Use these links to rapidly review the document

TABLE OF CONTENTS

HUNTSMAN LLC AND SUBSIDIARIES INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 28, 2004

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Huntsman LLC

(Exact Name of Registrant as Specified in its Charter)

Utah

(State or Other Jurisdiction

of Incorporation or Organization) | | 2800

(Primary Standard Industrial

Classification Code Number) | | 87-0533091

(I.R.S. Employer

Identification Number) |

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Address, Including Zip Code and Telephone Number, Including Area Code, of Co-Registrants' Principal Executive Offices) |

Samuel D. Scruggs, Esq.

Secretary

Huntsman LLC

500 Huntsman Way

Salt Lake City, UT 84108

(801) 584-5700

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

Copy to: |

Nathan W. Jones, Esq.

Stoel Rives LLP

201 South Main Street, Suite 1100

Salt Lake City, UT 84111

(801) 328-3131 |

Exact Name of Additional Registrants*

| | Jurisdiction of

Incorporation/Organization

| | Primary Standard Industrial

Classification Code Number

| | I.R.S. Employer

Identification Number

|

|---|

| Huntsman Specialty Chemicals Holdings Corporation | | Utah | | 2800 | | 84-1378762 |

| Huntsman Specialty Chemicals Corporation | | Delaware | | 2800 | | 76-0522314 |

| Huntsman Chemical Purchasing Corporation | | Utah | | 2800 | | 87-0568517 |

| Huntsman International Chemicals Corporation | | Utah | | 2800 | | 87-0440648 |

| Huntsman International Trading Corporation | | Delaware | | 2800 | | 87-0522263 |

| Huntsman Petrochemical Purchasing Corporation | | Utah | | 2800 | | 87-0568520 |

| Polymer Materials Inc. | | Utah | | 2800 | | 87-0432897 |

| Airstar Corporation | | Utah | | 2800 | | 87-0457111 |

| Huntsman Procurement Corporation | | Utah | | 2800 | | 87-0644129 |

| JK Holdings Corporation | | Delaware | | 2800 | | 87-0518183 |

| Huntsman Australia Inc. | | Utah | | 2800 | | 87-0510821 |

| Huntsman Chemical Finance Corporation | | Utah | | 2800 | | 87-0552847 |

| Huntsman Enterprises Inc. | | Utah | | 2800 | | 87-0562447 |

| Huntsman Family Corporation | | Utah | | 2800 | | 87-0517283 |

| Huntsman Group Holdings Finance Corporation | | Utah | | 2800 | | 87-0552846 |

| Huntsman Group Intellectual Property Holdings Corporation | | Utah | | 2800 | | 87-0540073 |

| Huntsman International Services Corporation | | Texas | | 2800 | | 75-1423616 |

| Huntsman MA Investment Corporation | | Utah | | 2800 | | 87-0564509 |

| Huntsman MA Services Corporation | | Utah | | 2800 | | 87-0661851 |

| Huntsman Petrochemical Finance Corporation | | Utah | | 2800 | | 87-0552845 |

| Huntsman Expandable Polymers Company LC | | Utah | | 2800 | | 87-0623756 |

| Huntsman Petrochemical Canada Holdings Corporation | | Utah | | 2800 | | 84-1375735 |

| Huntsman Polymers Holdings Corporation | | Utah | | 2800 | | 87-0577209 |

| Huntsman Chemical Company LLC | | Utah | | 2800 | | 68-0518488 |

| Huntsman Petrochemical Corporation | | Delaware | | 2800 | | 58-1594518 |

| Huntsman Polymers Corporation | | Delaware | | 2800 | | 75-2104131 |

| Huntsman Fuels, L.P. | | Texas | | 2800 | | 91-2085706 |

| Petrostar Fuels LLC | | Delaware | | 2800 | | 87-0668830 |

| Huntsman Purchasing, Ltd. | | Utah | | 2800 | | 84-1370346 |

| Petrostar Industries LLC | | Delaware | | 2800 | | 87-0668831 |

| Huntsman Headquarters Corporation | | Utah | | 2800 | | 87-0526140 |

- *

- Address and telephone of principal executive offices are the same as those of Huntsman LLC.

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

CALCULATION OF REGISTRATION FEE CHART

|

Title of Class of

Securities to be Registered

| | Amount to be

Registered

| | Proposed Maximum

Offering Price

per Note(1)

| | Proposed Maximum

Aggregate Offering

Price(1)

| | Amount of

Registration Fee

|

|---|

|

| 115/8% Senior Secured Notes due 2010 | | $455,400,000 | | 100% | | $455,400,000 | | $57,700 |

|

| Guarantees | | (2) | | (2) | | (2) | | (2) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) promulgated under the Securities Act of 1933, as amended.

- (2)

- Pursuant to Rule 457(n) under the Securities Act, no separate fee is payable with respect to the guarantees of the new notes being registered.

The Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion—Dated January 28, 2004

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

PRELIMINARY PROSPECTUS

Huntsman LLC

Exchange Offer for

$455,400,000 115/8% Senior Secured Notes due 2010

This exchange offer will expire at 5:00 p.m., New York City Time,

on , 2004, unless extended.

Terms of the exchange offer:

- •

- We will exchange all outstanding 115/8% Senior Secured Notes due 2010 ("old notes") that are validly tendered and not withdrawn prior to the expiration of the exchange offer. The old notes were sold in two separate transactions, $380,000,000 aggregate principal amount of which were issued on September 30, 2003 and $75,400,000 aggregate principal amount of which were issued on December 12, 2003.

- •

- You may withdraw tendered old notes at any time prior to the expiration of the exchange offer.

- •

- The exchange of old notes will not be a taxable exchange for United States federal income tax purposes.

- •

- The terms of the new 115/8% Senior Secured Notes due 2010 to be issued in this exchange offer ("new notes" and, collectively with the old notes, "notes") are substantially identical to the terms of the old notes, except for transfer restrictions and registration rights relating to the old notes.

- •

- We will not receive any proceeds from the exchange offer.

- •

- There is no existing market for the new notes, and we have not and will not apply for their listing on any securities exchange.

See the "Description of New Notes" section on page 148 for more information about the new notes to be issued in this exchange offer.

This investment involves risks. See the section entitled "Risk Factors" that begins on page 22 for a discussion of the risks that you should consider prior to tendering your old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2004

TABLE OF CONTENTS

PROSPECTUS SUMMARY

The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. This prospectus contains information regarding our business and detailed financial information (including with respect to Huntsman International Holdings LLC, our unrestricted subsidiary). You should carefully read this entire document.

In this prospectus, the term "HMP" refers to HMP Equity Holdings Corporation, the term "HGI" refers to Huntsman Group Inc., the term "HIH" refers to Huntsman International Holdings LLC, the term "HI" refers to Huntsman International LLC, the term "Huntsman Holdings" refers to Huntsman Holdings, LLC, the term "HAM" refers to Huntsman Advanced Materials LLC, the term "GOP" refers to MatlinPatterson Global Opportunities Partners, L.P., the term "CPH" refers collectively to Consolidated Press Holdings Limited and its subsidiaries, and the term "ICI" refers collectively to Imperial Chemical Industries PLC and its subsidiaries. In this prospectus, unless the context otherwise requires or as described in the following sentence, the words "we," "our," "us," the "Company" and "Huntsman LLC" refer collectively to Huntsman LLC and its subsidiaries. In "Supplemental Discussion of Results of Operations for the Restricted Group for the Nine Months Ended September 30, 2003," in "Description of New Notes" and in certain other places in this prospectus that deal with our "restricted group" (as discussed in "—Use of Supplemental Non-GAAP Information" below), the terms "we," "our," "us," "Huntsman LLC" and "restricted group" refer to Huntsman LLC and its restricted subsidiaries (which do not include HIH and its subsidiaries).

Prior to May 9, 2003, we owned 60% of the outstanding common equity of HIH; HMP owned 1%, ICI owned 30%, and a group of private institutional investors owned the remaining 9% of the outstanding common equity of HIH. On May 9, 2003, HMP completed the acquisition of the common equity interests of HIH held by ICI and the private institutional investors (the "HIH Consolidation Transaction"). Prior to May 1, 2003, we accounted for our investment in HIH using the equity method of accounting due to the significant management participation rights formerly granted to ICI pursuant to the HIH limited liability company agreement. As a result of the HIH Consolidation Transaction, and as a result of HMP's ownership of our Company, in accordance with U.S. generally accepted accounting principles ("US GAAP" or "GAAP"), HIH is considered to be a consolidated subsidiary, and its results of operations are consolidated with our results of operations from May 1, 2003.

