Assurant and The Warranty Group: Transaction Update January 9, 2018 Exhibit 99.2

Safe Harbor Statement Some of the statements included in this presentation, particularly those with respect to the proposed transaction, the benefits and synergies of the transaction, including operating synergies, the company’s financing plans, future opportunities for the combined company and any statements regarding the combined company’s future results, financial condition and operations, the impact of recently enacted U.S. tax reform legislation, anticipated business levels and offerings, planned activities, anticipated growth, market presence and opportunities, strategies, competition and other expectations, targets and financial metrics for future periods, are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these statements by the use of words such as “outlook,” “will,” “may,” “can,” “anticipates,” “expects,” “estimates,” “projects,” “intends,” “plans,” “believes,” “targets,” “forecasts,” “potential,” “approximately,” or the negative version of those words and other words and terms with a similar meaning. Any forward-looking statements contained in this presentation are based upon historical performance and current plans, estimates and expectations and are subject to significant uncertainties. The inclusion of this forward-looking information should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. Actual results might differ materially from those projected in the forward-looking statements. Assurant undertakes no obligation to update or review any forward-looking statements in this presentation, whether as a result of new information, future events or other developments. For a detailed discussion of the general risk factors that could affect Assurant’s actual results, please refer to the risk factors identified in Assurant’s annual and periodic reports filed with the Securities and Exchange Commission (the “SEC”). In addition, certain statements in this presentation reference certain financial data of TWG Holdings Limited (together with its subsidiaries “The Warranty Group”), which has been derived from The Warranty Group’s financial statements and records and other information made available to Assurant’s management. These financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The Warranty Group’s auditors have not (nor have any other auditors) audited, reviewed, compiled or performed procedures with respect to such financial data, nor expressed or provided an opinion with respect thereto.

Presenters Alan Colberg President & Chief Executive Officer Richard Dziadzio Executive Vice President, Chief Financial Officer & Treasurer

