Exhibit 99.2

| | |

| | | FINANCIAL SUPPLEMENT As of December 31, 2012 |

| | | | |

| | Aspen Insurance Holdings Limited |

| | This financial supplement is for information purposes only. It should be read in conjunction with other documents filed or to be filed by Aspen Insurance Holdings Limited with the United States Securities and Exchange Commission. www.aspen.co Investor Contact: Aspen Insurance Holdings Limited Kerry Calaiaro, Senior Vice President,

Investor Relations T: +1 646-502-1076 email: kerry.calaiaro@aspen.co | |

|

| | | AHL: NYSE | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Table Of Contents |

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Basis of Presentation |

Definitions and presentation: All financial information contained herein is unaudited except for information for the fiscal year ended December 31, 2011. Unless otherwise noted, all data is in U.S. dollars millions, except for per share amounts, percentages and ratio information.

In presenting Aspen’s results, management has included and discussed certain “non-GAAP financial measures”, as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain Aspen’s results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included in this financial supplement.

Operating income (a non-GAAP financial measure): Operating income is an internal performance measure used by Aspen in the management of its operations and represents after-tax operational results excluding, as applicable, after-tax net realized and unrealized capital gains or losses, including net realized and unrealized gains and losses on interest rate swaps, and after-tax net foreign exchange gains or losses, including net realized and unrealized gains and losses on foreign exchange contracts.

Aspen excludes these items from its calculation of operating income because the amount of these gains or losses is heavily influenced by, and fluctuates in part, according to the availability of market opportunities. Aspen believes these amounts are largely independent of its business and underwriting process and including them would distort the analysis of trends in its operations. In addition to presenting net income in accordance with GAAP, Aspen believes that showing operating income enables investors, analysts, rating agencies and other users of its financial information to more easily analyze Aspen’s results of operations in a manner similar to how management analyzes Aspen’s underlying business performance. Operating income should not be viewed as a substitute for GAAP net income. Please see page 23 for a reconciliation of operating income to net income.

Annualized operating return on average equity(“Operating ROE”) (a non-GAAP financial measure): Annualized operating return on average equity is calculated using operating income, as defined above, and average equity is calculated as the arithmetic average on a monthly basis for the stated periods of shareholders’ equity excluding the aggregate value of the liquidation preferences of our preference shares net of issuance costs.

Aspen presents Operating ROE as a measure that is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information. See page 23 for a reconciliation of operating income to net income and page 7 for a reconciliation of average ordinary shareholders’ equity to average shareholders’ equity.

Diluted operating earnings per share and basic operating earnings per share (non-GAAP financial measures): Aspen believes that the presentation of diluted operating earnings per share and basic operating earnings per share supports meaningful comparison from period to period and the analysis of normal business operations. Diluted operating earnings per share and basic operating earnings per share are calculated by dividing operating income by the diluted or basic weighted average number of shares outstanding for the period. See page 23 for a reconciliation of diluted and basic operating earnings per share to basic earnings per share.

Diluted book value per ordinary share (is not a non-GAAP financial measure): Aspen has included diluted book value per ordinary share as it illustrates the effect on basic book value per share of dilutive securities thereby providing a better benchmark for comparison with other companies. Diluted book value per share is calculated using the treasury stock method as defined on page 22.

Growth in adjusted diluted book value per share (“Adjusted BVPS”) (is not a non-GAAP financial measure): The growth in Adjusted BVPS is defined as the annual change in diluted book value per share after adding back dividends paid to ordinary shareholders during the year.

1

Underwriting ratios (GAAP financial measures): Aspen, along with others in the industry, uses underwriting ratios as measures of performance. The loss ratio is the ratio of net claims and claims adjustment expenses to net premiums earned. The acquisition expense ratio is the ratio of underwriting expenses (commissions, premium taxes, licenses and fees, as well as other underwriting expenses) to net premiums earned. The general and administrative expense ratio is the ratio of general and administrative expenses to net premiums earned. The combined ratio is the sum of the loss ratio, the acquisition expense ratio and the general and administrative expense ratio. These ratios are relative measurements that describe for every $100 of net premiums earned, the cost of losses and expenses, respectively. The combined ratio presents the total cost per $100 of earned premium. A combined ratio below 100% demonstrates underwriting profit; a combined ratio above 100% demonstrates underwriting loss.

GAAP combined ratios differ from U.S. statutory combined ratios primarily due to the deferral of certain third-party acquisition expenses for GAAP reporting purposes and the use of net premiums earned rather than net premiums written in the denominator when calculating the acquisition expense and the general and administrative expense ratios.

2

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Financial Highlights |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | | Twelve Months Ended December 31, | |

| (in US$ millions except for percentages, share and per share amounts) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| | | | | | |

Gross written premium | | | $576.2 | | | | $458.7 | | | | 25.6 | % | | | $2,583.3 | | | | $2,207.8 | | | | 17.0 | % |

Net written premium | | | $524.4 | | | | $431.2 | | | | 21.6 | % | | | $2,246.9 | | | | $1,929.1 | | | | 16.5 | % |

Net earned premium | | | $558.5 | | | | $489.4 | | | | 14.1 | % | | | $2,083.5 | | | | $1,888.5 | | | | 10.3 | % |

Net income/(loss) after tax(1) | | | $2.0 | | | | $12.4 | | | | (83.9 | %) | | | $280.4 | | | | $(110.1 | ) | | | NM | |

Operating (loss)/income after tax (1) | | | $(2.9 | ) | | | $5.0 | | | | NM | | | | $279.9 | | | | $(70.4 | ) | | | NM | |

Net investment income | | | $51.1 | | | | $54.2 | | | | (5.7 | %) | | | $204.9 | | | | $225.6 | | | | (9.2 | %) |

Underwriting (loss)/income(1) | | | $(45.0 | ) | | | $(69.9 | ) | | | NM | | | | $118.7 | | | | $(299.0 | ) | | | NM | |

| | |

Earnings Per Share and Book Value Per Share | | | | | | | | | | | | | | | | | | | | | | | | |

Basic earnings per ordinary share | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend(1) | | | $(0.09 | ) | | | $0.09 | | | | NM | | | | $3.51 | | | | $(1.88 | ) | | | NM | |

Operating (loss)/income adjusted for preference share dividend(1) | | | $(0.15 | ) | | | $(0.01 | ) | | | NM | | | | $3.50 | | | | $(1.32 | ) | | | NM | |

Diluted earnings per ordinary share | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend(1) | | | $(0.09 | ) | | | $0.09 | | | | NM | | | | $3.38 | | | | $(1.88 | ) | | | NM | |

Operating (loss)/income adjusted for preference share dividend(1) | | | $(0.15 | ) | | | $(0.01 | ) | | | NM | | | | $3.37 | | | | $(1.32 | ) | | | NM | |

Weighted average number of ordinary shares outstanding (in millions of shares) | | | 71.007 | | | | 70.615 | | | | 0.6 | % | | | 71.096 | | | | 70.665 | | | | 0.6 | % |

Diluted weighted average number of ordinary shares outstanding (in millions of shares) | | | 73.558 | | | | 73.258 | | | | 0.4 | % | | | 73.689 | | | | 70.655 | | | | 4.3 | % |

Book value per ordinary share (1) | | | $42.12 | | | | $39.66 | | | | 6.2 | % | | | $42.12 | | | | $39.66 | | | | 6.2 | % |

Diluted book value per ordinary share (1) | | | $40.65 | | | | $38.21 | | | | 6.4 | % | | | $40.65 | | | | $38.21 | | | | 6.4 | % |

Ordinary shares outstanding at December 31, 2012 and December 31, 2011 (in millions of shares) | | | 70.754 | | | | 70.656 | | | | | | | | | | | | | | | | | |

Diluted ordinary shares outstanding at December 31, 2012 and December 31, 2011 (in millions of shares) | | | 73.312 | | | | 73.339 | | | | | | | | | | | | | | | | | |

| | |

Underwriting Ratios | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 78.3 | % | | | 80.6 | % | | | | | | | 59.4 | % | | | 82.4 | % | | | | |

Policy acquisition expense ratio | | | 14.3 | % | | | 17.5 | % | | | | | | | 18.3 | % | | | 18.4 | % | | | | |

General, administrative and corporate expense ratio(1) | | | 15.4 | % | | | 16.2 | % | | | | | | | 16.6 | % | | | 15.1 | % | | | | |

Expense ratio (1) | | | 29.7 | % | | | 33.7 | % | | | | | | | 34.9 | % | | | 33.5 | % | | | | |

Combined ratio(1) | | | 108.0 | % | | | 114.3 | % | | | | | | | 94.3 | % | | | 115.9 | % | | | | |

| | |

Return On Equity | | | | | | | | | | | | | | | | | | | | | | | | |

Average equity (2) | | | $3,013.2 | | | | $2,781.4 | | | | | | | | $2,933.8 | | | | $2,776.5 | | | | | |

Return on average equity | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend(1) | | | (0.2 | %) | | | 0.2 | % | | | | | | | 8.5 | % | | | (4.8 | %) | | | | |

Operating (loss)/income adjusted for preference share dividend(1) | | | (0.4 | %) | | | – | | | | | | | | 8.5 | % | | | (3.4 | %) | | | | |

Annualized return on average equity | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss)/income(1) | | | (0.8 | %) | | | 0.8 | % | | | | | | | 8.5 | % | | | (4.8 | %) | | | | |

Operating (loss)/income(1) | | | (1.6 | %) | | | – | | | | | | | | 8.5 | % | | | (3.4 | %) | | | | |

| | |

See pages 7 and 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) Average equity excludes preference shares.

