Non-current debenture loans comprise three bonds each with a nominal value of $750m, maturing in September 2010, March 2013, and August 2016 with fixed coupon rates of 7.875%, 5.25%, and 6.125% respectively. Non-current bank loans include an unsecured 4.57% fixed rate debt obligation with a nominal value of £199.8m repayable in 2008.

A reconciliation of net cash outflow after financing to net debt is set out below:

The increase in provisions due to discounting of £15.4m (decrease of £1.2m) is represented by an increase due to the unwinding of the discount of £24.2m (£10.5m) and a decrease due to the change in the discount rate of £8.8m (£11.7m) .

Back to Contents

Notes to the accounts continued

for the 12 months ended December 31, 2006

The discounted pre-tax provision for the gross cost of asbestos is shown above. The related insurance asset is included within “Receivables” in note 17 and the deferred tax asset relating to asbestos payments is included within “Deferred tax” in note 22.

Claimant numbers and costs during the year

Information regarding the movement in asbestos claimants in the year and the cost of resolution in the year is provided below: | |

|

|

|

|

|

|

|

| | 2006 | | 2005 | | 2004 | |

| |

|

|

|

|

| |

| New claimants | 6,350 | | 10,350 | | 18,700 | |

|

|

|

|

|

| |

| Resolutions | (30,100 | ) | (14,750 | ) | (7,150 | ) |

|

|

|

|

|

| |

| Outstanding claimants | 107,600 | | 131,350 | | 135,750 | |

|

|

|

|

|

| |

| Average gross cost of resolution ($) | 1,811 | | 2,929 | | 8,294 | |

|

|

|

|

|

| |

| Gross cost of resolution ($m) | 54.5 | | 43.2 | | 59.3 | |

|

|

|

|

|

| |

| Less insurance recoveries ($m) | (3.4 | ) | (11.5 | ) | (46.5 | ) |

|

|

|

|

|

| |

| Net cost before tax ($m) | 51.1 | | 31.7 | | 12.8 | |

|

|

|

|

|

| |

New claimants in 2006 were approximately 6,350 (10,350,18,700). At the end of 2006, outstanding claimants totalled approximately 107,600 (131,350, 135,750). Of the 30,100 (14,750, 7,150) claimants whose cases were resolved during 2006, over 90% were dismissed without payment. In the USA, claimants can file without illness or product identification. In the absence to date of federal reform, a number of states have introduced or are looking to introduce an unimpaired docket which will suspend claims until there is proven evidence of illness.

The gross cost of resolving asbestos claims in 2006 was $54.5m ($43.2m, $59.3m) including legal fees of $25.4m ($26.3m, $27.4m) . The net pre-tax cost of asbestos for the year after insurance was $51.1m ($31.7m, $12.8m), equivalent to a sterling cost of £16.9m after tax.

The aggregate amounts paid in settlement and average settlement payments in any given period, together with related defence costs, have fluctuated widely and are expected to continue to fluctuate widely depending on the nature of the claims resolved (including the proportion of which that are mass claims), disease mix, number of other defendants and jurisdiction of claim.

Each of the Company’s relevant US subsidiaries, together with its insurance carriers and outside counsel, review each asbestos claim that is pursued by claimants. In many cases claimants are unable to demonstrate that any injury they have suffered resulted from exposure to the subsidiary’s products, in which case their claim is generally dismissed without payment. In those cases where a compensatable disease, exposure to the subsidiary’s products and causation can be established by claimants, the subsidiary generally settles for amounts that reflect the type of disease, the seriousness of the injury, the age of the claimant, the particular jurisdiction of the claim and the number and solvency of the other defendants.

The Company’s approach to accounting for the asbestos claims against its US subsidiaries is to provide for those costs of resolution which are both probable and reliably estimable. The costs of resolving possible claims are disclosed as contingent liabilities (refer note 26). At present, based on detailed analysis and the assumptions noted below, the provision for those costs which are both probable and reliably estimable equates to approximately eight years of gross cost, assuming an annual level of approximately $60m. Whilst further claims are likely to be resolved beyond this eight year period, the associated costs of resolution are not able to be reliably estimated and hence no provision has been made to cover these possible liabilities.

Assumptions made in establishing the provision relate to the number, disease mix and location of future claimants, trends in dismissal rates, settlement and defence costs, resolution of all existing claimants, time scale of resolution of new claimants, the continued solvency of co-defendants and expected insurance recoveries. In light of the significant uncertainty associated with asbestos claims, there can be no guarantee that the assumptions used to estimate the provision for the cost of resolving asbestos claims will be an accurate prediction of the actual costs that may be incurred and as a result the provision will be subject to potential revision from time to time as additional information becomes available and to reflect any changes in trends.

Gross cost provision

The provision of $496.8m at January 1, 2006 was increased by $60.0m (the estimated gross cost for an additional year) and reduced by the gross cost incurred in 2006 of $54.5m, to give a closing provision at December 31, 2006 of $502.3m. This represents the estimated gross cost of asbestos for the next eight years, and is equivalent to $398.7m on a discounted basis, or £203.7m.

| Movements in the provision for the year were as follows: |

|

| | January 1, | | | | | | | | | | January 1, | | | | | | New | | | | | | December | |

| | 2005 | | Discount | | Provided | | Utilised | | Exchange | | 2006 | | Discount | | Provided | | Insurance | | Utilised | | Exchange | | 31, 2006 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Undiscounted $m | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Gross cost provision | 480.0 | | – | | 60.0 | | (43.2 | ) | – | | 496.8 | | – | | 60.0 | | – | | (54.5 | ) | – | | 502.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Insurance asset | (26.1 | ) | – | | – | | 11.5 | | – | | (14.6 | ) | – | | (20.0 | ) | (58.5 | ) | 3.4 | | – | | (89.7 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cost | 453.9 | | – | | 60.0 | | (31.7 | ) | – | | 482.2 | | – | | 40.0 | | (58.5 | ) | (51.1 | ) | – | | 412.6 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Deferred tax asset | (177.0 | ) | – | | (23.4 | ) | 12.4 | | – | | (188.0 | ) | – | | (15.6 | ) | 22.8 | | 19.9 | | – | | (160.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Post-tax net cost | 276.9 | | – | | 36.6 | | (19.3 | ) | – | | 294.2 | | – | | 24.4 | | (35.7 | ) | (31.2 | ) | – | | 251.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Discounted $m | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Gross cost provision | 401.2 | | 0.9 | | 39.7 | | (43.2 | ) | – | | 398.6 | | 15.8 | | 38.8 | | – | | (54.5 | ) | – | | 398.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Insurance asset | (24.0 | ) | 0.3 | | – | | 11.5 | | – | | (12.2 | ) | (2.9 | ) | (13.0 | ) | (42.3 | ) | 3.4 | | – | | (67.0 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cost | 377.2 | | 1.2 | | 39.7 | | (31.7 | ) | – | | 386.4 | | 12.9 | | 25.8 | | (42.3 | ) | (51.1 | ) | – | | 331.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Deferred tax asset | (147.1 | ) | (0.5 | ) | (15.5 | ) | 12.4 | | – | | (150.7 | ) | (5.0 | ) | (10.1 | ) | 16.5 | | 19.9 | | – | | (129.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Post-tax net cost | 230.1 | | 0.7 | | 24.2 | | (19.3 | ) | – | | 235.7 | | 7.9 | | 15.7 | | (25.8 | ) | (31.2 | ) | – | | 202.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Discounted £m | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Gross cost provision | 209.0 | | 0.5 | | 21.8 | | (23.8 | ) | 24.7 | | 232.2 | | 8.6 | | 21.1 | | – | | (29.6 | ) | (28.6 | ) | 203.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Insurance asset | (12.5 | ) | 0.1 | | – | | 6.4 | | (1.1 | ) | (7.1 | ) | (1.5 | ) | (7.1 | ) | (23.0 | ) | 1.9 | | 2.6 | | (34.2 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net cost | 196.5 | | 0.6 | | 21.8 | | (17.4 | ) | 23.6 | | 225.1 | | 7.1 | | 14.0 | | (23.0 | ) | (27.7 | ) | (26.0 | ) | 169.5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Deferred tax asset | (76.6 | ) | (0.2 | ) | (8.5 | ) | 6.8 | | (9.3 | ) | (87.8 | ) | (2.7 | ) | (5.5 | ) | 9.0 | | 10.8 | | 10.1 | | (66.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Post-tax net cost | 119.9 | | 0.4 | | 13.3 | | (10.6 | ) | 14.3 | | 137.3 | | 4.4 | | 8.5 | | (14.0 | ) | (16.9 | ) | (15.9 | ) | 103.4 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| The rate used to discount the provision and insurance assets was 5.60% (5.30%, 4.25%) . | | | |

