Forward Looking Statements:

Except for historical information, this presentation may include forward looking statements which are subject to certain risk factors that could cause actual results to differ materially from those presented in the forward looking statements. Some of the risk factors that could affect future results are described in our Annual Report on Form 10-K and other filings with the Securities and Exchange Commission.

Basis of Preparation and Non-GAAP Measures:

Definitions and presentation: All financial information contained herein is unaudited by the Company’s independent registered public accounting firm, except for the financial data relating to the year-ended December 31, 2006, to the extent it was derived from the Company’s audited financial statements. Unless otherwise noted, all data is in U.S. dollars thousands, except for per share, percentage and ratio information.

GAAP refers to generally accepted accounting principles in the United States. In presenting the Company’s results, management has included and discussed certain “non-GAAP financial measures”, as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company’s results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included in this financial supplement.

Discontinued operations:As a result of the disposal of Environmental Strategies Consulting LLC (“ESC”) on September 15, 2006, the Company’s technical services segment now consists of the Company’s two environmental liability assumption programs. The three months ended March 31, 2006 comparatives have been reclassified to conform with the presentation of ESC in discontinued operations.

Operating income (loss) from continuing operations before tax (a non-GAAP financial measure): Operating income (loss) from continuing operations before tax is an internal performance measure used by the Company in the management of its operations and represents continuing income (loss) before tax excluding, as applicable, net investment gains or losses and net foreign exchange gains or losses (consists of net realized gains or losses and change in net unrealized gains or losses) and other items of income and expense not attributable to its operating segments. The Company excludes net investment gains or losses and after-tax net foreign exchange gains or losses from its calculation of operating income (loss) before tax because the amount of these gains or losses is heavily influenced by, and fluctuates in part, according to investment and foreign exchange market conditions. The Company believes these amounts are largely independent of its underwriting and technical services decision making process and profitability and including them distorts the analysis of trends in its operations. In addition to presenting net income or loss determined in accordance with GAAP, the Company believes that showing continuing operating income (loss) before tax enables investors, analysts, rating agencies, clients and other users of its financial information to more easily analyze the Company’s results of operations in a manner similar to how management analyzes the Company’s underlying business performance. Continuing operating income (loss) before tax should not be viewed as a substitute for GAAP net income (loss) available to common shareholders.

Underwriting segments income(a GAAP financial measure): Underwriting loss is a measure of profitability of the Company’s underwriting segments that takes into account net premiums earned and other insurance related income as revenue and net loss and loss expenses, acquisition costs and underwriting related general and administrative expenses as expenses. Underwriting income (loss) is the difference between revenues, expense items and other income.

Underwriting ratios(a GAAP financial measures): The Company uses underwriting ratios as measures of performance. The loss ratio is calculated by dividing net losses and loss expense by net premiums earned. The acquisition expense ratio is calculated by dividing acquisition expenses by net premiums earned.

Diluted book value per share(a non-GAAP financial measure):The Company has included diluted book value per share because it takes into account the effect of dilutive securities; therefore, the Company believes it is a better measure of calculating shareholder returns than book value per share.

Tangible book value per share and diluted tangible book value per share(non-GAAP financial measures): The Company has included tangible book value per share and diluted tangible book value per share because it believes it provides a clear measure of the value of its tangible shareholders’ equity on a per share basis. Tangible book value excludes goodwill and other intangible assets as itemized in the Company’s consolidated balance sheets. A reconciliation from tangible book value per share to book value per share is provided on page 8 of this supplement.

1

QUANTA CAPITAL HOLDINGS LTD.

Unaudited Summary Statement of Operations

(in thousands)

The summary statements of operations are presented on a classified basis in order to show the Company’s segment components of operating income (loss) before tax.

| | For the three

months ended

March 31, 2007 | | For the three

months ended

March 31, 2006 | |

UNDERWRITING SEGMENTS: | | | | | | | |

Underwriting revenues | | | | | | | |

Gross premiums written | | $ | 29,798 | | $ | 114,869 | |

Premiums ceded | | | (15,448 | ) | | (52,155 | ) |

Net premiums written | | | 14,350 | | | 62,714 | |

Change in unearned premiums | | | 11,287 | | | 16,854 | |

Net premiums earned | | | 25,637 | | | 79,568 | |

Underwriting expenses | | | | | | | |

Net losses and loss expenses | | | (14,295 | ) | | (54,492 | ) |

Acquisition expenses | | | (5,199 | ) | | (13,933 | ) |

General and administrative expenses | | | (4,674 | ) | | (11,561 | ) |

Other income | | | 1,131 | | | 1,004 | |

Total underwriting expenses | | | (23,037 | ) | | (78,982 | ) |

Underwriting segments income (1) | | | 2,600 | | | 586 | |

OTHER: | | | | | | | |

Other operating revenue | | | | | | | |

Corporate general and administrative expenses | | | (10,294 | ) | | (17,891 | ) |

