UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21439

Fidelity Rutland Square Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Stuart Fross, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

| |

Date of reporting period: | August 31, 2006 |

Item 1. Reports to Stockholders

PAS International Fund of FundsSM

Managed exclusively for clients of

Strategic Advisers, Inc. - not available

for sale to the general public

Semiannual Report

August 31, 2006

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Summary | <Click Here> | A summary of the fund's investments. |

Investments | <Click Here> | A complete list of the fund's investments with their

market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and

changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Board Approval of Investment Advisory Contracts | <Click Here> | |

To view a fund's proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

PAS International Fund of Funds

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The actual expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 23, 2006 to August 31, 2006). The hypothetical expense Example is based on an investment of $1,000 invested for the one-half year period (March 1, 2006 to August 31, 2006).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value | Ending

Account Value

August 31, 2006 | Expenses Paid

During Period |

Actual | $ 1,000.00 | $ 1,050.00 | $ .00* |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,025.21 | $ .00** |

* Actual expenses are equal to the Fund's annualized expense ratio of .00%; multiplied by the average account value over the period, multiplied by 162/365 (to reflect the period March 23, 2006 to August 31, 2006). The fees and expenses of the underlying funds in which the fund invests are not included in the fund's annualized expense ratio.

** Hypothetical expenses are equal to the Fund's annualized expense ratio of .00%; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The fees and expenses of the underlying funds in which the fund invests are not included in the fund's annualized expense ratio.

Semiannual Report

PAS International Fund of Funds

Investment Summary

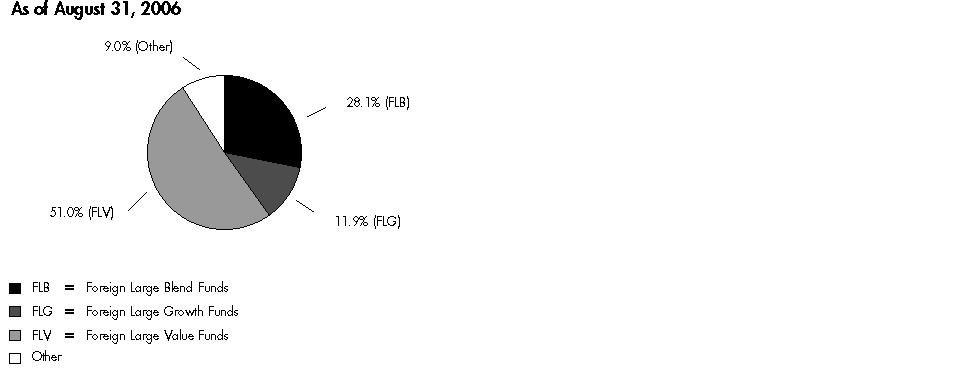

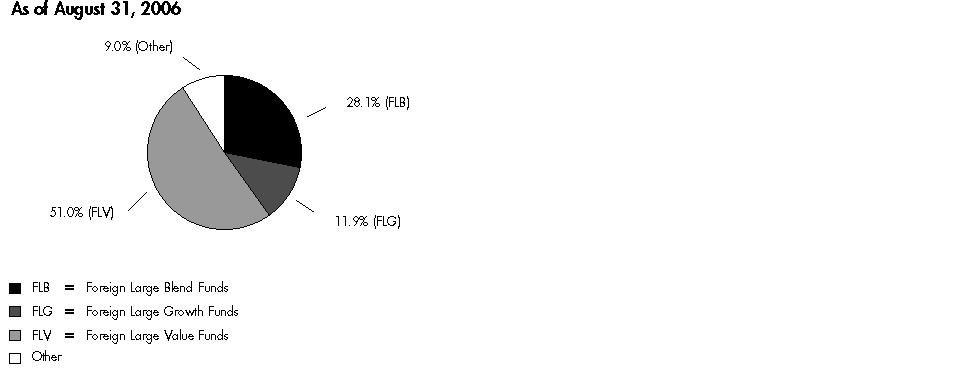

Fund Holdings as of August 31, 2006 |

| % of fund's

investments |

Foreign Large Blend Funds | |

SSgA International Stock

Selection Fund Institutional Class | 10.1 |

MFS Research International Fund Class A | 8.4 |

Henderson International Opportunities Fund Class A | 5.0 |

GE Institutional International Equity Fund Service Class | 2.7 |

Julius Baer International Equity Fund II Class A | 1.8 |

Thornburg International Value Fund Class A | 0.1 |

| 28.1 |

Foreign Large Growth Funds | |

William Blair International Growth Fund Class N | 6.2 |

AIM International Growth Fund Class A | 5.7 |

| 11.9 |

Foreign Large Value Funds | |

Goldman Sachs Structured International Equity Fund

Class A | 17.5 |

Causeway International Value Fund Investor Class | 14.9 |

Morgan Stanley Insitutional Fund, Inc. - International Equity Portfolio Class B | 14.1 |

Harbor International Fund

Investor Class | 4.5 |

| 51.0 |

Other | |

Merrill Lynch Pacific Fund, Inc. Class A | 4.3 |

GMO Emerging Countries Fund Class M | 2.7 |

Morgan Stanley Institutional Fund, Inc. - International Real Estate Portfolio Class B | 1.9 |

