UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

CABELA’S INCORPORATED

(Name of Registrant as Specified In Its Charter)

Not applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY PROXY MATERIALS

SUBJECT TO COMPLETION

The approximate date on which definitive copies of this proxy statement and accompanying proxy are intended to be released to shareholders is March 27, 2006.

March 27, 2006

Dear Fellow Shareholder:

You are cordially invited to attend our Annual Meeting of Shareholders on Wednesday, May 10, 2006, at 10:00 a.m. Mountain Time at the Holiday Inn, 664 Chase Boulevard, Sidney, Nebraska 69162.

Details of the business to be conducted at the Annual Meeting are set forth in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. At the meeting, we also will discuss our results for the past year and answer your questions.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Please mark, sign, and date your proxy card today and return it in the envelope provided. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

Thank you for your continued support and interest in Cabela’s.

Sincerely,

Dennis Highby

President and Chief Executive Officer

CABELA’S INCORPORATED

ONE CABELA DRIVE

SIDNEY, NEBRASKA 69160

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 10, 2006

The 2006 Annual Meeting of Shareholders (the “Annual Meeting”) of Cabela’s Incorporated (the “Company”) will be held at the Holiday Inn, 664 Chase Boulevard, Sidney, Nebraska 69162, on Wednesday, May 10, 2006, beginning at 10:00 a.m. Mountain Time. The purposes of the Annual Meeting are to:

| | 1. | Elect four Class II directors; |

| | 2. | Approve management’s proposal to declassify the Company’s Board of Directors; |

| | 3. | Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2006; and |

| | 4. | Transact such other business as may properly come before the meeting or any adjournment thereof. |

Each outstanding share of the Company’s voting common stock entitles the holder of record at the close of business on March 15, 2006, to receive notice of, and to vote at, the Annual Meeting. Shares of the Company’s voting common stock can be voted at the Annual Meeting in person or by valid proxy.

A list of all shareholders entitled to vote at the Annual Meeting will be available for examination at Company’s principal offices located at One Cabela Drive, Sidney, Nebraska 69160 for ten days before the Annual Meeting between 9:00 a.m. and 5:00 p.m. Mountain Time, and at the place of the Annual Meeting during the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, we encourage you to vote your shares by proxy. This will ensure the presence of a quorum at the Annual Meeting. Voting by proxy will not limit your right to change your vote or to attend the Annual Meeting.

By order of the Board of Directors

Reed Gilmore

Secretary

March 27, 2006

TABLE OF CONTENTS

i

CABELA’S INCORPORATED

ONE CABELA DRIVE

SIDNEY, NEBRASKA 69160

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 10, 2006

This Proxy Statement is furnished in connection with the solicitation of proxies from the holders of shares of voting common stock of Cabela’s Incorporated to be voted at the Annual Meeting of Shareholders to be held on Wednesday, May 10, 2006, at 10:00 a.m. Mountain Time, at the Holiday Inn, 664 Chase Boulevard, Sidney, Nebraska 69162 (the “Annual Meeting”). The enclosed proxy is solicited by the Board of Directors of the Company (the “Board”). This Proxy Statement, the proxy card, and our Annual Report were first mailed to shareholders entitled to vote at the meeting on or about March 27, 2006.

The terms “we,” “our,” “us,” “Cabela’s,” or the “Company” refer to Cabela’s Incorporated and its subsidiaries.

VOTING INFORMATION

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act on the matters outlined in the accompanying Notice of Annual Meeting of Shareholders. In addition, management will report on the performance of Cabela’s during fiscal 2005 and respond to questions from shareholders.

Who may vote?

We have two classes of common stock outstanding: voting common stock and non-voting common stock. Unless otherwise specified, when we refer to “common stock” in this Proxy Statement we are referring to voting common stock. You may vote at the Annual Meeting if you owned shares of our common stock at the close of business on March 15, 2006 (the “Record Date”). You are entitled to one vote on each matter presented at the Annual Meeting for each share of common stock you owned on the Record Date. As of the Record Date, there were shares of our voting common stock issued and outstanding and shares of our non-voting common stock issued and outstanding.

Who counts the votes?

Votes at the Annual Meeting will be tabulated by a representative of Wells Fargo Shareowner Services, who will serve as the Inspector of Elections, and the results of all items voted upon will be announced at the Annual Meeting.

Who can attend the Annual Meeting?

All shareholders as of the close of business on the Record Date, or their duly appointed proxies, may attend the Annual Meeting, and each may be accompanied by one guest. Registration and seating will begin at 9:30 a.m. Mountain Time. Cameras, recording devices, and other electronic devices will not be permitted at the Annual Meeting.

Please note that if you hold your shares in “street name” (that is, through a broker or other nominee) you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the Record Date and check in at the registration desk at the Annual Meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the Record Date will constitute a quorum, permitting Cabela’s to conduct its business at the

Annual Meeting. Abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present. A “broker non-vote” occurs if you do not provide the record holder of your shares with voting instructions on a matter and the holder is not permitted to vote on the matter without instructions from you.

What vote is required to approve each item?

The election of directors requires a plurality of the votes cast. The affirmative vote of the holders of at least 66 2/3% of the outstanding common stock of the Company is required for approval of the proposal to declassify the Company’s Board. The affirmative vote of the holders of a majority of the common stock present in person or represented by proxy at the Annual Meeting is required for approval of the proposal to ratify the appointment of the independent registered public accounting firm.

Abstentions are not relevant to the election of directors and will have the effect of a vote against any other proposal. A broker non-vote will not be considered entitled to vote on matters as to which the brokers withhold authority; therefore, broker non-votes are not included in the tabulation of voting results. Broker non-votes are not relevant to the election of directors or the proposal to ratify the appointment of the independent registered public accounting firm. A broker non-vote on the proposal to declassify the Company’s Board will have the same effect as a negative vote.

If you participate in the Company’s 401(k) Savings Plan (the “401(k) Plan”) and have contributions invested in the Company’s common stock as of the Record Date, the proxy card you receive will serve as voting instructions for the trustee of the 401(k) Plan. If your proxy card is not received by our transfer agent prior to the date of the Annual Meeting, your shares of common stock held in the 401(k) Plan will not be voted and will not be counted as present at the meeting.

How do I vote?

You can vote on a matter to come before the Annual Meeting in two ways:

| | • | | You can attend the Annual Meeting and cast your vote in person; or |

| | • | | You can vote by completing, dating, and signing the enclosed proxy card and returning it in the enclosed postage-paid envelope. |

Written ballots will be available at the Annual Meeting if you wish to vote at the Annual Meeting. However, if your shares are held in the name of your broker, bank, or other nominee, and you want to vote in person, you will need to obtain a legal proxy from the institution that holds your shares indicating that you were the beneficial owner of the shares on the Record Date.

Voting by proxy authorizes the individuals named on the proxy card, referred to as the proxies, to vote your shares according to your instructions, or if you provide no instructions, according to the recommendation of the Board.

Can I revoke my proxy?

Yes, you can revoke your proxy if your shares are held in your name by:

| | • | | Filing a written notice of revocation with our Secretary before the Annual Meeting; |

| | • | | Signing a proxy bearing a later date; or |

| | • | | Voting in person at the Annual Meeting. |

2

Who will bear the cost of this proxy solicitation?

We will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock. Proxies will be solicited by mail, and may be solicited personally by directors, officers, or our employees, who will not receive any additional compensation for any such services.