Technical services revenues | | | 492 | | | 1,699 | |

Net investment income | | | 11,805 | | | 10,776 | |

Interest expense | | | (1,393 | ) | | (1,262 | ) |

Other (loss) income | | | (80 | ) | | 28 | |

Total other operating revenue | | | 530 | | | (6,650 | ) |

OPERATING INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAX (2) | | | 3,130 | | | (6,064 | ) |

Net foreign exchange gains (losses) | | | 264 | | | (319 | ) |

Net gains (losses) on investments | | | 1,886 | | | (8,320 | ) |

Depreciation of fixed assets and amortization of intangibles | | | (677 | ) | | (833 | ) |

NET INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAX | | | 4,603 | | | (15,536 | ) |

Income tax (benefit) expense | | | (25 | ) | | 25 | |

NET INCOME (LOSS) FROM CONTINUING OPERATIONS | | | 4,628 | | | (15,561 | ) |

Income from operations of discontinued operations | | | — | | | 342 | |

NET INCOME (LOSS) FROM DISCONTINUED OPERATIONS | | | — | | | 342 | |

NET INCOME (LOSS) | | | 4,628 | | | (15,219 | ) |

Dividends on preferred shares | | | — | | | (1,916 | ) |

NET INCOME (LOSS) TO COMMON SHAREHOLDERS | | $ | 4,628 | | $ | (17,135 | ) |

2

Footnotes:

| 1. | The Company’s underwriting segments comprise, and are an aggregation of, its specialty insurance run-off, specialty reinsurance run-off and Lloyd’s reportable segments as presented on pages 10 to13. |

| 2. | As a result of the disposal of ESC on September 15, 2006, the Company’s technical services segment now consists of the Company’s two environmental liability assumption programs. The three months ended March 31, 2006 comparatives have been reclassified to conform with the presentation of ESC in discontinued operations. |

3

QUANTA CAPITAL HOLDINGS LTD.

Consolidated Balance Sheets

(in thousands)

| | | (Unaudited)

As of March 31, 2007 | | | As of December 31,2006 | |

Assets | | | | | | | |

Investments at fair market value | | | | | | | |

Trading investments | | $ | 740,315 | | $ | 37,273 | |

Available for sale investments | | | — | | | 809,902 | |

Total investments at fair value | | | 740,315 | | | 847,175 | |

Cash and cash equivalents | | | 84,415 | | | 32,894 | |

Restricted cash and cash equivalents | | | 120,073 | | | 68,143 | |

Accrued investment income | | | 5,197 | | | 6,833 | |

Premiums receivable | | | 40,802 | | | 34,587 | |

Funds withheld by cedents | | | 22,681 | | | 25,204 | |

Losses and loss adjustment expenses recoverable | | | 176,058 | | | 221,228 | |

Other accounts receivable | | | 670 | | | 481 | |

Net receivable for investments sold | | | 166 | | | 134 | |

Deferred acquisition costs, net | | | 14,745 | | | 12,124 | |

Deferred reinsurance premiums | | | 29,426 | | | 35,259 | |

Software, property and equipment, net | | | 476 | | | 1,112 | |

Goodwill and other intangtible assets | | | 7,175 | | | 7,350 | |

Other assets | | | 40,399 | | | 36,702 | |

Total assets | | $ | 1,282,598 | | $ | 1,329,226 | |

Liabilities | | | | | | | |

Reserve for losses and loss expenses | | $ | 603,494 | | $ | 623,618 | |

Unearned premiums | | | 104,122 | | | 119,197 | |

Environmental liabilities assumed | | | 2,892 | | | 3,346 | |

Reinsurance balances payable | | | 32,005 | | | 37,070 | |

Accounts payable and accrued expenses | | | 27,852 | | | 38,511 | |

Deposit liabilities | | | 37,784 | | | 37,014 | |

Deferred income and other liabilities | | | 4,711 | | | 5,279 | |

Junior subordinated debentures | | | 61,857 | | | 61,857 | |

Total liabilities | | | 874,717 | | | 925,892 | |

Mandatorily redeemable preferred shares | | | 74,998 | | | 74,998 | |

Shareholders’ equity | | | | | | | |

Common shares | | | 700 | | | 700 | |

Additional paid-in capital | | | 582,623 | | | 582,578 | |

Accumulated deficit (1) | | | (249,181 | ) | | (263,830 | ) |

Accumulated other comprehensive (loss) income | | | (1,259 | ) | | 8,888 | |

Total shareholders’ equity | | | 332,883 | | | 328,336 | |

Total liabilities, redeemable preferred shares and shareholders’ equity | | $ | 1,282,598 | | $ | 1,329,226 | |