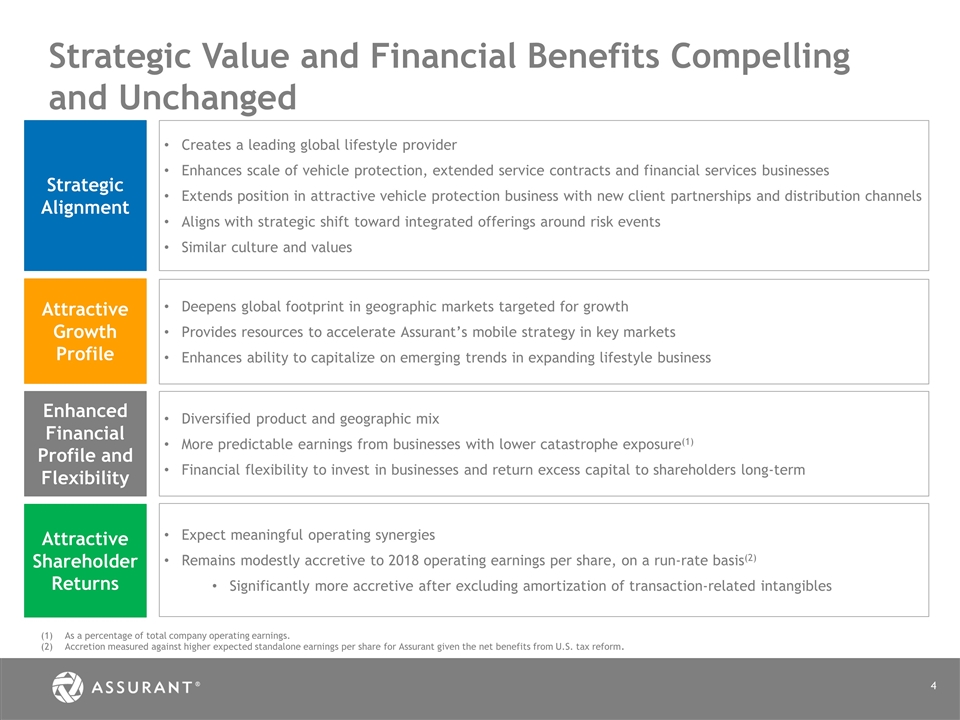

Strategic Value and Financial Benefits Compelling and Unchanged Strategic Alignment Creates a leading global lifestyle provider Enhances scale of vehicle protection, extended service contracts and financial services businesses Extends position in attractive vehicle protection business with new client partnerships and distribution channels Aligns with strategic shift toward integrated offerings around risk events Similar culture and values Attractive Growth Profile Deepens global footprint in geographic markets targeted for growth Provides resources to accelerate Assurant’s mobile strategy in key markets Enhances ability to capitalize on emerging trends in expanding lifestyle business Enhanced Financial Profile and Flexibility Diversified product and geographic mix More predictable earnings from businesses with lower catastrophe exposure(1) Financial flexibility to invest in businesses and return excess capital to shareholders long-term Attractive Shareholder Returns Expect meaningful operating synergies Remains modestly