UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED) |

For the fiscal year ended March 31, 2009

Commission file number 0-27618

_________________

COLUMBUS McKINNON CORPORATION

(Exact name of Registrant as specified in its charter)

| New York | 16-0547600 |

| (State of Incorporation) | (I.R.S. Employer Identification Number) |

140 John James Audubon Parkway

Amherst, New York 14228-1197

(Address of principal executive offices, including zip code)

(716) 689-5400

(Registrant’s telephone number, including area code)

_________________

Securities pursuant to section 12(b) of the Act:

NONE

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 Par Value (and rights attached thereto)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Act.

Large accelerated filer ¨ | Accelerated filer x |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 28, 2008 was approximately $429 million, based upon the closing price of the Company’s common shares as quoted on the Nasdaq Stock Market on such date. The number of shares of the Registrant’s common stock outstanding as of April 30, 2009 was 19,047,430 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s proxy statement for its 2009 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the Registrant’s fiscal year ended March 31, 2009 are incorporated by reference into Part III of this report.

COLUMBUS McKINNON CORPORATION

2009 Annual Report on Form 10-K

This annual report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause our actual results to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by us and our subsidiaries, conditions affecting our customers and suppliers, competitor responses to our products and services, the overall market acceptance of such products and services, the integration of acquisitions and other factors set forth herein under “Risk Factors.” We use words like “will,” “may,” “should,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “future” and other similar expressions to identify forward looking statements. These forward looking statements speak only as of their respective dates and we do not undertake and specifically decline any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated changes. Our actual operating results could differ materially from those predicted in these forward-looking statements, and any other events anticipated in the forward-looking statements may not actually occur.

PART I

General

We are a leading manufacturer and marketer of hoists, cranes, actuators, chain, forged attachments, lift tables and other material handling products serving a wide variety of commercial and industrial end-user markets. Our products are used to efficiently and ergonomically move, lift, position or secure objects and loads. We are the U.S. market leader in hoists, our principal line of products, which we believe provides us with a strategic advantage in selling our other products. We have achieved this leadership position through strategic acquisitions, our extensive, diverse and well-established distribution channels and our commitment to product innovation and quality. We have one of the most comprehensive product offerings in the industry and we believe we have more overhead hoists in use in North America than all of our competitors combined. Our products are sold globally and our brand names, including CM, Coffing, Chester, Duff-Norton, Pfaff, Shaw-Box and Yale, are among the most recognized and well-respected in the marketplace.

As part of our continuing evaluation of its businesses, the Company determined that its integrated material handling conveyor systems business (Univeyor A/S) no longer provided a strategic fit with its long-term growth and operational objectives. On July 25, 2008, the Company completed the sale of Univeyor A/S, and its results of operations for all periods presented have been classified as discontinued operations in the consolidated balance sheets, statements of operations and statements of cash flows presented herein.

On October 1, 2008, we acquired Pfaff Beteiligungs GmbH (“Pfaff-silberblau” or “Pfaff”), a Kissing, Germany based company with leading European position in lifting, material handling and actuator products. Pfaff had revenue of approximately $90 million USD, in calendar 2007. This strategic acquisition continues the execution of our strategic plan to grow our revenue in complimentary product lines and also broaden that revenue in international markets. We believe Pfaff-silberblau complements our existing material handling business in Europe and the U.S. and creates a more global actuator business when combined with our U.S. based Duff Norton actuator company. We expect to create value from this acquisition through integrating the Pfaff business with our Columbus McKinnon European and U.S. based material handling businesses and Duff Norton. Value will be created by cross selling products among these groups as well reducing costs through business integration and procurement activities.

Our business is cyclical in nature and sensitive to changes in general economic conditions, including changes in the industrial capacity utilization, industrial production and the general economic activity indicators like GDP. The U.S. industrial capacity utilization, which we use as a leading market indicator for our U.S. based businesses, was 65.8% in both March 2009 and April 2009. This is the lowest reported US industrial capacity utilization as published by the U.S. Federal Reserve Board.

In light of the current economic climate and in accordance with our manufacturing strategy, subsequent to March 31, 2009, we have commenced with a plan to rationalize our North American hoist and rigging operations to improve efficiency, control costs and facilitate future growth. The execution of the plan is contingent upon successful bargaining unit negotiations with the labor unions at each facility. The process currently involves closing two manufacturing facilities and significantly downsizing a third facility beginning in the second quarter of fiscal 2010 and continuing through fiscal 2011 resulting in a reduction of 500,000 square feet of manufacturing space and generating annual savings estimated at approximately $8-$10 million. The cost of the restructuring is expected to be approximately $8-$10 million with 80% of the total charges occurring in fiscal year 2010. This strategy, together with steps to integrate our sales force will provide increased operating leverage when the global economy returns to more normalized levels.

Our Position in the Industry

The broad, global material handling industry includes the following sectors:

| | • | overhead material handling and lifting devices; |

| | • | continuous materials movement; |

| | • | wheeled handling devices; |

| | • | pallets, containers and packaging; |

| | • | storage equipment and shop furniture; |

| | • | automation systems and robots; and |

| | • | services and unbundled software. |

The breadth of our products and services enables us to participate in most of these sectors. This diversification, together with our extensive and varied distribution channels, minimizes our dependence on any particular product, market or customer. We believe that none of our competitors offers the variety of products or services in the markets we serve.

We believe that the demand for our products and services will be aided by several macro-economic growth drivers. These drivers include:

Productivity Enhancement. We believe employers respond to competitive pressures by seeking to maximize productivity and efficiency, among other actions. Our hoists and other lifting and positioning products allow loads to be lifted and placed quickly, precisely, with little effort and fewer people, thereby increasing productivity and reducing cycle time.

Safety Regulations. Driven by workplace safety regulations such as the Occupational Safety and Health Act and the Americans with Disabilities Act in the U.S. and other safety regulations around the world, and by the general competitive need to reduce costs such as health insurance premiums and workers’ compensation expenses, employers seek safer ways to lift and position loads. Our lifting and positioning products enable these tasks to be performed with reduced risk of personal injury.

Consolidation of Suppliers. In an effort to reduce costs and increase productivity, our customers and end-users are increasingly consolidating their suppliers. We believe that our broad product offering combined with our well established brand names will enable us to benefit from this consolidation and enhance our market share.

Our Competitive Strengths

Leading North American Market Positions. We are a leading manufacturer of hoists and alloy and high strength carbon steel chain and attachments in North America. We have developed our leading market positions over our 134-year history by emphasizing technological innovation, manufacturing excellence and superior after-sale service. Approximately 68% of our U.S. net sales for the year ended March 31, 2009 were from product categories in which we believe we hold the number one market share. We believe that the strength of our established products and brands and our leading market positions provide us with significant competitive advantages, including preferred supplier status with a majority of our largest customers. Our large installed base of products also provides us with a significant competitive advantage in selling our products to existing customers as well as providing repair and replacement parts.

