QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on March 1, 2007

File 333-139293

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4 TO

FORM F-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

ONCOGENEX TECHNOLOGIES INC.

(Name of Registrant as specified in its Charter)

Canada

State or other Jurisdiction of

Incorporation or Organization | | 2834

Primary Standard Industrial

Classification Code Number | | N/A

I.R.S Employer

Identification No |

1001 West Broadway, Suite 400

Vancouver, British Columbia

Canada V6H 4B1

(604) 736-3678

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

DL Services Inc.

1420 Fifth Avenue, Suite 3400

Seattle, Washington 98101

(206) 903-8800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service) |

Copies of Communications to: |

Randal R. Jones

Christopher L. Doerksen

Dorsey & Whitney LLP

1420 Fifth Avenue, Suite 3400

Seattle, Washington 98101

(206) 903-8800 | J. Douglas Seppala

DuMoulin Black LLP

10th Floor — 595 Howe Street

Vancouver, BC

Canada V6C 2T5

(604) 687-1224 | R. Hector MacKay-Dunn, Q.C.

Farris, Vaughan, Wills &

Murphy LLP

25th Floor, 700 West Georgia Street

Vancouver, BC

Canada V7Y 1B3

(604) 684-9151 | Christopher J. Cummings

Shearman & Sterling LLP

Suite 4405

P.O. Box 247

Toronto, Ontario

Canada M5L 1E8

(416) 360-8484 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the United States Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated February 28, 2007

5,000,000 Shares

OncoGenex Technologies Inc.

Common Shares

This is our initial public offering. We are selling 5,000,000 of our common shares.

We expect the public offering price to be between $7.50 and $8.50 per common share. Currently, no public market exists for our common shares. The Nasdaq Global Market has approved the listing of our common shares under the symbol "OGXI" and the Toronto Stock Exchange has conditionally approved the listing of our common shares under the symbol "OGX".

Investing in our common shares involves risks that are described in the "Risk Factors" section beginning on page 9 of this prospectus.

| | Price to Public

| | Underwriting Discount

| | Net Proceeds to Us

|

|---|

| Per common share | | $ | | | $ | | | $ | |

| Total | | $ | | | $ | | | $ | |

The underwriters may also purchase up to an additional 750,000 common shares from us, at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The common shares will be ready for delivery on or about , 2007.

RBC CAPITAL MARKETS

| NEEDHAM & COMPANY, LLC | | LAZARD CAPITAL MARKETS |

CANACCORD ADAMS INC. |

|

SUSQUEHANNA FINANCIAL GROUP, LLLP |

The date of this prospectus is , 2007.

TABLE OF CONTENTS

| | Page

|

|---|

| Prospectus Summary | | 1 |

| The Offering | | 6 |

| Summary Consolidated Financial Data | | 7 |

| Risk Factors | | 9 |

| Special Note Regarding Forward-Looking Statements | | 34 |

| Use of Proceeds | | 35 |

| Dividend Policy | | 36 |

| Consolidated Capitalization | | 37 |

| Dilution | | 38 |

| Selected Consolidated Financial Data | | 40 |

| Management's Discussion and Analysis of Financial Condition and Results of Operation | | 42 |

| Business | | 53 |

| Management | | 94 |

| Principal Shareholders | | 116 |

| Certain Relationships and Related Party Transactions | | 120 |

| Description of Capital Stock | | 122 |

| Shares Eligible for Future Sale | | 131 |

| Material United States and Canadian Income Tax Consequences | | 135 |

| Underwriting | | 147 |

| Legal Matters | | 152 |

| Experts | | 152 |

| Relationship between Our Company and Certain Underwriters | | 152 |

| Expenses of the Offering | | 153 |

| Where You Can Find More Information | | 153 |

| Prior Sales | | 154 |

| Reorganization | | 154 |

| Material Contracts | | 154 |

| Promoters | | 155 |

| Eligibility for Investment | | 155 |

| Purchasers' Statutory Rights | | 156 |

| Index to Consolidated Financial Statements | | F-1 |

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, unless otherwise specified, all monetary amounts are in United States dollars. To the extent such monetary amounts have been derived from our consolidated financial statements, they have been translated into United States dollars in accordance with our accounting policies as described therein. Unless otherwise indicated, all other Canadian dollar, or C$, amounts have been translated into United States dollars at the February 23, 2007 noon buying rate published by the Federal Reserve Bank of New York, being US$1.00 = C$1.1586.

PROSPECTUS SUMMARY

This summary does not contain all of the information you should consider before buying our common shares. You should read the entire prospectus carefully, especially the "Risk Factors" section, the "Special Note Regarding Forward-Looking Statements" section and our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common shares.

OncoGenex Technologies Inc.

Our Company

We are a biopharmaceutical company committed to the development and commercialization of new cancer therapies that address treatment resistance in cancer patients. Our product candidates are being developed to block the production of specific proteins associated with the development of treatment resistance, which we believe will increase survival time and improve the quality of life for cancer patients.

In response to many cancer therapies (including hormone ablation therapy, chemotherapy and radiation therapy), tumor cells become stressed and increase production of certain proteins. These proteins cause tumor cells to become resistant to the cancer therapies and promote the survival of tumor cells. Therefore, in spite of the initial effectiveness of cancer therapies, many patients develop treatment resistance and the patients die due to the lack of an effective therapy.

We currently have three product candidates in development: OGX-011, OGX-427 and OGX-225. These product candidates are designed to selectively inhibit the production of proteins that are associated with treatment resistance and that are over-produced in response to a variety of cancer treatments. Our aim in targeting these particular proteins is to disable the tumor cell's adaptive defenses, render the tumor cells susceptible to attack with a variety of cancer therapies, including chemotherapy, and facilitate tumor cell death.

Cancer is a group of diseases characterized by the uncontrolled growth and spread of abnormal cells. Cancer growth can cause tissue damage, organ failure and, ultimately, death. In North America, cancer is expected to strike one in two men and one in three women in their lifetimes and has recently surpassed heart disease as the leading cause of death in the United States. Our product candidates are currently being developed for use in the treatment of prostate, non-small cell lung, breast, ovarian and bladder cancers and multiple myeloma. Collectively, these cancers account for approximately 44 percent of the cancer deaths in the United States each year.

Product Development Programs

While we are encouraged by the results of our clinical trials to-date, we will need to conduct additional clinical trials for each of our product candidates in order to generate the safety and efficacy data needed to support an application with the FDA and regulatory agencies in other countries. Successful early clinical trials do not ensure that later clinical trials will also be successful.

Our Lead Product Candidate, OGX-011

The development program for our lead product candidate, OGX-011, is focused on reducing clusterin production to enhance treatment sensitivity and delay tumor progression in patients who

1

have not fully developed treatment resistance and to restore treatment sensitivity in patients who have developed treatment resistance. Clusterin is a cell survival protein that is over-produced in several cancer indications and in response to many cancer treatments, including hormone ablation therapy, chemotherapy and radiation therapy. Increased clusterin production is observed in many human cancers, including prostate, non-small cell lung, breast, ovarian, bladder, renal, pancreatic, anaplastic large cell lymphoma and colon cancers and melanoma. Increased clusterin production is linked to faster rates of cancer progression, treatment resistance and shorter survival duration.