accretive to 2018 operating earnings per share, on a run-rate basis(2) Significantly more accretive after excluding amortization of transaction-related intangibles As a percentage of total company operating earnings. Accretion measured against higher expected standalone earnings per share for Assurant given the net benefits from U.S. tax reform.

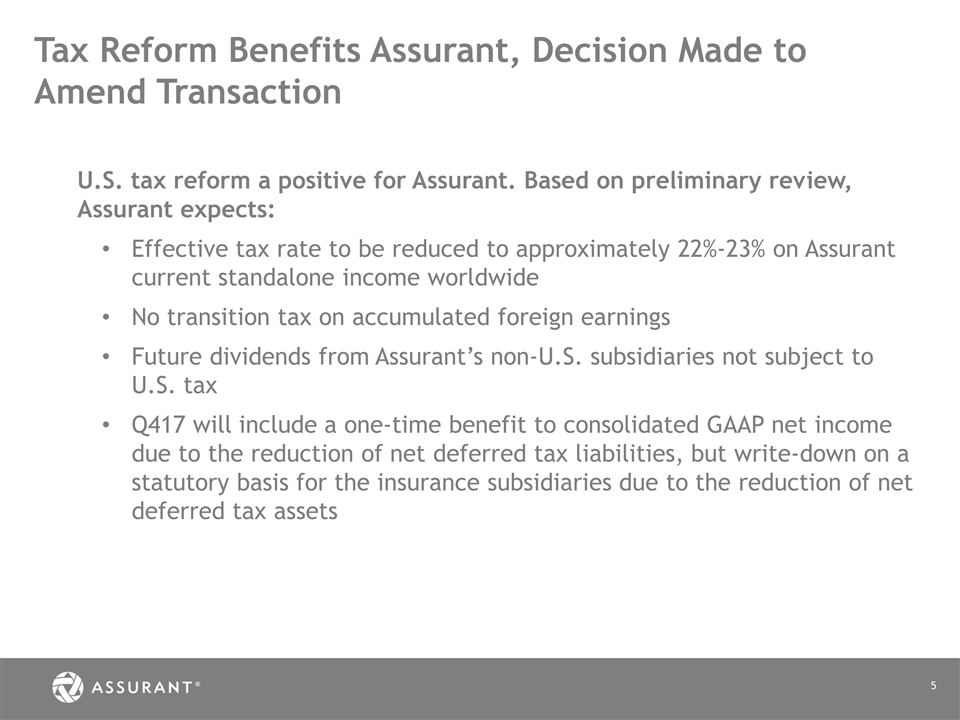

Tax Reform Benefits Assurant, Decision Made to Amend Transaction Benefits of U.S. Tax Reform and Remaining U.S. Domiciled U.S. tax reform a positive for Assurant. Based on preliminary review, Assurant expects: Effective tax rate to be reduced to approximately 22%-23% on Assurant current standalone income worldwide No transition tax on accumulated foreign earnings Future dividends from Assurant’s non-U.S. subsidiaries not subject to U.S. tax Q417 will include a one-time benefit to consolidated GAAP net income due to the reduction of net deferred tax liabilities, but write-down on a statutory basis for the insurance subsidiaries due to the reduction of net deferred tax assets