The following table summarizes the product categories where we believe we are the U.S. market leader:

| Product Category | | U.S. Market Share | | | U.S. Market Position | | | Percentage of U.S. Net Sales | |

| Powered Hoists (1) | | | 46 | % | | | #1 | | | | 25 | % |

| Manual Hoists & Trolleys (1) | | | 58 | % | | | #1 | | | | 14 | % |

| Forged Attachments (1) | | | 38 | % | | | #1 | | | | 7 | % |

| Lifting and Sling Chains (1) | | | 71 | % | | | #1 | | | | 4 | % |

| Hoist Parts (2) | | | 60 | % | | | #1 | | | | 8 | % |

| Mechanical Actuators (3) | | | 44 | % | | | #1 | | | | 5 | % |

| Tire Shredders (4) | | | 80 | % | | | #1 | | | | 3 | % |

| Jib Cranes (5) | | | 25 | % | | | #1 | | | | 2 | % |

| | | | | | | | | | | | 68 | % |

_____________

| | (1) | Market share and market position data are internal estimates derived from survey information collected and provided by our trade associations in 2009. |

| | (2) | Market share and market position data are internal estimates based on our market shares of Powered Hoists and Manual Hoists & Trolleys, which we believe are good proxies for our Hoist Parts market share because we believe most end-users purchase Hoist Parts from the original equipment supplier. |

| | (3) | Market share and market position data are internal estimates derived by comparison of our net sales to net sales of one of our competitors and to estimates of total market sales from a trade association in 2009. |

| | (4) | Market share and market position data are internal estimates derived by comparing the number of our tire shredders in use and their capacity to estimates of the total number of tires shredded published by a trade association in 2008. |

| | (5) | Market share and market position are internal estimates derived from both the number of bids we win as a percentage of the total projects for which we submit bids and from estimates of our competitors’ net sales based on their relative position in distributor catalogues in 2009. |

Comprehensive Product Lines and Strong Brand Name Recognition. We believe we offer the most comprehensive product lines in the markets we serve. We are the only major supplier of material handling equipment offering full lines of hoists, chain and lifting tools. Our capability as a full-line supplier has allowed us to (i) provide our customers with “one-stop shopping” for material handling equipment, which meets some customers’ desires to reduce the number of their supply relationships in order to lower their costs, (ii) leverage our engineering, product development and marketing costs over a larger sales base and (iii) achieve purchasing efficiencies on common materials used across our product lines.

In addition, our brand names, including Budgit, Chester, CM, Coffing, Duff-Norton, Little Mule, Pfaff, Shaw-Box and Yale, are among the most recognized and respected in the industry. The CM and Yale names have been synonymous with overhead hoists since manual hoists were first developed and marketed under the name in the early 1900s. We believe that our strong brand name recognition has created customer loyalty and helps us maintain existing business, as well as capture additional business. No single SKU comprises more than 1% of our sales, a testament to our broad and diversified product offering.

Distribution Channel Diversity and Strength. Our products are sold to over 15,000 general and specialty distributors, end users and OEMs globally. We enjoy long-standing relationships with, and are a preferred provider to the majority of our largest distributors and industrial buying groups. There has been consolidation among distributors of material handling equipment and we have benefited from this consolidation by maintaining and enhancing our relationships with our leading distributors, as well as forming new relationships. We believe our extensive distribution channels provide a significant competitive advantage and allow us to effectively market new product line extensions and promote cross-selling.

Expanding International Markets. We have significantly grown our international sales since becoming a public company in 1996. Our international sales have grown from $34.3 million (representing 16% of total sales) in fiscal 1996 to $224.5 million (representing 37% of our total sales) during the year ended March 31, 2009. This growth has occurred primarily in Europe, Latin America and Asia-Pacific. The Pfaff acquisition in October 2008 will further enhance our international revenue growth. Additionally, we have recently opened a sales office in Beijing, China to sell into this growing industrial market. Our international business has provided us, and we believe will continue to provide us, with significant growth opportunities and new markets for our products.

Low-Cost Manufacturing with Significant Operating Leverage. We believe we are a low-cost manufacturer and we have and will continue to generate significant operating leverage due to the initiatives summarized below. Once the economic climate resumes growth, our operating leverage goal is for each incremental sales dollar to generate 20%-30% of additional operating income.

| | — | Rationalization and Consolidation. We have a successful history of consolidating manufacturing facilities and optimizing warehouse utilization and location resulting in lower annual operating costs and improving our fixed-variable cost relationship. During fiscal 2010, we are undergoing consolidation of our North American hoist and rigging operations in accordance with our strategy subject to bargaining unit negotiations. In the event of successful union negotiations, we expect this will involve the closing of two manufacturing facilities and significantly downsizing a third facility beginning in the second quarter of fiscal 2010 and continuing through fiscal 2011 resulting in a reduction of approximately 500,000 square feet of manufacturing space and generating annual savings estimated at approximately of $8-$10 million. |

| | — | Lean Culture. We have been applying Lean techniques since 2001, facilitating inventory reductions, a significant decline in required manufacturing floor space, a decrease in product lead time and improved productivity and on-time deliveries. We believe continued application of Lean tools will generate benefits for many years to come. We are developing our people and focusing on now becoming a Lean culture where we improve our processes and reduce waste in all forms in all our business activities. |

| | — | International Expansion. Our continued expansion of our manufacturing facilities in China and Hungary provides us with another cost efficient platform to manufacture and distribute certain of our products and components. We now operate 24 manufacturing facilities in seven countries, with 39 stand alone sales and service offices in 19 countries, and nine stand alone warehouse facilities in four countries. |

| | — | Purchasing Council. We continue to leverage our company-wide purchasing power through our Purchasing Council to reduce our costs and manage fluctuations in commodity pricing, including steel. |

| | — | Selective Vertical Integration. We manufacture many of the critical parts and components used in the manufacture of our hoists and cranes, resulting in reduced costs. |

Strong After-Market Sales and Support. We believe that we retain customers and attract new customers due to our ongoing commitment to customer service and ultimate satisfaction. We have a large installed base of hoists and rigging tools that drives our after-market sales for components and repair parts and is a stable source of higher margin business. We maintain strong relationships with our distribution channel partners and provide prompt aftermarket service to end-users of our products through our authorized network of 16 chain repair stations and approximately 225 hoist service and repair stations.

Long History of Free Cash Flow Generation and Significant Debt Reduction. We have consistently generated positive free cash flow (which we define as net cash provided by operating activities less capital expenditures) by continually controlling our costs, improving our working capital management, and reducing the capital intensity of our manufacturing operations. In the past five years, we have reduced total net debt by $174.8 million, from $273.5 million to $98.7 million and continued to grow our cash balance.

Experienced Management Team with Equity Ownership. Our senior management team provides a depth and continuity of experience in the material handling industry. Our management has experience in the material handling industry as well as growing businesses, aggressive cost management, balance sheet management, efficient manufacturing techniques, acquiring and integrating businesses and global operations, all of which are critical to our long-term growth. Our directors and executive officers, as a group, own an aggregate of approximately 3% of our outstanding common stock.

