Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Assurant, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

March 27, 2012

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Assurant, Inc. The meeting will be held on May 10, 2012 at 9:00 a.m. at the Down Town Association located at 60 Pine Street, New York, New York 10005. We hope you attend the Annual Meeting.

At the Annual Meeting, in addition to the election of directors and appointment of auditors, stockholders are being asked to cast an advisory vote approving the compensation of the Company’s named executive officers for 2011.

We will be using the “Notice and Access” method of providing proxy materials to you via the Internet, which we adopted last year. On or about March 27, 2012, we will send you a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and 2011 Annual Report to Stockholders and how to vote. The Notice also contains instructions on how to receive a paper copy of your proxy materials.

Please give these materials your prompt attention. We then ask that you vote by Internet or telephone, or by requesting a printed copy of the proxy materials and completing, signing and returning the proxy card in the manner described therein. You may still vote in person at the Annual Meeting if you so desire by withdrawing your proxy, but voting by Internet or telephone now or requesting and returning your proxy card prior to the Annual Meeting will assure that your vote is counted if you are unable to attend.

Your vote is important, regardless of the number of shares you own. If you hold your shares through a broker, bank or other nominee, your shares will not be voted on the election of directors or the advisory vote on compensation unless you take action and provide voting instructions. Therefore, please promptly submit your vote by telephone, Internet or mail. We urge you to indicate your approval, as unanimously recommended by the directors, by voting FOR Proposals One, Two and Three.

On behalf of the Board of Directors, we thank you for your continued interest and support.

Sincerely,

Robert B. Pollock

President and Chief Executive Officer

Assurant, Inc.

Table of Contents

Assurant, Inc.

One Chase Manhattan Plaza

41st Floor

New York, New York 10005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 10, 2012

To the Stockholders of ASSURANT, INC.:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of Assurant, Inc. (“Assurant” or the “Company”) will be held at the Down Town Association located at 60 Pine Street, New York, New York 10005 on May 10, 2012 at 9:00 a.m., local time, for the following purposes:

1. To elect each of our directors standing for re-election to our Board of Directors to serve until the 2013 Annual Meeting of Stockholders;

2. To ratify the appointment of PricewaterhouseCoopers LLP as Assurant’s Independent Registered Public Accounting Firm for the year ending December 31, 2012;

3. To cast an advisory vote approving the compensation of the Company’s named executive officers for 2011; and

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

The proposals described above are more fully described in the accompanying proxy statement, which forms a part of this notice.

If you plan to attend the Annual Meeting, please notify the undersigned at the address set forth above so that appropriate preparations can be made. If you hold your shares through a bank, broker or other nominee you must also request a legal proxy from your bank, broker or other nominee to validly vote at the Annual Meeting.

The Board of Directors has fixed March 15, 2012 as the record date for the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof. A list of those stockholders will be available for inspection at the offices of Assurant located at One Chase Manhattan Plaza, 41st Floor, New York, New York 10005 commencing at least ten days before the Annual Meeting.

We are pleased to take advantage of the U.S. Securities and Exchange Commission’s “Notice and Access” rule that allows us to provide stockholders with notice of their ability to access proxy materials via the Internet. This allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials, while providing our stockholders with access to the proxy materials in a convenient and quick manner via the Internet. Under this process, on or about March 27, 2012, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders informing them that our proxy statement, annual report to stockholders and voting instructions are available on the Internet. As more fully described in the Notice, all stockholders may choose to access our proxy materials via the Internet or may request printed copies of the proxy materials.

Whether or not you plan to attend the Annual Meeting, we hope that you will read the proxy statement and submit your vote by telephone, via the Internet, or by requesting a printed copy of the proxy materials and completing, signing and returning the proxy card in the manner described therein. If you are present at the Annual Meeting you may, if you wish, withdraw your proxy and vote in person. Thank you for your interest in and consideration of the proposals listed above.

By Order of the Board of Directors,

Bart R. Schwartz

Executive Vice President,

Chief Legal Officer and Secretary

March 27, 2012

The Assurant Proxy Statement and Annual Report are available at

www.proxyvote.com

You will need your 12-digit control number, listed on the Notice, to access these materials and to vote.

EACH VOTE IS IMPORTANT. TO VOTE YOUR SHARES, PLEASE PROMPTLY SUBMIT YOUR VOTE BY TELEPHONE, INTERNET OR MAIL AS DESCRIBED ABOVE.

Table of Contents

| 1 | ||||

| 3 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 11 | ||||

| 19 | ||||

| 21 | ||||

| 23 | ||||

| 25 | ||||

Summary Compensation Table for Fiscal Years 2011, 2010 and 2009 | 25 | |||

| 27 | ||||

Narrative to the Summary Compensation Table and Grants of Plan-Based Awards Table | 28 | |||

| 29 | ||||

Option Exercises and Stock Vested Table for Fiscal Year 2011 | 32 | |||

| 33 | ||||

| 33 | ||||

| 37 | ||||

| 38 | ||||

Potential Payments Upon Termination or Change of Control Table | 40 | |||

Narrative to the Potential Payments Upon Termination or Change of Control Table | 42 | |||

| 45 | ||||

| 45 | ||||

| 46 | ||||

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 48 | |||

| 49 | ||||

| 49 | ||||

Review, Approval or Ratification of Transactions with Related Persons | 49 | |||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 57 | ||||

Communicating with the Presiding Director and the Board of Directors | 57 | |||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 |

i

Table of Contents

| 64 | ||||

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 64 | |||

| 65 | ||||

| 65 | ||||

| 66 | ||||

| 66 | ||||

| 66 | ||||

| 67 | ||||

ii

Table of Contents

One Chase Manhattan Plaza

41st Floor

New York, New York 10005

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 10, 2012

This proxy statement is furnished to stockholders of Assurant, Inc. (to which we sometimes refer in this proxy statement as “Assurant” or the “Company”) in connection with the solicitation by the Board of Directors (the “Board”) of Assurant of proxies to be voted at the 2012 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Down Town Association located at 60 Pine Street, New York, New York 10005 on May 10, 2012 at 9:00 a.m., or at any adjournment or postponement thereof.

The U.S. Securities and Exchange Commission has adopted rules that allow us to use a “Notice and Access” model to make our proxy statement and other Annual Meeting materials available to you. On or about March 27, 2012, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders advising them that our proxy statement, annual report to stockholders and voting instructions can be accessed on the Internet upon the commencement of such mailing. You may then access these materials and vote your shares via the Internet or by telephone or you may request that a printed copy of the proxy materials be sent to you. You will not receive a printed copy of the proxy materials unless you request one in the manner described in the Notice. Using the Notice allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials, while providing our stockholders with access to the proxy materials in a convenient and quick manner via the Internet.

The solicitation of proxies for the Annual Meeting is being made by telephone, Internet and mail. Officers, directors and employees of Assurant, none of whom will receive additional compensation therefor, may also solicit proxies by telephone or other personal or electronic contact. We have retained D.F. King & Co., Inc. to assist in the solicitation of proxies for an estimated fee of $5,000 plus reimbursement of expenses. We will bear the cost of the solicitation of proxies, including postage, printing and handling, and will reimburse brokerage firms and other record holders of shares beneficially owned by others for their reasonable expenses incurred in forwarding solicitation material to beneficial owners of shares.

Any stockholder of record may revoke his or her proxy at any time before it is voted by delivering a later dated, signed proxy or other written notice of revocation to the Corporate Secretary of Assurant. Any record holder of shares present at the Annual Meeting may also withdraw his or her proxy and vote in person on each matter brought before the Annual Meeting. All shares represented by properly signed and returned proxies in the accompanying form or those submitted by Internet or telephone, unless revoked, will be voted in accordance with the instructions given thereon. A properly executed proxy without specific voting instructions will be voted as recommended by the Board: FOR each director nominee; and FOR Proposals Two and Three each as described in this proxy statement.

