The insurance business is subject to extensive regulation and legislative changes, which impact the manner in which we operate our business.

Our insurance business is subject to extensive regulation by the applicable state agencies in the jurisdictions in which we operate, perhaps most significantly by the Illinois Department of Insurance and the California Department of Insurance. These state agencies have broad regulatory powers designed to protect policyholders, not stockholders or other investors. These powers include, among other things, the ability to:

Our ability to transact business with our affiliates and to enter into mergers, acquisitions and divestitures involving our insurance company subsidiary is limited by the requirements of the insurance holding company laws of Illinois and California. To comply with these laws, we are required to file notices with the Illinois Department of Insurance and the California Department of Insurance to seek their respective approvals at least 30 days before engaging in any intercompany transactions, such as sales, purchases, exchanges of assets, loans, extensions of credit, cost sharing arrangements and extraordinary dividends or other distributions to stockholders. Under these holding company laws, any change of control transaction also requires prior notification and approval. Because these governmental agencies may not take action or give approval within the 30 day period, these notification and approval requirements may subject us to business delays and additional business expense. If we fail to give these notifications, we may be subject to significant fines and penalties and damaged working relations with these governmental agencies.

In addition, workers’ compensation insurance is statutorily provided for in all of the states in which we do business. State laws and regulations provide for the form and content of policy coverage and the rights and benefits that are available to injured workers, their representatives and medical providers. For example, in California, on January 1, 2003, workers’ compensation legislation became effective that provided for increases in the benefits payable to injured workers. Also, in California, workers’ compensation legislation intended to reduce certain costs was enacted in September 2003 and April 2004. Among other things, this legislation established an independent medical review process for resolving medical disputes, tightened standards for determining impairment ratings by applying specific medical treatment guidelines, capped temporary total disability payments to 104 weeks from first payment and enabled injured workers to access immediate medical care up to $10,000 but required them to get medical care through a network of doctors chosen by the employer. The implementation of these reforms affects the manner in which we coordinate medical care costs with employers and the manner in which we oversee treatment plans. However, the reforms are subject to continuing opposition in the California legislature, in the courts and by ballot initiatives, any of which could overturn or substantially amend the reforms and regulatory rules applicable to the legislation. Since the passage of the 2003 and 2004 reforms, bills have been introduced to roll back many areas of significant reform. Some compromise measures have succeeded. In October 2011, the governor of California vetoed several workers’ compensation bills that would have increased costs in California’s workers’ compensation system. Legislative attempts to erode the 2003 and 2004 reforms are expected to continue. We cannot predict the ultimate impact of the reforms or of any amendments to them.

Our business is also affected by federal laws, including the USL&H Act, which is administered by the Department of Labor, and the Merchant Marine Act of 1920, or Jones Act. The USL&H Act contains various provisions affecting our business, including the nature of the liability of employers of longshoremen, the rate of compensation to an injured longshoreman, the selection of physicians, compensation for disability and death and the filing of claims.

In addition, we are impacted by the Terrorism Risk Act and by the Gramm-Leach-Bliley Act of 2002 related to disclosure of personal information. The Gramm-Leach-Bliley Act, which, among other things, protects consumers from the unauthorized dissemination of certain personal information, and various state laws and regulations addressing privacy issues, require us to maintain appropriate procedures for managing and protecting certain personal information of our customers and to fully disclose our privacy practices to our customers. The Terrorism Risk Act requires that commercial property and casualty insurance companies offer coverage for certain acts of terrorism and has established a federal assistance program through the end of 2014 to help insurers cover claims arising out of such acts. Although SeaBright Insurance Company is protected by federally funded terrorism reinsurance to the extent provided for in the Terrorism Risk Act, there are limitations and restrictions on this protection, including a substantial deductible that must be met, which could have an adverse effect on our financial condition or results of operations. Potential future changes to the Terrorism Risk Act could also adversely affect us by causing our reinsurers to increase prices or withdraw from certain markets where terrorism coverage is required. See the discussion under “Risks Related to Our Industry — The threat of terrorism and military and other actions may result in decreases in our net income, revenue and assets under management and may adversely affect our investment portfolio” in Part I, Item 1A of this annual report.

On July 21, 2010, the President signed into law the Dodd Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which has significant implications for the insurance industry. In addition to imposing a number of new compliance obligations on publicly traded companies, the Dodd-Frank Act established the Financial Services Oversight Council (“FSOC”), which is authorized to recommend that certain systemically significant non-bank financial companies, including insurance companies, be regulated by the Board of Governors of the Federal Reserve. The Dodd-Frank Act also created within the United States Department of the Treasury a new Federal Insurance Office (“FIO”) and authorizes the federal preemption of certain state insurance laws. The FSOC and the FIO are authorized to study, monitor and report to Congress on the U.S. insurance industry and the significance of global reinsurance to the U.S. insurance market. Many sections of the Dodd-Frank Act will become effective over time, and certain provisions of the Dodd-Frank Act require the implementation of regulations that have not yet been adopted. The potential impact of the Dodd-Frank Act on the U.S. insurance industry is not clear. However, our business could be affected by changes to the U.S. system of insurance regulation or our designation or the designation of insurers or reinsurers with which we do business as systemically significant non-bank financial companies.

For the past several years, the financial markets have experienced a period of extreme turmoil, including the bankruptcy, restructuring or sale of certain financial institutions, which resulted in unprecedented intervention by the U.S. federal government, including unprecedented levels of direct investment by the federal government in certain financial and insurance institutions. While the ultimate outcome of governmental initiatives intended to alleviate the recent financial crisis cannot be predicted, it is likely that governmental authorities may seek to exercise their supervisory or enforcement power in new or more robust ways, which could affect our business and the way we manage our capital, and may require us to satisfy increased capital requirements or impose additional restrictions on us.

This extensive regulation of our business may affect the cost or demand for our products and may limit our ability to obtain rate increases or to take other actions that we might desire to increase our profitability. In addition, we may be unable to maintain all required approvals or comply fully with the wide variety of applicable laws and regulations, which are continually undergoing revision, or the relevant authority’s interpretation of such laws and regulations.

Our geographic concentration ties our performance to the business, economic and regulatory conditions in California, Louisiana, Alaska and Texas. Any single catastrophe or other condition affecting losses in these states could adversely affect our results of operations.

Our business is concentrated in California (approximately 49.2% of direct premiums written for the year ended December 31, 2011), Louisiana (approximately 8.7% of direct premiums written for the same period), Texas (approximately 6.0% of direct premiums written for the same period) and Alaska (approximately 4.6% of direct premiums written for the same period). Accordingly, unfavorable business, economic or regulatory conditions in those states could negatively impact our business. For example, California, Louisiana, Texas and Alaska are states that are susceptible to severe natural perils, such as tsunamis, earthquakes, tornados and hurricanes, along with the possibility of terrorist acts. Accordingly, we could suffer losses as a result of catastrophic events in those states. Although geographic concentration has not adversely affected our business in the past, we may in the future be exposed to economic and regulatory risks or risks from natural perils that are greater than the risks faced by insurance companies that conduct business over a greater geographic area. This concentration of our business could have a material adverse effect on our financial condition or results of operations.

If we are unable to obtain or collect on our reinsurance protection, our business, financial condition and results of operations could be materially adversely affected.

The agreements for our current workers’ compensation excess of loss reinsurance treaty program expire on September 30, 2012. Any decrease in the amount of our reinsurance at the time of renewal, whether caused by the existence of more restrictive terms and conditions or decreased availability, will also increase our risk of loss and, as a result, could materially adversely affect our business, financial condition and results of operations. We have not experienced difficulty in qualifying for or obtaining sufficient reinsurance to appropriately cover our risks in the past. We currently have nine reinsurers participating in our excess of loss reinsurance treaty program, and believe that this is a sufficient number of reinsurers to provide us with reinsurance in the volume that we require. However, it is possible that one or more of our current reinsurers could cancel participation, or we could find it necessary to cancel the participation of one of our reinsurers, in our excess of loss reinsurance treaty program. In either of those events, if our reinsurance broker is unable to spread the cancelled or terminated reinsurance among the remaining reinsurers in the program, we estimate that it could take approximately one to three weeks or longer to identify and negotiate appropriate documentation with a replacement reinsurer. During this time, we could be exposed to an increased risk of loss, the extent of which would depend on the volume of cancelled reinsurance.