Our Strategy

Grow our Core Business. We intend to leverage our strong competitive advantages to increase our market shares across all of our product lines and geographies by:

| | — | Leveraging Our Strong Competitive Position. Our large, diversified, global customer base, our extensive distribution channels and our close relationships with our distributors provide us with insights into customer preferences and product requirements that allow us to anticipate and address the future needs of end-users. We are also investing in key vertical markets that will help us grow our revenues in these key markets. |

| | — | Introducing New and Cross-Branded Products. We continue to expand our business by developing new material handling products and services and expanding the breadth of our product lines to address material handling needs. The majority of the powered hoist products under development are guided by the Federation of European Manufacturing, or FEM, standard. We believe these FEM hoist products, as well as other international design products will facilitate our global sales expansion strategy as well as improve our cost competitiveness against internationally made products imported into the U.S. Over the past year, we have adopted the StageGate process to enhance discipline and focus in our new product development program. New product sales (as defined by new items introduced within the last three years) amounted to $74.8 million, $89.0 million and $79.5 million in fiscal 2009, 2008 and 2007, respectively. |

| | — | Leveraging Our Brand Portfolio to Maximize Market Coverage. Most industrial distributors carry one or two lines of material handling products on a semi-exclusive basis. Unlike many of our competitors, we have developed and acquired multiple well-recognized brands that are viewed by both distributors and end-users as discrete product lines. As a result, we are able to sell our products to multiple distributors in the same geographic area. This strategy maximizes our market coverage and provides the largest number of end-users with access to our products. |

Continue to Grow in International Markets. Our international sales of $224.5 million comprised 37% of our net sales for the year ended March 31, 2009, as compared to $34.3 million, or 16% of our net sales, in fiscal 1996, the year we became a public company. We sell to distributors in over 50 countries and have our primary international manufacturing facilities in China, France, Germany, Hungary, Mexico and the United Kingdom. In addition to new product introductions, we continue to expand our sales and service presence in the major and developing market areas of Europe, Asia-Pacific and Latin America including through our sales offices and warehouse facilities in Canada, various countries in Western and Eastern Europe, China, Thailand, Brazil, Uruguay, Panama and Mexico. We intend to increase our sales by manufacturing and exporting a broader array of high quality, low-cost products and components from our facilities in China and Hungary for distribution in Europe, Latin America and Asia-Pacific. We have developed and are continuing to expand upon new hoist and other products in compliance with FEM standards and international designs to enhance our global distribution.

Further Reduce Our Operating Costs and Increase Manufacturing Productivity. Our objective is to remain a low-cost producer. We continually seek ways to reduce our operating costs and increase our manufacturing productivity including through our on-going expansion of our manufacturing capacity in low-cost regions, including China and Hungary. In furtherance of this objective, we have undertaken the following:

| | — | Lean. We continuously identify value streams throughout our businesses and intensely remove waste in all forms. We started Lean in 2001 and continue to recognize benefits from this effort. |

| | — | Rationalization of Facilities. We have a successful history of consolidating manufacturing resulting in lower annual operating costs and improving our fixed-variable cost relationship. We have sufficient capacity to meet current and future demand and we periodically investigate opportunities for further facility rationalization. During fiscal 2010, we are undergoing consolidation of our North American hoist and rigging operations in accordance with our strategy subject to bargaining unit negotiations. In the event of successful union negotiations, we expect this will involve the closing of two manufacturing facilities and significantly downsizing a third facility beginning in the second quarter of fiscal 2010 and continuing through fiscal 2011 resulting in a reduction of approximately 500,000 square feet of manufacturing space and generating annual savings estimated at approximately $8-$10 million. |

| | — | Leveraging of Our Purchasing Power. Our Purchasing Council was formed in fiscal 1998 to centralize and leverage our overall purchasing power and has resulted in significant savings for our Company as well as management of fluctuations in commodity pricing, including steel. |

Drive EPS Growth through De-leveraging. We intend to continue our focus on cash generation for debt reduction through the following initiatives:

| | — | Increase Operating Cash Flow. As a result of the execution of our strategies to control our operating costs, increase our U.S. organic growth and increase our penetration of international markets, we believe that we will continue to realize favorable operating leverage once the economic climate resumes growth. Our operating leverage goal is for each incremental sales dollar to generate 20%-30% of operating income in a healthy economic environment. We believe that such operating leverage will result in increased operating cash flow available for debt reduction, as well as investment in new products and new markets, organically and via acquisitions. |

| | — | Reduce Working Capital. As described above, we believe that our Lean activities are facilitating inventory reduction, improving product lead times and increasing our productivity. We have other initiatives underway to further improve other routine working capital components, including accounts payable and accounts receivable, all initiatives driving toward our long-term goal of total working capital (excluding cash and debt) of 15% of latest 12 months’ revenues. We believe our improved working capital management and increased productivity will further result in increased free cash flow. |

Pursue Strategic Acquisitions and Alliances. We intend to pursue synergistic acquisitions to complement our organic growth. Priorities for such acquisitions include: 1) increasing international geographic penetration, particularly in the Asia-Pacific region and other emerging markets, and 2) further broadening our offering with complementary products frequently used in conjunction with hoists. Additionally, we continually challenge the long-term fit of underperforming businesses for potential divestiture and redeployment of capital.

Our Business

SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information,” establishes the standards for reporting information about operating segments in financial statements. Historically we had two operating and reportable segments, Products and Solutions. The Solutions segment engaged primarily in the design, fabrication and installation of integrated material handling conveyor systems and service and in the design and manufacture of tire shredders, lift tables and light-rail systems. In the first quarter of fiscal 2009, we re-evaluated our operating and reportable segments in connection with the divestiture of our integrated material handling conveyor systems and service business. With this divestiture, and in consideration of the quantitative contribution of the remaining portions of the Solutions segment to the Company as a whole and our products-orientated strategic growth initiatives, we determined that we now have only one operating and reportable segment for both internal and external reporting purposes. Prior period financial information included herein has been restated to reflect the financial position and results of operations as one segment. As part of the organizational restructuring announced in our December 22, 2008 press release and form 8-K filing, we reevaluated our reportable segments and we continue to believe that we have only one reportable operating segment.

We design, manufacture and distribute a broad range of material handling products for various applications. Products include a wide variety of electric, lever, hand and air-powered hoists, hoist trolleys, winches industrial crane systems such as bridge, gantry and jib cranes; alloy and carbon steel chain; closed-die forged attachments, such as hooks, shackles, textile slings, clamps logging tools and loadbinders; industrial components, such as mechanical and electromechanical actuators and rotary unions; below-the-hook special purpose lifters; tire shredders; lift tables and light-rail systems. These products are typically manufactured for stock or assembled to order from standard components and are sold primarily through a variety of commercial distributors; and to a lesser extent directly to end-users. The diverse end-users of our products are in a variety of industries including: manufacturing, power generation and distribution, utilities, wind power, ,warehouses, commercial construction, oil exploration and refining, petrochemical , marine, ship building, and heavy duty trucks, agriculture, logging and mining. ,We also serve a niche market for the entertainment industry including permanent and traveling concerts, live theater and sporting venues.

Products

In excess of 75% of our net sales are derived from the sale of products that we sell at a unit price of less than $5,000. Of our 2009 sales, $382.2 million, or 63% were U.S. and $224.5 million, or 37% were international. The following table sets forth certain sales data for our products, expressed as a percentage of net sales for fiscal 2009 and 2008:

| | | Fiscal Years Ended March 31, | |

| | | 2009 | | | 2008 | |

| Hoists | | | 55 | % | | | 54 | % |

| Chain | | | 12 | | | | 13 | |

| Forged attachments | | | 10 | | | | 11 | |

| Industrial cranes | | | 10 | | | | 11 | |

| Actuators and rotary unions | | | 10 | | | | 7 | |

| Other | | | 3 | | | | 4 | |

| | | | 100 | % | | | 100 | % |

Hoists. We manufacture a wide variety of electric chain hoists, electric wire rope hoists, hand-operated hoists, winches, lever tools and air-powered balancers and hoists. Load capacities for our hoist product lines range from one-eighth of a ton to 100 tons. These products are sold under our Budgit, Chester, CM, Coffing, Little Mule, Pfaff, Shaw-Box, Yale and other recognized brands. Our hoists are sold for use in numerous general industrial applications, as well as for use in the construction, energy, mining, food services, entertainment and other markets. We also supply hoist trolleys, driven manually or by electric motors, for the industrial, consumer and OEM markets.