4

Footnotes:

| 1. | The $14.6 million change in accumulated deficit for the three months ended March 31, 2007, is as follows: |

| | 2007 | |

| | (in thousands,

unaudited) | |

Cumulative effect adjustment resulting from the adoption of SFAS 159 | | $ | 10,000 | |

Net income available to common shareholders | | | 4,600 | |

| | $ | 14,600 | |

5

QUANTA CAPITAL HOLDINGS LTD.

Total Capitalization

(in thousands)

| | (Unaudited)

As of March 31,

2007 | |

As of December 31,2006

| |

Debt outstanding: | | | | | | | |

Letters of credit facilities (1) | | $ | — | | $ | — | |

Junior subordinated debentures | | | 61,857 | | | 61,857 | |

Redeemable preferred shares: | | | | | | | |

Redeemable preferred shares($0.01 par value; 25,000,000 shares authorized; 3,130,525 issued and outstanding, at March 31, 2007; and at December 31, 2006) | | | 74,998 | | | 74,998 | |

Shareholders’ equity: | | | | | | | |

Common shares($0.01 par value; 200,000,000 common shares authorized, 70,008,185 issued and outstanding at March 31, 2007 and December 31, 2006) (2) | | | 700 | | | 700 | |

Additional paid-in capital | | | 582,623 | | | 582,578 | |

Accumulated deficit | | | (249,181 | ) | | (263,830 | ) |

Accumulated other comprehensive income | | | (1,259 | ) | | 8,888 | |

Total shareholders’ equity | | $ | 332,883 | | $ | 328,336 | |

Total capitalization | | $ | 469,738 | | $ | 465,191 | |

Total debt to total capital ratio (3) | | | 29 | % | | 29 | % |

Footnotes:

| 1. | As at December 31, 2006, consisted of a $240 million secured letter of credit facility. The Company elected to reduce the aggregate commitment to $210.0 million, as of February 9, 2007. The company elected a further reduction in the aggregate commitment from $210.0 million to $185.0 million effective May 4, 2007. As of March 31, 2007 and May 8, 2007 the Company had obligations related to fully secured letters of credit of approximately $155.0 million and $145.8 million. |

| 2. | This table does not give effect to the 2,542,813 warrants outstanding at March 31, 2007 and December 31, 2006 and outstanding options to purchase common shares of 782,181 and 786,764 at March 31, 2007 and December 31, 2006. |

| 3. | The debt to total capital ratio is calculated as the sum of the letter of credit facility, junior subordinated debentures and redeemable preferred shares, or Total Debt, divided by the sum of Total Debt and Total Shareholders’ Equity, or Total Capitalization. |

6

QUANTA CAPITAL HOLDINGS LTD.

Unaudited Summarized Cash Flow Statement

(in thousands)

| | Three months

ended

March 31, 2007 | | Three months

ended

March 31, 2006 | |

Net cash (used in) provided by continuing operating activities | | $ | (58,090 | ) | $ | 19,094 | |

Net cash provided by (used in) investing activities | | | 109,611 | | | (77,825 | ) |

Net cash provided by financing activities | | | — | | | 1,244 | |

Net cash used in discontinued operations | | | — | | | (1,658 | ) |

Increase (decrease) in cash and cash equivalents: | | | 51,521 | | | (59,145 | ) |

Unrestricted cash and cash equivalents at beginning of the period | | | 32,894 | | | 178,135 | |

Unrestricted cash and cash equivalents at end of the period | | $ | 84,415 | | $ | 118,990 | |

Restricted cash and cash equivalents at end of period | | $ | 120,073 | | $ | 85,945 | |

Total cash and cash equivalents at end of period | | $ | 204,488 | | $ | 204,935 | |

7

QUANTA CAPITAL HOLDINGS LTD.

