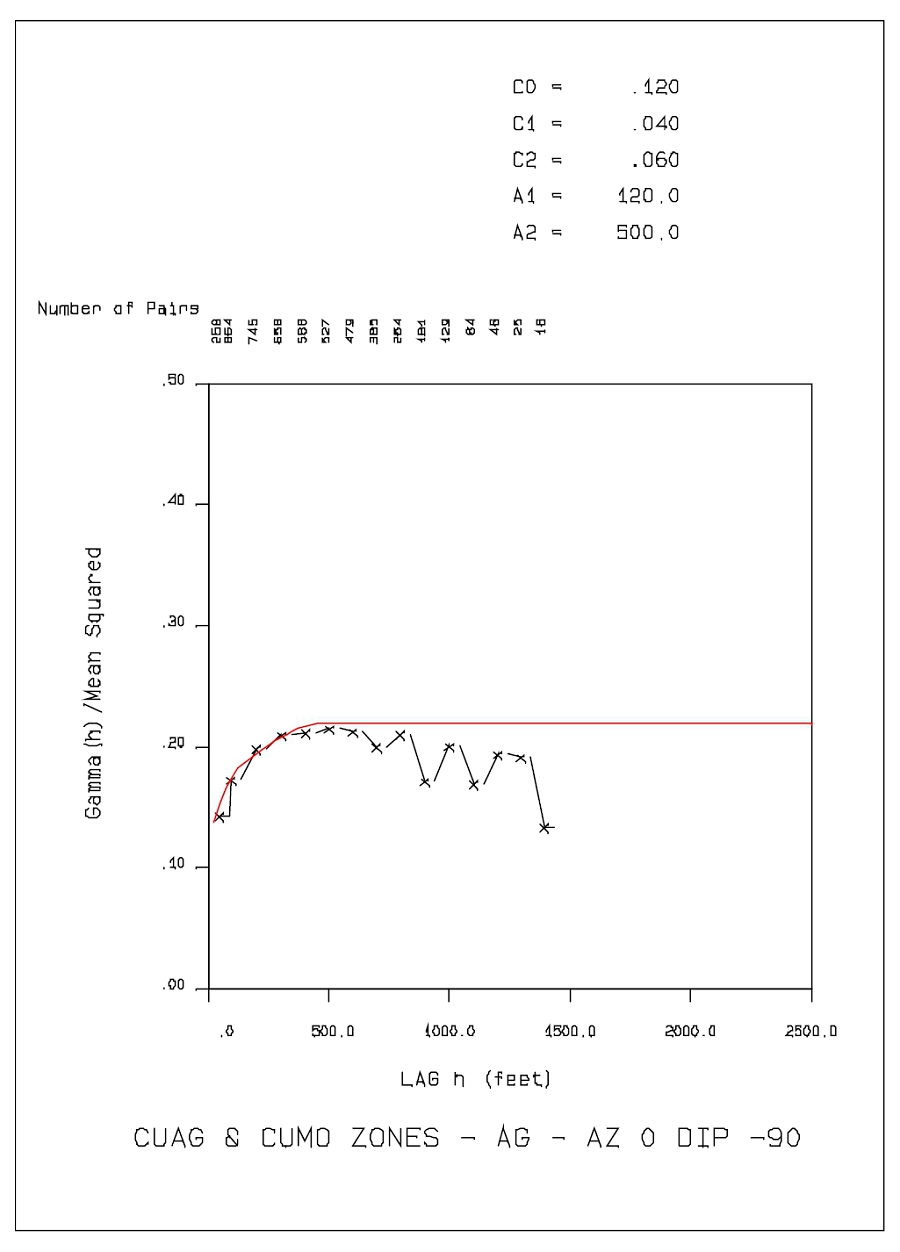

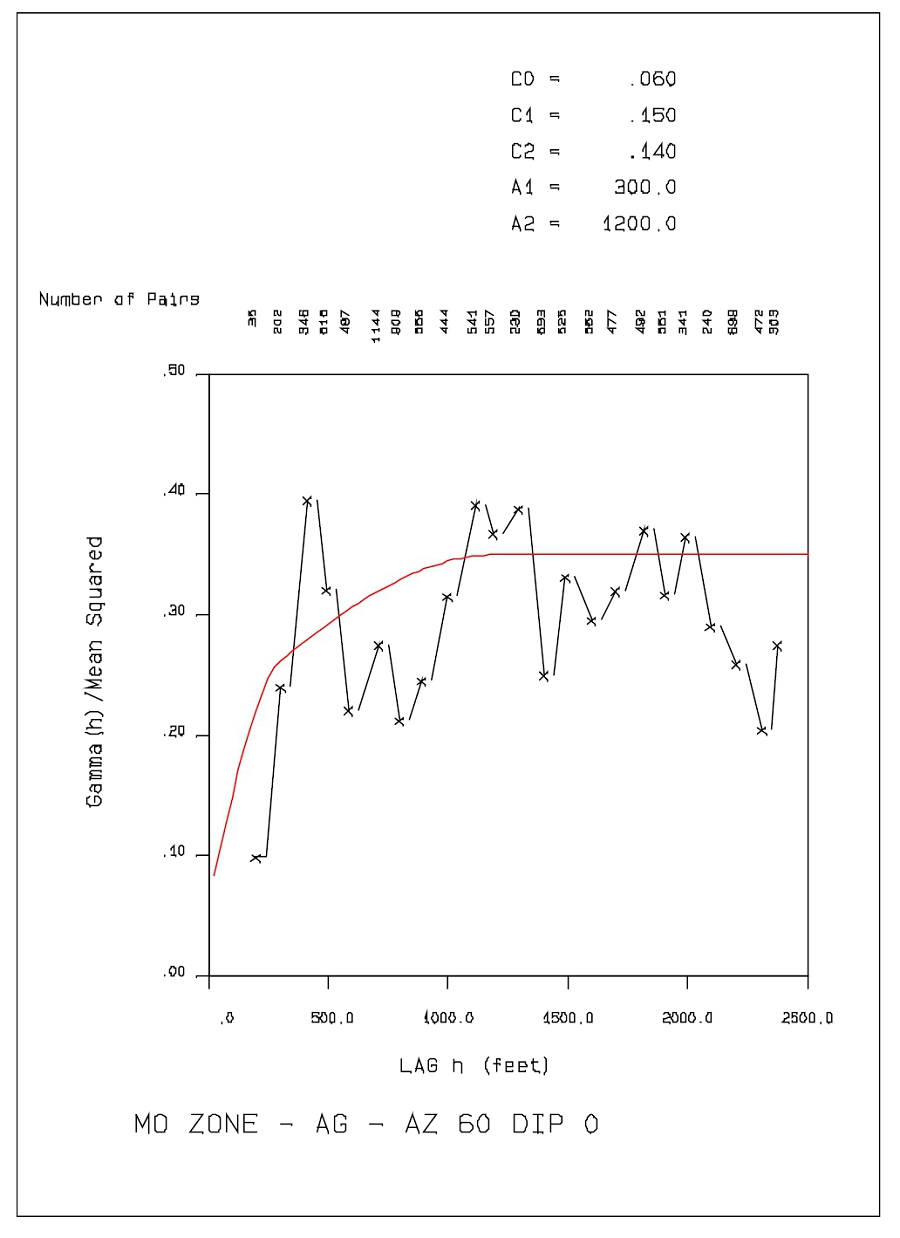

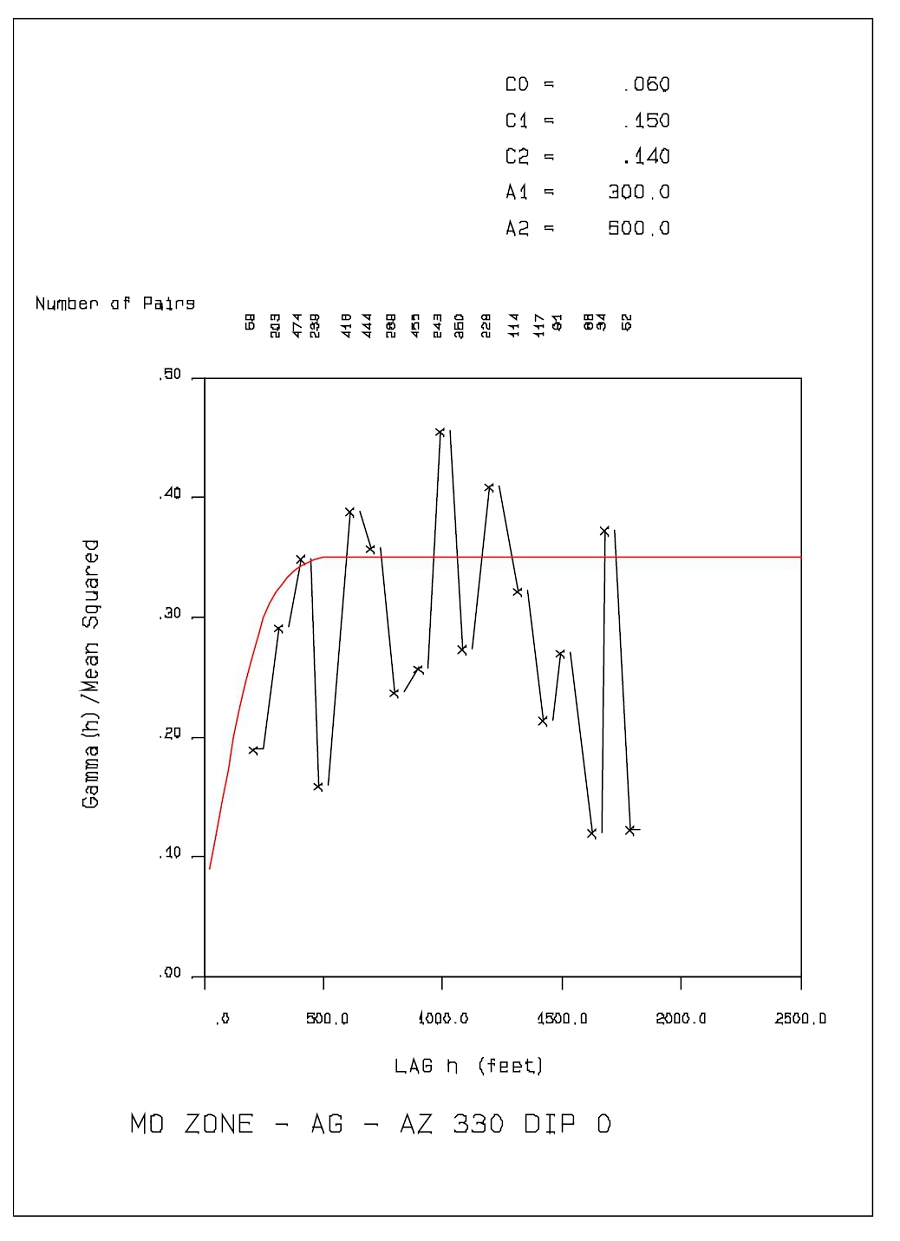

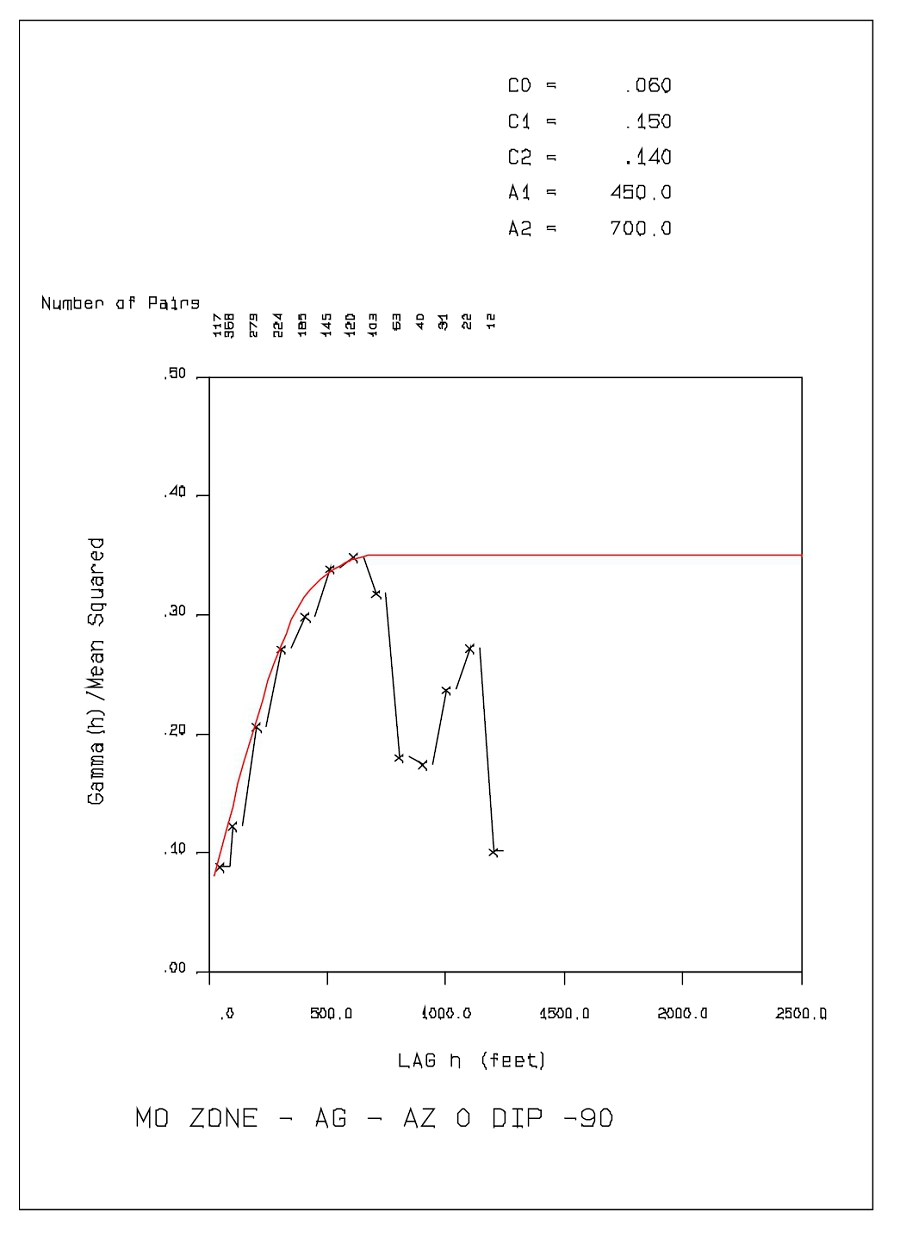

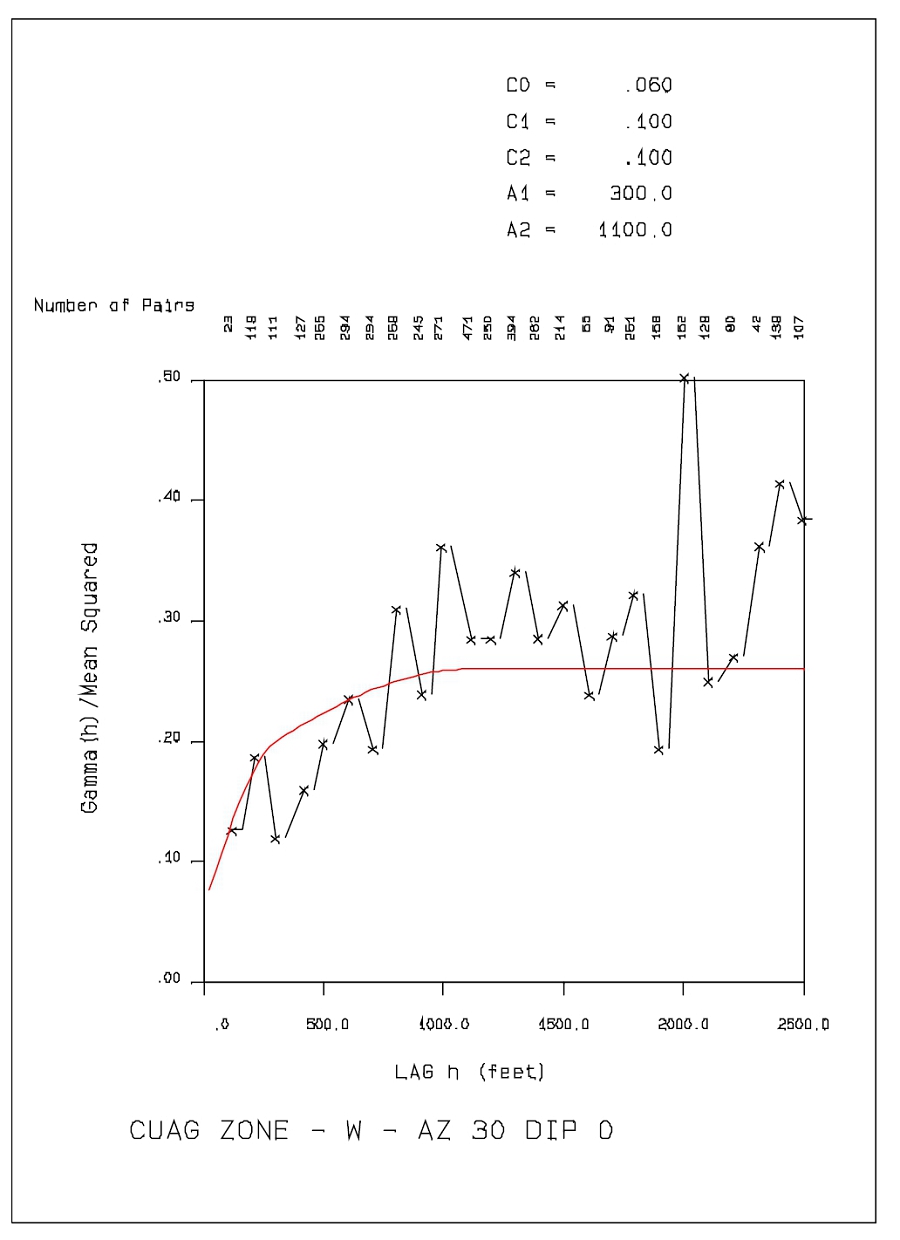

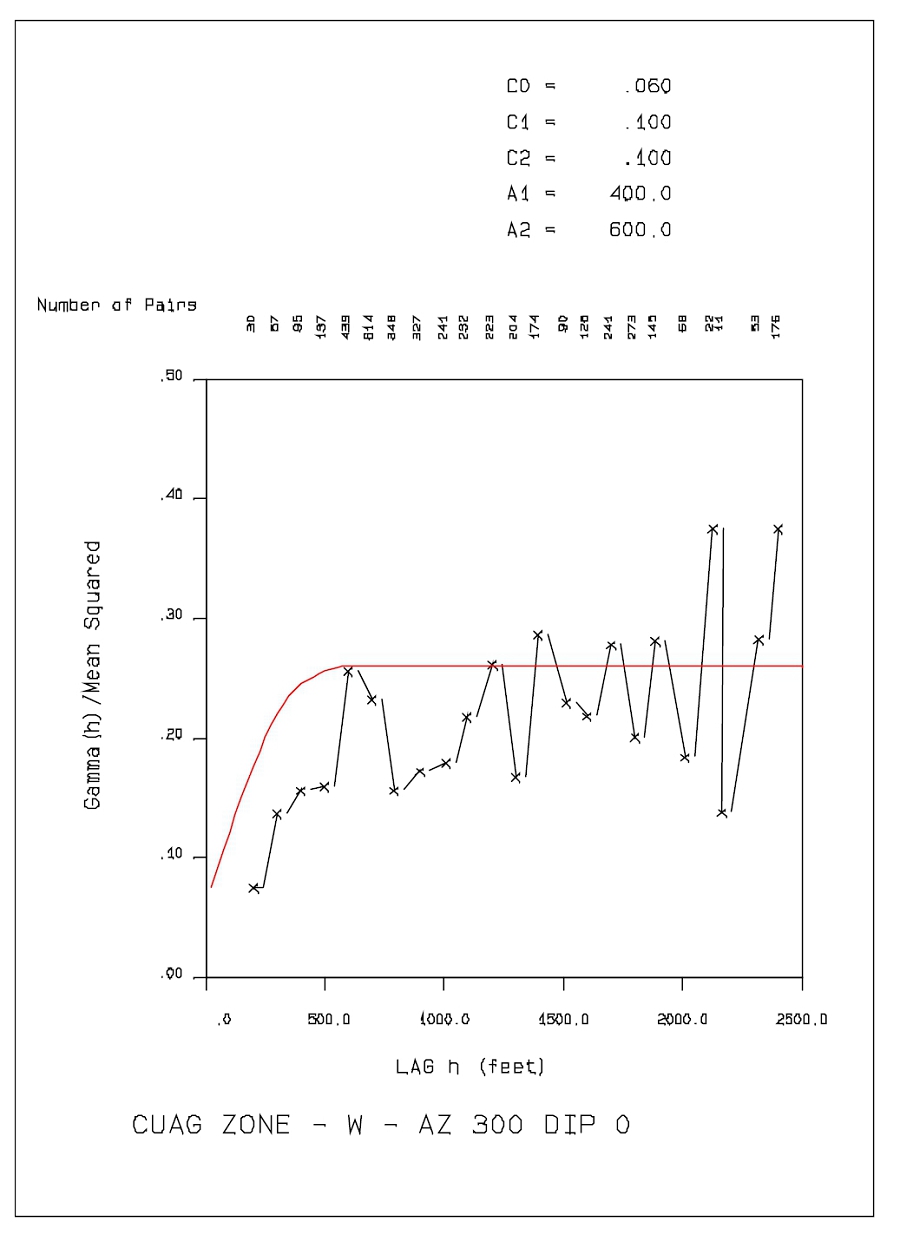

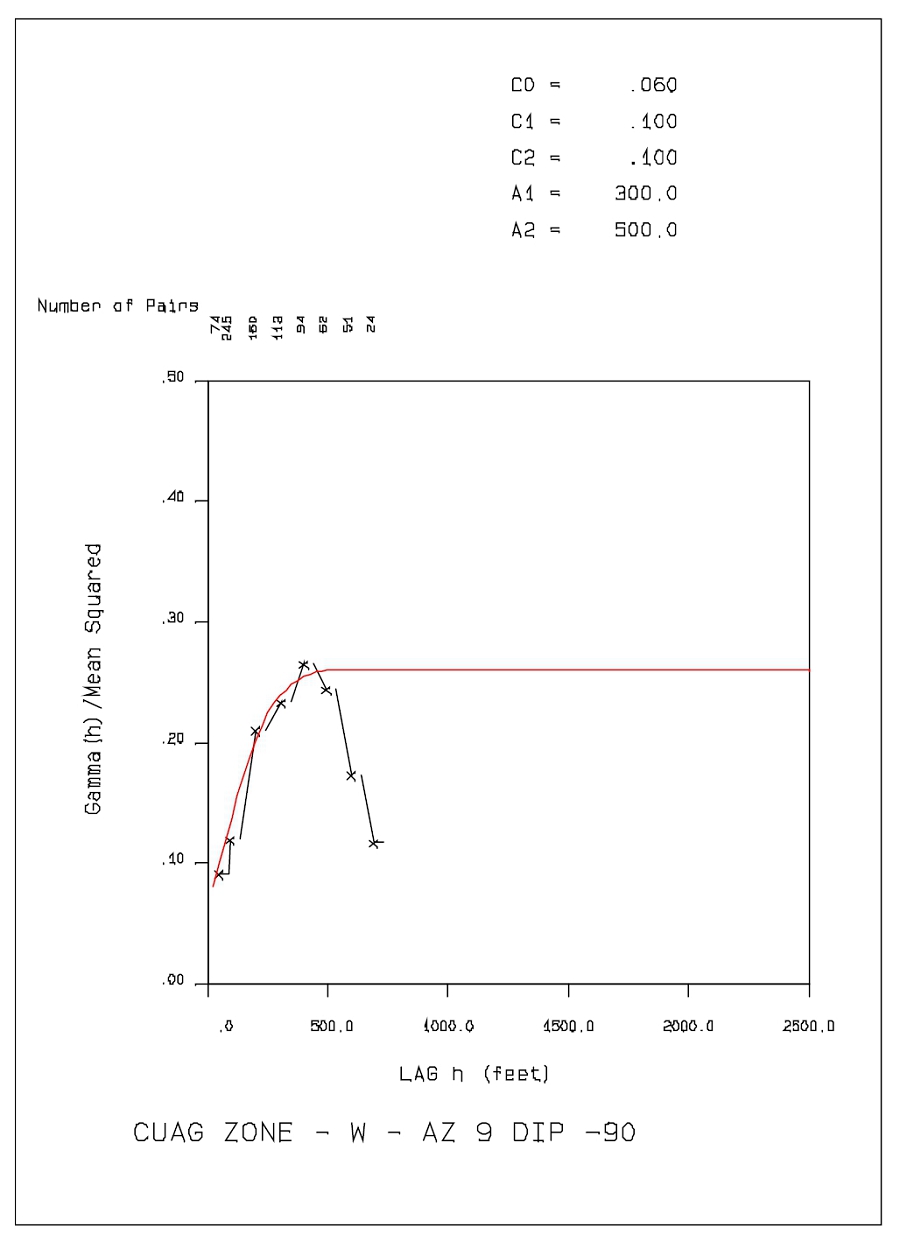

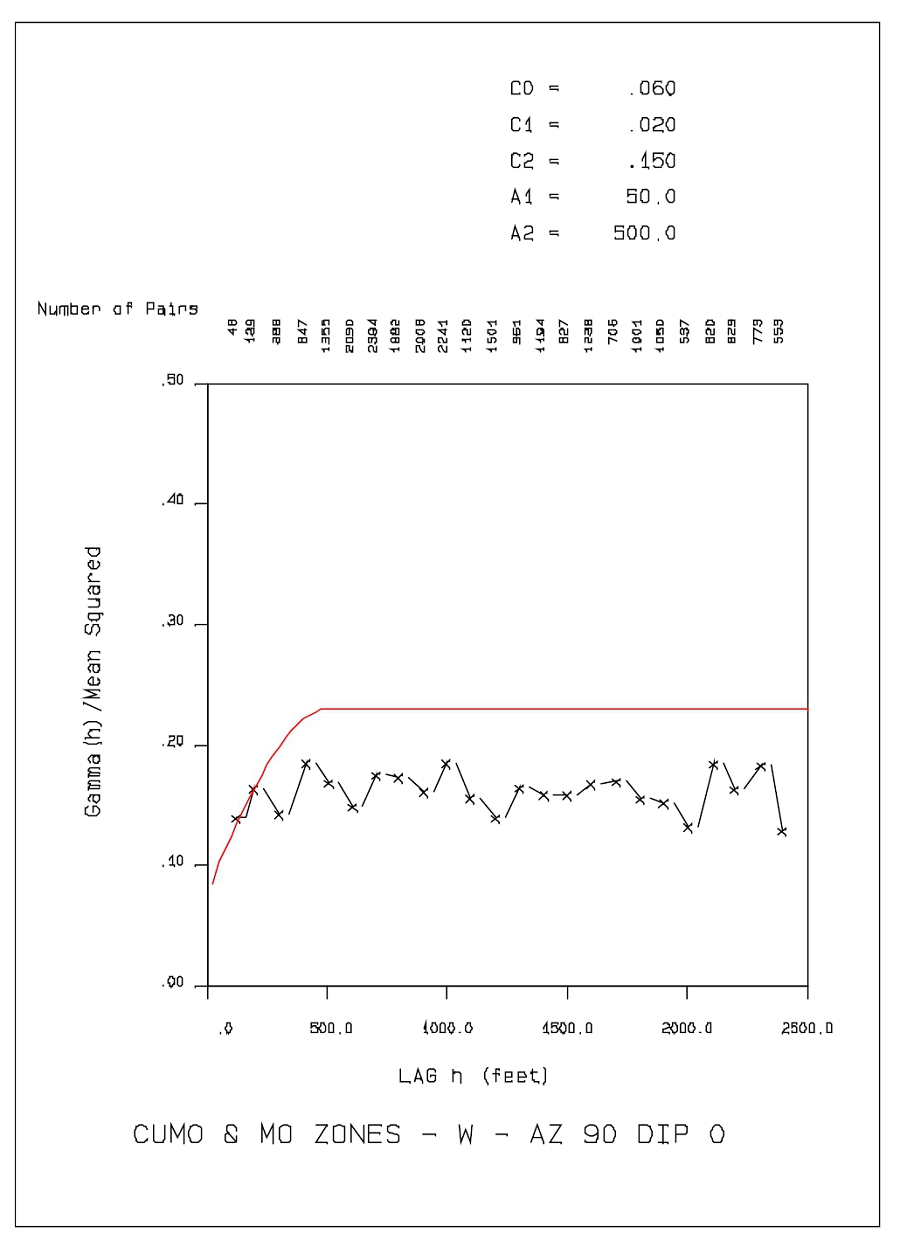

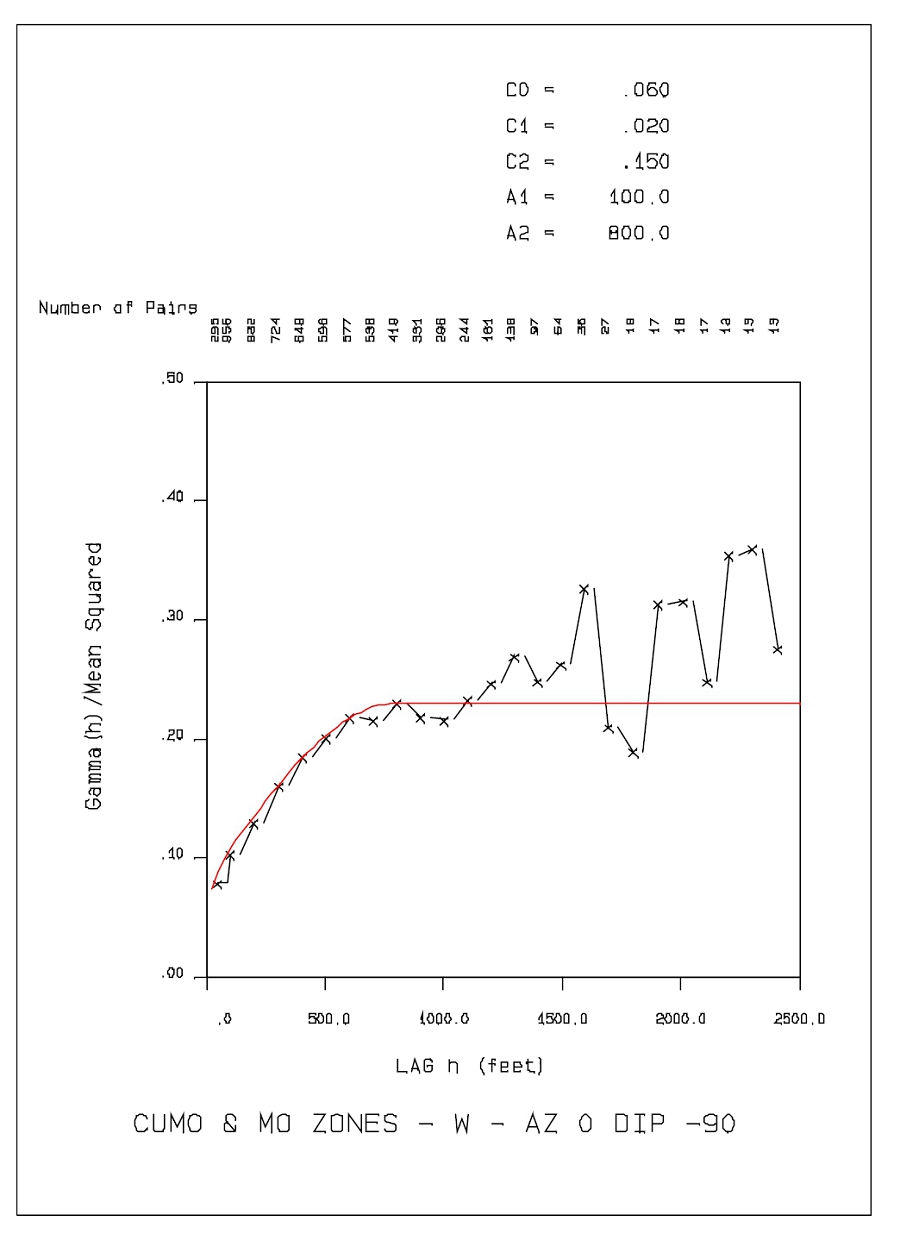

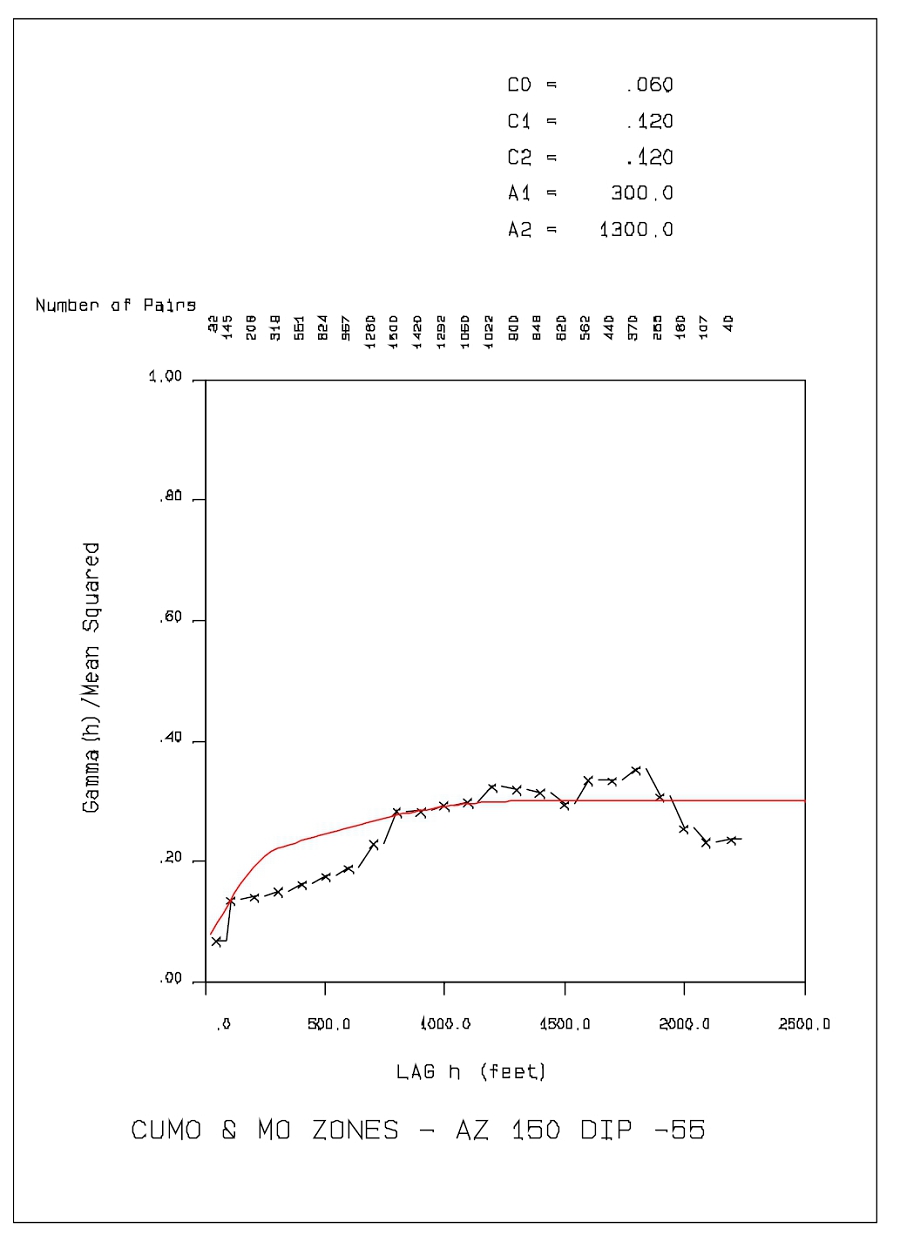

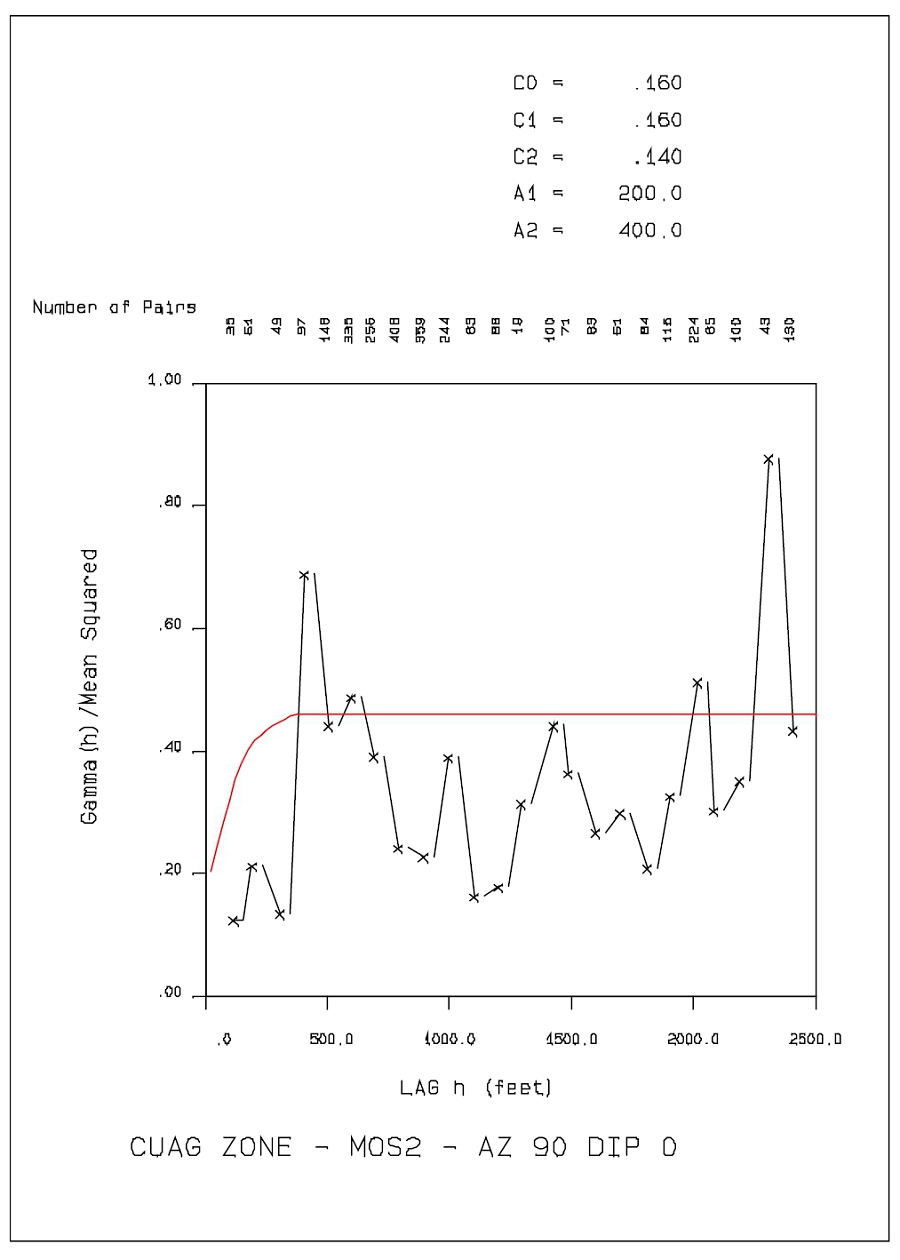

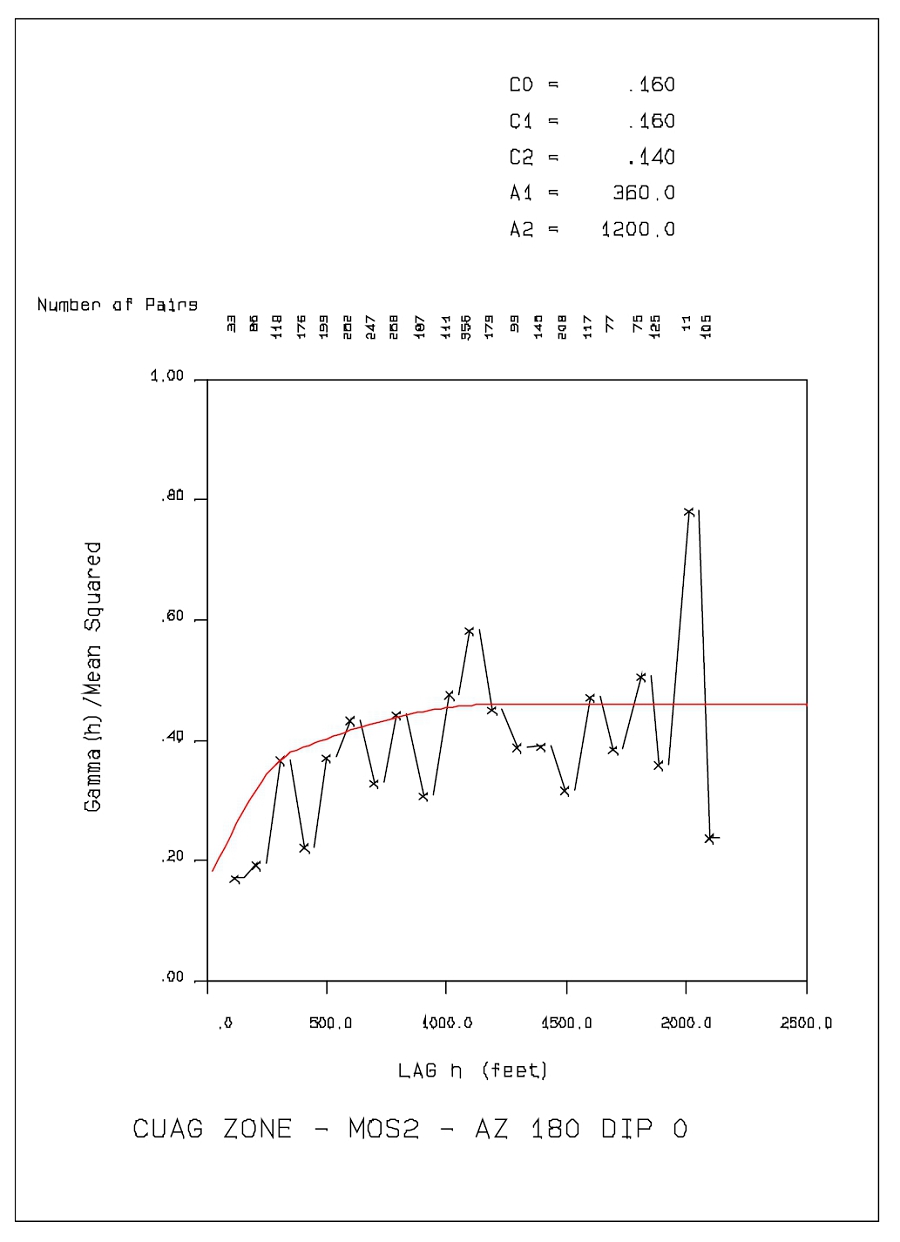

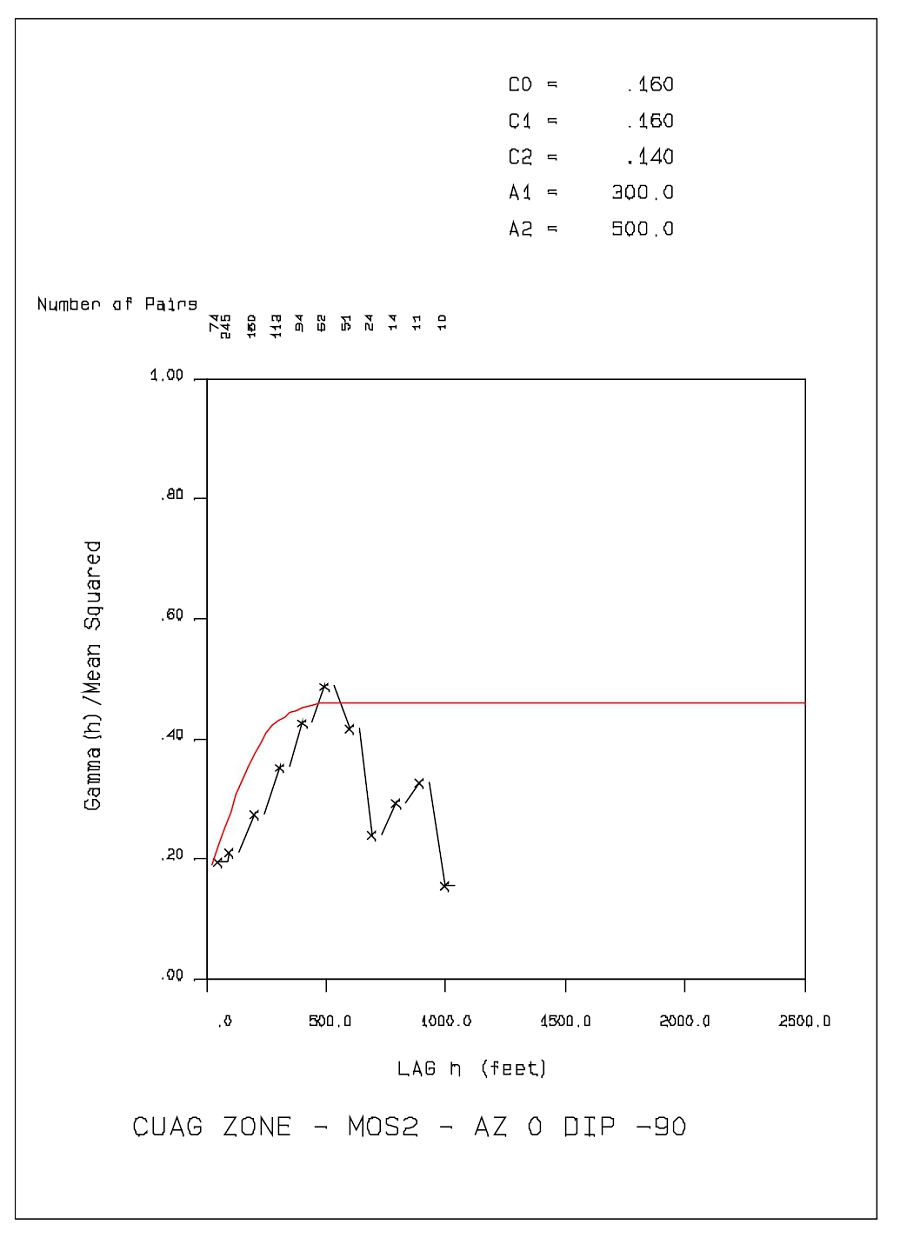

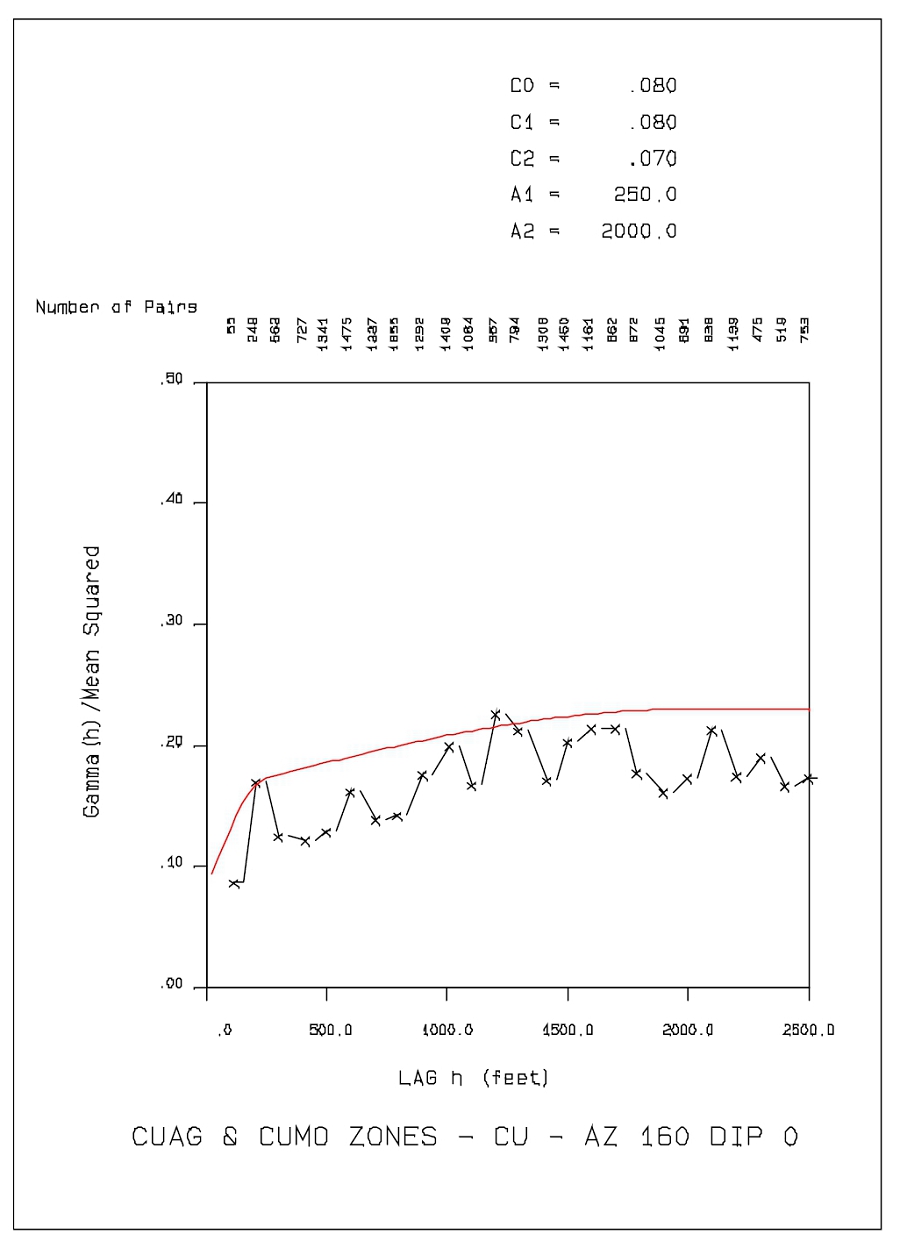

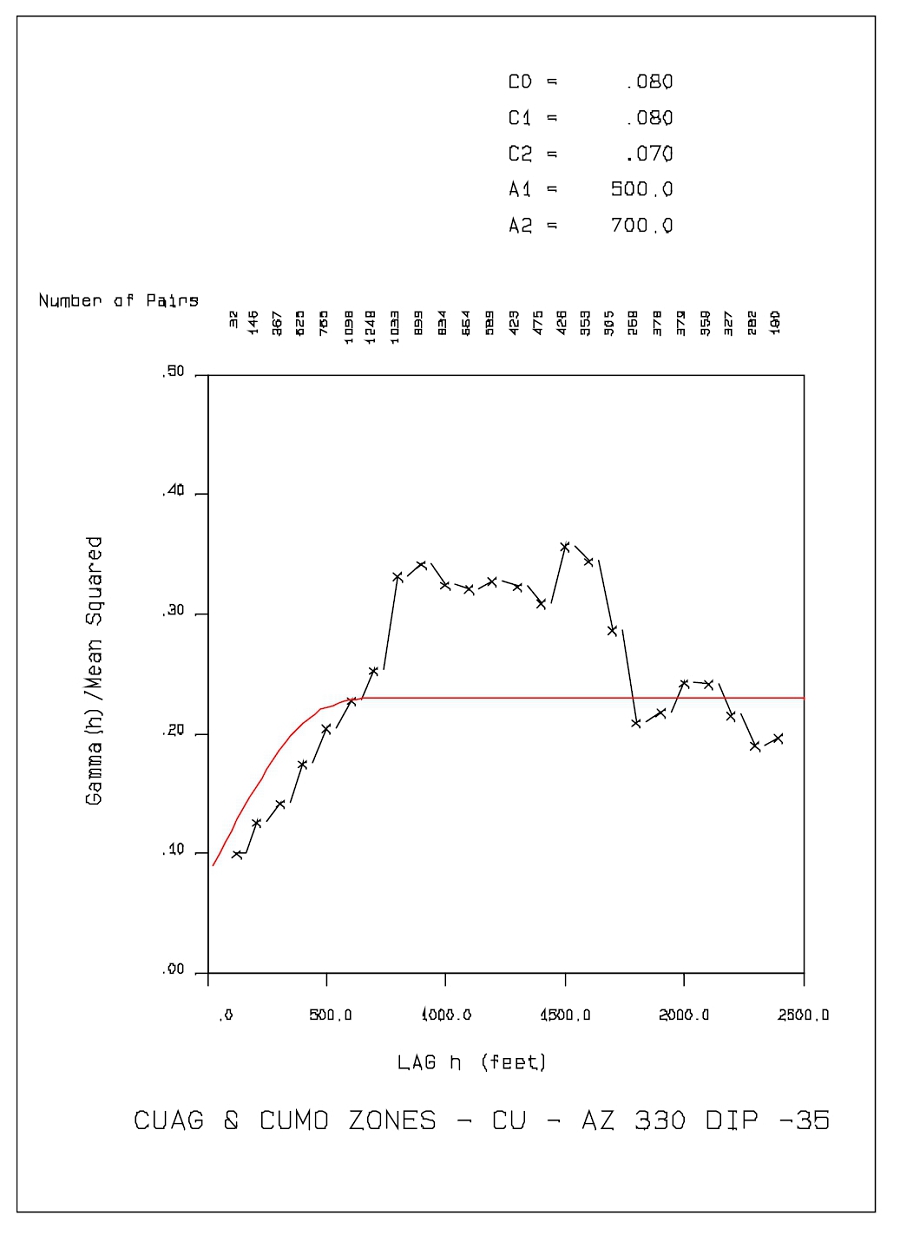

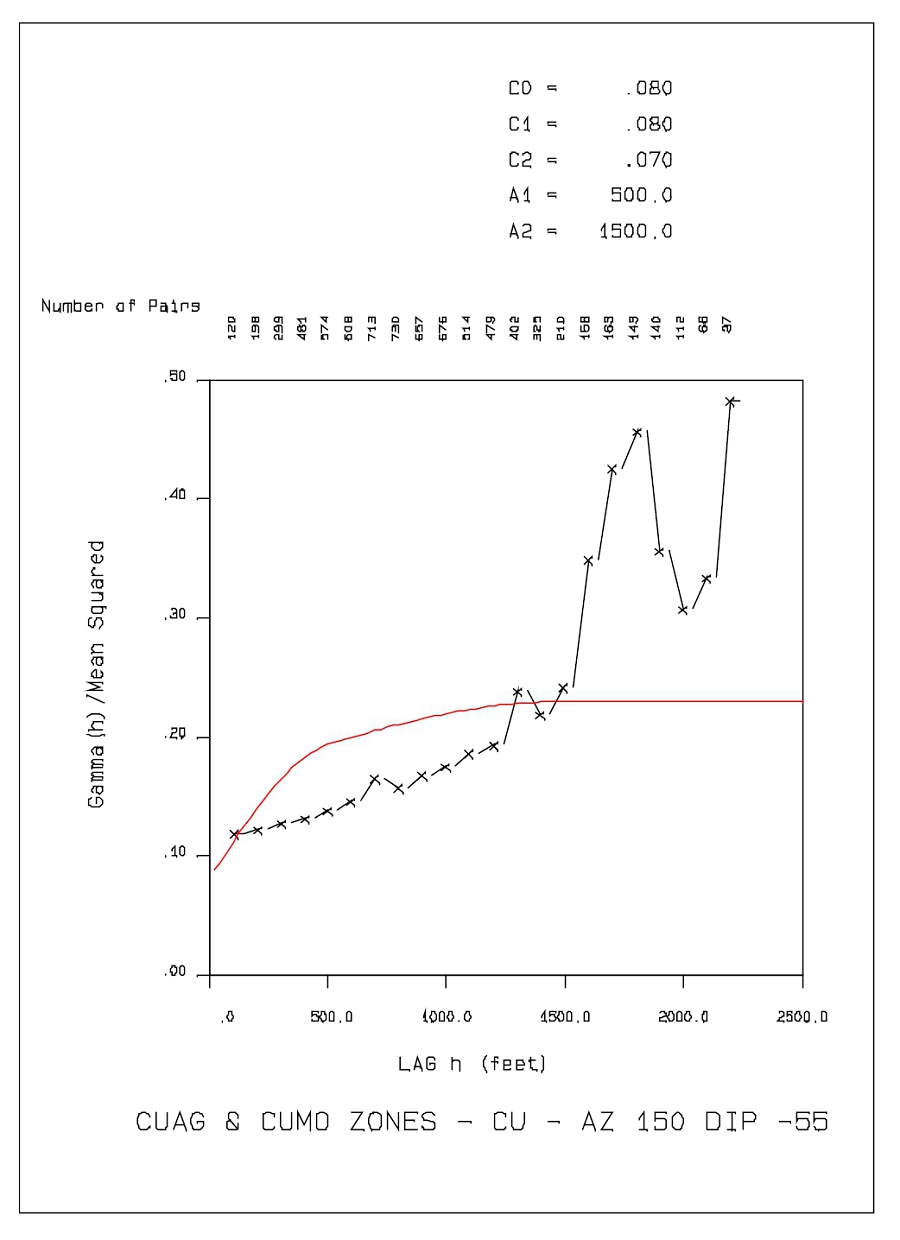

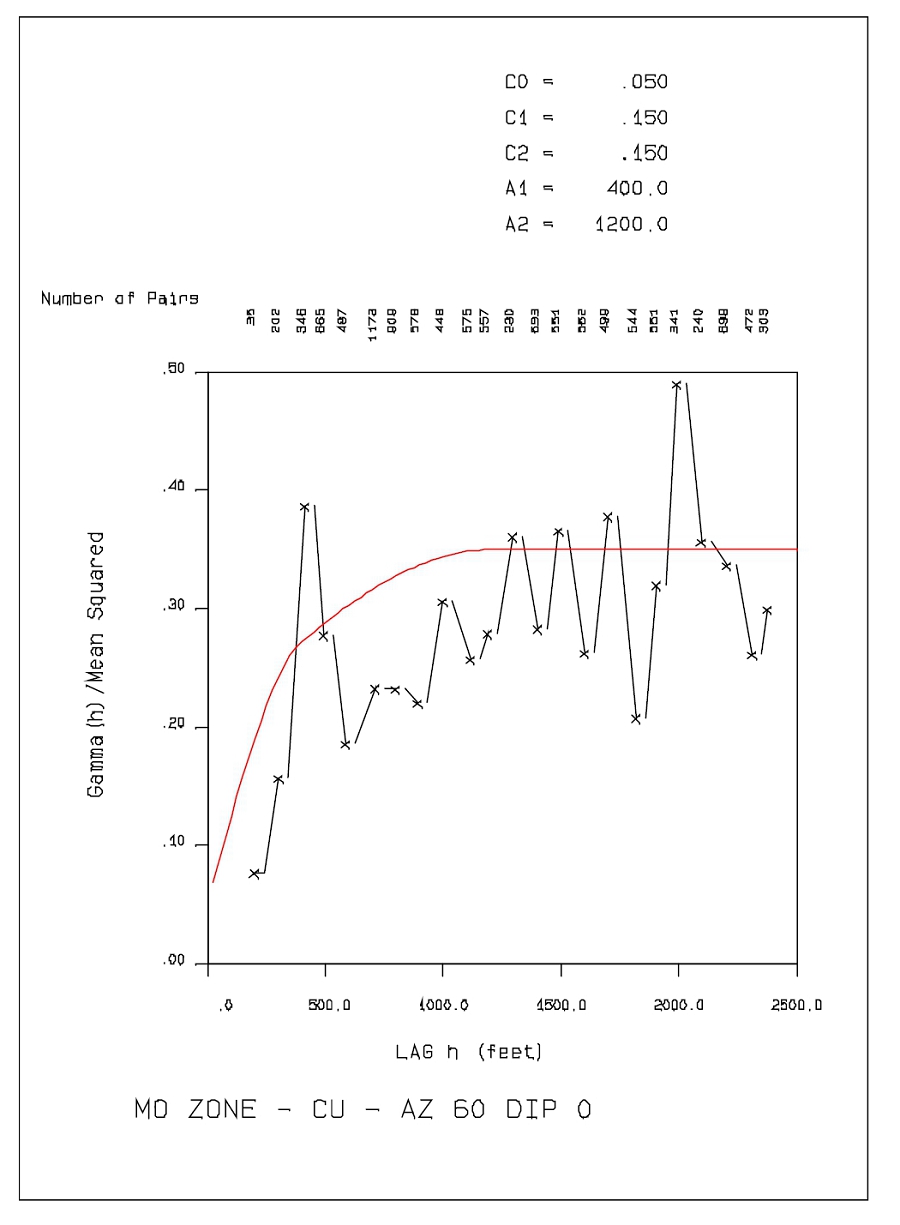

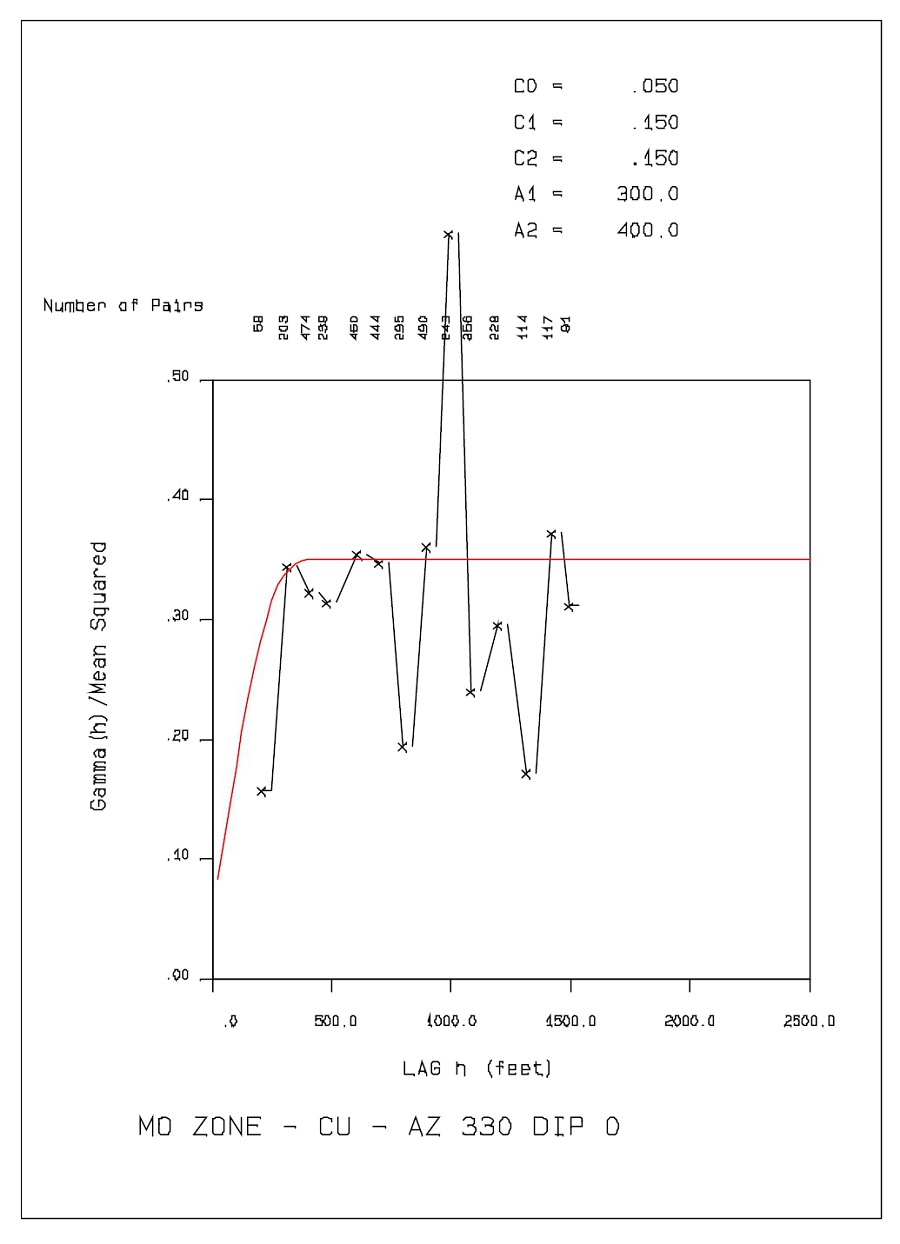

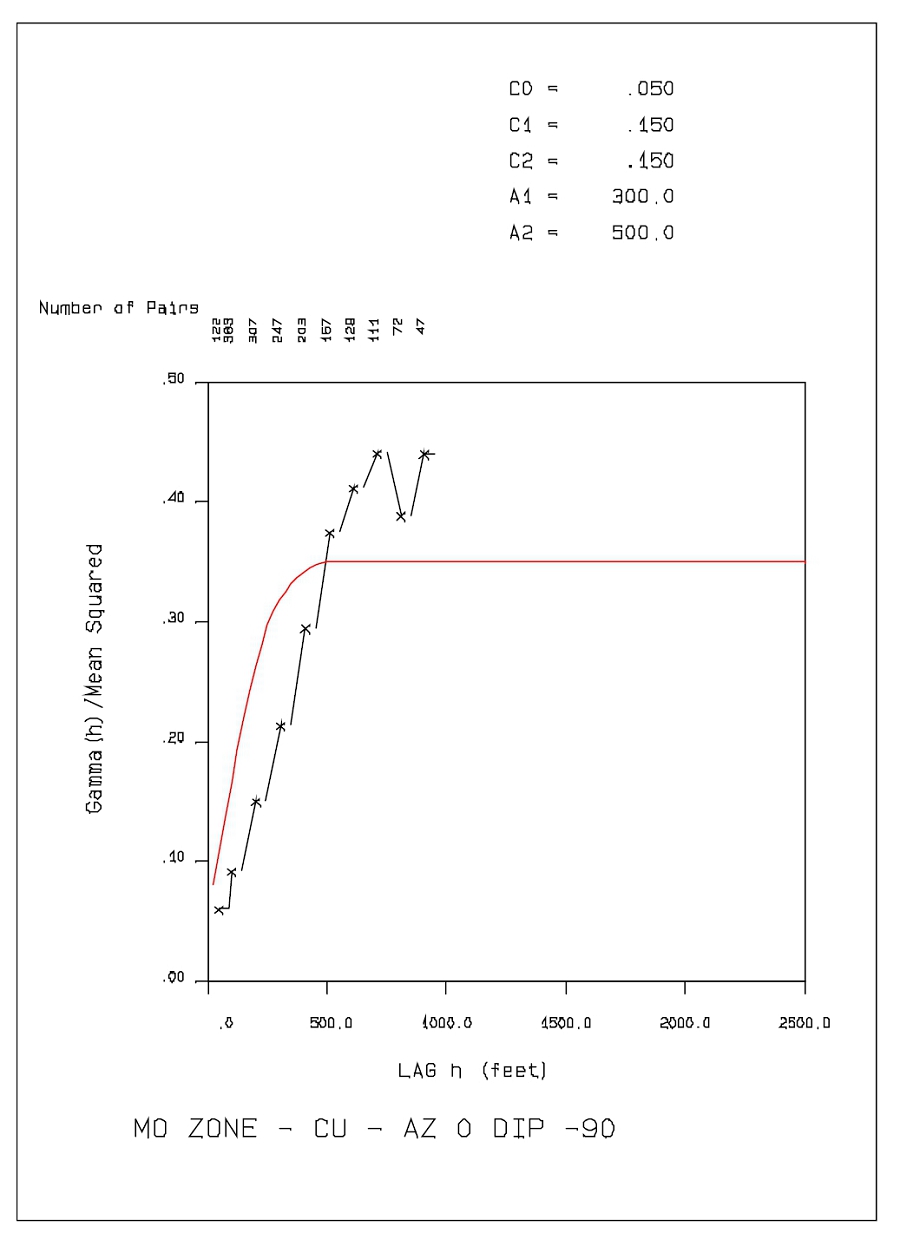

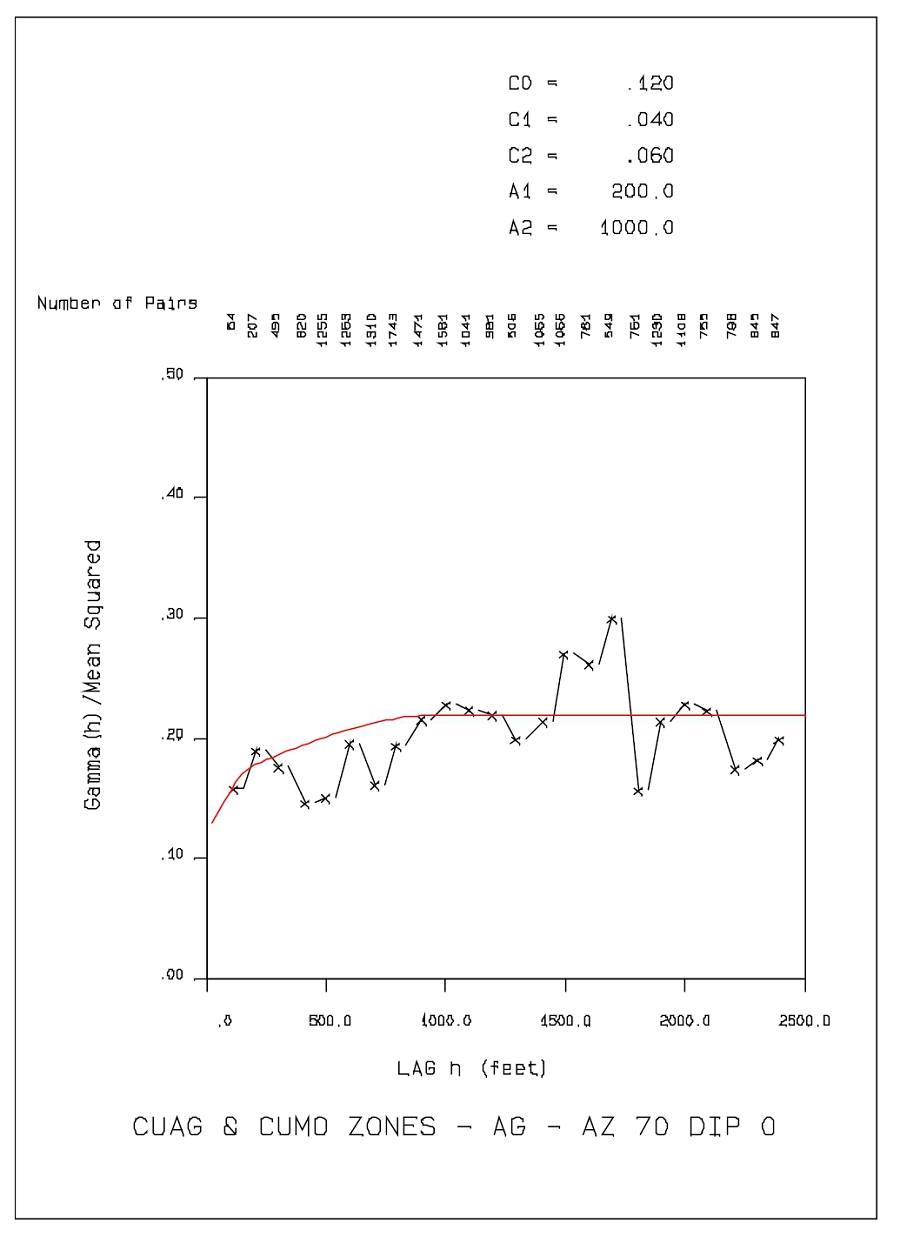

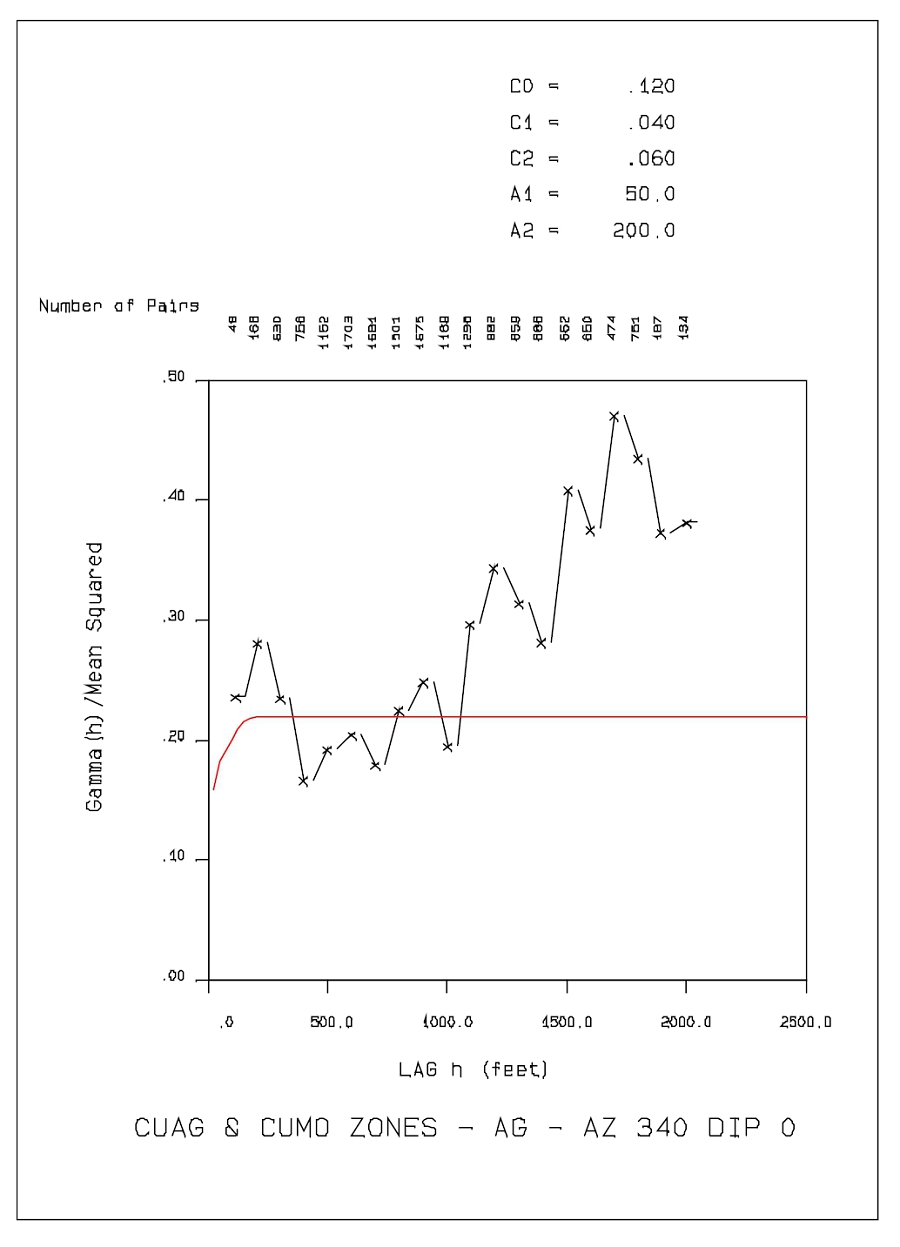

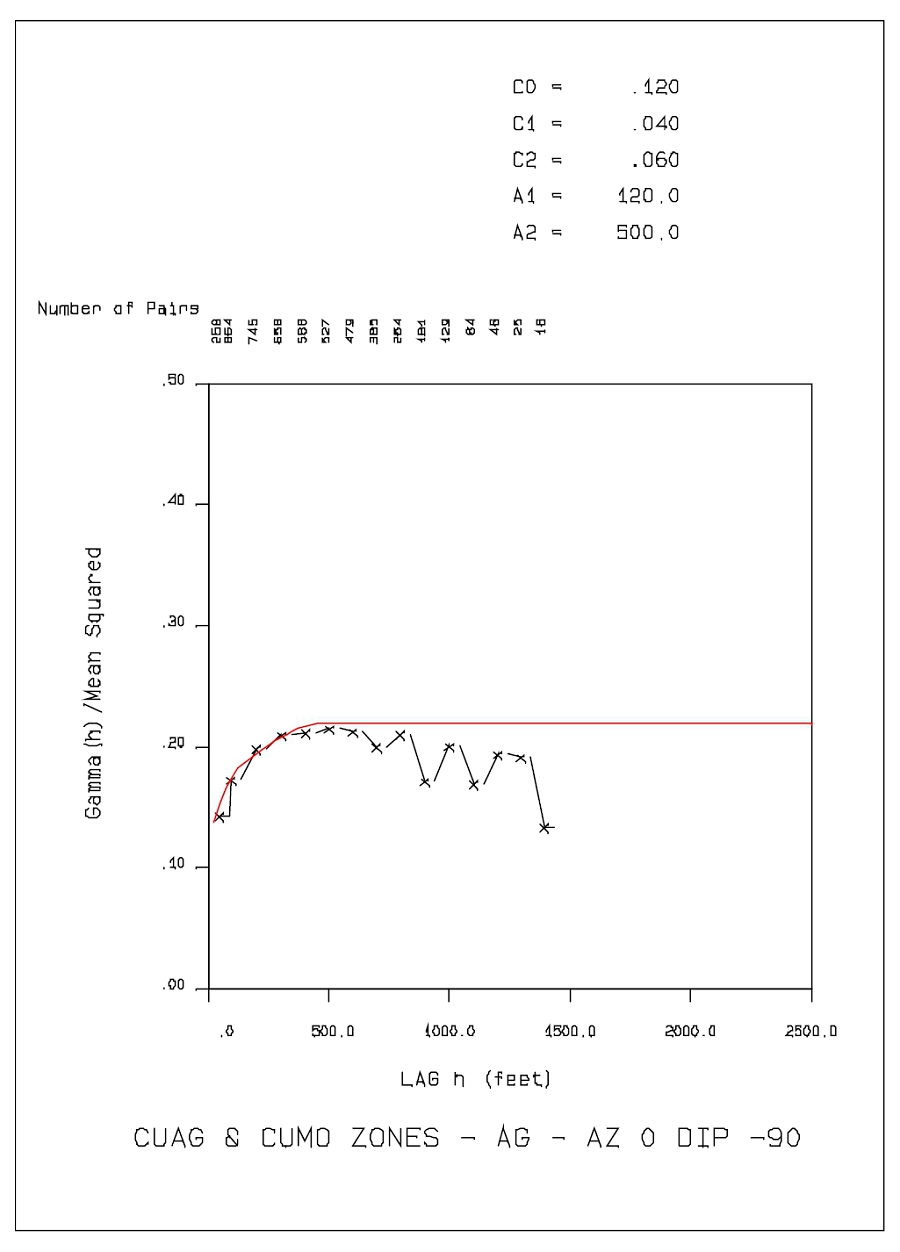

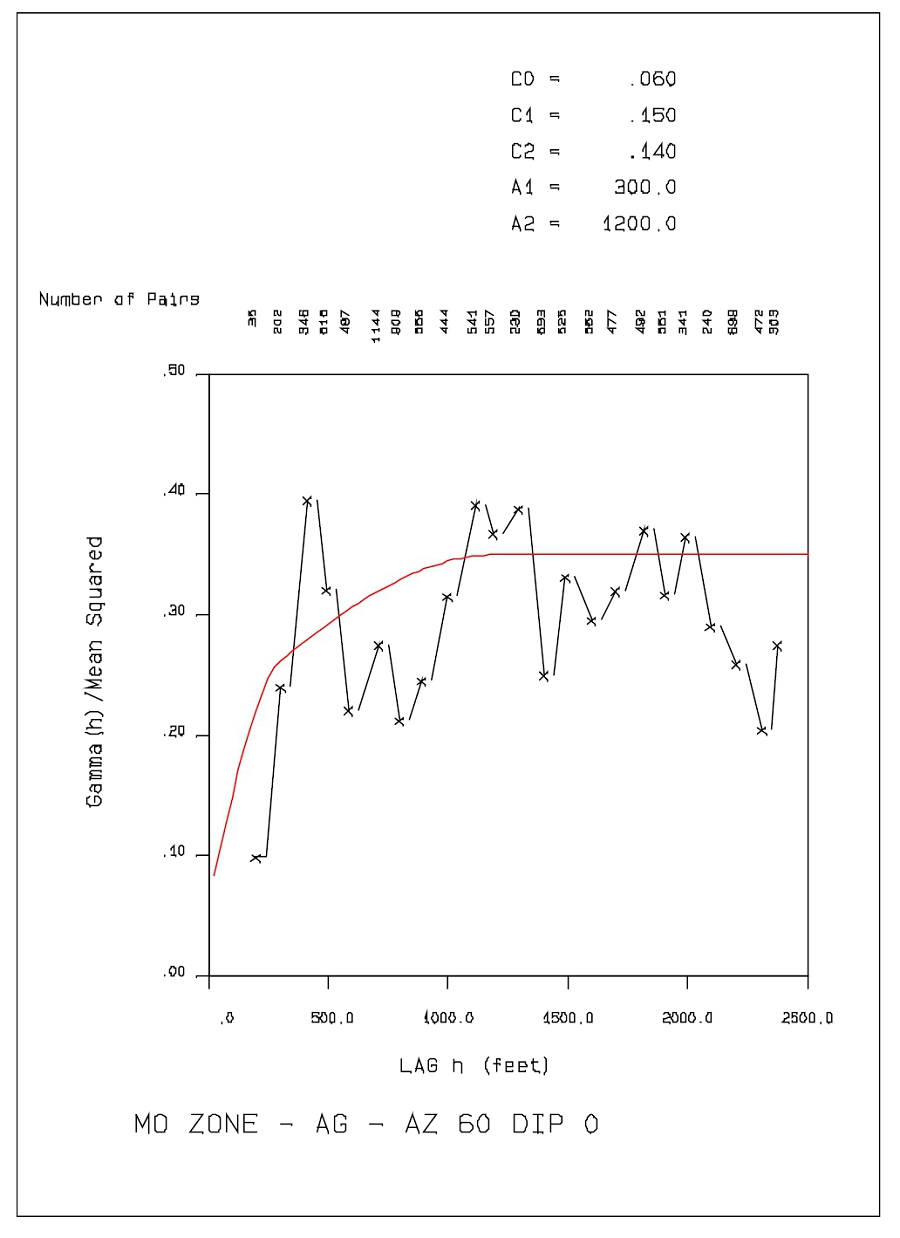

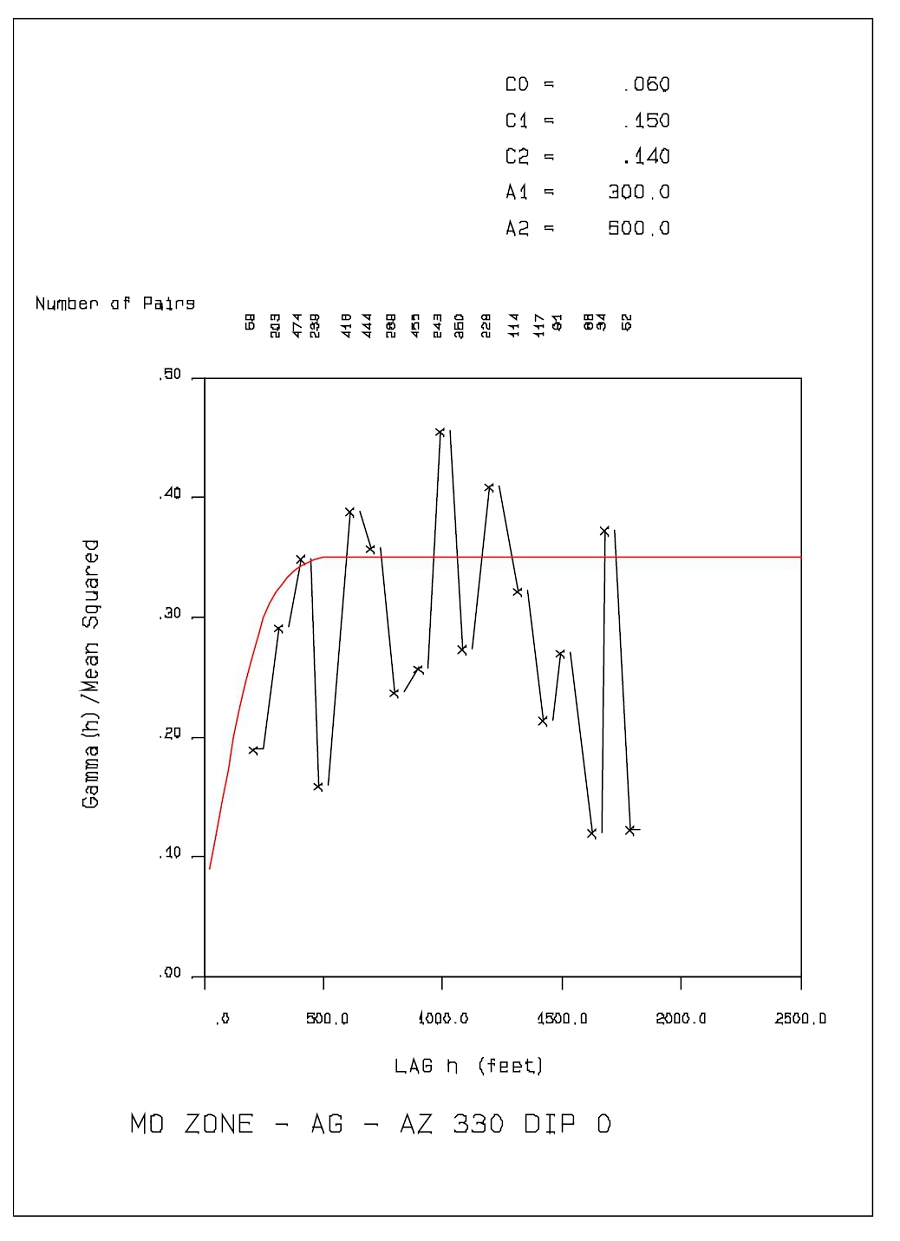

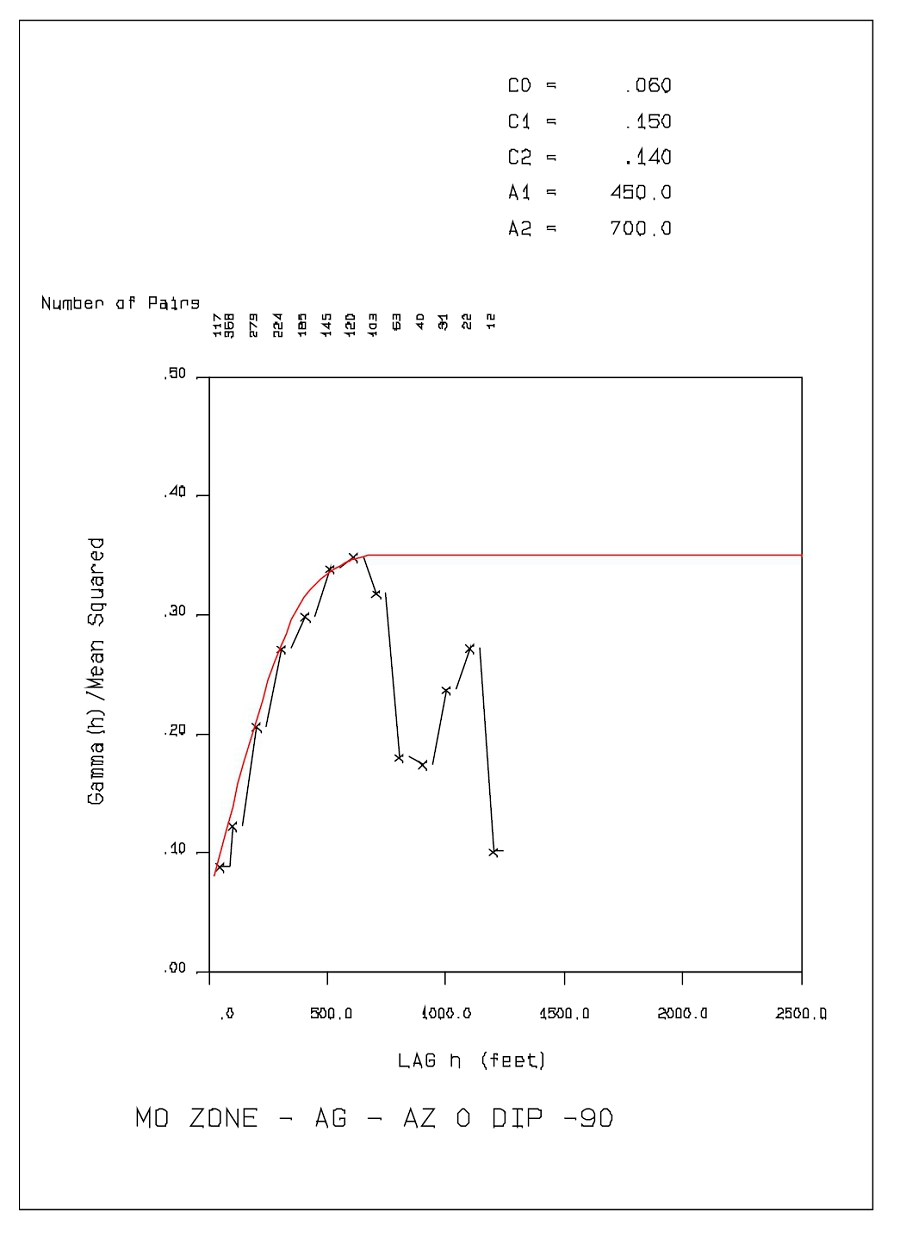

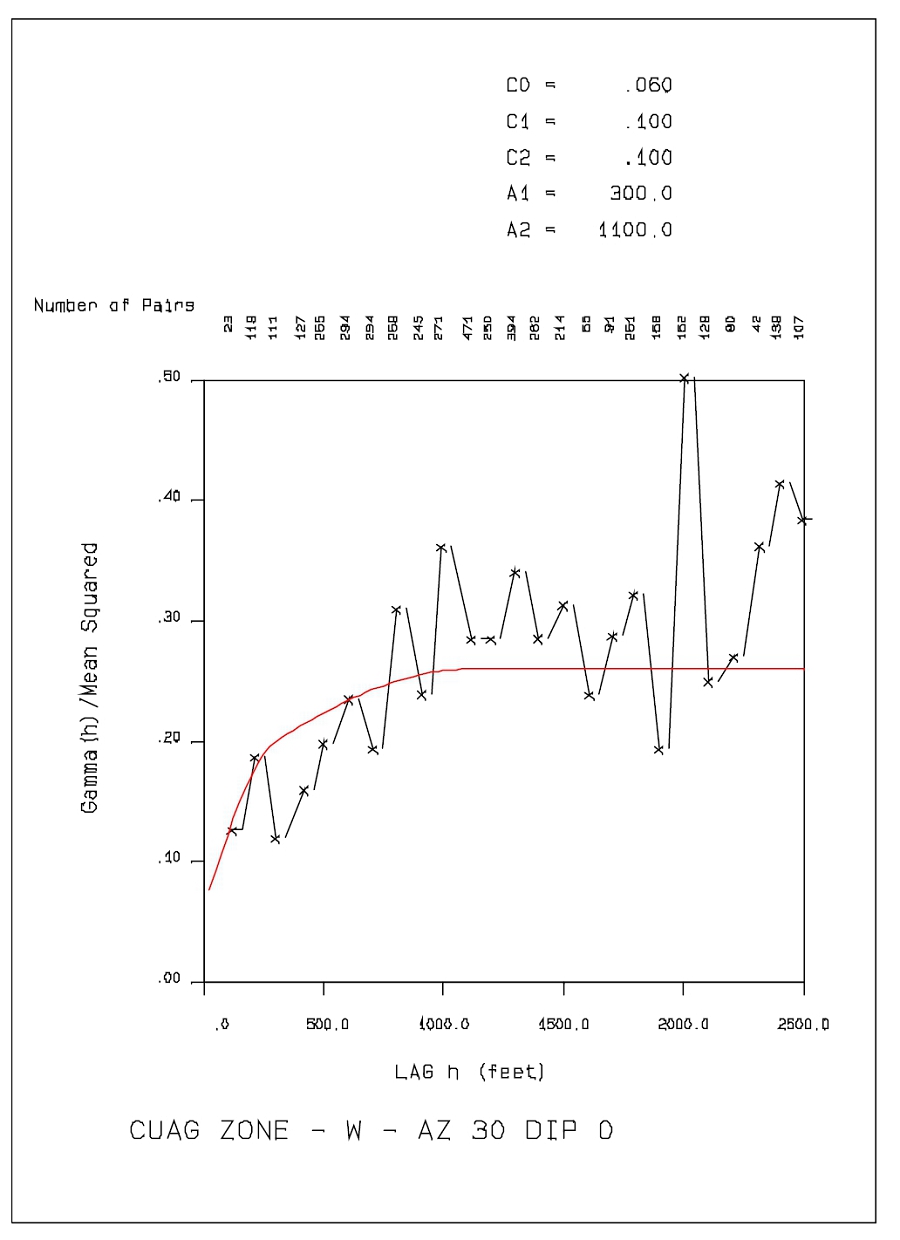

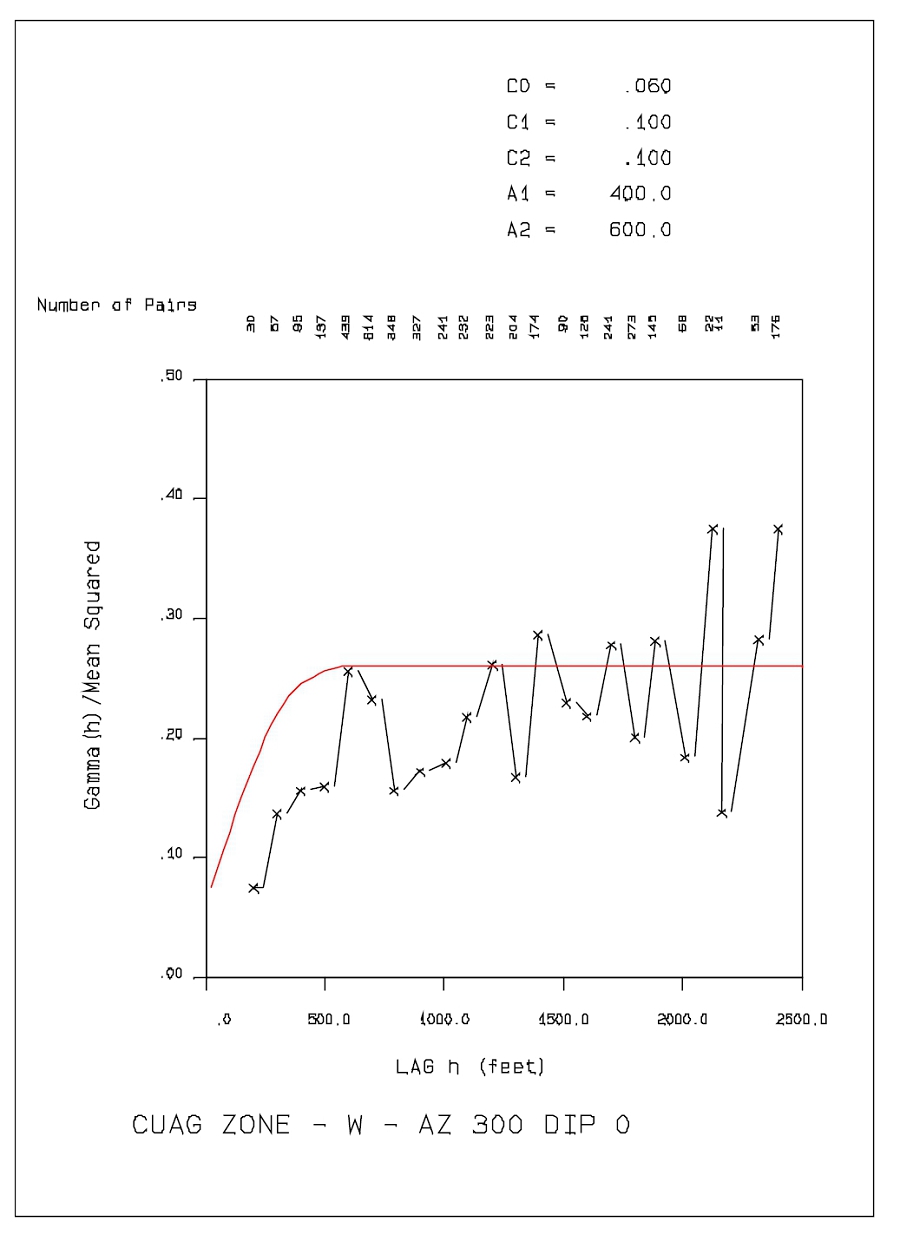

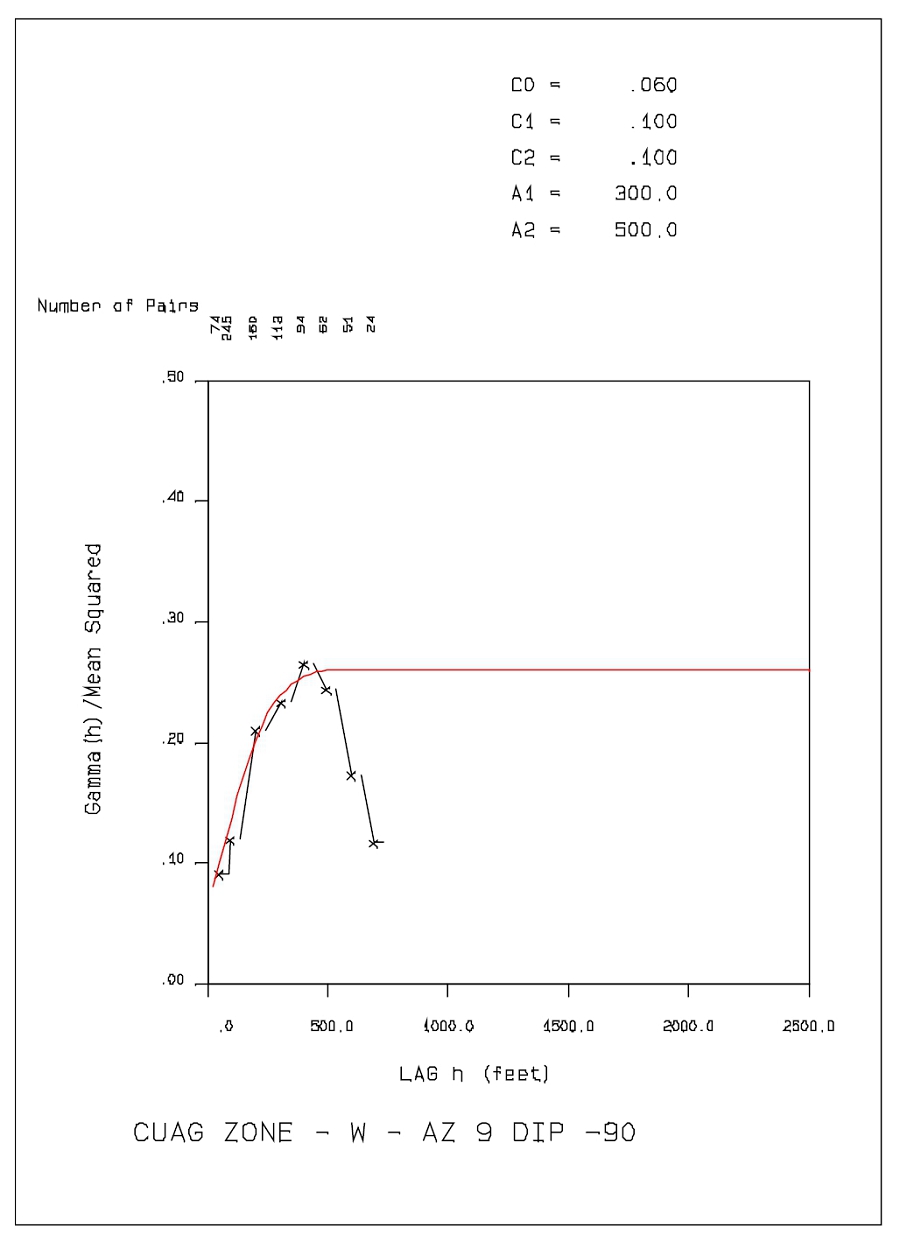

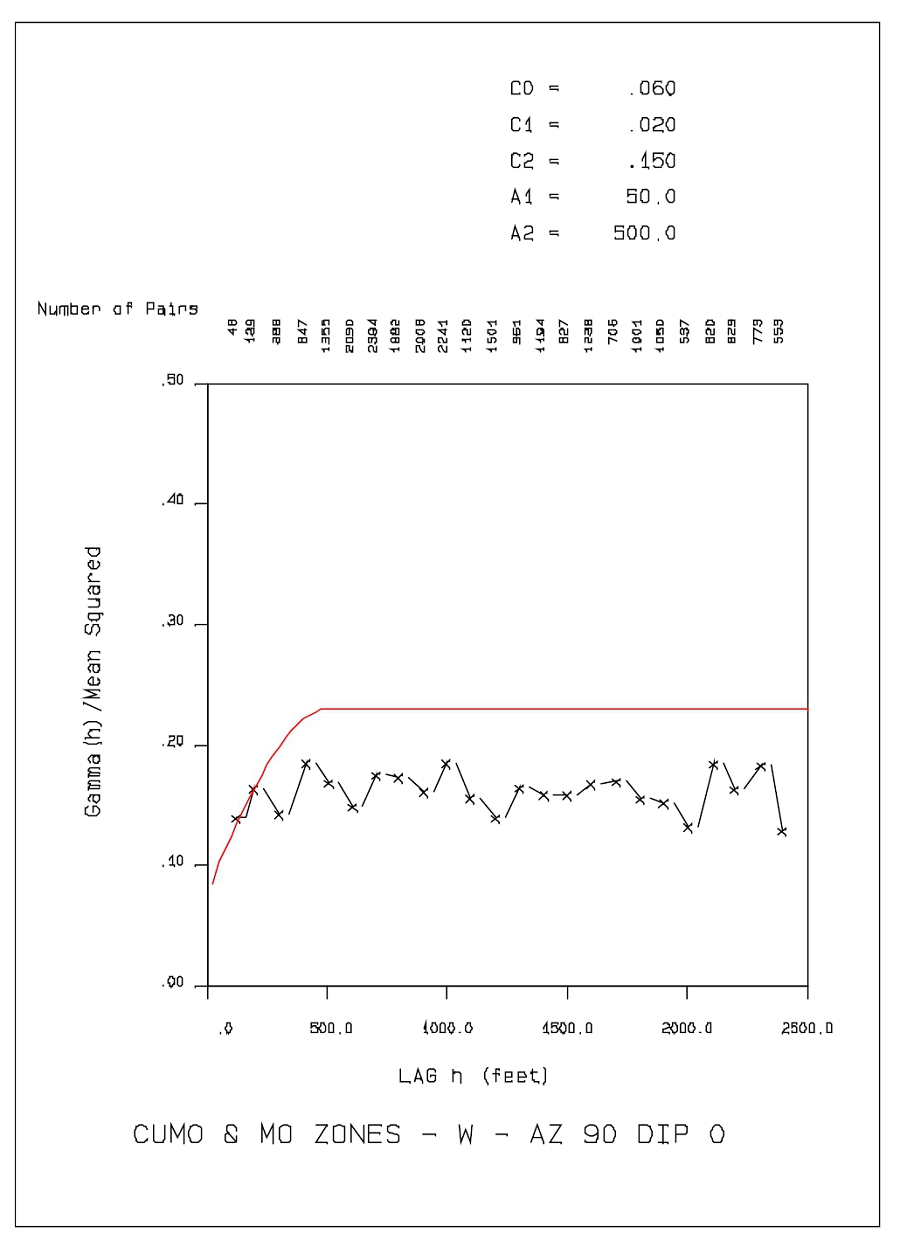

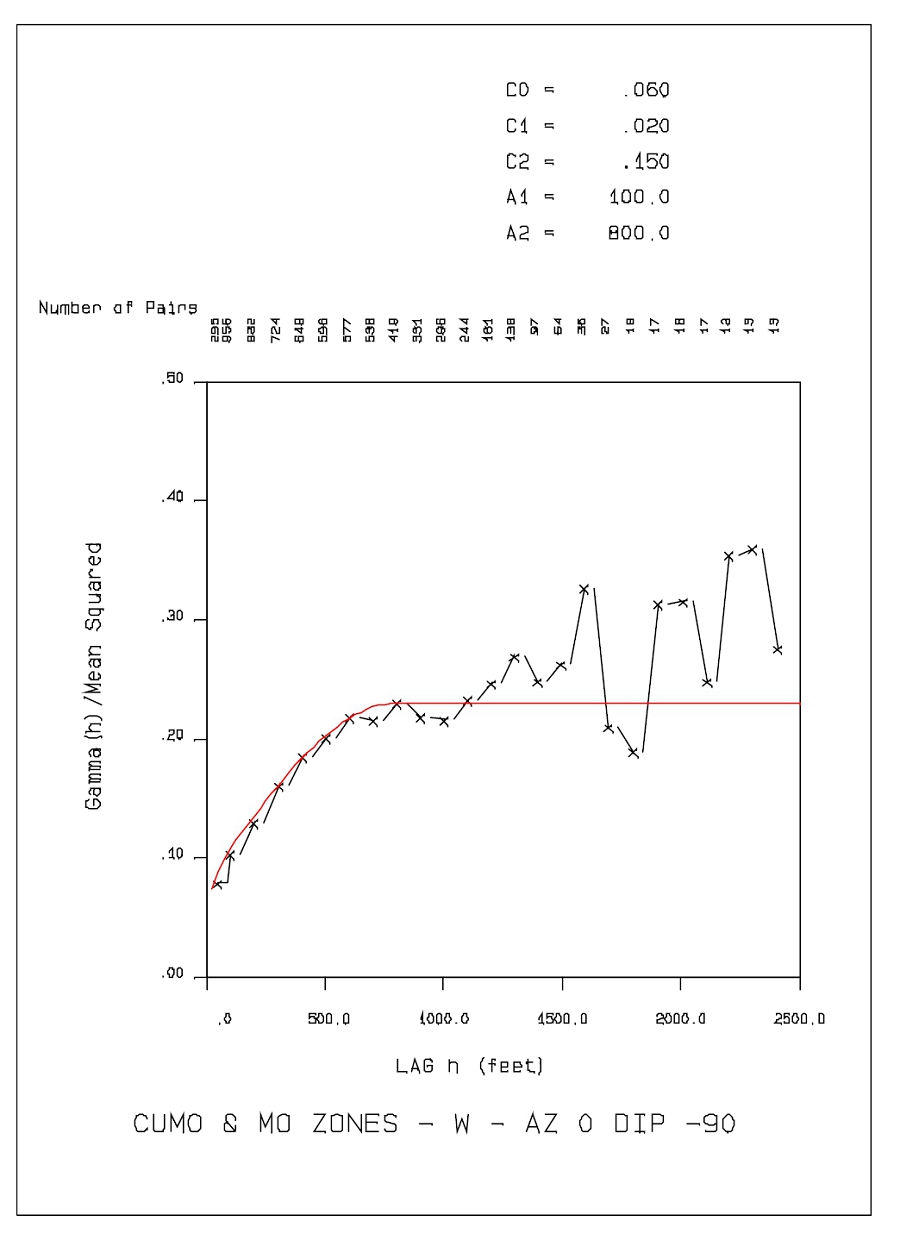

| | 11.4 | Variography | 92 |

| | 11.5 | Block Model and Grade Estimation | 93 |

