UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)

ASSET ACCEPTANCE CAPITAL CORP. (AACC)

(Name of Issuer)

(Title of Class of Securities)

04543P100

(CUSIP Number)

David Nierenberg

The D3 Family Funds

19605 NE 8th Street

Camas, WA 98607

(360) 604-8600

_______________

With a copy to:

Christopher P. Davis

Kleinberg, Kaplan, Wolff & Cohen, P.C.

551 Fifth Avenue

New York, NY 10176

(212) 986-6000

______________________________________

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box Ô.

| 1 | NAME OF REPORTING PERSONS The D3 Family Fund, L.P. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Washington |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 755,243 common shares (2.5%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 755,243 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 755,243; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 2.5%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON (See Instructions) PN |

| 1 | NAME OF REPORTING PERSONS The D3 Family Bulldog Fund, L.P. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Washington |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 3,043,700 common shares (9.9%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 3,043,700 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 3,043,700; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 9.9%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON (See Instructions) PN |

| 1 | NAME OF REPORTING PERSONS The D3 Family Canadian Fund, L.P. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Washington |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 284,265 common shares (0.9%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 284,265 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 284,265; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 0.9%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON PN |

| 1 | NAME OF REPORTING PERSONS The DIII Offshore Fund, L.P. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) WC |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Bahamas |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 847,841 common shares (2.8%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 847,841 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 847,841; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 2.8%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON PN |

| 1 | NAME OF REPORTING PERSONS Nierenberg Investment Management Company, Inc. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Washington |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 4,931,049 common shares (16.1%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 4,931,049 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 4,931,049; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 16.1%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON CO |

| 1 | NAME OF REPORTING PERSONS Nierenberg Investment Management Offshore, Inc |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION Bahamas |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 847,841 common shares (2.8%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 847,841 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 847,841; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 2.8%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON CO |

| 1 | NAME OF REPORTING PERSONS David Nierenberg |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) (a) [X] (b) [ ] |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS (See Instructions) AF |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States of America |

NUMBER OF SHARES BENEFICIALLY | 7 | SOLE VOTING POWER 0 |

OWNED BY EACH REPORTING | 8 | SHARED VOTING POWER 4,931,049 common shares (16.1%) |

PERSON WITH | 9 | SOLE DISPOSITIVE POWER 0 |

| | 10 | SHARED DISPOSITIVE POWER 4,931,049 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON For the reporting person listed on this page, 4,931,049; for all reporting persons as a group, 4,931,049 shares (16.1%) |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) TM |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) For the reporting person listed on this page, 16.1%; for all reporting persons as a group, 16.1%. |

| 14 | TYPE OF REPORTING PERSON IN |

This Amendment No. 7 to Schedule 13D (this “Amendment”) amends the below-indicated Items from the Schedule 13D with respect to the shares of common stock (the “Common Stock”) of Asset Acceptance Capital Corp. (the “Issuer” or “AACC”) previously filed by or on behalf of the Reporting Persons (as defined below), as previously amended (collectively the “Schedule 13D”), by supplementing such Items with the information below.

The names of the persons filing this Amendment (collectively, the “Reporting Persons” or “we”) are: The D3 Family Fund, L.P. (the “Family Fund”), The D3 Family Bulldog Fund, L.P. (the “Bulldog Fund”), The D3 Family Canadian Fund, L.P. (the “Canadian Fund”), The DIII Offshore Fund, L.P. (the “Offshore Fund”), Nierenberg Investment Management Company, Inc. (“NIMCO”), Nierenberg Investment Management Offshore, Inc. (“NIMO”) and David Nierenberg (“Mr. Nierenberg”).

Item 4. Purpose of Transaction

Item 4 of the Schedule 13D is supplemented with the following:

We have reviewed AACC’s definitive proxy statement for the 2011 Annual Meeting of Shareholders, filed with the United States Securities and Exchange Commission on March 28 (the “Proxy Statement”). As AACC’s largest outside shareholder, we feel compelled at this time to disclose our views about important matters of corporate governance at AACC.