Unaudited per share data

Three months ended March 31, 2007 and 2006

(in thousands, except per share amounts)

| | For the three

months ended

March 31, 2007 | | For the three

months ended

March 31, 2006 | |

INCOME (LOSS) PER SHARE | | | | | | | |

Income from continuing operations prior to effects of SFAS 159 | | $ | 3,727 | | $ | (15,561 | ) |

Effect of adopting SFAS 159 | | | 901 | | | — | |

Net income (loss) from continuing operations to common shareholder after effects of SFAS 159 | | | 4,628 | | | (15,561 | ) |

Income from discontinued operations | | | — | | | 342 | |

Net income (loss) | | | 4,628 | | | (15,219 | ) |

Dividends on preferred shares | | | — | | | 1,916 | |

Net income (loss) to common shareholder | | | 4,628 | | | (17,135 | ) |

Weighted average common shares outstanding - basic | | | 70,008,185 | | | 69,946,861 | |

Weighted average common shares equivalents: | | | | | | | |

Weighted average common shares outstanding - diluted | | | 70,008,185 | | | 69,946,861 | |

Basic income (loss) per common share | | | | | | | |

Basic income (loss) from continuing operations prior to effects of SFAS 159 per common share | | $ | 0.05 | | $ | (0.22 | ) |

Basic income from effects of SFAS 159 per common share | | | 0.01 | | | — | |

Basic income from discontinued operations per common share | | | — | | | — | |

Basic income (loss) per common share | | $ | 0.06 | | $ | (0.22 | ) |

Diluted income (loss) per common share | | | | | | | |

Diluted income (loss) from continuing operations prior to effects of SFAS 159 per common share | | $ | 0.05 | | $ | (0.22 | ) |

Diluted income from effects of SFAS 159 per common share | | | 0.01 | | | — | |

Diluted income from discontinued operations per common share (1) | | | — | | | — | |

Diluted income (loss) per common share | | $ | 0.06 | | $ | (0.22 | ) |

BOOK VALUE PER SHARE | | | | | | | |

Total shareholders’ equity | | $ | 332,883 | | $ | 367,065 | |

Common share and common share equivalents outstanding at the end of the period: | | | | | | | |

Basic | | | 70,008,185 | | | 69,946,861 | |

Diluted (2) | | | 70,008,185 | | | 69,946,861 | |

Basic book value per share | | $ | 4.75 | | $ | 5.25 | |

Diluted book value per share (2) | | $ | 4.75 | | $ | 5.25 | |

TANGIBLE BOOK VALUE PER SHARE | | | | | | | |

Total shareholders‘ equity | | $ | 332,883 | | $ | 367,065 | |

Goodwill and other intangible assets | | $ | 7,175 | | $ | 24,692 | |

Total shareholders‘ equity adjusted to exclude goodwill and other intangible assets | | $ | 325,708 | | $ | 342,373 | |

Basic tangible book value per share | | $ | 4.65 | | $ | 4.89 | |

8

Footnote:

| | 1. | For the three months ended March 31, 2007 and March 31, 2006 the assumed net exercise of options and warrants under the treasury stock method has been excluded as the effect would have been anti-dilutive. |

| | 2. | As of March 31, 2007 and March 31, 2006 all outstanding options were anti-dilutive, therefore the outstanding options have not been included in the calculation of the diluted number of shares for the calculation of diluted book value and diluted tangible book value per share. |

9

QUANTA CAPITAL HOLDINGS LTD.

Unaudited segment results

Three months ended March 31, 2007

(in thousands)

During the third quarter of 2006, the Company changed the composition of its reportable segments and renamed its specialty insurance segment and specialty reinsurance segment to specialty insurance run-off segment and specialty reinsurance run-off segment. The Company has segregated its Lloyd’s operating segment, which was previously aggregated with its specialty insurance run-off reportable segment, to be a reportable segment, given it was no longer appropriate to aggregate Lloyd’s and specialty insurance run-off operating segments given their different economic characteristics. In addition, during the fourth quarter of 2006, the Company ceased allocating corporate general and administrative expenses to its reportable segments as it no longer allocates capital to its reportable segments. The March 31, 2006 balances have been reclassified to conform with the presentation for the quarter ended March 31, 2007.

| | Specialty

Insurance

run-off | | Specialty

Reinsurance

run-off | | Lloyd’s | | Underwriting

Total | | Technical Services | | Consolidated | |

Direct insurance | | $ | (10,257 | ) | $ | — | | $ | 38,531 | | $ | 28,274 | | $ | — | | $ | 28,274 | |

Reinsurance assumed | | | (440 | ) | | 1,964 | | | — | | | 1,524 | | | — | | | 1,524 | |

Total gross premiums written | | | (10,697 | ) | | 1,964 | | | 38,531 | | | 29,798 | | | — | | | 29,798 | |

Premiums ceded | | | (1,354 | ) | | (3,875 | ) | | (10,219 | ) | | (15,448 | ) | | — | | | (15,448 | ) |

Net premiums written | | $ | (12,051 | ) | $ | (1,911 | ) | $ | 28,312 | | $ | 14,350 | | $ | — | | $ | 14,350 | |