| Hanson 2006 www.hanson.biz |

Back to Contents

Insurance asset

The insurance asset of $14.6m at January 1, 2006 was reduced by insurance utilisation during the year of $3.4m, on an undiscounted basis.

Most of the US subsidiaries involved with asbestos claims have had agreements with their respective insurance carriers regarding the defence and settlement of asbestos claims, the terms of which varied for each such subsidiary. These insurance arrangements have resulted in the insurance companies having met substantially all of the amounts such subsidiaries have paid prior to 2006 in settlements and defence costs. In 2006, most of these costs were borne by the relevant subsidiaries. The amounts to be paid by the relevant subsidiaries in future years may vary, depending on litigation and negotiation with the relevant insurers.

On February 13, 2006, Hanson announced that one of its US subsidiaries, responsible for approximately 20% of the group’s present asbestos costs, had reached a settlement with its insurers. The settlement is effective from January 1, 2006 and resolves a number of issues relating to historic insurance policies which provided insurance cover for a range of claims, including those relating to asbestos. Under the settlement, the subsidiary will pay the first $35.0m of its future asbestos costs, which the subsidiary estimates will be paid over approximately four years from January 1, 2006. Thereafter the subsidiary’s asbestos costs will be paid in full by the insurance carriers up to agreed limits. These limits have not been disclosed as they are subject to a confidentiality agreement between the subsidiary and the insurance carriers. These limits, assuming they are not utilised for non-asbestos claims, are expected to provide asbestos insurance cover for this subsidiary well beyond 2020. The receivable recognised as a result of this settlement increased the insurance asset by $58.5m, or £23.0m on a discounted basis. The closing insurance asset at December 31, 2006 is $89.7m, equivalent to £34.2m on a discounted basis as shown in note 17.

Certain other US subsidiaries, not party to the recent settlement, continue to pursue litigation and negotiation to maximise the insurance cover available. Litigation proceedings are progressing in the state of California.

Deferred tax asset

The net cost of asbestos is deductible for US taxation at an estimated rate of 39%. At December 31, 2006, the deferred tax asset relating to the discounted asbestos provision, net of insurance, was £66.1m as shown in note 22.

Income statement

The net impact on the income statement, shown under discontinued items in note 9, was a profit of £1.1m after tax. This consists of a discounted charge after tax of £8.5m, as shown in the ‘Provided’ column of the above table, plus the net impact of the discount unwind and change in discount rate which was a charge of £4.4m after tax as shown in the ‘Discount’ column of the above table, less the new insurance of £14.0m.

Cash flow

The net cash flow impact, shown within net cash inflow from operating activities, was a net cash outflow of £16.9m shown in the ‘Utilised’ column of the above table.

Risk factors

Factors which could cause actual results to differ from these estimates include: (i) adverse trends in the ultimate number of claimants filing asbestos claims against the Company’s US subsidiaries; (ii) increases in the cost of resolving current and future asbestos claims as a result of adverse trends relating to settlement and/or defence costs, dismissal rates, and/or judgment amounts; (iii) increases or decreases in the amount of insurance available to cover asbestos claims; (iv) the emergence of new trends or legal theories that enlarge the number of potential claimants; (v) the impact of bankruptcies of other defendant companies whose share of liability may be imposed on the Company’s US subsidiaries under certain state liability laws; (vi) the unpredictable aspects of the US litigation process; (vii) adverse changes in the mix of asbestos-related diseases with respect to which asbestos claims are made against the Company’s US subsidiaries; and (viii) potential legislative changes.

In light of such factors, the costs of the Company’s US subsidiaries involved in resolving asbestos claims may be materially different from current estimates and consequently might have a material adverse effect on the Company’s consolidated financial condition, results of operations and cash flow. However, assuming that current trends continue, the Company does not expect that such costs will have such a material adverse effect and, even assuming a material deterioration in current trends, on the evidence available to it, the Company does not expect that such claims would impact the ability of the Company to continue as a going concern.

Koppers’ liabilities

Koppers’ environmental obligations and related costs arise primarily from the US chemical and related operations formerly operated by Koppers Company Inc, a company acquired by Beazer PLC, which itself was acquired by the Company in 1991. Members of the Beazer group remain contractually and statutorily liable for certain environmental costs relating to these discontinued operations. During 1998 an agreement was signed under which, for a one-off premium and related transaction costs totalling $275.0m, insurance cover of $800.0m in perpetuity (after payment by members of the Beazer group of the first $100.0m of remediation costs arising since January 1, 1998) was provided by subsidiaries of two reinsurance companies, Centre Solutions and Swiss Re.

At the end of 2006, $467.9m of the $800.0m insurance cover had been utilised. The estimate of future probable cost, discounted at 5.9% (5.3%, 5.1%), is shown as a provision of £104.9m at December 31, 2006. These costs are the responsibility of the insurers and hence a receivable of £104.9m is recorded at December 31, 2006 as shown in note 17.

Based upon existing known circumstances, the Company considers that the remaining $332.1m of insurance cover is expected to meet the related future costs, recognising that the estimate of future probable costs could increase and new sites may arise to which the insurance cover does not apply. Factors which could cause such remediation costs to increase include (i) unknown adverse conditions arising at sites; (ii) third party claims in excess of estimates; (iii) changes to regulatory requirements; (iv) changes in remediation techniques; and (v) any other significant variations to assumptions made in support of these estimates.

Other provisions

Long-term provisions have been discounted at rates of up to 7.1% (6.25%) .

