Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

OPERATIONS AND FINANCIAL CONDITION

FOR THE YEARS ENDED DECEMBER 31, 2011 AND 2010

TABLE OF CONTENTS

1: | | Core Business | 1 |

2: | | Highlights | 1 |

3: | | Outlook and Strategy | 4 |

4: | | Summary of Financial and Operating Statistics | 7 |

| | 4.1: | Three-Year Annual Financial Statistics | 7 |

| | 4.2: | Three-Year Annual Operating Statistics | 8 |

| | 4.3: | Quarterly Financial Statistics | 9 |

| | 4.4: | Quarterly Operating Statistics | 10 |

5: | | Overview of Annual Results | 12 |

| | 5.1: | Overview of Annual Financial Results | 12 |

| | 5.2: | Overview of Annual Operating Results | 15 |

6: | | Overview of Quarterly Results | 16 |

| | 6.1: | Overview of Quarterly Financial Results | 16 |

| | 6.2: | Overview of Quarterly Operating Results | 18 |

7: | | Operating Mines | 19 |

8: | | Construction, Development and Exploration | 29 |

9: | | Mineral Reserve and Mineral Resource Estimates | 31 |

10: | | Liquidity, Capital Resources and Contractual Commitments | 35 |

11: | | Income Taxes | 39 |

12: | | Economic Trends, Risks and Uncertainties | 40 |

13: | | Contingencies | 45 |

14: | | Critical Accounting Policies and Estimates | 45 |

15: | | Non-GAAP Measures | 48 |

16: | | Selected Quarterly Financial and Operating Summary | 53 |

17: | | Disclosures Controls and Procedures | 55 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS AND FINANCIAL CONDITION

(All figures are in United States Dollars unless otherwise specified and are in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”))

Cautionary notes regarding forward-looking statements, including estimates of Measured, Indicated and Inferred Mineral Resources and regarding Mineral Reserves and Mineral Resources follow this Management’s Discussion and Analysis of Operations and Financial Condition

1. CORE BUSINESS

Yamana Gold Inc. (the “Company” or “Yamana”) is a Canadian-based gold producer engaged in gold mining and related activities including exploration, extraction, processing and reclamation. The Company has significant properties involved in gold and other precious metal production, development, exploration and land positions throughout the Americas including Brazil, Argentina, Chile, Mexico and Colombia.

The Company plans to continue to build on its current production base through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas. Note 34(a) “Related Parties” to the accompanying consolidated financial statements lists Yamana’s significant subsidiaries with 100% equity interest. Yamana does not have any material off-balance sheet arrangements.

Yamana is listed on the Toronto Stock Exchange (Symbol: YRI), The New York Stock Exchange (Symbol: AUY) and The London Stock Exchange (Symbol: YAU).

2. HIGHLIGHTS

Financial

Twelve months ended December 31, 2011

· Record-setting results for most financial metrics including:

· Revenues of $2.2 billion, an increase of 29% over 2010.

· Net earnings of $548.3 million representing an increase of 18% over 2010 after deducting an after-tax unrealized loss on the write-down of its investment securities portfolio of $81.0 million.

· Adjusted earnings* of $712.9 million an increase of 59% over 2010, representing basic and diluted adjusted earnings per share* of $0.96 compared to $0.61 per share in 2010.

· Mine operating earnings of $1.1 billion, a 46% increase from 2010.

· Cash flows from operating activities after changes in non-cash working capital of $1.2 billion, representing an increase of 80%, compared with 2010.

· Cash flows generated from operations before changes in non-cash working capital of $1.3 billion, representing an increase of 48%, compared with 2010.

· Cash and cash equivalents at December 31, 2011 were $550.4 million, a $219.9 million increase from the beginning of the year, after debt repayments during the year totaling $55.0 million and total dividend payments of $100.1 million, more than double the dividends paid in 2010.

· Increase in the Company’s annual dividend rate to $0.20 per share or $0.05 per share per quarter.

Three months ended December 31, 2011

· Revenues of $568.8 million, an increase of 6% over the same quarter of 2010.

· Net earnings of $89.6 million or $0.12 basic and diluted earnings per share were lower than the comparative quarter in 2010 after deducting an after-tax unrealized loss on the write-down of its investment securities portfolio of $81.0 million.

· Adjusted earnings of $184.2 million or $0.25 basic and diluted adjusted earnings per share, representing an increase of 8% over the same quarter of 2010.

· Record mine operating earnings of $296.8 million, a 9% increase over the same quarter of 2010.

· Cash flows from operations after changes in non-cash working capital of $338.9 million, representing an increase of 35%, compared with the same quarter of 2010.

· Cash flows generated from operating activities before changes in non-cash working capital of $320.4 million, representing an increase of 12%, compared with the same quarter of 2010.

*A non-GAAP measure — Refer to Section 15

1

Operational

Twelve months ended December 31, 2011

· Record total production of 1,102,296 gold equivalent ounces (“GEO”) from continuing operations was 5% higher than 2010.

· Record commercial production of 1,093,858 GEO which was 4% higher than production from continuing operations in 2010.

· Attributable production of operating mines is summarized as follows:

| | For the years ended December 31, | |

(In GEO) | | 2011 | | 2010 | |

Chapada | | 135,347 | | 135,613 | |

El Peñón | | 475,586 | | 427,934 | |

Gualcamayo | | 158,847 | | 135,140 | |

Jacobina | | 121,675 | | 122,160 | |

Minera Florida | | 102,738 | | 105,604 | |

Fazenda Brasileiro | | 55,163 | | 70,084 | |

Alumbrera (12.5%) | | 44,502 | | 50,656 | |

Mercedes (commissioning production) | | 8,438 | | — | |

· Production of 9.3 million silver ounces which, for presentation purposes only, is treated as GEO (assuming a gold equivalent ratio of 50:1).

· Year-over-year increase in GEO production from the Company’s largest gold mines: Gualcamayo and El Peñón of 18% and 11%, respectively, compared with 2010.

· By-product cash costs of $50 per GEO*.

· Co-product cash costs of $463 per GEO*.

· Production of 166.1 million pounds of copper contained in concentrate from Chapada, which was 11% higher than 2010 with co-product cash costs per pound of copper* of $1.29.

Three months ended December 31, 2011

· Total production of 276,918 GEO for the quarter including Mercedes.

· Commercial production of 268,480 GEO.

· Attributable production from operating mines is summarized as follows:

| | For the three months ended December 31, | |

(In GEO) | | 2011 | | 2010 | |

Chapada | | 34,313 | | 36,965 | |

El Peñón | | 115,043 | | 113,800 | |

Gualcamayo | | 40,676 | | 36,239 | |

Jacobina | | 31,983 | | 33,718 | |

Minera Florida | | 23,151 | | 32,048 | |

Fazenda Brasileiro | | 15,568 | | 19,852 | |

Alumbrera (12.5%) | | 7,746 | | 14,061 | |

Mercedes (commissioning production) | | 8,438 | | — | |

· Production of 2.3 million silver ounces which, for presentation purposes only, is treated as GEO (assuming a gold equivalent ratio of 50:1).

· Quarter-over-quarter increase in GEO production from the Company’s largest gold mines: Gualcamayo and El Peñón of 12% and 1% respectively, compared with the same quarter of 2010.

· By-product cash costs of $174 per GEO*.

· Co-product cash costs of $486 per GEO*.

· Production of 45.4 million pounds of copper contained in concentrate from Chapada, representing an increase of 14% over the same quarter of 2010 with co-product cash costs per pound of copper* of $1.20.

· Mercedes, Mexico — Subsequent to the year end, Mercedes reached commercial production as of February 1, 2012 upon achieving sustainable levels of operations based on qualitative and quantitative factors.

*A non-GAAP measure — Refer to Section 15

2

Construction, Development and Exploration

· Construction Projects - Construction is progressing to planned start-up of operations with C1 Santa Luz and Ernesto/Pau-a-Pique scheduled for the end of 2012 with current physical advancement of approximately 60% and 75% complete, respectively and at Pilar for mid-2013 with current physical advancement of approximately 25%.

· Jacobina, Brazil - Successful infill drilling at Canavieiras and Morro do Vento resulted in measured and indicated mineral resource increases of approximately 392,000 ounces of gold in 2.2 million tonnes at 3.83 g/t and 81,000 gold ounces in 814,584 tonnes at 3.09 g/t, respectively representing potential additional mine life of more than three years. The gold grade at Canavieiras averaged approximately 3.83 g/t which improved the average grade of global mineral resources and mineral reserves.

· El Peñón, Chile — Total gold equivalent mineral reserves increased by 20% to 3.5 million GEO supporting an increased mine life and a higher sustainable production level of 440,000 GEO per year. Infill drilling upgraded the previously defined mineral resources to mineral reserves and identified higher grade areas. The 2012 exploration program at El Peñón will focus on the extension of Pampa Augusta Victoria and areas within the North Block as well as more recent discoveries. This effort is expected to result in continued increases in mineral resources in 2012.

· Chapada, Brazil — Feasibility Study of Suruca oxide ore, a satellite deposit, was completed in December 2011, which supports average annual production of 49,000 gold ounces for five years beginning in 2013. Corpo Sul is a new discovery made during 2011. It is expected that further work at Corpo Sul will significantly contribute to 2012 growth of mineral reserves. The strategic plan of the Company is to ensure sustainable production at Chapada of 150,000 gold ounces and 135 million pounds of copper for 2013 and onwards for at least five years from the main Chapada pit, Suruca and Corpo Sul.

· The Company’s total mineral reserves on a GEO basis increased by 11% over the previous year; total measured and indicated mineral resources modestly declined primarily from the conversion of mineral resources to mineral reserves and inferred mineral resources increased by 39% over 2010.

3

3. OUTLOOK AND STRATEGY

The Company is focused on operational predictability and reliability with a concentrated effort in increasing cash flows, containing costs and expanding margins to maximize shareholder value. The Company continues on a steady path of organic growth through expanding current, near-term and in-development production plans, developing new projects and advancing its exploration properties.