Net premiums earned | | $ | 3,398 | | $ | (864 | ) | $ | 23,103 | | $ | 25,637 | | $ | — | | $ | 25,637 | |

Technical services revenues | | | — | | | — | | | — | | | — | | | 492 | | | 492 | |

Other income | | | 970 | | | 161 | | | — | | | 1,131 | | | — | | | 1,131 | |

Net losses and loss expenses | | | (1,399 | ) | | 2,598 | | | (15,494 | ) | | (14,295 | ) | | — | | | (14,295 | ) |

Acquisition expenses | | | (272 | ) | | 857 | | | (5,784 | ) | | (5,199 | ) | | — | | | (5,199 | ) |

General and administrative expenses | | | (1,744 | ) | | (493 | ) | | (2,437 | ) | | (4,674 | ) | | (507 | ) | | (5,181 | ) |

Segment income (loss) | | $ | 953 | | $ | 2,259 | | $ | (612 | ) | $ | 2,600 | | $ | (15 | ) | $ | 2,585 | |

Depreciation of fixed assets and amortization of intangibles | | | | | | | | | | | | | | | | | $ | (677 | ) |

Interest expense | | | | | | | | | | | | | | | | | | (1,393 | ) |

Net investment income | | | | | | | | | | | | | | | | | | 11,805 | |

Net realized gains on investments | | | | | | | | | | | | | | | | | | 1,886 | |

Corporate general and administrative expenses | | | | | | | | | | | | | | | | | | (9,787 | ) |

Other income | | | | | | | | | | | | | | | | | | (80 | ) |

Net foreign exchange gains | | | | | | | | | | | | | | | | | | 264 | |

Net income from continuing operations before income tax | | | | | | | | | | | | | | | | | $ | 4,603 | |

Loss ratio | | | n/m | | | n/m | | | 67.1 | % | | n/m | | | | | | | |

Acquisition expense ratio | | | n/m | | | n/m | | | 25.0 | % | | n/m | | | | | | | |

n/m = not meaningful

10

QUANTA CAPITAL HOLDINGS LTD.

Unaudited segment results

Three months ended March 31, 2006

(in thousands)

| | Specialty

Insurance

run-off | | Specialty

Reinsurance

run-off | | Lloyd’s | | Underwriting

Total | | Technical

Services | | Consolidated | |

Direct insurance | | $ | 56,589 | | $ | — | | $ | 19,256 | | $ | 75,845 | | $ | — | | $ | 75,845 | |

Reinsurance assumed | | | 8,498 | | | 30,526 | | | — | | | 39,024 | | | — | | | 39,024 | |

Total gross premiums written | | | 65,087 | | | 30,526 | | | 19,256 | | | 114,869 | | | — | | | 114,869 | |

Premiums ceded | | | (25,181 | ) | | (22,556 | ) | | (4,418 | ) | | (52,155 | ) | | — | | | (52,155 | ) |

Net premiums written | | $ | 39,906 | | $ | 7,970 | | $ | 14,838 | | $ | 62,714 | | $ | — | | $ | 62,714 | |

Net premiums earned | | $ | 41,547 | | $ | 21,529 | | $ | 16,492 | | $ | 79,568 | | $ | — | | $ | 79,568 | |

Technical services revenues | | | — | | | — | | | — | | | — | | | 1,699 | | | 1,699 | |

Other income | | | 768 | | | 236 | | | — | | | 1,004 | | | — | | | 1,004 | |

Net losses and loss expenses | | | (27,647 | ) | | (15,761 | ) | | (11,084 | ) | | (54,492 | ) | | — | | | (54,492 | ) |

Acquisition expenses | | | (5,411 | ) | | (5,567 | ) | | (2,955 | ) | | (13,933 | ) | | — | | | (13,933 | ) |

General and administrative expenses | | | (6,563 | ) | | (2,636 | ) | | (2,362 | ) | | (11,561 | ) | | (1,372 | ) | | (12,933 | ) |

Segment income (loss) | | $ | 2,694 | | $ | (2,199 | ) | $ | 91 | | $ | 586 | | $ | 327 | | $ | 913 | |

Depreciation of fixed assets and amortization of intangibles | | | | | | | | | | | | | | | | | $ | (833 | ) |

Interest expense | | | | | | | | | | | | | | | | | | (1,262 | ) |

Net investment income | | | | | | | | | | | | | | | | | | 10,776 | |

Net realized losses on investments | | | | | | | | | | | | | | | | | | (8,320 | ) |

Corporate general and administrative expenses | | | | | | | | | | | | | | | | | | (16,519 | ) |

Other expense | | | | | | | | | | | | | | | | | | 28 | |

Net foreign exchange losses | | | | | | | | | | | | | | | | | | (319 | ) |

Net loss from continuing operations before income tax | | | | | | | | | | | | | | | | | $ | (15,536 | ) |

Loss ratio | | | 66.5 | % | | 73.2 | % | | 67.2 | % | | 68.5 | % | | | | | | |

Acquisition expense ratio | | | 13.0 | % | | 25.9 | % | | 17.9 | % | | 17.5 | % | | | | | | |

11

QUANTA CAPITAL HOLDINGS LTD.