We also offer several lines of standard and custom-designed, below-the-hook tooling, clamps, pallet trucks and textile strappings. Below-the-hook tooling and clamps are specialized lifting apparatus used in a variety of lifting activities performed in conjunction with hoist and chain applications. Textile strappings are below-the-hook attachments, frequently used in conjunction with hoists.

Chain. We manufacture alloy and carbon steel chain for various industrial and consumer applications. U.S. federal regulations require the use of alloy chain, which we first developed, for overhead lifting applications because of its strength and wear characteristics. A line of our alloy chain is sold under the Herc-Alloy brand name for use in overhead lifting, pulling and restraining applications. In addition, we also sell specialized load chain for use in hoists, as well as three grades and multiple sizes of carbon steel welded-link chain for various load securing and other non-overhead lifting applications. We also manufacture kiln chain sold primarily to the cement manufacturing market.

Forged Attachments. We produce a broad line of alloy and carbon steel closed-die forged attachments, including hooks, shackles, hitch pins and master links. These forged attachments are used in chain, wire rope and textile rigging applications in a variety of industries, including transportation, mining, construction, marine, logging, petrochemical and agriculture.

In addition, we manufacture carbon steel forged and stamped products, such as loadbinders, logging tools and other securing devices, for sale to the industrial, consumer and logging markets through industrial distributors, hardware distributors, mass merchandiser outlets and OEMs.

Industrial Cranes. We participate in the U.S. crane manufacturing and servicing markets through our offering of overhead bridge, jib and gantry cranes. Our products are sold under the CES, Abell-Howe, Gaffey and Washington Equipment brands. Crane builders represent a specific distribution channel for electric wire rope hoists, chain hoists and other crane components.

Actuators and Rotary Unions. Through our Duff-Norton and Pfaff divisions, we design and manufacture industrial components such as mechanical and electromechanical actuators and rotary unions. Actuators are linear motion devices used in a variety of industries, including the paper, steel, energy, aerospace and many other commercial industries. Rotary unions are devices that transfer a liquid or gas from a fixed pipe or hose to a rotating drum, cylinder or other device. Rotary unions are used in a variety of industries including pulp and paper, printing, textile and fabric manufacturing, rubber and plastic.

Other. This category includes tire shredders, lift tables and light-rail systems. We have developed and patented a line of heavy equipment that shreds whole tires, for use in recycling the various components of a tire including: rubber and steel. These recycled products also can be used as aggregate, playgrounds, sports surfaces, landscaping and other such applications, as well as scrap steel. Our American Lifts division manufactures powered lift tables. These products enhance workplace ergonomics and are sold primarily to customers in the general manufacturing, construction, and air cargo industries. Light-rail systems are portable steel overhead beam configurations used at workstations, from which hoists are an integral component .

Sales and Marketing

Our sales and marketing efforts consist of the following programs:

Factory-Direct Field Sales and Customer Service. We sell our products through our sales force of more than 150 sales people and through independent sales agents worldwide. Our sales are further supported by over 425 company-trained customer service correspondents and sales application engineers. We compensate our sales force through a combination of base salary and a commission plan based on top line sales and a pre-established sales quota.

Product Advertising. We promote our products by advertising in leading trade journals as well as producing and distributing high quality information catalogs. We run targeted advertisements for hoists, chain, forged attachments, actuators, and cranes.

Target Marketing. We provide marketing literature to target specific end-user market sectors including entertainment, construction, energy, mining, food service, and others. This literature displays our broad product offering applicable to those sectors to enhance awareness at the end-user level within those sectors.

Trade Show Participation. Trade shows are central to the promotion of our products, and we participate in more than 40 regional, national and international trade shows each year. Shows in which we participate range from global events held in Germany to local “markets” and “open houses” organized by individual hardware and industrial distributors. We also attend specialty shows for the entertainment, rental and safety markets, construction, as well as general purpose industrial and hardware shows. In fiscal 2009, we participated in trade shows in the U.S., Canada, Mexico, Germany, the United Kingdom, France, China, Brazil, Russia, Korea, Chile, Argentina, and the United Arab Emirates.

Industry Association Membership and Participation. As a recognized industry leader, we have a long history of work and participation in a variety of industry associations. Our management is directly involved in numerous industry associations including the following: ISA (Industrial Supply Association), AWRF (Associated Wire Rope Fabricators), PTDA (Power Transmission and Distributors Association), SCRA (Specialty Carriers and Riggers Association), WSTDA (Web Sling and Tie Down Association), MHI (Material Handling Institute), HMI (Hoist Manufacturers Institute), CMAA (Crane Manufacturers Association of America), ESTA (Entertainment Services and Technology Association), NACM (National Association of Chain Manufacturers) and ARA (American Rental Association).

Product Standards and Safety Training Classes. We conduct on-site training programs worldwide for distributors and end-users to promote and reinforce the attributes of our products and their safe use and operation in various material handling applications.

Web Sites. In addition to our main corporate web site at www.cmworks.com, we currently sponsor an additional 27 brand specific web sites and sell hand pallet trucks on one of these sites. Several of our brand web sites include electronic catalogs of our various products and list prices. Current and potential customers can browse through our diverse product offering or search for specific products by name or classification code and obtain technical product specifications. We continue to add additional product catalogs, maintenance manuals, advertisements and customer service information on our various web sites. Many of the web sites allow distributors to enter sales orders, search pricing information, order status and product serial number data.

Distribution and Markets

Our distribution channels include a variety of commercial distributors. In addition, we sell overhead bridge, jib and gantry cranes as well as certain Pfaff products directly to end-users. The following describes our global distribution channels:

General Distribution Channels. Our global general distribution channels consist of:

| | — | Industrial distributors that serve local or regional industrial markets and sell a variety of products for maintenance repair, operating and production, or MROP, applications through their own direct sales force. |

| | — | Rigging shops that are distributors with expertise in rigging, lifting, positioning and load securing. Most rigging shops assemble and distribute chain, wire rope and synthetic slings and distribute manual hoists and attachments, chain slings and other products. |

| | — | Independent crane builders that design, build, install and service overhead crane and light-rail systems for general industry and also distribute a wide variety of hoists and crane components. We sell electric wire rope hoists and chain hoists as well as crane components, such as end trucks, trolleys, drives and electrification systems to crane builders. |

Crane End-Users. We market and sell overhead bridge, jib and gantry cranes, parts and service to end-users through our wholly owned crane builder, Crane Equipment & Service, Inc. (“CES”). CES which includes Abell-Howe, Gaffey and Washington Equipment brands designs, manufactures, installs and services a variety of cranes with capacities up to 100 tons.

Specialty Distribution Channels. Our global specialty distribution channels consist of:

| | — | National distributors that market a variety of MROP supplies, including material handling products, either exclusively through large, nationally distributed catalogs, or through a combination of catalog, internet and branch sales and a field sales force. The customer base served by national distributors such as W. W. Grainger, which traditionally included smaller industrial companies and consumers, has grown to include large industrial accounts and integrated suppliers. |

| | — | Material handling specialists and integrators that design and assemble systems incorporating hoists, overhead rail systems, trolleys, scissor lift tables, manipulators, air balancers, jib arms and other material handling products to provide end-users with solutions to their material handling problems. |

| | — | Entertainment equipment distributors that design, supply and install a variety of material handling and rigging equipment for concerts, theaters, ice shows, sporting events, convention centers and night clubs. |

Service-After-Sale Distribution Channel. Service-after-sale distributors include our authorized network of 16 chain repair service stations and approximately 225 hoist service and repair stations. This service network is designed for easy parts and service access for our large installed base of hoists and related equipment in North America.

OEM/Government Distribution Channels. This channel consists of:

| | — | OEMs that supply various component parts directly to other industrial manufacturers as well as private branding and packaging of our traditional products for material handling, lifting, positioning and special purpose applications. |

| | — | Government agencies, including the U.S. and Canadian Navies and Coast Guards, that purchase primarily load securing chain and forged attachments. We also provide our products to the U.S government for a variety of military applications.. |

Customer Service and Training

We maintain customer service departments staffed by trained personnel for all of our sales divisions, and regularly schedule product and service training schools for all customer service representatives and field sales personnel. Training programs for distribution and service station personnel, as well as for end-users, are scheduled on a regular basis at most of our facilities and in the field. We have approximately 225 service and repair stations worldwide that provide local and regional repair, warranty and general service work for distributors and end-users. End-user trainees attending our various programs include representatives of 3M, Cummins Engine, DuPont, GTE, General Electric, John Deere, Praxair and many other industrial and entertainment organizations.

We also provide, in multiple languages, a variety of collateral material in video, cassette, CD-ROM, slide and print format addressing relevant material handling topics such as the care, use and inspection of chains and hoists, and overhead lifting and positioning safety. In addition, we sponsor advisory boards made up of representatives of our primary distributors and service-after-sale network members who are invited to participate in discussions focused on improving products and service. These boards enable us and our primary distributors to exchange product and market information relevant to industry trends.

Backlog

Our backlog of orders at March 31, 2009 was approximately $70.1 million compared to approximately $57.7 million at March 31, 2008 with our Pfaff acquisition contributing to the significant increase from the prior year. Our orders for standard products are generally shipped within one week. Orders for products that are manufactured to customers’ specifications are generally shipped within four to twelve weeks. Given the short product lead times, we do not believe that the amount of our backlog of orders is a reliable indication of our future sales.

Competition

The material handling industry remains highly fragmented. We face competition from a wide range of regional, national and international manufacturers in both U.S. and international markets. In addition, we often compete with individual operating units of larger, highly diversified companies.

The principal competitive factors affecting our business include customer service and support as well as product availability, performance, functionality, brand reputation, reliability and price. Other important factors include distributor relationships and territory coverage.

Major competitors for hoists are Konecranes, Demag Cranes and Kito-Harrington; for chain are Campbell Chain, Peerless Chain Company and American Chain and Cable Company; for forged attachments are The Crosby Group and Brewer Tichner Company; for cranes are Konecranes, Demag Cranes and a variety of independent crane builders; for actuators and rotary unions are Deublin, Joyce-Dayton and Nook Industries; for tire shredders is Granutech; for lift tables is Southworth; and for light-rail systems is Gorbel.

Employees

At March 31, 2009, we had 2,886 employees; 1,709 in the U.S./Canada, 139 in Latin America, 690 in Europe and 348 in Asia. Approximately 18% of our employees are represented under seven separate U.S. or Canadian collective bargaining agreements which terminate at various times between April 2010 and March 2012. We believe that our relationship with our employees is good.

Raw Materials and Components

Our principal raw materials and components are steel, consisting of structural steel, processed steel bar, forging bar steel, steel rod and wire, steel pipe and tubing and tool steel; electric motors; bearings; gear reducers; castings; and electro-mechanical components. These commodities are all available from multiple sources. We purchase most of these raw materials and components from a limited number of strategic and preferred suppliers under long-term agreements which are negotiated on a company-wide basis through our Purchasing Council to take advantage of volume discounts. We generally seek to pass on materials price increases to our distribution channel partners and end-user customers. We will continue to monitor our costs and reevaluate our pricing policies. Our ability to pass on these increases is determined by market conditions.

Manufacturing

We complement our own manufacturing by outsourcing components and finished goods from an established global network of suppliers. We regularly upgrade our global manufacturing facilities and invest in tooling, equipment and technology. In 2001, we began implementing Lean improvement techniques in our business which has resulted in inventory reductions, reductions in required manufacturing floor area, shorter product lead time and increased productivity.

Our manufacturing operations are highly integrated. Although raw materials and some components such as motors, bearings, gear reducers, castings and electro-mechanical components are purchased, our vertical integration enables us to produce many of the components used in the manufacturing of our products. We manufacture hoist lifting chain, steel forged gear blanks, lift wheels, trolley wheels, and hooks and other attachments for incorporation into our hoist products. These products are also sold as spare parts for hoist repair. Additionally, our hoists are used as components in the manufacture of crane systems by us as well as our crane-builder customers..

Environmental and Other Governmental Regulation

Like most manufacturing companies, we are subject to various federal, state and local laws relating to the protection of the environment. To address the requirements of such laws, we have adopted a corporate environmental protection policy which provides that all of our owned or leased facilities shall, and all of our employees have the duty to, comply with all applicable environmental regulatory standards, and we have initiated an environmental auditing program for our facilities to ensure compliance with such regulatory standards. We have also established managerial responsibilities and internal communication channels for dealing with environmental compliance issues that may arise in the course of our business. We have made and could be required to continue to make significant expenditures to comply with environmental requirements. Because of the complexity and changing nature of environmental regulatory standards, it is possible that situations will arise from time to time requiring us to incur additional expenditures in order to ensure environmental regulatory compliance. However, we are not aware of any environmental condition or any operation at any of our facilities, either individually or in the aggregate, which would cause expenditures having a material adverse effect on our results of operations, financial condition or cash flows and, accordingly, have not budgeted any material capital expenditures for environmental compliance for fiscal 2010.

We have completed our investigation of past waste disposal activities at a facility in Cleveland, Texas, operated by our subsidiary, Crane Equipment and Service, Inc. Remediation activities under the terms of the voluntary agreement with the Texas Commission on Environmental Quality (“TCEQ”) have received final regulatory approval from the TCEQ.

In addition, we notified the North Carolina Department of Environment and Natural Resources (the “DENR”) in April 2006 of the presence of certain contaminants in excess of regulatory standards at our Coffing Hoist facility in Wadesboro, North Carolina. We filed an application with the DENR to enter its voluntary cleanup program and were accepted. We are currently investigating under the supervision of a DENR Registered Environmental Consultant (“”the REC”) and, if appropriate, will remediate site conditions at the facility. At this time, investigative and remediation costs are expected to not exceed $350,000.

In March of 2007, we also discovered in the presence of certain contaminants in excess of regulatory standards at our Damascus, Virginia hoist plant and have notified the Virginia Department of Environmental Quality (the “DEQ”). We filed an application with the DEQ to participate in its voluntary remediation program and have been accepted. We are currently investigating under the terms of the DEQ Voluntary Remediation Program and, if appropriate, will remediate site conditions at the facility. At this time, investigative and remediation costs are expected to not exceed $100,000.

In June of 2007, we were identified by the New York State Department of Environmental Conservation (“the DEC”), along with other companies, as a potential responsible party (“PRP”) at the Frontier Chemical Royal Avenue Site in Niagara Falls, New York. From 1974 to 1992, the Frontier Royal Avenue Site had been operated as a commercial waste treatment and disposal facility. We sent waste pickle liquor generated at our facility in Tonawanda, New York to the Frontier Royal Avenue Site during the period from approximately 1982 to 1984. We have joined with other PRP members known as the Frontier Chemical Site Joint Defense Alliance Group to conduct investigation and, if appropriate, remediation activities at the site. At this early stage, we do not have an estimate of likely remediation costs, if any, but do not believe that such costs would have a material adverse effect on our financial condition or operating results.

