FILED BY ENDURANCE SPECIALTY HOLDINGS LTD.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14a-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: ASPEN INSURANCE HOLDINGS LIMITED

SEC REGISTRATION STATEMENT FILE NO. 333-196596

Endurance

Endurance and Aspen:

Creating a Global Leader in Specialty Insurance and Reinsurance

July 2014

Forward looking statements & other information

Cautionary Note Regarding Forward Looking Statements

Some of the statements in this presentation may include, and Endurance may make related oral, forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. These statements may also include assumptions about our proposed acquisition of Aspen (including its benefits, results, effects and timing). Statements which include the words “should,” “would,” “expect,” “intend,” “plan,” “believe,” “project,” “target,” “anticipate,” “seek,” “will,” “deliver,” and similar statements of a future or forward-looking nature identify forward-looking statements in this presentation for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995, except to the extent made in connection with Endurance’s exchange offer. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, but are not limited to, the effects of competitors’ pricing policies, greater frequency or severity of claims and loss activity, changes in market conditions in the agriculture insurance industry, termination of or changes in the terms of the U.S. multiple peril crop insurance program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance or retrocessional coverage, our inability to renew business previously underwritten or acquired, our inability to maintain our applicable financial strength ratings, our inability to effectively integrate acquired operations, uncertainties in our reserving process, changes to our tax status, changes in insurance regulations, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker counterparties, assessments for high risk or otherwise uninsured individuals, possible terrorism or the outbreak of war, a loss of key personnel, political conditions, changes in accounting policies, our investment performance, the valuation of our invested assets, a breach of our investment guidelines, the unavailability of capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention in the insurance and reinsurance industry, illiquidity in the credit markets, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014. Additional risks and uncertainties related to the proposed transaction include, among others, uncertainty as to whether Endurance will be able to enter into or consummate the transaction on the terms set forth in the proposal, the risk that our or Aspen’s shareholders do not approve the transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction, uncertainties as to the timing of the transaction, uncertainty as to whether Aspen shareholders tender into the exchange offer, uncertainty as to the actual premium of the Endurance share component of the proposal that will be realized by Aspen shareholders in connection with the transaction, competitive responses to the transaction, the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated, the risk that the conditions to the closing of the transaction are not satisfied, costs and difficulties related to the integration of Aspen’s businesses and operations with Endurance’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the transaction, unexpected costs, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation publicly to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in our most recent reports on Form 10-K and Form 10-Q and the risk factors included in Aspen’s most recent reports on Form 10-K and Form 10-Q and other documents of Endurance and Aspen on file with the U.S. Securities and Exchange Commission (the “SEC”). Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Endurance will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations.

Additional Information and Where to Find It

This presentation relates to the offer commenced by Endurance to exchange each issued and outstanding common share of Aspen (together with associated preferred share purchase rights) for $49.50 in cash, 0.9197 Endurance common shares, or a combination of cash and Endurance common shares, subject to a customary proration mechanism. This presentation is for informational purposes only and does not constitute an offer to exchange, or a solicitation of an offer to exchange, Aspen common shares, nor is it a substitute for the Tender Offer Statement on Schedule TO or the preliminary Prospectus/Offer to Exchange included in the Registration Statement on Form S-4

(including the Letter of Transmittal and Election and related documents and as amended from time to time, the “Exchange Offer Documents”) that Endurance has filed with the SEC. The Endurance exchange offer will be made only through the Exchange Offer Documents.

This presentation is not a substitute for any other relevant documents that Endurance may file with the SEC or any other documents that Endurance may send to its or Aspen’s shareholders in connection with the proposed transaction. Endurance has sent to Aspen shareholders a solicitation statement with respect to the solicitation of (i) written requisitions that the board of directors of Aspen convene a special general meeting of Aspen’s shareholders to vote on an increase in the size of Aspen’s board of directors from 12 to 19 directors and (ii) Aspen shareholder support for the proposal of a scheme of arrangement by Endurance which will entail the holding of a court-ordered meeting of Aspen shareholders at which Aspen’s shareholders would vote to approve a scheme of arrangement under Bermuda law pursuant to which Endurance would acquire all of Aspen’s outstanding common shares on financial terms no less favorable than those contained in its acquisition proposal announced on June 2, 2014 (the “Solicitation Statement”).

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE EXCHANGE OFFER DOCUMENTS AND THE SOLICITATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ENDURANCE HAS FILED OR MAY FILE WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. All such documents, when filed, are available free of charge at the SEC’s website (www.sec.gov) or by directing a request to Endurance, +1 441 278 0988 (phone), investorrelations@endurance.bm (email).

Participants in the Solicitation

Endurance and its directors and certain of its executive officers and employees may be deemed to be participants in any solicitation of shareholders in connection with the proposed transaction. Information about Endurance’s directors, executive officers and employees who may be deemed to be participants in the solicitation, including a description of their direct and indirect interests, by security holdings or otherwise, is set forth in the Solicitation

Statement and Endurance’s proxy statement, dated April 9, 2014, for its 2014 annual general meeting of shareholders.

2 Endurance

Forward looking statements & other information (continued)

Regulation G Disclaimer

In this presentation, management has included and discussed certain non-GAAP measures, including return on equity, combined ratio, net premiums written and diluted book value per share. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the proposed transaction in a manner that allows for a more complete understanding. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP measures and reconciliations, please review the Investor Financial Supplement on our web site at www.endurance.bm.

Third Party-Sourced Information

Certain information included in this presentation has been sourced from third parties. Endurance does not make any representations regarding the accuracy, completeness or timeliness of such third party information. Permission to cite such information has neither been sought nor obtained.

All information in this presentation regarding Aspen, including its businesses, operations and financial results, was obtained from public sources. While Endurance has no knowledge that any such information is inaccurate or incomplete, Endurance has not had the opportunity to verify any of that information.