Matthews Pacific Tiger Fund | 0.1 |

Neuberger Berman International Fund Trust Class | 0.0 |

MFS International New Discovery Fund Class A | 0.0 |

| 9.0 |

Total | 100.0 |

Asset Allocation (% of fund's investments) |

Asset allocations in the pie chart reflect the categorization of assets as defined by Morningstar as of the reporting date indicated above. |

Semiannual Report

PAS International Fund of Funds

Investments August 31, 2006 (Unaudited)

Showing Percentage of Total Value of Investment in Securities

Equity Funds - 100.0% |

| Shares | | Value (Note 1) |

Foreign Large Blend Funds - 28.1% |

GE Institutional International Equity Fund Service Class (a) | 355,334 | | $ 5,383,316 |

Henderson International Opportunities Fund Class A | 455,478 | | 10,056,949 |

Julius Baer International Equity Fund II Class A (a) | 264,382 | | 3,566,510 |

MFS Research International Fund Class A | 865,428 | | 16,823,923 |

SSgA International Stock Selection Fund Institutional Class | 1,567,810 | | 20,193,391 |

Thornburg International Value Fund Class A | 7,505 | | 199,938 |

TOTAL FOREIGN LARGE BLEND FUNDS | | 56,224,027 |

Foreign Large Growth Funds - 11.9% |

AIM International Growth Fund Class A | 431,278 | | 11,497,871 |

William Blair International Growth Fund Class N | 445,258 | | 12,329,194 |

TOTAL FOREIGN LARGE GROWTH FUNDS | | 23,827,065 |

Foreign Large Value Funds - 51.0% |

Causeway International Value Fund Investor Class | 1,582,483 | | 29,813,976 |

Goldman Sachs Structured International Equity Fund Class A | 2,454,029 | | 35,068,078 |

Harbor International Fund Investor Class | 156,428 | | 8,913,247 |

Morgan Stanley Institutional Fund, Inc. - International Equity Portfolio Class B | 1,241,382 | | 28,253,843 |

TOTAL FOREIGN LARGE VALUE FUNDS | | 102,049,144 |

Other - 9.0% |

GMO Emerging Countries Fund Class M | 304,551 | | 5,311,363 |

Matthews Pacific Tiger Fund | 9,623 | | 201,312 |

Merrill Lynch Pacific Fund, Inc. Class A | 321,913 | | 8,688,444 |

MFS International New Discovery Fund Class A | 38 | | 1,000 |

Morgan Stanley Institutional Fund, Inc. - International Real Estate Portfolio Class B | 129,499 | | 3,804,688 |

Neuberger Berman International Fund Trust Class | 299 | | 7,924 |

TOTAL OTHER | | 18,014,731 |

TOTAL EQUITY FUNDS (Cost $193,534,327) | 200,114,967 |

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $193,534,327) | $ 200,114,967 |

Legend |

(a) Non-income producing |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

PAS International Fund of Funds

Financial Statements

Statement of Assets and Liabilities

| August 31, 2006 (Unaudited) |

| | |

Assets | | |

Investment in unaffiliated securities, at value (cost $193,534,327) - See accompanying schedule | | $ 200,114,967 |

Receivable for investments sold | | 1,000 |

Receivable for fund shares sold | | 209,827 |

Total assets | | 200,325,794 |

| | |

Liabilities | | |

Payable for investments purchased | $ 76,496 | |

Payable for fund shares redeemed | 134,330 | |

Total liabilities | | 210,826 |

| | |

Net Assets | | $ 200,114,968 |

Net Assets consist of: | | |

Paid in capital | | $ 193,203,682 |

Undistributed net investment income | | 39,679 |

Accumulated undistributed net realized gain (loss) on investments | | 290,967 |

Net unrealized appreciation (depreciation) on investments | | 6,580,640 |

Net Assets, for 19,060,649 shares outstanding | | $ 200,114,968 |

Net Asset Value, offering price and redemption price per share ($200,114,968 ÷ 19,060,649 shares) | | $ 10.50 |

Statement of Operations

| For the period March 23, 2006 (commencement of operations) to August 31, 2006 (Unaudited) |

| | |

Investment Income | | |

Dividends from underlying funds | | $ 39,551 |

Interest | | 128 |

Total income | | 39,679 |

| | |

Expenses | | |

Management fee | $ 126,022 | |

Independent trustees' compensation | 7,297 | |

Total expenses before reductions | 133,319 | |

Expense reductions | (133,319) | - |

Net investment income (loss) | | 39,679 |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | (210,749) | |

Realized gain distributions from underlying funds | 501,716 | 290,967 |

Change in net unrealized appreciation (depreciation) on underlying funds | | 6,580,640 |

Net gain (loss) | | 6,871,607 |

Net increase (decrease) in net assets resulting from operations | | $ 6,911,286 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| For the period

March 23, 2006

(commencement

of operations) to

August 31, 2006

(Unaudited) |

Increase (Decrease) in Net Assets | |

Operations | |

Net investment income (loss) | $ 39,679 |

Net realized gain (loss) | 290,967 |

Change in net unrealized appreciation (depreciation) | 6,580,640 |

Net increase (decrease) in net assets resulting from operations | 6,911,286 |

Share transactions

Proceeds from sales of shares | 205,170,501 |

Cost of shares redeemed | (11,966,819) |

Net increase (decrease) in net assets resulting from share transactions | 193,203,682 |