In addition, we are subject to credit risk with respect to our reinsurers. Reinsurance protection that we receive does not discharge our direct obligations under the policies we write. We remain liable to our policyholders, even if we are unable to make recoveries to which we believe we are entitled under our reinsurance contracts. Losses may not be recovered from our reinsurers until claims are paid, and, in the case of long-term workers’ compensation cases, the creditworthiness of our reinsurers may change before we can recover amounts to which we are entitled. Although we have not experienced problems in the past resulting from the failure of a reinsurer to pay our claims in a timely manner, if we experience this problem in the future, our costs would increase and our revenues would decline. As of December 31, 2011, we had $94.2 million of amounts recoverable from our reinsurers, excluding the receivable on our adverse development cover, that we would be obligated to pay if our reinsurers failed to pay us.

A downgrade in the A.M. Best rating of our insurance subsidiary could reduce the amount of business we are able to write.

Rating agencies rate insurance companies based on each company’s ability to pay claims. Our insurance company subsidiary currently has a rating of “A-” (Excellent) from A.M. Best. In August 2011, A.M. Best reviewed our rating and outlook and maintained our rating of “A-” (Excellent) with “Negative” outlook, indicating the possibility of a rating downgrade due to unfavorable financial/market trends relative to the current rating level. A.M. Best, is the rating agency that we believe has the most influence on our business. The ratings of A.M. Best are subject to periodic review using, among other things, proprietary capital adequacy models, and are subject to revision or withdrawal at any time. Insurance ratings are directed toward the concerns of policyholders and insurance agents and are not intended for the protection of investors or as a recommendation to buy, hold or sell any of our securities. Our competitive position relative to other companies is determined in part by our A.M. Best rating. We believe that our business is particularly sensitive to our A.M. Best rating because we focus on larger customers which tend to give substantial weight to the A.M. Best rating of their insurers. We expect that any reduction in our A.M. Best rating below “A-” would cause a reduction in the number of policies we write and could have a material adverse effect on our results of operations and our financial position.

The effects of emerging claim and coverage issues on our business are uncertain.

As industry practices and legal, judicial, social and other environmental conditions change, unexpected and unintended issues related to claims and coverage may emerge. These issues may adversely affect our business by either extending coverage beyond our underwriting intent or by increasing the number or size of claims. In some instances, these changes may not become apparent until some time after we have issued insurance contracts that are affected by the changes. As a result, the full extent of liability under our insurance contracts may not be known for many years after a contract is issued. For example, the number or nature of existing occupational diseases may expand beyond our expectation. In addition, medical claims costs associated with permanent and partial disabilities may inflate more rapidly or higher than we currently expect. Expansions of this nature may expose us to more claims than we anticipated when we wrote the underlying policy.

Intense competition could adversely affect our ability to sell policies at rates we deem adequate.

In most of the states in which we operate, we face significant competition which, at times, is intense. If we are unable to compete effectively, our business and financial condition could be materially adversely affected. Competition in our businesses is based on many factors, including premiums charged, services provided, financial strength ratings assigned by independent rating agencies, speed of claims payments, reputation, perceived financial strength and general experience. We compete with regional and national insurance companies and state-sponsored insurance funds, as well as potential insureds that have decided to self-insure. Our principal competitors include ALMA, Chartis (AIG), Hartford, Liberty Mutual, Old Republic, PMA Insurance, Signal Mutual, Travelers and Zurich. Many of our competitors have substantially greater financial and marketing resources than we do, and some of our competitors, including the State Compensation Insurance Fund of California, benefit financially by not being subject to federal income tax.

In addition, our competitive advantage may be limited due to the small number of insurance products we offer. Some of our competitors, such as Chartis (AIG) or Zurich, have additional competitive leverage because of the wide array of insurance products they offer. For example, a potential customer may consider it more convenient to purchase multiple types of insurance products from one insurance carrier. We do not offer a wide array of insurance products due to our targeted market niches, and we may lose potential customers to our larger, more diverse competitors as a result.

As explained under the heading “Regulation – Federal and State Legislative and Regulatory Changes” in Part I, Item 1 of this annual report, we have experienced significant changes in our premium rates since 2003. Most recently, we increased our premium rates for business written in California, our largest state by premiums volume, by an average of 5.0% effective January 1, 2009, 10.6% effective August 1, 2009, 15.3% effective September 1, 2010, and 10.9% effective January 1, 2012. We have also increased our premium rates in other states. If other insurers do not adopt rate changes similar to ours, we may be unable to compete effectively and our business, financial condition and results of operations could be materially adversely affected.

If we are unable to realize our investment objectives, our financial condition may be adversely affected.

Investment income is an important component of our revenues and net income. The ability to achieve our investment objectives is affected by factors that are beyond our control. For example, the significant downturn in the United States economy generally could cause our investment income to decrease. Interest rates are highly sensitive to many factors, including governmental monetary policies and domestic and international economic and political conditions. The United States’ participation in hostilities with other countries, acts of terrorism or large-scale natural disasters or catastrophic events may further adversely affect the economy generally. These and other factors also affect the capital markets, and, consequently, the value of the securities we own. The outlook for our investment income is dependent on the future direction of interest rates and the amount of cash flows from operations that are available for investment. The fair values of fixed maturity investments that are “available-for-sale” fluctuate with changes in interest rates and cause fluctuations in our stockholders’ equity. Any significant decline in our investment income as a result of rising interest rates or general market conditions would have an adverse effect on our net income and, as a result, on our stockholders’ equity and our policyholders’ surplus. See “Liquidity and Capital Resources” in Part II, Item 7 of this annual report for a discussion of the limited exposure in our investment portfolio at December 31, 2011 to sub-prime mortgages.

The capital markets in the United States and elsewhere experienced extreme volatility and disruption in 2008 and 2009, and, to a lesser extent, in 2010 and 2011. We are exposed to significant capital markets risk, including changes in interest rates, credit spreads, equity prices and foreign exchange rates. Our investment portfolio has been affected by these changes in the capital markets. For example, for the year ended December 31, 2008, we recorded an impairment charge of $13.4 million for other-than-temporary losses related principally to our preferred stock investments and holdings of equity indexed securities exchange-traded funds. In addition, changes in interest rates and credit quality may result in fluctuations in the income derived from, or the valuation of, our fixed income securities. Our investment portfolio is also subject to credit and cash flow risk, including risks associated with our investment in asset-backed and mortgage-backed securities, and the risk that issuers in our portfolio may cease operations or other events may cause our investments to become illiquid. Further adverse changes in the capital markets could result in other-than-temporary impairments in the future, which may affect our financial condition, or could reduce our investment income, which would adversely affect our results of operations.

As of December 31, 2011, our investment portfolio included approximately $351.0 million of debt securities issued by various states, counties, cities and other municipal issuers. Many of these issuers are operating under deficits or projected deficits due to many factors, including the impact of the prolonged economic recession and downturn. A continuation or worsening of current economic conditions could cause the value of these securities to decline or could cause some issuers of securities in our portfolio to default on their obligations. If issuers of municipal securities we hold default on, or delay payment of, their obligations, or if bond insurers default on their obligations or the amount of bond insurance is inadequate, our financial position and results of operations may suffer harm, which could be material.

See “Investments” in Part I, Item 1 of this annual report for a discussion of the exposure in our investment portfolio at December 31, 2011 to sub-prime mortgages and the European sovereign debt crisis.

We could be adversely affected by the loss of one or more principal employees or by an inability to attract and retain staff.