| | 11.6 | Bulk Density | 96 |

| | 11.7 | Reasonable Prospects of Eventual Economic Extraction | 96 |

| | 11.8 | Resource Classification | 97 |

| | 11.9 | Recovered Value | 99 |

| | 11.10 | Mineral Resource Estimate | 101 |

| 12 | Mineral Reserve Estimates | 102 |

| 13 | Mining Methods | 103 |

| | 13.1 | Mining Approach | 103 |

| | 13.2 | Pit Optimization | 103 |

| | | | |

| | | 13.2.1 | Pit Geotechnical Considerations | 103 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page v |

| | | 13.2.2 | Bulk Sorting | 107 |

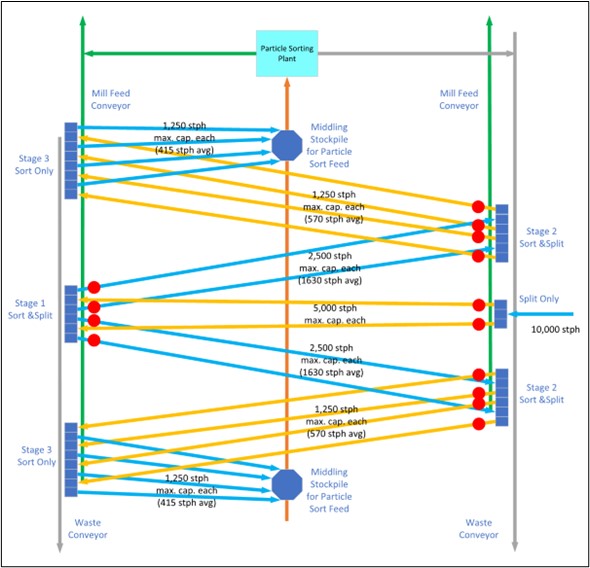

| | | 13.2.3 | Particle Sorting | 109 |

| | | 13.2.4 | Pit Optimization Input Parameters | 110 |

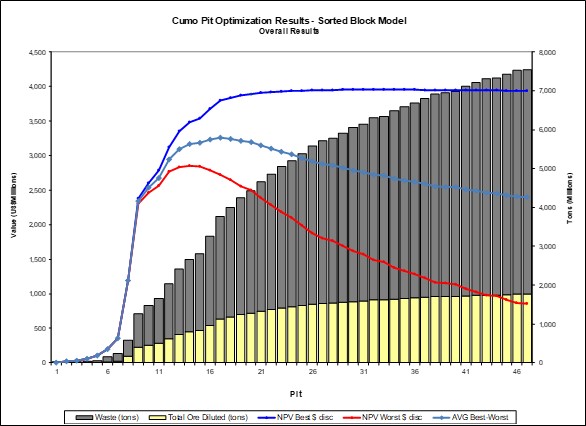

| | | 13.2.5 | Optimization Results | 111 |

| | | 13.2.6 | Pit Shell Selection | 113 |

| | 13.3 | Waste Rock Facilities and Stockpile Design | 115 |

| | | 13.3.1 | Charlotte’s Gulch Waste Rock Facility | 117 |

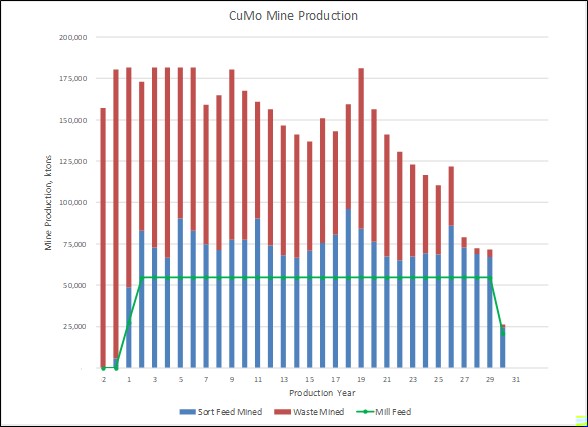

| | 13.4 | Production Schedule | 117 |

| | 13.5 | Equipment Selection and Fleet Requirements | 118 |

| 14 | Recovery Methods | 119 |

| | 14.1 | General | 119 |

| | 14.2 | Bulk Sorting | 119 |

| | 14.3 | Particle Sorting | 121 |

| | 14.4 | Mill Design Criteria Summary | 121 |

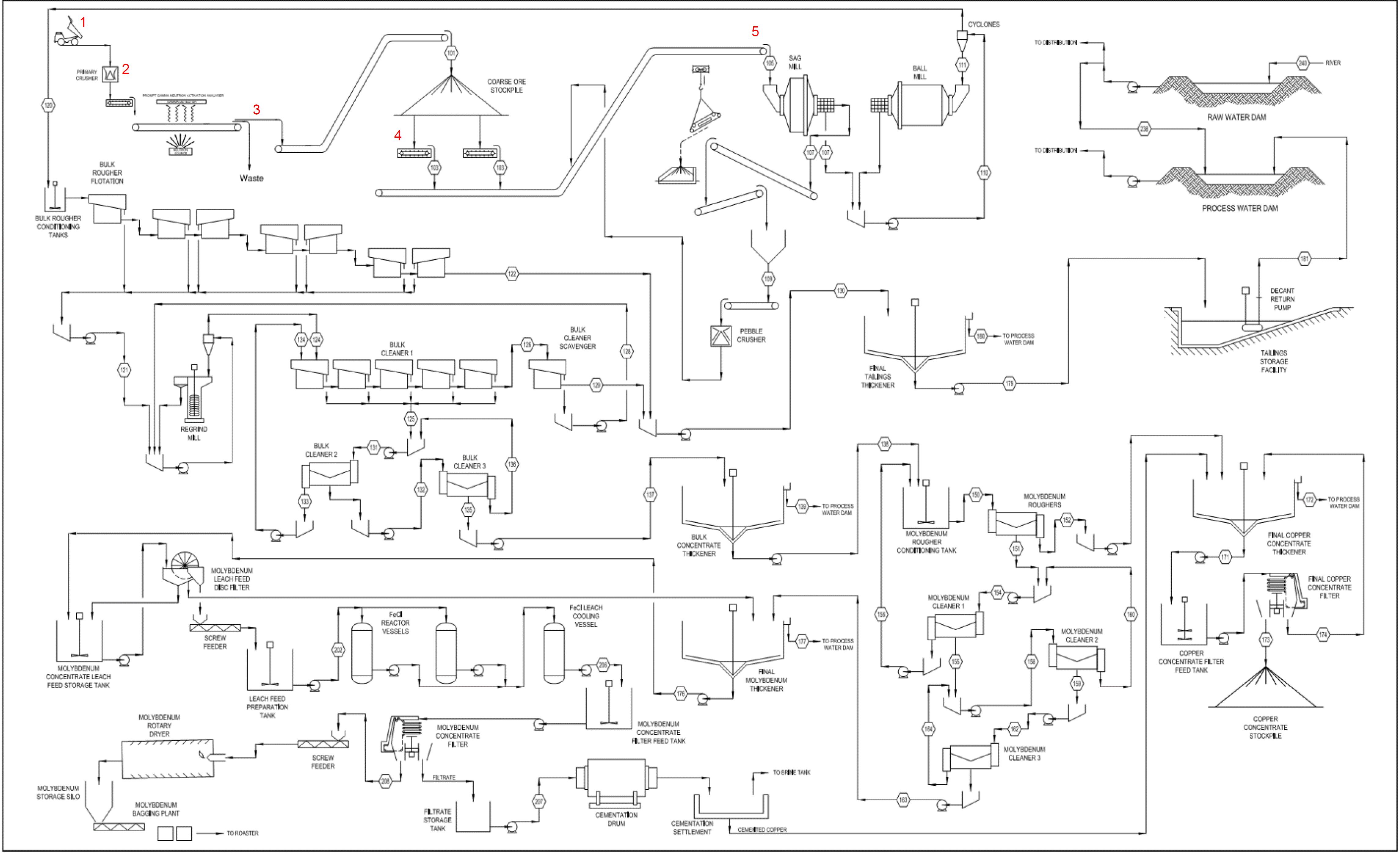