Reclamation obligations have been established to cover those situations where members of the group have either a legal or constructive obligation to carry out remedial works. Reclamation provisions are expected to be utilised over the life of the relevant site. Legal, insurance, environmental and other provisions relate to acquisitions, disposals and rationalisations both arising on acquisitions and provided for in current and prior years. Legal, insurance, environmental and other provisions are expected to be utilised on a reducing basis over the next five years, depending in each case on the nature of the underlying obligation.

Where appropriate, reclamation and environmental provisions have been established after taking into account the opinions of suitably qualified and experienced consultants and after estimating the costs in line with current practice and standards.

Back to Contents

Notes to the accounts continued

for the 12 months ended December 31, 2006

| 22 | Tax payable/receivable and deferred tax |

|

|

| a) | Tax payable/receivable |

|

|

| Current and non-current tax payable/receivable represents expected taxes payable/receivable for tax filings in respect of current and prior years that exceed payments made and received. It also includes provisions for potential adjustments by tax authorities with respect to tax filings. Examination of tax filings by tax authorities may last several years beyond the year of filing. |

At any given time, the group is undergoing tax audits in several tax jurisdictions and covering multiple years. The group has provisions for taxes that may become payable in future periods as a result of these tax audits. The group recognises liabilities for anticipated tax audit issues based on estimates of whether additional taxes will be due. Where the final outcome of these matters is different from the amounts provided, such differences will impact the tax provisions in the period in which such determination is made. Interest on tax liabilities is accrued for in the tax charge and is included in the provisions. The tax provisions are analysed at each balance sheet date and adjustments are made as events occur to warrant adjustments to the provisions. The provisions at December 31, 2006 were £99.3m (£112.8m, £126.9m) . The decrease is due to revisions to the best reasonable estimate of the tax exposures, cash paid on certain audits and foreign exchange movements on non UK provisions.

| Analysis of movements in the net deferred tax balance during the year: |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| At January 1 | (256.1 | ) | (238.1 | ) |

|

|

|

| |

| Charge to income statement | (12.9 | ) | (3.8 | ) |

|

|

|

| |

| Acquisitions | (72.7 | ) | (20.8 | ) |

|

|

|

| |

| (Charge)/credit to reserves | (3.9 | ) | 11.8 | |

|

|

|

| |

| Other movements | – | | 1.7 | |

|

|

|

| |

| Exchange movements | 13.1 | | (6.9 | ) |

|

|

|

| |

| At December 31 | (332.5 | ) | (256.1 | ) |

|

|

|

| |

| | | | | |

| The deferred tax assets/(liabilities) included in the balance sheet are as follows: |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| Property, plant and equipment | (549.1 | ) | (531.7 | ) |

|

|

|

| |

| Other assets | (11.5 | ) | 0.2 | |

|

|

|

| |

| Other liabilities | 116.8 | | 108.2 | |

|

|

|

| |

| Asbestos | 66.1 | | 87.8 | |

|

|

|

| |

| Pensions | 37.1 | | 64.2 | |

|

|

|

| |

| Losses | 8.1 | | 15.2 | |

|

|

|

| |

| | (332.5 | ) | (256.1 | ) |

|

|

|

| |

| | | | | |

| Represented in the balance sheet, after offset of balances within countries (as described in note 1), as follows: |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| Deferred tax assets | 0.8 | | 0.7 | |

|

|

|

| |

| Deferred tax liabilities | (333.3 | ) | (256.8 | ) |

|

|

|

| |

| Net deferred tax liabilities | (332.5 | ) | (256.1 | ) |

|

|

|

| |

| | | | | |

| The deferred tax (charged)/credited to the consolidated income statement is analysed by type of temporary difference as follows: |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| Property, plant and equipment | 24.6 | | 12.4 | |

|

|

|

| |

| Other assets | (5.0 | ) | (5.8 | ) |

|

|

|

| |

| Other liabilities | (0.1 | ) | (5.2 | ) |

|

|

|

| |

| Asbestos | (11.6 | ) | 1.9 | |

|

|

|

| |

| Pensions | (12.2 | ) | (5.0 | ) |

|

|

|

| |

| Losses | (8.6 | ) | (2.1 | ) |

|

|

|

| |

| | (12.9 | ) | (3.8 | ) |

|

|

|

| |

| | | | | |

| The deferred tax (charged)/credited to the consolidated income statement is analysed as follows: | | | | |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| From continuing operations | (5.6 | ) | (4.2 | ) |

|

|

|

| |

| From impairments | 2.1 | | (5.6 | ) |

|

|

|

| |

| From discontinued operations | (9.4 | ) | 6.0 | |

|

|

|

| |

| Total charge to consolidated income statement | (12.9 | ) | (3.8 | ) |

|

|

|

| |

Hanson 2006www.hanson.biz

Back to Contents

| | | | |

| | | |

| | | |

| | 101 | |

|

|

|

|

| | | | |

| Notes to the accounts |

| 22 | Tax payable/receivable and deferred taxcontinued |

|

|

| Deferred tax |

| i) | Losses |

|

| The group only recognises a deferred tax asset on losses where it expects to realise the benefit from those losses in the foreseeable future. The group has a significant amount of capital and non-trading losses. These can only be offset against certain types of income in particular legal entities, and no such income is currently envisaged. |

| | | | | |

|

|

|

|

|

| | 2006 | | 2005 | |

| |

|

|

| |

| | £m | | £m | |

|

|

|

| |

| Gross losses | 999.8 | | 656.7 | |

|

|

|

| |

| Deferred tax at applicable tax rates | 300.0 | | 202.0 | |

|

|

|

| |

| Less deferred tax recognised | (8.1 | ) | (15.2 | ) |

|

|

|

| |

| Unrecognised deferred tax | 291.9 | | 186.8 | |

|

|

|

| |

The increase in losses relates to losses generated from restructurings in the current year, as well as agreement of prior year losses with tax authorities.

The losses have no expiry date.

| ii) | Other temporary differences |

| At December 31, 2006 the group has other deductible temporary differences of £16.8m (£20.8m) for which deferred tax assets of £5.1m (£6.4m) have not been recognised because it is not probable that future taxable income will be available against which the group can utilise the benefits. The deductible temporary differences do not expire under current tax legislation. |

| |

| iii) | Unrecognised tax base |

| The group has deductible temporary differences for which no tax benefit has been recognised related to certain additional tax attributes of property, plant and equipment located in the UK and Australia. The amount of these deductible temporary differences at December 31, 2006 was £275.3m (£288.9m) . These additional tax attributes have not been recognised because it is not probable that suitable profits will be available. There is no expiry date for these differences. |

| | |

| iv) | Overseas subsidiaries |

| At December 31, 2006, the group has not provided deferred tax in relation to temporary differences on its overseas subsidiaries, joint-ventures or associates. Quantifying the temporary differences is not practical, however, based on current enacted law, and on the basis that the group can control the timing and realisation of these temporary differences, no material tax consequences are expected to arise. |

| | |

| 23 | Share capital |

|

|

| The share capital of the Company is shown below: |

|

|

|

|

|

|

|

| | 2006 | 2005 | 2004 | 2006 | 2005 | 2004 |

| |

|

|

|

|

|

|

| | Number | Number | Number | £m | £m | £m |

|

|

|

|

|

|

|

| Authorised | | | | | | |

| Ordinary shares of £0.10 (£0.10, £0.10) | 1,000,000,000 | 1,000,000,000 | 1,000,000,000 | 100 | 100 | 100 |

|

|

|

|

|

|

|

| Allotted, called-up and fully paid | | | | | | |

| Ordinary shares of £0.10 (£0.10, £0.10) | 736,968,849 | 736,968,849 | 736,968,849 | 73.7 | 73.7 | 73.7 |

|

|

|

|

|

|

|

| Treasury shares | | | | | | |

| Ordinary shares of £0.10 (£0.10, £0.10) | 24,645,000 | 14,685,000 | 6,350,000 | 2.5 | 1.5 | 0.6 |

|

|

|

|

|

|

|

During the period January 1, 2006 to December 31, 2006 no ordinary share capital was allotted.