Total increase (decrease) in net assets | 200,114,968 |

| |

Net Assets | |

Beginning of period | - |

End of period (including undistributed net investment income of $39,679) | $ 200,114,968 |

Other Information Shares | |

Sold | 20,254,144 |

Redeemed | (1,193,495) |

Net increase (decrease) | 19,060,649 |

Financial Highlights

| Period ended

August 31, 2006 F |

| (Unaudited) |

Selected Per-Share Data | |

Net asset value, beginning of period | $ 10.00 |

Income from Investment Operations | |

Net investment income (loss) D | - H |

Net realized and unrealized gain (loss) | .50 |

Total from investment operations | .50 |

Net asset value, end of period | $ 10.50 |

Total Return B, C | 5.00% |

Ratios to Average Net Assets G | |

Expenses before expense reductions | .26% A |

Expenses net of contractual waivers | .00% A |

Expenses net of all reductions | .00% A |

Net investment income (loss) | .08% A |

Supplemental Data | |

Net assets, end of period (000 omitted) | $ 200,115 |

Portfolio turnover rate E | 18% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amounts do not include the portfolio activity of the Underlying Funds.

F For the period March 23, 2006 (commencement of operations) to August 31, 2006.

G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts contractually reimbursed by the investment adviser and do not represent the amount paid by the Fund during periods when reimbursements occur. Expenses net of contractual waivers reflect expenses after reimbursement by the investment adviser. Expenses net of all reductions represent the net expenses paid by the Fund. Fees and expenses of the Underlying Funds are not included in the Fund's annualized ratios. The Fund indirectly bears its proportionate share of the expenses of the Underlying Funds.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended August 31, 2006 (Unaudited)

1. Significant Accounting Policies.

PAS International Fund of Funds (the Fund) is a fund of Fidelity Rutland Square Trust (the trust), an open-end management investment company organized as a Delaware statutory trust. The Fund invests in unaffiliated mutual funds (the Underlying Funds) and operates under Section 10(d) of the Investment Company Act of 1940. The Fund's investments in the Underlying Funds were not subject to front-end sales charges or contingent deferred sales charges. The Fund is offered exclusively to clients of Strategic Advisers, Inc. (Strategic Advisers), an affiliate of Fidelity Management and Research Company (FMR). The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Net asset value per share is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Investments in the Underlying Funds are valued at their net asset value each business day. If an Underlying Fund's net asset value is unavailable, shares of that fund may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued on the basis of amortized cost.

Investment Transactions and Income. Security transactions, normally shares of the Underlying Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend and realized gain distributions from the Underlying Funds, if any, are recorded on the ex-dividend date and are automatically reinvested. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Underlying Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Underlying Funds' expenses through the impact of these expenses on each Underlying Fund's net asset value. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

Unrealized appreciation | $ 7,004,703 |

Unrealized depreciation | (424,121) |

Net unrealized appreciation (depreciation) | $ 6,580,582 |

Cost for federal income tax purposes | $ 193,534,385 |

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management is currently evaluating the impact, if any, the adoption of FIN 48 will have on the Fund's net assets and results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

2. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Semiannual Report

3. Purchases and Sales of Investments.

Purchases and redemptions of the Underlying Fund shares aggregated $204,161,599 and $10,416,524, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. Strategic Advisers provides the Fund with investment management related services. For these services, the Fund pays a monthly management fee to Strategic Advisers. The management fee is computed at an annual rate of .25% of the Fund's average net assets. Strategic Advisers, either itself or through an affiliated company, pays all other expenses of the Fund with certain exceptions such as interest expense and independent Trustees' compensation.

Strategic Advisers has contractually agreed to waive its management fee until March 20, 2009.

Other Transactions. Strategic Advisers has entered into an administration agreement with FMR under which FMR provides management and administrative services (other than investment advisory services) necessary for the operation of the Fund. FMR also contracts with other Fidelity companies to perform the services necessary for the operation of the Fund. Under this agreement, Strategic Advisers agrees to pay FMR a monthly administration fee. The Fund does not pay any fees for these services.

5. Expense Reductions.

In addition to waiving its management fee, Strategic Advisers has contractually agreed to reimburse the Fund until March 20, 2009 to the extent that annual operating expenses exceed .00% of average net assets. Some expenses, for example, interest expense, are excluded from this reimbursement. During the period, this waiver and reimbursement reduced the Fund's expenses by $133,319.

Semiannual Report

Board Approval of the Existing Investment Advisory Contracts

Matters Considered by the Board. The Board of Trustees is scheduled to meet four times per year. The Board of Trustees, including the Independent Trustees, expects that matters bearing on the fund's management contract will be considered at most, if not all, of its meetings. While the full Board of Trustees or the Independent Trustees, as appropriate, act on all major matters, a portion of the activities of the Board of Trustees (including certain of those described herein) may be conducted through committees. The Independent Trustees expect to meet from time to time in executive session and are advised by legal counsel selected by the Independent Trustees.