Use of Supplemental Non-GAAP Information

Notwithstanding that HIH is a consolidated subsidiary for US GAAP purposes, it is financed separately from Huntsman LLC, its debt is non-recourse to Huntsman LLC and it is not a guarantor of the old notes, nor will it be a guarantor of the new notes, although we have pledged, and will pledge, our 60% interest in HIH to secure our obligations under the old notes and the new notes, respectively. Specifically, the indenture governing the notes and our senior secured credit facilities (the "HLLC Credit Facilities") contain financial covenants and other provisions that relate to our restricted group and exclude HIH. Accordingly, in addition to presenting the consolidated information that includes HIH in accordance with US GAAP, we also present certain supplemental non-GAAP information with respect to Huntsman LLC and its restricted subsidiaries, which does not include HIH. We believe this supplemental non-GAAP information provides investors with material and meaningful information with respect to the financial results of the business and operations which provide the primary source of cash flow to meet our payment obligations under the notes and which are subject to the restrictive covenants in the indenture governing the notes.

Unless otherwise specified in this prospectus, (i) in our historical consolidated financial results for the periods prior to the HIH Consolidation Transaction, our equity interest in HIH is accounted for using the equity method of accounting, (ii) our Pro Forma—Consolidated Group financial results include the consolidated financial results of HIH and reflect the other pro forma adjustments described herein, and (iii) the Pro Forma—Restricted Group financial results represent the financial results of Huntsman LLC

1

and those subsidiaries of Huntsman LLC that are "restricted" subsidiaries under the indenture governing the notes (and continue to account for Huntsman LLC's 60% equity ownership in HIH using the equity method of accounting), and also reflect the other pro forma adjustments described herein. For more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Explanatory Note" and "Supplemental Discussion of Results of Operations for the Restricted Group for the Nine Months Ended September 30, 2003—Explanatory Note."

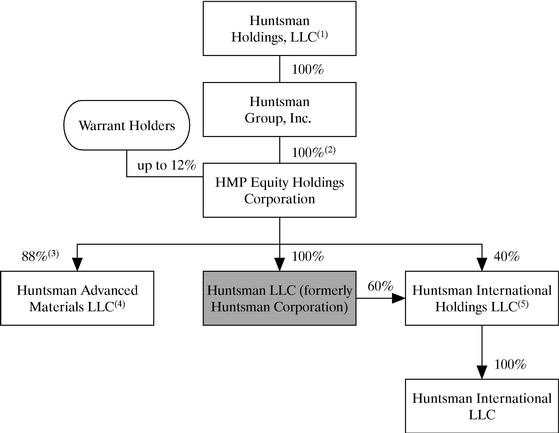

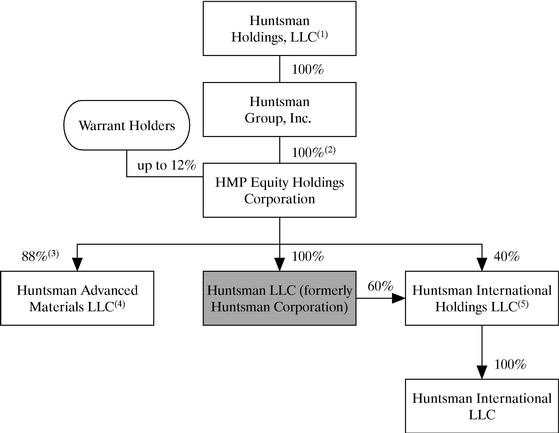

Our Company

Our Company is a Utah limited liability company and all of our units of interest are owned by HMP. HMP is a Delaware corporation and is owned 100% by HGI, subject to warrants that, if exercised, would entitle the holders to up to 12% of the common stock of HMP. HGI is owned 100% by Huntsman Holdings, a Delaware limited liability company. The voting membership interests of Huntsman Holdings are owned 50.2% by the Huntsman family, 47.8% by GOP, 1.8% by CPH and 0.2% by senior management. In addition, Huntsman Holdings has issued certain non-voting preferred units to Huntsman Holdings Preferred Member LLC, which, in turn, is owned 93.7%, indirectly, by GOP, 3.6% by CPH, 1.8% by the Huntsman Cancer Foundation, 0.6% by senior management and 0.3% by the Huntsman family. Huntsman Holdings has also issued certain non-voting preferred units to the Huntsman family, GOP and CPH that track the performance of the HAM business. The Huntsman family has board and operational control of our Company.

We own 60% of the membership interests of HIH, and on May 9, 2003 our parent, HMP, completed the HIH Consolidation Transaction. HIH is a global manufacturer and marketer of polyurethanes, amines, surfactants, titanium dioxide ("TiO2") and basic petrochemicals. HIH and its subsidiaries are non-guarantor, unrestricted subsidiaries of Huntsman LLC. HIH and its subsidiaries are separately financed from us, their debt is non-recourse to us, and we are not obligated to make cash contributions to, or investments in, HIH and its subsidiaries. On June 30, 2003, our parent companies (HMP and Huntsman Holdings) completed a restructuring and acquisition (the "Vantico Transaction") of Vantico Group S.A. ("Vantico"), a leading European-based global specialty chemical producer. HAM was created as a subsidiary of HMP (and is our affiliate) to hold the acquired Vantico businesses. HAM is also separately financed from us, its debt is non-recourse to us, and we are not obligated to make cash contributions to, or investments in, HAM.

Our principal executive offices are located at 500 Huntsman Way, Salt Lake City, Utah 84108, and our telephone number is (801) 584-5700.

2

Corporate Organization

The following chart reflects our organizational structure after the HIH Consolidation Transaction and the Vantico Transaction.

- (1)

- The voting membership interests of Huntsman Holdings are owned 50.2% by the Huntsman family, 47.8% by GOP, 1.8% by CPH and 0.2% by senior management. See "Security Ownership of Certain Beneficial Owners and Management."

- (2)

- Subject to warrants which, if exercised, would entitle holders to up to 12% of the common stock of HMP.

- (3)

- Subject to preferred equity with a $513.3 million liquidation preference, held by HGI. The balance of the common equity is owned by third parties, including affiliates of SISU Capital Limited and Morgan Grenfell Private Equity Limited.

- (4)

- HAM and its subsidiaries are our affiliates. HAM is separately financed from us, its debt is non-recourse to us, and we are not obligated to make cash contributions to, or investments in, HAM.

- (5)

- HIH and its subsidiaries are non-guarantor, unrestricted subsidiaries of Huntsman LLC. HIH and its subsidiaries are separately financed from Huntsman LLC, their debt is non-recourse to Huntsman LLC, and Huntsman LLC is not obligated to make cash contributions to, or investments in, HIH and its subsidiaries.

3

Our Management

Our parent, HMP, manages all its businesses, including our business and the businesses of HIH and HAM, as one integrated global chemical company. This allows us to benefit from significant vertical integration, scale in purchasing and shared administrative, overhead and marketing expenses.

Our Business

We are a leading manufacturer and marketer of a wide range of chemical products that are sold to diversified consumer and industrial end markets. We have 47 primary manufacturing facilities located in North America, Europe, Asia, Australia, South America and Africa and sell our products globally through our five principal business segments: Polyurethanes, Performance Products, Polymers, Pigments and Base Chemicals. We believe that our Company is characterized by low-cost operating capabilities; a diversity of products, customers and end markets; significant production integration; and strong growth prospects.

Our Products

The following table sets forth information regarding the pro forma sales to external customers of our five business segments.

