Exhibit 4.5

ANNUAL INFORMATION FORM

OSISKO MINING CORPORATION

For the Fiscal Year Ended December 31, 2013

March 24, 2014

TABLE OF CONTENTS

GLOSSARY | 1 |

1. CORPORATE STRUCTURE | 4 |

CORPORATE OVERVIEW | 4 |

2. GENERAL DEVELOPMENT OF THE BUSINESS | 6 |

2.1 | THREE-YEAR HISTORY AND OUTLOOK FOR 2014 | 6 |

2.2 | SIGNIFICANT ACQUISITIONS | 14 |

2.3 | SUBSEQUENT EVENT - UNSOLICITED TAKE-OVER BID BY GOLDCORP | 14 |

3. DESCRIPTION OF THE BUSINESS | 16 |

3.1 | GENERAL | 16 |

3.2 | 2013 GOLD PRODUCTION | 17 |

3.2.1 | Mining | 18 |

3.2.2 | Production | 19 |

3.2.3 | Gold Marketing and Distribution | 20 |

3.2.4 | Taxation | 21 |

3.2.5 | Competitive Conditions | 21 |

3.3 | MINERAL PROPERTIES | 21 |

3.3.1 | Canadian Malartic Mine | 21 |

Technical Information Notice | 21 |

Property Location and Description | 22 |

Mining Titles | 22 |

Rights and Obligations Associated with Mining Titles | 22 |

Agreements and Encumbrances | 23 |

Environmental Exposures Related to Past Activities | 24 |

Environmental Approvals and Permits | 24 |

Accessibility, Climate, Local Resources, Infrastructure and Physiography | 27 |

Accessibility | 27 |

Climate | 27 |

Local Resources | 27 |

Infrastructure | 27 |

Physiography | 28 |

History | 28 |

Prior and Current Ownership | 28 |

Exploration History | 30 |

Historic Drilling | 30 |

Production History | 31 |

Geological Settings | 32 |

Mineralization | 33 |

Canadian Malartic | 33 |

South Barnat | 33 |

Drilling | 34 |

Database | 34 |

Drilling completed since the Canadian Malartic Updated Report | 34 |

Core and Casing | 34 |

Collar Surveying | 34 |

Downhole Surveying | 34 |

Sample Preparation, Analytical Procedures and Security | 35 |

Sampling Approach and Methodology | 35 |

Core Sampling, Security and Chain-of-Custody | 35 |

Analytical Laboratories | 36 |

Sample Preparation and Analytical Procedures | 36 |

Security and QA/QC procedures | 37 |

Mineral Resource and Reserve Estimates | 38 |

NI 43-101 Estimates and Reports | 41 |

| | | | |

Mining operations | 41 |

Annual Mine Production Plan | 41 |

Mineral Processing | 43 |

Development | 43 |

Mining Activities Development | 43 |

Community Relations | 43 |

Environment | 44 |

Health and Safety | 44 |

3.3.2 | Hammond Reef Project | 45 |

Technical Information Notice | 45 |

Property Location and Description | 45 |

Mining Titles | 45 |

Rights and Obligations Associated with Mining Titles | 46 |

Surface Rights | 46 |

Description of Property and Encumbrances | 46 |

Environmental Exposures | 48 |

Environmental Approvals and Permits | 49 |

Accessibility, Climate, Local Resources, Infrastructure and Physiography | 49 |

Accessibility | 49 |

Climate | 49 |

Local Resources | 50 |

Infrastructure | 50 |

Physiography | 50 |

History | 51 |

Prior and Current Ownership | 51 |

Exploration and Drilling History | 51 |

Production History | 53 |

Geological Settings | 53 |

Mineralization | 53 |

Drilling | 55 |

Database | 55 |

Additional Drilling | 55 |

Core and Casing | 56 |

Collar Surveying | 56 |

Downhole Surveying | 56 |

Sample Preparation, Analytical Procedures and Security | 57 |

Sampling Approach and Methodology | 57 |

Core Sampling, Security and Chain-of-Custody | 57 |

Analytical Laboratories | 57 |

Sample Preparation and Analytical Procedures | 58 |

Security and QA/QC procedures | 58 |

Mineral Resource Estimates | 59 |

NI 43-101 Estimates and Reports | 62 |

Development | 62 |

Impairment | 62 |

Community Relations | 63 |

Health and Safety | 63 |

3.3.3 | Upper Beaver Project | 64 |

Technical Information Notice | 64 |

Property Location and Description | 64 |

Mining Titles | 64 |

Rights and Obligations Associated with Mining Titles | 64 |

Surface Rights | 65 |

Agreements and Encumbrances | 65 |

Environmental Exposures | 65 |

Environmental Approvals and Permits | 66 |

Accessibility, Climate, Local Resources, Infrastructure and Physiography | 67 |

Accessibility | 67 |

Climate | 67 |

Local Resources | 67 |

Infrastructure | 67 |

Physiography | 67 |

| | | |

ii

History | 67 |

Prior and Current Ownership | 67 |

Exploration and Production History | 68 |

Geological Settings | 69 |

Mineralization | 70 |

Drilling | 70 |

Database | 70 |

Additional Drilling | 71 |

Core and Casing | 71 |

Collar Surveying | 71 |

Downhole Surveying | 71 |

Sample Preparation, Analytical Procedures and Security | 71 |

Sampling Approach and Methodology | 71 |

Core Logging and Chain-of-Custody | 72 |

Analytical Laboratories | 72 |

Sample Preparation and Analytical Procedures | 72 |

Security and QA/QC procedures | 73 |

Mineral Resource Estimates | 74 |

NI 43-101 Estimates and Reports | 75 |

Development | 75 |

Exploration | 75 |

Environment | 76 |

Community Relations | 76 |

Health and Safety | 76 |

3.4 | EXPLORATION—OTHER PROJECTS | 76 |

New transactions | 76 |

Exploration work | 77 |

3.5 | RISK FACTORS | 78 |

Financial Risk | 79 |

Commodity Prices | 79 |

Currency Fluctuations May Affect the Costs of Doing Business | 79 |

Risk Linked with Industry Conditions | 79 |

Risk Related to Mineral Reserve and Resource Estimates | 80 |

Risk of Project Delay | 80 |

Operational Risk | 80 |

Risk Linked to Community Relations | 80 |

Risk Linked with Government Regulation | 81 |

Environmental Risk | 81 |

Insurance Risks | 82 |

Risk on the Uncertainty of Title | 82 |

Risk Linked to Conflict of Interest | 82 |

Human Resource Risk | 82 |

Reputational Risk | 83 |

Geopolitical and Security Risks | 83 |

4. DIVIDENDS | 83 |

5. DESCRIPTION OF CAPITAL STRUCTURE | 84 |

6. MARKET FOR SECURITIES | 85 |

6.1 | TRADING PRICE AND VOLUME | 85 |

6.2 | PRIOR SALES | 85 |

7. DIRECTORS AND OFFICERS | 86 |

7.1 | NAME, OCCUPATION AND COMMON SHARES/DSU/RSU HOLDING | 86 |

7.2 | CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 93 |

7.3 | CONFLICTS OF INTEREST | 94 |

8. LEGAL PROCEEDINGS | 94 |

iii

9. INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 95 |

10. AUDITORS, TRANSFER AGENT AND REGISTRAR | 95 |

11. MATERIAL CONTRACTS | 95 |

12. INTERESTS OF EXPERTS | 95 |

12.1 | NAME OF EXPERTS | 95 |

12.2 | INTERESTS OF EXPERTS | 96 |

13. ADDITIONAL INFORMATION | 97 |

13.1 | AUDIT COMMITTEE | 97 |

Composition of the Audit Committee as of March 20, 2014 | 98 |

Relevant Education and Experience | 98 |

External Auditor Service Fees | 99 |

13.2 | ADDITIONAL INFORMATION | 99 |

| | | | |

iv

Explanatory Notes

1. In this annual information form for the fiscal year ended December 31, 2013 (the “Annual Information Form”), “Osisko” and the “Corporation” refer to Osisko Mining Corporation, unless otherwise indicated or the context otherwise requires. All information contained herein is as at December 31, 2013, unless otherwise indicated.

2. All dollar amounts presented in this Annual Information Form are expressed in Canadian Dollars, unless otherwise indicated.

3. The information in this Annual Information Form is complemented by the Corporation’s Audited Consolidated Financial Statements for the year ended December 31, 2013 and the management discussion and analysis thereon, copies of which are available on the SEDAR website (www.sedar.com) or on the Corporation’s website (www.osisko.com).

