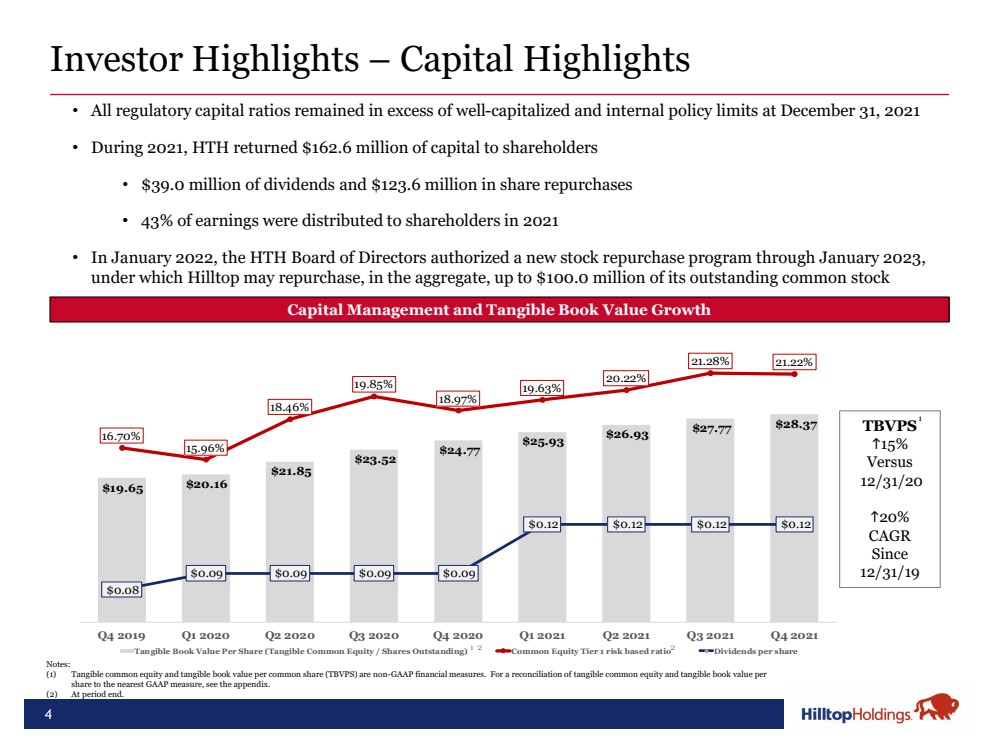

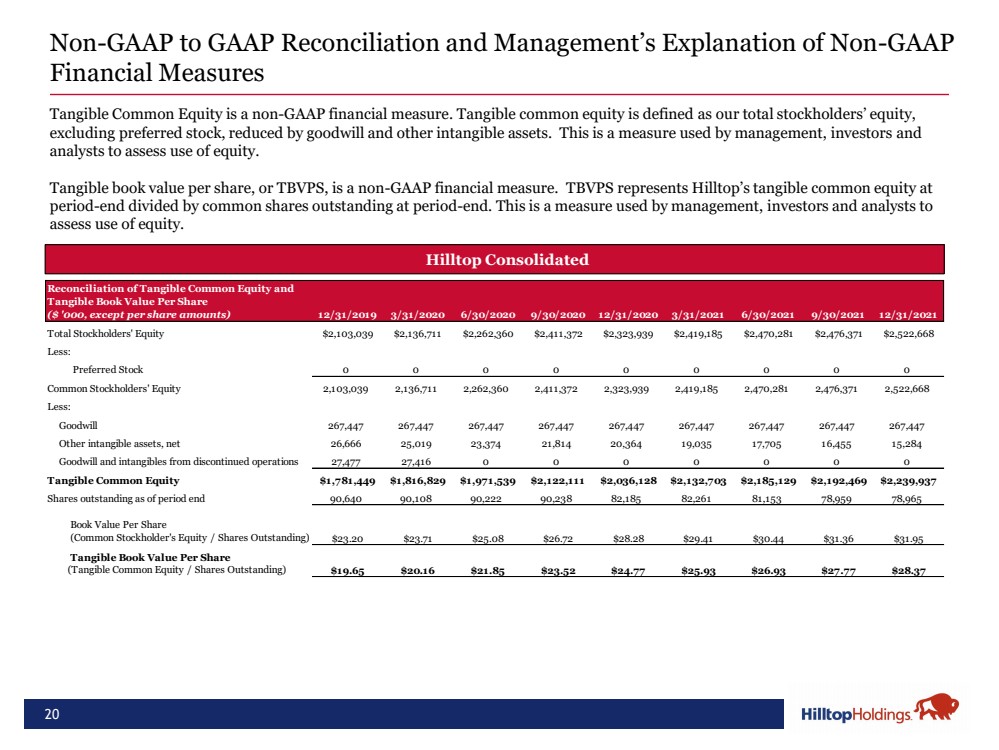

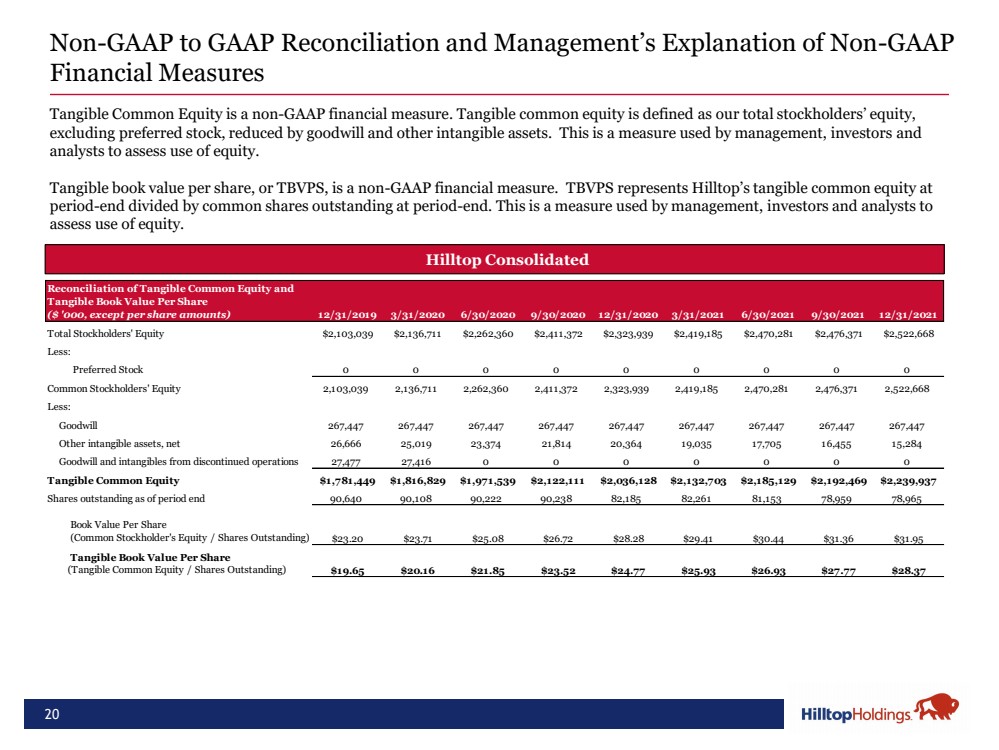

| 20 Non - GAAP to GAAP Reconciliation and Management’s Explanation of Non - GAAP Financial Measures • Hilltop Consolidated Tangible Common Equity is a non - GAAP financial measure. Tangible common equity is defined as our total stockholders’ equity, excluding preferred stock, reduced by goodwill and other intangible assets. This is a measure used by management, investors and analysts to assess use of equity. Tangible book value per share, or TBVPS, is a non - GAAP financial measure. TBVPS represents Hilltop’s tangible common equity at period - end divided by common shares outstanding at period - end. This is a measure used by management, investors and analysts to assess use of equity. Reconciliation of Tangible Common Equity and Tangible Book Value Per Share ($ '000, except per share amounts) 12/31/2019 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 Total Stockholders' Equity $2,103,039 $2,136,711 $2,262,360 $2,411,372 $2,323,939 $2,419,185 $2,470,281 $2,476,371 $2,522,668 Less: Preferred Stock 0 0 0 0 0 0 0 0 0 Common Stockholders' Equity 2,103,039 2,136,711 2,262,360 2,411,372 2,323,939 2,419,185 2,470,281 2,476,371 2,522,668 Less: Goodwill 267,447 267,447 267,447 267,447 267,447 267,447 267,447 267,447 267,447 Other intangible assets, net 26,666 25,019 23,374 21,814 20,364 19,035 17,705 16,455 15,284 Goodwill and intangibles from discontinued operations 27,477 27,416 0 0 0 0 0 0 0 Tangible Common Equity $1,781,449 $1,816,829 $1,971,539 $2,122,111 $2,036,128 $2,132,703 $2,185,129 $2,192,469 $2,239,937 Shares outstanding as of period end 90,640 90,108 90,222 90,238 82,185 82,261 81,153 78,959 78,965 Book Value Per Share (Common Stockholder's Equity / Shares Outstanding) $23.20 $23.71 $25.08 $26.72 $28.28 $29.41 $30.44 $31.36 $31.95 Tangible Book Value Per Share (Tangible Common Equity / Shares Outstanding) $19.65 $20.16 $21.85 $23.52 $24.77 $25.93 $26.93 $27.77 $28.37 |