- WF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Woori Financial (WF) 6-KCurrent report (foreign)

Filed: 14 Aug 24, 10:16am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-31811

Woori Financial Group Inc.

(Translation of registrant’s name into English)

51, Sogong-ro, Jung-gu, Seoul, 04632, Korea

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Summary of 2024 First Half Business Report

3

Except where indicated otherwise, financial information contained in this document (including the attached financial statements) has been prepared in accordance with the Korean equivalent of International Financial Reporting Standards (“Korean IFRS”), which differ in certain important respects from generally accepted accounting principles in the United States.

All references to “Woori Financial Group,” “we,” “us,” “the Group” or the “Company” are to Woori Financial Group Inc. and, unless the context requires otherwise, its subsidiaries. In addition, all references to “Won” or “KRW” in this document are to the currency of the Republic of Korea.

4

| I. | Introduction of the Company |

| 1. | Overview of the Company |

| a. | History |

| January 11, 2019 | Establishment of the Company pursuant to a comprehensive stock transfer, by which Woori Bank, Woori FIS, Woori Finance Research Institute, Woori Credit Information, Woori Fund Services and Woori Private Equity Asset Management became wholly-owned subsidiaries of the Company. | |||

| February 13, 2019 | Listed on the Korea Exchange (KRX). | |||

| April 5, 2019 | Entered into share purchase agreements to acquire Tongyang Asset Management Corp. and ABL Global Asset Management Co., Ltd. | |||

| June 21, 2019 | Entered into a purchase agreement with Woori Bank to acquire the common shares of Woori Investment Bank Co., Ltd. (“Woori Investment Bank”) and integrate Woori Investment Bank as a first-tier subsidiary of the Company (Buyer: Woori Financial Group, Seller: Woori Bank) | |||

| July 3, 2019 | Entered into a stock exchange agreement between the Company and Woori Card Co., Ltd (“Woori Card”) to integrate Woori Card as a first-tier subsidiary of the Company | |||

| July 25, 2019 | Entered into a share purchase agreement to acquire Kukje Asset Trust, Ltd. | |||

| August 1, 2019 | Integrated Woori Asset Management Corp. (formerly known as Tongyang Asset Management Co., Ltd.) as a first-tier subsidiary of the Company. | |||

| September 10, 2019 | Integrated Woori Card and Woori Investment Bank as first-tier subsidiaries of the Company. | |||

| September 26, 2019 | Disposed 4% of common shares of the Company held by Woori Bank to a Taiwanese company, Fubon Life Insurance Co., Ltd. | |||

| December 6, 2019 | Integrated Woori Global Asset Management Corp. as a first-tier subsidiary of the Company | |||

| December 30, 2019 | Integrated Woori Asset Trust Ltd. as a first-tier subsidiary of the Company | |||

| March 25, 2020 | Held the first annual general meeting of shareholders of Woori Financial Group; reappointed the Chief Executive Officer | |||

5

| October 26, 2020 | Entered into a share purchase agreement to acquire Aju Capital Co., Ltd. | |||

| December 10, 2020 | Integrated Woori Financial Capital Co., Ltd., (formerly known as Aju Capital Co., Ltd.) as a first-tier subsidiary of the Company | |||

| Integrated Woori Savings Bank (formerly known as Aju Savings Bank) as a second-tier subsidiary of the Company | ||||

| January 15, 2021 | Joined the Carbon Disclosure Project (CDP), announced support for the Task force on Climate related Financial Disclosure (TCFD) and established the ESG management principles of Woori Financial Group | |||

| March 5, 2021 | Established the Board ESG Management Committee | |||

| March 12, 2021 | Integrated Woori Savings Bank as a first-tier subsidiary of the Company | |||

| April 9, 2021 | After-hours trading of a 2% stake in Woori Financial Group held by the Korea Deposit Insurance Corporation | |||

| April 15, 2021 | Purchased additional equity shares of Woori Financial Capital Co., Ltd., increasing the Company’s equity ownership by 12.9% | |||

| May 13, 2021 | Participated in the capital increase of Woori Savings Bank (KRW 100 billion) | |||

| May 24, 2021 | Purchased 3.6% of Woori Financial Capital Co., Ltd. in treasury shares | |||

| June 4, 2021 | Entered into a stock exchange agreement to acquire the remaining shares of Woori Financial Capital Co., Ltd. | |||

| August 10, 2021 | Integrated Woori Financial Capital Co., Ltd., as a wholly-owned subsidiary of the Company (Completion of stock exchange) | |||

| September 9, 2021 | Announcement of contemplated sales of the remaining stake in Woori Financial Group held by the Korea Deposit Insurance Corporation | |||

| October 8, 2021 | Joined the SBTi (Science Based Targets initiative) as part of the roadmap for achieving carbon neutrality | |||

| November 2, 2021 | Obtained regulatory approval for using the IRB (Internal Rating Based) approach | |||

| November 9, 2021 | Obtained ‘AA’ rating from MSCI ESG assessment (2 grades higher than the previous year), ‘A’ rating from KCGS(Korea Corporate Governance Service)(1 grade higher than the previous year) | |||

6

| November 17, 2021 | Included newly in Asia Pacific Index of DJSI (Dow Jones Sustainability Indices) | |||

| December 9, 2021 | Achieved practically full privatization through the decrease of the KDIC’S stake in us from 15.1% to 5.8%, changing the largest shareholder from the KDIC to the Employee Stock Ownership Association of Woori Financial Group | |||

| December 26, 2021 | Launched the Group integrated car finance platform “Woori WON Car” | |||

| January 7, 2022 | Officially launched the NPL investment company Woori Financial F&I Inc. | |||

| January 13, 2022 | Joined the global environment initiative Taskforce on Nature-related Financial Disclosures (TNFD) | |||

| February 4, 2022 | Recognized as an ‘Industry Mover’ in a sustainability assessment by S&P Global for 2022 | |||

| February 10, 2022 | Disposal by the Korea Deposit Insurance Corporation of a 2.2% stake in Woori Financial Group (reducing the KDIC’s stake in Woori Financial Group from 5.8% to 3.6%) | |||

| May 11, 2022 | Became the first company in the world to join the launch of the ‘Business for Land (B4L) Initiative’ for the protection of sustainable forests and the recovery of land degradation | |||

| May 18, 2022 | Disposal by the Korea Deposit Insurance Corporation of a 2.3% stake in Woori Financial Group (reducing the KDIC’s stake in Woori Financial Group from 3.6% to 1.3%) | |||

| June 19, 2022 | Held the inaugural meeting of Woori Financial Future Foundation | |||

| August 22, 2022 | Joined the ‘Partnership for Biodiversity Accounting Financials(PBAF)’ as the first Asian company | |||

| November 7, 2022 | Held the global conference ‘Sustainable Finance for a Better World’ | |||

| December 14, 2022 | Signatory of Statement from the Financial Sector at the Conference of the Parties to the ‘UN Convention on Biological Diversity(UN CBD)’ | |||

7

| December 29, 2022 | Received ‘AA’ rating from MSCI ESG Research for 2 consecutive years | |||

| January 16, 2023 | Completed the establishment of the ‘WON Synergy’ system to create effective synergy within group companies | |||

| January 26, 2023 | Became the first financial company in Korea to join the ‘Finance Leadership Group on Plastics’ hosted by ‘UN Environment Programme Finance Initiative (UNEP FI)’ | |||

| February 27, 2023 | Entered into a stock purchase agreement to acquire Daol Investment (52% ownership) | |||

| March 23, 2023 | Daol Investment, re-named Woori Venture Partners, incorporated as a subsidiary into Woori Financial Holdings | |||

| March 24, 2023 | Jong-Yong Yim appointed as the 9th chairman of Woori Financial Group (4th annual general meeting of shareholders of Woori Financial Group) | |||

| April 21, 2023 | Resolved to repurchase and cancel treasury shares, a first-time since the transition to a holding company | |||

| June 01, 2023 | Entered into a comprehensive stock exchange agreement with Woori Investment Bank and Woori Venture Partners | |||

| August 08, 2023 | Woori Investment Bank and Woori Venture Partners to each become a wholly-owned subsidiary of Woori Financial Group | |||

| August 24, 2023 | Group Carbon Emission Reduction Target validated by SBTi (Science Based Targets initiative) | |||

| October 05, 2023 | Entered into a memorandum of understanding with the Korea Deposit Insurance Corporation to purchase its remaining stake in Woori Financial Group (1.2%) | |||

| December 22, 2023 | A capital increase of KRW 500 billion conducted by Woori Investment Bank (to enhance competitiveness) | |||

| December 26, 2023 | Obtained an ‘AAA’ rating from MSCI ESG assessment | |||

| January 29, 2024 | Merged Woori Global Asset Management with and into Woori Asset Management | |||

8

| March 13, 2024 | Resolved to acquire and cancel the remaining shares owned by the Korea Deposit Insurance Corporation | |||

| August 1, 2024 | Established ‘Woori Investment Securities’ as a new direct subsidiary | |||