Information Received by the Board of Trustees. In connection with their regular meetings, the Board of Trustees, including the Independent Trustees, expects to receive materials specifically relating to the existing management contract and administration agreement (the Investment Advisory Contracts). These materials may include (i) information on the investment performance of the fund, peer groups of funds and appropriate indices or combinations of indices, (ii) sales and redemption data in respect of comparable funds, and (iii) the economic outlook and the general investment outlook in the markets in which the fund invests. The Board of Trustees, including the Independent Trustees, also expects to consider periodically other material facts such as (1) the Investment Adviser's results and financial condition, (2) arrangements in respect of the distribution of the fund's shares, (3) the procedures employed to determine the value of the fund's assets, (4) the Investment Adviser's management of the relationships with the fund's custodians and subcustodians, (5) the resources devoted to and the record of compliance with the fund's investment policies and restrictions and with policies on personal securities transactions, and (6) the nature, cost and character of non-investment management services provided by the Investment Adviser and its affiliates.

Additional information to be furnished by the Investment Adviser may include, among other items, information on and analysis of (a) the overall organization of the Investment Adviser, (b) investment performance, (c) the choice of performance indices and benchmarks, (d) the composition of peer groups of funds, (e) transfer agency and bookkeeping fees paid to affiliates of the Investment Adviser, if charged to the fund, (f) investment management staffing, (g) the potential for achieving further economies of scale, (h) operating expenses paid to third parties, and (i) the information furnished to investors, including the fund's shareholders.

At a September 27, 2005 in-person meeting, the Board of Trustees, including the Independent Trustees, approved the Investment Advisory Contracts for their initial terms. In considering the Investment Advisory Contracts, the Board of Trustees, including the Independent Trustees, did not identify any single factor as all-important or controlling, and the following summary does not detail all the matters considered. Matters considered by the Board of Trustees, including the Independent Trustees, in connection with its approval of the Investment Advisory Contracts include the following:

The Investment Adviser's Personnel and Methods. The Board of Trustees, including the Independent Trustees, reviewed the background of the fund's portfolio managers and the fund's investment objective and discipline. The Independent Trustees have also had discussions with senior management of the Investment Adviser responsible for investment operations. Among other things they considered the size, education and experience of the Investment Adviser's investment staff, their use of technology, and the Investment Adviser's approach to recruiting, training and retaining portfolio managers and other research, advisory and management personnel.

Nature and Quality of Other Services. The Board of Trustees, including the Independent Trustees, considered the nature, quality, cost and extent of administrative and shareholder services to be performed by the Investment Adviser and affiliated companies, under the existing Investment Advisory Contracts and under separate agreements covering transfer agency functions and pricing and bookkeeping services. The Board of Trustees, including the Independent Trustees, also considered the nature and extent of the Investment Adviser's supervision of third party service providers, principally custodians and subcustodians.

Expenses. The Board of Trustees, including the Independent Trustees, considered the fund's expense ratio, and the contractual management fee waiver and expense reimbursement agreements expected to be in effect for an initial three year period. It also considered the amount and nature of fees paid by shareholders to the Investment Adviser. The Board of Trustees also considered the Investment Adviser's contractual commitment to waive its management fees and reimburse other expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) for an initial three year period, which management estimated would result in the fund having a net operating expense ratio of zero for that period.

Economies of Scale. The Board of Trustees, including the Independent Trustees, considered whether the Investment Adviser expected to experience economies of scale in respect of the management of the fund and whether there is potential for realization of any further economies of scale. The Board of Trustees, including the Independent Trustees, has concluded that any realized economies of scale in respect of the management of the fund would be shared between fund shareholders and the Investment Adviser in an appropriate manner.

Other Benefits to the Investment Adviser. The Board of Trustees, including the Independent Trustees, also considered the character and amount of fees that were expected to be paid by the fund and the fund's shareholders for services provided by the Investment Adviser and its affiliates, including fees for services like transfer agency, fund accounting, and direct shareholder services. The Board of Trustees, including the Independent Trustees, considered the intangible benefits that might reasonably be expected to accrue to the Investment Adviser and its affiliates by virtue of their relationship with the fund. The Board of Trustees also considered the Investment Adviser's contractual commitment to waive its management fees and reimburse other expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) for an initial three year period, and that operation of this waiver and reimbursement would reduce economic benefits that might otherwise inure to the Investment Adviser and its affiliates.

Conclusion. Based on its evaluation of all material factors and assisted by the advice of legal counsel, the Board of Trustees, including the Independent Trustees, concluded that the existing advisory fee structures are fair and reasonable, and that the existing Investment Advisory Contracts should be approved.

Semiannual Report

Semiannual Report

Investment Adviser

Strategic Advisers, Inc.

Boston, MA

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Bank of New York

New York, NY

FOI-SANN-1006

1.824712.100

PAS Small Cap Fund of Funds®

Managed exclusively for clients of

Strategic Advisers, Inc. - not available

for sale to the general public

Semiannual Report

August 31, 2006

Strategic Advisers, Inc.

A Fidelity Investments Company

Contents

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over

the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their

market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and

changes in net assets, as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

To view a fund's proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at www.sec.gov. You may call 1-800-544-3455 to request a free copy of the proxy voting guidelines.