Unaudited net earned premiums by product line

(in thousands)

| | Three months

ended

March 31, 2007 | | Three months

ended

March 31, 2006 | |

Specialty Insurance run-off: | | | | | | | |

Technical risk property - HBW | | $ | 1,355 | | $ | 24,237 | |

Technical risk property - other | | | (788 | ) | | 1,673 | |

Professional liability | | | 327 | | | 8,207 | |

Environmental liability | | | 260 | | | 3,072 | |

Surety | | | 353 | | | 2,506 | |

Fidelity and crime | | | (123 | ) | | 1,432 | |

Structured insurance | | | 1,979 | | | 182 | |

Trade credit and political risk | | | 35 | | | 238 | |

Total specialty insurance run-off | | $ | 3,398 | | $ | 41,547 | |

Specialty Reinsurance run-off: | | | | | | | |

Casualty | | $ | (946 | ) | $ | 16,845 | |

Marine, technical risk and aviation | | | 182 | | | 4,433 | |

Property | | | (100 | ) | | 251 | |

Total specialty reinsurance run-off | | $ | (864 | ) | $ | 21,529 | |

Lloyd’s: | | | | | | | |

Professional liability | | $ | 9,889 | | $ | 6,661 | |

Financial institutions | | | 11,044 | | | 9,352 | |

Specie and fine art | | | 1,624 | | | 479 | |

Kidnap and ransom | | | 546 | | | — | |

| | $ | 23,103 | | $ | 16,492 | |

Total | | $ | 25,637 | | $ | 79,568 | |

12

QUANTA CAPITAL HOLDINGS LTD.

Unaudited analysis of unpaid losses and loss expenses

(in thousands)

| | As of March 31, 2007 | | As of December 31, 2006 | |

| | Gross Loss

Reserves | | Ceded Loss

Reserves (1) (2) | | Net Loss

Reserves | | Gross Loss

Reserves | | Ceded Loss

Reserves (1) (2) | | Net Loss

Reserves | |

Specialty Insurance: | | | | | | | | | | | | | | | | | | | |

Technical risk property - HBW | | $ | 195,634 | | $ | (76,253 | ) | $ | 119,381 | | $ | 198,040 | | $ | (74,682 | ) | $ | 123,358 | |

Technical risk property - other | | | 20,793 | | | (13,450 | ) | | 7,343 | | | 30,725 | | | (26,934 | ) | | 3,791 | |

Professional liability | | | 53,722 | | | (14,183 | ) | | 39,539 | | | 54,567 | | | (14,215 | ) | | 40,352 | |

Environmental liability | | | 24,734 | | | (11,002 | ) | | 13,732 | | | 25,026 | | | (10,828 | ) | | 14,198 | |

Fidelity and crime | | | 2,688 | | | (1,125 | ) | | 1,563 | | | 3,024 | | | (1,336 | ) | | 1,688 | |

Other | | | 275 | | | — | | | 275 | | | 330 | | | — | | | 330 | |

Surety | | | 412 | | | — | | | 412 | | | 533 | | | — | | | 533 | |

Trade credit and political risk | | | 4,172 | | | (2,857 | ) | | 1,315 | | | 2,225 | | | — | | | 2,225 | |

| | | 302,430 | | | (118,870 | ) | | 183,560 | | | 314,470 | | | (127,995 | ) | | 186,475 | |

Specialty Reinsurance: | | | | | | | | | | | | | | | | | | | |

Marine, technical risk and aviation | | | 64,839 | | | (18,277 | ) | | 46,562 | | | 78,191 | | | (39,025 | ) | | 39,166 | |

Casualty | | | 80,561 | | | — | | | 80,561 | | | 82,106 | | | — | | | 82,106 | |

Property | | | 42,831 | | | (28,253 | ) | | 14,578 | | | 49,287 | | | (30,120 | ) | | 19,167 | |

| | | 188,231 | | | (46,530 | ) | | 141,701 | | | 209,584 | | | (69,145 | ) | | 140,439 | |