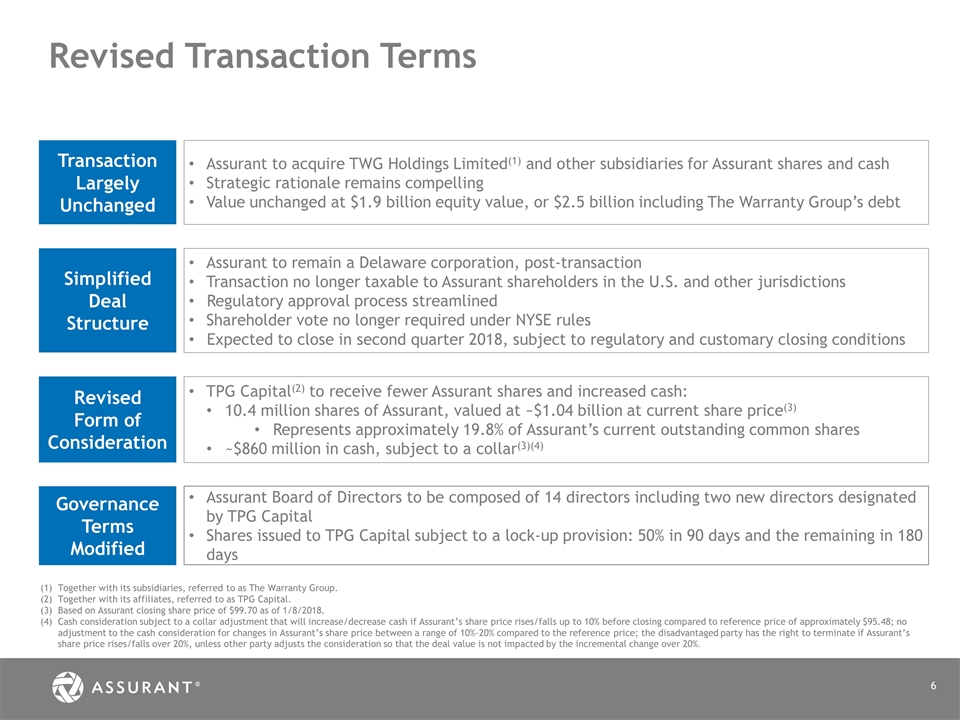

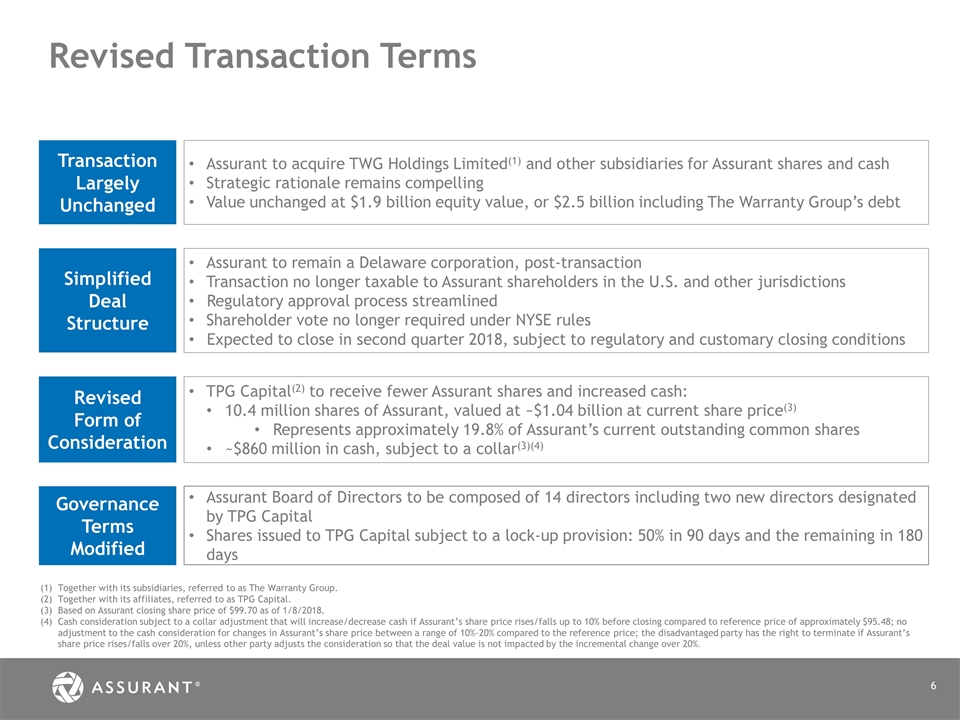

Revised Transaction Terms Transaction Largely Unchanged Assurant to acquire TWG Holdings Limited(1) and other subsidiaries for Assurant shares and cash Strategic rationale remains compelling Value unchanged at $1.9 billion equity value, or $2.5 billion including The Warranty Group’s debt Revised Form of Consideration TPG Capital(2) to receive fewer Assurant shares and increased cash: 10.4 million shares of Assurant, valued at ~$1.04 billion at current share price(3) Represents approximately 19.8% of Assurant’s current outstanding common shares ~$860 million in cash, subject to a collar(3)(4) Together with its subsidiaries, referred to as The Warranty Group. Together with its affiliates, referred to as TPG Capital. Based on Assurant closing share price of $99.70 as of 1/8/2018. Cash consideration subject to a collar adjustment that will increase/decrease cash if Assurant’s share price rises/falls up to 10% before closing compared to reference price of approximately $95.48; no adjustment to the cash consideration for changes in Assurant’s share price between a range of 10%-20% compared to the reference price; the disadvantaged party has the right to terminate if Assurant’s share price rises/falls over 20%, unless other party adjusts the consideration so that the deal value is not impacted by the incremental change over 20%. Simplified Deal Structure Assurant to remain a Delaware corporation, post-transaction Transaction no longer taxable to Assurant shareholders in the U.S. and other jurisdictions Regulatory approval process streamlined Shareholder vote no longer required under NYSE rules Expected to close in second quarter 2018, subject to regulatory and customary closing conditions Governance Terms Modified Assurant Board of Directors to be composed of 14 directors including two new directors designated by TPG Capital Shares issued to TPG Capital subject to a lock-up provision: 50% in 90 days and the remaining in 180 days