On the first ballot item, the re-election of directors, we have decided to vote FOR the re-election of CEO Rion Needs, but to WITHHOLD our vote from the re-election of Director Terrence Daniels, who represents AACC’s private equity sponsor and largest investor, Quad-C, because we do not believe that his impact on AACC’s performance justifies his re-election. (Similarly, last year, we withheld votes from other outside directors who were candidates for re-election.)

We intend to vote our shares for the re-election of AACC’s outside auditor and for proposed executive compensation. Most of AACC’s current management team are new to the company, working hard, and did not cause the problems which they inherited when they joined the company.

On the fourth ballot item, given the unacceptable operating and financial performance of AACC in 2009 and 2010, we believe that ANNUAL shareholder advisory votes on compensation are necessary until AACC returns to acceptable growth and profitability. We believe that management is capable of engineering this return to profitability and hope that they will succeed this year.

The independent directors of AACC, looked at in the aggregate, have presided over a substantial erosion of shareholder value, as measured by the company’s share price. We do not blame current management for this situation; their job is to ameliorate the problems they inherited. Since we are not present in AACC’s boardroom, we cannot know precisely which AACC directors have caused the company’s problems, nor which directors have done the most to solve them. But we do know that director Terrence Daniels is Founder and Chairman of AACC’s largest shareholder, Quad-C Investors LLC, which owns, according to the Proxy Statement, 35.9% of AACC. Moreover, director Daniels’ firm was and remains AACC’s private equity sponsor, providing capital for its growth as a private company, taking AACC public, and, we believe, leading the company’s board. The Proxy Statement, for example, declares that director Daniels “bring[s] a unique perspective to the Board on matters involving operations, strategy, and debt and capital markets transactions.” Also, one of director Daniels’ Quad-C partners has served as the AACC board’s “Independent” Presiding Director since March 1, 2006.

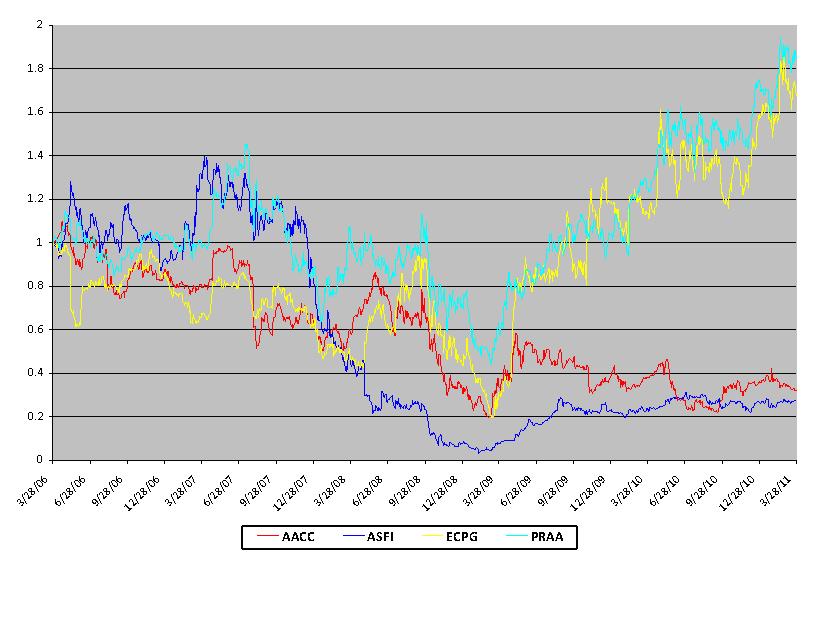

Investors need only look back five years, to March 28, 2006, to compare AACC’s share price performance under the sponsorship and leadership of Quad-C to the performance of the three publicly-held debt collection companies which the proxy identifies as AACC’s “direct competitors”: Asta Funding (ASFI), Encore Capital Group (ECPG), and Portfolio Recovery Associates (PRAA). During these five years this is how their respective share prices performed:

AACC down 72.5%

ASFI down 74.6%

ECPG up 67.4%

PRAA up 81.2%

Each dollar invested in AACC shrunk to only 27.5 cents while the dollar invested in the average of ECPG and PRAA grew to $1.743, a difference, from end to end, of 6.34 times!

This enormous difference between shareholder wealth destruction and shareholder value creation cannot in our opinion be attributed to a bad industry, a bad market, adverse regulation, or the recent recession. We believe that it is the direct result of board choices about strategy, leadership, and execution. We’ll cite four example of decisions made by AACC’s board, in ascending order of importance:

1. Before AACC’s current management team joined the company, but on this board’s watch, AACC diversified (unsuccessfully) into the collection of healthcare receivables. The company wrote off this misadventure in 2010.

2. Long before AACC’s current management team joined the company, prior management and the board failed to invest in the analytic capability/desktop software which competing debt collection firms purchased or developed to maximize collector productivity and intelligently price purchases of charged-off credit card portfolios. By the time that current management completed the implementation of COGENT’s software, we believe that AACC was using legacy systems which were nearly two decades old.

3. Once Rion Needs became CEO he began a process of assessing, and often turning over, members of the management team he had inherited. The current board was in place long before this. One wonders why they failed to make these changes on their watch and why, instead, they put a new CEO, brought in from outside the company, at the risk of replacing these executives, a time-consuming process which further delayed the company’s recovery.

4. Without question, the AACC board’s piece de resistance was the leveraged recapitalization of the company, which we can only describe as a colossal and horribly timed unforced error on their part. We believe this unwise recapitalization not only built double leverage into the company’s capital structure; it also left AACC’s borrowing ability impaired at precisely the moment of greatest portfolio purchasing opportunity, causing the loss of substantial scale and market share.

Accountability really does matter. We believe that director Daniels should be replaced. Therefore we are withholding our vote and we are voting for annual shareholder voting on executive compensation at this time. A more responsive and proactive board of directors would long ago have made changes in the composition and leadership of AACC’s board of directors. But they have repeatedly failed to do so. Such performance does not deserve re-election.

We believe that AACC management is capable of returning the company to decent profitability this year. We hope that finally does happen. If, however, it does not, we reserve our options available to us to improve the quality of board leadership and decision-making at AACC in the future.

Item 5. Interest in Securities of the Issuer.

(a) The Reporting Persons, in the aggregate, beneficially own 4,931,049 shares of Common Stock, constituting approximately 16.1% of the outstanding shares.

(b) The Family Fund, NIMCO and Mr. Nierenberg have shared power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 755,243 shares of Common Stock held by the Family Fund.

The Bulldog Fund, NIMCO and Mr. Nierenberg have shared power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 3,043,700 shares of Common Stock held by the Bulldog Fund.

The Canadian Fund, NIMCO and Mr. Nierenberg have shared power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 284,265 shares of Common Stock held by the Canadian Fund.

The Offshore Fund, NIMO, NIMCO and Mr. Nierenberg have shared power (i) to vote or direct the vote of, and (ii) to dispose or direct the disposition of, the 847,841 shares of Common Stock held by the Offshore Fund.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in the Statement is true, complete and correct.

D3 Family Fund, L.P., D3 Family Bulldog Fund, L.P., and D3 Family Canadian Fund, L.P.

By: Nierenberg Investment Management Company, Inc.

Its: General Partner

March 31, 2011 By: /s/ David Nierenberg

------------------------- -------------------------------------------

David Nierenberg, President

DIII Offshore Fund, L.P.

By: Nierenberg Investment Management Offshore, Inc.

Its: General Partner

March 31, 2011 By: /s/ David Nierenberg

------------------------- -------------------------------------------

David Nierenberg, President

Nierenberg Investment Management Company, Inc.

March 31, 2011 By: /s/ David Nierenberg

------------------------- -------------------------------------------

David Nierenberg, President

Nierenberg Investment Management Offshore, Inc.

March 31, 2011 By: /s/ David Nierenberg

------------------------- -------------------------------------------

David Nierenberg, President

March 31, 2011 By: /s/ David Nierenberg

------------------------- -------------------------------------------

David Nierenberg