At December 31, 2006, 5,482,171 (6,780,839) ordinary shares were reserved to satisfy rights in respect of various employee share option schemes. The nominal value of reserved shares totalled £0.5m (£0.7m) at the balance sheet date, as set out below:

| i) | options were outstanding over 1,415,477 ordinary shares under the Share Option Plan. Of these 39,955 were exercisable at dates up to 2011 at a subscription price of 473.3p per share, 17,761 were exercisable at dates up to 2012 at a subscription price of 461.75p per share and 167,607 were exercisable at dates up to 2013 at a subscription price of 290.4p per share. Subject to performance criteria being met, the remaining options will be capable of being exercised at dates up to 2015. Of these, 621,478 had a subscription price of 439.6p per share and 568,676 had a subscription price of 514.3p per share. |

| |

| | At December 31, 2005 options were outstanding over 2,927,109 ordinary shares under the Share Option Plan. Of these, 164,775 were exercisable at dates up to 2011 at a subscription price of 473.3p per share and 180,718 were exercisable at dates up to 2012 at a subscription price of 461.75p per share. Subject to performance criteria being met, the remaining options will be capable of being exercised at dates up to 2015. Of these, 647,618 had a subscription price of 514.3p per share, 710,196 had a subscription price of 439.6p per share and 1,223,802 had a subscription price of 290.4p per share, and |

| |

| ii) | options were outstanding over 4,066,694 (3,853,729) ordinary shares under the Sharesave Scheme and were capable of being exercised at dates up to 2014, with subscription prices ranging from 318.0p to 611.0p per share with an average of 401.68p (354.75p) per share. |

Back to Contents

Notes to the accounts continued

for the 12 months ended December 31, 2006

| 24 | Reconciliation of changes in total equity |

|

| | | | | | | | | | | | Equity | | | | | |

| | | | | | | | | | | | attributable | | | | | |

| | | | | Cash flow | | Cumulative | | | | | to equity | | | | | |

| | Share capital | Own | | hedge | | translation | | Retained | | Other | holders of | | Minority | | | |

| | (note 23) | shares | | reserve | | reserve | | earnings | | reserves | the Company | | interest | | Total equity | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | £m | £m | | £m | | £m | | £m | | £m | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At January 1, 2004 | 73.7 | (8.9 | ) | – | | – | | 1,289.5 | | 972.4 | 2,326.7 | | 2.7 | | 2,329.4 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Recognised income and expense | – | – | | – | | (12.1 | ) | 243.9 | | – | 231.8 | | (0.3 | ) | 231.5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid | – | – | | – | | – | | (127.3 | ) | – | (127.3 | ) | – | | (127.3 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Employee share awards | – | – | | – | | – | | (1.1 | ) | – | (1.1 | ) | – | | (1.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Purchase of own shares held in treasury | – | (26.1 | ) | – | | – | | – | | – | (26.1 | ) | – | | (26.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Disposal of own shares by ESOP Trust | – | 4.9 | | – | | – | | – | | – | 4.9 | | – | | 4.9 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Changes in minority interest | – | – | | – | | – | | – | | – | – | | (0.3 | ) | (0.3 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At December 31, 2004 | 73.7 | (30.1 | ) | – | | (12.1 | ) | 1,405.0 | | 972.4 | 2,408.9 | | 2.1 | | 2,411.0 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Restatement for effects of adopting IAS 39 | – | – | | (9.4 | ) | – | | (2.2 | ) | – | (11.6 | ) | – | | (11.6 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At January 1, 2005 | 73.7 | (30.1 | ) | (9.4 | ) | (12.1 | ) | 1,402.8 | | 972.4 | 2,397.3 | | 2.1 | | 2,399.4 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Recognised income and expense | – | – | | 6.4 | | 56.8 | | 388.5 | | – | 451.7 | | 0.6 | | 452.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid | – | – | | – | | – | | (136.2 | ) | – | (136.2 | ) | – | | (136.2 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Purchase of own shares held in treasury | – | (46.7 | ) | – | | – | | – | | – | (46.7 | ) | – | | (46.7 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Purchase of own shares by ESOP Trust | – | (6.0 | ) | – | | – | | – | | – | (6.0 | ) | – | | (6.0 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Disposal of own shares by ESOP Trust | – | 9.5 | | – | | – | | – | | – | 9.5 | | – | | 9.5 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Employee share awards | – | – | | – | | – | | 0.4 | | – | 0.4 | | – | | 0.4 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Changes in minority interest | – | – | | – | | – | | – | | – | – | | (0.4 | ) | (0.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At December 31, 2005 | 73.7 | (73.3 | ) | (3.0 | ) | 44.7 | | 1,655.5 | | 972.4 | 2,670.0 | | 2.3 | | 2,672.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Recognised income and expense | – | – | | 2.5 | | (107.9 | ) | 381.2 | | – | 275.8 | | 0.9 | | 276.7 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends paid | – | – | | – | | – | | (147.5 | ) | – | (147.5 | ) | – | | (147.5 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Purchase of own shares held in treasury | – | (64.1 | ) | – | | – | | – | | – | (64.1 | ) | – | | (64.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Purchase of own shares by ESOP Trust | – | (14.2 | ) | – | | – | | – | | – | (14.2 | ) | – | | (14.2 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Disposal of own shares by ESOP Trust | – | 13.2 | | – | | – | | – | | – | 13.2 | | – | | 13.2 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Employee share awards | – | – | | – | | – | | (9.9 | ) | – | (9.9 | ) | – | | (9.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Changes in minority interest | – | – | | – | | – | | – | | – | – | | 2.3 | | 2.3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At December 31, 2006 | 73.7 | (138.4 | ) | (0.5 | ) | (63.2 | ) | 1,879.3 | | 972.4 | 2,723.3 | | 5.5 | | 2,728.8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Own shares

On May 31, 1995 the group established an Employee Share Trust (the “Trust”) approved by shareholders on May 15, 1995. The Trust as at December 31, 2006 held 0.2m (0.1m, 1.0m) shares in the Company at a book value of £1.5m (£0.5m, £4.0m) . The Trust waived its rights to dividends payable during the year and to future dividends on its holding of shares. The cost of the Hanson Sharesave Scheme, where awards are granted at a discount to the market price of the Company’s shares, Share Option Plan and the Long Term Incentive Plan is charged to the income statement. During the year, the group contributed £14.2m (£6.0m, £nil) to the Trust.