3

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Statements of Operations - Quarterly Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions except for percentages and per share amounts) | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

UNDERWRITING REVENUES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross written premiums | | | $576.2 | | | | $558.4 | | | | $666.6 | | | | $782.1 | | | | $458.7 | | | | $495.6 | | | | $582.2 | | | | $671.3 | |

Premiums ceded | | | (51.8) | | | | (51.3) | | | | (84.7) | | | | (148.6) | | | | (27.5) | | | | (33.0) | | | | (56.5) | | | | (161.7) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net written premiums | | | 524.4 | | | | 507.1 | | | | 581.9 | | | | 633.5 | | | | 431.2 | | | | 462.6 | | | | 525.7 | | | | 509.6 | |

Change in unearned premiums | | | 34.1 | | | | 9.1 | | | | (68.5) | | | | (138.1) | | | | 58.2 | | | | 24.3 | | | | (65.9) | | | | (57.2) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net earned premiums | | | 558.5 | | | | 516.2 | | | | 513.4 | | | | 495.4 | | | | 489.4 | | | | 486.9 | | | | 459.8 | | | | 452.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNDERWRITING EXPENSES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Losses and loss adjustment expenses | | | 437.4 | | | | 255.0 | | | | 262.1 | | | | 284.0 | | | | 394.5 | | | | 306.2 | | | | 326.4 | | | | 528.9 | |

Policy acquisition expenses | | | 80.0 | | | | 103.1 | | | | 102.0 | | | | 96.1 | | | | 85.5 | | | | 93.4 | | | | 86.7 | | | | 81.4 | |

General, administrative and corporate expenses(1) | | | 86.1 | | | | 90.7 | | | | 83.5 | | | | 84.8 | | | | 79.3 | | | | 72.0 | | | | 70.7 | | | | 62.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total underwriting expenses | | | 603.5 | | | | 448.8 | | | | 447.6 | | | | 464.9 | | | | 559.3 | | | | 471.6 | | | | 483.8 | | | | 672.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting (loss)/income including corporate expenses | | | (45.0) | | | | 67.4 | | | | 65.8 | | | | 30.5 | | | | (69.9) | | | | 15.3 | | | | (24.0) | | | | (220.4) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

OTHER OPERATING REVENUE AND EXPENSES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 51.1 | | | | 48.6 | | | | 52.8 | | | | 52.4 | | | | 54.2 | | | | 57.3 | | | | 58.6 | | | | 55.5 | |

Interest expense | | | (7.7) | | | | (7.8) | | | | (7.7) | | | | (7.7) | | | | (7.7) | | | | (7.7) | | | | (7.7) | | | | (7.7) | |

Other (expense)/income | | | (6.2) | | | | 4.5 | | | | 2.9 | | | | (0.3) | | | | 3.6 | | | | (9.1) | | | | 6.8 | | | | (8.1) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total other operating revenue | | | 37.2 | | | | 45.3 | | | | 48.0 | | | | 44.4 | | | | 50.1 | | | | 40.5 | | | | 57.7 | | | | 39.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

OPERATING (LOSS)/INCOME BEFORE TAX | | | (7.8) | | | | 112.7 | | | | 113.8 | | | | 74.9 | | | | (19.8) | | | | 55.8 | | | | 33.7 | | | | (180.7) | |

Net realized and unrealized exchange (losses)/gains(2) | | | (0.4) | | | | 7.7 | | | | (13.0) | | | | 3.7 | | | | 2.3 | | | | 0.3 | | | | (7.7) | | | | 2.9 | |

Net realized and unrealized investment gains/(losses) (3) | | | 5.6 | | | | 2.7 | | | | (10.0) | | | | 5.5 | | | | 6.0 | | | | (32.9) | | | | (15.7) | | | | 8.5 | |

| | | | | | | | | �� | | | | | | | | | | | | | | | | | | | | | | | |

(LOSS)/INCOME BEFORE TAX | | | (2.6) | | | | 123.1 | | | | 90.8 | | | | 84.1 | | | | (11.5) | | | | 23.2 | | | | 10.3 | | | | (169.3) | |

Income tax recovery/(expense) | | | 4.6 | | | | (8.0) | | | | (6.2) | | | | (5.4) | | | | 23.9 | | | | (2.0) | | | | (1.2) | | | | 16.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NET INCOME/(LOSS) AFTER TAX | | | 2.0 | | | | 115.1 | | | | 84.6 | | | | 78.7 | | | | 12.4 | | | | 21.2 | | | | 9.1 | | | | (152.8) | |

Dividends paid on ordinary shares | | | (12.0) | | | | (12.2) | | | | (12.2) | | | | (10.6) | | | | (10.7) | | | | (10.6) | | | | (10.6) | | | | (10.6) | |

Dividends paid on preference shares | | | (8.5) | | | | (8.6) | | | | (8.3) | | | | (5.7) | | | | (5.7) | | | | (5.7) | | | | (5.7) | | | | (5.7) | |

Dividends paid to non-controlling interest | | | - | | | | (0.1) | | | | - | | | | - | | | | - | | | | (0.1) | | | | - | | | | - | |

Proportion due to non-controlling interest | | | (0.1) | | | | - | | | | 0.2 | | | | 0.1 | | | | (0.2) | | | | (0.1) | | | | 0.2 | | | | 0.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Retained (loss)/income | | | $(18.6) | | | | $94.2 | | | | $64.3 | | | | $62.5 | | | | $(4.2) | | | | $4.7 | | | | $(7.0) | | | | $(168.9) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Components of net income/(loss) after tax | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss)/income | | | $(2.9) | | | $ | 106.5 | | | $ | 105.8 | | | $ | 70.5 | | | $ | 5.0 | | | $ | 55.5 | | | $ | 30.8 | | | $ | (161.7 | ) |

Net realized and unrealized exchange (losses)/gains after tax(2) | | | (0.4) | | | | 6.1 | | | | (10.9 | ) | | | 3.0 | | | | 3.7 | | | | (0.8 | ) | | | (4.8 | ) | | | 1.8 | |

Net realized and unrealized investment gains/ (losses) after tax (3) | | | 5.3 | | | | 2.5 | | | | (10.3 | ) | | | 5.2 | | | | 3.7 | | | | (33.5 | ) | | | (16.9 | ) | | | 7.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NET INCOME/(LOSS) AFTER TAX | | | $2.0 | | | | $115.1 | | | | $84.6 | | | | $78.7 | | | | $12.4 | | | | $21.2 | | | | $9.1 | | | | $(152.8) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 78.3% | | | | 49.4% | | | | 51.1% | | | | 57.3% | | | | 80.6% | | | | 62.9% | | | | 71.0% | | | | 116.9% | |

Policy acquisition expense ratio | | | 14.3% | | | | 20.0% | | | | 19.9% | | | | 19.4% | | | | 17.5% | | | | 19.2% | | | | 18.9% | | | | 18.0% | |

General, administrative and corporate expense ratio (1) | | | 15.4% | | | | 17.6% | | | | 16.3% | | | | 17.1% | | | | 16.2% | | | | 14.8% | | | | 15.4% | | | | 13.8% | |

Expense ratio | | | 29.7% | | | | 37.6% | | | | 36.2% | | | | 36.5% | | | | 33.7% | | | | 34.0% | | | | 34.3% | | | | 31.8% | |

Combined ratio | | | 108.0% | | | | 87.0% | | | | 87.3% | | | | 93.8% | | | | 114.3% | | | | 96.9% | | | | 105.3% | | | | 148.7% | |

Basic (losses)/earnings per share(4) | | | $(0.09) | | | | $1.50 | | | | $1.07 | | | | $1.03 | | | | $0.09 | | | | $0.22 | | | | $0.05 | | | | $(2.25) | |

Diluted (losses)/earnings per share(4) | | | $(0.09) | | | | $1.45 | | | | $1.03 | | | | $0.99 | | | | $0.09 | | | | $0.21 | | | | $0.05 | | | | $(2.25) | |

Annualized return on average equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss)/income | | | (0.8%) | | | | 14.4% | | | | 10.8% | | | | 10.4% | | | | 0.8% | | | | 2.4% | | | | 0.4% | | | | (22.8%) | |

Operating (loss)/income | | | (1.6%) | | | | 13.2% | | | | 13.6% | | | | 9.2% | | | | - | | | | 7.2% | | | | 3.6% | | | | (24.0%) | |

See pages 7 and 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(3) Includes the net realized and unrealized gains/(losses) from interest rate swaps.

(4) Adjusted for preference share dividends.