Segment

| | % of Sales for the

Nine Months Ended

September 30, 2003

| |

|---|

| | (Pro Forma)

| |

|---|

| Polyurethanes | | 28 | % |

| Performance Products | | 21 | % |

| Polymers | | 14 | % |

| Pigments | | 12 | % |

| Base Chemicals | | 25 | % |

- •

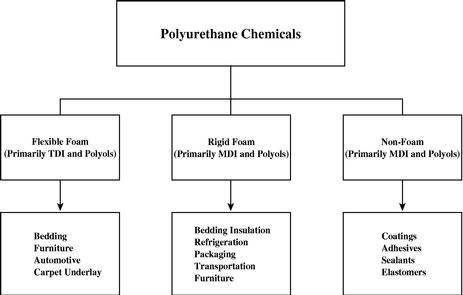

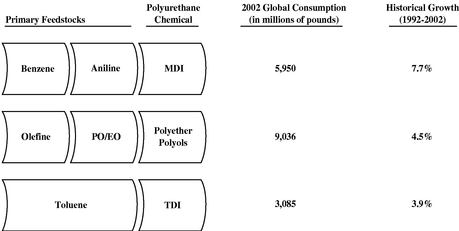

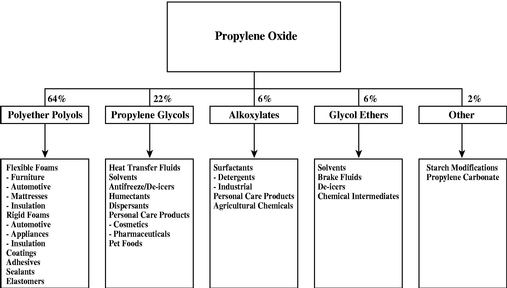

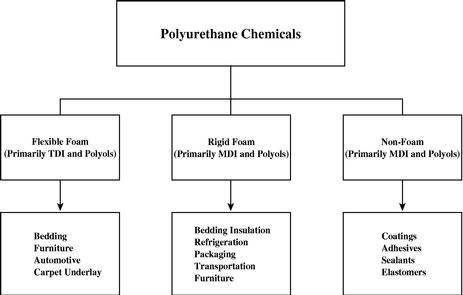

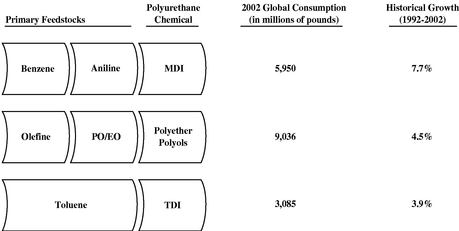

- We market a complete line of polyurethane chemicals, including MDI, TDI, TPU, polyols, polyurethane systems and aniline, with an emphasis on MDI-based chemicals. Our customers produce polyurethane products through the combination of an isocyanate, such as MDI or TDI, with polyols, which are derived largely from PO and ethylene oxide. Primary polyurethane end-uses include automotive interiors, refrigeration and appliance insulation, construction products, footwear, furniture cushioning, adhesives and other specialized engineering applications. Our entire polyurethane business is owned by HIH.

- •

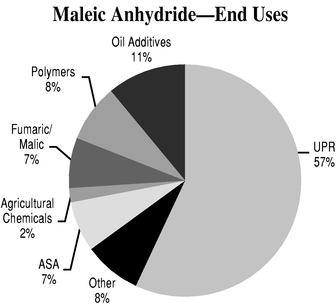

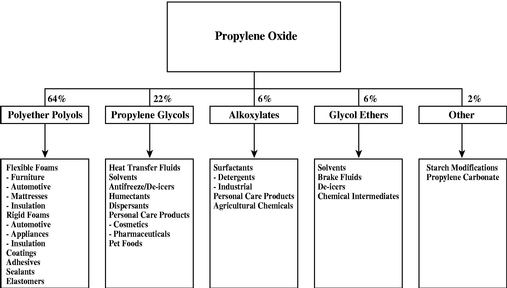

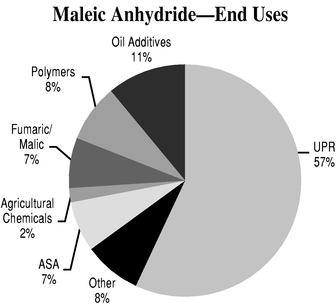

- Our Performance Products business includes surfactants and surfactant intermediates which are used primarily in consumer detergents, toiletries, shampoos, personal care products and agro chemicals, as well as in a variety of industrial uses. In addition, we are a leading producer of a wide range of amines, including ethanolamines, ethyleneamines and polyetheramines, and of alkylene carbonates. Our amines primarily use raw materials that we produce internally to make products used in agricultural herbicides, personal care products, polyurethane foams, fuel and lubricant additives and paints and coatings. We are also North America's largest producer of maleic anhydride ("MAn"). MAn is used in a wide variety of industrial uses, the largest of which is unsaturated polyester resins ("UPR") sold to the marine, automotive and construction industries. Our Performance Products business has a global presence, with manufacturing operations in North America, Europe and Australia. Our European surfactants operations and our global ethyleneamines operations are owned by HIH.

- •

- Our Polymers business produces polyethylene, polypropylene, styrene monomer, expandable polystyrene ("EPS"), and amorphous polyalphaolefins ("APAO"). Our Polymers business is located in North America and Australia. We pursue a niche marketing strategy for certain of our

4

Our History

We began operations in 1982 as a polystyrene chemical and packaging company and have grown through a series of significant acquisitions. In 1993, we purchased Monsanto's LAB and MAn businesses. In 1994, we purchased Texaco's global chemical business. In 1997, we purchased our PO business from Texaco. Also in 1997, we acquired Rexene Corporation, significantly increasing the size of our polymers business. In 1999, we formed HIH, and acquired certain polyurethanes, pigments and European petrochemicals operations from ICI. In 2000, HIH acquired the Rohm and Haas thermoplastic polyurethanes ("TPU") business and in 2001, HIH acquired Albright & Wilson's European surfactants business. We have also divested certain non-core businesses, including our packaging subsidiary in 1997 and our global styrenics business to NOVA Chemicals in 1998.

The Restructuring of Huntsman LLC and Huntsman Polymers

As general economic and business conditions deteriorated during 2000 and 2001, and our financial results declined, we addressed our relatively high level of indebtedness through a debt restructuring and the implementation of major cost saving initiatives across all our businesses.

In mid 2001, we initiated a major cost reduction program. This program resulted in the reduction of approximately 800 manufacturing, sales, administrative and technical service employees, as well as 300 third-party contractor positions. We also closed smaller, inefficient manufacturing units in Odessa, Port Neches and Austin, Texas. A restructuring charge, which was recorded in several phases during 2001, provided for the closure of these units. Approximately $42 million was accrued to pay for severance, fringe benefits and outplacement costs. The restructuring plan was substantially completed by the second quarter of 2002. As a result, our annual cash fixed indirect manufacturing and SG&A costs have declined.

On September 30, 2002, we, together with Huntsman Polymers Corporation ("Huntsman Polymers"), our wholly-owned subsidiary, completed debt for equity exchanges (the "Restructuring").

5

We obtained the approval of all our bank lenders to complete the Restructuring. As a result of the Restructuring, we have eliminated approximately $763 million of consolidated debt claims and have reduced annual interest expense on such debt claims by approximately $63 million. The Restructuring involved the following:

Prior to September 30, 2002, we were party to credit agreements with our bank lenders that provided for approximately $1.4 billion of term loans and a $150 million supplemental credit facility. On September 30, 2002, these credit agreements were effectively terminated or amended and restated, and we, together with our bank lenders, entered into new and amended and restated credit agreements as follows:

- •

- A new $275 million revolving credit facility maturing in 2006 (the "HLLC Revolving Facility") that is secured by a first lien on substantially all our assets and the assets of our domestic restricted subsidiaries.

- •

- A term loan agreement providing term loan tranches of $938 million ("Term Loan A") and $450 million ("Term Loan B") maturing in 2007 (the "HLLC Term Facilities" and, together with the HLLC Revolving Facility and other ancillary documents, the "HLLC Credit Facilities"), which are secured by a second lien on substantially the same assets that secure the HLLC Revolving Facility. On May 31, 2003, the principal amount of Term Loan B was increased to $459 million; the additional $9 million was a supplemental fee imposed because $350 million of Term Loan B was not repaid on May 31, 2003.

The HLLC Credit Facilities are also guaranteed by our restricted subsidiaries and by Huntsman Specialty Chemicals Holdings Corporation and Huntsman Specialty Chemicals Corporation, two of our unrestricted subsidiaries. Neither HIH nor its operating subsidiary, HI, are guarantors under the HLLC Credit Facilities.

The HLLC Credit Facilities contain representations and warranties, covenants, events of default and certain restrictions, all of which are usual and customary for facilities of this type. In conjunction with the offering of the notes, we obtained amendments to the terms of the HLLC Credit Facilities.

6

See "Other Indebtedness and Certain Financing Arrangements—Huntsman LLC—Description of Credit Facilities."

The aggregate net proceeds received by us from the sale of the old notes, after deducting the underwriting discounts and commissions and offering expenses, were approximately $433.3 million in cash. Of these proceeds, we used $65.0 million to reduce outstanding borrowings under the HLLC Revolving Facility and $331.5 million to prepay a portion of the Term Loan A under the HLLC Term Facilities, including all required amortization payments pursuant to the HLLC Term Facilities through December 2005. Additionally, we intend to use $36.8 million to redeem all of the outstanding senior unsecured notes due December 2004 of our subsidiary Huntsman Polymers Corporation (the "Huntsman Polymers Notes") as discussed in "—Recent Events—Amendments of HLLC Credit Facilities and Offering of the Notes" below.