A broad range of pre-clinical studies conducted by the Prostate Centre at Vancouver General Hospital, or the Prostate Centre, and others have shown that reducing clusterin production facilitates tumor cell death by sensitizing human prostate, non-small cell lung, breast, ovarian, bladder, renal, and melanoma tumor cells to chemotherapy. Pre-clinical studies conducted by the Prostate Centre and others also indicate that reducing clusterin production sensitizes prostate tumor cells to hormone ablation therapy and sensitizes prostate and non-small cell lung tumor cells to radiation therapy.

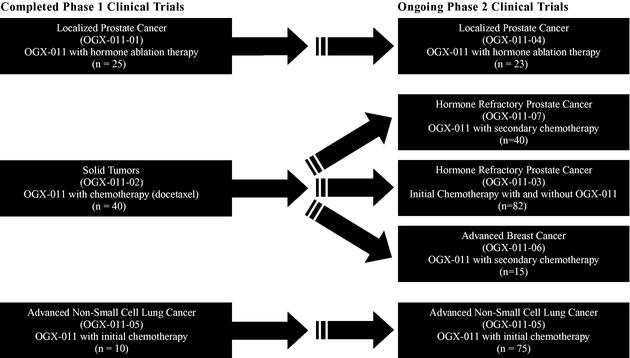

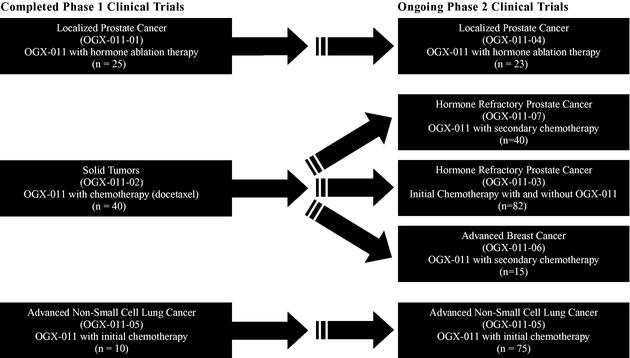

Three phase 1 clinical trials, involving a total of 75 patients, have been completed with OGX-011. In all of these clinical trials, OGX-011 was well tolerated by the patients, some of whom have experienced various adverse events, the majority of which are associated with other treatments in the protocol and the disease. The majority of adverse events were mild and the most common adverse events consisted of flu-like symptoms.

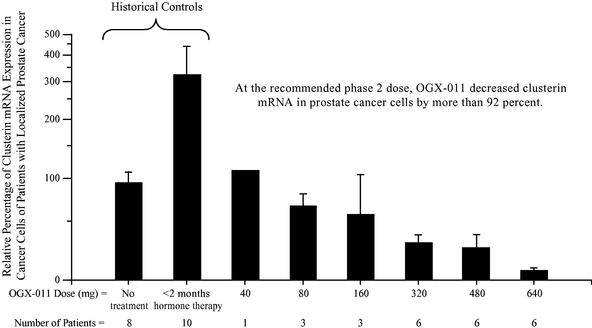

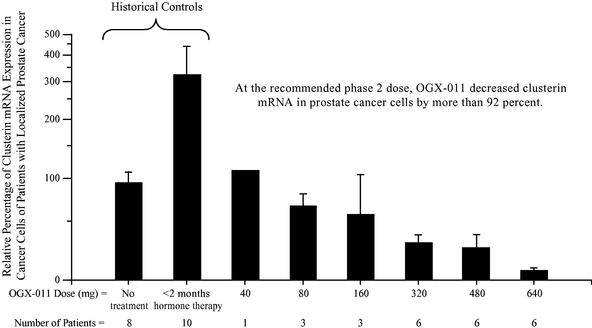

In the first phase 1 clinical trial, OGX-011 was intravenously administered once per week in combination with hormone ablation therapy to 25 patients with localized prostate cancer in advance of surgery to remove the prostate gland to evaluate safety and to determine drug concentration and clusterin inhibition in the prostate gland. Six different doses of OGX-011 were evaluated ranging from 40 mg per patient per dose to 640 mg per patient per dose. This clinical trial showed that OGX-011 reduced clusterin mRNA levels in both prostate cancer tissue and lymph node tissue in a dose dependent manner which was statistically significant (PTrend = 0.008 and PTrend<0.001, respectively) in each case. This clinical trial also showed that OGX-011 increased prostate tumor cell death in a dose dependent manner which was statistically significant (PTrend<0.001). A PTrend value of less than 0.05 was deemed statistically significant. At the 640 mg dose, OGX-011 reduced clusterin mRNA by approximately 92 percent in prostate cancer tissue and approximately 98 percent in lymph node tissue, and more than doubled the number of prostate tumor cells undergoing cell death compared to hormone ablation therapy alone. OGX-011 was well-tolerated and there were no serious adverse events reported. The most common adverse events were a mild suppression of white blood cell counts, flu-like symptoms and mild elevations in liver enzyme levels.

In the second phase 1 clinical trial, OGX-011 was intravenously administered once per week in combination with docetaxel chemotherapy to 40 patients with solid tumors known to express clusterin. Six different doses of OGX-011 were evaluated ranging from 40 mg per patient per dose to 640 mg per patient per dose. This clinical trial showed that serum clusterin levels dropped in patients while on treatment with 640 mg OGX-011 in combination with docetaxel. A statistical analysis was not performed. Ten patients experienced 13 serious adverse events. Six of the 13 serious adverse events were attributed to the combination of OGX-011 and the chemotherapy.

In the third phase 1 clinical trial, OGX-011 was intravenously administered once per week in combination with two commonly used chemotherapeutic agents to 10 patients with advanced non-small cell lung cancer. Two different doses of OGX-011 were evaluated ranging from 480 mg

2

per patient per dose to 640 mg per patient per dose. The one-year survival rate for all ten patients was 60 percent and for patients that received at least one dose of OGX-011 in combination with these chemotherapies was approximately 67 percent. This compares with results from prior published phase 3 clinical trials which reported one-year survival rates of 33 to 43 percent for patients that received chemotherapy treatment alone. Statistical analysis for treatment response was not performed. Five serious adverse events were reported in four of the 10 patients evaluated. All of the serious adverse events were attributed to the chemotherapy or disease, except for one case of elevated creatinine and one case of fever with a reduced number of cells of a specific white blood cell type which were both attributed to the combination of OGX-011 and the chemotherapeutic agents.

OGX-011 is currently in five phase 2 clinical trials investigating the potential to improve treatment outcomes for patients with prostate cancer, non-small cell lung cancer and breast cancer. We are conducting these clinical trials in parallel, rather than sequentially, to accelerate our evaluation of OGX-011 in several cancer indications and in combination with several treatment regimes, which will accelerate our assessment of these indications and combinations for further development. We plan to evaluate the results of our ongoing phase 2 clinical trials to determine which cancer indications and which treatment combinations demonstrate promise and we will design our phase 3 clinical trials accordingly. We have completed enrollment of four of our five phase 2 clinical trials and we expect that data from all five phase 2 clinical trials will be available by the end of 2007.

OGX-011 is being developed to work in combination with therapies that are broadly used by clinicians and considered highly effective in the treatment of each cancer indication that we are targeting with the intent of delaying treatment resistance to those therapies. Since production of clusterin and the resulting treatment resistance occurs in an array of cancer indications and in response to a variety of cancer treatments, we believe that our development options for OGX-011 are numerous.

