UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 6, 2021

Assurant, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-31978 | | 39-1126612 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

55 Broadway, Suite 2901

New York, New York 10006

(212) 859-7000

(Address, including zip code, and telephone number, including area code, of Registrant's Principal Executive Offices)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 Par Value | AIZ | New York Stock Exchange |

| 5.25% Subordinated Notes due 2061 | AIZN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On July 6, 2021, Assurant, Inc. (the “Company”) announced that it has finalized its 2021 property catastrophe reinsurance program, limiting the Company’s financial exposure and protecting its homeowners and renters policyholders against severe weather and other hazards.

2021 Catastrophe Reinsurance Program Summary

The Company continued to optimize its program to address both frequency and severity by reducing its retention to $55 million for certain second and third events while maintaining nearly $1 billion in loss coverage. At the same time, the Company increased its multiyear coverage to account for approximately 52% of its total U.S. Program and strategically exited certain international programs. These actions support the Company’s long-term strategy in reducing catastrophe risk to the enterprise, which ultimately allows the Company to focus on driving strong earnings growth and cash flow across its fee-based and capital-light offerings.

2021 U.S. Program Key Highlights

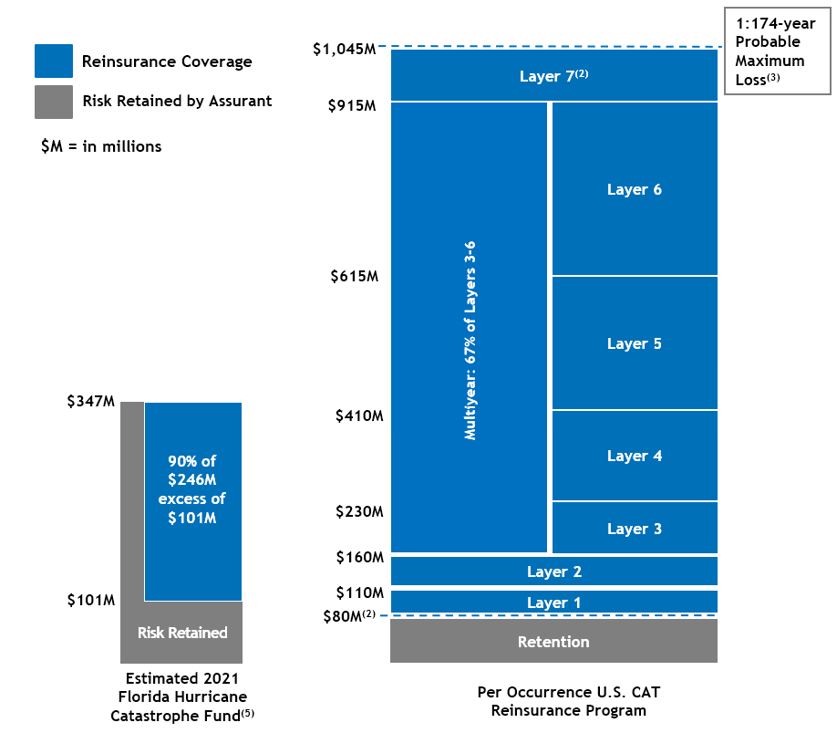

•The U.S. Program provides $965 million of coverage(1) in excess of a $80 million retention for a first event, with retention lowering to $55 million for a second and third event(2). Coverage protects against a projected probable maximum loss of approximately a 1-in-174-year storm, based on projected modeled loss estimates(3).

•When combined with the Florida Hurricane Catastrophe Fund, the U.S. Program protects against gross Florida losses of up to approximately $1.2 billion.

•Overall, the majority of Assurant’s business is not exposed to catastrophe losses and therefore, combined with the comprehensive 2021 catastrophe reinsurance program, the Company would expect to retain approximately 70% of net operating income in a 1-in-50-year event compared to approximately 40% in 2017.

•Multiyear reinsurance contracts now cover approximately 52% of the U.S. Program, reducing volatility in future reinsurance costs.

•Layers 2 through 6 allow for one automatic reinstatement; Layer 1 has two reinstatements.

•Maintains unique cascading feature that provides multi-event protection in which higher coverage layers (Layers 2 through 6) cascade down to $110 million as the lower layers and reinstatement limits are exhausted.

•2021 reinsurance premiums for the total program are estimated to be approximately $149 million pre-tax(4) based on current estimated exposure.

•Coverage was placed with more than 40 reinsurers that are all rated A- or better by A.M. Best.

(1)The 2021 Catastrophe Reinsurance Program also includes coverage in the Caribbean of up to $150 million in excess of $20 million, and the Company’s 2021 Latin America protection of up to $158 million in excess of $7 million which will renew in full on August 1, 2021. Renewals are subject to changes in coverage amount, retention and cost.

(2)Retention for second and third events is $55 million for hurricane and earthquake perils only, with the additional layer as part of a flexible limit that can be used for either $25 million in excess of $55 million or $50 million in excess of $915 million.

(3)Probable Maximum Loss is projected based on estimated December 31, 2021 exposure and a blend of industry modeling tools. Actual losses may differ materially from projections.

(4)Actual reinsurance premiums will vary if exposure changes significantly from estimates or if reinstatement premiums are required due to catastrophe events. Total pre-tax dollar amount includes Caribbean and Latin America coverage.

(5)The risk retained by the Company for the Florida Hurricane Catastrophe Fund (“FHCF”) is applied to the main U.S. Program retention. The FHCF inures to the benefit of the main U.S. Program. Once exhausted, there is no reinstatement of the FHCF coverage.

Cautionary Statement

Some of the statements included in this Form 8-K may constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained in this Form 8-K are based upon the Company’s historical performance and on current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company or any other person that the Company’s future plans, estimates or expectations will be achieved. Actual results may differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update or review any forward-looking statements, whether as a result of new information, future events or other developments. For additional information on factors that could affect the Company’s actual results, please refer to the factors identified in the reports that the Company files with the U.S. Securities and Exchange Commission (the “SEC”), including the risk factors identified in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, each as filed with the SEC.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Exhibit |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ASSURANT, INC. |

| | |

| Date: July 6, 2021 | By: | | /s/ Jay Rosenblum |

| | | Jay Rosenblum |

| | | Executive Vice President, Chief Legal Officer |