4

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Statements of Operations - Full Year Results |

| | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (in US$ millions except for percentages) | | 2012 | | | 2011 | | | 2010 | |

UNDERWRITING REVENUES | | | | | | | | | | | | |

Gross written premiums | | | $2,583.3 | | | | $2,207.8 | | | | $2,076.8 | |

Premiums ceded | | | (336.4) | | | | (278.7) | | | | (185.7) | |

| | | | | | | | | | | | |

Net written premiums | | | 2,246.9 | | | | 1,929.1 | | | | 1,891.1 | |

Change in unearned premiums | | | (163.4) | | | | (40.6) | | | | 7.8 | |

| | | | | | | | | | | | |

Net earned premiums | | | 2,083.5 | | | | 1,888.5 | | | | 1,898.9 | |

| | | | | | | | | | | | |

UNDERWRITING EXPENSES | | | | | | | | | | | | |

Losses and loss adjustment expenses | | | 1,238.5 | | | | 1,556.0 | | | | 1,248.7 | |

Policy acquisition expenses | | | 381.2 | | | | 347.0 | | | | 328.5 | |

General, administrative and corporate expenses(1) | | | 345.1 | | | | 284.5 | | | | 258.6 | |

| | | | | | | | | | | | |

Total underwriting expenses | | | 1,964.8 | | | | 2,187.5 | | | | 1,835.8 | |

| | | | | | | | | | | | |

Underwriting income/(loss) including corporate expenses | | | 118.7 | | | | (299.0) | | | | 63.1 | |

| | | | | | | | | | | | |

OTHER OPERATING REVENUE AND EXPENSES | | | | | | | | | | | | |

Net investment income | | | 204.9 | | | | 225.6 | | | | 232.0 | |

Interest expense | | | (30.9) | | | | (30.8) | | | | (16.5) | |

Other income/(expense) | | | 0.9 | | | | (6.8) | | | | 2.1 | |

| | | | | | | | | | | | |

Total other operating revenue | | | 174.9 | | | | 188.0 | | | | 217.6 | |

| | | | | | | | | | | | |

| | | |

OPERATING INCOME/(LOSS) BEFORE TAX | | | 293.6 | | | | (111.0) | | | | 280.7 | |

| | | |

Net realized and unrealized exchange (losses)/gains(2) | | | (2.0) | | | | (2.2) | | | | 2.2 | |

Net realized and unrealized investment gains/(losses)(3) | | | 3.8 | | | | (34.1) | | | | 57.4 | |

| | | | | | | | | | | | |

INCOME/(LOSS) BEFORE TAX | | | 295.4 | | | | (147.3) | | | | 340.3 | |

Income tax (expense)/recovery | | | (15.0) | | | | 37.2 | | | | (27.6) | |

| | | | | | | | | | | | |

NET INCOME/(LOSS) AFTER TAX | | | 280.4 | | | | (110.1) | | | | 312.7 | |

Dividends paid on ordinary shares | | | (47.0) | | | | (42.5) | | | | (46.5) | |

Dividends paid on preference shares | | | (31.1) | | | | (22.8) | | | | (22.8) | |

Dividends paid to non-controlling interest | | | (0.1) | | | | (0.1) | | | | - | |

Proportion due to non-controlling interest | | | 0.2 | | | | 0.1 | | | | 0.3 | |

| | | | | | | | | | | | |

Retained income/(loss) | | | $202.4 | | | | $(175.4) | | | | $243.7 | |

| | | | | | | | | | | | |

Components of net income/(loss) after tax | | | | | | | | | | | | |

Operating income/(loss) | | | 279.9 | | | | (70.4) | | | | 258.9 | |

Net realized and unrealized exchange (losses)/gains after tax(2) | | | (2.2) | | | | (0.1) | | | | 2.9 | |

Net realized and unrealized investment gains/(losses) after tax(3) | | | 2.7 | | | | (39.6) | | | | 50.9 | |

| | | | | | | | | | | | |

NET INCOME/(LOSS) AFTER TAX | | | $280.4 | | | | $(110.1) | | | | $312.7 | |

| | | | | | | | | | | | |

Loss ratio | | | 59.4% | | | | 82.4% | | | | 65.8% | |

Policy acquisition expense ratio | | | 18.3% | | | | 18.4% | | | | 17.3% | |

General, administrative and corporate expense ratio(1) | | | 16.6% | | | | 15.1% | | | | 13.6% | |

Expense ratio | | | 34.9% | | | | 33.5% | | | | 30.9% | |

Combined ratio | | | 94.3% | | | | 115.9% | | | | 96.7% | |

See pages 7 and 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

| (2) | Includes the net realized and unrealized gains/(losses) from foreign exchange contracts. |

| (3) | Includes the net realized and unrealized gains/(losses) from interest rate swaps. |

5

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Balance Sheets |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions except for per share amounts) | | December 31,

2012 | | | September 30,

2012 | | | June 30,

2012 | | | March 31,

2012 | | | December 31,

2011 | | | September 30,

2011 | | | June 30,

2011 | | | March 31,

2011 | |

ASSETS | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fixed income maturities | | | $6,013.4 | | | | $5,983.1 | | | | $5,791.2 | | | | $5,842.1 | | | | $5,820.2 | | | | $5,992.8 | | | | $5,972.8 | | | | $5,896.1 | |

Equity securities | | | 200.1 | | | | 197.1 | | | | 187.4 | | | | 188.1 | | | | 179.5 | | | | 163.8 | | | | 178.1 | | | | 173.5 | |

Other investments | | | 45.0 | | | | 34.8 | | | | 33.1 | | | | 33.1 | | | | 33.1 | | | | 32.3 | | | | 30.0 | | | | 30.1 | |

Short-term investments | | | 433.9 | | | | 505.3 | | | | 503.6 | | | | 433.8 | | | | 302.3 | | | | 295.9 | | | | 202.8 | | | | 187.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investments | | | 6,692.4 | | | | 6,720.3 | | | | 6,515.3 | | | | 6,497.1 | | | | 6,335.1 | | | | 6,484.8 | | | | 6,383.7 | | | | 6,287.3 | |

| | | | | | | | |

Cash and cash equivalents | | | 1,463.6 | | | | 1,374.2 | | | | 1,309.0 | | | | 1,173.3 | | | | 1,239.1 | | | | 1,038.8 | | | | 1,074.1 | | | | 1,116.9 | |

Reinsurance recoverables | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Unpaid losses | | | 499.0 | | | | 461.6 | | | | 457.4 | | | | 455.4 | | | | 426.6 | | | | 357.7 | | | | 359.3 | | | | 334.0 | |

Ceded unearned premiums | | | 122.6 | | | | 151.3 | | | | 190.8 | | | | 175.3 | | | | 87.8 | | | | 129.9 | | | | 146.2 | | | | 167.4 | |

Receivables | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting premiums | | | 1,057.5 | | | | 993.4 | | | | 1,063.3 | | | | 1,061.2 | | | | 894.4 | | | | 957.2 | | | | 1,054.3 | | | | 940.0 | |

Other | | | 68.5 | | | | 76.4 | | | | 75.1 | | | | 70.2 | | | | 69.7 | | | | 69.3 | | | | 70.0 | | | | 62.8 | |

Funds withheld | | | 84.3 | | | | 79.5 | | | | 91.0 | | | | 86.9 | | | | 90.7 | | | | 65.1 | | | | 81.9 | | | | 86.3 | |

Deferred policy acquisition costs(1) | | | 223.0 | | | | 232.0 | | | | 233.2 | | | | 215.3 | | | | 184.5 | | | | 192.2 | | | | 191.0 | | | | 178.2 | |

Derivatives at fair value | | | 2.0 | | | | 5.8 | | | | 3.3 | | | | 0.9 | | | | 1.3 | | | | 5.8 | | | | 5.7 | | | | 7.4 | |

Receivable for securities sold | | | 0.2 | | | | 14.6 | | | | 9.5 | | | | 2.0 | | | | 1.1 | | | | 0.5 | | | | 21.2 | | | | 10.6 | |

Office properties and equipment | | | 57.9 | | | | 59.1 | | | | 56.9 | | | | 58.5 | | | | 53.9 | | | | 49.5 | | | | 45.0 | | | | 38.6 | |

Income tax receivable | | | 2.4 | | | | 12.3 | | | | 15.7 | | | | 20.3 | | | | 19.5 | | | | 2.5 | | | | 19.9 | | | | 5.2 | |

Other assets | | | 18.2 | | | | 38.1 | | | | 39.3 | | | | 31.1 | | | | 36.8 | | | | 31.2 | | | | 30.2 | | | | 29.4 | |

Intangible assets | | | 19.0 | | | | 19.2 | | | | 19.5 | | | | 19.7 | | | | 20.0 | | | | 20.3 | | | | 20.5 | | | | 20.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | $10,310.6 | | | | $10,237.8 | | | | $10,079.3 | | | | $9,867.2 | | | | $9,460.5 | | | | $9,404.8 | | | | $9,503.0 | | | | $9,284.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance reserves | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Losses and loss adjustment expenses | | | $4,779.7 | | | | $4,639.6 | | | | $4,556.4 | | | | $4,585.7 | | | | $4,525.2 | | | | $4,399.4 | | | | $4,391.7 | | | | $4,229.3 | |