Any stockholder whose shares are held through a broker, bank or other nominee (shares held in street name) will receive instructions from the broker, bank or nominee that must be followed in order to have his or her shares voted. Such stockholders wishing to vote in person at the meeting must obtain a legal proxy from their broker, bank or other nominee and bring it to the meeting.

Only stockholders of record at the close of business on March 15, 2012, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting or at any adjournment or postponement thereof. As of the close of business on that date,86,986,775 shares of our common stock, par value $0.01 per share (the “Common Stock”), were outstanding. Stockholders will each be entitled to one vote per share of Common Stock held by them.

1

Table of Contents

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the inspector of elections appointed for the meeting. Pursuant to Assurant’s Bylaws and the Delaware General Corporation Law (the “DGCL”), the presence of the holders of shares representing a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, whether in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Under the DGCL, abstentions and “broker non-votes” will be treated as present for purposes of determining the presence of a quorum. Broker non-votes are proxies from brokers or nominees as to which such persons have not received instructions from the beneficial owners or other persons entitled to vote with respect to a matter on which the brokers or nominees do not have the discretionary power to vote.

The election of each of the director nominees under Proposal One requires that each director be elected by the holders of a majority of the votes cast, meaning that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election. The Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) has established guidelines pursuant to which any incumbent director who is not elected must promptly offer to tender his or her resignation for consideration by the Board. The Nominating Committee will consider any such resignation, taking into account all relevant factors, and make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. The Board, excluding the director in question, will act on the Nominating Committee’s recommendation and publicly disclose its decision and the rationale supporting it within 90 days following the date of the certification of the election results.

Under our Bylaws, the approval of each of Proposals Two and Three requires the affirmative vote of the holders of a majority in voting power of the stock present in person or represented by proxy and entitled to vote on the proposal at the Annual Meeting.

For purposes of the election of directors under Proposal One, an abstention will not affect whether the number of “for” votes exceeds the number of “against” votes, and accordingly will not affect whether the director is elected. For purposes of determining approval of Proposals Two and Three, abstentions will have the same legal effect as an “against” vote.

Assurant believes that the ratification of the appointment of PricewaterhouseCoopers LLP as our Independent Registered Public Accounting Firm for 2012 (Proposal Two) will be deemed to be a routine matter under Rule 452 of the New York Stock Exchange (“NYSE”) Listed Company Manual, and brokers will be permitted to vote uninstructed shares as to this matter. Stockholders are reminded that, beginning with the 2010 proxy season, the NYSE amended Rule 452 to make the election of directors in an uncontested election a “non-routine” item and, beginning with the 2011 proxy season, the NYSE amended Rule 452 to make votes with respect to executive compensation matters “non-routine” items. This means that brokers who do not receive voting instructions from their clients as to how to vote their shares with respect to Proposals One or Three will not exercise discretion to vote on those proposals. If a broker or other record holder of shares returns a proxy card indicating it does not have discretionary authority to vote as to a particular matter (thus, a “broker non-vote”), those shares will not be counted as voting for or against the matter or “entitled to vote” on the matter, and will, therefore, have no legal effect on the voting for which the broker non-vote is indicated.

For the above reasons, we urge stockholders to take action to vote their shares by Internet, telephone or mail.

2

Table of Contents

The table below sets forth certain information, as of March 27, 2012, concerning each person deemed to be an Executive Officer of the Company. There are no arrangements or understandings between any Executive Officer and any other person pursuant to which the officer was selected.

Name | Age | Position | ||||

Robert B. Pollock | 57 | President, Chief Executive Officer and Director | ||||

Michael J. Peninger | 57 | Executive Vice President and Chief Financial Officer | ||||

Alan B. Colberg | 50 | Executive Vice President, Marketing and Business Development | ||||

Adam D. Lamnin | 48 | Executive Vice President; President and Chief Executive Officer of Assurant Health | ||||

S. Craig Lemasters | 51 | Executive Vice President; President and Chief Executive Officer of Assurant Solutions | ||||

Gene E. Mergelmeyer | 53 | Executive Vice President; President and Chief Executive Officer of Assurant Specialty Property | ||||

Christopher J. Pagano | 48 | Executive Vice President, Treasurer and Chief Investment Officer; President of Assurant Asset Management | ||||

John S. Roberts | 56 | Executive Vice President; Chief Executive Officer of Assurant Employee Benefits | ||||

Bart R. Schwartz | 59 | Executive Vice President, Chief Legal Officer and Secretary | ||||

John A. Sondej | 47 | Senior Vice President, Controller and Principal Accounting Officer | ||||

Sylvia R. Wagner | 63 | Executive Vice President, Human Resources and Development | ||||

Robert B. Pollock, President, Chief Executive Officer and Director. Biography available in the section entitled “PROPOSAL ONE—ELECTION OF DIRECTORS”.

Michael J. Peninger, Executive Vice President and Chief Financial Officer. Mr. Peninger was appointed Chief Financial Officer of the Company in March 2009, having served as Executive Vice President and Interim Chief Financial Officer since July 2007. Prior to that, he served as President and Chief Executive Officer of Assurant Employee Benefits beginning in January 1999. Mr. Peninger is a Fellow of the Society of Actuaries and a member of the American Academy of Actuaries.

Alan B. Colberg, Executive Vice President, Marketing and Business Development.Mr. Colberg was appointed Executive Vice President, Marketing and Business Development, effective as of his commencement of employment with the Company on March 28, 2011. Prior to this, Mr. Colberg served in multiple positions at Bain & Company, Inc. (“Bain”), including as Managing Director of Bain’s Atlanta office and Southern region from 2000 to 2011, and as global head of the Financial Services practice from 2005 to 2011.

Adam D. Lamnin, Executive Vice President; President and Chief Executive Officer, Assurant Health.Mr. Lamnin was appointed President and Chief Executive Officer of Assurant Health in January 2011, having served as Chief Operating Officer of Assurant Health since October 2009. Prior to that, he served in a variety of leadership roles at Assurant Solutions and Assurant Specialty Property, including as Executive Vice President, Chief Financial Officer and Group Senior Vice President. Mr. Lamnin is a Certified Public Accountant.

S. Craig Lemasters, Executive Vice President; President and Chief Executive Officer, Assurant Solutions. Mr. Lemasters has been Assurant Solutions’ President and Chief Executive Officer and Executive Vice President of Assurant, Inc. since July 2005.

3

Table of Contents

Gene E. Mergelmeyer, Executive Vice President; President and Chief Executive Officer, Assurant Specialty Property. Mr. Mergelmeyer was appointed Chief Executive Officer of Assurant Specialty Property in August 2007 and President of Assurant Specialty Property and Executive Vice President of Assurant, Inc. in July 2007. Prior to that, Mr. Mergelmeyer served as Executive Vice President of Assurant Specialty Property beginning in 2006 and led Assurant Specialty Property’s lending solutions division since 1999.

Christopher J. Pagano, Executive Vice President, Treasurer and Chief Investment Officer; President, Assurant Asset Management. Mr. Pagano has been Executive Vice President, Treasurer and Chief Investment Officer since July 2007 and President of Assurant Asset Management, a division of the Company, since January 2005.

John S. Roberts, Executive Vice President; President and Chief Executive Officer, Assurant Employee Benefits. Mr. Roberts was appointed President and Chief Executive Officer of Assurant Employee Benefits and Executive Vice President of Assurant, Inc. in March 2009, having served as Interim President and Chief Executive Officer since July 2007. Prior to that, he served as Senior Vice President of Assurant Employee Benefits and President of Disability Reinsurance Management Services.

Bart R. Schwartz, Executive Vice President, Chief Legal Officer and Secretary. Mr. Schwartz has been Executive Vice President, Chief Legal Officer and Secretary since April 2008. He previously served as Chief Corporate Governance Officer and Secretary of The Bank of New York Mellon Corporation from 2006 to 2008.