Lloyd’s: | | | | | | | | | | | | | | | | | | | |

Professional liability and other | | | 112,833 | | | (10,658 | ) | | 102,175 | | | 99,564 | | | (24,088 | ) | | 75,476 | |

| | | 112,833 | | | (10,658 | ) | | 102,175 | | | 99,564 | | | (24,088 | ) | | 75,476 | |

Total | | $ | 603,494 | | $ | (176,058 | ) | $ | 427,436 | | $ | 623,618 | | $ | (221,228 | ) | $ | 402,390 | |

Specialty Insurance: | | | | | | | | | | | | | | | | | | | |

Case reserve | | $ | 35,316 | | $ | (14,231 | ) | $ | 21,085 | | $ | 40,308 | | $ | (28,157 | ) | $ | 12,151 | |

IBNR | | | 267,114 | | | (104,639 | ) | | 162,475 | | | 274,162 | | | (99,838 | ) | | 174,324 | |

Total | | | 302,430 | | | (118,870 | ) | | 183,560 | | | 314,470 | | | (127,995 | ) | | 186,475 | |

Specialty Reinsurance: | | | | | | | | | | | | | | | | | | | |

Case reserve | | | 92,340 | | | (14,644 | ) | | 77,696 | | | 99,208 | | | (46,828 | ) | | 52,380 | |

IBNR | | | 95,891 | | | (31,886 | ) | | 64,005 | | | 110,376 | | | (22,317 | ) | | 88,059 | |

Total | | | 188,231 | | | (46,530 | ) | | 141,701 | | | 209,584 | | | (69,145 | ) | | 140,439 | |

Lloyd’s: | | | | | | | | | | | | | | | | | | | |

Case reserve | | | 8,680 | | | — | | | 8,680 | | | 2,981 | | | — | | | 2,981 | |

IBNR | | | 104,153 | | | (10,658 | ) | | 93,495 | | | 96,583 | | | (24,088 | ) | | 72,495 | |

Total | | | 112,833 | | | (10,658 | ) | | 102,175 | | | 99,564 | | | (24,088 | ) | | 75,476 | |

Total: | | | | | | | | | | | | | | | | | | | |

Case reserve | | | 136,336 | | | (28,875 | ) | | 107,461 | | | 142,497 | | | (74,985 | ) | | 67,512 | |

IBNR | | | 467,158 | | | (147,183 | ) | | 319,975 | | | 481,121 | | | (146,243 | ) | | 334,878 | |

Total | | $ | 603,494 | | $ | (176,058 | ) | $ | 427,436 | | $ | 623,618 | | $ | (221,228 | ) | $ | 402,390 | |

Footnote:

| | 1. | Failure of the Company’s reinsurers to honor their obligations could result in credit losses. |

| | 2. | Ceded case reserves include amounts recoverable from re-insurers in relation to paid loss and loss adjustment expenses that were outstanding as of March 31, 2007 and December 31, 2006. |

13

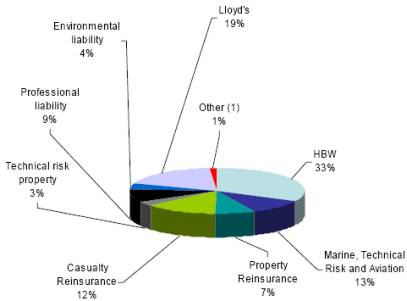

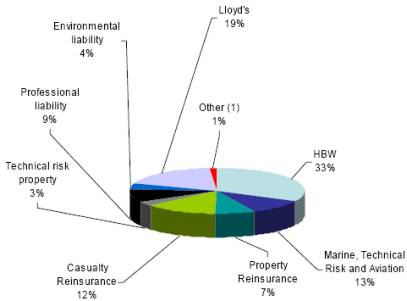

QUANTA CAPITAL HOLDINGS LTD.

Gross loss reserves as of March 31, 2007 and December 31, 2006

(in million)

2007 | | 2006 |

| |

|

Footnotes:

| | 1. | “Other” includes Trade Credit, Fidelity, Surety and other Specialty Insurance Run-off product lines. |