Unearned premiums | | | 1,120.8 | | | | 1,184.0 | | | | 1,223.8 | | | | 1,146.3 | | | | 916.1 | | | | 1,014.5 | | | | 1,086.2 | | | | 1,028.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total insurance reserves | | | 5,900.5 | | | | 5,823.6 | | | | 5,780.2 | | | | 5,732.0 | | | | 5,441.3 | | | | 5,413.9 | | | | 5,477.9 | | | | 5,257.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payables | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Reinsurance premiums | | | 154.1 | | | | 71.1 | | | | 109.5 | | | | 192.2 | | | | 155.8 | | | | 135.2 | | | | 181.6 | | | | 226.9 | |

Taxation | | | 11.8 | | | | 23.7 | | | | 22.5 | | | | 22.9 | | | | 18.5 | | | | 35.2 | | | | 49.1 | | | | 45.3 | |

Accrued expenses and other payables | | | 249.3 | | | | 261.4 | | | | 230.3 | | | | 208.9 | | | | 187.8 | | | | 186.0 | | | | 204.8 | | | | 214.5 | |

Liabilities under derivative contracts | | | 7.4 | | | | 4.7 | | | | 2.7 | | | | 1.3 | | | | 2.1 | | | | - | | | | - | | | | 3.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total payables | | | 422.6 | | | | 360.9 | | | | 365.0 | | | | 425.3 | | | | 364.2 | | | | 356.4 | | | | 435.5 | | | | 490.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Long-term debt | | | 499.1 | | | | 499.1 | | | | 499.0 | | | | 499.0 | | | | 499.0 | | | | 498.9 | | | | 498.9 | | | | 498.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 6,822.2 | | | | 6,683.6 | | | | 6,644.2 | | | | 6,656.3 | | | | 6,304.5 | | | | 6,269.2 | | | | 6,412.3 | | | | 6,246.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ordinary shares | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Non-controlling interest | | | 0.2 | | | | (0.1) | | | | 0.1 | | | | 0.3 | | | | 0.4 | | | | 0.2 | | | | 0.1 | | | | 0.3 | |

Preference shares | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Additional paid-in capital | | | 1,516.7 | | | | 1,521.9 | | | | 1,523.2 | | | | 1,390.8 | | | | 1,385.0 | | | | 1,381.8 | | | | 1,388.2 | | | | 1,388.2 | |

Retained earnings(1) | | | 1,544.0 | | | | 1,562.6 | | | | 1,468.4 | | | | 1,404.1 | | | | 1,341.6 | | | | 1,345.8 | | | | 1,341.1 | | | | 1,348.1 | |

Accumulated other comprehensive income, net of taxes | | | 427.4 | | | | 469.7 | | | | 443.3 | | | | 415.6 | | | | 428.9 | | | | 407.7 | | | | 361.2 | | | | 301.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity | | | 3,488.4 | | | | 3,554.2 | | | | 3,435.1 | | | | 3,210.9 | | | | 3,156.0 | | | | 3,135.6 | | | | 3,090.7 | | | | 3,038.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | | $10,310.6 | | | | $10,237.8 | | | | $10,079.3 | | | | $9,867.2 | | | | $9,460.5 | | | | $9,404.8 | | | | $9,503.0 | | | | $9,284.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Book value per ordinary share | | | $42.12 | | | | $42.90 | | | | $41.41 | | | | $39.96 | | | | $39.66 | | | | $39.41 | | | | $38.64 | | | | $37.96 | |

Book value per diluted ordinary share | | | $40.65 | | | | $41.53 | | | | $40.01 | | | | $38.58 | | | | $38.21 | | | | $38.07 | | | | $37.24 | | | | $36.48 | |

See pages 7 and 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

6

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Earnings Per Share and Book Value Per Share |

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

(in US$ except for number of

shares) | | December 31, 2012 | | | December 31, 2011 (1) | | | December 31, 2012 | | | December 31, 2011 (1) | |

| | | | |

Basic earnings per ordinary share | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend | | | $(0.09 | ) | | | $0.09 | | | | $3.51 | | | | $(1.88 | ) |

Operating (loss)/income adjusted for preference share dividend | | | $(0.15 | ) | | | $(0.01 | ) | | | $3.50 | | | | $(1.32 | ) |

Diluted earnings per ordinary share | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend | | | $(0.09 | ) | | | $0.09 | | | | $3.38 | | | | $(1.88 | ) |

Operating (loss)/income adjusted for preference share dividend | | | $(0.15 | ) | | | $(0.01 | ) | | | $3.37 | | | | $(1.32 | ) |

| | | | |

Weighted average number of ordinary shares outstanding (in millions)(2) | | | 71.007 | | | | 70.615 | | | | 71.096 | | | | 70.665 | |

Weighted average number of ordinary shares outstanding and dilutive potential ordinary shares (in millions)(2) | | | 73.558 | | | | 73.258 | | | | 73.689 | | | | 70.655 | |

| | | | |

Book value per ordinary share | | | $42.12 | | | | $39.66 | | | | $42.12 | | | | $39.66 | |

Diluted book value per ordinary share | | | $40.65 | | | | $38.21 | | | | $40.65 | | | | $38.21 | |

| | | | |

Ordinary shares outstanding at end of the period (in millions) | | | 70.754 | | | | 70.656 | | | | 70.754 | | | | 70.656 | |

Ordinary shares outstanding and dilutive potential ordinary shares at end of the period (in millions) | | | 73.312 | | | | 73.339 | | | | 73.312 | | | | 73.339 | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) The basic and diluted number of ordinary shares for the twelve months ended December 31, 2011 is the same, as the inclusion of dilutive securities in a loss-making period would be anti-dilutive.

See pages 7 and 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Return On Average Equity |

| | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve Months Ended | |

(in US$ millions except for

percentages) | | December 31, 2012 | | | December 31, 2011 | | | December 31, 2012 | | | December 31, 2011 | |

| | | | |

Average shareholders’ equity(1) | | | $3,521.3 | | | | $3,135.0 | | | | $3,394.4 | | | | $3,130.1 | |

Average preference shares | | | (508.1) | | | | (353.6) | | | | (460.6) | | | | (353.6) | |

| | | | | | | | | | | | | | | | |

Average ordinary shareholders’ equity | | | $3,013.2 | | | | $2,781.4 | | | | $2,933.8 | | | | $2,776.5 | |

| | | | | | | | | | | | | | | | |

Return on average equity: | | | | | | | | | | | | | | | | |

Net (loss)/income adjusted for preference share dividend | | | (0.2%) | | | | 0.2% | | | | 8.5% | | | | (4.8%) | |

Operating (loss)/income adjusted for preference share dividend | | | (0.4%) | | | | – | | | | 8.5% | | | | (3.4%) | |

| | | | |

Annualized return on average equity: | | | | | | | | | | | | | | | | |

Net (loss)/income | | | (0.8%) | | | | 0.8% | | | | 8.5% | | | | (4.8%) | |

Operating (loss)/income | | | (1.6%) | | | | – | | | | 8.5% | | | | (3.4%) | |

| | | | |

Components of return on average equity: | | | | | | | | | | | | | | | | |

| | | | |

Return on average equity from underwriting activity(2) | | | (1.5%) | | | | (2.5%) | | | | 4.0% | | | | (10.8%) | |

Return on average equity from investment and other activity(3) | | | 1.0% | | | | 1.6% | | | | 4.9% | | | | 5.9% | |

Pre-tax operating (loss)/income return on average equity | | | (0.5%) | | | | (0.9%) | | | | 8.9% | | | | (4.8%) | |

Post-tax operating (loss)/income return on average equity(4) | | | (0.4%) | | | | – | | | | 8.5% | | | | (3.4%) | |

See page 23 for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures.

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) Calculated by using underwriting income.

(3) Calculated by using total other operating revenue and other income/(expense) adjusted for preference share dividends.

(4) Calculated by using operating income after-tax adjusted for preference share dividends.

