Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Assurant, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

2016 PROXY STATEMENT

AND NOTICE OF ANNUAL

MEETING OF STOCKHOLDERS

Table of Contents

March 29, 2016

Dear Fellow Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Assurant, Inc. The meeting will be held on May 12, 2016 at 9:00 a.m. at the Club Quarters, Conference Center, 52 William Street, New York, New York 10005. We hope you attend the Annual Meeting but, whether or not you plan to attend, we encourage you to designate the proxies on the proxy card to vote your shares.

At last year’s annual meeting of stockholders, our advisory “say on pay” proposal received approval of approximately 95% of the vote. We attribute this support to the alignment of our compensation programs with the interests of our stockholders. In 2015, we continued our regular investor outreach program to hear our investor’s thoughts about executive compensation and corporate governance issues, and we look forward to continuing this important dialogue with our investors.

As a member of the Board of Directors, I am pleased to report to you that our well-qualified and diverse group of directors brings a balanced mix of executive leadership, industry, boardroom, financial and operating experience to Assurant. Our highly experienced directors provide critical insights on important issues facing our business today, always with a focus on maximizing stockholder value and adhering to Assurant’s bedrock principles concerning ethics, compliance and respect for every employee in the Company.

At the Annual Meeting, stockholders are being asked to elect directors; ratify the appointment of the Company’s auditors; cast an advisory vote approving the compensation of the Company’s named executive officers for 2015; and vote on an advisory stockholder proposal concerning proposed changes in our by-laws and articles of incorporation, if properly presented at the meeting.

We ask that you please give these materials your prompt attention. Your vote is important.

On behalf of the Board of Directors, I thank you for your continued interest and support.

Sincerely,

Alan B. Colberg

President, Chief Executive Officer and Director

Assurant, Inc.

Table of Contents

Assurant, Inc.

28 Liberty Street

41st Floor

New York, New York 10005

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

DATE AND TIME: | May 12, 2016, 9:00 a.m. |

LOCATION: | The Club Quarters, Conference Center, 52 William Street, New York, New York 10005 |

PURPOSE OF THE

MEETING: | To elect each of our directors standing for re-election to our Board of Directors to serve until the 2017 Annual Meeting of Stockholders; |

To ratify the appointment of PricewaterhouseCoopers LLP as Assurant’s Independent Registered Public Accounting Firm for the year ending December 31, 2016; |

To cast an advisory vote approving the compensation of the Company’s named executive officers for 2015; |

To vote on an advisory stockholder proposal concerning proposed changes in our by-laws and articles of incorporation, if properly presented at the meeting; and |

To transact such other business as may properly come before the meeting or any adjournment thereof. |

RECORD DATE: | Stockholders of record at the close of business on March 17, 2016 are entitled to receive this notice and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

A list of those stockholders will be available for inspection at the offices of Assurant beginning at least ten days before the Annual Meeting. |

PROXY VOTING: | Whether or not you plan to attend the Annual Meeting, we hope that you will read this proxy statement and submit your vote by telephone, via the Internet, or by requesting a printed copy of the proxy materials and completing, signing and returning the proxy card as instructed. |

VOTE BY INTERNET –www.proxy.vote.com |

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time on May 11, 2016. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

VOTE BYPHONE – 1-800-690-6903 |

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time on May 11, 2016. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL |

Mark, sign and date your proxy card and return it in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Pursuant to the “Notice and Access” rule of the U.S. Securities and Exchange Commission (the “SEC”), stockholders may choose to access our proxy materials via the Internet or may request printed copies of

Table of Contents

such materials. Electronic delivery allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials. On or about March 29, 2016, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders informing them that our proxy statement, 2015 annual report to stockholders and voting instructions are available on the Internet as of such date.

If you plan to attend the Annual Meeting, please notify the Chief Legal Officer and Secretary at Assurant, Inc., 28 Liberty Street, 41st Floor, New York, New York 10005, so that we can make appropriate arrangements. Please bring a government-issued photo identification and, if you hold your shares through a bank, broker or other nominee, a legal proxy, which will allow you to attend the Annual Meeting and vote in person. In addition, if you are representing an organization that is a stockholder, you must bring evidence of your authority to represent that organization at the Annual Meeting.

Thank you for your interest in and consideration of the proposals listed above.

By Order of the Board of Directors,

Bart R. Schwartz

Executive Vice President,

Chief Legal Officer and Secretary

March 29, 2016

The Assurant Proxy Statement and Annual Report are available at

www.proxyvote.com

You will need your 12-digit control number, listed on the Notice, to access these materials and to vote.

EACH VOTE IS IMPORTANT. TO VOTE YOUR SHARES, PLEASE PROMPTLY SUBMIT YOUR VOTE BY TELEPHONE, INTERNET OR MAIL AS EXPLAINED ABOVE.

Table of Contents

Summary Information

SUMMARY INFORMATION

Provided below is a summary of certain information contained in this proxy statement. Before casting your vote, please refer to the complete proxy statement and the 2015 annual report to stockholders.

MATTERS TO BE VOTED ON

| Proposals | Board Recommendation | Page | ||

Election of 10 Director Nominees | FOR | 3 | ||

Ratification of Appointment of PricewaterhouseCoopers LLP as Assurant’s Independent Registered Public Accounting Firm for 2016 | FOR | 9 | ||

Advisory Approval of 2015 Compensation of Named Executive Officers | FOR | 10 | ||

Advisory Stockholder Proposal Concerning Proposed Changes in our By-laws and Articles of Incorporation | FOR | 11 |

BUSINESS HIGHLIGHTS

Overview. Assurant insures clients and consumers against specialized risks and offers related products and services. We operate in North America, Latin America, Western Europe and other select geographic markets through two ongoing operating segments: Assurant Solutions and Assurant Specialty Property.

Strategic Realignment of Business Strategy. To sharpen our focus on products and services related to housing and lifestyle, recently we sold our Assurant Employee Benefits segment to Sun Life Assurance Company of Canada and our supplemental and small-group self-funded health insurance businesses to National General Holdings Corp. The remainder of Assurant Health is in run-off, a process we expect substantially to complete in 2016.

ü 2015 Financial Highlights1 2 |

Total net earned premiums, fees and other income decreased 4.0% in 2015 to $7.4 billion |

Fees and other income increased to $1.2 billion in 2015, compared to 1.0 billion in 2014 |

Diluted operating earnings per share of $6.58 |

Book value per diluted share (including Assurant Health results), excluding accumulated other comprehensive income (“AOCI”), of $65.29 |

11.3% operating return on equity, excluding AOCI |

ü Disciplined Capital Management |

In 2015, Assurant: |

• returned approximately $379 million to its stockholders through share repurchases and common stock dividends |

• $285 million in share repurchases |

• increased quarterly dividend in May by approximately 11% to $0.30 and then again in December by approximately 67% to $0.50 to acknowledge management’s increased confidence in the Company’s long-term cash flows following the strategic realignment |

• invested approximately $20 million in acquisitions |

• ended 2015 with $460 million of holding company capital and $210 million of deployable capital

|

1 Results for Assurant Health are excluded, unless otherwise noted. |

2 Certain measures are non-GAAP. A reconciliation of these non-GAAP measures to their most comparable GAAP measures can be found in Appendix A hereto. |

Table of Contents

Summary Information

COMPENSATION HIGHLIGHTS

Assurant’s executive compensation programs are aligned with the Company’s strategic and financial objectives. As explained in detail below, they tie a large portion of executive compensation to the Company’s financial performance. Highlights of our 2015 executive compensation programs include:

ü Pay for Performance Commitment | ||

In 2015, we again received strong support for our executive compensation programs, with 95% of votes cast approving our advisory say-on-pay resolution | ||

Significant portion of executive short- and long-term compensation tied to the Company’s overall performance and to the growth of businesses targeted for profitable growth long-term | ||

Above-target compensation paid only if the Company delivers above-target performance | ||

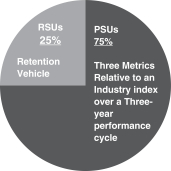

For executive officers, the performance stock unit (“PSU”) component of the Company’s long-term incentive award represents 75% of their long-term incentive compensation opportunity and the restricted stock unit (“RSU”) component represents 25%. | ||

PSUs have been earned on the basis of the Company’s ranking relative to an industry index, with regard to three financial metrics: (i) total stockholder return; (ii) revenue growth; and (iii) growth in book value per share, excluding AOCI | ||

ü Stringent Executive Compensation Governance | ||

Maximum payout caps for annual incentive compensation; limited to 200% of each NEO’s target opportunity | ||

No dividend equivalents on unvested PSUs | ||

Robust stock ownership guidelines for NEOs and directors | ||

Clawback policy applicable to current and former executive officers in the event of financial statement restatement | ||

NEO change of control agreements are “double trigger” and do not provide for excise tax gross-ups.

