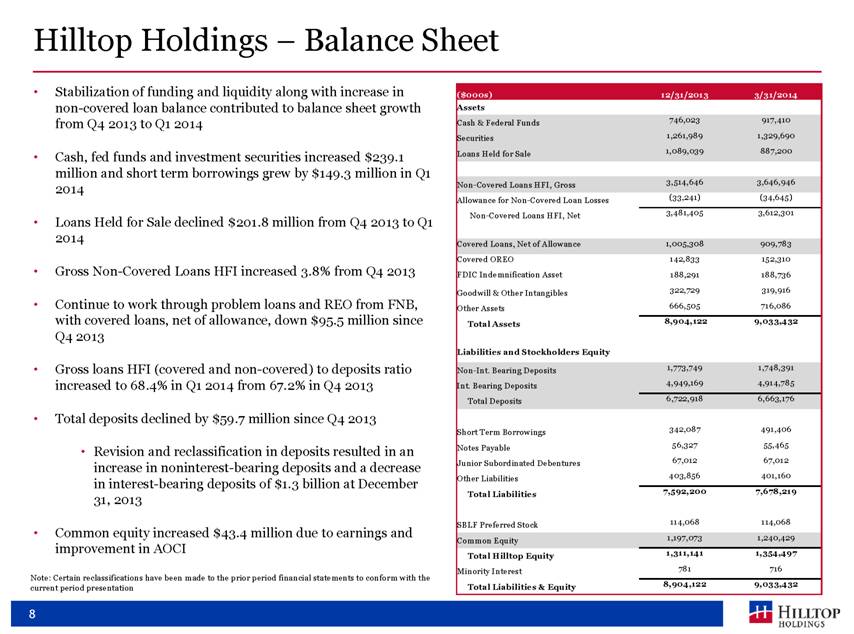

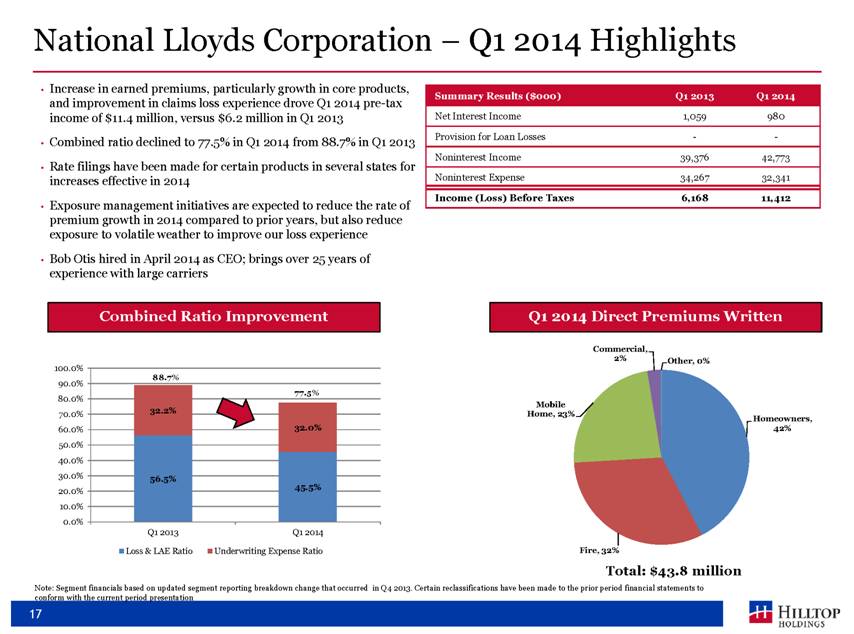

| Hilltop Holdings – Balance Sheet Stabilization of funding and liquidity along with increase in non-covered loan balance contributed to balance sheet growth from Q4 2013 to Q1 2014 Cash, fed funds and investment securities increased $239.1 million and short term borrowings grew by $149.3 million in Q1 2014 Loans Held for Sale declined $201.8 million from Q4 2013 to Q1 2014 Gross Non-Covered Loans HFI increased 3.8% from Q4 2013 Continue to work through problem loans and REO from FNB, with covered loans, net of allowance, down $95.5 million since Q4 2013 Gross loans HFI (covered and non-covered) to deposits ratio increased to 68.4% in Q1 2014 from 67.2% in Q4 2013 Total deposits declined by $59.7 million since Q4 2013 Revision and reclassification in deposits resulted in an increase in noninterest-bearing deposits and a decrease in interest-bearing deposits of $1.3 billion at December 31, 2013 Common equity increased $43.4 million due to earnings and improvement in AOCI 8 ($000s) 12/31/2013 3/31/2014 Assets Cash & Federal Funds 746,023 917,410 Securities 1,261,989 1,329,690 Loans Held for Sale 1,089,039 887,200 Non-Covered Loans HFI, Gross 3,514,646 3,646,946 Allowance for Non-Covered Loan Losses (33,241) (34,645) Non-Covered Loans HFI, Net 3,481,405 3,612,301 Covered Loans, Net of Allowance 1,005,308 909,783 Covered OREO 142,833 152,310 FDIC Indemnification Asset 188,291 188,736 Goodwill & Other Intangibles 322,729 319,916 Other Assets 666,505 716,086 Total Assets 8,904,122 9,033,432 Liabilities and Stockholders Equity Non-Int. Bearing Deposits 1,773,749 1,748,391 Int. Bearing Deposits 4,949,169 4,914,785 Total Deposits 6,722,918 6,663,176 Short Term Borrowings 342,087 491,406 Notes Payable 56,327 55,465 Junior Subordinated Debentures 67,012 67,012 Other Liabilities 403,856 401,160 Total Liabilities 7,592,200 7,678,219 SBLF Preferred Stock 114,068 114,068 Common Equity 1,197,073 1,240,429 Total Hilltop Equity 1,311,141 1,354,497 Minority Interest 781 716 Total Liabilities & Equity 8,904,122 9,033,432 Note: Certain reclassifications have been made to the prior period financial statements to conform with the current period presentation |