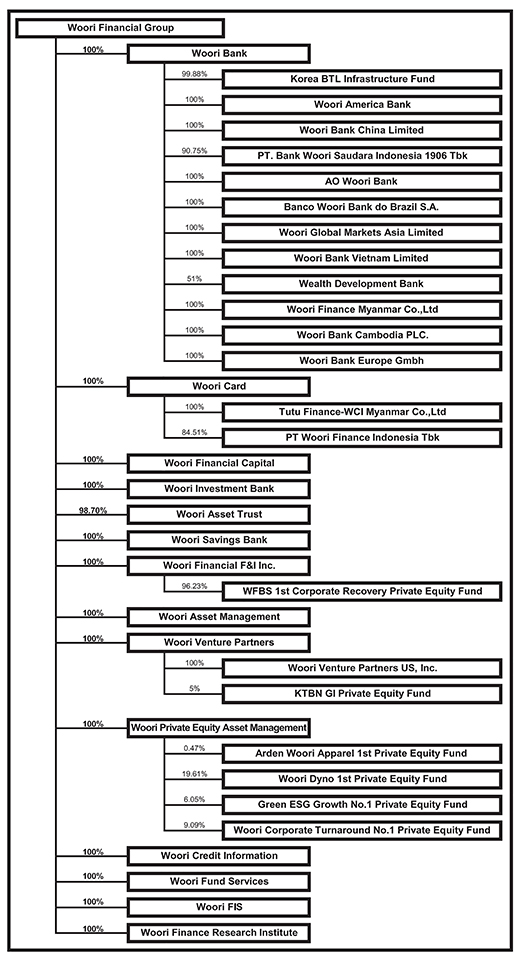

| b. | Affiliated Companies |

| (1) | Overview of Business Group |

| 1. | Name of business group: Woori Financial Group Inc. |

| (2) | Affiliated companies within the business group |

As of June 30, 2024

Type | Name of Company | |

Listed company (3 companies) | Woori Financial Group | |

| PT Bank Woori Saudara Indonesia 1906 Tbk | ||

| PT Woori Finance Indonesia Tbk | ||

Unlisted company (33 companies) | Woori Bank | |

| Woori Card | ||

| Woori Financial Capital | ||

| Woori Investment Bank | ||

| Woori Asset Trust | ||

| Woori Savings Bank | ||

| Woori Asset Management | ||

| Woori Venture Partners | ||

| Woori Financial F&I Inc. | ||

| Woori Credit Information | ||

| Woori Fund Services | ||

| Woori Private Equity Asset Management | ||

| Woori FIS | ||

| Woori Finance Research Institute | ||

| Korea BTL Infrastructure Fund | ||

| Woori America Bank | ||

| Woori Bank China Limited | ||

| AO Woori Bank | ||

| Banco Woori Bank do Brazil S.A. | ||

| Woori Global Markets Asia Limited | ||

9

Type | Name of Company | |

| Woori Bank Vietnam Limited | ||

| Wealth Development Bank | ||

| Woori Finance Myanmar Co., Ltd. | ||

| Woori Bank (Cambodia) PLC. | ||

| Woori Bank Europe Gmbh | ||

| Tutu Finance-WCI Myanmar Co., Ltd. | ||

| WFBS 1st Corporate Recovery Private Equity Fund | ||

| Woori Venture Partners US, Inc. | ||

| KTBN GI Private Equity Fund | ||

| Arden Woori Apparel 1st Private Equity Fund | ||

| Woori Dyno 1st Private Equity Fund | ||

| Green ESG Growth No.1 Private Equity Fund | ||

| Woori Corporate Turnaround No.1 Private Equity Fund |

Note 1) Includes first-tier and second-tier subsidiaries under the Financial Holding Company Act

10

11

| 2. | Capital Structure (Changes in Capital) |

| (units: Won, shares) | ||||||||||||||

Date | Item | Type | ||||||||||||

| Common Shares | Preferred Shares | Others | ||||||||||||

June 30, 2024 | Number of issued shares | 742,591,501 | — | — | ||||||||||

| Par Value | 5,000 | — | — | |||||||||||

| Capital Stock | 3,802,676,300,000 | — | — | |||||||||||

December 31, 2023 | Number of issued shares | 751,949,461 | ||||||||||||

| Par Value | 5,000 | |||||||||||||

| Capital Stock | 3,802,676,300,000 | |||||||||||||

December 31, 2022 | Number of issued shares | 728,060,549 | — | — | ||||||||||

| Par Value | 5,000 | — | — | |||||||||||

| Capital Stock | 3,640,302,745,000 | — | — | |||||||||||

December 31, 2021 | Number of issued shares | 728,060,549 | — | — | ||||||||||

| Par Value | 5,000 | — | — | |||||||||||

| Capital Stock | 3,640,302,745,000 | — | — | |||||||||||

December 31, 2020 | Number of issued shares | 722,267,683 | — | — | ||||||||||

| Par Value | 5,000 | — | — | |||||||||||

| Capital Stock | 3,611,338,415,000 | — | — | |||||||||||

Note 1) Our common shares of 680,164,306 were issued in January 2019 upon our establishment and the number of our common shares increased by 42,103,377 as a result of a comprehensive stock exchange that took place between Woori Financial Group and Woori Card in September 2019.

Note 2) The number of our common shares increased by 5,792,866 on August 10, 2021 due to a comprehensive stock exchange to integrate Woori Financial Capital as a wholly-owned subsidiary.

Note 3) The number of our common shares increased by 32,474,711 as a result of a comprehensive stock exchange that took place on August 8, 2023 to convert Woori Investment Bank and Woori Venture Partners as our wholly-owned subsidiaries.

Note 4) On October 30, 2023, the number of our common shares was reduced by 8,585,799 due to the cancellation of our treasury shares acquired through a trust agreement.

- Our paid-in capital does not match the par value of our total issued shares at year-end because our cancellation of treasury shares constitutes the cancellation of treasury shares acquired within the limits of profits available for dividends, which means that there would be no reduction in the paid-in capital of Woori Financial Group.

Note 5) On March 22, 2024, the number of our common shares was reduced by 9,357,960 due to the cancellation of the treasury shares that we acquired from KDIC.

Note 6) As the cancellation of treasury shares in October 2023 and March 2024 was carried out within the scope of distributable profits, there was no decrease in capital stock. As such, Woori Financial Group’s capital stock as of June 30, 2024 and December 31, 2023 does not match the face value of the total number of issued shares.

12

| As of June 30, 2024 | (units: Won, shares) | |||||||||||||||||||||

Date | Category | Stock Decrease/Increase | ||||||||||||||||||||

| Type | Quantity | Par Value | Issue price | Note | ||||||||||||||||||

January 11, 2019 | — | Common | 680,164,306 | 5,000 | 26,415 | Establishment (comprehensive stock transfer) | ||||||||||||||||

September 10, 2019 | — | Common | 42,103,377 | 5,000 | 12,350 | Comprehensive stock exchange Stock increase ratio: 6.19018% | ||||||||||||||||

August 10, 2021 | — | Common | 5,792,866 | 5,000 | 11,100 | Comprehensive stock exchange Stock increase ratio: 0.80204% | ||||||||||||||||

August 8, 2023 | — | Common | 32,474,711 | 5,000 | 11,520 | Comprehensive stock exchange Stock increase ratio: 4.46044% | ||||||||||||||||

October 30, 2023 | — | Common | (8,585,799 | ) | 5,000 | — | Cancellation of treasury shares | |||||||||||||||

March 22, 2024 | — | Common | (9,357,960 | ) | 5,000 | — | Cancellation of treasury shares | |||||||||||||||

Note 1) Due to Woori Financial Group’s establishment through a comprehensive stock transfer, the issue price was calculated by dividing the total equity from its financial statements at the time of establishment (Won 17,966,458,911,689) by the total number of issued shares (680,164,306).

Note 2) Our capital changed in September 2019 and August 2021 due to a comprehensive stock exchanges. The issue prices were based on the closing stock price on the comprehensive stock exchange date.

Note 3) On October 30, 2023, we canceled our treasury shares (8,585,799 common shares) acquired through a trust agreement. This share cancellation falls under the provision of Article 343, Paragraph 1 of the Commercial Code, and as it involves the cancellation of treasury shares acquired within the limits of distributable profits, the paid-in capital remains unchanged despite the decrease in the number of the total issued shares (common shares).

Note 4) On March 22, 2024, Woori Financial Group cancelled 9,357,960 shares, which were acquired from the remaining shares previously held by KDIC. This cancellation was carried out in accordance with Article 343, Paragraph 1 of the Commercial Act. Since the retirement of these shares was done within the scope of distributable profits, the total number of issued shares (common stock) decreased, but there was no change in capital stock.

13

| 3. | Total Number of Authorized Shares |

| As of June 30, 2024 | (unit: shares) |

Items | Type | Notes | ||||||||

| Common Shares | Total | |||||||||

Number of authorized shares | 4,000,000,000 | 4,000,000,000 | — | |||||||

Number of issued shares | 760,535,260 | 760,535,260 | — | |||||||

Number of decreased shares | 17,943,759 | 17,943,759 | Cancellation of Treasury Shares Note 1) | |||||||

Number of treasury shares | 53,945 | 53,945 | Note 2) | |||||||

Number of outstanding shares | 742,537,556 | 742,537,556 | — | |||||||

Note 1) Cancellation of treasury shares : 8,585,799 shares in October 2023, 9,357,960 shares in March 2024

Note 2) Acquired from the issuance of fractional shares (2,322 new fractional shares were added in August 2021 due to the comprehensive stock exchange between Woori Financial Group and Woori Financial Capital. 51,621 shares from comprehensive stock exchange between Woori Financial Group-Woori Investment Bank and Woori Financial Group-Woori Venture Partners, etc.)

| II. | Business Overview |

| 1. | Results of Operations |

| (unit: billions of Won) | ||||||

Type | 2024 1H | 2023 | 2022 | |||||||||

Operating income | 2,404 | 3,499 | 4,431 | |||||||||

Net non-operating income (expense) | (13 | ) | 18 | 55 | ||||||||

Income before income tax | 2,391 | 3,517 | 4,485 | |||||||||

Income tax expense | 590 | 891 | 1,161 | |||||||||

Net income | 1,800 | 2,627 | 3,324 | |||||||||

Controlling Interest | 1,755 | 2,506 | 3,142 | |||||||||

Non-controlling Interest | 45 | 121 | 182 | |||||||||

Note 1) Based on K-IFRS consolidated financial statements

14

| 2. | Funding Sources and Uses of Funds |

| a. | Sources of Funds |

| For the periods indicated other than as noted below | (units: millions of Won, %) |