Third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

PAS Small Cap Fund of Funds

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (March 1, 2006 to August 31, 2006).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition to the direct expenses incurred by the Fund presented in the table, as a shareholder of the underlying non-affiliated funds (underlying funds), the Fund also indirectly bears its proportionate share of the expenses of the underlying funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Beginning

Account Value

March 1, 2006 | Ending

Account Value

August 31, 2006 | Expenses Paid

During Period*

March 1, 2006

to August 31, 2006 |

Actual | $ 1,000.00 | $ 960.90 | $ .00 |

Hypothetical (5% return per year before expenses) | $ 1,000.00 | $ 1,025.21 | $ .00 |

* Expenses are equal to the Fund's annualized expense ratio of .00%; multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The fees and expenses of the underlying funds in which the fund invests are not included in the fund's annualized expense ratio.

Semiannual Report

PAS Small Cap Fund of Funds

Investment Changes

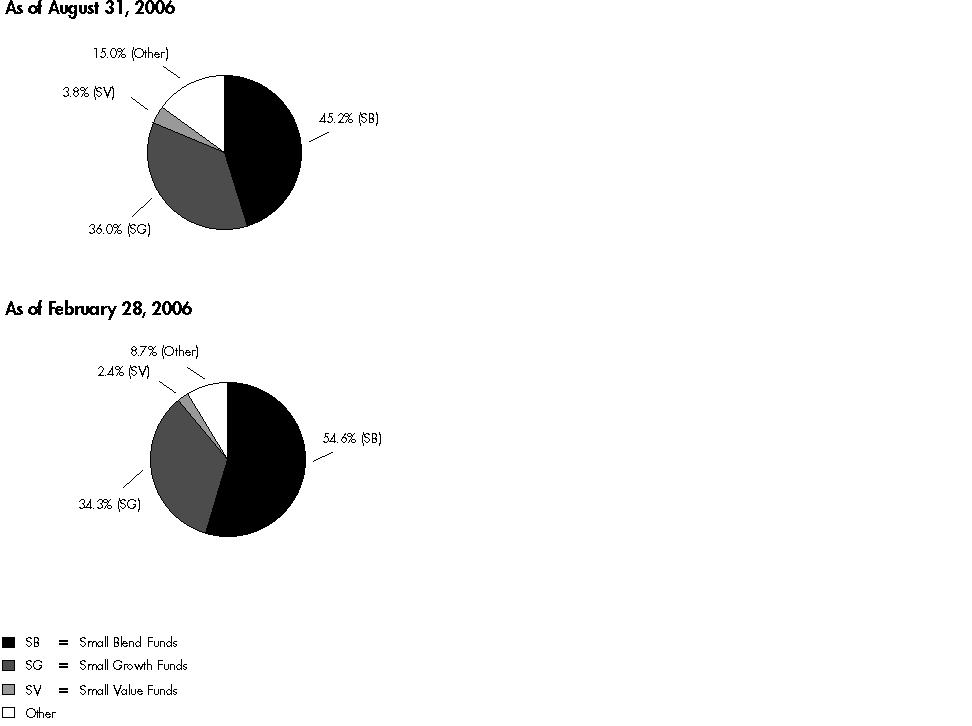

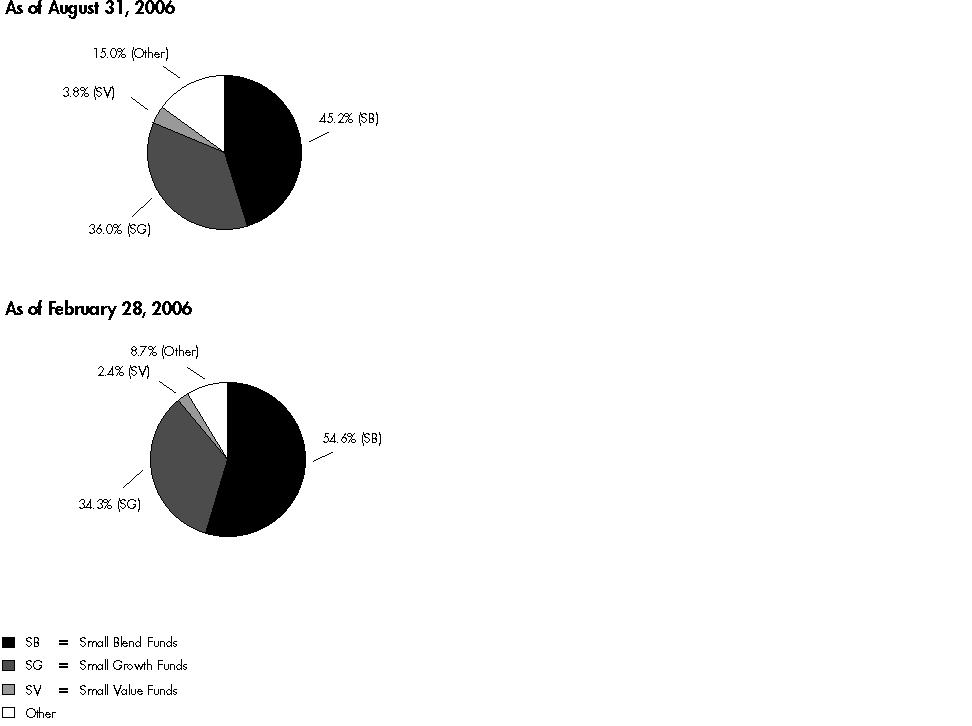

Fund Holdings as of August 31, 2006 |

| % of fund's

investments | % of fund's investments 6 months ago |

Small Blend Funds | | |

Oppenheimer Main Street Small Cap Fund Class A | 13.1 | 12.1 |

RS Partners Fund | 9.5 | 8.3 |

Keeley Small Cap Value Fund, Inc. | 7.3 | 7.3 |

Laudus Rosenberg U.S. Discovery Fund Investor Class | 5.7 | 4.9 |

Perritt MicroCap Opportunities Fund | 4.6 | 3.8 |

Hennessy Cornerstone Growth II Fund | 2.5 | 3.0 |

Neuberger Berman Genesis Fund Trust Class | 1.8 | 6.3 |

AIM Trimark Small Companies Fund Class A | 0.3 | 0.0 |

ICM Small Co. Portfolio Institutional Class | 0.2 | 0.2 |

CRM Small Cap Value Fund Investor Class | 0.2 | 0.2 |

| 45.2 | 46.1 |

Small Growth Funds | | |

BlackRock Funds Small Cap Growth Equity Fund Investor Class A | 7.0 | 7.0 |

Baron Small Cap Fund | 4.6 | 4.5 |

William Blair Small Cap Growth Fund Class N | 3.6 | 3.4 |

Harbor Small Cap Growth Fund Investor Class | 3.4 | 3.0 |

Buffalo Small Cap Fund | 3.3 | 2.1 |

Turner Small Cap Growth Fund Class I | 2.6 | 3.2 |

RS Smaller Co. Growth Fund | 2.4 | 2.9 |

Oberwies Emerging Growth Fund | 2.1 | 2.3 |

Munder Micro-Cap Equity Fund Class A | 2.1 | 2.3 |

Old Mutual Emerging Growth Fund

Class Z | 1.8 | 0.0 |

Franklin Small Cap Growth Fund II

Class A | 1.7 | 3.0 |

Old Mutual Copper Rock Emerging Growth Portfolio Class A | 0.7 | 0.1 |

Champlain Small Company Fund Advisor Class | 0.5 | 0.0 |

RS Emerging Growth Fund | 0.1 | 0.3 |

Managers Special Equity Fund Managers Class | 0.1 | 0.2 |

| 36.0 | 34.3 |

Small Value Funds | | |

HighMark Small Cap Value Fund Class A | 2.7 | 2.2 |

Perritt Emerging Opportunities Fund | 1.0 | 0.0 |

American Beacon Small Cap Value Fund PlanAhead Class | 0.1 | 0.2 |

| 3.8 | 2.4 |

Other | | |

Hennessy Cornerstone Growth Fund | 7.5 | 8.5* |

Westport Select Cap Fund Class R | 6.7 | 7.6 |

The Information Age Fund | 0.8 | 1.1 |

| 15.0 | 17.2 |

Total | 100.0 | 100.0 |

* Reflects current Morningstar classifications |

Asset Allocation (% of fund's investments) |

Asset allocations in the pie chart reflect the categorization of assets as defined by Morningstar as of the reporting dates indicated above. |

Semiannual Report

PAS Small Cap Fund of Funds

Investments August 31, 2006 (Unaudited)

Showing Percentage of Total Value of Investment in Securities

Equity Funds - 100.0% |

| Shares | | Value (Note 1) |

Small Blend Funds - 45.2% |

AIM Trimark Small Companies Fund Class A | 50,190 | | $ 751,849 |

CRM Small Cap Value Fund Investor Class | 21,664 | | 575,604 |

Hennessy Cornerstone Growth II Fund | 216,625 | | 6,396,942 |

ICM Small Co. Portfolio Institutional Class (a) | 14,655 | | 577,549 |

Keeley Small Cap Value Fund, Inc. | 782,847 | | 18,670,912 |

Laudus Rosenberg U.S. Discovery Fund Investor Class | 812,199 | | 14,587,102 |

Neuberger Berman Genesis Fund Trust Class | 93,142 | | 4,646,862 |

Oppenheimer Main Street Small Cap Fund Class A | 1,549,606 | | 33,394,004 |

Perritt MicroCap Opportunities Fund | 383,962 | | 11,872,113 |

RS Partners Fund | 705,562 | | 24,264,276 |

TOTAL SMALL BLEND FUNDS | | 115,737,213 |

Small Growth Funds - 36.0% |

Baron Small Cap Fund | 514,370 | | 11,748,203 |

BlackRock Funds Small Cap Growth Equity Fund Investor Class A (a) | 1,029,411 | | 18,004,403 |

Buffalo Small Cap Fund | 326,305 | | 8,490,458 |

Champlain Small Company Fund Advisor Class | 106,195 | | 1,211,681 |

Franklin Small Cap Growth Fund II Class A | 339,475 | | 4,240,044 |

Harbor Small Cap Growth Fund Investor Class | 680,004 | | 8,738,053 |

Managers Special Equity Fund Managers Class | 2,653 | | 234,966 |

Munder Micro-Cap Equity Fund Class A | 125,055 | | 5,318,605 |

Oberwies Emerging Growth Fund | 212,517 | | 5,359,678 |

Old Mutual Copper Rock Emerging Growth Portfolio Class A (a) | 181,140 | | 1,918,272 |