At December 31, 2006, 24,645,000 shares were held in treasury, none of which has the right to receive dividends. No shares were purchased by the Company to be held in treasury during the period January 1 to February 19, 2007. Pursuant to approval given by shareholders at the AGM held on April 26, 2006, as at December 31, 2006 the Company retains the authority to purchase a further 48,955,000 of its own shares up to the end of the AGM to be held on April 24, 2007. Details of shares purchased during the year are shown below:

|

|

|

|

|

| | | Nominal value of | Average price paid per share, | Total cost of purchasing |

| | Number of shares purchased | shares purchased | inclusive of transaction costs | shares held in treasury |

| |

|

|

|

|

| Period | | £m | (pence) | £m |

|

|

|

|

|

| January 2006 | 3,315,000 | 0.3 | 632.3 | 21.0 |

|

|

|

|

|

| February 2006 | 450,000 | 0.1 | 676.7 | 3.0 |

|

|

|

|

|

| May 2006 | 400,000 | 0.1 | 664.1 | 2.7 |

|

|

|

|

|

| June 2006 | 2,100,000 | 0.2 | 635.9 | 13.4 |

|

|

|

|

|

| July 2006 | 2,150,000 | 0.2 | 646.7 | 13.9 |

|

|

|

|

|

| August 2006 | 1,295,000 | 0.1 | 659.7 | 8.5 |

|

|

|

|

|

| September 2006 | 250,000 | – | 649.0 | 1.6 |

|

|

|

|

|

| Total | 9,960,000 | 1.0 | 643.4 | 64.1 |

|

|

|

|

|

The following own shares are held by the “Trust” and the Company:

|

|

|

|

|

|

|

| | Employee Share Trust | | Treasury Shares | | Total | |

| |

|

|

|

|

| |

| | Number of shares | | Number of shares | | Number of shares | |

|

|

|

|

|

| |

| At January 1, 2005 | 983,392 | | 6,350,000 | | 7,333,392 | |

|

|

|

|

|

| |

| Purchased | 1,000,000 | | 8,335,000 | | 9,335,000 | |

|

|

|

|

|

| |

| Distributed | (1,894,945 | ) | – | | (1,894,945 | ) |

|

|

|

|

|

| |

| At December 31, 2005 | 88,447 | | 14,685,000 | | 14,773,447 | |

|

|

|

|

|

| |

| Purchased | 2,000,000 | | 9,960,000 | | 11,960,000 | |

|

|

|

|

|

| |

| Distributed | (1,869,475 | ) | – | | (1,869,475 | ) |

|

|

|

|

|

| |

| At December 31, 2006 | 218,972 | | 24,645,000 | | 24,863,972 | |

|

|

|

|

|

| |

Cash flow hedge reserve

Movements in the cash flow hedge reserve represent:

| – | changes in the fair value of cash flow hedges; |

| – | the recycling of the above changes through the income statement (totalling £(0.2)m since January 1, 2006), offsetting therein the impact of the underlyinghedged item; and |

| – | related deferred tax. |

The change in the fair value of derivatives in the cash flow hedge reserve in the period relates mainly to interest rate swaps with a maximum maturity date of 2013 hedging floating rate debt and commodity swaps with a maximum maturity date of 2007 hedging fluctuations in energy prices. Underlying cash flows are therefore expected to occur until these dates.

Hanson 2006www.hanson.biz

Back to Contents

| | | | |

| | | |

| | | |

| | 103 | |

|

|

|

|

| | | | |

| Notes to the accounts |

| 24 | Reconciliation of changes in total equitycontinued |

|

|

Cumulative translation reserve

Included within the foreign exchange adjustments of £(107.9)m (£56.8m, £(12.1)m) is foreign exchange of £nil (£0.1m, £(0.3m)) recycled through the income statement on disposal of overseas operations. The reserve was set to £nil on transition to IFRS on January 1, 2004.

Retained earnings

Included within the retained earnings balance of £1,879.3m (£1,655.5m, £1,402.8m) is £45.3m (£37.6m, £(2.5)m) in respect of joint-ventures and associates of which profit after tax for the current year is £33.7m (£43.2m, £2.0m) and dividends are £27.3m (£32.9m, £19.9m) . The undistributed earnings of joint-ventures and associates are £45.3m (£38.9m, £18.0m) .

Other reserves

Other reserves represent merger reserves on acquisition of Pioneer International Limited of £216.3m, and £756.1m created on the reduction of share capital through the Scheme of Arrangement under Section 425 of the Companies Act.

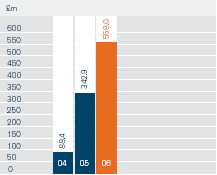

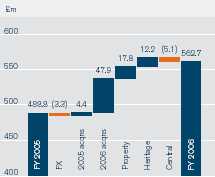

Total cash consideration on acquisitions including acquisition costs for 2006 was £558.0m (£342.9m) .

During 2006, Building Products UK acquired the share capital of Red Bank Manufacturing, a producer of terracotta and clay products, on January 10 and Building Products North America acquired the share capital of PaverModule Inc., a concrete paving manufacturer, on January 20 for a total consideration for these acquisitions of £60.6m. On March 2, Aggregates UK purchased the share capital of Civil and Marine (Holdings) Ltd, a leading producer of ground granulated blast furnace slag in the UK, with additional operations in the US and in the Czech Republic, for £248.1m. Aggregates North America completed its acquisition of the share capital of Material Service Corporation, a leading aggregate materials producer in the USA, on June 16 for £166.3m. The group completed a further five acquisitions of entities based in the UK, USA and Spain, along with seven assets acquisitions, primarily concrete plants and quarries, for a total consideration of £83.0m. All acquisitions of share capital included the transfer of the entire voting rights to the group.

On January 4, 2005, Building Products UK acquired the share capital of UK brick manufacturer, Marshalls Clay Products, for £64.7m and of Thermalite, a market leader in aircrete blocks, on March 7 for £124.2m. On June 17, Aggregates North America acquired the share capital of Mission Valley Rock, Berkeley Ready Mix and Berkeley Asphalt, and Building Products North America acquired the assets of Sherman Pipe, a concrete pipe and precast concrete products business, for a total consideration of £108.0m. Other acquisitions made in the year consisted of three quarries in Southern Indiana by Aggregates North America in December, and a further six acquisitions totalling £46.0m.

