YAMANA GOLD INC.

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

March 28, 2017

200 Bay Street, Suite 2200

Royal Bank Plaza, North Tower

Toronto, Ontario M5J 2J3

|

| | |

| Table of Contents | |

| INTRODUCTORY NOTES | 3 |

|

| Cautionary Note Regarding Forward-Looking Statements | 3 |

|

| Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources | 4 |

|

| Currency Presentation and Exchange Rate Information | 5 |

|

| CORPORATE STRUCTURE | 5 |

|

| GENERAL DEVELOPMENT OF THE BUSINESS | 7 |

|

| Overview of Business | 7 |

|

| History | 8 |

|

| DESCRIPTION OF THE BUSINESS | 12 |

|

| Principal Products | 12 |

|

| Competitive Conditions | 13 |

|

| Operations | 13 |

|

| Environment and Communities | 13 |

|

| Risks of the Business | 19 |

|

| Technical Information | 36 |

|

| Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources | 38 |

|

| Mineral Projects | 40 |

|

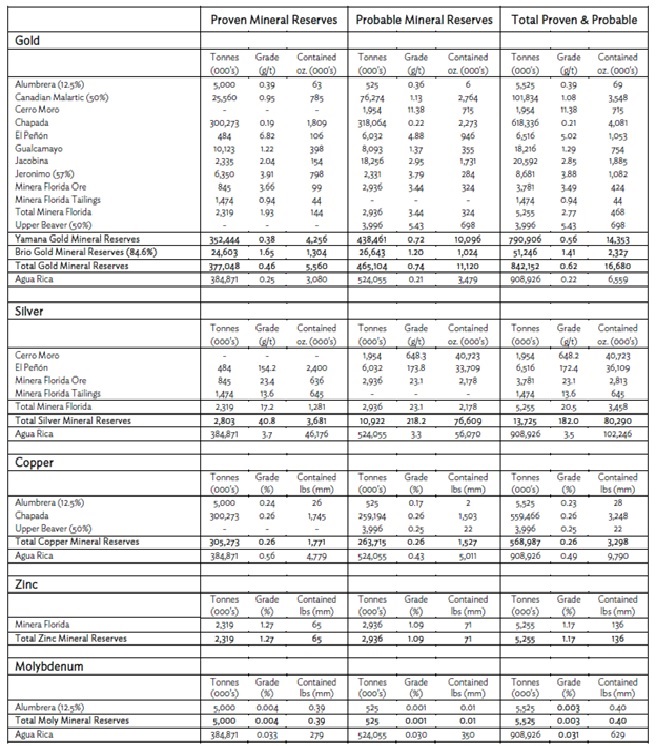

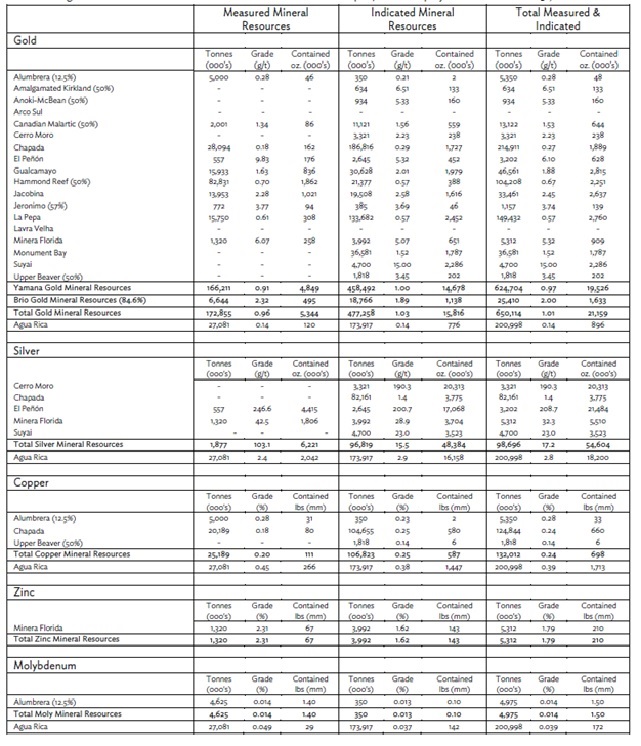

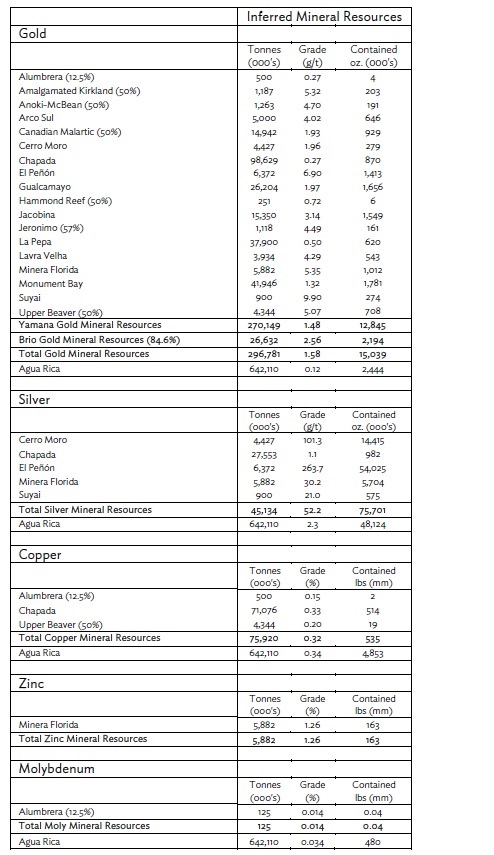

| Summary of Mineral Reserve and Mineral Resource Estimates | 40 |

|

| Material Producing Mines | 46 |

|

| Chapada Mine | 46 |

|

| El Peñón Mine | 54 |

|

| Canadian Malartic Mine | 64 |

|

| Other Producing Mines | 74 |

|

| Gualcamayo Mine | 74 |

|

| Jacobina Mining Complex | 75 |

|

| Minera Florida Mine | 76 |

|

| Additional Projects | 77 |

|

| Cerro Moro Project | 77 |

|

| Agua Rica Project | 79 |

|

| Suyai Project | 79 |

|

| Monument Bay | 80 |

|

| Brio Gold Inc. Properties | 80 |

|

| DIVIDENDS | 81 |

|

| DESCRIPTION OF CAPITAL STRUCTURE | 81 |

|

| MARKET FOR SECURITIES | 82 |

|

| DIRECTORS AND OFFICERS | 83 |

|

| PROMOTER | 90 |

|

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 91 |

|

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 92 |

|

| TRANSFER AGENTS AND REGISTRAR | 92 |

|

| MATERIAL CONTRACTS | 92 |

|

| AUDIT COMMITTEE | 93 |

|

| INTERESTS OF EXPERTS | 95 |

|

| ADDITIONAL INFORMATION | 96 |

|

| SCHEDULE ”A” – CHARTER OF THE AUDIT COMMITTEE | 97 |

|

ITEM 1

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

This annual information form contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities legislation. Except for statements of historical fact relating to the Company (as defined herein), information contained herein constitutes forward-looking statements, including, but not limited to, any information as to the Company’s strategy, plans or future financial or operating performance. Forward-looking statements are characterized by words such as “plan”, “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward looking information included in this annual information form includes, without limitation, statements with respect to:

| |

| • | the Company’s expectations in connection with the production and exploration, development and expansion plans at the Company’s projects discussed herein being met; |

| |

| • | the Company’s plans to continue building on its base of significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas; |

| |

| • | the Company’s expectations regarding the timing of construction, development and production at the Cerro Moro Project; |

| |

| • | the impact of proposed optimizations at the Company’s projects; |

| |

| • | the effect of government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people, mine safety and receipt of necessary permits; |

| |

| • | the impact of the proposed new mining law in Brazil and the Chilean tax reform package; |

| |

| • | Yamana’s expectations relating to the performance of the Canadian Malartic Mine; |

| |

| • | Yamana’s evaluation of various monetization opportunities for its Brio Gold holding from time to time; |

| |

| • | the Company’s investments and development of infrastructure improvements to enhance community relations in the locations where it operates and the further development of the Company’s social responsibility programs; |

| |

| • | the payment of any future dividends; |

| |

| • | the outcome of any current or pending litigation against the Company; and |

| |

| • | the outcome of any current or pending tax assessments involving the Company. |

Forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the impact of general domestic and foreign business, economic and political conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating metal prices (such as gold, copper, silver and zinc), currency exchange rates (such as the Brazilian real, the Chilean peso, the Argentine peso, and the Canadian dollar versus the United States dollar), interest rates, possible variations in ore grade or recovery rates, changes in the Company’s hedging program, changes in accounting policies, changes in Mineral Resources (as defined herein) and Mineral Reserves (as defined herein), and risks related to acquisitions and/or dispositions, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, risks related to joint venture operations, the possibility of project cost overruns or unanticipated costs and expenses, potential impairment charges, higher prices for fuel, steel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, including but not limited to, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, final pricing for concentrate sales, unanticipated results of future studies, seasonality and unanticipated weather

changes, costs and timing of the development of new deposits, success of exploration activities, permitting timelines, environmental and government regulation and the risk of government expropriation or nationalization of mining operations, risks related to relying on local advisors and consultants in foreign jurisdictions, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage and timing and possible outcome of pending and outstanding litigation and labour disputes, risks related to enforcing legal rights in foreign jurisdictions, vulnerability of information systems, as well as those risk factors discussed or referred to herein and in the Company’s annual management’s discussion and analysis filed with the securities regulatory authorities in all provinces of Canada and available under the Company’s SEDAR profile at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources

This annual information form has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements of United States securities laws. The terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). These definitions differ significantly from the definitions in the disclosure requirements promulgated by the Securities and Exchange Commission (the “Commission”) and contained in Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended (the “Securities Act”). In particular, under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report Mineral Reserves, the three-year historical average price is used in any Mineral Reserve or cash flow analysis to designate Mineral Reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, Industry Guide 7 applies different standards in order to classify mineralization as a mineral reserve. As a result, the definitions of Proven Mineral Reserves (as defined herein) and Probable Mineral Reserves (as defined herein) used in NI 43-101 differ from the definitions used in Industry Guide 7. Under Commission standards, mineralization may not be classified as a mineral reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the mineral reserve determination is made. Among other things, all necessary permits would be required to be in hand or the issuance must be imminent in order to classify mineralized material as mineral reserves under the Commission’s standards. Accordingly, Mineral Reserve estimates contained in this annual information form may not qualify as mineral reserves under Commission standards.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101. However, the Commission does not recognize Mineral Resources and United States companies are generally not permitted to disclose Mineral Resources of any category in documents they file with the Commission. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into Mineral Reserves as defined in NI 43-101 or Industry Guide 7. Further, Inferred Mineral Resources (as defined herein) have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable, or that all or any part of Measured Mineral Resources (as defined herein), Indicated Mineral Resources (as defined herein), or Inferred Mineral Resources will ever be upgraded to a higher category. In addition, disclosure of “contained ounces” in a Mineral Resource is permitted disclosure under Canadian regulations. In contrast, the Commission only permits United States companies to report mineralization that does not constitute Mineral Reserves by Commission standards as in place tonnage and grade, without reference to unit measures. Investors are cautioned that information contained in this annual information form may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations of the Commission thereunder.

Currency Presentation and Exchange Rate Information

This annual information form contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “Canadian dollars” or “Cdn$”.

The closing, high, low and average exchange rates for the United States dollar in terms of Canadian dollars for the years ended December 31, 2016, December 31, 2015, December 31, 2014 and December 31, 2013 based on the noon spot rate reported by the Bank of Canada, were as follows:

|

| | | | |

| | Year-Ended December 31 |

| | 2016 | 2015 | 2014 | 2013 |

| Closing | Cdn$1.34 | Cdn$1.38 | Cdn$1.16 | Cdn$1.06 |

| High | 1.46 | 1.40 | 1.16 | 1.07 |

| Low | 1.25 | 1.17 | 1.06 | 0.98 |

Average(1) | 1.32 | 1.28 | 1.10 | 1.03 |

(1)Calculated as an average of the daily noon rates for each period.

On March 28, 2017, the Bank of Canada rate of exchange was $1.00 = Cdn$1.3363 or Cdn$1.00 = $0.7483.

ITEM 2

CORPORATE STRUCTURE

Yamana Gold Inc. (the “Company” or “Yamana”) was continued under the Canada Business Corporations Act by Articles of Continuance dated February 7, 1995. On February 7, 2001, pursuant to Articles of Amendment, the Company created and authorized the issuance of a maximum of 8,000,000 first preference shares, Series 1. On July 30, 2003, pursuant to Articles of Amendment, the name of the Company was changed from Yamana Resources Inc. to Yamana Gold Inc. On August 12, 2003, the authorized capital of the Company was altered by consolidating all of the then issued and outstanding common shares of the Company on the basis of one new common share for 27.86 existing common shares.

The Company’s head office is located at 200 Bay Street, Royal Bank Plaza, North Tower, Suite 2200, Toronto, Ontario M5J 2J3 and its registered office is located at 2100 Scotia Plaza, 40 King Street West, Toronto, Ontario M5H 3C2.