Old Mutual Emerging Growth Fund Class Z | 336,697 | | 4,649,792 |

RS Emerging Growth Fund (a) | 7,520 | | 243,936 |

RS Smaller Co. Growth Fund | 301,815 | | 6,069,497 |

Turner Small Cap Growth Fund Class I (a) | 255,928 | | 6,697,626 |

William Blair Small Cap Growth Fund Class N | 372,533 | | 9,253,731 |

TOTAL SMALL GROWTH FUNDS | | 92,178,945 |

Small Value Funds - 3.8% |

American Beacon Small Cap Value Fund PlanAhead Class | 12,203 | | 254,928 |

HighMark Small Cap Value Fund Class A | 391,738 | | 7,035,613 |

Perritt Emerging Opportunities Fund | 180,844 | | 2,463,094 |

TOTAL SMALL VALUE FUNDS | | 9,753,635 |

|

| Shares | | Value (Note 1) |

Other - 15.0% |

Hennessy Cornerstone Growth Fund | 985,307 | | $ 19,124,815 |

The Information Age Fund (a) | 131,242 | | 2,034,255 |

Westport Select Cap Fund Class R | 686,805 | | 17,094,571 |

TOTAL OTHER | | 38,253,641 |

TOTAL EQUITY FUNDS (Cost $262,205,052) | 255,923,434 |

TOTAL INVESTMENT IN SECURITIES - 100% (Cost $262,205,052) | $ 255,923,434 |

Legend |

(a) Non-income producing |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

PAS Small Cap Fund of Funds

Financial Statements

Statement of Assets and Liabilities

| August 31, 2006 (Unaudited) |

| | |

Assets | | |

Investment in unaffiliated securities, at value (cost $262,205,052) - See accompanying schedule | | $ 255,923,434 |

Cash | | 7 |

Receivable for fund shares sold | | 389,980 |

Total assets | | 256,313,421 |

| | |

Liabilities | | |

Payable for investments purchased | $ 156,471 | |

Payable for fund shares redeemed | 233,509 | |

Total liabilities | | 389,980 |

| | |

Net Assets | | $ 255,923,441 |

Net Assets consist of: | | |

Paid in capital | | $ 262,336,451 |

Accumulated undistributed net realized gain (loss) on investments | | (131,392) |

Net unrealized appreciation (depreciation) on investments | | (6,281,618) |

Net Assets, for 23,859,642 shares outstanding | | $ 255,923,441 |

Net Asset Value, offering price and redemption price per share ($255,923,441 ÷ 23,859,642 shares) | | $ 10.73 |

Statement of Operations

| Six months ended August 31, 2006 (Unaudited) |

| | |

Investment Income | | |

Dividends from underlying funds | | $ - |

Expenses | | |

Management fee | $ 307,943 | |

Independent trustees' compensation | 26,089 | |

Total expenses before reductions | 334,032 | |

Expense reductions | (334,032) | - |

Net investment income (loss) | | - |

Realized and Unrealized Gain (Loss) Realized gain (loss) on sale of underlying fund shares | | (49,168) |

Change in net unrealized appreciation (depreciation) on underlying funds | | (10,289,333) |

Net gain (loss) | | (10,338,501) |

Net increase (decrease) in net assets resulting from operations | | $ (10,338,501) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

| Six months ended

August 31, 2006

(Unaudited) | For the period

June 23, 2005

(commencement

of operations) to

February 28, 2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ - | $ 17,631 |

Net realized gain (loss) | (49,168) | 4,215,623 |

Change in net unrealized appreciation (depreciation) | (10,289,333) | 4,007,715 |

Net increase (decrease) in net assets resulting from operations | (10,338,501) | 8,240,969 |

Distributions to shareholders from net realized gain | (3,164,535) | (1,150,943) |

Share transactions

Proceeds from sales of shares | 64,745,524 | 240,524,097 |

Reinvestment of distributions | 3,125,514 | 1,112,499 |

Cost of shares redeemed | (29,015,773) | (18,155,410) |

Net increase (decrease) in net assets resulting from share transactions | 38,855,265 | 223,481,186 |

Total increase (decrease) in net assets | 25,352,229 | 230,571,212 |

| | |

Net Assets | | |

Beginning of period | 230,571,212 | - |

End of period (including undistributed net investment income of $0 and $17,631, respectively) | $ 255,923,441 | $ 230,571,212 |

Other Information Shares | | |

Sold | 5,823,202 | 21,966,570 |

Issued in reinvestment of distributions | 268,515 | 104,264 |

Redeemed | (2,615,913) | (1,686,996) |

Net increase (decrease) | 3,475,804 | 20,383,838 |

Financial Highlights

| Six months ended

August, 31, 2006 | Period ended

February 28, |

| (Unaudited) | 2006 F |

Selected Per-Share Data | | |

Net asset value, beginning of period | $ 11.31 | $ 10.00 |

Income from Investment Operations | | |

Net investment income (loss) D | - | - H |

Net realized and unrealized gain (loss) | (.43) | 1.46 |

Total from investment operations | (.43) | 1.46 |

Distributions from net realized gain | (.15) | (.15) |

Net asset value, end of period | $ 10.73 | $ 11.31 |

Total Return B, C | (3.91)% | 14.69% |

Ratios to Average Net Assets G | | |

Expenses before expense reductions | .27% A | .37% A |

Expenses net of contractual waivers | .00% A | .00% A |

Expenses net of all reductions | .00% A | .00% A |

Net investment income (loss) | .00% A | .03% A |

Supplemental Data | | |

Net assets, end of period (000 omitted) | $ 255,923 | $ 230,571 |

Portfolio turnover rate E | 14% A | 10% A |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Amounts do not include the portfolio activity of the Underlying Funds.