Additionally, with respect to 2015 compensation, starting in the second quarter of 2015, in connection with the Company’s wind-down of its health insurance business, in certain tables in our quarterly earnings news releases we now show the profit and loss from Assurant Health separately as Assurant run-off operations. The Compensation Committee has decided that Assurant Health results will be excluded from the Company’s performance targets. | ||

ü Changes to 2016 Compensation to Align with Transformation | ||

As a result of the strategic repositioning of the Company, the Compensation Committee has made a number of changes to the Company’s short-term and long-term incentive programs for 2016. These changes further align our incentive compensation programs with the strategy of the Company to drive profitable growth long-term through a greater focus on our Housing and Lifestyle protection offerings. See table below. | ||

CORPORATE GOVERNANCE HIGHLIGHTS

Assurant is committed to strong corporate governance practices. Certain highlights include:

ü Independent Board Chair | ü Appropriate mix of director diversity and tenure | |

ü Declassified Board | ü Greater than 95% director attendance at meetings | |

ü Majority voting standard for director elections | ü Regular outreach to investors | |

ü Independent Board (with exception of CEO) | ü Clawback policy | |

ü Annual Board and committee self-evaluations | ü No stockholder rights plan | |

ü Policy against corporate independent political expenditures | ü Officers and directors prohibited from hedging and pledging of Company securities | |

ü Code of Ethics applicable to all employees and directors |

Table of Contents

Summary Information

KEY CHANGES TO 2016 COMPENSATION PLANS

| Executive Short-Term Annual Incentive Plan (ESTIP) | ||||||||

| 2015 Program | Changes for 2016 Program | 2015 Program | Changes for 2016 Program | Rationale for 2016 Changes | ||||

Enterprise | Enterprise | Business Segment | Business Segment | The Compensation Committee believes that the new ESTIP metrics will:

• drive greater

• reinforce the

• promote the | ||||

40% Consolidated Revenue | 40% Consolidated Core/Accelerated Revenue | 40% Business Segment Revenue | 20% Business Segment Core/ Accelerated Revenue | |||||

25% Consolidated Net Operating Income | 30% Consolidated Net Operating Income | 25% Business Segment Net Operating Income | 30% Business Segment Net Operating Income | |||||

20% Consolidated Operating Earnings per Diluted Share | 30% Consolidated Net Operating Income – Operating Earnings per Diluted Share (“NOI-EPS”) | 20% Consolidated Operating Earnings per Diluted Share | 50% Enterprise Metrics | |||||

15% Operating Return on Equity, excluding AOCI | 15% Operating Return on Equity, excluding AOCI, for the segment | |||||||

| Executive Long-Term Equity Incentive Plan (ALTEIP) | ||||

Award Mix. The long-term incentive award mix for executive officers will continue to reflect a 75% PSU component and a 25% RSU component, both of which will vest over three years. | ||||

Current Program for 2015

Metrics measured relative to the S&P Total Market Index | Changes to Program for 2016 | Rationale for 2016 Changes | ||

o 1/3 growth in book value per diluted share (excluding AOCI)

o 1/3 total stockholder return (“TSR”)

o 1/3 revenue growth | 50% absolute NOI-EPS

Absolute NOI-EPS measure supports the enterprise multi-year transformation, including profitable growth, operating efficiency and capital management. | The Compensation Committee believes that these new metrics:

• complement the metrics in the annual plan; and

• support the Company’s strategy of growing fee-based, capital light non-insurance businesses that have attractive margins and generate free cash flow. | ||

50% relative TSR

TSR relative to the S&P 500 index, which the Compensation Committee believes, given our current transformation, is an appropriate benchmark across a broad set of companies and industries. | ||||

Table of Contents

i

Table of Contents

ii

Table of Contents

ASSURANT, INC.

28 Liberty Street

41st Floor

New York, New York 10005

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 12, 2016

This proxy statement is furnished to stockholders of Assurant, Inc. (“Assurant” or the “Company”) in connection with the solicitation by the Board of Directors of Assurant (the “Board”) of proxies to be voted at the 2016 Annual Meeting of Stockholders to be held at The Club Quarters, Conference Center, 52 William Street, New York, New York 10005 on May 12, 2016 at 9:00 a.m., or at any adjournment or postponement thereof.

The SEC rules allow us to use a “Notice and Access” model to make our proxy statement and other Annual Meeting materials available to you. On or about March 29, 2016, we will begin mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders advising them that our proxy statement, 2015 annual report to stockholders and voting instructions can be accessed via the Internet upon the commencement of such mailing. You may then access these materials and vote your shares via the Internet or by telephone or you may request that a printed copy of the proxy materials be sent to you. You will not receive a printed copy of the proxy materials unless you request one in the manner described in the Notice. Using the Notice allows us to conserve natural resources and reduces the costs of printing and distributing the proxy materials, while providing our stockholders with convenient access to the proxy materials via the Internet.

Additionally, in accordance with a notice sent to certain stockholders who shared a single address, only one annual report and proxy statement will be sent to that address unless any stockholder at that address requested that multiple sets be sent. However, if any stockholder who agreed to householding wishes to receive a separate annual report or proxy statement for 2016 or in the future, he or she may telephone toll-free 1-866-540-7095 or write to Broadridge Householding Department, 51 Mercedes Way, Edgewood, NY 11717. Stockholders sharing an address who wish to receive a single set of reports may do so by contacting their banks or brokers, if they are beneficial holders, or by contacting Broadridge at the address set forth above if they are record holders.

The solicitation of proxies for the Annual Meeting is being made by telephone, Internet and mail. Proxies may be solicited on behalf of the Company by its officers, directors or employees by telephone, in person or by other electronic means. We have retained Morrow & Co., LLC, 470 West Ave. Stamford, Connecticut 06902, to assist with the solicitation of proxies for an estimated fee of $12,000 plus reimbursement of expenses. We will bear the cost of the solicitation of proxies, including postage, printing and handling, and will reimburse brokerage firms and other record holders of shares beneficially owned by others for their reasonable expenses incurred in forwarding solicitation material to beneficial owners of shares.

Any stockholder of record may revoke his or her proxy at any time before it is voted by delivering a later dated, signed proxy or other written notice of revocation to the Corporate Secretary of Assurant. Any record holder of shares present at the Annual Meeting may also withdraw his or her proxy and vote in person on each matter brought before the Annual Meeting. All shares represented by properly signed and returned proxies in the accompanying form or those submitted by Internet or telephone, unless revoked, will be voted in accordance with the instructions given thereon. A properly executed proxy without specific voting instructions will be voted as recommended by the Board: FOR each director nominee; and FOR Proposals Two, Three and the stockholder proposal, each as described in this proxy statement.

Any stockholder whose shares are held through a broker, bank or other nominee (shares held in street name) will receive instructions from the broker, bank or nominee that must be followed in order to have his or her shares voted. Such stockholders wishing to vote in person at the meeting must obtain a legal proxy from their broker, bank or other nominee and bring it to the meeting.

1

Table of Contents

Only stockholders of record at the close of business on March 17, 2016, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting or at any adjournment or postponement thereof. As of the close of business on that date, 63,507,208 shares of our common stock, par value $0.01 per share (the “Common Stock”), were outstanding. Stockholders will each be entitled to one vote per share of Common Stock held.