John A. Sondej, Senior Vice President, Controller and Principal Accounting Officer. Mr. Sondej has been Senior Vice President, Controller and Principal Accounting Officer of the Company since January 2005. Mr. Sondej is a Certified Public Accountant and is a member of the American Institute of Certified Public Accountants and the New Jersey Society of Certified Public Accountants.

Sylvia R. Wagner, Executive Vice President, Human Resources and Development. Ms. Wagner was appointed Executive Vice President, Human Resources and Development effective April 2009. She previously served as Senior Vice President, Human Resources and Development of Assurant Employee Benefits beginning in May 1995.

The Management Committee of Assurant (the “Management Committee”) consists of the Company’s President and Chief Executive Officer, all of the Company’s Executive Vice Presidents and the Chief Executive Officers of each of Assurant’s operating segments. The Management Committee is ultimately responsible for setting the policies, strategy and direction of the Company, subject to the overall discretion and supervision of the Board.

4

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table provides, with respect to each person or entity known by Assurant to be the beneficial owner of more than 5% of Assurant’s outstanding Common Stock as of February 1, 2012, (a) the number of shares of Common Stock owned (based upon the most recently reported number of shares outstanding as of the date the entity filed a Schedule 13G with the SEC) and (b) the percentage of all outstanding shares represented by such ownership as of February 1, 2012 (based on an outstanding share amount of 87,680,079 as of that date).

Name of Beneficial Owner | Shares of Common Stock Owned Beneficially | Percentage of Class | ||||||

BlackRock, Inc.1 | 7,600,037 | 8.7 | % | |||||

FMR LLC2 | 9,375,295 | 10.7 | % | |||||

Vanguard Group, Inc.3 | 4,954,366 | 5.7 | % | |||||

| 1 | BlackRock, Inc., 40 East 52nd Street, New York, New York 10022, filed a Schedule 13G/A on February 10, 2012, with respect to beneficial ownership of 7,600,037 shares. This represented 8.7% of our Common Stock as of February 1, 2012. BlackRock, Inc. has indicated that it filed this Schedule 13G/A on behalf of the following subsidiaries: BlackRock Japan Co. Ltd.; BlackRock Advisors (UK) Limited; BlackRock Institutional Trust Company, N.A.; BlackRock Fund Advisors; BlackRock Asset Management Canada Limited; BlackRock Asset Management Australia Limited; BlackRock Advisors LLC; BlackRock Capital Management, Inc.; BlackRock Financial Management, Inc.; BlackRock Investment Management, LLC; BlackRock Investment Management (Australia) Limited; BlackRock (Luxembourg) S.A.; BlackRock (Netherlands) B.V.; BlackRock Fund Managers Limited; BlackRock Pensions Limited; BlackRock Asset Management Ireland Limited; BlackRock International Limited; and BlackRock Investment Management (UK) Limited. |

| 2 | FMR LLC, 82 Devonshire Street, Boston, Massachusetts 02109, filed a Schedule 13G/A on February 14, 2012, with respect to the beneficial ownership of 9,375,295 shares. This represented 10.7% of our Common Stock as of February 1, 2012. |

| 3 | The Vanguard Group, Inc., 100 Vanguard Blvd., Malvern, PA 19355, filed a Schedule 13G/A on February 8, 2012, with respect to the beneficial ownership of 4,954,366 shares. This represented 5.7% of our Common Stock as of February 1, 2012. |

5

Table of Contents

SECURITY OWNERSHIP OF MANAGEMENT

The following table provides information concerning the beneficial ownership of Common Stock as of February 1, 2012 by Assurant’s Chief Executive Officer, Chief Financial Officer, and each of Assurant’s other three most highly compensated executive officers, each director, and all executive officers and directors as a group. As of February 1, 2012, we had 87,680,079 outstanding shares of Common Stock. Except as otherwise indicated, all persons listed below have sole voting power and dispositive power with respect to their shares, except to the extent that authority is shared by their spouses, and have record and beneficial ownership of their shares.

Name of Beneficial Owner | Shares of Common Stock Owned Beneficially1 | Percentage of Class | ||||||||

Robert B. Pollock | 370,924 | * | ||||||||

Michael J. Peninger | 186,158 | * | ||||||||

Alan B. Colberg | 3,973 | * | ||||||||

S. Craig Lemasters | 64,775 | * | ||||||||

Gene E. Mergelmeyer | 44,726 | * | ||||||||

Elaine D. Rosen | 3,105 | * | ||||||||

Howard L. Carver | 22,415 | * | ||||||||

Juan N. Cento | 6,229 | * | ||||||||

Elyse Douglas | 0 | 2 | * | |||||||

Lawrence V. Jackson | 2,960 | * | ||||||||

David B. Kelso | 5,827 | * | ||||||||

Charles J. Koch | 22,805 | * | ||||||||

H. Carroll Mackin | 21,275 | * | ||||||||

Paul J. Reilly | 0 | 2 | * | |||||||

Robert W. Stein | 7,500 | 2 | * | |||||||

John A. C. Swainson | 743 | * | ||||||||

All directors and executive officers as a group (22 persons) | 1,000,501 | 1.14 | % | |||||||

| * | Less than one percent of class. |

| 1 | (a) Includes: for Mr. Pollock, 12,819 shares of Common Stock; for all directors and executive officers as a group, 16,393 shares of Common Stock held through the Assurant 401(k) Plan, as of December 31, 2011. |

(b) Includes: for all executive officers as a group, 4,000 shares of restricted stock awarded under the Assurant, Inc. 2004 Long-Term Incentive Plan.

(c) Includes: 1,897 shares of Common Stock awarded to each of Messrs. Carver, Cento, Kelso, Koch and Mackin under the Directors Compensation Plan. The directors as a group hold a total of 9,485 shares of Common Stock subject to a five-year holding period commencing on the applicable grant date.

(d) Shares reported for Mr. Pollock include 200 shares that are considered to be pledged because they are held in a margin account. Shares reported for Mr. Carver include 12,000 shares that are considered to be pledged because they are held in a brokerage account as collateral for a nominal short-term loan. Shares reported for Mr. Mackin include 1,000 shares that are considered to be pledged because they are held in a margin account. As of February 1, 2012, a total of 16,598 of the shares beneficially owned by directors and executive officers as a group were considered to be pledged.

6

Table of Contents

(e) Includes restricted stock units (“RSUs”) that will vest and/or become payable on or within 60 days of February 1, 2012 in exchange for the following amounts of Common Stock as of February 1, 2012: for Mr. Pollock, 86,659 shares (including 39,947 shares that would be issuable upon a retirement); for Mr. Peninger, 83,007 shares (including 66,039 shares that would be issuable upon a retirement); for Mr. Colberg, 3,973 shares, and for each of Messrs. Lemasters and Mergelmeyer, 14,565 shares. RSUs that will vest on or within 60 days of February 1, 2012 in exchange for shares of Common Stock, for all directors and executive officers as a group, totaled 302,930.

(f) Includes vested and unexercised stock appreciation rights (“SARs”) that could have been exercised on or within 60 days of February 1, 2012 in exchange for the following amounts of Common Stock as of February 1, 2012: for Mr. Pollock, 97,048 shares; for Mr. Peninger, 22,936 shares; and for Mr. Lemasters, 17,795 shares. Vested and unexercised SARs that could have been exercised on or within 60 days of February 1, 2012 in exchange for shares of Common Stock, for all directors and executive officers as a group, totaled 150,727.

| 2 | As of February 1, 2012, Ms. Douglas held 2,231 RSUs, Mr. Reilly held 2,318 RSUs, and Mr. Stein held 2,235 RSUs, none of which will vest or become payable within 60 days of that date. For additional information regarding RSU awards granted to our non-employee directors in 2011, please see the Director Compensation Table on page 45, below. |

7

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (“CD&A”) provides a detailed review of the compensation principles and strategic objectives governing the compensation of the following individuals, who were our named executive officers for 2011:

Robert B. Pollock | President and Chief Executive Officer | |

Michael J. Peninger | Executive Vice President and Chief Financial Officer | |

Alan B. Colberg | Executive Vice President, Marketing and Business Development | |

S. Craig Lemasters | Executive Vice President; President and Chief Executive Officer, Assurant Solutions | |

Gene E. Mergelmeyer | Executive Vice President; President and Chief Executive Officer, Assurant Specialty Property |

Throughout this CD&A, we refer to these individuals as our “NEOs” and to Mr. Pollock as our “CEO.”