Our success will depend in substantial part upon our ability to attract and retain qualified executive officers, experienced underwriting talent and other skilled employees who are knowledgeable about our business. We rely substantially upon the services of our senior management team and key employees, consisting of John G. Pasqualetto, Chairman, President and Chief Executive Officer; Richard J. Gergasko, Chief Operating Officer; Neal A. Fuller, Senior Vice President, Chief Financial Officer and Assistant Secretary; D. Drue Wax, Senior Vice President, General Counsel and Corporate Secretary; Richard W. Seelinger, Senior Vice President — Policyholder Services; Marc B. Miller, M.D., Senior Vice President and Chief Medical Officer; Jeffrey C. Wanamaker, Senior Vice President — Underwriting; Christopher Desautel, Senior Vice President and Chief Information Officer — SeaBright Insurance Company; M. Philip Romney, Vice President — Finance, Principal Accounting Officer and Assistant Secretary; and Craig A. Pankow, President — PointSure. Although we are not aware of any planned departures or retirements, if we were to lose the services of members of our management team, our business could be adversely affected. Many of our principal employees possess skills and extensive experience relating to our market niches. Were we to lose any of these employees, it may be challenging for us to attract a replacement employee with comparable skills and experience in our market niches. We have employment agreements with some of our executive officers, which will be described in our proxy statement for the 2012 annual meeting of stockholders and incorporated by reference into Part III, Item 11 of this annual report. We do not currently maintain key man life insurance policies with respect to any member of our senior management team or other employees.

We may require additional capital in the future, which may not be available or only available on unfavorable terms.

Our future capital requirements depend on many factors, including our ability to write new business successfully and to establish premium rates and loss reserves at levels sufficient to cover losses. We believe that cash provided by operations will satisfy our capital requirements for the foreseeable future. However, because the timing and amount of our future needs for capital will depend on our growth and profitability, we cannot provide any assurance in this regard. If we had to raise additional capital, equity or debt financing may not be available at all or may be available only on terms that are not favorable to us. In the case of equity financings, dilution to our stockholders could result, and in any case such securities may have rights, preferences and privileges that are senior to those of the shares currently outstanding. If we cannot obtain adequate capital on favorable terms or at all, we may be unable to support future growth or operating requirements and, accordingly, our business, financial condition or results of operations could be materially adversely affected.

Our status as an insurance holding company with no direct operations could adversely affect our ability to pay dividends in the future.

We are a holding company that transacts our business through our operating subsidiaries, SeaBright Insurance Company, PointSure, and PMCS. Our primary assets are the stock of these operating subsidiaries. Our ability to pay expenses and dividends depends, in the long run, upon the surplus and earnings of our subsidiaries and the ability of our subsidiaries to pay dividends to us. Payment of dividends by SeaBright Insurance Company is restricted by state insurance laws, including laws establishing minimum solvency and liquidity thresholds, and could be subject to contractual restrictions in the future, including those imposed by indebtedness we may incur in the future. SeaBright Insurance Company is required to report any ordinary dividends to the Illinois Department of Insurance and the California Department of Insurance prior to the payment of the dividend. In addition, SeaBright Insurance Company is not authorized to pay any extraordinary dividends to us under Illinois or California insurance laws without prior regulatory approval from the Illinois Department of Insurance or the California Department of Insurance. See the discussion under the heading “Regulation — Dividend Limitations” in Part I, Item 1 of this annual report. As a result, at times, we may not be able to receive dividends from SeaBright Insurance Company and we may not receive dividends in amounts necessary to pay dividends on our capital stock. In addition, the payment of dividends by us is within the discretion of our Board of Directors and will depend on numerous factors, including our financial condition, our capital requirements and other factors that our Board of Directors considers relevant.

We rely on independent insurance brokers to distribute our products.

Our business depends in part on the efforts of independent insurance brokers to market our insurance programs successfully and produce business for us, as well as our ability to offer insurance programs and services that meet the requirements of the clients and customers of these brokers. The majority of the business in our workers’ compensation operations is produced by a group of licensed insurance brokers that totaled approximately 235 at December 31, 2011. Brokers are not obligated to promote our insurance programs and may sell competitors’ insurance programs. Several of our competitors, including Chartis (AIG) and Zurich, offer a broader array of insurance programs than we do. Accordingly, our brokers may find it easier to promote the broader range of programs of our competitors than to promote our niche selection of insurance products. If our brokers fail or choose not to market our insurance programs successfully or to produce business for us, our growth may be limited and our financial condition and results of operations may be negatively affected.

Assessments and other surcharges for guaranty funds and second injury funds and other mandatory pooling arrangements may reduce our profitability.

Virtually all states require insurers licensed to do business in their state to bear a portion of the unfunded obligations of impaired or insolvent insurance companies. These obligations are funded by assessments that are expected to continue in the future as a result of insolvencies. Assessments are levied by guaranty associations within the state, up to prescribed limits, on all member insurers in the state on the basis of the proportionate share of the premium written by member insurers in the lines of business in which the impaired, insolvent or failed insurer is engaged. See the discussion under the heading “Regulation” in Part I, Item 1 of this annual report. Accordingly, the assessments levied on us may increase as we increase our premiums written. Further, Washington state legislation enacted on April 20, 2005 created a separate account within the Guaranty Fund for USL&H Act claims and authorized prefunding of potential insolvencies in order to establish a cash balance. Many states also have laws that established second injury funds to provide compensation to injured employees for aggravation of a prior condition or injury, which are funded by either assessments based on paid losses or premium surcharge mechanisms. For example, Alaska requires insurers to contribute to its second injury fund annually an amount equal to the compensation the injured employee is owed multiplied by a contribution rate based on the fund’s reserve rate. In addition, as a condition of the ability to conduct business in some states, including California, insurance companies are required to participate in mandatory workers’ compensation shared market mechanisms or pooling arrangements, which provide workers’ compensation insurance coverage from private insurers. These pooling arrangements require us to assume a portion of the insurance written by a state-mandated pool. Although we price our products to account for the obligations that we may have under these pooling arrangements, we may not be successful in estimating our liability for these obligations. Accordingly, our prices may not fully account for our liabilities under pooling arrangements, which may cause a decrease in our profits. As we write policies in new states that have pooling arrangements, we will be required to participate in additional pooling arrangements. Further, the insolvency of other insurers in these pooling arrangements would likely increase the liability for other members remaining in the pool. The effect of these assessments and mandatory shared market mechanisms or changes in them could reduce our profitability in any given period or limit our ability to grow our business.

In the event LMC is placed into receivership, we could lose our rights to fee income and protective arrangements that were established in connection with the Acquisition, our reputation and credibility could be adversely affected and we could be subject to claims under applicable voidable preference and fraudulent transfer laws.

The assets that SeaBright acquired in the Acquisition were acquired from LMC and certain of its affiliates. LMC and its insurance company affiliates are currently operating under a voluntary “run-off” plan approved by the Illinois Department of Insurance. Under the run-off plan, LMC has instituted aggressive expense control measures to reduce its future loss exposure and allow it to meet its obligations to current policyholders. According to LMC’s statutory financial statements, as of and for the year ended December 31, 2011, LMC, and another company under common management with LMC, had a combined statutory surplus of $41.3 million (unaudited), a decrease of approximately $3.9 million from its surplus of $45.2 million (audited) as of December 31, 2010. In connection with the Acquisition, we established various arrangements with LMC and certain of its affiliates, including (1) servicing arrangements entitling us to fee income for providing claims administration services for Eagle and (2) other protective arrangements designed to minimize our exposure to any past business underwritten by KEIC, the shell entity that we acquired from LMC for its insurance licenses, and any adverse developments in KEIC’s loss reserves as they existed at the date of the Acquisition. See the discussion under the heading “Loss Reserves — KEIC Loss Reserves” in Part I, Item 1 of this annual report. In the event LMC is placed into receivership, our business could be adversely affected in the following ways:

We may pursue strategic mergers, acquisitions, and divestitures which could have an adverse impact on our business.