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this Annual Information Form constitute forward-looking statements. These statements relate to future events or the Corporation’s future performance, business prospects or opportunities. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. These forward- looking statements include statements regarding the future price of gold and silver, the timing and amount of estimated future production, costs of production, currency fluctuations, capital expenditures, permitting timelines, the requirements of future capital, drill results and the estimation of mineral resources and reserves. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Corporation believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements contained in this report should not be unduly relied upon. These statements speak only as of the date of this report. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this report. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about:

· general business and economic conditions;

· the supply and demand for, deliveries of, and the level and volatility of prices of gold and silver as well as petroleum products;

· impact of change in foreign currency exchange rates and interest rates;

· the timing of the receipt of regulatory and governmental approvals for the Corporation’s development project and other operations;

· the availability of financing for the Corporation’s development for future projects;

· the Corporation’s estimation of its costs of production, expected production, capital expenditure requirements, and productivity levels;

· power prices;

· the ability to procure equipment and operating supplies in sufficient quantities and on a timely basis;

· the ability to attract and retain skilled staff;

v

· engineering and construction timetables and capital costs for the Corporation’s development project;

· market competition;

· the accuracy of the Corporation’s estimate of reserves and resources (including, with respect to size, grade and recoverability) and the geological, operational and price assumptions on which it is based;

· change in governments regulations and policies, including change in tax benefits and tax rates;

· environmental risks including increased regulatory constraints;

· the ability to deviate Québec’s highway 117 to allow for the mining of the South Barnat deposit

in Malartic;

· the Corporation’s ongoing relations with its employees, its business partners and the communities and aboriginal groups related to its exploration and mining activities;

· the obtaining of the requested precisions and amendments of its Canadian Malartic Mine operating permits in a timely manner, further to discussions with the Ministère du Développement durable, de l’Environnement de la Faune et des Parcs (“MDDEFP”); and

· the robustness of the Corporation process to pursue value maximizing alternatives.

Factors that could cause actual results to differ materially include, but are not limited to, the risk factors incorporated by reference herein. For additional risk factors described in more detail see “3.5 Risk Factors”. The Corporation cautions that the foregoing list of important factors is not exhaustive. Investors and others who base themselves on the Corporation’s forward-looking statements should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. The Corporation also cautions readers not to place undue reliance on these forward-looking statements. Moreover, these forward-looking statements may not be suitable for establishing strategic priorities and objectives, future strategies or actions, financial objectives and projections other than those mentioned above. The forward-looking statements contained in this Annual Information Form are expressly qualified by this cautionary statement.

vi

GLOSSARY

In this Annual Information Form, unless there is something in the subject matter or context inconsistent therewith, the following terms shall have the respective meanings set out below:

“Au” means gold;

“BQ diameter” means diamond drill core with diameter of 36.5 mm;

“CAPEX” or “Capital Expenditures” means all expenditures not classified as operating costs;

“CL” means Claim;

“cm” means centimetre;

“deposit” means a mineralized body which has been physically delineated by sufficient drilling, trenching and/or underground work and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; a deposit does not qualify as a commercially mineable ore body or as containing mineral reserves until certain legal, technical and economic factors have been resolved;

“Feasibility Study” means a comprehensive study of a deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production;

“g” means grams;

“g/t” means grams per tonne;

“ha” means hectare, a unit of area equal to 10,000 square metres;

“Indicated Mineral Resources” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from location such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed;

“Inferred Mineral Resources” means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes;

“kg” means kilogram;

“km” means kilometre;

“kt” means kilotonne;

“m” means metre;

“M” means million;

“MC” means Mining Concession;

“MDC” means Map Designated Claim;

“Measured Mineral Resources” means that part of a mineral resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity;

“Mineral Reserve” means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined;

“Mineral Resource” means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge;

“Mineralization” means the concentration of potentially economic minerals within a body of rock;

“ML” means Mining Lease;

“mm” means millimetre;

“National Instrument 43-101” or “NI 43-101” means National Instrument 43-101 Standards of Disclosure for Mineral Projects established by the Canadian Securities Administrators or Regulation 43-101 respecting Standards of Disclosure for Mineral Projects in Québec;

“National Instrument 51-102” or “NI 51-102” means National Instrument 51-102 Continuous Disclosure Obligations established by the Canadian Securities Administrators or Regulation 51-102 respecting Continuous Disclosure Obligations in Québec;

“NSR” means Net Smelter Return royalty, which means the amount actually paid to the mine owner from the sale of ore, minerals or concentrates mined and removed from mineral properties, net of expenditures such as transportation of the product sold, smelting and refining charges;

“NQ diameter” means diamond drill core with a diameter of 60.0 mm;

“ounce” or “oz” means troy ounce, a unit of weight equivalent to 31.1035 g when referring to gold or silver;

2

“Probable Mineral Reserve” means the economically mineable part of an Indicated Mineral Resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified;

“Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified;

“QA/QC” means Quality Assurance/Quality Control;

“SEDAR” means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

“t” or “tonne” means metric unit of weight equivalent to 1,000 kg;

“t/m3” means tonnes per cubic meter;

“ton” or “st” means a short ton of weight equivalent to 2000 pounds (or 907.18474 kg);

“tpd” means tonnes per day.

3

1. CORPORATE STRUCTURE

Corporate Overview

Osisko was incorporated pursuant to the Canada Business Corporations Act (the “Act”) on February 18, 1982 under the name “Ormico Exploration Ltée”. Osisko subsequently amended its articles on September 24, 1998, to change its corporate name to “Osisko Exploration Ltée”. On the same date, the Corporation also consolidated its common shares on the basis of one new common share for each two issued common shares and amended its articles in order to change the location of its registered office from Québec to Montréal. On June 21, 2007, the Corporation completed a two-for-one stock-split whereby each shareholder received one additional share for every share owned as of the record date. Outstanding warrants and options were adjusted accordingly. Osisko amended its articles on May 15, 2008, to change its corporate name to “Osisko Mining Corporation” and, on September 27, 2013, to provide for the appointment by the Board of Directors of additional directors in accordance with subsection 106(8) of the Act, which may not exceed one third of the number of directors elected at the previous annual meeting of shareholders.

The Corporation is focused on acquiring, exploring, developing and mining gold properties in the Americas, with the aim of becoming a leading mid-tier gold producer. Its flagship asset is the Canadian Malartic gold mine located in the Abitibi mining district (the “Canadian Malartic Property” or “Canadian Malartic Mine”). The Canadian Malartic Property currently represents one of the largest gold reserves in production in Canada with Proven and Probable Mineral Reserves of 9.37 million ounces of gold (see “3.3 Mineral Properties”). Since the beginning of commercial production, the Canadian Malartic Mine has produced 1,140,653 ounces of gold (including the months of January and February 2014). In 2013, the Canadian Malartic Mine produced 475,277 ounces and 422,619 ounces of silver (see “3.2 2012 Gold Production”).

The Corporation is pursuing exploration on a number of properties, including the Upper Beaver project in Northeastern Ontario (the “Upper Beaver Property” or “Upper Beaver Project”), which is part of the 230 km2 mineral exploration holdings in the historic Kirkland Lake gold camp held by Osisko Mining Ltd. (“OML”), a wholly-owned subsidiary of the Corporation. Based on underground mining scenario, the Indicated and Inferred Mineral Resources for the Upper Beaver Property are respectively 1.46 and 0.71 million ounces of gold at a cut-off grade of 2.0 g/t Au (see “3.3 Mineral Properties”).

The Corporation is also the owner of the advanced stage Hammond Reef project in Northern Ontario (the “Hammond Reef Property” or “Hammond Reef Project”), which is the principal asset of Osisko Hammond Reef Gold Ltd. (“OHRG”), a wholly-owned subsidiary of the Corporation. The total in-pit Measured and Indicated Mineral Resources for the Hammond Reef Property is 5.31 million ounces of gold at an average undiluted grade of 0.72 g/t Au (see “3.3 Mineral Properties”). Based on preliminary feasibility results and current market conditions in the gold sector, the Corporation determined in 2013 that an impairment charge of $487.8 million, net of a deferred tax recovery of $43.1 million, was necessary (see “3.3 Mineral Properties”).

Osisko’s operations, development projects and exploration activities are mostly concentrated on its wholly-owned Canadian Malartic Mine, its advanced stage Upper Beaver and Hammond Reef Projects (see “3.3 Mineral Properties”), and its Kirkland Lake and Mexico exploration properties.