7

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Underwriting Results by Operating Segment |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2012 | | | Three Months Ended December 31, 2011 | |

(in US$ millions except for

percentages) | | Reinsurance | | | Insurance | | | Total | | | Reinsurance | | | Insurance | | | Total | |

| | | | | | |

Gross written premiums | | | $194.4 | | | | $381.8 | | | | $576.2 | | | | $186.3 | | | | $272.4 | | | | $458.7 | |

Net written premiums | | | 193.7 | | | | 330.7 | | | | 524.4 | | | | 182.3 | | | | 248.9 | | | | 431.2 | |

Gross earned premiums | | | 317.2 | | | | 328.2 | | | | 645.4 | | | | 311.9 | | | | 245.7 | | | | 557.6 | |

Net earned premiums | | | 299.8 | | | | 258.7 | | | | 558.5 | | | | 288.7 | | | | 200.7 | | | | 489.4 | |

Losses and loss adjustment expenses | | | 248.9 | | | | 188.5 | | | | 437.4 | | | | 278.1 | | | | 116.4 | | | | 394.5 | |

Policy acquisition expenses | | | 41.0 | | | | 39.0 | | | | 80.0 | �� | | | 47.4 | | | | 38.1 | | | | 85.5 | |

General and administrative expenses(1) | | | 31.3 | | | | 41.9 | | | | 73.2 | | | | 33.2 | | | | 33.5 | | | | 66.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting (loss)/income | | | $(21.4) | | | | $(10.7) | | | | $(32.1) | | | | $(70.0) | | | | $12.7 | | | | $(57.3) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | | | | | | | | | 51.1 | | | | | | | | | | | | 54.2 | |

Net realized and unrealized investment gains (2) | | | | | | | | | | | 5.6 | | | | | | | | | | | | 6.0 | |

Corporate (expenses) | | | | | | | | | | | (12.9) | | | | | | | | | | | | (12.6) | |

Other (expenses)/income | | | | | | | | | | | (6.2) | | | | | | | | | | | | 3.6 | |

Interest (expense) | | | | | | | | | | | (7.7) | | | | | | | | | | | | (7.7) | |

Net realized and unrealized foreign exchange (losses)/gains(3) | | | | (0.4) | | | | | | | | | | | | 2.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) before income taxes | | | | | | | | | | | $(2.6) | | | | | | | | | | | | $(11.5) | |

Income tax recovery | | | | | | | | | | | 4.6 | | | | | | | | | | | | 23.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | $2.0 | | | | | | | | | | | | $12.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratios | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 83.0% | | | | 72.9% | | | | 78.3% | | | | 96.3% | | | | 58.0% | | | | 80.6% | |

Policy acquisition expense ratio | | | 13.7% | | | | 15.1% | | | | 14.3% | | | | 16.4% | | | | 19.0% | | | | 17.5% | |

General and administrative expense ratio (1,4) | | | 10.4% | | | | 16.2% | | | | 15.4% | | | | 11.5% | | | | 16.7% | | | | 16.2% | |

Expense ratio | | | 24.1% | | | | 31.3% | | | | 29.7% | | | | 27.9% | | | | 35.7% | | | | 33.7% | |

Combined ratio | | | 107.1% | | | | 104.2% | | | | 108.0% | | | | 124.2% | | | | 93.7% | | | | 114.3% | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) Includes the net realized and unrealized gains/(losses) from interest rate swaps.

(3) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(4) The total group general and administrative expense ratio includes the impact from corporate expenses.

8

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Underwriting Results by Operating Segment |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, 2012 | | | Twelve Months Ended December 31, 2011 | |

(in US$ millions except for

percentages) | | Reinsurance | | | Insurance | | | Total | | | Reinsurance | | | Insurance | | | Total | |

| | | | | | |

Gross written premiums | | | $1,227.9 | | | | $1,355.4 | | | | $2,583.3 | | | | $1,187.5 | | | | $1,020.3 | | | | $2,207.8 | |

Net written premiums | | | 1,156.9 | | | | 1,090.0 | | | | 2,246.9 | | | | 1,098.1 | | | | 831.0 | | | | 1,929.1 | |

Gross earned premiums | | | 1,208.0 | | | | 1,177.0 | | | | 2,385.0 | | | | 1,190.6 | | | | 950.5 | | | | 2,141.1 | |

Net earned premiums | | | 1,132.4 | | | | 951.1 | | | | 2,083.5 | | | | 1,108.3 | | | | 780.2 | | | | 1,888.5 | |

Losses and loss adjustment expenses | | | 635.3 | | | | 603.2 | | | | 1,238.5 | | | | 1,083.3 | | | | 472.7 | | | | 1,556.0 | |

Policy acquisition expenses | | | 207.8 | | | | 173.4 | | | | 381.2 | | | | 197.7 | | | | 149.3 | | | | 347.0 | |

General and administrative expenses(1) | | | 123.9 | | | | 168.2 | | | | 292.1 | | | | 111.8 | | | | 128.0 | | | | 239.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting income/(loss) | | | $165.4 | | | | $6.3 | | | | $171.7 | | | | $(284.5) | | | | $30.2 | | | | $(254.3) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | | | | | | | | | 204.9 | | | | | | | | | | | | 225.6 | |

Net realized and unrealized investment gains/(losses)(2) | | | | | | | | | | | 3.8 | | | | | | | | | | | | (34.1) | |

Corporate (expenses) | | | | | | | | | | | (53.0) | | | | | | | | | | | | (44.7) | |

Other income/(expenses) | | | | | | | | | | | 0.9 | | | | | | | | | | | | (6.8) | |

Interest (expense) | | | | | | | | | | | (30.9) | | | | | | | | | | | | (30.8) | |

Net realized and unrealized foreign exchange (losses)(3) | | | | | | | | | | | (2.0) | | | | | | | | | | | | (2.2) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income/(loss) before income tax | | | | | | | | | | | $295.4 | | | | | | | | | | | | $(147.3) | |

Income tax (expense)/recovery | | | | | | | | | | | (15.0) | | | | | | | | | | | | 37.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income/(loss) | | | | | | | | | | | $280.4 | | | | | | | | | | | | $(110.1) | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Ratios | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 56.1% | | | | 63.4% | | | | 59.4% | | | | 97.7% | | | | 60.6% | | | | 82.4% | |

Policy acquisition expense ratio | | | 18.4% | | | | 18.2% | | | | 18.3% | | | | 17.8% | | | | 19.1% | | | | 18.4% | |

General and administrative expense ratio (1,4) | | | 10.9% | | | | 17.7% | | | | 16.6% | | | | 10.1% | | | | 16.4% | | | | 15.1% | |

Expense ratio | | | 29.3% | | | | 35.9% | | | | 34.9% | | | | 27.9% | | | | 35.5% | | | | 33.5% | |

Combined ratio | | | 85.4% | | | | 99.3% | | | | 94.3% | | | | 125.6% | | | | 96.1% | | | | 115.9% | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

(2) Includes the net realized and unrealized gains/(losses) from interest rate swaps.

(3) Includes the net realized and unrealized gains/(losses) from foreign exchange contracts.

(4) The total group general and administrative expense ratio includes the impact from corporate expenses.

9

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Reinsurance Segment - Quarterly Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(in US$ millions except for

percentages) | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

| | | | | | | | |

Gross written premiums | | | $194.4 | | | | $259.5 | | | | $299.8 | | | | $474.2 | | | | $186.3 | | | | $276.1 | | | | $288.0 | | | | $437.1 | |

Net written premiums | | | 193.7 | | | | 256.9 | | | | 276.8 | | | | 429.5 | | | | 182.3 | | | | 270.5 | | | | 256.9 | | | | 388.4 | |

Gross earned premiums | | | 317.2 | | | | 299.8 | | | | 300.8 | | | | 290.2 | | | | 311.9 | | | | 303.2 | | | | 290.7 | | | | 284.8 | |

Net earned premiums | | | 299.8 | | | | 279.6 | | | | 282.0 | | | | 271.0 | | | | 288.7 | | | | 279.6 | | | | 268.0 | | | | 272.0 | |

Net losses and loss adjustment expenses | | | 248.9 | | | | 117.1 | | | | 133.7 | | | | 135.6 | | | | 278.1 | | | | 188.8 | | | | 206.3 | | | | 410.1 | |

Policy acquisition expenses | | | 41.0 | | | | 55.7 | | | | 59.3 | | | | 51.8 | | | | 47.4 | | | | 51.8 | | | | 49.1 | | | | 49.4 | |

General and administrative expenses(1) | | | 31.3 | | | | 33.6 | | | | 30.0 | | | | 29.0 | | | | 33.2 | | | | 26.7 | | | | 26.9 | | | | 25.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting (loss)/income | | | $(21.4) | | | | $73.2 | | | | $59.0 | | | | $54.6 | | | | $(70.0) | | | | $12.3 | | | | $(14.3) | | | | $(212.5) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 83.0% | | | | 41.9% | | | | 47.4% | | | | 50.0% | | | | 96.3% | | | | 67.5% | | | | 77.0% | | | | 150.8% | |

Policy acquisition expense ratio | | | 13.7% | | | | 19.9% | | | | 21.0% | | | | 19.1% | | | | 16.4% | | | | 18.5% | | | | 18.3% | | | | 18.2% | |

General and administrative expense ratio(1) | | | 10.4% | | | | 12.0% | | | | 10.6% | | | | 10.7% | | | | 11.5% | | | | 9.5% | | | | 10.0% | | | | 9.2% | |

Expense ratio | | | 24.1% | | | | 31.9% | | | | 31.6% | | | | 29.8% | | | | 27.9% | | | | 28.0% | | | | 28.3% | | | | 27.4% | |

Combined ratio | | | 107.1% | | | | 73.8% | | | | 79.0% | | | | 79.8% | | | | 124.2% | | | | 95.5% | | | | 105.3% | | | | 178.2% | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

10

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Insurance Segment - Quarterly Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions except for percentages) | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

Gross written premiums | | | $381.8 | | | | $298.9 | | | | $366.8 | | | | $307.9 | | | | $272.4 | | | | $219.5 | | | | $294.2 | | | | $234.2 | |

Net written premiums | | | 330.7 | | | | 250.2 | | | | 305.1 | | | | 204.0 | | | | 248.9 | | | | 192.1 | | | | 268.8 | | | | 121.2 | |

Gross earned premiums | | | 328.2 | | | | 302.0 | | | | 279.9 | | | | 266.9 | | | | 245.7 | | | | 246.7 | | | | 234.1 | | | | 224.0 | |