In December 2007, we acquired PMCS, a provider of medical bill review, utilization review, nurse case management and other related services, and in July 2008 we acquired BWNV, a privately held managing general agent and wholesale insurance broker. We may, from time to time, consider acquiring additional complementary companies or businesses. To do so, we would need to identify suitable acquisition candidates and negotiate acceptable acquisition terms. Pursuit of an acquisition may divert management’s attention and resources, and completion of an acquisition will require use of our capital and may require additional financing. If we complete additional acquisitions, we may have difficulty integrating acquired businesses into our existing businesses, which could adversely affect our operations, particularly in the fiscal quarters immediately following the acquisition as they are integrated into our operations.

If we are unable to collect future retrospective premium adjustments under our retrospectively rated policies, our financial position and results of operations may be adversely affected.

Retrospectively rated policies accounted for approximately 6.6% and 5.9% of direct premiums written in the years ended December 31, 2011 and 2010, respectively. Beginning six months after the expiration of the relevant insurance policy, and annually thereafter, we recalculate the premium during the policy term based on the current value of the known losses that occurred during the policy term. While the typical retrospectively rated policy has around five annual adjustment or measurement periods, premium adjustments continue until mutual agreement to cease future adjustments is reached with the policyholder. We bear credit risk with respect to retrospectively rated policies. Because of the long duration of our loss sensitive plans, there is a risk that the customer will fail to pay the additional premium. Accordingly, we obtain collateral in the form of letters of credit or deposits to mitigate credit risk associated with our loss sensitive plans. If we are unable to collect future retrospective premium adjustments from an insured, we would be required to write off the related amounts, which could impact our financial position and results of operations.

We may face substantial exposure to losses from terrorism for which we are required by law to provide coverage.

Under our workers’ compensation policies, we are required to provide workers’ compensation benefits for losses arising from acts of terrorism. The impact of any terrorist act is unpredictable, and the ultimate impact on us would depend upon the nature, extent, location and timing of such an act. Notwithstanding the protection provided by the reinsurance we have purchased and any protection provided by the Terrorism Risk Act, the risk of severe losses to us from acts of terrorism has not been eliminated because, as discussed above, our excess of loss reinsurance treaty program contains various sub-limits and exclusions limiting our reinsurers’ obligation to cover losses caused by acts of terrorism. Accordingly, events may not be covered by, or may exceed the capacity of, our reinsurance protection and any protection offered by the Terrorism Risk Act or any successor legislation. Thus, any acts of terrorism could materially adversely affect our business and financial condition.

The threat of terrorism and military and other actions may result in decreases in our net income, revenue and assets under management and may adversely affect our investment portfolio.

The threat of terrorism, both within the United States and abroad, and military and other actions and heightened security measures in response to these types of threats, may cause significant volatility and declines in the equity markets in the United States and abroad, as well as loss of life, property damage, additional disruptions to commerce and reduced economic activity. Actual terrorist attacks could cause a decrease in our stockholders’ equity, net income and/or revenue. The effects of these changes may result in a decrease in our stock price. In addition, some of the assets in our investment portfolio may be adversely affected by declines in the bond markets and declines in economic activity caused by the continued threat of terrorism, ongoing military and other actions and heightened security measures.

We cannot predict at this time whether and the extent to which industry sectors in which we maintain investments may suffer losses as a result of potential decreased commercial and economic activity, or how any such decrease might impact the ability of companies within the affected industry sectors to pay interest or principal on their securities, or how the value of any underlying collateral might be affected.

We can offer no assurances that terrorist attacks or the threat of future terrorist events in the United States and abroad or military actions by the United States will not have a material adverse effect on our business, financial condition or results of operations.

Our results of operations and revenues may fluctuate as a result of many factors, including cyclical changes in the insurance industry, which may cause the price of our common stock to be volatile.

The results of operations of companies in the insurance industry historically have been subject to significant fluctuations and uncertainties. Our profitability can be affected significantly by:

The availability of insurance is related to prevailing prices, the level of insured losses and the level of industry surplus which, in turn, may fluctuate in response to changes in rates of return on investments being earned in the insurance industry. As a result, the insurance business historically has been a cyclical industry characterized by periods of intense price competition due to excessive underwriting capacity as well as periods when shortages of capacity permitted favorable premium levels. During 1998, 1999 and 2000, the workers’ compensation insurance industry experienced substantial pricing competition, and this pricing competition greatly affected the ability of our predecessor to increase premiums. Beginning in 2001, our predecessor witnessed a decrease in pricing competition in the industry, which enabled them to raise their rates. Although rates for many products increased from 2000 to 2003, legislative reforms caused premium rates in certain states, including California, to decrease in 2004 through 2008, and rates may decrease again or may decrease in other states. In addition, the availability of insurance has and may continue to increase, either by capital provided by new entrants or by the commitment of additional capital by existing insurers, which may perpetuate rate decreases. Any of these factors could lead to a significant reduction in premium rates, less favorable policy terms and fewer submissions for our underwriting services. In addition to these considerations, changes in the frequency and severity of losses suffered by insureds and insurers may affect the cycles of the insurance business significantly, and we expect to experience the effects of such cyclicality. This cyclicality may cause the price of our securities to be volatile.

The price of our common stock may decrease.

The trading price of shares of our common stock has declined in recent years and may continue to decline for many reasons, some of which are beyond our control, including, among others:

In addition, the stock market has recently experienced substantial price and volume fluctuations that sometimes have been unrelated or disproportionate to the operating performance of companies whose shares are traded. The trading price of shares of our common stock may decrease if our future operating results fail to meet or exceed the expectations of market analysts and investors or current economic or market conditions persist or worsen.

Applicable insurance laws may make it difficult to effect a change of control of our company.

Our insurance company subsidiary is domiciled in the state of Illinois and commercially domiciled in the state of California. The insurance holding company laws of Illinois and California require advance approval by the Illinois Department of Insurance and the California Department of Insurance of any change in control of SeaBright Insurance Company. “Control” is generally presumed to exist through the direct or indirect ownership of 10% or more of the voting securities of a domestic insurance company or of any entity that controls a domestic insurance company. In addition, insurance laws in many states contain provisions that require prenotification to the insurance commissioners of a change in control of a non-domestic insurance company licensed in those states. Any future transactions that would constitute a change in control of SeaBright Insurance Company, including a change of control of us, would generally require the party acquiring control to obtain the prior approval of the Illinois Department of Insurance and the California Department of Insurance and may require pre-acquisition notification in applicable states that have adopted pre-acquisition notification provisions. Obtaining these approvals may result in a material delay of, or deter, any such transaction. See the discussion under the heading “Regulation” in Part I, Item 1 of this annual report.

These laws may discourage potential acquisition proposals and may delay, deter or prevent a change of control of us, including through transactions, and in particular unsolicited transactions, that some or all of our stockholders might consider to be desirable.

Anti-takeover provisions in our amended and restated certificate of incorporation and by-laws and under the laws of the State of Delaware could impede an attempt to replace or remove our directors or otherwise effect a change of control of our company, which could diminish the value of our common stock.

Our amended and restated certificate of incorporation and by-laws contain provisions that may make it more difficult for stockholders to replace directors even if the stockholders consider it beneficial to do so. In addition, these provisions could delay or prevent a change of control that a stockholder might consider favorable. For example, these provisions may prevent a stockholder from receiving the benefit from any premium over the market price of our common stock offered by a bidder in a potential takeover. Even in the absence of an attempt to effect a change in management or a takeover attempt, these provisions may adversely affect the prevailing market price of our common stock if they are viewed as discouraging takeover attempts in the future. In addition, Section 203 of the Delaware General Corporation Law may limit the ability of an “interested stockholder” to engage in business combinations with us. An interested stockholder is defined to include persons owning 15% or more of any class of our outstanding voting stock.