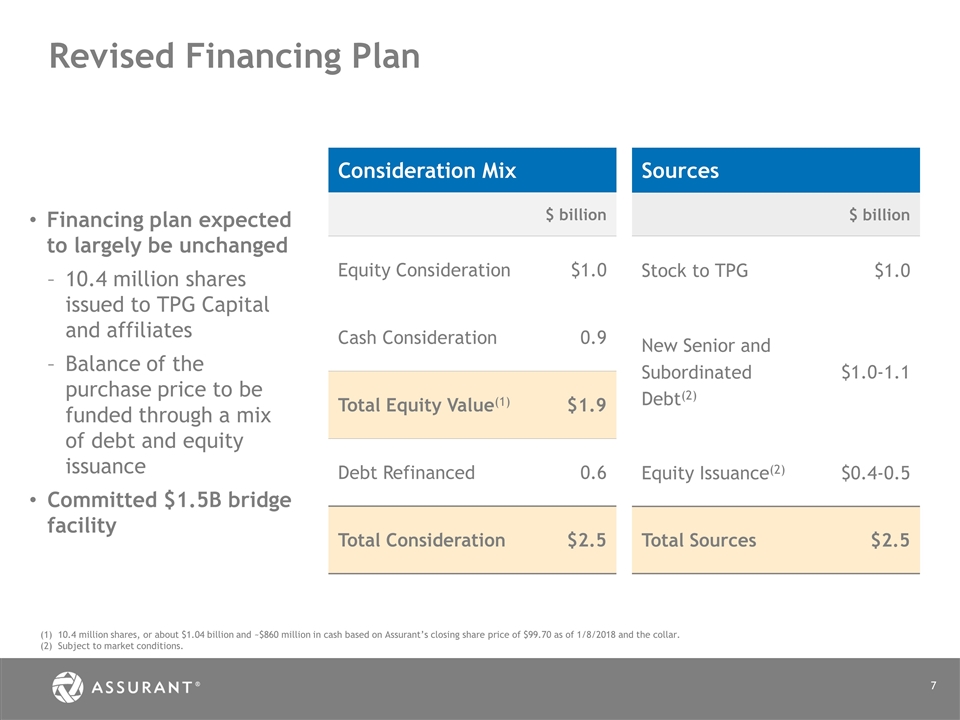

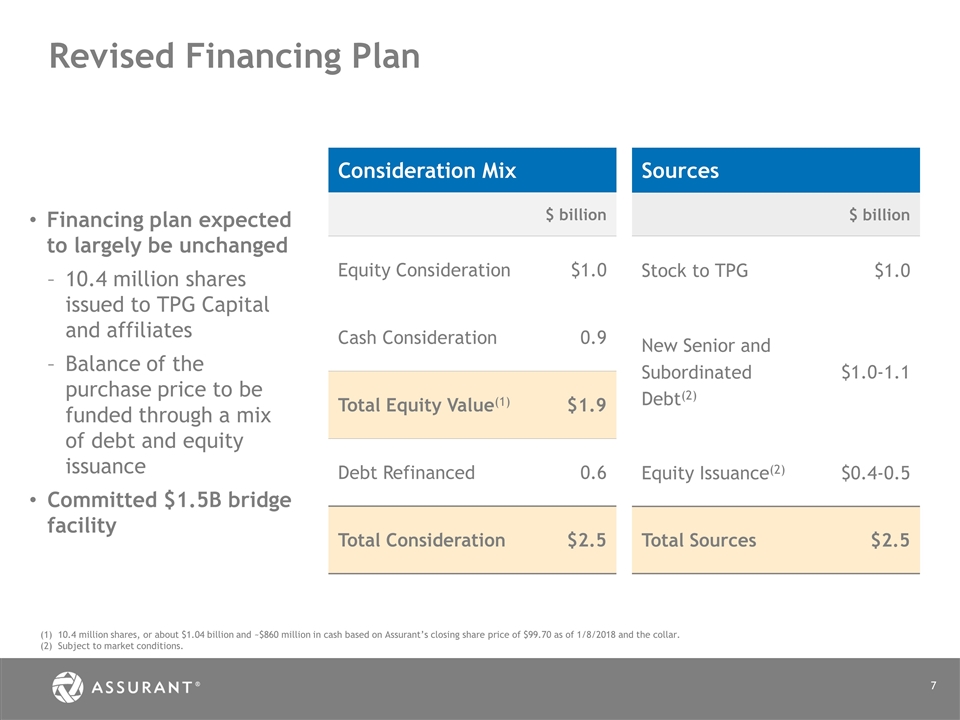

Revised Financing Plan 10.4 million shares, or about $1.04 billion and ~$860 million in cash based on Assurant’s closing share price of $99.70 as of 1/8/2018 and the collar. Subject to market conditions. Consideration Mix $ billion Equity Consideration $1.0 Cash Consideration 0.9 Total Equity Value(1) $1.9 Debt Refinanced 0.6 Total Consideration $2.5 Financing plan expected to largely be unchanged 10.4 million shares issued to TPG Capital and affiliates Balance of the purchase price to be funded through a mix of debt and equity issuance Committed $1.5B bridge facility Sources $ billion Stock to TPG $1.0 New Senior and Subordinated Debt(2) $1.0-1.1 Equity Issuance(2) $0.4-0.5 Total Sources $2.5