| | 14.5 | Plant Design Basis | 124 |

| | 14.6 | Throughput/Mill Feed and Availability | 124 |

| | 14.7 | Processing Strategy | 124 |

| | 14.8 | Flow Sheet Development and Equipment Sizing | 124 |

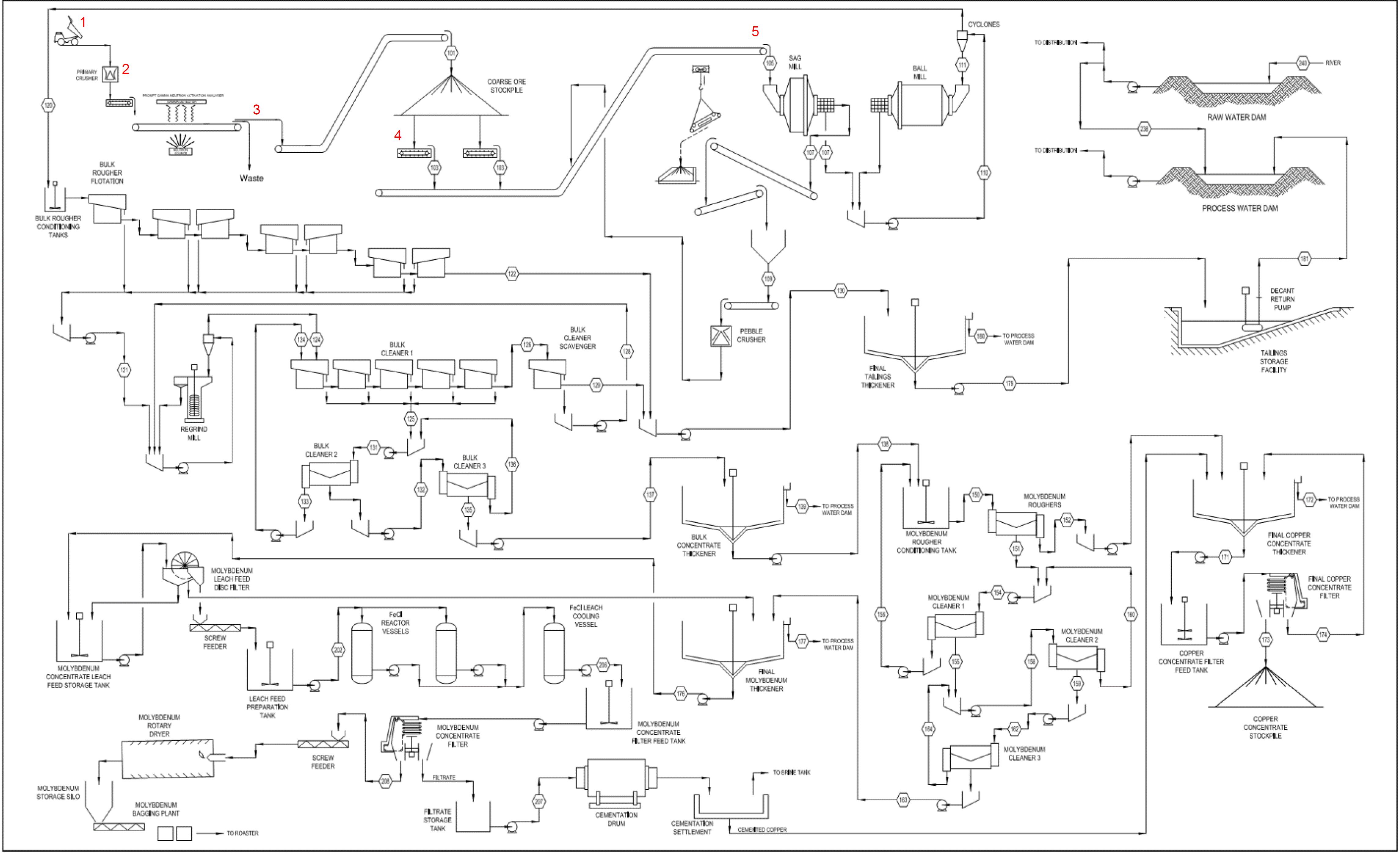

| | 14.9 | Unit Process Selection | 126 |

| 15 | Project Infrastructure | 128 |

| | 15.1 | General Layout | 128 |

| | 15.2 | Road Access | 128 |

| | 15.3 | Rail Access | 128 |

| | 15.4 | Electrical Power | 129 |

| | 15.5 | Water Supply | 129 |

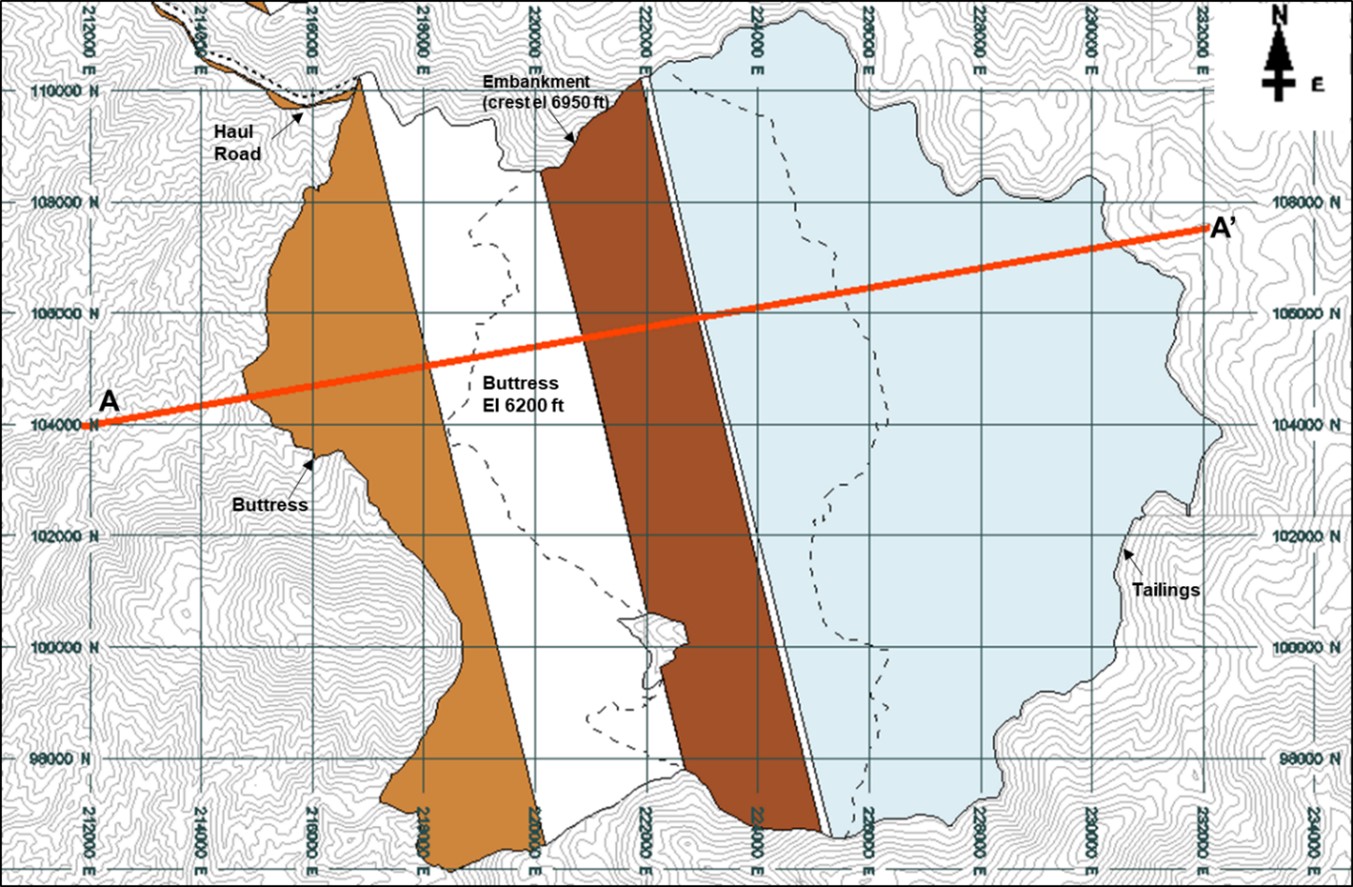

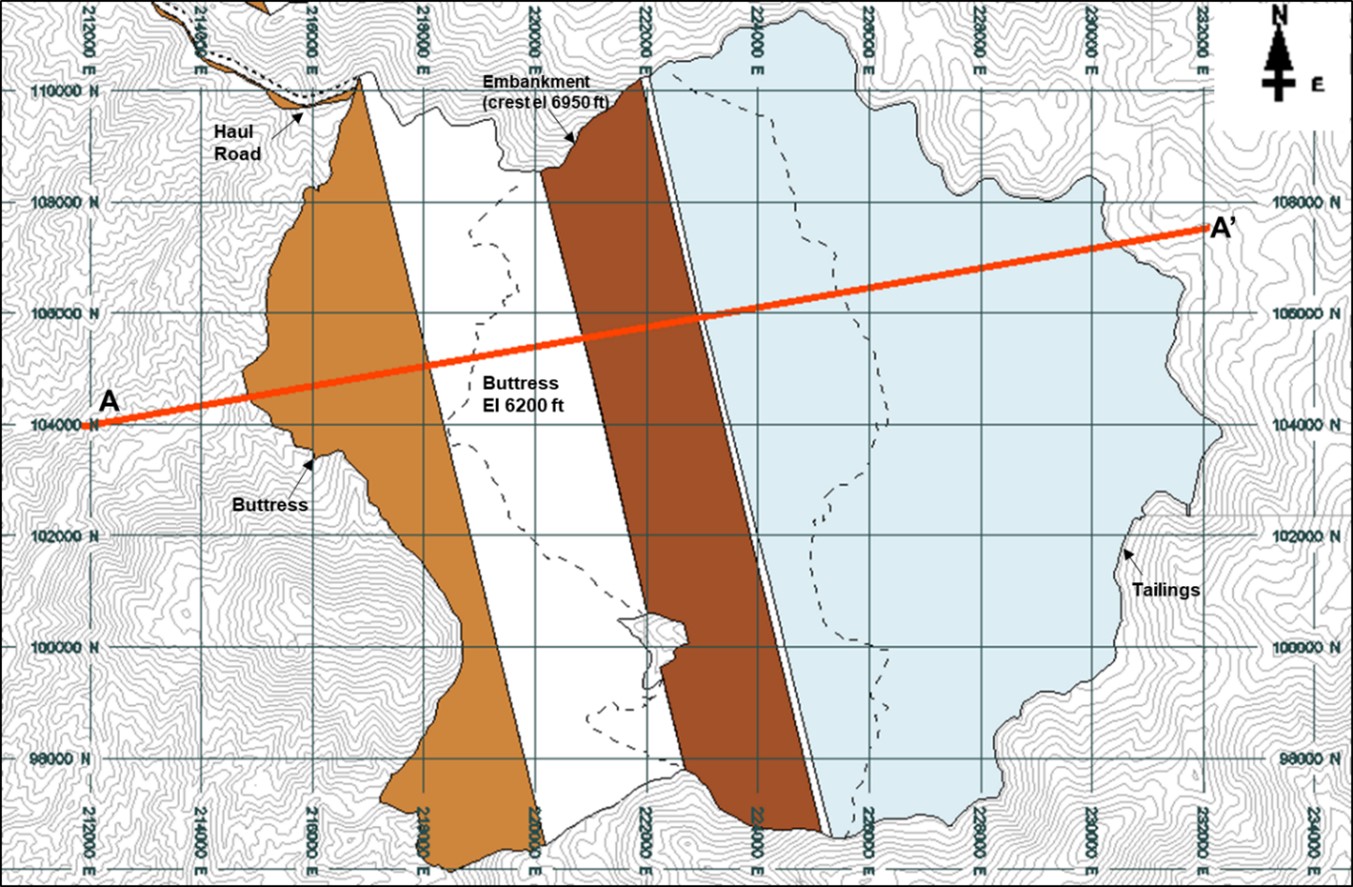

| | 15.6 | Tailings Storage Facility | 129 |

| | | 15.6.1 | Tailings Embankment | 130 |

| | | 15.6.2 | Tailings Impoundment | 130 |

| 16 | Market Studies and Contracts | 131 |

| | 16.1 | Market Analysis | 131 |

| | | 16.1.1 | Treatment and refining costs | 131 |

| | | 16.1.2 | Metal Prices | 131 |

| 17 | Environmental Studies, Permitting, and Social or Community Impact | 132 |

| | 17.1 | Environmental and Permitting | 132 |

| | | 17.1.1 | Past and Present Permitting for Exploration Project | 132 |

| | 17.2 | Permitting for Mining Operations | 134 |

| | | 17.2.1 | Federal Authorizations and Permits | 134 |

| | | 17.2.2 | Idaho State Authorizations and Permits | 137 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page vi |