14

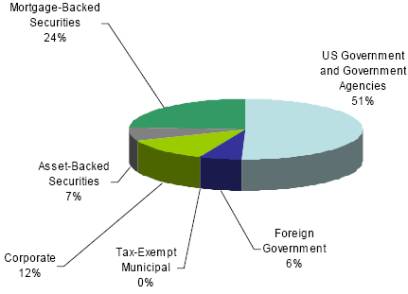

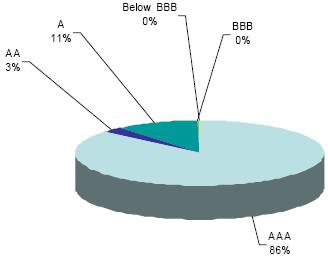

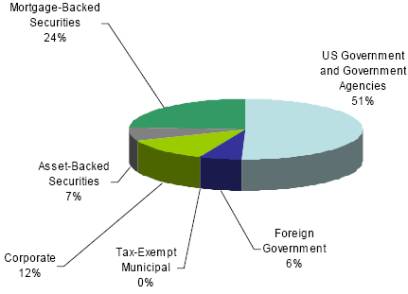

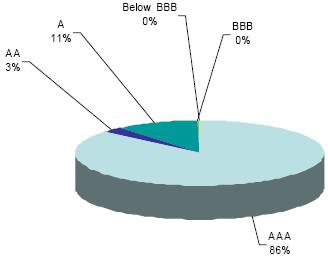

QUANTA CAPITAL HOLDINGS LTD.

Composition of Investments at March 31, 2007

Asset Class | | Credit Rating (1) |

| |

|

Footnotes:

(1) | Ratings as assigned by Standard & Poor’s Corporation. |

15

QUANTA CAPITAL HOLDINGS LTD.

Estimated 2005 Hurricane Catastrophes Losses and Loss Expenses Incurred (cumulative)

(in thousands)

(Unaudited)

| | Cumulative as of March 31, 2007 | | Cumulative as of December 31, 2006 | |

| | Gross Losses

and Loss

Expenses | | Ceded Losses

and Loss

Expenses | | Net Losses and

Loss Expenses | | Gross Losses

and Loss

Expenses | | Ceded Losses

and Loss

Expenses | | Net Losses and

Loss Expenses | |

Specialty Insurance: | | | | | | | | | | | | | | | | | | | |

Technical risk property | | $ | 33,036 | | $ | (22,104 | ) | $ | 10,932 | | $ | 40,845 | | $ | (29,656 | ) | $ | 11,189 | |

Fidelity and crime | | | 450 | | | (225 | ) | | 225 | | | 450 | | | (225 | ) | | 225 | |

| | | 33,486 | | | (22,329 | ) | | 11,157 | | | 41,295 | | | (29,881 | ) | | 11,414 | |

Specialty Reinsurance: | | | | | | | | | | | | | | | | | | | |

Marine, technical risk and aviation | | | 72,601 | | | (29,384 | ) | | 43,217 | | | 71,511 | | | (29,303 | ) | | 42,208 | |

Property | | | 80,637 | | | (48,818 | ) | | 31,819 | | | 84,789 | | | (50,098 | ) | | 34,691 | |

| | | 153,238 | | | (78,202 | ) | | 75,036 | | | 156,300 | | | (79,401 | ) | | 76,899 | |

Total losses and loss expenses incurred | | $ | 186,724 | | $ | (100,531 | ) | $ | 86,193 | | $ | 197,595 | | $ | (109,282 | ) | $ | 88,313 | |

Losses and Loss Expenses by Event | | | | | | | | | | | | | | | | | | | |

Katrina and Rita | | $ | 157,290 | | $ | (81,904 | ) | $ | 75,386 | | $ | 165,408 | | $ | (87,898 | ) | $ | 77,510 | |

Wilma | | | 29,434 | | | (18,627 | ) | | 10,807 | | | 32,187 | | | (21,384 | ) | | 10,803 | |

| | | 186,724 | | | (100,531 | ) | | 86,193 | | | 197,595 | | | (109,282 | ) | | 88,313 | |

Reinstatement premiums | | | | | | | | | | | | | | | | | | | |

Katrina and Rita | | | (10,279 | ) | | 12,568 | | | 2,289 | | | (10,239 | ) | | 12,763 | | | 2,524 | |

Wilma | | | (1,125 | ) | | 152 | | | (973 | ) | | (1,207 | ) | | 362 | | | (845 | ) |

| | | (11,404 | ) | | 12,720 | | | 1,316 | | | (11,446 | ) | | 13,125 | | | 1,679 | |

Net income impact of 2005 Hurricanes | | $ | 175,320 | | $ | (87,811 | ) | $ | 87,509 | | $ | 186,149 | | $ | (96,157 | ) | $ | 89,992 | |

Footnote:

| 1. | The above analysis includes losses incurred from the 2005 hurricanes Katrina, Rita and Wilma only and does not include development on losses incurred from the 2004 hurricanes Charley, Frances, Ivan and Jeanne. |

| 2. | As at March 31, 2007 and December 31, 2006, $42.0 million and $32.3 million of estimated 2005 net hurricane losses and loss expenses were unpaid. |

16