Net earned premiums | | | 258.7 | | | | 236.6 | | | | 231.4 | | | | 224.4 | | | | 200.7 | | | | 207.3 | | | | 191.8 | | | | 180.4 | |

Net losses and loss adjustment expenses | | | 188.5 | | | | 137.9 | | | | 128.4 | | | | 148.4 | | | | 116.4 | | | | 117.4 | | | | 120.1 | | | | 118.8 | |

Policy acquisition expenses | | | 39.0 | | | | 47.4 | | | | 42.7 | | | | 44.3 | | | | 38.1 | | | | 41.6 | | | | 37.6 | | | | 32.0 | |

General and administrative expenses(1) | | | 41.9 | | | | 42.8 | | | | 42.1 | | | | 41.4 | | | | 33.5 | | | | 34.9 | | | | 29.8 | | | | 29.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Underwriting (loss)/income | | | $(10.7) | | | | $8.5 | | | | $18.2 | | | | $(9.7) | | | | $12.7 | | | | $13.4 | | | | $4.3 | | | | $(0.2) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss ratio | | | 72.9% | | | | 58.3% | | | | 55.5% | | | | 66.1% | | | | 58.0% | | | | 56.6% | | | | 62.6% | | | | 65.9% | |

Policy acquisition expense ratio | | | 15.1% | | | | 20.0% | | | | 18.5% | | | | 19.7% | | | | 19.0% | | | | 20.1% | | | | 19.6% | | | | 17.7% | |

General and administrative expense ratio(1) | | | 16.2% | | | | 18.1% | | | | 18.2% | | | | 18.4% | | | | 16.7% | | | | 16.8% | | | | 15.5% | | | | 16.5% | |

Expense ratio | | | 31.3% | | | | 38.1% | | | | 36.7% | | | | 38.1% | | | | 35.7% | | | | 36.9% | | | | 35.1% | | | | 34.2% | |

Combined ratio | | | 104.2% | | | | 96.4% | | | | 92.2% | | | | 104.2% | | | | 93.7% | | | | 93.5% | | | | 97.7% | | | | 100.1% | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

11

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Written and Earned Premiums by Segment and Line of Business |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Gross Written Premiums | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

Reinsurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Catastrophe Reinsurance | | | $23.8 | | | | $42.7 | | | | $91.9 | | | | $152.9 | | | | $9.4 | | | | $53.5 | | | | $93.0 | | | | $151.0 | |

Other Property Reinsurance | | | 61.3 | | | | 92.6 | | | | 81.0 | | | | 78.5 | | | | 64.8 | | | | 78.6 | | | | 70.9 | | | | 64.8 | |

Casualty Reinsurance | | | 55.7 | | | | 76.3 | | | | 66.6 | | | | 138.9 | | | | 42.5 | | | | 83.4 | | | | 44.6 | | | | 138.6 | |

Specialty Reinsurance | | | 53.6 | | | | 47.9 | | | | 60.3 | | | | 103.9 | | | | 69.6 | | | | 60.6 | | | | 79.5 | | | | 82.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Reinsurance | | | $194.4 | | | | $259.5 | | | | $299.8 | | | | $474.2 | | | | $186.3 | | | | $276.1 | | | | $288.0 | | | | $437.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Insurance | | | $53.7 | | | | $51.5 | | | | $82.1 | | | | $52.4 | | | | $53.1 | | | | $37.0 | | | | $73.6 | | | | $38.6 | |

Casualty Insurance | | | 61.3 | | | | 49.9 | | | | 53.0 | | | | 28.6 | | | | 36.6 | | | | 38.1 | | | | 32.9 | | | | 19.6 | |

Marine, Energy and Transportation Insurance | | | 145.4 | | | | 102.2 | | | | 133.7 | | | | 149.6 | | | | 107.6 | | | | 70.5 | | | | 130.3 | | | | 123.8 | |

Financial and Professional Lines Insurance | | | 89.8 | | | | 63.8 | | | | 68.3 | | | | 49.7 | | | | 52.5 | | | | 68.4 | | | | 57.4 | | | | 52.2 | |

Programs | | | 31.6 | | | | 31.5 | | | | 29.7 | | | | 27.6 | | | | 22.6 | | | | 5.5 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | $381.8 | | | | $298.9 | | | | $366.8 | | | | $307.9 | | | | $272.4 | | | | $219.5 | | | | $294.2 | | | | $234.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Gross Written Premiums | | | $576.2 | | | | $558.4 | | | | $666.6 | | | | $782.1 | | | | $458.7 | | | | $495.6 | | | | $582.2 | | | | $671.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Written Premiums | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Reinsurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Catastrophe Reinsurance | | | $23.9 | | | | $43.7 | | | | $76.0 | | | | $123.5 | | | | $9.2 | | | | $53.5 | | | | $69.6 | | | | $116.1 | |

Other Property Reinsurance | | | 62.3 | | | | 89.2 | | | | 76.8 | | | | 64.8 | | | | 61.0 | | | | 73.8 | | | | 63.5 | | | | 53.3 | |

Casualty Reinsurance | | | 53.9 | | | | 76.1 | | | | 66.5 | | | | 137.3 | | | | 42.5 | | | | 82.6 | | | | 44.3 | | | | 136.4 | |

Specialty Reinsurance | | | 53.6 | | | | 47.9 | | | | 57.5 | | | | 103.9 | | | | 69.6 | | | | 60.6 | | | | 79.5 | | | | 82.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Reinsurance | | | $193.7 | | | | $256.9 | | | | $276.8 | | | | $429.5 | | | | $182.3 | | | | $270.5 | | | | $256.9 | | | | $388.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Insurance | | | $41.4 | | | | $37.9 | | | | $72.1 | | | | $21.0 | | | | $46.1 | | | | $26.9 | | | | $65.2 | | | | $1.6 | |

Casualty Insurance | | | 43.6 | | | | 35.5 | | | | 42.1 | | | | 20.0 | | | | 25.7 | | | | 31.2 | | | | 24.9 | | | | 10.5 | |

Marine, Energy and Transportation Insurance | | | 142.2 | | | | 93.1 | | | | 103.4 | | | | 140.7 | | | | 107.5 | | | | 59.8 | | | | 121.5 | | | | 98.8 | |

Financial and Professional Lines Insurance | | | 82.0 | | | | 57.9 | | | | 59.0 | | | | (3.1) | | | | 48.0 | | | | 69.9 | | | | 57.2 | | | | 10.3 | |

Programs | | | 21.5 | | | | 25.8 | | | | 28.5 | | | | 25.4 | | | | 21.6 | | | | 4.3 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | $330.7 | | | | $250.2 | | | | $305.1 | | | | $204.0 | | | | $248.9 | | | | $192.1 | | | | $268.8 | | | | $121.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Net Written Premiums | | | $524.4 | | | | $507.1 | | | | $581.9 | | | | $633.5 | | | | $431.2 | | | | $462.6 | | | | $525.7 | | | | $509.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Earned Premiums | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Reinsurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Catastrophe Reinsurance | | | $83.3 | | | | $62.3 | | | | $60.8 | | | | $62.9 | | | | $60.4 | | | | $52.1 | | | | $58.5 | | | | $71.6 | |

Other Property Reinsurance | | | 68.0 | | | | 72.7 | | | | 68.2 | | | | 68.2 | | | | 70.0 | | | | 64.4 | | | | 57.0 | | | | 60.1 | |

Casualty Reinsurance | | | 88.1 | | | | 82.3 | | | | 88.1 | | | | 66.9 | | | | 75.7 | | | | 95.3 | | | | 75.7 | | | | 82.4 | |

Specialty Reinsurance | | | 60.4 | | | | 62.3 | | | | 64.9 | | | | 73.0 | | | | 82.6 | | | | 67.8 | | | | 76.8 | | | | 57.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Reinsurance | | | $299.8 | | | | $279.6 | | | | $282.0 | | | | $271.0 | | | | $288.7 | | | | $279.6 | | | | $268.0 | | | | $272.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Insurance | | | $42.8 | | | | $36.9 | | | | $38.4 | | | | $38.4 | | | | $37.2 | | | | $27.9 | | | | $29.1 | | | | $28.2 | |

Casualty Insurance | | | 32.5 | | | | 29.6 | | | | 29.9 | | | | 26.3 | | | | 23.5 | | | | 25.4 | | | | 26.5 | | | | 25.4 | |

Marine, Energy and Transportation Insurance | | | 126.3 | | | | 108.2 | | | | 110.9 | | | | 102.6 | | | | 100.4 | | | | 96.6 | | | | 99.2 | | | | 93.3 | |

Financial and Professional Lines Insurance | | | 47.0 | | | | 45.4 | | | | 39.9 | | | | 51.5 | | | | 36.9 | | | | 57.3 | | | | 37.0 | | | | 33.5 | |

Programs | | | 10.1 | | | | 16.5 | | | | 12.3 | | | | 5.6 | | | | 2.7 | | | | 0.1 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | $258.7 | | | | $236.6 | | | | $231.4 | | | | $224.4 | | | | $200.7 | | | | $207.3 | | | | $191.8 | | | | $180.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Net Earned Premiums | | | $558.5 | | | | $516.2 | | | | $513.4 | | | | $495.4 | | | | $489.4 | | | | $486.9 | | | | $459.8 | | | | $452.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Statements of Changes in Shareholders’ Equity |

| | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (in US$ millions) | | 2012 | | | 2011 | |