Votes cast in person or by proxy at the Annual Meeting will be tabulated by the inspector of elections appointed for the meeting. Pursuant to Assurant’s by-laws and the Delaware General Corporation Law (the “DGCL”), the presence of the holders of shares representing a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, whether in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Under the DGCL, abstentions and “broker non-votes” will be treated as present for purposes of determining the presence of a quorum. Broker non-votes are proxies from brokers or nominees as to which such persons have not received instructions from the beneficial owners or other persons entitled to vote with respect to a matter on which the brokers or nominees do not have the discretionary power to vote.

For Proposal One, to be elected as a director, a nominee must receive the support of a majority of the votes cast, meaning that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election. Any incumbent director who is not elected by a majority of the votes cast must promptly tender his or her resignation. The Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) will consider the matter, taking into account all relevant factors, and recommend to the Board whether to accept or reject the tendered resignation or to take other action. The Board, excluding the director in question, will act on the Nominating Committee’s recommendation and publicly disclose its decision and the rationale within 90 days following the date of the certification of the election results.

Under our by-laws, the approval of each of Proposals Two and Three requires the affirmative vote of a majority of the stock held by persons who are present or represented by proxy at the Annual Meeting and entitled to vote. The approval of the stockholder proposal requires the affirmative vote of a majority of the stock held by persons who are present or represented by proxy at the Annual Meeting and entitled to vote.

For purposes of the election of directors under Proposal One, an abstention will not affect whether the number of “for” votes exceeds the number of “against” votes, and accordingly will not affect whether the director is elected. For purposes of determining approval of Proposals Two, Three and the stockholder proposal, abstentions will have the same effect as an “against” vote.

Under Rule 452 of the New York Stock Exchange (the “NYSE”) Listed Company Manual, the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2016 (Proposal Two) is a routine matter as to which brokers will be permitted to vote uninstructed shares. Nevertheless, under NYSE Rule 452, brokers who do not receive voting instructions from their clients with respect to Proposals One, Three or the stockholder proposal will not exercise discretion to vote on those proposals. If a broker or other record holder of shares returns a proxy card indicating it does not have discretionary authority to vote as to a particular matter (thus, a “broker non-vote”), those shares will not be counted as voting for or against the matter or “entitled to vote” on the matter, and will, therefore, have no legal effect on the voting for which the broker non-vote is indicated.

We urge stockholders to vote their shares by Internet, telephone or mail.

2

Table of Contents

Proposal One

PROPOSALS REQUIRING YOUR VOTE

We have ten directors, all of whom have been nominated for re-election to serve until the 2017 Annual Meeting or until their successors are elected and have qualified. In the absence of contrary instructions, it is the intention of the persons named in the accompanying proxy to vote for the nominees listed below. If any nominee becomes unavailable to serve for any reason, the proxies solicited hereby will be voted for election of the person, if any, designated by the Board to replace that nominee.

The following biographies summarize the director nominees’ tenure on the Assurant Board, business experience, director positions held during the last five years, and the particular experience, qualifications, attributes and/or skills that led the Board to conclude that they should serve as directors. The skills, experience and qualifications we believe are important for directors to possess and which are highlighted below include:

| Corporate Governance/Public Company. Directors with corporate governance experience support our goals of strong Board and management accountability, transparency and protection of stockholder interests. | |

| Finance, Accounting or Financial Reporting. Our Board values directors with an understanding of finance, financial reporting processes and accounting practices, given the importance of accurate financial reporting and strong financial controls. | |

| Financial Services/Insurance Industry. Directors with financial services or insurance industry experience offer a valuable perspective when reviewing our business and strategy. | |

| International. Our Company is a global organization; directors with broad international exposure and experience provide useful business, strategic and cultural perspectives. | |

| Risk Management. Directors with risk management experience are critical to the Board’s role in overseeing the risks facing the Company. | |

| Senior Leadership. Directors who have served in relevant senior leadership positions bring a unique experience and perspective. We seek directors who have demonstrated expertise in operations, strategy and talent management. | |

The following persons have been nominated to serve as directors of Assurant until the 2017 Annual Meeting:

Elaine D. Rosen

| Non-Executive Chair of the Board: | Since November 2010 | |

Director: Since February 2009 | Board Committees: Compensation | |

Age: 63 | Other Public Company Boards: Kforce, Inc. (Since 2003) |

Ms. Rosen served as Executive Vice President of UNUM/Provident Corporation from 1999 to 2001 and as President of UNUM Life Insurance Company of America from 1997 to 1999 after serving in various positions at the company since 1975. Ms. Rosen currently chairs the Board of Trustees of The Kresge Foundation and serves on the Board of Directors of Preble Street, a collaborative for the homeless and low income community in Portland, Maine. She also serves as a Trustee and a member of the Executive Committee of the Foundation for Maine’s Community Colleges.

3

Table of Contents

Proposal One

| Ms. Rosen has significant public company and corporate governance experience, including chairing the Compensation Committee at Kforce and serving on its Nomination Committee and its Corporate Governance Committee. Ms. Rosen previously chaired Assurant’s Nominating and Corporate Governance Committee. | |

| Ms. Rosen has held senior executive roles at Unum Life Insurance Company and has substantial financial knowledge. | |

| Ms. Rosen has extensive management and operational experience in the insurance industry. | |

| Ms. Rosen has extensive experience as a senior executive at Unum, as the Chair of our Board and as the chair of a major philanthropic foundation. | |

Howard L. Carver

Director: Since March 2002 | Board Committees: Audit, Nominating and Corporate Governance (Chair) | |

Age: 71 | Other Public Company Boards: StoneMor Partners L.P. (Since 2005) |

Mr. Carver retired as an Office Managing Partner of Ernst & Young LLP in June of 2002. Mr. Carver’s career at Ernst & Young spanned five decades, beginning as an auditor and a financial consultant. In 2013, Mr. Carver was appointed to the board of directors of Pinnacol Assurance, the workers compensation facility for the State of Colorado, and has been a member of its Audit Committee since 2012 and, since August 2015 chair of its Governance & Ethics Committee and chair of its board. Mr. Carver is a Certified Public Accountant and is a member of both the American Institute of Certified Public Accountants and the Connecticut Society of CPAs. Mr. Carver also serves or has recently served on the boards and/or audit committees of several civic and charitable organizations. Given Mr. Carver’s experience and qualifications, the Company has designated him as an Audit Committee financial expert for purposes of SEC Regulation S-K, Item 407(d)(5).

| Mr. Carver has considerable corporate governance experience from his service on two public company boards. In addition to his committee roles at Assurant, Mr. Carver is a member of StoneMor’s Audit Committee and its Trust and Compliance Committee and chairs its Conflicts Committee. | |

| Mr. Carver has extensive accounting and audit expertise with over 35 years at Ernst & Young and as the former chair of our Audit Committee. | |

| Mr. Carver has over 40 years of financial services industry experience and is closely familiar with the insurance industry. | |

| Mr. Carver has significant insurance-related risk management experience. | |

Juan N. Cento

Director: Since May 2006 | Board Committees: Compensation, Nominating and Corporate Governance | |

Age: 64 | Other Public Company Boards: None |

Mr. Cento is the President of the Latin America and Caribbean Division of FedEx Express, headquartered in Miami, Florida. Mr. Cento has more than 30 years of experience in the air cargo and express transportation industry. He previously worked with Flying Tigers Line, Inc. and transitioned to FedEx in 1989 when the two companies were combined. Mr. Cento is involved in several non-profit organizations. He is a member of the International Advisory Board of Baptist Health System and the Council of the Americas. Additionally, Mr. Cento is Chair of the board of directors for CLADEC (Conference of Latin American and Caribbean Express Companies) and a member of the board of the United Way ofMiami-Dade.

4

Table of Contents

Proposal One

| Mr. Cento has substantial corporate governance and public company experience as a result of his tenure at FedEx and as a member of our Nominating and Corporate Governance Committee. | |

| Mr. Cento has over 30 years of international, strategic and operational business experience. | |

| Mr. Cento has considerable experience as a senior executive, leading the Latin American expansion of FedEx’s business. | |

Alan B. Colberg

Director: Since January 2015 | Board Committees: None | |

Age: 54 | Other Public Company Boards: CarMax, Inc. (Since 2015) |

Mr. Colberg is President and Chief Executive Officer of Assurant, Inc. He was named the Company’s President, effective September 16, 2014, and became Chief Executive Officer and director on January 1, 2015. Mr. Colberg joined Assurant as Executive Vice President of Marketing and Business Development in March 2011. Before joining Assurant, Mr. Colberg worked for Bain & Company, Inc. for 22 years, founding and heading Bain’s Atlanta office since 2000. He also served as Bain’s global practice leader for financial services, advising leading global companies, including Assurant. Mr. Colberg has long been active in civic leadership roles having served as chairman of the board of the Atlanta International School and on the boards of the Woodruff Arts Center and the Metro Atlanta Chamber of Commerce. Mr. Colberg was elected to the board of directors of CarMax, Inc. in October 2015 and is a member of its Audit Committee.

| Mr. Colberg dedicated much of his 22 year career at Bain & Company to financial services and for six years served as the global practice leader of financial services. | |

| During his tenure at Bain & Company Mr. Colberg advised several leading global companies including Assurant, Inc. | |

| Mr. Colberg has over 25 years of senior leadership experience. | |

Elyse Douglas

Director: Since July 2011 | Board Committees: Audit, Finance and Investment (Chair) | |

Age: 60 | Other Public Company Boards: None |

Ms. Douglas served as Executive Vice President and Chief Financial Officer of Hertz Global Holdings, Inc. and The Hertz Corporation until October 1, 2013. Ms. Douglas joined Hertz in July 2006. Prior to her role at Hertz, Ms. Douglas served as Treasurer of Coty Inc. from December 1999 until July 2006. Previously, Ms. Douglas served as an Assistant Treasurer of Nabisco, Inc. from June 1995 until December 1999. She also served in various financial services capacities for 12 years at Chase Manhattan Bank (now JPMorgan Chase). Ms. Douglas is a Certified Public Accountant and chartered financial analyst.

| Ms. Douglas gained extensive financial experience through her roles as chief financial officer and treasurer of two multinational corporations. | |

| Ms. Douglas has significant financial services industry experience through her roles at Chase Manhattan Bank. | |

| Ms. Douglas has over 20 years of senior leadership experience including her tenure with Hertz Corporation and Coty. | |

5

Table of Contents

Proposal One

Lawrence V. Jackson

Director: Since July 2009 | Board Committees: Compensation (Chair), Finance and Investment | |

Age: 62 | Other Public Company Boards: Snyder’s-Lance, Inc. (Since 2015) and Constar, Inc. (2009-2011) |

Mr. Jackson currently serves as a senior advisor with New Mountain Capital, LLC, as a manager of private equity funds based in New York and as Chair of the board of SourceMark LLC. Previously, Mr. Jackson served as the President and Chief Executive Officer of the global procurement division and as the Executive Vice President and Chief People Officer at Wal-Mart Stores, Inc. Prior to that, Mr. Jackson was President and Chief Operating Officer of Dollar General Corporation and Senior Vice President, Supply Operations, for Safeway, Inc. Mr. Jackson was also with PepsiCo, Inc. for 16 years in various executive roles. In connection with his position at New Mountain Capital, Mr. Jackson serves on the boards of several portfolio companies. Mr. Jackson previously served as a director on the board of Parsons Corporation and as chair of its Compensation Committee.

| Mr. Jackson has served on the boards of a number of public companies including ProLogis and Constar and also serves as the chair of our Compensation Committee. | |

| Mr. Jackson has over 20 years of international expertise with several multinational corporations including Walmart and PepsiCo. | |

| Mr. Jackson has over 20 years of senior leadership experience, having held a number of executive management positions. | |

Charles J. Koch

Director: Since August 2005 | Board Committees: Compensation, Finance and Investment | |

Age: 69 | Other Public Company Boards: Citizens Financial Group, Inc. (Since 2014) and Home Properties, Inc. (2010-2013) |

Mr. Koch is a Public Interest Director on the board of The Federal Home Loan Bank of Cincinnati and serves as a member of its Personnel and Compensation Committee, its Finance and Risk Management Committee and its Nomination & Governance Committee. Mr. Koch previously served as Chair, President and Chief Executive Officer of Charter One Financial, Inc. prior to its sale to The Royal Bank of Scotland. He was elected President and Chief Operating Officer in 1980, served as President and Chief Executive Officer beginning in 1988 and then became Chair, President and Chief Executive Officer in 1990. Mr. Koch is also a past Chair of the Board of Trustees of Case Western Reserve University.

| Mr. Koch has served on the boards of directors of public companies for more than ten years. | |

| Mr. Koch has significant experience in the financial services industry, having led one of the country’s largest regional banks. | |

| Mr. Koch has considerable risk management experience and serves as the chair of the Risk Committee at Citizens Financial Group, Inc. and previously chaired the Company’s Finance & Investment Committee. | |

| Mr. Koch has over 30 years of senior leadership experience including several high level financial services positions. | |

6

Table of Contents

Proposal One

Jean-Paul L. Montupet

Director: Since September 2012 | Board Committees: Finance and Investment, Nominating and Corporate Governance | |

Age: 68 | Other Public Company Boards: IHS Inc. (Since 2012), Lexmark International, Inc. (Since 2006), PartnerRe Ltd. (Since 2002) and WABCO Holdings, Inc. (Since 2012) |

Until his retirement in December 2012, Mr. Montupet was the Chair of Emerson Electric Co.’s Industrial Automation business and President of Emerson Europe. During his 22 year career with Emerson Electric Co., Mr. Montupet held a number of senior leadership roles including Executive Vice President of Emerson Electric Co. and Chief Executive Officer of Emerson Electric Asia Pacific.

| Mr. Montupet has substantial corporate governance and public company experience, including chairing the Corporate Governance and Public Policy Committee at Lexmark International, the Compensation, Nominating and Governance Committee at WABCO Holdings and the Compensation & Management Development Committee at PartnerRe. | |

| Mr. Montupet has considerable insurance-related expertise through his service as the non-executive chairman of the board of PartnerRe Ltd. | |

| Mr. Montupet has expertise in international markets having served as President of Emerson Europe and Chief Executive Officer of Emerson Electric Asia Pacific. | |

| Mr. Montupet has significant risk management knowledge and is a member of three public company risk committees. | |

| Mr. Montupet has considerable senior management experience having held a number of executive positions over 30 years at Emerson Electric Co. and Leroy-Somer, Inc. | |

Paul J. Reilly

Director: Since June 2011 | Board Committees: Audit, Nominating and Corporate Governance | |

Age: 59 | Other Public Company Boards: None |

Mr. Reilly currently serves as Executive Vice President and Chief Financial Officer of Arrow Electronics, Inc., a distributor of electronic components and computer products. Mr. Reilly joined Arrow Electronics in 1991 and held various positions within the company prior to assuming the role of Chief Financial Officer in 2001. Prior to joining Arrow Electronics, Mr. Reilly was a Certified Public Accountant in the business assurance practice of the New York office of KPMG Peat Marwick.

| Mr. Reilly, in his current role as Chief Financial Officer of Arrow Electronics, has oversight of the company’s treasury, capital structuring, budgeting and controller functions and has substantial financial knowledge. | |

| Mr. Reilly is a Certified Public Accountant and was employed by KPMG where he provided audit services to a wide range of public and private multinational organizations. | |

| Mr. Reilly has served as a senior executive at a public company for 15 years. | |

7

Table of Contents

Proposal One

Robert W. Stein

Director: Since October 2011 | Board Committees: Audit (Chair) | |

Age: 67 | Other Public Company Boards: Aviva plc (Since 2013) |

Mr. Stein is a former Global Managing Partner, Actuarial Services at Ernst & Young LLP. Mr. Stein joined Ernst & Young in 1976 and held various leadership roles in the firm’s actuarial and insurance practice. He currently serves on the board of Resolution Life Holdings, Inc. He is a Certified Public Accountant and is a member of the AICPA. He is also a member of the American Academy of Actuaries, a Fellow of the Society of Actuaries and a Trustee Emeritus of the Actuarial Foundation. Given Mr. Stein’s experience and qualifications, the Company has designated him as an Audit Committee financial expert for purposes of SEC Regulation S-K, Item 407(d)(5).

| Mr. Stein is Certified Public Accountant and has significant accounting and financial reporting experience. | |

| Mr. Stein has more than 40 years of experience advising many of the world’s leading insurance companies on financial and operating matters. | |

| Mr. Stein has vast knowledge and experience in the areas of actuarial matters and risk management. He also currently serves on the Risk Committee of Aviva plc and chairs the Audit Committee of Resolution Life Holdings. | |

| Mr. Stein spent more than 30 years leading various practice areas within Ernst & Young LLP. | |

Vote Required; Board Recommendation

Under our by-laws, each director must be elected by the holders of a majority of the votes cast, meaning that the number of votes cast “for” the nominee’s election must exceed the number of votes cast “against” the nominee’s election. Abstentions will have no effect on this determination.

The Board of Directors recommends that stockholders voteFOR each of the nominees named above to serve until the 2017 Annual Meeting or until their successors are elected and have qualified.

8

Table of Contents

Proposal Two

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

General

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm to audit our consolidated financial statements for the year ending December 31, 2016. PricewaterhouseCoopers LLP has acted as our independent registered public accounting firm since 2000. In accordance with a resolution of the Audit Committee, this appointment is being presented to stockholders for ratification at the Annual Meeting. If the stockholders do not ratify the appointment of PricewaterhouseCoopers LLP, the Audit Committee will reconsider its appointment. A representative of PricewaterhouseCoopers LLP will be present at the Annual Meeting, will have an opportunity to make a statement if he wishes to do so, and will be available to respond to appropriate questions.

Vote Required; Board Recommendation

The affirmative vote of a majority of the stock held by persons who are present or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for ratification. For purposes of determining approval of this proposal, an abstention will have the same effect as an “against” vote.

The Board of Directors recommends a voteFOR ratification of the appointment of PricewaterhouseCoopers LLP as Assurant’s Independent Registered Public Accounting Firm for the year ending December 31, 2016.

9

Table of Contents

Proposal Three

ADVISORY VOTE ON EXECUTIVE COMPENSATION FOR 2015

The following Company proposal gives the stockholders the opportunity to cast a non-binding advisory vote with respect to the 2015 compensation of the Company’s NEOs. In response to stockholder vote, the Company holds this advisory vote on an annual basis. In considering your vote, we invite you to review the Compensation Discussion and Analysis (the “CD&A”), beginning on page 16. As described in the CD&A, we believe our current compensation programs and policies directly link executive compensation to Company performance and thereby align the interests of our executive officers with those of our stockholders.

Our Board intends to carefully consider the stockholder vote resulting from this proposal. Please cast a vote either to approve or not approve the following resolution:

“RESOLVED, that the 2015 compensation provided to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K of the U.S. Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is herebyAPPROVED.”

Vote Required; Board Recommendation

The affirmative vote of a majority of the stock held by persons who are present or represented by proxy at the Annual Meeting and entitled to vote on this proposal is required for approval of this non-binding resolution. For purposes of determining approval of this proposal, an abstention will have the same effect as an “against” vote.

The Board of Directors recommends that you voteFOR approval of the 2015 compensation of our NEOs as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative.

10

Table of Contents

Stockholder Proposal

ADVISORY PROPOSAL CONCERNING PROPOSED CHANGES IN OUR BY-LAWS AND ARTICLES OF INCORPORATION

John Chevedden, 2215 Nelson Avenue, No 205, Redondo Beach, CA 90278, proxy for William Steiner, beneficial owner of no fewer than 100 shares of Assurant, Inc. since July 1, 2014, has given notice that he intends to present the following proposal for action at the Annual Meeting. The exact share holdings of the stockholder proponent will be supplied promptly upon oral or written request.

In accordance with SEC rules and regulations, we have included the following complete text of the stockholder proposal exactly as submitted; the Board’s response follows. The stockholder proposal includes some incorrect assertions. The Company has not addressed all of these inaccuracies and accepts no responsibility for the accuracy or content of the stockholder proposal.

Shareholder Proposal — Simple Majority Vote

RESOLVED, Shareholders request that our board take the steps necessary so that each voting requirement in our charter and by-laws that calls for a greater than simple majority vote be eliminated, and replaced by a requirement for a majority of the votes cast for and against applicable proposals, or a simple majority in compliance with applicable laws. If necessary this means the closest standard to a majority of the votes cast for and against such proposals consistent with applicable laws.

Shareowners are willing to pay a premium for shares of corporations that have excellent corporate governance. Supermajority voting requirements have been found to be one of 6 entrenching mechanisms that are negatively related to company performance according to “What Matters in Corporate Governance” by Lucien Bebchuk, Alma Cohen and Allen Ferrell of the Harvard Law School. Supermajority requirements are arguably most often used to block initiatives supported by most shareowners but opposed by a status quo management.

This proposal topic also won from 74% to 88% support at Weyerhaeuser, Alcoa, Waste Management, Goldman Sachs, FirstEnergy, McGraw-Hill and Macy’s. Currently a 1%-minority can frustrate the will of our 66%-shareholder majority. In other words, a 1% minority could have the power to prevent shareholders from improving our corporate governing documents.

Please vote to enhance shareholder value: Simple Majority Vote

BOARD OF DIRECTORS’ RESPONSE:

THE BOARD OF DIRECTORS SUPPORTS THE PROPOSED RESOLUTION, IF PROPERLY PRESENTED AT THE 2016 ANNUAL MEETING, AND RECOMMENDS A VOTEFOR THE PROPOSAL FOR THE FOLLOWING REASONS:

The Company’s Board is firmly committed to good corporate governance and has adopted a wide range of practices and procedures that promote effective corporate governance and Board oversight. In 2009 and 2010, through a stockholder vote, the Company proactively amended its articles of incorporation and by-laws to bring them in line with modern corporate governance practices, including by eliminating the classified board, implementing majority voting for election of directors and updating certain other provisions of its articles of incorporation and by-laws. In particular, at the 2009 Annual Meeting, the Board adopted resolutions approving and recommending to stockholders amendments to the Company’s articles of incorporation to, among other things, eliminate the two-thirds voting standard required with respect to the approval of mergers or consolidations of the Company and the sale, lease, exchange, transfer or other disposition of all or substantially all of the Company’s assets. With the Board’s support, this 2009 proposal to amend the Company’s articles of incorporation passed, receiving more than the

11

Table of Contents

Stockholder Proposal

required two-thirds vote. Nevertheless, at that time, we did not change certain other supermajority voting provisions in our articles of incorporation and by-laws.

If the Company had not received the stockholder proposal, at the 2016 Annual Meeting the Board would have recommended proactive adoption of a simple majority voting standard for the remaining supermajority voting provisions. To timely effectuate the change in the voting standard and improve our corporate governance practices as soon as possible, we had respectfully requested that the stockholder withdraw the proposal so that, without creating confusion and risking a failed vote, we could include a similar proposal that would go directly to the stockholders and eliminate one step in the process of finalizing the changes (since Mr. Chevedden’s proposal is merely advisory, or “precatory”). Unfortunately, we were unable to reach an agreement with the stockholder on this point. Consequently, stockholder approval of Mr. Chevedden’s proposal will not eliminate the supermajority voting provisions this year. Instead, at the 2017 Annual Meeting, the Board will present a resolution to amend the Company’s articles of incorporation that, if approved, will eliminate the two-thirds supermajority voting standard required to alter, amend, or repeal certain sections of the Company’s articles of incorporation and by-laws.

The affirmative vote of a majority of the stock held by persons who are present or represented by proxy at the Annual Meeting and entitled to vote will be required for the approval of this advisory stockholder proposal. For purposes of determining approval of this proposal, an abstention will have the same effect as an “against” vote.

The Board of Directors recommends a vote “FOR” this Proposal. Proxies solicited by the Board of Directors will be voted “FOR” this Proposal, unless a different vote is specified.

12

Table of Contents

Executive Officers

The table below sets forth certain information, as of March 29, 2016, concerning each person deemed to be an Executive Officer of the Company. There are no arrangements or understandings between any Executive Officer and any other person pursuant to which the officer was selected.

Name

| Age

| Position

| ||

Alan B. Colberg | 54 | President, Chief Executive Officer and Director | ||

Christopher J. Pagano | 52 | Executive Vice President, Chief Financial Officer and Treasurer | ||

Gene E. Mergelmeyer | 57 | Executive Vice President and Chief Administrative Officer; President and Chief Executive Officer of Assurant Specialty Property | ||

Bart R. Schwartz | 63 | Executive Vice President, Chief Legal Officer and Secretary | ||

Robyn Price Stonehill | 44 | Executive Vice President and Chief Human Resources Officer | ||

John A. Sondej | 51 | Senior Vice President, Controller and Principal Accounting Officer | ||

Michael D. Anderson | 58 | Interim President of Assurant Solutions |

Alan B. Colberg, President, Chief Executive Officer and Director. Biography available in the section entitled “PROPOSAL ONE–ELECTION OF DIRECTORS.”

Christopher J. Pagano, Executive Vice President, Chief Financial Officer and Treasurer. Mr. Pagano was named Chief Financial Officer in August 2014. Before assuming his current position, Mr. Pagano served as Executive Vice President, Treasurer and Chief Investment Officer of Assurant, Inc. since July 2007. On September 24, 2015, the Company announced that Mr. Pagano is to be named Chief Risk Officer. The Company has underway an external search for a chief financial officer to succeed Mr. Pagano, who will remain in his current role until a successor is in place.

Gene E. Mergelmeyer, Executive Vice President and Chief Administrative Officer; President and Chief Executive Officer, Assurant Specialty Property. Mr. Mergelmeyer was named Chief Administrative Officer of Assurant in August 2014 with responsibility for Assurant’s Technology Infrastructure Group and other corporate enterprise functions. He was appointed Chief Executive Officer of Assurant Specialty Property in August 2007 and President of Assurant Specialty Property and Executive Vice President of Assurant, Inc. in July 2007. On February 16, 2016, the Company announced that Mr. Mergelmeyer is to be named Chief Operating Officer, effective July 1, 2016.

Bart R. Schwartz, Executive Vice President, Chief Legal Officer and Secretary. Mr. Schwartz has been Executive Vice President, Chief Legal Officer and Secretary since April 2008.

Robyn Price Stonehill, Executive Vice President and Chief Human Resources Officer. Ms. Price Stonehill was appointed Executive Vice President and Chief Human Resources Officer of Assurant, Inc. in July 2014. Before assuming her current role at Assurant, she served as Senior Vice President of Compensation, Benefits and Shared Services at the Company since 2009.

John A. Sondej, Senior Vice President, Controller and Principal Accounting Officer. Mr. Sondej has been Senior Vice President, Controller and Principal Accounting Officer of the Company since January 2005.

Michael D. Anderson, Interim President, Assurant Solutions. Mr. Anderson has been interim President of Assurant Solutions since February 2016. Before assuming his current role, he served as Senior Vice President, Chief Operating Officer at Assurant Solutions since 2013.

The Management Committee of Assurant (the “Management Committee”) consists of the Company’s President and Chief Executive Officer, certain Company Executive Vice Presidents and the head of each of Assurant’s operating segments.

13

Table of Contents

Security Ownership of Certain Beneficial Owners

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table provides, with respect to each person or entity known by Assurant to be the beneficial owner of more than five percent of Assurant’s outstanding Common Stock as of February 1, 2016, (a) the number of shares of Common Stock owned (based upon the most recently reported number of shares outstanding as of the date the entity filed a Schedule 13G with the SEC) and (b) the percentage of all outstanding shares represented by such ownership as of February 1, 2016 (based on an outstanding share amount of 64,777,357 as of that date).

Name of Beneficial Owner | Shares of Common Stock Owned Beneficially | Percentage of Class | ||||||

FMR LLC1 | 5,903,925 | 9.1 | % | |||||

Vanguard Group, Inc.2 | 5,871,250 | 9.1 | % | |||||

BlackRock, Inc.3 | 3,906,333 | 6.0 | % | |||||

Neuberger Berman Group LLC.4 | 3,425,240 | 5.3 | % | |||||

| 1 | FMR LLC, 245 Summer Street, Boston, Massachusetts 02210, filed a Schedule 13G/A on February 12, 2016, with respect to the beneficial ownership of 5,903,925 shares. This represented 9.1 % of our Common Stock as of February 1, 2016. |

| 2 | The Vanguard Group, Inc., 100 Vanguard Blvd., Malvern, PA 19355, filed a Schedule 13G/A on February 10, 2016, with respect to the beneficial ownership of 5,871,250 shares. This represented 9.1% of our Common Stock as of February 1, 2016. |

| 3 | BlackRock, Inc., 55 East 52nd Street, New York, New York 10022, filed a Schedule 13G/A on January 25, 2016, with respect to beneficial ownership of 3,906,333 shares. This represented 6.0% of our Common Stock as of February 1, 2016. BlackRock, Inc. has indicated that it filed this Schedule 13G/A on behalf of the following subsidiaries: BlackRock Japan Co. Ltd., BlackRock Advisors (UK) Limited, BlackRock Institutional Trust Company, N.A., BlackRock Fund Advisors, BlackRock Asset Management Canada Limited, BlackRock Advisors LLC, BlackRock Financial Management, Inc., BlackRock Investment Management, LLC, BlackRock Investment Management (Australia) Limited., BlackRock Fund Managers Ltd., BlackRock Asset Management Ireland Limited, BlackRock International Limited, BlackRock Investment Management (UK) Ltd., BlackRock Life Limited, BlackRock (Luxembourg) S.A., BlackRock (Netherlands) B.V., BlackRock Asset Management North Asia Limited, BlackRock Asset Management Schweiz AG, BlackRock Capital Management and Xulu, Inc. |

| 4 | Neuberger Berman Group LLC, 605 Third Avenue, New York, New York 10158, filed a Schedule 13G on February 9, 2016, with respect to the beneficial ownership of 3,425,240 shares. This represented 5.3 % of our Common Stock as of February 1, 2016. |

14

Table of Contents

Security Ownership of Directors and Executive Officers

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table provides information concerning the beneficial ownership of Common Stock as of February 1, 2016 by Assurant’s Chief Executive Officer, Chief Financial Officer, and each of Assurant’s other named executive officers for 2015, each director, and all executive officers and directors as a group. As of February 1, 2016, we had 64,777,357 outstanding shares of Common Stock. Except as otherwise indicated, all persons listed below have sole voting power and dispositive power with respect to their shares, except to the extent that authority is shared by their spouses, and have record and beneficial ownership of their shares.

Name of Beneficial Owner | Shares of Common Stock | Percentage of Class | ||||

Alan B. Colberg | 38,392 | * | ||||

Christopher J. Pagano | 62,745 | * | ||||

Gene E. Mergelmeyer | 95,202 | * | ||||

Bart R. Schwartz | 66,138 | * | ||||

S. Craig Lemasters | 129,608 | * | ||||

Elaine Rosen | 11,865 | * | ||||

Howard L. Carver | 31,497 | * | ||||

Juan N. Cento | 14,989 | * | ||||

Elyse Douglas | 6,247 | * | ||||

Lawrence V. Jackson | 11,648 | * | ||||

Charles J. Koch | 31,565 | * | ||||

Jean-Paul Montupet | 5,710 | * | ||||

Paul J. Reilly | 6,334 | * | ||||

Robert W. Stein | 8,251 | * | ||||

All directors and executive officers as a group (17 persons) | 550,558 | * | ||||

| * | Less than one percent of class. |

| 1 | Includes: for Mr. Pagano, 3,841 shares of Common Stock; for all directors and executive officers as a group, 3,841 shares of Common Stock held through the Assurant 401(k) Plan, as of December 31, 2015. |

Includes for Mr. Stein, 4,351 shares of Common Stock held by the Robert W. Stein Revocable Living Trust and Christine M. Denham Revocable Living Trust, Tenants in Common. Also includes 2,000 shares of Common Stock held by the Denham Stein Family Foundation. Because Mr. Stein serves as a trustee of this tax exempt charitable foundation, Mr. Stein is deemed to “control” these 2,000 shares in which he has no economic interest.

Includes restricted stock units (“RSUs”) that will vest and/or become payable on or within 60 day of February 1, 2016 in exchange for the following amounts of Common Stock as of February 1, 2016: For Mr. Colberg, 10,892 shares; for Mr. Pagano, 7,928 shares; for Mr. Mergelmeyer, 36,798 shares (including 29,149 shares that would be issuable upon a retirement); for Mr. Schwartz, 7,513 shares; and for Mr. Lemasters, 19,889 shares (including 12,376 shares that would be issuable upon a retirement.) RSUs that will vest on or within 60 days of February 1, 2016 in exchange for shares of Common Stock, for all directors and executive officers as a group, totaled 88,845.

15

Table of Contents

Compensation Discussion & Analysis

Part I - Executive Summary

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis (“CD&A”) provides a detailed review of the compensation principles and strategic objectives governing the compensation of the following individuals, who were our named executive officers for 2015:

| Name | Title | |

| ||

Alan B. Colberg | President and Chief Executive Officer | |

Christopher J. Pagano | Executive Vice President, Chief Financial Officer and Treasurer | |

Gene E. Mergelmeyer | Executive Vice President and Chief Administrative Officer; President and Chief Executive Officer, Assurant Specialty Property | |

Bart R. Schwartz | Executive Vice President; Chief Legal Officer and Secretary | |

S. Craig Lemasters | Executive Vice President; President and Chief Executive Officer, Assurant Solutions | |

| ||

Throughout this CD&A, we refer to these individuals as our “NEOs”, to Mr. Colberg as our “CEO” and to Mr. Pagano as our “CFO”.

Impact of 2015 Business Results on NEO Compensation

Highlights for the enterprise’s 2015 fiscal year1 financial metrics related to short-term and long-term incentive programs include2:

Annual Incentive Plan (ESTIP)

| • | 40% annual growth in consolidated revenue |

| • | 25% growth in consolidated net operating income |

| • | 20% annual growth in consolidated operating earnings per diluted share |

| • | 15% operating return on equity (“ROE”), excluding AOCI |

Based on the Company’s 2015 performance as noted in the2015 Financial Highlights section above, the resulting annual incentive plan performance multiplier for 2015 for enterprise NEOs was 1.53 and for business segment NEOs was 1.07 (for Mr. Lemasters) and 1.67 (for Mr. Mergelmeyer). ESTIP metrics and NEO payouts are described in greater detail in the section entitled “2015 Annual Incentive Compensation — 2015 Results” beginning on page 21.

Long-Term Equity Incentive Plan (ALTEIP)

| • | 1/3 annual growth in book value per diluted share, excluding accumulated other comprehensive income (“AOCI”) |

| • | 1/3 growth in revenue |

| • | 1/3 growth in total stockholder return |

2015 payouts under the ALTEIP will be determined over the three-year performance cycle based on the Company’s performance of the above listed pre-established metric goals relative to a broad market index. Final payout amounts for 2015 will not be finalized until 2018. 2015 results contribute to the final payout amounts for the 2013 and 2014 outstanding awards.

1 Certain measures are non-GAAP. A reconciliation of these non-GAAP measures to their most comparable GAAP measures can be found in Appendix A hereto.

2 The Compensation Committee decided that Assurant Health results would be excluded from the Company’s performance. This decision is consistent with certain tables in the Company’s earnings news releases.

16

Table of Contents

Compensation Discussion & Analysis

Part I - Executive Summary

Elements of 2015 Compensation

Base Salary. In 2015 our NEOs’ salaries were as follows:

Alan B. Colberg | $850,000 | |||

Christopher J. Pagano | $650,000 | |||

Gene E. Mergelmeyer | $630,000 | |||

Bart R. Schwartz | $585,000 | |||

S. Craig Lemasters | $585,000 |

Annual Incentive. In 2015, in accordance with the Assurant, Inc. Executive Short Term Incentive Plan (the “ESTIP”), our NEOs received annual incentive payments in the amounts set forth in the chart on page 24.

Long-term Incentive Performance Awards. In 2015, in accordance with the Amended and Restated Assurant, Inc. Long Term Equity Incentive Plan (the “ALTEIP”), our NEOs received long-term equity awards — of which 75% was delivered in the form of PSUs and 25% was delivered in the form of RSUs. Vesting of performance-based equity awards for the 2015-2017 performance cycle will not be determined until after the end of 2017, and our NEOs will be eligible for payouts in respect of these awards in 2018. RSUs vest in equal annual installments on the first three anniversaries of grant.

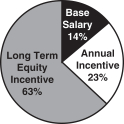

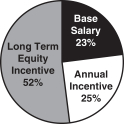

Our Executive Compensation Principles

Assurant’s executive compensation programs are designed to align the interests of our executives with those of our stockholders by tying significant portions of their compensation to the Company’s financial performance. The following charts show the relative percentages of target variable (annual and long-term incentive) and fixed (base salary) compensation established for our CEO and our other NEOs at the beginning of 2015:

| 2015 CEO Target Compensation | 2015 NEO Target Compensation | |

|  | |

(For additional details on the percentage components of our NEOs’ fixed and variable compensation, see the discussion under “Mix of Target Total Direct Compensation Elements” on page 20.)

Set forth below are our core executive compensation principles, along with key features of our executive compensation program that support these principles:

Executive compensation opportunities at Assurant should be sufficiently competitive to attract and retain talented executives while aligning their interests with those of our stockholders.

| • | Generally, when setting target total direct compensation opportunities (base salary, annual incentives and long-term equity incentives) for our NEOs, the Compensation Committee seeks to approximate median levels for comparable positions at companies in our compensation peer group.(For details on our compensation peer group, please see the discussion on page 30.) |

17

Table of Contents

Compensation Discussion & Analysis

Part I - Executive Summary

| • | The Company continues to emphasize performance-based compensation that attracts, retains and rewards the executives necessary to successfully execute the Company’s business strategy. |

| • | Each NEO’s annual incentive opportunity is contingent on the Company’s earnings. If the Company does not produce positive net income, as defined in the ESTIP, no annual executive incentive payments are made. |

| • | 75% of the annual long-term equity incentive award granted to our NEOs in 2015 was delivered in the form of PSUs and 25% was delivered in the form of RSUs, each with a three-year vesting schedule. |

Our incentive-based programs should motivate our executives to deliver above-median results.

| • | We design performance goals under our annual executive incentive program so that above-target compensation will be paid only if the Company delivers above-target performance. |

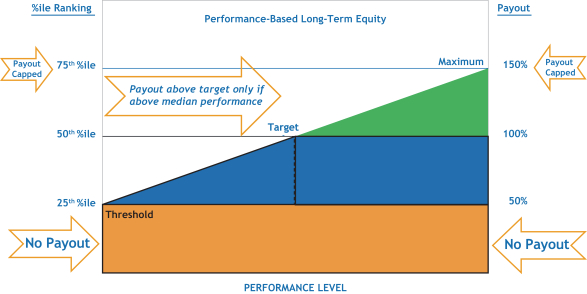

| • | In 2015, payouts with respect to PSU awards are contingent on performance relative to a broad index of insurance and related services companies and reach above-target levels only if our performance exceeds the 50th percentile of this index with the payout capped at 150% if the Company performs at or above the 75thpercentile. There is no payout if performance falls below the 25th percentile of this index. |