| | | 17.2.3 | Boise County Permits | 137 |

| | 17.3 | Monitoring | 137 |

| | 17.4 | Reclamation | 138 |

| | | 17.4.1 | Federal Reclamation Performance Bond | 138 |

| | | 17.4.2 | State Reclamation Performance Bond | 138 |

| | 17.5 | Social and Community Impact | 139 |

| | 17.6 | Potential Issues | 140 |

| | 17.7 | Mine Closure – General Discussion | 141 |

| 18 | Capital and Operating Costs | 143 |

| | 18.1 | Capital Cost Estimate | 143 |

| | | 18.1.1 | Mining Capital Costs | 144 |

| | | 18.1.2 | Processing Capital Costs | 144 |

| | | 18.1.3 | Tailings Storage Facilities Capital Costs | 147 |

| | | 18.1.4 | Capital Cost Estimate Exclusions | 148 |

| | 18.2 | Operating Cost Estimate | 149 |

| | | 18.2.1 | Mine Operating Costs | 149 |

| | | 18.2.2 | Sort Plant Operating Costs | 150 |

| | | 18.2.3 | Mill Operating Costs | 150 |

| | | 18.2.4 | General Site and Administrative Costs | 151 |

| 19 | Economic Analysis | 152 |

| | 19.1 | Cautionary Statements | 152 |

| | | 19.1.1 | Certainty of Preliminary Economic Assessment | 152 |

| | | 19.1.2 | Mineral Resources are Not Reserves | 152 |

| | 19.2 | General | 152 |

| | 19.3 | Summary | 152 |

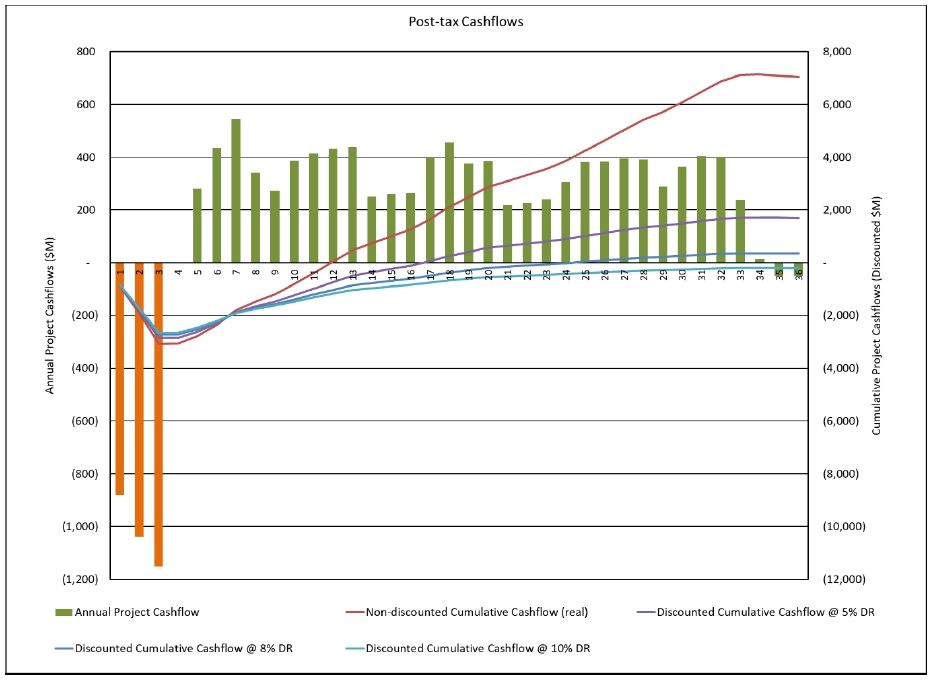

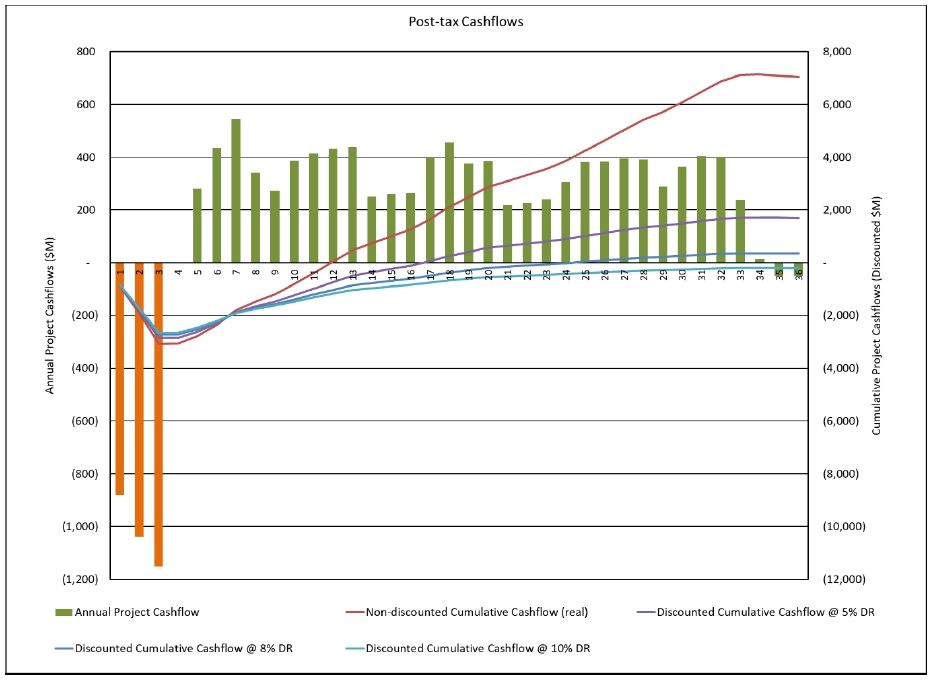

| | 19.4 | Project Cashflows | 155 |

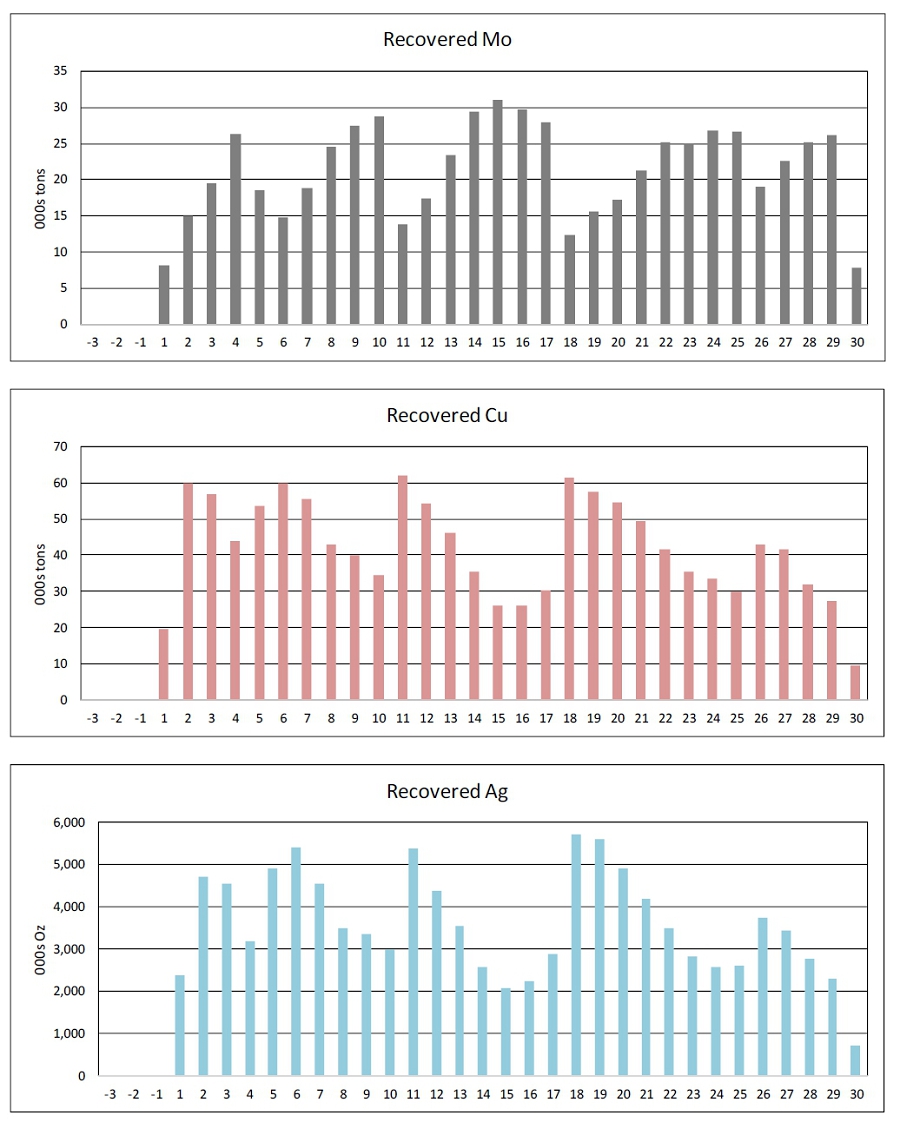

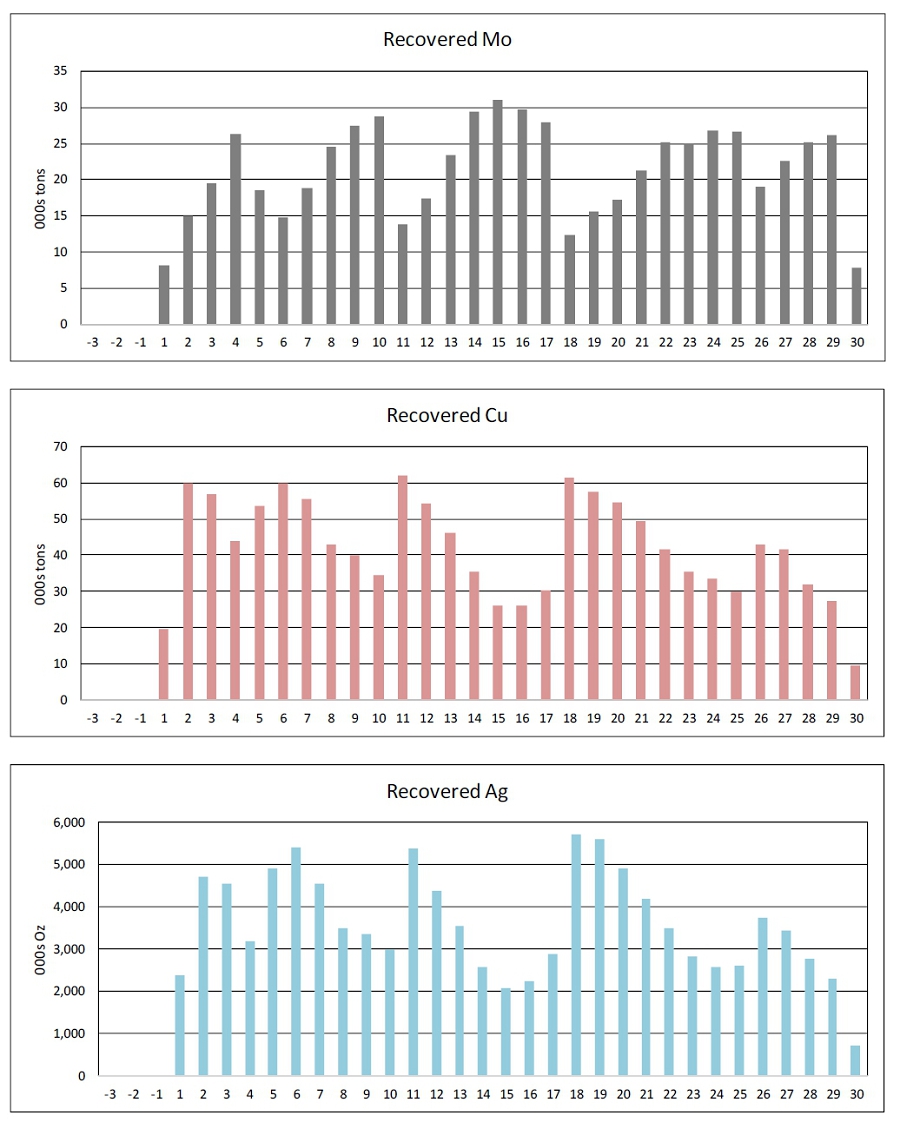

| | 19.5 | Production Schedule | 155 |

| | 19.6 | Pricing Assumptions | 160 |

| | 19.7 | Processing Recovery Assumptions | 160 |

| | 19.8 | Capital Costs | 160 |

| | 19.9 | Operating Costs | 162 |

| | 19.10 | Royalties | 162 |

| | 19.11 | Taxation | 162 |

| | 19.12 | Off-Site Costs | 162 |

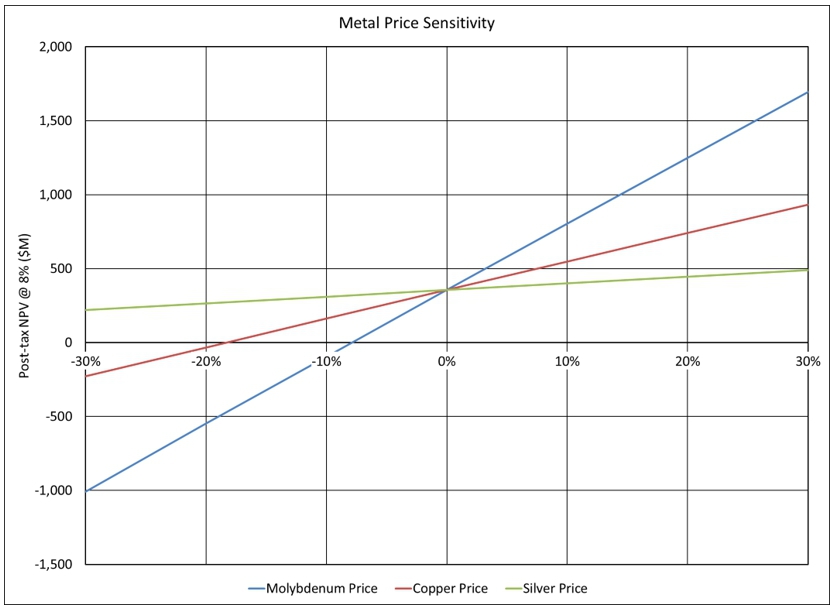

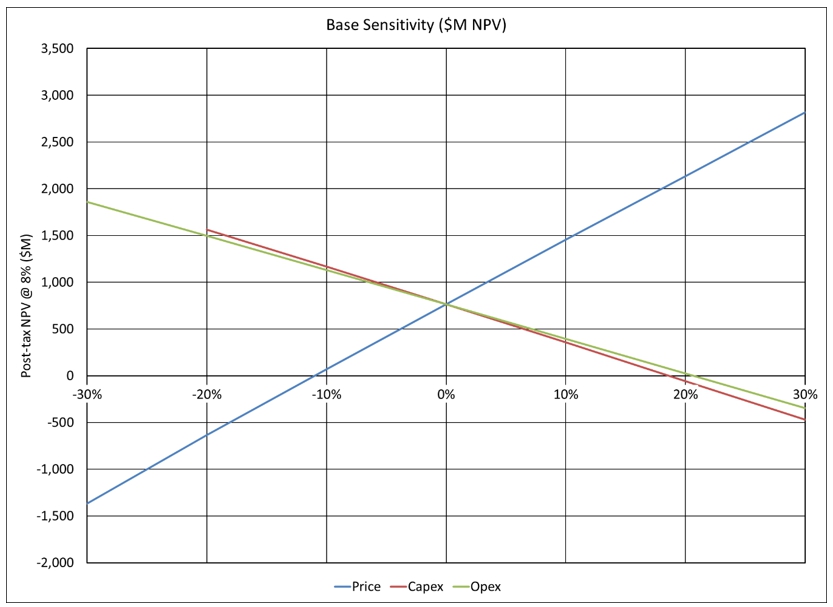

| | 19.13 | Sensitivity Analysis | 163 |

| 20 | Adjacent Properties | 165 |

| 21 | Other Relevant Data and Information | 165 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page vii |

| 22 | Interpretations and Conclusions | 165 |

| | 22.1 | Conclusions | 165 |

| | | 22.1.1 | Mineral Resource | 165 |

| | | 22.1.2 | Mining | 165 |

| | | 22.1.3 | Bulk Sorting | 165 |

| | | 22.1.4 | Particle Sorting | 165 |

| | | 22.1.5 | Project Economics | 166 |

| | 22.2 | Project Risks | 166 |

| | | 22.2.1 | Mineral Resource | 166 |

| | | 22.2.2 | Mining | 166 |

| | | 22.2.3 | Mineral Sorting | 166 |

| | | 22.2.4 | Processing | 166 |

| | | 22.2.5 | Project Infrastructure | 167 |

| | | 22.2.6 | Permitting | 167 |

| | | 22.2.7 | Economic Risks | 167 |

| | 22.3 | Project Opportunities | 168 |

| | | 22.3.1 | Mineral Resource | 168 |

| | | 22.3.2 | Mining | 168 |

| | | 22.3.3 | Mineral Sorting | 169 |

| | | 22.3.4 | Processing | 169 |

| | | 22.3.5 | Project Infrastructure | 169 |

| | | 22.3.6 | Economic Opportunities | 169 |

| 23 | Recommendations | 171 |

| | 23.1 | Mineral Resources | 171 |

| | 23.2 | Pit Geotechnical | 171 |

| | 23.3 | Mining | 172 |

| | 23.4 | Mineral Sorting | 172 |

| | 23.5 | Processing | 172 |

| | 23.6 | Tailings Management | 173 |

| | 23.7 | Permitting | 173 |

| | 23.8 | Plan and Budget for Additional Work | 173 |

| 24 | References | 175 |

| 25 | Reliance on Other Experts | 177 |

| Appendix 1: Claims List | 178 |

| Appendix 2: Re-Splits of Rejects | 184 |

| Appendix 3: Drill Holes used in Resource Estimate | 187 |

| Appendix 4: Semi-variograms | 189 |

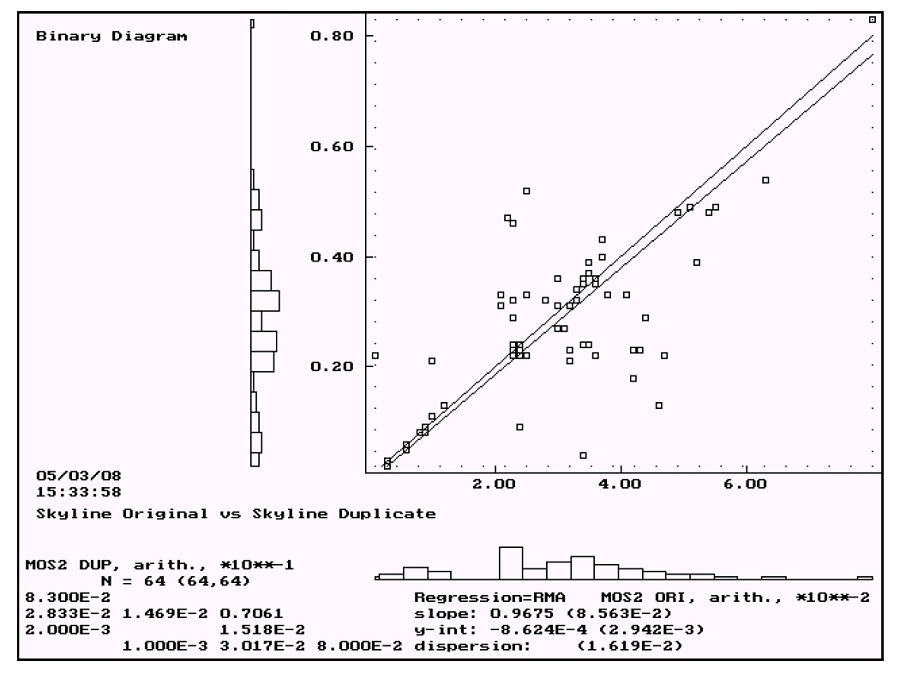

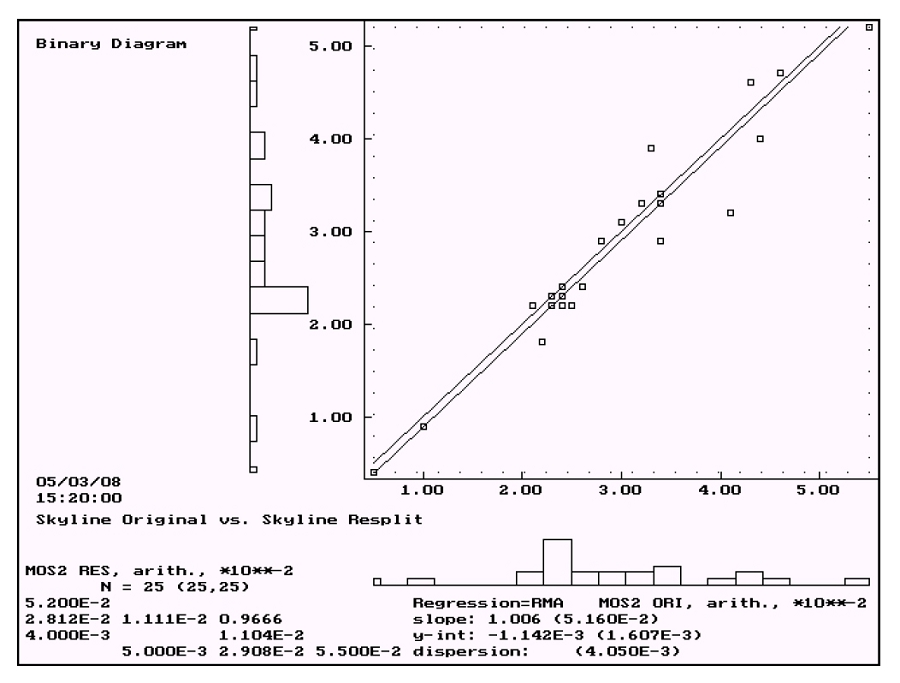

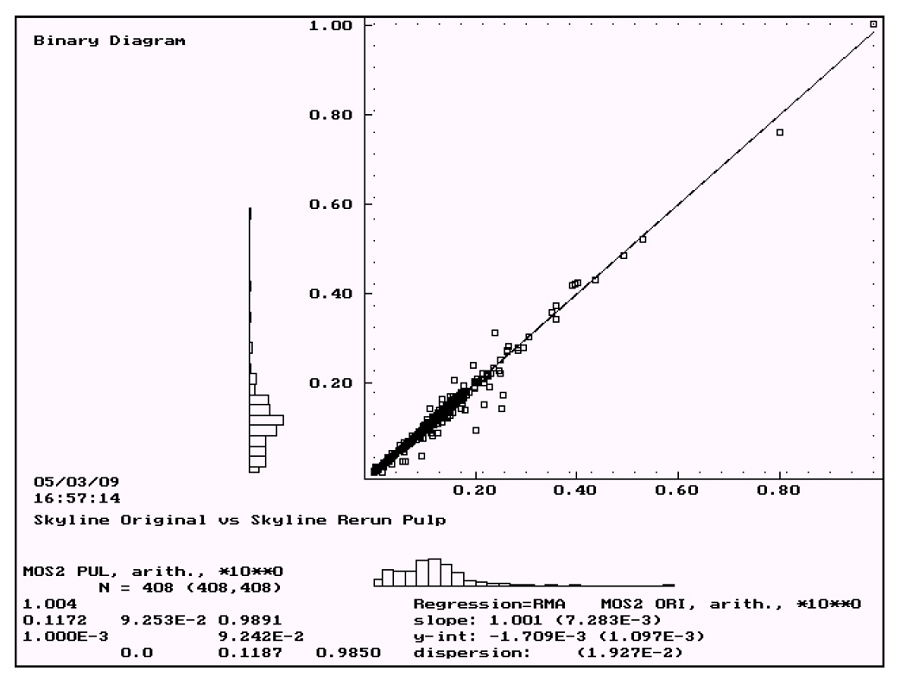

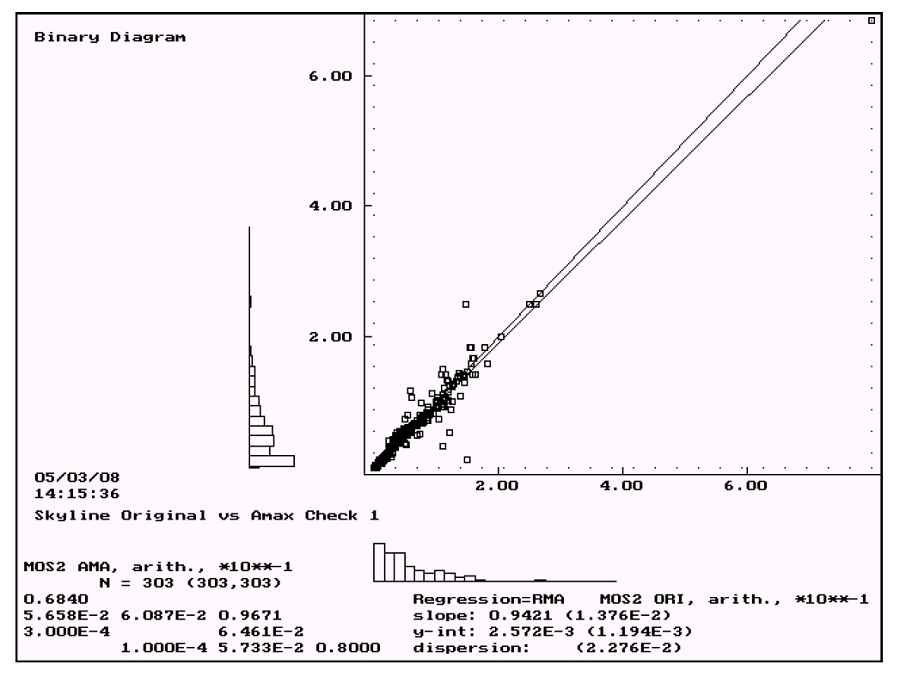

| Appendix 5: Scatter Plots showing Results from Historic Data Verification | 214 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page viii |