Additional Information

All references in this presentation to “$” refer to United States dollars. The contents of any website referenced in this presentation are not incorporated by reference herein.

3 Endurance

Table of Contents

Executive Summary

Strategic Rationale and Compelling Value of Endurance’s Proposal

Endurance’s Actions to Expedite the Transaction

Appendix

4 Endurance

Endurance

Executive Summary

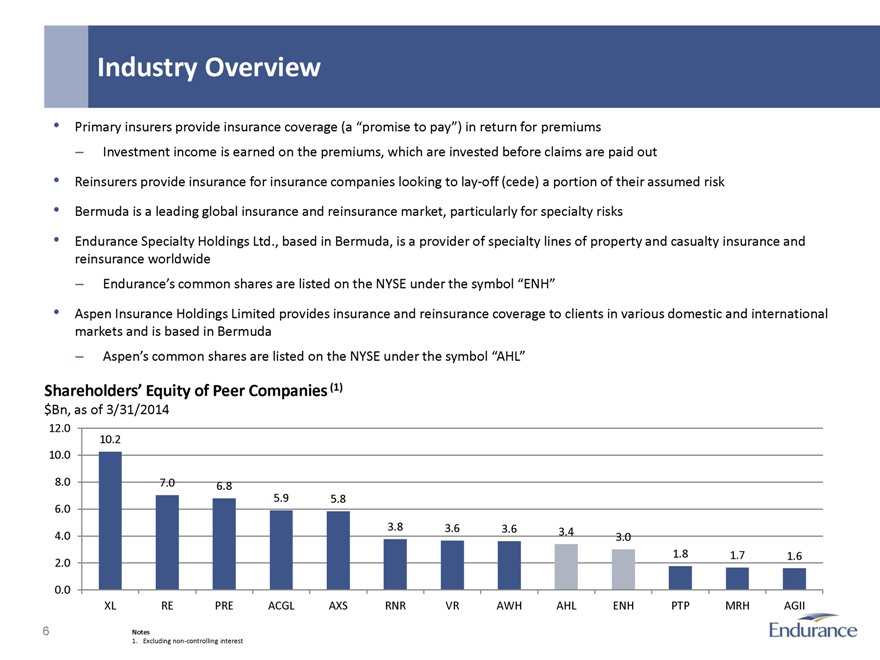

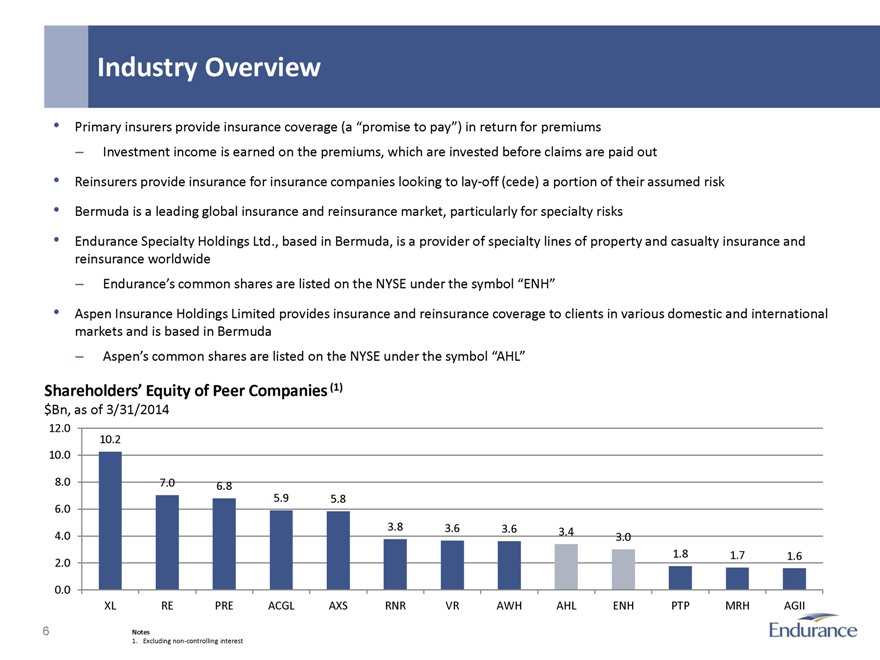

Industry Overview

Primary insurers provide insurance coverage (a “promise to pay”) in return for premiums

Investment income is earned on the premiums, which are invested before claims are paid out

Reinsurers provide insurance for insurance companies looking to lay-off (cede) a portion of their assumed risk

Bermuda is a leading global insurance and reinsurance market, particularly for specialty risks

Endurance Specialty Holdings Ltd., based in Bermuda, is a provider of specialty lines of property and casualty insurance and reinsurance worldwide

Endurance’s common shares are listed on the NYSE under the symbol “ENH”

Aspen Insurance Holdings Limited provides insurance and reinsurance coverage to clients in various domestic and international markets and is based in Bermuda

Aspen’s common shares are listed on the NYSE under the symbol “AHL”

Shareholders’ Equity of Peer Companies (1)