Our executive compensation programs are informed by strong governance practices that reinforce our pay for performance philosophy, support our culture of accountability and encourage prudent risk management.

| • | Under our executive compensation recoupment policy, in effect since 2012, the Compensation Committee may recover (“claw back”) annual and long-term incentive compensation from current and former executive officers in the event of a financial restatement as a result of material non-compliance with any financial reporting requirement under the securities laws that has resulted in an overpayment. |

| • | Under our stock ownership guidelines, our NEOs and directors are required to hold a meaningful amount of Company stock throughout their service. |

| • | Under our insider trading policy, our NEOs and directors are prohibited from: |

| • | engaging in hedging and monetizing transactions with respect to Company securities; |

| • | holding Company securities in a margin account; or |

| • | pledging Company securities as collateral for a loan. |

| • | Change of control agreements with our NEOs are “double trigger” and do not provide for excise tax gross-ups. |

| • | In 2015, the Compensation Committee, assisted by Towers Watson & Co. (“Towers Watson”) (the Compensation Committee’s independent compensation consultant), undertook an annual risk review of the Company’s variable pay plans, policies and practices for all employees, and did not identify any risks that are reasonably likely to have a material adverse effect on the Company. |

| • | We do not provide any significant perquisites to our NEOs. |

| • | Annual incentive payouts are capped at 200% of each NEO’s target opportunity. |

| • | For 2015, PSU award payouts are capped at 150% of each NEO’s target opportunity, even if performance exceeded the 75th percentile. |

| • | There is no PSU award payout if the Company’s ranking falls below the 25th percentile of the relevant index. |

| • | Assurant does not pay dividends on unvested PSUs. |

18

Table of Contents

Compensation Discussion & Analysis

Part I - Executive Summary

2015 Say on Pay Vote and Stockholder Engagement

In light of the 95% favorable advisory vote by stockholders to approve executive compensation at the Company’s 2015 annual meeting and our regular discussions with stockholders, and because we believe that our executive compensation program supported the Company’s business strategy and was in line with market practices, we did not implement any significant changes to our program in 2015. Through our ongoing investor outreach program, we were able to engage with investors throughout the year to receive their input and feedback on aspects of the Company’s corporate governance practices and executive compensation program. In 2015, we continued our regular investor outreach program and reached out to the majority of our institutional stockholder base. We discussed with investors the Company’s strategic transformation and solicited input on compensation plan design for 2016. Investor input helped shape changes to our compensation programs for 2016.

19

Table of Contents

Compensation Discussion & Analysis

Part II - Elements of Our Executive Compensation Process

II. Elements of Our Executive Compensation Program

Pay Elements

The following table sets forth the primary elements of the compensation programs that apply to our NEOs and the objective or purpose each element is designed to achieve:

| Compensation Element | Objective/Purpose | |

Annual base salary | Provides fixed compensation that, in conjunction with our annual and long-term incentive programs, approximates the median level of target total compensation for comparable positions at companies in our compensation peer group.

Attracts and retains talented executives with compensation levels that are consistent with our target total compensation mix. | |

| Annual incentive program | Motivates executives to achieve specific near-term enterprise or business segment goals designed to increase long-term stockholder value.

Requires above-target performance to earn an above-target payout. | |

| Long-term equity incentive award program | Motivates executives to consider longer-term ramifications of their actions and appropriately balance long- and near-term objectives.

Reinforces a culture of accountability focused on long-term value creation.

Requires above-median performance for an above-target payout on long-term performance-based equity awards. | |

| Retirement, deferral and health and welfare programs | Provides a competitive program that addresses retirement needs of executives.

Offers NEOs participation in the same health and welfare programs available to all U.S. employees.

Provides an executive long-term disability program. | |

| Payments upon change of control | Provides separation pay upon certain terminations of employment in connection with the sale of the Company or an applicable business segment. Executives are not contractually entitled to separation pay beyond these instances.

Enables executives to focus on maximizing value for stockholders in the context of a change of control transaction. |

Mix of Target Total Direct Compensation Elements

The following charts show the relative percentages of the components of target total direct compensation that were established for our CEO and our other NEOs at the beginning of 2015:

| 2015 CEO Pay Mix | 2015 NEO Average Pay Mix | |

|  | |

20

Table of Contents

Compensation Discussion & Analysis

Part II - Elements of Our Executive Compensation Process

Because our CEO is primarily responsible for achieving the strategic objectives of the Company, his variable compensation is a greater portion of his target total direct compensation than that of our other NEOs. 70% of his target total direct compensation opportunity is subject to performance goals.

Changes to Compensation Levels and Pay Mix in 2015

In January 2015, Towers Watson presented data to the Compensation Committee demonstrating that target total direct compensation (base salary, target annual incentive compensation and target long-term incentive compensation) of most of our NEOs continued to be generally aligned with or fall below median levels for similarly situated executives at companies in our compensation peer group.

To continue to align NEO compensation with median levels, the Compensation Committee made changes to certain elements of NEO compensation as illustrated in the following chart:

| Base Salary | Target Annual Incentive | Target Long-term Incentive | Target Total Direct Compensation | |||||||||||||||||||||||||||||

| NEO | YE 2014 | YE 2015 | YE 2014 | YE 2015 | YE 2014 | YE 2015 | YE 2014 | YE 2015 | ||||||||||||||||||||||||

Alan B. Colberg | $ | 700,000 | $ | 850,000 | 100 | % | 160 | % | 225 | % | 450 | % | $ | 2,975,000 | $ | 6,035,000 | ||||||||||||||||

Christopher J. Pagano | $ | 615,000 | $ | 650,000 | 120 | % | 120 | % | 225 | % | 250 | % | $ | 2,736,750 | $ | 3,055,000 | ||||||||||||||||

Gene E. Mergelmeyer | $ | 615,000 | $ | 630,000 | 120 | % | 120 | % | 225 | % | 225 | % | $ | 2,736,750 | $ | 2,803,500 | ||||||||||||||||

Bart R. Schwartz | $ | 565,000 | $ | 585,000 | 100 | % | 100 | % | 225 | % | 225 | % | $ | 2,401,250 | $ | 2,486,250 | ||||||||||||||||

S. Craig Lemasters | $ | 565,000 | $ | 585,000 | 100 | % | 100 | % | 225 | % | 225 | % | $ | 2,401,250 | $ | 2,486,250 | ||||||||||||||||

The year-over-year increase in Mr. Colberg’s compensation between 2014 and 2015 was primarily attributable to his promotion to CEO at the beginning of 2015. The year-over-year changes for the other NEOs is primarily attributable to, among other things, role changes and expanded responsibilities, as well as the alignment of their compensation with median levels for comparable positions at other companies.

2015 Annual Incentive Compensation

In setting near-term Company or segment goals for the annual incentive program, the Compensation Committee takes into account a number of factors, including management’s expectations regarding business performance, results from prior years, Company-specific factors, opportunities for organic and strategic growth, the regulatory environment in which our business operates and/or macroeconomic trends (e.g., levels of consumer spending, housing market conditions and interest rates) that may affect our business. For 2015, the Committee established financial targets designed to be challenging and to motivate our senior executives to position the Company to deliver profitable growth.

21

Table of Contents

Compensation Discussion & Analysis

Part II - Elements of Our Executive Compensation Process

In 2015, to more closely align the enterprise and business segments annual incentive goals, the Compensation Committee added NOI (defined below) as a performance metric for our enterprise executives and consolidated operating diluted EPS (defined below) as a performance metric for our business segment executives. Also, to further emphasize profitable growth, the Compensation Committee revised the allocation between profitability and revenue for our executives’ target annual incentive opportunity by increasing the weighting of profitability targets from 50% to 60% and decreasing the weighting of revenue targets from 50% to 40%. We use operating measures for these financial targets because they exclude the impact of net realized gains (losses) on investments and other unusual and/or non-recurring or infrequent items.