Our Second Product Candidate, OGX-427

The development program for our second product candidate, OGX-427, is focused on reducing heat shock protein 27 (Hsp27) production to enhance treatment sensitivity and delay tumor progression in patients who have not fully developed treatment resistance and to restore treatment sensitivity in patients who have developed treatment resistance. Hsp27 is a cell survival protein that is over-produced in response to many cancer treatments, including hormone ablation therapy, chemotherapy and radiation therapy. Increased Hsp27 production is observed in many human cancers, including prostate, non-small cell lung, breast, ovarian, bladder, renal, pancreatic, multiple myeloma and liver cancers. Increased Hsp27 production is linked to faster rates of cancer progression, treatment resistance and shorter survival duration.

A number of pre-clinical studies conducted by the Prostate Centre and others have shown that inhibiting the production of Hsp27 in human prostate, breast, ovarian, pancreatic and bladder tumor cells sensitizes the cells to chemotherapy. The Prostate Centre has also conducted pre-clinical studies that indicate that reducing Hsp27 production sensitizes prostate tumor cells to hormone ablation therapy. Pre-clinical studies conducted by the Prostate Centre and others have shown that reducing Hsp27 production induces tumor cell death in prostate, breast, non-small cell lung, bladder and pancreatic cancers.

3

We intend to file our investigational new drug application for OGX-427 in early 2007 and begin dosing patients in our initial phase 1 clinical trial by mid-2007.

Our Third Product Candidate, OGX-225

The development program for our third product candidate, OGX-225, is focused on reducing the production of both insulin-like growth factor binding protein-2 (IGFBP-2) and insulin-like growth factor binding protein-5 (IGFBP-5) with a single product to enhance treatment sensitivity and delay tumor progression in patients who are resistant to hormone ablation therapy. In the treatment of cancers that require hormones for growth, clinicians use hormone ablation therapy to inhibit the production of the primary hormone (e.g., testosterone or estrogen) required for tumor growth. While tumors often regress initially following hormone ablation therapy, IGFBP-2 or IGFBP-5 make an alternate hormone, insulin-like growth factor-1, or IGF-1, available to the tumor that facilitates continued tumor growth. By inhibiting the production of IGFBP-2 and IGFBP-5, the tumor's access to IGF-1 is reduced and tumor growth is delayed.

Increased IGFBP-2 or IGFBP-5 production is observed in several cancers, including prostate, non-small cell lung, breast, ovarian, bladder, pancreatic and colon cancers, acute myeloid leukemia, acute lymphoblastic leukemia, neuroblastoma, glioma and melanoma. Increased IGFBP-2 or IGFBP-5 production is linked to faster rates of cancer progression, treatment resistance and shorter survival duration.

Pre-clinical studies conducted by the Prostate Centre and others in human prostate, bladder, glioma and breast cancer, have shown that reducing IGFBP-2 and IGFBP-5 production with OGX-225 induced tumor cell death or sensitized all of these tumor types to chemotherapy. We intend to continue to evaluate OGX-225 in pre-clinical studies to assess its ability to inhibit or delay progression of hormone-dependent and other tumors.

Our Approach to Treatment Resistance

We are focused on inhibiting the processes by which cancers develop treatment resistance. Our current product candidates are designed to target and selectively inhibit the production of proteins that facilitate the survival and growth of tumor cells. A protein's influence in the body can be inhibited by either interfering with its structure and function, or by disrupting its production; however, the structure of certain proteins, such as clusterin and Hsp27, have not been solved and hence are difficult to inhibit by interfering with their structure or function. For this reason, we are focusing on disrupting the production of these proteins. We have chosen to disrupt the production of these proteins using "second-generation" antisense technology because we believe that it is the most effective means of disrupting production of these proteins. To facilitate this approach, our protein production inhibitors have been combined with Isis Pharmaceuticals, Inc.'s second- generation antisense chemistry to overcome the limitations of first-generation antisense technology.

Our Strategy

- •

- Focus on developing and commercializing new cancer therapies to inhibit treatment resistance in cancer patients.

- •

- Focus on enhancing the effectiveness of broadly used cancer therapeutics through combination with OGX-011.

4

- •

- Accelerate the assessment of OGX-011 by conducting concurrent clinical trials in multiple indications.

- •

- Advance our product pipeline by conducting clinical trials across multiple cancer indications for each of OGX-427 and OGX-225.

- •

- Optimize the development of our product candidates through use of outsourcing and internal expertise.

- •

- Selectively establish collaborations that expand capabilities and accelerate development and marketing of our product candidates.

Risk Factors

Investing in our common shares involves substantial risk. In executing our business strategy we face significant risks and uncertainties, which are highlighted in the section entitled "Risk Factors". These risks include the following:

- •

- We are not profitable and have incurred significant net losses in each year since our inception. As of September 30, 2006, we had incurred cumulative losses before taxes of $19.9 million, and we expect to incur losses for the foreseeable future.

- •

- In order to successfully implement our strategy, we will need to raise substantial additional capital to support our operations for a number of years while we continue our research activities and pursue the development of, and regulatory approval for, our product candidates.

- •

- All of our product candidates are subject to regulatory approval by the U.S. Food and Drug Administration and comparable agencies in other countries. None of our product candidates have completed the expensive and lengthy clinical trials required for obtaining regulatory approval.

- •

- If we are unable to develop, receive regulatory approval for and successfully commercialize any of our product candidates, we will be unable to generate significant revenues, and we may never become profitable.

Company Information

We were incorporated under the Canada Business Corporations Act, or CBCA, on May 26, 2000 as 3766284 Canada Inc. We changed our named to OncoGenex Technologies Inc. on July 6, 2000. We have one wholly-owned subsidiary: OncoGenex, Inc., a corporation incorporated under the laws of the State of Washington. Unless the context otherwise requires, any reference to "OncoGenex", "the Company", "we", "our" and "us" in this prospectus refers to OncoGenex Technologies Inc. and our subsidiary. Our principal place of business is at 1001 West Broadway, Suite 400, Vancouver, British Columbia, V6H 4B1. Our telephone number is (604) 736-3678 and our facsimile number is (604) 736-3687. We also maintain a web site atwww.oncogenex.ca. The information contained in, or that can be accessed through, our web site is not a part of this prospectus.

5

THE OFFERING

| Common shares we are offering | | 5,000,000 shares |

Common shares to be outstanding after this offering |

|

16,079,738 shares |

Use of proceeds |

|

We estimate that our net proceeds from this offering will be $35.2 million at an assumed initial public offering price of $8.00 per share, after deducting underwriting discounts and commissions and estimated offering expenses. We plan to use the net proceeds from this offering to fund the further development and expansion of our product candidates and other working capital and general corporate purposes. See "Use of Proceeds". |

Nasdaq Global Market symbol |

|

"OGXI" |

Toronto Stock Exchange symbol |

|

"OGX" |

The number of our common shares to be outstanding immediately after this offering is based on 11,079,738 common shares outstanding as of February 28, 2007 after giving effect to the conversion of all of our outstanding classes and series of preferred shares as described under the heading "Reorganization", and excludes:

- •

- 1,423,147 common shares issuable upon the exercise of stock options outstanding, with a weighted average exercise price of C$0.92 per share; and

- •

- 482,410 common shares reserved for future stock option grants under our 2006 Stock Incentive Plan.