Impact of 2011 Business Results on NEO Compensation

Highlights for the Company’s 2011 fiscal year1 include:

| • | 9.9% operating return on equity (“ROE”), excluding accumulated other comprehensive income (“AOCI”) |

| • | Approximately $760 million of holding company capital at year-end |

| • | Approximately $600 million returned to stockholders in repurchases and dividends |

| • | 14% annual growth in book value per diluted share, excluding AOCI |

| • | Achievement of strategic enterprise-wide initiatives to improve efficiency, standardize operations and further reduce costs |

Solid earnings, disciplined capital management, revenue growth in key areas of focus in 2011 and achievement of strategic development goals resulted in annual incentive payments for Messrs. Pollock, Peninger and Colberg equal to 1.27 times their respective target opportunities, an annual incentive payment to Mr. Lemasters equal to 1.72 times his target opportunity, and an annual incentive payment to Mr. Mergelmeyer equal to 1.35 times his target opportunity.

The Compensation Committee of the Board (the “Committee”) has decided not to increase the base salary of any NEO or other member of the Company’s Management Committee for 2012.

Vesting of performance-based equity awards for the 2009-2011 performance cycle will not be determinable until May 2012 after 2011 financial results for the companies in the A.M. Best U.S. Insurance Index, against which the Company compares its performance, have been publicly disclosed. Similarly, vesting of performance-based equity awards for the 2010-2012, 2011-2013 and 2012-2014 performance cycles will not be determined until after the end of the applicable three-year cycle, and our NEOs will be eligible for payouts in respect of these awards in 2013, 2014 and 2015, respectively.

For more information about our fiscal 2011 operating results, please see the earnings release, attached as Exhibit 99.1 to our Current Report on Form 8-K furnished to the SEC on February 1, 2012, and the financial supplement posted on the “Investor Relations” section of our website athttp://ir.assurant.com. Neither the earnings release nor the financial supplement is incorporated by reference into this proxy statement.

| 1 | Certain measures are non-GAAP. A reconciliation of these non-GAAP measures to their most comparable GAAP measures can be found in Appendix A hereto. |

8

Table of Contents

Our Executive Compensation Principles

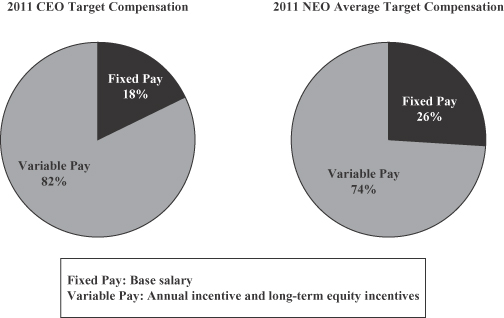

Assurant’s executive compensation programs are designed to align the interests of our executives with those of our stockholders by tying significant portions of their compensation to the Company’s financial performance. The following charts show the relative percentages of target variable and fixed compensation established for our CEO and our other NEOs at the beginning of 2011:

Set forth below are our core executive compensation principles, along with key features of our executive compensation program that support these principles:

| • | Executive compensation opportunities at Assurant should be sufficiently competitive to attract and retain talented executives while aligning their interests with those of our stockholders. |

| • | When setting target total direct compensation opportunities (base salary, annual incentives and long-term equity incentives) for our NEOs, we seek to approximate median levels for comparable positions at companies in our compensation peer group. |

| • | Each NEO’s annual incentive opportunity is contingent on the Company’s earnings. If the Company does not produce positive net operating income, no pool is available for annual executive incentive payments. |

| • | Since 2009, the annual long-term equity based incentive award provided to our NEOs has been awarded 50% in the form of performance stock units (“PSUs”) and 50% in the form of restricted stock units (“RSUs”). |

| • | Our incentive-based programs should motivate our executives to deliver above-median results. |

| • | We design performance goals under our annual executive incentive program so that above-target compensation will be paid only if the Company delivers above-target performance. |

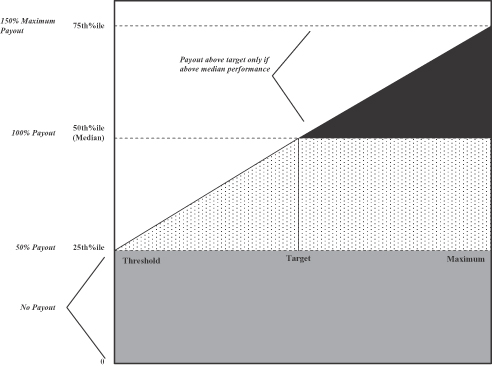

| • | Payouts with respect to PSU awards are contingent on performance relative to a broad index and only reach above-target levels if our performance exceeds the 50th percentile of this index. No payout is made if performance falls below the 25th percentile of this index. |

9

Table of Contents

| • | Our executive compensation programs should be informed by strong governance practices that reinforce our pay for performance philosophy, support our culture of accountability and encourage prudent risk management. |

| • | Under our executive compensation recoupment policy, beginning in 2012, the Compensation Committee may recover (“claw back”) incentive-based compensation from current and former executive officers in the event of a financial restatement as a result of material non-compliance with any financial reporting requirement under the securities laws that has resulted in an overpayment. |

| • | Under our stock ownership guidelines, our NEOs and directors are required to hold a meaningful amount of Company stock throughout their periods of service. |

| • | Under our insider trading policy, our NEOs and directors are prohibited from engaging in hedging and monetizing transactions with respect to Company securities. |

| • | Change of control agreements with our NEOs are “double trigger” and do not provide for excise tax gross-ups. |

| • | The Committee, assisted by Towers Watson & Co. (“Towers Watson”) (the Committee’s independent compensation consultant), undertook an annual risk review of the Company’s variable pay plans, policies and practices for all employees, and did not identify any risks that are reasonably likely to have a material adverse effect on the Company. |

| • | We do not provide excise or other tax gross-up benefits or any significant perquisites to our NEOs. |

| • | Since 2004, annual incentive payouts have been limited to 200% of each NEO’s target opportunity. |

| • | Assurant does not pay dividends on unvested PSUs. |

In light of the favorable advisory vote received by stockholders at the Company’s 2011 annual meeting and our discussions with stockholders, and because we believe that our executive compensation program is in line with market practices, we did not implement any significant changes to our program in 2011.

10

Table of Contents

II. Elements of Our Executive Compensation Program

The following table sets forth the primary elements of the compensation programs that apply to our NEOs and the objective each element is designed to achieve:

| Pay Elements | ||

| Compensation Element | Objective/Purpose | |

| Annual base salary | • Provides fixed compensation that, in conjunction with our annual and long-term incentive programs, approximates the median level of total target compensation for comparable positions at companies in our compensation peer group.

• Helps to attract and retain talented executives with compensation levels that are consistent with stockholders’ long-term interests. | |

| Annual incentive program | • Motivates executives to achieve specific near-term corporate or business segment goals designed to increase long-term stockholder value.

• Requires above-target performance to earn an above-target payout. | |

| Long-term equity incentive award program | • Motivates executives to consider longer-term ramifications of their actions and appropriately balance long- and near-term objectives.

• Reinforces a culture of accountability focused on long-term value creation.

• Requires above-median performance for an above-target payout on long-term performance-based equity awards. | |

| Retirement, deferral and health and welfare programs | • Provides a competitive program that addresses retirement needs of executives.

• Offers NEOs participation in the same health and welfare programs available to all U.S. employees.

• Provides an executive long-term disability program. | |

| Separation pay | • Provides separation pay upon certain termination of employment in connection with the sale of the Company or an applicable business segment. Executives are not contractually entitled to separation pay beyond these instances.