Ordinary shares | | | | | | | | |

Beginning and end of period | | | $0.1 | | | | $0.1 | |

| | | | | | | | |

Preference shares | | | | | | | | |

Beginning and end of period | | | - | | | | - | |

| | | | | | | | |

Non-controlling interest | | | | | | | | |

Beginning of period | | | 0.4 | | | | 0.5 | |

Net (loss) for the period | | | (0.2) | | | | (0.1) | |

| | | | | | | | |

End of period | | | 0.2 | | | | 0.4 | |

| | | | | | | | |

Additional paid-in capital | | | | | | | | |

Beginning of period | | | 1,385.0 | | | | 1,388.3 | |

New shares issued | | | 22.1 | | | | 0.8 | |

Ordinary shares repurchased | | | (62.7) | | | | (8.1) | |

Preference shares issued | | | 154.5 | | | | - | |

Share-based compensation | | | 17.8 | | | | 4.0 | |

| | | | | | | | |

End of period | | | 1,516.7 | | | | 1,385.0 | |

| | | | | | | | |

Retained earnings | | | | | | | | |

Beginning of period(1) | | | 1,341.6 | | | | 1,517.0 | |

Net income/(loss) for the period (1) | | | 280.4 | | | | (110.1) | |

Dividends paid on ordinary and preference shares | | | (78.2) | | | | (65.4) | |

Proportion due to non-controlling interest | | | 0.2 | | | | 0.1 | |

| | | | | | | | |

End of period | | | 1,544.0 | | | | 1,341.6 | |

| | | | | | | | |

Accumulated other comprehensive income: | | | | | | | | |

Cumulative foreign currency translation adjustments, net of taxes: | | | | | | | | |

Beginning of period | | | 124.2 | | | | 113.4 | |

Change for the period | | | (11.5) | | | | 10.8 | |

| | | | | | | | |

End of period | | | 112.7 | | | | 124.2 | |

| | | | | | | | |

Loss on derivatives: | | | | | | | | |

Beginning of period | | | (0.7) | | | | (1.0) | |

Reclassification to interest payable | | | 0.2 | | | | 0.3 | |

| | | | | | | | |

End of period | | | (0.5) | | | | (0.7) | |

| | | | | | | | |

Unrealized appreciation/(depreciation) on investments, net of taxes: | | | | | | | | |

Beginning of period | | | 305.4 | | | | 211.9 | |

Change for the period | | | 9.8 | | | | 93.5 | |

| | | | | | | | |

End of period | | | 315.2 | | | | 305.4 | |

| | | | | | | | |

Total accumulated other comprehensive income | | | 427.4 | | | | 428.9 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Total shareholders’ equity | | | $3,488.4 | | | | $3,156.0 | |

| | | | | | | | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

13

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Statements of Comprehensive Income |

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | | Twelve Months Ended December 31, | |

| (in US$ millions) | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Net income/(loss)(1) | | | $2.0 | | | | $12.4 | | | | $280.4 | | | | $(110.1) | |

| | | | | | | | | | | | | | | | |

Other comprehensive income/(loss), net of taxes: | | | | | | | | | | | | | | | | |

Available for sale investments: | | | | | | | | | | | | | | | | |

Reclassification adjustment for net realized losses/(gains) included in net income | | | (3.1) | | | | (3.0) | | | | 2.0 | | | | (16.6) | |

Change in net unrealized gains and losses on available for sale securities held | | | (43.4) | | | | 13.6 | | | | 7.8 | | | | 110.1 | |

Loss on derivatives reclassified to interest expense | | | (0.1) | | | | 0.1 | | | | 0.2 | | | | 0.3 | |

Change in foreign currency translation adjustment | | | 4.3 | | | | 10.5 | | | | (11.5) | | | | 10.8 | |

| | | | | | | | | | | | | | | | |

Other comprehensive (loss)/income | | | (42.3) | | | | 21.2 | | | | (1.5) | | | | 104.6 | |

| | | | | | | | | | | | | | | | |

Comprehensive (loss)/income | | | $(40.3) | | | | $33.6 | | | | $278.9 | | | | $(5.5) | |

| | | | | | | | | | | | | | | | |

(1) In 2012, the Company adopted the provision of ASU 2010-26, “Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts.” Under the standard, the Company is required to expense the proportion of its general and administrative deferred acquisition costs not directly related to successful business acquisition. The application of this standard has resulted in a net $16.0 million write down of deferred acquisition costs through retained earnings brought forward and the restatement of our quarterly balance sheets from December 31, 2010 to December 31, 2011.

14

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Condensed Consolidated Statements of Cash Flows |

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | | Twelve Months Ended December 31, | |

| (in US$ millions) | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

Net cash from operating activities | | | $157.8 | | | | $65.1 | | | | $502.9 | | | | $343.5 | |

Net cash (used in)/from investing activities | | | (30.0) | | | | 157.9 | | | | (317.2) | | | | (210.5) | |

Net cash (used in)/from financing activities | | | (30.8) | | | | (16.2) | | | | 35.7 | | | | (72.7) | |

Effect of exchange rate movements on cash and cash equivalents | | | (7.6) | | | | (6.5) | | | | 3.1 | | | | (0.3) | |

| | | | | | | | | | | | | | | | |

Increase in cash and cash equivalents | | | 89.4 | | | | 200.3 | | | | 224.5 | | | | 60.0 | |

Cash at beginning of period | | | 1,374.2 | | | | 1,038.8 | | | | 1,239.1 | | | | 1,179.1 | |

| | | | | | | | | | | | | | | | |

Cash at end of period | | | $1,463.6 | | | | $1,239.1 | | | | $1,463.6 | | | | $1,239.1 | |

| | | | | | | | | | | | | | | | |

15

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Reserves for Losses and Loss Adjustment Expenses |

| | | | | | | | |

| (in US$ millions) | | For the

Twelve Months Ended

December 31, 2012 | | | For the

Twelve Months Ended

December 31, 2011 | |

Provision for losses and loss adjustment expenses at the start of the period | | | $4,525.2 | | | | $3,820.5 | |

Reinsurance recoverables | | | (426.6) | | | | (279.9) | |

| | | | | | | | |

Net loss and loss adjustment expenses at the start of the period | | | 4,098.6 | | | | 3,540.6 | |

| | | | | | | | |

Net loss and loss adjustment expenses disposed | | | (9.0) | | | | (20.6) | |

| | | | | | | | |

Provision for losses and loss adjustment expenses for claims incurred | | | | | | | | |

Current period | | | 1,375.9 | | | | 1,648.3 | |

Prior period release | | | (137.4) | | | | (92.3) | |

| | | | | | | | |

Total incurred | | | 1,238.5 | | | | 1,556.0 | |

| | | | | | | | |

Losses and loss adjustment expenses payments for claims incurred | | | (1,080.0) | | | | (982.2) | |

| | | | | | | | |

Foreign exchange losses | | | 32.6 | | | | 4.8 | |

| | | | | | | | |

Net loss and loss adjustment expenses reserves at the end of the period | | | 4,280.7 | | | | 4,098.6 | |

Reinsurance recoverables on unpaid losses at the end of the period | | | 499.0 | | | | 426.6 | |

| | | | | | | | |

Gross loss and loss adjustment expenses reserves at the end of the period | | | $4,779.7 | | | | $4,525.2 | |

| | | | | | | | |

16

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Reserves by Operating Segment |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | As At December 31, 2012 | | | As At December 31, 2011 | |

| (in US$ millions) | | Gross | | | Reinsurance

Recoverables | | | Net | | | Gross | | | Reinsurance

Recoverables | | | Net | |

Reinsurance | | | $2,983.7 | | | | $(186.2) | | | | $2,797.5 | | | | $2,953.5 | | | | $(183.5) | | | | $2,770.0 | |

Insurance | | | 1,796.0 | | | | (312.8) | | | | 1,483.2 | | | | 1,571.7 | | | | (243.1) | | | | 1,328.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total losses and loss adjustment expense reserves | | | $4,779.7 | | | | $(499.0) | | | | $4,280.7 | | | | $4,525.2 | | | | $(426.6) | | | | $4,098.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

17

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Prior Year Reserve Movements |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions) | | Three Months Ended December 31, 2012 | | | Three Months Ended December 31, 2011 | |

| | | Gross | | | Reinsurance

Recoverables | | | Net | | | Gross | | | Reinsurance

Recoverables | | | Net | |

Reinsurance | | | $38.6 | | | | $(0.8) | | | | $37.8 | | | | $13.5 | | | | $1.1 | | | | $14.6 | |