|

|

|

|

|

|

|

|

|

|

|

|

|

| | 2006 | | 2006 | | 2006 | | 2005 | | 2005 | | 2005 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | Total carrying | | Fair value | | Total | | Total carrying | | Fair value | | Total | |

| | value | | adjustments | | fair value | | value | | adjustments | | fair value | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Intangible assets (other than goodwill) | – | | 13.1 | | 13.1 | | – | | 25.6 | | 25.6 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Property, plant and equipment | 175.0 | | 138.4 | | 313.4 | | 107.6 | | 26.2 | | 133.8 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Inventories | 35.8 | | (1.8 | ) | 34.0 | | 22.8 | | (0.4 | ) | 22.4 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Receivables | 50.6 | | 0.3 | | 50.9 | | 20.8 | | 6.2 | | 27.0 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Cash and cash equivalents | 9.4 | | – | | 9.4 | | 0.1 | | – | | 0.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Payables | (46.3 | ) | (1.3 | ) | (47.6 | ) | (12.7 | ) | (9.2 | ) | (21.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Borrowings | (8.3 | ) | – | | (8.3 | ) | (1.9 | ) | – | | (1.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Provisions | (7.6 | ) | (2.3 | ) | (9.9 | ) | (1.6 | ) | (0.8 | ) | (2.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Pensions | (4.5 | ) | – | | (4.5 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current tax liabilities | (2.2 | ) | – | | (2.2 | ) | (0.1 | ) | – | | (0.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Non-current tax liabilities | – | | – | | – | | (7.7 | ) | – | | (7.7 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Deferred tax liabilities | (18.9 | ) | (53.8 | ) | (72.7 | ) | (6.9 | ) | (13.9 | ) | (20.8 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Minority interest | (2.9 | ) | – | | (2.9 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 180.1 | | 92.6 | | 272.7 | | 120.4 | | 33.7 | | 154.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Goodwill on acquisition | | | | | 286.7 | | | | | | 190.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | 559.4 | | | | | | 344.2 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Consideration: | | | | | | | | | | | | |

| Cash paid | | | | | 551.7 | | | | | | 340.5 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Other consideration | | | | | 1.4 | | | | | | 1.3 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Acquisition costs (primarily legal and accounting fees) | | | | | 6.3 | | | | | | 2.4 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Total consideration | | | | | 559.4 | | | | | | 344.2 | |

|

|

|

|

|

|

|

|

|

|

|

| |

Included in the goodwill arising on acquisitions are items that cannot be individually separated and reliably measured due to their nature. This includes market share, as well as new market and product entry, and synergy benefits. Of the total goodwill on current year acquisitions of £286.7m (£190.1m), £12.5m (£36.9m) is deductible for tax purposes.

For the period since acquisition, turnover of £215.0m and operating profit before impairments of £47.9m in respect of the current year acquisitions is included within the income statement as continuing operations. If the acquisitions had taken place at the beginning of the financial year, the continuing operating profit before impairments of the group would have been £557.3m (£527.6m) and turnover from continuing operations would have been £4,215.1m (£4,048.9m) .

The preliminary allocation of the purchase consideration to net assets and liabilities will be reviewed based on additional information up to a year from the date of acquisition. The Directors do not anticipate that any net adjustments resulting from such reviews will have a material effect on the financial position or results of Hanson’s operations. In respect of acquisitions in 2005, there were no material subsequent amendments to the preliminary allocations made.

Back to Contents

Notes to the accounts continued

for the 12 months ended December 31, 2006

| 26 | Contingent liabilities |

|

| Litigation relating to certain discontinued operations |

| Certain of the Company’s US subsidiaries, either directly or as a result of indemnity obligations, are the subject of claims or lawsuits both on an individual and class action basis for bodily injury or property damage, relating to products incorporating asbestos, coal by-products and chemicals, in particular for the wood treating industry. |

Asbestos

The Company’s approach to accounting for the asbestos claims against its US subsidiaries is to provide for those costs of resolution which are both probable and reliably estimable (refer note 21). The costs of resolving possible claims are disclosed as contingent liabilities. At present, based on detailed analysis and the assumptions noted below, the provision for those costs which are both probable and reliably estimable equates to approximately eight years of gross cost, assuming an annual level of approximately $60m. Whilst further claims are likely to be resolved beyond this eight year period, the associated costs of resolution are not able to be reliably estimated and hence no provision has been made to cover these possible liabilities.

Assumptions made in establishing the provision relate to the number, disease mix and location of future claimants, trends in dismissal rates, settlement and defence costs, resolution of all existing claimants, time scale of resolution of new claimants, the continued solvency of co-defendants and expected insurance recoveries. In light of the significant uncertainty associated with asbestos claims, there can be no guarantee that the assumptions used to estimate the provision for the cost of resolving asbestos claims will be an accurate prediction of the actual costs that may be incurred and as a result the provision will be subject to potential revision from time to time as additional information becomes available and to reflect any changes in trends. Factors which could cause actual results to differ from these estimates include: (i) adverse trends in the ultimate number of claimants filing asbestos claims against the Company’s US subsidiaries; (ii) increases in the cost of resolving current and future asbestos claims as a result of adverse trends relating to settlement and/or defence costs, dismissal rates, and/or judgement amounts; (iii) increases or decreases in the amount of insurance available to cover asbestos claims; (iv) the emergence of new trends or legal theories that enlarge the number of potential claimants; (v) the impact of bankruptcies of other defendant companies whose share of liability may be imposed on the Company’s US subsidiaries under certain state liability laws; (vi) the unpredictable aspects of the US litigation process; (vii) adverse changes in the mix of asbestos-related diseases with respect to which asbestos claims are made against the Company’s US subsidiaries; and (viii) potential legislative changes.

In light of such factors, the costs of the Company’s US subsidiaries involved in resolving asbestos claims may be materially different from current estimates and consequently might have a material adverse effect on the Company’s consolidated financial condition, results of operations and cash flow. However, assuming that current trends continue, the Company does not expect that such costs will have such a material adverse effect and, even assuming a material deterioration in current trends, on the evidence available to it, the Company does not expect that such claims would impact the ability of the Company to continue as a going concern.

Details of asbestos claims against the Company’s US subsidiaries and the Company’s approach to provisioning (and the associated contingent liabilities) are detailed in note 21. At December 31, 2006, approximately 107,600 claimants were outstanding. The amounts of compensation formally claimed in the cases initially filed by these claimants vary but typically follow standard formulations that are used in various jurisdictions by various plaintiffs’ law firms. Of the claimants outstanding as of December 31, 2006, Hanson estimates that approximately 36% do not specify a dollar claim for damages, approximately 57% claim an amount “greater than $10,000” and approximately 7% specify various amounts, typically “greater than” specified amounts between $50,000 and $1m. Hanson is not aware of any claim specifying an amount greater than $40m. Hanson does not believe that the specific dollar amount mentioned in any claim is an accurate gauge of what relief, if any, the claimant may eventually recover from one of Hanson’s US subsidiaries, and most claimants fail to allocate their alleged claims of liability amongst the various named defendants.

Coal by-products and chemicals

These claims and lawsuits relate primarily to former US chemical products and operations, in particular those relating to the wood treating and coal tar derivative industries; products and operations which are unrelated to the group’s present business and activities. In such cases where one of the Company’s subsidiaries is involved, there are often several potential defendants named in the claim or lawsuit. Since the final demerger in 1997 no settlements have been paid by, or judgments rendered against, any of the Company’s subsidiaries which have had or could have a material adverse effect on the Company’s consolidated financial condition, results of operations or cash flow in connection with any such claims or lawsuits. In a number of instances, the claim or lawsuit against the subsidiary has not been pursued and has been dismissed. With respect to those claims or lawsuits that have been or are being pursued, the subsidiary concerned generally believes itself to have had or to have meritorious defences and such claims and lawsuits have been and are being vigorously defended.

The costs of defence and the amounts that are claimed by the plaintiffs, particularly in those lawsuits which involve numerous claimants, can be significant with claims amounting to tens of millions of dollars. The unpredictable aspects of the US litigation process and the potential for juries to award punitive damages mean that there is a possibility that the Company’s subsidiary may suffer at some stage a significant adverse verdict. Insurance issues do arise on these claims and lawsuits, both in terms of settlement and defence coverage, the outcome of which can be uncertain. In certain instances no insurance coverage may be available to the relevant subsidiary. The insurance cover referred to in note 21 relating to the Koppers’ environmental obligations does not apply to the bodily injury claims and lawsuits described in this note, although it will address certain of the property damage claims. The cost relating to these claims is shown in note 21.

Other litigation

Several of the Company’s US subsidiaries are subject to litigation in California courts arising out of sand dredging operations on submerged lands leased from the state of California. The litigation involves allegations that these subsidiaries underpaid royalties due under the leases and that sand was dredged from state owned lands without authorisation. The litigation includes claims by the state of California under California statutes providing for the recovery of treble damages and certain fines, penalties and attorney fees where the wrongful conduct involves false statements or conversion of state owned property. A press release by the California Attorney General states that he is seeking damages of $200m, although the complaint actually filed in court does not specify the amount of damages sought. The court’s decision on a declaratory motion regarding the interpretation of the royalty provisions of the relevant leases has not served to clarify the situation. The parties are now engaged in litigation on all matters arising out of the case. In light of the uncertainties involved in any litigation, no assurances or predictions can be made on the outcome of this litigation.

Various subsidiaries of the Company are also the subject of a number of other pending legal proceedings. The Company does not anticipate that the outcome of these proceedings, either individually or in aggregate, will have a material adverse effect upon the Company’s consolidated financial condition, results of operations or cash flow. However, in light of the uncertainties involved in any litigation and in particular in the USA, where there is the added potential for punitive damage awards, there can be no guarantee that a settlement might have to be made by, or an unfavourable judgement may be rendered against, the Company or one of its subsidiaries, which could have a material adverse effect on the Company’s consolidated financial condition, results of operations or cash flow in connection with the above mentioned non-asbestos claims and lawsuits.

Hanson 2006www.hanson.biz

Back to Contents

| | | | |

| | | |

| | | |

| | 105 | |

|

|

|

|

| | | | |

| Notes to the accounts |

| 26 | Contingent liabilities continued |

|

|

Demergers

In connection with the demergers, each of the four companies into which the Company demerged its respective businesses agreed to indemnify the Company against, among other things, the past, present and future obligations and liabilities of the businesses transferred to it on its respective demerger while the Company agreed to indemnify each of these companies against, among other things, the past, present and future obligations and liabilities of all other businesses owned or previously owned by the Company (including the businesses transferred to the other demerged companies). Neither the Company nor any of its existing subsidiaries has incurred any liability in respect of a claim that related to the above-mentioned businesses demerged by the Company, any such liability being borne by the relevant demerged company without liability to the Company or any of its existing subsidiaries. The Energy Group PLC, one of the demerged companies, was acquired by TXU Corp. in 1998. In November 2002, TXU Corp. announced that several of TXU Corp’s UK subsidiaries had been placed under the administration process in the UK, including The Energy Group PLC. The Energy Group PLC itself is therefore unlikely to be able to fulfil its indemnification obligations to the Company and its existing subsidiaries if and when required. The Company is, however, not aware of any claims against it or its subsidiaries that would give rise to an indemnity obligation owed to the Company or its subsidiaries, on the part of The Energy Group PLC. |

Bonds and guarantees

As at December 31, 2006 the group had contingent liabilities of:

| – | £127.1m (£111.7m, £97.8m) in respect of bank guarantees and performance bonds given to third parties primarily relating to environmental and restoration obligations and the deductible element of insurance programmes, of which £0.2m (£0.2m, £0.2m) relates to former trading activities of the group; and |

| – | £121.1m (£99.7m, £81.6m) in respect of surety bonds issued by US insurance companies in respect of reclamation liabilities of £50.2m (£51.6m, £42.1m), performance bonds of £49.9m (£38.0m, £31.2m) and other surety obligations of £21.0m (£10.1m, £8.3m). |

Whilst the group holds provisions (see note 21) for certain liabilities to which the bonds and guarantees relate, the liabilities under the bonds and guarantees are not directly recorded on the consolidated balance sheet.

Group as lessee:

The future minimum rental commitments as at December 31, for finance leases and non-cancellable operating leases, together with the present value of minimum lease payments under finance leases, are as follows:

|

|

|

|

|

|

|

| |

| Operating leases | | Finance leases | |

| |

|

|

|

|

|

|

| |

| | 2006 | | 2005 | | 2006 | | 2005 | |

| |

|

|

|

|

|

|

| |

| | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |

| Within one year | 24.6 | | 31.1 | | 1.1 | | 0.4 | |

|

|

|

|

|

|

|

| |

| After one year but not more than two years | 21.1 | | 25.9 | | 0.8 | | 0.2 | |

|

|

|

|

|

|

|

| |

| After two years but not more than three years | 16.9 | | 21.7 | | 0.8 | | – | |

|

|

|

|

|

|

|

| |

| After three years but not more than four years | 13.6 | | 16.8 | | 0.6 | | – | |

|

|

|

|

|

|

|

| |

| After four years but not more than five years | 12.0 | | 14.8 | | 0.3 | | – | |

|

|

|

|

|

|

|

| |

| After more than five years | 123.3 | | 128.5 | | 0.4 | | – | |

|

|

|

|

|

|

|

| |

| Total minimum lease payments | 211.5 | | 238.8 | | 4.0 | | 0.6 | |

|

|

|

|

|

|

|

| |

| Less amount representing finance charges | | | | | (0.6 | ) | (0.1 | ) |

|

|

|

|

|

|

|

| |

| Present value of minimum lease payments | | | | | 3.4 | | 0.5 | |

|

|

|

|

|

|

|

| |

| Future minimum sublease receivable | (9.1 | ) | (8.6 | ) | – | | – | |

|

|

|

|

|

|

|

| |

| | | | | | | | | |

| 28 | Pensions and other post-employment medical plans |

|

|

| i) | Description of plans |

| Hanson provides pension and post-employment medical plans in a number of countries in which it operates in accordance with local employment practices. These arrangements have been subject to change in recent years and, with the exception of some arrangements covered under collective bargaining agreements in the US, new employees are no longer eligible for inclusion in either defined benefit pension plans (“DB plans”) or post-employment medical plans. |

The liabilities of the group’s DB plans primarily relate to pensioners currently in receipt of benefits, ex-employees with accrued rights to receive pensions in future and current employees who were members of DB plans before the relevant cut-off date, being July 2002 in the UK and July 2005 in the USA. The group follows a policy of funding DB plans to a target of the accrued benefit obligation, a level which is higher than the statutory minimum funding level in each country. Together with plan trustees, the group has a long term goal of matching the liabilities of the plans with appropriate assets.