Classification | Funding Source | 2024 1H | 2023 | 2022 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest Rate | Proportion | Average Balance | Interest Rate | Proportion | Average Balance | Interest Rate | Proportion | ||||||||||||||||||||||||||||||

Source | Deposits | 343,814,061 | 2.91 | 70.15 | 324,824,465 | 2.83 | 68.98 | 313,019,768 | 1.45 | 68.21 | ||||||||||||||||||||||||||||

| Borrowings | 28,295,821 | 4.25 | 5.77 | 28,052,983 | 4.02 | 5.96 | 27,296,742 | 1.99 | 5.95 | |||||||||||||||||||||||||||||

| Debentures | 41,679,131 | 4.13 | 8.50 | 42,458,653 | 3.55 | 9.02 | 45,945,392 | 2.26 | 10.01 | |||||||||||||||||||||||||||||

| Others | 42,172,997 | — | 8.60 | 42,829,998 | — | 9.09 | 42,537,152 | — | 9.27 | |||||||||||||||||||||||||||||

| Total Liabilities | 455,962,010 | — | 93.03 | 438,166,099 | — | 93.05 | 428,799,054 | — | 93.44 | |||||||||||||||||||||||||||||

Total Equity | 34,156,482 | — | 6.97 | 32,708,219 | — | 6.95 | 30,082,662 | — | 6.56 | |||||||||||||||||||||||||||||

Total Liabilities & Equity | 490,118,492 | — | 100.00 | 470,874,318 | — | 100.00 | 458,881,716 | — | 100.00 | |||||||||||||||||||||||||||||

Note 1) Average Balance : the simple average of the balances at the start of the fiscal year and at the end of each quarter

Note 2) Based on K-IFRS consolidated financial statements

| b. | Use of Funds |

| For the periods indicated other than as noted below | (units: millions of Won, %) |

Type | Managed Item | 2024 1H | 2023 | 2022 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest Rate | Proportion | Average Balance | Interest Rate | Proportion | Average Balance | Interest Rate | Proportion | ||||||||||||||||||||||||||||||

Use | Cash & Due from Banks | 17,171,955 | 3.59 | 3.50 | 16,692,268 | 3.26 | 3.54 | 16,097,533 | 1.52 | 3.51 | ||||||||||||||||||||||||||||

| Marketable securities | 77,344,582 | 3.18 | 15.78 | 75,522,522 | 3.61 | 16.04 | 68,661,882 | 1.50 | 14.96 | |||||||||||||||||||||||||||||

| Loans | 352,829,186 | 5.03 | 71.99 | 334,205,508 | 5.08 | 70.98 | 326,710,683 | 3.73 | 71.20 | |||||||||||||||||||||||||||||

| Loans in local currency | 303,061,878 | 4.76 | 61.83 | 287,312,990 | 4.84 | 61.02 | 280,414,033 | 3.53 | 61.12 | |||||||||||||||||||||||||||||

| Loans in foreign currency | 33,329,625 | 6.65 | 6.80 | 31,215,114 | 6.64 | 6.63 | 30,916,107 | 4.54 | 6.74 | |||||||||||||||||||||||||||||

| Guarantee payments | 13,925 | 1.93 | 0.00 | 14,567 | 2.28 | 0.00 | 21,260 | 2.67 | 0.00 | |||||||||||||||||||||||||||||

| Credit card receivables | 12,056,633 | 7.05 | 2.46 | 11,215,186 | 6.85 | 2.38 | 10,026,037 | 7.24 | 2.18 | |||||||||||||||||||||||||||||

| Foreign bills bought | 4,367,125 | 5.81 | 0.89 | 4,447,651 | 5.33 | 0.95 | 5,333,246 | 2.58 | 1.16 | |||||||||||||||||||||||||||||

| Bad debt expense (Δ) | 3,106,695 | 0.63 | 2,609,403 | — | 0.55 | 2,128,867 | — | 0.46 | ||||||||||||||||||||||||||||||

| Others | 45,879,464 | 9.36 | 47,063,423 | — | 9.99 | 49,540,485 | — | 10.79 | ||||||||||||||||||||||||||||||

Total Assets | 490,118,492 | 100.00 | 470,874,318 | — | 100.00 | 458,881,716 | — | 100.00 | ||||||||||||||||||||||||||||||

Note 1) Average Balance : the simple average of the balances at the start of the fiscal year and at the end of each quarter

Note 2) Based on K-IFRS consolidated financial statements

15

| 3. | Other Information Necessary for Making Investment Decisions |

| a. | Capital Adequacy Ratios |

Group BIS Capital Adequacy Ratios

| As of the end of the period indicated | (units: billions of Won, % ) | |||||||||||

Type | 2024 1H | 2023 | 2022 | |||||||||

Equity capital (A) | 36,763 | 34,756 | 31,404 | |||||||||

Risk weighted assets (B) | 230,812 | 219,792 | 205,307 | |||||||||

BIS(Capital adequacy) ratio (A/B) | 15.93 | 15.81 | 15.30 | |||||||||

Note 1) BIS (Bank for International Settlements) Capital Adequacy Ratios = Equity capital / Risk weighted assets * 100

Note 2) Based on K-IFRS consolidated financial statements and Basel III standards

Note 3) 2024 1H figures are estimates only and are subject to change

Capital Adequacy Ratios for Significant Subsidiaries and Consolidated Companies

| As of the end of the periods indicated | (units: millions of Won, % ) | |||||||||||||||

Name of Company | Type | 2024 1H | 2023 | 2022 | ||||||||||||

Woori Bank Note 2) | BIS ratio Note 1) | Equity capital (A) | 30,326,300 | 28,237,929 | 26,119,135 | |||||||||||

| Risk weighted assets (B) | 187,957,223 | 176,073,743 | 167,432,214 | |||||||||||||

| Capital adequacy ratio (A/B) | 16.13 | 16.04 | 15.60 | |||||||||||||

Woori Card Note 3) | Adjusted capital ratio | 17.41 | 16.03 | 16.54 | ||||||||||||

Tangible common equity ratio | 11.87 | 10.97 | 11.28 | |||||||||||||

Woori Financial Capital Note 3) | Adjusted capital ratio | 14.12 | 14.35 | 13.78 | ||||||||||||

Tangible common equity ratio | 11.55 | 11.48 | 10.66 | |||||||||||||

Woori Investment Bank Note 4) | BIS ratio Note 1) | Equity capital (A) | 1,120,633 | 1,127,425 | 674,082 | |||||||||||

| Risk weighted assets (B) | 4,113,945 | 4,664,162 | 4,448,524 | |||||||||||||

| Capital adequacy ratio (A/B) | 27.24 | 24.17 | 15.15 | |||||||||||||

Woori Asset Trust Note 5) | Operating capital ratio | 3,219.51 | 1,284.26 | 1,189.77 | ||||||||||||

Woori Asset Management Note 3) | Minimum operating capital ratio | 710.84 | 650.26 | 681.18 | ||||||||||||

Woori Venture Partners Note 6) | Tangible common equity ratio | 87.21 | 90.82 | 90.92 | ||||||||||||

Woori Savings Bank Note 7) | BIS Capital adequacy ratio Note1) | 19.82 | 13.21 | 18.06 | ||||||||||||

Woori Private Equity Asset Management Note 3) | Minimum operating capital ratio | 8,560.29 | 8,618.79 | 8,937.76 | ||||||||||||

Note 1) BIS (Bank for International Settlements) Capital Adequacy Ratio : Equity capital / Risk weighted assets * 100

Note 2) Figures for Woori Bank are based on the K-IFRS consolidated financial statements and Basel III standards. 2024 1H figures are estimates only and are subject to change

Note 3) Figures for Woori Card, Woori Financial Capital, Woori Asset Management and Woori Private Equity Asset Management are based on the applicable standards for business reports submitted to the Financial Supervisory Service and our K-IFRS separate financial statements

16

Note 4) Figures for Woori Investment Bank are based on the applicable standards for business reports submitted to the Financial Supervisory Service and our K-IFRS consolidated financial statements

Note 5) Figures for Woori Asset Trust are based on K-IFRS separate financial statements

Note 6) Figures for Woori Venture Partners are based on K-IFRS consolidated financial statements

Note 7) Figures for Woori Savings Bank are based on K-GAAP

| b. | Liquidity Ratios |

Won Liquidity Ratios

| As of the end of the periods indicated | (units: millions of Won, % ) | |||||||||||||||||||||||||||||||||||

Type | 2024 1H | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Won Liquidity Assets | Won Liquidity Liabilities | Won Liquidity Ratio | Won Liquidity Assets | Won Liquidity Liabilities | Won Liquidity Ratio | Won Liquidity Assets | Won Liquidity Liabilities | Won Liquidity Ratio | ||||||||||||||||||||||||||||

Woori Financial Group Note 1) | 572,342 | 19,733 | 2,900.4 | 111,895 | 8,155 | 1,372.1 | 316,876 | 7,656 | 4,138.9 | |||||||||||||||||||||||||||

Woori Card Note 2) | 8,731,521 | 3,560,245 | 245.25 | 9,119,265 | 2,454,480 | 371.54 | 8,282,745 | 1,832,484 | 452.0 | |||||||||||||||||||||||||||

Woori Financial Capital Note 2) | 2,022,045 | 1,519,283 | 133.1 | 1,919,083 | 1,245,067 | 154.1 | 2,468,298 | 1,205,067 | 204.8 | |||||||||||||||||||||||||||

