UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

x | Soliciting Material Pursuant to §240.14a-12 |

|

TRW AUTOMOTIVE HOLDINGS CORP. |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

This filing consists of the following documents:

· A presentation distributed to employees of TRW Automotive Holdings Corp. (the “Company”) and used at townhall meetings.

FORWARD LOOKING STATEMENTS

This communication includes “forward-looking statements,” as that term is defined by the federal securities laws. The forward-looking statements include statements concerning regulatory approvals and the expected timing, completion and effects of the proposed merger, the Company’s outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. When used in this communication, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” and future or conditional verbs, such as “will,” “should,” “could” or “may,” as well as variations of such words or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements are so designated. All forward-looking statements are based upon our current expectations and various assumptions, and apply only as of the date of this communication. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved.

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from those suggested by our forward-looking statements. These risks and uncertainties include the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to complete the proposed merger due to the failure to obtain stockholder approval for the proposed merger or the failure to satisfy other conditions to completion of the proposed merger, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction; risks related to disruption of management’s attention from the Company’s ongoing business operations due to the transaction; the effect of the announcement of the proposed merger on the Company’s relationships with its customers, operating results and business generally; the risk that the proposed merger will not be consummated in a timely manner; economic conditions adversely affecting our business, results or the viability of our supply base; risks associated with non-U.S. operations, including economic and political uncertainty in some regions, adversely affecting our business, results or financial condition; the unsuccessful implementation of our current expansion efforts adversely impacting our business or results; any developments related to antitrust investigations adversely affecting our financial condition, results, cash flows or reputation; pricing pressures from our customers adversely affecting our profitability; global competition adversely affecting our sales, profitability or financial condition; any disruption in our information technology systems adversely impacting our business and operations; any shortage of supplies causing a production disruption for any customers or us; the loss of any of our largest customers or a significant amount of their business, or a significant decline in their production levels, adversely affecting us; strengthening of the U.S. dollar and other foreign currency exchange rate fluctuations impacting our results; our contingent liabilities and tax matters causing us to incur losses or costs; any inability to protect our intellectual property rights adversely affecting our business or our competitive position; commodity inflationary pressures adversely affecting our profitability or supply base; costs or adverse effects on our business, reputation or results from governmental regulations; work stoppages or other labor issues at our facilities or those of our customers or others in our supply chain adversely affecting our business, results or financial condition; any increase in the expense of our pension and other postretirement benefits or the funding requirements of our pension plans reducing our profitability and other risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for fiscal year ended December 31, 2013 under “Item 1A. Risk Factors”.

All forward-looking statements are expressly qualified in their entirety by such cautionary statements. We do not undertake any obligation to release publicly any update or revision to any of the forward-looking statements.

2

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This filing may be deemed solicitation material in respect of the proposed acquisition of the Company by Parent. In connection with the proposed merger transaction, the Company will file with the SEC and furnish to the Company’s stockholders a proxy statement and other relevant documents. This filing does not constitute a solicitation of any vote or approval. Stockholders are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement because they will contain important information about the proposed merger.

Investors will be able to obtain free of charge the proxy statement and other documents filed with the SEC at the SEC’s website at http://www.sec.gov. In addition, the proxy statement and our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website at www.trw.com. as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

The directors, executive officers and certain other members of management and employees of the Company may be deemed “participants” in the solicitation of proxies from stockholders of the Company in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of the Company in connection with the proposed merger will be set forth in the proxy statement and the other relevant documents to be filed with the SEC. You can find information about the Company’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and in its definitive proxy statement filed with the SEC on Schedule 14A on March 26, 2014.

3

| ZF Friedrichshafen AG and TRW Automotive Townhall Meeting Sept 17, 2014 |

| Cautionary Statement Regarding Forward-Looking Statements This communication includes "forward-looking statements," as that term is defined by the federal securities laws. The forward-looking statements include statements concerning regulatory approvals and the expected timing, completion and effects of the proposed merger, the outlook for the future, as well as other statements of beliefs, future plans and strategies or anticipated events, and similar expressions concerning matters that are not historical facts. All forward-looking statements are based upon current expectations and various assumptions, and apply only as of the date of this communication. There are a number of risks, uncertainties and other important factors that could cause actual results to differ materially from those suggested by the forward-looking statements made in this presentation. Stockholders are urged to read the proxy statement when it becomes available and any other documents to be filed with the SEC in connection with the proposed merger or incorporated by reference in the proxy statement because they will contain important information about the proposed merger. The directors, executive officers and certain other members of management and employees of TRW Automotive Holdings Corp. (the “Company”) may be deemed “participants” in the solicitation of proxies from stockholders of the Company in favor of the proposed merger. Information regarding the foregoing will be set forth in the proxy statement and the other relevant documents to be filed with the SEC and available free of charge at the SEC’s website at http://www.sec.gov. You can find information about the Company’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and in its definitive proxy statement filed with the SEC on Schedule 14A on March 26, 2014. Disclaimer i |