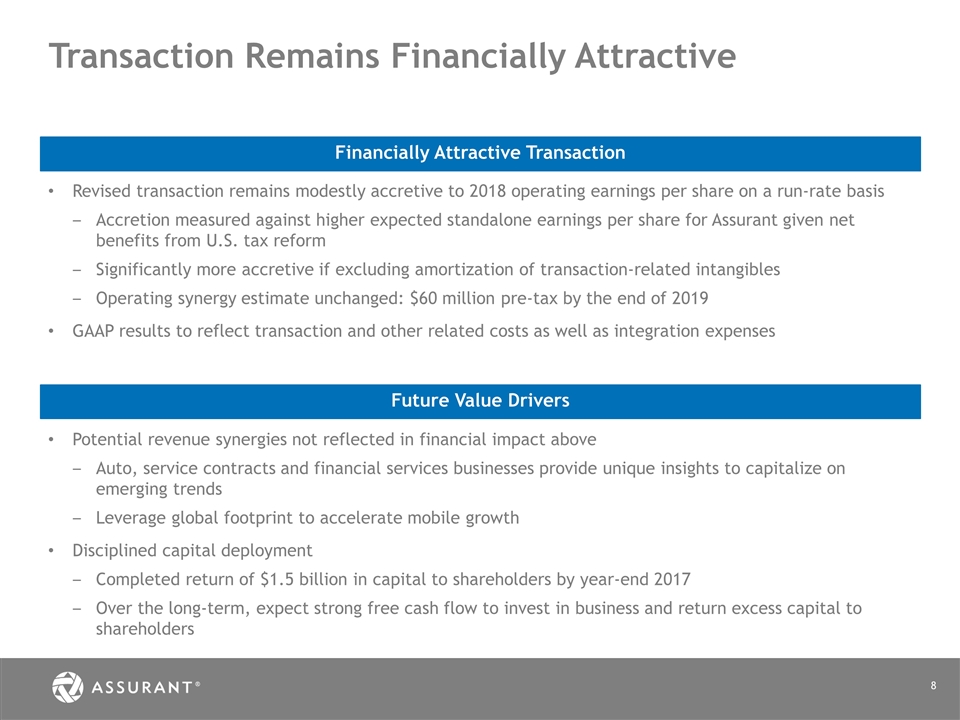

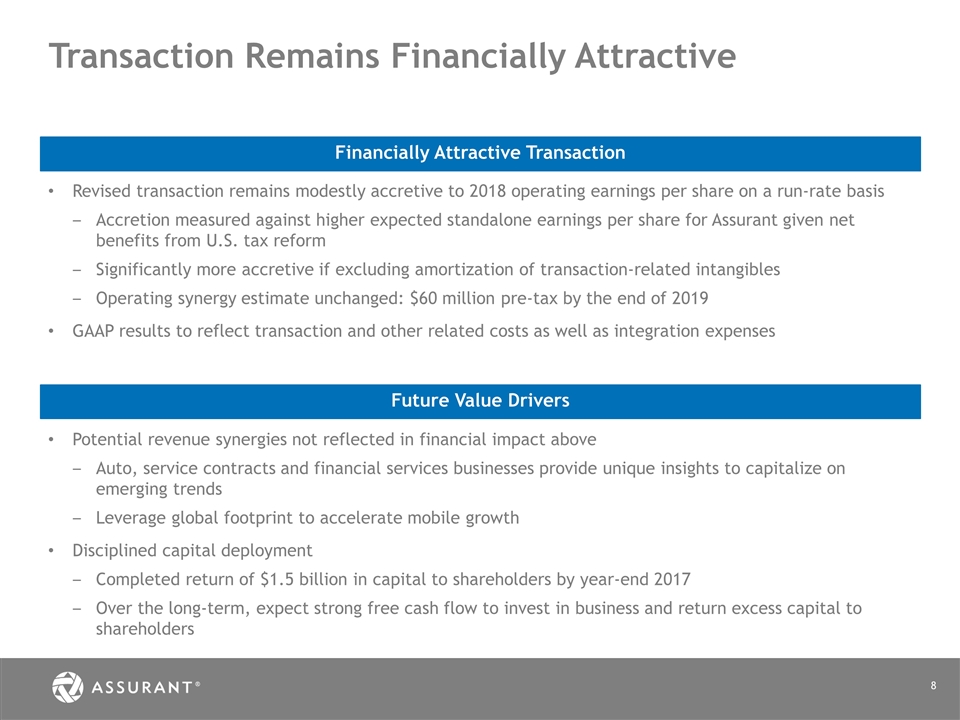

Transaction Remains Financially Attractive Revised transaction remains modestly accretive to 2018 operating earnings per share on a run-rate basis Accretion measured against higher expected standalone earnings per share for Assurant given net benefits from U.S. tax reform Significantly more accretive if excluding amortization of transaction-related intangibles Operating synergy estimate unchanged: $60 million pre-tax by the end of 2019 GAAP results to reflect transaction and other related costs as well as integration expenses [GAAP results to reflect transactions costs, integration expense] Financially Attractive Transaction Potential revenue synergies not reflected in financial impact above Auto, service contracts and financial services businesses provide unique insights to capitalize on emerging trends Leverage global footprint to accelerate mobile growth Disciplined capital deployment Completed return of $1.5 billion in capital to shareholders by year-end 2017 Over the long-term, expect strong free cash flow to invest in business and return excess capital to shareholders Future Value Drivers

Creating Shareholder Value Transaction remains compelling- strategically, operationally and financially Leading provider in lifestyle businesses delivering operating synergies, scale efficiencies and deepened global footprint for profitable growth Well-positioned to capitalize on growth opportunities Enhanced financial profile with more predictable and diversified earnings Expect to generate attractive shareholder returns