Woori Investment Bank Note 2) | 4,657,991 | 1,777,204 | 262.1 | 4,032,290 | 1,926,080 | 209.4 | 3,128,499 | 1,802,149 | 173.6 | |||||||||||||||||||||||||||

Woori Asset Trust Note 2) | 320,459 | 8,364 | 3,831.6 | 171,860 | 18,555 | 926.2 | 232,036 | 32,755 | 708.4 | |||||||||||||||||||||||||||

Woori Savings Bank Note 2), Note 3) | 439,645 | 198,166 | 221.86 | 434,495 | 231,003 | 188.09 | 534,678 | 384,493 | 139.1 | |||||||||||||||||||||||||||

Woori Venture Partners Note 2) | 174,307 | 41,930 | 415.7 | 103,367 | 7,210 | 1,433.6 | 109,432 | 10,707 | 1,022.1 | |||||||||||||||||||||||||||

Woori Private Equity Asset Management Note 2) | 31,287 | 895 | 3,493.7 | 27,506 | 2,396 | 1,147.8 | 23,226 | 1,897 | 1,224.4 | |||||||||||||||||||||||||||

Note 1) Based on current assets and liabilities within one month of maturity

Note 2) Based on current assets and liabilities within 90 days of maturity

Note 3) Based on K-GAAP

Foreign Currency (FC) Liquidity Ratios

| As of the end of the periods indicated | (units: millions of Won, % ) | |||||||||||||||||||||||||||||||||||

Type | 2024 1H | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| FC Liquidity Assets | FC Liquidity Liabilities | FC Liquidity Ratio | FC Liquidity Assets | FC Liquidity Liabilities | FC Liquidity Ratio | FC Liquidity Assets | FC Liquidity Liabilities | FC Liquidity Ratio | ||||||||||||||||||||||||||||

Woori Investment Bank Note 1) | 1,851 | 210 | 881.24 | 9,450 | 7,362 | 128.36 | 65,102 | 63,365 | 102.74 | |||||||||||||||||||||||||||

Note 1) Based on current assets and liabilities within three months of maturity

17

Liquidity Coverage Ratios (LCR)

| (unit: % ) | ||||||||||||||

Name of Company | Type | 2024 1H | 2023 | 2022 | ||||||||||

Woori Bank | Liquidity coverage ratio Note 1) | 101.17 | 101.26 | 102.40 | ||||||||||

| Foreign currency liquidity coverage ratio Note 2) | 140.24 | 162.75 | 143.11 | |||||||||||

| Ratio of business purpose premises and equipment | 9.93 | 10.20 | 11.04 | |||||||||||

Note 1) The LCR is calculated as the average of daily ratios during the applicable period (same as the calculation method used for business disclosures). The applicable LCR requirements for banks were 95.0%, 95.0%, and 92.5% as of June 30, 2024, December 31,2023, and December 31, 2022, respectively.

Note 2) The foreign currency LCR is calculated based on averages of the amount of each category (same as the calculation method used for business disclosures). The applicable foreign currency LCR requirements for banks were 80% for all applicable periods.

| c. | Profitability Ratio |

Type | 2024 1H | 2023 | 2022 | |||||||||||||||||||||

| ROA | ROE | ROA | ROE | ROA | ROE | |||||||||||||||||||

Woori Financial Group | ||||||||||||||||||||||||

Including non-controlling interests | 0.71 | 11.10 | 0.54 | 8.65 | 0.70 | 12.21 | ||||||||||||||||||

Excluding non-controlling interests | 0.70 | 10.82 | 0.52 | 8.25 | 0.66 | 11.54 | ||||||||||||||||||

Note 1) On an annualized basis based on the applicable standards for business reports submitted to the Financial Supervisory Service.

Note 2) Total assets and total equity : the simple average of the balances at the start of the fiscal year and at the end of each quarter

18

| d. | Asset Quality |

Group Asset Quality

| (units: billions of Won, % ) | ||||||||||||

Type | 2024 1H | 2023 | 2022 | |||||||||

Total loans | 380,367 | 365,780 | 343,821 | |||||||||

Substandard and below loans | 2,148 | 1,357 | 1,082 | |||||||||

Substandard and below loans ratio | 0.56 | 0.37 | 0.31 | |||||||||

Non-performing loans | 1,843 | 1,299 | 997 | |||||||||

NPL ratio | 0.48 | 0.36 | 0.29 | |||||||||

Substandard and below coverage ratio (A/B) | 149.7 | 220.1 | 217.6 | |||||||||

Loan loss reserve (A) | 3,215 | 2,986 | 2,354 | |||||||||

Substandard and below loans (B) | 2,148 | 1,357 | 1,082 | |||||||||

Note 1) Based on the applicable standards for financial holding company business reports submitted to the Financial Supervisory Service

Asset Quality for Significant Subsidiaries and Consolidated Companies

| (units: % ) | ||||||||||||||||||||||||||||||||||||

Type | 2024 1H | 2023 | 2022 | |||||||||||||||||||||||||||||||||

| Substandard and below ratio | NPL ratio | Substandard and below coverage ratio | Substandard and below ratio | NPL ratio | Substandard and below coverage ratio | Substandard and below ratio | NPL ratio | Substandard and below coverage ratio | ||||||||||||||||||||||||||||

Woori Bank | 0.23 | 0.17 | 249.82 | 0.18 | 0.17 | 320.84 | 0.19 | 0.16 | 263.43 | |||||||||||||||||||||||||||

Woori Card | 1.44 | — | 105.23 | 0.97 | — | 104.92 | 0.8 | — | 104.92 | |||||||||||||||||||||||||||

Woori Financial Capital | 2.39 | — | 107.98 | 2.37 | — | 113.21 | 1.22 | — | 198.56 | |||||||||||||||||||||||||||

Woori Investment Bank | 5.96 | 2.02 | 69.62 | 0.55 | 0.55 | 578.29 | 0.63 | 0.58 | 151.81 | |||||||||||||||||||||||||||

Woori Asset Trust | 70.37 | — | — | 32.11 | — | — | 32.23 | — | — | |||||||||||||||||||||||||||

Woori Savings Bank | 9.54 | — | 66.37 | 3.53 | — | 101.66 | 3.22 | — | 97.54 | |||||||||||||||||||||||||||

Note 1) Based on the applicable standards for business reports submitted to the Financial Supervisory Service

Note 2) Figures for Woori Savings Bank are based on K-GAAP

19

| III. | Financial Information |

| 1. | Condensed Financial Statements (Consolidated) |

Summary Consolidated Statement of Financial Position

| (The Company and its Consolidated Subsidiaries, as of the end of the periods indicated) | (unit: millions of Won) |

Classification | 2024 1H | 2023 | 2022 | |||||||||

ASSETS | ||||||||||||

Cash and cash equivalents | 25,471,632 | 30,556,618 | 34,219,148 | |||||||||

Financial assets at fair value through profit or loss (“FVTPL”) | 23,309,282 | 21,544,756 | 19,860,573 | |||||||||

Financial assets at fair value through other comprehensive income | 38,875,628 | 37,891,495 | 33,085,080 | |||||||||

Securities at amortized cost | 22,408,759 | 23,996,172 | 28,268,516 | |||||||||

Loans and other financial assets at amortized cost | 387,374,084 | 373,148,148 | 355,760,729 | |||||||||

Investments in joint ventures and associates | 1,899,281 | 1,795,370 | 1,305,636 | |||||||||

Investment properties | 495,032 | 472,768 | 387,707 | |||||||||

Premises and equipment | 3,306,955 | 3,176,759 | 3,142,930 | |||||||||

Intangible assets and goodwill | 1,025,291 | 996,842 | 849,114 | |||||||||

Assets held for sale | 35,333 | 20,345 | 13,772 | |||||||||

Net defined benefit asset | 111,599 | 240,260 | 319,280 | |||||||||

Current tax assets | 69,325 | 203,542 | 53,274 | |||||||||

Deferred tax assets | 49,904 | 93,366 | 109,299 | |||||||||

Derivative assets (designated for hedging) | 85,106 | 26,708 | 37,786 | |||||||||

Other assets | 4,263,954 | 3,841,787 | 3,061,552 | |||||||||

Total assets | 508,781,165 | 498,004,936 | 480,474,396 | |||||||||

LIABILITIES | ||||||||||||

Financial liabilities at FVTPL | 7,515,789 | 6,138,313 | 8,952,399 | |||||||||

Deposits due to customers | 359,302,549 | 357,784,297 | 342,105,209 | |||||||||

Borrowings | 30,315,001 | 30,986,746 | 28,429,603 | |||||||||

Debentures | 42,102,432 | 41,239,245 | 44,198,486 | |||||||||

Provisions | 634,578 | 806,031 | 545,865 | |||||||||

Net defined benefit liability | 4,375 | 6,939 | 35,202 | |||||||||

Current tax liabilities | 145,887 | 103,655 | 843,555 | |||||||||

Deferred tax liabilities | 653,876 | 470,311 | 31,799 | |||||||||

Derivative liabilities (designated for hedging) | 150,585 | 153,007 | 202,911 | |||||||||