• Enables executives to focus on maximizing value for stockholders in the context of a change of control transaction. | |

11

Table of Contents

Mix of Total Direct Compensation Elements

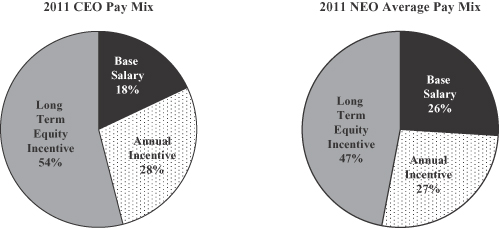

The following charts show the relative percentages of the components of target total direct compensation that were established for our CEO and our other NEOs at the beginning of 2011:

Because our CEO is primarily responsible for executing the strategic objectives of the Company, we have established variable compensation, including annual and long-term equity incentives, as a greater portion of his target total direct compensation compared to our other NEOs. A majority of his target total direct compensation opportunity is subject to pre-established performance goals.

Changes to Compensation Mix in 2011

In January 2011, Towers Watson presented data to the Committee demonstrating that base salaries and annual incentive opportunities provided to our NEOs fell below median levels for similarly situated executives at companies in our compensation peer group. To further align NEO compensation with median levels, the Committee approved the following base salary and target annual incentive increases for 2011:

| • | CEO Compensation.The Committee approved an increase in base salary, which had remained unchanged since 2008, from $950,000 to $975,000. The Committee also approved an increase in target annual incentive opportunity, which had remained unchanged since 2008, from 150% to 160% of base salary. |

| • | CFO Compensation. The Committee approved an increase in base salary from $550,000 to $600,000 and an increase in target annual incentive opportunity from 100% to 120% of base salary. |

| • | Other NEOs. The Committee approved an increase in base salary, which had remained unchanged since 2009, from $500,000 to $520,000 and an increase in target annual incentive opportunity from 90% to 100% of base salary. |

The target long-term incentive opportunity for 2011 for each of our NEOs remained unchanged from 2010 levels.

12

Table of Contents

2011 Annual Incentive Compensation

In selecting near-term Company or segment goals for the annual incentive program, the Committee takes a number of factors into account, including management’s expectations regarding business performance, results from prior years, opportunities for strategic growth and/or economic trends that may affect our business (e.g., levels of consumer spending, unemployment rates, mortgage default rates or prevailing conditions in the credit markets).

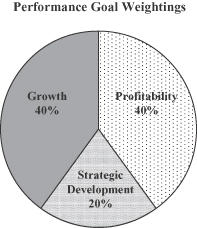

Annual Performance Goals.The following chart shows the relative weightings for each performance goal under our annual incentive program:

Financial Performance (80%): Balancing Growth and Profitability. Since becoming a public company in 2004, and consistent with our sustainable growth strategy, we have allocated 40% of our executives’ target annual incentive opportunity to profitability and 40% to revenue growth of specified businesses where we believe we can achieve superior returns. We believe that weighting profitability and growth measures equally motivates our executives to strike an appropriate balance between expanding our businesses and generating returns from them. We use operating measures for these financial targets because they exclude the impact of net realized gains (losses) on investments and other unusual and/or non-recurring or infrequent items.

| • | For NEOs who serve in a corporate capacity, revenue growth is measured by a weighted average of the revenue growth of the business segments, and profitability is measured using consolidated operating EPS and operating ROE.2 |

| 2 | Consolidated operating EPS is determined by dividing NOI for the Company as a whole by the weighted average number of diluted shares of our Common Stock outstanding during the year. Operating ROE for the Company is determined by dividing NOI for the Company by average stockholders’ equity for the year, excluding AOCI. For additional information regarding these measures, please see the earning release, Exhibit 99.1 to our Current Report on Form 8-K furnished to the SEC on February 1, 2012, and the financial supplement posted on the “Investor Relations” section of our website athttp://ir.assurant.com. Neither the earnings release nor the financial supplement is incorporated by reference into this proxy statement. |

13

Table of Contents

| • | For NEOs who serve as business segment leaders, the financial objectives apply to the business segments they lead. Top-line growth is measured through a combination of gross or net earned premiums and fees and gross written premium/new sales of designated products. Profitability is measured using NOI and operating ROE for the segment.3 |

For 2011, the Committee established financial targets designed to be challenging and to motivate our senior executives to deliver profitable growth in a difficult economic environment.

Strategic Development (20%):Strategic development goals are designed to motivate executives to achieve specified strategic, operational and/or organizational objectives viewed as critical to the Company’s long-term financial success. Performance measurements against strategic development goals for all NEOs are based on certain enterprise-wide projects.

For 2011, the Committee selected goals reflecting enterprise-wide initiatives to improve efficiency, standardize operations and further reduce costs. These initiatives focus on the following four areas:

| (i) | technology optimization (to reduce cost and improve efficiency of information systems); |

| (ii) | customer contact strategy (to reduce cost and improve quality of call center operations); |

| (iii) | finance and accounting service delivery model optimization (to reduce cost and maintain or improve quality of accounting and finance functions); and |

| (iv) | strategic vendor relations (to reduce cost and maintain or improve quality of certain functions by optimizing sourcing and shared services). |

During the year, management tracked and reported to the Committee on the Company’s progress in these four areas and recommended performance ratings. On the basis of the Company’s achievements in each of these areas, the Committee approved a 1.85 multiplier for this strategic development goal. These initiatives establish a strong framework for long-term operational efficiencies and cost savings, which management will continue to measure and report to the Board.

| 3 | NOI for each business segment is determined by excluding net realized gains or losses on investments and unusual and/or infrequent items from net income. Operating ROE for each business segment is determined by dividing NOI for the segment by average stockholders’ equity for the segment. For additional information regarding these measures, please see the earnings release, Exhibit 99.1 to our Current Report on Form 8-K furnished to the SEC on February 1, 2012, and the financial supplement posted on our “Investor Relations” section of our website athttp://ir.assurant.com. Neither the earnings release nor the financial supplement is incorporated by reference into this proxy statement. |

14

Table of Contents

2011 Results.The following table sets forth performance targets applicable to our NEOs for 2011, along with the resulting multipliers:

2011 Annual Incentive Performance Targets and Results1

| Weighting | Performance Metric | 0.0 | 0.5 | 1.0 | 1.5 | 2.0 | 2011 Results | Performance Multiplier | Composite Multiplier | |||||||||||||||||||||||||

| Assurant Enterprise | ||||||||||||||||||||||||||||||||||

| 40% | Profitability |

| 1.27 |

| ||||||||||||||||||||||||||||||

25%: Consolidated Operating Earnings per Share (EPS) | $3.70 | $3.95 | $4.20 | $4.45 | $4.70 | $4.33 | 1.26 | |||||||||||||||||||||||||||

15%: Operating Return on Equity (ROE) | 8.65% | 9.2% | 9.75% | 10.3% | 10.85% | 9.47% | 0.75 | |||||||||||||||||||||||||||

| 40% | Revenue Growth2 | N/A | 1.19 | |||||||||||||||||||||||||||||||

| 20% | Strategic Development | N/A | 1.85 | |||||||||||||||||||||||||||||||

| Assurant Specialty Property | ||||||||||||||||||||||||||||||||||

| 40% | Profitability |

| 1.35 |

| ||||||||||||||||||||||||||||||

25%: Net Operating Income (NOI) | $220 | $270 | $320 | $345 | $370 | $305.1 | 0.85 | |||||||||||||||||||||||||||

15%: Operating Return on Equity (ROE) | 20% | 24% | 28% | 31% | 34% | 27.4% | 0.93 | |||||||||||||||||||||||||||

| 40% | Revenue Growth | |||||||||||||||||||||||||||||||||

50%: Gross earned premium + fee income | $2,775 | $2,850 | $2,925 | $3,000 | $3,075 | $2,957 | 1.21 | |||||||||||||||||||||||||||