List of Figures

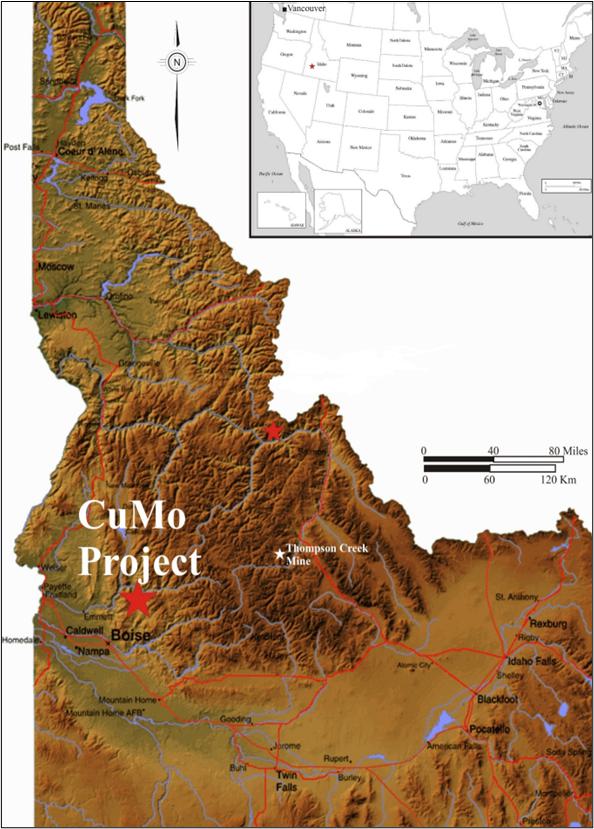

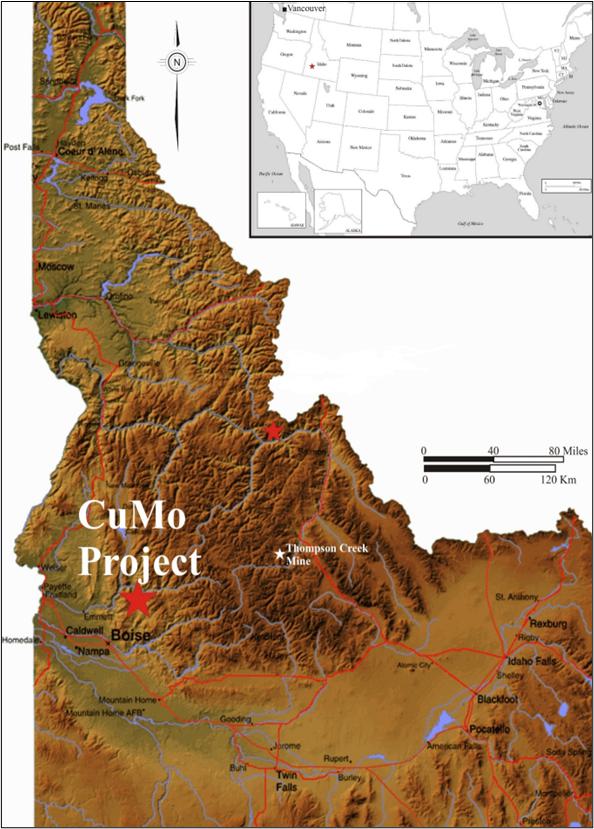

| Figure 4-1: CuMo property location map | 24 |

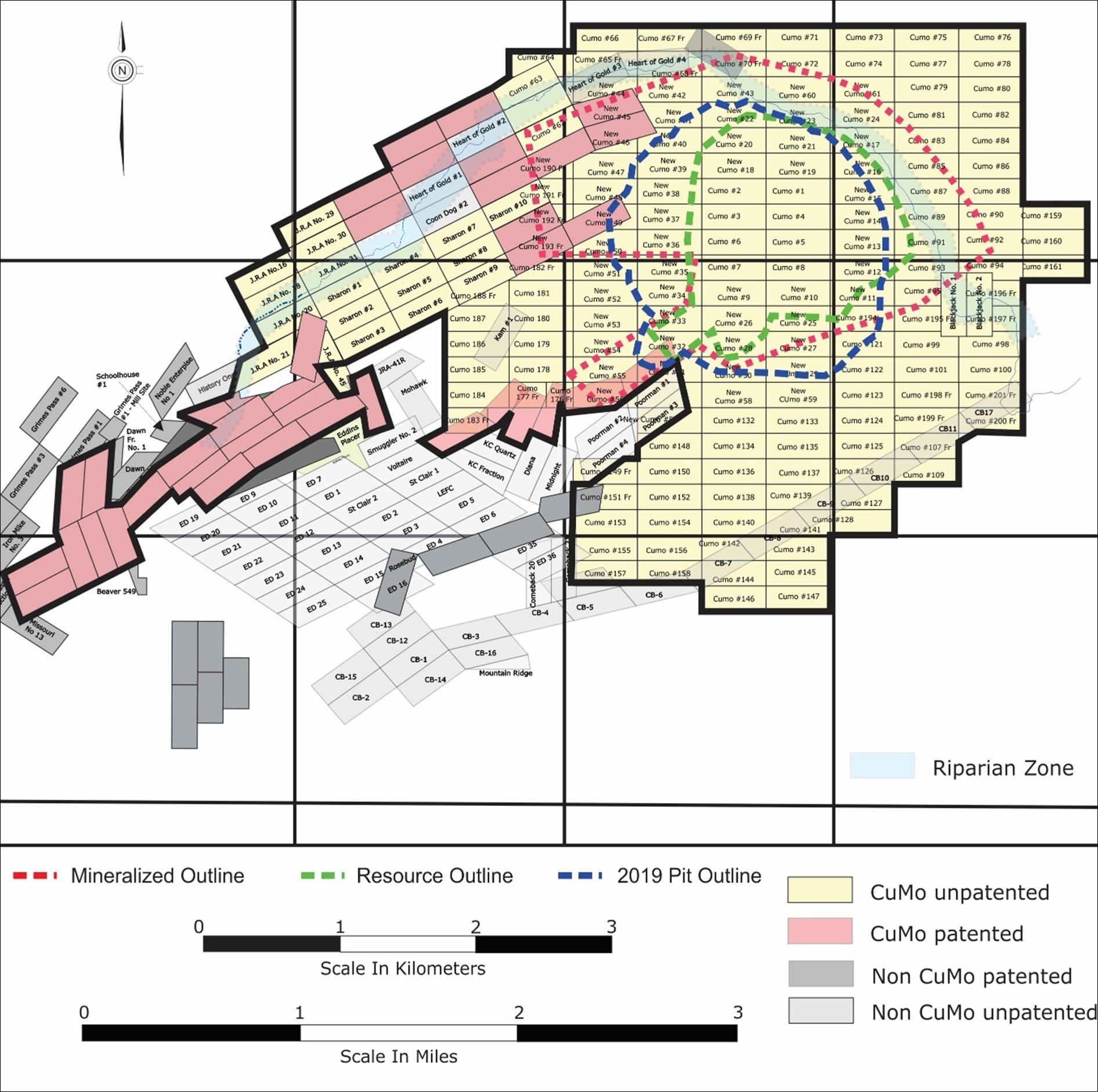

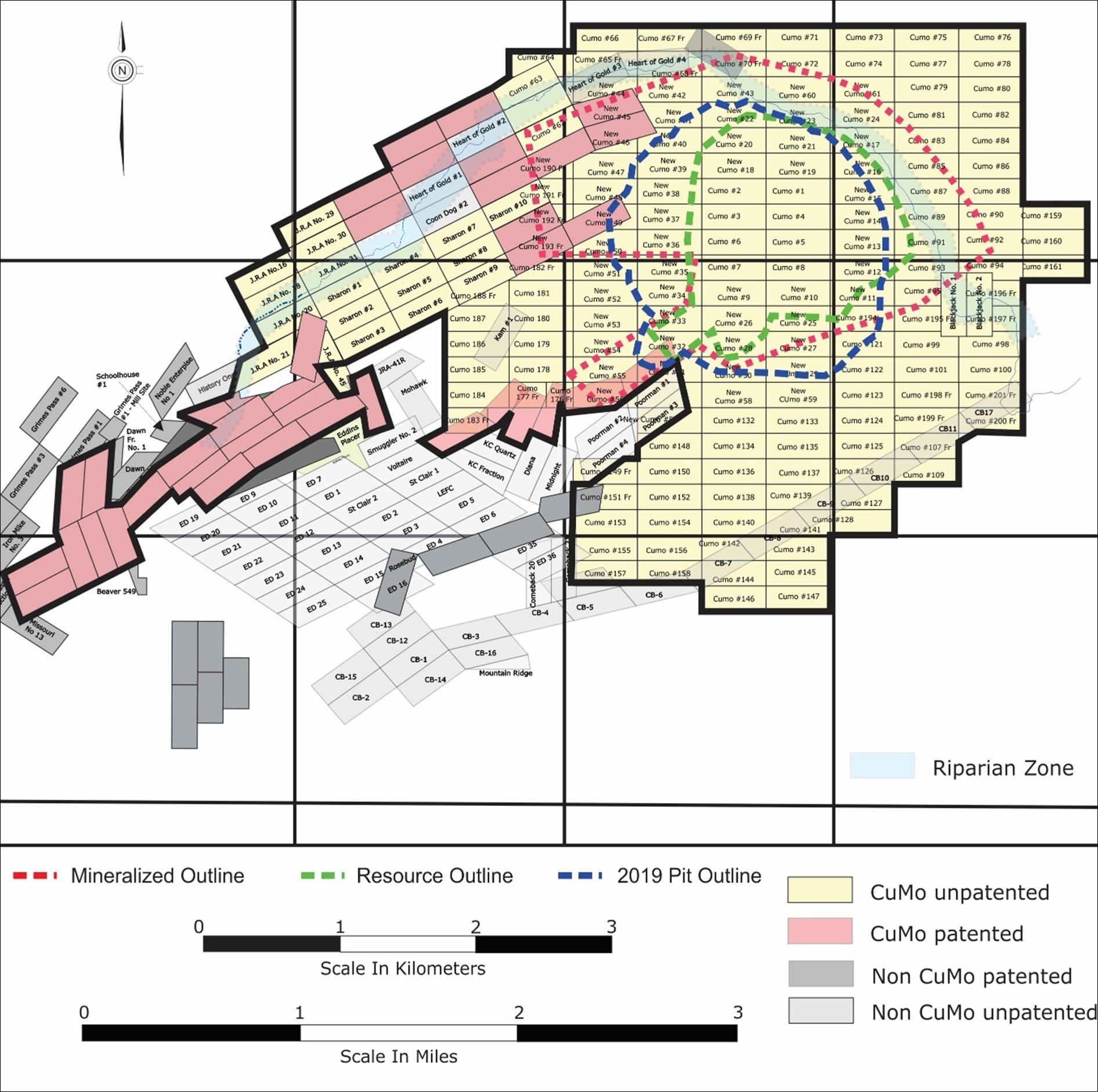

| Figure 4-2: Claim location map for the CuMo property | 25 |

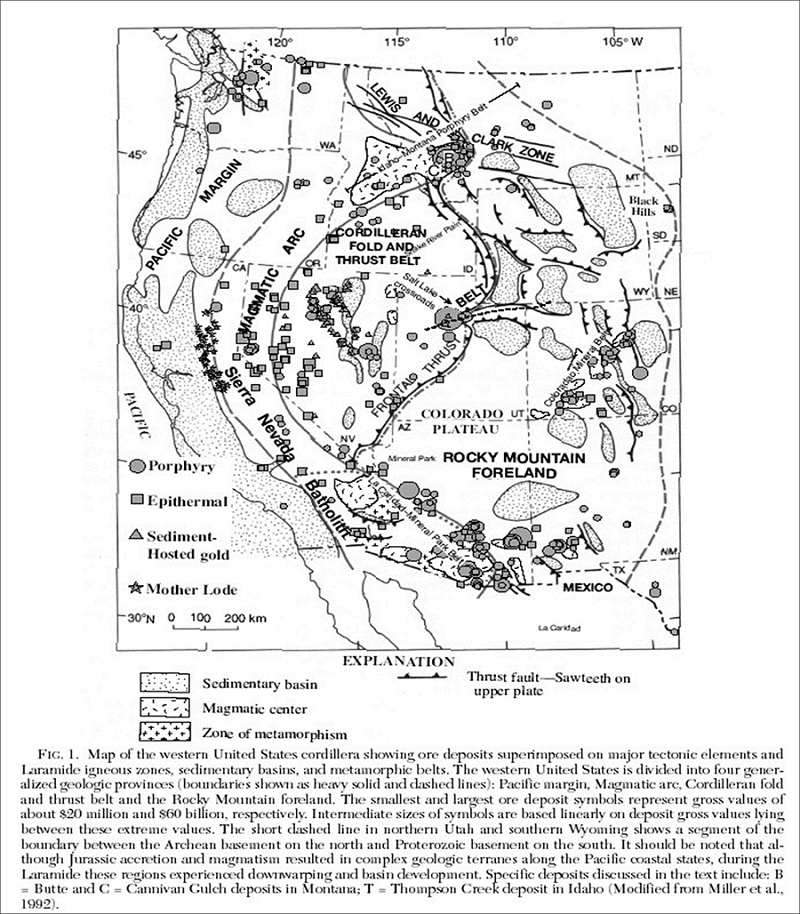

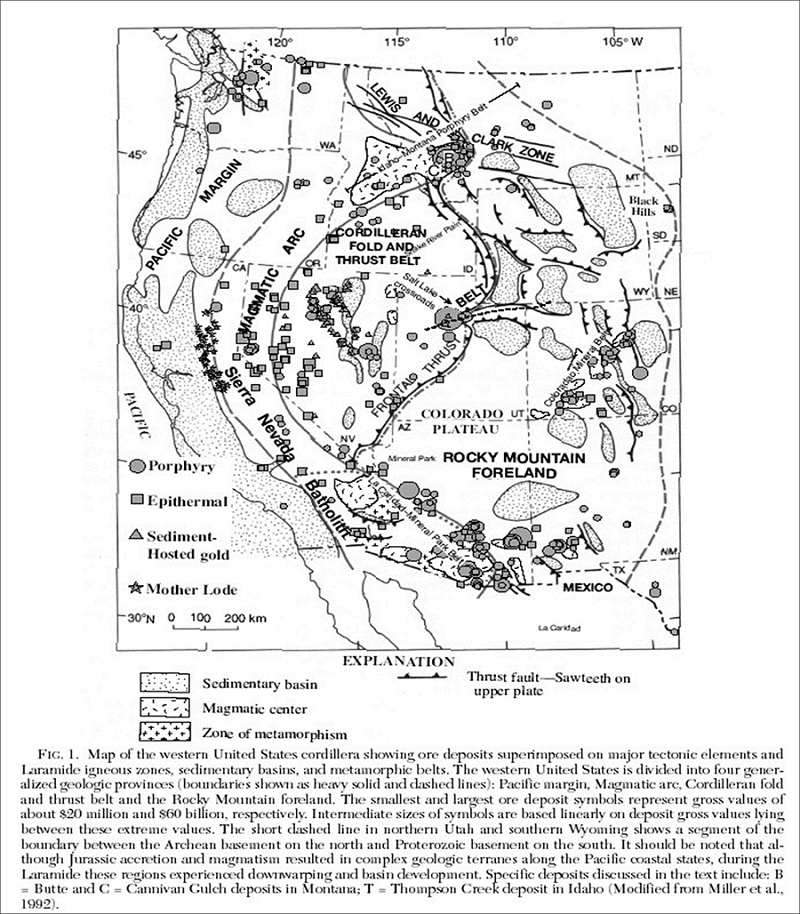

| Figure 7-1: Tectonic map of the western United States | 34 |

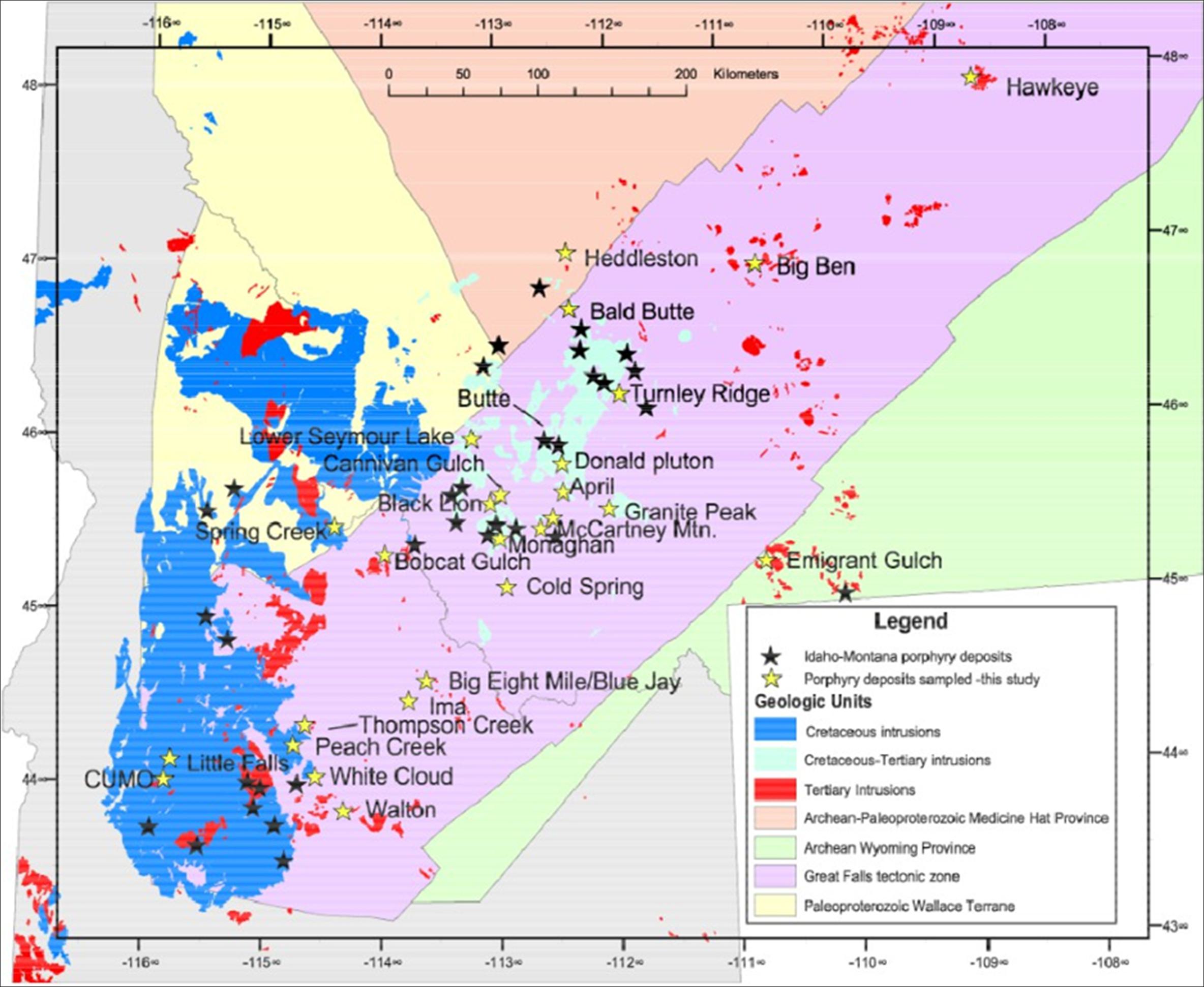

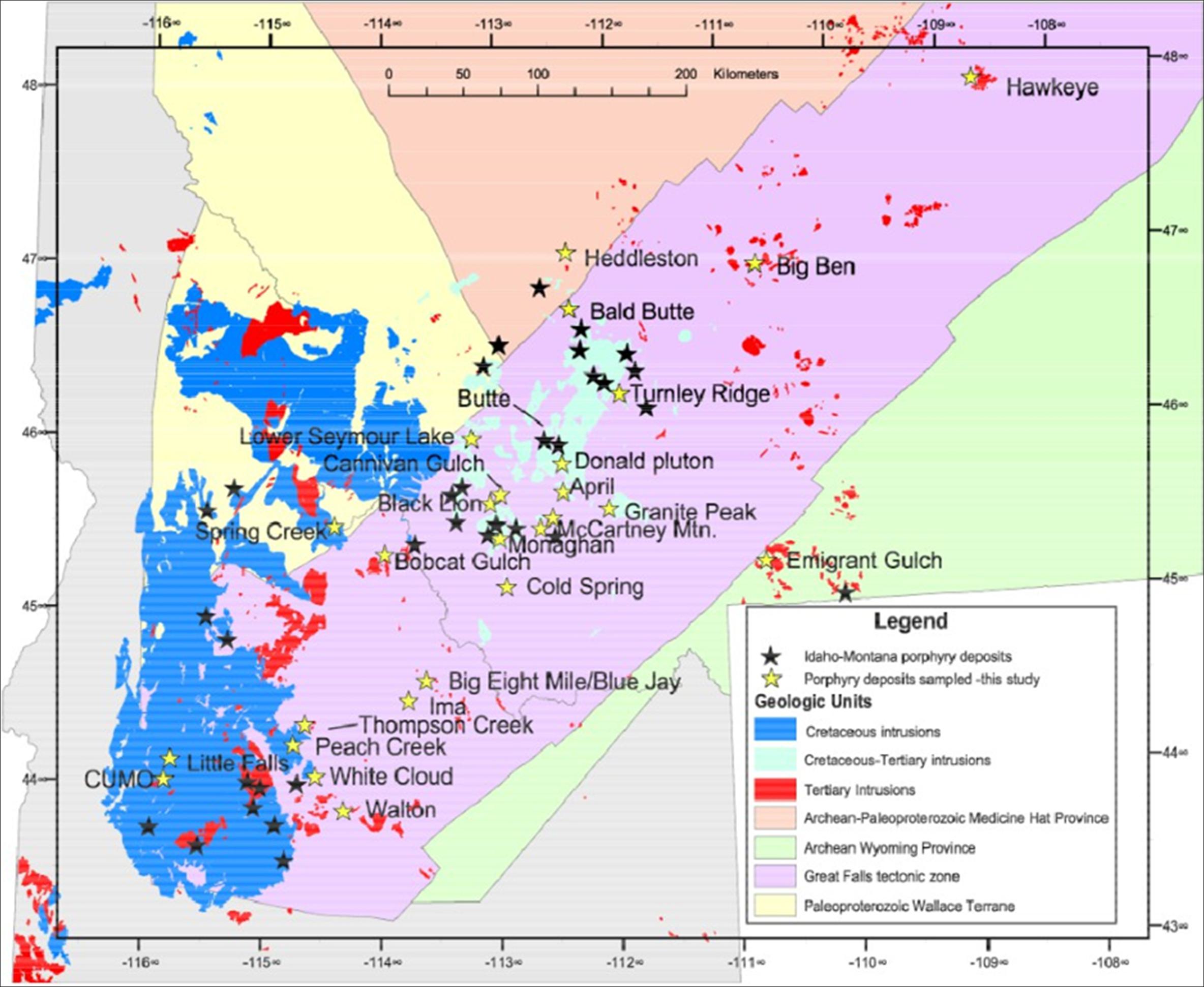

| Figure 7-2: Distribution of Idaho-Montana porphyry deposits in relation to the great falls tectonic zone | 35 |

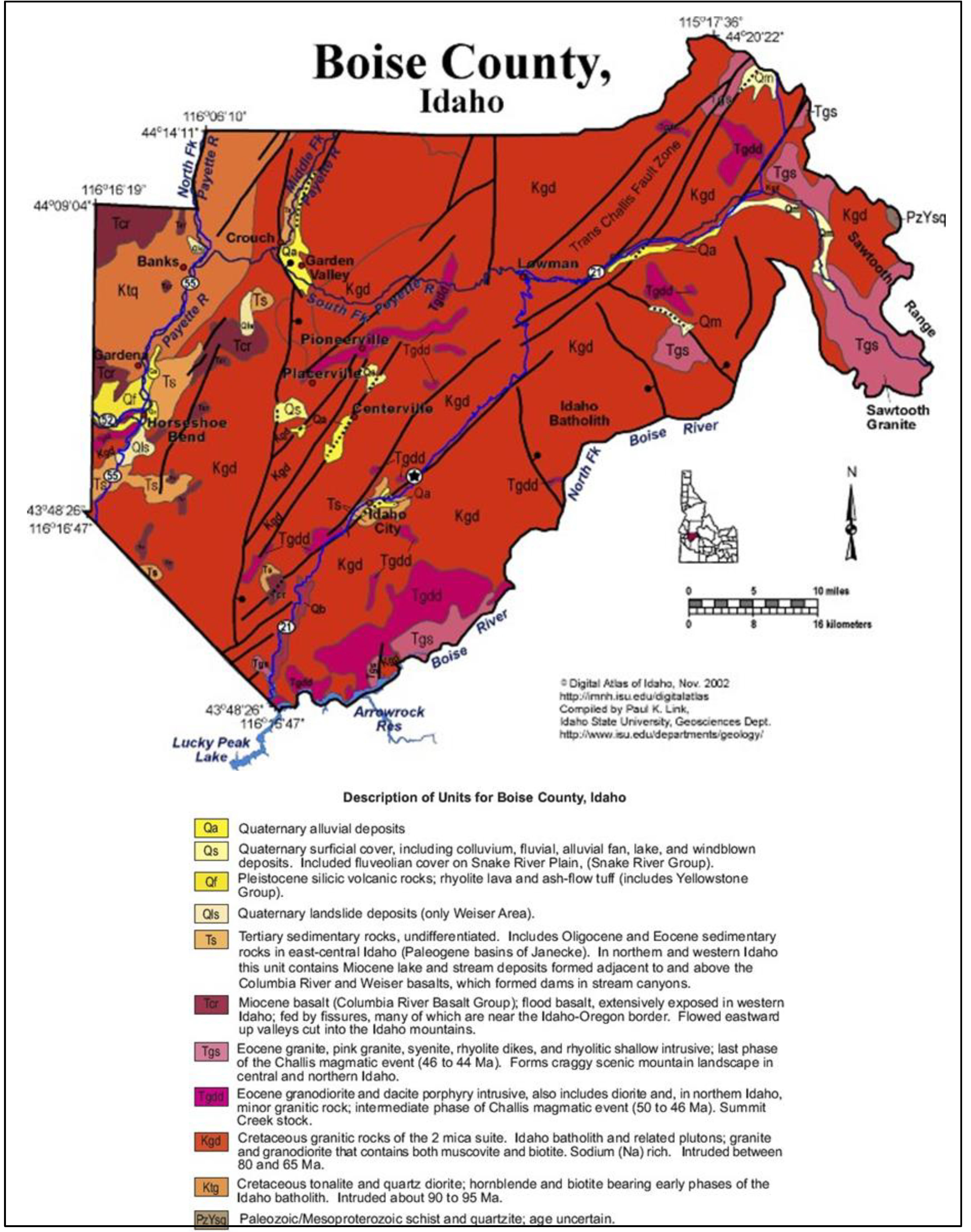

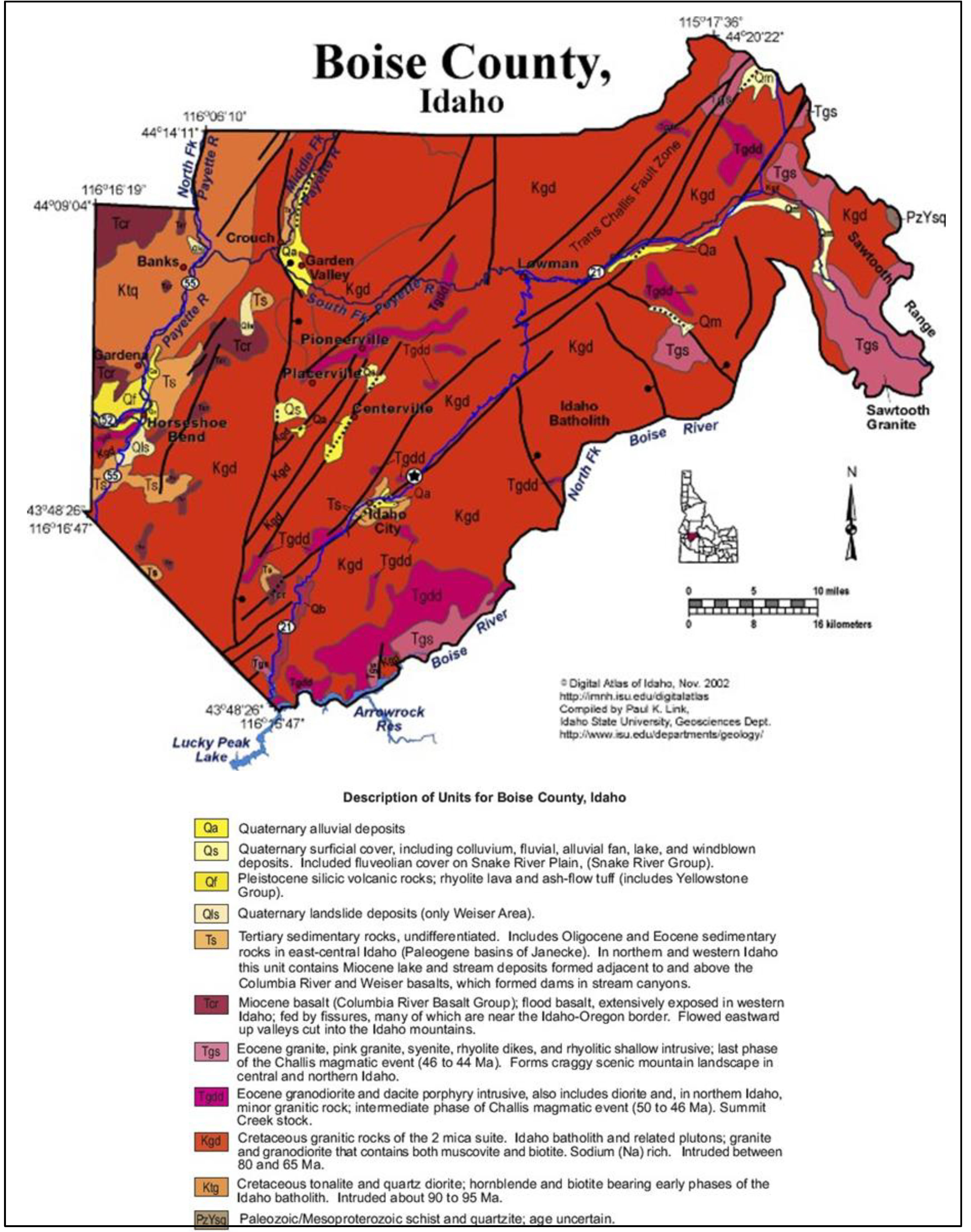

| Figure 7-3: Geology of Boise County, Idaho, showing geological setting of CuMo deposit | 37 |

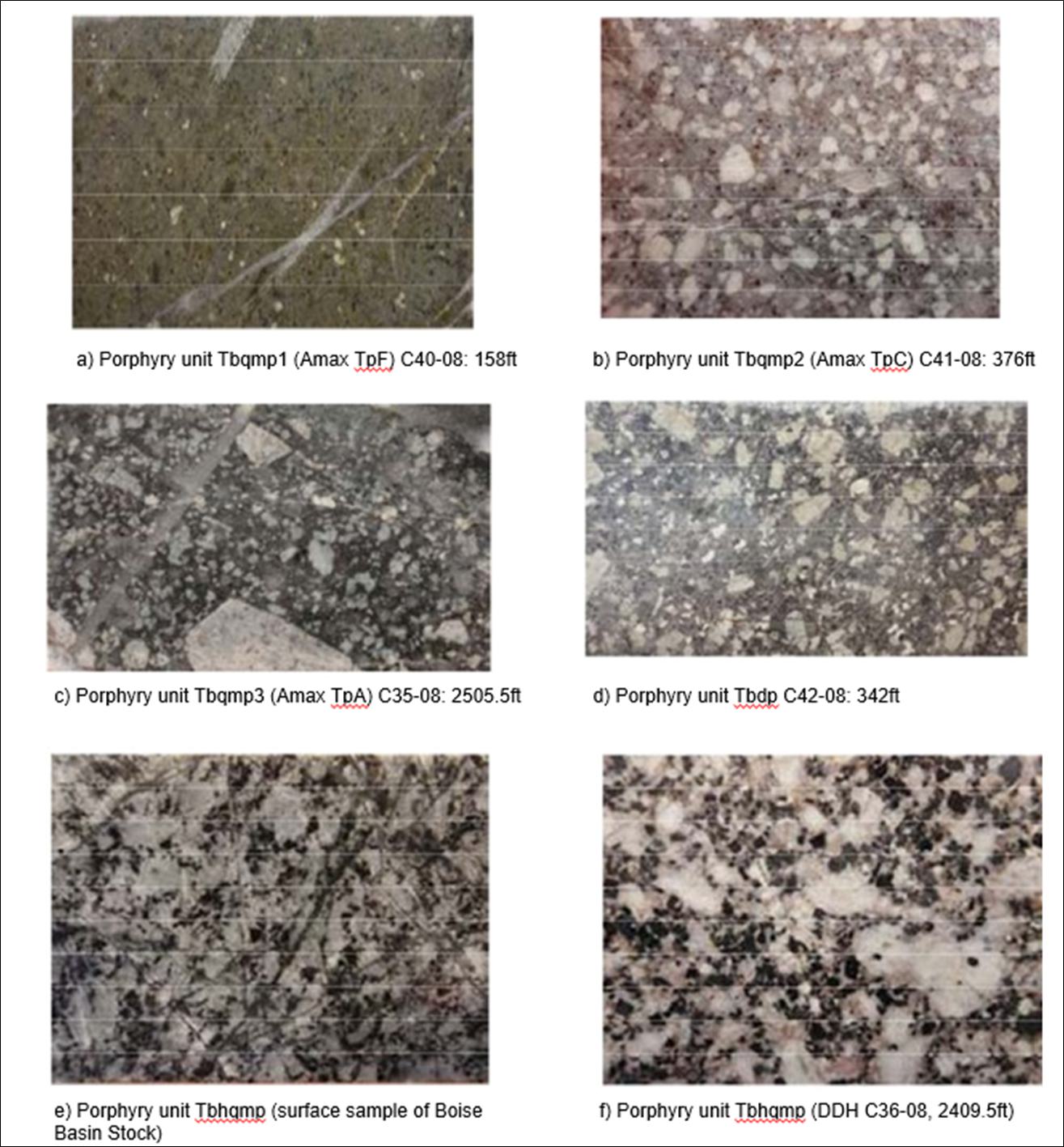

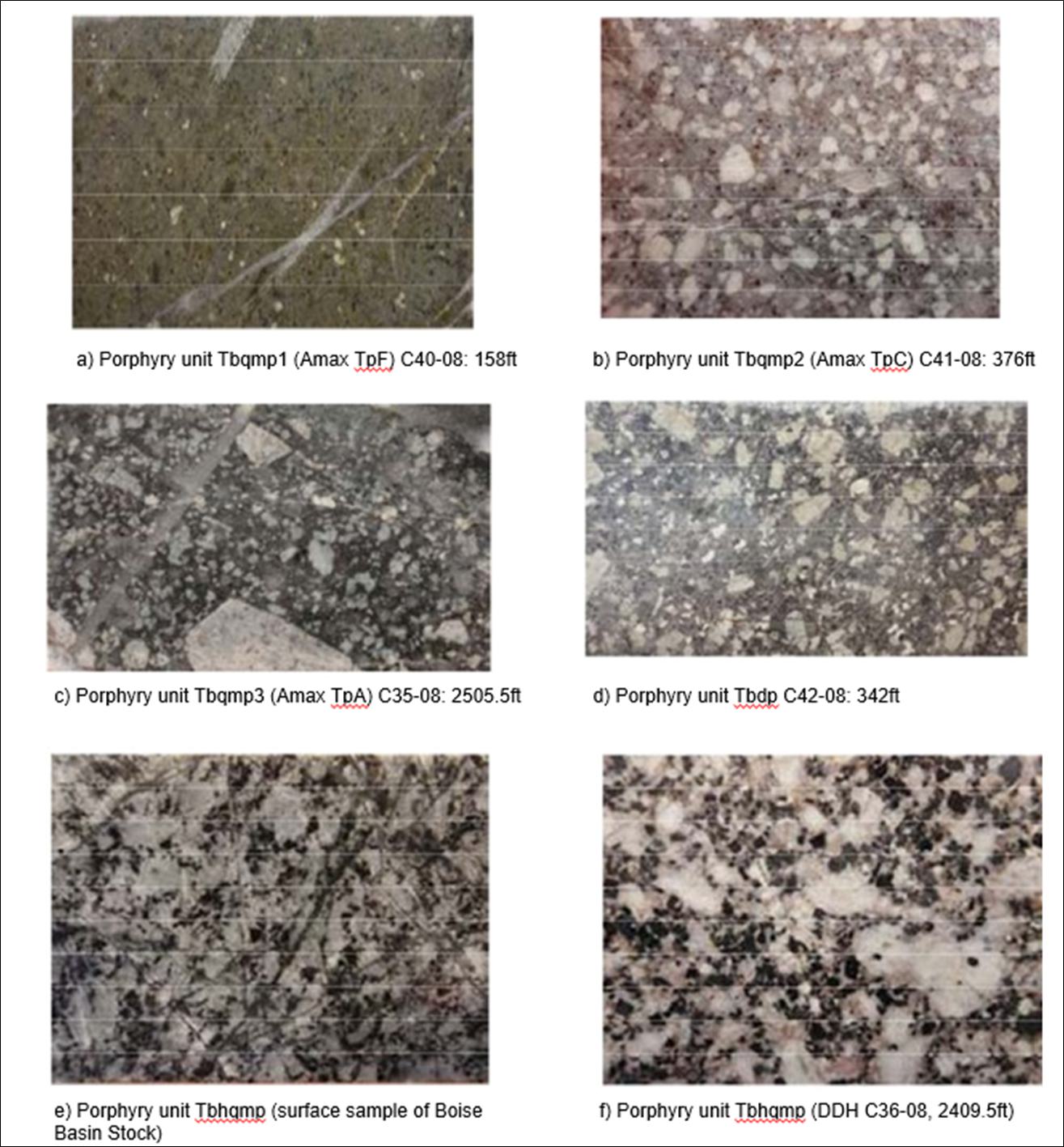

| Figure 7-4: Core photographs of felsic porphyry types recognized in drill core | 40 |

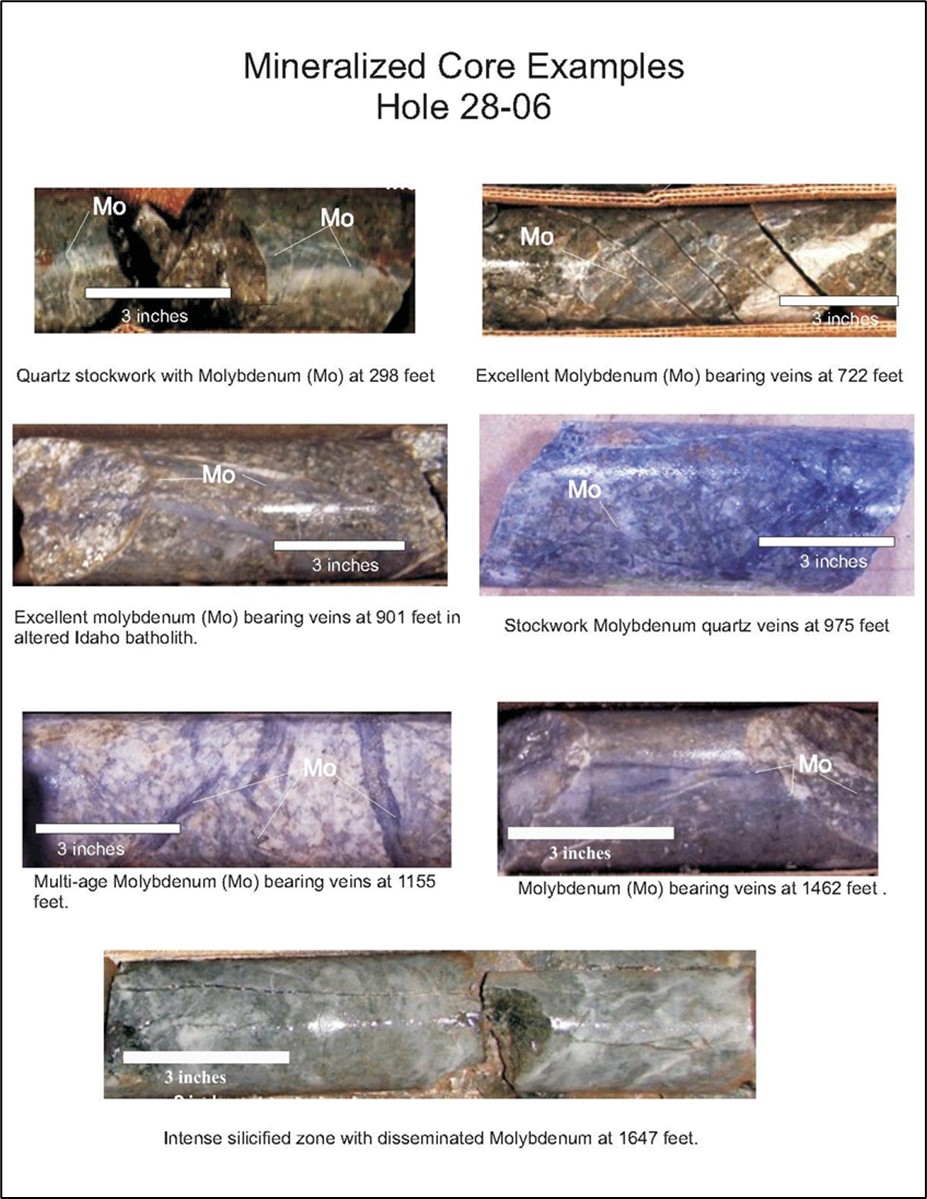

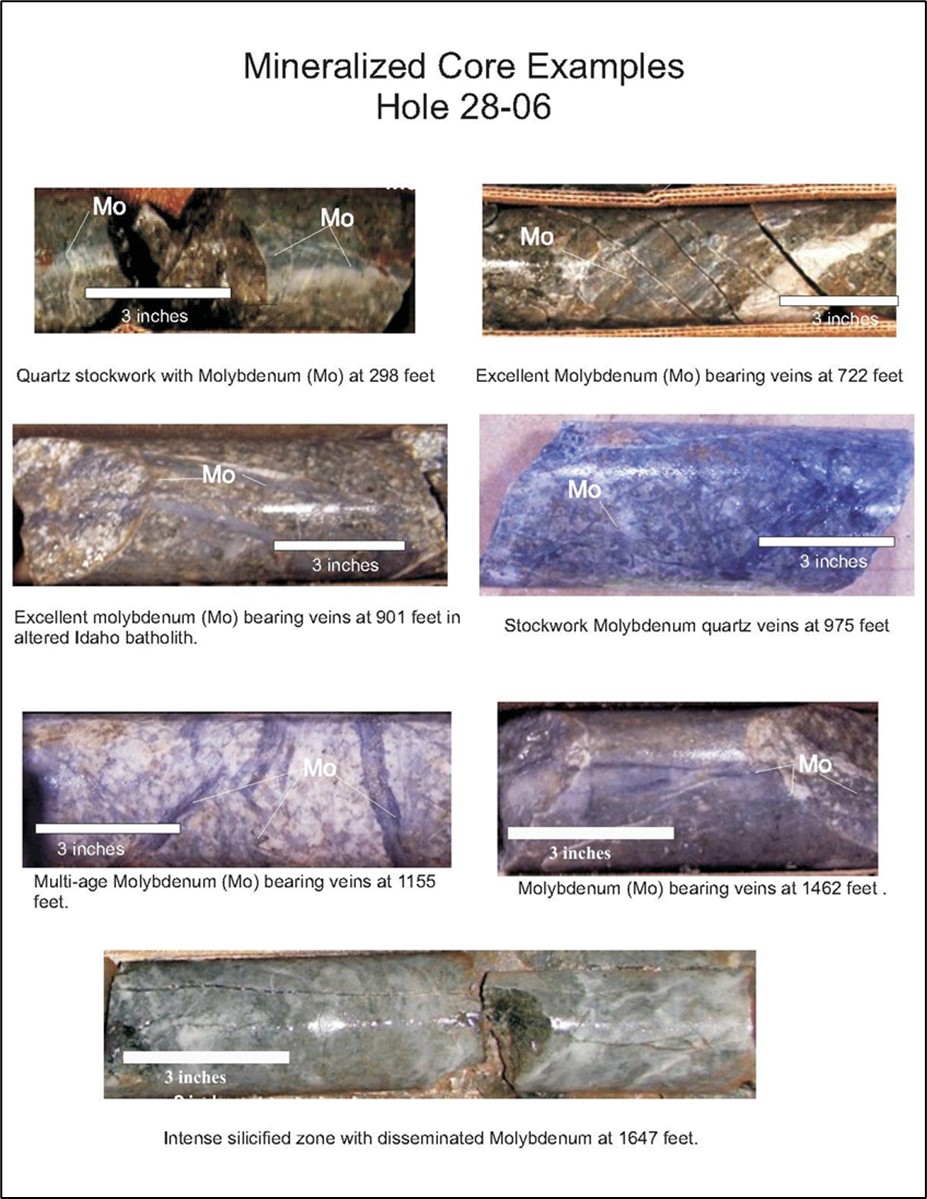

| Figure 7-5: Photographs of mineralized core from the CuMo 2006 program, hole C06-28 | 42 |

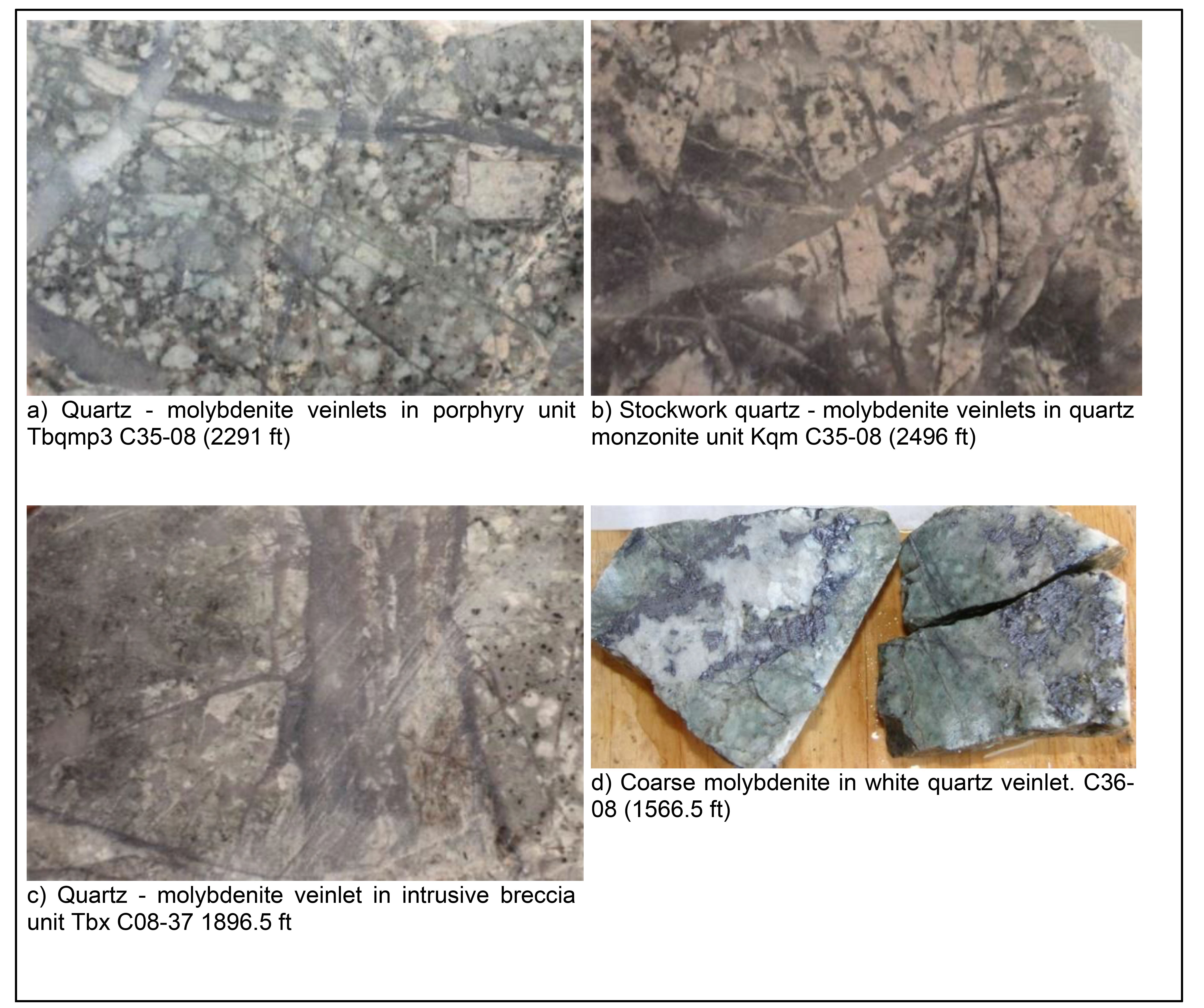

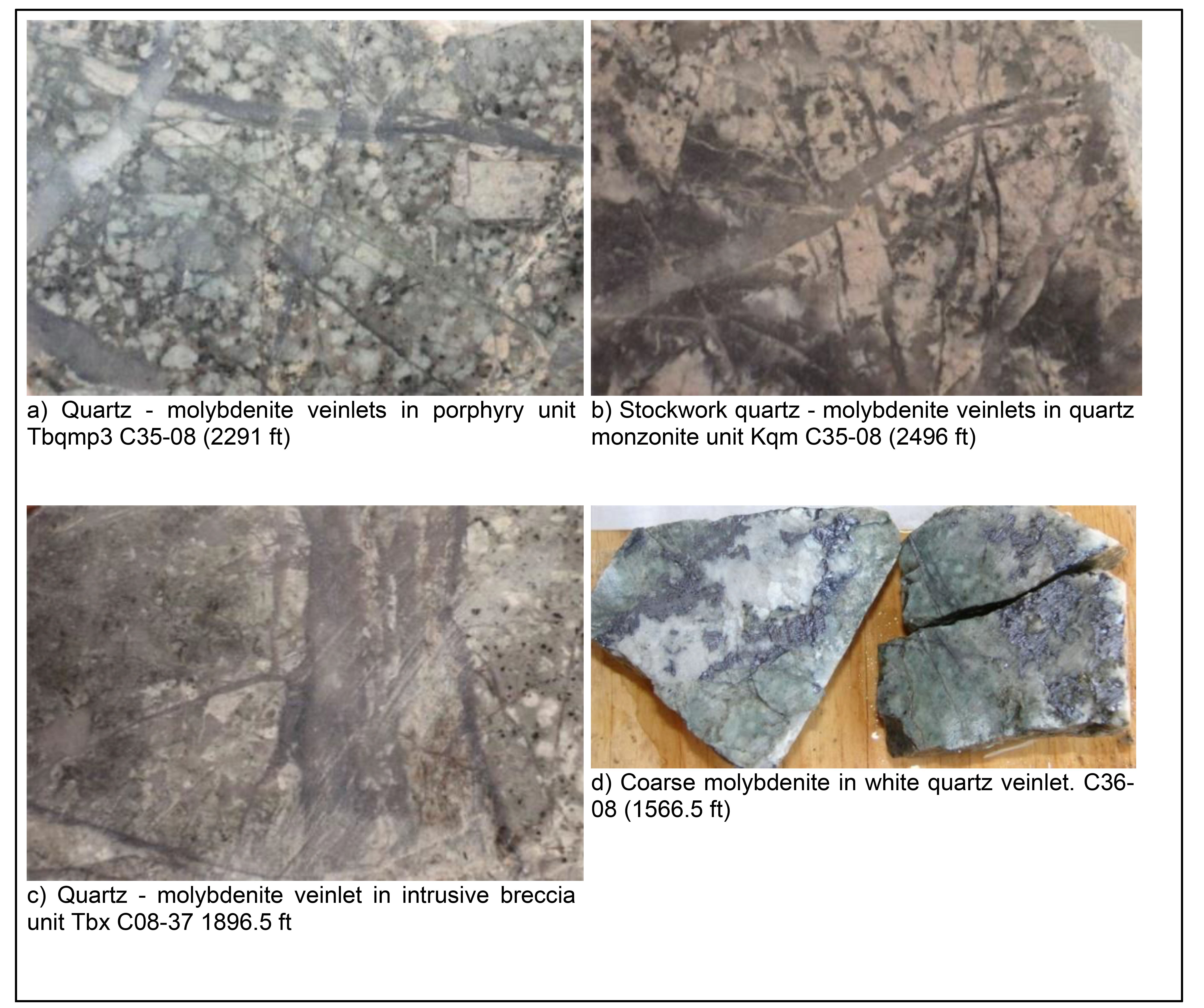

| Figure 7-6: Photographs of molybdenite mineralization in 2008 drill core | 43 |

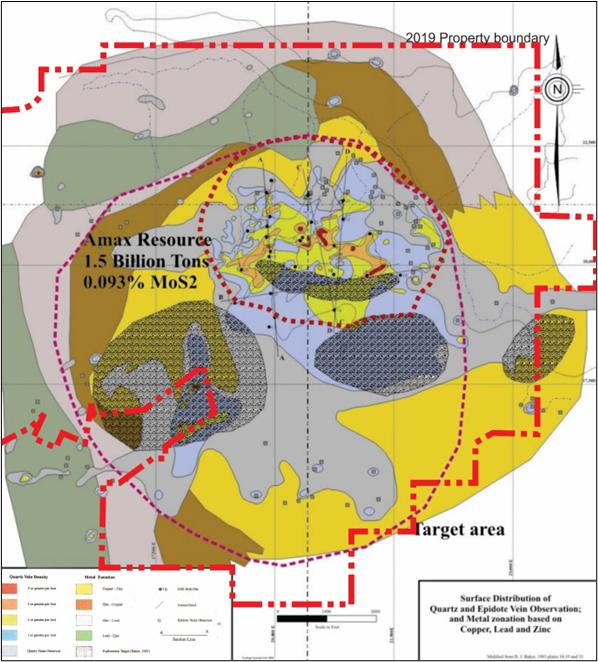

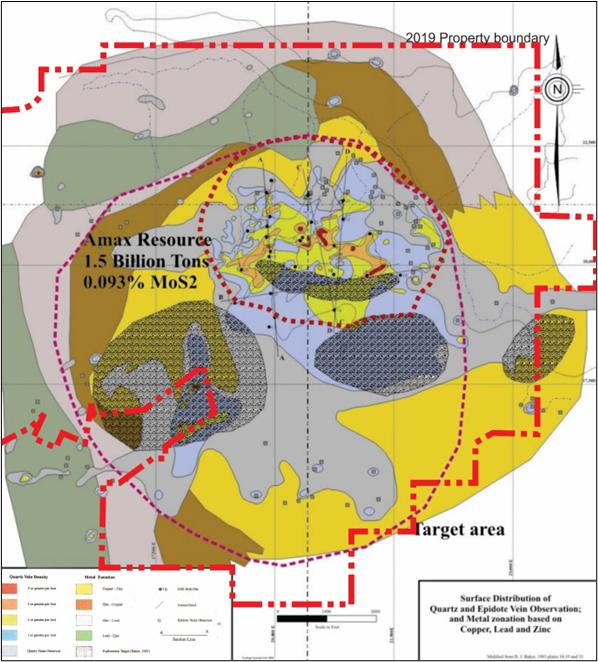

| Figure 7-7: Surface distribution of quartz and epidote veinlets and metal zonation | 44 |