Other financial liabilities | 32,033,007 | 26,115,005 | 22,811,868 | |||||||||

Other liabilities | 775,472 | 803,897 | 690,157 | |||||||||

Total liabilities | 473,633,551 | 464,607,446 | 448,847,054 | |||||||||

EQUITY | ||||||||||||

Owners’ equity: | 33,466,569 | 31,666,881 | 28,761,897 | |||||||||

Capital stock | 3,802,676 | 3,802,676 | 3,640,303 | |||||||||

Hybrid securities | 4,409,042 | 3,611,129 | 3,112,449 | |||||||||

Capital surplus | 937,826 | 935,563 | 682,385 | |||||||||

Other equity | (1,598,997 | ) | (1,668,957 | ) | (2,423,392 | ) | ||||||

Retained earnings | 25,916,022 | 24,986,470 | 23,750,152 | |||||||||

Non-controlling interests | 1,681,045 | 1,730,609 | 2,865,445 | |||||||||

Total equity | 35,147,614 | 33,397,490 | 31,627,342 | |||||||||

|

|

|

|

|

| |||||||

Total liabilities and equity | 508,781,165 | 498,004,936 | 480,474,396 | |||||||||

|

|

|

|

|

| |||||||

Number of Consolidated Subsidiaries (excluding holding company) | 184 | 179 | 167 | |||||||||

20

Summary Consolidated Statement of Comprehensive Income

| (The Company and its Consolidated Subsidiaries, for the periods indicated) | (unit: millions of Won, except per share amounts) | |||||||||||||||

Classification | 2024 1H | 2023 1H | 2023 | 2022 | ||||||||||||

Operating income | 2,404,009 | 2,147,438 | 3,499,029 | 4,430,524 | ||||||||||||

Net interest income | 4,395,099 | 4,412,993 | 8,742,540 | 8,696,579 | ||||||||||||

Net fees and commissions income | 1,058,166 | 842,265 | 1,720,481 | 1,710,170 | ||||||||||||

Dividend income | 152,738 | 92,005 | 240,293 | 159,982 | ||||||||||||

Net gain or loss on financial instruments at FVTPL | 902,118 | 360,517 | 488,486 | 238,502 | ||||||||||||

Net gain or loss on financial assets at FVTOCI | 38,515 | (398 | ) | (37,641 | ) | (21,498 | ) | |||||||||

Net gain or loss arising on financial assets at amortized cost | 165,645 | 115,708 | 203,942 | 74,204 | ||||||||||||

Impairment losses due to credit loss | (775,492 | ) | (817,815 | ) | (1,894,916 | ) | (885,272 | ) | ||||||||

General and administrative expenses | (2,100,987 | ) | (2,057,916 | ) | (4,443,433 | ) | (4,529,890 | ) | ||||||||

Other net operating expenses | (1,431,793 | ) | (799,921 | ) | (1,520,723 | ) | (1,012,253 | ) | ||||||||

Non-operating income (expense) | (13,150 | ) | 1,095 | 18,424 | 54,850 | |||||||||||

Net income before income tax expense | 2,390,859 | 2,148,533 | 3,517,453 | 4,485,374 | ||||||||||||

Income tax expense | (590,439 | ) | (534,721 | ) | (890,559 | ) | (1,161,392 | ) | ||||||||

Net income | 1,800,420 | 1,613,812 | 2,626,894 | 3,323,982 | ||||||||||||

Net income attributable to owners | 1,755,496 | 1,538,876 | 2,506,296 | 3,141,680 | ||||||||||||

Net income attributable to the non-controlling interests | 44,924 | 74,936 | 120,598 | 182,302 | ||||||||||||

Other comprehensive income (loss), net of tax | 66,598 | 382,460 | 663,537 | (239,819 | ) | |||||||||||

Items that will not be reclassified to profit or loss | (136,151 | ) | 72,019 | 122,334 | 216,767 | |||||||||||

Items that may be reclassified to profit or loss | 202,749 | 310,441 | 541,203 | (456,586 | ) | |||||||||||

Total comprehensive income | 1,867,018 | 1,996,272 | 3,290,431 | 3,084,163 | ||||||||||||

Comprehensive income attributable to the owners | 1,819,493 | 1,907,895 | 3,164,464 | 2,909,053 | ||||||||||||

Comprehensive income attributable to non-controlling interests | 47,525 | 88,377 | 125,967 | 175,110 | ||||||||||||

Net income per share: | ||||||||||||||||

Basic and diluted loss per share (in Korean Won) | 2,262 | 2,028 | 3,230 | 4,191 | ||||||||||||

21

| 2. | Condensed Financial Statements (Separate) |

Summary Statement of Financial Position

| (The Company, as of the end of the period indicated) | (unit: millions of Won) |

Classification | 2024 1H | 2023 | 2022 | |||||||||

ASSETS | ||||||||||||

Cash and cash equivalents | 225,281 | 289,507 | 313,361 | |||||||||

Financial assets at fair value through profit or loss | — | — | 689 | |||||||||

Financial assets at fair value through other comprehensive income | 545,153 | 539,709 | 312,771 | |||||||||

Loans and other financial assets at amortized cost | 1,952,420 | 1,104,815 | 2,041,877 | |||||||||

Investments in subsidiaries | 24,144,282 | 23,670,476 | 22,394,915 | |||||||||

Premises and equipment | 4,447 | 6,609 | 11,052 | |||||||||

Intangible assets | 3,710 | 4,052 | 4,859 | |||||||||

Net defined benefit asset | — | 3,941 | 5,947 | |||||||||

Current tax assets | 51,046 | 158,951 | 14,350 | |||||||||

Deferred tax assets | 5,736 | 7,478 | 13,433 | |||||||||

Other assets | 294 | 484 | 322 | |||||||||

Total assets | 26,932,369 | 25,786,022 | 25,113,576 | |||||||||

LIABILITIES | ||||||||||||

Debentures | 1,588,028 | 1,587,659 | 1,447,762 | |||||||||

Provisions | 1,230 | 1,227 | 487 | |||||||||

Net defined benefit liability | 563 | — | — | |||||||||

Current tax liabilities | 103,298 | 32,125 | 721,795 | |||||||||

Other financial liabilities | 106,048 | 163,621 | 46,039 | |||||||||

Other liabilities | 333 | 392 | 591 | |||||||||

Total liabilities | 1,799,500 | 1,785,024 | 2,216,674 | |||||||||

EQUITY | ||||||||||||

Capital stock | 3,802,676 | 3,802,676 | 3,640,303 | |||||||||

Hybrid securities | 4,408,867 | 3,610,953 | 3,112,273 | |||||||||

Capital surplus | 11,120,236 | 11,120,236 | 10,909,281 | |||||||||

Other equity | (4,846 | ) | (7,871 | ) | (26,186 | ) | ||||||

Retained Earnings | 5,805,936 | 5,475,004 | 5,261,231 | |||||||||

|

|

|

|

|

| |||||||

Total equity | 25,132,869 | 24,000,998 | 22,896,902 | |||||||||

|

|

|

|

|

| |||||||

Total liabilities and equity | 26,932,369 | 25,786,022 | 25,113,576 | |||||||||

|

|

|

|

|

| |||||||

22

Summary Statement of Comprehensive Income

| (The Company, for the period indicated) | (unit: millions of Won, except per share amounts) | |||

Classification | 2024 1H | 2023 1H | 2023 | 2022 | ||||||||||||

Operating income: | 1,158,218 | 1,445,324 | 1,424,670 | 1,185,627 | ||||||||||||

Net interest expense | 6,181 | 15,692 | 27,495 | (5,030 | ) | |||||||||||

Interest income | 28,748 | 32,068 | 64,592 | 25,614 | ||||||||||||

Interest expense | (22,567 | ) | (16,376 | ) | (37,097 | ) | (30,644 | ) | ||||||||

Net fees and commissions loss | (8,848 | ) | (8,755 | ) | (20,097 | ) | (15,059 | ) | ||||||||

Fees and commissions income | 813 | 798 | 1,625 | 1,596 | ||||||||||||

Fees and commissions expense | (9,661 | ) | (9,553 | ) | (21,722 | ) | (16,655 | ) | ||||||||

Dividend income | 1,195,721 | 1,472,869 | 1,482,956 | 1,272,393 | ||||||||||||

Net gain or loss on financial instruments at FVTPL | — | 2,023 | 2,023 | 1,018 | ||||||||||||

Reversal of (Provisions for) impairment losses due to credit loss | (442 | ) | (978 | ) | (348 | ) | (244 | ) | ||||||||

General and administrative expenses | (34,394 | ) | (35,527 | ) | (67,359 | ) | (67,451 | ) | ||||||||

Non-operating income (expense) | (63 | ) | 9 | (1,043 | ) | (1,363 | ) | |||||||||

Net income before income tax expense | 1,158,155 | 1,445,333 | 1,423,627 | 1,184,264 | ||||||||||||

Income tax benefit (expense) | (658 | ) | 96 | 881 | (1,015 | ) | ||||||||||

Net income | 1,157,497 | 1,445,429 | 1,424,508 | 1,183,249 | ||||||||||||

Other comprehensive income (loss), net of tax | 3,025 | 7,885 | 18,916 | (22,312 | ) | |||||||||||

Items that will not be reclassified to profit or loss | 3,025 | 7,885 | 18,916 | (22,312 | ) | |||||||||||

Net gain or loss on valuation of equity securities at FVTOCI | 4,008 | 8,826 | 19,789 | (24,676 | ) | |||||||||||

Remeasurement of the net defined benefit liability | (983 | ) | (941 | ) | (873 | ) | 2,364 | |||||||||

Total comprehensive income | 1,160,522 | 1,453,314 | 1,443,424 | 1,160,937 | ||||||||||||

Net income per share: | ||||||||||||||||

Basic and diluted income per share (in Korean Won) | 1,450 | 1,899 | 1,754 | 1,499 | ||||||||||||

23

| 3. | Dividend Information |

As a financial holding company, we depend on receiving dividends from our subsidiaries to pay dividends, and our subsidiaries pay us dividends within the limits of their distributable profits after deducting the necessary internal reserves required to maintain the adequate regulatory capital imposed by the financial authorities by sector. Therefore, the levels of our dividend payouts take into holistic consideration the current and future asset growth of Woori Financial Group and its subsidiaries and surplus funds after maintaining the appropriate capital adequacy ratios, among other factors.