On September 30, 2002 Huntsman LLC reinstated $59.3 million in outstanding senior subordinated notes (the "Huntsman Notes") by paying in full the interest due. In addition, Huntsman Polymers reinstated $36.8 million in outstanding Huntsman Polymers Notes by paying in full the interest due. For more information concerning the Huntsman Polymers Notes, see "—Recent Events—Amendments of HLLC Credit Facilities and Offering of the Notes."

HIH Consolidation Transaction

On May 9, 2003, HMP issued units (the "HMP Units"), consisting of 15% Senior Secured Discount Notes (the "HMP Senior Discount Notes") with an initial accreted value of $423 million and warrants to purchase approximately 12% of HMP's common stock. A portion of the net offering proceeds from the HMP Units offering were used to complete the HIH Consolidation Transaction and to complete the purchase of the senior subordinated reset discount notes due 2009 of HIH (the "HIH B Notes") that were held by ICI. The HMP Senior Discount Notes are secured by (i) the HIH B Notes, (ii) HMP's 40% equity interest in HIH, (iii) 100% of HMP's common stock, and (iv) 100% of our common membership units owned by HMP.

Acquisition of Vantico by our Parent Companies

On June 30, 2003, our parent companies, HMP and Huntsman Holdings, completed the Vantico Transaction. Vantico is a leading European-based global specialty chemical producer providing solutions in a wide variety of applications, such as adhesives, coating systems, electrical insulating materials, optronics, pre-production solutions and structural composites. In conjunction with this transaction, HAM was formed to hold the Vantico business and HMP now indirectly owns approximately 88% of the common equity of HAM, while HMP's parent, Huntsman Group, Inc., indirectly owns 100% of the preferred equity of HAM.

In conjunction with the Vantico Transaction, HAM issued $350 million aggregate principal amount fixed and floating rate senior secured notes and entered into a new $60 million revolving credit facility. Net proceeds from this financing were used, together with an equity contribution from GOP and others, to refinance and repay substantially all of Vantico's existing indebtedness.

HAM is our affiliate, but we do not own any securities of HAM and are not required to make any cash contributions to HAM. In addition, we have not guaranteed, or otherwise agreed to support, any of HAM's financing arrangements. HAM is separately financed from us, its debt is non-recourse to us, and we are not obligated to make cash contributions to, or investments in, HAM. Both our Company and HI, our subsidiary, have entered into contractual arrangements with HAM regarding management, technology and commercial matters and certain of our employees and our affiliates' employees have assumed senior positions at HAM. We believe that these transactions have been made on terms which

7

are no less favorable to our Company than would be expected from an unaffiliated third-party. See "Certain Relationships and Related Transactions—Huntsman Advanced Materials LLC."

Recent Events

Amendments of HLLC Credit Facilities and Offering of the Notes

On September 12, 2003, we entered into amendments to the HLLC Credit Facilities that, among other things, permitted us to grant a security interest in connection with the notes and to issue the notes. On September 30, 2003, we sold $380 million aggregate principal amount of the old notes at a discount to yield 117/8% in a private offering (the "September 2003 Offering"). The proceeds from the September 2003 Offering were used to repay $65.0 million on the HLLC Revolving Facility, without reducing commitments, and $296.6 million on Term Loan A. The repayment on Term Loan A included a prepayment of $130.0 million of scheduled amortization payments in the direct order of maturity.

On November 20, 2003, we entered into an amendment to the HLLC Credit Facilities that, among other things, extended the time during which we were permitted to issue additional notes from November 28, 2003 to March 31, 2004, and allowed us to use a portion of the proceeds of such additional issuance to redeem all the outstanding Huntsman Polymers Notes. On December 3, 2003, we sold $75.4 million aggregate principal amount of the old notes at a discount to yield 11.72% in a private offering (the "December 2003 Offering"). We intend to use $36.8 million of the net cash proceeds from the December 2003 Offering to redeem all the outstanding Huntsman Polymers Notes which are due in December 2004, while $34.9 million of the net proceeds has been used to prepay a portion of the Term Loan A under the HLLC Credit Facilities. Pro forma for the December 2003 Offering, the combined total repayment on Term Loan A included a prepayment of $164.9 million of scheduled amortization payments in the direct order of maturity such that the next scheduled quarterly amortization payment under the HLLC Credit Facilities is due March 2006 in the amount of approximately $14 million, and approximately $30 million per quarter thereafter until final maturity in 2007 when approximately $503 million is due.

The Huntsman Polymers Notes are callable at 100% of their aggregate principal amount at any time prior to December 2004. On December 12, 2003, we gave notice to the trustee under the indenture governing the Huntsman Polymers Notes of our intention to redeem such notes. The redemption of all the outstanding Huntsman Polymers Notes is expected to be completed on January 28, 2004. Until the redemption date for the Huntsman Polymers Notes, we have used $36.8 million of the net proceeds from the December 2003 Offering to temporarily reduce borrowings under the HLLC Revolving Facility. On the redemption date for the Huntsman Polymers Notes, we intend to reborrow $37.5 million under the HLLC Revolving Facility, which we will use to redeem all outstanding Huntsman Polymers Notes, including accrued interest, that are properly tendered for redemption. To the extent the aggregate amount necessary to redeem the Huntsman Polymer Notes is less than $36.8 million, such amount is required to be used to repay the Term Loan A under the HLLC Credit Facilities.

Amendment of HI Credit Facilities and Refinancing of HI Term A Loan

On October 17, 2003, HI, HIH's operating subsidiary, amended its senior secured credit facilities (the "HI Credit Facilities"). The amendment provides, among other things, for changes to certain financial covenants, including an increase in the leverage and interest coverage ratios, a decrease in the annual amount of permitted capital expenditures, and a decrease in the consolidated net worth covenant. With the exception of the changes relating to capital expenditures, these changes to the financial covenants apply to the quarterly periods ended September 30, 2003 through December 31, 2004. The amendment also allowed HI to obtain $205 million of additional term B and term C loans, which HI completed on October 22, 2003. The net proceeds of the additional term B and term C loans were applied to pay down HI's revolving loan facility (the "HI Revolving Facility") by approximately $53 million, and the remainder of the net proceeds were applied to repay, in full, HI's term A loan. As a result of this refinancing, HI has no scheduled term loan maturities in 2004 and scheduled term loan maturities of approximately $12 million in each of 2005 and 2006. The amendment also allows HI to issue additional senior unsecured notes up to a maximum of $800 million.

8

Global Cost Reduction Initiative

On November 10, 2003, HMP announced an initiative to reduce fixed costs and overhead expenses by a minimum of $200 million over the next 18 months. HMP is reviewing redundant sites, underutilized assets and all of its spending to reduce costs. HMP announced that it intends to continue to leverage its size, its global infrastructure and its people to increase productivity and reduce overall costs. HMP has not yet announced the extent to which the cost initiatives will directly impact our Company, or our subsidiary, HIH. HMP expects to make additional announcements of site consolidations and headcount reductions in the near future.