$Bn, as of 3/31/2014

12.0

10.2

10.0

8.0

6.0

4.0

2.0

0.0

XL

7.0 RE

6.8 PRE

5.9 ACGL

5.8 AXS

3.8 RNR

3.6 VR

3.6 AWH

3.4 AHL

3.0 ENH

1.8 PTP

1.7 MRH

1.6 AGII

Notes

1. Excluding non-controlling interest

6 Endurance

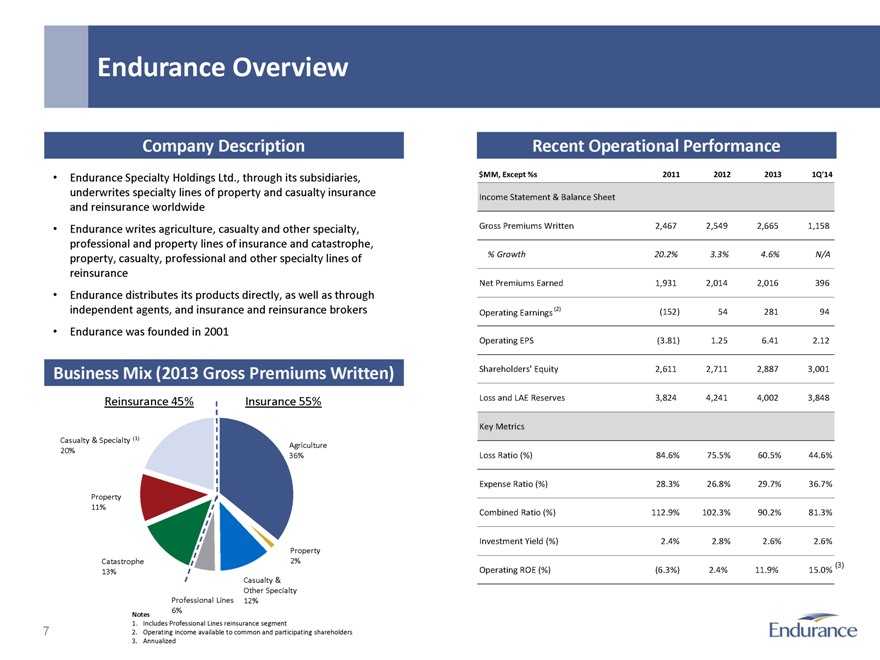

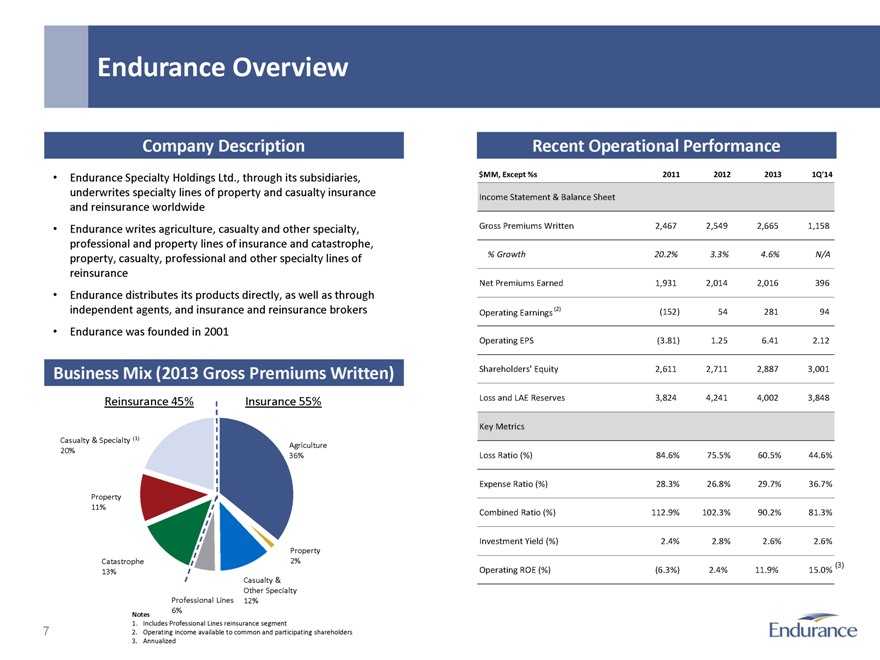

Endurance Overview

Company Description

Endurance Specialty Holdings Ltd., through its subsidiaries, underwrites specialty lines of property and casualty insurance and reinsurance worldwide

Endurance writes agriculture, casualty and other specialty, professional and property lines of insurance and catastrophe, property, casualty, professional and other specialty lines of reinsurance

Endurance distributes its products directly, as well as through independent agents, and insurance and reinsurance brokers

Endurance was founded in 2001

Business Mix (2013 Gross Premiums Written) Reinsurance 45% Casualty & Specialty (1) 20% Property 11% Catastrophe 13% Insurance 55% Agriculture 36% Property 2% Casualty & Other Specialty 12% Professional Lines 6%

Notes

1. Includes Professional Lines reinsurance segment

2. Operating income available to common and participating shareholders

3. Annualized

Recent Operational Performance

$MM, Except %s

Income Statement & Balance Sheet

Gross Premiums Written

% Growth

Net Premiums Earned

Operating Earnings (2)

Operating EPS

Shareholders’ Equity

Loss and LAE Reserves

Key Metrics

Loss Ratio (%)

Expense Ratio (%)

Combined Ratio (%)

Investment Yield (%)

Operating ROE (%)

2011 2,467 20.2% 1,931 (152) (3.81) 2,611 3,824 84.6% 28.3% 112.9% 2.4% (6.3%)

2012 2,549 3.3% 2,014 54 1.25 2,711 4,241 75.5% 26.8% 102.3% 2.8% 2.4%

2013 2,665 4.6% 2,016 281 6.41 2,887 4,002 60.5% 29.7% 90.2% 2.6% 11.9%

1Q’14 1,158 N/A 396 94 2.12 3,001 3,848 44.6% 36.7% 81.3% 2.6% 15.0%(3)

7 Endurance

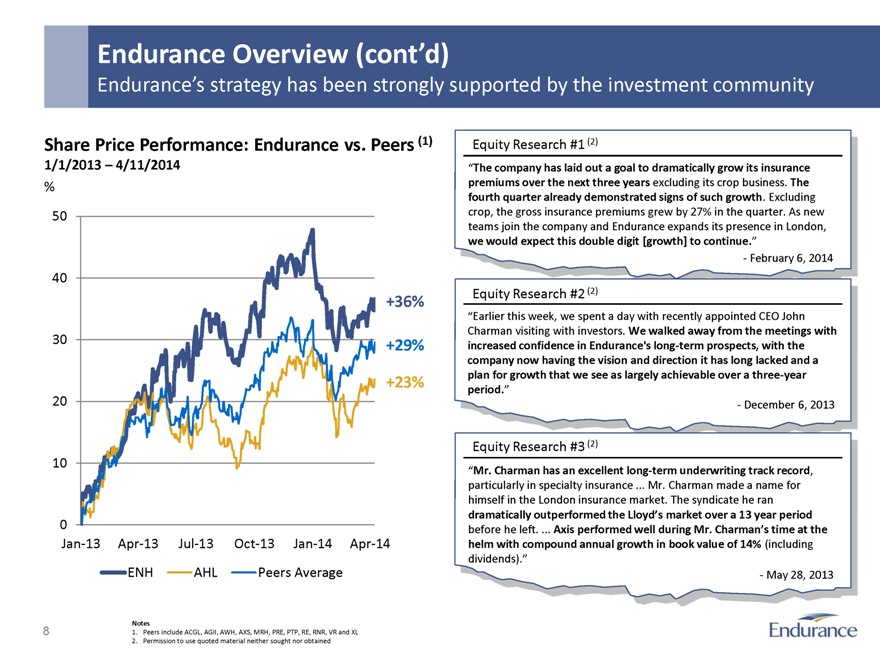

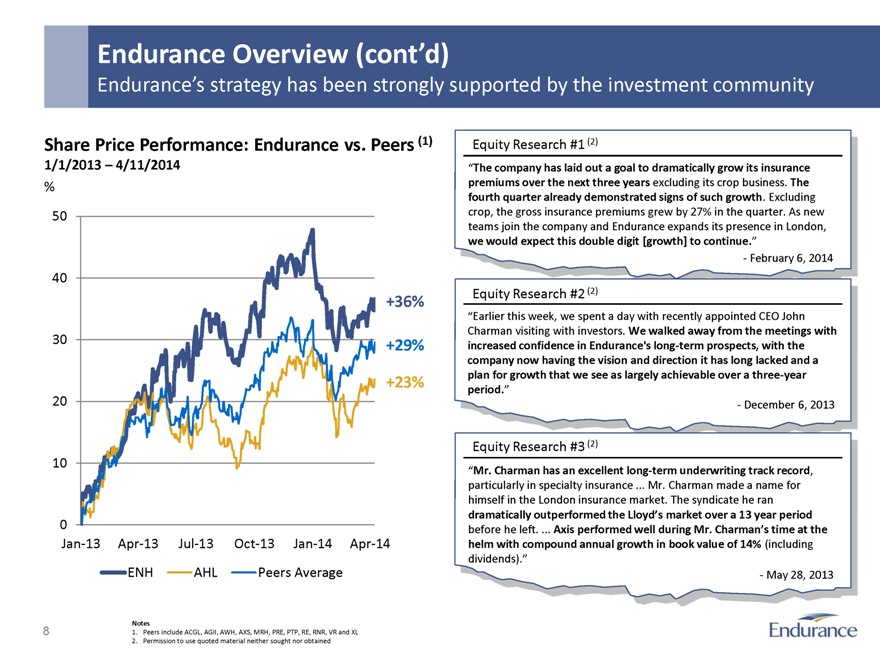

Endurance Overview (cont’d)

Endurance’s strategy has been strongly supported by the investment community

Share Price Performance: Endurance vs. Peers (1)

1/1/2013 – 4/11/2014

% 50 40 30 20 10 0

+36% +29% +23%

Jan-13 Apr-13 Jul-13

Oct-13 Jan-14 Apr-14

ENH AHL Peers Average

Notes

1. Peers include ACGL, AGII, AWH, AXS, MRH, PRE, PTP, RE, RNR, VR and XL

2. Permission to use quoted material neither sought nor obtained

Equity Research #1 (2)

“The company has laid out a goal to dramatically grow its insurance premiums over the next three years excluding its crop business. The fourth quarter already demonstrated signs of such growth. Excluding crop, the gross insurance premiums grew by 27% in the quarter. As new teams join the company and Endurance expands its presence in London, we would expect this double digit [growth] to continue.”

- February 6, 2014

Equity Research #2 (2)

“Earlier this week, we spent a day with recently appointed CEO John Charman visiting with investors. We walked away from the meetings with increased confidence in Endurance’s long-term prospects, with the company now having the vision and direction it has long lacked and a plan for growth that we see as largely achievable over a three-year period.”

- December 6, 2013

Equity Research #3 (2)

“Mr. Charman has an excellent long-term underwriting track record, particularly in specialty insurance … Mr. Charman made a name for himself in the London insurance market. The syndicate he ran dramatically outperformed the Lloyd’s market over a 13 year period before he left. … Axis performed well during Mr. Charman’s time at the helm with compound annual growth in book value of 14% (including dividends).”

- May 28, 2013

8 Endurance

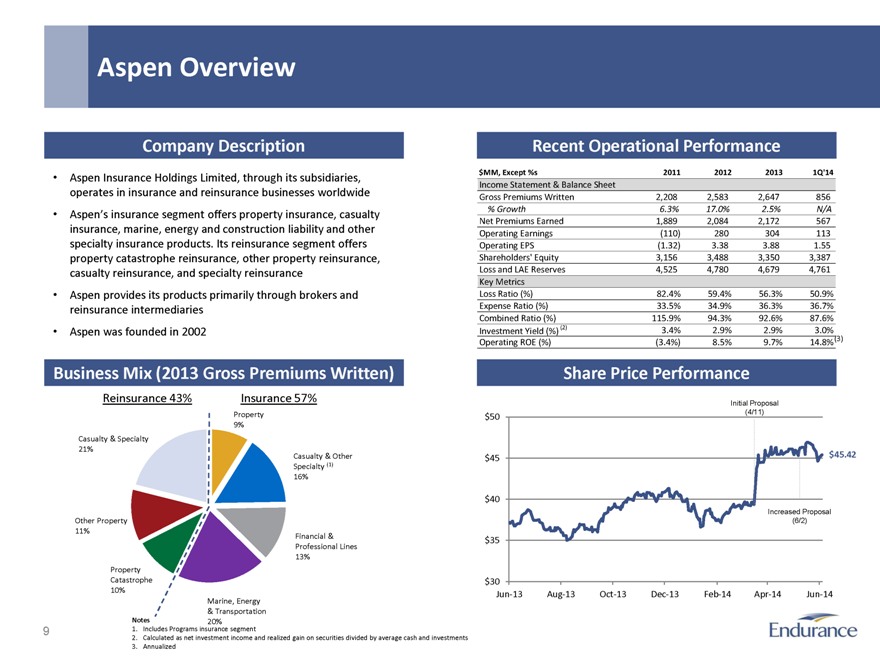

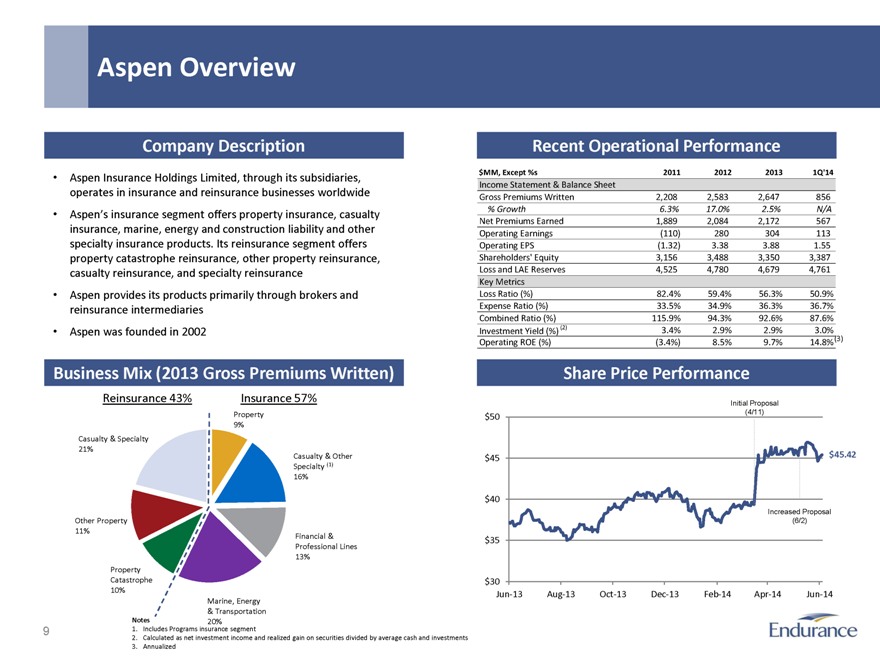

Aspen Overview

Company Description

Aspen Insurance Holdings Limited, through its subsidiaries, operates in insurance and reinsurance businesses worldwide

Aspen’s insurance segment offers property insurance, casualty insurance, marine, energy and construction liability and other specialty insurance products. Its reinsurance segment offers property catastrophe reinsurance, other property reinsurance, casualty reinsurance, and specialty reinsurance

Aspen provides its products primarily through brokers and reinsurance intermediaries

Aspen was founded in 2002

Business Mix (2013 Gross Premiums Written)

Reinsurance 43%

Casualty & Specialty 21%

Other Property 11%

Property

Catastrophe 10%

Insurance 57%

Property 9%

Casualty & Other

Specialty (1)

16%

Financial & Professional Lines

13%

Marine, Energy & Transportation

20%

Notes

1. Includes Programs insurance segment

2. Calculated as net investment income and realized gain on securities divided by average cash and investments

3. Annualized

Recent Operational Performance

$MM, Except %s

Income Statement & Balance Sheet

Gross Premiums Written

% Growth

Net Premiums Earned

Operating Earnings

Operating EPS

Shareholders’ Equity

Loss and LAE Reserves

Key Metrics

Loss Ratio (%)

Expense Ratio (%)

Combined Ratio (%)

Investment Yield (%) (2)

Operating ROE (%)

2011 2,208 6.3% 1,889 (110) (1.32) 3,156 4,525 82.4% 33.5% 115.9% 3.4% (3.4%)

2012 2,583 17.0% 2,084 280 3.38 3,488 4,780 59.4% 34.9% 94.3% 2.9% 8.5%

2013 2,647 2.5% 2,172 304 3.88 3,350 4,679 56.3% 36.3% 92.6% 2.9% 9.7%

1Q’14 856 N/A 567 113 1.55 3,387 4,761 50.9% 36.7% 87.6% 3.0% 14.8%(3)

Share Price Performance

Initial Proposal (4/11)

$45.42

Increased Proposal (6/2)

$50

$45

$40

$35

$30

Jun-13 Apr-14 Jun-14 Aug-13 Oct-13 Dec-13 Feb-14

9 Endurance

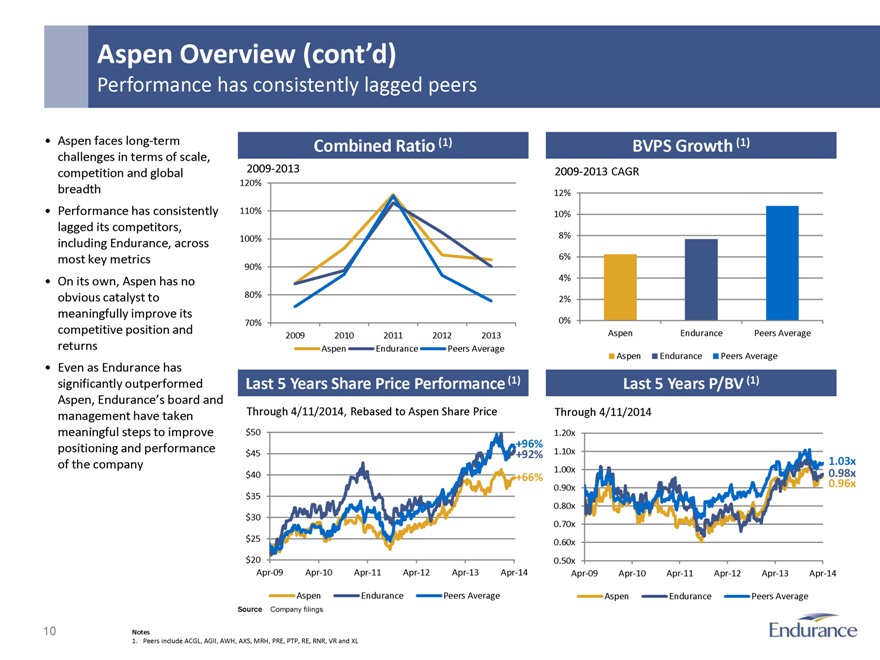

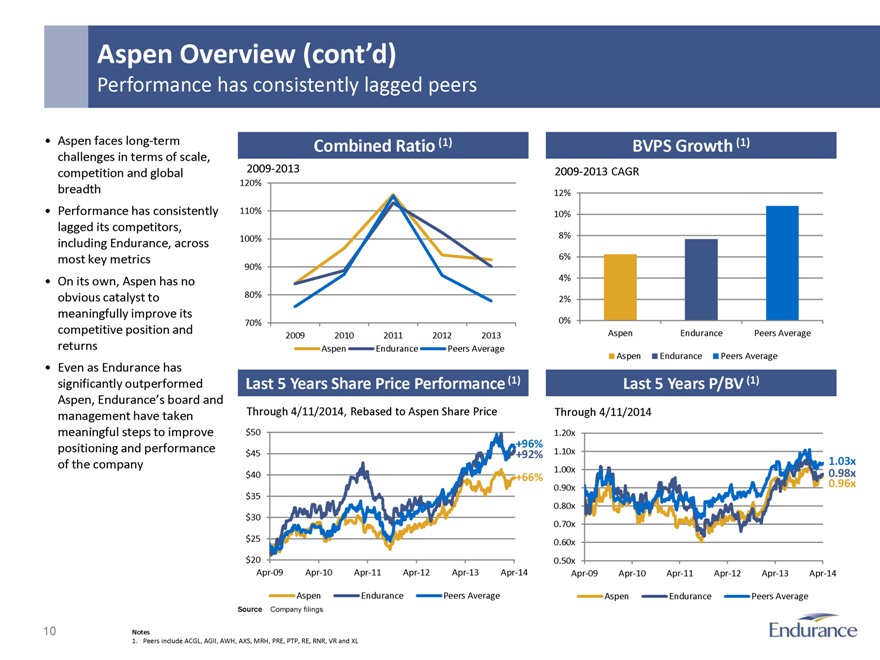

Aspen Overview (cont’d)

Performance has consistently lagged peers

Aspen faces long-term challenges in terms of scale, competition and global breadth

Performance has consistently lagged its competitors, including Endurance, across most key metrics

On its own, Aspen has no obvious catalyst to meaningfully improve its competitive position and returns

Even as Endurance has significantly outperformed

Aspen, Endurance’s board and management have taken meaningful steps to improve positioning and performance of the company

Combined Ratio (1)

2009-2013

120% 110% 100% 90% 80% 70%

2009 2010 2011 2012 2013

Aspen Endurance Peers Average

BVPS Growth (1)

2009-2013 CAGR

12% 10% 8% 6% 4% 2% 0%

Aspen Endurance Peers Average

Aspen Endurance Peers Average

Last 5 Years Share Price Performance (1)

Through 4/11/2014, Rebased to Aspen Share Price

$50 $45 $40 $35 $30 $25 $20

Apr-09 Apr-10 Apr-11 Apr-12 Apr-13 Apr-14

+96% +92% +66%

Aspen Endurance Peers Average

Source Company filings

Last 5 Years P/BV (1)