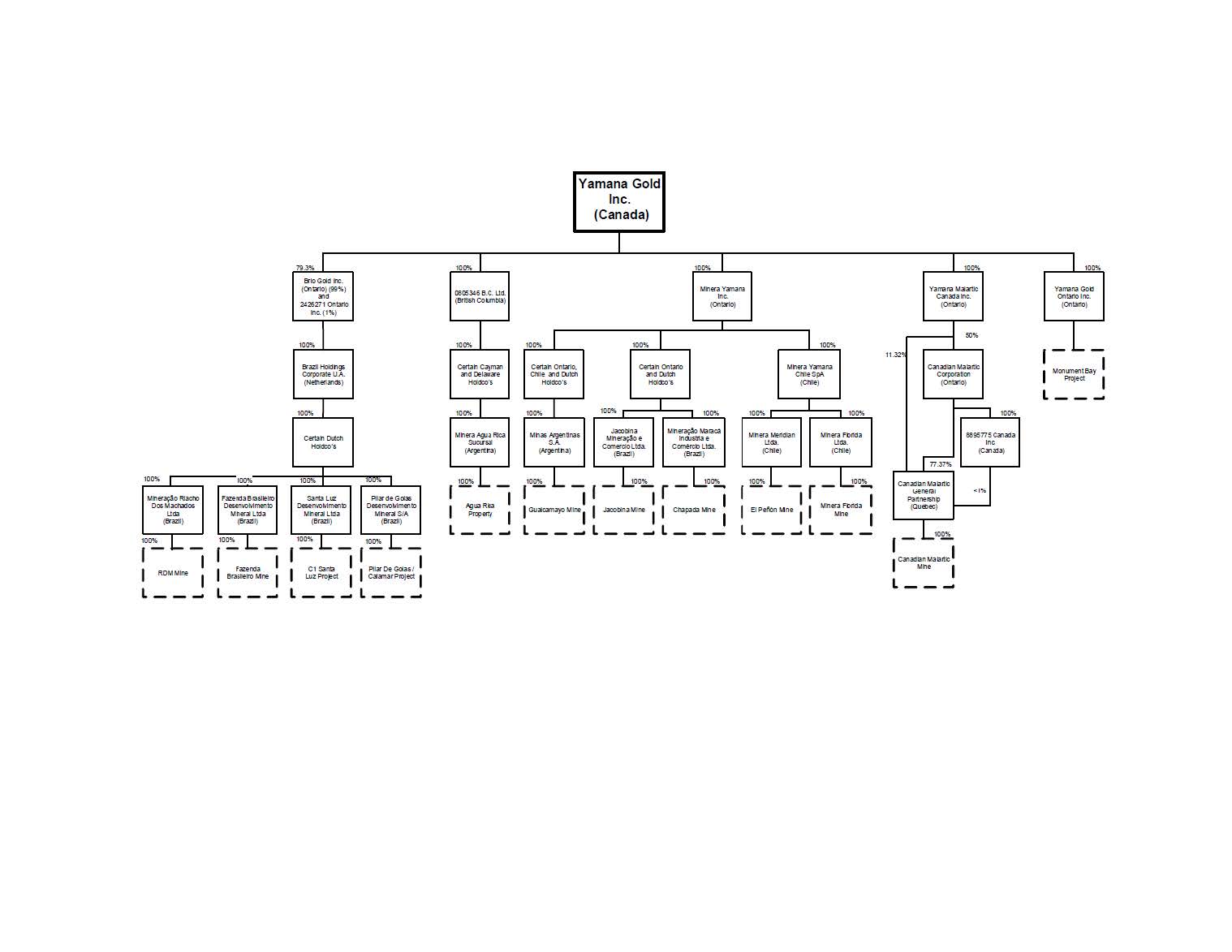

The corporate chart that follows on the next page illustrates the Company’s principal subsidiaries (collectively, the “Subsidiaries”) as of March 28, 2017, together with the jurisdiction of incorporation of each company and the percentage of voting securities beneficially owned, controlled or directed, directly or indirectly, by the Company. As used in this annual information form, except as otherwise required by the context, reference to the “Company” or “Yamana” means Yamana Gold Inc. and the Subsidiaries.

ITEM 3

GENERAL DEVELOPMENT OF THE BUSINESS

Overview of Business

Yamana is a Canadian-based gold producer with significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina. Yamana plans to continue to build on this base through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas.

The Company’s portfolio includes six operating gold mines, one development stage project currently under construction and various advanced and near development stage projects and exploration properties in Canada, Brazil, Chile, and Argentina. Yamana operates its mines and projects in two divisions under common corporate oversight: (i) Northern Operations, which includes, among other earlier stage projects, Canadian Malartic (gold/silver), Jacobina (gold) and Chapada (copper/gold), (ii) Southern Operations, which includes, among other earlier stage projects, El Peñón (gold/silver), Minera Florida (gold/silver/zinc);and Gualcamayo (gold). In addition, the Company holds a majority interest in Brio Gold Inc. (“Brio Gold”), a public company which holds the Pilar mine (gold), the Fazenda Brasileiro mine (gold), the Riachos dos Machados mine (gold), the C1 Santa Luz project (gold), and some related exploration concessions. Within this structure, Chapada, El Peñón and Canadian Malartic are the Company’s material producing mines and the largest contributors to cash flow.

Set out below is a list of Yamana’s main properties and mines:

Material Producing Mines

Chapada Mine (Brazil)

El Peñón Mine (Chile)

Canadian Malartic Mine (Canada) - 50% indirect interest

Other Producing Mines

Gualcamayo Mine (Argentina)

Jacobina Mining Complex (Brazil)

Minera Florida Mine (Chile)

Additional Projects

Cerro Moro Project (Argentina)

Agua Rica Project (Argentina)

Suyai Project (Argentina)

Monument Bay Project (Canada)

Alumbrera Mine (Argentina) - 12.5% indirect interest

Other

Brio Gold Inc.

History

Over the three most recently completed financial years, the following events contributed materially to the development of the Company’s business:

Brio Gold

On December 10, 2014, the Company provided an update on strategic initiatives relating to the Fazenda Brasileiro Mine, the Pilar Mine and the C1 Santa Luz Project. The Company subsequently structured its intercorporate holdings to form a new 100%-owned subsidiary company, Brio Gold, to hold these assets as well as some related exploration concessions. On April 29, 2016, Brio Gold completed the acquisition of the Riachos dos Machados gold mine (“RDM”) in Minas Gerais State from Macquarie Bank and Carpathian Gold for approximately $57.4 million in total consideration, including expenses and a $6 million option

payment. On July 28, 2016, the Company announced the decision to recommission the C1 Santa Luz property. This followed detailed metallurgical testwork program being completed in 2015 with the results of this work incorporated into a Preliminary Economic assessment. See “Description of the Business – The Brio Assets”.

On November 17, 2016, the Company announced that Brio Gold had filed its final prospectus with, and obtained receipts in respect thereof from, the securities regulatory authorities in each of the provinces and territories of Canada in connection with the secondary offering (the "Offering") of common shares in the capital of Brio Gold held by Yamana (the "Brio Shares"). The Brio Shares were to be transferred to purchasers through the exercise of purchase rights (the "Purchase Rights") that Yamana distributed as a dividend in-kind to its shareholders of record as of 5:00 p.m. (Toronto time) on November 25, 2016. The Purchase Rights were distributed on the basis of 0.0625 of a Purchase Right for each Yamana Share held (or one whole Purchase Right for every 16 Yamana Shares held). Holders of Purchase Rights had a 21 day exercise period, commencing December 1, 2016, to exercise the Purchase Rights to acquire Brio Shares. Each whole Purchase Right entitled the holder to purchase one (1) Brio Share upon payment of Cdn$3.25 per Brio Share. Any unexercised Purchase Rights expired at 5:00 p.m. (Toronto time) on December 21, 2016.

On December 23, 2016, the Company announced the closing of the Offering and related transactions pursuant to which Yamana transferred Brio Shares. A total of 17,324,507 Brio Shares owned by Yamana were transferred pursuant to the transactions at a price of Cdn$3.25 per Brio Share for aggregate proceeds of Cdn$56,304,648 to Yamana. As a result of the completion of these transactions, Brio Gold became a standalone public company. Yamana continued to be a significant shareholder of Brio Gold, holding approximately 85% of the issued and outstanding Brio Shares at closing. The net proceeds from the Offering and the additional distribution increase Yamana's cash balances and thereby reduce Yamana's net debt. Each of CIBC World Markets Inc., National Bank Financial Inc., Canaccord Genuity Corp. and Cormark Securities Inc. acted as managing dealers in connection with the Offering to solicit, on a commercially reasonable efforts basis, the exercise of the Purchase Rights.

On March 6, 2017, the Company announced the sale of 6,000,000 common shares of Brio Gold at a price of Cdn$3.35 per share, for total proceeds of Cdn$20,100,000 to an arm’s length institutional shareholder. Following the sale, Yamana now holds 89,202,922 shares of Brio, representing 79.3% of the issued and outstanding common shares of Brio.

Sale of Mercedes

On July 28, 2016, the Company entered into an agreement with Premier Gold Inc. (“Premier”) to sell 100% of its interest in the Mercedes mine through the sale of its Mexician subsidiaries. As consideration for the sale, the Company received cash consideration of $122.5 million, six million Premier common shares, and three million Premier common share purchase warrants exercisable at Cdn$4.75 per common share for 24 months. In addition, the Company received a 1% net smelter return royalty on the Mercedes mine, that becomes payable upon the earlier of six years from the completion of the sale and the date upon which cumulative production of 450,000 ounces of gold equivalent from Mercedes has been achieved, as well as a 2% net smelter return royalty on the La Silla property in Sinaloa, Mexico and the La Espera property in Sonora, Mexico. The sale was completed on September 30, 2016.

Board and Management Update

On February 15, 2017, the Company announced the formal appointment of Mr. Jason LeBlanc as Chief Financial Officer (“CFO”) upon the retirement of Mr. Charles Main, Executive Vice President, Finance and CFO. Mr. LeBlanc joined the Company in January 2006 and has over 15 years of research-based and financial experience in the mining industry. During his time at Yamana, Mr. LeBlanc has held increasingly senior positions including most recently the position of Senior Vice President, Finance as of February 2016 as part of his transition to CFO. Mr. LeBlanc has a Master of Finance from the University of Toronto, a Bachelor of Commerce from the University of Windsor and holds a Chartered Financial Analyst designation.

Also on February 15, 2017, the Company announced the appointment of Ms. Kimberly Keating to the Company’s board of directors, effective as of February 15, 2017. Ms. Keating has nearly 20 years of experience in the Canadian energy industry with extensive engineering and project management expertise. Ms. Keating is currently Vice President, Fabrication with the Cahill Group, where among other things she has overseen the construction of the largest offshore accommodation facility built in Canada. In Ms. Keating’s career, she has made significant engineering and project management contributions to key projects in the North Atlantic offshore oil and gas industry.