F For the period June 23, 2005 (commencement of operations) to February 28, 2006.

G Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts contractually reimbursed by the investment adviser and do not represent the amount paid by the Fund during periods when reimbursements occur. Expenses net of contractual waivers reflect expenses after reimbursement by the investment adviser. Expenses net of all reductions represent the net expenses paid by the Fund. Fees and expenses of the Underlying Funds are not included in the Fund's annualized ratios. The Fund indirectly bears its proportionate share of the expenses of the Underlying Funds.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended August 31, 2006 (Unaudited)

1. Significant Accounting Policies.

PAS Small Cap Fund of Funds (the Fund) is a fund of Fidelity Rutland Square Trust (the trust), an open-end management investment company organized as a Delaware statutory trust. The Fund invests in unaffiliated mutual funds (the Underlying Funds) and operates under Section 10(d) of the Investment Company Act of 1940. The Fund's investments in the Underlying Funds were not subject to front-end sales charges or contingent deferred sales charges. The Fund is offered exclusively to clients of Strategic Advisers, Inc. (Strategic Advisers), an affiliate of Fidelity Management and Research Company (FMR). The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Net asset value per share is calculated as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Investments in the Underlying Funds are valued at their net asset value each business day. If an Underlying Fund's net asset value is unavailable, shares of that fund may be valued by another method that the Board of Trustees believes reflects fair value in accordance with the Board's fair value pricing policies.

Investment Transactions and Income. Security transactions, normally shares of the Underlying Funds, are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend and realized gain distributions from the Underlying Funds, if any, are recorded on the ex-dividend date and are automatically reinvested.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust. Expenses included in the accompanying financial statements reflect the expenses of the Fund and do not include any expenses of the Underlying Funds. Although not included in the Fund's expenses, the Fund indirectly bears its proportionate share of the Underlying Funds' expenses through the impact of these expenses on each Underlying Fund's net asset value. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Distributions are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes. Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to the short-term gain distributions from the Underlying Funds and losses deferred due to wash sales.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

Unrealized appreciation | $ 3,057,226 |

Unrealized depreciation | (9,342,069) |

Net unrealized appreciation (depreciation) | $ (6,284,843) |

Cost for federal income tax purposes | $ 262,208,277 |

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management is currently evaluating the impact, if any, the adoption of FIN 48 will have on the Fund's net assets and results of operations and financial statement disclosures.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

2. Purchases and Sales of Investments.

Purchases and redemptions of the Underlying Fund shares aggregated $53,605,501 and $17,914,773, respectively.

3. Fees and Other Transactions with Affiliates.

Management Fee. Strategic Advisers provides the Fund with investment management related services. For these services, the Fund pays a monthly management fee to Strategic Advisers. The management fee is computed at an annual rate of .25% of the Fund's average net assets. Strategic Advisers, either itself or through an affiliated company, pays all other expenses of the Fund with certain exceptions such as interest expense and independent Trustees' compensation.

Strategic Advisers has contractually agreed to waive its management fee until June 15, 2008.

Semiannual Report

3. Fees and Other Transactions with Affiliates - continued

Other Transactions. Strategic Advisers has entered into an administration agreement with FMR under which FMR provides management and administrative services (other than investment advisory services) necessary for the operation of the Fund. FMR also contracts with other Fidelity companies to perform the services necessary for the operation of the Fund. Under this agreement, Strategic Advisers agrees to pay FMR a monthly administration fee. The Fund does not pay any fees for these services.

4. Expense Reductions.

In addition to waiving its management fee, Strategic Advisers has contractually agreed to reimburse the Fund until June 15, 2008 to the extent that annual operating expenses exceed .00% of average net assets. Some expenses, for example, interest expense, are excluded from this reimbursement. During the period, this waiver and reimbursement reduced the Fund's expenses by $334,032.

Semiannual Report

Semiannual Report

Semiannual Report

Investment Adviser

Strategic Advisers, Inc.

Boston, MA

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agent

Fidelity Service Company, Inc.

Boston, MA

Custodian

Bank of New York

New York, NY

FOF-SANN-1006

1.816939.101

Item 2. Code of Ethics

Not applicable.

Item 3. Audit Committee Financial Expert

Not applicable.

Item 4. Principal Accountant Fees and Services

Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 11. Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Rutland Square Trust's (the "Trust") disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

Item 12. Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. |

(a) | (3) | Not applicable. |

(b) | | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Rutland Square Trust

By: | /s/Kimberley Monasterio |

| Kimberley Monasterio |

| President and Treasurer |

| |

Date: | October 25, 2006 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Kimberley Monasterio |

| Kimberley Monasterio |

| President and Treasurer |

| |

Date: | October 25, 2006 |

By: | /s/Kathleen A. Tucker |

| Kathleen A. Tucker |

| Chief Financial Officer |

| |

Date: | October 25, 2006 |