4

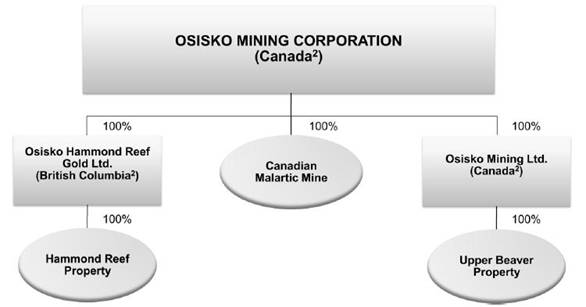

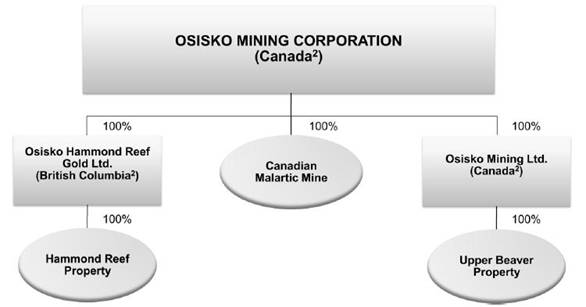

The Corporation’s holdings in significant mineral properties are represented by the following chart:

CORPORATE AND PROPERTIES CHART(1)

as of December 31, 2013

(1) This chart does not include all subsidiaries or affiliates of the Corporation.

(2) Jurisdiction of incorporation.

The Corporation’s head and registered office is located at 1100 av. des Canadiens-de-Montréal, Suite 300, P.O. Box 211, Montreal, Québec, H3B 2S2.

5

2. GENERAL DEVELOPMENT OF THE BUSINESS

In 2013, the Corporation produced 475,277 ounces of gold at its Canadian Malartic Mine, established a quarterly gold production record of 137,321 ounces in the fourth quarter, and, through its continuing modifications and optimization work, reached close to the throughput nameplate design capacity of 55,000 tonnes per day (95%) on an operating day basis for the year. The Corporation focussed its exploration activities on the Kirkland Lake and Mexico properties, and continued the development of its advanced stage projects through the pursuit of permitting activities (Hammond Reef Project) and the review of its construction and development approach (Upper Beaver Project).

2.1 Three-Year History and Outlook for 2014

Event | | Date | | Details Three-Year History | |

| | | | | |

CORPORATE DEVELOPMENT | | | | | |

| | | | | |

- Acquisition of Queenston Mining Inc. (“QMI”) (now OML) | | December 28, 2012 (following a friendly offer dated November 12, 2012) | | On December 28, 2012, Osisko completed the acquisition of all common shares of QMI pursuant to a court-approved plan of arrangement. This transaction provided Osisko with a highly strategic land package, including the Upper Beaver Property, in another prolific Canadian gold camp. Based on an underground mining scenario, the Indicated and Inferred Mineral Resources for the Upper Beaver Property are respectively at 1.46 and 0.71 million ounces of gold at a cut-off grade of 2.0 g/t Au. For more details, see “3.3 Mineral Properties”. | |

| | | | | |

- Launch of a hostile take-over bid by Goldcorp Inc. (“Goldcorp”) against the Corporation | | January 14, 2014 | | On January 14, 2014, Goldcorp launched a hostile take-over bid for Osisko’s shares, which was announced the day before. The Board of Directors of the Corporation has unanimously recommended that Osisko shareholders REJECT the hostile take-over bid initiated by Goldcorp and NOT TENDER their Osisko shares to the Goldcorp Offer. The Osisko Board determined that the Goldcorp offer fails to adequately compensate Osisko shareholders for, among others things, the strategic value of Osisko’s world-class asset base, the significant upside potential of Osisko’s Canadian Malartic Mine, or the increased risk inherent in Goldcorp common shares. The full basis for the Osisko Board’s recommendation is available in a Directors’ Circular, a copy of which is available online at www.osisko.com. See “2.3 Subsequent Event - Unsolicited take-over bid by Goldcorp”. | |

6

Event | | Date | | Details Three-Year History | |

| | | | | |

GOVERNANCE DEVELOPMENT | | | |

| | | | | |

- Amendment of the general by-laws of the Corporation to increase quorum at shareholders’ meeting | | February 25, 2011 | | On February 25, 2011, the Board of Directors of the Corporation adopted a resolution to amend the general by-laws in order to provide that the presence of two (2) persons present in person or by proxy, holding or representing by proxy twenty five percent (25%) of the voting shares constitute a quorum of any meeting of shareholders, unless a different number of shareholders and/or a different number of shares are required to be represented by the Act or by the articles or by any other by-law. The resolution was ratified by 99.9 % of shareholders at the annual and special meeting of the Corporation on May 12, 2011. | |

| | | | | |

- Adoption of a Majority Voting Policy for Election of Directors | | April 3, 2011 | | On April 3, 2011, the Board of Directors of the Corporation adopted a Majority Voting Policy for the Election of Directors in uncontested elections, a copy of which is available on the Corporation’s web site at www.osisko.com. Under that policy, if a nominee does not receive the affirmative vote of at least the majority of votes cast at the meeting of shareholders, the director shall promptly tender his or her resignation within 60 days of said election for consideration by the Governance/Nomination Committee and the Board. | |

| | | | | |

- Adoption of a Deferred Share Unit Plan (the “DSU Plan”) and a Restricted Share Unit Plan (“RSU Plan”) | | August 11, 2011 | | On August 11, 2011, the Corporation adopted DSU and RSU Plans to enhance, without any dilution for Osisko shareholders, the Corporation’s ability to attract and retain talented individuals to serve as members of the Board of Directors or as officers and executives of the Corporation and to promote alignment of interests of such individuals with that of shareholders of the Corporation. Annual option grants to Directors were replaced with deferred share unit grants. | |

| | | | | |

- Adoption of an advance notice by-law | | December 21, 2012 | | On December 21, 2012, the Board of Directors of the Corporation adopted a modification to its by-laws to include advance notice provisions, the purpose of which is to require advance notice be provided to the Corporation in circumstances where nominations of persons for election to the Board are made by shareholders of the Corporation other than pursuant to a requisition of a meeting of shareholders or a shareholder proposal made pursuant to the provisions of the Canada Business Corporations Act. The resolution was ratified by 66.11% of shareholders at the annual and special meeting of the Corporation on May 9, 2013. | |

7

Event | | Date | | Details Three-Year History | |

| | | | | |

- Ratification of the continued existence of the Shareholder Rights Plan (the “SRP”) | | May 9, 2013 | | On May 17, 2010, the Board of Directors of the Corporation adopted a SRP which was ratified by 94.1% of shareholders at the annual and special meeting of the Corporation on June 30, 2010. The purpose of the SRP is to provide the board of directors and shareholders with sufficient time to properly consider any takeover bid made for the corporation and to allow for competing bids and alternative proposals to emerge. The continued existence of the SRP was ratified by 97.86% of shareholders at the annual and special meeting of the Corporation on May 9, 2013. | |

| | | | | |

DEVELOPMENT OF MINING PROPERTIES | | | |

| | | | | |

- Construction program completed at the Canadian Malartic Property | | February, 2011 | | The construction program was completed at the end of February 2011, 18 months after construction release. The construction project was three months ahead of schedule and was recognized by the Association of Québec Contractors as the “Major Project of the Year”. | |

| | | | | |

- 1% royalty interest buy back on Canadian Malartic Property | | March 28, 2011 | | The Corporation purchased back a 1% royalty interest from RG Exchangeco Inc. for US$1.5 million. This royalty was encumbering certain claims included in the Canadian Malartic Property. | |

| | | | | |

- Updated resource and reserve estimates for the Canadian Malartic Mine | | March 31, 2011 | | This estimate was based on the combined resources of the Canadian Malartic and South Barnat deposits. The open pit reserve increased to 10.71 million ounces gold at an average fully-diluted grade of 0.97 g/t., a 1.74 million ounce or 19.3 percent increase relative to the previously-published estimate of 8.97 million ounces (see February 10, 2010). See “3.3 Mineral Properties”. | |

| | | | | |

- First gold pour at the Canadian Malartic Mine | | April 13, 2011 | | The first gold pour occurred on April 13, 2011, following the introduction of ore into the mill in late March 2011. | |

| | | | | |

- First day of commercial production at the Canadian Malartic Mine | | May 19, 2011 | | On June 21, 2011, the Corporation declared commercial production at the Canadian Malartic Mine, as the gold milling plant processed an average of 33,300 tonnes per day during the 30-day period ending June 17, 2011. Accordingly, the first day of commercial production was May 19, 2011. | |

| | | | | |

- 1% royalty interest buy back on Canadian Malartic Mine | | July 12, 2011 | | On July 12, 2011, the Corporation purchased back a 1% royalty interest from Géoconseils Jack Stoch Limitée in consideration for the issuance of 460,000 common shares of Osisko. This royalty was encumbering a portion of the Canadian Malartic and Barnat deposits and is part of a 2.5% gross metal royalty interest that was granted as a result of the acquisition of certain claims of the Canadian Malartic Property in March 2006. The remaining 1.5% royalty interest was assigned to Franco-Nevada Corporation. | |