Our amended and restated certificate of incorporation and by-laws contain the following provisions that could have an anti-takeover effect:

These provisions may make it difficult for stockholders to replace management and could have the effect of discouraging a future takeover attempt which is not approved by our Board of Directors but which individual stockholders might consider favorable.

None.

Our principal executive offices are located in approximately 36,090 square feet of leased office space in Seattle, Washington. We also lease office space consisting of approximately 2,470 square feet in Anchorage, Alaska; 5,650 square feet in Chicago, Illinois; 4,640 square feet in Las Vegas, Nevada; 2,650 square feet in Honolulu, Hawaii; 3,280 square feet in Houston, Texas; 17,040 square feet in Orange, California; 6,260 square feet in Phoenix, Arizona; 3,910 square feet in Radnor, Pennsylvania; 8,830 square feet in Santa Ana, California; 400 square feet in Yucca Valley, California; and an executive suite in Benicia, California. We conduct claims and underwriting operations in our branch offices, with the exception of our Honolulu office, where we conduct only claims and loss control operations. We do not own any real property. We consider our leased facilities to be adequate for our current operations.

We are, from time to time, involved in various legal proceedings in the ordinary course of business. We believe we have sufficient loss reserves and reinsurance to cover claims under policies issued by us. Accordingly, we do not believe that the resolution of any currently pending legal proceedings, either individually or taken as a whole, will have a material adverse effect on our business, financial condition or results of operations.

None.

The information required by this item is incorporated by reference from the section captioned “Executive Officers and Key Employees” contained in our proxy statement for the 2012 annual meeting of stockholders, to be filed with the Commission pursuant to Regulation 14A not later than 120 days after December 31, 2011.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is listed on the New York Stock Exchange under the symbol “SBX”. The following table sets forth, for the periods indicated, the high and low sales prices for our common stock as quoted on the New York Stock Exchange.

| | | High | | | Low | |

| 2011: | | | | | | |

First quarter | | $ | 10.55 | | | $ | 9.13 | |

Second quarter | | | 10.40 | | | | 9.19 | |

Third quarter | | | 11.11 | | | | 5.14 | |

Fourth quarter | | | 7.99 | | | | 5.97 | |

| | | | | | | | | |

| 2010: | | | | | | | | |

First quarter | | $ | 11.88 | | | $ | 9.58 | |

Second quarter | | | 11.52 | | | | 9.46 | |

Third quarter | | | 10.09 | | | | 6.53 | |

Fourth quarter | | | 9.46 | | | | 7.62 | |

As of March 2, 2012, there were 104 holders of record of our common stock.

Dividend Policy

In 2011, our Board of Directors declared quarterly cash dividends of $0.05 per common share on March 8, May 10, August 9 and November 8. In 2010, our Board of Directors declared quarterly cash dividends of $0.05 per common share on March 2, May 11, August 10 and November 9. Any future determination to pay cash dividends on our common stock will be at the discretion of our Board of Directors and will be dependent on our earnings, financial condition, operating results, capital requirements, any contractual restrictions, regulatory and other restrictions on the payment of dividends by our subsidiaries to us, and other factors that our Board of Directors deems relevant.

We are a holding company and have no direct operations. Our ability to pay dividends in the future depends on the ability of our operating subsidiaries to pay dividends to us. Our subsidiary, SeaBright Insurance Company, is a regulated insurance company and therefore is subject to significant regulatory restrictions limiting its ability to declare and pay dividends.

SeaBright Insurance Company’s ability to pay dividends is subject to restrictions contained in the insurance laws and related regulations of Illinois and California. The insurance holding company laws in these states require that ordinary dividends be reported to the Illinois Department of Insurance and the California Department of Insurance prior to payment of the dividend and that extraordinary dividends be submitted for prior approval. See “Regulation” in Part I, Item 1 of this annual report.

For information regarding restrictions on the payment of dividends by us and SeaBright Insurance Company, see the discussion under the heading “Liquidity and Capital Resources” in Part II, Item 7 and the discussion under the heading “Business — Regulation — Dividend Limitations” in Part I, Item 1 of this annual report.

Sales of Unregistered Securities

We did not sell any equity securities during 2011 that were not registered under the Securities Act of 1933, as amended.

Purchases of Equity Securities by the Issuer

No purchases of shares of our common stock were made by, or on behalf of, us or any affiliated purchaser during the three months ended December 31, 2011.

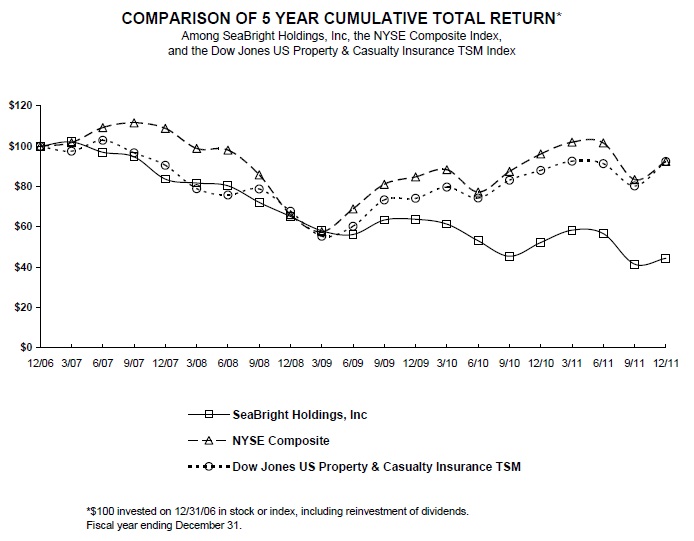

Performance Graph

The following graph and table compare the total return on $100 invested in SeaBright common stock for the period commencing on December 31, 2006 and ending on December 31, 2011 with the total return on $100 invested in each of the New York Stock Exchange Composite Index and the Dow Jones U.S. Property & Casualty Insurance TSM Index. The closing market price for SeaBright common stock at the end of fiscal year 2011 was $7.65.

________________

| * | Based on $100 invested on December 31, 2006, the last trading day before the beginning of the fifth preceding fiscal year and, for purposes of the indexes, assumes the reinvestment of dividends. |

| | | Cumulative Total Return | |

| | | SeaBright Holdings, Inc. | | | NYSE Composite Index | | | Dow Jones U.S. Property & Casualty Insurance TSM Index | |

12/31/06 | | $ | 100.00 | | | $ | 100.00 | | | $ | 100.00 | |

3/31/07 | | | 102.17 | | | | 101.83 | | | | 97.58 | |

6/30/07 | | | 97.06 | | | | 109.30 | | | | 102.97 | |

9/30/07 | | | 94.78 | | | | 111.65 | | | | 96.73 | |

12/31/07 | | | 83.73 | | | | 108.87 | | | | 90.57 | |

3/31/08 | | | 81.79 | | | | 98.93 | | | | 78.96 | |

6/30/08 | | | 80.40 | | | | 98.10 | | | | 75.83 | |

9/30/08 | | | 72.18 | | | | 85.85 | | | | 78.81 | |

12/31/08 | | | 65.19 | | | | 66.13 | | | | 67.78 | |

3/31/09 | | | 58.08 | | | | 57.64 | | | | 55.37 | |

6/30/09 | | | 56.25 | | | | 68.95 | | | | 60.34 | |

9/30/09 | | | 63.41 | | | | 81.16 | | | | 73.40 | |

12/31/09 | | | 63.80 | | | | 84.83 | | | | 74.19 | |

3/31/10 | | | 61.40 | | | | 88.41 | | | | 79.75 | |

6/30/10 | | | 53.14 | | | | 77.31 | | | | 74.35 | |

9/30/10 | | | 45.46 | | | | 87.50 | | | | 83.18 | |

12/31/10 | | | 52.28 | | | | 96.19 | | | | 88.01 | |

3/31/11 | | | 58.41 | | | | 102.05 | | | | 92.61 | |

6/30/11 | | | 56.70 | | | | 101.67 | | | | 91.40 | |

9/30/11 | | | 41.54 | | | | 83.51 | | | | 80.31 | |

12/31/11 | | | 44.43 | | | | 92.50 | | | | 92.48 | |

The information in the graph and table above is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), whether made before or after the date of this annual report and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate such information by reference.

Item 6. Selected Financial Data.

The following table sets forth our selected historical financial information for the periods ended and as of the dates indicated. This information comes from our consolidated financial statements. Certain reclassifications have been made to prior year financials statements to conform to classifications used in the current year. For further information, see Part II, Item 8, Note 2, “Summary of Significant Accounting Policies”. You should read the following selected financial information along with the information contained in this annual report, including Part II, Item 7 of this annual report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the combined and consolidated financial statements and related notes and the reports of the independent registered public accounting firm included in Part II, Item 8 and elsewhere in this annual report. These historical results are not necessarily indicative of results to be expected from any future period.

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | ($ in thousands, except share and per share data) | |

| Income Statement Data: | | | | | | | | | | | | | | | |

Gross premiums written | | $ | 261,392 | | | $ | 264,323 | | | $ | 290,002 | | | $ | 270,344 | | | $ | 282,658 | |

Ceded premiums written | | | (35,768 | ) | | | (24,109 | ) | | | (27,234 | ) | | | (14,520 | ) | | | (15,300 | ) |

Net premiums written | | $ | 225,624 | | | $ | 240,214 | | | $ | 262,768 | | | $ | 255,824 | | | $ | 267,358 | |

| | | | | | | | | | | | | | | | | | | | | |

Premiums earned | | $ | 249,551 | | | $ | 254,326 | | | $ | 244,427 | | | $ | 248,644 | | | $ | 227,995 | |

Claims service income | | | 1,261 | | | | 889 | | | | 1,011 | | | | 959 | | | | 1,711 | |

Net investment income | | | 21,041 | | | | 23,466 | | | | 23,132 | | | | 22,605 | | | | 20,307 | |

Other-than-temporary impairment losses | | | — | | | | — | | | | (258 | ) | | | (13,405 | ) | | | — | |

| Other net realized gains (losses) | | | 1,051 | | | | 15,425 | | | | (171 | ) | | | (476 | ) | �� | | (105 | ) |

Other income | | | 4,257 | | | | 4,253 | | | | 5,284 | | | | 5,207 | | | | 651 | |

Total revenues | | | 277,161 | | | | 298,359 | | | | 273,425 | | | | 263,534 | | | | 250,559 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss and loss adjustment expenses | | | 218,413 | | | | 223,050 | | | | 174,324 | | | | 141,935 | | | | 128,185 | |

| Underwriting, acquisition, and insurance expenses (1) | | | 75,521 | | | | 72,084 | | | | 72,837 | | | | 70,923 | | | | 58,784 | |

Interest expense | | | 525 | | | | 528 | | | | 599 | | | | 867 | | | | 1,139 | |

Goodwill impairment | | | — | | | | 1,527 | | | | — | | | | — | | | | — | |

Other expenses | | | 8,028 | | | | 7,509 | | | | 9,079 | | | | 7,668 | | | | 4,055 | |

Total expenses | | | 302,487 | | | | 304,698 | | | | 256,839 | | | | 221,393 | | | | 192,163 | |

Income (loss) before taxes | | | (25,326 | ) | | | (6,339 | ) | | | 16,586 | | | | 42,141 | | | | 58,396 | |

Income tax expense (benefit) | | | (10,800 | ) | | | (4,756 | ) | | | 3,051 | | | | 12,863 | | | | 18,484 | |

Net (loss) income | | $ | (14,526 | ) | | $ | (1,583 | ) | | $ | 13,535 | | | $ | 29,278 | | | $ | 39,912 | |

| | | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | $ | (0.69 | ) | | $ | (0.08 | ) | | $ | 0.65 | | | $ | 1.43 | | | $ | 1.96 | |

| Diluted earnings (loss) per share | | $ | (0.69 | ) | | $ | (0.08 | ) | | $ | 0.63 | | | $ | 1.38 | | | $ | 1.90 | |

| Weighted average basic shares outstanding | | | 21,118,711 | | | | 20,867,720 | | | | 20,702,572 | | | | 20,498,305 | | | | 20,341,931 | |

| Weighted average diluted shares outstanding | | | 21,118,711 | | | | 20,867,720 | | | | 21,515,153 | | | | 21,232,762 | | | | 20,976,525 | |

| Cash dividends declared per common share | | $ | 0.20 | | | $ | 0.20 | | | $ | — | | | $ | — | | | $ | — | |

| Selected Insurance Ratios: | | | | | | | | | | | | | | | | | | | | |

Current year loss ratio (2) | | | 75.0 | % | | | 74.8 | % | | | 71.0 | % | | | 67.4 | % | | | 70.3 | % |

Prior years’ loss ratio (3) | | | 12.0 | % | | | 12.6 | % | | | (0.1 | )% | | | (10.7 | )% | | | (14.8 | )% |

Net loss ratio | | | 87.0 | % | | | 87.4 | % | | | 70.9 | % | | | 56.7 | % | | | 55.5 | % |

| Net underwriting expense ratio (4) | | | 30.3 | % | | | 28.3 | % | | | 29.8 | % | | | 28.5 | % | | | 25.8 | % |

Net combined ratio (5) | | | 117.3 | % | | | 115.7 | % | | | 100.7 | % | | | 85.2 | % | | | 81.3 | % |

| | | As of December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | ($ in thousands) | |

| Selected Balance Sheet Data: | | | | | | | | | | | | | | | |

| Investment securities available-for sale, at fair value | | $ | 700,346 | | | $ | 672,968 | | | $ | 626,608 | | | $ | 531,505 | | | $ | 494,437 | |

Cash and cash equivalents | | | 28,503 | | | | 15,958 | | | | 12,896 | | | | 22,872 | | | | 20,292 | |

Reinsurance recoverables | | | 94,173 | | | | 56,746 | | | | 34,339 | | | | 18,544 | | | | 14,210 | |

Deferred policy acquisition costs, net | | | 21,834 | | | | 25,574 | | | | 25,537 | | | | 23,175 | | | | 19,832 | |

Total assets | | | 1,078,838 | | | | 1,026,562 | | | | 964,861 | | | | 842,687 | | | | 755,569 | |

| Unpaid loss and loss adjustment expense | | | 518,044 | | | | 440,919 | | | | 351,890 | | | | 292,027 | | | | 250,085 | |

Unearned premiums | | | 130,300 | | | | 155,786 | | | | 175,766 | | | | 155,931 | | | | 147,033 | |

Total stockholders’ equity | | | 353,511 | | | | 351,017 | | | | 359,473 | | | | 324,813 | | | | 294,306 | |

____________

| (1) | Includes acquisition expenses such as commissions, premium taxes and other general administrative expenses related to underwriting operations in our insurance subsidiary and are included in the amortization of deferred policy acquisition costs. |

| | |

| (2) | The current year loss ratio is calculated by dividing loss and loss adjustment expenses for the current year less claims service income by the current year’s net premiums earned. |

| | |

| (3) | The prior years’ loss ratio is calculated by dividing the change in the loss and loss adjustment expenses for the prior years by the current year’s net premiums earned. |

| | |

| (4) | The underwriting expense ratio is calculated by dividing net underwriting expenses by the current year’s net premiums earned. |

| | |

| (5) | The net combined ratio is the sum of the net loss ratio and the net underwriting expense ratio. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the notes to those statements included elsewhere in this annual report. The discussion and analysis below includes forward-looking statements that are subject to risks, uncertainties and other factors described in Part I, Item 1A of this annual report that could cause our actual results of operations, performance and business prospects and opportunities in 2012 and beyond to differ materially from those expressed in, or implied by, those forward-looking statements. See “Note on Forward-Looking Statements” in Part I, Item 1 of this annual report.