In February 2023, we disclosed our “Shareholder Return Policy and Group Capital Management Plan considering the Total Shareholder Return Rate (including dividends and share buybacks and cancellations).” In our 2023 fiscal year business report, we amended our existing shareholder return policy by increasing the CET1 ratio benchmark from 12% to 13%, taking into consideration the strengthened regulations on capital, our expanded loss-absorbing capacity, and the shareholder return levels of our competitors.

Accordingly, in 2023, we achieved a total shareholder return (“TSR”) of approximately 33.8% through the payment of quarterly dividends (Won 180 per share for each of the 2nd and 3rd quarters), our first-ever buyback and cancellation of treasury shares worth Won 100 billion , and the payment of year-end dividends of Won 640 per share. In 2024, we repurchased and canceled all of the remaining shares that had been held by KDIC (9,357,960 shares), which amounted to approximately Won 136.6 billion and paid out quarterly dividends from the first quarter onwards (Won 180 per share for the 1st and 2nd quarters).

On July 25, 2024 we became the first financial group in Korea to disclose the “Corporate Value Enhancement Plan” as our guide to enhance corporate value by increasing shareholder returns based on the CET1 ratio. (For more details, please refer to the materials posted on our website (https://www.woorifg.com))

Some of the highlights of the shareholder return direction and the plan are as follows: Note 1)

① Concurrently paying out dividends and buying back and canceling treasury shares while gradually increasing their amounts (continually increasing the DPS)

② CET1 Ratio Tiered to enhance sustainability and visibility

| Tier 1 | Tier 2 | Tier 3 | Tier 4 | |||||||||||||

CET1 Ratio | ~ 11.5 | % | 11.5 ~ 12.5 | % | 12.5 ~ 13.0 | % | 13.0 | % ~ | ||||||||

Total Shareholder Return | ~ 30 | % | ~ 35 | % | ~ 40 | % | ~ 50 | % | ||||||||

Note 1) The TSR and DPS may vary depending on macroeconomic conditions, regulatory policies/guidelines and management purposes (including one-off events such as M&As)

24

Note 2) The determination of the CET1 ratio tier is applied on a year-end basis

③When the TSR is within 40%, maintain a dividend payout ratio of approximately 30%, while buying back and cancelling as treasury shares the excess amount

When the TSR is over 40%, maintain a balance of dividend payments and share buybacks and cancellation

We will continue our efforts to enhance our shareholder value and ensure the predictability of our shareholder return policy. If there are any changes to the shareholder return policy, we will actively communicate with our stakeholders through notices and disclosures.

Key information regarding dividends:

Items | 2024 1H | 2023 | 2022 | |||||||||||

Par value per share (Won) | 5,000 | 5,000 | 5,000 | |||||||||||

Net profit (Millions of Won) | 1,755,496 | 2,506,296 | 3,141,680 | |||||||||||

Earnings per share (Won) | 2,262 | 3,230 | 4,191 | |||||||||||

Total cash dividends (Millions of Won) | 267,314 | 747,302 | 822,706 | |||||||||||

Total stock dividends (Millions of Won) | — | — | — | |||||||||||

Cash dividend payout ratio (%) | 15.23 | 29.82 | 26.19 | |||||||||||

Cash dividend yield (%) | Common Shares | 2.5 | 6.7 | 8.8 | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Stock dividend yield (%) | Common Shares | — | — | — | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Cash dividend per share (Won) | Common Shares | 360 | 1,000 | 1,130 | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Stock dividend per share (Share) | Common Shares | — | — | — | ||||||||||

| Preferred Shares | — | — | — | |||||||||||

Note 1) The dividends for 1H 2024include first quarter dividends of Won 133,657 million (Won 180 per share) and second quarter dividends of Won 133,657 million (Won 180 per share through a board resolution on July 25, 2024)

Note 2) The dividends for FY2023 include second quarter dividends of Won 130,748 million (Won 180 per share) and third quarter dividends of Won 135,341 million (Won 180 per share)

Note 3) The dividends for FY2022 include an interim dividend of Won 109,209 million (Won 150 per share)

Note 4) The above cash dividend yield is calculated as the percentage of dividend per share to the arithmetic average price formed in the stock market during the past week, starting from two trading days before the record date. The percentage is rounded to the first decimal place.

25

| IV. | Independent Auditor’s Opinion |

| 1. | Independent Auditor’s Opinion |

2024 1H | 2023 | 2022 | ||||

| Auditor | KPMG Samjong Accounting Corp. | KPMG Samjong Accounting Corp. | Samil PricewaterhouseCoopers | |||

| Auditor’s Opinion | Note 1) | Note 2) | Note 3) |

Note 1) In its review report attached to this report, KPMG Samjong Accounting Corp. has stated that nothing had come to their attention that caused them to believe that the accompanying consolidated and separate interim financial statements of Woori Financial Group are not presented fairly in all material respects, in accordance with Korean IFRS.

Note 2) In its audit report, KPMG Samjong Accounting Corp. has stated that the financial statements present fairly, in all material respects, the financial position of Woori Financial Group as of December 31, 2023, and its financial performance and its cash flows for the year then ended in accordance with Korean IFRS

Note 3) In its audit report, Samil PricewaterhouseCoopers has stated that the financial statements present fairly, in all material respects, the financial position of Woori Financial Group as of December 31, 2022, and its financial performance and its cash flows for the year then ended in accordance with Korean IFRS.

| 2. | Compensation to the Independent Auditor |

| a. | Audit Services |

Term | Auditor | Description | Contract | Actual | ||||||||

Fee | Time | Fee | Time | |||||||||

2024 1H | KPMG Samjong Accounting Corp. | 1Q/1H/3Q Review Closing audit (including internal accounting management system) | KRW 1,037 million | 9,930 hours | KRW 350 million | 3,840 hours | ||||||

2023 | KPMG Samjong Accounting Corp. | 1Q/1H/3Q Review Closing audit (including internal accounting management system) | KRW 964 million | 9,380 hours | KRW 964 million | 9,613 hours | ||||||

2022 | Samil PricewaterhouseCoopers | 1Q/1H/3Q Review Closing audit (including internal accounting management system) | KRW 1,068 million | 9,380 hours | KRW 1,068 million | 8,714 hours | ||||||

| Note | 1) Fee excludes VAT |

| Note | 2) Time includes planning time up until the commencement of the applicable services |

26

| b. | Other Audit Services |

None.

| c. | Current Status of Audit Service Agreements with the Independent Auditor Relating to U.S. Listing |

Term | Auditor | Description | Fee | |||

| 2024 1H | KPMG Samjong Accounting Corp. | U.S. PCAOB standard audit of consolidated financial statements and internal control over financial reporting (for FY2024) | KRW 2,015 million | |||

| 2023 | KPMG Samjong Accounting Corp. | U.S. PCAOB standard audit of consolidated financial statements and internal control over financial reporting (for FY2023) | KRW 1,891 million | |||

| 2022 | Samil PricewaterhouseCoopers | U.S. PCAOB standard audit of consolidated financial statements and internal control over financial reporting (for FY2022) | KRW 2,240 million | |||

Note 1) Fee excludes VAT

| d. | Non-Audit Services |

Term | Date of Execution of Agreement | Description of Service | Service Term | Fees | ||||

| 2023 1H | March 31, 2024 | Tax adjustment (including review relating to application of consolidated tax) | April 1, 2024 ~ June 2, 2025 | KRW 68 million | ||||

| 2023 | March 31, 2023 | Tax adjustment (including review relating to application of consolidated tax) | April 1, 2023 ~ May 31, 2024 | KRW 64 million | ||||

| 2022 | March 30, 2022 | Tax adjustment (including review relating to application of consolidated tax) | April 1, 2022 ~ May 31, 2023 | KRW 64 million | ||||

Note 1) Fee excludes VAT

27

| V. | Corporate Governance |

| 1. | About the Board of Directors |

| a. | Composition of the Board of Directors |

As of June 30, 2024, our board of directors consisted of eight directors in total, including seven outside directors and one standing director.

On March 22, 2024, at the annual general meeting of shareholders, five outside directors were appointed.

- New outside directors (2): Eun-Ju Lee, Sunyoung Park

- Reappointed outside directors (3): Chan-Hyoung Chung, In-Sub Yoon, Yo-Hwan Shin

On March 22, 2024, one outside director completed her term.

- Retired outside director (1): Soo-Young Song

The board of directors operates a total of six standing committees: the Audit Committee, the Risk Management Committee, the Compensation Committee, the Officer Candidates Recommendation Committee, the Subsidiary Representative Director Candidate Recommendation Committee and the ESG Management Committee.