8

Event | | Date | | Details Three-Year History | |

| | | | | |

- Updated global Inferred Mineral Resources estimate for the Hammond Reef Property | | November 7, 2011 | | SGS Canada Inc. has estimated a global Inferred Mineral Resource at 10.52 million ounces gold based on 0.30 g/t Au lower cut-off, an increase of 65% or 4.16 million new ounces from the total resources previously released by Brett Resources Inc. (“Brett”) (now OHRG) in 2009. The in-pit inferred resource was estimated at 6.86 million ounces at a diluted grade of 0.63 g/t Au, based on a Whittle-optimized pit shell using a gold price of US$1,200 per ounce, a corresponding lower cut-off grade of 0.28 g/t Au and a waste/ore strip ratio of 1.25. This represented an increase of 25% or 1.36 million ounces gold above the previous in-pit resource estimate released by Brett in 2009. See “3.3 Mineral Properties”. | |

| | | | | |

- Completion of a new relocation program as part of noise mitigation measure | | December 22, 2011 | | In 2011, the Corporation received 21 notices of violation mainly caused by exceeding noise levels and blast-induced vibrations. The Corporation implemented several mitigating measures to reduce the impact on the Malartic community, one of which was a new relocation program which increased the buffer zone between the pit crest and the Malartic residents. The relocation program was consistent with the modified decree issued on April 13, 2011 by the Québec Government for the Canadian Malartic Property and the new zoning by-law adopted by the City of Malartic on July 12, 2011, which together increased the noise level parameters under which the mine can operate. | |

| | | | | |

- Modifications to the crushing circuit at the Canadian Malartic Mine | | March, August and December 2012 | | The Corporation completed the addition of two new large cone crushing units in March and August 2012 and, in December 2012, finalized the installation of a second pebble crusher. These modifications were an important step towards the completion of the Canadian Malartic Mine ramp-up phase. | |

| | | | | |

- Fire at the Canadian Malartic Mine milling plant | | May 9, 2012 | | Operations at the Canadian Malartic Mine were affected by a fire that occurred on May 9, 2012 to the number four cyclone area that forced the shutdown of the mill for six days. This shutdown was followed by four days of lower production and the mill returned to its full operations on May 19, 2012. | |

| | | | | |

- Updated reserve and resource estimate for the Hammond Reef Property | | January 28, 2013 | | The global Measured and Indicated Mineral Resources at the Hammond Reef Property currently stand at 5.43 million ounces gold at an average grade of 0.86 g/t Au and the global Inferred Mineral Resource stands at 1.75 million ounces gold at an average grade of 0.72 g/t Au (based on 0.50 g/t Au lower cut-off). See “3.3 Mineral Properties”. | |

9

Event | | Date | | Details Three-Year History | |

| | | | | |

- New operating parameters for the Canadian Malartic Mine | | February 13, 2013 | | On February 13, 2013, the Québec Government issued a new decree allowing the Corporation to increase access to the northern portion of the Canadian Malartic Mine and to improve the framework for the execution of its blasting operations. This decree resolved most interpretation issues with the MDDEFP regarding blasting operations. These interpretation issues were the source of 14 of the 37 notices of non-compliance received by the Corporation in 2012 and at the main origin of the searches conducted by the MDDEFP at the Canadian Malartic Mine during the second semester of 2012. | |

| | | | | |

- Updated reserve and resource estimate for the Canadian Malartic Property | | February 19, 2013 | | Under this update, the in-pit Proven and Probable Mineral Reserves (using US$1,475 gold) stood at 10.1 M ounces at a fully diluted average gold grade of 1.01 g/t Au, following total production of 588,615 ounces of gold since beginning of operations in 2011. Global Measured and Indicated Mineral Resources above a cut-off grade of 0.31 (South Barnat) to 0.34 g/t Au (Canadian Malartic and satellites) stood at 11.70 M ounces gold, and global Inferred Mineral Resources stood at 1.20 M ounces gold. The global in situ Mineral Resources included Mineral Reserves but excluded production. See “3.3 Mineral Properties”. | |

| | | | | |

- Implementation of a capital expenditure reduction program | | April 29, 2013 | | Due to volatility in the gold price and financial markets, the Corporation reviewed its rate of discretionary spending in exploration and advancing new projects and, as a result, announced on April 29, 2013 the implementation of a $80 million capital expenditure reduction program for 2013. The Corporation finally achieved a total reduction of $96.3 million, $16.0 million over the initial objective. | |

| | | | | |

- Study reporting local and regional economic impact of the Canadian Malartic Mine | | July 10, 2013 | | On July 10, 2013, the Corporation filed with the MDDEFP a study conducted by the independent consulting firm KPMG-SECOR on Canadian Malartic Mine’s local and regional economic impact. The study shows that Canadian Malartic: supports nearly 1,600 jobs in Abitibi-Témiscamingue, including 635 direct jobs at the mine site; supports a payroll of more than $100 million through direct and indirect jobs; pays $61.6 million in direct wages, with an average salary of $87,000, 66% higher than the average in the Vallée-de-l’Or Regional County Municipality; makes purchases of over $290 million annually in Abitibi-Témiscamingue; and improves Malartic’s quality of life and revitalizes its community and business assets. | |

10

Event | | Date | | Details Three-Year History | |

| | | | | |

- Impairment charge on the Hammond Reef Project | | August 1, 2013 | | On August 1, 2013, the Corporation announced that, based on preliminary feasibility results and market conditions in the gold sector, it had undertaken a review of its Hammond Reef Project since the end of the second quarter of 2013. The impairment testing conducted in conformity with IFRS practices determined that an impairment charge of $487.8 million, net of a deferred tax recovery of $43.1 million, was necessary. Accordingly, the project value recorded on the Corporation’s books was reduced to nil in the second quarter of 2013. The Corporation continues to pursue low-cost permitting activities in the near-term, monitor market conditions, and review optimization scenarios (see “Environmental Approvals and Permits” under “3.3.2 Hammond Reef Project”). | |

| | | | | |

- Production of millionth ounce at the Canadian Malartic Mine | | November, 2013 | | On November 21, 2013, the Corporation was very proud to announce that it had produced its 1,000,000th ounce of gold from its flagship Canadian Malartic Mine. | |

| | | | | |

- Receipt of 27 statements of offence related to the construction of the “green wall” in 2010 | | November 28, 2013 | | On November 28, 2013, the Corporation received 27 statements of offence relating to building activities carried out in 2010 in connection with the construction of its “green wall” in the Town of Malartic. Uncontested, the statements would total approximately $389,000 in imposed fines. On November 29, 2013, the Corporation appeared and pleaded not guilty to all charges. The Corporation firmly believes that all construction activity related to the green wall was carried out under best practices to minimize the impact of the construction on the residents of Malartic. | |

| | | | | |

- New modifications to the Canadian Malartic Mine operating decree and new mining lease (ML) for the exploitation of the Gouldie zone | | February, 2014 | | On February 26, 2014, the Québec Government issued a new decree allowing the exploitation of the Gouldie zone. Few days earlier, on February 18, 2014, the Ministère des Ressources naturelles (“MRN”) granted Osisko a ML having an approximate total area 66 ha. As per these documents, Osisko has 30 months to mine the Gouldie zone and shall not exceed a daily production rate of 6,990 t of ore and a daily extraction rate of 30,000 t of ore, waste and over-burden. | |

| | | | | |

- Updated reserve and resource estimate for the Canadian Malartic Property | | March 12, 2014 | | Under this new estimate, the open pit Proven and Probable Mineral Reserves now stand at 9.37 M ounces at a fully diluted average gold grade of 1.04 g/t Au, following total 2013 production of 475,277 ounces of gold. Using a 12% lower gold price (US$1300 versus US$1475), the net difference from the 2013 estimate of 10.1 million ounces is only 235,000 fewer ounces (2%), once 2013 production (before recovery) is taken into account. Total precious metal production from the beginning of operations in April 2011 to December 31, 2013 was 1,044,388 ounces gold and 753,776 ounces silver. Global Measured and Indicated Mineral Resources now stand at 11.10 M ounces gold, and global Inferred Mineral Resources now stand at 1.16 M ounces gold. The global in situ 2014 Mineral Resources include Mineral Reserves but exclude production. See “3.3 Mineral Properties”. | |