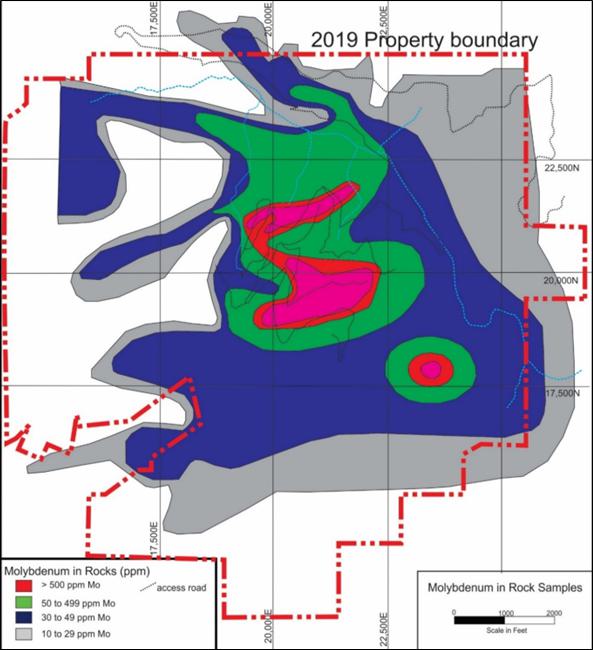

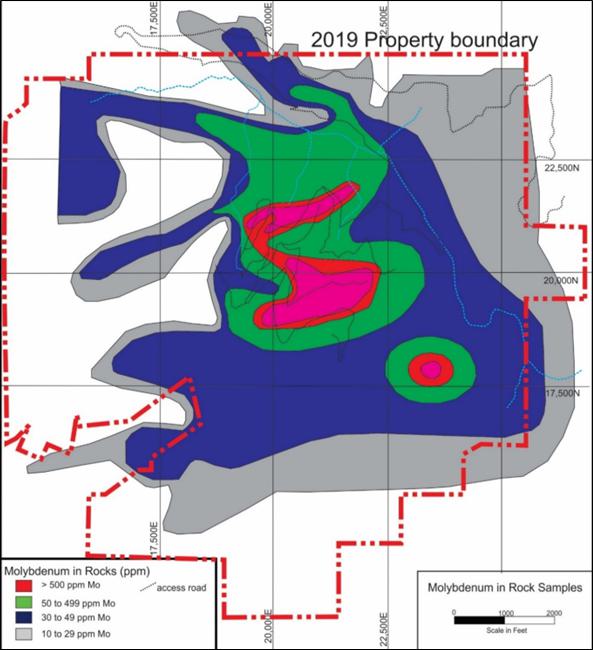

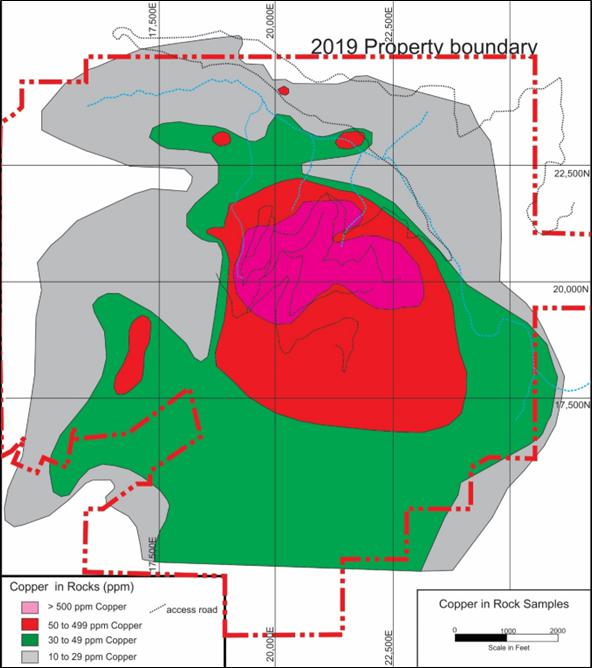

| Figure 7-8: Geochemical distribution of Mo in surface rock chip samples | 45 |

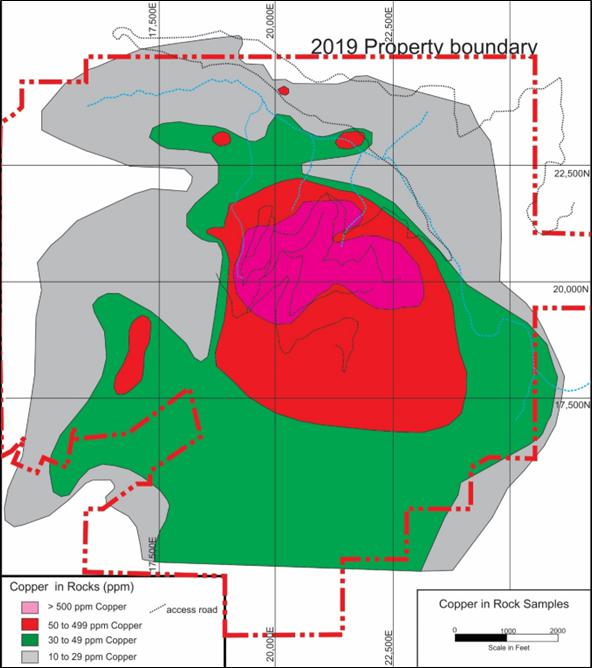

| Figure 7-9: Geochemical distribution of Cu in surface rock chip samples | 46 |

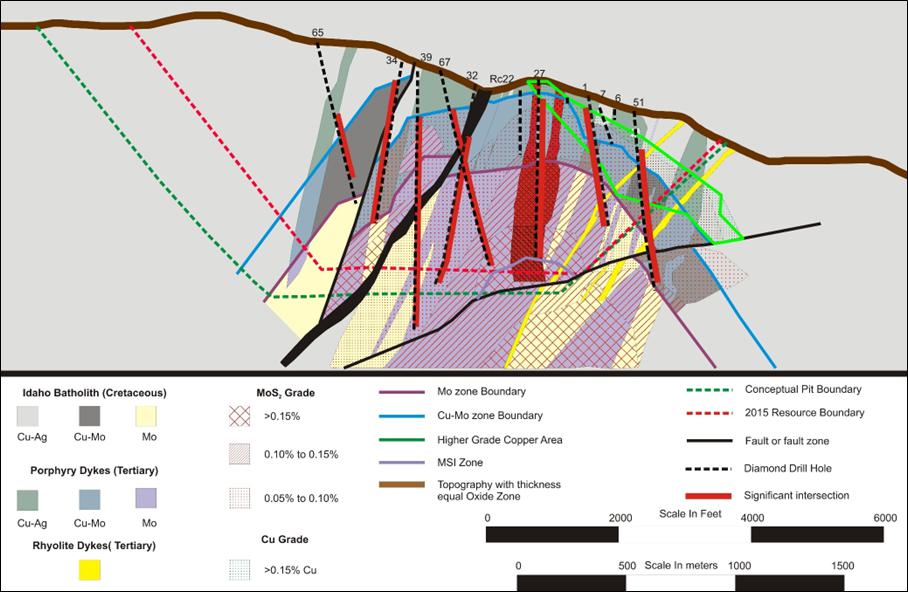

| Figure 10-1: Map showing the location of completed and proposed drill holes | 51 |

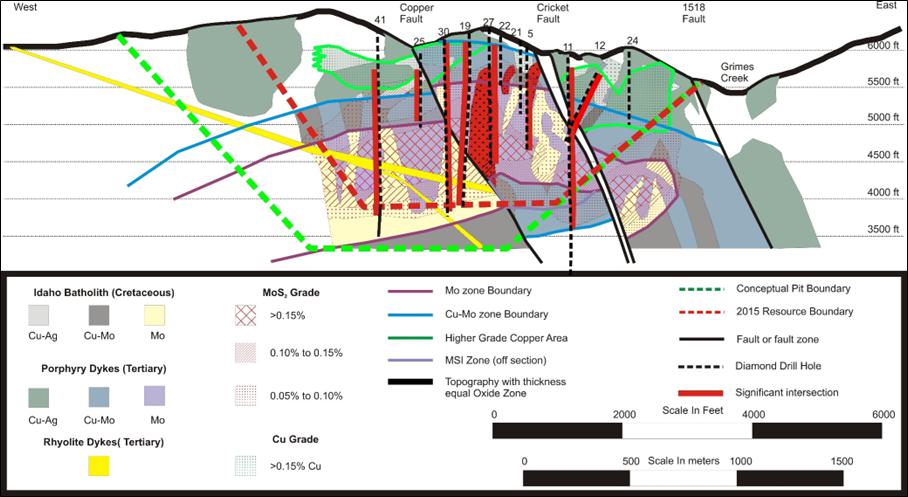

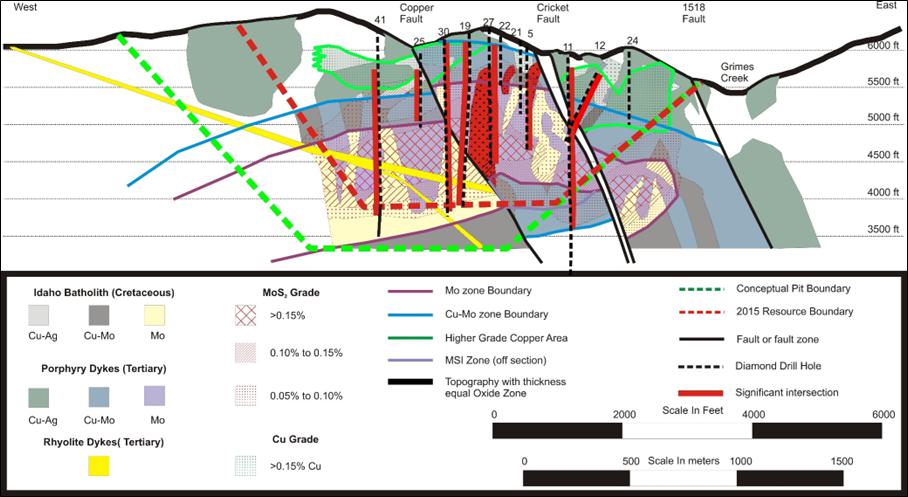

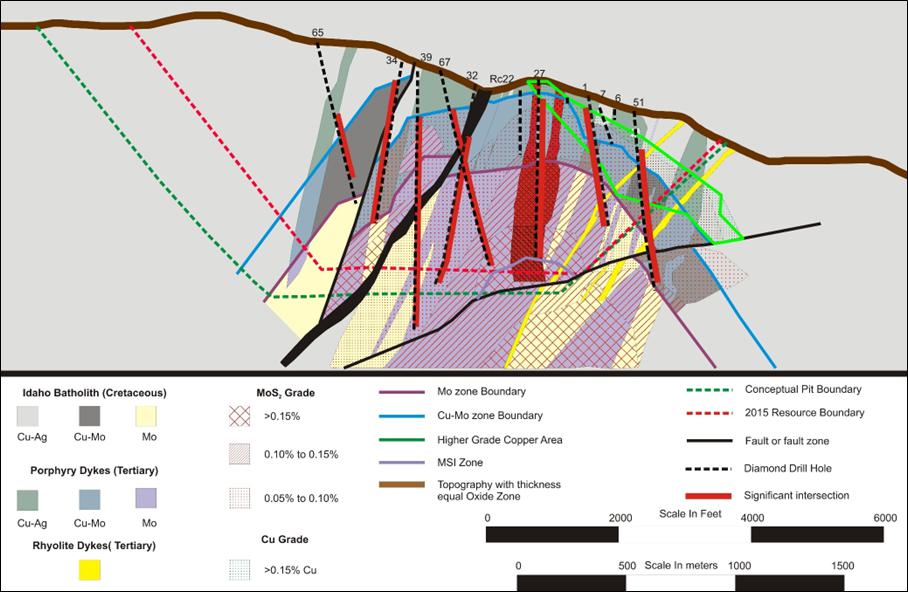

| Figure 10-2: CuMo deposit Q-Q cross section | 52 |

| Figure 10-3: CuMo deposit H-H cross section | 53 |

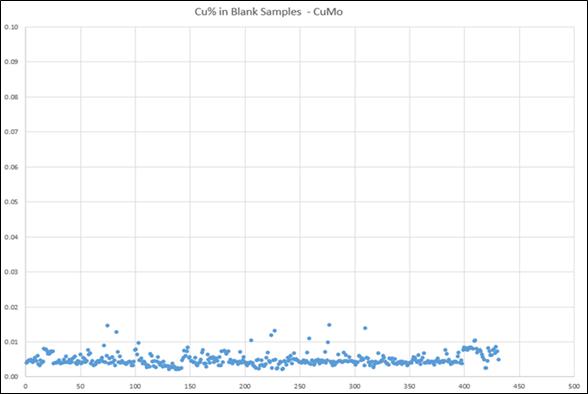

| Figure 11-1: MoS2 in blank samples from CuMoCo drill programs at CuMo | 65 |

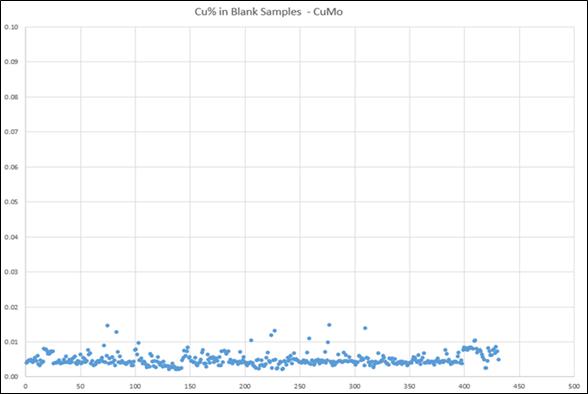

| Figure 11-2: Cu in blank samples from 2008 drill program CuMo | 66 |

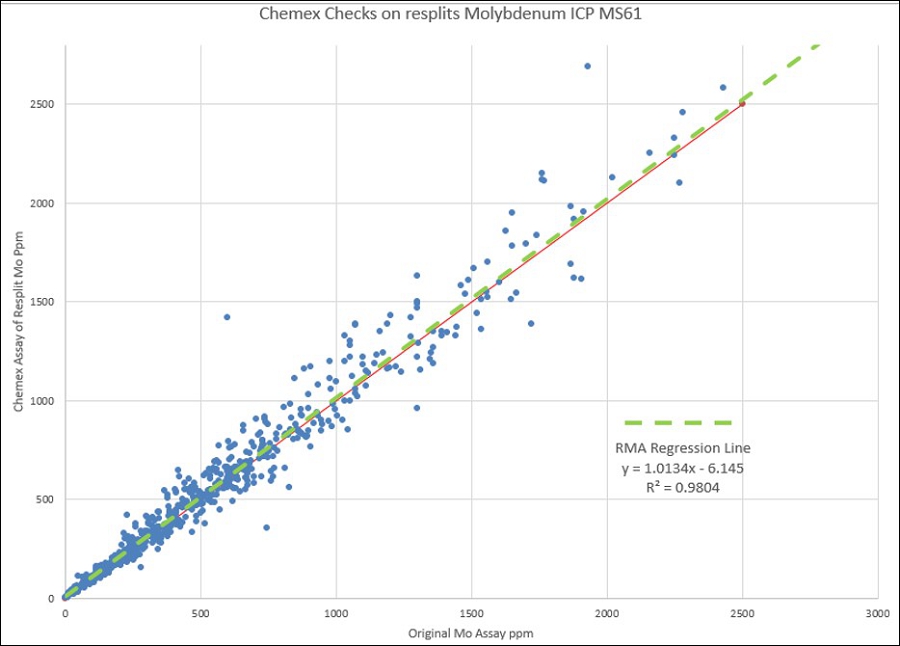

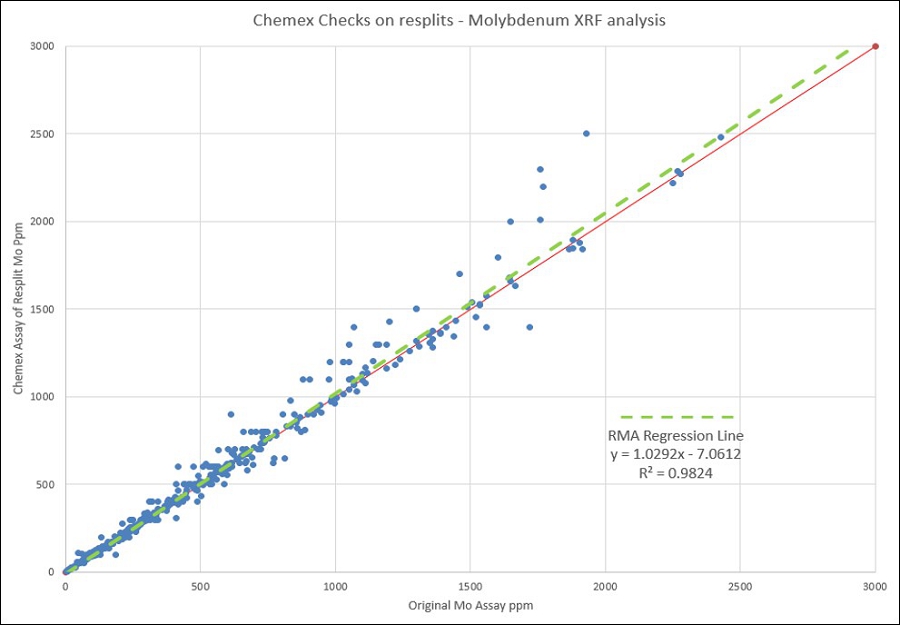

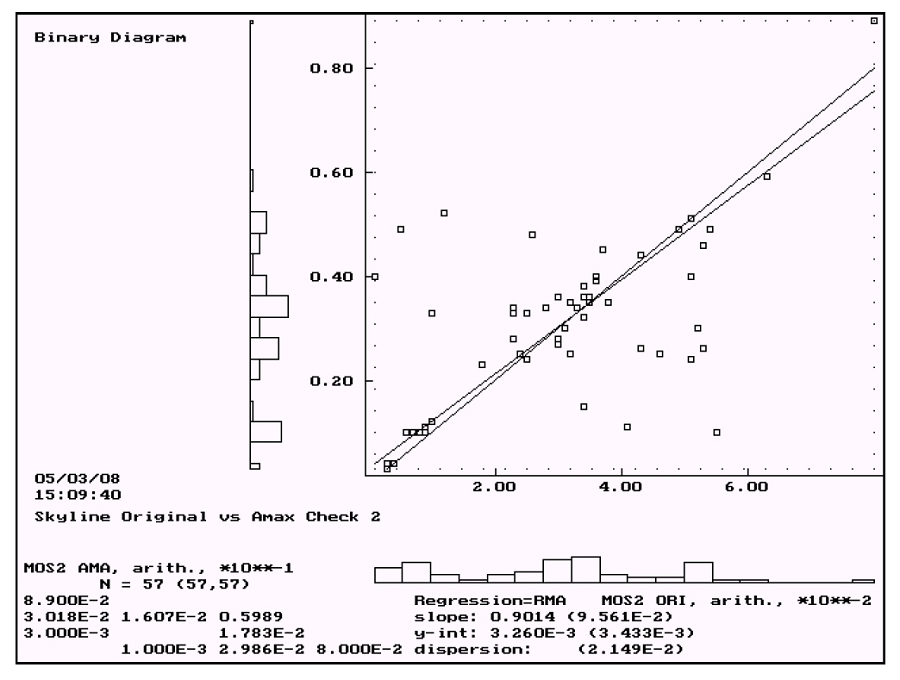

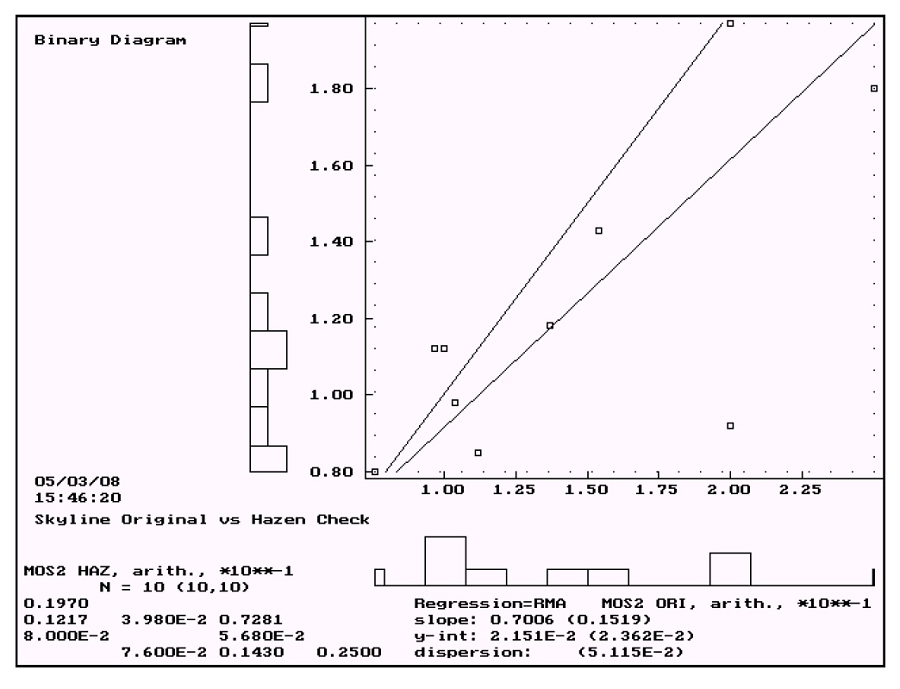

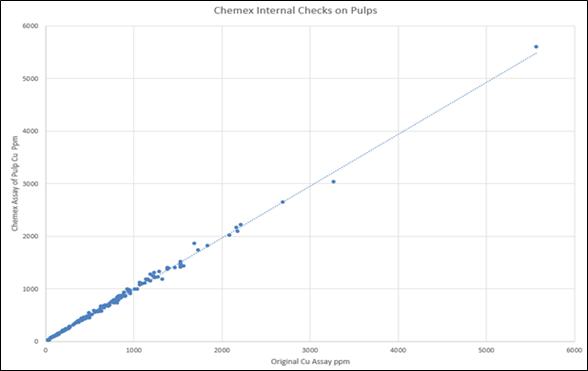

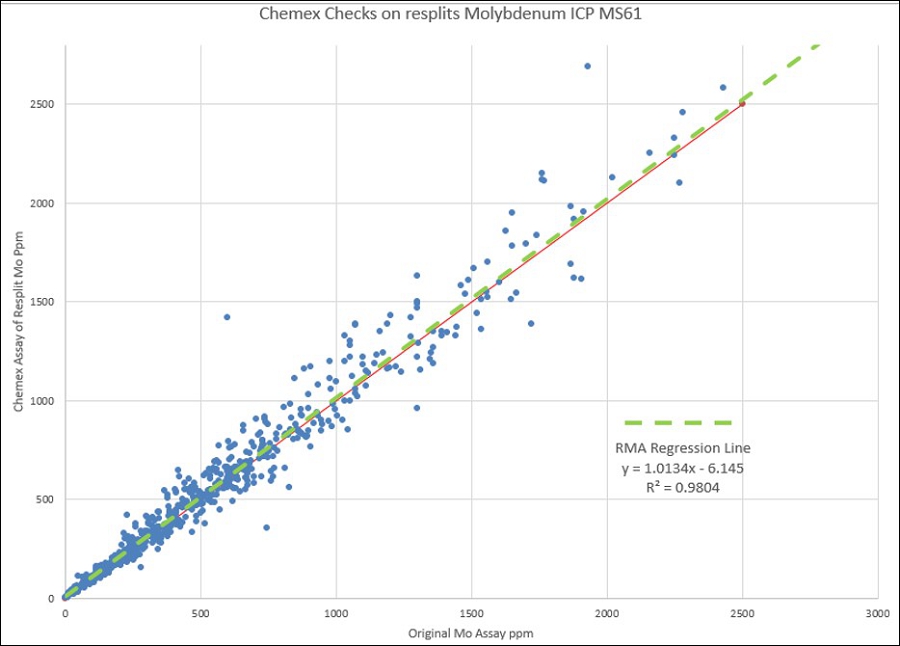

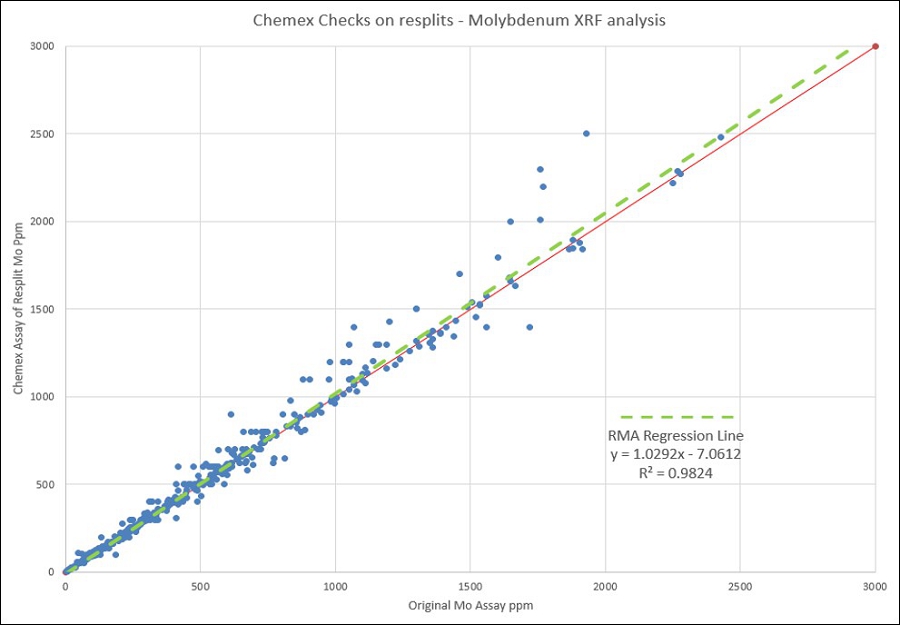

| Figure 11-3: Scatter plot of Chemex internal duplicates for Mo ppm (Mo metal) | 67 |

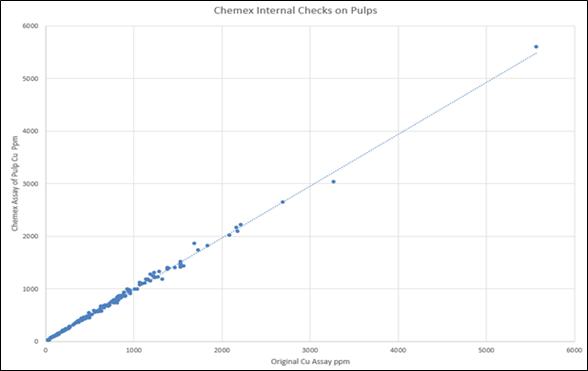

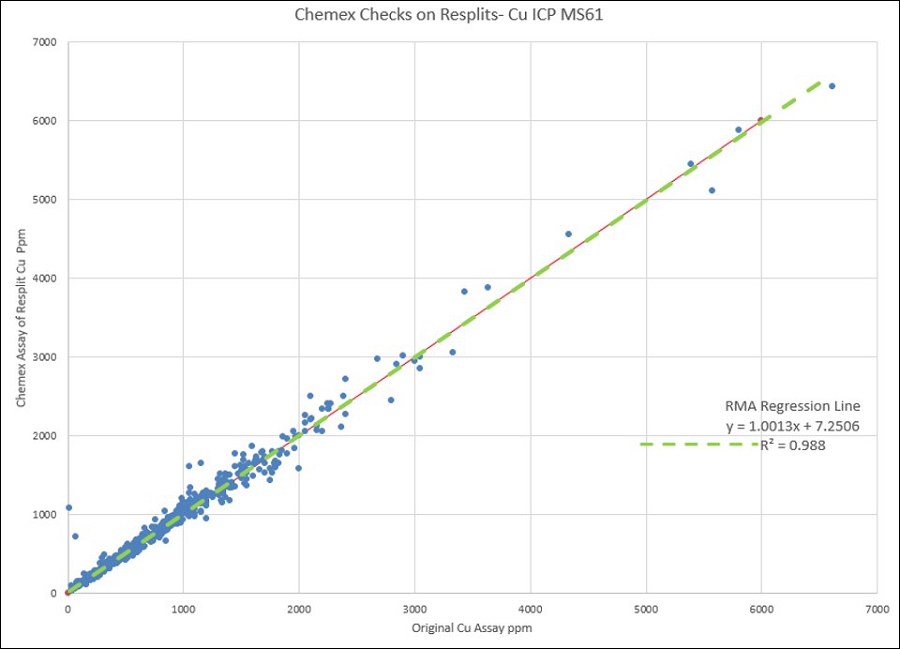

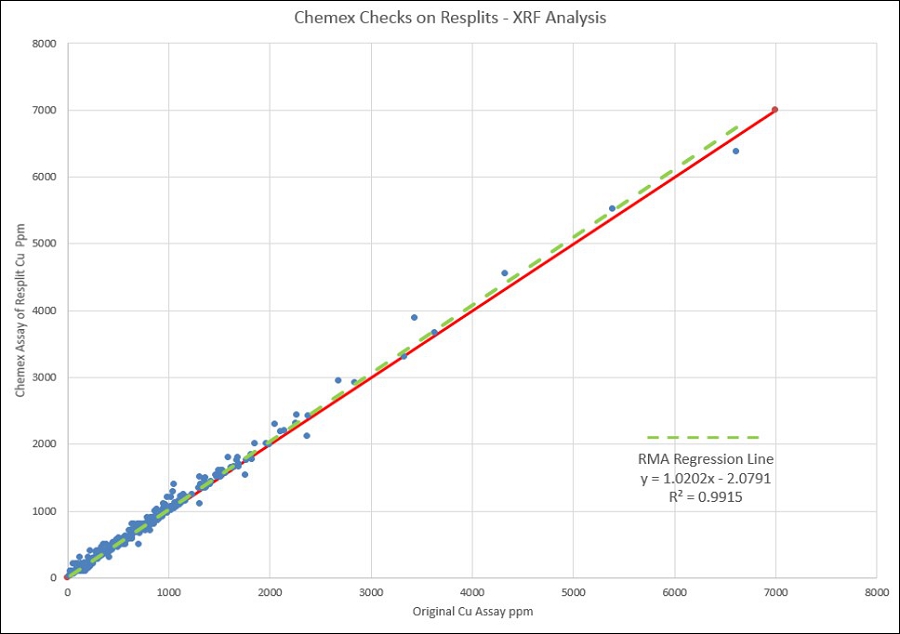

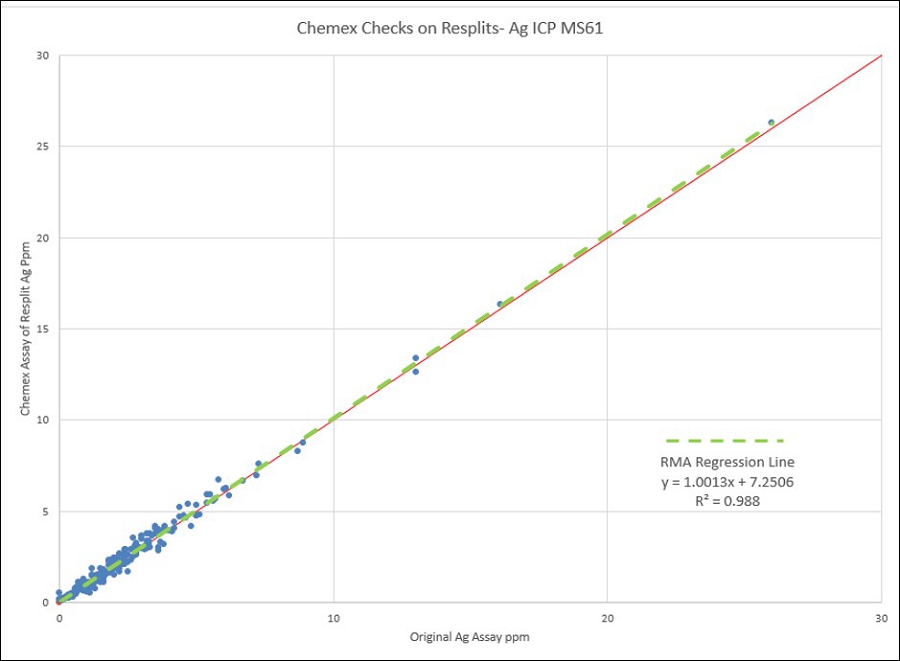

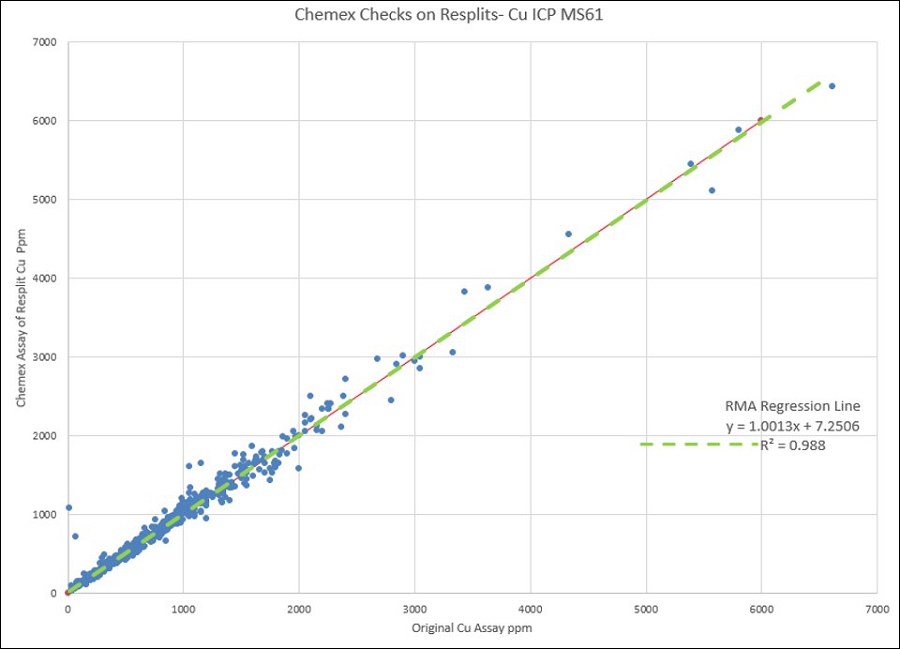

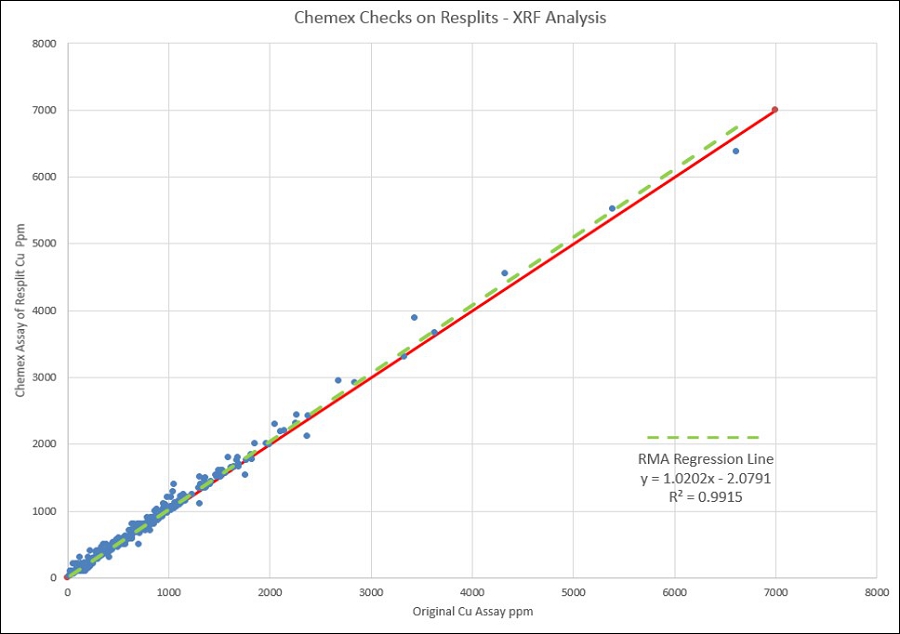

| Figure 11-4: Scatter plot of Chemex internal duplicates for Cu ppm | 67 |

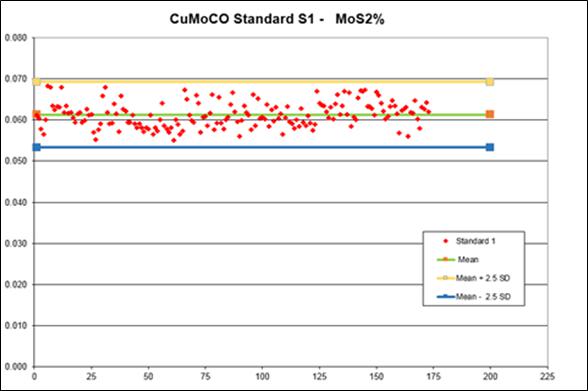

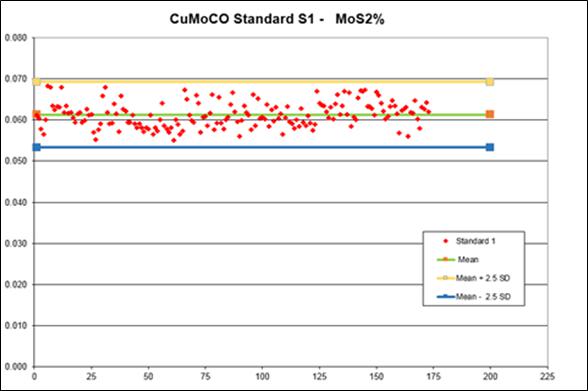

| Figure 11-5: Results for Standard S1 | 68 |

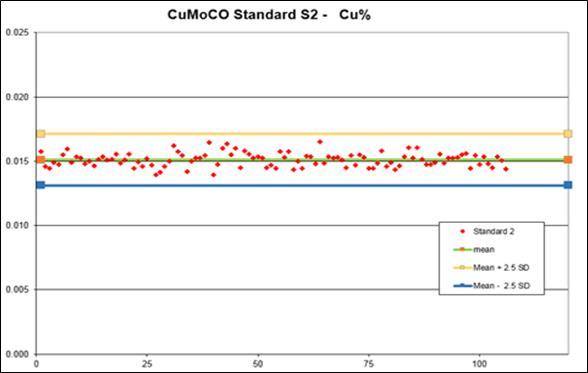

| Figure 11-6: Results for Standard S2 | 69 |

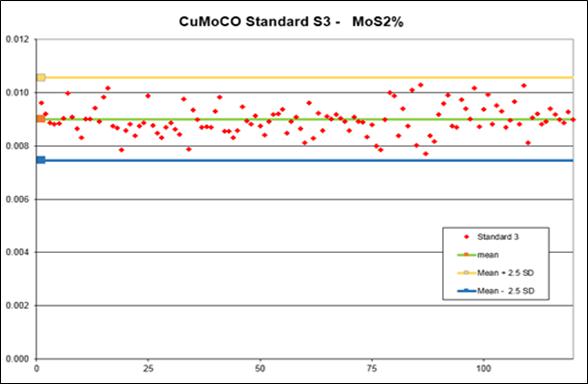

| Figure 11-7: Results for Standard S3 | 70 |

| Figure 13-1: Particle sort XRF test results | 81 |

| Figure 13-2: Impact of scale on distribution heterogeneity | 82 |

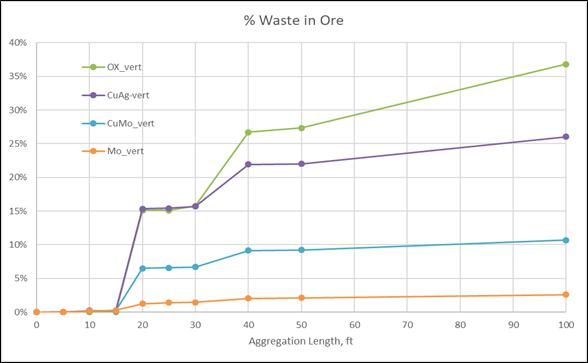

| Figure 13-3: Impact of scale on “Waste in Ore” ratio | 83 |

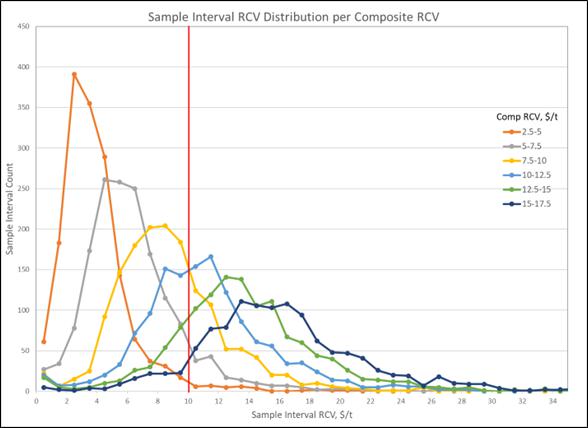

| Figure 13-4: CuMo composite-sample relationship | 84 |

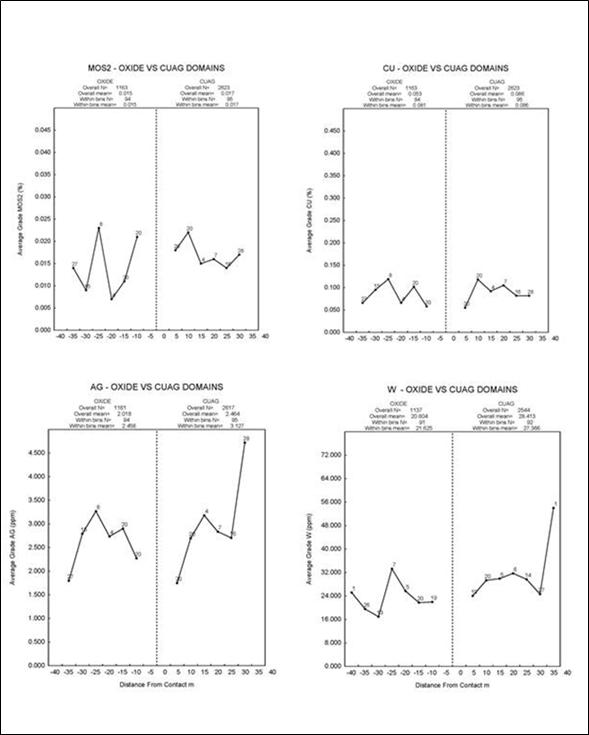

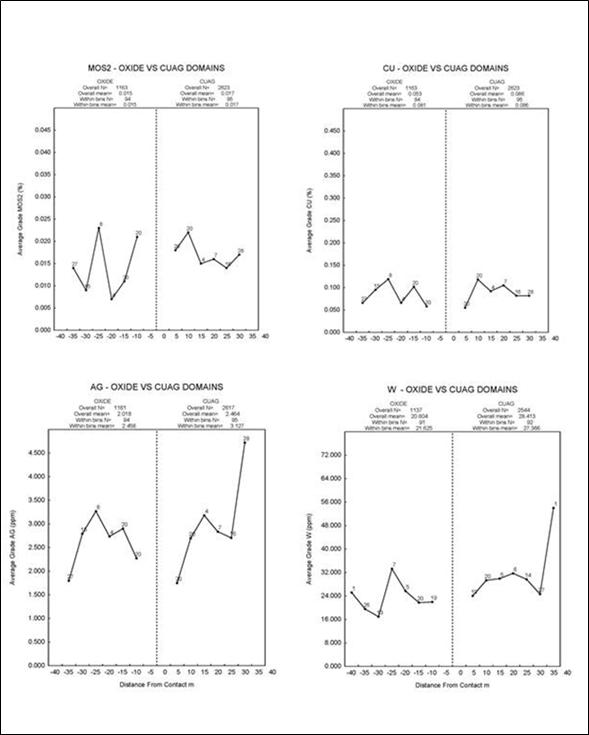

| Figure 14-1: Contact plots for oxide-Cu-Ag Zone contact | 87 |

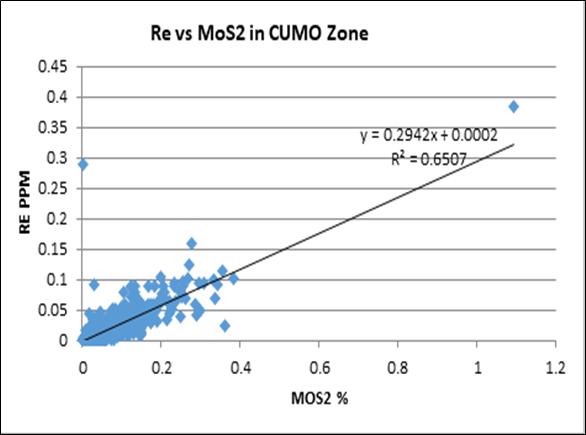

| Figure 14-2: Scatter plot showing Re vs MoS2 in the Cu-Mo Zone | 95 |

| Figure 14-3: Plan views of the measured, indicated and inferred blocks at CuMo | 99 |