The liabilities of the group’s post-employment medical plans are primarily in the USA and Canada. These comprise a number of separate arrangements which have been closed to new entrants over time such that the substantial part of the liabilities relates to retirees. Post-employment medical liabilities are unfunded and are held as a balance sheet provision.

Where pension benefits are provided to new employees of the group, they are eligible to join defined contribution pension plans (“DC plans”). The group contribution to such plans is generally related to the employee contribution and ranges from 5-10% in the UK and 3-6% in the USA, in each case as a proportion of pensionable salary.

The group also participates in multi-employer pension plans, primarily in the USA. These provide defined benefits to certain of the group’s union employees. Multi-employer pension plans are accounted for as DC plans as it is not possible to isolate the components of such plans which would collectively comprise the group’s liability.

Back to Contents

Notes to the accountscontinued

for the 12 months ended December 31, 2006

| 28 | Pensions and other post-employment medical plans continued |

|

|

| ii) | Details of cash contributions |

|

| Contributions by the group to its pension plans totalled £73.9m (£59.1m, £57.8m) in the year, principally in the UK, USA and Canada. This is represented by regular contributions of £30.3m (£31.1m, £38.0m) and additional contributions of £22.4m (£12.1m, £8.4m) to DB pension plans; contributions to DC plans of £15.5m (£12.1m, £7.6m); and contributions to multi-employer plans of £5.7m (£3.8m, £3.8m) . In addition to the ongoing regular contributions, group companies are scheduled to make additional payments to the principal UK DB plan of £8.4m in each of the next two years. No conclusion has currently been reached on the level of contributions to other plans although, overall, the group expects to maintain its regular contributions at broadly the same level in 2007. Contributions relating to multi-employer plans are based on negotiated collective bargaining agreements. The surpluses and deficits in the multi-employer plans are not considered to have a material impact on the Company. Benefits paid by the group in respect of its post-employment medical plans, totalled £10.4m (£9.0m, £8.5m) . |

| | |

| iii) | Net employee benefit obligations |

|

| The amounts recognised in the balance sheet are as follows: |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| | Defined | | Defined | | Defined | | Post- | | Post- | | Post- | |

| | benefit | | benefit | | benefit | | employment | | employment | | employment | |

| | pension plans | | pension plans | | Pension plans | | medical plans | | medical plans | | medical plans | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Present value of funded obligations at December 31 | (2,026.7 | ) | (1,998.7 | ) | (1,779.5 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Fair value of plan assets at December 31 | 2,026.9 | | 1,991.6 | | 1,742.2 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 0.2 | | (7.1 | ) | (37.3 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Present value of unfunded obligations | (13.7 | ) | (13.7 | ) | (11.2 | ) | (77.4 | ) | (103.3 | ) | (80.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Net liability | (13.5 | ) | (20.8 | ) | (48.5 | ) | (77.4 | ) | (103.3 | ) | (80.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Represented by amounts in the balance sheet: | | | | | | | | | | | | |

| Plan deficits | (31.8 | ) | (47.7 | ) | (76.1 | ) | (77.4 | ) | (103.3 | ) | (80.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Plan surpluses | 18.3 | | 26.9 | | 27.6 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Net liability | (13.5 | ) | (20.8 | ) | (48.5 | ) | (77.4 | ) | (103.3 | ) | (80.4 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

The net liability for the defined benefit and post-employment medical plans is shown before the associated deferred tax credit of £37.1m (£64.2m, £57.5m) .

There are three UK pension plans and two US plans with a surplus of the fair value of plan assets over the present value of obligations at December 31, 2006. These plans had combined net assets of £17.6m and £0.7m respectively. The remaining plans (including post-employment medical plans) had a deficit of £109.2m.

The amounts recognised in the income statement and statement of recognised income and expense are as follows:

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | Post- | | Post- | | Post- | |

| | | | | | | | employment | | employment | | employment | |

| | Pension plans | | Pension plans | | Pension plans | | medical plans | | medical plans | | medical plans | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current service cost (defined benefit plans) | 31.7 | | 31.1 | | 37.1 | | 0.7 | | 1.1 | | 1.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current service cost (defined contribution plans) | 15.5 | | 12.1 | | 7.6 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current service cost (multi-employer plans) | 5.7 | | 3.8 | | 3.8 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Total recognised in operating profit | 52.9 | | 47.0 | | 48.5 | | 0.7 | | 1.1 | | 1.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

| Interest costs on plan obligations | 98.3 | | 98.6 | | 96.2 | | 4.9 | | 4.6 | | 3.0 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Expected return on plan assets | (114.5 | ) | (108.7 | ) | (111.2 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Total recognised in net finance costs | (16.2 | ) | (10.1 | ) | (15.0 | ) | 4.9 | | 4.6 | | 3.0 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

| Interest costs on plan obligations recognised in discontinued operations | – | | – | | – | | 0.2 | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Total expense recognised in the income statement | 36.7 | | 36.9 | | 33.5 | | 5.8 | | 5.7 | | 4.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | |

| Actual return on plan assets | 129.0 | | 216.2 | | 125.7 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Less: Expected return on plan assets | (114.5 | ) | (108.7 | ) | (111.2 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Actuarial gain on plan assets | 14.5 | | 107.5 | | 14.5 | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Actuarial (losses)/gains on plan obligations | (43.4 | ) | (98.3 | ) | (37.3 | ) | 10.3 | | (16.3 | ) | (2.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Other actuarial losses | – | | (0.9 | ) | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Net actuarial (loss)/gain recognised in the statement of recognised income and expense | (28.9 | ) | 8.3 | | (22.8 | ) | 10.3 | | (16.3 | ) | (2.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Cumulative amount of actuarial (losses)/gains recognised | (37.7 | ) | (8.8 | ) | (17.1 | ) | (4.9 | ) | (15.2 | ) | 1.1 | |

|

|

|

|

|

|

|

|

|

|

|

| |

The group recognises all actuarial gains and losses through the statement of recognised income and expense in the year in which they arise.

Changes in the present value of the defined benefit obligation are as follows:

|

|

|

|

|

|

|

|

|

|

|

| |

| | Defined | | Defined | | Defined | | Post- | | Post- | | Post- | |

| | benefit | | benefit | | benefit | | employment | | employment | | employment | |

| | pension plans | | pension plans | | pension plans | | medical plans | | medical plans | | medical plans | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | 2006 | | 2005 | | 2004 | | 2006 | | 2005 | | 2004 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| At January 1 | (2,012.4 | ) | (1,790.7 | ) | (1,737.6 | ) | (103.3 | ) | (80.4 | ) | (87.9 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current service cost for defined benefit plans | (31.7 | ) | (31.1 | ) | (37.1 | ) | (0.7 | ) | (1.1 | ) | (1.1 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Employee contributions | (6.0 | ) | (6.2 | ) | (7.3 | ) | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Interest costs on plan obligations | (98.3 | ) | (98.6 | ) | (96.2 | ) | (5.1 | ) | (4.6 | ) | (3.0 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Actuarial (losses)/gains on plan obligations | (43.4 | ) | (98.3 | ) | (37.3 | ) | 10.3 | | (16.3 | ) | (2.9 | ) |

|

|

|

|

|

|

|

|