11

Event | | Date | | Details Three-Year History | |

| | | | | |

- Updated annual mine production plan for the Canadian Malartic Mine | | March 20, 2014 | | Under this new annual mine production plan, the mine life is now estimated at 14.2 years based on a 55,000 tpd milling rate, assuming 92% availability. Average gold production is now estimated at 610,000 ounces per year over the next five years (2014-2018) at cash costs of US$516 per ounce and at 597,000 ounces per year over life of mine at cash costs of US$525 per ounce. See “3.3 Mineral Properties”. | |

| | | | | |

FINANCIAL TRANSACTIONS | | | | | |

| | | | | |

- Non-brokered private placements of flow-through shares | | May 2011 | | The Corporation closed a non-brokered private placement with funds, certain accredited investors, Directors, employees and officers. The Corporation issued 934,915 flow-through shares at a price of $17.50 per share for gross proceeds of $16,361,000. | |

| | | | | |

- Increase in Caterpillar finance lease | | August 9, 2011 | | The Corporation entered into an agreement with Caterpillar Financial Services Corporation to increase its equipment leasing facility by US $56.3 million. The facility will be used to acquire additional mobile mining equipment fleet to develop the Canadian Malartic Mine and the Barnat gold deposit. | |

| | | | | |

- Non-brokered private placements of flow-through shares | | September 2011 | | The Corporation closed a non-brokered private placement with funds, certain accredited investors, Directors, employees and officers. The Corporation issued 889,053 flow-through shares at a price of $18.00 per share for gross proceeds of $16,003,000. | |

| | | | | |

- Amendment of the credit facility agreement with CPPIB Credit Investments Inc. (“CPPIB”) | | June 29, 2012 | | The Corporation completed an Amended and restated loan agreement with CPPIB to (a) delay by one year the first reimbursement of capital (the first payment being postponed to the third quarter of 2013); (b) make available to the Corporation up to $100,000,000 under a delay-draw term loan at a rate of 7.5% with a maturity of December 31, 2013; and (c) amend the outstanding warrants originally issued when the loans were initially drawn (exercise prices of the warrants issued in September 2009 and March 2010 are respectively reduced from $10.75 and $19.25 to $10.00). | |

| | | | | |

- Receipt of a final $30 million payment from Kirkland Lake Gold Inc. | | July, 2013 | | The Corporation received the final $30 million payment from Kirkland Lake Gold Inc. (“KL Gold”) under a property sale agreement between KL Gold and QMI (now OML), pursuant to which QMI had agreed to sell to KL Gold its 50% interest in properties held under a joint venture located in Teck Township for $60 million cash and a royalty. The royalty gives Osisko the right to receive $15 per ounce on any gold produced from the sold properties after the first 1.3 million ounces of gold have been produced, for the next 1 million ounces produced; and $20 per ounce on any gold produced thereafter. | |

12

Event | | Date | | Details Three-Year History | |

| | | | | |

- Non-brokered private placements of flow-through shares | | December, 2013 | | The Corporation closed a non-brokered private placement with funds, certain accredited investors, Directors, employees and officers. The Corporation issued 1,416,400 flow-through shares at a price of $6.25 per share for gross proceeds of $8,852,500. | |

| | | | | |

- Modifications to long-term debt terms | | December, 2013 | | In July 2013, the Corporation entered into preliminary agreements with CPPIB, the Caisse de dépôt et placement du Québec (“CDPQ”) and Ressources Québec (“RQ”), a subsidiary of Investissement Québec, to amend certain elements related to its loans. The final agreements were executed in December 2013, effective October 1, 2013. The repayment schedule of the $150 million CPPIB facility and the $75 million convertible debentures has been modified and the CPPIB credit facility and the convertible debentures now bears a fixed rate of interest of 6.875%, compared to 7.5% previously. The 12.5 million warrants held by CPPIB will now expire on September 30, 2017, with an exercise price of $6.25 (previously $10.00). The exercise of the warrants may be accelerated at the Corporation’s option if the Osisko shares trade at a price above $8.15 for 15 consecutive days. The $100 million delayed drawdown facility established in May 2012 with CPPIB has been terminated as previously agreed. The convertible debentures held by CDPQ and RQ will now become due in November 2017. The debentures will be convertible into Osisko shares at any time prior to the due date at the price of $6.25 per share (previously $9.18). | |

| | | | | |

SUSTAINABLE DEVELOPMENT AND ENVIRONMENT | | | |

| | | | | |

- Deposit of the first tranche of the financial guarantee covering the entire cost of rehabilitating the Canadian Malartic Mine site | | October 12, 2011 | | On October 12, 2011, the Corporation deposited an amount of $22.1 million with the Québec Government to cover the entire estimated future cost of rehabilitating the Canadian Malartic Mine site, which amount to $46.4 million. | |

| | | | | |

- Signing of a Memorandum of Understanding (“MOU”) between OHRG and the Métis Nation of Ontario (“MNO”) | | March 6, 2012 | | The MOU sets out the way in which the local Métis communities will be consulted regarding the development of the Hammond Reef Project and commits the parties to working together to address any potential impacts the project may have on Métis rights, interests and way of life. | |

| | | | | |

- Deposit of the second tranche of the financial guarantee covering the entire cost of rehabilitating the Canadian Malartic Mine site | | October 3, 2012 | | On October 3, 2012, the Corporation deposited an amount of $12.7 million with the Québec Government. The Corporation intends to deposit an additional $11.6 million in 2013, thereby completing its commitment to deposit in the first years of operations the entire financial guarantee covering the total costs of the environmental rehabilitation of its Canadian Malartic Mine. | |

13

Event | | Date | | Details Three-Year History | |

| | | | | |

- Fifth annual sustainability report of the Corporation | | July 2013 | | The Corporation published in July its fifth annual sustainability report. The report covers the 2012 activities and is available on Osisko’s website at www.osisko.com. | |

| | | | | |

- Deposit of the final tranche of the financial guarantee covering the entire cost of rehabilitating the Canadian Malartic Mine site | | July 5, 2013 | | On July 5, 2013, the Corporation deposited an amount of $11.6 million with the Québec Government, representing the balance of the total guarantee required to cover the entire future costs of rehabilitating the Canadian Malartic Mine site. The aggregate deposits for the Government of Québec amount to $46.4 million. | |

Outlook for 2014

The Canadian Malartic Mine continues to establish new records in 2014. Gold production for the first two months of 2014 reached 96,265 ounces at average cash costs per ounce of US$585.

Mill throughput is expected to stabilize at approximately 55,000 tonnes per day in 2014 with the completion of optimization programs currently in progress. Together with increased contribution from higher grade material in the now accessible northern pit wall, it is anticipated that gold production for the current year will increase to between 525,000 to 575,000 ounces (an increase of between 11% and 21% over record 2013 production of 475,277 ounces gold).

Cash costs per ounce are estimated between $580 and $635, a 24% to 16% reduction in costs from 2013. Cash costs per ounce in US dollars are estimated at US$527 to US$577 using an exchange rate of 1.10.

Capital expenditures for 2014 are estimated at $148 million:

(In millions of dollars)

Canadian Malartic(1) | | 125.9 | |

Exploration and evaluation - capitalized | | 22.2 | |

Capital expenditures | | 148.0 | |

(1) Includes $65.6 million related to stripping and pit preparation activities.

2.2 Significant Acquisitions

There was no significant acquisition completed by Osisko during the financial year ended December 31, 2013.

2.3 Subsequent Event - Unsolicited take-over bid by Goldcorp

On January 13, 2014, Goldcorp announced an unsolicited take-over bid to acquire all of the outstanding common shares of Osisko Mining Corporation in exchange for $2.26 in cash plus 0.146 of a Goldcorp common share (the “Unsolicited take-over bid”). The Unsolicited take-over bid was originally valid until February 19, 2014.

The Board of Directors of Osisko recommended that Osisko shareholders reject Goldcorp’s Unsolicited take-over bid and, on January 29, 2014, filed and mailed to Osisko shareholders the Director’s Circular.