Except as otherwise noted, all of the information presented in this prospectus is based on the assumption that the Reorganization has been implemented and that the underwriters will not have exercised their overallotment option. In addition, all historical share numbers have been adjusted retroactively to give effect to the one-for-five share consolidation we completed on September 23, 2003. See "Description of Capital Stock".

6

SUMMARY CONSOLIDATED FINANCIAL DATA

In the table below we provide a summary of our historical financial data. We have prepared this data using our audited consolidated financial statements for the years ended December 31, 2001, 2002, 2003, 2004 and 2005 and our unaudited interim consolidated financial statements for the nine months ended September 30, 2005 and 2006 and for the period from May 26, 2000 (inception) to September 30, 2006. You should read this data together with our consolidated financial statements, including the related notes, and "Management's Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this prospectus. Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States. The summary consolidated balance sheet data is presented on an actual basis and on an as adjusted basis to reflect the sale of the 5,000,000 common shares offered at an assumed initial public offering price of $8.00 per share, after deducting underwriting discounts and commissions and estimated offering expenses and the conversion of all our series preferred shares into an aggregate of 9,794,238 common shares pursuant to the Reorganization.

| |

| |

| |

| |

| |

| | Nine Months Ended

September 30,

| | Period from

May 26, 2000

(Inception) to

September 30

2006

| |

|---|

| | Year Ended December 31,

| |

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2006

| | 2005

| |

|---|

| | (In thousands, except share and per share amounts)

| |

|---|

| Consolidated Statements of Loss Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Research and development | | $ | 3,143 | | $ | 2,778 | | $ | 1,381 | | $ | 1,124 | | $ | 253 | | $ | 6,822 | | $ | 1,857 | | $ | 15,502 | |

| | General and administrative (1) | | | 1,523 | | | 930 | | | 487 | | | 249 | | | 65 | | | 1,553 | | | 1,128 | | | 4,813 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Total expenses | | | 4,666 | | | 3,708 | | | 1,868 | | | 1,373 | | | 318 | | | 8,375 | | | 2,985 | | | 20,315 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Interest income | | | 313 | | | 199 | | | 41 | | | 17 | | | — | | | 357 | | | 160 | | | 928 | |

| | Other | | | (144 | ) | | (156 | ) | | (99 | ) | | — | | | — | | | (111 | ) | | (139 | ) | | (510 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Total other income (expense) | | | 169 | | | 43 | | | (58 | ) | | 17 | | | — | | | 246 | | | 21 | | | 418 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Loss for the period before taxes | | $ | 4,497 | | $ | 3,665 | | $ | 1,926 | | $ | 1,356 | | $ | 318 | | $ | 8,129 | | $ | 2,964 | | $ | 19,897 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Tax Expense | | $ | 432 | | $ | 346 | | $ | — | | $ | — | | $ | — | | $ | 473 | | $ | 274 | | $ | 1,251 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Net Loss | | $ | 4,929 | | $ | 4,011 | | $ | 1,926 | | $ | 1,356 | | $ | 318 | | $ | 8,602 | | $ | 3,238 | | $ | 21,148 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Redeemable convertible preferred share accretion | | $ | 1,843 | | $ | 1,248 | | $ | 385 | | $ | 129 | | $ | 3 | | $ | 1,912 | | $ | 1,202 | | $ | 5,520 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Loss attributable to common shareholders | | $ | 6,772 | | $ | 5,259 | | $ | 2,311 | | $ | 1,485 | | $ | 321 | | $ | 10,514 | | $ | 4,440 | | $ | 26,668 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Basic and diluted loss per common share | | $ | 5.43 | | $ | 4.55 | | $ | 2.01 | | $ | 1.46 | | $ | 0.35 | | $ | 8.18 | | $ | 3.59 | | $ | 25.19 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Weighted average number of common shares | | | 1,248,158 | | | 1,155,500 | | | 1,148,925 | | | 1,018,958 | | | 906,050 | | | 1,285,500 | | | 1,235,573 | | | 1,058,755 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Pro forma basic and diluted loss per common share (2) | | $ | 0.81 | | $ | 0.83 | | $ | 0.87 | | $ | 0.93 | | $ | 0.35 | | $ | 0.95 | | $ | 0.60 | | $ | 5.95 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Pro forma weighted average number of common shares (2) | | | 8,365,079 | | | 6,374,239 | | | 2,648,968 | | | 1,589,776 | | | 919,066 | | | 11,079,738 | | | 7,450,248 | | | 4,485,061 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| (1) Includes stock-based compensation expense as follows: | |

|

|

$ |

55 |

|

$ |

40 |

|

$ |

15 |

|

$ |

5 |

|

$ |

— |

|

$ |

144 |

|

$ |

40 |

|

$ |

260 |

|

| | |

| |

| |

| |

| |

| |

| |

| |

| |

(2) Pro forma figures retroactively give effect to the Reorganization. See "Reorganization". |

|

7

| | As of December 31, 2005

| | As of September 30, 2006

| |

|---|

| | Actual

| | Pro Forma As

Adjusted(4)

| | Actual

| | Pro Forma As

Adjusted(4)

| |

|---|

| | (In thousands)

| | (In thousands)

| |

|---|

| Consolidated Balance Sheet Data | | | | | | | | | | | | | |

| Cash, cash equivalents, short-term investments and long-term investments (3) | | $ | 18,369 | | $ | 53,589 | | $ | 11,040 | | $ | 46,260 | |

| Working capital | | | 14,037 | | | 49,257 | | | 9,994 | | | 45,214 | |

| Total assets | | | 19,750 | | | 54,970 | | | 13,533 | | | 48,753 | |

| Net assets | | | 17,998 | | | 53,218 | | | 10,174 | | | 45,394 | |

| Series preferred shares | | | 31,825 | | | — | | | 33,737 | | | — | |

| Common shares | | | 399 | | | 67,444 | | | 399 | | | 69,356 | |

| Deficit accumulated during the development stage | | | (16,154 | ) | | (16,154 | ) | | (26,668 | ) | | (26,668 | ) |

| Total shareholders' equity (deficiency) | | | (13,827 | ) | | 21,393 | | | (23,563 | ) | | 11,657 | |

- (3)

- Investments with maturities greater than one year are classified as long-term investments.

- (4)

- Assumes completion of the offering and the Reorganization. See "Reorganization".

8

RISK FACTORS

Investing in our common shares involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this prospectus, before deciding to invest in our common shares. If any of the following risks materialize, our business, financial condition, results of operation and future prospects will likely be materially and adversely affected. In that event, the market price of our common shares could decline and you could lose all or part of your investment.

Risks Related to Our Business

We have a limited operating history, have incurred losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We have never had any products available for commercial sale and we may never achieve or sustain profitability.

We are a clinical-stage biopharmaceutical company with a limited operating history. We are not profitable and have incurred losses in each year since our inception in 2000. We have never had any products available for commercial sale and we have not generated any revenue from product sales. We do not anticipate that we will generate revenue from the sale of products for the foreseeable future. We have not yet submitted any products for approval by regulatory authorities. We continue to incur research and development and general and administrative expenses related to our operations. Our loss before taxes for the years ended December 31, 2003, 2004 and 2005 was $1.9 million, $3.7 million and $4.5 million, respectively. As of September 30, 2006, we had incurred cumulative losses before taxes of $19.9 million. We expect to continue to incur losses for the foreseeable future, and we expect these losses to increase as we continue our research activities and conduct development of, and seek regulatory approvals for, our product candidates, and prepare for and begin to commercialize any approved products. If our product candidates fail in clinical trials or do not gain regulatory approval, or if our product candidates do not achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

We are highly dependent on the success of our lead product candidate, OGX-011, and we cannot give any assurance that it or any of our other product candidates will receive regulatory approval or be successfully commercialized.