The Exchange Offer

| Securities Offered | | $455,400,000 aggregate principal amount of new 115/8% Senior Secured Notes due 2010, all of which have been registered under the Securities Act of 1933, as amended (the "Securities Act"). The terms of the new notes offered in the exchange offer are substantially identical to those of the old notes, except that certain transfer restrictions, registration rights and liquidated damages provisions relating to the old notes do not apply to the new registered notes. |

The Exchange Offer |

|

We are offering to issue registered notes in exchange for a like principal amount and like denomination of our old notes. We are offering to issue these registered notes to satisfy our obligations under exchange and registration rights agreements that we entered into with the initial purchasers of the old notes when we sold them in transactions which were exempt from the registration requirements of the Securities Act. You may tender your old notes for exchange by following the procedures described under the heading "The Exchange Offer". |

Tenders; Expiration Date; Withdrawal |

|

The exchange offer will expire at 5:00 p.m., New York City time, on , 2004, unless we extend it. If you decide to exchange your old notes for new notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the new notes. You may withdraw any notes that you tender for exchange at any time prior to , 2004. If we decide for any reason not to accept any old notes you have tendered for exchange, those notes will be returned to you without cost promptly after the expiration or termination of the exchange offer. See "The Exchange Offer—Terms of the Exchange Offer" for a more complete description of the tender and withdrawal provisions. |

9

Conditions to the Exchange Offer |

|

The exchange offer is subject to customary conditions and we may terminate or amend the exchange offer if any of these conditions occur prior to the expiration of the exchange offer. These conditions include any change in applicable law or legal interpretation or governmental or regulatory actions that would impair our ability to proceed with the exchange offer, any general suspension or general limitation relating to trading of securities on any national securities exchange or the over-the-counter market or a declaration of war or other hostilities involving the United States. We may waive any of these conditions in our sole discretion. |

U.S. Federal Tax Consequences |

|

Your exchange of old notes for new notes in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. See "Material U.S. Federal Income Tax Consequences." |

Use of Proceeds |

|

We will not receive any cash proceeds from the exchange offer. We will pay all expenses incident to the exchange offer. See "Use of Proceeds" for a discussion of the use of proceeds from the issuance of the old notes. |

Exchange Agent |

|

HSBC Bank USA, N.A. |

Consequences of Failure to Exchange |

|

Old notes that are not tendered or that are tendered but not accepted will continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your old notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. We, however, will have no further obligation to register the old notes. If you do not participate in the exchange offer, the liquidity of your notes could be adversely affected. |

Consequences of Exchanging Your Old Notes |

|

Based on interpretations of the SEC set forth in certain no-action letters issued to third parties, we believe that you may offer for resale, resell or otherwise transfer the new notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you: |

|

|

• |

|

acquire the new notes issued in the exchange offer in the ordinary course of your business; |

|

|

• |

|

are not participating, do not intend to participate, and have no arrangement or understanding with anyone to participate, in the distribution of the new notes issued to you in the exchange offer; and |

|

|

• |

|

are not an "affiliate" of our company as defined in Rule 405 of the Securities Act. |

10

|

|

If any of these conditions are not satisfied and you transfer any new notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for or indemnify you against any liability you may incur. |

|

|

Any broker-dealer that acquires new notes in the exchange offer for its own account in exchange for old notes which it acquired through market-making or other trading activities must acknowledge that it will deliver a prospectus when it resells or transfers any new notes. See "Plan of Distribution" for a description of the prospectus delivery obligations of broker-dealers in the exchange offer. |

The New Notes

The terms of the new notes and those of the outstanding old notes are identical in all material respects, except:

- (1)

- the new notes will have been registered under the Securities Act;

- (2)

- the new notes will not contain transfer restrictions and registration rights that relate to the old notes; and

- (3)

- the new notes will not contain provisions relating to the payment of liquidated damages to be made to the holders of the old notes under circumstances related to the timing of the exchange offer.

A brief description of the material terms of the new notes follows:

| Issuer | | Huntsman LLC. |

Notes Offered |

|

$455,400,000 aggregate principal amount at maturity of 115/8% Senior Secured Notes due 2010. |

Maturity |

|

October 15, 2010. |

Interest Rate |

|

115/8% per year (calculated using a 360-day year). |

Interest Payment Dates |

|

April 15 and October 15 of each year, commencing April 15, 2004. The old notes were sold with accrued interest from September 30, 2003. |

Guarantees |

|

The new notes will be guaranteed by some of our subsidiaries. If we cannot make payments on the notes when they are due, then our guarantors will be required to make payments on our behalf. |

11

| Optional Redemption | | Prior to October 15, 2006, we may, at our option and subject to certain requirements, use the net proceeds from (i) one or more offerings of qualified capital stock or (ii) capital contributions to the equity of Huntsman LLC, to redeem up to 35% of the aggregate principal amount of the new notes at 111.625% of their face amount, plus accrued and unpaid interest. See "Description of New Notes—Optional Redemption." On or before October 15, 2007, we may redeem some or all of the new notes at a redemption price equal to 100% of their face amount plus a "make whole" premium. After October 15, 2007, we may redeem the new notes in whole or in part, at our option at any time at the redemption prices listed in "Description of New Notes—Optional Redemption." |

Sinking Fund |

|

None. |

Security |

|

The new notes and guarantees initially will be secured by second priority liens (or a second priority position under the security agreements) on substantially all our assets (including our equity interests in HIH) and those of our subsidiaries that from time to time secure our obligations under the HLLC Credit Facilities. The HLLC Revolving Facility will be secured by first priority liens (or a first priority position under the security agreements) on those same assets and the HLLC Term Facilities will be secured by second priority liens (or a second priority position under the security agreements) on those same assets on an equal and ratable basis with the second priority liens (or the second priority position under the security agreements) securing the new notes and guarantees. As of September 30, 2003, after giving effect to the issuance of the old notes and the application of the net proceeds therefrom, Huntsman and the guarantors would have had approximately $84.7 million of revolver borrowings, $14.0 million of outstanding letters of credit, and $176.3 million available for additional revolver borrowings or, within limits, issuance of letters of credit, secured by liens (or a first priority position under the security agreements) senior to the liens securing the notes and the guarantees and $1,065.6 million of outstanding indebtedness under the HLLC Term Facilities secured by liens (or a second priority position under the security agreements)pari passu with the liens securing the notes and the guarantees. See "Description of New Notes—Security." |

12

Intercreditor Arrangements |

|

The trustee, on behalf of the holders of the notes, and the bank agents, on behalf of the lenders under the HLLC Revolving Facility and the HLLC Term Facilities, have entered into an intercreditor agreement which, together with the applicable security documents, provides, among other things, that the bank agent under the HLLC Revolving Facility, in its capacity as first priority collateral agent, on behalf of the lenders under the HLLC Revolving Facility and certain other first priority indebtedness we may incur in limited circumstances in the future, will hold a first priority security interest (or a first priority position under the security agreements) in the collateral and, that the bank agent under the HLLC Term Facilities, in its capacity as second priority collateral agent, on behalf of the lenders under the HLLC Term Facilities and the holders of the notes, will hold a second priority security interest (or a second priority position under the security agreements) in the collateral. The second priority liens securing the HLLC Term Facilities will be on an equal and ratable basis with the second priority liens (or the second priority position under the security agreements) securing the notes and the guarantees and certain other second priority indebtedness we may incur in limited circumstances in the future. The intercreditor agreement and the related security documents provide that for so long as any obligations or commitments are outstanding under the HLLC Credit Facilities, each bank agent will have the exclusive right to instruct the first priority collateral agent or the second priority collateral agent, as the case may be, to manage, perform and enforce the terms of the security documents relating to the collateral and to exercise and enforce all privileges, rights and remedies thereunder according to its direction. The bank agents may, without the consent of the trustee or the holders of the notes, release any or all of the collateral securing the HLLC Term Facilities, the notes and the guarantees, except during the occurrence of a default or an event of default under the indenture governing the notes, subject to certain limited exceptions. See "Description of New Notes—Collateral and Intercreditor Arrangements." |

13

Ranking |

|

Our obligations and those of the guarantors with respect to the new notes will rank equally in right of payment with all our and their senior obligations. The new notes will effectively rank senior in right of payment to all our and their senior unsecured obligations to the extent of the value of the collateral securing the new notes. Our obligations and those of the guarantors with respect to the new notes will effectively rank junior in right of payment to our and their obligations secured on a first priority basis under the HLLC Revolving Facility to the extent of the value of the assets securing such facility and equal with our and their obligations secured on a second priority basis under the HLLC Term Facilities. The new notes will be structurally subordinated to the obligations of our subsidiaries that are not guarantors. See "Description of New Notes—Brief Description of the Notes and the Guarantees." |

Change of Control Offer |

|

If we undergo a change of control, we will be required to make an offer to purchase new notes at a price equal to 101% of their face amount plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of New Notes—Repurchase at the Option of Holders upon a Change of Control." |

Asset Sales |

|

We may have to use the net proceeds from asset sales to offer to repurchase the new notes under certain circumstances at their face amount, plus accrued and unpaid interest, if any, to the date of repurchase. See "Description of New Notes—Certain Covenants—Limitation on Asset Sales." |

Covenants |

|

The indenture governing the new notes contains covenants that limit our ability and the ability of certain of our subsidiaries to: |

|

|

• |

|

incur additional indebtedness; |

|

|

• |

|

pay dividends or distributions on, or redeem, repurchase or issue our capital stock; |

|

|

• |

|

make investments; |

|

|

• |

|

engage in transactions with affiliates; |

|

|

• |

|

transfer or sell assets; |

|

|

• |

|

create liens; |

|

|

• |

|

restrict dividend or other payments to us from our subsidiaries; |

|

|

• |

|

issue preferred stock; |

|

|

• |

|

consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries; and |

|

|

• |

|

guarantee indebtedness. |

14

|

|

These covenants are subject to important exceptions and qualifications, which are described in "Description of New Notes—Certain Covenants." |

