Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

AHL-PE similar filings

- 13 Oct 06 Entry into a Material Definitive Agreement

- 1 Sep 06 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

- 10 Aug 06 Entry into a Material Definitive Agreement

- 31 Jul 06 Regulation FD Disclosure

- 27 Jul 06 Regulation FD Disclosure

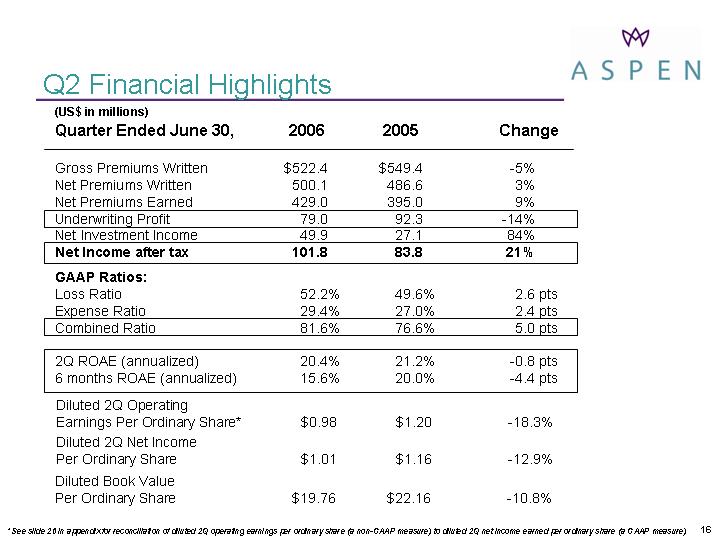

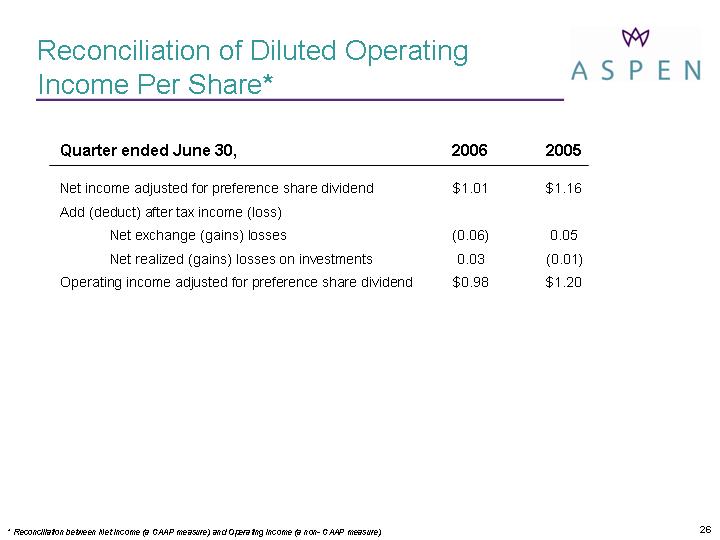

- 26 Jul 06 Aspen Insurance Holdings Limited Reports Second Quarter 2006 Earnings

- 26 May 06 Entry into a Material Definitive Agreement

Filing view

External links