50%: Gross written premium for designated products | $2,075 | $2,150 | $2,225 | $2,300 | $2,375 | $2,363 | 1.92 | |||||||||||||||||||||||||||

| 20% | Strategic Development | N/A | 1.85 | |||||||||||||||||||||||||||||||

| Assurant Solutions | ||||||||||||||||||||||||||||||||||

| 40% | Profitability |

| 1.72 |

| ||||||||||||||||||||||||||||||

25%: Net Operating Income (NOI) | $112 | $117 | $122 | $132 | $142 | $141.6 | 1.98 | |||||||||||||||||||||||||||

15%: Operating Return on Equity (ROE) | 7.4% | 8.0% | 8.6% | 9.2% | 9.8% | 9.8% | 2.0 | |||||||||||||||||||||||||||

| 40% | Revenue Growth | |||||||||||||||||||||||||||||||||

50%: Gross earned premium + fee income | $3,450 | $3,550 | $3,650 | $3,750 | $3,850 | $3,729 | 1.39 | |||||||||||||||||||||||||||

50%: Gross written premium for designated products | $3,400 | $3,600 | $3,800 | $4,000 | $4,200 | $3,950 | 1.38 | |||||||||||||||||||||||||||

| 20% | Strategic Development | N/A | 1.85 | |||||||||||||||||||||||||||||||

| 1 | Dollar amounts applicable to performance metrics other than EPS are expressed in millions. The performance targets included in this table are disclosed only to assist investors and other readers in understanding the Company’s executive compensation. They are not intended to provide guidance on the Company’s future performance and should not be relied upon as predictive of the Company’s future performance or the future performance of any of our operating segments. |

| 2 | The corporate-level revenue growth multiplier is determined based on a weighted average of the performance multipliers applicable to each business segment, which are weighted as follows: Assurant Specialty Property—25%; Assurant Solutions—30%; Assurant Health—25%; and Assurant Employee Benefits—20%. The revenue growth multiplier for: (i) Assurant Health was 0.73, based on weighted targets of $1.83 billion for net earned premium and fee income (50%) and $410 million for new sales of designated products (50%), and results of $1.8 billion for net earned premium and fee income and $406 million for new sales of designated products; and (ii) Assurant Employee Benefits was 1.01, based on weighted targets of $1.13 billion for net earned premium and fee income (50%) and $140 million in total sales of designated products (50%), and results of $1.09 billion in net earned premium and fee income and $147.6 million in total sales of designated products. |

15

Table of Contents

Although Assurant Health net operating income was $40.9 million in 2011, the Committee determined that, for purposes of calculating the corporate-level ROE and EPS results, net operating income would be capped at $20 million to exclude certain non-recurring items that benefitted the Company during its first year adapting to health care reform. In addition, the enterprise-level and Assurant Specialty Property results exclude fees generated during 2011 from the Company’s acquisition of SureDeposit in June 2011.

The following table shows target annual incentive compensation, the weighted average composite multipliers for each NEO and the resulting annual incentive award payout for 2011:

| NEO | 2011 Target Annual Incentive | 2011 Multiplier | 2011 Annual Incentive Payment | |||||||||

Robert B. Pollock | $ | 1,560,000 | 1.27 | $ | 1,981,200 | |||||||

Michael J. Peninger | $ | 720,000 | 1.27 | $ | 914,400 | |||||||

Alan B. Colberg | $ | 520,000 | 1.27 | $ | 660,400 | |||||||

S. Craig Lemasters | $ | 520,000 | 1.72 | $ | 894,400 | |||||||

Gene E. Mergelmeyer | $ | 520,000 | 1.35 | $ | 702,000 | |||||||

Annual incentive awards are paid pursuant to the Assurant, Inc. Executive Short Term Incentive Plan (the “ESTIP”). Payments under the ESTIP are generally intended to be deductible as “performance based compensation” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “IRC”). The aggregate payments to all ESTIP participants for any performance period cannot exceed 5% of the Company’s net income (defined as net income as reported in the Company’s income statement, adjusted to eliminate the effects of charges for restructurings, discontinued operations, extraordinary items and other unusual or non-recurring items, and the cumulative effect of tax or accounting charges, each as defined by generally accepted accounting principles in the United States of America (“GAAP”) or identified in the Company’s financial statements, notes to the financial statements or management’s discussion and analysis). This aggregate maximum amount is allocated to all participants equally, except that the amount allocated to the Chief Executive Officer is twice the amount allocated to the other participants. With respect to 2011 annual incentives, the Committee exercised negative discretion to reduce participants’ awards by applying the performance goals set forth in the table entitled “2011 Annual Incentive Performance Targets and Results” on page 15, above, and additional negative discretion as described above on this page.

Long-Term Equity Incentive Compensation

Since 2009, we have used PSUs and RSUs as our equity compensation vehicles. A unit represents the right to receive a share of Common Stock at a specified date in the future, subject, in the case of PSUs, to the attainment of pre-established performance criteria. Because such units reflect the performance of actual shares of stock, the Committee determined that PSUs and RSUs were best suited for aligning the interests of our executives with the interests of our stockholders. In addition, the relatively uniform tax treatment afforded to stock units internationally provides a more common rewards platform that facilitates collaboration and cooperation throughout the global enterprise. The Committee also believes that a 50/50 split between RSU and PSU components of our long-term equity compensation program provides an appropriate balance between direct alignment with stockholders through equity holdings and performance-weighted equity compensation.

PSUs. The Committee selected PSUs as an equity compensation vehicle to ensure that a portion of long-term equity compensation would be paid only if the Company achieves specified financial objectives over an extended period. For each year in the applicable performance cycle, Assurant’s performance with respect to selected metrics is compared against a broad index of insurance companies and assigned a percentile ranking. These rankings are then averaged to determine the composite percentile ranking for the performance period.

16

Table of Contents

Applicable metrics for the 2009 – 2011, 2010 – 2012, 2011 – 2013 and 2012 – 2014 performance cycles are set forth in the chart below:

PSU Relative Performance Metrics and Relative Index

| Performance Cycles | 2009 – 2011 | 2010 – 2012, 2011 – 2013 and 2012 – 2014 | Weighting | |||||

| Relative Performance Metrics | Growth in EPS1 | Growth in book value per share excluding AOCI4 | 1/3 | |||||

Revenue growth2 | Revenue growth | 1/3 | ||||||

Total stockholder return3 | Total stockholder return | 1/3 | ||||||

| Relative Index | A.M. Best U.S. Insurance Index | A.M. Best U.S. Insurance Index, excluding companies with revenues of less than $1 billion or that are not in the health or insurance Global Industry Classification Standard codes (3510 and 4030). | N/A | |||||

| 1 | Year-over-year growth in GAAP EPS |

| 2 | Year-over-year growth in total GAAP revenue |

| 3 | Percent change on Company stock plus dividend yield percentage |

| 4 | Year-over-year growth in the Company’s common equity, excluding AOCI, divided by fully diluted shares of Common Stock outstanding at year-end |

Changes to Relative Performance Metrics and Index. In light of the significant volatility in EPS across the financial services sector, and in response to comments from our investors, the Committee decided to replace growth in GAAP EPS with growth in book value per diluted share excluding AOCI as a performance metric beginning with the 2010 – 2012 PSU performance cycle. We believe this change will provide a more consistent basis for investors to compare the Company’s long-term financial performance to that of our competitors.

The change in the index used to measure relative performance starting with the 2010 – 2012 cycle more accurately benchmarks our performance against the performance of companies of comparable size that operate one or more businesses similar to ours.

17

Table of Contents

As illustrated in the chart below, executives do not receive any payout with respect to any PSUs if the Company’s composite percentile ranking falls below the 25th percentile. If the composite percentile ranking is at or above the 75th percentile, the maximum payout is attained. Payouts for performance between the 25th and the 75th percentiles are determined on a straight-line basis using linear interpolation.