Registration Covenant; Exchange Offer |

|

We have agreed to consummate the exchange offer within 45 days after the effective date of our registration statement. In addition, we have agreed to file a "shelf registration statement" that would allow some or all of the old notes to be offered to the public if we are unable to complete the exchange offer or a change in applicable laws or legal interpretation occurs that would limit the intended effects or availability of the exchange offer. |

|

|

If we fail to fulfill our obligations with respect to registration of the new notes (a "registration default"), the annual interest rates on the affected notes will increase by 0.25% during the first 90-day period during which the registration default continues, and will increase by an additional 0.25% for each subsequent 90-day period during which the registration default continues, up to a maximum increase of 1.00% over the interest rates that would otherwise apply to the new notes. As soon as we cure a registration default, the accretion rates on the affected notes will revert to their original levels. |

|

|

Upon consummation of the exchange offer, holders of old notes will no longer have any rights under the exchange and registration rights agreements, except to the extent that we have continuing obligations to file a shelf registration statement. |

|

|

For additional information concerning the above, see "Description of New Notes—Registration Covenant; Exchange Offer". |

Further Issuances |

|

Under the indenture, we will be entitled to issue additional notes. Any issuance of additional notes will be subject to our compliance with the covenant described below under "Description of New Notes—Certain Covenants—Limitation on Incurrence of Additional Indebtedness". All notes will be substantially identical in all material respects, other than issuance dates, and will constitute the same series of notes, including for purposes of redemption and voting. |

Use of Proceeds |

|

We will not receive any proceeds from the exchange offer. We have used a portion of the net proceeds from the sale of the old notes to repay certain outstanding indebtedness under our senior secured credit facilities and we intend to use a portion of the proceeds from the sale of the old notes to redeem the Huntsman Polymers Notes. See "Use of Proceeds". |

15

Risk Factors |

|

You should carefully consider all the information set forth in this prospectus and, in particular, should evaluate the specific risk factors set forth under "Risk Factors," beginning on page 19, before participating in this exchange offer. |

Failure to Exchange Your Old Notes

The old notes which you do not tender or we do not accept will, following the exchange offer, continue to be restricted securities. Therefore, you may only transfer or resell them in a transaction registered under or exempt from the Securities Act and all applicable state securities laws. We will issue the new notes in exchange for the old notes under the exchange offer only following the satisfaction of the procedures and conditions described in the caption "The Exchange Offer".

Because we anticipate that most holders of the old notes will elect to exchange their old notes, we expect that the liquidity of the markets, if any, for any old notes remaining after the completion of the exchange offer will be substantially limited. Any old notes tendered and exchanged in the exchange offer will reduce the aggregate principal amount outstanding of the old notes.

Other Debt

On a pro forma basis, as of September 30, 2003, we had on a restricted group basis $84.7 million of debt outstanding under the HLLC Credit Facilities that ranked senior to the notes, and $1,065.6 million of debt that was on apari passu basis with the notes. On a pro forma basis, we have no amortization payments due under the HLLC Credit Facilities or any of our outstanding notes due in 2004, and we have approximately $150 million due in total annual net interest payments. As of September 30, 2003, our guarantors had $115.6 million in outstanding third-party debt. As of September 30, 2003, HIH had $3,765.5 million of debt outstanding. HIH is financed separately from us, its debt is non-recourse to us and it is not a guarantor of the old notes, nor will it be a guarantor of the new notes, although we have pledged, and will pledge our 60% interest in HIH to secure our obligations under the old notes and the new notes, respectively.

The agreements governing the HLLC Credit Facilities and the indenture governing the notes limit our ability to incur additional debt. Consequently, we would be required to obtain amendments of the agreements and the indenture before we incurred any additional debt, other than the types of debt specifically identified in those documents as permitted. For more information, see "Other Indebtedness and Certain Financing Arrangements" below.

16

Summary Historical and Pro Forma Financial Data

The summary historical financial data presents Huntsman LLC (including HIH accounted for using the equity method of accounting through April 30, 2003). Effective May 1, 2003, as a result of the HIH Consolidation Transaction, we have consolidated the financial results of Huntsman LLC and HIH. As a result, the financial information as of and for the nine months ended September 30, 2003 is not comparable to the other historical financial data presented herein.

The summary pro forma balance sheet data gives effect to the issuance of the old notes in the December 2003 Offering and the application of the proceeds therefrom, as if such transactions occurred as of September 30, 2003. The summary pro forma statements of operations data for the nine months ended September 30, 2003 and the year ended December 31, 2002 give effect to the following transactions as if each transaction had occurred on January 1, 2002:

- •

- Issuance of the old notes and the application of the proceeds therefrom;

- •

- Issuance by HI on April 11, 2003 of $150 million aggregate principal amount of its 97/8% Senior Notes due 2009 (the "HI 2003 Senior Notes");

- •

- Completion of the refinancing of a portion of the borrowings under the HI Credit Facilities;

- •

- Completion of the HIH Consolidation Transaction;

- •

- Completion of the restructuring by Huntsman LLC and Huntsman Polymers; and

- •

- The Minority Interests Acquisition.

The summary financial data set forth below should be read in conjunction with the audited and unaudited consolidated financial statements of Huntsman LLC, "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Supplemental Discussion of Results of Operations for the Restricted Group for the Nine Months Ended September 30, 2003," "Unaudited Pro Forma Financial Data," and "Selected Historical Financial Data" included elsewhere in this prospectus and, in each case, any related notes thereto.

The unaudited pro forma financial data does not purport to be indicative of the combined financial position or results of operations of future periods or indicative of results that would have occurred had the above transactions been consummated on the dates indicated.

17

| | Summary Historical Financial Data

| |

|---|

| | Nine Months Ended September 30,

| | Year Ended December 31,

| |

|---|

| | 2003(a)

| | 2002

| | 2002

| | 2001

| | 2000

| |

|---|

| | (Dollars in Millions)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | |

| Revenues | | $ | 4,453.8 | | $ | 1,964.6 | | $ | 2,661.0 | | $ | 2,757.4 | | $ | 3,325.7 | |

| Cost of goods sold | | | 4,052.5 | | | 1,763.1 | | | 2,421.0 | | | 2,666.6 | | | 3,197.0 | |

| | |

| |

| |

| |

| |

| |

| | Gross profit | | | 401.3 | | | 201.5 | | | 240.0 | | | 90.8 | | | 128.7 | |

| Operating expenses | | | 283.2 | | | 126.2 | | | 174.7 | | | 211.7 | | | 207.4 | |

| Restructuring, impairment and plant closing costs | | | 27.2 | | | (3.7 | ) | | (1.0 | ) | | 588.5 | | | — | |

| | |

| |

| |

| |

| |

| |

| Operating income (loss) | | | 90.9 | | | 79.0 | | | 66.3 | | | (709.4 | ) | | (78.7 | ) |

| Interest expense—net | | | (261.3 | ) | | (164.3 | ) | | (192.7 | ) | | (239.3 | ) | | (208.6 | ) |

| Loss on sale of accounts receivable | | | (12.3 | ) | | — | | | — | | | (5.9 | ) | | (9.4 | ) |

| Other income (expense) | | | 0.2 | | | (7.1 | ) | | (7.6 | ) | | 0.6 | | | 25.7 | |

| Equity in income (loss) of unconsolidated affiliates | | | (51.3 | ) | | (13.0 | ) | | (31.1 | ) | | (86.8 | ) | | 50.1 | |

| | |

| |

| |

| |

| |

| |

| | Loss before income taxes | | | (233.8 | ) | | (105.4 | ) | | (165.1 | ) | | (1,040.8 | ) | | (220.9 | ) |

| Income tax benefit (expense) | | | 4.2 | | | (7.2 | ) | | (8.5 | ) | | 184.9 | | | 81.2 | |

| Minority interest in subsidiaries | | | 37.2 | | | (28.8 | ) | | (28.8 | ) | | 13.1 | | | 1.1 | |

| | |

| |

| |

| |

| |

| |

| Loss from continuing operations | | | (192.4 | ) | | (141.4 | ) | | (202.4 | ) | | (842.8 | ) | | (138.6 | ) |

| Cumulative effect of accounting changes | | | — | | | 169.7 | | | 169.7 | | | 0.1 | | | — | |