On July 27, 2016, Mr. Yohann Bouchard was promoted into the role of Senior Vice President, Operations. Mr. Bouchard joined Yamana in October 2014. Mr. Bouchard has progressive technical and operating experience with a solid background of

more than 20 years of mining in underground and open pit operations. Also on July 27, 2016, Gerardo Fernandez was promoted into the role of Senior Vice President, Operations. Mr. Fernandez has been with the Company since 2000, having worked in several positions in mine operations, mine planning and project development.

On May 4, 2016, the Company announced the promotion of Daniel Racine from the position of Senior Vice President, Northern Operations to the position of Executive Vice President and Chief Operating Officer. In this role, Mr. Racine will assume full oversight responsibility for the Company's operations. Mr. Racine is a registered engineer with L'Ordre des Ingenieurs du Quebec, a professional engineer with Professional Engineers Ontario and a member of the Ontario Society of Professional Engineers. Mr. Racine joined Yamana Gold in May 2014.

On February 18, 2016, Mr. Greg McKnight was promoted into the role of Executive Vice President, Business Development. He previously held the role of Senior Vice President, Business Development of the Company.

On April 28, 2015, the Company announced the appointment of Ross Gallinger as Senior Vice President, Health, Safety and Sustainable Development. Mr. Gallinger is responsible for the oversight, strategic development, delivery and management of the Company’s health, safety, environment and community policies, programs, and activities to ensure the effectiveness of such programs with the objective to improve the Company’s overall performance.

On September 2, 2014, the Company announced the appointment of two new directors to the board of directors, namely Christiane Bergevin and Jane Sadowsky. The Company also announced the appointment of Barry Murphy as Senior Vice President, Technical Services, which the Company believes increases the technical depth of its management as the Company continues to advance its development projects.

Altius

On March 31, 2016, the Company announced that it had entered into a copper purchase agreement with Altius Minerals Corporation (“Altius”) pursuant to which Altius agreed to pay Yamana total advanced payments of $60 million in cash consideration plus 400,000 Altius purchase warrants. The agreement provides Altius with the right to receive payments of copper related to the production from the Company’s Chapada mine in Brazil. A non-refundable deposit of $8 million was paid to Yamana on signing with the balance paid on May 3, 2016. The proceeds from this agreement were used to finance the acquisition of RDM.

Dividend Policy

In January 2016, the Company’s board of directors amended the Company’s dividend policy to set the quarterly dividends paid per common share at $0.02 annually, beginning with the declaration and payment of the first quarter 2016 dividend. Payment of any future dividends will be at the discretion of the Company’s board of directors after taking into account many factors, including the Company’s operating results, financial condition, comparability of the dividend yield to peer group gold companies and current and anticipated cash needs.

Sandstorm Gold Transactions

On October 27, 2015, the Company announced that it had entered into three metal purchase agreements with Sandstorm Gold Ltd. (“Sandstorm”), for which Sandstorm paid the Company total cash payments of $148 million and issued the Company 15 million common share purchase warrants with a five year term and strike price of $3.50. The warrants are exercisable when the Company has incurred an additional $40 million in capital expenditures in respect of the development and construction of the Cerro Moro mine. Sandstorm will also pay the Company an additional cash payment of $4 million in April 2016. The metal purchase agreements include a silver purchase contract related to production from Cerro Moro, Minera Florida and Chapada, a copper purchase transaction related to production from Chapada, and a gold purchase transaction related to production from Agua Rica. All amounts received will be used by the Company to reduce the balance outstanding on its revolving credit facility.

On October 3, 2016, the Company announced the sale of the Sandstorm warrants for total net proceeds of approximately $33.55 million, or approximately $2.24 per warrant.

Copper Hedge Program

As at December 31, 2016, the Company had 23 million pounds of copper forward contracts in place for the first half of 2017 at an average sales price of $2.58 per pound.

Cerro Moro Construction Decision

The Company announced, in early 2015, the formal decision to proceed with the construction of Cerro Moro and provided updated project parameters with respect to timing and capital investment. During the course of 2015, detailed engineering for the 1,000 tonnes per day processing plant and mine was advanced to approximately 50% completion, in line with the published project execution schedule. Included in the 2015 work program was the upgrading and extension of the site access road, conclusion of the locked-cycle metallurgical test work program, the placement of orders on various long-lead time items such as the tailings thickeners, and the continuation of the first stage of the construction camp. The 2016 work program included the ramp-up of site construction activities; the continuation of detailed engineering; and the advancement of underground mining in order to gain a better understanding of in-situ mining conditions. See “Description of the Business - Additional Projects - Cerro Moro Project”.

Mega Precious - Acquisition

On June 22, 2015, the Company acquired all of the issued and outstanding common shares of Mega Precious Metals Inc. (“Mega Precious”). Mega Precious was a Canadian-based exploration company with a high quality pipeline of projects located in Manitoba, Northwestern Ontario and Nunavut. The most significant and advanced project is the Monument Bay gold/tungsten project located in northeastern Manitoba. The transaction is expected to advance the Company’s strategy to expand its presence in Canada.

Total consideration paid for the acquisition of Mega Precious was $14.5 million which consisted of approximately $0.2 million in cash, $14.0 million in Yamana common shares (4,366,675 shares) and transaction costs. Each Mega Precious shareholder received $0.068 per share comprised of Cdn$0.001 in cash and 0.02092 of a Yamana common share for each Mega common share held. As part of the acquisition and included in the total consideration paid, the Company acquired the convertible notes of Pacific Road Capital II Pty Limited, as trustee for Pacific Road Resources Fund II, and Pacific Road Capital Management GP II Limited, as general partner of Pacific Road Resources Fund II L.P. (collectively, “Pacific Road”) totaling $2.4 million, and issued 744,187 Yamana common shares at $3.21 per share, which concurrently terminated the existing agreement between Pacific Road and Mega Precious.

Dividend Reinvestment Plan

On February 18, 2015, the Company announced the implementation of a dividend reinvestment plan (the “DRIP”), effective for the first quarter dividend of 2015 forward, which provides eligible holders of the Company’s common shares with the option of reinvesting all or a portion of the dividends paid to them as shareholders (less any withholding tax) to purchase additional common shares of the Company. Participation in the DRIP is optional. The common shares acquired on behalf of eligible participants by the DRIP agent, CST Trust Company, will, at the sole option of the Company, be common shares issued from the treasury of the Company or common shares acquired on the open market through the facilities of the Toronto Stock Exchange (the “TSX”), the New York Stock Exchange (the “NYSE”) or any other stock exchange on which the common shares of the Company are then listed (each a “Listed Market”). The purchase price of the common shares purchased under the DRIP shall be the volume weighted average price of the common shares on the applicable Listed Market for the five (5) trading days preceding the dividend payment date.

Public Offering

On February 3, 2015, the Company closed a bought deal offering (the “Public Offering”) of common shares of the Company. A total of 56,465,000 common shares were issued at a price of Cdn$5.30 per share, for aggregate gross proceeds of Cdn$299,264,500 (which included the full exercise by the underwriters of the over-allotment option for 7,365,000 common shares). The common shares of the Company were sold pursuant to an underwriting agreement (the “Underwriting Agreement”) dated January 15, 2015 between the Company and a syndicate of underwriters led by Canaccord Genuity Corp. and National Bank Financial Inc., and including CIBC World Markets Inc., RBC Dominion Securities Inc., Scotia Capital Inc., TD Securities Inc., Merrill Lynch Canada Inc., Credit Suisse Securities (Canada), Inc., Raymond James Ltd., Citigroup Global Markets Canada Inc., Cormark Securities Inc., Macquarie Capital Markets Canada Ltd., Morgan Stanley Canada Limited, and Barclays Capital Canada Inc. The net proceeds of the Public Offering were used to repay amounts under the Company’s $1 billion revolving credit facility, in order to reduce the Company’s debt position and further strengthen its balance sheet. See “Material Contracts”.