OGX-011 is in several phase 2 clinical trials, which we expect will be completed by the end of 2007. In order to market OGX-011, we will have to conduct additional clinical trials, including phase 3 clinical trials, to demonstrate safety and efficacy. We have not initiated any phase 3 clinical trials with any of our product candidates. If our ongoing phase 2 clinical trials generate safety concerns or lack of efficacy, or competitive products developed by third parties show significant benefit in the cancer indications in which we are developing our product candidates, any planned phase 3 clinical trial may be delayed, altered or not initiated and OGX-011 may never receive regulatory approval or be successfully commercialized. Our other product candidates, OGX-427 and OGX-225, have not yet been tested in humans. Our pre-clinical testing of either of these product candidates may not be successful and we may be unable to initiate clinical evaluation of them. Our clinical development programs for OGX-011, OGX-427 and OGX-225 may not receive regulatory approval either if we fail to demonstrate that they are safe and effective in clinical trials and consequently fail to obtain necessary approvals from the U.S. Food and Drug Administration, or the FDA, or similar non-U.S. regulatory agencies, or if we have

9

inadequate financial or other resources to advance these product candidates through the clinical trial process. Even if our product candidates receive regulatory approval, we may not be successful in marketing them for a number of reasons, including the introduction by our competitors of more clinically-effective or cost-effective alternatives or failure in our sales and marketing efforts. Any failure to obtain approval of OGX-011 or our other product candidates, and successfully commercialize them, would have a material and adverse impact on our business.

Clinical trials may not demonstrate a clinical benefit of our product candidates.

Positive results from pre-clinical studies and early clinical trials should not be relied upon as evidence that later-stage or large-scale clinical trials will succeed. We will be required to demonstrate with substantial evidence through well-controlled clinical trials that our product candidates are safe and effective for use in a diverse population before we can seek regulatory approvals for their commercial sale. Success in early clinical trials does not mean that future clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety and efficacy to the satisfaction of the FDA and other non-U.S. regulatory authorities despite having progressed through initial clinical trials.

Even after the completion of phase 3 clinical trials, the FDA or other non-U.S. regulatory authorities may disagree with our clinical trial design and our interpretation of data, and may require us to conduct additional clinical trials to demonstrate the efficacy of our product candidates.

Failure to recruit and enroll patients for clinical trials may cause the development of our product candidates to be delayed.

We may encounter delays or rejections if we are unable to recruit and enroll enough patients to complete clinical trials. In the past, we have experienced delays enrolling patients in our clinical trials due to slower than expected approvals by ethics review boards and patient availability. We have been enrolling patients in our ongoing phase 2 clinical trials for OGX-011 as follows:

- •

- phase 2 clinical trial for hormone refractory prostate cancer patients in combination with initial chemotherapy;

- •

- phase 2 clinical trial for hormone refractory prostate cancer patients that have failed initial chemotherapy;

- •

- phase 2 clinical trial for advanced non-small cell lung cancer patients in combination with chemotherapy;

- •

- phase 2 clinical trial for localized prostate cancer in combination with hormone ablation therapy; and

- •

- phase 2 clinical trial for advanced breast cancer patients in combination with chemotherapy.

As of February 28, 2007, we have enrolled 100%, 95%, 100%, 100% and 100% of our planned number of patients, respectively, in these trials. Patient enrollment depends on many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites and the eligibility criteria for the clinical trial. Any delays in planned patient enrollment may result in delays to our product development and increased development costs, which could harm our ability to develop products.

10

Our drug development activities could be delayed or stopped.

We do not know whether any of our ongoing or planned clinical trials for OGX-011, or pre-clinical studies or clinical trials for our other product candidates, will proceed or be completed on schedule, or at all. The commencement of our planned clinical trials could be substantially delayed or prevented by several factors, including:

- •

- limited number of, and competition for, suitable patients with the particular types of cancer required for enrollment in our clinical trials;

- •

- limited number of, and competition for, suitable sites to conduct our clinical trials;

- •

- delay or failure to obtain FDA or non-U.S. regulatory agencies' approval or agreement to commence a clinical trial;

- •

- delay or failure to obtain sufficient supplies of the product candidate for our clinical trials;

- •

- delay or failure to reach agreement on acceptable clinical trial agreement terms or clinical trial protocols with prospective sites or investigators; and

- •

- delay or failure to obtain institutional review board, or IRB, approval to conduct a clinical trial at a prospective site.

The completion of our current clinical trials could also be substantially delayed or prevented by several factors, including:

- •

- slower than expected rates of patient recruitment and enrollment;

- •

- failure of patients to complete the clinical trial;

- •

- unforeseen safety issues;

- •

- lack of efficacy evidenced during clinical trials;

- •

- termination of our clinical trials by one or more clinical trial sites;

- •

- inability or unwillingness of patients or medical investigators to follow our clinical trial protocols;

- •

- inability to monitor patients adequately during or after treatment; and

- •

- introduction of competitive products that may impede our ability to retain patients in our clinical trials.

Our clinical trials may be suspended or terminated at any time by the FDA, other regulatory authorities, the IRB overseeing the clinical trial at issue, any of our clinical trial sites with respect to that site, or us. Any failure or significant delay in completing clinical trials for our product candidates could materially harm our financial results and the commercial prospects for our product candidates.

Our product candidates may cause undesirable and potentially serious side effects during clinical trials that could delay or prevent their regulatory approval or commercialization.

Three phase 1 clinical trials, involving a total of 75 patients, have been completed with OGX-011. Some of the patients experienced various adverse events, the majority of which are associated with other treatments in the protocol and the disease. The majority of adverse events were mild and the most common adverse events consisted of flu-like symptoms. Since patients in

11

our clinical trials have advanced stages of cancer, we expect additional adverse events, including serious adverse events, will occur.

Undesirable side effects caused by any of our product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or non-U.S. regulatory authorities for any or all targeted indications. This, in turn, could prevent us from commercializing our product candidates and generating revenues from their sale. In addition, if our product candidates receive marketing approval and we or others later identify undesirable side effects caused by the product:

- •

- regulatory authorities may withdraw their approval of the product;

- •

- we may be required to recall the product, change the way the product is administered, conduct additional clinical trials or change the labeling of the product;

- •

- a product may become less competitive and product sales may decrease; or

- •

- our reputation may suffer.

Any one or a combination of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase the costs and expenses of commercializing the product, which in turn could delay or prevent us from generating significant revenues from the sale of the product.

Recent events have raised questions about the safety of marketed drugs and may result in increased cautiousness by the FDA in reviewing new drugs based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals, additional clinical trials being required, or more stringent product labeling requirements. Any delay in obtaining, or inability to obtain, applicable regulatory approvals, would prevent us from commercializing our product candidates.

The success of OGX-011 is influenced by our collaboration with Isis Pharmaceuticals, Inc., or Isis, and involves a complex sharing of decisions, responsibilities, costs and benefits. The loss of Isis as a partner, or any adverse developments in the collaboration, would materially harm our business.