Insurance | | | 7.6 | | | | (3.4) | | | | 4.2 | | | | (1.1) | | | | 8.5 | | | | 7.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Release in reserves for prior years during the period | | | $46.2 | | | | $(4.2) | | | | $42.0 | | | | $12.4 | | | | $9.6 | | | | $22.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Twelve Months Ended December 31, 2012 | | | Twelve Months Ended December 31, 2011 | |

| | | Gross | | | Reinsurance

Recoverables | | | Net | | | Gross | | | Reinsurance

Recoverables | | | Net | |

Reinsurance | | | $97.9 | | | | $4.3 | | | | $102.2 | | | | $69.6 | | | | $2.7 | | | | $72.3 | |

Insurance | | | 30.9 | | | | 4.3 | | | | 35.2 | | | | (22.7) | | | | 42.7 | | | | 20.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Release in reserves for prior years during the period | | | $128.8 | | | | $8.6 | | | | $137.4 | | | | $46.9 | | | | $45.4 | | | | $92.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

18

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

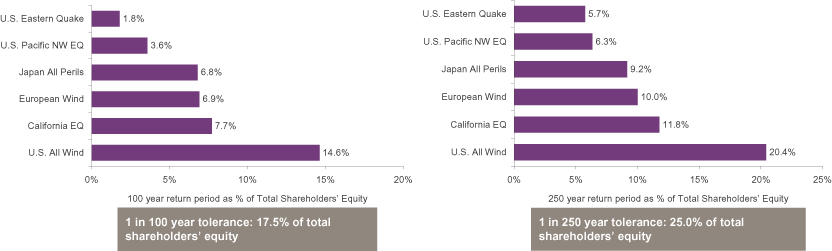

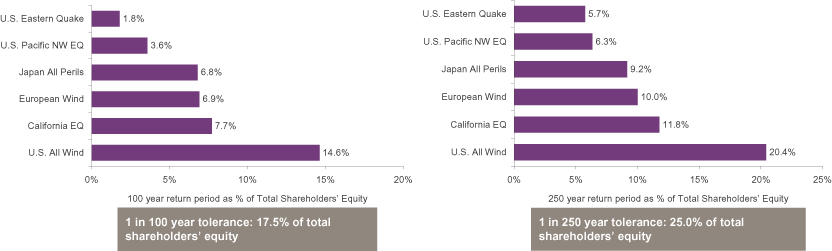

| | Worldwide Natural Catastrophe Exposures: Major Peril Zones |

Based on shareholders’ equity of $3,488.4 million at December 31, 2012. The estimates reflect Aspen’s own view of the modelled maximum losses (“PML’s”) at the return periods shown which include input from various third party vendor models and our own proprietary adjustments to these models. Catastrophe loss experience may materially differ from the modelled PML’s due to limitations in one or more of the models or uncertainties in the application of policy terms and limits.

19

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Consolidated Investment Portfolio |

(in US$ millions)

| | | | | | | | | | | | | | | | | | | | |

| | | Fair Market Value | |

| Marketable Securities - Available For Sale | | As At

December 31,

2012 | | | As At

September 30,

2012 | | | As At

June 30,

2012 | | | As At

March 31,

2012 | | | As At

December 31,

2011 | |

| | | | | |

U.S. government securities | | | $1,126.3 | | | | $1,068.6 | | | | $975.7 | | | | $897.8 | | | | $932.4 | |

U.S. agency securities | | | 308.6 | | | | 311.7 | | | | 309.2 | | | | 331.3 | | | | 295.5 | |

Municipal securities | | | 39.7 | | | | 39.9 | | | | 39.9 | | | | 38.7 | | | | 35.6 | |

Corporate securities | | | 2,038.5 | | | | 1,929.7 | | | | 1,896.7 | | | | 1,889.1 | | | | 1,846.5 | |

Foreign government securities | | | 641.0 | | | | 628.5 | | | | 596.3 | | | | 619.5 | | | | 660.4 | |

Asset-backed securities | | | 53.8 | | | | 63.8 | | | | 62.0 | | | | 63.4 | | | | 61.0 | |

FDIC Guaranteed | | | - | | | | 3.0 | | | | 3.0 | | | | 63.6 | | | | 72.9 | |

Bonds backed by foreign government | | | 101.1 | | | | 139.1 | | | | 119.8 | | | | 158.5 | | | | 167.8 | |

Mortgage-backed securities | | | 1,248.3 | | | | 1,363.5 | | | | 1,384.8 | | | | 1,382.7 | | | | 1,353.7 | |

| | | | | | | | | | | | | | | | | | | | |

Total fixed income maturities | | | 5,557.3 | | | | 5,547.8 | | | | 5,387.4 | | | | 5,444.6 | | | | 5,425.8 | |

Short-term investments | | | 431.5 | | | | 494.7 | | | | 489.6 | | | | 423.5 | | | | 298.2 | |

Equity securities | | | 200.1 | | | | 197.1 | | | | 187.4 | | | | 188.1 | | | | 179.5 | |

| | | | | | | | | | | | | | | | | | | | |

Total Available For Sale | | | $6,188.9 | | | | $6,239.6 | | | | $6,064.4 | | | | $6,056.2 | | | | $5,903.5 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Marketable Securities - Trading | | | | | | | | | | | | | | | | | | | | |

| | | | | |

U.S. government securities | | | $9.4 | | | | $38.8 | | | | $38.8 | | | | $37.4 | | | | $32.3 | |

U.S. agency securities | | | 0.2 | | | | 2.0 | | | | 1.9 | | | | 1.8 | | | | 1.8 | |

Municipal securities | | | 2.9 | | | | 2.9 | | | | 2.9 | | | | 2.9 | | | | 2.9 | |

Corporate securities | | | 414.4 | | | | 368.2 | | | | 337.7 | | | | 341.9 | | | | 349.3 | |

Foreign government securities | | | 26.3 | | | | 21.8 | | | | 21.9 | | | | 12.9 | | | | 7.4 | |

Mortgage-backed securities | | | - | | | | 0.3 | | | | - | | | | - | | | | - | |

Asset-backed securities | | | 2.9 | | | | 1.3 | | | | 0.6 | | | | 0.6 | | | | 0.7 | |

| | | | | | | | | | | | | | | | | | | | |

Total fixed income maturities | | | 456.1 | | | | 435.3 | | | | 403.8 | | | | 397.5 | | | | 394.4 | |

Short-term investments | | | 2.4 | | | | 10.6 | | | | 14.0 | | | | 10.3 | | | | 4.1 | |

| | | | | | | | | | | | | | | | | | | | |

Total Trading | | | $458.5 | | | | $445.9 | | | | $417.8 | | | | $407.8 | | | | $398.5 | |

| | | | | | | | | | | | | | | | | | | | |

Other investments | | | $45.0 | | | | $34.8 | | | | $33.1 | | | | $33.1 | | | | $33.1 | |

| | | | | | | | | | | | | | | | | | | | |

Cash | | | 1,463.6 | | | | 1,374.2 | | | | 1,309.0 | | | | 1,173.3 | | | | 1,239.1 | |

Accrued interest | | | 47.7 | | | | 49.7 | | | | 48.8 | | | | 48.7 | | | | 49.6 | |

| | | | | | | | | | | | | | | | | | | | |

Total Cash and Accrued Interest | | | $1,511.3 | | | | $1,423.9 | | | | $1,357.8 | | | | $1,222.0 | | | | $1,288.7 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Cash and Investments | | | $8,203.7 | | | | $8,144.2 | | | | $7,873.1 | | | | $7,719.1 | | | | $7,623.8 | |

| | | | | | | | | | | | | | | | | | | | |

20

| | |

| | ASPEN INSURANCE HOLDINGS LIMITED |

| |

| | Investment Analysis |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in US$ millions except for percentages) | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

| | | | | | | | |

Net investment income from fixed income investments and cash | | | $49.8 | | | | $46.9 | | | | $51.0 | | | | $51.0 | | | | $52.9 | | | | $55.6 | | | | $55.6 | | | | $55.3 | |

Net investment income from equity securities | | | 1.3 | | | | 1.7 | | | | 1.8 | | | | 1.4 | | | | 1.3 | | | | 1.7 | | | | 3.0 | | | | 0.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 51.1 | | | | 48.6 | | | | 52.8 | | | | 52.4 | | | | 54.2 | | | | 57.3 | | | | 58.6 | | | | 55.5 | |

| | | | | | | | |

Net realized and unrealized investment gains excluding the interest rate swaps | | | 5.7 | | | | 12.9 | | | | 2.2 | | | | 9.0 | | | | 8.9 | | | | 3.2 | | | | 9.8 | | | | 8.4 | |

Net realized investment (losses)/gains from the interest rate swaps | | | (0.1 | ) | | | (8.1 | ) | | | (11.3 | ) | | | (3.5 | ) | | | (2.9 | ) | | | (36.1 | ) | | | (25.5 | ) | | | 0.1 | |

Other-than-temporary impairment charges | | | - | | | | (2.1 | ) | | | (0.9 | ) | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net realized and unrealized investment gains/(losses) | | | 5.6 | | | | 2.7 | | | | (10.0 | ) | | | 5.5 | | | | 6.0 | | | | (32.9 | ) | | | (15.7 | ) | | | 8.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Change in unrealized (losses)/gains on available for sale investments (gross of tax) | | | (37.9 | ) | | | 32.2 | | | | 36.6 | | | | (11.7 | ) | | | 6.1 | | | | 71.6 | | | | 52.1 | | | | (33.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |