Draft Date: March 29, 2005

YAMANA GOLD INC.

RENEWAL ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2004

March 28, 2005

150 York Street, Suite 1902

Toronto, Ontario M5H 3S5

YAMANA GOLD INC.

RENEWAL ANNUAL INFORMATION FORM FOR THE

FISCAL YEAR ENDED DECEMBER 31, 2004

TABLE OF CONTENTS

DESCRIPTION | | PAGE NO. | |

| | | | |

ITEM 1 - INTRODUCTORY NOTES | | | 1 | |

ITEM 2 - CORPORATE STRUCTURE | | | 1 | |

ITEM 3 - GENERAL DEVELOPMENT OF THE BUSINESS OF THE COMPANY | | | 3 | |

| Overview of Business | | | 3 | |

| Three Year History | | | 3 | |

| Acquisitions and Dispositions | | | 5 | |

ITEM 4 - NARRATIVE DESCRIPTION OF THE BUSINESS | | | 6 | |

| Principal Products | | | 6 | |

| Competitive Conditions | | | 6 | |

| Operations | | | 6 | |

| Risks of the Business | | | 9 | |

| Technical Information | | | 15 | |

| Mineral Projects | | | 16 | |

ITEM 5 - DIVIDENDS | | | 65 | |

ITEM 6 - DESCRIPTION OF CAPITAL STRUCTURE | | | 65 | |

ITEM 7 - MARKET FOR SECURITIES | | | 66 | |

ITEM 8 - DIRECTORS AND OFFICERS | | | 67 | |

| Corporate Cease Trade Orders, Bankruptcies, Penalties or Sanctions | | | 69 | |

| Conflicts of Interest | | | 69 | |

ITEM 9 - PROMOTER | | | 70 | |

ITEM 10 - LEGAL PROCEEDINGS | | | 70 | |

ITEM 11 - INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 70 | |

ITEM 12 - AUDITORS, TRANSFER AGENT AND REGISTRAR | | | 71 | |

ITEM 13 - MATERIAL CONTRACTS | | | 71 | |

ITEM 14 - AUDIT COMMITTEE | | | 72 | |

ITEM 15 - INTERESTS OF EXPERTS | | | 73 | |

ITEM 16 - ADDITIONAL INFORMATION | | | 74 | |

SCHEDULE “A” - AUDIT COMMITTEE CHARTER | | | 75 | |

ITEM 1

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

Except for statements of historical fact relating to Yamana Gold Inc., certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as “plan,” “expect,” “project,” “intend,” “believe,” “anticipate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological data, fluctuating metal prices, the possibility of project cost overruns or unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and other factors described in this document under the heading “Risks to the Business”. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements.

Currency Presentation And Exchange Rate Information

This renewal annual information form contains references to both US dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “Canadian dollars” or “Cdn$”.

The closing, high, low and average exchange rates for the US dollar in terms of Canadian dollars for the years ended February 28, 2003, February 29, 2004 and December 31, 2004, as reported by the Bank of Canada, were as follows:

| | | Year Ended December 31 | | Year Ended February 29 | | Year Ended February 28 | |

| | | 2004 | | 2004 | | 2003 | |

| Closing | | $ | 1.20 | | $ | 1.33 | | $ | 1.49 | |

| High | | | 1.39 | | | 1.49 | | | 1.62 | |

| Low | | | 1.17 | | | 1.27 | | | 1.51 | |

Average(1) | | | 1.30 | | | 1.37 | | | 1.56 | |

(1)

Calculated as an average of the daily noon rates for each period.

On March 28, 2005, the Bank of Canada noon rate of exchange was US$1.00 = Cdn$1.22 or Cdn$1.00 = US$0.82.

ITEM 2

CORPORATE STRUCTURE

Yamana Gold Inc. (the “Company” or “Yamana”) was continued under theCanada Business Corporations Act by Articles of Continuance dated February 7, 1995. On August 15, 1995, pursuant to Articles of Amendment, the directors were authorized to determine the maximum number of directors, within the minimum and maximum numbers authorized in the Company’s articles, and to appoint one or more directors to hold office for a term expiring not later than the close of the next annual meeting of shareholders, the total number of directors so appointed not to exceed one-third of the number of directors elected at the previous annual meeting of shareholders. On February 7, 2001, pursuant to Articles of Amendment, the Company created, and authorized the issuance of a maximum of 8,000,000, first preference shares, Series 1. On July 30, 2003, pursuant to Articles of Amendment, the name of the Company was changed from Yamana Resources Inc. to Yamana Gold Inc. On August 12, 2003, the authorized capital of the Company was altered by consolidating all of the then issued and outstanding common shares of the Company on the basis of one new Common Share for 27.86 existing common shares. All references to Common Shares in this annual information form are to post-consolidation shares, unless otherwise noted.

The Company’s head office is located at 150 York Street, Suite 1902, Toronto, Ontario M5H 3S5 and its registered office is located at 2100 Scotia Plaza, 40 King Street West, Toronto, Ontario M5H 3C2.