In November 2001, we entered into a co-development and license agreement with Isis to co-develop OGX-011, the material terms of which are described under the heading, "License and Collaboration Agreements" within the Business section of this prospectus.

We are subject to a number of risks associated with our collaboration with Isis, including:

- •

- we and Isis could disagree as to development plans, including clinical trials or regulatory approval strategy, or as to which additional indications for OGX-011 should be pursued. Disputes regarding the collaboration agreement that delay or terminate the development, commercialization or receipt of regulatory approvals of OGX-011 would harm our business and could result in significant litigation or arbitration;

- •

- Isis could fail to devote sufficient resources to the development, approval, or partnering of OGX-011;

- •

- Isis could refuse to manufacture OGX-011 or facilitate transfer of manufacturing knowledge to an alternate drug substance manufacturer;

12

- •

- Isis could fail to effectively manage its manufacturing relationships with raw materials suppliers necessary for the manufacture of OGX-011. Raw materials used in the manufacture of OGX-011 are available from a limited number of suppliers and Isis has established and maintains these relationships for OGX-011 and themselves; and

- •

- Isis may terminate our collaboration agreement upon our material breach of the collaboration agreement or our bankruptcy.

In addition, we do not currently have the resources necessary to develop and market OGX-011 on our own. Isis is currently funding 35 percent of the development costs of OGX-011. If either we or Isis do not perform our respective obligations under, or devote sufficient resources to, our collaboration, or if we and Isis do not work effectively together, OGX-011 may not be successfully commercialized, or its development may be delayed. If our collaboration were to be terminated, we may need to secure an alternative source of funding and may not be able to do so on acceptable terms, or at all.

If we fail to obtain additional financing, we may be unable to complete the development and commercialization of OGX-011 and our other product candidates, or continue our research and development programs.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to:

- •

- continue and complete the clinical development of OGX-011:

- •

- initiate and complete the clinical development of our other product candidates;

- •

- develop, license or acquire additional product candidates;

- •

- launch and commercialize any product candidates for which we receive regulatory approval; and

- •

- continue our research and development programs.

We expect that our existing capital resources, together with the proceeds from this offering, will be sufficient to fund our operations through at least early 2009. We anticipate that we will need to raise additional capital, through private placements or public offerings of our equity or debt securities, in addition to the capital provided by this offering to complete the development and commercialization of our current product candidates.

We anticipate that the cost of our first phase 3 clinical trial, including any proceeds of this offering that are used to plan and initiate our first phase 3 clinical trial, will be approximately $20 million to $40 million. The actual cost of our first phase 3 clinical trial will vary depending on a number of factors, including the cancer indication and stage of disease for which the clinical trial is undertaken, the number of patients included in the clinical trial, and the number and geographic distribution of clinical trial sites.

Many factors will affect our ability to develop our product candidates as anticipated. We may be subject to unanticipated costs or delays that would accelerate our need for additional capital or increase the costs of individual clinical trials. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the

13

development and/or commercialization of one or more of our product candidates. We also may be required to:

- •

- seek collaborators for our product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise be available; and

- •

- relinquish or license on unfavorable terms our rights to technologies or product candidates that we otherwise would seek to develop or commercialize ourselves.

If we raise additional financing, the terms of such transactions may cause dilution to existing shareholders or contain terms that are not favorable to us.

To date, our sources of cash have been limited primarily to proceeds from the private placement of our securities. In the future, we may seek to raise additional financing through private placements or public offerings of our equity or debt securities. We cannot be certain that additional funding will be available on acceptable terms, or at all. To the extent that we raise additional funds by issuing equity securities, our shareholders may experience significant dilution. Any debt financing, if available, may involve restrictive covenants, such as limitations on our ability to incur additional indebtedness, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business.

If our competitors develop and market products that are more effective, safer or less expensive than our future product candidates, our clinical trials and commercial opportunities will be negatively impacted.

The life sciences industry is highly competitive, and we face significant competition from many pharmaceutical, biopharmaceutical and biotechnology companies that are researching and marketing products designed to address cancer indications for which we are currently developing products or for which we may develop products in the future. We are aware of several other companies, including Genta Incorporated, Conforma Therapeutics Corporation, Eli Lilly and Company, Aegera Therapeutics Inc. and Gemin X Biotechnologies Inc., which are developing therapeutics that seek to promote tumor cell death by inhibiting cell survival proteins. Any products we may develop in the future are also likely to face competition from other drugs and therapies. Many of our competitors have significantly greater financial, manufacturing, marketing and drug development resources than we do. Large pharmaceutical companies, in particular, have extensive experience in clinical testing and in obtaining regulatory approvals for drugs. These companies also have significantly greater research and marketing capabilities than we do. In addition, many universities and private and public research institutes are, or may become, active in cancer research, the products of which may be in direct competition with us. If our competitors market products that are more effective, safer or less expensive than our future product candidates, if any, or that reach the market sooner than our future product candidates, if any, we may not achieve commercial success.

14

If new therapies become broadly used we may need to conduct clinical trials of our product candidates in combination with these new therapies to demonstrate safety and efficacy of the combination. Additional trials will delay the development of our product candidates and increase our costs. The failure of our product candidates to work in combination with these new therapies would have an adverse effect on our business.

Our intention is to combine our product candidates with therapies that are broadly used by clinicians and considered highly effective. As new therapies are developed we will need to assess these therapies to determine whether to conduct clinical trials of our product candidates in combination with them to demonstrate safety and efficacy of the combination. If we determine to conduct additional clinical trials of our product candidates in combination with these new therapies, the development of our product candidates will be delayed and our costs increased. If these clinical trials generate safety concerns or lack of efficacy, our business would be adversely affected.

If our product candidates become approved in combination with a specific therapy that is broadly used and that therapy becomes displaced by another product, the market for our product candidate may decrease.

If product liability lawsuits are successfully brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates.

We face an inherent risk of product liability lawsuits related to the testing of our product candidates, and will face an even greater risk if product candidates are introduced commercially. An individual may bring a liability claim against us if one of our product candidates causes, or merely appears to have caused, an injury. Because we conduct clinical trials in humans, we face the risk that the use of our product candidates will result in adverse side effects. We cannot predict the possible harms or side effects that may result from our clinical trials. Although we have clinical trial liability insurance for up to C$10 million in aggregate per annum, our insurance may be insufficient to cover any such events. We do not know whether we will be able to continue to obtain clinical trial coverage on acceptable terms, or at all. We may not have sufficient resources to pay for any liabilities resulting from a claim excluded from, or beyond the limit of, our insurance coverage. There is also a risk that third parties that we have agreed to indemnify, such as the University of British Columbia, or UBC, could incur liability. If we cannot successfully defend ourselves against a product liability claim, we may incur substantial liabilities. Regardless of merit or eventual outcome, liability claims either during clinical trials or following commercial introduction may result in:

- •

- decreased demand for our product candidates;

- •

- injury to our reputation;

- •

- withdrawal of clinical trial participants;

- •

- significant litigation costs;

- •

- substantial monetary awards to or costly settlement with patients;

- •

- product recalls;

- •

- loss of revenue; and

- •

- the inability to commercialize our product candidates.

15

We could also be adversely affected if any of our product candidates or any similar products distributed by other companies prove to be, or are asserted to be, harmful to consumers.