| | |

| |

| |

| |

| |

| |

| | Net loss | | $ | (192.4 | ) | $ | 28.3 | | $ | (32.7 | ) | $ | (842.7 | ) | $ | (138.6 | ) |

| | |

| |

| |

| |

| |

| |

| Other Data: | | | | | | | | | | | | | | | | |

| EBITDA(b) | | $ | 276.8 | | $ | 144.0 | | $ | 151.5 | | $ | (590.9 | ) | $ | 189.1 | |

| Depreciation and amortization | | | 212.1 | | | 113.9 | | | 152.7 | | | 197.5 | | | 200.3 | |

| Capital expenditures | | | 128.4 | | | 35.7 | | | 70.2 | | | 76.4 | | | 90.3 | |

| Ratio of earnings to fixed charges(c) | | | — | | | — | | | — | | | — | | | — | |

| Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | |

| Net working capital(d) | | $ | 777.9 | | $ | 318.4 | | $ | 294.3 | | $ | 260.5 | | $ | 304.0 | |

| Total assets | | | 7,471.5 | | | 2,475.4 | | | 2,456.4 | | | 2,357.8 | | | 3,543.8 | |

| Long-term debt(e) | | | 5,659.4 | | | 1,756.3 | | | 1,736.1 | | | 2,450.5 | | | 2,268.6 | |

| Total liabilities | | | 7,455.9 | | | 2,333.8 | | | 2,426.3 | | | 3,046.3 | | | 3,322.3 | |

| Minority interests | | | 104.8 | | | — | | | ��� | | | 73.8 | | | 79.1 | |

| Total equity (deficit) | | | (89.2 | ) | | 141.6 | | | 30.1 | | | (762.3 | ) | | 142.4 | |

18

| | Pro Forma Consolidated Group Financial Data

| | Pro Forma Restricted Group Financial Data(f)

| |

|---|

| | Nine Months

Ended

September 30,

2003

| | Year Ended

December 31,

2002

| | Nine Months

Ended

September 30,

2003

| | Year Ended

December 31,

2002

| |

|---|

| | (Dollars in Millions)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | |

| Revenues | | $ | 6,093.9 | | $ | 7,063.2 | | $ | 2,431.5 | | $ | 2,764.9 | |

| Cost of goods sold | | | 5,511.7 | | | 6,195.2 | | | 2,284.1 | | | 2,512.3 | |

| | |

| |

| |

| |

| |

| | Gross profit | | | 582.2 | | | 868.0 | | | 147.4 | | | 252.6 | |

| Operating expenses | | | 411.3 | | | 564.5 | | | 114.5 | | | 184.9 | |

| Restructuring, impairment and plant closing costs | | | 44.3 | | | 6.7 | | | 0.9 | | | (1.0 | ) |

| | |

| |

| |

| |

| |

| | Operating income | | | 126.6 | | | 296.8 | | | 32.0 | | | 68.7 | |

| Interest expense—net | | | (392.0 | ) | | (489.0 | ) | | (126.0 | ) | | (148.9 | ) |

| Loss on sale of accounts receivable | | | (24.0 | ) | | (5.5 | ) | | — | | | — | |

| Other income (expense) | | | (2.0 | ) | | 0.2 | | | (0.7 | ) | | (1.1 | ) |

| Equity in income (loss) of unconsolidated affiliates | | | 1.7 | | | 2.0 | | | (51.4 | ) | | (39.1 | ) |

| | |

| |

| |

| |

| |

| | Loss before income taxes | | | (289.7 | ) | | (195.5 | ) | | (146.1 | ) | | (120.4 | ) |

| Income tax benefit (expense) | | | 6.6 | | | 33.2 | | | (7.4 | ) | | (8.3 | ) |

| Minority interest in subsidiaries | | | 72.6 | | | 0.1 | | | — | | | — | |

| | |

| |

| |

| |

| |

| | Loss from continuing operations | | $ | (210.5 | ) | $ | (162.2 | ) | $ | (153.5 | ) | $ | (128.7 | ) |

| | |

| |

| |

| |

| |

| Other Data: | | | | | | | | | | | | | |

| EBITDA(g) | | | 478.1 | | | 706.4 | | $ | 76.2 | | $ | 185.1 | |

| Depreciation and amortization | | | 303.2 | | | 412.8 | | | 96.3 | | | 156.6 | |

| Capital expenditures | | | 160.3 | | | 262.4 | | | 64.6 | | | 71.9 | |

| Ratio of earnings to fixed charges(c) | | | — | | | — | | | — | | | — | |

| Balance Sheet Data (at period end): | | | | | | | | | | | | | |

| Net working capital(d) | | $ | 777.9 | | | | | $ | 341.3 | | | | |

| Total assets | | | 7,478.3 | | | | | | 2,510.1 | | | | |

| Long-term debt(e) | | | 5,666.2 | | | | | | 1,897.2 | | | | |

| Minority interests | | | 104.8 | | | | | | — | | | | |

| Total liabilities | | | 7,462.7 | | | | | | 2,598.4 | | | | |

| Total equity (deficit) | | | (89.2 | ) | | | | | (88.3 | ) | | | |

- (a)

- On May 9, 2003, HMP completed the HIH Consolidation Transaction. As a result, as of May 9, 2003, HMP directly and indirectly owns 100% of the HIH membership interests. Prior to May 1, 2003, we accounted for our investment in HIH using the equity method of accounting due to the significant management participation rights formerly granted to ICI pursuant to the HIH limited liability company agreement. As a consequence of HMP's 100% direct and indirect ownership of HIH and the resulting termination of ICI's management participation rights, we are considered to have a controlling financial interest in HIH. Accordingly, we no longer account for HIH using the equity method of accounting, but effective May 1, 2003 HIH is consolidated with Huntsman LLC, with HMP's 40% interest in HIH recorded as a minority interest. Consequently, results of HIH through April 30, 2003 are recorded using the equity method of accounting, and results of HIH beginning May 1, 2003 are recorded on a consolidated basis. As a result, the summary historical financial data for periods ending prior to May 1, 2003 are not comparable to financial periods ending on or after May 1, 2003.

19

- (b)

- EBITDA is defined as net loss before interest, taxes, depreciation and amortization. EBITDA is included in this prospectus because it is a basis on which we assess our financial performance and debt service capabilities, and because certain covenants in our borrowing arrangements are tied to similar measures. However, EBITDA should not be considered in isolation or viewed as a substitute for cash flow from operations, net income or other measures of performance as defined by accounting principles generally accepted in the United States or as a measure of a company's profitability or liquidity. We understand that while EBITDA is frequently used by security analysts, lenders and others in their evaluation of companies, EBITDA as used herein is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the method of calculation. See "Note 17—Operating Segment Information" of the consolidated financial statements of Huntsman LLC and subsidiaries. The following table reconciles our loss from continuing operations to EBITDA.

| | Historical

| |

|---|

| | Nine Months Ended

September 30,

| | Year Ended

December 31,

| |

|---|

| | 2003

| | 2002

| | 2002

| | 2001

| | 2000

| |

|---|

| | (Dollars in Millions)

| |

|---|

| Net loss | | $ | (192.4 | ) | $ | (141.4 | ) | $ | (202.4 | ) | $ | (842.8 | ) | $ | (138.6 | ) |

| Depreciation and amortization | | | 212.1 | | | 113.9 | | | 152.7 | | | 197.5 | | | 200.3 | |

| Interest expense, net | | | 261.3 | | | 164.3 | | | 192.7 | | | 239.3 | | | 208.6 | |

| Income tax expense (benefit) | | | (4.2 | ) | | 7.2 | | | 8.5 | | | (184.9 | ) | | (81.2 | ) |

| | |

| |

| |

| |

| |

| |

| EBITDA | | $ | 276.8 | | $ | 144.0 | | $ | 151.5 | | $ | (590.9 | ) | $ | 189.1 | |

| | |

| |

| |

| |

| |

| |

- (c)

- The ratio of earnings to fixed charges has been calculated by dividing (A) the sum of pretax income (loss) from continuing operations before minority interest and equity income (loss), fixed charges, amortization of capitalized interest, and distributed income to equity investees less interest capitalized, preference security dividend requirements of consolidated subsidiaries, and minority interest in pretax income of subsidiaries that have not incurred fixed charges by (B) fixed charges. Fixed charges are equal to interest expense (including amortization of deferred financing costs) plus the portion of rent expense estimated to represent interest. Earnings for the nine months ended September 30, 2003 and 2002 and the years ended December 31, 2002, 2001 and 2000 were insufficient to cover fixed charges by $181.8, $95.5, $144.0, $974.6 and $283.3, respectively. Pro forma consolidated earnings for the nine months ended September 30, 2003 and the year ended December 31, 2002 were insufficient to cover fixed charges by $290.4 and $197.5, respectively. Pro forma restricted group earnings for the nine months ended September 30, 2003 and the year ended December 31, 2002 were insufficient to cover fixed charges by $94.8 and $82.0, respectively.