Production in 2012 is expected to be in the range of 1.2 to 1.3 million gold equivalent ounces (“GEO”). This will represent an increase from 2011 production of approximately 13%, most of which will come from Mercedes as its production ramps up, as well as the Minera Florida expansion which will add to production starting in March 2012. C1 Santa Luz and Ernesto/Pau-a-Pique are also expected to start production by the end of 2012.

Production in 2013 is expected to increase by 43% from 2011 levels, to a range of 1.5 to 1.7 million GEO, most of which will come from a full year of production from C1 Santa Luz and Ernesto/Pau-a-Pique, the start-up of Pilar and the Gualcamayo expansion.

A summary of the Company’s development stage projects is provided below:

| | Expected Average Annual Contribution | | Expected Start-date | |

C1 Santa Luz (i) | | 100,000 gold ounces | | Late-2012 | |

Ernesto/Pau-a-Pique (i) | | 100,000 gold ounces | | Late-2012 | |

Pilar | | 140,000-150,000 gold ounces | | Mid-2013 | |

(i) In the first two full years of production at C1 Santa Luz, average annual production is expected to exceed 130,000 ounces of gold and at Ernesto/Pau-a-Pique average annual production in the first two years is expected to be approximately 120,000 ounces of gold which would accelerate pay-back.

4

Estimated production on a mine-by-mine basis for 2012 and 2013 is detailed below:

Estimated Production (GEO) | | 2012E | | 2013E | |

Chapada | | 110,000 - 120,000 | | 140,000 - 160,000 | |

El Peñón (i) | | 430,000 - 455,000 | | 435,000 - 455,000 | |

Gualcamayo | | 155,000 - 180,000 | | 180,000 - 190,000 | |

Jacobina | | 130,000 - 145,000 | | 130,000 - 140,000 | |

Minera Florida (i) | | 135,000 - 150,000 | | 140,000 - 155,000 | |

Mercedes (i) | | 105,000 - 120,000 | | 125,000 - 135,000 | |

Fazenda Brasileiro | | 50,000 - 60,000 | | 50,000 - 60,000 | |

Alumbrera (12.5%) | | 40,000 - 50,000 | | 40,000 - 50,000 | |

Development Projects | | 20,000 - 30,000 | | 240,000 - 315,000 | |

Total GEO | | 1,175,000 - 1,310,000 | | 1,480,000 - 1,660,000 | |

Total Copper (M lbs, Chapada) | | 140 - 155 | | 120 - 135 | |

(i) Silver production is reported as GEO at a ratio of 50:1.

Silver production is expected to be consistent at between eight to nine million ounces in each of 2012 and 2013. Silver production is reported as a gold equivalent.

Copper production is expected to be in the range of 140 to 155 million pounds in 2012 and 120 to 135 million pounds in 2013. These estimates reflect the production from Chapada and do not include the attributable production from the Company’s 12.5% interest in Alumbrera.

By 2014, production is targeted to be at a sustainable level of approximately 1.75 million GEO. This includes production from the existing mines and development projects for which construction decisions have been made. Planned sustainable production of over 1.75 million GEO in 2014 and thereafter will be permitted in part due to the following opportunities:

· Development plan for Chapada to incorporate Corpo Sul which is expected to primarily sustain current production grades and levels for both copper and gold.

· Production at El Peñón increasing to a sustainable 440,000 GEO per year as development work is completed at newly discovered ore bodies.

· Full ramp up of Gualcamayo’s expansions to be completed mid-2013, which should increase sustainable production to over 200,000 gold ounces per year beginning in 2014.

· Evaluation of milling higher grade ore at Gualcamayo subject to mineral resource increases into 2012 and 2013, in relation to which a scoping study is expected to be completed in mid-2012.

· Development of higher grade areas at Jacobina increasing production to above 140,000 gold ounces per year beginning in 2014.

· Increasing Mercedes production to a sustainable level of 140,000 GEO beginning in 2014 resulting mostly from a throughput increase to up to 1,800 tonnes per day.

· Increasing Pilar production to 140,000-150,000 gold ounces beginning in 2014 mostly due to an increase in plant capacity and processing ore from nearby Caiamar which is higher grade.

Current exploration and early development projects will potentially add to this production level and will be included once construction decisions have been made. These projects include: Jeronimo, Agua Rica and Suyai.

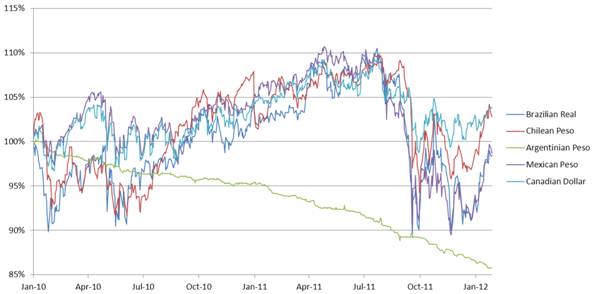

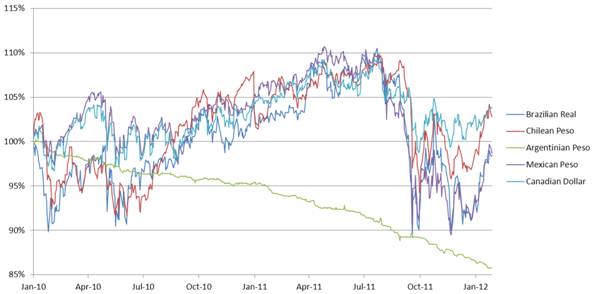

Cash costs (a non-GAAP measure — see Section 15) for 2012 are forecasted to be below $250 per GEO. Cash costs are calculated after base metal by-product credits. The Company believes that by-product cash costs are a better representation of the Company’s cost structure as any erosion in costs due to mining inflation and the appreciation of the Chilean peso will be off-set by additional cash flow from increases in the copper price. Cash costs are reported annually and are expected to vary from quarter to quarter. Cash costs are also impacted by inflation year-over-year.

5

Cash costs were estimated using the following copper price and exchange rates:

| | 2012 | | 2013 | | 2014 | |

Copper - $/pound | | 4.00 | | 4.00 | | 4.00 | |

Brazil - Reais/$ | | 1.80 | | 1.80 | | 1.80 | |

Argentina – Pesos/$ | | 4.50 | | 4.75 | | 4.75 | |

Chile – Pesos/$ | | 500.00 | | 500.00 | | 500.00 | |

Development capital to be spent in 2012, including $65 million carried forward from 2011 and excluding capitalized exploration, is expected to be $665 million. This includes amounts for new projects for which capital was not committed in 2011. Development capital will decline into 2013 and the following years as the Company’s development projects are completed.

For 2012, sustaining capital is expected to be $340 million across all operations and is expected to decline after current sustaining development projects are completed in 2014.

The Company is also contemplating certain initiatives that will result in improved recoveries, reduced costs and/or mine life extension at various operations. These projects are currently being evaluated with final decisions still pending. The most significant impact projects are at El Peñón, Chapada and Pilar.

The Company expects to spend approximately $125 million on exploration in 2012, a continuation of the successful 2011 program. Yamana’s 2012 exploration program will continue to focus on increasing mineral reserves and mineral resources with its near-mine and regional exploration programs, as well as continuing to explore greenfield targets. The Company remains committed to the development of a pool of talented geoscientists in sustaining its exploration performance.

In addition to $1.1 billion of available cash and undrawn credit available at the end of 2011, the expected robust cash flows from operations under the current and intermediate-term pricing conditions for gold will enable the Company to fully fund its growth, reward shareholders through dividends and accelerate capital spending to enhance the Company’s production growth profile.

6

4. SUMMARY OF FINANCIAL AND OPERATING STATISTICS

4.1 THREE-YEAR ANNUAL FINANCIAL STATISTICS

| | Twelve months ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | 2011 | | 2010 | | 2009(vi) | |

Revenues (i) | | $ | 2,173,325 | | $ | 1,686,811 | | $ | 1,183,314 | |

Cost of sales excluding depletion, depreciation and amortization | | (716,692 | ) | (631,063 | ) | (479,847 | ) |

Gross margin | | 1,456,633 | | 1,055,748 | | 703,467 | |

Depletion, depreciation and amortization | | (356,759 | ) | (301,912 | ) | (233,687 | ) |

Mine operating earnings | | 1,099,874 | | 753,836 | | 469,780 | |

Equity earnings, expenses and income tax expense | | (458,980 | ) | (298,678 | ) | (258,009 | ) |

Impairment of investment in available-for-sale securities | | (92,600 | ) | — | | — | |

Earnings from continuing operations | | 548,294 | | 455,158 | | 211,771 | |

Earnings from discontinued operations (ii) | | — | | 11,329 | | (19,140 | ) |

Net earnings | | $ | 548,294 | | $ | 466,487 | | $ | 192,631 | |

Adjusted earnings (iii) | | $ | 712,896 | | $ | 448,203 | | $ | 346,131 | |

Earnings per share - basic and diluted | | $ | 0.74 | | $ | 0.63 | | $ | 0.26 | |

Adjusted earnings per share (iii) - basic and diluted | | $ | 0.96 | | $ | 0.61 | | $ | 0.47 | |

Cash flows from operating activities of continuing operations | | $ | 1,225,782 | | $ | 681,331 | | $ | 528,026 | |

Cash flows generated from operations before changes in non-cash working capital items | | $ | 1,266,373 | | $ | 856,827 | | $ | 495,619 | |

Cash flows to investing activities of continuing operations | | $ | (846,075 | ) | $ | (460,640 | ) | $ | (469,916 | ) |

Cash flows to financing activities of continuing operations | | $ | (142,678 | ) | $ | (68,870 | ) | $ | (64,957 | ) |