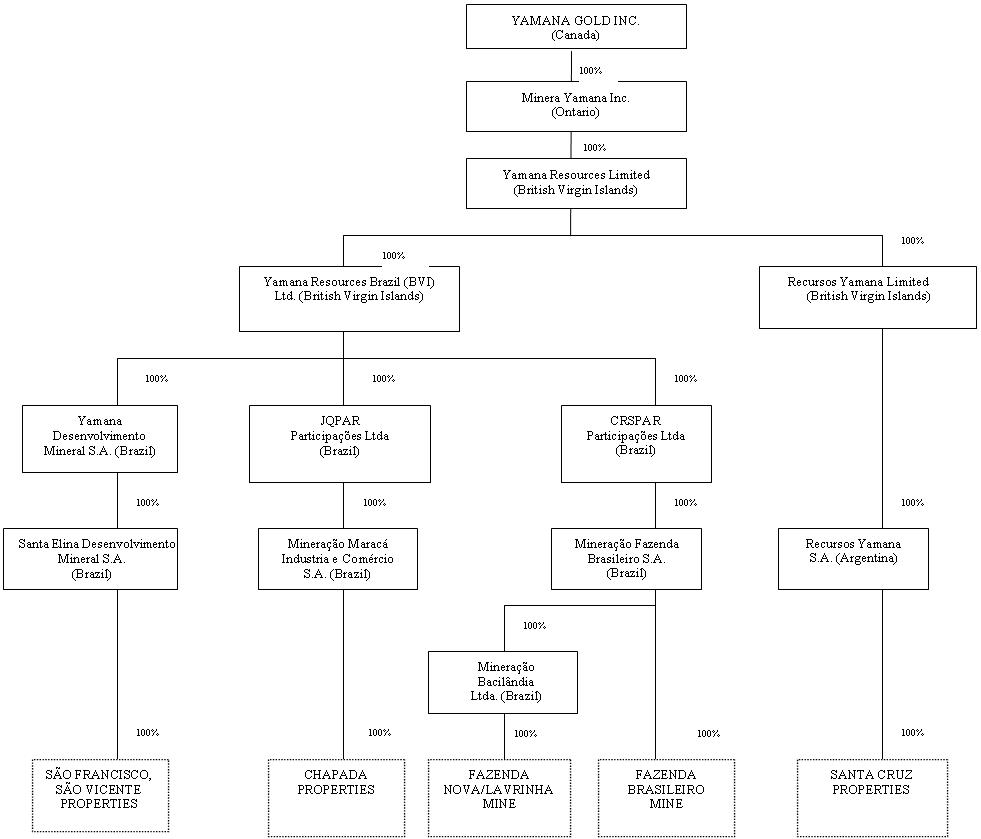

The following chart illustrates the Company’s principal subsidiaries (the “Subsidiaries”), together with the jurisdiction of incorporation of each company and the percentage of voting securities beneficially owned or over which control or direction is exercised by the Company. As used in this annual information form, except as otherwise required by the context, reference to the “Company” or “Yamana” means Yamana Gold Inc. and the Subsidiaries.

ITEM 3

GENERAL DEVELOPMENT OF THE BUSINESS OF THE COMPANY

Overview of Business

The Company is currently engaged in the acquisition, exploration, development and operation of mineral properties in Brazil and Argentina. In August 2003, the Company acquired the São Francisco, São Vicente and Fazenda Nova/Lavrinha properties (the “Santa Elina Properties”) and the Chapada copper-gold project (the “Chapada Properties”) in Brazil from Santa Elina Mines Corporation (“Santa Elina”) and the Fazenda Brasileiro gold mine (the “Fazenda Brasileiro Mine”) in Brazil from Companhia Vale do Rio Doce (“CVRD”). These acquisitions have made the Company a significant gold producer in Brazil and one of Brazil’s largest gold exploration landholders.

The Company also holds exploration gold properties in the eastern part of Santa Cruz Province in the Patagonian region of Argentina and the Cumaru and Gradaus properties in Brazil.

Three Year History

Between April 1999 and April 2002, Yamana’s activities were focused on developing and producing high-grade silver ore from the Company’s Martha Mine (“Mina Martha”), located in the western part of the province of Santa Cruz, Argentina. In April 2002, Yamana sold its interest in the Mina Martha Mine and the other silver-dominant properties in western Santa Cruz Province to Coeur d’Alene Mines Corporation. The sale of the western Santa Cruz silver properties allowed Yamana to refocus on its gold-dominant properties in the eastern part of Santa Cruz Province and to seek new exploration opportunities elsewhere in the world.

In April 2002, Yamana entered into an agreement (the “Santa Cruz Joint Venture”) with Compañia de Minas Buenaventura S.A.A. (“Buenaventura”), a Peruvian mining company, to fund a two-phase exploration program of the eastern region gold properties. Subsequently, Mauricio Hochschild & Compania S.A.C. (“Hochschild”), another Peruvian mining company, agreed to join the Santa Cruz Joint Venture. Each of Hochschild, in late 2003, and Buenaventura, in June 2004, withdrew from the Santa Cruz Joint Venture. The Company is currently evaluating its options with respect to exploring the eastern region gold properties, which may include seeking further joint venture partners, selling the properties or the Company conducting the exploration program on its own.

In October 2002, Yamana began an evaluation of its operations in view of the improvement of gold prices in early 2002. Yamana’s investigation of opportunities in South America resulted in the acquisition of an option to acquire, over a five year period, the 1,000-square-kilometre area of Cumaru, Brazil’s largest garimpeiro reserve, in the Carajas Region of Para State, Brazil.

As part of its developing emphasis on Brazil, in early 2003, Yamana began discussions with Santa Elina. From April to July 2003, Yamana and Santa Elina negotiated the terms of the acquisition of the Santa Elina Properties and the Chapada Properties from Santa Elina and the acquisition of the Fazenda Brasileiro Mine from CVRD. The Chapada Properties are composed of the Chapada copper-gold project and other exploration lands in northern Goiás State, Brazil. The Santa Elina Properties include São Francisco project and São Vicente property and two advanced pre-production gold projects, the Fazenda Nova Mine and the Lavrinha property, as well as some exploration projects, claims and concessions in Brazil. The pre-production projects were all in advanced stages of permitting and licensing. The Fazenda Nova Mine and the Lavrinha property are located in the Goiás Mineral District in central Goiás State, while São Vicente and São Francisco are located approximately 50 kilometres apart along the Santa Elina Gold Belt in west central Mato Grosso State near the Bolivian border.

On July 31, 2003, the Company closed a private placement for gross proceeds of Cdn.$55.5 million to fund the acquisition of the Fazenda Brasileiro Mine and the development of the Santa Elina Properties.

In connection with the acquisition of the Santa Elina Properties, the Chapada Properties and the Fazenda Brasileiro Mine, in August 2003 the Company’s board of directors was increased from six to seven members and was reconstituted. The board of directors is currently comprised of Peter Marrone, Antenor Silva, Jr., Juvenal Mesquita, James Askew, Victor Bradley, Patrick Mars and Lance Tigert. Peter Marrone was appointed President and Chief Executive Officer of the Company.

On December 23, 2003, Yamana closed a public offering for gross proceeds of Cdn.$27.7 million to fund the advancement of the Company’s mineral projects, potential acquisitions and general corporate purposes.

In January 2004, the Company commenced construction at its Fazenda Nova Mine, which was completed in the second half of 2004. The decision to construct the mine was based on a feasibility study dated November 2003 prepared by Kappes Cassiday & Associates. Gold production at the mine began in late 2004 and 2005 will be the first full year of production at the mine.

On October 15, 2004, the Company secured a $100 million debt financing commitment from Amulet Limited (“Amulet”), a private investment fund advised by Amaranth Advisors (Canada) ULC, and entered into a subscription agreement with Amulet dated as of October 15, 2004 (the “Subscription Agreement”) whereby Amulet agreed to subscribe for $100 million of senior secured notes of the Company (“Senior Secured Notes”). The proceeds from the issue and sale of the Senior Secured Notes will be used to fund construction of the Chapada Project.

The Senior Secured Notes will have a six year term with principal repayable in full at maturity. The Senior Secured Notes will bear interest at the rate of 10.95% per annum and interest is payable semi-annually. At the option of the Company, interest may be accrued during the first two years, in which case the interest rate will be 12.45%. The Company has the right, but not the obligation, to pay interest (but not principal) in common shares, subject to the Company obtaining all necessary regulatory approvals, based on the prevailing market price of the common shares at the time. The Senior Secured Notes will be secured against all of the assets of the Company and its material subsidiaries and will be guaranteed by certain subsidiaries of the Company, including each of its material subsidiaries. The Company may redeem the Senior Secured Notes at any time after three years from the date of issue at a redemption price, payable in cash, of the principal amount plus a premium and any accrued but unpaid interest.

The Senior Secured Notes will be created and issued pursuant to a trust indenture (the “Trust Indenture”) entered into between the Company and BNY Trust Company of Canada as of December 21, 2004. During the period prior to drawdown, the forms of security agreements will be settled and security will be registered. The proceeds of the debt financing will be registered with the Brazilian Central Bank prior to the advance of the proceeds to the Company.

The subscription for the Senior Secured Notes under the Trust Indenture may occur on or before April 30, 2005, which date may be extended by 60 days at the option of the Company. The entire amount of the proceeds from the issue and sale of the Senior Secured Notes will be advanced to the Company in a single tranche. The issue and sale of the Senior Secured Notes is subject to certain conditions including receipt of all requisite regulatory approvals.

In connection with the financing commitment, the Company has paid fees of $1,350,000 and will pay a further facility fee of $850,000 upon funding.

As additional consideration, the Company has issued common share purchase warrants to Amulet to purchase up to 5 million common shares pursuant to the terms of the Subscription Agreement. Of such warrants, (a) warrants to purchase up to 1,250,000 Common Shares are exercisable at a price of Cdn$4.05 per share at any time until October 15, 2009; (b) warrants to purchase up to 1,250,000 Common Shares are exercisable at a price of Cdn$4.05 per share at any time until December 15, 2009; and (c) warrants to purchase up to 2,500,000 Common Shares are exercisable at a price equal to 125% of the prevailing market price of the common shares on the TSX at the time of funding, at any time during the period from funding of the Senior Secured Notes until five years thereafter.

On November 9, 2004, Yamana closed a public offering of 26,377,000 common shares for gross proceeds of Cdn$91 million to fund the advancement of the Company’s mineral projects, potential acquisitions and general corporate purposes.

In November 2004, the Company made a formal construction decision at its Chapada Property, based on the results of an updated feasibility study on the property completed in August 2004. The Company plans to commence production at the property in early 2007.

In November 2004, the Company made a formal construction decision at is São Francisco gold project, upon the completion of a final feasibility study for São Francisco, and construction was commenced shortly thereafter. With construction now underway, production at São Francisco is planned for the fourth quarter of 2005.

Acquisitions and Dispositions

Santa Elina Properties

On August 12, 2003, Yamana acquired (i) a 100% interest in Mineração Bacilândia Ltda., the holder of the Fazenda Nova/Lavrinha properties; (ii) a 100% economic interest in Santa Elina Desenvolvimento Mineral S.A., the holder of the São Francisco and São Vicente properties; pursuant to an amended and restated agreement (the “Share Purchase Agreement”) entered into with Santa Elina dated June 23, 2003. In order to comply with legal restrictions applicable to border areas, 74.5% of the common shares of Santa Elina Desenvolvimento Mineral S.A. are held by Yamana Desenvolvimento Mineral S.A. FTFPAR Participações Ltda. holds 51% of the common shares of Santa Elina Desenvolvimento Mineral S.A in trust for Yamana Desenvolvimento Mineral S.A. and a shareholders’ agreement was entered into between Yamana and MSP, providing that, among other things, MSP will hold such shares for the benefit of Yamana and that Yamana controls the voting and disposition of such shares. Pursuant to the Share Purchase Agreement, Yamana issued 14,677,380 common shares and 7,338,690 warrants to Santa Elina.

Chapada Properties

On August 12, 2003, Yamana, through a wholly-owned subsidiary, acquired all of the shares of Mineração Maracá Industria e Comércio S.A. (“Mineração Maracá”), an affiliate of Santa Elina and the holder of the Chapada Properties, and any intercompany loans owing by Mineração Maracá to Santa Elina, pursuant to an amended and restated option agreement (the “Chapada Agreement”) entered into with Mineração Maracá dated as of June 23, 2003. Pursuant to the Chapada Agreement, the aggregate consideration paid by Yamana was $24,250,000, payable by the issuance of 20,208,333 common shares and 10,104,166 warrants.

Fazenda Brasileiro Mine

On August 12, 2003, Yamana acquired all of the shares of Mineração Fazenda Brasileiro S.A. (“Mineração Brasileiro“), an affiliate of Santa Elina. On August 15, 2003, pursuant to an agreement (the “Fazenda Brasileiro Acquisition Agreement”) entered into among Santa Elina, Mineração Brasileiro and CVRD dated June 17, 2003, Mineração Brasileiro acquired the Fazenda Brasileiro Mine for $20.9 million in cash. The range of environmental liabilities and closure costs assumed by Mineração Brasileiro was $5.6 million to $6.6 million as at 2007 assuming closure of the mine at that time and the mine life not being further extended. Some of these obligations have been settled, and the book value of environmental liabilities and closure costs at Fazenda Brasileiro as at December 31, 2004 was $4,944,800. Yamana paid Canaccord Capital Corporation (“Canaccord”) a fiscal advisory fee of Cdn.$450,000 in connection with the Fazenda Brasileiro Acquisition pursuant to a fiscal advisory agreement dated July 25, 2003 between Yamana and Canaccord. Yamana paid Canaccord Cdn.$125,000 for other services under the fiscal advisory agreement including sponsorship of the Company on the TSX.

Other Acquisitions and Dispositions

In April 2002, Yamana closed a three-way agreement (the “Coeur-Northgate Agreement”) with Coeur and Northgate in which Coeur acquired Compañia Minera Polimet S.A. (“Polimet”), a former Argentine subsidiary of Yamana and all its assets located in Santa Cruz Province, Argentina, in exchange for satisfying in full Yamana’s loan obligation to Northgate under a two year $4,000,000 loan facility (later increased to $4,500,000). Under the Coeur-Northgate Agreement, Coeur agreed to transfer from Polimet back to Yamana’s Argentine subsidiary, RYSA, all Santa Cruz properties and assets in the gold-dominant eastern part of the province while Polimet retains ownership of only the silver-dominant properties and assets in the western part of the province.

In January 2003, Yamana acquired from the Cumaru Garimpeiro Cooperativa a 100% interest in the 970-square kilometre Cumaru Garimpeiro Reserve and the adjoining 17-square kilometre Gradaus mining property located in Brazil. Gradaus consists of partially developed private ground with an active mining license and a modern operations camp. Pursuant to the land agreement, Yamana is required to make property payments of approximately $1,300,000 over the next three years with the final payment due on February 28, 2008.

ITEM 4

NARRATIVE DESCRIPTION OF THE BUSINESS

Yamana is engaged in the acquisition, financing, exploration, development and operation of precious metal mining properties in Brazil and Argentina.

Principal Products

The Company’s principal product is gold, with gold production forming a significant part of revenues. There is a global gold market into which Yamana can sell its gold and, as a result, the Company will not be dependent on a particular purchaser with regard to the sale of the gold that it produces.

The Company expects to begin producing copper in 2007, which is expected to add to the revenues and cash flow generated from its gold production.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Operations

Employees

As of December 31, 2004, the Company has approximately 745 employees. In addition to this, the Company employs approximately562 contractors at its operations.

Foreign Operations

The Company is entirely dependent upon its foreign operations, as all of its precious metal mining properties are located in Brazil and Argentina. The Company currently owns the Fazenda Brasileiro Mine, the São Francisco/São Vicente property, Fazenda Nova Mine and the Lavrinha property, the Chapada Properties and the Cumaru-Gradaus properties in Brazil and the Santa Cruz properties in Argentina. Any changes in regulations or shifts in political attitudes in Brazil or Argentina are beyond the control of the Company and may adversely affect its business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. The effect of these factors cannot be accurately predicted.

Brazil

Brazil is one of the ten largest economies in the world, and South America’s largest country in population and area. It is a constitutional democracy with a strong national policy encouraging foreign investment. No special taxes or registration requirements are imposed on foreign-owned companies and foreign investment capital is treated equal to domestic capital.

Brazil ranks as one of the world’s leading jurisdictions for mining investment. The country offers extensive infrastructure, a large pool of skilled technical and professional personnel, and an established legal system. Mineral resources are defined and mining rights guaranteed under Brazil’s Federal Constitution, Federal Mining Code and various Executive Laws. The Federal Government collects royalties on mineral production; up to half this royalty is paid to the surface land owner.

Brazilian Mining Laws

Under the Brazilian Constitution, mineral deposits represent a property interest separate from the surface rights and belong to the federal government. The prospecting and mining of mineral resources in Brazil may be carried out by Brazilians or by companies duly incorporated in Brazil, which hold a license or concession granted by the federal government.

Certain royalties are levied on mineral production in accordance with Brazilian law. The current statutory royalty imposed by the federal government on gold properties is 1% of net smelter revenue ("NSR"). Of this 1% NSR, 65% is payable to the municipality, 23% is payable to the state government, and 12% is payable to the federal government. The statutory royalty for copper properties is 2%.

The DNPM. In Brazil, mining activity requires the grant of licenses and concessions from the Departamento Nacional da Produção Mineral (the "DNPM"), an agency of the Brazilian federal government responsible for controlling and enforcing the Brazilian Mining Code. Agreements with landowners are also required. Government concessions consist of: (i) applications for exploration licenses; (ii) exploration licenses; and (iii) mining concessions. The area covered by concessions is limited to 10,000 hectares but may be smaller in area depending upon the region where the concession is situated.

Applications for Exploration Licenses. An application for an exploration license must be supported by a location map, exploration plan and motivation report, and must comply with certain other requirements. Provided the area of interest is not already covered by a pre-existing application or exploration license and that all requirements are met, the DNPM would normally grant the permit on a priority of application basis. Applications are sequentially numbered and dated on filing with the DNPM.

Exploration Licenses. An exploration license entitling the holder to prospect must be requested in an exploration application addressed to the DNPM which, when registered, guarantees the applicant priority if the prospect applied for is not already covered by a geological reconnaissance permit, exploration license, mining concession or mine manifest in favour of others, and if no prior application has been filed for authorization to prospect in the same area. An exploration license from the DNPM specifies the properties included within the area of prospecting and defines the latter by locality, boundaries and surface area.

An exploration license is valid for up to three years, can be renewed for a further period under special conditions and may be transferred. Exploration must begin within 60 days of the issuance of the license and must not be suspended for more than three consecutive months or 120 non-consecutive days. Otherwise, the DNPM has the discretion to terminate the license. Within the term of an exploration license, the holder of an exploration license must carry out the work necessary to determine the existence and extent of a mineral deposit and to assess its exploitability in economical and technical terms. In addition, the holder of an exploration license must submit to the DNPM a report of exploratory work done. Upon submission of that report, the DNPM has the right to inspect the area to confirm the accuracy of the report and shall approve the report when the existence of a mineral deposit has been confirmed. Upon approval of that report, the holder of the license has one year to apply for a mining concession. In exceptional cases the extraction of mineral substances in authorized areas may be permitted before the granting of a mining concession, subject to the prior authorization of the DNPM.

Mining Concessions. An application for a mining concession must be addressed to the Brazilian Mining Ministry by the holder of an approved exploration license, supported by information regarding the plan for economic development of the deposit, including a description of the mining plan, the processing plants, proof of the availability of funds or existence of financial arrangements for carrying out the economic development plan and operation of the mine.

Applications for mining concessions must also include an independently prepared environmental plan that must deal with water treatment, soil erosion, air quality control, revegetation and reforestation (where necessary) and reclamation. Mining concessions will not be granted unless the mining plan, including the environmental plan, is approved by the state authorities. The mining concession, once granted, will contain terms and conditions of the concession which will include terms and conditions relating to environmental matters. Terms relating to environmental matters may include employment conditions for employees working with hazardous materials (such as periodic employee rotation), a code for mine construction (as may be necessary, for example, to avoid contamination of soil and ground water, for proper drainage and to limit erosion), tailings disposal guidelines, procedures and timetables for revegetation and reforestation, and the plan for reclamation once mining is completed.

Site visits by governmental authorities to properties where mining concessions are granted occur on a regular basis (generally, the frequency of visits will depend upon the nature of the work being undertaken and the length of the prior visit) and annual progress or status reports must be submitted by the mining company that holds the mining concession. Those visits or reports may require a mining company to adopt changes to the mining plan based on the recommendations made by governmental authorities. Failure to comply with the recommendations may result in fines, damages, restitution and, if such punitive actions are not complied with, imprisonment for officers of the mining company. A mining company's annual operating permit may not be renewed if the mining company has not complied with the recommendations.

The holder of an approved Brazilian mining concession must, among other things, start working within six months after publication of the mining concession. The mining work, once commenced, cannot be interrupted for more than six consecutive months except for proven reasons of force majeure, otherwise the concession may be revoked. The mining company is also required to file with the DNPM annually, detailed statistical reports on the mine's performance. Mining concessions are not limited in time and will remain valid until full depletion of the mineral deposit. Mining concessions can be transferred between parties qualified to hold them. The holder of a mining concession is entitled to sell or lease the concession subject to the approval of the appropriate governmental authority which will be granted if the conditions provided for in the applicable legislation are met. Once a mining concession is granted, a mining company is required to obtain an operating permit for each mine that is operated. The operating permit is renewed annually subject to compliance with environmental matters.

No significant fees or other payments are required to be paid in connection with the issuance of an exploration licence, an application for an exploration license or mining concession, or a mining concession itself. However, surface owners must be compensated for disturbance of their farming and other activities. If compensation cannot be resolved by negotiation between the parties, then any such dispute will be resolved by the courts based upon tradition for the region and type of mining.

Foreign Investment Controls. In accordance with Brazilian laws and regulations, foreign investment must be registered at the Central Bank of Brazil (the "Central Bank"). Such registration is electronic, and no preliminary official authorization is required for investment in currency. The investment to subscribe for capital or to buy a stake in an existing Brazilian company can be remitted to Brazil through any banking establishment authorized to deal in foreign exchange. However, closing of the exchange contract is conditional on the existence of an Electronic Declaratory Registry (RDE) registration number for the foreign investor and the Brazilian investee. The RDE is part of the Central Bank Information System (SISBACEN). The registration of investments as foreign capital, as evidenced by the appropriate Central Bank electronic registration, grants the foreign investor the right to repatriate the registered investments and to remit after-tax earnings attributable to such investments. These earnings may be reinvested in Brazil, either through their capitalization in the entity which produced the earnings or their investment in another Brazilian entity. Such capitalized earnings may then be registered as foreign capital with the Central Bank in foreign currency.

On the ultimate sale of an investment in Brazil, current Brazilian regulations provide that the foreign investor may remit the proceeds of the sale free of withholding tax up to the amount of the registered foreign capital of the remitter.

Environmental Policy

Yamana has implemented an environmental health and safety policy that is fundamental to its mining operations. The Company, in its extraction and production of gold, is guided by principals of sustainable growth and development assuming the following commitments:

| (1) | to continuously employ in its activities and products environmental advancements that reduce pollution, environmental, health and safety risks, adhering to applicable environmental, health and safety laws and legislations; |

| (2) | to prioritize the development of more efficient, safer and pollution minimizing technology, and contribute technologically to the improvement of the environmental performance of its processes, products and services of its suppliers, and contractors; |

| (3) | to train, educate and motivate employees and contractors, to execute their tasks and duties in a safe and environmentally responsible manner; |

| (4) | to adapt a healthy and safe working environment, in which maintenance and support of this environment is the responsibility of all employees and consultants in accordance with their functions and activities; |

| (5) | to establish environmental, health and safety objectives and goals, and taking care that they are periodically reviewed and documented and communicated to interested parties and the general public; |

| (6) | to establish in the management of environmental, health and safety policies, recommendations to our suppliers and contractors of products and services and in doing so to consider the expectations of interested parties, such as clients, employees, shareholders and the community; and |

| (7) | to build and operate facilities according to applicable international standards for environmental compliance. |

Risks of the Business

The operations of the Company are speculative due to the high-risk nature of its business which is the acquisition, financing, exploration, development and operation of mining properties. These risk factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company.

Exploration, Development and Operating Risks

Mining operations generally involve a high degree of risk. Yamana's operations are subject to all the hazards and risks normally encountered in the exploration, development and production of gold and copper, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding pit wall failure and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although adequate precautions to minimize risk will be taken, milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability.

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Yamana will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices that are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Yamana not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Yamana towards the search and evaluation of mineral deposits will result in discoveries or development of commercial quantities of ore.

Insurance and Uninsured Risks

Yamana’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company's properties or the properties of others, delays in mining, monetary losses and possible legal liability.

Although Yamana maintains insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with a mining company's operations. Yamana may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to Yamana or to other companies in the mining industry on acceptable terms. Yamana might also become subject to liability for pollution or other hazards that may not be insured against or that Yamana may elect not to insure against because of premium costs or other reasons. Losses from these events may cause Yamana to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Environmental Risks and Hazards

All phases of the Company's operations are subject to environmental regulation in the various jurisdictions in which it operates. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that existing or future environmental regulation will not materially adversely affect the Company's business, financial condition and results of operations. Environmental hazards may exist on the properties on which the Company holds interests that are unknown to the Company at present and that have been caused by previous or existing owners or operators of the properties.

Government approvals and permits are currently, or may in the future be, required in connection with the Company's operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from proceeding with planned exploration or development of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations, including the Company, may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or production costs, reduction in levels of production at producing properties, or abandonment or delays in development of new mining properties.

Infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company's operations, financial condition and results of operations.

Uncertainty in the Estimation of Mineral Reserves and Mineral Resources

The figures for Mineral Reserves and Mineral Resources contained in this annual information form are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that Mineral Reserves could be mined or processed profitably. There are numerous uncertainties inherent in estimating Mineral Reserves and Mineral Resources, including many factors beyond the Company’s control. Such estimation is a subjective process, and the accuracy of any reserve or resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the Mineral Reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Fluctuation in gold prices, results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of such estimate. The volume and grade of reserves mined and processed and recovery rates may not be the same as currently anticipated. Any material reductions in estimates of Mineral Reserves and Mineral Resources, or of the Company’s ability to extract these Mineral Reserves, could have a material adverse effect on the Company’s results of operations and financial condition.

Need for Additional Reserves

Because mines have limited lives based on proven and probable reserves, the Company must continually replace and expand its reserves as its mines produce gold. The life-of-mine estimates included in this annual information form may not be correct. The Company’s ability to maintain or increase its annual production of gold will be dependent in significant part on its ability to bring new mines into production and to expand reserves at existing mines.

Land Title

The acquisition of title to mineral properties is a very detailed and time-consuming process. Title to, and the area of, mineral concessions may be disputed. Although the Company believes it has taken reasonable measures to ensure proper title to its properties, there is no guarantee that title to any of its properties will not be challenged or impaired. Third parties may have valid claims underlying portions of the Company's interests, including prior unregistered liens, agreements, transfers or claims, including native land claims, and title may be affected by, among other things, undetected defects. In addition, the Company may be unable to operate its properties as permitted or to enforce its rights with respect to its properties.

Competition

The mining industry is intensely competitive in all of its phases and the Company competes with many companies possessing greater financial and technical resources than itself. Competition in the precious metals mining industry is primarily for mineral rich properties that can be developed and produced economically; the technical expertise to find, develop, and operate such properties; the labour to operate the properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a global basis. Such competition may result in the Company being unable to acquire desired properties, to recruit or retain qualified employees or to acquire the capital necessary to fund its operations and develop its properties. Existing or future competition in the mining industry could materially adversely affect the Company's prospects for mineral exploration and success in the future.

Additional Capital

The exploration and development of the Company's properties, including continuing exploration and development projects, and the construction of mining facilities and commencement of mining operations, will require substantial additional financing. Failure to obtain sufficient financing will result in a delay or indefinite postponement of exploration, development or production on any or all of the Company's properties or even a loss of a property interest. The only source of funds now available to the Company is through the sale of equity capital, properties, royalty interests or the entering into of joint ventures. Additional financing may not be available when needed or if available, the terms of such financing might not be favourable to the Company and might involve substantial dilution to existing shareholders. Failure to raise capital when needed would have a material adverse effect on the Company's business, financial condition and results of operations.

Commodity Prices

The profitability of the Company’s operations will be dependent upon the market price of mineral commodities. Mineral prices fluctuate widely and are affected by numerous factors beyond the control of the Company. The level of interest rates, the rate of inflation, the world supply of mineral commodities and the stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The price of mineral commodities has fluctuated widely in recent years, and future price declines could cause commercial production to be impracticable, thereby having a material adverse effect on the Company's business, financial condition and results of operations.

Furthermore, reserve calculations and life-of-mine plans using significantly lower gold prices could result in material write-downs of the Company’s investment in mining properties and increased amortization, reclamation and closure charges.

In addition to adversely affecting the Company’s reserve estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Governmental Regulation of the Mining Industry

The mineral exploration activities of the Company are subject to various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances and other matters. Mining and exploration activities are also subject to various laws and regulations relating to the protection of the environment. Although the Company believes that its exploration activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail production or development of the Company’s properties. Amendments to current laws and regulations governing the operations and activities of the Company or more stringent implementation thereof could have a material adverse effect on the Company's business, financial condition and results of operations.

Foreign Operations

The Company's operations are currently conducted in Brazil and Argentina and, as such, the Company's operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties vary from country to country and include, but are not limited to, terrorism; hostage taking; military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labour unrest; the risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licences, permits and contracts; illegal mining; changes in taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

Changes, if any, in mining or investment policies or shifts in political attitude in Brazil or Argentina may adversely affect the Company's operations or profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Company's operations or profitability.

Labour and Employment Matters

While the Company has good relations with both its unionized and non-unionized employees, production at its mining operations is dependant upon the efforts of the Company's employees. In addition, relations between the Company and its employees may be affected by changes in the scheme of labour relations that may be introduced by the relevant governmental authorities in whose jurisdictions the Company carries on business. Changes in such legislation or in the relationship between the Company and its employees may have a material adverse effect on the Company's business, results of operations and financial condition.

Foreign Subsidiaries

The Company is a holding company that conducts operations through Brazilian and Argentinean subsidiaries and substantially all of its assets are held in such entities. Accordingly, any limitation on the transfer of cash or other assets between the parent corporation and such entities, or among such entities, could restrict the Company’s ability to fund its operations efficiently. Any such limitations, or the perception that such limitations may exist now or in the future, could have an adverse impact on the Company’s valuation and stock price.

Market Price of Common Shares

The Common Shares are listed on the Toronto Stock Exchange (the “TSX”), the American Stock Exchange (“Amex”) and the London Alternative Investment Market (“AIM”). Securities of small-cap companies have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America and globally and market perceptions of the attractiveness of particular industries. The Company’s share price is also likely to be significantly affected by short-term changes in gold prices or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to the Company’s performance that may have an effect on the price of the Common Shares include the following: the extent of analytical coverage available to investors concerning the Company’s business may be limited if investment banks with research capabilities do not continue to follow the Company’s securities; the lessening in trading volume and general market interest in the Company’s securities may affect an investor's ability to trade significant numbers of Common Shares; the size of the Company’s public float may limit the ability of some institutions to invest in the Company’s securities.

As a result of any of these factors, the market price of the Common Shares at any given point in time may not accurately reflect the Company’s long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management's attention and resources.

Dividend Policy

No dividends on the Common Shares have been paid by the Company to date. The Company anticipates that it will retain all future earnings and other cash resources for the future operation and development of its business. The Company does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends will be at the discretion of the Company's board of directors after taking into account many factors, including the Company's operating results, financial condition and current and anticipated cash needs.

Dilution to Common Shares

As of February 28, 2005, approximately 50,094,311 Common Shares were issuable on exercise of warrants, options or other rights to purchase Common Shares at prices ranging from Cdn.$1.50 to Cdn.$5.57.

During the life of the warrants, options and other rights, the holders are given an opportunity to profit from a rise in the market price of the Common Shares with a resulting dilution in the interest of the other shareholders. The Company’s ability to obtain additional financing during the period such rights are outstanding may be adversely affected and the existence of the rights may have an adverse effect on the price of the Common Shares. The holders of the warrants, options and other rights may exercise such securities at a time when the Company would, in all likelihood, be able to obtain any needed capital by a new offering of securities on terms more favourable than those provided by the outstanding rights.

The increase in the number of Common Shares in the market and the possibility of sales of such shares may have a depressive effect on the price of the Common Shares. In addition, as a result of such additional Common Shares, the voting power of the Company's existing shareholders will be substantially diluted.

Future Sales of Common Shares by Existing Shareholders

Sales of a large number of Common Shares in the public markets, or the potential for such sales, could decrease the trading price of the Common Shares and could impair the Company’s ability to raise capital through future sales of Common Shares. Substantially all of the Common Shares not held by affiliates of the Company can be resold without material restriction either in the United States, in Canada or both.

Dependence Upon Key Management Personnel and Executives

The Company is dependent upon a number of key management personnel, including its President and Chief Executive Officer. The loss of the services of one or more of such key management personnel could have a material adverse effect on the Company. The Company's ability to manage its exploration and development activities, and hence its success, will depend in large part on the efforts of these individuals. The Company faces intense competition for qualified personnel, and there can be no assurance that the Company will be able to attract and retain such personnel. The Company has entered into employment agreements with certain of its key executives.

Possible Conflicts of Interest of Directors and Officers of the Company

Certain of the directors and officers of the Company also serve as directors and/or officers of other companies involved in natural resource exploration and development and consequently there exists the possibility for such directors and officers to be in a position of conflict. The Company expects that any decision made by any of such directors and officers involving the Company will be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Company and its shareholders, but there can be no assurance in this regard. In addition, each of the directors is required to declare and refrain from voting on any matter in which such directors may have a conflict of interest with or which are governed by the procedures set forth in the Canada Business Corporations Act and any other applicable law.

History of Losses

Although the Company retained earnings of $263,000 as at December 31, 2004, and had recorded earnings of $1,007,646 for the year ended February 29, 2004, the Company has previously experienced operating losses since its incorporation on March 17, 1994. Prior to August 2003, the Company was an early stage exploration company. The loss for the year ended February 28, 2003 amounted to $3,391,949. The Company had an accumulated deficit of $52,644,546 as at February 28, 2002 and on August 30, 2002, Yamana’s shareholders approved the elimination of this deficit by way of a corresponding reduction to capital stock. There can be no assurance that the Company will be able to sustain profitability in the future.

Copper Supply Industry Subject to World-Wide Antitrust Investigation

The Company expects to begin producing copper in 2007. There is currently a multijurisdictional and industry-wide investigation relating to the competition practices in the copper concentrate market. The Company cannot determine the impact, if any, this investigation will have on operations, the copper industry, copper prices or the Company’s ability to profit from the production of copper.

Technical Information

The estimated mineral reserves and mineral resources for the Fazenda Brasileiro Mine, the Fazenda Nova Mine, the São Francisco property, the São Vincente property and the Chapada property have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Council Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council on August 20, 2000 (the “CIM Standards”). The following definitions are reproduced from the CIM Standards:

The term “Mineral Resource” means a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

The term “Inferred Mineral Resource” means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term “Indicated Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The term“Measured Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The term“Mineral Reserve” means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term“Probable Mineral Reserve” means the economically mineable part of an Indicated Mineral Resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term“Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This section uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies.United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

Average Total Cash Costs

“Average total cash costs” figures are calculated in accordance with a standard developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is the accepted standard of reporting cash costs of production in North America. Adoption of the standard is voluntary and the cost measures presented herein may not be comparable to other similarly titled measures of other companies. Costs include mine site operating costs such as mining, processing, administration, royalties and production taxes, but are exclusive of amortization, reclamation, capital, development and exploration costs. These costs are then divided by ounces sold to arrive at the total cash costs of sales. The measure, along with sales, is considered to be a key indicator of a company’s ability to generate operating earnings and cash flow from its mining operations. This data is furnished to provide additional information and is a non-GAAP measure. It should not be considered in isolation as a substitute for measures of performance prepared in accordance with GAAP and is not necessarily indicative of operating costs presented under GAAP.

Mineral Projects

Fazenda BrasileiroMine

The disclosure under the heading “Narrative Description of the Business - Mineral Projects - Fazenda Brasileiro Mine” has been derived, in part, from a technical report dated July 4, 2003 entitled “A Technical Review of the Fazenda Brasileiro Gold Mine and Adjacent Exploration Property in Bahia State, Brazil for Santa Elina Mines Corporation” prepared by John R. Sullivan, P.Geo., Senior Associate Geologist, G. Ross MacFarlane, P.Eng., Senior Associate Metallurgical Engineer, and Velasquez Spring, P.Eng., Senior Geologist, of Watts, Griffis and McOuat Limited (“WGM”), each of whom is a “qualified person” as defined in National Instrument 43-101. Certain disclosure has also been derived from an estimate of mineral reserves dated December 31, 2004 prepared by Porfirio Cabeleiro Rodriguez, Geostatitician, and reviewed by Mel Klohn, Geologist Consultant, as a “qualified person” as defined in National Instrument 43-101.

Property Description and Location

The Fazenda Brasileiro property includes a producing gold mine and approximately 150,000 hectares of adjacent exploration properties. It is located in northeast Brazil in the eastern portion of Bahia state, 180 kilometres NNW of the state capital city of Salvador. The property, all of which is within the Rio Itapicura Greenstone Belt (“RIGB”), can be roughly divided into two parts. One part covers the east-west trending Weber Belt, which hosts the mine, operating open pits and areas of immediate exploration potential. The other part covers large portions of the north-south trending portion of the RIGB and several exploration permits southwest of the mining area. The Weber Belt area is comprised of 15 contiguous tenements at various stages of the Brazilian tenure process, totalling approximately 12,000 hectares. The remaining area is comprised of 61 blocks, many of which are contiguous and all at various stages of the tenure process, totalling approximately 60,000 hectares in area.

Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Fazenda Brasileiro site is accessed from Salvador via 180 kilometres of paved roads, including two-lane and four-lane highways and secondary paved highways to the village of Teofilandia, which is 15 kilometres by road southeast of the mine. This road from Teofilandia to the mine is unpaved but of good quality. There are numerous direct flights daily from Salvador to São Paulo and other major Brazilian cities from which connections are available to a variety of international destinations. Various secondary and tertiary roads, some of poor quality, lead from the mine area to portions of the exploration properties although the routes are circuitous.

The climate is semi-arid and seasonal variations are minimal but rain is more prevalent between November and January. Average annual rainfall, measured on the site, is around 500 millimetres. Average annual temperature is approximately 24° Celsius with virtually no month-to-month variation.

The town of Teofilandia serves as the main community for workers at the mine and there is a much smaller village between it and the mine. The local population is approximately 15,000 people, the vast majority of whom live in Teofilandia. The general area of the exploration properties is inhabited largely by subsistence farmers and garimpeiros. Outside of the Fazenda Brasileiro mine, local economic activity consists of subsistence agriculture, goat herding and cattle ranching.

Teofilandia is a full service town and it and the mine are served by the national power grid and highways. There is a freight-only rail line that passes close to the mine, but it is not used by the mine.

Mine site infrastructure includes a 470 metre vertical shaft; a series of underground ramps; a 960,000 tonnes per year carbon-in-pulp (“CIP”) milling facility; a series of plastic lined tailings disposal ponds; a warehouse and maintenance shops; drill core logging, splitting and storage facilities; a sample preparation facility and assay laboratory; a cafeteria; a helicopter landing pad from which gold bullion is shipped off site and several office complexes. In addition, the mine has a water system consisting of a well field located east of Teofilandia, a buried pipeline and a pumping system to provide potable and processing water to Teofilandia and the mine.

Topography is gently rolling with elevations of 300 to 500 metres above mean sea level. Relief is generally 50 to 100 metres although there are occasional hills and series of hills rising 200 to 300 metres. Vegetation is generally sparse although at the time of the WGM site visits the entire area was green. Plant cover is composed of rough, low grasses, algaroba (mesquite-like) trees and sisal plants. There are very few flowing water courses in the area.

History

The Fazenda Brasileiro mine began production in 1984 as an open pit, heap leach operation. In 1988, production began from underground operations with processing in the newly constructed CIP plant and has been continuous since such time. Heap leach production has since been discontinued. Total gold production at the end of 2004 was over 2,240,000 ounces. Heap leach and CIP mill recoveries have averaged 75% and 95%, respectively. CIP throughput and grade have been very consistent on a year-by-year basis.

Geological Setting

The RIGB is of early Proterozoic age (2,500 to 1,600 million years ago) and is generally divided into three lithologic domains: (i) a mafic volcanic domain of pillowed and massive tholeitic basalts; (ii) a felsic volcanic domain of calc-alkaline andesites, rhyodacites and pyroclastics; and (iii) a sedimentary domain of fine-grained clastics and conglomerates of volcanic origin, portions of which are intercalated with the volcanic sequences. All these domains are intruded by Proterozoic granitoids and the belt is underlain by Archean basement gneisses and migmatites. Most of the belt was metamorphosed to middle greenschist facies, except where amphibolite facies metamorphism developed around intrusions.

Outcrop is sparse both regionally and locally throughout the project area. Most of the detailed geological information is obtained from surface trenching, which is routinely used as a mapping tool. Other detailed information is obtained from drill holes (diamond and percussion) and underground mapping, although the latter is used mainly as a double check on drill core geology and is carried out by technicians.

The Weber Belt is a ten-kilometre long east-west trending south dipping shear zone, which abruptly turns towards the south near its western extremity. A similar southern bend may occur at its eastern extremity as Weber Belt stratigraphy has been intersected by drilling in this area, south of the main trend. The Weber Belt is host to the most significant gold mineralization in the RIGB, including the Fazenda Brasileiro mine. The Weber Belt also hosts the Barrocas Oeste, Papagaio, Lagoa do Gato and Canto satellite zones, all of which are either in small-scale production or have been in production from small tonnage open pits.

The Weber Belt has been grouped into the following four distinct overturned sequences from south to north:

| | 1. | the Riacho do Incó unit, which is mainly composed of carbonate-chlorite schist with minor intercalations of carbonaceous schist lenses. The protolith of this rock is assumed to be basaltic lava; |

| | 2. | the Fazenda Brasileiro unit, which is dominated by felsic and mafic schists. This unit contains the dominant gold concentrations and is subdivided into three units, namely: |

| | (i) | the graphitic schist (“GRX”), which forms the hanging wall of the main Fazenda Brasileiro mine ore zone. Due to its lateral persistence and distinctive character, it is considered a marker horizon; |

| | (ii) | the magnetic quartz-chlorite schist (“CLX”), which consists of two major layers of 20 metre and 3 metre average thickness. Part of this unit is situated at the contact with the GRX and hosts the main ore shoot; and |

| | (iii) | the Intermediate Sequence, which is composed of sericite-chlorite-carbonate schist (“CAX”) and plagioclase-actinolite schist (“PAX”). The latter are weakly altered gabbroic bodies which show ophitic to subophitic textures and occur disseminated within the CAX and sometimes within the CLX units. The CAX rocks represent less mafic surrounding basalts. Researchers feel that the Fazenda Brasileiro unit as a whole represents a mafic sill, emplaced between metabasalts and turbidites. The intrusion is differentiated into metagabbro (PAX and CAX), grading to metaferrogabbro (CLX), and even into meta-anorthosite (quartz-feldspathic breccia) at the top. Such a pattern, however, appears inconsistent with the reverse dip of the unit. An alternative interpretation suggests that the gabbro was restricted to the PAX lithologies and that the CLX consisted of differentiated tholeiitic basalts; |

| | 3. | the Canto unit, which consists of fine-grained carbonaceous sediments (pelites and rhythmically banded pelites and psammites), volcanic layers and an agglomeratic pyroclastic sequence. The pyroclastic sequence is the main host rock for the Canto mineralization; and |

| | 4. | the Abóbora unit, which is located in the northernmost part of the Weber Belt. It comprises a thick sequence of basalt flows with local, narrow sedimentary intercalations. |

Deformation along the main east-west shear zone has destroyed most of the original features in the rocks of the mine area.

The structural history of the area is complex, with at least three phases of ductile and ductile-brittle deformation followed by late brittle faulting which latterly offset the Fazenda Brasileiro ore shoots (referred to as “orebodies” in some papers and reports) by up to 100 metres. The main mineralization, in the form of sulphide bearing quartz veining, is associated with the second phase.

Mineralization within the magnetic schist (CLX unit), host to the vast majority of the deposit, exhibits a hydrothermal alteration zoning affecting single veins and entire ore shoots. Three types of quartz veins are recognized, simple quartz veins, quartz-carbonate-biotite veins and quartz-albite-sulphide veins. Simple quartz veins are composed of recrystalized quartz and minor calcite and the host CLX has alteration haloes with sericite, chlorite and occasionally biotite a few centimetres thick. The quartz-carbonate-biotite veins are composed of carbonate with interstitial quartz and brown biotite. Surrounding alteration consists of carbonate, biotite and rare pyrite and pyrrhotite. The quartz-albite-sulphide veins, host to the high grade mineralization, are composed of quartz, albite, pyrite and arsenopyrite. Pyrite and arsenopyrite concentrate at the contacts with the adjacent altered CLX. In general, alteration zones form centimetric to decimetric bands parallel to vein margins. Since most ore shoots are formed by several generations of crosscutting veins, alteration bands related to each generation of veins are superimposed and form a coarse-grained brecciated rock composed of quartz, albite, carbonate and sulphides. The CLX alteration is characterized by a major decrease in chlorite content along with increases in albite, calcite, pyrite and arsenopyrite.

Exploration

Mine exploration is primarily concentrating on the F, G, E-east and E-deep ore bodies. Fan diamond drilling on 25 by 10 metre grids from footwall drifts has been conducted as part of the stope definition process. This zone hosts the bulk of the Proven and Probable Mineral Reserves and nearly all of the present underground production comes from it. This is routine drilling designed to upgrade Indicated Mineral Resources to the Measured Mineral Resources category.

In 2000, a deep diamond drilling program began from hanging wall access drifts just below the bottom of the 470 metre shaft. Holes were drilled over a 2.6 kilometre strike length from 500 metres to 1,000 metres below surface on a nominal 100 metre horizontal by 25 metre vertical grid (increasing to 50 metres with depth). In 2001, significant results were obtained about 300 metres below the CE zone. Nine holes intersected typical CLX unit related mineralization over a 1 kilometre strike length now known as the “E-Deep zone”.

Since August 2003, Yamana has conducted an exploration and infill drilling program at the Fazenda Brasileiro Mine designed to upgrade the current probable mineral reserves to proven mineral reserves and replace mined mineral reserves and a deeper drilling program designed to extend the mine’s underground mineral resources at depth and to the east. Drilling has been focused on underground orebodies adjacent to the mine, underground orebodies at or near the level of existing mine workings and orebodies beneath the existing mine workings. As at December 31, 2004, Yamana had completed over 126,000 metres of drilling from 2,585 holes, which drilling was aimed at exploration and development at the Fazenda Brasileiro Mine, as well as near mine target evaluation.

Although exploration near the Fazenda Brasileiro Mine has included several targets and properties, the main focus of this exploration has been on the Pau-a-pique, Barrocas Oeste, Papagaio and Lagoa do Gato properties.

Pau-a-Pique