APPENDIX

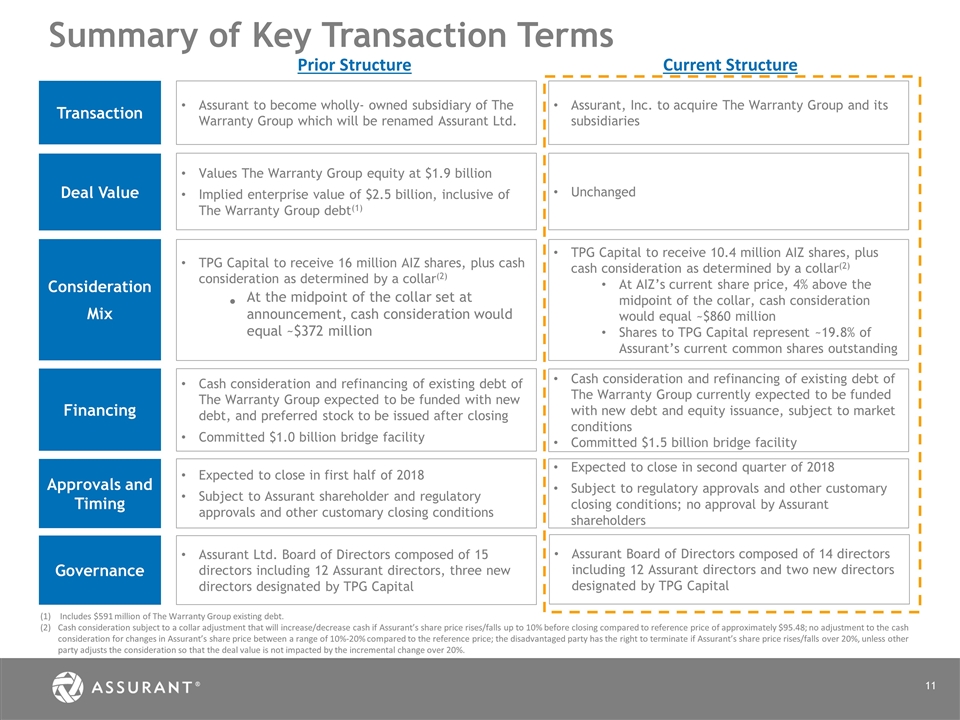

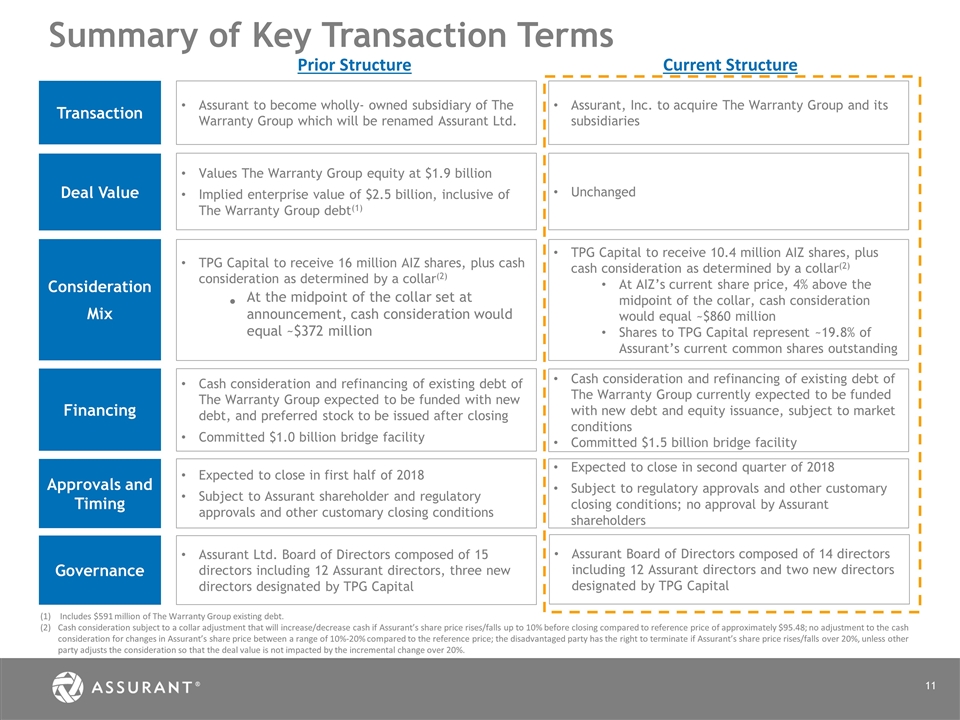

Summary of Key Transaction Terms Transaction Assurant to become wholly- owned subsidiary of The Warranty Group which will be renamed Assurant Ltd. Consideration Mix Financing Includes $591 million of The Warranty Group existing debt. Cash consideration subject to a collar adjustment that will increase/decrease cash if Assurant’s share price rises/falls up to 10% before closing compared to reference price of approximately $95.48; no adjustment to the cash consideration for changes in Assurant’s share price between a range of 10%-20% compared to the reference price; the disadvantaged party has the right to terminate if Assurant’s share price rises/falls over 20%, unless other party adjusts the consideration so that the deal value is not impacted by the incremental change over 20%. Deal Value Assurant, Inc. to acquire The Warranty Group and its subsidiaries Values The Warranty Group equity at $1.9 billion Implied enterprise value of $2.5 billion, inclusive of The Warranty Group debt(1) Unchanged TPG Capital to receive 16 million AIZ shares, plus cash consideration as determined by a collar(2) At the midpoint of the collar set at announcement, cash consideration would equal ~$372 million TPG Capital to receive 10.4 million AIZ shares, plus cash consideration as determined by a collar(2) At AIZ’s current share price, 4% above the midpoint of the collar, cash consideration would equal ~$860 million Shares to TPG Capital represent ~19.8% of Assurant’s current common shares outstanding Prior Structure Current Structure Cash consideration and refinancing of existing debt of The Warranty Group expected to be funded with new debt, and preferred stock to be issued after closing Committed $1.0 billion bridge facility Cash consideration and refinancing of existing debt of The Warranty Group currently expected to be funded with new debt and equity issuance, subject to market conditions Committed $1.5 billion bridge facility Approvals and Timing Expected to close in first half of 2018 Subject to Assurant shareholder and regulatory approvals and other customary closing conditions Expected to close in second quarter of 2018 Subject to regulatory approvals and other customary closing conditions; no approval by Assurant shareholders Governance Assurant Ltd. Board of Directors composed of 15 directors including 12 Assurant directors, three new directors designated by TPG Capital Assurant Board of Directors composed of 14 directors including 12 Assurant directors and two new directors designated by TPG Capital