Capital expenditures | | $ | 822,223 | | $ | 531,081 | | $ | 498,757 | |

Working capital | | $ | 608,021 | | $ | 518,081 | | $ | 260,337 | |

Dividends declared per share | | $ | 0.15 | | $ | 0.08 | | $ | 0.04 | |

Weighted average number of common shares outstanding | | $ | 744,600 | | $ | 739,938 | | $ | 733,093 | |

Cash and cash equivalents | | $ | 550,438 | | $ | 330,498 | | $ | 170,070 | |

Total assets | | $ | 10,769,940 | | $ | 10,319,092 | | $ | 9,707,260 | |

Total long-term liabilities | | $ | 2,783,786 | | $ | 2,838,324 | | $ | 2,589,460 | |

Total equity | | $ | 7,491,523 | | $ | 7,086,271 | | $ | 6,571,534 | |

Average realized gold price per ounce (iv) | | $ | 1,567 | | $ | 1,237 | | $ | 980 | |

Average realized copper price per pound (excluding derivative contracts) (iv) | | $ | 3.93 | | $ | 3.37 | | $ | 2.44 | |

Average realized silver price per ounce (iv) | | $ | 35.19 | | $ | 20.70 | | $ | 14.89 | |

Average market gold price per ounce (v) | | $ | 1,573 | | $ | 1,225 | | $ | 974 | |

Average market copper price per pound (v) | | $ | 4.00 | | $ | 3.42 | | $ | 2.34 | |

Average market silver price per ounce (v) | | $ | 35.32 | | $ | 20.24 | | $ | 14.7 | |

(i) | | Revenues consist of sales net of sales taxes. |

(ii) | | Results of San Andrés, São Vicente and São Francisco mines have been reclassified as discontinued operations (in accordance with IFRS) with restatement of prior period comparatives. |

(iii) | | A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share. |

(iv) | | Realized prices based on gross sales compared to market prices for metals may vary due to infrequent shipments and depending on timing of the sales. Realized prices reflect continuing operations only for the comparative periods. |

(v) | | Source of information: Bloomberg. |

(vi) | | The financial results for periods ending prior to January 1, 2010 have not been restated in accordance with IFRS. |

7

4.2 THREE-YEAR ANNUAL OPERATING STATISTICS

| | Twelve months ended December 31, | |

| | 2011 | | 2010 | | 2009 | |

Total Gold Equivalent Ounces (GEO) (i) | | | | | | | |

BRAZIL | | | | | | | |

Chapada | | 135,347 | | 135,613 | | 156,251 | |

Jacobina | | 121,675 | | 122,160 | | 110,515 | |

Fazenda Brasileiro | | 55,163 | | 70,084 | | 76,413 | |

CHILE | | | | | | | |

El Peñón (ii) | | 475,586 | | 427,934 | | 394,400 | |

Minera Florida (ii) | | 102,738 | | 105,604 | | 91,877 | |

ARGENTINA | | | | | | | |

Gualcamayo | | 158,847 | | 135,140 | | 98,641 | |

Alumbrera (iii) | | 44,502 | | 50,656 | | 52,750 | |

Commercial GEO - continuing operations (i) | | 1,093,858 | | 1,047,191 | | 980,847 | |

Commissioning GEO produced (i) (iv) | | 8,438 | | — | | 44,830 | |

GEO - discontinued operations (i) (v) | | — | | 43,287 | | 175,338 | |

Total GEO produced (i) | | 1,102,296 | | 1,090,478 | | 1,201,015 | |

By-product Cash Costs per GEO (i) (vi) | | | | | | | |

BRAZIL | | | | | | | |

Chapada | | $ | (2,454 | ) | $ | (2,073 | ) | $ | (848 | ) |

Jacobina | | 643 | | 535 | | 476 | |

Fazenda Brasileiro | | 937 | | 628 | | 453 | |

CHILE | | | | | | | |

El Peñón (ii) | | 400 | | 428 | | 353 | |

Minera Florida (ii) | | 591 | | 416 | | 373 | |

ARGENTINA | | | | | | | |

Gualcamayo | | 441 | | 506 | | 301 | |

Alumbrera (iii) | | (1,448 | ) | (1,404 | ) | (703 | ) |

By-product cash costs per GEO produced (i) (vi) | | $ | 50 | | $ | 50 | | $ | 123 | |

Co-product cash costs per GEO produced (i) (vi) | | $ | 463 | | $ | 442 | | $ | 357 | |

Concentrate Production | | | | | | | |

Chapada concentrate production (tonnes) | | 297,294 | | 264,195 | | 248,940 | |

Chapada copper contained in concentrate production (millions of lbs) | | 166.1 | | 149.4 | | 144.0 | |

Chapada co-product cash costs per lb of copper (vi) | | $ | 1.29 | | $ | 1.17 | | $ | 0.99 | |

Alumbrera concentrate production (tonnes) (iii) | | 55,840 | | 68,351 | | 68,868 | |

Alumbrera attributable copper contained in concentrate production (millions of lbs) (iii) | | 32.2 | | 38.7 | | 39.4 | |

Alumbrera co-product cash costs per lb of copper (iii) (vi) | | $ | 1.82 | | $ | 1.29 | | $ | 1.49 | |

Gold Equivalent Ounces Breakdown - Continuing Operations | | | | | | | |

Total gold ounces produced | | 916,284 | | 864,768 | | 835,265 | |

Commercial gold ounces produced | | 908,632 | | 864,768 | | 790,435 | |

Commercial silver ounces produced (millions of ounces) | | 9.3 | | 10.0 | | 10.5 | |

Sales | | | | | | | |

Commercial gold sales - continuing operations (ounces) | | 906,985 | | 862,053 | | 769,636 | |

Commissioning gold sales (ounces) (iv) | | — | | — | | 41,298 | |

Gold sales - discontinued operations (ounces) (v) | | — | | 47,932 | | 164,651 | |

Total gold sales (ounces) | | 906,985 | | 909,985 | | 975,585 | |

Chapada concentrate sales (tonnes) | | 293,092 | | 264,825 | | 261,841 | |

Chapada payable copper contained in concentrate sales (millions of lbs) | | 153.6 | | 143.8 | | 137.4 | |

Silver sales (millions of ounces) | | 9.1 | | 10.1 | | 10.5 | |

8

(i) | | Gold equivalent ounce calculations are based on an assumed gold to silver ratio of 50:1; for presentation purposes only. The assumed gold to silver ratio was 55:1 for 2010 and prior periods. |

(ii) | | 2011 gold production: El Peñón — 306,184 ounces; Minera Florida — 86,914 ounces, and silver production: El Peñón — 8.5 million ounces; Mineral Florida — 0.8 million ounces. Silver production is treated as a gold equivalent. |

(iii) | | Alumbrera represents a 12.5% interest. |

(iv) | | Including commissioning gold ounces from Mercedes for 2011 and Gualcamayo for 2009 produced and sold. |

(v) | | Results of San Andrés, São Vicente and São Francisco mines have been reclassified as discontinued operations (in accordance with IFRS) with restatement of prior period comparatives. |

(vi) | | A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share. |

4.3 QUARTERLY FINANCIAL STATISTICS

| | Three months ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | 2011 | | 2010 | |

Revenues (i) | | $ | 568,754 | | $ | 535,130 | |

Cost of sales excluding depletion, depreciation and amortization | | (178,384 | ) | (178,341 | ) |

Gross margin | | 390,370 | | 356,789 | |

Depletion, depreciation and amortization | | (93,611 | ) | (83,657 | ) |

Mine operating earnings | | 296,759 | | 273,132 | |

Equity earnings, expenses and income tax expense | | (114,560 | ) | (147,563 | ) |

Impairment of investments in available-for-sale securities | | (92,600 | ) | — | |

Net earnings | | $ | 89,599 | | $ | 125,569 | |

Adjusted earnings (ii) | | $ | 184,242 | | $ | 170,979 | |

Earnings per share - basic and diluted | | $ | 0.12 | | $ | 0.17 | |

Adjusted earnings per share (ii) - basic and diluted | | $ | 0.25 | | $ | 0.23 | |

Cash flows from operating activities of continuing operations | | $ | 338,850 | | $ | 250,506 | |

Cash flows generated from operations before changes in non-cash working capital items | | $ | 320,434 | | $ | 287,222 | |

Cash flows to investing activities of continuing operations | | $ | (315,505 | ) | $ | (147,192 | ) |

Cash flows to financing activities of continuing operations | | $ | (38,415 | ) | $ | (54,199 | ) |

Working capital | | $ | 608,021 | | $ | 518,081 | |

Dividends declared per share | | $ | 0.05 | | $ | 0.04 | |

Weighted average number of common shares outstanding | | $ | 745,669 | | $ | 741,207 | |

Cash and cash equivalents | | $ | 550,438 | | $ | 330,498 | |

Total assets | | $ | 10,769,940 | | $ | 10,319,092 | |

Total long-term liabilities | | $ | 2,783,786 | | $ | 2,838,324 | |

Total equity | | $ | 7,491,523 | | $ | 7,086,271 | |

Average realized gold price per ounce (iii) | | $ | 1,670 | | $ | 1,374 | |

Average realized copper price per pound (excluding derivative contracts) (iii) | | $ | 3.36 | | $ | 3.81 | |

Average realized silver price per ounce (iii) | | $ | 31.29 | | $ | 28.20 | |

Average market gold price per ounce (iv) | | $ | 1,683 | | $ | 1,367 | |

Average market copper price per pound (iv) | | $ | 3.41 | | $ | 3.92 | |

Average market silver price per ounce (iv) | | $ | 31.84 | | $ | 26.50 | |

(i) | | Revenues consist of sales net of sales taxes. |

(ii) | | A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share. |

(iii) | | Realized prices based on gross sales compared to market prices for metals may vary due to infrequent shipments and depending on timing of the sales. |

(iv) | | Source of information: Bloomberg. |

9

4.4 QUARTERLY OPERATING STATISTICS

| | Three months ended December 31, | |

| | 2011 | | 2010 | |

Gold Equivalent Ounces (GEO) (i) | | | | | |

BRAZIL | | | | | |

Chapada | | 34,313 | | 36,965 | |

Jacobina | | 31,983 | | 33,718 | |

Fazenda Brasileiro | | 15,568 | | 19,852 | |

CHILE | | | | | |

El Peñón (ii) | | 115,043 | | 113,800 | |

Minera Florida (ii) | | 23,151 | | 32,048 | |

ARGENTINA | | | | | |

Gualcamayo | | 40,676 | | 36,239 | |

Alumbrera (iii) | | 7,746 | | 14,061 | |

Total commercial GEO production (i) | | 268,480 | | 286,683 | |

Commissioning GEO - Mercedes (i) | | 8,438 | | — | |

Total GEO production (i) | | 276,918 | | 286,683 | |

By-product Cash Costs per GEO (i) (iv) | | | | | |

BRAZIL | | | | | |

Chapada | | $ | (1,715 | ) | $ | (2,863 | ) |

Jacobina | | 646 | | 495 | |

Fazenda Brasileiro | | 915 | | 705 | |

CHILE | | | | | |

El Peñón (ii) | | 413 | | 421 | |

Minera Florida (ii) | | 706 | | 479 | |

ARGENTINA | | | | | |

Gualcamayo | | 424 | | 662 | |

Alumbrera (iii) | | (1,351 | ) | (1,556 | ) |

By-product cash costs per GEO produced (i) (iv) | | $ | 174 | | $ | (34 | ) |

Co-product cash costs per GEO produced (i) (iv) | | $ | 486 | | $ | 465 | |

Concentrate Production | | | | | |

Chapada concentrate production (tonnes) | | 81,396 | | 69,869 | |

Chapada copper contained in concentrate production (millions of lbs) | | 45.4 | | 39.9 | |

Chapada co-product cash costs per pound of copper (iv) | | $ | 1.20 | | $ | 1.20 | |

Alumbrera concentrate production (tonnes) (iii) | | 10,691 | | 16,422 | |

Alumbrera attributable copper contained in concentrate production (millions of lbs) (iii) | | 6.2 | | 9.3 | |

Alumbrera co-product cash costs per lb of copper (iii) (iv) | | $ | 2.59 | | $ | 1.37 | |

Gold Equivalent Ounces Breakdown | | | | | |

Total gold ounces produced | | 231,670 | | 243,407 | |

Silver ounces produced (millions of ounces) | | 2.3 | | 2.4 | |

Sales | | | | | |

Total gold sales (ounces) | | 228,539 | | 234,708 | |

Chapada concentrate sales (tonnes) | | 81,436 | | 74,009 | |

Chapada payable copper contained in concentrate sales (millions of lbs) | | 43.6 | | 39.6 | |

Silver sales (millions of ounces) | | 2.2 | | 2.4 | |

(i) | | Silver production is treated as a gold equivalent. Gold equivalent ounce calculations are based on an average historical gold to silver ratio (50:1) which is used and presented solely for quarter-over-quarter comparative purposes only. The assumed gold to silver ratio was 55:1 for 2010 and prior periods. |

10

(ii) | | 2011 fourth quarter gold production: El Peñón — 75,407 ounces; Minera Florida — 18,326 ounces, and silver production: El Peñón — 2.0 million ounces; Mineral Florida — 0.2 million ounces. Silver production is treated as a gold equivalent. |

(iii) | | Alumbrera represents a 12.5% interest. |

(iv) | | A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share. |

11

5. OVERVIEW OF ANNUAL RESULTS

5.1 OVERVIEW OF ANNUAL FINANCIAL RESULTS

| | Years ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | 2011 | | 2010 | | 2009 (v) | |

Revenues (i) | | $ | 2,173,325 | | $ | 1,686,811 | | $ | 1,183,314 | |

Cost of sales excluding depletion, depreciation and amortization | | (716,692 | ) | (631,063 | ) | (479,847 | ) |

Gross margin | | 1,456,633 | | 1,055,748 | | 703,467 | |

Depletion, depreciation and amortization | | (356,759 | ) | (301,912 | ) | (233,687 | ) |

Mine operating earnings | | 1,099,874 | | 753,836 | | 469,780 | |

Other expenses (iv) | | (228,109 | ) | (219,616 | ) | (152,523 | ) |

Equity earnings from associate | | 39,019 | | 49,264 | | 31,073 | |

Impairment of investment in available-for-sale securities | | (92,600 | ) | — | | — | |

Earnings from continuing operations before income taxes | | 818,184 | | 583,484 | | 348,330 | |

Income tax expense | | (269,890 | ) | (128,326 | ) | (136,559 | ) |

Earnings from continuing operations | | 548,294 | | 455,158 | | 211,771 | |

Earnings from discontinued operations (ii) | | — | | 11,329 | | (19,140 | ) |

Net earnings | | $ | 548,294 | | $ | 466,487 | | $ | 192,631 | |

Earnings adjustments (iii): | | | | | | | |

Non-cash unrealized foreign exchange losses (gains) | | 58,284 | | (46,539 | ) | (36,672 | ) |

Non-cash unrealized gains on derivatives | | (1,125 | ) | (1,948 | ) | 112,519 | |

Share-based payments and other compensation | | 20,554 | | 12,053 | | 23,275 | |

Deferred income tax (recovery) expense on translation of intercompany debt | | (6,256 | ) | 3,680 | | 51,578 | |

Non-recurring deferred income tax adjustments | | — | | — | | 35,826 | |

Impairment of investment in available-for-sale securities | | 92,600 | | — | | — | |

Other non-recurring losses | | 18,118 | | 16,602 | | 8,301 | |

Adjusted earnings before income tax effect | | 730,469 | | 450,335 | | 387,458 | |

Income tax effect of adjustments | | (17,573 | ) | (2,132 | ) | (41,327 | ) |

Adjusted earnings (iii) | | $ | 712,896 | | $ | 448,203 | | $ | 346,131 | |

Earnings per share - basic and diluted | | $ | 0.74 | | $ | 0.63 | | $ | 0.26 | |

Adjusted earnings per share (iii) - basic and diluted | | $ | 0.96 | | $ | 0.61 | | $ | 0.47 | |

(i) | | Revenues consist of sales net of sales taxes. |

(ii) | | Results of San Andrés, São Vicente and São Francisco mines have been reclassified as discontinued operations (in accordance with IFRS) with restatement of prior period comparatives. |

(iii) | | A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share. |

(iv) | | Other expenses include general and administrative, exploration, other operating expenses and net finance expense. |

(v) | | The financial results for periods ending prior to January 1, 2010 have not been restated in accordance with IFRS. |

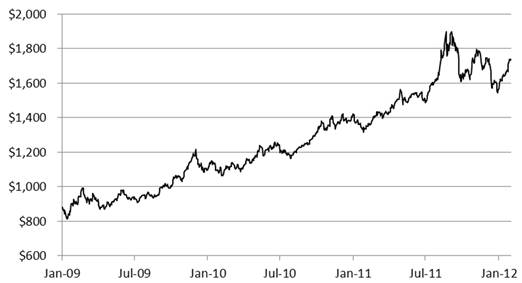

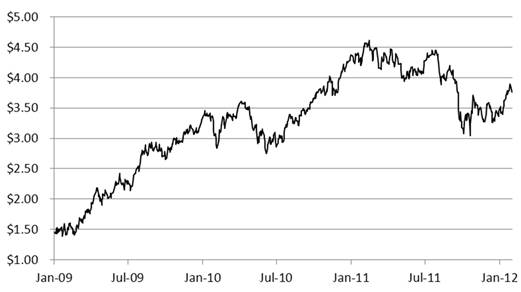

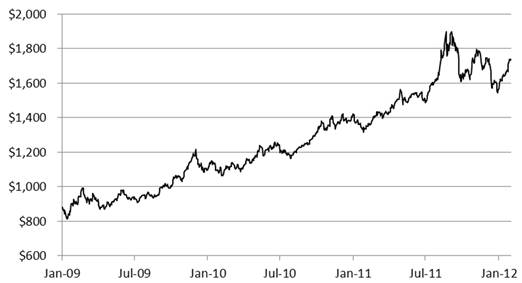

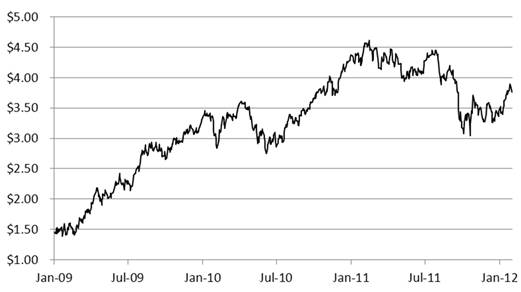

Precious metal prices continued to climb during 2011 with gold prices increasing to new record highs amidst continued risk aversion by investors seeking gold as a safe haven. The average market prices for gold and silver in 2011 were up by 28% and 75%, respectively, compared with 2010. Additionally, demand for copper continued a steady climb for most of 2011 increasing prices by 17% from 2010. Record metal prices in combination with record production for the year contributed to record-setting financial results for the Company despite an unrealized non-cash loss on the Company’s investment portfolio of $81.0 million on an after-tax basis.

Record adjusted earnings of $712.9 million or $0.96 per share for the year, a 59% increase compared with adjusted earnings of $448.2 million or $0.61 per share for 2010. Higher adjusted earnings were mainly due to increased revenues as a result of more favourable realized prices for gold, copper and silver, and increased production from continuing operations offset by higher other expenses and higher income tax expense compared to 2011.

12

Net earnings for the year were $548.3 million compared with net earnings of $466.5 million in 2010 despite an unrealized non-cash loss on the Company’s investment portfolio of $81.0 million on an after-tax basis ($92.6 million on a pre-tax basis). Basic earnings per share were $0.74 compared with $0.63 per share for 2010. Higher net earnings were mainly due the same contributing factors as adjusted earnings and negatively impacted by an unrealized non-cash impairment loss on investment in available-for-sale securities and higher unrealized foreign exchange losses.

Mine operating earnings of $1.1 billion for the year, compared with $753.8 million in 2010, represents a 46% increase from 2010. Year-over-year, revenues increased by 29% while cost of sales excluding depletion, depreciation and amortization only increased by 14%, evident by the gross margin increase, as the Company reaps from the benefits of higher metal prices, higher volume of sales and cost-containment initiatives implemented during the year despite an environment of rising mining industry inflationary pressures and strengthening of Brazilian Reais, Chilean and Mexican pesos. The combination of these favourable outcomes contributed to record mine operating earnings for the year.

Revenues for the year were $2,173.3 million compared to $1,686.8 million; an increase of 29% and are comprised of the following:

| | Quantity | | Realized | | Years ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | Sold | | Price | | 2011 | | 2010 | |

Gold (i) | | 862,321 | | oz | | $ | 1,567 | | $ | 1,351,428 | | $ | 1,005,956 | |

Silver | | 9,141,302 | | oz | | $ | 35.19 | | 321,666 | | 209,766 | |

Total precious metals | | 1,045,147 | | GEO | | | | 1,673,094 | | 1,215,722 | |

Copper (i) | | 153,627,653 | | lbs | | $ | 3.93 | | 603,423 | | 482,016 | |

Gross revenues | | | | | | | | $ | 2,276,517 | | $ | 1,697,738 | |

(Deduct) Add : | | | | | | | | | | | |

- Treatment and refining charges of gold and copper concentrate | | | | | | | | $ | (31,122 | ) | $ | (31,707 | ) |

- Sales taxes and royalties | | | | | | | | (40,480 | ) | (24,334 | ) |

- Metal price adjustments related to concentrate revenues | | | | | | | | (38,974 | ) | 41,206 | |

- Other adjustments | | | | | | | | 7,384 | | 3,908 | |

Revenues | | | | | | | | $ | 2,173,325 | | $ | 1,686,811 | |

(i) Includes payable copper and gold contained in concentrate.

Cost of sales excluding depletion, depreciation and amortization for the year was $716.7 million compared with $631.1 million in 2010. The following table provides a reconciliation of the co-product cash costs to the cost of sales excluding depletion, depreciation and amortization for the year:

| | Gold Ounces or | | | | | | | |

| | Pounds of | | Co-product | | | | | |

| | Copper | | Cash Cost | | Years ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | Produced | | per Unit | | 2011 | | 2010 | |

Chapada — Gold | | 135,347 | oz | | $ | 319 | | $ | 43,218 | | $ | 44,356 | |

Chapada — Copper | | 166,098,966 | lbs | | 1.29 | | 215,010 | | 175,194 | |

El Peñón (GEO) (i) | | 475,586 | oz | | 400 | | 190,072 | | 183,201 | |

Jacobina | | 121,675 | oz | | 643 | | 78,270 | | 65,367 | |

Gualcamayo | | 158,847 | oz | | 441 | | 70,030 | | 68,368 | |

Minera Florida (GEO) (i) | | 102,738 | oz | | 591 | | 60,711 | | 43,950 | |

Fazenda Brasileiro | | 55,163 | oz | | 937 | | 51,682 | | 44,042 | |

Co-product cash cost of sales (ii) | | | | | | | $ | 708,993 | | $ | 624,478 | |

(Deduct) Add: | | | | | | | | | | |

- Inventory and other non-cash adjustments | | | | | | | 7,057 | | 11,781 | |

- Chapada concentrate treatment and refining charges | | | | | | | (31,122 | ) | (31,707 | ) |

- Other commercial costs | | | | | | | 21,778 | | 12,204 | |

- Overseas freight for Chapada concentrate | | | | | | | 9,986 | | 14,307 | |

Cost of sales excluding depletion, depreciation and amortization | | | | | | | $ | 716,692 | | $ | 631,063 | |

| | | | | | | | | | | | | |

(i) Silver ounces reported are gold equivalent ounces for El Peñón and Minera Florida.

13

(ii) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis of Operations and Financial Condition.

Depletion, depreciation and amortization and (“DDA”) expense for the quarter was $356.8 million, an increase from $301.9 million in 2010. DDA is highly impacted by fixed asset acquisitions supporting expansionary projects and by the relative portion of fixed assets depreciating on a time basis versus a unit of production basis.

Other expenses for the year were $228.1 increasing from $219.6 in 2010 mainly due to higher general and administrative expenses and other operating expenses from the impact of the Company’s growing operations partially being offset by lower exploration costs and net finance expense. Net finance expense of $34.2 million decreased compared with net finance expense of $48.0 million in 2010 mainly due to lower financing costs and lower interest expense from continued repayment of long-term debt offset by foreign exchange losses. The Company has also capitalized higher interest expense in the current year compared with 2010 as construction and development projects ramped up.

Equity earnings from associate of $39.0 million for the year decreased compared with $49.3 million in 2010 due to lower earnings attributable to the Company from its 12.5% interest in Minera Alumbrera Limited mainly due to lower sales, higher operating costs from lower gold and copper grades and an unfavourable concentrate pricing adjustments recorded in the fourth quarter resulting from the downward trend of the copper price from the third quarter of the year.

Income tax expense for the year was $269.9 increasing from $128.3 in 2010 mainly due to higher net earnings for the year and the impact of foreign exchange on non-monetary assets in Brazil and Argentina.

14

5.2 OVERVIEW OF ANNUAL OPERATING RESULTS

In 2011, production of gold equivalent ounces (“GEO”) totaled 1,102,296 GEO compared with 1,047,191 GEO in 2010, representing a year-to-year increase of 5% including the commissioning GEO from Mercedes.

Copper production of 166.1 million pounds from the Chapada Mine for the year increased by 11% over production of 149.4 million pounds in 2010. Tonnage of copper concentrate production at Chapada also increased by 13% over the prior year. Additionally, 32.2 million pounds of copper produced from Alumbrera were attributable to the Company in 2011, compared to 38.7 million pounds in 2010.

By-product cash costs (a non-GAAP measure, see Section 15) of continuing operations on commercial production of 1,093,858 GEO were $50 per GEO comparable with $50 per GEO in 2010 (2009: $123 per GEO). By-product cash costs per GEO were consistent to last year reflecting continuing effective cost constraint and consistent by-product credits on higher sale volume of copper.

Average co-product cash costs (a non-GAAP measure, see Section 15) of continuing operations on commercial production of 1,093,858 GEO for the year were $463 per GEO. This compares to co-product cash costs of continuing operations of $442 per GEO for the year ended December 31, 2010 (2009: $357 per GEO).

Co-product cash costs per pound of copper (a non-GAAP measure, see Section 15) were $1.29 for the year from Chapada, compared with $1.17 for the year ended December 31, 2010 (2009: $0.99 per pound). Co-product cash costs for the year, including the Company’s interest in the Alumbrera Mine, were $1.38 per pound, compared with $1.20 for 2010 (2009: $1.10 per pound).

The Company’s proven and probable mineral reserves were 18.6 million GEO (contained gold — 17.0 million ounces; contained silver 82.9 million ounces) as at December 31, 2011, which represents an 11% increase over the comparative year. Most of the Company’s mines showed an increase in mineral reserves after depletion of mined GEO with most notable increases at Mercedes, El Peñón, Jacobina, Chapada, Minera Florida, Fazenda Brasileiro, C1 Santa Luz, Ernesto/Pau-a-Pique and Jeronimo. Measured and Indicated mineral resources modestly decreased by 3% to 13.6 million GEO from 2010 mainly due to conversion to mineral reserves. Total inferred mineral resources increased to 10.3 million GEO, which represents an increase of 39% over 2010 as a result of new discoveries at Chapada, Gualcamayo, Fazenda Brasileiro, C1 Santa Luz and significant extensions to known deposits at Pilar, El Peñón and Mercedes. Refer to Section 9 — “Mineral Reserve and Mineral Resource Estimates” for a detailed discussion on the Company’s mineral reserve and mineral resource estimates and metal price assumptions. Complete information relating to mineral reserves and mineral resources is also contained in a mineral reserve and mineral resource table which indicates complete information on tonnage and grade. This mineral reserve and mineral resource table accompanies the 2011 annual report and is also available on the Company’s website, www.yamana.com.

15

6. OVERVIEW OF QUARTERLY RESULTS

6.1 OVERVIEW OF QUARTERLY FINANCIAL RESULTS

| | Three months ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | 2011 | | 2010 | |

Revenues (i) | | $ | 568,754 | | $ | 535,130 | |

Cost of sales excluding depletion, depreciation and amortization | | (178,384 | ) | (178,341 | ) |

Gross margin | | 390,370 | | 356,789 | |

Depletion, depreciation and amortization | | (93,611 | ) | (83,657 | ) |

Mine operating earnings | | 296,759 | | 273,132 | |

Other expenses (iii) | | (52,264 | ) | (67,037 | ) |

Equity earnings from associate | | 1,269 | | 19,124 | |

Impairment of investment in available-for-sale securities | | (92,600 | ) | — | |

Earnings from operations before income taxes | | 153,164 | | 225,219 | |

Income tax expense | | (63,565 | ) | (99,650 | ) |

Net earnings | | $ | 89,599 | | $ | 125,569 | |

Earnings adjustments (ii): | | | | | |

Non-cash unrealized foreign exchange losses | | 1,694 | | 37,274 | |

Non-cash unrealized (gains) losses on derivatives | | (449 | ) | 506 | |

Share-based payments | | 6,656 | | 2,810 | |

Deferred income tax expense on translation of intercompany debt | | 26 | | 1,751 | |

Impairment of investment in available-for-sale securities | | 92,600 | | — | |

Other non-recurring losses (gains) | | 7,140 | | 4,044 | |

Adjusted earnings before income tax effect | | 197,266 | | 171,954 | |

Income tax effect of adjustments | | (13,024 | ) | (975 | ) |

Adjusted earnings (ii) | | $ | 184,242 | | $ | 170,979 | |

Earnings per share - basic and diluted | | $ | 0.12 | | $ | 0.17 | |

Adjusted earnings per share (ii) - basic and diluted | | $ | 0.25 | | $ | 0.23 | |

(i) Revenues consist of sales net of sales taxes.

(ii) A cautionary note regarding non-GAAP measures and their respective reconciliations are included in Section 15 including a discussion and definition of Adjusted Earnings and Adjusted Earnings per Share.

(iii) Other expenses include general and administrative, exploration, other operating expenses and net finance expense.

Higher demand for precious metals continued during the quarter with double-digit price gains relative to the comparative quarter as the average price of gold and silver increased by 23% and 20%, respectively. Average copper prices were $3.41 per pound which is 13% lower compared to the same quarter of 2010.

Adjusted earnings were $184.2 million or $0.25 per share in the fourth quarter of 2011 compared with $171.0 million or $0.23 per share in the same quarter of 2010 representing an increase of 8%. Higher adjusted earnings were mainly due to record-high mine operating earnings as a result of more favourable gold and silver realized prices as well as higher concentrate sales volume, partly offset by lower equity earnings from associate.

Net earnings for the quarter were $89.6 million or $0.12 per share on a basic and diluted basis compared with net earnings of $125.6 million or basic and diluted earnings per share of $0.17 for the fourth quarter of 2010. Despite contribution from record-high mine operating earnings, net earnings were lower as a result of an after-tax $81.0 million unrealized non-cash impairment loss on investments in available-for-sale securities recorded in the quarter. The accumulated loss was previously recorded in other comprehensive income (“OCI”) and has been reclassified to the Consolidated Statement of Operations for the quarter. This loss is unrealized and non-recurring, and does not impact or relate to the Company’s ability to generate operating cash flows or profit from its operations. As such, the unrealized loss has been excluded from the calculation of adjusted earnings and adjusted earnings per share. The Company will recognize a gain on any value of these investments above the level at which they have been written down upon disposition.

16

Revenues of $568.8 million in the fourth quarter were 6% higher compared with $535.1 million in the same quarter of 2010 mainly due to higher realized prices for gold and silver and increased sales of copper pounds. Higher revenues also contributed to record mine operating earnings of $296.8 million in the quarter, compared with $273.1 million in the fourth quarter of 2010.

Revenues for the quarter are comprised of the following:

| | | | | | Realized | | Three months ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | Quantity Sold | | Price | | 2011 | | 2010 | |

Gold (i) | | 218,831 | | oz | | $ | 1,670 | | $ | 365,374 | | $ | 304,713 | |

Silver | | 2,197,580 | | oz | | $ | 31.29 | | 68,756 | | 67,603 | |

Total Precious Metals | | 262,782 | | GEO | | | | 434,130 | | 372,316 | |

Copper (i) | | 43,635,304 | | lbs | | $ | 3.36 | | 146,817 | | 150,964 | |

Gross Revenues | | | | | | | | $ | 580,947 | | $ | 523,280 | |

Add (deduct): | | | | | | | | | | | |

- Treatment and refining charges of gold and copper concentrate | | | | | | | | $ | (8,776 | ) | $ | (9,495 | ) |

- Sales taxes | | | | | | | | (9,327 | ) | (7,196 | ) |

- Metal price adjustments related to concentrate revenues | | | | | | | | 4,702 | | 27,033 | |

- Other adjustments | | | | | | | | 1,208 | | 1,508 | |

Revenues | | | | | | | | $ | 568,754 | | $ | 535,130 | |

(i) Includes payable copper and gold contained in concentrate.

Cost of sales excluding depletion, depreciation and amortization for the quarter was $178.4 million compared with $178.3 million in the fourth quarter of 2010. The following table provides a reconciliation of the co-product cash costs to the cost of sales excluding depletion, depreciation and amortization for the quarter:

| | Gold Ounces or

Pounds of

Copper | | Co-product

Cash Cost | | Three months ended December 31, | |

(in thousands of United States Dollars; unless otherwise noted) | | Produced | | per unit | | 2011 | | 2010 | |

Chapada — Gold | | 34,313 | | oz | | $ | 320 | | $ | 10,990 | | $ | 11,922 | |

Chapada — Copper | | 45,457,664 | | lbs | | 1.20 | | 54,732 | | 47,793 | |

El Peñón (GEO) (i) | | 115,043 | | oz | | 413 | | 47,499 | | 47,959 | |

Jacobina | | 31,983 | | oz | | 646 | | 20,652 | | 16,693 | |

Gualcamayo | | 40,676 | | oz | | 424 | | 17,227 | | 23,982 | |

Minera Florida (GEO) (i) | | 23,151 | | oz | | 706 | | 16,345 | | 15,355 | |

Fazenda Brasileiro | | 15,568 | | oz | | 915 | | 14,239 | | 14,003 | |

Co-product cash cost of sales (ii) | | | | | | | | $ | 181,684 | | $ | 177,707 | |

Add (deduct): | | | | | | | | | | | |

- Inventory and other non-cash adjustments | | | | | | | | (2,506 | ) | 2,659 | |

- Chapada concentrate treatment and refining charges | | | | | | | | (8,776 | ) | (9,495 | ) |

- Other commercial costs | | | | | | | | 7,244 | | 3,413 | |

- Overseas freight for Chapada concentrate | | | | | | | | 738 | | 4,057 | |

Cost of sales excluding depletion, depreciation and amortization | | | | | | | | $ | 178,384 | | $ | 178,341 | |

| | | | | | | | | | | | | | |

(i) Silver ounces reported are gold equivalent ounces for El Peñón and Minera Florida.

(ii) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis of Operations and Financial Condition.

Depletion, depreciation and amortization and (“DDA”) expense for the quarter was $93.6 million, an increase from $83.7 million in the fourth quarter of 2010. DDA per quarter is highly impacted by fixed asset acquisitions.

Other expenses for the year were $52.3 decreasing from $67.0 in 2010 mainly due to lower exploration expenses, lower other operating expenses as a result of reduction in provisions and lower net finance expense partially offset by higher general and administrative expenses. Net finance expense of $2.1 million decreased compared with net finance expense of $13.3 million in 2010 from higher capitalized interest and lower realized losses on derivatives.

17

Equity earnings from associates were $1.3 million for the quarter compared with $19.1 million in the fourth quarter of 2010. This was due to lower earnings attributable to the Company from its 12.5% interest in Minera Alumbrera Limited as a result of lower sales and higher operating costs relative to the comparative quarter of 2010.

Income tax expense for the quarter was $63.6 million decreasing from $99.7 million in 2010 mainly due to a smaller foreign exchange loss in comparison to the fourth quarter of 2010 and a reversal of a tax contingency during the quarter with no comparable prior period balance.

6.2 OVERVIEW OF QUARTERLY OPERATING RESULTS

Total production from operations was 276,918 GEO for the quarter, including the commissioning production from Mercedes and the Company’s proportionate interest in production from the Alumbrera Mine, compared with production of 286,683 GEO for the comparative quarter ended December 31, 2010.

Copper production for the quarter ended December 31, 2011 was 45.4 million pounds from the Chapada Mine, compared with 39.9 million pounds for the fourth quarter 2010. Additionally, 6.2 million pounds of copper were produced from Alumbrera attributable to the Company, compared with 9.3 million pounds for the quarter ended December 31, 2010. Total copper production for the fourth quarter was 51.6 million pounds.

By-product cash costs (a non-GAAP measure, see Section 15) were positive $174 per GEO on commercial production of 268,480 GEO, compared with negative $34 per GEO in the fourth quarter of 2010. Co-product cash costs (a non-GAAP measure, see Section 15) from continuing operations were $486 per GEO on commercial production of 268,480 GEO for the quarter compared with $465 per GEO for the fourth quarter of 2010.

Co-product cash costs per pound of copper (a non-GAAP measure, see Section 15) were $1.20 for the quarter from the Chapada Mine, unchanged from the fourth quarter in 2010. Co-product cash costs per pound of copper for the quarter including the Company’s interest in the Alumbrera Mine were $1.37 per pound versus $1.23 per pound for the quarter ended December 31, 2010.

18

7. OPERATING MINES

CHAPADA MINE

| | Three months ended | | Years ended | |

| | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | |

Operating Statistics | | 2011 | | 2010 | | 2011 | | 2010 | | 2009 | |

Production | | | | | | | | | | | |

Concentrate (tonnes) | | 81,396 | | 69,869 | | 297,294 | | 264,195 | | 248,940 | |

Gold contained in concentrate production (ounces) | | 34,313 | | 36,965 | | 135,347 | | 135,613 | | 156,251 | |

Copper contained in concentrate (millions of pounds) | | 45.4 | | 39.9 | | 166.1 | | 149.4 | | 144.0 | |

By-product cash costs per oz of gold produced (i) | | $ | (1,715 | ) | $ | (2,863 | ) | $ | (2,454 | ) | $ | (2,073 | ) | $ | (848 | ) |

Co-product cash costs per oz of gold produced (i) | | $ | 320 | | $ | 323 | | $ | 319 | | $ | 327 | | $ | 258 | |

Co-product cash costs per lb of copper produced (i) | | $ | 1.20 | | $ | 1.20 | | $ | 1.29 | | $ | 1.17 | | $ | 0.99 | |

Ore mined (tonnes) | | 6,210,285 | | 5,228,059 | | 22,084,779 | | 21,482,527 | | 16,998,887 | |

Ore processed (tonnes) | | 5,559,778 | | 4,757,679 | | 20,581,385 | | 19,195,578 | | 17,307,429 | |

Gold ore grade (g/t) | | 0.32 | | 0.37 | | 0.32 | | 0.35 | | 0.41 | |

Copper ore grade (%) | | 0.43 | | 0.44 | | 0.42 | | 0.41 | | 0.43 | |

Concentrate grade - gold (g/t) | | 13.11 | | 16.46 | | 14.16 | | 15.97 | | 19.63 | |

Concentrate grade - copper (%) | | 25.33 | | 25.92 | | 25.34 | | 25.65 | | 26.24 | |

Gold recovery rate (%) | | 60.5 | | 64.9 | | 63.8 | | 62.3 | | 69.0 | |

Copper recovery rate (%) | | 86.7 | | 86.2 | | 87.4 | | 86.5 | | 88.0 | |

Sales (ii) | | | | | | | | | | | |

Concentrate (tonnes) | | 81,436 | | 74,009 | | 293,092 | | 264,825 | | 261,841 | |

Payable gold contained in concentrate (ounces) | | 33,146 | | 31,421 | | 129,419 | | 127,450 | | 143,939 | |

Payable copper contained in concentrate (millions of pounds) | | 43.6 | | 39.6 | | 153.6 | | 143.8 | | 137.4 | |

Depletion, depreciation and amortization per gold ounce sold | | $ | 68 | | $ | 75 | | $ | 63 | | $ | 67 | | $ | 54 | |

Depletion, depreciation and amortization per copper pound sold | | $ | 0.21 | | $ | 0.18 | | $ | 0.21 | | $ | 0.18 | | $ | 0.13 | |

(i) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis.

(ii) Quantities sold include quantity adjustment on provisional and final invoice settlements.

Chapada produced a total of 135,347 ounces of gold contained in concentrate in 2011 compared with 135,613 ounces of gold in concentrate in 2010. Chapada copper production of 166.1 million pounds in the year was 11% higher than the production of 149.4 million pounds of copper contained in concentrate in 2010.

By-product cash costs for the year were negative $2,454 compared with negative $2,073 per GEO for 2010. Increased sales of copper and higher copper prices were the main contributing factors to the increase in by-product credit.

Co-product cash costs for gold were $319 per ounce in 2011 compared with $327 per ounce in 2010. Lower co-product cash costs were primarily due to higher tonnage throughput positively impacting unit costs and improved recoveries partly offset by lower grades. Co-product cash costs for copper were $1.29 per pound in 2011 versus $1.17 per pound in 2010.

Chapada produced a total of 34,313 ounces of gold contained in concentrate in the fourth quarter compared with 36,965 ounces of gold in concentrate in the fourth quarter of 2010. Chapada copper production of 45.4 million pounds in the fourth quarter was 14% higher than the production of 39.9 million pounds of copper contained in concentrate during the comparable period in 2010. Lower production of gold in the quarter compared with the fourth quarter of 2010 was mainly due to lower feed grade and recovery, partly offset by increased tonnage of ore mined and processed as a result of the plant optimization initiatives undertaken since the end of 2010. Decrease in gold grade is in line with the life of mine plan.

19

By-product cash costs for the fourth quarter were negative $1,715 per ounce, compared with negative $2,863 per GEO for the same quarter of 2010. Lower credit to by-product cash costs reflects lower copper prices partly offset by higher copper sale volume compared to prior year, resulting in higher by-product cash costs.

Co-product cash costs for the quarter were $320 per gold ounce and $1.20 per pound of copper compared to $323 per gold ounce and $1.20 per pound of copper for the same quarter of 2010. Co-product cash costs per ounce of gold and per pound of copper remain largely unchanged in spite of lower feed grade and recovery for gold, reflecting effective cost control practices by the operation.

Chapada revenues for the quarter net of sales taxes and treatment and refining costs were $196.4 million (2010 — $209.3 million). Revenues included mark-to-market adjustments and final and provisional pricing settlements in the quarter of positive $4.7 million (2010 — positive $18.8 million).

In December 2011, the Company completed the feasibility study and basic engineering on the oxides at Suruca Project. Suruca is six kilometres northeast of Chapada mine. The deposit will support an additional average production of 49,000 gold ounces per year to Chapada’s operations over an initial five years beginning in 2013.

The Company continues to evaluate the gold and copper production contribution to Chapada from Corpo Sul which is a recently discovered gold and copper mineralization at the southwest end of the orebody. A total of 30 drill holes were completed traced along a strike length of almost 7 kilometers during the fourth quarter of 2011. The mineral resource has higher average grade cores especially near the current Chapada pit which could provide opportunity for near-term higher than average mineral reserve grades.

Planned production from Chapada will decline in 2012 over 2011 levels, although will increase in terms of gold production in 2013 and in the years to follow, mostly as a result of the start-up of the oxide gold operation at Suruca and gold and copper production from Corpo Sul beginning in 2014. The Company’s strategic plan is to ensure sustainable production from Chapada of 150,000 gold ounces and 135.0 million pounds of copper from 2013 and onwards for at least five years.

Total gold mineral reserves for Chapada increased by 6% compared to 2010 with consecutive increases in mineral reserves over the last two years.

20

EL PEÑÓN

| | Three months ended | | Years ended | |

| | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | |

Operating Statistics | | 2011 | | 2010 | | 2011 | | 2010 | | 2009 | |

Production | | | | | | | | | | | |

Gold equivalent (ounces) | | 115,043 | | 113,800 | | 475,586 | | 427,934 | | 394,400 | |

Gold production (ounces) | | 75,407 | | 74,785 | | 306,184 | | 256,530 | | 215,846 | |

Silver production (ounces) | | 1,981,806 | | 2,145,809 | | 8,470,112 | | 9,427,208 | | 9,820,475 | |

Cash costs per gold equivalent ounce produced (i) | | $ | 413 | | $ | 421 | | $ | 400 | | $ | 428 | | $ | 353 | |

Ore mined (tonnes) | | 326,915 | | 333,243 | | 1,307,351 | | 1,301,877 | | 1,314,759 | |

Ore processed (tonnes) | | 363,796 | | 366,424 | | 1,452,090 | | 1,522,366 | | 1,271,594 | |

Gold ore grade (g/t) | | 6.91 | | 6.94 | | 7.05 | | 5.74 | | 5.78 | |

Silver ore grade (g/t) | | 200.2 | | 229.2 | | 215.9 | | 228.5 | | 276.3 | |

Gold recovery rate (%) | | 93.1 | | 91.3 | | 93.0 | | 91.2 | | 91.2 | |

Silver recovery rate (%) | | 83.9 | | 79.5 | | 84.0 | | 84.1 | | 86.9 | |

Sales | | | | | | | | | | | |

Gold sales (ounces) | | 75,886 | | 75,219 | | 304,530 | | 258,301 | | 219,764 | |

Silver sales (ounces) | | 2,014,420 | | 2,155,113 | | 8,453,857 | | 9,535,012 | | 10,034,160 | |

| | | | | | | | | | | | | | | | |

Depletion, depreciation and amortization per gold equivalent ounce sold | | $ | 344 | | $ | 334 | | $ | 321 | | $ | 318 | | $ | 277 | |

(i) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis.

Annual production at El Peñón was 475,586 GEO in 2011, representing a year-over-year increase of 11% in GEO compared with production of 2010, which was the transition year to owner-mining. Since conversion to owner-mining in early 2010, operational dilution has decreased and feed grade has improved. This, combined with increased capacity, has led to increased GEO production. Production for the year of 475,586 GEO consisted of 306,184 ounces of gold and 8.5 million ounces of silver, compared with 427,934 GEO, which consisted of 256,530 ounces of gold and 9.4 million ounces of silver produced in 2010. Production of gold has increased consecutively year over year since 2009.

Cash costs were $400 per GEO compared with $428 per GEO in 2010. Improvement of operational reliability and cost management was the main contributing factor to more than offset the negative effect of a higher exchange rate for the Chilean Peso resulting in lower cash costs in 2011.

El Peñón produced 115,043 GEO during the fourth quarter of 2011. Production for the quarter consisted of 75,407 ounces of gold and 2.0 million ounces of silver, compared with 113,800 GEO, which consisted of 74,785 ounces of gold and 2.1 million ounces of silver produced in the fourth quarter of 2010, primarily due to higher recoveries.

Cash costs were $413 per GEO in the quarter ended December 31, 2011, representing a 2% improvement, compared with $421 per GEO in the fourth quarter in 2010. Favourable exchange rate of the United States Dollar versus the Chilean Peso, operational reliability and cost management improvements allowed mine management to mitigate the adverse impact of mining inflation.

El Peñón has a long track record of replacement of ounces of mineral resource expansion. During the fourth quarter of 2011, 251 drill holes were completed totaling over 66 kilometres with the majority in areas of the North Block to extend and define the Al Este, Abundancia and Esmeralda targets, the Fortuna area where infill drilling extended the deposit to depth and at Pampa Augusta Victoria to better define the Victoria vein to depth and parallel structures to the east. Infill drilling upgraded the previously defined mineral resources to mineral reserves and identified higher grade areas. Total mineral reserves on a GEO basis for El Peñón increased by 20% compared to 2010 with consecutive increases in mineral reserves on a GEO basis over the last two years.

Continuous exploration effort on high grade at El Peñón is expected to return significant near surface gold and silver values, improve production, provide mining flexibility for a sustainable production level of at least 440,000 GEO per year and ultimately increase mine life.