14

As described in the Director’s Circular, the Goldcorp offer is not a permitted bid under the Osisko’s Shareholder Rights Plan. As a result, the Board of Directors, in accordance with the Shareholder Rights Plan, has deferred the rights issuable under Osisko’s Shareholder Rights Plan until such later date as is determined by the Board of Directors.

On January 29, 2014, Osisko announced that it had commenced a legal proceeding against Goldcorp in the Québec Superior Court. In the proceeding, Osisko alleged that, in making its Unsolicited take-over bid for Osisko, Goldcorp misused confidential information and otherwise acted in a manner not permitted by the confidentiality agreement between the parties. Osisko also alleged that Goldcorp acted in bad faith and in a manner contrary to applicable law, in actions taken by Goldcorp prior to launching its Unsolicited take-over bid. Accordingly, Osisko sought an order enjoining the Unsolicited take-over bid and further conduct by Goldcorp that Osisko alleges is in breach of the confidentiality agreement.

On February 4, 2014, Goldcorp announced that it would not take up and pay for Osisko shares until Québec Superior Court judgement and extended its Unsolicited take-over bid to March 10, 2014. The Québec Superior Court had scheduled a hearing from March 3, 2014 to March 5, 2014.

On March 3, 2014, Osisko reached an agreement with Goldcorp to settle the proceeding that Osisko had commenced against Goldcorp in the Québec Superior Court. Pursuant to the settlement, Goldcorp has agreed not to take up and pay for any shares deposited to its Unsolicited take-over bid prior to April 15, 2014. In return, Osisko has agreed to waive the application of its shareholder rights plan on the earlier to occur of April 15, 2014, and the date Osisko enters into any third party transaction, to provide Goldcorp access to due diligence materials beginning on the earlier to occur of April 1, 2014 and the date that Osisko enters into any third party transaction, and to terminate its court proceeding against Goldcorp. The settlement also contemplates that no alternative transaction can be closed prior to April 15, 2014.

Osisko is continuing to manage a robust process to aggressively pursue a range of value maximizing alternatives that are in the best interests of Osisko, the Osisko shareholders and other stakeholders. The settlement contemplates that the deadlines described above may be abbreviated if Osisko announces a value maximizing alternative to Goldcorp’s Unsolicited take-over bid prior to April 15, 2014. While Osisko is engaged in a process to pursue value maximizing alternatives, there can be no assurance that an alternative transaction will arise.

In relation with the Unsolicited take-over bid, Osisko is incurring significant expenses that cannot be fully estimated at this time for financial and legal advisors. The Corporation would be required to pay, on the date of the change of control, termination payments to officers and certain employees, all outstanding share options, restricted and deferred shares units would vest, the loans and convertible debentures may become payable at the discretion of the lenders and FSTQ could elect to convert its remaining loan into shares.

The Board of Directors of the Corporation has formed a Special Independent Committee including five independent members. The Special Independent Committee has retained Stikeman Elliott LLP as its legal adviser. BMO Capital Markets and Maxit Capital LP are acting as financial advisers to the Corporation. Canadian legal counsel to the Corporation is Bennett Jones LLP and U.S. counsel is Skadden, Arps, Slate, Meagher & Flom LLP.

15

3. DESCRIPTION OF THE BUSINESS

3.1 General

Osisko is focused on acquiring, exploring, developing and mining gold properties, with the aim of becoming a leading mid-tier gold producer.

The Corporation’s flagship asset is the Canadian Malartic Mine located in the Abitibi Gold Belt, immediately south of the town of Malartic and approximately 25 kilometres west of the city of Val-d’Or, Québec. The Canadian Malartic deposit was acquired in late 2004, with drilling commencing in March 2005. Following an intensive drilling program, a $1 billion capital construction project was completed in early 2011 with the first gold poured in April 2011. The Canadian Malartic Mine reached commercial production on May 19, 2011 and currently has an estimated 9.37 million ounces in Proven and Probable Mineral Reserves (See “3.3 Mineral Properties”). In 2013, the Corporation produced 475,277 ounces of gold (See “3.2 2013 Gold Production”).

Osisko acquired two advanced exploration projects, Hammond Reef (2010) and Upper Beaver (2012). The Hammond Reef Project is located in the Sawbill Bay-Marmion Reservoir area of the Thunder Bay Mining District, approximately 170 km west of Thunder Bay, Ontario, and roughly 23 km northeast of the town of Atikokan, Ontario (See “3.3 Mineral Properties”). The Upper Beaver Property, which is part of the 230 km2 mineral exploration holdings in the historic Kirkland Lake gold camp held by OML, is located in north-eastern Gauthier Township and north-western McVittie Township in the Larder Lake mining division in north-eastern Ontario (See “3.3 Mineral Properties”).

The Corporation and its subsidiaries also maintain operation, exploration, and development activities on the following gold exploration properties which are not presently considered material projects:

Properties | | No. of Titles | | Interest | | Planned Work

(for 2014) | |

Black Hills, South Dakota | | 206 | | 100% Option | | Geophysics | |

Guerrero, Mexico | | 27 | | 100%(1)(2) | | Geological mapping, sampling, drilling | |

Kirkland Lake, Ontario, Canada | | | | | | | |

Amalgamated Kirkland | | 1 | | 100% | | Nil | |

Lebel (Bidgood) | | 69 | | 100% | | Drilling | |

Canadian Kirkland (Munro) (3) | | 44 | | 100% | | Drilling | |

Upper Canada | | 62 | | 100% | | Resource estimate | |

Others | | 950 | | Various | | Drilling | |

| | | | | | | |

Malartic CHL, Québec, Canada | | 10 | | 70% | | Drilling | |

(1) Eighteen (18) titles are in application stage and four (4) titles are subject to option agreements with different owners.

(2) Mining titles were acquired by another corporation on behalf of Osisko.

(3) At the end of 2013, an intensive drilling program has been initiated and, in February 2014, Osisko announced the discovery of a potentially large, bulk tonnage disseminated gold deposit on its 100% owned Kirkland Lake property. This discovery, named the “Canadian Kirkland” zone (formerly the Munro property), consists of a previously unreported type of mineralization in this world-class gold camp. For more information, please refer to Osisko’s press release dated February 21, 2014, New Discovery Named “Canadian Kirkland” Confirms Potential for Bulk Tonnage Gold in Kirkland Camp, available on Osisko’s website at www.osisko.com.

16

Employees

As of December 31, 2013, Osisko and its wholly-owned subsidiaries, OHRG and OML, employed a total of 770 individuals:

Employer | | Employees

(December 31, 2013) | | Employees

(December 31, 2012) | |

Osisko Mining Corporation | | | | | |

- Montreal and Toronto offices | | 52 | | 55 | |

- Canadian Malartic Mine | | 677 | | 642 | |

- Exploration | | 10 | | 26 | |

Subtotal | | 737 | | 723 | |

Osisko Hammond Reef Gold Ltd. (Hammond Reef Project) | | 3 | | 25 | |

Osisko Mining Ltd. (Upper Beaver Project) | | 28 | | 64 | |

Total | | 770 | | 812 | |

3.2 2013 Gold Production

The Canadian Malartic Mine is a large open pit operation. Following a two-year construction period program, which necessitated an investment of approximately $1 billion, the mine reached commercial production on May 19, 2011.

Similarly to many large new mining projects, the Canadian Malartic Mine has faced challenges since commencement of commercial production. The Corporation has continued to intensively work on various initiatives to optimize its operations at the Canadian Malartic Mine. Osisko’s optimization program initiatives and substantial results are as follow:

· Increase throughput rate to name plate capacity of 55,000 tonnes per day:

· Add crushing capacity with the addition of two large cone crushing units, a second pebble crusher and modifications to the ore conveying system which were completed in 2012.

· Improve mill availability

Results: at the end of 2013, the mill was at near name plate capacity (98%) on an operating day basis (95% for the year).

· Improve mining activities:

· Gain flexibility by developing additional working areas

· Improve drilling and blasting procedures

· Increase equipment availability

· Improve productivity over old-mine working areas

· Gain access to higher grade materials

Results: for the year 2013, tonnes moved per day reached an average of 179,000, a 12% increase over the year 2012.

17

· Optimize costs:

· Reduce the use of contractors

· Improve utilization of supplies and materials

· Reduce cost of materials through better procurement and logistics

Results: in 2013, cash costs per ounce(1) were reduced by 11% compared to the year 2012.

Several of these initiatives have been completed and are contributing to improve effectiveness. The Corporation is maintaining its continuous improvement efforts to optimize operations and is pursuing cost reductions with its suppliers. It anticipates that it will gain further benefits over the upcoming quarters, which should favorably impact production costs.

3.2.1 Mining

In 2013, approximately 58.4 million tonnes of ore and waste and 6.9 million tonnes of re-handling from stockpiles were moved during 2013 (179,000 tonnes/day), compared to 50.7 million tonnes of ore and waste and 8.0 million tonnes of re-handling from stockpiles during 2012 (160,000 tonnes/day). The fourth quarter was challenging for the mine after a record of tonnes moved in the third quarter. However, the last three blasts over a surface pillar were successfully executed during the fourth quarter which will improve mining operations going forward. These blasts required special procedures to ensure the safety of Osisko’s employees and the community and impacted productivity adversely.

Mining operations continued to be adversely affected in 2013 due to noise and weather constraints. As the mine is located in an urban area, the utilization of the mining fleet is occasionally reduced due to wind conditions to meet the noise-level restrictions. Operating procedures restrict blasting activities when winds are from the southerly direction as a precautionary measure to protect the community from potential NOx emissions. The mine staff continues to work at increasing productivity over the old mine workings and in the northern part of the deposit while ensuring workers safety. Higher grade materials were accessible in greater quantities in the fourth quarter and going forward.

The 2013 quarterly mine production is as follows:

| | Ore

(t) | | Waste(1)

(t) | | Total Mined

(t) | | Re-handling

(t) | | Total Moved

(t) | | Overburden

(t) | |

Q4 2013 | | 4,905,712 | | 9,907,438 | | 14,813,150 | | 1,419,571 | | 16,232,721 | | 159,592 | |

Q3 2013 | | 4,423,224 | | 11,334,861 | | 15,758,085 | | 1,767,602 | | 17,525,687 | | 304,535 | |

Q2 2013 | | 3,604,314 | | 10,009,579 | | 13,613,893 | | 2,036,802 | | 15,650,695 | | 870,567 | |

Q1 2013 | | 4,090,870 | | 10,157,993 | | 14,248,863 | | 1,626,651 | | 15,875,514 | | 1,783,318 | |

YTD 2013 | | 17,024,120 | | 41,409,871 | | 58,433,991 | | 6,850,626 | | 65,284,617 | | 3,118,012 | |

Q4 2012 | | 3,553,080 | | 7,846,981 | | 11,400,061 | | 2,121,248 | | 13,521,309 | | 627,476 | |

Q3 2012 | | 4,852,977 | | 9,215,070 | | 14,068,047 | | 1,976,746 | | 16,044,793 | | 1,408,530 | |

Q2 2012 | | 3,234,013 | | 9,545,522 | | 12,779,535 | | 2,460,224 | | 15,239,759 | | 1,739,705 | |

Q1 2012 | | 4,037,282 | | 8,457,681 | | 12,494,963 | | 1,405,929 | | 13,900,982 | | 1,954,030 | |

Total 2012 | | 15,677,352 | | 35,065,254 | | 50,742,606 | | 7,964,147 | | 58,706,753 | | 5,729,741 | |

(1) Including topographic drilling of 4.9 million tonnes in 2013 and 2.5 million tonnes for the year 2012.

(1) Non-IFRS financial performance measures have no standard definition under IFRS. See “Non-IFRS Financial Performance Measures” section of the Management’s Discussion and Analysis for the fiscal year ended December 31, 2013, which can be found on the SEDAR website at www.sedar.com.

18

During 2013, a total of 18,830 equipment hours were lost due to noise and weather constraints compared to 14,840 equipment hours in 2012. Quarterly statistics are as follows:

| | Number of Hours Lost | | (%) | |

Q4 2013 | | 7,670 | | 6.3 | |

Q3 2013 | | 5,180 | | 4.3 | |

Q2 2013 | | 4,470 | | 3.9 | |

Q1 2013 | | 1,510 | | 1.4 | |

Q4 2012 | | 2,840 | | 2.5 | |

Q3 2012 | | 5,830 | | 5.3 | |

Q2 2012 | | 4,510 | | 4.6 | |

Q1 2012 | | 1,660 | | 1.9 | |

On February 13, 2013, the Québec Government approved a new decree which modified the operating parameters of the Canadian Malartic Mine. Changes included extending the duration of blasts, increasing the time period during which blasts can be executed, and provided greater access to the northern part of the deposit. The modified parameters provide greater flexibility in day-to-day operations (see “Environmental Approvals and Permits” under “3.3.1 Canadian Malartic Mine”).

3.2.2 Production

Following continued improvement in mill availability and throughput rates, the mine established a quarterly gold production record of 137,321 ounces in the fourth quarter of 2013. Average daily throughput reached 54,043 tonnes, in line with the third quarter of 2013 and a 17% increase over the corresponding period in 2012. Throughput rate progressed favorably in 2013 with seven quarterly increases since the end of 2011, averaging 52,350 tonnes per operating day for the year 2013. In coordination with the technical advisors, the Canadian Malartic team continues to work on improving the mill throughput and enhancing operating efficiencies.

For the year-ended December 31, 2013, the Corporation produced 475,277 ounces of gold and 464,991 ounces of silver. Production statistics for the year 2013 are as follows:

| | 2013 | |

| | Q4 | | Q3 | | Q2 | | Q1 | | Total | |

Tonnes milled (t) | | 4,647,677 | | 4,682,530 | | 4,444,042 | | 4,234,001 | | 17,024,120 | |

| | | | | | | | | | | |

Grade (g/t Au) | | 1.04 | | 0.90 | | 0.87 | | 0.88 | | 0.92 | |

Recovery Au (%) | | 88.6 | | 89.2 | | 89.7 | | 88.0 | | 88.9 | |

Gold ounces produced (oz) | | 137,321 | | 120,208 | | 111,701 | | 106,047 | | 475,277 | |

Gold ounces sold (oz) | | 136,826 | | 123,151 | | 109,503 | | 95,511 | | 464,991 | |

| | | | | | | | | | | |

Grade (g/t Ag) | | 1.06 | | 1.09 | | 1.12 | | 0.86 | | 1.04 | |

Recovery Ag (%) | | 72.9 | | 68.4 | | 69.5 | | 71.5 | | 70.5 | |

Silver ounces produced (oz) | | 115,562 | | 112,637 | | 110,823 | | 83,597 | | 422,619 | |

Silver ounces sold (oz) | | 106,907 | | 117,750 | | 95,205 | | 73,683 | | 393,545 | |

Cash costs per ounce(2) in 2013 stood at $760, compared to $849 in 2012 and cash costs per ounce for the fourth quarter amounted to $713. The improvement is mainly the result of increased throughput and gold production, improved efficiencies and reduction in contractors’ costs. As the operations at the Canadian Malartic Mine are further optimized, the operating costs should continue their downward trend.

(2) Non-IFRS financial performance measures have no standard definition under IFRS. See “Non-IFRS Financial Performance Measures” section of the Management’s Discussion and Analysis for the fiscal year ended December 31, 2013, which can be found on the SEDAR website at www.sedar.com.

19

3.2.3 Gold Marketing and Distribution

Gold is a metal that is traded on world markets, with benchmark prices generally based on the London Bullion market. Gold has two principal uses: product fabrication and bullion investment. Within the fabrication category, there are a wide variety of end uses, the largest of which is the manufacture of jewelry. Other fabrication purposes include official coins, electronics, miscellaneous industrial and decorative uses, dentistry, medals and medallions. Gold bullion is held primarily as a store of value and a safeguard against devaluation of paper assets denominated in fiat currencies.

In 2013, precious metals have been under pressure for most of the year and the fourth quarter gold price averaged at US$1,276/oz, the lowest quarterly price since the third quarter of 2010. During the fourth quarter, the price trended lower for the second time in 2013 towards a low of US$1,192/oz before rebounding at the start of 2014. After rising for 12 consecutive years, gold price closed US$453 or 27% lower than the 2012 close at US$1,205/oz and averaged for the year at US$1,411/oz, down 15% from 2012 average of US$1,669/oz.

The market was under pressure and mainly driven by the following developments during the year:

· Eroding demand for bullion as a store value was driven by the strength of the global equities;

· The absence of growing inflation;

· Signs of U.S. recovery fuelling speculations that the Federal Reserve would finally start tapering;

· Exchange-traded fund redemption that has fallen more than 30% in 2013 suggesting that institutional investors remain bearish in the face of rising U.S. government bond yields; and

· Good physical demand from Asia especially from China.

The following table outlines the gold price trading range for the past five years:

(US$/ounce) | | High | | Low | | Average | | Close | |

2013 | | 1,694 | | 1,192 | | 1,411 | | 1,205 | |

2012 | | 1,792 | | 1,540 | | 1,669 | | 1,658 | |

2011 | | 1,895 | | 1,319 | | 1,572 | | 1,531 | |

2010 | | 1,421 | | 1,058 | | 1,225 | | 1,406 | |

2009 | | 1,213 | | 810 | | 972 | | 1,088 | |

The Corporation believes that despite the decrease in the gold price in 2013, the fundamentals of the gold market remains well in place, namely:

· Expansionary monetary policies and continued effects of the economic problems around the world;

· High level of government indebtedness;

· Diversification of central bank currency holdings, particularly in emerging markets;

· Continued geo-political instability.

Global gold mine production continues to be relatively stable. The challenges of new production discoveries, high capital costs, suspension of major projects and permitting issues lead Osisko to believe that global production will remain stable or decline in the near/medium term.

The gold produced at the Canadian Malartic Mine is refined to market delivery standards by the Royal Canadian Mint in Ottawa. The gold is sold to various banks at market prices. The Corporation believes that, because of the availability of alternative refiners, no material adverse effect would result if the Corporation lost the services of its refiner.

In 2013, total precious metal sales of the Corporation amounted to $675.7 million, comprising of 464,991 ounces of gold and 393,545 ounces of silver, compared to precious metal sales of $665.4 million in 2012,

20

which included 394,603 ounces of gold and 225,531 ounces of silver. The Canadian Malartic Mine generated operating earnings of $190.3 million, compared to $259.1 million in 2012. The decrease in profit from mine operations is mainly due to a 14% decline in the US$ price realized on the sale of gold and higher depreciation charges as a result of higher gold output.

The Corporation’s gold production is completely unhedged.

3.2.4 Taxation

The Canadian Malartic Mine is subject to a combined federal and provincial statutory income tax rate of 26.90 %. Additionally, it is subject to a mining tax from the Province of Québec at a statutory tax rate of 16 %. On November 12, 2013, the Québec government introduces amendments to Québec’s Mining Tax Act under Québec Bill 55. The Bill introduces a new method for computing mining tax, among other changes. The new regime is scheduled to come into effect as of January 1st, 2014. However, pursuant to an order of the Government of Québec issued on March 5, 2014 a general election will be held in Québec on April 7. As such, the Bill 55 may or may not be re-introduced in the Québec National Assembly after the election depending on the outcome of the election.

3.2.5 Competitive Conditions

The gold exploration and mining business is a competitive business. The Corporation competes with numerous other companies in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Corporation to replace or increase its mineral reserves and resources in the future will depend not only on its ability to develop its present mineral properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

3.3 Mineral Properties

The Corporation’s material mineral properties are Canadian and include the Canadian Malartic Mine, located in the Province of Québec, and the Hammond Reef and Upper Beaver Projects, located in the province of Ontario.

3.3.1 Canadian Malartic Mine

Technical Information Notice

Part of the following disclosure relating to the Canadian Malartic Property has been derived from:

(1) an independent technical report (herein referred to as the “Canadian Malartic Report”) on the Canadian Malartic Property entitled “Feasibility Study — Canadian Malartic project (Malartic, Québec)” dated December 2008 compiled by BBA Inc. (“BBA”), with the collaboration of MICON International Limited (“MICON”), Belzile Solutions Inc. (“Belzile Solutions”), G Mining Services Inc. (“G Mining”), Genivar Limited Partnership (“Genivar”), Golder Associates Limited (“Golder”) and the Osisko technical group. Messrs. David Runnels, Eng. (BBA), B. Terrence Hennessey, P. Geo. (MICON), Elzéar Belzile, Eng. (Belzile Solutions), Louis-Pierre Gignac, Eng. (G Mining), André-Martin Bouchard (Genivar) and Michel R. Julien, Eng., Ph.D. (Golder) are “qualified persons” within the meaning of NI 43-101, and are independent of the Corporation. The Canadian Malartic Report is available for inspection during regular business hours at the corporate head office of the Corporation and may also be reviewed under the Corporation’s profile on the SEDAR website (www.sedar.com); and

21

(2) an independent technical report (herein referred to as the “Canadian Malartic Updated Report”) on the Canadian Malartic Property entitled “Updated resource and reserve estimates for the Canadian Malartic project (Malartic, Québec)” dated May, 2011 by Belzile Solutions, G Mining. Messrs. Elzéar Belzile, Eng. (Belzile Solutions) and Louis-Pierre Gignac, Eng. (G Mining) are “qualified persons” within the meaning of NI 43-101 and are independent of the Corporation. The Canadian Malartic Updated Report is available for inspection during regular business hours at the corporate head office of the Corporation and may also be reviewed under the Corporation’s profile on the SEDAR website (www.sedar.com).

Unless otherwise indicated, technical information which has been disclosed since the release of the Canadian Malartic Updated Report has been prepared under the supervision of Robert Wares, Hon. D.Sc., P. Geo. and Senior Vice President, Exploration and Resource Development of the Corporation, Luc Lessard, Ing., Senior Vice President and Chief Operating Officer of the Corporation, and Donald Gervais, P. Geo, Technical Services Director at the Canadian Malartic Mine, who are “qualified person” within the meaning of NI 43-101.

Property Location and Description

The Canadian Malartic Property is located in the Abitibi region of north-western Québec. It lies entirely within Fournière Township, immediately south of the town of Malartic, about 25 km west of Val-d’Or, Québec and about 550 km northwest of Montréal, Québec. The Canadian Malartic Property also covers the southern portion of the town of Malartic itself.

Mining Titles

The Canadian Malartic Property is comprised of 119 contiguous mining titles: 107 MDC’s, seven (7) CL’s, one (1) MC and four (4) ML’s covering a total of approximately 5, 287 ha. During 2009, the Corporation was granted two surface leases covering 1,856 ha for its tailings and milling plant. On November 25, 2009, the MRN granted Osisko a ML having a total area of approximately 189 ha. In addition, two (2) ML, together representing approximately 12 ha, were granted by the MRN during the second quarter of 2011 regarding the southern portion of the town of Malartic, which was subject of the relocation program. More recently, on February 18, 2014, the MRN granted Osisko a new ML having a total area of approximately 66 ha for the exploitation of the Gouldie zone (accordingly, three (3) MDC’s will be canceled or reduced). Application for another ML related to the South Barnat deposit is currently under review by the MRN (accordingly, six (6) MDC’s have been suspended).

Exploration rights immediately north of the Canadian Malartic Property are owned by the Corporation (East Amphi property) and by Niogold Mining Corp. Rights to the east are owned by 9265-9911 Québec inc. and NSR Resources. The Malartic CHL property is owned by Abitibi Royalties Inc., successor to Golden Valley Mines Ltd., with respect to which the Corporation exercised an option to earn a 70% interest; the Corporation received the confirmation of said exercise on September 7th, 2011. Rights to the south and southeast of the Canadian Malartic Property are owned by an individual prospector and C2C Inc.

Rights and Obligations Associated with Mining Titles

A ML entitles the holder to mine and remove minerals from the land forming part of such ML. A mining lease is granted for an initial term of 20 years and is renewable up to three times, each for a 10-year term. The holder of a mining lease shall pay an annual rent which is prescribed by mining regulations.

A claim (CL or MDC) provides the owner with a two-year exclusive right to explore the designated territory for any mineral substances with certain exceptions. After the two-year period, claims can be

22

renewed for an additional two-year term on certain conditions including that sufficient assessment work is done. A claim provides a right of access, though not surface rights, to a designated parcel of land on which exploration work may be undertaken. Access to land that has been granted, alienated or leased by the Crown for non-mining purposes requires the permission of the current surface rights-holder. Additionally, claims that lie within town boundaries or lands identified as state reserves may be subject to further conditions and obligations concerning the work to be performed on the claim. Expiration dates for the various mining titles of the Canadian Malartic Property vary between February 10, 2015 and February 18, 2034. Incurred exploration expenditures on the Canadian Malartic Property currently exceed the minimum expenditures required to maintain the claims in good standing.

A MC provides the owner with mining rights and some surface rights limited to those necessary for mining activities. There is no obligation or work requirement needed to maintain the concession other than the payment of an annual fee based on the size of the concession.

Each of the two surface leases was granted in 2009 for a one-year term, renewable on a yearly basis. Starting in 2011, these leases have been renewed for a five-year term, with the possibility of further renewals, each time for a five-year period.