On March 22, 2024, Chan-Hyoung Chung, an outside director, was appointed as the chair of the board of directors. Chan-Hyoung Chung, a former CEO of a finance company, has outstanding insight into, and experience in, the financial and accounting sectors. He has demonstrated leadership and responsibility as an outside director of Woori Financial Group (from January 11, 2019 to present) and as the chair of the Audit Committee (from January 11, 2019 to March 24, 2023), which led to his appointment as the chair of our board of directors based on unanimous consent from all of the directors. The chair of the board of directors does not concurrently hold the position of representative director.

| b. | Committees under the Board of Directors |

We currently have the following committees serving under the board of directors:

| (a) | Audit Committee |

| (b) | Risk Management Committee |

| (c) | Compensation Committee |

| (d) | Officer Candidate Recommendation Committee |

| (e) | Subsidiary Representative Director Candidate Recommendation Committee |

| (f) | ESG Management Committee |

28

(As of June 30, 2024)

Name of Committee | Composition | Names of Members | ||

| Audit Committee | Four outside directors | (Chair) Su-Young Yun (outside director) Chan-Hyoung Chung (outside director) Yo-Hwan Shin (outside director) Sung-Bae Ji (outside director) | ||

| Risk Management Committee | Three outside directors | (Chair) In-Sub Yoon (outside director) Eun-Ju Lee (outside director) Sunyoung Park (outside director) | ||

| Compensation Committee | Four outside directors | (Chair) Yo-Hwan Shin (outside director) In-Sub Yoon (outside director) Chan-Hyoung Chung (outside director) Su-Young Yun (outside director) | ||

| Officer Candidate Recommendation Committee | Seven outside directors | (Chair) Sung-Bae Ji (outside director) In-Sub Yoon (outside director) Chan-Hyoung Chung (outside director) Su-Young Yun (outside director) Yo-Hwan Shin (outside director) Eun-Ju Lee (outside director) Sunyoung Park (outside director) | ||

| Subsidiary Representative Director Candidate Recommendation Committee | Seven outside directors One standing director | (Chair) Jong-Yong Yim (standing director) In-Sub Yoon (outside director) Chan-Hyoung Chung (outside director) Su-Young Yun (outside director) Yo-Hwan Shin (outside director) Sung-Bae Ji (outside director) Eun-Ju Lee (outside director) Sunyoung Park (outside director) | ||

| ESG Management Committee | Seven outside directors One standing director | (Chair) Eun-Ju Lee (outside director) In-Sub Yoon (outside director) Chan-Hyoung Chung (outside director) Su-Young Yun (outside director) Yo-Hwan Shin (outside director) Sung-Bae Ji (outside director) Sunyoung Park (outside director) Jong-Yong Yim (standing director) | ||

29

| 2. | Shareholder’s Meeting |

| a. | Voting Rights |

| As of June 30, 2024 | (unit: shares) | |||||||||||

Items | Number of shares | Notes | ||||||||||

Number of issued shares | Common Shares | 742,591,501 | — | |||||||||

| Preferred Shares | — | — | ||||||||||

Number of shares without voting rights | Common Shares | 3,082,264 | Note 1 | ) | ||||||||

| Preferred Shares | — | — | ||||||||||

Number of shares for which voting rights are excluded pursuant to the articles of incorporation | Common Shares | — | — | |||||||||

| Preferred Shares | — | — | ||||||||||

Number of shares for which voting rights are limited by law | Common Shares | — | — | |||||||||

| Preferred Shares | — | — | ||||||||||

Number of shares for which voting rights have been restored | Common Shares | — | — | |||||||||

| Preferred Shares | — | — | ||||||||||

Number of shares for which voting rights may be exercised | Common Shares | 739,509,237 | — | |||||||||

| Preferred Shares | — | — | ||||||||||

Note 1) Treasury shares acquired from the issuance of fractional shares and purchased through a trust agreement, and shares in mutual ownership (pursuant to Article 369 of the Commercial Act)

| b. | Summary of the Shareholder’s Meeting Minutes |

Agenda | Result | |||

Annual General Meeting of Shareholders for FY2020 (March 26, 2021) | 1. Approval of financial statements for the fiscal year 2020 | Approved as submitted | ||

2. Approval of amendments to the Articles of Incorporation | Approved as submitted | |||

3. Approval of reduction of Capital Reserve | Approved as submitted | |||

4. Appointment of directors (1 standing director, 4 outside directors)

- 4-1 Candidate for standing director : Won-Duk Lee

- 4-2 Candidate for outside director : Sung-Tae Ro

- 4-3 Candidate for outside director : Sang-Yong Park

- 4-4 Candidate for outside director : Zhiping Tian

- 4-5 Candidate for outside director : Dong-Woo Chang | Approved as submitted | |||

5. Appointment of outside director who will serve as an Audit Committee Member

- Candidate for outside director who will serve as an Audit Committee Member : Chan-Hyoung Chung | Approved as submitted | |||

30

6. Appointment of Audit Committee Members who are outside directors

- 6-1 Candidate for Audit Committee Member who is an outside director : Sung-Tae Ro

- 6-2 Candidate for Audit Committee Member who is an outside director : Dong-Woo Chang

| Approved as submitted | |||

7. Approval of the maximum limit on directors’ compensation

| Approved as submitted | |||

Extraordinary General Meeting of Shareholder in 2022 (January 27, 2022) | 1. Appointment of directors (2 outside directors)

- 1-1 Candidate for outside director : In-Sub Yoon

- 1-2 Candidate for outside director : Yo-Hwan Shin

| Approved as submitted | ||

Annual General Meeting of Shareholders for FY2021 (March 25, 2022) | 1. Approval of financial statements for the fiscal year 2021

| Approved as submitted | ||

2. Approval of amendments to the Articles of Incorporation

| Approved as submitted | |||

3. Appointment of directors (4 outside directors, 1 non-standing director)

- 3-1 Candidate for outside director : Soo-Young Song

- 3-2 Candidate for outside director : Sung-Tae Ro

- 3-3 Candidate for outside director : Sang-Yong Park

- 3-4 Candidate for outside director : Dong-Woo Chang

- 3-5 Candidate for non-standing director : Won-Duk Lee

| Approved as submitted | |||

4. Appointment of outside director who will serve as an Audit Committee Member

- Candidate for outside director who will serve as an Audit Committee Member : Chan-Hyoung Chung

| Approved as submitted | |||

5. Appointment of Audit Committee Members who are outside directors

- 5-1 Candidate for Audit Committee Member who is an outside director : Sung-Tae Ro

- 5-2 Candidate for Audit Committee Member who is an outside director : Dong-Woo Chang

| Approved as submitted | |||

6. Approval of the maximum limit on directors’ compensation

| Approved as submitted | |||

Annual General Meeting of Shareholders for FY2022 (March 24, 2023) | 1. Approval of financial statements for the fiscal year 2022 (Jan. 1, 2022 – Dec.31, 2022)

| Approved as submitted | ||

2. Approval of amendments to the Articles of Incorporation

| Approved as submitted | |||

3. Election of directors (2 outside directors, 1 standing director)

- 3-1 Candidate for outside director : Chan-Hyoung Chung

- 3-2 Candidate for outside director : Su-Young Yun

- 3-3 Candidate for standing director : Jong-Yong Yim

| Approved as submitted | |||

4. Election of outside director who will serve as an Audit Committee Member

- Candidate for outside director who will serve as an Audit Committee Member : Sung-Bae Ji | Approved as submitted |

31

5. Election of Audit Committee Members who are outside directors

- 5-1 Candidate for Audit Committee Member who is an Outside director : Chan-Hyoung Chung

- 5-2 Candidate for Audit Committee Member who is an Outside director : Su-Young Yun

- 5-3 Candidate for Audit Committee Member who is an Outside director : Yo-Hwan Shin

| Approved as submitted | |||

6. Approval of maximum limit on directors’ compensation

| Approved as submitted | |||

Annual General Meeting of Shareholders for FY2023 (March 22, 2024) | 1. Approval of separate financial statements (including statements of appropriations of retained earnings) and consolidated financial statements for the fiscal year 2023 (Jan. 1, 2023 – Dec. 31, 2023)

| Approved as submitted | ||

2. Election of directors (5 outside directors)

- 2-1 Candidate for outside director : Chan-Hyoung Chung

- 2-2 Candidate for outside director : In-Sub Yoon

- 2-3 Candidate for outside director : Yo-Hwan Shin

- 2-4 Candidate for outside director : Eun-Ju Lee

- 2-5 Candidate for outside director : Sunyoung Park

| Approved as submitted | |||

3. Election of Audit Committee Members who are outside directors (2 directors)

- 3-1 Candidate for Audit Committee Member who is an outside director : Chan-Hyoung Chung

- 3-2 Candidate for Audit Committee Member who is an outside director : Yo-Hwan Shin

| Approved as submitted | |||

| 4. Approval of maximum limit on directors’ compensation | Approved as submitted |

32

| VI. | Shareholder Information |

| 1. | Share Distribution |

| a. | Share Information of the Largest Shareholder and Specially Related Parties |

| As of June 30, 2024 | (units: shares, %) | |||||||||||||||||||||||

Name | Relation | Type | Shares Held | Notes | ||||||||||||||||||||

| Beginning balance | Ending balance | |||||||||||||||||||||||

| Number | Share | Number | Share | |||||||||||||||||||||

Employee Stock Ownership Association of Woori Financial Group | The largest shareholder | Common | 43,990,091 | 5.85 | 44,341,714 | 5.97 | — | |||||||||||||||||

Employee Stock Ownership Association of Woori Bank | Specially related party of the largest shareholder | Common | 25,040,007 | 3.33 | 21,710,856 | 2.92 | — | |||||||||||||||||

Total | Common | 69,030,098 | 9.18 | 66,052,570 | 8.89 | — | ||||||||||||||||||

| Others | — | — | — | — | — | |||||||||||||||||||

| b. | Changes in the largest shareholder |

| As of June 30, 2024 | (units: shares, %) | |||||||

Change of Date | Largest Shareholder | Number Held | Share | Notes | ||||

December 9, 2021 | Employee Stock Ownership Association of Woori Financial Group and others 1 | 71,346,178 | 9.80 | Purchased 1.00% of the KDIC’s remaining shares of Woori Financial Group (8.80% share already held) Note 1) |

Note 1) Refer to the prior disclosure on Form 6-K on December 10, 2021, “Changes in the Largest Shareholder” for further details.

33

| c. | Share Ownership of More Than 5% |

| As of June 30, 2024 | (units: shares, %) | |||||||

| Name | Shares | Notes | ||||||

| No. of shares | Percentage of shareholding | |||||||

Share ownership of more than 5% | Blackrock Fund Advisors | 45,100,755 | 6.07 | Note 1) | ||||

| National Pension Service | 44,760,871 | 6.03 | — | |||||

Employee Stock Ownership Association | 66,052,570 | 8.89 | The largest shareholder Note 2) | |||||

Note 1) Based on the disclosure of Blackrock Fund Advisors on June 10, 2024

Note 2) Total shares of the employee stock ownership association of Woori Financial Group and Woori Bank

| 2. | Stock Price and Stock Market Performance |

| a. | Domestic Stock Market |

(units: Won, shares)

Period |

| January 2024 | February 2024 | March 2024 | April 2024 | May 2024 | June 2024 | |||||||||||||||||||

Common Shares | High | 13,920 | 15,060 | 15,290 | 14,350 | 14,870 | 14,690 | |||||||||||||||||||

| Low | 12,450 | 14,020 | 14,250 | 13,170 | 13,980 | 13,950 | ||||||||||||||||||||

| Average | 12,782 | 14,636 | 14,721 | 13,875 | 14,413 | 14,246 | ||||||||||||||||||||

Monthly Trade Volume | High | 3,552,141 | 6,674,144 | 19,050,010 | 3,245,321 | 3,595,365 | 4,197,495 | |||||||||||||||||||

| Low | 668,847 | 1,763,594 | 2,059,724 | 880,023 | 877,182 | 788,061 | ||||||||||||||||||||

| Monthly Total | 34,163,534 | 75,043,442 | 89,864,427 | 39,996,589 | 33,335,824 | 32,771,976 | ||||||||||||||||||||

Note 1) Source: KRX KOSPI Market

Note 2) Share prices are based on closing prices.

34

| b. | Foreign Stock Market (NYSE) |

(units: US Dollars, Won, ADSs)

Period | January 2024 | February 2024 | March 2024 | April 2024 | May 2024 | June 2024 | ||||||||||||||||||||

ADS | High | 31.01 | 34.02 | 35.74 | 31.61 | 33.25 | 32.04 | |||||||||||||||||||

| Low | 28.15 | 31.39 | 32.43 | 28.84 | 31.03 | 30.65 | ||||||||||||||||||||

| Average | 29.10 | 33.01 | 34.18 | 30.53 | 32.02 | 31.28 | ||||||||||||||||||||

Won Conversion | High | 41,261.91 | 45,280.62 | 47,066.01 | 42,572.35 | 45,093.65 | 44,509.97 | |||||||||||||||||||

| Low | 37,411.35 | 41,660.81 | 43,644.29 | 40,240.45 | 42,759.34 | 42,229.57 | ||||||||||||||||||||

| Average | 38,519.04 | 43,964.73 | 45,481.33 | 41,764.2 | 43,722.27 | 43,173.37 | ||||||||||||||||||||

Monthly Trade Volume | High | 200,578 | 104,306 | 87,949 | 99,002 | 177,795 | 80,392 | |||||||||||||||||||

| Low | 29,465 | 18,841 | 17,132 | 27,679 | 21,667 | 27,983 | ||||||||||||||||||||

| Monthly Total | 1,270,198 | 885,499 | 878,343 | 1,138,232 | 1,117,898 | 885,535 | ||||||||||||||||||||

Note 1) Source: standard trading rate (daily and monthly average) (Seoul Money Brokerage, www.smbs.biz)

Note 2) One ADS represents three common shares.

Note 3) Share prices are based on closing prices.

35

| VII. | Directors and Employee Information |

| 1. | Directors and Executives |

As of June 30, 2024

Position | Name | Common Shares Owned | Term Commencement Date | Expiration of Term | ||||||||

Chief Executive Officer | Registered | Jong-Yong Yim | 10,000 | March 24, 2023 | Note 1) | |||||||

Outside Director | Registered | In-Sub Yoon | — | January 27, 2022 | Note 2) | |||||||

Outside Director | Registered | Chan-Hyoung Chung | 10,532 | January 11, 2019 | Note 2) | |||||||

Outside Director | Registered | Su-Young Yun | — | March 24, 2023 | Note 2) | |||||||

Outside Director | Registered | Yo-Hwan Shin | — | January 27, 2022 | Note 2) | |||||||

Outside Director | Registered | Sung-Bae Ji | — | March 24, 2023 | Note 2) | |||||||

Outside Director | Registered | Eun-Ju Lee | — | March 28, 2024 | Note 1) | |||||||

Outside Director | Registered | Sunyoung Park | — | March 26, 2024 | Note 1) | |||||||

Deputy President | Non-Registered | Sung-Wook Lee | 16,000 | February 25, 2022 | February 10,2025 | |||||||

Deputy President | Non-Registered | Gwang-Ik Jang | 1,200 | April 3, 2023 | April 2, 2025 | |||||||

Deputy President | Non-Registered | Il-Jin Ouk | 4,000 | December 8, 2023 | November 30, 2024 | |||||||

Deputy President | Non-Registered | Jang-Keun Park | 2,000 | December 8, 2023 | March 6, 2025 | |||||||

Deputy President | Non-Registered | Jung-Soo Lee | 6,890 | December 8, 2023 | March 6, 2025 | |||||||

Deputy President | Non-Registered | Chan-Ho Jeong | 7,492 | December 8, 2023 | November 30, 2025 | |||||||

Deputy President | Non-Registered | Yoon-Hong Song | — | December 8, 2023 | November 30, 2025 | |||||||

Deputy President | Non-Registered | Jae-Hwa Jeon | 7,872 | December 8, 2023 | March 6, 2025 Note 5) | |||||||

Deputy President | Non-Registered | Kyu-Hwang Jeong | 11,741 | December 8, 2023 | November 30, 2025 Note 6) | |||||||

Managing Director | Non-Registered | Hae-Kwang Lee | — | December 8, 2023 | December 22, 2024 | |||||||

Note 1) Until the end of the annual general meeting of shareholders for FY2025.

Note 2) Until the end of the annual general meeting of shareholders for FY2024.

Note 3) Term commencement date: date of inauguration for registered officers or directors / date of appointment for non-registered officers or directors

Note 4) Common shares owned are as of the date of submission of this report, and those owned by executives exclude the shares owned through the Employee Stock Ownership Association.

Note 5) Resigned from Woori Financial Group after June 30, 2024: Jae-Hwa Jeon (July 5, 2024)

Note 6) Changes in term expiration dates after June 30, 2024: Kyu-Hwang Jeong (July 4, 2026)

36

| 2. | Employee Status |

| As of June 30, 2024 | (units: persons, millions of Won) |

| Number of Employees | Average Tenure | Total Compensation | Average Compensation Per Person | Note | ||||||||||||||||||||||||||||||

| Regular | Contract | Total | ||||||||||||||||||||||||||||||||

| Total | (Short time worker) | Total | (Short time worker) | |||||||||||||||||||||||||||||||

Total | 77 | — | 32 | — | 109 | 3 years 6 months (14 years 9 months) | 10,760 | 97 | — | |||||||||||||||||||||||||

Note 1) Average tenure: term in ( ) includes tenure at affiliated companies

Note 2) Contract employees include non-registered executives

| 3. | Directors’ Compensation |

| As of June 30, (units: persons, millions of Won) |

Items | Number of Persons | Total Compensation | Average Compensation Per Director | Note | ||||||||||||

Registered Directors (excludes outside directors and audit committee members) | 1 | 712 | 712 | — | ||||||||||||

Outside Directors (excludes audit committee members) | 3 | 104 | 42 | — | ||||||||||||

Audit Committee Members | 4 | 134 | 33 | — | ||||||||||||

Auditor | — | — | — | — | ||||||||||||

Note 1) Number of persons is as of June 30, 2024

Note 2) Total compensation is the amount paid from January to June 2024

Note 3) Average compensation per director was calculated by dividing the total compensation by the average number of persons

Note 4) Registered directors and audit committee members include uncompensated directors

Note 5) Only the compensation amount paid by Woori Financial Group is included for the executives concurrently employed by Woori Bank

37

| 4. | Stock-based Compensation |

The Company operates a performance-based stock-linked compensation system, pursuant to the standards established by the shareholders at the shareholders’ meeting and the Compensation Committee. The Company initially determines, for each recipient, the maximum share amounts that can be granted under the system, and then determines the final share amounts based on an evaluation of the long-term performance indices over four years (including the current year). The compensation is then paid in cash, based on the final share amount and the share price at the time the compensation is granted. The long-term performance indices include relative shareholder return, return on equity, profit for the period, cost-to-income ratio, non-performing loan ratio and individual performance evaluations. For further information, please refer to the notes to the financial statements.

(Unit: shares, except number of recipients)

Items | 2024 | 2023 | 2022 | |||||||||

Number of Recipients | 9 | 21 | 20 | |||||||||

Maximum Amount of Shares | 100,914 | 160,929 | 223,176 | |||||||||

Shares Paid during the Period | 164,164 | 68,746 | — | |||||||||

(Adjustments) | (19,554 | ) | (8,982 | ) | — | |||||||

Cumulative Shares Paid | 232,910 | 68,746 | — | |||||||||

Unpaid Shares | 730,369 | 813,173 | 729,972 | |||||||||

38

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Woori Financial Group Inc. | ||||||

| (Registrant) | ||||||

Date: August 14, 2024 | ||||||

By:

| /s/ Sung-Wook Lee | |||||

(Signature) | ||||||

Name: Sung-Wook Lee | ||||||

Title: Deputy President | ||||||

39