21

GUALCAMAYO

| | Three months ended | | Years Ended | |

| | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | |

Operating Statistics | | 2011 | | 2010 | | 2011 | | 2010 | | 2009 | |

Production | | | | | | | | | | | |

Total Gold production (ounces) | | 40,676 | | 36,239 | | 158,847 | | 135,140 | | 143,471 | |

Commercial Gold production (ounces) | | 40,676 | | 36,239 | | 158,847 | | 135,140 | | 98,641 | |

Commissioning gold production (ounces) | | — | | — | | — | | — | | 44,830 | |

Cash costs per ounce produced (i) | | $ | 424 | | $ | 662 | | $ | 441 | | $ | 506 | | $ | 301 | |

Ore mined (tonnes) | | 1,883,622 | | 2,283,577 | | 7,580,950 | | 8,845,992 | | 3,294,175 | |

Ore processed (tonnes) | | 1,955,094 | | 1,818,571 | | 7,578,156 | | 7,528,690 | | 3,370,057 | |

Gold Grade (g/t) | | 0.99 | | 0.89 | | 0.97 | | 0.82 | | 1.19 | |

Gold Recovery rate (%) | | 65.4 | | 69.5 | | 68.4 | | 67.8 | | 76.6 | |

Sales | | | | | | | | | | | |

Gold sales (ounces) | | 40,908 | | 36,649 | | 160,326 | | 141,734 | | 88,555 | |

| | | | | | | | | | | | | | | | |

Depletion, depreciation and amortization per gold ounce sold | | $ | 389 | | $ | 314 | | $ | 370 | | $ | 277 | | $ | 228 | |

(i) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis.

Gualcamayo produced 158,847 ounces of gold in 2011 compared with 135,140 ounces produced in 2010, representing an 18% year-over-year increase. Production increased primarily as a result of mining higher grade benches.

Cash costs for the year were $441 compared with $506 per ounce in 2010.

Gold production of 40,676 ounces in the fourth quarter compared with 36,239 ounces produced in the fourth quarter of 2010, represents a 12% quarter-over-quarter improvement. Production increased mainly due to higher grade and higher tonnage processed partly offset by lower recovery. Management continues to work on recovery improvement.

Cash costs were $424 per ounce in the quarter ended December 31, 2011, representing a 36% improvement, compared with $662 per ounce in the fourth quarter of 2010, which was adversely affected by the necessary stoppage of conveyor belts and the plant for the expansion of capacity; as a result, ore was transported by truck while the conveyor belts were down and that contributed to higher cash costs in the fourth quarter of 2010.

Development of QDD Lower West advanced to 33% of the overall physical progress, with tunnel advance and equipment and material procurement Project completion remains on schedule. Brownfield exploration for the fourth quarter of 2011 was focused on increasing mineral resources in the QDD Lower area, which will continue to be the main target in the first half of 2012. Exploration efforts during 2011 at Gualcamayo began late in the year due to limited access to the orebody during the first half of the year. Gualcamayo is expected to contribute more meaningfully to Company mineral reserve and mineral resource growth going forward.

Full ramp-up of Gualcamayo’s expansions to be completed by mid-2013 are expected to increase sustainable production to over 200,000 gold ounces per year beginning in 2014.

22

JACOBINA

| | Three months ended | | Years ended | |

| | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | |

Operating Statistics | | 2011 | | 2010 | | 2011 | | 2010 | | 2009 | |

Production | | | | | | | | | | | |

Gold production (ounces) | | 31,983 | | 33,718 | | 121,675 | | 122,160 | | 110,515 | |

Cash costs per ounce produced (i) | | $ | 646 | | $ | 495 | | $ | 643 | | $ | 535 | | $ | 476 | |

Ore mined (tonnes) | | 529,452 | | 542,055 | | 2,148,473 | | 2,158,097 | | 2,004,936 | |

Ore processed (tonnes) | | 527,537 | | 542,055 | | 2,148,275 | | 2,158,096 | | 1,996,989 | |

Gold Grade (g/t) | | 2.03 | | 2.06 | | 1.89 | | 1.89 | | 1.88 | |

Gold Recovery rate (%) | | 93.4 | | 94.1 | | 93.3 | | 93.2 | | 91.7 | |

Sales | | | | | | | | | | | |

Gold sales (ounces) | | 32,904 | | 33,530 | | 123,323 | | 121,405 | | 111,906 | |

| | | | | | | | | | | | | | | | |

Depletion, depreciation and amortization per gold ounce sold | | $ | 394 | | $ | 343 | | $ | 390 | | $ | 338 | | $ | 316 | |

(i) A cautionary note regarding non-GAAP measures is included in Section 15 of this Management’s Discussion and Analysis.

Jacobina produced 121,675 ounces of gold in 2011, compared with production of 122,160 ounces of gold in 2010. The decrease in production was mainly due to lower tonnage of ore processed.

Cash costs were $643 per ounce in 2011 compared with $535 per ounce in 2010.

Gold production at Jacobina was 31,983 ounces in the fourth quarter, compared with 33,718 ounces in the fourth quarter of 2010. The decrease in production was primarily a result of lower tonnage of ore processed and lower feed grade and recovery. Increased mine gallery reinforcement work also negatively affected production.

Cash costs were $646 per ounce of gold for the fourth quarter compared with $495 per ounce of gold in the fourth quarter of 2010 mainly due to mining inflation pressure, increase in hauling distance and increased secondary development. Additionally, more effort was undertaken on mine development during the quarter resulting in lower production and higher cash costs in the short term. Costs are expected to decrease in 2012.

The Company continues to focus on upgrading the current mineral resources to mineral reserves at Canavieiras and Morro do Vento and improving overall mineral reserve grade for the mine. Additional drilling during the fourth quarter was completed to upgrade inferred mineral resources to measured and indicated mineral reserves at both Canavieiras and Morro Do Vento. Successful infill drilling at Canavieiras and Morro do Vento resulted in measured and indicated mineral resource increases of approximately 392,000 ounces of gold in 2.2 million tonnes at 3.83 g/t and 81,000 gold ounces in 814,584 tonnes at 3.09 g/t, respectively representing potential additional mine life of more than three years. The gold grade at Canavieiras averaged approximately 3.83 g/t which improved the average grade of global mineral resources and mineral reserves. Mining of higher grade areas could increase average annual production at Jacobina to 140,000 gold ounces beginning in 2014. Production increases from higher grade and new gold ounces from new areas will utilize the existing processing capacity and hence should result in significant cash cost per ounce improvements.

Total gold mineral reserves for Jacobina increased by 20% compared to 2010 with consecutive increases in mineral reserves since acquisition of 69%. Measured and Indicated gold mineral resources have also increased since 2010 by 44%.

23

MINERA FLORIDA

| | Three months ended | | Years ended | |

| | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | |

Operating Statistics | | 2011 | | 2010 | | 2011 | | 2010 | | 2009 | |

Production | | | | | | | | | | | |

Gold equivalent (ounces) | | 23,151 | | 32,048 | | 102,738 | | 105,604 | | 91,877 | |

Gold production (ounces) | | 18,326 | | 27,787 | | 86,914 | | 94,585 | | 80,019 | |

Silver production (ounces) | | 241,208 | | 234,339 | | 791,173 | | 606,071 | | 652,192 | |

Cash costs per gold equivalent ounce produced (i) | | $ | 706 | | $ | 479 | | $ | 591 | | $ | 416 | | $ | 373 | |

Ore mined (tonnes) | | 191,206 | | 200,106 | | 848,373 | | 761,386 | | 718,603 | |

Ore processed (tonnes) | | 207,147 | | 214,859 | | 920,388 | | 779,836 | | 723,061 | |

Gold grade (g/t) | | 3.37 | | 4.68 | | 3.50 | | 4.41 | | 4.21 | |

Silver ore grade (g/t) | | 50.3 | | 45.1 | | 38.4 | | 33.4 | | 40.9 | |

Gold recovery rate (%) | | 83.5 | | 84.7 | | 84.0 | | 83.7 | | 82.3 | |

Silver recovery rate (%) | | 68.9 | | 70.6 | | 68.3 | | 67.8 | | 68.9 | |

Sales | | | | | | | | | | | |

Gold sales (ounces) | | 19,556 | | 26,116 | | 87,816 | | 91,907 | | 75,396 | |

Silver sales (ounces) | | 183,160 | | 242,468 | | 687,445 | | 600,156 | | 461,567 | |

| | | | | | | | | | | | | | | | |

Depletion, depreciation and amortization per gold equivalent ounce sold | | $ | 447 | | $ | 332 | | $ | 430 | | $ | 365 | | $ | 344 | |

(i) A cautionary note regarding non-GAAP measures is included in Section 13 of this Management’s Discussion and Analysis.

Annual production at Minera Florida totaled 102,738 GEO in 2011 compared with 105,604 GEO in 2010. Tonnes of ore processed increased by 18% in 2011 from 2010 levels. The combined impact of higher tonnage and higher silver feed grade resulted in an increase in silver production of 31%. Gold production decreased year over year as a result of lower gold feed grade.

Cash costs were $591 per GEO in 2011 compared with $416 per GEO in 2010.

Production of zinc, which is accounted for as a by-product, was 6,958 tonnes in 2011 versus 6,289 tonnes in 2010.

Minera Florida produced a total of 23,151 GEO in the quarter, representing a decrease of 28%, compared with 32,048 GEO in the fourth quarter of 2010, mainly as a result of a strike-related work stoppage at the mine. Operations returned to normal by year-end and a two-year collective bargaining agreement was signed.

Gold grade for the quarter was 3.37 g/t which was lower than the 4.68 g/t for the fourth quarter of 2010. In 2012 and years to follow, mine grade is expected to be consistent with mineral reserve grade and process efficiency will be augmented by low-cost historical tailings material. In 2012 production is expected to be in excess of 135,000 GEO with the start of production from the tailings re-treatment project.

In addition, the mine produced 1,586 tonnes of zinc in the three-month period ended December 31, 2011 compared with 1,519 tonnes of zinc produced in the fourth quarter of 2010. Zinc is accounted for as a by-product credit to cash costs.

Cash costs for the fourth quarter were $706 per GEO compared with $479 per GEO in the same quarter in 2010 primarily as a result of the work stoppage and to a lesser extent, mining inflation, higher energy costs and lower gold feed grades. In 2012, cash costs are expected to return to historical levels.

The Company’s expansion project at Minera Florida is designed to increase annual production by approximately 40,000 GEO per year for five years through the re-treatment of tailings. The construction of the project continues to advance and is expected to be completed in March with first production expected in April. Overall costs are expected to improve with the addition of tailings production given the lack of mining costs associated with the tailings products.