Payments in respect of PSUs awarded under the Amended and Restated Assurant, Inc. Long Term Equity Incentive Plan (“ALTEIP”) are intended to be deductible, to the maximum extent possible, as “performance based compensation” within the meaning of IRC Section 162(m)(4). Additional information regarding the terms and conditions of PSUs and RSUs awarded under the ALTEIP is provided under the heading “Narrative to the Summary Compensation Table and Grants of Plan-Based Awards Table—Long Term Equity Incentive Awards” on page 28, below.

RSUs. RSUs typically vest in equal annual installments over a three-year vesting period and are granted in March of each year. In addition, from time to time the Committee may grant special awards to executives who demonstrate exceptional performance and are critical to the success of the Company’s business strategy over the long term. These awards typically consist of RSUs subject to vesting periods that are structured to facilitate retention through important business and/or career milestones. In November 2011, the Committee awarded 10,000 RSUs to Mr. Mergelmeyer in recognition of his leadership in connection with various business development initiatives within Assurant Specialty Property and the redesign of the Company’s customer contact strategy across all business segments. To facilitate retention, the award will vest over a five-year period, vesting in four 10% increments on each of the first four anniversaries of the grant date, with the remaining 60% increment vesting on the fifth anniversary of the grant date, subject to Mr. Mergelmeyer’s continued employment through the applicable vesting dates.

Stock Ownership Guidelines. Executives’ ownership of Company stock aligns their financial interests with those of other stockholders. For this reason, the Company has implemented ownership requirements for each of

18

Table of Contents

our NEOs. NEOs who fail to comply with the guidelines by their respective compliance dates will be prohibited from selling any shares of Assurant stock until compliance is achieved. Additional information about our Stock Ownership Guidelines is provided under the heading “Stock Ownership Guidelines” on page 22, below.

Compensation Levels and Pay Mix for 2012

In January 2012, Towers Watson presented data to the Committee demonstrating that total target direct compensation (base salary, annual incentive compensation and long-term incentive compensation) of most of our NEOs continued to fall below median levels for similarly situated executives at companies in our compensation peer group. To further align NEO compensation with median levels, the Committee approved an increase in the target long-term incentive opportunities as a percentage of base salary, which had remained unchanged since 2010, for Mr. Pollock from 300% to 325%, for Mr. Peninger from 200% to 230% and for each of Messrs. Colberg, Lemasters and Mergelmeyer from 175% to 200%.

The Committee did not increase base salaries or target annual incentive opportunities for our NEOs for 2012.

III. Compensation Arrangements with Mr. Colberg

In connection with the Company’s commitment to continue growing stockholder value, effective March 2011 we appointed Mr. Colberg to the newly created position of Executive Vice President, Marketing and Business Development. Before joining Assurant, Mr. Colberg served in multiple positions at Bain & Co., Inc. (“Bain”), including as global head of the Financial Services practice from 2005 to 2011. We believe that his market and industry knowledge, business contacts and extensive experience advising global financial services organizations will enhance our ability to deliver on this commitment.

To induce him to join the Company as a senior executive and to replace certain compensation and other benefits that he forfeited upon his resignation from Bain, the Company made a cash sign-on payment to Mr. Colberg of $7.5 million. The sign-on payment is subject to clawback provisions requiring Mr. Colberg to pay back the sign-on payment upon a voluntary termination of employment or a termination of employment by the Company for cause during the first year of his employment and to pay back apro rata portion of the sign-on payment upon termination during the second or third year of his employment. The Company has not guaranteed Mr. Colberg’s salary or bonus for any year.

For more information regarding Mr. Colberg’s compensation, please see the tables and related narrative disclosures presented throughout this proxy statement, and the offer letter filed as Exhibit 10.38 to the Company’s 2010 Annual Report on Form 10-K filed with the SEC on February 23, 2011.

IV. The Compensation Committee’s Decision-Making Process

The Committee oversees our executive compensation program and advises the full Board on general aspects of Assurant’s compensation and benefit policies. The Committee is composed entirely of independent directors, as determined in accordance with its charter, our Corporate Governance Guidelines and applicable NYSE rules. The Committee’s charter and our Corporate Governance Guidelines are available under the “Board Committees and Charters” tab under the “Corporate Governance” tab of the “Investor Relations” section of our website athttp://ir.assurant.com.

19

Table of Contents

Annual Compensation Review

The following chart outlines the Committee’s annual process in setting NEO compensation:

Input from Management

Our CEO is not involved in the Committee’s determination of his compensation. Although he completes a self-assessment of his own performance against prescribed criteria, each independent director separately assesses his performance on the same criteria. He annually reviews the performance and compensation of each member of our Management Committee in consultation with the Executive Vice President, Human Resources and Development and makes recommendations regarding their compensation to the Committee. The CEO also provides input to the Committee, in consultation with the Company’s Chief Financial Officer and Executive Vice President, Human Resources and Development, on the annual incentive plan performance goals for the Company’s executive officers.

The Committee evaluates the recommendations of the CEO along with information and analysis provided by Towers Watson. The Committee exercises its discretion in evaluating, modifying, approving or rejecting the CEO’s recommendations and makes all final decisions with regard to base salary, short-term incentives and long-term incentives for executive officers. The Committee also meets periodically in executive session without any members of management present to discuss recommendations and make decisions with respect to compensation of the Company’s executive officers.

Input from Independent Compensation Consultant

The Committee has engaged Towers Watson as its independent compensation consultant to provide analysis and advice on such items as pay competitiveness, incentive plan design, performance measurement, design and use of equity compensation and relevant market practices and trends with respect to the compensation of our executive officers and non-management directors (as applicable). Among other things, Towers Watson prepares reports, delivers presentations and engages in discussions with the Committee regarding the information collected. These reports, presentations and discussions may address topics ranging from strategic considerations for compensation programs generally to the amount or specific components of each executive officer’s compensation. Towers Watson also reviews and provides input on the portions of the Company’s annual proxy statement regarding executive and director compensation matters.

At the direction of the Chair of the Committee, Towers Watson reviews Committee materials and management’s recommendations in advance of each Committee meeting or other Committee communication. Towers Watson participates in most Committee meetings, in each case at the request of the Chair of the Committee. The decisions made by the Committee are the responsibility of the Committee and may reflect factors other than the recommendations and information provided by Towers Watson.

20

Table of Contents

Level of Compensation Provided

Market Positioning. We aim to set target total direct compensation for each NEO at approximately the median level provided to executives with similar responsibilities at companies in our compensation peer group, based on the most recent publicly available data, as analyzed by Towers Watson.

Our Compensation Peer Group. While we face competition in each of our businesses, no single competitor directly competes with us in all business lines. Additionally, the business lines in which we operate are generally characterized by a limited number of competitors. We believe that the following companies collectively represent the best match for Assurant because they operate in the insurance or financial services sector and may share one or more of the following characteristics with us: similar product lines; similar services and business models; similar revenues and assets; and a similar talent pool for recruiting new employees:

• Aetna Inc. | • Coventry Health Care, Inc. | • Stancorp Financial Group, Inc. | ||

• Aflac Incorporated | • Genworth Financial, Inc. | • Sunlife Financial, Inc. | ||

• CIGNA Corporation | • Hanover Insurance Group Inc. | • Torchmark Corporation | ||

• CNO Financial Group, Inc. | • Humana Inc. | • Unum Group | ||

• CNA Financial Corporation | • Markel Corporation | • W.R. Berkley Corporation | ||

• Principal Financial Group, Inc. | ||||

We have not made any changes to our peer group since 2006. Although our position may change from year to year, based on the most recent publicly available data, we believe we are approaching the median of our compensation peer group when measured by revenues, assets and net income.

V. Governance Features of Executive Compensation

Our executive compensation programs are guided by strong governance practices intended to reinforce our pay for performance philosophy, support our culture of accountability and encourage prudent risk management. Summarized below are the key governance features of our executive compensation programs.