If we fail to acquire and develop products or product candidates at all or on commercially reasonable terms, we may be unable to grow our business.

We currently neither have nor intend to establish internal discovery capabilities and are dependent upon pharmaceutical and biotechnology companies and other researchers to sell or license products or product candidates to us. To date, our product candidates have been derived from technologies discovered by the Prostate Centre at Vancouver General Hospital, or the Prostate Centre, and licensed to us by UBC. We intend to continue to rely on the Prostate Centre, UBC and other research institutions as sources of product candidates. We cannot guarantee that the Prostate Centre or UBC will continue to develop new product candidate opportunities, that we will continue to have access to such opportunities or that we will be able to purchase or license these product candidates on commercially reasonable terms, or at all. If we are unable to purchase or license new product candidates from the Prostate Center or UBC, we will be required to identify alternative sources of product candidates.

The success of our product pipeline strategy depends upon our ability to identify, select and acquire pharmaceutical product candidates. Proposing, negotiating and implementing an economically viable product acquisition or license is a lengthy and complex process. We compete for partnering arrangements and license agreements with pharmaceutical and biotechnology companies and academic research institutions. Our competitors may have stronger relationships with third parties with whom we are interested in collaborating and/or may have more established histories of developing and commercializing products. As a result, our competitors may have a competitive advantage in entering into partnering arrangements with such third parties. In addition, even if we find promising product candidates, and generate interest in a partnering or strategic arrangement to acquire such product candidates, we may not be able to acquire rights to additional product candidates or approved products on terms that we find acceptable, or at all. If we fail to acquire and develop product candidates from UBC, or otherwise, we may be unable to grow our business.

We expect that any product candidate to which we acquire rights will require additional development efforts prior to commercial sale, including extensive clinical testing and approval by the FDA and non-U.S. regulatory authorities. All product candidates are subject to the risks of failure inherent in pharmaceutical product development, including the possibility that the product candidate will not be shown to be sufficiently safe and effective for approval by regulatory authorities. Even if the product candidates are approved, we cannot be sure that they would be capable of economically feasible production or commercial success.

If we fail to attract and retain key management and scientific personnel, we may be unable to successfully develop or commercialize our product candidates.

We will need to expand and effectively manage our managerial, operational, financial, development and other resources in order to successfully pursue our research, development and commercialization efforts for our existing and future product candidates. Our success depends on our continued ability to attract, retain and motivate highly qualified management, pre-clinical and clinical personnel, including our key management personnel, Scott Cormack, Martin Gleave, Cindy Jacobs and Stephen Anderson. The loss of the services of any of our senior management could

16

delay or prevent the commercialization of our product candidates. Although we have entered into employment agreements with each of Mr. Cormack, Dr. Jacobs and Mr. Anderson for an indefinite term, such agreements permit the executive to terminate his or her employment with us at any time, subject to providing us with advance written notice. Our existing consulting agreement with Dr. Gleave is for a fixed term expiring on December 31, 2008. We maintain "key man" insurance policies on the lives of Mr. Cormack and Dr. Gleave. We will need to hire additional personnel as we continue to expand our development activities.

We have scientific and clinical advisors who assist us in formulating our development and clinical strategies. These advisors are not our employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to us. In addition, our advisors may have arrangements with other companies to assist those companies in developing products or technologies that may compete with ours.

We may not be able to attract or retain qualified management and scientific personnel in the future due to the intense competition for qualified personnel among biotechnology, pharmaceutical and other businesses. If we are not able to attract and retain the necessary personnel to accomplish our business objectives, we may experience constraints that will impede significantly the achievement of our development objectives, our ability to raise additional capital and our ability to implement our business strategy. In particular, if we lose any members of our senior management team, we may not be able to find suitable replacements in a timely fashion or at all and our business may be harmed as a result.

We may encounter difficulties in managing our expected growth and in expanding our operations successfully.

As we advance our product candidates through development and clinical trials, we will need to develop or expand our development, regulatory, manufacturing, marketing and sales capabilities or contract with third parties to provide these capabilities for us. Maintaining additional relationships and managing our future growth will impose significant added responsibilities on members of our management. We must be able to: manage our development efforts effectively; manage our clinical trials effectively; hire, train and integrate additional management, development, administrative and sales and marketing personnel; improve our managerial, development, operational and finance systems; and expand our facilities, all of which may impose a strain on our administrative and operational infrastructure.

Furthermore, we may acquire additional businesses, products or product candidates that complement or augment our existing business. To date, we have no experience in acquiring and integrating other businesses. Integrating any newly acquired business, product or product candidate could be expensive and time-consuming. We may not be able to integrate any acquired business, product or product candidate successfully or operate any acquired business profitably. Our future financial performance will depend, in part, on our ability to manage any future growth effectively and our ability to integrate any acquired businesses. We may not be able to accomplish these tasks, and our failure to accomplish any of them could prevent us from successfully growing our company.

17

We rely, in part, on third parties to conduct clinical trials for our product candidates and plan to rely on third parties to conduct future clinical trials. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, we may be unable to obtain regulatory approval for or commercialize our current and future product candidates.

To implement our product development strategies, we rely on third parties, such as contract research organizations, medical institutions, clinical investigators and contract laboratories, to conduct our clinical trials of our product candidates. Although we rely on these third parties to conduct our clinical trials, we are responsible for ensuring that each of our clinical trials is conducted in accordance with its investigational plan and protocol. Moreover, the FDA and non-U.S. regulatory authorities require us to comply with regulations and standards, commonly referred to as Good Clinical Practices, or GCPs, for conducting, monitoring, recording and reporting the results of clinical trials to ensure that the data and results are scientifically credible and accurate and that the clinical trial subjects are adequately informed of the potential risks of participating in clinical trials. Our reliance on third parties does not relieve us of these responsibilities and requirements. If the third parties conducting our clinical trials do not perform their contractual duties or obligations, do not meet expected deadlines or need to be replaced, or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to GCPs or for any other reason, we may need to enter into new arrangements with alternative third parties and our clinical trials may be extended, delayed or terminated. In addition, a failure by such third parties to perform their obligations in compliance with GCPs may cause our clinical trials to fail to meet regulatory requirements, which may require us to repeat our clinical trials.

We rely on third parties to manufacture and supply our product candidates.

We do not own or operate manufacturing facilities, and we depend on third-party contract manufacturers for production of our product candidates. We have no experience in drug formulation or manufacturing, and we lack the resources and the capability to manufacture any of our product candidates. To date, our product candidates have been manufactured in limited quantities for pre-clinical studies and clinical trials. All active pharmaceutical ingredient for OGX-011 has been manufactured for us by Isis and all drug product has been manufactured for us by Formatech, Inc. and Pyramid Laboratories, Inc., in each case pursuant to a purchase order or short-term contract that has been fulfilled. Although we have sufficient quantities of OGX-011 to complete our current phase 2 clinical trials and initiate our first phase 3 clinical trial, we will need to obtain additional quantities to complete our first phase 3 clinical trial. All active pharmaceutical ingredient for OGX-427 for IND-enabling toxicology studies and initial clinical trials has been manufactured for us by Avecia Biotechnology Inc. and all drug product has been manufactured for us by Laureate Pharma, Inc., in each case pursuant to a purchase order or short-term contract that has been fulfilled. If, in the future, one of our product candidates is approved for commercial sale, we will need to manufacture that product candidate in commercial quantities. We cannot assure you that the third-party manufacturers with which we have contracted in the past will have sufficient capacity to satisfy our future manufacturing needs, or that we will be able to negotiate additional purchases of active pharmaceutical ingredient or drug product from these or alternative manufacturers on terms favorable to us, or at all.