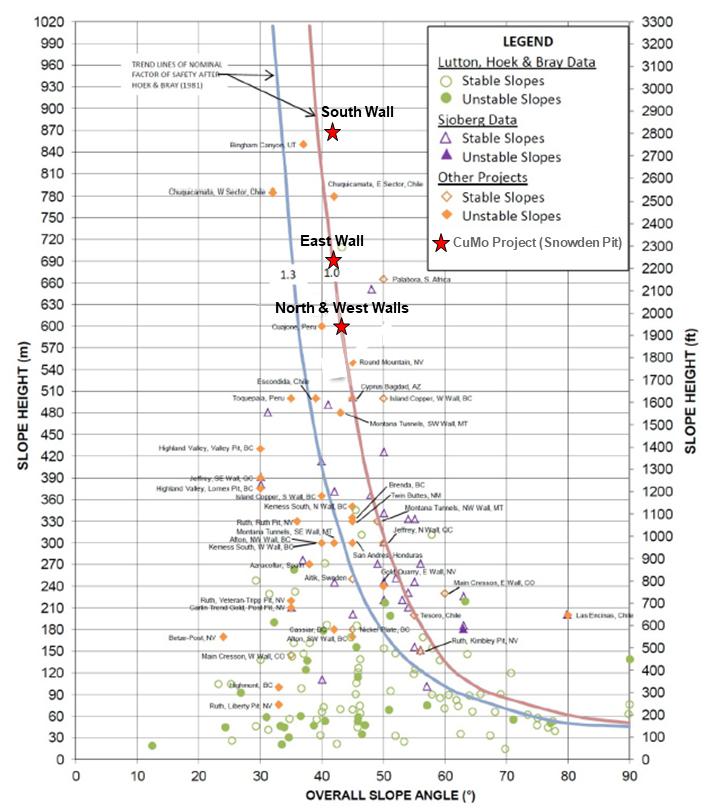

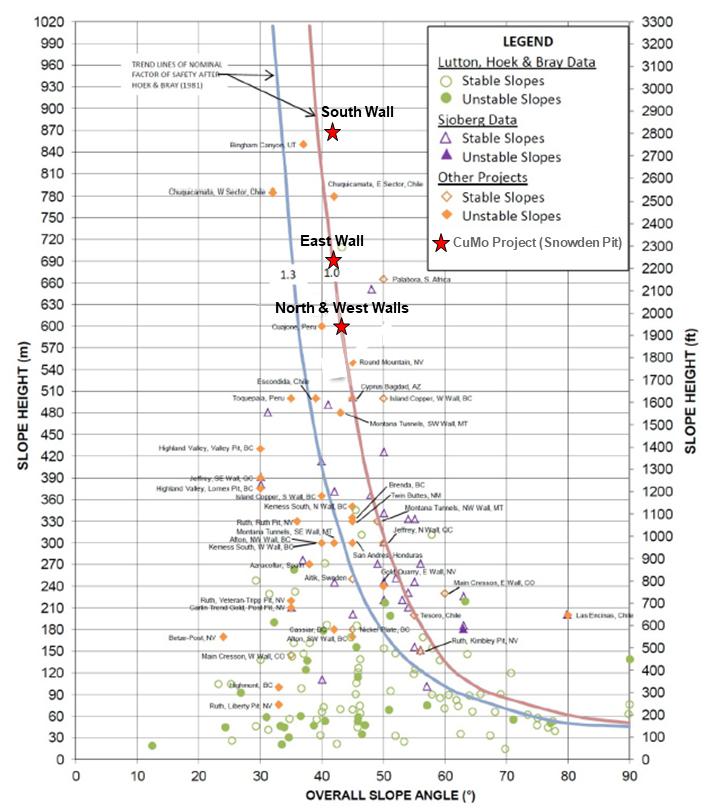

| Figure 16-1: Empirical pit wall chart with the Snowden (2012) walls added | 105 |

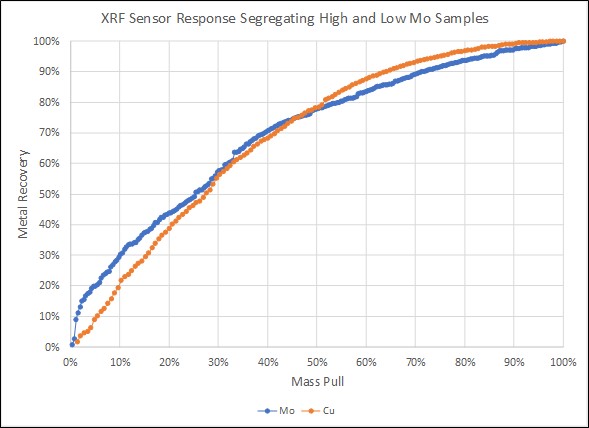

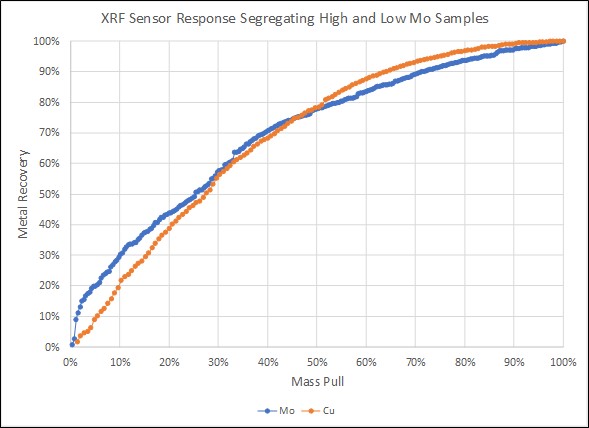

| Figure 16-2: Particle sort analysis splitting between Mo-rich and Mo-poor samples | 110 |

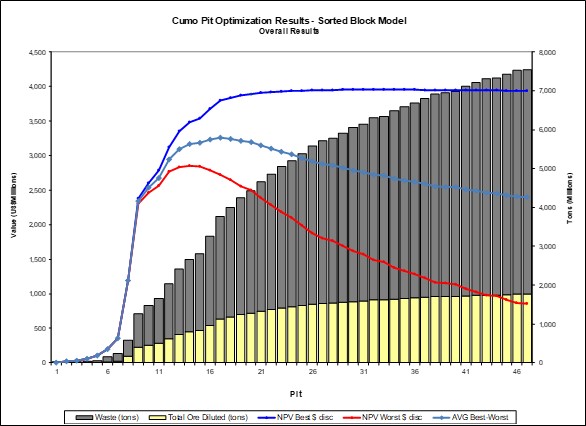

| Figure 16-3: Pit optimization results | 113 |

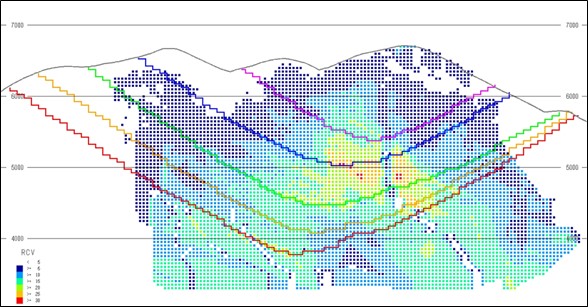

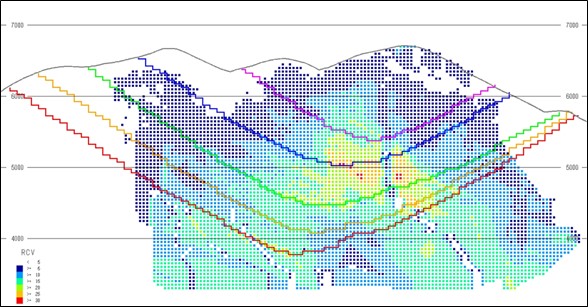

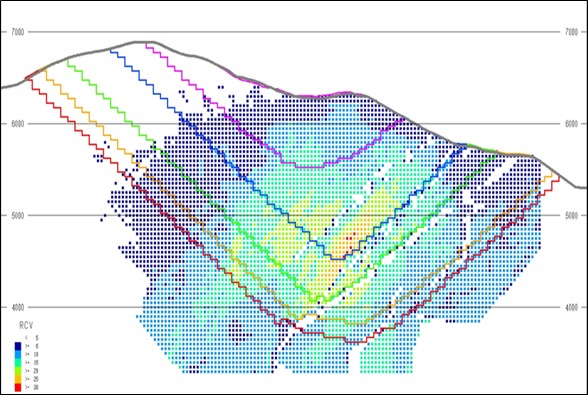

| Figure 16-4: CuMo pit phase shell outlines | 114 |

| Figure 16-5: CuMo pit phase shell east-west cross-section A-A’ | 114 |

| Figure 16-6: CuMo pit phase shell north-south cross-section B-B’ | 115 |

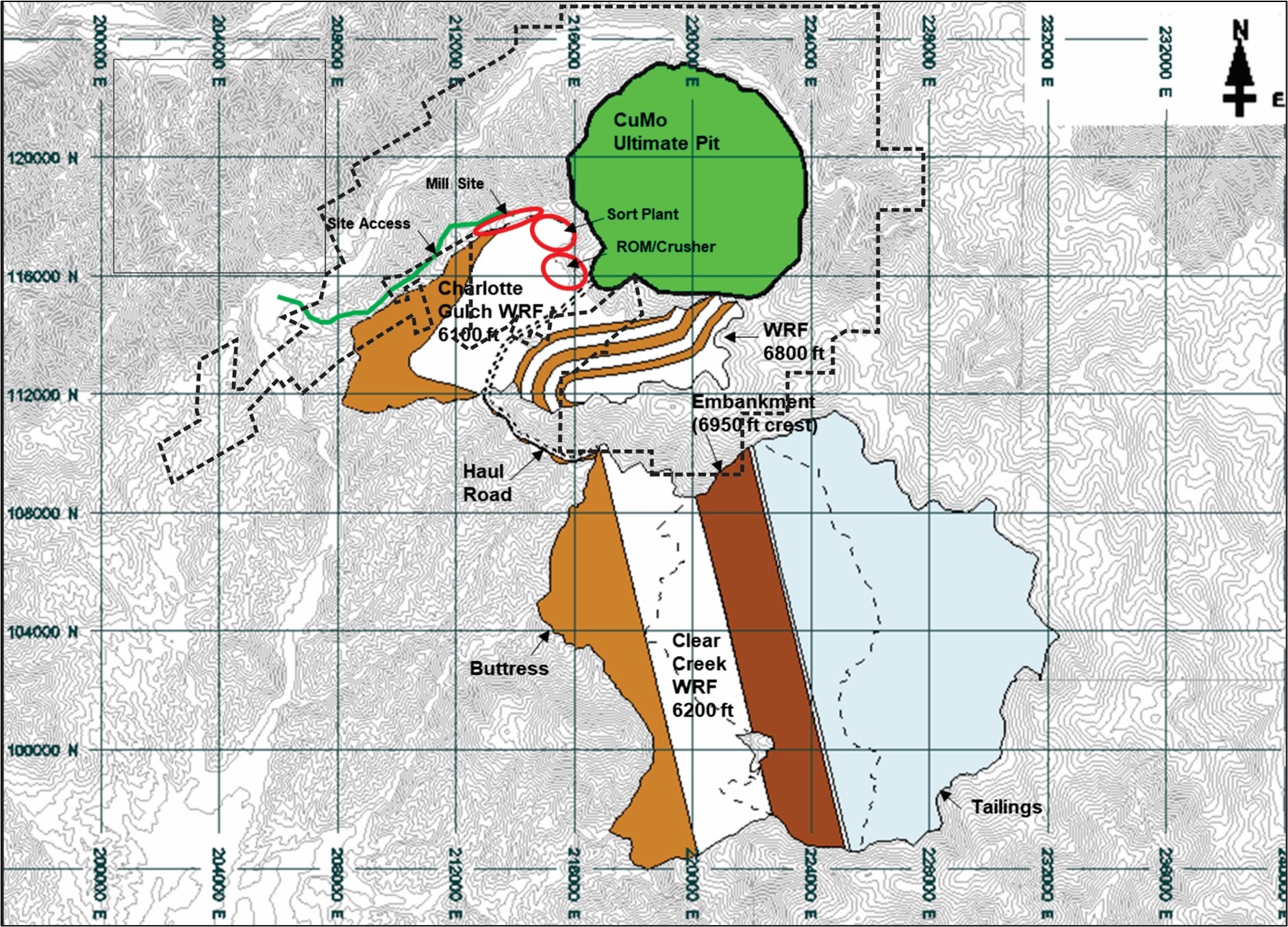

| Figure 16-7: CuMo mine layout | 116 |

| Figure 16-8: CuMo LOM production schedule | 118 |

| Figure 17-1: Schematic of three-stage bulk sorting plant with particle sorting | 120 |

| Figure 17-2: Schematic of bulk sorting diversion system | 121 |

| Figure 17-3: CuMo process schematic | 125 |

| Figure 18-1: CuMo Clear Creek TSF and WRF buttress | 130 |

| Figure 18-2: Cross-section A-A’ through Clear Creek TSF and WRF buttress | 130 |

| Figure 22-1: Project cashflow summary chart | 155 |

| Figure 22-2: Metal production schedule graph | 159 |

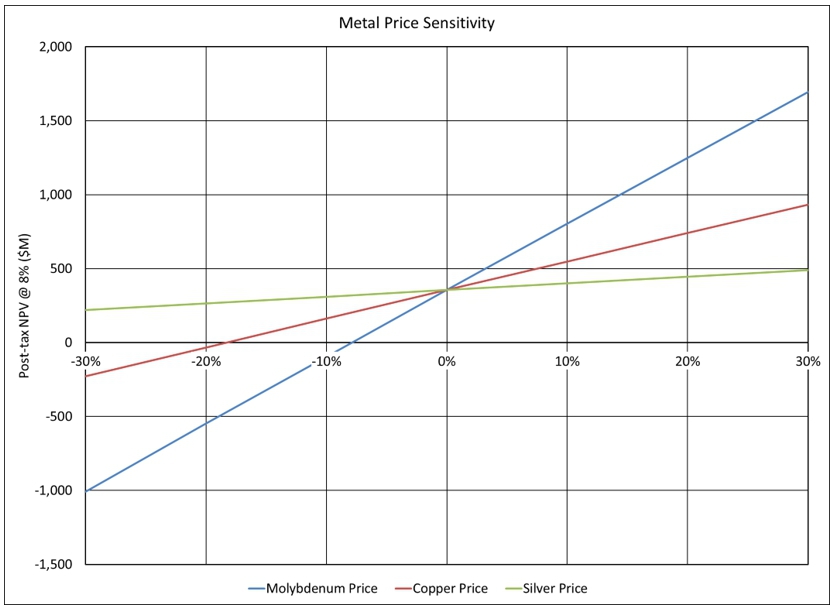

| Figure 22-3: Metals price sensitivity – net present value | 164 |

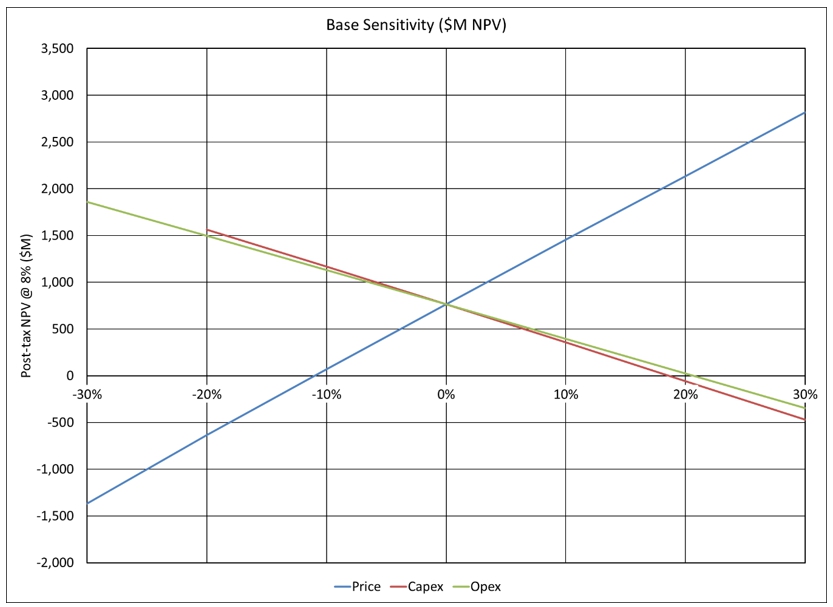

| Figure 22-4: Single factor sensitivity – net present value | 164 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page ix |

| List of Tables | |

| | |

| Table 1-1: Metal prices for resource estimation | 4 |

| Table 1-2: CuMo metal recoveries by zone | 4 |

| Table 1-3: Measured resource within pit shell | 5 |

| Table 1-4: Indicated resources | 5 |

| Table 1-5: Measured and indicated resources | 6 |

| Table 1-6: Inferred resources (molybdenum, copper, silver, rhenium and sulfur) | 6 |

| Table 1-7a: Summary of Project Economics with Inferred Resources | 9 |

| Table 1-7b: Summary of Project Economics without Inferred Resources | 10 |

| Table 1-8: Budget for additional work | 19 |

| Table 2-1: QP responsibilities | |

| Table 6-1: Summary of historic drilling | 31 |

| Table 6-2: List of historic drill holes | 32 |

| Table 6-3: CuMo historical results, 1982 Amax block model | |

| Table 7-1: Summary of rock units present at the CuMo property | 38 |

| Table 10-1: Summary of holes drilled by CuMoCo | 48 |

| Table 10-2: Summary of 2006 to 2011 diamond drilling at CuMo | 49 |

| Table 10-3: Significant intersections from CuMo drilling | 54 |

| Table 10-4: Summary of 2012 diamond drilling | 56 |

| Table 10-5: Significant intersections from 2011-2012 CuMo drilling | 57 |

| Table 10-6: Recoverable equivalent grades for significant intersections from 2011-2012 CuMo drilling | 57 |

| Table 10-7: Metal prices used to calculate copper and molybdenum equivalent | 58 |

| Table 10-8: Metallurgical recoveries used to calculate copper and MoS2 equivalent | 58 |

| Table 10-9: Terms used in formulae for equivalent grade calculations | 59 |

| Table 11-1: Certified standards prepared for CuMo project | 61 |

| Table 11-2: Density data example | 62 |

| Table 11-3: Density measurement results summary | 62 |

| Table 13-1: Summary of comminution test-work data | 75 |

| Table 13-2: Baseline flotation results for CuMo composite samples | 76 |

| Table 13-3: Cleaner flotation results for CuMo composite samples | 77 |

| Table 13-4: Locked cycle test results | 78 |

| Table 13-5: Tungsten recovery test results | 78 |

| Table 13-6: Grade/recovery predictions for CuMo | 80 |

| Table 14-1: Summary of MoS2 and Cu contents | 86 |

| Table 14-2: Summary of assay statistics for Cu and MoS2 sorted by zone | 86 |

| Table 14-3: Summary of assay statistics for Ag and W sorted by zone | 88 |

| Table 14-4: Summary of capping levels by mineralized zone | 89 |

| Table 14-5: Summary of capped assay statistics for Cu and MoS2 sorted by zone | 90 |

| Table 14-6: Summary of capped assay statistics for Ag and W sorted by zone | 90 |

| Table 14-7: Summary of 50 ft composite statistics | 91 |

| Table 14-8: Parameters for semi-variogram models at CuMo | 92 |

| Table 14-9: Estimation boundary summary | 93 |

| Table 14-10: Summary of kriging search parameters for each mineralized zone | 94 |

| Table 14-11: Summary of density parameters for each mineralized zone | 96 |

| Table 14-12: Metal prices for resources | 100 |

| Table 14-13: Metal recoveries sorted by mineralized zone | 100 |

| Table 14-14: Measured resources | 101 |

| Table 14-15: Indicated resources | 102 |

| Table 14-16: Measured and indicated resources | 102 |

| Table 14-17: Inferred resources (molybdenum, copper, silver, rhenium and sulfur) | 102 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page x |

| Table 16-1: Summary of the reviewed data types | 104 |

| Table 16-2: Pit slope design details in Snowden (2012) | 104 |

| Table 16-3: Pit optimization input parameters | 112 |

| Table 16-4: CuMo mined quantities | 113 |

| Table 16-5: CuMo primary mine equipment fleet | 118 |

| Table 17-1: Summary of the process plant design criteria (150 ktpd). | 123 |

| Table 20-1: Major permits and authorizations that may be required1 | 135 |

| Table 21-1: Summary of initial capital costs | 143 |

| Table 21-2: Mine primary equipment capital costs | 144 |

| Table 21-3: Summary of plant initial capital cost estimate | 145 |

| Table 21-4: Summary of roaster initial capital cost estimate | 146 |

| Table 21-5: Summary of LOM operating costs | 149 |

| Table 21-6: Estimated plant average operating costs | 150 |

| Table 22-1a: Summary of potential project economics with Inferred resources | 153 |

| Table 22-1b: Summary of potential project economics without inferred resources | 154 |

| Table 22-2: LOM annual project cash flow | 156 |

| Table 22-3: LOM annual project cash flow – continued | 157 |

| Table 22-4: Production schedule summary | 158 |

| Table 22-5: Pricing assumptions for economic analysis | 160 |

| Table 22-6: Processing recovery assumptions used for economic analysis | 160 |

| Table 22-7: Capital cost summary | 161 |

| Table 22-8: Operating costs summary | 162 |

| Table 22-9: Two-factor sensitivity (NPV(8%) in $M) – Capex and Opex | 163 |

| Table 22-10: Two-factor sensitivity (NPV(8%) in $M) – Capex and metal prices | 163 |

| Table 22-11: Two-factor sensitivity (NPV(8%) in $M) – Opex and metal prices | 163 |

| Table 22-12: Sensitivity (NPV(8%) in $M) – Individual metal prices | 163 |

| Table 26-1: Budget for additional work | 174 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 1 |

The CuMo Project (Project) is designed to develop Cumo, Copper-Molybdenum-Silver- Rhenium deposit, and provide long-term employment and business opportunities for a rural area in Idaho, funded by an economically viable project. It would become one of the largest open pit Copper-Molybdenum mines in the United States and producer of Copper, Molybdenum, Silver and Rhenium , critical and strategic minerals.

This Technical Report Summary (TRS or Report) provides an overview of the Project and includes recommendations for future work. It discloses, at an Initial Assessment level, information about the geology, mineralization, exploration potential, Mineral Resources, mining methods, processing methods, infrastructure, social and economic benefits, environmental protection, cleanup, and repair of historical impacts, permitting, reclamation and closure concepts, capital and operating costs and an economic analysis for the Project. The accuracy level for all operating and capital cost estimates contained in the initial assessment is +/-40% with a contingency level of +/-20%

For readers to fully understand the information in this Report, they should read this Report in its entirety, including all qualifications, assumptions and exclusions that relate to the information set out in this Report that qualifies the technical information contained in the Report. The Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The technical information in the Report is subject to the assumptions and qualifications contained in the Report. The economic and technical analyses included in this Report provide only a summary of the potential Project economics based on the assumptions set out herein. There is no guarantee that the Project economics described herein can be achieved.

This technical report summary (TRS or Report) was commissioned by the registrant, International CuMo Mining Corp. (CuMoCo), for its Copper-Molybdenum-Silver Project (CuMo or Project) In Boise County, Idaho for the purpose of reporting an initial assessment. CuMoCo is an Idaho company exploring options for the development and restoration of the project area.

This Report is the inaugural TRS developed for the CuMo Project in accordance with United States SEC S-K 1300 regulations. The TRS summarizes a 2020 Preliminary Economic Analysis (PEA) Technical Report (SRK, 2020) that was completed under Canadian Securities Administrators National Instrument (NI) 43-101 guidelines and published June , 2020 with the following notable differences:

| ○ | An additional set of summary cash flows were produced that do not include inferred resources |

| ○ | The TRS is classified as an Initial Assessment study whereas the 2020 PEA was classified as a Preliminary Economic Analysis . |

Site visits for the purposes of personal inspections of the CuMo property have been undertaken by Shaun Dykes, Geologic QP, 2005 to 2022;

Note: Throughout this report, all currency is United States dollars and all units are imperial, unless otherwise specifically noted.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 2 |

| 1.2 | Property Description, History, and Ownership |

The CuMo deposit is a molybdenum-copper deposit situated 37 miles, equivalent to 60 kilometers (km), northeast of Boise, Idaho, USA. The project is situated in the southern section of the Boise Mountains which are characterized by north-northwest trending mountain ranges separated by alluvial filled valleys. Topographic elevations on the CuMo claims range from 5,400 feet (1,700 meters) to 7,100 ft (2,400 m) above sea level.

Situated in a historic lode gold camp with a recorded production of 2.8 million ounces, molybdenite (MoS2) mineralization was not discovered in this area until 1963 by Amax Exploration (Amax). After conducting surface sampling in 1964, Amax relinquished rights to the property. It was subsequently explored by Curwood Mining Company, Midwest Oil Corporation (later Amoco Minerals Company), Amax (a second time), and then Climax Molybdenum Company (a subsidiary of Amax Inc.). The Historic Drilling was done between 1969 and 1982 for a total of 10,981 m (36,026 ft) in 23 diamond drill holes and three reverse circulation holes. Note: Reverse circulation holes are not used in the resource calculation.

The property was re-staked in 1998 by CuMo Molybdenum Mining Inc. and optioned to Mosquito Consolidated Gold Mines Ltd., (now CuMoCo) in 2004.

Presently, the CuMo project is held by a wholly owned USA subsidiary of CuMoCo, International CuMo Mining Corporation (CuMoCo).

After CuMoCo had optioned the property in 2004, Kobex Resources Ltd. (Kobex) optioned it from CuMoCo in 2005 and commenced drilling in 2006. Kobex drilled one complete hole and 50% of a second hole 1,087 m (3,565 ft). In late 2006, CuMoCo resumed control and completed the 2006 to 2011 exploration drilling programs, including the incomplete hole by Kobex. CuMoCo completed 20,187 m (66,230 ft) of drilling in 32 diamond drill holes in that program. During 2012, CuMoCo drilled nine additional holes totaling 4,713 m (15,464 ft), aimed at improving the resource categorization and gaining a better understanding of the extent of the deposit.

| 1.4 | Geology and Mineralization |

The CuMo deposit is located at the southwestern end of the Idaho-Montana Porphyry Belt. Igneous complexes in this belt are interpreted to be related to an Eocene, intra-arc rift, and are characterized by alkalic rocks in the northeast, mixed alkalic and calc-alkalic rocks in the middle, and calc-alkaline rocks in the southwest. The CuMo deposit is typical of large, dispersed, low grade molybdenum ± copper porphyry deposits that are associated with hybrid magmas typified by fluorine-poor, differentiated monzogranite igneous complexes. Due to their large size, the total contained economic molybdenum in these types of deposits can be equivalent to or exceed that of high-grade molybdenum deposits.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 3 |

CuMoCo’s work has resulted in the interpretation and modelling of three distinct mineralized zones within the deposit. These zones were previously interpreted by Amax as distinct shells that were produced by separate intrusions. Re-interpretation of down-hole histograms for copper (Cu), silver (Ag) and molybdenite (MoS21) suggests the mineralized zones are part of a single, large, concentrically zoned system with an upper copper-silver zone (named Cu-Ag Zone), underlain by a transitional copper-molybdenum zone (named Cu-Mo Zone), in turn underlain by a lower molybdenum-rich zone (named Mo Zone). Three-dimensional modeling of the above zonation indicates the current area being drilled is located on the north side of a large system extending 4.5 km (15,000 ft) in diameter, of which 1.5 km (3,000 ft) has been drilled.

| 1.5 | Mineral Resource Estimate |

The Mineral Resource estimates for the Project were estimated in conformity with Committee for Mineral Reserves International Reporting Standards (CRIRSCO) “International Reporting Template for the public reporting of Exploration Targets, Exploration Results, Mineral Resources and Mineral Reserves” as adopted by the International Council on Mining & Metals November 2019. The mineral resources are reported in in accordance with §§229.1300 through 229.1305 (subpart 229.1300 of Regulation S-K).

The resource estimate was based on a total of 65 diamond drill holes totaling 36,166 m (118,654 ft). Note that the three reverse circulation holes were not used in the resource estimate. Nine of the 65 diamond drill holes were completed in 2012. As no additional drilling has been completed since the 2015 resource was estimated, it is considered current.

A geological model separating the CuMo Deposit into four mineralize zones with an oxidized layer on top was developed by CuMoCo geologists. In addition, major fault blocks were identified both by assay data and by marker beds. Assays were tagged as one of four mineralized zones: a near surface Cu-Ag Zone, a deeper Cu-Mo Zone and a still deeper Mo Zone and an underlying potassic-silica zone (MSI). Statistical analysis of each variable in each zone led to the capping of assays based on the grade distribution within each zone. Uniform down-hole 50 feet (ft) composites were produced for each zone. For variography, the major post mineral fault blocks were rotated back to their original position using marker beds. Semi-variograms were produced for each variable within each zone based on the samples’ original pre-fault locations. A block model with block dimensions of 50 ft was superimposed on the mineralized zones. Grade was interpolated into blocks by ordinary kriging. A tonnage factor was determined for each zone based on multiple specific gravity determinations. Individual blocks were classified as measured, indicated or inferred resource based on their location relative to drill-hole composites.

To take into account the four primary potentially economic minerals estimated, a form of metal equivalent or recoverable value (RCV) was calculated for each block based on reasonable commodity prices and estimated recoveries in each of five zones; the oxide zone (a combination of altered Cu-Ag and Cu-Mo Zones), Cu-Ag Zone, Cu-Mo Zone, Mo Zone and MSI Zone. The 2015 resource estimate is summarized below for RCV cut-offs.

The metal prices used for resource estimation are provided in Table 1-1 and represent the long er term predictions for future prices combined with the moving average for the past 3 years..

1 The convention for the CuMo project has been to measure percent elemental molybdenum (%Mo) in assays and to calculate %MoS2by multiplying %Mo by 1.6681. Both %Mo and %MoS2 are stored in the project’s database, and the latter, %MoS2, is used in resource estimates and mine planning.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 4 |

Table 1-1: Metal prices for resource estimation

| Metal | Price |

| Copper (Cu) (per lb) | $3.00 |

| Molybdenum oxide (MoO3) (per lb) | $10.00 |

| Molybdenum Metal (Mo) (per lb) | $15.00 |

| Silver (Ag) (per oz) | $12.50 |

The metal recoveries used were a function of mineralized zones as follows in Table 1-2.

Table 1-2: CuMo metal recoveries by zone

| Zone | Cu Recovery (%) | Mo Recovery (%) | Ag Recovery (%) |

| OX | 60 | 80 | 65 |

| Cu-Ag | 68 | 86 | 75 |

| Cu-Mo | 85 | 92 | 78 |

| Mo | 72 | 95 | 55 |

| MSI | 72 | 95 | 55 |

In 2012, Snowden Mining Consultants (Snowden) used Geovia’s WhittleTM pit optimizer to determine a constraining open pit shell for the CuMo deposit. Optimization parameters were from Thompson Creek mine (a comparable open pit molybdenum project located in Idaho). The optimization parameters included mill feed, mining and processing costs of $7.52 per processed ton, overall pit slope angles of 45°, metallurgical recoveries as shown above and appropriate dilution and offsite costs and royalties. The commodity prices used in 2012 by Snowden for restraining the resource were Mo at $25/lb, Cu at $3/lb, Ag at $20/oz and W at $10/lb. This pit constraint is still valid.

Since the infill drill holes completed in 2012 were all within the conceptual pit, this resource update uses the Snowden 2012 optimum pit shell to constrain the estimate.

In the mineral resource estimate tables below (Table 1-3, Table 1-4, Table 1-5, and Table 1-6), the base case $5.00/t RCV cut-off is highlighted and is selected based on operating costs and the results of grade improvement using a mineral sorting process. The $5.00 cut-off is suggested to separate waste from material that is fed into the sorters. From the sorters, only mill feed above an economic cut-off would be sent for immediate processing.

It should be noted that since the convention for the CuMo project has been to work with %MoS2, as calculated from measured %Mo, the %MoS2 values in the resource estimate tables are 1.6681 times greater than %Mo.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 5 |

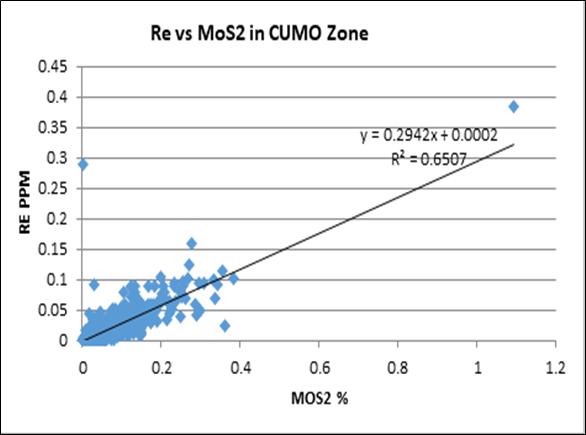

An estimate for rhenium (Re) and sulfur (S) associated with the MoS2 was completed using linear regression of MoS2 vs. Re and MoS2 vs S to show the average grades of Re and S that would be contained with MoS2 within each block. The Re and S were not used to determine the RCV value of resources shown in Table 1-3, Table 1-4, Table 1-5, and Table 1-6 below.

Note: Regression analysis is not industry standard practice in calculating overall resources. However, the fact that rhenium is entirely and almost all the sulfur are contained within the material containing MoS2, (note; a minor amount of sulfur is contained in pyrite) which has been estimated by kriging, means that regression is a valid method of obtaining a reasonable estimate of the rhenium and sulfur contents at the level of precision of this study. Due to the large number of samples involved in the regression analysis, the confidence of this particular regression estimate is comparable to that obtained by the method of ordinary kriging.

Table 1-3: Measured resource within pit shell

Cut-off RCV ($) | Grade > RCV Cut-off | Contained Metal |

Quantity (Mt) | MoS2 (%) | Cu (%) | Ag (ppm) | RCV ($) | Re (ppm) | S (%) | Mo (mmlbs) | Cu (mmlbs) | Ag (Moz) |

| 2.5 | 308.4 | 0.079 | 0.074 | 2.09 | 17.32 | 0.029 | 0.233 | 292.1 | 456.5 | 18.8 |

| 5.0 | 297.2 | 0.081 | 0.076 | 2.09 | 17.83 | 0.03 | 0.229 | 288.6 | 451.7 | 18.1 |

| 7.5 | 282 | 0.085 | 0.076 | 2.06 | 18.48 | 0.031 | 0.223 | 287.4 | 428.7 | 16.9 |

| 12.5 | 227.9 | 0.097 | 0.075 | 2 | 20.50 | 0.036 | 0.217 | 265 | 341.8 | 13.3 |

| 15.0 | 195.4 | 0.105 | 0.072 | 1.9 | 21.71 | 0.039 | 0.212 | 246 | 281.3 | 10.8 |

| 17.5 | 159.7 | 0.115 | 0.067 | 1.8 | 23.04 | 0.043 | 0.207 | 220.1 | 213.9 | 8.4 |

| 20.0 | 122.9 | 0.125 | 0.063 | 1.7 | 24.50 | 0.047 | 0.202 | 184.1 | 154.8 | 6.1 |

Source: Giroux et al, 2015, modified 2019

Table 1-4: Indicated resources

Cut-off RCV ($) | Grade > RCV Cut-off | Contained Metal |

Quantity (Mt) | MoS2 (%) | Cu (%) | Ag (ppm) | RCV ($) | Re (ppm) | S (%) | Mo (mmlbs) | Cu (mmlbs) | Ag (Moz) |

| 2.5 | 2216.1 | 0.049 | 0.079 | 2.48 | 12.32 | 0.018 | 0.277 | 1301.9 | 3501.4 | 160.3 |

| 5.0 | 1972.3 | 0.053 | 0.085 | 2.57 | 13.40 | 0.019 | 0.269 | 1253.3 | 3352.9 | 147.8 |

| 7.5 | 1708.3 | 0.059 | 0.088 | 2.59 | 14.55 | 0.021 | 0.258 | 1208.4 | 3006.5 | 129 |

| 12.5 | 1050.6 | 0.076 | 0.09 | 2.55 | 17.67 | 0.027 | 0.235 | 957.4 | 1891.1 | 78.1 |

| 15.0 | 798.5 | 0.083 | 0.09 | 2.56 | 19.06 | 0.03 | 0.231 | 794.6 | 1437.2 | 59.6 |

| 17.5 | 541.6 | 0.093 | 0.088 | 2.49 | 20.60 | 0.034 | 0.226 | 603.9 | 953.2 | 39.3 |

| 20.0 | 301.3 | 0.106 | 0.082 | 2.36 | 22.49 | 0.039 | 0.219 | 383 | 494.2 | 20.7 |

Source: Giroux et al, 2015, modified 2019

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 6 |

Table 1-5: Measured and indicated resources

Cut-off RCV ($) | Grade > RCV Cut-off | Contained Metal |

Quantity (Mt) | MoS2 (%) | Cu (%) | Ag (ppm) | RCV ($) | Re (ppm) | S (%) | Mo (mmlbs) | Cu (mmlbs) | Ag (Moz) |

| 2.5 | 2524.6 | 0.053 | 0.079 | 2.43 | 12.93 | 0.019 | 0.272 | 1604.3 | 3988.9 | 178.9 |

| 5.0 | 2269.6 | 0.057 | 0.084 | 2.5 | 13.98 | 0.021 | 0.264 | 1551.1 | 3812.9 | 165.5 |

| 7.5 | 1990.4 | 0.063 | 0.086 | 2.51 | 15.10 | 0.022 | 0.253 | 1503.5 | 3423.5 | 145.7 |

| 12.5 | 1278.6 | 0.079 | 0.087 | 2.46 | 18.17 | 0.029 | 0.232 | 1211.1 | 2224.8 | 91.7 |

| 15.0 | 993.9 | 0.088 | 0.087 | 2.43 | 19.58 | 0.032 | 0.227 | 1048.7 | 1729.5 | 70.4 |

| 17.5 | 701.4 | 0.098 | 0.083 | 2.33 | 21.16 | 0.036 | 0.221 | 824.1 | 1164.2 | 47.7 |

| 20.0 | 424.3 | 0.112 | 0.077 | 2.17 | 23.07 | 0.041 | 0.214 | 569.8 | 653.4 | 26.9 |

Source: Giroux et al, 2015, modified 2019

Table 1-6: Inferred resources (molybdenum, copper, silver, rhenium and sulfur)

Cut-off RCV ($) | Grade > RCV Cut-off | Contained Metal |

Quantity (Mt) | MoS2 (%) | Cu (%) | Ag (ppm) | RCV ($) | Re (ppm) | S (%) | Mo (mmlbs) | Cu (mmlbs) | Ag (Moz) |

| 2.5 | 3373.6 | 0.04 | 0.057 | 1.93 | 9.55 | 0.014 | 0.304 | 1617.9 | 3845.9 | 189.9 |

| 5.0 | 2556.6 | 0.048 | 0.067 | 2.13 | 11.48 | 0.017 | 0.282 | 1471.4 | 3425.9 | 158.8 |

| 7.5 | 1996 | 0.056 | 0.07 | 2.23 | 13.07 | 0.02 | 0.261 | 1340.1 | 2794.4 | 129.8 |

| 12.5 | 996.4 | 0.078 | 0.064 | 1.98 | 16.74 | 0.028 | 0.231 | 931.8 | 1275.4 | 57.5 |

| 15.0 | 637 | 0.086 | 0.074 | 2.16 | 18.63 | 0.03 | 0.244 | 656.8 | 942.7 | 40.1 |

| 17.5 | 384.8 | 0.094 | 0.084 | 2.34 | 20.49 | 0.032 | 0.259 | 433.7 | 646.4 | 26.3 |

| 20.0 | 190.2 | 0.109 | 0.078 | 2.37 | 22.80 | 0.037 | 0.262 | 248.6 | 296.8 | 13.1 |

The Initial assessment described herein is preliminary in nature and is partly based on inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the initial assessment based on these mineral resources will be realized.

| 1.6 | Project Development and Operations |

CuMo is to be developed as an open pit mining operation, mining waste and providing feed to a primary crusher which then supplies crushed material to a mineral sorting plant. The sorting plant consists of both bulk and particle sorting and produces feed for a mill and flotation plant. The project plan includes an off-site roaster to convert molybdenum concentrate (as MoS2) to saleable MoO3. Major by-products are copper and silver, and minor by-products are rhenium and sulfuric acid. Potential for the production of tungsten as a minor by-product may also exist.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 7 |

The proposed operation is for a 150,000 short tons per day (stpd) feed rate to the mill. This requires a sort feed rate averaging about 200,000 stpd, with a maximum of about 265,000 stpd. Mining rates to achieve this feed average about 400,00 stpd, reaching a maximum mining rate of 500,000 stpd.