Overview

We provide workers’ compensation insurance coverage for prescribed benefits that employers are required to provide to their employees who may be injured in the course of their employment. We currently provide workers’ compensation insurance to customers in the maritime, ADR and state act markets.

Principal Revenue and Expense Items

We derive our revenue from premiums earned, net investment income, net realized gains and losses from investments and service fee income. Our primary expense items are loss and loss adjustment expenses and underwriting, acquisition and insurance expenses.

Premiums Earned

Direct premiums written include all premiums charged for policies we issue during a fiscal period. Assumed premiums are premiums that we receive from an authorized state mandated pool. Gross premiums written is the sum of direct and assumed premiums written. Net premiums written represent gross premiums written less premiums ceded or paid to reinsurers (ceded premiums written).

Net premiums earned is the earned portion of our net premiums written. Premiums are earned over the terms of the related policies in proportion to the risks underwritten. Our policies typically have terms of 12 months. Thus, for example, for a policy that is written on July 1, 2011, approximately one-half of the premiums would be earned in 2011 and the other half would be earned in 2012. At the end of each accounting period, the portion of the premiums that are not yet earned is included in unearned premiums and is realized as revenue in the subsequent periods over the remaining term of the policies.

We earn our direct premiums written from our maritime, ADR and state act customers. We also earn a small portion of our direct premiums written from employers who participate in the Washington USL&H Plan. We immediately cede 100% of those premiums, net of our expenses, and 100% of the losses in connection with that business to the plan.

Net Investment Income and Realized Gains and Losses on Investments

We invest our statutory surplus and the funds supporting our insurance liabilities (including unearned premiums and unpaid loss and loss adjustment expenses) in cash, cash equivalents and fixed income securities. Our investment income includes interest and dividends earned on our invested assets. Realized gains and losses on invested assets are reported separately from net investment income. We earn realized gains when invested assets are sold for an amount greater than their amortized cost in the case of fixed maturity securities and recognize realized losses when investment securities are written down as a result of an other-than-temporary impairment or sold for an amount less than their carrying value.

Claims Service Income

We receive claims service income in return for providing claims administration services for other companies. The claims service income we receive for providing these services approximates our costs. For the years ended December 31, 2011, 2010, and 2009, approximately 23.6%, 26.0%, and 32.3% respectively, of our claims service income was generated by contracts we have with LMC to provide claims handling services for the policies written by the Eagle Entities prior to the Acquisition. We expect income from these contracts to continue to decrease over the next several years as transactions related to the Eagle Entities diminish. The next largest claims administration services customer represented approximately 25.0%, 20.9%, and 20.5% of claims service income for the years ended December 31, 2011, 2010 and 2009, respectively.

Loss and Loss Adjustment Expenses

Loss and loss adjustment expenses represent our largest expense item and include (1) claim payments made, (2) estimates for future claim payments and changes in those estimates for current and prior periods and (3) costs associated with investigating, defending and adjusting claims. For further information regarding our loss and loss adjustment expenses, including amounts paid and unpaid, see the discussion under the heading “Critical Accounting Policies, Estimates and Judgments — Unpaid Loss and Loss Adjustment Expense” in Part II, Item 7 of this annual report.

Underwriting, Acquisition and Insurance Expenses

In our insurance subsidiary, we refer to the expenses that we incur to underwrite risks as underwriting, acquisition and insurance expenses. Underwriting expenses consist of commission expenses, premium taxes and fees and other underwriting expenses incurred in writing and maintaining our business. We pay commission expense in our insurance subsidiary to our brokers for the premiums that they produce for us. We pay state and local taxes based on premiums; licenses and fees; assessments; and contributions to workers’ compensation security funds. Other underwriting expenses consist of general administrative expenses such as salaries and employee benefits, rent and all other operating expenses not otherwise classified separately, and boards, bureaus and assessments of statistical agencies for policy service and administration items such as rating manuals, rating plans and experience data. Certain of these costs that vary with and are primarily related to the acquisition of insurance contracts (“deferred acquisition costs”) are initially deferred and amortized over the typical policy term of 12 months. Therefore, with respect to deferred acquisition costs, there are timing differences between when the costs are incurred or paid and when the related expense is recognized in our statements of operations and comprehensive income (loss).

Results of Operations

Year Ended December 31, 2011 Compared to Year Ended December 31, 2010

Gross Premiums Written. Gross premiums written consists of direct premiums written and premiums assumed from the NCCI residual markets. The number of customers we service, in-force payrolls and in-force premiums represent some of the factors we consider when analyzing gross premiums written.

Gross premiums written totaled $261.4 million in 2011 compared to $264.3 million in 2010, representing a decrease of $2.9 million, or 1.1%. The change from 2010 resulted from premium declines primarily related to our “core” business, offset by business growth in our “Program Business.” Program Business, which includes alternative markets and small maritime programs, increased $13.8 million in 2011 compared to 2010. This increase was offset by a $15.4 million decrease in our core product lines, which include everything other than our Program Business (primarily energy, maritime and construction business). The decrease was primarily driven by declines in our construction business as a result of the continuing impact of the economic downturn. We have also experienced a reduction in our renewal retention rates as a result of rate increases and other underwriting actions we’ve taken in response to recent upward trends in medical and indemnity claims costs. Our overall renewal retention rate was 65% for the fourth quarter of 2011, compared to 74% for third quarter 2011 and 70% for fourth quarter 2010.

Excluding work we perform as the servicing carrier for the Washington USL&H Plan and business assumed from the NCCI residual market pools, the total number of customers we serviced decreased from approximately 1,640 at December 31, 2010 to approximately 1,510 at December 31, 2011. We experienced an increase of approximately 100 customers related to our Program Business, which was offset by a decrease of approximately 240 customers in our core business. By design, our Program Business will have a larger number of customers with a smaller average premium size than our core book of business. As of December 31, 2011, the average premium size in our Program Business was approximately $100,700 compared to approximately $262,200 in our core business, compared to approximately $100,400 for Program Business and $235,900 for core business at December 31, 2010. Total in-force payrolls, one of the factors used to determine premium charges, decreased 8.6% from $7.0 billion at December 31, 2010 to $6.4 billion at year end 2011. California continues to be our largest market, accounting for approximately $127.1 million, or 48.7% of our in-force premiums at December 31, 2011. This represents a decrease of $18.4 million, or 12.6%, from approximately $145.5 million of in-force premiums in California, or 49.9% of our in-force premiums, at December 31, 2010.

We expect our California concentration to decline significantly in 2012 as a result of previously announced changes in our underwriting standards for California construction business. Effective October 1, 2011, we offer California construction coverage only to contractors with estimated annual premiums greater than $500,000 and only on a loss sensitive basis. We no longer offer guaranteed cost plans to California contractors. Although these changes will reduce our premiums in the short term, we believe they will produce a stronger, more balanced book of business in the long term. We expect the reduction in California construction premiums will be partially offset by growth in California in other industries, such as healthcare and manufacturing, as well as growth in other states where we currently do business. We also expect to reduce the proportion of writings in California to 25 to 30% of our overall book, down from historical levels which have typically been approximately 50% or higher.

The following is a summary of our top five markets based on direct premiums written (excluding premiums written under the Washington USL&H Plan):

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | |

| | Direct Premiums Written | | | % | | | Direct Premiums Written | | | % | |

| | | (in thousands) | |

California | | $ | 124,731 | | | | 49.2 | % | | $ | 133,388 | | | | 51.8 | % |

Louisiana | | | 22,126 | | | | 8.7 | % | | | 27,900 | | | | 10.8 | % |

Texas | | | 15,216 | | | | 6.0 | % | | | 14,357 | | | | 5.6 | % |

Alaska | | | 11,662 | | | | 4.6 | % | | | 15,157 | | | | 5.9 | % |

Pennsylvania | | | 9,979 | | | | 3.9 | % | | | 8,497 | | | | 3.3 | % |

Total | | $ | 183,714 | | | | 72.4 | % | | $ | 199,299 | | | | 77.4 | % |

Premiums assumed from the NCCI residual markets in the twelve months ended December 31, 2011 totaled $3.7 million compared to $2.3 million for the same period in 2010, representing an increase of $1.4 million, or 60.9%. The increase was primarily attributable to adjustments in our prior policy year estimates.