Executive Compensation Recoupment (“Clawback”) Policy

On November 10, 2011, the Committee implemented a policy regarding the recoupment of performance-based incentive compensation awarded to the Company’s key executives on or after January 1, 2012. The policy provides that, in the event that the Company is required to prepare a restatement of its financial results due to material noncompliance with any financial reporting requirement under the securities laws, the Committee may recover the excess of (x) any annual cash incentive and long-term cash or equity-based incentive award amounts provided to any of the Company’s current or former executive officers based on the original financial statements (including any deferrals thereof) over (y) the amounts that would have been provided based on the restatement. The recovery period may comprise up to three years preceding the date on which the Company is required to prepare the restatement. This is in addition to the clawback requirements of the Sarbanes-Oxley Act applicable to the CEO and CFO.

In determining whether to seek recovery of any excess incentive-based compensation, the Committee will consider (i) whether a covered individual engaged in intentional misconduct that contributed to the requirement to prepare a restatement, (ii) whether the assertion of a claim may violate applicable law or adversely affect the Company in any related proceeding or investigation, (iii) the cost and likely outcome of any potential litigation in connection with the Company’s efforts to recover excess incentive-based compensation, and (iv) any other factors it deems appropriate.

21

Table of Contents

Stock Ownership Guidelines

As noted above, we believe that a sustained level of stock ownership is critical to ensuring that the creation of long-term value for our stockholders remains a primary objective for our executives and non-employee directors. Accordingly, in 2006 the Company adopted the following Stock Ownership Guidelines and holding requirements for its non-employee directors and senior executives:

| Position | Minimum Stock Ownership Requirement | |

Non-Employee Director | Market value of 5 times annual base cash retainer | |

Chief Executive Officer | Market value of 5 times current base salary | |

Assurant, Inc. Executive Vice President (including all other NEOs) | Market value of 3 times current base salary | |

Individuals have five years from the later of July 1, 2006 or the date of their permanent appointment to a specified position to acquire the required holdings. The compliance date for Messrs Pollock, Peninger and Lemasters was July 1, 2011. Mr. Mergelmeyer has a compliance date of July 16, 2012. Mr. Colberg has a compliance date of March 28, 2016. Eligible sources of shares include personal holdings, vested or unvested restricted stock and RSUs, 401(k) holdings and Employee Stock Purchase Plan shares. Shares underlying PSUs are not counted toward the holding requirement until delivered. The Committee tracks the ownership amounts of the non-employee directors and the Management Committee on an annual basis. As of December 31, 2011, all of our NEOs were in compliance with the Company’s stock ownership requirements.

Timing of Equity Grants

Assurant does not coordinate the timing of equity awards with the release of material non-public information. Under the Company’s Equity Grant Policy, annual equity awards granted by the Committee pursuant to the ALTEIP must be granted on the second Thursday in March each year. If the Committee decides that a second grant in the same calendar year is necessary for, among other reasons, salary adjustments, promotions or new hires, additional awards under the ALTEIP may generally be granted on the second Thursday in November.

Prohibition on Hedging Transactions

The NEOs are subject to the Company’s Insider Trading Policy, which prohibits employees and directors from engaging in hedging or monetizing transactions with respect to Company securities they own.

Tax and Accounting Implications

Under IRC Section 162(m)(1)-(4), certain compensation amounts in excess of $1 million paid to a public corporation’s chief executive officer and the three other most highly-paid executive officers (other than the chief financial officer) are not deductible for federal income tax purposes unless the executive compensation is awarded under a performance-based plan approved by stockholders and meets certain additional requirements. The Committee continues to emphasize performance-based compensation for Assurant’s executives and seeks to maximize deductibility of compensation under Section 162(m)(4). However, because the Committee believes that its primary responsibility is to provide a compensation program that attracts, retains and rewards the executives necessary to successfully execute the Company’s business strategy, the Committee may approve non-deductible compensation.

The compensation that we pay to the NEOs is reflected in our consolidated financial statements as required by GAAP. The Committee considers the financial statement impact, along with other factors, in determining the amount and form of compensation provided to executives. We account for stock-based compensation under the ALTEIP and all predecessor plans in accordance with the requirements of FASB ASC Topic 718.

22

Table of Contents

Assurant’s NEOs participate in the same health care, disability, life insurance, pension and 401(k) benefit plans made available generally to the Company’s U.S. employees. In addition, they are eligible for certain change of control benefits and supplemental retirement plans described below.

Change of Control Benefits. Assurant is party to a change of control agreement (a “COC Agreement”) with each of its NEOs. The purpose of these COC Agreements is to enable our executives to focus on maximizing stockholder value in the context of a control transaction without regard to personal concerns related to job security.

The COC Agreements with our NEOs contain a “double trigger,” meaning that benefits are generally payable only upon a termination of employment “without cause” or for “good reason” within two years following a change of control. Executives who have COC Agreements are also subject to non-compete and non-solicitation provisions. In addition, these agreements do not contain excise tax gross-up provisions. Rather, in the event of a change of control, our NEOs are entitled to receive either (i) the full benefits payable in connection with a change of control (whether under the COC Agreement or otherwise) or (ii) a reduced amount that falls below the applicable safe harbor provided under the IRC, whichever amount provides the greater after-tax value for the executive.

Additional information regarding the terms and conditions of the COC Agreements is provided under the heading “Narrative to the Potential Payments Upon Termination or Change of Control Table—Change of Control Agreements” on page 42, below.

Retirement Plans. We have a Supplemental Executive Retirement Plan (the “SERP”), an Executive Pension Plan (the “Executive Pension Plan”), an Executive 401(k) Plan (the “Executive 401(k) Plan”) and a Pension Plan (the “Pension Plan”). These retirement plans are intended to provide our NEOs with competitive levels of income replacement upon retirement and thus to attract and retain talented executives in key positions. The Executive Pension Plan is designed to replace income levels capped under the Pension Plan by the compensation limit of IRC Section 401(a)(17) ($245,000 for 2011). The SERP is designed to supplement the pension benefits provided under the Pension Plan, Executive Pension Plan and Social Security so that total income replacement from these programs will equal up to 50% of an NEO’s base salary plus his or her annual incentive target. Additional information regarding the terms and conditions of these plans is provided under the headings “Narrative to the Pension Benefits Table” on page 33, below, and “Narrative to the Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans Table” on page 38, below.

Deferred Compensation Plans. Each of the NEOs is eligible to participate in the Amended and Restated Assurant Deferred Compensation Plan (the “ADC Plan”). The ADC Plan enables key employees to defer a portion of eligible compensation, which is then notionally invested in a variety of mutual funds. Deferrals and withdrawals under the ADC Plan are intended to comply with IRC Section 409A (“Section 409A”). Before the adoption of Section 409A and the establishment of the ADC Plan in 2005, the NEOs were eligible to participate in either the Assurant Investment Plan (the “AIP”) or the American Security Insurance Company Investment Plan (the “ASIC Plan”). However, after the enactment of Section 409A, both plans were frozen as of January 1, 2005 and, currently, only withdrawals may be made.

Additional information regarding the terms and conditions of these plans is provided under the heading “Narrative to the Nonqualified Defined Contribution and Other Nonqualified Deferred Compensation Plans Table” on page 38, below.

23

Table of Contents

Health and Welfare Benefits. As part of the Company’s general benefits program, the Company provides Long-Term Disability (“LTD”) coverage for all benefits-eligible employees under a group policy. LTD benefits replace 60% of an employee’s monthly plan pay (which is generally defined as base salary plus the amount of the employee’s target bonus percentage), up to a maximum monthly benefit of $15,000. As an additional benefit, each NEO is eligible for Executive LTD coverage, subject to underwriting for amounts in excess of a guaranteed monthly benefit of $3,000. Executive LTD supplements benefits payable under the standard coverage and provides a maximum monthly benefit of $25,000, less amounts payable under the group policy.4 This coverage is provided through the purchase of individual policies and is fully paid for by the Company.

Additional information regarding executive LTD benefits is provided in footnote 4 to the Summary Compensation Table on page 26, below.