For all of the currently known environmental matters, we have accrued a total of $0.7 million as of March 31, 2009, which, in our opinion, is sufficient to deal with such matters. Further, we believe that the environmental matters known to, or anticipated by, us should not, individually or in the aggregate, have a material adverse effect on our operating results or financial condition. However, there can be no assurance that potential liabilities and expenditures associated with unknown environmental matters, unanticipated events, or future compliance with environmental laws and regulations will not have a material adverse effect on us.

Our operations are also governed by many other laws and regulations, including those relating to workplace safety and worker health, principally OSHA in the U.S. and regulations thereunder. We believe that we are in material compliance with these laws and regulations and do not believe that future compliance with such laws and regulations will have a material adverse effect on our operating results or financial condition.

Available Information

Our internet address is www.cmworks.com. We make available free of charge through our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission.

Columbus McKinnon is subject to a number of risk factors that could negatively affect our results from business operations or cause actual results to differ materially from those projected or indicated in any forward looking statement. Such factors include, but are not limited to, the following:

Our business is cyclical and is affected by industrial economic conditions.

Many of the end-users of our products are in highly cyclical industries, such as general manufacturing and construction that are sensitive to changes in general economic conditions. Their demand for our products, and thus our results of operations, is directly related to the level of production in their facilities, which changes as a result of changes in general economic conditions and other factors beyond our control. During the fourth quarter of fiscal 2009, we experienced significantly reduced demand for our products, generally as a result of the rapid and severe contraction in industrial markets worldwide. These lower levels of demand resulted in a significant decline in net sales as well as a decline in income from operations during that period. If the current economic conditions deteriorate further with respect to the general economy or in the industries we serve, our business, results of operations and financial condition could be materially adversely affected. In addition, the cyclical nature of our business could at times also adversely affect our liquidity and ability to borrow under our revolving credit facility.

We are subject to the risk of loss resulting from financial institutions or customers defaulting on their obligations.

Due to the general weakening of the U.S. economy, certain of the lenders in our senior credit facility may have a weakened financial condition related to their lending and other financial relationships. As a result, they may tighten their lending standards, which could make it more difficult for us to borrow under our credit facility or to obtain other financing on favorable terms or at all. Also, any cash balances with our banks are insured only up to $250,000 per bank by the FDIC, and any deposits in excess of this limit are also subject to risk. In addition, the weakening of the national economy and the recent reduced availability of credit may have decreased the financial stability of our major customers and suppliers. As a result, it may become more difficult for us to collect our accounts receivable and outsource products and services to our suppliers. If any of these conditions were to occur, our financial condition and results of operations could be adversely affected.

We rely in large part on independent distributors for sales of our products.

For the most part, we depend on independent distributors to sell our products and provide service and aftermarket support to our end-user customers. Distributors play a significant role in determining which of our products are stocked at the branch locations, and hence are most readily accessible to aftermarket buyers, and the price at which these products are sold. Almost all of the distributors with whom we transact business offer competitive products and services to our end-user customers. For the most part, we do not have written agreements with our distributors located in the United States. The loss of a substantial number of these distributors or an increase in the distributors’ sales of our competitors’ products to our ultimate customers could materially reduce our sales and profits.

We are subject to currency fluctuations from our international sales.

Our products are sold in many countries around the world. Thus, a portion of our revenues (approximately $186 million in fiscal year 2009) is generated in foreign currencies, including principally the euro and the Canadian dollar, and while much of the costs incurred to generate those revenues are incurred in the same currency, a portion is incurred in other currencies. Since our financial statements are denominated in U.S. dollars, changes in currency exchange rates between the U.S. dollar and other currencies have had, and will continue to have, an impact on our earnings. Currency fluctuations may impact our financial performance in the future.

Our international operations pose certain risks that may adversely impact sales and earnings.

We have operations and assets located outside of the United States, primarily in China, Mexico, Germany, the United Kingdom, France, and Hungary. In addition, we import a portion of our hoist product line from Asia, and sell our products to distributors located in approximately 50 countries. In fiscal year 2009, approximately 37% of our net sales were derived from non-U.S. markets. These international operations are subject to a number of special risks, in addition to the risks of our U.S. business, including currency exchange rate fluctuations, differing protections of intellectual property, trade barriers, labor unrest, exchange controls, regional economic uncertainty, differing (and possibly more stringent) labor regulation, risk of governmental expropriation, U.S. and foreign customs and tariffs, current and changing regulatory environments, difficulty in obtaining distribution support, difficulty in staffing and managing widespread operations, differences in the availability and terms of financing, political instability and risks of increases in taxes. Also, in some foreign jurisdictions we may be subject to laws limiting the right and ability of entities organized or operating therein to pay dividends or remit earnings to affiliated companies unless specified conditions are met. These factors may adversely affect our future profits.

Part of our strategy is to expand our worldwide market share and reduce costs by strengthening our international distribution capabilities and sourcing basic components in lower cost countries, in particular in China and Hungary. Implementation of this strategy may increase the impact of the risks described above, and we cannot assure you that such risks will not have an adverse effect on our business, results of operations or financial condition.

Our business is highly competitive and increased competition could reduce our sales, earnings and profitability.

The principal markets that we serve within the material handling industry are fragmented and highly competitive. Competition is based primarily on customer service and support as well as product availability, performance, functionality, brand reputation, reliability and price. Our competition in the markets in which we participate comes from companies of various sizes, some of which have greater financial and other resources than we do. Increased competition could force us to lower our prices or to offer additional services at a higher cost to us, which could reduce our gross margins and net income.

The greater financial resources or the lower amount of debt of certain of our competitors may enable them to commit larger amounts of capital in response to changing market conditions. Certain competitors may also have the ability to develop product or service innovations that could put us at a disadvantage. In addition, some of our competitors have achieved substantially more market penetration in certain of the markets in which we operate. If we are unable to compete successfully against other manufacturers of material handling equipment, we could lose customers and our revenues may decline. There can also be no assurance that customers will continue to regard our products favorably, that we will be able to develop new products that appeal to customers, that we will be able to improve or maintain our profit margins on sales to our customers or that we will be able to continue to compete successfully in our core markets.

We are subject to debt covenant restrictions.

Our credit facility contains several financial and other restrictive covenants. A significant decline in our operating income could cause us to violate our fixed charge coverage ratio in our bank credit facility. This could result in our being unable to borrow under our bank credit facility or being obliged to refinance and renegotiate the terms of our bank indebtedness.

Our strategy depends on successful integration of acquisitions.

Acquisitions are a key part of our growth strategy. Our historical growth has depended, and our future growth is likely to depend on our ability to successfully implement our acquisition strategy, and the successful integration of acquired businesses into our existing operations. We intend to continue to seek additional acquisition opportunities in accordance with our acquisition strategy, both to expand into new markets and to enhance our position in existing markets throughout the world. If we are unable to successfully integrate acquired businesses into our existing operations or expand into new markets, our sales and earnings growth could be reduced.

Our products involve risks of personal injury and property damage, which exposes us to potential liability.

Our business exposes us to possible claims for personal injury or death and property damage resulting from the products that we sell. We maintain insurance through a combination of self-insurance retentions and excess insurance coverage. We monitor claims and potential claims of which we become aware and establish accrued liability reserves for the self-insurance amounts based on our liability estimates for such claims. We cannot give any assurance that existing or future claims will not exceed our estimates for self-insurance or the amount of our excess insurance coverage. In addition, we cannot give any assurance that insurance will continue to be available to us on economically reasonable terms or that our insurers would not require us to increase our self-insurance amounts. Claims brought against us that are not covered by insurance or that result in recoveries in excess of insurance coverage could have a material adverse effect on our results and financial condition.

Our future operating results may be affected by fluctuations in steel or other material prices. We may not be able to pass on increases in raw material costs to our customers.

The principal raw material used in our chain, forging and crane building operations is steel. The steel industry as a whole is highly cyclical, and at times pricing and availability can be volatile due to a number of factors beyond our control, including general economic conditions, labor costs, competition, import duties, tariffs and currency exchange rates. This volatility can significantly affect our raw material costs. In an environment of increasing raw material prices, competitive conditions will determine how much of the steel price increases we can pass on to our customers. During historical rising cost periods, we were generally successful in adding and maintaining a surcharge to the prices of our high steel content products or incorporating them into price increases, with a goal of margin neutrality. In the future, to the extent we are unable to pass on any steel price increases to our customers, our profitability could be adversely affected.

We depend on our senior management team and the loss of any member could adversely affect our operations.

Our success is dependent on the management and leadership skills of our senior management team. The loss of any of these individuals or an inability to attract, retain and maintain additional personnel could prevent us from implementing our business strategy. We cannot assure you that we will be able to retain our existing senior management personnel or to attract additional qualified personnel when needed. We have not entered into employment agreements with any of our senior management personnel with the exception of Wolfgang Wegener, our Vice President and Managing Director of Columbus McKinnon Europe.

We are subject to various environmental laws which may require us to expend significant capital and incur substantial cost.

Our operations and facilities are subject to various federal, state, local and foreign requirements relating to the protection of the environment, including those governing the discharges of pollutants in the air and water, the generation, management and disposal of hazardous substances and wastes and the cleanup of contaminated sites. We have made, and will continue to make, expenditures to comply with such requirements. Violations of, or liabilities under, environmental laws and regulations, or changes in such laws and regulations (such as the imposition of more stringent standards for discharges into the environment), could result in substantial costs to us, including operating costs and capital expenditures, fines and civil and criminal sanctions, third party claims for property damage or personal injury, clean-up costs or costs relating to the temporary or permanent discontinuance of operations. Certain of our facilities have been in operation for many years, and we have remediated contamination at some of our facilities. Over time, we and other predecessor operators of such facilities have generated, used, handled and disposed of hazardous and other regulated wastes. Additional environmental liabilities could exist, including clean-up obligations at these locations or other sites at which materials from our operations were disposed, which could result in substantial future expenditures that cannot be currently quantified and which could reduce our profits or have an adverse effect on our financial condition.

We rely on subcontractors or suppliers to perform their contractual obligations.

Some of our contracts involve subcontracts with other companies upon which we rely to perform a portion of the services we must provide to our customers. There is a risk that we may have disputes with our subcontractors, including disputes regarding the quality and timeliness of work performed by our subcontractor or customer concerns about the subcontractor. Failure by our subcontractors to satisfactorily provide on a timely basis the agreed-upon supplies or perform the agreed upon services may materially and adversely impact our ability to perform our obligations as the prime contractor. A delay in our ability to obtain components and equipment parts from our suppliers may affect our ability to meet our customers’ needs and may have an adverse effect upon our profitability.

| Item 1B. | Unresolved Staff Comments |

None.

We maintain our corporate headquarters in Amherst, New York and, as of March 31, 2009, conducted our principal manufacturing at the following facilities:

| Location | | Products/Operations | | Square Footage | | Owned or Leased |

| United States: | | | | | | |

| Muskegon, MI | | Hoists | | | 441,000 | | Owned |

| Wadesboro, NC | | Hoists | | | 186,000 | | Owned |

| Lexington, TN | | Chain | | | 165,000 | | Owned |

| Charlotte, NC | | Industrial components | | | 146,000 | | Leased |

| Cedar Rapids, IA | | Forged attachments | | | 100,000 | | Owned |

| Eureka, IL | | Cranes | | | 91,000 | | Owned |

| Damascus, VA | | Hoists | | | 90,000 | | Owned |

| Greensburg, IN | | Scissor lifts | | | 86,000 | | Owned |

| Chattanooga, TN | | Forged attachments | | | 81,000 | | Owned |

| Chattanooga, TN | | Forged attachments | | | 59,000 | | Owned |

| Cleveland, TX | | Cranes | | | 39,000 | | Owned |

| Lisbon, OH | | Hoists and below-the-hook tooling | | | 37,000 | | Owned |

| Tonawanda, NY | | Light-rail crane systems | | | 35,000 | | Owned |

| Sarasota, FL | | Tire shredders | | | 25,000 | | Owned |

| | | | | | | |

| | | | | | | |

| International: | | | | | | |

| Velbert, Germany | | Hoists | | | 108,000 | | Leased |

| Kissing, Germany | | Hoists, winches, and actuators | | | 107,000 | | Leased |

| Santiago, Tianguistenco, Mexico | | Hoists and chain | | | 91,000 | | Owned |

| Hangzhou, China | | Hoists and hand pallet trucks | | | 78,000 | | Leased |

| Hangzhou, China | | Textile strappings | | | 58,000 | | Leased |

| Hangzhou, China | | Metal fabrication, textiles and textile strappings | | | 51,000 | | Leased |

| Chester, United Kingdom | | Plate clamps | | | 48,000 | | Leased |

| Heilbronn, Germany | | Actuators | | | 23,000 | | Leased |

| Romeny-sur-Marne, France | | Rotary unions | | | 22,000 | | Owned |

| Szekesfeher, Hungary | | Textiles and textile strappings | | | 18,000 | | Leased |

In addition, we have a total of 48 sales offices, distribution centers and warehouses. We believe that our properties have been adequately maintained, are in generally good condition and are suitable for our business as presently conducted. We also believe our existing facilities provide sufficient production capacity for our present needs and for our anticipated needs in the foreseeable future. Upon the expiration of our current leases, we believe that either we will be able to secure renewal terms or enter into leases for alternative locations at market terms.

From time to time, we are named a defendant in legal actions arising out of the normal course of business. We are not a party to any pending legal proceeding other than ordinary, routine litigation incidental to our business. We do not believe that any of our pending litigation will have a material impact on our business. We maintain comprehensive general product liability insurance against risks arising out of the use of our products sold to customers through our wholly-owned New York state captive insurance subsidiary of which we are the sole policy holder. The limits of this coverage are currently $3.0 million per occurrence ($2.0 million through March 31, 2003) and $6.0 million aggregate ($5.0 million through March 31, 2003) per year. We obtain additional insurance coverage from independent insurers to cover potential losses in excess of these limits.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None.

PART II

| Item 5. | Market for the Company’s Common Stock and Related Security Holder Matters |

Our common stock is traded on the Nasdaq Stock Market under the symbol ‘‘CMCO.” As of April 30, 2009, there were 464 holders of record of our common stock.

We do not currently pay cash dividends. Our current credit agreement allows, but limits our ability to pay dividends. We may reconsider or revise this policy from time to time based upon conditions then existing, including, without limitation, our earnings, financial condition, capital requirements, restrictions under credit agreements or other conditions our Board of Directors may deem relevant.

We did not repurchase any shares of our company stock during the fourth quarter of fiscal 2009.

The following table sets forth, for the fiscal periods indicated, the high and low sale prices per share for our common stock as reported on the Nasdaq Stock Market.

| | | Price Range of Common Stock | |

| | | High | | | Low | |

| | | | | | | |

| Year Ended March 31, 2008 | | | | | | |

| First Quarter | | $ | 33.68 | | | $ | 21.84 | |

| Second Quarter | | | 34.30 | | | | 22.55 | |

| Third Quarter | | | 33.85 | | | | 24.46 | |

| Fourth Quarter | | | 33.34 | | | | 22.00 | |

| | | | | | | | | |

| Year Ended March 31, 2009 | | | | | | | | |

| First Quarter | | $ | 32.36 | | | $ | 24.05 | |

| Second Quarter | | | 29.88 | | | | 22.04 | |

| Third Quarter | | | 23.34 | | | | 10.11 | |

| Fourth Quarter | | | 15.51 | | | | 7.37 | |

On April 30, 2009, the closing price of our common stock on the Nasdaq Stock Market was $12.96 per share.

PERFORMANCE GRAPH

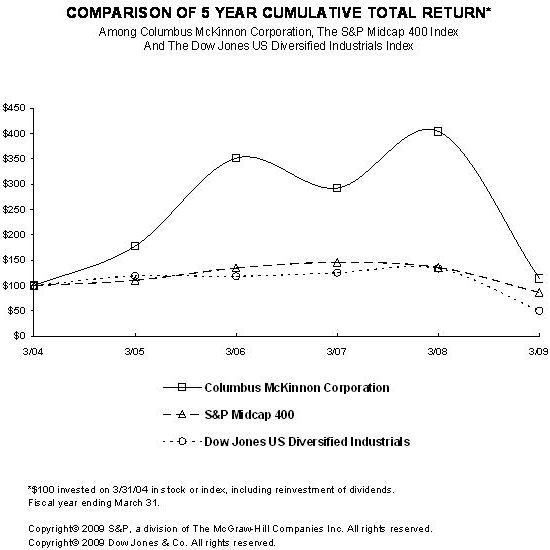

The Performance Graph shown below compares the cumulative total shareholder return on our common stock based on its market price, with the total return of the S&P MidCap 400 Index and the Dow Jones US Diversified Industrials. The comparison of total return assumes that a fixed investment of $100 was invested on March 31, 2004 in our common stock and in each of the foregoing indices and further assumes the reinvestment of dividends. The stock price performance shown on the graph is not necessarily indicative of future price performance.

| Item 6. | Selected Financial Data |

The consolidated balance sheets as of March 31, 2009 and 2008 and the related statements of operations, cash flows and shareholders’ equity for the three years ended March 31, 2009 and notes thereto appear elsewhere in this annual report. The selected consolidated financial data presented below should be read in conjunction with, and are qualified in their entirety by “Management’s Discussion and Analysis of Results of Operations and Financial Condition,” our consolidated financial statements and the notes thereto and other financial information included elsewhere in this annual report.

| | | Fiscal Years Ended March 31, | |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | (Amounts in millions, except per share data) | |

| Statements of Operations Data: | | | | | | | | | | | | | | | |

| Net sales | | $ | 606.7 | | | $ | 593.8 | | | $ | 550.5 | | | $ | 513.3 | | | $ | 472.1 | |

| Cost of products sold | | | 433.0 | | | | 408.2 | | | | 385.7 | | | | 372.1 | | | | 352.6 | |

| Gross profit | | | 173.7 | | | | 185.6 | | | | 164.8 | | | | 141.2 | | | | 119.5 | |

| Selling expenses | | | 72.6 | | | | 69.9 | | | | 59.4 | | | | 51.9 | | | | 50.0 | |

| General and administrative expenses | | | 37.7 | | | | 34.1 | | | | 30.6 | | | | 30.4 | | | | 28.5 | |

| Restructuring charges (1) | | | 1.9 | | | | 0.8 | | | | (0.1 | ) | | | 1.6 | | | | 0.9 | |

| Impairment loss (2) | | | 107.0 | | | | — | | | | — | | | | — | | | | — | |

| Amortization of intangibles | | | 1.0 | | | | 0.1 | | | | 0.2 | | | | 0.3 | | | | 0.3 | |

| (Loss) income from operations | | | (46.5 | ) | | | 80.7 | | | | 74.7 | | | | 57.0 | | | | 39.8 | |

| Interest and debt expense | | | 13.2 | | | | 13.6 | | | | 15.9 | | | | 24.4 | | | | 27.4 | |

| Other (income) and expense, net | | | (1.6 | ) | | | (2.6 | ) | | | (1.9 | ) | | | 5.3 | | | | (5.1 | ) |

| (Loss) income before income taxes | | | (58.1 | ) | | | 69.7 | | | | 60.7 | | | | 27.3 | | | | 17.5 | |

| Income tax expense (benefit) | | | 18.0 | | | | 22.8 | | | | 22.1 | | | | (31.4 | ) | | | 1.8 | |

| (Loss) income from continuing operations | | | (76.1 | ) | | | 46.9 | | | | 38.6 | | | | 58.7 | | | | 15.7 | |

| (Loss) income from discontinued operations (3) | | | (2.3 | ) | | | (9.6 | ) | | | (4.5 | ) | | | 1.1 | | | | 1.0 | |

| Net (loss) income | | $ | (78.4 | ) | | $ | 37.3 | | | $ | 34.1 | | | $ | 59.8 | | | $ | 16.7 | |

| Diluted (loss) earnings per share from continuing operations | | $ | (4.16 | ) | | $ | 2.45 | | | $ | 2.04 | | | $ | 3.53 | | | $ | 1.06 | |

| Basic (loss) earnings per share from continuing operations | | $ | (4.16 | ) | | $ | 2.50 | | | $ | 2.09 | | | $ | 3.66 | | | $ | 1.07 | |

| Weighted average shares outstanding – assuming dilution | | | 18.9 | | | | 19.2 | | | | 19.0 | | | | 16.6 | | | | 14.8 | |

| Weighted average shares outstanding – basic | | | 18.9 | | | | 18.7 | | | | 18.5 | | | | 16.1 | | | | 14.6 | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | |

| Total assets | | $ | 491.7 | | | $ | 590.0 | | | $ | 565.6 | | | $ | 566.0 | | | $ | 480.9 | |

| Total debt (4) | | | 137.9 | | | | 133.3 | | | | 159.4 | | | | 204.3 | | | | 265.9 | |

| Total shareholders’ equity | | | 181.9 | | | | 295.5 | | | | 241.3 | | | | 204.4 | | | | 81.8 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Data: | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 60.2 | | | | 59.6 | | | | 45.5 | | | | 46.4 | | | | 17.2 | |

| Net cash (used) provided by investing activities | | | (65.5 | ) | | | (8.6 | ) | | | (3.4 | ) | | | (6.4 | ) | | | 3.1 | |

| Net cash used in financing activities | | | (22.5 | ) | | | (28.6 | ) | | | (39.9 | ) | | | (4.2 | ) | | | (21.9 | ) |

| Capital expenditures | | | 12.2 | | | | 12.5 | | | | 10.5 | | | | 8.2 | | | | 5.0 | |

| Cash dividends per common share | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | | | | 0.00 | |

_____________