Canadian Malartic Mine - Acquisition

On June 16, 2014, the Company and Agnico Eagle Mines Limited (“Agnico Eagle”) jointly acquired 100% of all issued and outstanding common shares (with each company owning 50%) of Osisko (the “Osisko Acquisition”). Osisko operated the Canadian Malartic Mine in the Abitibi Gold Belt, immediately south of the Town of Malartic located in the province of Québec, Canada. Additionally, Osisko conducted advanced exploration activities at the Kirkland Lake and Hammond Reef properties in Northern Ontario, Canada and additional exploration projects located in the Americas. Total consideration paid by Yamana consisted of approximately $0.5 billion in cash and $1.0 billion in common shares of the Company (based on a share price of $8.18 per share).

On March 19, 2015, the Company and Agnico through Canadian Malartic GP (as defined herein) jointly acquired the remaining 30% interest in the Malartic CHL prospect from Abitibi Royalties Inc. (“Abitibi”) for total consideration of approximately Cdn$57 million in shares and a 3.0% net smelter return royalty on the Malartic CHL prospect. The Company issued a total of 3,549,695 common shares at $3.63 (Cdn$4.63) for its portion of the consideration. Following the completion of the transaction, Canadian Malartic GP holds a 100% interest in the Malartic CHL prospect.

Strategic Initiatives Update

In October 2014, the Company entered into a Memorandum of Understanding (“MOU”) with the provincial Government of Catamarca, Argentina (the “Catamarca Government”), represented by the provincial mining company Catamarca Mineria y Energetica Sociedad del Estado (“CAMYEN”), with respect to the creation of the Catamarca Mining District. The MOU established the groundwork for the Company and the Catamarca Government to work together to consolidate important mining projects and prospective properties in the province, currently consisting of the Agua Rica Project and the Cerro Atajo prospect. On February 27, 2015, a formal agreement was entered into among the parties to the MOU. This agreement forms the basis of a working relationship between the Catamarca Government through CAMYEN, other mining companies and the Company and is expected to help advance the Agua Rica Project and the Cerro Atajo prospect. The formal agreement also establishes a maximum ownership interest of up to 5% for CAMYEN of a combined entity, including the Agua Rica Project and Cerro Atajo prospect, and some exploration and infrastructure spending during the term of the agreement. The formal agreement does not restrict the Company’s ability to continue with Agua Rica, although it provides a framework of cooperation that would see Agua Rica advance to development more efficiently and on an expedited timeline. Presently, the Company is considering the development of Agua Rica in conjunction with other financial and mining industry participants. See “Description of the Business - Additional Projects”.

Note Exchange Offer

On June 30, 2014, the Company issued $500 million aggregate principal amount of 4.95% Senior Notes due 2024 (the “Initial Notes”) in a transaction that was exempt from registration under the Securities Act, and resold to qualified institutional buyers in reliance on Rule 144A and non-U.S. persons outside the United States in reliance on Regulation S. In connection with the issuance of the Initial Notes, the Company entered into a registration rights agreement, dated as of June 30, 2014, with the initial purchasers of the Initial Notes, providing for the issuance of new notes in exchange for a like aggregate principal amount of Initial Notes. Subsequently, in October 2014, the Company commenced an exchange offer which expired on November 20, 2014, pursuant to which new notes (the “New Notes”) were issued in exchange for an equal aggregate principal amount of outstanding Initial Notes validly tendered and accepted in the exchange offer. The terms of the New Notes are substantially identical to the terms of the Initial Notes, except that, among other things, the New Notes are registered under the Securities Act and do not contain restrictions on transfer.

In connection with the issuance of the Initial Notes, the Company entered into a trust indenture, dated as of June 30, 2014, as supplemented by the first supplemental indenture dated as of June 30, 2014 (collectively, the “Indenture”). Pursuant to the terms of the Indenture, the New Notes are unsecured, unsubordinated obligations of Yamana evidencing the same continuing indebtedness as the Initial Notes and will mature on July 15, 2024. The New Notes bear interest at the rate of 4.95% per annum from and including the most recent interest payment date to which interest has been paid or provided for, or if no interest has been paid or provided for, from June 30, 2014. Interest on the New Notes is payable semi-annually in arrears on January 15 and July 15 of each year, beginning on January 15, 2015, to the persons in whose names the New Notes are registered at the close of business on the preceding January 1 or July 1, as the case may be. See “Material Contracts”.

ITEM 4

DESCRIPTION OF THE BUSINESS

Yamana is a Canadian-based gold producer with significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina.Yamana plans to continue to build on this base through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas.

Principal Products

The Company’s principal product is gold, with gold production forming a significant part of revenues. There is a global gold market into which Yamana can sell its gold and, as a result, the Company is not dependent on a particular purchaser with regard to the sale of the gold that it produces.

The Company produces gold-copper concentrate at its Chapada Mine, gold and silver doré bars at its El Peñón Mine, gold doré bars at its Jacobina Mining Complex (the “JMC”) and Gualcamayo Mine, and gold and silver doré bars and zinc concentrate at its Minera Florida Mine. Additionally, the Company has a 50% indirect interest in the Canadian Malartic Mine which produces gold and silver doré bars, and a 12.5% indirect interest in the Alumbrera Mine which produces copper and gold concentrate and gold doré bars. The Company has contracts with a number of smelters, refineries and trading companies to sell gold and silver doré and gold-copper and zinc concentrate.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Operations

Employees

As at December 31, 2016, the Company had the following employees and contractors at its operations:

|

| | | |

| Country | Employees | Contractors | Total |

| Canada, Corporate | 114 | 7 | 121 |

| Canada, Canadian Malartic (50% indirect interest) | 694 | 423 | 1117 |

| Argentina | 1,060 | 760 | 1,820 |

| Brazil | 1,529 | 2091 | 3,620 |

| Chile | 1,861 | 2,489 | 4,350 |

| Netherlands | 1 | | 1 |

| United States | 7 | 1 | 8 |

| Total | 5,266 | 5,771 | 11,037 |

Domestic and Foreign Operations

The Company’s mine and mineral projects are located in Brazil, Chile, Argentina, and Canada. See “General Development of the Business - Overview of Business” for a summary of the Company’s projects. Any changes in regulations or shifts in political attitudes in any of these jurisdictions, or other jurisdictions in which Yamana has projects from time to time, are beyond the control of the Company and may adversely affect its business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local

people, mine safety and receipt of necessary permits. The effect of these factors cannot be accurately predicted. See “- Risks of the Business”.

Environment and Communities

Protecting the environment and maintaining a social license with the communities where the Company operates is integral to the success of the Company. The following overview sets out the Company’s commitment to health, safety and sustainability in each of the communities in which the Company operates. A detailed overview of Yamana’s environmental performance is described in the Company’s Sustainability Reports, which are available on the Company’s website at www.yamana.com.

Health, Safety & Sustainable Development

Yamana’s approach to health, safety and sustainability is guided by both the legal guidelines in the jurisdictions in which the Company operates, as well as by a combination of Company-specific policies and standards with a commitment to best practice management. Yamana has implemented and maintains a number of management systems at its wholly owned operations, including the internationally regarded ISO and OHSAS systems, all of which are underpinned by the Yamana Management System (“YMS”) for health, safety and sustainable development. Canadian Malartic Mine, which is a jointly owned operation with Agnico Eagle, operates Agnico Eagle’s HSEC management systems, which is also based on international best practice.

The YMS establishes policies and standards in respect of planning; risk assessment; standard operating procedures; the identification of all legal and contractual requirements; the definition of Company objectives and targets; and internal auditing systems. The foundation of the YMS is risk-management. The YMS effectively maps each operation’s HSEC risks and helps ensure ongoing management and monitoring. High level risks, including but not limited to those associated with tailings dam facilities, waste rock dumps, heap leach piles or cyanide usage, have enhanced, specific management measures in order to be better able the mitigation of potential failures, spills or slides. These systems are based on the permanent monitoring of the particular structure, using specific tools that assist in monitoring such risks. In addition, reports on tailings dam facilities are prepared by third party consultants on a monthly basis and reviewed regularly and periodically by the Company. See “Risks of the Business”.