- (d)

- Net working capital represents total current assets less total current liabilities, excluding cash and the current portion of long-term debt.

- (e)

- Long-term debt includes the current portion of long-term debt.

- (f)

- The summary pro forma restricted group financial data reflects the Minority Interests Acquisition as if the acquisitions had occurred on January 1, 2002. Revenues of the previously unconsolidated companies involved in the Minority Interests Acquisition for the period prior to the acquisition date of September 30, 2002 were $104.0 million for the year ended December 31, 2002. EBITDA of the previously unconsolidated companies involved in the Minority Interests Acquisition for the period prior to the acquisition date of September 30, 2002 was $5.8 million for the year ended December 31, 2002. The summary pro forma restricted group financial data does not purport to be indicative of the combined results of operations of future periods or indicative of results that would have occurred had the Minority Interests Acquisition been consummated on the dates

20

indicated. This restricted group pro forma financial data reflects the transactions described above and accounts for the 60% equity ownership of HIH by Huntsman LLC using the equity method of accounting for all periods presented.

- (g)

- EBITDA is defined as net loss before interest, taxes, depreciation and amortization. EBITDA is included in this document because it is a basis on which we assess our financial performance and debt service capabilities, and because certain covenants in our borrowing arrangements are tied to similar measures. However, EBITDA should not be considered in isolation or viewed as a substitute for cash flow from operations, net income or other measures of performance as defined by GAAP or as a measure of a company's profitability or liquidity. We understand that while EBITDA is frequently used by security analysts, lenders and others in their evaluation of companies, EBITDA as used herein is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the method of calculation. The following table reconciles our pro forma consolidated group and pro forma restricted group loss from continuing operations to EBITDA.

| | Pro Forma Consolidated Group

| | Pro Forma Restricted Group

| |

|---|

| | Nine Months

Ended

September 30,

2003

| | Year Ended

December 31,

2002

| | Nine Months

Ended

September 30,

2003

| | Year Ended

December 31,

2002

| |

|---|

| | (Dollars in millions)

| |

|---|

| Net loss | | $ | (210.5 | ) | $ | (162.2 | ) | $ | (153.5 | ) | $ | (128.7 | ) |

| Depreciation and amortization | | | 303.2 | | | 412.8 | | | 96.3 | | | 156.6 | |

| Interest expense, net | | | 392.0 | | | 489.0 | | | 126.0 | | | 148.9 | |

| Income tax expense (benefit) | | | (6.6 | ) | | (33.2 | ) | | 7.4 | | | 8.3 | |

| | |

| |

| |

| |

| |

| EBITDA | | $ | 478.1 | | $ | 706.4 | | $ | 76.2 | | $ | 185.1 | |

| | |

| |

| |

| |

| |

21

RISK FACTORS

You should carefully consider the risks described below in addition to all other information provided to you in this prospectus before participating in this exchange offer. The risks described below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially and adversely affect our business, financial condition or results of operations.

Risks Related to Our Business

We have substantial debt that we may be unable to service and that restricts our activities, which could adversely affect our ability to meet our obligations.

As of September 30, 2003, on a pro forma basis, we had total outstanding indebtedness of $5,666.2 million, and on a pro forma restricted group basis we had total outstanding indebtedness of $1,897.2 million (including the current portion of long-term debt). We require substantial capital to finance our operations and continued growth, and we incur substantial additional debt from time to time for a variety of purposes. However, the HLLC Credit Facilities contain restrictive covenants. Among other things, these covenants restrict our ability to incur more debt, make prepayments of other debt, pay dividends, redeem stock or make other distributions, issue capital stock, make investments, create liens, enter into transactions with affiliates, enter into sale and leaseback transactions, and merge or consolidate and transfer or sell assets.

The degree to which we have outstanding debt could have important consequences for our business, including:

- •

- a substantial portion of the cash flow from our operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes;

- •

- our ability to obtain additional financing may be constrained due to our existing level of debt;

- •

- a high degree of debt will make us more vulnerable to a downturn in our business or the economy in general; and

- •

- part of our debt is, and any future debt may be, subject to variable interest rates, which makes us vulnerable to increases in interest rates.

If we are unable to generate sufficient cash flow and are unable to obtain the funds required to meet payments of principal and interest on our indebtedness, or if we otherwise fail to comply with the various covenants in the instruments governing our indebtedness, including those under the HLLC Credit Facilities and the indenture governing the notes, we could be in default under the terms of those agreements. In the event of a default, a holder of the indebtedness could elect to declare all the funds borrowed under those agreements to be due and payable together with accrued and unpaid interest, the lenders under the HLLC Credit Facilities could elect to terminate their commitments thereunder and we could be forced into bankruptcy or liquidation. Any of the foregoing consequences could materially adversely affect our results of operations and financial condition.

In addition, our unrestricted subsidiary, HIH and its subsidiaries, have substantial indebtedness. Although none of such indebtedness is recourse to us or any of our restricted subsidiaries, the consequences to HIH of such indebtedness could be similar to those described above. Further, the senior credit facilities and other indebtedness of HIH and its subsidiaries contain restrictive covenants, which prohibit or otherwise limit HIH and its subsidiaries from paying dividends or making certain other payments to Huntsman LLC and its restricted subsidiaries.

22

Demand for some of our products is cyclical and we may experience prolonged depressed market conditions for our products.

A substantial portion of our revenue is attributable to sales of commodity products, including most of the products of our Base Chemicals, Polymers and Pigments businesses, which generated approximately 51% of our revenue for the nine months ended September 30, 2003 on a pro forma basis. Historically, the prices for our commodity products have been cyclical and sensitive to relative changes in supply and demand, the availability and price of feedstocks and general economic conditions. Our other products may be subject to these same factors, but, typically, the impact of these factors is greatest on our commodity products.

Historically, the markets for many of our products, particularly our commodity products, have experienced alternating periods of tight supply, causing prices and profit margins to increase, followed by periods of capacity additions, resulting in oversupply and declining prices and profit margins. Currently, several of our markets are experiencing periods of oversupply, and the pricing of our products in these markets is depressed. We cannot guarantee that future growth in demand for these products will be sufficient to alleviate any existing or future conditions of excess industry capacity or that such conditions will not be sustained or further aggravated by anticipated or unanticipated capacity additions or other events.

Significant price volatility of many of our raw materials may result in increased costs.

The prices for a large portion of our raw materials are cyclical. While we frequently enter into supply agreements, as is the general practice in our industries, these agreements typically provide for market-based pricing. As a result, our supply agreements provide only limited protection against price volatility. Recently, prices for crude oil and natural gas based feedstocks have fluctuated dramatically. While we attempt to match cost increases with corresponding product price increases, we are not always able to immediately raise product prices, and, ultimately, our ability to pass on underlying cost increases to our customers is greatly dependent upon market conditions. Any underlying cost increase that we are not able to pass on to our customers could have a material adverse effect on our business, financial condition, results of operations and cash flows.

The industries in which we compete are highly competitive and we may not be able to compete effectively with our competitors that are larger and have greater resources.

The industries in which we operate are highly competitive. Among our competitors are some of the world's largest chemical companies and major integrated petroleum companies that have their own raw material resources. Some of these companies may be able to produce products more economically than we can. In addition, many of our competitors are larger and have greater financial resources, which may enable them to invest significant capital into their businesses, including expenditures for research and development. If any of our current or future competitors develops proprietary technology that enables them to produce products at a significantly lower cost, our technology could be rendered uneconomical or obsolete. Moreover, certain of our businesses use technology that is widely available. Accordingly, barriers to entry, apart from capital availability, are low in certain product segments of our business, and the entrance of new competitors into the industry may reduce our ability to capture improving profit margins in circumstances where capacity utilization in the industry is increasing. Further, petroleum-rich countries have become more significant participants in the petrochemical industry and may expand this role significantly in the future. Any of these developments would have a significant impact on our ability to enjoy higher profit margins during periods of increased demand.

23

Pending or future litigation or legislative initiatives related to MTBE may subject us or our products to environmental liability or materially adversely affect our sales and costs.