in the secondary market—typically within 30 days of closing the transaction—they use the money received from the sale of the mortgage to replenish their lines of credit.

Personal Banking. The Bank offers a broad range of personal banking products and services for individuals. Similar to its business banking operations, the Bank also provides its personal banking customers with a variety of add-on features such as check cards, safe deposit boxes, online banking, bill pay, overdraft privilege services and access to automated teller machine (ATM) facilities throughout the United States. The Bank offers a variety of deposit accounts to its personal banking customers including savings, checking, interest-bearing checking, money market and certificates of deposit.

The Bank loans to individuals for personal, family and household purposes, including lines of credit, home improvement loans, home equity loans, and loans for purchasing and carrying securities. At December 31, 2019, the Bank had $47.0 million of loans for these purposes, which are shown in the loans held for investment table above as “Consumer.”

Wealth and Investment Management. The Bank’s private banking team personally assists high net worth individuals and their families with their banking needs, including depository, credit, asset management, and trust and estate services. The Bank offers trust and asset management services in order to assist these customers in managing, and ultimately transferring, their wealth.

The Bank’s wealth management services provide personal trust, investment management and employee benefit plan administration services, including estate planning, management and administration, investment portfolio management, employee benefit accounts and individual retirement accounts.

Broker-Dealer

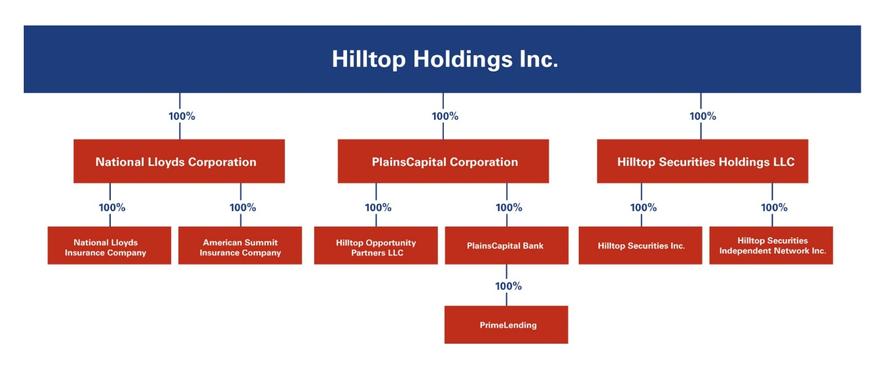

The “Hilltop Broker-Dealers” include the operations of Hilltop Securities, a clearing broker-dealer subsidiary registered with the SEC and the Financial Industry Regulatory Authority (“FINRA”) and a member of the NYSE, HTS Independent Network, an introducing broker-dealer subsidiary that is also registered with the SEC and FINRA, and Hilltop Securities Asset Management, LLC. Hilltop Securities and HTS Independent Network are both registered with the Commodity Futures Trading Commission (“CFTC”) as non-guaranteed introducing brokers and as members of the National Futures Association (“NFA”). Additionally, Hilltop Securities Asset Management, LLC, Hilltop Securities and HTS Independent Network are investment advisers registered under the Investment Advisers Act of 1940. At December 31, 2019, Hilltop Securities had consolidated assets of $3.5 billion and net capital of $318.7 million, which was $310.9 million in excess of its minimum net capital requirement of $7.8 million. At December 31, 2019, the Hilltop Broker-Dealers employed approximately 790 people and maintained 52 locations in 20 states.

Our broker-dealer segment has four primary lines of business: (i) public finance services, (ii) structured finance, (iii) fixed income services, and (iv) wealth management, which includes retail, clearing services and securities lending. These lines of business and the respective services provided reflect the current manner in which the broker-dealer segment’s operations are managed.

Public Finance Services. The public finance services line of business assists public entities nationwide, including cities, counties, school districts, utility districts, tax increment zones, special districts, state agencies and other governmental entities, in originating, syndicating and distributing securities of municipalities and political subdivisions. In addition, the public finance services line of business provides specialized advisory and investment banking services for airports, convention centers, healthcare institutions, institutions of higher education, housing, industrial development agencies, toll road authorities, and public power and utility providers.

Additionally, through its arbitrage rebate, treasury management and government investment pools management departments, the public finance services line of business provides state and local governments with advice and guidance with respect to arbitrage rebate compliance, portfolio management and local government investment pool administration.

Structured Finance. The structured finance line of business provides structured asset and liability services and commodity hedging advisory services to facilitate balance sheet management primarily to clients of the public finance services business. In addition, the structured finance line of business participates in programs in which it issues forward purchase commitments of mortgage-backed securities to certain non-profit housing clients and sells U.S. Agency to-be-announced (“TBA”) mortgage-backed securities.