Designed to reflect international industry best practice, the YMS was first implemented in Brazil in 2007 and in Yamana’s other operating jurisdictions beginning in 2008, and continues to mature and has extended to both exploration and construction areas. In order to verify compliance with the YMS, internal corporate audits have been conducted at each mine site, exploration project and construction project since 2009. Over the last six years the compliance with YMS increased 15.5%, including an increase from an overall compliance level of 87.8% in 2014 to full 100% compliance by 2015. Compliance with YMS is critical to the Company’s ability to manage HSEC matters at its sites.

In addition to its internal standards and assurance processes, Yamana also maintains a number of external commitments and certifications, including certification of ISO 14001 Environmental Management Systems and OHSAS 18001 Occupational Health and Safety Management Systems. Maintaining certification of these externally verified systems is linked to management compensation. Additionally, Yamana has been a signatory to the International Cyanide Management Code since 2008, with all operations maintaining full certification through their last round of audits, between 2014 and 2016. Results of these audits can be found on the website of the International Cyanide Management Code. Yamana also participates in the World Gold Council’s Conflict-Free Gold Standard. Summary and Assurance reports from 2014 onward can be found on the Company’s website.

HSEC Governance

To support both internal and external audit processes, overall governance of Yamana’s HSEC management is supported from the mine site to the board of directors through various management committees. Each of the Company’s mining operations has established a Health, Safety, Environment and Community committee (collectively, the “HSEC Committees”) which are chaired by the site’s General Manager. The HSEC Committees meet at least once a month to discuss issues and solutions related to HSEC relations and other operational practices. The goal of each HSEC Committee is to monitor the effectiveness and performance of the site’s sustainability programs and reports on any material issues to the site General Manager, who will escalate matters as necessary. The Sustainability Committee of Yamana’s board of directors assists the board of directors in overseeing sustainability, environmental, health and safety matters, including but not limited to overseeing the Company’s sustainable development, environmental, health and safety policies, reviewing any compliance issues and incidents to determine, on behalf of the board of directors, if all necessary action have been taken and ensure that the Company has been duly diligent in carrying out our responsibilities and activities.

In 2015, Yamana began a strategic review and restructuring of the Company’s HSEC team, beginning with the appointment of a Senior Vice President of Health, Safety and Sustainable Development who reports directly to the CEO. From there, the

Company established a new regional model with a more centralized focus to amplify hands-on HSEC support for all operations. The Company then undertook a series of strategic initiatives and internal reviews in 2016 with the objective of further fostering Yamana’s HSEC performance culture.

In support of Yamana’s mission statement; to mine precious metals profitably and responsibly, the Company also developed a HSEC-specific mission statement in 2016: “One team, One goal: Zero.” The vision is being embedded at all operations throughout 2017 as the foundation of a number of important step changes towards the full integration of HSEC into Yamana’s operational and corporate culture.

An Integrated HSEC Framework was also developed in 2016 which aims to tie together Yamana’s HSEC mission with its wide range of policies, standards, procedures and management systems. The framework provides strategic guidance in each of the Health & Safety, Environment and Community Relations disciples that uniquely focuses on management effectiveness and the shift towards full integration of HSEC responsibilities into operational management.

HSEC Performance

Yamana had no significant spills, releases or incidents in 2015 or 2016. Yamana’s Sustainability Report is consistent with the most up-to-date guidelines produced by the Global Reporting Initiative. Audit reports for Yamana’s cyanide management can be found on the International Cyanide Management Code website. The Company also externally reports its energy and emissions performance to the Carbon Disclosure Project.

Health & Safety

Yamana had an overall improvement in its health and safety performance in 2016, with zero workplace fatalities. While the total recordable incident rate increased slightly from 0.91 to 1.19 (data includes Canadian Malartic), the overall number of Lost Time Incidents (LTIs) decreased by approximately 20% in over the past year. The Company’s explorations teams also achieved a significant milestone in 2016, with the Chile, Argentina and Brazil teams concluding the year without incident (no injuries, no restricted work cases and no medical aids). Incidents that are criminal activities by external perpetrators, where employees and contractors act appropriately and in accordance with procedures and training, are deemed to be outside the scope of the health and safety performance criteria.

Stability in our safety performance reflects the Company’s efforts toward its goal of zero serious injuries, but also highlights the need for further improvement to achieve year-over-year reductions. The Company has continuous learning and improvement initiatives in place across our organization that target ways to effect step changes in safety performance. Priorities for Yamana’s health and safety team in 2016 and into 2017 are as follows: increased measurement and reporting of leading indicators (preventative activities); ensuring that the Company’s Fatal Risk Controls are best-in-class; and the development of new leadership standards.

Social

Similar to previous years, the Company had no significant community conflicts or incidents. Each of the operations maintains a Community Relations team that engages regularly through formal and informal engagement mechanisms. Through open-houses, and community meetings, Yamana’s operations hosted a total 87 formal meetings throughout 2016, with a total of over 1650 participants in those meetings. Through its formal grievance mechanisms, the Company received a total of 32 grievances relating primarily to issues of dust, noise or vibrations. Operations responded to 100% of the grievances within their designated closeout periods (typically 7 to 14 days).

Yamana’s social performance is guided by a specific set of Community Relations standards contained in the YMS. Underpinning these standards are a number of social policies, including Yamana’s Human Rights Policy as found on the Company’s website. The Company is committed to acting in accordance with Voluntary Principles on Security and Human Rights and requires the same adherence from its service providers.

Every year, the Company makes substantial commitments to local community development, with programs focusing largely on sustainable income generation, education, health and culture. In 2015, the Company contributed a total $5.8 million to the communities in which the Company operates through these development programs and through direct contributions to municipal governments through local taxes and royalties. In addition to our community investments, Yamana maintains a local employment rate of 75% and a host-country procurement rate of 95%.

Climate Change

The Company’s approach to climate change is two-fold. First, the Company monitors existing climatic changes or extreme weather events that may impact operations, and modifies facilities accordingly. Each site’s tailings management facilities are constantly reviewed and modified, including new dams or additions to existing facilities) and other operational aspects. These ongoing re-evaluations, based on the latest estimates, are designed to ensure our tailings management is robust and incorporates the latest environmental data.

The second prong of Yamana’s climate change strategy manages energy efficiency and emissions reduction. Energy efficiency programs across the operations are focused on minimizing the use of fossil fuels across and reducing the carbon footprint wherever possible. The focus on fossil fuel use provides the greatest returns; however, aging fleets and operations that require deeper and longer haulage routes, which require more energy. In this context, each operation, with corporate oversight, is responsible for developing its own energy reduction program and site-specific targets.

Tailings and Waste Management

Yamana has always prioritized the management of tailings and is diligent with the Company’s tailings management system, SYGBAR, which is built on a 6-point management system that focuses on: standards for design and construction, and use of design reviews; constant tailings management facility (“TMF”) monitoring and site-specific key performance indicators (“KPI”) development and performance management; periodic safety inspections; documentation and monthly reporting; training and continuous improvement; and emergency response plans with dam failure analysis. Yamana has a senior level, dedicated corporate manager whose sole responsibility is the governance of the tailings management system and support for the operations in ensuring compliance.

In conjunction with our robust internal management systems, Yamana also embarked on a series of independent third party TMF facility reviews in 2016. The review process was undertaken by a renowned global expert in the field who examined the design, construction and operation of the tailings facilities. The review also examined Yamana’s policies, procedures and management systems. The reviewer concluded there were no significant weaknesses or discrepancies from international best practices. The improvements opportunities that were identified saw action plans put in place to address the gaps that are currently in progress.

General waste management is also managed closely at each of Yamana’s operations. With a strong emphasis on reduction, reuse, recycling and proper disposal services, each of the operations maintain a diligent sorting and separation-at-source facility. Over the previous three years, Yamana’s operations recycled between 19% and 38% of all non-hazardous waste.

Water Management

Given the water-intensive nature of processing ore, the wide array of climatic environments in which Yamana operates and the importance of this issue for communities and other stakeholders, water management is an on-going management focus across the sites. Each operation maintains its own unique water management strategy, based on the location-specific challenges, but all operations take a disciplined approach to managing both water quality and water quantity issues. More specifically, the Company works to reduce its freshwater consumption, while maximizing water recycling on site. Only two of Yamana’s operations have process water discharges to the environment, and most operations draw the bulk of their water needs from within the mine and/or rainfall. Only 8% of the total water used across Yamana’s portfolio of operations was sourced from lakes or rivers in the areas around our mines, while the 2015 total for water consumption included approximately 68% recycled water.

Water quality is also managed closely at Yamana as non-compliance issues can present a risk to operations’ operating license, with human and aquatic health issues remaining the most significant concern. Monitoring programs are in place at all operations to ensure mining activities do not significantly impact water supplies, and to ensure no significant impacts on downstream users. At some of our operations in South America, monitoring programs include community participation. As noted above, there have been no significant spills at our operations since 2014 and all operations remain compliant the International Cyanide Management Code.

Mine Closure

Mine closure is managed closely by the operations with corporate oversight. Each operation maintains a closure plan and a corresponding Asset Retirement Obligation (ARO) that is updated annually. Yamana’s total liabilities for reclamation and closure cost obligations as at December 31, 2016 were $235.6 million.

External recognition

Yamana’s approach to HSEC management and overall performance has been recognized by a number of organizations in the last year. In 2016, Yamana was named to Corporate Knights Magazine’s Best 50 Corporate Citizens in Canada for the sixth year in a row. The Company was also included in Sustainalytics’ Jantzi Social Index, for the eighth consecutive year, which partners with the Dow Jones Sustainability Index to screen the top performing 50 Canadian companies from an ESG perspective. Yamana’s operations and country offices have also received recognition in the jurisdictions in which they operate, including the National Safety award in Chile by Chile’s National Safety Association; being named the Mining Company of the Year in Argentina by the non-profit organization FUNDAMIN, and recognition by the NGO Childhood Brazil, for being a partner of the Business Pact Against Sexual Exploitation of Children and Adolescents.

Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets

Due to the risks inherent in mineral production and the desire to organize and structure its affairs in a tax efficient manner, the Company holds each of its material properties in a separate corporate entity (through local subsidiary companies in foreign jurisdictions and other holding companies in various jurisdictions).

The risks of the corporate structure of the Company and its subsidiaries are risks that are typical and inherent for Company’s who have material assets and property interests held indirectly through foreign subsidiaries and located in foreign jurisdictions. The Company’s business and operations in emerging markets are exposed to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction such as difference in laws, business cultures and practices, banking systems and internal control over financial reporting. See below under “- Risks of the Business”.

The Company has implemented a system of corporate governance, internal controls over financial reporting and disclosure controls and procedures that apply at all levels of the Company and its subsidiaries. These systems are overseen by the Company’s board of directors, and implemented by the Company’s senior management. The relevant features of these systems are set out below.

Control over Foreign Subsidiaries

The Company controls its foreign subsidiaries by virtue of corporate oversight and by its ownership of 100% of the shares issued by such entities (exclusive of non-material subsidiaries). The Company’s management has the (i) power to appoint and dismiss, at any time, any and all of the foreign subsidiaries’ officers and directors, (ii) power to instruct the foreign subsidiaries’ officers to pursue business activities in accordance with the Company’s wishes, and (iii) legal right, as a shareholder, to require the officers of each such foreign subsidiaries to comply with their fiduciary obligations. The Company can also enforce its rights by way of various shareholder remedies available to it under local laws. As a result, the management of the Company can effectively align its business objectives with those of the foreign subsidiaries and implement such objectives at the subsidiary level.

Board and Management Expertise

A majority of the Company’s directors have been directors for a period in excess of five years. Likewise, a majority of the Company’s senior officers have at least five years of experience in senior leadership positions with the Company. As a result of their tenure, these officers and directors have gained extensive experience conducting business in the emerging jurisdictions. Please see the biographical information on pages 81 of this AIF for further information on the senior officers’ and directors’ experience.

In addition, the board of directors, through its corporate governance practices, regularly receives management and technical updates and progress reports in connection with the foreign subsidiaries, and in so doing, maintains effective oversight of their business and operations. Further, the Company’s directors and senior officers visit the Company’s operations in foreign jurisdictions on a regular basis in order to ensure effective control and management of the Company’s foreign operations. During these visits they come into contact with local employees, government officials and business persons; such interactions enhance the visiting directors’ and officers’ knowledge of local culture and business practices. Generally, the Company’s directors visit at least one of the Company’s operations in each calendar year, on a rotating basis. Certain senior and non-senior officers visit the Company’s operations quarterly, or more frequently if circumstances require, on a rotating basis.

Internal Control Over Financial Reporting and Funds

The Company maintains internal control over financial reporting with respect to its operations in emerging jurisdictions by taking various measures. Several of the Company’s Vice Presidents have the relevant language proficiency (Spanish and Brazilian Portuguese), local cultural understanding and relevant work experience in each of the Company’s operating jurisdictions which facilitates better understanding and oversight of the Company’s operations in the foreign jurisdictions in the context of internal controls over financial reporting.

Pursuant to the requirements of NI 52-109, the Company assesses the design of its internal controls over financial reporting on an annual basis. Furthermore, key controls for the accounts in scope are tested across the Company on an annual basis and the working papers of these tests performed at all the locations are reviewed at the head office level. Please refer to the Company’s annual audited consolidated financial statements for the year ended December 31, 2015, as filed under the Company’s profile on SEDAR and on the Company’s website.

Differences in banking systems and controls between Canada and the emerging jurisdictions are addressed by having stringent controls over cash in all locations; especially over access to cash, cash disbursements, appropriate authorization levels, performing and reviewing bank reconciliations in the applicable jurisdiction on at least a monthly basis and the segregation of duties.

The difference in cultures and practices between Canada and the emerging jurisdictions is addressed by employing competent staff in Canada and the emerging jurisdictions who are familiar with the local laws, business culture and standard practices, have local language proficiency, are experienced in working in the applicable emerging jurisdiction and in dealing with the respective government authorities; and have experience and knowledge of the local banking systems and treasury requirements.

The foreign subsidiaries’ also have established practices, protocols and routines in place for the distribution of its excess cash to its foreign owners. Furthermore, the opening and closing of bank accounts in the name of a foreign subsidiary is controlled, overseen and approved by the Company’s Executive Vice President, Finance and Chief Financial Officer and/or the Company’s Senior Vice President Finance and the Treasurer.

The Company ensures the flow of funds between Canada and each emerging jurisdiction functions as intended by:

| |

| • | appointing common officers of the Company and the foreign subsidiary; |

| |

| • | involving the Company’s Chief Financial Officer, located in Toronto, in hiring key finance personnel in each of the emerging jurisdictions; and |

| |

| • | closely monitoring the finance departments in each of the emerging jurisdictions, and by regular personal visits by the Chief Financial Officer and other key executives to the emerging jurisdictions. |

Communication

The Company maintains open communication with each of its foreign operations through many senior and non-senior officers who are fluent in either Brazilian Portuguese or Spanish, as applicable. In addition, all management team members in local jurisdictions are fluent in the jurisdiction’s primary language and are proficient in English. The primary language used in management and board meetings is English and material documents relating to the Company that are provided to the board of directors are in English. The Company does not currently have a formal communication plan or policy in place and has not to date, experienced any communication-related issues.

Records

All of the minute books and corporate records and documents of the foreign subsidiaries are filed at the relevant entity’s headquarters, and with the relevant governmental or regulatory body in each applicable jurisdiction in which the applicable entity’s headquarters are located. The custodians of such documents report directly to the Company’s head office and senior management team to ensure continued oversight.

Risks of the Business

The operations of the Company are speculative due to the high-risk nature of its business, which is the acquisition, financing, exploration, development and operation of mining properties. These risk factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company.