We experienced significant reductions in our California premium rates from 2003 to 2008. Over that period, we filed, and the California Department of Insurance approved, eight rate reductions resulting in a net cumulative reduction of our California rates of approximately 54.8%. Beginning in 2008, we filed, and the California Department of Insurance approved, the following increases in our California rates: 5.0% increase effective January 1, 2009; 10.6% increase effective August 1, 2009; 15.3% increase effective September 1, 2010; and 10.9% increase effective January 1, 2012. These rate increases were filed following the completion of internal studies of our California loss costs and were primarily in response to increased projected medical costs and recent decisions by the Workers’ Compensation Appeals Board. If other insurers do not adopt similar rate increases, these rate increases may have a negative effect on our ability to compete in California. Rate changes have also been adopted in other states in which we operate. For additional information regarding recent rate change activity in California and other states, see the discussion under the heading “Regulation — Federal and State Legislative and Regulatory Changes” in Part I, Item 1 of this annual report.

Net Premiums Written. Net premiums written totaled $225.6 million in 2011 compared to $240.2 million in 2010, representing a decrease of $14.6 million, or 6.1%. The decrease was primarily attributable to an increase in ceded premiums resulting from higher ceding rates in our excess of loss reinsurance program effective October 1, 2010 through September 30, 2011. Our ceding rate under that program increased by approximately 141% as a result of lowering the attachment point from $0.5 million to $0.25 million and increasing maximum coverage from $85.0 million to $100.0 million. When we renewed our reinsurance program on October 1, 2011, we increased the attachment point to $0.5 million and reduced our maximum coverage to $75.0 million, which reduced our ceding rate to more historical levels.

Net Premiums Earned. Net premiums earned totaled $249.6 million in 2011 compared to $254.3 million in 2010, representing a decrease of $4.8 million, or 1.9%. We record the entire annual policy premium as unearned premium at inception and earn the premium over the life of the policy, which is generally twelve months, in proportion to the underlying exposure. Consequently, the amount of premiums earned in any given year depends on when the underlying policies were written and how the underlying payroll exposure is reported. Our direct premiums earned increased $4.5 million, or 1.6%, to $281.5 million in 2011 from $277.0 million in 2010. Net premiums earned in 2011 were reduced by net adjustments of approximately $2.7 million on retrospectively rated policies due to favorable loss results on those policies. Net premiums earned were also affected by premiums ceded under reinsurance treaties. Ceded earned premiums in 2011 totaled $36.3 million compared to $27.0 million in 2010, representing an increase of $9.3 million, or 34.6%.

Net Investment Income. Net investment income was $21.0 million in 2011 compared to $23.5 million in 2010, representing a decrease of $2.4 million, or 10.3%. Average invested assets increased $44.7 million, or 6.7%, from $664.2 million in 2010 to $708.9 million in 2011. This increase in our investment portfolio is due primarily to cash flow from operations of $27.6 million for the year ended December 31, 2011, which was invested primarily in fixed income securities. Net investment income as a percentage of average invested assets decreased slightly to 3.0% in 2011 from 3.5% in 2010 primarily due to reduced reinvestment interest rates.

Claims Service Income. Claims Service income totaled $1.3 million in 2011 and $0.9 million in 2010. Our claims service income resulted primarily from service arrangements we have with customers for claims processing services and policy administration services that we perform for them.

Other Net Realized Gains. Other net realized gains recognized in earnings totaled $1.1 million in 2011 and $15.4 million in 2010. The 2010 gains were realized in order to allow us to fully realize the approximately $15.0 million of tax capital loss carry forwards that existed at December 31, 2009.

Other Income. Other income totaled $4.3 million for the years ended December 31, 2011 and 2010. Other income is derived primarily from the operations of PointSure, our wholesale broker, and PMCS, our provider of medical bill review, utilization review, nurse case management and related services.

Loss and Loss Adjustment Expenses. Loss and loss adjustment expenses totaled $218.4 million in 2011 compared to $223.1 million in 2010, representing a decrease of $4.6 million, or 2.1%. Our net loss ratio, which is calculated by dividing loss and loss adjustment expenses less claims service income by premiums earned, was 87.0% in 2011 compared to 87.4% in 2010. The net loss ratio reflects unfavorable development of prior accident year loss reserves of $31.4 million in 2011 (offset by a $0.5 million favorable commutation gain), compared to unfavorable development of prior year accident year loss reserves of $32.6 million in 2010 (offset by a $0.6 million favorable commutation gain). Our net loss ratio was also impacted by an increase in the net current accident year expected loss ratio (“ELR”) from 64.5% in 2010 to 65.0% in 2011. Our direct loss reserves are net of reinsurance and exclude reserves associated with KEIC, whom we acquired from LMC in September 2003, and the business that we involuntarily assume from the NCCI.

For accident year 2011, an ELR of 62.5% was established initially, which took into consideration the higher ceding rates under our 2010-2011 reinsurance program and adverse reserve development experienced in recent accident years. The ELR was multiplied by the booked accident year earned premium to produce the ultimate loss to date. The ELR selections are reviewed quarterly with each internal IBNR study. Given the short experience period for the current accident year, the ELRs are usually maintained at least through the first 12 months of the accident year and revised as the underlying data matures. However, we increased the ELR for 2011 from 62.5% to 65.0% in the fourth quarter of 2011 after reviewing results for the 2011 accident year and considering the adverse development in recent accident years.

For accident year 2010, the ultimate loss estimates at December 31, 2011 were higher when compared to December 31, 2010 and resulted in net adverse development of our loss reserves of $9.7 million. The development was attributable to the following jurisdictions: $3.8 million for California state act, driven primarily by medical costs; $8.0 million for non-California state act, driven primarily by medical costs with additional impact due to indemnity costs; $0.2 million for our IBNR accrual for earned but unbilled premiums; offset by $2.3 million of favorable loss development for USL&H, driven primarily by favorable development in medical costs. This net adverse development was offset by net favorable development of $1.6 million related to ULAE, loss based assessments and NCCI.

For accident year 2009, the ultimate loss estimates at December 31, 2011 were higher when compared to December 31, 2010 and resulted in adverse development of our loss reserves of $8.5 million. The development was attributable to the following jurisdictions: $4.6 million for California state act, driven primarily by medical and indemnity costs; $3.3 million for non-California state act, driven primarily by indemnity costs; and $0.6 million for USL&H, driven primarily by indemnity costs. This adverse development was offset by favorable development of $1.4 million related to ULAE, loss based assessments and NCCI, as well as a $0.4 million favorable commutation gain.

For accident year 2008, the ultimate loss estimates at December 31, 2011 were higher when compared to December 31, 2010 and resulted in adverse development of our loss reserves of $9.0 million. The development was attributable to the following jurisdictions: $3.2 million for California state act, driven primarily by medical and indemnity costs; $5.3 million for non-California state act, driven primarily by indemnity costs; and $0.5 million for USL&H, driven primarily by indemnity costs. This adverse development was offset by net favorable development of $0.7 million related to ULAE, loss based assessments and NCCI, as well as a $0.1 million favorable commutation gain.

For accident year 2007, the ultimate loss estimates at December 31, 2011 were higher when compared to December 31, 2010 and resulted in adverse development of our loss reserves of $6.7 million. The development was attributable to the following jurisdictions: $3.0 million for California state act, driven primarily by medical and indemnity costs; $2.3 million for non-California state act, driven primarily by indemnity costs; and $1.4 million for USL&H, driven primarily by indemnity costs. This adverse development was offset by favorable development of $0.7 million related to ULAE, loss based assessments and NCCI.