| ZF Group Key Figures 2013/2014 ZF-Konzern im Überblick The ZF Group – An Overview 2013 2014* Sales $22.2 billion > $24 billion Employees (end of year) 72,643 74,000 (August) Capital expenditure $1.3 billion R&D expenditure $ 1.1 billion 122 production companies in 26 countries 8 main development locations in 4 countries 33 service companies and more than 650 service partners * Estimated |

| Key Figures Locations ZF in North America (2013) Sales: $ 4,268 million Employees: 7,237 Capital expenditure: $ 241 million Locations in: Mexico USA |

| Key Figures Locations 122 Production companies 8 Main development locations 33 Service companies More than 650 service partners worldwide Worldwide Presence with Production, Development, Sales |

| Product Portfolio Automatic transmissions manual transmissions dual clutch transmissions front and rear axle drives all-wheel drive systems electric drives differentials and bevel gearsets active starting systems torque converters and dual clutches clutch systems automation of manual transmissions Front and rear axle systems powertrain suspension systems chassis subframes corner modules damper modules and damping systems tie rods, stabilizers and stabilizer links control arms suspension joints cross-axis joints wheel carriers and hubs leveling systems crash-absorption elements chassis mounts Passenger Car Technology |

| Commercial Vehicle Technology Product Portfolio Manual transmissions automatic transmissions control, gearshift and clutch systems dual-mass flywheels PTOs, retarder systems front and rear axle systems tag axle systems rear axle suspension systems damper modules and damping systems electric drives suspension modules 4-point links v-links control arms stabilizer links torque rods tie rods drag links stabilizer supports suspension joints cabin suspension systems cabin anti-roll bars software diagnosis tools services |

| Product Portfolio Manual transmissions automatic transmissions powershift transmissions continuously variable transmissions synchromesh transmissions generator / hybrid systems electric drives PTOs differentials retarder systems clutches axles and axle components corner modules dampers and damper modules torque converters transfer cases thrusters shallow draft thrusters propellers bow thrusters surface drives pod drives test systems rotor heads brakes telematics systems Industrial Technology |

| Product Portfolio Human machine interface: gearshift systems for automatic and manual transmissions in passenger cars and commercial vehicles Body chassis driveline: control units incl. software, power electronics, sensors, and mechatronic systems Industrial solutions: electromechanical components, electronic control units, power electronics modules, and sensors Computer input devices: keyboards, mice, and card readers Electronic Systems |

| Latest Innovations Innovation Car 2013 Innovation Truck 2014 8-Speed Plug-in-Hybrid Transmission Active Kinematics Control (AKC) |

| brings together a broad, complementary portfolio of acknowledged products including driveline, chassis, safety and electronic technologies is an R&D leader that benefits from global megatrends towards fuel efficiency, increased safety requirements and autonomous driving has a balanced regional and customer portfolio in both volume and premium segments ideally addresses two of the most significant countries of the world: US and China meets the increasing demand from OEMs* for integrated offerings from their suppliers The combined company of two successful automotive suppliers with pro forma revenues of more than € 30 billion (US$ 41 billion) and 138,000 employees ZF Friedrichshafen AG and TRW Automotive Transaction Follows a Clear Strategic Rationale * Original Equipment Manufacturers |

| Both Companies at a Glance ZF Friedrichshafen AG and TRW Automotive are Highly Successful Companies ZF Friedrichshafen AG TRW Automotive * without ZF Lenksysteme The group’s product range comprises transmissions and steering systems as well as chassis components and complete axle systems and modules. ZF is a global leader in driveline and chassis technology with 122 production companies in 26 countries. In 2013, the Group achieved a sales figure of € 16.8 billion1 (US$ 23.2 billion) with approximately 72,600 employees. With the broadest portfolio of active and passive safety techno-logies of any supplier, TRW produces advanced active systems in braking; steering and suspension; and sophisticated occupant safety systems, including airbags, seat belts and steering wheels. TRW has over 65,000 employees working in more than 185 locations in every vehicle-producing region worldwide. In 2013, TRW achieved a sales figure of € 12.6 billion1 (US$ 17.4 billion). 1 Underlying exchange rate as of 31.12.2013 (EUR/USD = 1.3810) 8.9 9.9 10.8 11.7 12.6 12.5 9.4 12.9 15.5 15.5 * 16.8 * 00 02 04 06 08 10 12 14 16 18 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 ZF Revenue in € billion 11.3 12.0 12.6 13.1 14.7 15.0 11.6 14.4 16.2 16.4 17.4 00 02 04 06 08 10 12 14 16 18 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 TRW Revenue in US$ billion |

| Global Megatrends in the Automotive Sector Game Changing Potential for Suppliers Emission reduction is driven by regulation Increasing demand for lighter weight materials in key growth areas going forward Fuel efficiency Increased safety requirements OEMs as well as customers desire more safety content Increased governmental regulations and safety standards Autonomous driving Foundation for autonomous driving already exists (Advanced Driving Assistance Systems: ADAS) The driver-assistance segment expected to grow six-fold by the end of the decade |

| Highly Complementary Product Portfolio and Technologies Core Competences of Both Companies Ideally Address Future Trends ZF Friedrichshafen AG TRW Automotive ZF is an important player in driveline and chassis, delivering answers that significantly improve fuel efficiency TRW is a significant supplier of active and passive safety systems with a strong position in driver-assistance systems and collision avoidance will have a strong portfolio mix, combining leading technologies in segments with excellent growth prospects offers all the relevant technologies for a fully autonomous driving chassis under one roof The combined company |

| Key Automotive Regions Ongoing Demand Shift to China, further Growth in the US and Europe China is already the largest region for automotive sales, producing more than 30 million vehicles by the year 2020 North America will stay second-largest region Western Europe, as the third-largest region, to recover from market downturn Source: MDI, ZF Procast 84.008 103.961 0 5.000 10.000 15.000 20.000 25.000 30.000 0 20.000 40.000 60.000 80.000 100.000 120.000 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 Light Vehicles (Cars and CV <=6t) Production Worldwide (in 1,000 ) Scale total production ( column ) Scale regional production ( lines ) Western Europe North America South Korea China Japan South America India Other Asia Africa Eastern Europe today 120,000 100,000 80,000 6 0,000 4 0,000 2 0,000 30,000 25,000 20,000 15,000 10,000 5,000 0 0 |

| ZF Friedrichshafen AG to Double Sales in Key Automotive Regions Strong Presence in Most Relevant Regions would generate about half of its sales in Europe would double its sales volume in two of the most significant countries of the world, China and the US China: From € 2.0 billion (US$ 2.8 billion) to € 4.0 billion (US$ 5.5 billion) US: From € 2.8 billion (US$ 3.9 billion) to € 6.5 billion (US$ 9.0 billion) ZF Friedrichshafen AG TRW Automotive The combined company Europe ; 59% North America ; 18% Asia Pacific ; 18% Rest of World ; 5% Europe ; 41% North America ; 36% Asia Pacific ; 19% Rest of World ; 4% Europe ; 51% North America ; 26% Asia Pacific ; 18% Rest of World ; 5% |

| Balanced Portfolio of Customers Partner of Choice for Important OEMs around the Globe ZF has a diversified customer base Strong in the premium segment TRW with a large portion of sales in the volume segment Strong relationships with US & European volume manufacturers will have access to a broader customer base will be a key supplier to some of the fastest growing OEMs in emerging markets ZF Friedrichshafen AG TRW Automotive The combined company |

| Relevance of R&D in the Automotive Industry Customers Call for Innovative Solutions |

| A Global Leader in R&D and Innovation Substantial Investments for Future Growth R&D expenses of almost € 850 million (over US$ 1.1 billion) in 2013 More than 6,000 employees in R&D 8 major R&D hubs around the world R&D expenses* totals over € 650 million (US$ 900 million) in 2013 Several thousand employees in R&D 13 test tracks and 22 technical centers will have one of the strongest R&D capability in the global automotive industry, with pro forma combined R&D expenditures of approximately € 1.5 billion (US$ 2.1 billion) will continue to make long term focused investments in R&D ZF Friedrichshafen AG TRW Automotive * Total company funded engineering expenses incl. R&D The combined company |

| Delivering Value to Key Stakeholders Benefit for Customers, Employees and Shareholders Customers Employees Shareholders will have access to a broad portfolio of technologies to serve megatrends will get integrated systemic offerings via one-stop-shop will benefit from an enhanced growth perspective will enjoy enhanced career opportunities in exciting new fields and across all locations TRW stockholders will receive full and certain value for their stocks ZF shareholders (Zeppelin and Ulderup foundation) will benefit from improved business prospects |

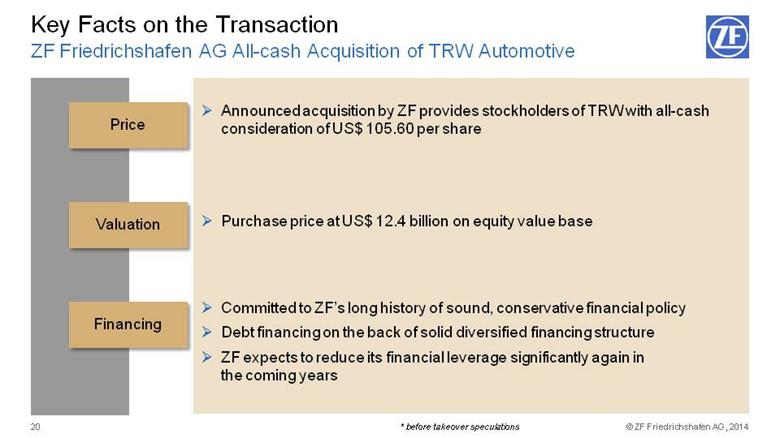

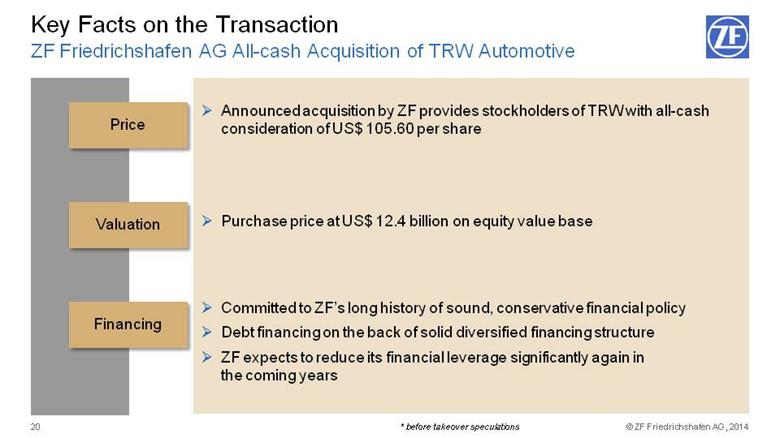

| Key Facts on the Transaction ZF Friedrichshafen AG All-cash Acquisition of TRW Automotive Valuation Financing Announced acquisition by ZF provides stockholders of TRW with all-cash consideration of US$ 105.60 per share Purchase price at US$ 12.4 billion on equity value base Committed to ZF’s long history of sound, conservative financial policy Debt financing on the back of solid diversified financing structure ZF expects to reduce its financial leverage significantly again in the coming years Price * before takeover speculations |

| Roadmap to Completion Transaction Expected to Close in the First Half of 2015 TRW stock-holder approval All-cash consideration Regulatory process TRW stockholder approval (>50% of shares outstanding) at a special stockholder meeting required TRW stockholders to receive cash consideration TRW to be delisted from NYSE Antitrust filings, including US, EU and China US foreign investment clearance (CFIUS) Proxy statement filing with US Securities and Exchange Commission |

| Post-Transaction-Integration TRW Automotive to Become Separate Business Division of ZF Friedrichshafen AG Organisation Integration process ZF will remain headquartered in Friedrichshafen TRW will be integrated into ZF as a separate business division The ZF Corporate Headquarters remains in Friedrichshafen. The Detroit metro area will remain a major business center for the combined company. The companies will establish integration teams with balanced representation from each in a common spirit of innovation and quality |

| Thank You for Your Attention! |