Gold, Copper and Silver Prices

The Company’s profitability and long-term viability depend, in large part, upon the market prices of metals that may be produced from its properties, primarily gold, copper and silver. Market price fluctuations of these commodities could adversely affect profitability of the Company’s operations and lead to impairments and write downs of mineral properties. Metal prices fluctuate widely and are affected by numerous factors beyond the Company’s control, including:

| |

| • | global and regional supply and demand for industrial products containing metals generally; |

| |

| • | changes in global or regional investment or consumption patterns; |

| |

| • | increased production due to new mine developments and improved mining and production methods; |

| |

| • | decreased production due to mine closures; |

| |

| • | interest rates and interest rate expectation; |

| |

| • | expectations with respect to the rate of inflation or deflation; |

| |

| • | fluctuations in the value of the United States dollar and other currencies; |

| |

| • | availability and costs of metal substitutes; |

| |

| • | global or regional political or economic conditions; and |

| |

| • | sales by central banks, holders, speculators and other producers of metals in response to any of the above factors. |

There can be no assurance that metal prices will remain at current levels or that such prices will improve. A decrease in the market prices could adversely affect the profitability of the Company’s existing mines and projects as well as its ability to finance the exploration and development of additional properties, which would have a material adverse effect on the Company’s results of operations, cash flows and financial position. A decline in metal prices may require the Company to write-down Mineral Reserve and Mineral Resource estimates by removing ores from reserves that would not be economically processed at lower metal prices and revise life-of-mine plans (“LOM Plans”), which could result in material write-downs of investments in mining properties. Any of these factors could result in a material adverse effect on the Company’s results of operations, cash flows and financial position. Further, if revenue from metal sales declines, the Company may experience liquidity difficulties. Its cash flow from mining operations may be insufficient to meet its operating needs, and as a result the Company could be forced to discontinue production and could lose its interest in, or be forced to sell, some or all of its properties.

In addition to adversely affecting Mineral Reserve and Mineral Resource estimates and the Company’s results of operations, cash flows and financial position, declining metal prices can impact operations by requiring a reassessment of the feasibility of a particular project. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays and/or may interrupt operations until the reassessment can be completed, which may have a material adverse effect on the Company’s results of operations, cash flows and financial position. In addition, lower metal prices may require the Company to reduce funds available for exploration with the result that the depleted reserves may not be replaced.

Exploration, Development and Operating Risks

Mining operations are inherently dangerous and generally involve a high degree of risk. Yamana’s operations are subject to all the hazards and risks normally encountered in the exploration, development and production of gold, copper and silver, including, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding, pit wall failure and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, personal injury or loss of life, damage to property and environmental damage, all of which may result in possible legal liability. Although the Company expects that adequate precautions to minimize risk will be taken, mining operations are subject to hazards such as fire, rock falls, geomechanical issues, equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability. The occurrence of any of these events could result in a prolonged interruption of the Company’s operations that would have a material adverse effect on its business, financial condition, results of operations and prospects.

The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish Mineral Reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Yamana will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices that are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Yamana not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Yamana towards the search and evaluation of mineral deposits will result in discoveries or development of commercial quantities of ore.

Health, Safety and Environmental Risks and Hazards

Mining, like many other extractive natural resource industries, is subject to potential risks and liabilities due to accidents that could result in serious injury or death and/or material damage to the environment and Company assets. The impact of such accidents could affect the profitability of the operations, cause an interruption to operations, lead to a loss of licenses, affect the reputation of the Company and its ability to obtain further licenses, damage community relations and reduce the perceived appeal of the Company as an employer.

The Company strives to manage all such risks in compliance with local and international standards. All phases of the Company’s operations are subject to environmental and safety regulations in the various jurisdictions in which it operates. These regulations mandate, among other things, worker safety, water quality, water management, land reclamation, waste disposal (including the generation, transportation, storage and disposal of hazardous waste), mine development and protection of endangered and other special status species. Failure to comply with applicable health, safety and environmental laws and regulations could result in injunctions, fines, suspension or cancellation of permits and approvals and could include other penalties. Health, safety and environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that the Company has been or will at all times be in full compliance with all environmental laws and regulations or hold, and be in full compliance with, all required environmental and health and safety permits. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations, including the Company, may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. The potential costs and delays associated with compliance with such laws, regulations and permits could prevent the Company from proceeding with the development of a project or the operation or further development of a project, and any non-compliance therewith may adversely affect the Company’s business, financial condition and results of operations.

Government environmental approvals and permits are currently, or may in the future be, required in connection with the Company’s operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from proceeding with planned exploration or development of mineral properties.

The Company may also be held financially responsible for remediation of contamination at current or former sites, or at third party sites. The Company could also be held responsible for exposure to hazardous substances. The costs associated with such instances and liabilities could be significant.

The Company has implemented extensive health and safety initiatives at its sites to protect the health and safety of its employees, contractors and communities local to operations; however, there is no assurance that such measures will eliminate the occurrence of accidents or other incidents which may result in personal injuries or damage to property. Such occurrences, in some situations, may yield regulatory fines and/or civil liability.

In some countries where the Company operates, there is a requirement to have a government approved reclamation plan for a mining operation that establishes the Company’s obligation to reclaim property after minerals have been mined from the site. For some countries, bonds or other forms of financial assurance is required to secure the costs to implement reclamation. The Company may incur costs associated with reclamation activities, which may materially exceed the provisions established by the company for the activities. In addition, possible additional future regulatory requirements may require additional reclamation

requirements creating uncertainties related to future reclamation costs. Changes in unit costs and exchange rates of local currencies will affect the cost estimates for reclamation. Additionally, when a previously unrecognized reclamation liability becomes known or a previously estimated cost is increased, the amount of that liability or additional cost is expensed, which may materially reduce net income in that period.

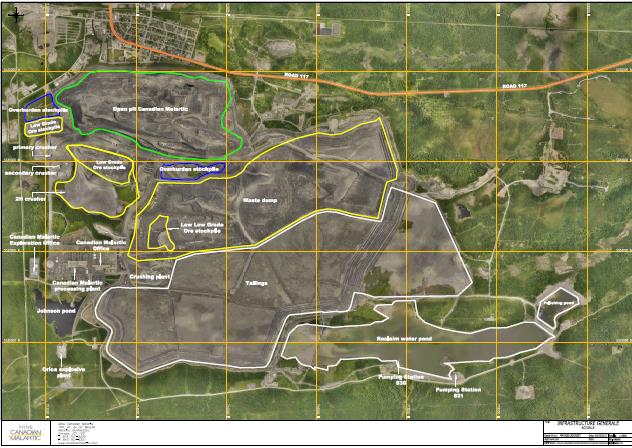

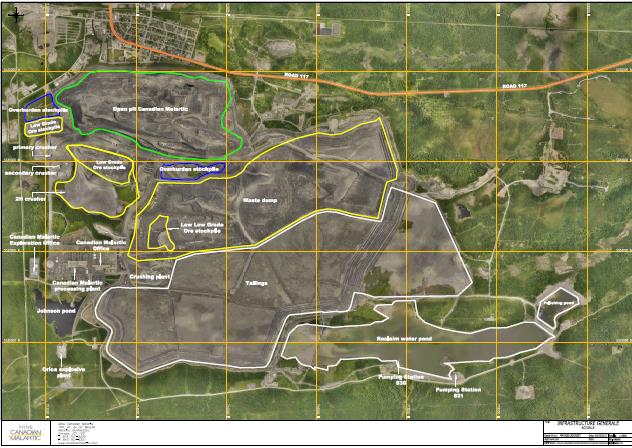

In certain jurisdictions, the Company may be required to submit, for government approval, a reclamation plan for each of its mining/project sites. The reclamation plan establishes the Company’s obligation to reclaim property after minerals have been mined from the sites. In some jurisdictions, bonds or other forms of financial assurances are required as security to ensure performance of the required reclamation activities. The Company may incur significant reclamation costs which may materially exceed the provisions the Company has made for such reclamation. In addition, the potential for additional regulatory requirements relating to reclamation or additional reclamation activities may have a material adverse effect on the Company’s financial condition, liquidity or results of operations. When a previously unrecognized reclamation liability becomes known or a previously estimated cost is increased, the amount of that liability or additional cost may be expensed, which may materially reduce net income in that period.