The overall process is for material to be mined at the mining rate, and a grade control cut-off is applied to that material to determine what material is sent to the sort plant (sorter feed); the remaining material is sent to waste dumps. The sort plant consists of an initial three-stage bulk sort process, where for each stage, a pair of cut-offs is applied to produce mill feed, waste, and middlings streams. The middlings stream for each sort stage becomes the feed for the next sort stage. After the third sort, the middlings are sent to a stockpile which is the feed source for a particle sorting process. The product from the particle sort process is combined with the mill feed product of the bulk sort process in a coarse material stockpile for feed to the mill.

The mill is a conventional semi-autogenous grinding circuit and flotation circuit creating an interim copper-molybdenum concentrate which is then further processed in a molybdenum flotation circuit to separate copper and molybdenum concentrates. Molybdenum concentrate is transported to the project roaster for production of MoO3. Copper concentrate is shipped to market.

The tailings storage facility (TSF) will be located at the headwaters of the Clear Creek watershed, in a natural basin formed by the surrounding ridgeline. The TSF will have capacity to store the 1,582M tons (~900M m3) of tailings produced over the 28 year mine life, with an ultimate crest elevation of 6,950 ft. Tailings containment will be provided by the natural topography on the valley sides and an engineered dam that will be buttressed by the Clear Creek waste rock facility (WRF) constructed immediately downstream of the TSF. A starter dam will be constructed to elevation 6300 ft to facilitate early mine production, followed by an additional five raises spread out over the life of the mine.

| 1.7 | Social and Environmental |

At this time, no issues were identified that would materially impact the ability to eventually extract mineral resources at the project.

The proposed mine will be located on public land administered by the United States Forest Service (USFS) and private land owned and controlled by ICMC. The permitting path will involve multiple state and federal agencies. Permits likely to be required for the project are presented in Table 20-1. An environmental impact statement will be required at the level of NEPA analysis for mine development, operations, and closure. Reclamation bonds will be required by both federal and state agencies. The reclamation liability for the proposed mine will have to be determined based on third-party costs, and the bond amount will have to be posted using an approved financial instrument

ICMC has initiated consultation with various stakeholders namely: government officials at all levels and local communities in regard to the potential social and community impacts or improvements that may occur as the project progresses. All groups are provided regular updates as the project is proceeding. Local communities and officials have come out in strong support of the project and are actively working with the project on both the Grimes Creek project and future planning (Hilscher et al, 2018).

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 8 |

The mine will be located in an area used for weekend summer dispersed recreation and fall big-game hunting and is well-known in the Boise area. Organized environmental groups such as the Idaho Conservation League and Sierra Club are keeping their constituents informed so as to coordinate opposition to the project. As such, well-funded, organized opposition to mining activities should be anticipated.

At the current time the United States Forest Service (USFS) is working on a Supplemental Red Line Environmental Assessment that will allow the Company to proceed to the next round of drilling and road access construction on the property. The authorization is expected in 2020, and no surface disturbing activities can proceed on the property until the authorization is received. This is the only ongoing permitting activity.

Operating costs were derived from the mining operation based on comparison to similar size operations and the authors’ experience. Modifications were made to account for varying haul profiles that are expected during the mine life. General and administrative costs were similarly based on similar size operations and the authors’ experience.

Processing costs were based on prior work by Ausenco (Ausenco, 2009) and compare well with more recent studies and so continue to apply.

Capital costs for mining were based on evaluation of mining equipment fleet requirements and application of unit equipment prices used in recent studies. Pre-production mining (pre-stripping) was also capitalized for the purpose of economic analysis. Capital costs for the sorting plant were estimated based on its material handling focus (conveyors).

The capital costs for infrastructure and mineral processing from the earlier Ausenco work (Ausenco, 2009) were reviewed and were deemed reasonable in comparison to more recent studies of large porphyry projects though some cost escalation was applied.

| 1.9.1 | Cautionary Statements |

Certainty of Initial Assessment

The Initial Assessment is preliminary in nature, that it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that initial assessment will be realized.

The project as presented and under the current assumptions has the potential to be economic. The after-tax NPV is positive and is robust across a range of sensitivities with respect to capital costs, operating costs and revenue (price). A summary of the project economics is shown in Table 1-7a and b. Two tables are presented one with the inferred resource included one without. Due to the ore sorting and central location of the pit a large portion of the inferred component of the resource is located on the outer edges in the waste blocks. What inferred that is located within the mineable resource has been converted to waste. A total of 12.4% of the resources included in the economic analysis is inferred.

Metal prices assumptions are described in TRS Table 1-1: Metal prices for resource estimation. In addition, TRS Table 22-5: Pricing assumptions for economic analysis sets forth the metals prices assumptions used for the life of mine economic evaluation.

Cut-off grades for resources used in the economic analysis are contained in TRS Tables 1-1 to 1-6, and are described in terms of Recoverable Metal Value (RCV), which is the total value of the metals contained in the resources at various cut-offs. The base case economic analysis used an RCV cut-off of $5 per ton.

Costs utilized for the economic analysis are found in Table 22-7 (Capital costs) and Table 22-8 (Operating costs), all contained within Article 19--Economic Analysis.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 9 |

Table 1-7a: Summary of Project Economics with Inferred Resources

| Project Metric | Units | Value |

| Pre-Tax NPV @ 5% | $M | 2,470 |

| Pre-Tax NPV @ 8% | $M | 800 |

| Pre-Tax NPV @ 10% | $M | 113 |

| Pre-Tax IRR | % | 10% |

| After-Tax NPV @ 5% | $M | 1,709 |

| After-Tax NPV @ 8% | $M | 356 |

| After-Tax NPV @ 10% | $M | -205 |

| After-Tax IRR | % | 9% |

| Undiscounted After-Tax Cash Flow (LOM) | $M | 7,032 |

| Payback Period from Start of Processing | years | 8.0 |

| Initial Capital Expenditure | $M | 3,071 |

| LOM Sustaining Capital Expenditure | $M | 972 |

| Closure | $M | 150 |

| LOM C-1 Cash Costs After By-product Credits | $/lb Mo | 4.67 |

| Nominal Flotation Process Capacity | stpd | 150,000 |

| Mine Life (years @ > 90% of full production) | years | 28 |

| LOM Flotation Mill Feed | kst | 1,582,526 |

| LOM Grades |

| Molybdenite (MoS2) | % | 0.074% |

| Molybdenum (elemental Mo) | % | 0.044% |

| Copper | % | 0.105% |

| Silver | grams per tonne | 3.00 |

| LOM Waste Volume | kst | 2,425,101 |

| LOM Strip Ratio (Waste:Sort Feed) | ratio | 1.11 |

| Mass Pull to Mill from Sort Feed | % | 72% |

| LOM Strip Ratio (Waste:Mill Feed) | ratio | 1.53 |

| First Five Years Average Annual Metal Production |

| Molybdenum (Mo) | klbs/yr | 34,976 |

| Copper | klbs/yr | 93,394 |

| Silver | kounces/yr | 3,940 |

| LOM Average Annual Metal Production |

| Molybdenum (Mo) | klbs/yr | 43,072 |

| Copper | klbs/yr | 84,229 |

| Silver | kounces/yr | 3,575 |

| LOM Average Mill Process Recovery |

| Molybdenum (Mo) | % contained metal | 91.87% |

| Copper | % contained metal | 76.33% |

| Silver | % contained metal | 70.42% |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 10 |

Table 1-7b: Summary of Project Economics without Inferred Resources

| Project Metric | Units | Value |

| Pre-Tax NPV @ 5% | $M | 2,328 |

| Pre-Tax NPV @ 8% | $M | 771 |

| Pre-Tax NPV @ 10% | $M | 102 |

| Pre-Tax IRR | % | 10% |

| After-Tax NPV @ 5% | $M | 1,674 |

| After-Tax NPV @ 8% | $M | 356 |

| After-Tax NPV @ 10% | $M | -225 |

| After-Tax IRR | % | 9% |

| Undiscounted After-Tax Cash Flow (LOM) | $M | 6,575 |

| Payback Period from Start of Processing | years | 8.0 |

| Initial Capital Expenditure | $M | 3,071 |

| LOM Sustaining Capital Expenditure | $M | 972 |

| Closure | $M | 150 |

| LOM C-1 Cash Costs After By-product Credits | $/lb Mo | 4.67 |

| Nominal Flotation Process Capacity | stpd | 150,000 |

| Mine Life (years @ > 90% of full production) | years | 28 |

| LOM Flotation Mill Feed | kst | 1,582,526 |

| LOM Grades |

| Molybdenite (MoS2) | % | 0.076% |

| Molybdenum (elemental Mo) | % | 0.045% |

| Copper | % | 0.108% |

| Silver | grams per tonne | 3.10 |

| LOM Waste Volume | kst | 2,55,706 |

| LOM Strip Ratio (Waste:Sort Feed) | ratio | 1.11 |

| Mass Pull to Mill from Sort Feed | % | 72% |

| LOM Strip Ratio (Waste:Mill Feed) | ratio | 1.53 |

| First Five Years Average Annual Metal Production |

| Molybdenum (Mo) | klbs/yr | 37,640 |

| Copper | klbs/yr | 90,756 |

| Silver | kounces/yr | 3,731 |

| LOM Average Annual Metal Production |

| Molybdenum (Mo) | klbs/yr | 34,980 |

| Copper | klbs/yr | 84,233 |

| Silver | kounces/yr | 3,375 |

| LOM Average Mill Process Recovery |

| Molybdenum (Mo) | % contained metal | 91.87% |

| Copper | % contained metal | 76.33% |

| Silver | % contained metal | 70.42% |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 11 |

This Technical Report Summary is preliminary in nature and includes mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is increased risk and uncertainty to commencing and conducting production without established mineral reserves which may result in economic and technical failure and may adversely impact future profitability.

The mineral resource is supported by exploration results, test-work and modelling. As with any mineral resource estimate there is uncertainty inherent in the estimation process. There is a risk that the grades and metallurgical recoveries may be lower than currently modelled. There is also a risk that the interpretation of the results is inaccurate and that less mineralized material is present than is currently modelled. The estimate of Mineral Reserves may be materially affected by metal prices, environmental, permitting, legal, title, taxation, socio-political, marketing, infrastructure development, or other relevant issues

Additional exploration and test-work will potentially reduce this risk as the project is advanced.

The QP considers the scale and quality of the mineral resources at the Project to indicate favorable conditions for future extraction and any uncertainties should be resolved through additional work.

The mining concepts for CuMo are largely proven. The adoption of autonomous equipment does possess some risk in that federal and local regulators may require extensive efforts by proponents to ensure the safety of their operations.

The CuMo open pit is envisioned to be a large, deep pit (up to 3500 ft deep). With this comes the potential geotechnical risk for wall failures. While the author has assumed a relatively flat overall wall angle for the study (37°), there may be risks associated with yet unknown rock mass or structural geology conditions that may require consideration of even flatter slopes in places.

The technology envisioned in this study for bulk sorting, prompt gamma neutron activation analysis (PGNAA), has had limited application to molybdenum-copper deposits. While demonstrated for some low-grade copper deposits, testing is required to verify that molybdenum is measurable at the specific grades envisioned for CuMo.

As with bulk sorting technology, additional testing is required to better estimate the final results expected from particle sorting.

There is a risk that achieved recoveries could be lower than estimated, that throughputs will not be achieved and that costs may be higher than modelled. The process recovery, throughput and cost estimates will be refined as part of the pre-feasibility study.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 12 |

| 1.10.5 | Project Infrastructure |

The planned mine will be a green-fields site and requires construction of mine and process-related infrastructure including the TSF. Access roads in and around the project site will be required. There is a risk that the designs, costs and implementation timelines for the provision of this infrastructure may not be as anticipated, increasing costs and schedule.

At this time, no issues were identified that would materially impact the ability to eventually extract mineral resources at the project. Previous environmental analyses have identified the presence of a rare plant Sacajawea’s bitterroot (Lewisia sacajawa), and potential habitat for Endangered Species Act wildlife, and USFS sensitive species. These potential issues will need to be analyzed and disclosed in NEPA documents and potentially mitigated.

The mine will be located in an area used for weekend summer dispersed recreation and fall big-game hunting and is well-known in the Boise area. Organized environmental groups such as the Idaho Conservation League and Sierra Club are keeping their constituents informed citing issues of potential pollution of the Boise river which supplies drinking water to the city of Boise. As such, well-funded, organized opposition to mining activities should be anticipated.

Under the 1872 Mining Law as amended, ICMC has the legal right to develop the mineral resources on their mining claims. The USFS has a requirement to manage ICMC’s activities in accordance with its mining regulations at 36 CFR 228A and must ensure compliance with the requirements of the National Environmental Policy Act. As defined in law and regulations, the USFS is limited in that it may not deny ICMC’s mining plan of operations provided that the activities proposed are reasonably incident to mining, not needlessly destructive, and comply with applicable federal, state, and local laws and regulations. The USFS does not have the authority to impose unreasonable requirements that would have the effect of denying the statutory right to explore and develop the mineral resource, provided the mining plan of operations otherwise meets the intent of applicable laws and regulations (USFS 2018).

There is a risk that the mining plan of operations would identify and characterize issues that may lengthen the timeline and increase the costs of the permitting the project. Note that the STUDY described in this report does not quantify the timeline and costs for the pre-construction and permitting activities.

Table 20-1 in Section 20.2 summarizes the federal, state, and local authorizations and permits that will be required for mining. No applications for mining authorizations and permits have been filed with federal, state, and local agencies. Reclamation bonds will have to be posted with the state of Idaho and the USFS.

Project Strategy Risk

Overall, the author considers that the likelihood of a major revision to project strategy emerging from the pre-feasibility study to be moderate. Mineral sorting as contemplated in this study is not a mature technology, and there is a risk that the assumptions used may not prove accurate. Elimination of the mineral sorting pre-process from the strategy has the potential to materially reduce the economic proposition of the project.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 13 |

Commodity Price Risk

There is a risk that commodity prices may not be consistent with assumptions made in this study. In particular, molybdenum, which contributes to the majority of the project value is historically subject to significant price volatility.

Capital Cost Risk

There is a risk that the capital required to build and operate the project may be higher than that forecast in this study. The author recommends that the precision of the estimates be refined at the pre-feasibility study and feasibility study before commitment to project construction is made.

Operating Cost Risk

There is a risk that the operating costs incurred to operate the project may be higher than that forecast in this study. The author notes that variability in the operating cost drivers (productivity, input costs and labor costs) over time is expected. The analysis assumes constant conditions but is best thought of as reflecting an expectation of average costs. The author recommends that the precision of the estimates be refined in the pre-feasibility and feasibility studies before commitment to project construction is made.

Schedule Risk

There is a risk that the schedule to build the project may vary from that assumed in the study. This is an asymmetrical risk, with significantly more downside scope than upside. This risk is exacerbated by the seasonality of the location, with somewhat difficult construction conditions occurring in some winter months. Small delays have the potential to be more significant than, might otherwise be the case, if they push critical path activities into winter months, thereby incurring a much longer delay.

Process Recovery Risk

There is a risk that achieved recoveries could be lower than estimated, reducing the revenue and economic returns of the project. The process recovery estimates will be refined as part of the feasibility study.

Permitting and Pre-construction Schedule Risk

This was not explicitly considered for the purposes of this study in the economic analysis as the analysis is conducted only from the commencement of construction. Nevertheless, the risk of longer-than-anticipated permitting timeline will reduce the project value is considered from “today” forward.

| 1.11 | Project Opportunities |

The exploration drilling and thus mineral resource model for CuMo is constrained on the western extents of the deposit. There is potentially an opportunity with increased exploration to expand the resource to the west, thus offering either more process feed within the current envisioned open pit or increasing the size of the open pit to the west.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 14 |

With increased knowledge of the rock mass and structural geology, through additional geotechnical field programs and investigation, there is potential to steepen the wall angles for CuMo, potentially reducing and/or deferring some mining costs.

Further consideration of high angle conveying solutions in combination with semi-mobile crushing and conveying (IPCC) concepts could highlight opportunities for cost savings at CuMo. Applying IPCC to sort feed, which needs to be crushed either way and is up to 50% of the mined material, poses the greatest opportunity.

The bulk sorting analysis was conducted on drill core that was sampled on a standard 10 ft interval. Thus, heterogeneity could only be assessed down to this scale. With multiple stage sorting and splitting, smaller size packets of material could be measured. As heterogeneity increases with reduced scale, there is potential that better segregation of waste, mill feed and middlings is possible. The opportunity would be for increased waste rejection and ultimately reduced middlings fractions to improve the economics of the project.

Ultimately, the potential for exploitation of the heterogeneity of the deposit may not be firmly quantified by way of studies conducted on exploration-level data. Much higher-resolution sampling and sorting may be possible at an operational scale. This has the potential to enhance project economics, but the quantum of that improvement is difficult to quantify.

The field of mineral-sorting is the subject of significant research and development. There exists an opportunity for this project to exploit improvements in this technology.

Additional metallurgical work to determine optimum grind size (the current assessment is based on the finest grind tested to date), analyze recoveries of the various metals in the proposed unit operations, and analyze the effects of the higher grade coming from the mineral sorters on metal recoveries. This has the potential to improve project economics.

Optimization of reagents to reduce costs and improve metallurgical recoveries has the potential to improve recoveries.

There may be opportunity to economically recover tungsten from the mineralized material.

| 1.11.5 | Project Infrastructure |

Further studies may allow for optimization of infrastructure design, costing and schedule. Whilst optimization is worth pursuing, the author views modification to the infrastructure concepts to be unlikely to materially affect the economic proposition at a strategic level for the project.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 15 |

| 1.11.6 | Economic Opportunities |

Real Option Value

In the case of a large, long-life open-pit mine such as is contemplated for the CuMo project, there exists significant optionality that can be leveraged to improve project cashflows and values. The simple sensitivity analysis conducted in Section 22.12 assumes a constant operating strategy, even as assumptions are varied. In practice, management has the option to alter strategy in response to those variations. Downsides can be mitigated, and upsides can be leveraged for greater returns.

It is also expected that the mine would run using a dynamic cut-off policy where sorting strategies and cut-offs, mill-feed cut-offs, stockpiling strategies and mining rates will all be varied in real time to maximize returns as prices and costs vary. The benefits of this strategy are not reflected in the central estimate approach to valuation summarized in this report.

Project Strategy Opportunity

While the probability of a major revision to project strategy can be considered moderate, careful consideration and revision of the strategic decisions should be a feature of studies going forward. In particular, effort should be made to enhance the optionality of the project, particularly where this is a low-cost investment.

Commodity Price Opportunity

There is a risk that commodity prices may not be consistent with assumptions made in this study. Higher prices, both realized and forecast, would lead to re-optimization of the mine and processing plans with a potential to create additional value beyond that shown by the sensitivity analysis summarized in Section 22.11.

Capital Cost Opportunity

Opportunities to reduce or defer capital expenditure may be realized in future studies. Care should be taken when considering the relationship between lower capital opportunities and technical risk to the project.

Operating Cost Opportunity

Operating costs may be lower than forecast for the purposes of this study. Lower costs should feed into both strategic and short-term mine planning, to allow optimization of stockpiling, sorting and mill feed strategies.

Schedule Opportunity

This risk is highly asymmetric. The author considers that the opportunity to execute a significantly shorter construction program is low. The author cautions that optimized schedules with multiple critical or near-critical path activities will contain additional embedded risks.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 16 |

Process Recovery Opportunity

Further metallurgical test-work will allow for optimization of the process flow sheet and plant design in the pre-feasibility and feasibility studies. Better than planned recoveries are possible.

Pit Slope Angle Opportunity

This is not considered to be a significant opportunity from an economic perspective. Strip ratios are relatively low, and incremental change in waste-movement volumes do not impact the overall project economics significantly.

| 1.12 | Conclusions and Recommendations |

Exploration work consisting mainly of drilling is required to reach feasibility. It is estimated that a total of 33 additional holes for 71,000 ft plus an additional five geotechnical holes for 12,000 ft on the deposit plus additional 74,800 ft allocated to condemnation drilling of waste dump, mill site and tailings pond areas, making a total of 157,8000 ft of drilling budgeted. This drilling is broken into the following categories:

| ● | Orientated geotechnical drilling – requires orientated core recovery system, |

| ● | Drilling for metallurgical sample – large diameter hole (PQ size) recommended, and |

| ● | Condemnation drilling waste dump, mill and tailings site. |

The shortest time to complete this work will be two seasons using four drill rigs each season.

The author provides these recommendations for the next steps of geotechnical assessment:

| ● | Geotechnical database for quality assurance and quality check assessment (to address the inconsistencies and potentially poor data observed in the existing data set) |

| – | Select a sub-set (~10%) of resource drill holes that give good spatial coverage of the proposed pit walls, and from multiple drilling campaigns |

| – | Undertake quantitative basic geotechnical logging using the full core photographs of these drill holes (total core recovery (TCR), solid core recovery (SCR), rock quality designation (RQD) and fracture frequency - FF/m) |

| – | FF/m vs RQD plots for both data-sets |

| – | Comparison of the values in the database with the photo-logged values |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 17 |

| – | Assessment of differences in order to determine whether variance is systematic or random, and consequently decide on the respective approach to address (e.g. apply correction factor, re-logging more of the drill holes) |

| – | Qualitative assessment of the rock susceptibility to deterioration by comparing core in the photos (fresh), to the current condition of the stored core (aged) |

| ● | Major structures assessment |

| – | Log the photos of the core for major structures |

| – | Develop conceptual integrated litho-structural 3-D model |

| ● | Geotechnical-specific diamond-cored drill holes targeted to provide coverage of the proposed interim and ultimate pit walls, and compatible with the pit depth |

| – | Geotechnical logging to RMRB89 system (historical logging to RMRL90 which is typically for underground mine applications) |

| – | Field (empirical and point load) and laboratory (uniaxial and triaxial compressive strength and direct shear) testing of fresh core to determine intact rock strength |

| – | Calculate RMR values and conduct comparison with lithology, alteration and mineralogy zones of the 3-D geology model to establish broad geotechnical domains |

| – | Establish pit sectors and domain-representative sections to conduct pit slope stability analyses and select pit design angles |

The author recommends further study of the application of high angle conveying of sort feed at CuMo.

The author further recommends the continued consideration of autonomous haulage for CuMo, with commensurate refinement of performance parameters and costs.

The author recommends that CuMoCo engage with bulk sorting technology providers to advance testing of penetrative technologies (e.g. PGNAA) for the measurement of molybdenum in lower grade applications.

Additional scanning of the existing core to examine heterogeneity at a finer level than the 10 ft intervals used in the current study is recommended. Further testing of existing particle sorting technologies/machines to look for improvements in throughput is recommended.

Metallurgical aspects to be studied were highlighted in the preliminary metallurgical analysis, some of which require larger samples to finalize the detailed flow sheet and determine how many cleaning stages will be required.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 18 |

A critical part of the analysis is a grinding-versus-recoverability study, since in the previous study, only two grinding sizes were studied: coarse and fine. The fine grind promised to be more economically favorable despite the increase in costs. Further study with multiple grinding size options is required to determine an optimum grinding system. An intermediate grind for example in the range between 71 to 106 microns P80, would allow single stage SAG milling to be evaluated for reduced comminution energy cost, lower operating and maintenance labor in comminution and dewatering, and easier discard of a coarser tailing product when compared to the present grind P80 of 63 microns. The single stage SAG milling concept also allows for low cost future expansion of the initial lines provided by simply adding a ball mill to each SAG mill line to create about double the tonnage capability, without adding feed bins or conveyors. SAG mills with diameter/length aspect ratios over two are needed to make this work.

Work will consist of collecting and analyzing sufficient large bulk samples to determine the optimum flow sheet for the deposit. This work is expected to be further supported by a variability study to analyze variations within the deposit. Typically, a total of 100 to 150 twenty-kilogram samples will be used for the variability study.

| 1.12.6 | Tailings Management |

Engineering studies, including TSF design and potential water management and treatment design, including:

| ● | Updating the TSF and Clear Creek Waste Facility designs based on field investigation results |

| ● | Developing tailings deposition plan and waste placement sequence to match pit development and mill output |

| ● | Detailed analysis of the water and load balance to predict the accumulation of mill reagents in the process water circuit from the tailings |

At this time, no issues were identified that would materially impact the ability to eventually extract mineral resources at the project. A mining plan of operations and reclamation cost estimate must be prepared to identify locations of the mine, waste rock dumps, roads (haul and access), power and water line corridors from the source to the point of use, mill, tailings storage facility, and other support facilities. Operating plans must be developed in conjunction with the mining plan of operations. ICMC should develop robust reclamation and closure plans for the facilities. ICMC should also begin acquiring any necessary water rights. Stakeholder outreach should continue.

Once the facility locations have been determined, ICMC should coordinate with state and federal agencies to identify the baseline studies that will need to be completed to support the development of an environmental impact statement and initiate those studies.

Previous environmental analyses have identified the presence of a rare plant Sacajawea’s bitterroot (Lewisia sacajawa), and potential habitat for Endangered Species Act wildlife, and USFS sensitive species. These potential issues will need to be analyzed and disclosed in NEPA documents and potentially mitigated.

Organized environmental groups such as the Idaho Conservation League and Sierra Club are keeping their constituents informed so as to coordinate opposition to the project. As such, well-funded, organized opposition to mining activities should be anticipated.

| 1.12.8 | Plan and Budget for Additional Work |

Table 1-8 sets out a summary of work expected to be completed prior to a commitment to construction. The estimated time frame for this work program is three years.

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 19 |

Table 1-8: Budget for additional work

| Item | Additional Information | Budget (000s $) |

| Diamond Drilling | | |

| Delineation, infill, metallurgy | 48,097 m (157,800 ft) @ $100/ft | 15,780 |

| | | |

| Road Construction | 2 km @ $50,000/km | 100 |

| | | |

| Sample Preparation and Analysis | 8,800 @ $60 each | 528 |

| Metallurgical Testing | Sample Collection, etc. | 125 |

| | Batch Round of Testing | 1,000 |

| | Variability Test-work | 1,200 |

| Land Acquisition and Staking Costs | | 8,000 |

| Environmental Studies | Environmental Assessment | 713 |

| | Baseline Studies Startup | 12,500 |

| | Environmental Plan of Operations | 800 |

| | Environmental Impact Statement | 23,500 |

| | Permitting | 3,000 |

| Engineering Studies Scoping | Mill Site, Tailings Site Analysis | 550 |

| | Intergoverment Task Force Creation | 500 |

| | Mining Plan of Operations | 1,200 |

| | Pre-feasibility Study | 5,500 |

| Mobilization-Demobilization | | 427 |

| Road Maintenance | | 325 |

| Supervision and Project Management | Supervision | 225 |

| | Corporate Manager | 360 |

| | Project Manager | 240 |

| | Assistant Geologist(2) | 364 |

| | Technicians (12) | 1,174 |

| Vehicles | 5 Vehicles | 150 |

| Accommodation and Food | 30 Personnel | 760 |

| Travel | | 42 |

| Project Office and Warehouse | | 1,225 |

| Land Filing Fees | Current BLM: $155/claim/year | 87 |

| Land Filing Fees | Projected Additional Filing Fees | 256 |

| | | |

| Consultants | (Mining, Metallurgical and Marketing) | 575 |

| Resource Modeling | | 1,650 |

| Public Relations and Project | Public Relations and Legal, etc. | 2,550 |

| Presentation | Liaison County and State Officials | 1,250 |

| Subtotal | | 86,655 |

| Contingency | | 13,345 |

| Total | | 100,000 |

| SMD | Cumo S-k 1300 Technical Report | November 2022 |

Geologic 2CM027.001 CuMoCo. | Page 20 |

| 2 | Introduction and Terms of Reference |

The CuMo project is an early-stage molybdenum-copper exploration project, located approximately 37 miles northeast of Boise, Idaho, USA. CuMoCo holds its interest in the CuMo project through its direct ownership of patented and unpatented mining claims.

This technical report summary (TRS or Report) was commissioned by the registrant, International CuMo Mining Corp. (CuMoCo), for its Copper-Molybdenum-Silver Project (CuMo or Project) In Boise County, Idaho for the purpose of reporting an initial assessment. ICMC is an Idaho company exploring options for the development and restoration of the project area.

This Report is the inaugural TRS developed for the CuMo Project in accordance with United States SEC S-K 1300 regulations. The TRS summarizes a 2020 Preliminary Economic Analysis (PEA) Technical Report (SRK, 2020) that was completed under Canadian Securities Administrators National Instrument (NI) 43-101 guidelines and published June , 2020 with the following notable differences:

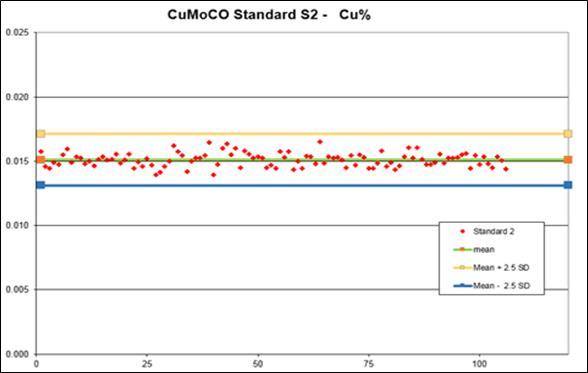

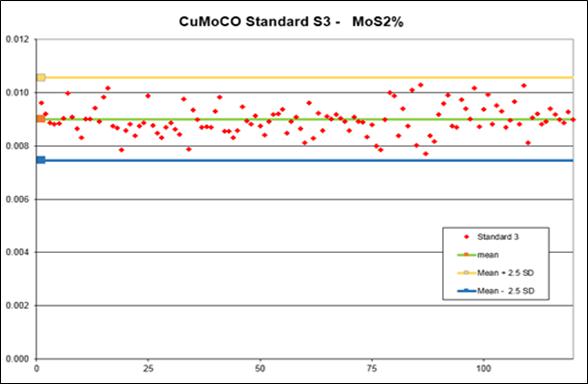

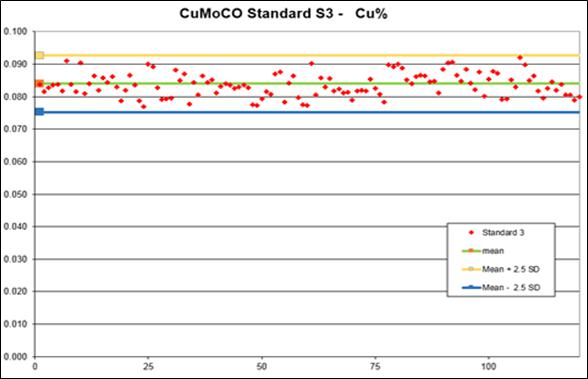

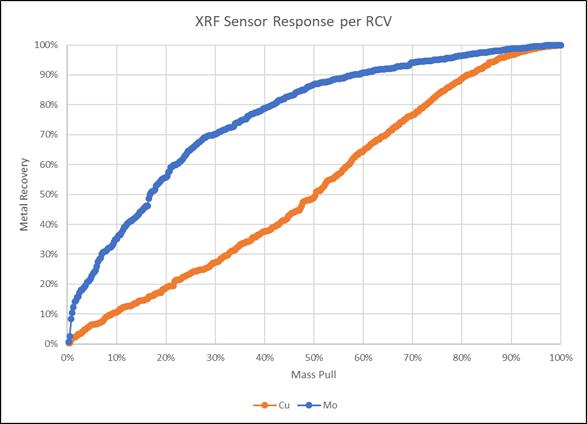

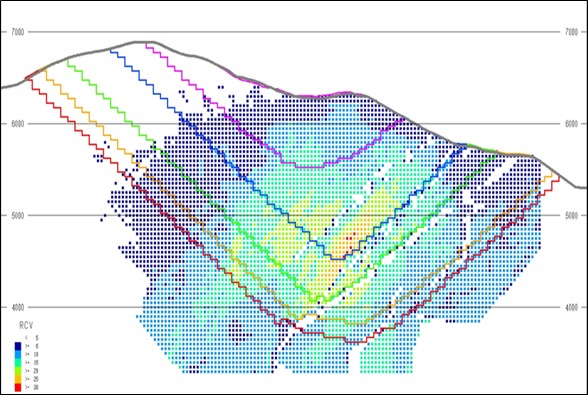

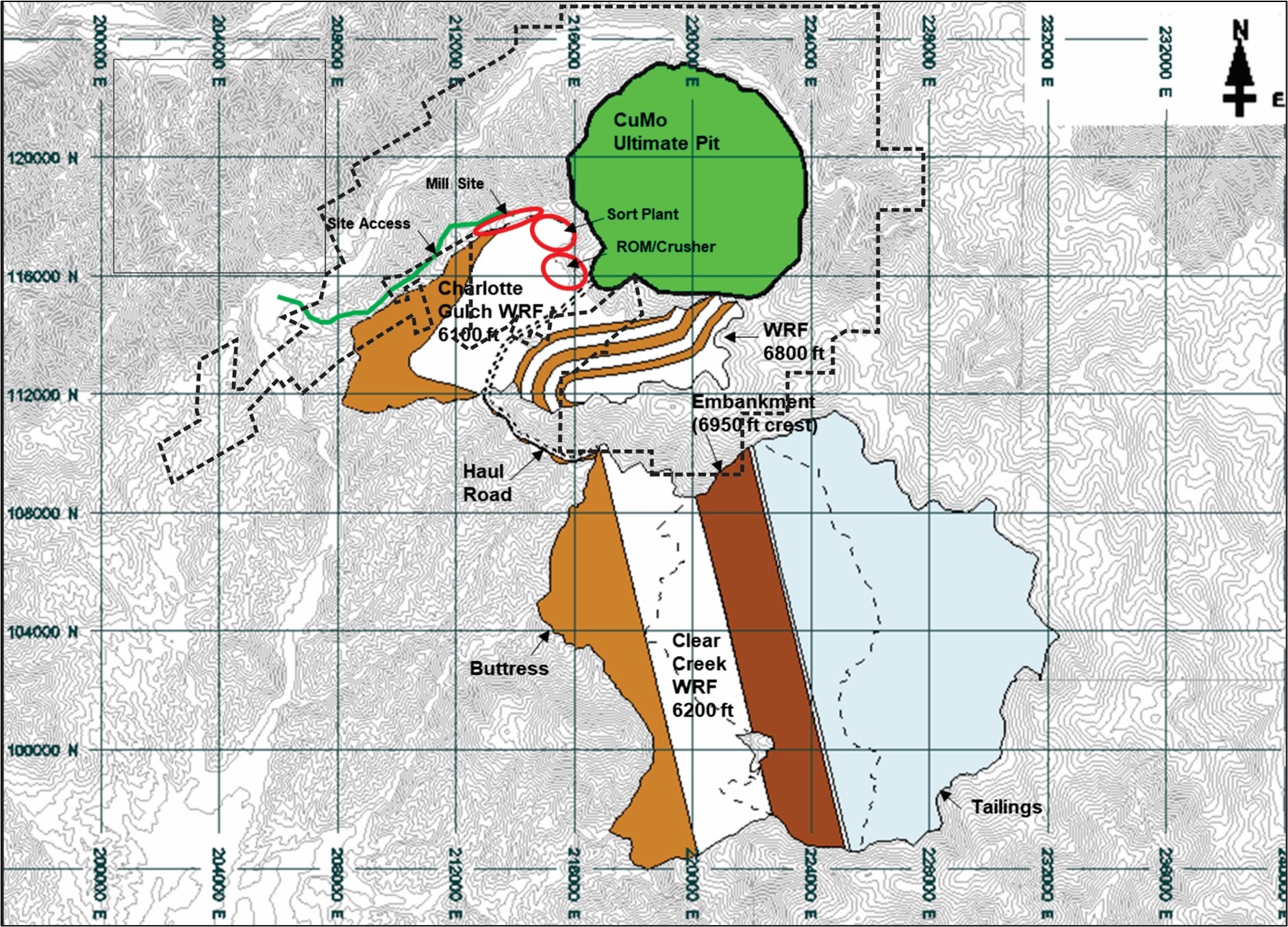

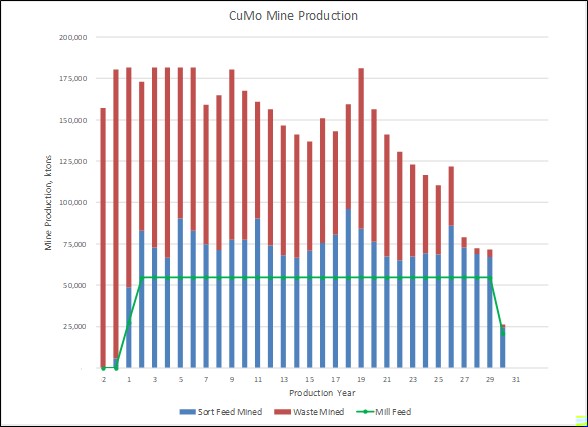

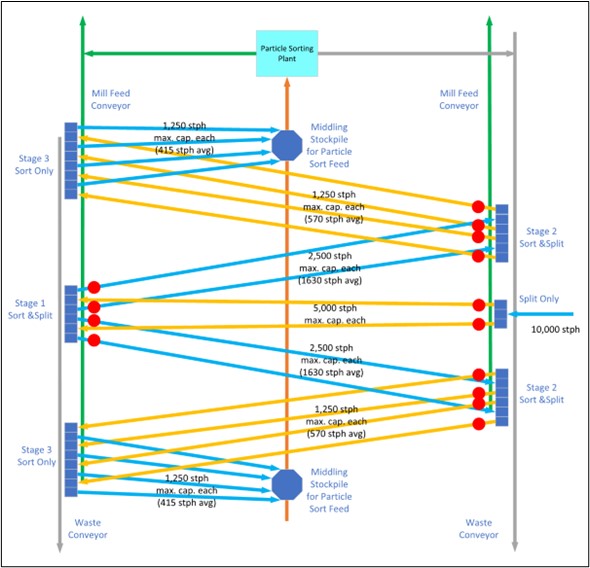

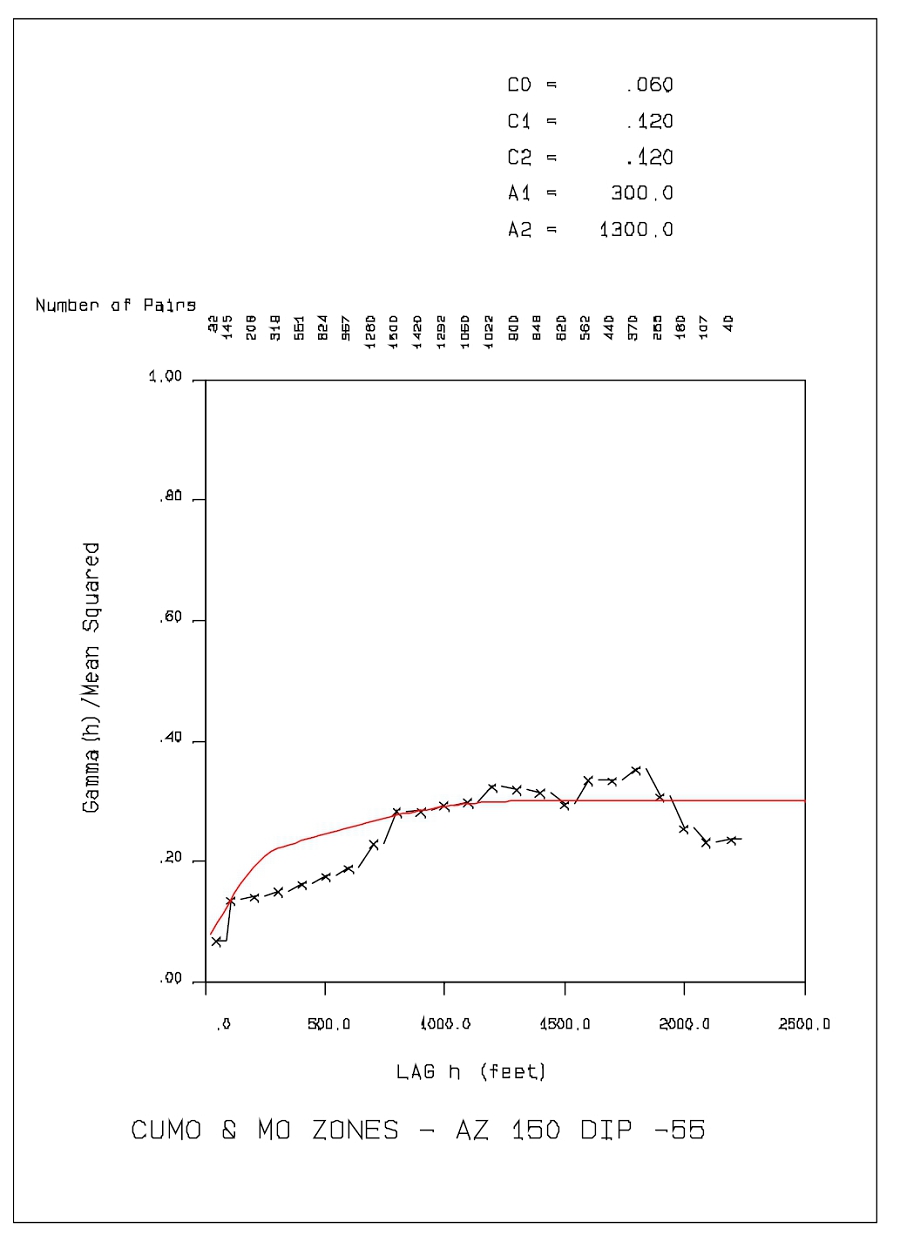

| ○ | An additional set of summary cash flows were produced that do not include inferred resources |