Third party manufacturers may fail to perform under their contractual obligations, or may fail to deliver the required commercial quantities of bulk drug substance or finished product on a timely basis and at commercially reasonable prices. Any performance failure on the part of our

18

contract manufacturers could delay clinical development or regulatory approval of our product candidates or commercialization of our future product candidates, depriving us of potential product revenue and resulting in additional losses. If we are required to identify and qualify an alternate manufacturer, we may be forced to delay or suspend our clinical trials, regulatory submissions, required approvals or commercialization of our product candidates, which may cause us to incur higher costs and could prevent us from commercializing our product candidates successfully. If we are unable to find one or more replacement manufacturers capable of production at a reasonably favorable cost, in adequate volumes, of adequate quality, and on a timely basis, we would likely be unable to meet demand for our product candidates and our clinical trials could be delayed or we could lose potential revenue. Our ability to replace an existing active pharmaceutical ingredient manufacturer may be difficult because the number of potential manufacturers is limited to approximately four manufacturers, and the FDA must approve any replacement manufacturer before it can begin manufacturing our product candidates. Such approval would require new testing and compliance inspections. It may be difficult or impossible for us to identify and engage a replacement manufacturer on acceptable terms in a timely manner, or at all. We expect to continue to depend on third-party contract manufacturers for the foreseeable future.

Our product candidates require precise, high quality manufacturing. Any of our contract manufacturers will be subject to ongoing periodic unannounced inspection by the FDA and non-U.S. regulatory authorities to ensure strict compliance with current Good Manufacturing Practice, or cGMP, and other applicable government regulations and corresponding standards. If our contract manufacturers fail to achieve and maintain high manufacturing standards in compliance with cGMP regulations, we may experience manufacturing errors resulting in patient injury or death, product recalls or withdrawals, delays or interruptions of production or failures in product testing or delivery, delay or prevention of filing or approval of marketing applications for our product candidates, cost overruns or other problems that could seriously harm our business.

Significant scale-up of manufacturing may require additional validation studies, which the FDA must review and approve. Additionally, any third party manufacturers we retain to manufacture our product candidates on a commercial scale must pass an FDA pre-approval inspection for conformance to the cGMPs before we can obtain approval of our product candidates. If we are unable to successfully increase the manufacturing capacity for a product candidate in conformance with cGMPs, the regulatory approval or commercial launch of any related products may be delayed or there may be a shortage in supply.

If we are unable to develop our sales and marketing and distribution capability on our own or through collaborations with marketing partners, we will not be successful in commercializing our product candidates. We currently do not have a marketing staff nor a sales or distribution organization.

We currently do not have marketing, sales or distribution capabilities. If our product candidates are approved, we may establish a sales and marketing organization with technical expertise and supporting distribution capabilities to commercialize our product candidates, which will be expensive and time consuming. Any failure or delay in the development of internal sales, marketing and distribution capabilities would adversely impact the commercialization of these product candidates. We may choose to collaborate with third parties that have direct sales forces and established distribution systems, either to augment our own sales force and distribution systems or in lieu of our own sales force and distribution systems. To the extent that we enter into

19

co-promotion or other licensing arrangements, our product revenue is likely to be lower than if we directly marketed or sold our products, when and if we have any. In addition, any revenue we receive will depend in whole or in part upon the efforts of such third parties, which may not be successful and will generally not be within our control. If we are unable to enter into such arrangements on acceptable terms or at all, we may not be able to successfully commercialize our existing and future product candidates. If we are not successful in commercializing our existing and future product candidates, either on our own or through collaborations with one or more third parties, our future product revenue will suffer and we may incur significant additional losses.

Risks Related to Our Intellectual Property

Our proprietary rights may not adequately protect our technologies and product candidates.

Our commercial success will depend on our ability to obtain patents and/or regulatory exclusivity and maintain adequate protection for our technologies and product candidates in Canada, the United States and other countries. As of February 28, 2007, we owned or had exclusive rights to approximately ten issued U.S. and foreign patents and approximately 89 pending U.S. and foreign patent applications. We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary technologies and future product candidates are covered by valid and enforceable patents or are effectively maintained as trade secrets.

We apply for patents covering both our technologies and product candidates, as we deem appropriate. However, we may fail to apply for patents on important technologies or product candidates in a timely fashion, or at all. Our existing patents and any future patents we obtain may not be sufficiently broad to prevent others from practicing our technologies or from developing competing products and technologies. In addition, we do not always control the patent prosecution of subject matter that we license from others. Accordingly, we are sometimes unable to exercise the same degree of control over this intellectual property as we would over our own. Moreover, the patent positions of biopharmaceutical companies are highly uncertain and involve complex legal and factual questions for which important legal principles remain unresolved. As a result, the validity and enforceability of our patents cannot be predicted with certainty. In addition, we cannot guarantee that:

- •

- we or our licensors were the first to make the inventions covered by each of our issued patents and pending patent applications;

- •

- we or our licensors were the first to file patent applications for these inventions;

- •

- others will not independently develop similar or alternative technologies or duplicate any of our technologies;

- •

- any of our or our licensors' pending patent applications will result in issued patents;

- •

- any of our or our licensors' patents will be valid or enforceable;

- •

- any patents issued to us or our licensors and collaboration partners will provide us with any competitive advantages, or will not be challenged by third parties;

- •

- we will develop additional proprietary technologies that are patentable; or

- •

- the patents of others will not have an adverse effect on our business.

20

The actual protection afforded by a patent varies on a product-by-product basis, from country to country and depends upon many factors, including the type of patent, the scope of its coverage, the availability of regulatory related extensions, the availability of legal remedies in a particular country and the validity and enforceability of the patents. Our ability to maintain and solidify our proprietary position for our product candidates will depend on our success in obtaining effective claims and enforcing those claims once granted. Our issued patents and those that may issue in the future, or those licensed to us, may be challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages against competitors with similar products. Due to the extensive amount of time required for the development, testing and regulatory review of a potential product, it is possible that, before any of our product candidates can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby reducing any advantage of the patent.

Protection afforded by U.S. patents may be adversely affected by proposed changes to patent related U.S. statutes and to U.S. Patent and Trademark Office, or U.S.PTO, rules, especially changes to rules concerning the filing of continuation applications. If implemented, the rules may require that second or subsequent continuing application filings be supported by a showing as to why the new amendments or claims, argument or evidence presented could not have been previously submitted. Other rules, if implemented, may limit consideration by the U.S.PTO of up to only ten claims per application. It is common practice to file multiple patent applications with many claims in an effort to maximize patent protection. If the first set of proposed U.S.PTO rules are implemented, they may limit our ability to file continuing applications directed to our product candidates and methods and related competing products and methods. In addition, if the second set of U.S.PTO rules are implemented, they may limit our ability to patent a number of claims sufficient to cover our product candidates and methods and related competing products and methods. Other changes to the patent statutes may adversely affect the protection afforded by U.S. patents and/or open U.S. patents up to third party attack in non-litigation settings.