PROPOSAL ONE –

ELECTION OF DIRECTORS

The Board currently is divided into three classes and consists of eight members. One class is elected each year to hold office for a term of three years. At the Annual Meeting, four directors are to be elected to hold office until the annual meeting of shareholders to be held in the year 2009 (“Class II Directors”). If the Company’s shareholders approve the proposal to amend our Amended and Restated Certificate of Incorporation to provide for the annual election of directors, as more fully described in Proposal Two below, all four nominees will serve for one-year terms expiring at the 2007 annual meeting of shareholders. All of the nominees currently are directors of the Company. There is no cumulative voting, and the four nominees receiving the most votes will be elected by a plurality. The remaining directors of the Company, whose terms expire in the year 2007 (“Class III Directors”) or the year 2008 (“Class I Directors”), will continue to serve in accordance with their previous election.

Gerald E. Matzke, who served as a director of the Company from 1996 to May 2005, has been re-appointed by the Board as an emeritus director of the Company to serve until the next annual meeting of shareholders. As an emeritus director, the Board has provided Mr. Matzke a standing invitation to all Board and committee meetings. Mr. Matzke does not have any voting rights in his position as an emeritus director.

Unless authority is withheld, it is the intention of the persons named in the enclosed proxy card to vote for the nominees listed and, in the event any nominee is unable to serve as a director, to vote for any substitute nominee proposed by the Board. Information concerning each director nominee and each continuing director is set forth below.

Nominees for Class II Directors for Terms to Expire in 2009

Theodore M. Armstrong, 66, has been a director since December 2004. Mr. Armstrong served as Senior Vice President-Finance and Administration and Chief Financial Officer of Angelica Corporation from 1986 to his retirement in February 2004, and as a consultant to Angelica thereafter. Angelica Corporation is a leading provider of textile rental and linen management services to the U.S. healthcare market. Mr. Armstrong also is a board member of UMB Financial Corporation, and Chairman of its audit committee, UMB Bank of St. Louis, and several non-profit organizations.

Richard N. Cabela, 69, founded our Company in 1961 and has served on our Board since our incorporation in 1964. Since our founding, Mr. R. Cabela has been employed by us in an executive position and has served as our Chairman since our incorporation.

Dennis Highby, 57, has been our President and Chief Executive Officer and a director since July 2003. Mr. Highby has been employed by us since 1976 and held various management positions, including Merchandise Manager, Director of Merchandising, and Vice President. He held the position of Vice President from 1996 to July 2003.

Stephen P. Murray, 43, has been a director since December 2005. Mr. Murray has been a partner in the New York office of JPMorgan Partners since 1994 and member of the firm since 1984. JPMorgan Partners is a leading private equity firm with over $11 billion in capital under management. Mr. Murray also is a director of several other companies, including Pinnacle Foods Group Inc. and LPA Holding Corp.

3

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” ALL OF THE NOMINEES.

Continuing Class I Directors Whose Terms Expire in 2008

Reuben Mark, 67, has been a director since July 2004. Mr. Mark is Chairman and Chief Executive Officer of Colgate-Palmolive Company. Mr. Mark joined Colgate-Palmolive in 1963 and has held a series of senior management positions in the United States and overseas since then. He was elected Chief Executive Officer and Chairman of Colgate-Palmolive in 1984 and 1986, respectively. Mr. Mark also is a director of Colgate-Palmolive, Pearson plc, and Time Warner Inc.

Michael R. McCarthy, 54, has been a director since 1996. Mr. McCarthy has served as a director and Chairman of McCarthy Group, Inc. since 1986. McCarthy Group, Inc. is a private equity investment and merchant banking firm. Mr. McCarthy also serves as a member of the board of directors, the compensation committee, and the executive compensation subcommittee, and as Chairman of the audit committee, of Peter Kiewit Sons’, Inc., a national construction company.

Continuing Class III Directors Whose Terms Expire in 2007

James W. Cabela, 66, is our co-founder and has served on our Board since our 1964 incorporation. Since our incorporation, Mr. J. Cabela has been employed by us in various capacities, and was our President until July 2003. Mr. J. Cabela has been Vice Chairman since the creation of that executive position in 1996. Mr. J. Cabela is the brother of Mr. R. Cabela.

John Gottschalk, 62, has been a director since July 2004. Mr. Gottschalk has been the Chairman and Chief Executive Officer of the Omaha World-Herald Company since 1989 and a member of its board of directors since 1980. The Omaha World-Herald Company publishes the Omaha World-Herald newspaper and, through its subsidiaries, owns and operates other newspapers, engages in direct marketing, and holds interests in other diversified businesses. Mr. Gottschalk also has served as a director of McCarthy Group, Inc. since 1997.

Emeritus Director

Gerald E. Matzke, 75, has been a non-voting emeritus director since May 2005. Mr. Matzke was a director from 1996 to May 2005. Mr. Matzke was our Secretary from July 2003 to February 2005 and was our Assistant Secretary prior to that time. Mr. Matzke has been a partner with the law firm of Matzke, Mattoon & Miller since 1956. He served as a state senator in the Nebraska legislature from 1993 to 2000.

CORPORATE GOVERNANCE

The Board has developed corporate governance practices to help it fulfill its responsibility to shareholders to oversee the work of management in the conduct of the Company’s business and to seek to serve the long-term interests of shareholders. The Company’s corporate governance practices are memorialized in our Corporate Governance Guidelines (our “Governance Guidelines”) and the charters of the three committees of the Board. The Governance Guidelines and committee charters are reviewed periodically and updated as necessary to reflect changes in regulatory requirements and evolving oversight practices. These documents are available on our website at www.cabelas.com and upon request by writing to our Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160.

Board of Directors

Our Board currently consists of eight members. Five of our directors are independent under the requirements set forth in the New York Stock Exchange (“NYSE”) listing rules and our Governance Guidelines. For a director to be considered independent, the Board must determine that the director does not have any direct

4

or indirect material relationship with Cabela’s. The Board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements of the NYSE listing rules. The Board also has determined that certain relationships between Cabela’s and its directors are categorically immaterial and shall not disqualify a director or nominee from being considered independent. These independence guidelines and categorical standards are included as Appendix A to this Proxy Statement.

In addition to applying the independence guidelines, the Board will consider all relevant facts and circumstances in making an independence determination, and not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation. The Board has determined that Messrs. Armstrong, Gottschalk, Mark, McCarthy, and Murray satisfy the NYSE independence requirements and Cabela’s independence guidelines. The Board also has determined that Messrs. Armstrong, Mark, and McCarthy have no relationships with Cabela’s (other than being a director and shareholder), and that Messrs. Gottschalk and Murray have only immaterial relationships with Cabela’s that fall within the categorical standards adopted by the Board.

During fiscal 2005, our Board held seven meetings and acted by written consent one time. During fiscal 2005, all of our directors attended 75% or more of the aggregate number of Board meetings and committee meetings on which they served (during the periods for which they served as such), except that Mr. R. Cabela attended 71% of the meetings of the Board due to scheduling conflicts. It is the Board’s policy to encourage directors nominated for election and remaining in office to be present at annual meetings of shareholders, unless attendance would be impracticable or constitute an undue burden on such nominee or director. All directors attended our 2005 annual shareholders’ meeting.

The Board recently amended our Governance Guidelines to create the role of lead independent director (“Lead Director”). The Lead Director is selected by the independent directors on the Board to serve a one-year term as Lead Director. The Lead Director’s roles and responsibilities include: developing, with input from the other independent directors, the agenda for executive sessions involving only the independent directors; presiding over executive sessions involving only the independent directors and, at the request of the Chairman, other meetings of the Board; facilitating communication between the independent directors and the Company’s management; and approving, in consultation with the Chairman and CEO, the agenda and materials for each Board meeting. The Lead Director may, in appropriate circumstances, call meetings of the independent directors and communicate with various constituencies that are involved with the Company. Mr. McCarthy currently serves as Lead Director.

Time is allotted at the beginning of each Board meeting for an executive session involving only our independent directors. All of our non-management directors are independent. The Lead Director or, in his absence, the independent director with the most seniority on the Board who is present serves as the presiding director at each executive session.

Committees of the Board of Directors

The Board has three standing committees, the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. All committee members meet the independence requirements of the United States Securities and Exchange Commission (“SEC”) and NYSE. The charters of these committees are available on our website at www.cabelas.com and upon request by writing to our Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160. The current Chairman and members of these committees are set forth below.

| | | | | | |

Name | | Audit

Committee | | Compensation

Committee | | Nominating and Corporate

Governance Committee |

Theodore M. Armstrong | | X | | X | | X |

| | | |

John Gottschalk | | Chairman | | | | X |

| | | |

Michael R. McCarthy | | | | Chairman | | X |

| | | |

Reuben Mark | | X | | | | Chairman |

| | | |

Stephen P. Murray | | | | X | | X |

5

Audit Committee

The Audit Committee is responsible for the oversight of our accounting, reporting, and financial control practices. The Audit Committee also reviews the qualifications of the independent registered public accounting firm, selects and engages the independent registered public accounting firm, informs our Board as to their selection and engagement, reviews the plan, fees, and results of their audits, reviews reports of management and the independent registered public accounting firm concerning our system of internal control, and considers and approves any non-audit services proposed to be performed by the independent registered public accounting firm. The Audit Committee held twelve meetings during 2005.

The Board has determined, in its business judgment, that Messrs. Gottschalk, Mark, and Armstrong are independent as required by the Securities and Exchange Act of 1934, as amended, the applicable listing standards of the NYSE, and our Governance Guidelines. The Board has determined that it would be desirable for all members of the Audit Committee to be “audit committee financial experts,” as that term is defined by SEC rules, to the extent they qualify for such status. The Board has conducted an inquiry into the qualifications and experience of each member of the Audit Committee. Based on this inquiry, the Board has determined that Messrs. Gottschalk, Mark, and Armstrong meet the SEC’s criteria for audit committee financial experts and that each has accounting and related financial management expertise within the meaning of the listing standards of the NYSE.

Compensation Committee

The Compensation Committee is responsible for the oversight of our compensation and benefit policies and programs, including administration of our annual bonus awards and incentive plans, and the evaluation of our Chief Executive Officer and other executive officers. The Compensation Committee held four meetings during 2005.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for the oversight of, and assisting our Board in, developing and recommending corporate governance practices and selecting the director nominees to stand for election at annual meetings of our shareholders. The Nominating and Corporate Governance Committee held five meetings during 2005.

Report of the Audit Committee

The Audit Committee assists the Board in its oversight of the Company’s financial statements and reporting practices. The Audit Committee operates under a written charter adopted by the Board, which describes this and the other responsibilities of the Audit Committee.

The Audit Committee has reviewed and discussed the Company’s audited financial statements with management, which has primary responsibility for the financial statements. Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm for 2005, is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles. The Audit Committee has discussed with Deloitte the matters that are required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees). The Audit Committee has received and reviewed the written disclosures and the letter provided by Deloitte that are required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with Deloitte that firm’s independence from the Company.

Based on the review and discussions referred to above, the Audit Committee (i) recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for fiscal 2005

6

for filing with the SEC, and (ii) appointed Deloitte as the Company’s independent registered public accounting firm for fiscal 2006. This report is provided by the following directors, who constitute the Audit Committee:

John Gottschalk (Chairman)

Theodore M. Armstrong

Reuben Mark

Communications with the Board of Directors

Interested parties may contact an individual director, the Board as a group, or a specific Board committee or group, including the non-employee directors as a group, by writing to Board of Directors, c/o Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160. Each communication should specify the applicable addressee or addressees to be contacted, a statement of the type and amount of the securities of the Company that the person holds, and the address, telephone number, and e-mail address, if any, of the person submitting the communication. The Board has instructed the Company’s Secretary to review all communications to the Board and to only distribute communications if appropriate to the duties and responsibilities of the Board. The Board has instructed the Company’s Secretary to not forward to the directors any interested party communications that he determines to be primarily commercial in nature, that relate to an improper or irrelevant topic, or that request general information about the Company.

Concerns about our financial statements, accounting practices, or internal controls, or possible violations of Cabela’s Business Code of Conduct and Ethics, should be reported pursuant to the procedures outlined in Cabela’s Business Code of Conduct and Ethics, which is available on our website at www.cabelas.com, or by writing to Chairman of the Audit Committee, c/o Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160.

Procedures Regarding Director Candidates Recommended by Shareholders

The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders, evaluating them using criteria similar to that used to evaluate candidates recommended by others. The Nominating and Corporate Governance Committee has not established a minimum number of shares that a shareholder must own in order to present a candidate for consideration, or a minimum length of time during which the shareholder must own its shares. Such recommendations should be made in writing to the Nominating and Corporate Governance Committee, c/o Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160, and should include a description of the qualifications of the proposed candidate. The Nominating and Corporate Governance Committee’s qualifications and specific qualities and skills required for directors are set forth in our Governance Guidelines. In addition to considering candidates suggested by shareholders, the Nominating and Corporate Governance Committee considers potential candidates recommended by current directors, officers, employees, and others. The Nominating and Corporate Governance Committee screens all potential candidates in a similar manner regardless of the source of the recommendation. The Nominating and Corporate Governance Committee’s review is typically based on any written materials provided with respect to the potential candidate as well as the Committee’s own investigation. The Nominating and Corporate Governance Committee determines whether the candidate meets the Company’s qualifications and specific qualities and skills for directors and whether requesting additional information or an interview is appropriate. It is the Committee’s policy to re-nominate incumbent directors who continue to satisfy the Committee’s criteria for membership on the Board, whom the Committee believes continue to make important contributions to the Board, and who consent to continue their service on the Board.

The Nominating and Corporate Governance Committee also will consider whether to nominate any person nominated by a shareholder in accordance with the information and timely notice requirements set forth in Article II, Section 11 of our Amended and Restated Bylaws. A copy of our Amended and Restated Bylaws may be obtained by request addressed to our Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160.

7

Director Compensation

We pay our non-employee directors an annual retainer of $22,500, a fee of $2,500 for each Board meeting attended ($1,000 for meetings attended by telephone) and a fee of $1,500 for each committee meeting attended (other than meetings held in conjunction with a board meeting) ($500 for meetings attended by telephone). In addition, the Chairman of the Audit Committee receives an additional $10,000 annual retainer.

We promptly reimburse all non-employee directors for reasonable expenses incurred to attend Board meetings. In addition, non-employee directors are eligible to receive option grants under our 2004 Stock Plan. Under this plan, each of our non-employee directors is automatically granted an initial option to purchase 2,000 shares of our common stock upon the date the non-employee director first joins our Board. In addition, subject to certain restrictions in the plan, each non-employee director also will be automatically granted an annual option to purchase 2,000 shares of our common stock on the date immediately following our annual meeting of shareholders. The exercise price for each of these options will be the fair market value of the stock underlying the option on the date of the grant. The initial and annual option grants to non-employee directors vest on the first anniversary of the grant date.

As an emeritus director, Mr. Matzke receives compensation in the amount of $22,500 per year for his service, is reimbursed for his travel expenses to attend Board and committee meetings, and is entitled to indemnification in his role as an emeritus director.

Business Code of Conduct and Ethics and Code of Ethics

The Board has adopted a Business Code of Conduct and Ethics applicable to all directors, officers, and employees of the Company, which constitutes a “code of ethics” within the meaning of SEC rules. A copy of our Business Code of Conduct and Ethics is available on our website at www.cabelas.com. You also may request a copy of this document by writing to our Secretary, Cabela’s, One Cabela Drive, Sidney, Nebraska 69160. We expect to disclose to shareholders any waiver of the Business Code of Conduct and Ethics for directors or executive officers by posting such information on our website at the address specified above.

EXECUTIVE OFFICERS OF THE COMPANY

The table below sets forth certain information regarding our executive officers.

| | | | |

Name | | Age | | Position |

Richard N. Cabela | | 69 | | Chairman |

| | |

James W. Cabela | | 66 | | Vice Chairman |

| | |

Dennis Highby | | 57 | | President and Chief Executive Officer |

| | |

Patrick A. Snyder | | 51 | | Senior Vice President of Merchandising |

| | |

Michael Callahan | | 56 | | Senior Vice President, Retail Operations and Marketing |

| | |

Ralph W. Castner | | 42 | | Vice President and Chief Financial Officer, and interim Chief Executive Officer of World’s Foremost Bank |

| | |

Brian J. Linneman | | 39 | | Vice President and Chief Operating Officer |

Patrick A. Snyder has been our Senior Vice President of Merchandising since July 2003. From 1996 to July 2003 he was Director of Merchandise for Clothing. Mr. Snyder joined us in 1981 as Product Manager.

Michael Callahan has been our Senior Vice President, Retail Operations and Marketing since July 2003. From January 1995 to July 2003, Mr. Callahan was Director of Merchandise for Hard Goods. He joined us as a Product Manager in 1990. Prior to joining us, Mr. Callahan was employed by Gart Brothers Sporting Goods, most recently as a merchandise manager.

8

Ralph W. Castner has been our Vice President and Chief Financial Officer since July 2003, and interim Chief Executive Officer of World’s Foremost Bank, our bank subsidiary, since January 2006. From 2000 to July 2003, Mr. Castner was our Director of Accounting and Finance and Treasurer of World’s Foremost Bank. Prior to joining us, he was employed by First Data Corporation from 1990 to 2000, most recently as a vice president. Prior to joining First Data Corporation, Mr. Castner was a certified public accountant with the public accounting firm of Touche Ross and Company.

Brian J. Linneman has been our Vice President and Chief Operating Officer since April 2004. From July 2003 to April 2004, Mr. Linneman was our Vice President of Strategic Projects & MIS. From 2002 to July 2003, Mr. Linneman was our Director of Strategic Projects. From 1999 to 2002, Mr. Linneman was our Corporate Logistics Manager. Prior to joining us, he was employed by United Parcel Service from 1987 to 1999, most recently as a logistics manager in the west region.

See “Proposal One – Election of Directors” for information concerning the business experience of Mr. R. Cabela, Mr. J. Cabela, and Mr. Highby.

EXECUTIVE COMPENSATION

The following table sets forth in summary form information concerning the compensation we paid during fiscal 2005, 2004, and 2003 to our Chief Executive Officer and our four other most highly compensated executive officers, each of whom earned more than $100,000 during the fiscal year. In this Proxy Statement, these individuals are referred to as the “named executive officers.”

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation(1) | | Long-Term

Compensation | | |

Name and Principal Position | | Fiscal Year | | Salary | | Bonus | | Other Annual

Compensation(2) | | Securities Underlying Options | | All Other Compensation(3) |

Dennis Highby

President and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 642,598

564,525

308,285 | | $

$

$ | 1,676,550

1,516,905

1,325,300 | | $

| 34,916

—

— | | 40,000

238,550

— | | $

$

$ | 11,980

18,380

6,000 |

Patrick A. Snyder

Senior Vice President of Merchandising | | 2005

2004

2003 | | $

$

$ | 396,106

352,298

197,613 | | $

$

$ | 526,550

466,905

375,300 | | $

$

| 4,808

1,089

— | | 20,000

18,350

73,400 | | $

$

$ | 7,870

16,076

6,000 |

Michael Callahan

Senior Vice President, Retail Operations and Marketing | | 2005

2004

2003 | | $

$

$ | 396,106

348,730

187,395 | | $

$

$ | 526,550

466,905

375,300 | | $

| 4,802

—

— | | 20,000

18,350

73,400 | | $

$

$ | 7,828

16,037

6,000 |

Ralph W. Castner

Vice President and Chief Financial Officer, and interim Chief Executive Officer of World’s Foremost Bank | | 2005

2004

2003 | | $

$

$ | 308,654

275,891

161,615 | | $

$

$ | 441,550

391,905

288,421 | | $

$

| 12,291

1,584

— | | 20,000

44,040

36,700 | | $

$

$ | 7,554

15,825

3,149 |

Brian J. Linneman

Vice President and Chief Operating Officer | | 2005

2004

2003 | | $

$

$ | 257,211

224,662

114,743 | | $

$

$ | 441,550

391,905

217,180 | | $

| 3,763

—

— | | 20,000

36,700

29,360 | | $

$

$ | 7,193

15,526

4,051 |

| (1) | In accordance with the rules of the SEC, the annual compensation described in this table does not include various perquisites and other personal benefits received by our named executive officers that do not exceed, in the aggregate, the lesser of $50,000 or 10% of any such officer’s salary and bonus disclosed in this table. |

9

| (2) | Consists of above-market interest earned on deferred compensation that was paid during the fiscal year or payable during the fiscal year but deferred at the election of the named executive officer and, for Mr. Highby only, $18,692 of vacation sold back to the Company at 75% of value in accordance with the Company’s standard vacation policy. The named executive officers had the following balances in the Company’s deferred compensation plan as of fiscal year-end 2005: Mr. Highby, $348,203; Mr. Snyder, $96,369; Mr. Callahan, $93,693; Mr. Castner, $585,609; and Mr. Linneman, $56,624. The interest rate paid on balances in the Company’s deferred compensation plan is prime plus 1.75% and is adjusted semi-annually. |

| (3) | For fiscal 2003, consists of 401(k) matching contributions for each of the named executive officers. For fiscal 2004, consists of 401(k) matching contributions in the amount of $6,150, and 401(k) discretionary contributions in the amount of $9,020, for each of the named executive officers, with the balance for each of the named executive officers attributable to above-market interest earned on deferred compensation during the fiscal year that was not paid or payable during the fiscal year. For fiscal 2005, consists of 401(k) matching contributions in the amount of $6,300 for each of the named executive officers, with the balance for each of the named executive officers attributable to above-market interest earned on deferred compensation during the fiscal year that was not paid or payable during the fiscal year. |

Options Granted in the Last Fiscal Year

The following table sets forth, as to the named executive officers, information concerning stock options granted during fiscal 2005.

| | | | | | | | | | | | | | | |

Name | | Individual Grants | | | | |

| | Number of Securities Underlying Options Granted(1) | | Percentage

of Total

Options Granted to Employees During

Period(2) | | Exercise Price Per Share | | Expiration Date | | Potential Realizable Value At Assumed Annual Rates of Stock

Price Appreciation For Option Term(3) |

| | | | | | 5% | | 10% |

Dennis Highby | | 40,000 | | 6% | | $ | 20.00 | | April 14, 2015 | | $ | 503,116 | | $ | 1,247,994 |

| | | | | | |

Patrick A. Snyder | | 20,000 | | 3% | | $ | 20.00 | | April 14, 2015 | | $ | 251,558 | | $ | 637,497 |

| | | | | | |

Michael Callahan | | 20,000 | | 3% | | $ | 20.00 | | April 14, 2015 | | $ | 251,558 | | $ | 637,497 |

| | | | | | |

Ralph W. Castner | | 20,000 | | 3% | | $ | 20.00 | | April 14, 2015 | | $ | 251,558 | | $ | 637,497 |

| | | | | | |

Brian J. Linneman | | 20,000 | | 3% | | $ | 20.00 | | April 14, 2015 | | $ | 251,558 | | $ | 637,497 |

| (1) | Options fully vested upon grant. |

| (2) | During fiscal 2005, we granted employees options to purchase an aggregate of 678,000 shares of our common stock. |

| (3) | The potential realizable value is calculated based on the term for the option at the time of grant. The assumed rates of appreciation are prescribed by the SEC for illustrative purposes only and are not intended to forecast or predict future stock prices. The potential realizable value at 5% and 10% appreciation is calculated by assuming that fair market price appreciates at the indicated rate for the entire term of the option and that the option is exercised at the exercise price and sold on the last day of its term at its appreciated price. |

10

Aggregated Options Exercised in the Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth, for each of the named executive officers, the number of shares of our common stock acquired and the dollar value realized upon exercise of options during fiscal 2005 and the number and value of securities underlying options held at fiscal year-end 2005.

| | | | | | | | | | | | | | |

| | | Number of

Shares

Acquired on

Exercise | | Value

Realized | | Number of Securities

Underlying Unexercised

Options at December 31, 2005 | | Value of Unexercised In-the-Money Options at December 31, 2005(1) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Dennis Highby | | — | | — | | 87,710 | | 190,840 | | | — | | | — |

Patrick A. Snyder | | — | | — | | 23,670 | | 44,040 | | $ | 11,964 | | $ | 206,401 |

Michael Callahan | | — | | — | | 53,030 | | 58,720 | | $ | 170,508 | | $ | 285,673 |

Ralph W. Castner | | — | | — | | 47,158 | | 141,662 | | $ | 145,809 | | $ | 944,108 |

Brian J. Linneman | | — | | — | | 43,855 | | 100,925 | | $ | 132,891 | | $ | 577,089 |

| (1) | The value of unexercised in-the-money options equals the difference between the option exercise price and the closing price of our common stock at fiscal year-end, multiplied by the number of shares underlying the options. At fiscal year-end, the closing price of our common stock on the NYSE was $16.60 per share. |

Equity Compensation Plan Information as of Fiscal Year-End

The following table summarizes, as of fiscal year-end 2005, information about our compensation plans under which equity securities of the Company are authorized for issuance:

| | | | | | |

Plan Category | | Number of Securities To Be

Issued Upon Exercise of

Outstanding Options | | Weighted-Average

Exercise Price of

Outstanding Options | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans |

Equity compensation plans approved by security holders | | 4,695,748 | | $12.36 | | 2,457,258(1) |

Equity compensation plans not approved by security holders | | — | | — | | — |

Total | | 4,695,748 | | $12.36 | | 2,457,258(1) |

| (1) | Of these shares, 1,705,279 remain available for future issuance under our Employee Stock Purchase Plan and 751,979 remain available for future issuance under our 2004 Stock Plan. |

Employment Agreements

In January 2004, we entered into an employment agreement with Mr. R. Cabela. Mr. R. Cabela agreed to serve in the executive position of Chairman of our Company. Under the employment agreement, Mr. R. Cabela currently receives an annual base salary of $263,084 and is precluded from participating in any of our incentive compensation programs. We may terminate Mr. R. Cabela’s employment agreement without cause upon 180 days written notice. We may terminate Mr. R. Cabela’s employment agreement at any time for cause. Mr. R. Cabela may terminate his employment agreement upon 90 days written notice. We are required to pay Mr. R. Cabela his base salary through the effective date of any termination of his employment agreement. The employment agreement prohibits Mr. R. Cabela from competing with us for a period of twelve months following the termination of the employment agreement for any reason. Mr. R. Cabela has assigned to us exclusive rights in and to any intellectual property developed by him during his employment with us in the scope of our actual or anticipated business operations or that relates to any of our actual or anticipated products or services. We are required to provide Mr. R. Cabela with statutory indemnification to the fullest extent provided by law for any claims asserted against him relating to his service as an officer or director of the Company.

In January 2004, we entered into an employment agreement with Mr. J. Cabela. Mr. J. Cabela agreed to serve in the executive position of Vice Chairman of our Company. Under the employment agreement, Mr. J. Cabela currently receives an annual base salary of $268,453 and is precluded from participating in any of

11

our incentive compensation programs. We may terminate Mr. J. Cabela’s employment agreement without cause upon 180 days written notice. We may terminate Mr. J. Cabela’s employment agreement at any time for cause. Mr. J. Cabela may terminate his employment agreement upon 90 days written notice. We are required to pay Mr. J. Cabela his base salary through the effective date of any termination of his employment agreement. The employment agreement prohibits Mr. J. Cabela from competing with us for a period of twelve months following the termination of the employment agreement for any reason. Mr. J. Cabela has assigned to us exclusive rights in and to any intellectual property developed by him during his employment with us in the scope of our actual or anticipated business operations or that relates to any of our actual or anticipated products or services. We are required to provide Mr. J. Cabela with statutory indemnification to the fullest extent provided by law for any claims asserted against him relating to his service as an officer or director of the Company.

Change in Control Arrangements

Management Change of Control Severance Agreements. We have entered into agreements containing change of control severance provisions with Dennis Highby, Patrick A. Snyder, Michael Callahan, Ralph W. Castner, Brian J. Linneman and certain other members of senior management. Under these agreements, if any of these employees are terminated without cause or resigns for good reason within twenty-four months of certain transactions resulting in a change in control, then the employee will be entitled to receive severance benefits equal to two years’ base salary and bonus, payable in a lump sum, and insurance benefits. In addition, any unvested stock options and unvested deferred compensation benefits owned by such an employee, that did not vest upon the change in control, will become fully vested and any non-competition and non-solicitation agreements we have with such an employee will automatically terminate. Each of these agreements also provides that to the extent any of the payments under the agreements would exceed the limitation of Section 280G of the Internal Revenue Code, or the Code, such that an excise tax would be imposed under Section 4999 of the Code, the executive will receive an additional “gross up” payment to indemnify him for the effect of such excise tax.

1997 Stock Option Plan. Should we undergo certain changes in control or ownership, then each outstanding option under the 1997 Stock Option Plan will be canceled in return for a cash payment per share of common stock subject to that option (whether or not the option is otherwise at that time vested and exercisable for all the option shares) equal to the highest price per share paid for our common stock in effecting that change in control or ownership less the option exercise price payable per share under the canceled option. However, such a cashout of the outstanding options will not occur if in the good faith discretion of the Compensation Committee those options are to be honored or assumed by the acquiring company or new rights substituted therefore to acquire fully-vested, publicly-traded securities of the acquiring company or its corporate parent at an exercise price per share which preserves the economic value of each such option immediately prior to the change in control or ownership.

2004 Stock Plan. In the event of a change in control (as defined in the 2004 Stock Plan), all outstanding options and stock appreciation rights shall become fully vested and exercisable, the restriction period applicable to any awards of restricted stock and restricted stock units shall lapse, and shares of our common stock underlying restricted units shall be issued or, at the discretion of the Compensation Committee, each award of options, stock appreciation rights, or restricted stock units, as the case may be, shall be canceled in exchange for a payment in cash equal to the product of (i) (A) in the case of options and stock appreciation rights, the excess of the change in control price over the exercise price or base price, as the case may be, and (B) in the case of all other awards, the change of control price, and (ii) the number of shares of common stock covered by such award.

Upon a change in control, (a) any performance period in progress at the time of the change in control for which performance stock or performance units are outstanding shall end, (b) all participants granted such awards of performance stock or performance units shall be deemed to have earned a pro rata award equal to the product of (i) such participant’s target award opportunity for the performance period in question and (ii) the percentage of performance objectives achieved as of the date of such change in control, or (c) at the discretion of the

12

Compensation Committee, all such earned performance units shall be canceled in exchange for an amount equal to the product of (i) the change in control price, multiplied by (ii) the aggregate number of shares of our common stock covered by such award. All of the performance shares and performance units that have not been so earned shall be forfeited and canceled as of the date of the change in control.

Notwithstanding the foregoing, if the Compensation Committee determines before the change in control either that all outstanding awards of options, stock appreciation rights, restricted stock, and restricted stock units will be honored or assumed by the acquirer, or alternative awards with equal or better terms will be made available, such outstanding awards of options, stock appreciation rights, restricted stock, and restricted stock units will not be canceled, their vesting and exercisability will not be accelerated, and there will be no payment in exchange for such awards.

Compensation Committee Report on Executive Compensation

The Compensation Committee is responsible for establishing the Company’s philosophy, policies, and strategy relative to executive compensation, administering the Company’s executive officer and key personnel compensation programs, and evaluating and setting the compensation of the Company’s executive officers. The Compensation Committee’s charter reflects these various responsibilities, and the Compensation Committee and the Board are required to periodically review the charter for any improvements that the Committee considers necessary or valuable.

Compensation Philosophy and Practice

The Company’s compensation programs are intended to provide a link between the creation of shareholder value and the compensation earned by executive officers and certain key personnel. The Company’s compensation programs are designed to:

| | • | | attract, motivate, and retain superior talent; |

| | • | | ensure that compensation is commensurate with the Company’s performance and shareholder returns; |

| | • | | provide performance awards for the achievement of strategic objectives that are critical to the Company’s long-term growth; and |

| | • | | ensure that executive officers and certain key personnel have financial incentives to achieve sustainable growth in shareholder value. |

In carrying out the compensation programs, the Company’s general compensation philosophy is that executive officers’ total compensation should be aligned with the performance of the Company in achieving financial and non-financial objectives.

Components of Executive Compensation

The Company has historically compensated its executive officers by providing compensation consisting of a base salary component, an annual bonus component linked to individual and Company performance, and a long-term incentive component, including stock option grants.

Base Salary. Salary is paid for ongoing performance throughout the year. The Compensation Committee determines executive officer base salaries by evaluating the responsibilities of the position held, past and current performance, and compensation for similar positions at peer group companies. Prior to the Company’s initial public offering in June 2004, the Company engaged a compensation consultant to assist it in determining compensation levels at peer group companies. The Compensation Committee reviews base salaries for executive officers annually and makes adjustments as appropriate based on individual performance, the average base salary increases provided to other members of management, and such other factors as the Compensation Committee determines are important. During fiscal 2005, each executive officer received a 3.75% increase in base salary.

13

Annual Bonus. Pursuant to the Company’s Restated Bonus Plan, exempt employees, other than Messrs. R. Cabela and J. Cabela, are eligible for an annual cash bonus. Bonuses are generally paid in March for the prior year’s performance. The Compensation Committee has the sole discretion to determine the aggregate bonus pool for each fiscal year and the individual bonuses paid under the Restated Bonus Plan. Historically, the Compensation Committee has allocated a certain percentage of the Company’s pre-tax profit, after making certain adjustments, to the aggregate bonus pool. Accordingly, the annual bonus component of executive officer compensation is linked to the annual financial performance of the Company, thus motivating and rewarding executive officers for excellent performance. The Compensation Committee determines the portion of the aggregate bonus pool to be allocated to the Company’s President and Chief Executive Officer, Dennis Highby, on the basis of several factors, including individual performance and the historical amount of the President and Chief Executive Officer’s bonus as a percentage of the aggregate bonus pool and as a percentage of profit before bonus expense. Mr. Highby makes recommendations to the Compensation Committee with respect to the particular executive officers who should share in the aggregate bonus pool and the respective portion of the pool to be allocated to each such individual, taking into account each officer’s level and amount of responsibility. The Compensation Committee makes the actual selection of the executive officers who are to receive an award and determines the amount to be allocated to each such individual. In determining the allocation of awards to executive officers under the Restated Bonus Plan, the Compensation Committee takes into account the respective contributions made by the individual to the success of the Company for the fiscal year. The Compensation Committee also determines the portion of the aggregate bonus pool to be allocated to the Company’s non-executive officer employees and, based upon the recommendations of Mr. Highby and the Company’s executive officers, the amount each such individual shall receive.

Long-Term Incentives. To encourage and reward the long-term growth of the Company, the Compensation Committee may award stock options or other equity-based incentives to executive officers and key employees from time to time pursuant to the Company’s 2004 Stock Plan. The purposes of the 2004 Stock Plan are to foster and promote the long-term financial success of the Company and materially increase shareholder value by motivating superior performance, providing an ownership interest in the Company, and enabling the Company to attract and retain the services of outstanding employees. To date, the Compensation Committee has only awarded stock options under the 2004 Stock Plan, but may consider other equity-based incentives in the future. The stock options granted by the Committee during fiscal 2005 were fully vested upon grant. The Compensation Committee determined to fully vest these stock options to reward management for their outstanding performance in fiscal 2004, both in terms of the Company’s financial performance and the Company’s transition from a private to public company, and due to the future financial reporting benefits of immediate option vesting under Statement of Accounting Financial Standards No. 123R, which the Company adopted on January 1, 2006. Statement No. 123R requires the Company to recognize expense in its financial statements for share-based or equity payments, including expense for any outstanding unvested options at the time of adoption. The Compensation Committee does not plan to grant fully vested stock options in the future. Stock options align executives’ interests with those of other shareholders because stock options result in minimal or no reward if the Company’s stock price does not appreciate, but provide substantial rewards to executives if the Company’s stock price increases. The number of stock options granted to the executive officers during fiscal 2005 was based primarily on the Committee’s assessment of each executive officer’s performance, potential to enhance long-term shareholder value, and each executive officer’s portion of the total number of options being granted to employees in fiscal 2005.

Compensation of the President and Chief Executive Officer

Mr. Highby’s base salary for fiscal 2005 was $642,598, and he earned a bonus of $1,650,000 during fiscal 2005 under the Company’s Restated Bonus Plan. In addition, on April 14, 2005, Mr. Highby was granted an option under the 2004 Stock Plan to purchase 40,000 shares of common stock at an exercise price of $20 per share. The Compensation Committee’s determination of the compensation package for Mr. Highby is consistent with the overall compensation philosophy for other executive officers. Mr. Highby’s compensation is weighted heavily to performance and long-term forms of compensation that provide a strong link between the Company’s

14

performance and Mr. Highby’s compensation. In determining Mr. Highby’s compensation package for fiscal 2005, the Compensation Committee considered a number of factors, including the Company’s performance, the compensation of CEOs at comparable companies, Mr. Highby’s contribution to the Company’s past success, and awards given to Mr. Highby in past years.

Review of all Components of Compensation and Conclusion

The Compensation Committee reviewed all components of Mr. Highby’s and the other executive officers’ compensation for fiscal 2005, including salary, bonus, long-term incentive compensation, accumulated realized and unrealized stock option gains, the dollar value to the executive and cost to the Company of all perquisites and other personal benefits, the interest income under the Company’s deferred compensation plan, and the potential payout obligations under the Company’s management change of control severance agreements. Based on this review, the Compensation Committee found Mr. Highby’s and the other executive officers’ total compensation (and, in the case of the management change of control severance agreements, the potential payouts) in the aggregate to be reasonable and not excessive.

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Tax Code”), places a limit of $1,000,000 on the amount of compensation that the Company may deduct in any one year with respect to its five most highly paid executive officers, unless the compensation in excess of $1,000,000 is “performance-based” compensation. Prior to June 2004, Section 162(m) did not apply to the Company because it was not publicly held. Section 162(m) and the regulations thereunder provide a transitional exception to the deduction limit for compensation plans established prior to the Company’s initial public offering, such as the 2004 Stock Plan and the Restated Bonus Plan. Due to this transitional exception, stock options granted and bonuses paid to the Company’s five most highly paid executive officers through the end of fiscal 2005 will be exempt from Section 162(m). Stock options granted and bonuses paid to the Company’s five most highly paid executives in fiscal 2006 also will be exempt from Section 162(m) so long as the Company continues to comply with the terms of the transitional exemption. The Compensation Committee believes that any other compensation (such as salary) that is paid to the five most highly paid executive officers in fiscal 2006 will either not exceed the $1 million limitation or will meet the criteria for deductibility under Section 162(m).

To maintain flexibility in compensating executive officers in a manner designed to promote varying corporate goals, the Committee has not adopted a policy that all compensation must be deductible.

The foregoing report on executive compensation for 2005 is provided by the undersigned members of the Compensation Committee of the Board of Directors.

Michael R. McCarthy (Chairman)

John Gottschalk

Reuben Mark

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 10, 2006 (except as noted below), the number and percentage of outstanding shares of our common stock and non-voting common stock beneficially owned by each person known by us to beneficially own more than 5% of such stock, by each director and named executive officer, and by all directors and executive officers as a group.

Except as otherwise noted below, the address for those individuals for which an address is not otherwise indicated is c/o Cabela’s Incorporated, One Cabela Drive, Sidney, Nebraska 69160.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as otherwise indicated in the footnotes to the table below, we believe that the beneficial owners of the common stock and non-voting common stock listed below, based on the information furnished by such owners, have sole voting power and investment power with respect to such shares, subject to applicable community property laws. We have based our calculation of the percentage of beneficial ownership on shares of common stock and shares of non-voting common stock outstanding as of March 10, 2006. All shares of our non-voting common stock are convertible into common stock upon the option of the holder; provided, however, that no shares of non-voting common stock held by a regulated shareholder may be converted into shares of common stock if the conversion would result in the regulated shareholder holding shares of common stock in excess of its permitted regulatory amount.

In computing the percentage of shares of common stock and non-voting common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock as to which the person has the right to acquire beneficial ownership within 60 days of March 10, 2006, through the exercise of any option, conversion rights, or other rights. We did not deem these shares outstanding for purposes of computing the percentage ownership of any other person.

| | | | | | | | |

| | | Number of Shares Beneficially Owned | | Percentage of Shares

Beneficially Owned |

Name of Beneficial Owner | | Common Stock | | Total Common

and Non-voting | | Common

Stock (19) | | Total Common

and Non-voting |

5% Shareholders | | | | | | | | |

JPMP Capital Corp. (1) | | — | | 6,252,768 | | — | | % |

Richard N. Cabela (2) | | 9,588,931 | | 9,588,931 | | % | | % |

Mary A. Cabela (3) | | 8,695,813 | | 8,695,813 | | % | | % |

James W. Cabela (4) | | 11,726,260 | | 11,726,260 | | % | | % |

McCarthy Group, Inc. (5) | | 1,961,579 | | 3,782,016 | | % | | % |

Wallace R. Weitz & Company (6) | | 3,250,895 | | 3,250,895 | | % | | % |

Directors and Executive Officers | | | | | | | | |

Dennis Highby (7) | | 853,505 | | 853,505 | | % | | % |

Patrick A. Snyder (8) | | 278,231 | | 278,231 | | * | | * |

Michael Callahan (9) | | 432,302 | | 432,302 | | * | | * |

Ralph W. Castner (10) | | 180,537 | | 180,537 | | * | | * |

Brian J. Linneman (11) | | 102,262 | | 102,262 | | * | | * |

Theodore M. Armstrong (12) | | 6,000 | | 6,000 | | * | | * |

John Gottschalk (13) | | 209,711 | | 209,711 | | * | | * |

Reuben Mark (14) | | 22,000 | | 22,000 | | * | | * |

Gerald E. Matzke (emeritus director) (15) | | 33,195 | | 33,195 | | * | | * |

Michael R. McCarthy (16) | | 2,059,934 | | 3,880,371 | | % | | % |

Stephen P. Murray (17) | | — | | 6,252,768 | | — | | % |

All Directors and Executive Officers

(13 persons) (18) | | 25,492,868 | | 33,566,073 | | % | | % |

*Less than 1% of total.

16

| (1) | JPMP Capital Corp. beneficially owns 6,252,768 shares of non-voting common stock, which represents 77.45% of our issued and outstanding non-voting common stock. JPMP Capital Corp.’s beneficial ownership consists of (a) 5,497,682 shares of non-voting common stock held by J.P. Morgan Partners (BHCA), L.P., (b) 368,257 shares of non-voting common stock held by J.P. Morgan Partners Global Investors, L.P., (c) 184,879 shares of non-voting common stock held by J.P. Morgan Partners Global Investors (Cayman), L.P., (d) 124,692 shares of non-voting common stock held by J.P. Morgan Partners Global Investors (Selldown), L.P., (e) 56,583 shares of non-voting common stock held by J.P. Morgan Partners Global Investors A, L.P., and (f) 20,675 shares of non-voting common stock held by J.P. Morgan Partners Global Investors (Cayman) II, L.P. The general partner of J.P. Morgan Partners (BHCA), L.P. is JPMP Master Fund Manager, L.P. The general partner of each of J.P. Morgan Partners Global Investors, L.P., J.P. Morgan Partners Global Investors (Cayman), L.P., J.P. Morgan Partners Global Investors (Selldown), L.P., J.P. Morgan Partners Global Investors A, L.P., and J.P. Morgan Partners Global Investors (Cayman) II, L.P. is JPMP Global Investors, L.P. JPMP Capital Corp., a wholly-owned subsidiary of J.P. Morgan Chase & Co., a publicly traded company, is the general partner of each of JPMP Master Fund Manager, L.P. and JPMP Global Investors, L.P. Each of JPMP Master Fund Manager, L.P., JPMP Global Investors, L.P., JPMP Capital Corp., and J.P. Morgan Chase & Co. may be deemed beneficial owners of the shares held by J.P. Morgan Partners (BHCA), L.P., J.P. Morgan Partners Global Investors, L.P., J.P. Morgan Partners Global Investors (Cayman), L.P., J.P. Morgan Partners Global Investors (Selldown), L.P., J.P. Morgan Partners Global Investors A, L.P., and J.P. Morgan Partners Global Investors (Cayman) II, L.P., however, the foregoing shall not be construed as an admission that such entities are the beneficial owners of the shares held by J.P. Morgan Partners (BHCA), L.P., J.P. Morgan Partners Global Investors, L.P., J.P. Morgan Partners Global Investors (Cayman), L.P., J.P. Morgan Partners Global Investors (Selldown), L.P., J.P. Morgan Partners Global Investors A, L.P., and J.P. Morgan Partners Global Investors (Cayman) II, L.P. The address for JPMP Capital Corp. is 1221 Avenue of the Americas, New York, New York 10020. |

| (2) | Includes (a) 8,449,891 shares of common stock held by Cabela’s Family, LLC with respect to which Mr. R. Cabela has shared investment power and sole voting power, (b) 214,073 shares of common stock held by Cabela’s Family, LLC, with respect to which Mr. R. Cabela has shared investment power, but not voting power, and (c) 12,580 shares of common stock held in our 401(k) plan. |

| (3) | Includes (a) 214,073 shares of common stock held by Cabela’s Family, LLC, with respect to which Mrs. Cabela has shared investment power and sole voting power, and (b) 8,449,891 shares of common stock held by Cabela’s Family, LLC, with respect to which Mrs. Cabela has shared investment power, but not voting power. |

| (4) | Includes 10,402 shares of common stock held in our 401(k) plan. |

| (5) | McCarthy Group, Inc., or MGI, beneficially owns 1,820,437 shares of non-voting common stock, which represents 22.55% of our issued and outstanding non-voting common stock. MGI’s beneficial ownership includes (a) 1,820,437 shares of non-voting common stock, and 750,000 shares of common stock, held by MGI, (b) 1,003,226 shares of common stock held by Fulcrum Growth Partners, L.L.C., or Fulcrum, and (c) 208,353 shares of common stock held by McCarthy Capital Corporation, or McCarthy Capital. Mr. McCarthy, one of our directors, is the Chairman of MGI. MGI is the managing member of Fulcrum. McCarthy Capital is a wholly-owned subsidiary of MGI. The address for McCarthy Group, Inc. is First National Tower, 1601 Dodge Street, Suite 3800, Omaha, Nebraska 68102. |

| (6) | Represents shares held by investment advisory clients of Wallace R. Weitz & Company, a registered investment advisor (“Weitz & Co.”). Includes 103,000 shares of common stock with respect to which Weitz & Co. has sole investment power, but no voting power. Wallace R. Weitz serves as President and is the primary owner of Weitz & Co. As a result, he may be deemed to be the beneficial owner of the shares of common stock beneficially held by Weitz & Co. The address for Weitz & Co. is 1125 South 103rd Street, Suite 600, Omaha, Nebraska 68124. Information is shown as of December 31, 2005 and has been derived from a Schedule 13G filed with the SEC on January 13, 2006. |

| (7) | Includes (a) 249,358 shares of our common stock held by a Grantor Retained Annuity Trust with respect to which Mr. Highby retains certain rights, (b) 14,595 shares of common stock held in our 401(k) plan, and |

17

| | (c) 135,420 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. |

| (8) | Includes (a) 22,020 shares of our common stock held by a Grantor Retained Annuity Trust with respect to which Mr. Snyder retains certain rights, (b) 12,351 shares of common stock held in our 401(k) plan, and (c) 27,340 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. |

| (9) | Includes (a) 90,090 shares held in a Grantor Retained Annuity Trust with respect to which Mr. Callahan retains certain rights, (b) 13,308 shares of common stock held in our 401(k) plan, and (c) 71,380 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. |

| (10) | Includes (a) 119 shares of common stock held in our 401(k) plan, and (b) 81,656 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. |

| (11) | Includes (a) 314 shares of common stock held in our 401(k) plan, and (b) 67,710 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. |

| (12) | Includes 2,000 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. The address for Mr. Armstrong is 7730 Carondelet, Suite 103, St. Louis, Missouri 63105. |

| (13) | Includes 2,000 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. The address for Mr. Gottschalk is c/o Omaha World-Herald Company, 1334 Dodge Street, Omaha, Nebraska 68102. |

| (14) | Includes 2,000 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. The address for Mr. Mark is c/o Colgate-Palmolive Company, 300 Park Avenue, New York, New York 10022. |

| (15) | Includes 9,340 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006. The address for Mr. Matzke is 907 Jackson Street, P. O. Box 316, Sidney, Nebraska 69162-0316. |

| (16) | Mr. McCarthy may be deemed to beneficially own 1,820,437 shares of non-voting common stock beneficially owned by MGI, which represents 22.55% of our issued and outstanding non-voting common stock. Mr. McCarthy’s beneficial ownership includes (a) 7,340 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006, (b) 1,820,437 shares of non-voting common stock, and 750,000 shares of common stock, held by MGI, (c) 1,003,226 shares of common stock held by Fulcrum, and (d) 208,353 shares of common stock held by McCarthy Capital. Mr. McCarthy is the Chairman of MGI. Although Mr. McCarthy may be deemed the beneficial owner of these shares, he disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address for Mr. McCarthy is First National Tower, 1601 Dodge Street, Suite 3800, Omaha, Nebraska 68102. |

| (17) | Mr. Murray may be deemed to beneficially own 6,252,768 shares of non-voting common stock beneficially owned by JPMP Capital Corp. (see footnote (1) above), which represents 77.45% of our issued and outstanding non-voting common stock. Mr. Murray is a Managing Director of JPMP Capital Corp. Although Mr. Murray may be deemed the beneficial owner of these shares, he disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address for Mr. Murray is 1221 Avenue of the Americas, New York, New York 10020. |

| (18) | Includes (a) 406,186 shares of common stock issuable upon exercise of stock options within 60 days of March 10, 2006, (b) 8,449,891 shares of common stock with respect to which our directors and officers have shared investment power and sole voting power, (c) 214,073 shares of common stock with respect to which our directors and officers have shared investment power, but not voting power, and (d) 1,820,437 shares of non-voting common stock that are convertible into shares of common stock at the option of the holder. |

| (19) | The percentages reflected in this column assume the conversion of the non-regulated holder’s non-voting common stock to common stock. |

18

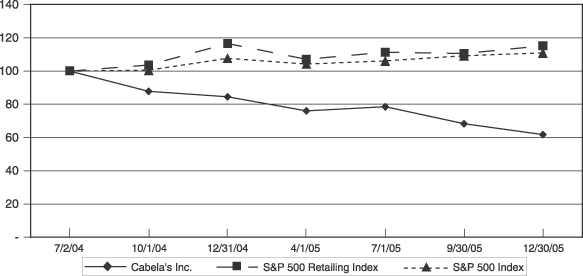

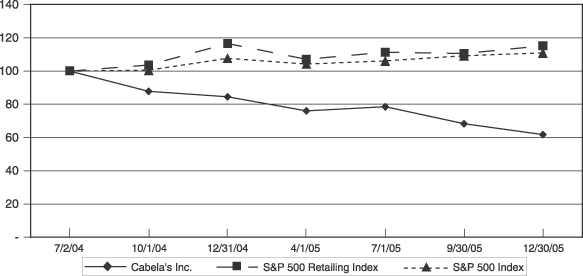

STOCK PERFORMANCE GRAPH

The following stock performance graph and table show Cabela’s cumulative total shareholder return on a quarterly basis since the beginning of our first full fiscal quarter following the date of our initial public offering. The graph also shows the cumulative total returns of the S&P 500 Retailing Index and the S&P 500 Index. The graph assumes that $100 was invested on July 2, 2004.

Market closing price at closest date to end of Company’s fiscal quarter.

| | | | | | | | | | | | | | |

| | | July 2,

2004 | | Oct 1,

2004 | | Dec 31,

2004 | | Apr 1,

2005 | | July 1,

2005 | | Sept 30,

2005 | | Dec 30,

2005 |

Cabela’s Inc. | | 100.0 | | 87.77 | | 84.54 | | 76.06 | | 78.44 | | 68.29 | | 61.71 |

S&P 500 Retailing Index | | 100.0 | | 103.61 | | 116.56 | | 106.98 | | 111.36 | | 110.56 | | 115.17 |

S&P 500 Index | | 100.0 | | 100.54 | | 107.69 | | 104.22 | | 106.14 | | 109.19 | | 110.92 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC and NYSE reports of ownership of our securities and changes in reported ownership. Based solely on a review of the reports furnished to us, or written representations from reporting persons that all reportable transactions were reported, we believe that during the fiscal year ended December 31, 2005, our officers, directors and greater than ten percent owners timely filed all reports they were required to file under Section 16(a).

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company entered into an Employee Lease Agreement with an affiliate of the Company’s Board Chairman dated January 1, 2005, pursuant to which such affiliate leases the services of certain of our employees. The amount of the lease payments paid under such Employee Lease Agreement in 2005 was $297,000, which we believe is comparable to terms obtainable from unaffiliated third parties.

A son-in-law of Dennis Highby was employed by us throughout fiscal 2005 and paid an aggregate salary and bonus of $85,996 during fiscal 2005 for his services. A son of Dennis Highby was employed by us throughout fiscal 2005 and paid an aggregate salary and bonus of $94,749 during fiscal 2005 for his services. We believe the compensation paid to each of the individuals disclosed in this paragraph is comparable to compensation paid to unrelated third parties for similar services.

19

PROPOSAL TWO –

APPROVAL OF AMENDMENTS TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO DECLASSIFY THE COMPANY’S BOARD OF DIRECTORS