Through 4/11/2014

1.20x 1.10x 1.00x 0.90x 0.80x 0.70x 0.60x 0.50x

Apr-09 Apr-10 Apr-11 Apr-12 Apr-13 Apr-14

1.03x 0.98x 0.96x

Aspen Endurance Peers Average

Notes

1. Peers include ACGL, AGII, AWH, AXS, MRH, PRE, PTP, RE, RNR, VR and XL

10 Endurance

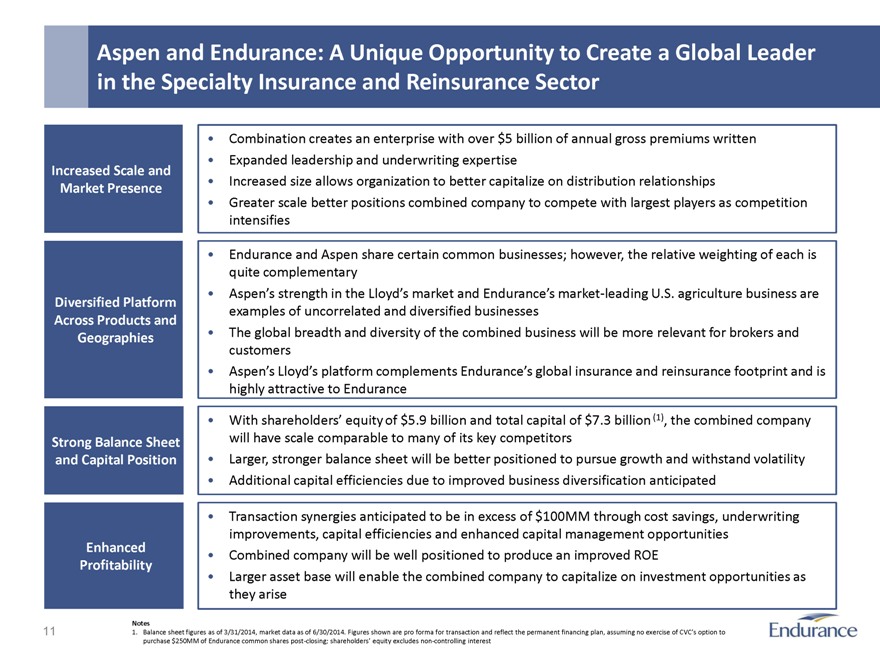

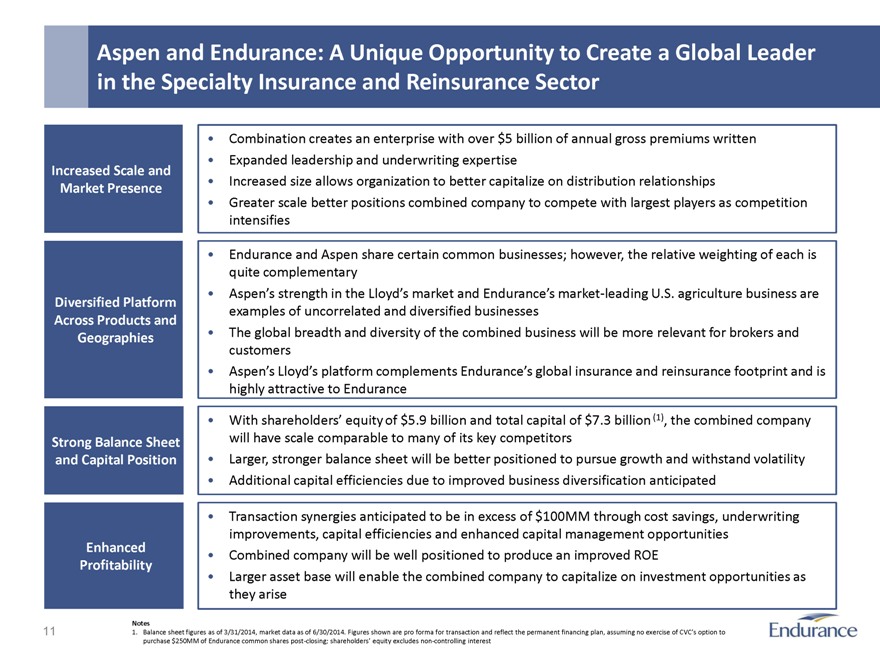

Aspen and Endurance: A Unique Opportunity to Create a Global Leader in the Specialty Insurance and Reinsurance Sector

Increased Scale and Market Presence

Diversified Platform Across Products and Geographies

Strong Balance Sheet and Capital Position

Enhanced Profitability

Combination creates an enterprise with over $5 billion of annual gross premiums written

Expanded leadership and underwriting expertise

Increased size allows organization to better capitalize on distribution relationships

Greater scale better positions combined company to compete with largest players as competition intensifies

Endurance and Aspen share certain common businesses; however, the relative weighting of each is quite complementary

Aspen’s strength in the Lloyd’s market and Endurance’s market-leading U.S. agriculture business are examples of uncorrelated and diversified businesses

The global breadth and diversity of the combined business will be more relevant for brokers and customers

Aspen’s Lloyd’s platform complements Endurance’s global insurance and reinsurance footprint and is highly attractive to Endurance

With shareholders’ equity of $5.9 billion and total capital of $7.3 billion (1), the combined company will have scale comparable to many of its key competitors

Larger, stronger balance sheet will be better positioned to pursue growth and withstand volatility

Additional capital efficiencies due to improved business diversification anticipated

Transaction synergies anticipated to be in excess of $100MM through cost savings, underwriting improvements, capital efficiencies and enhanced capital management opportunities

Combined company will be well positioned to produce an improved ROE

Larger asset base will enable the combined company to capitalize on investment opportunities as they arise

Notes

1. Balance sheet figures as of 3/31/2014, market data as of 6/30/2014. Figures shown are pro forma for transaction and reflect the permanent financing plan, assuming no exercise of CVC’s option to purchase $250MM of Endurance common shares post-closing; shareholders’ equity excludes non-controlling interest

11 Endurance

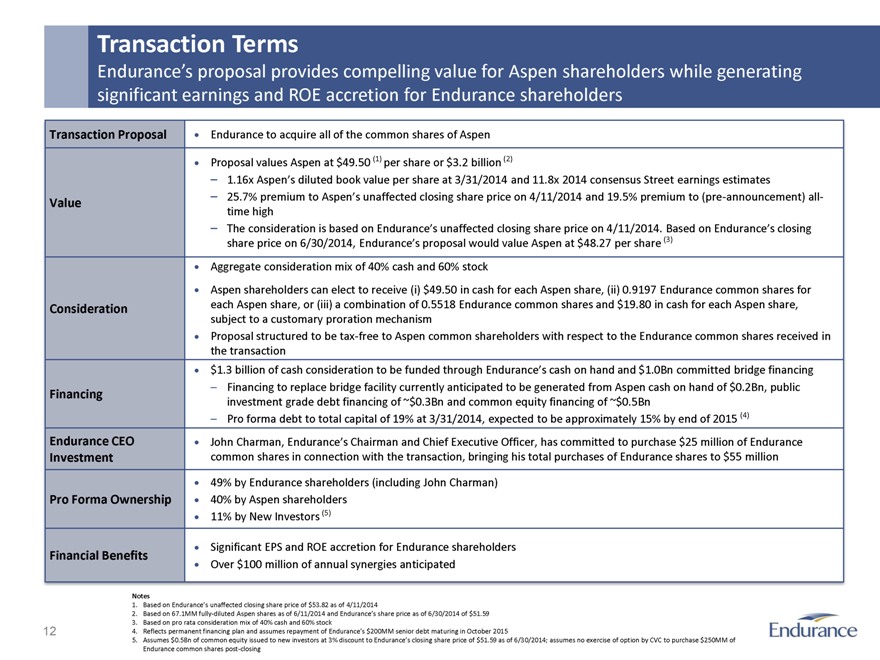

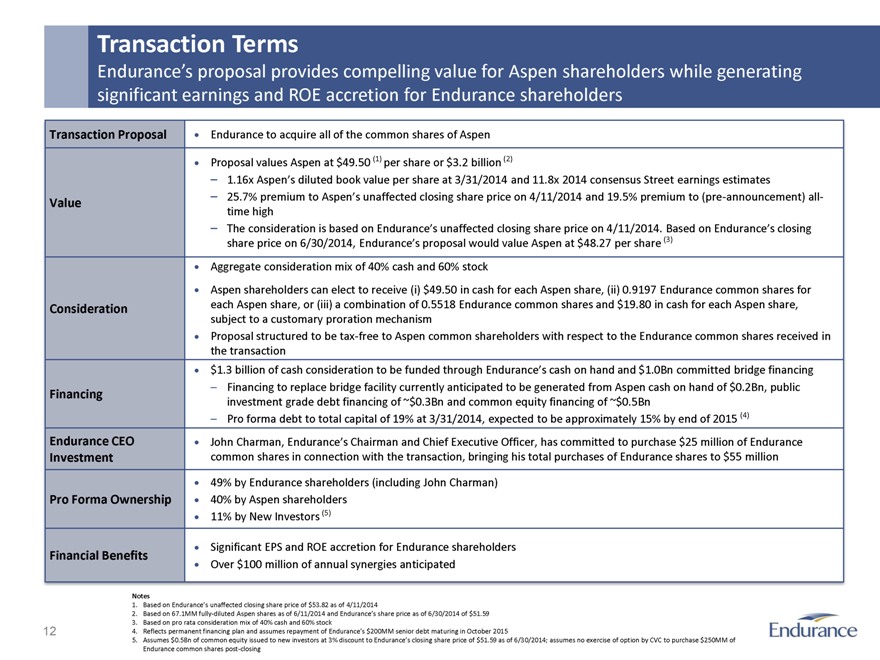

Transaction Terms

Endurance’s proposal provides compelling value for Aspen shareholders while generating significant earnings and ROE accretion for Endurance shareholders

Transaction Proposal

Value

Consideration

Financing

Endurance CEO Investment

Pro Forma Ownership

Financial Benefits

Endurance to acquire all of the common shares of Aspen

Proposal values Aspen at $49.50 (1) per share or $3.2 billion (2)

– 1.16x Aspen’s diluted book value per share at 3/31/2014 and 11.8x 2014 consensus Street earnings estimates

– 25.7% premium to Aspen’s unaffected closing share price on 4/11/2014 and 19.5% premium to (pre-announcement) all-time high

– The consideration is based on Endurance’s unaffected closing share price on 4/11/2014. Based on Endurance’s closing

share price on 6/30/2014, Endurance’s proposal would value Aspen at $48.27 per share (3)

Aggregate consideration mix of 40% cash and 60% stock

Aspen shareholders can elect to receive (i) $49.50 in cash for each Aspen share, (ii) 0.9197 Endurance common shares for each Aspen share, or (iii) a combination of 0.5518 Endurance common shares and $19.80 in cash for each Aspen share, subject to a customary proration mechanism

Proposal structured to be tax-free to Aspen common shareholders with respect to the Endurance common shares received in the transaction

$1.3 billion of cash consideration to be funded through Endurance’s cash on hand and $1.0Bn committed bridge financing

– Financing to replace bridge facility currently anticipated to be generated from Aspen cash on hand of $0.2Bn, public investment grade debt financing of ~$0.3Bn and common equity financing of ~$0.5Bn

– Pro forma debt to total capital of 19% at 3/31/2014, expected to be approximately 15% by end of 2015 (4)

John Charman, Endurance’s Chairman and Chief Executive Officer, has committed to purchase $25 million of Endurance common shares in connection with the transaction, bringing his total purchases of Endurance shares to $55 million

49% by Endurance shareholders (including John Charman)

40% by Aspen shareholders

11% by New Investors (5)

Significant EPS and ROE accretion for Endurance shareholders

Over $100 million of annual synergies anticipated

Notes

1. Based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014

2. Based on 67.1MM fully-diluted Aspen shares as of 6/11/2014 and Endurance’s share price as of 6/30/2014 of $51.59

3. Based on pro rata consideration mix of 40% cash and 60% stock

4. Reflects permanent financing plan and assumes repayment of Endurance’s $200MM senior debt maturing in October 2015

5. Assumes $0.5Bn of common equity issued to new investors at 3% discount to Endurance’s closing share price of $51.59 as of 6/30/2014; assumes no exercise of option by CVC to purchase $250MM of

Endurance common shares post-closing

12 Endurance

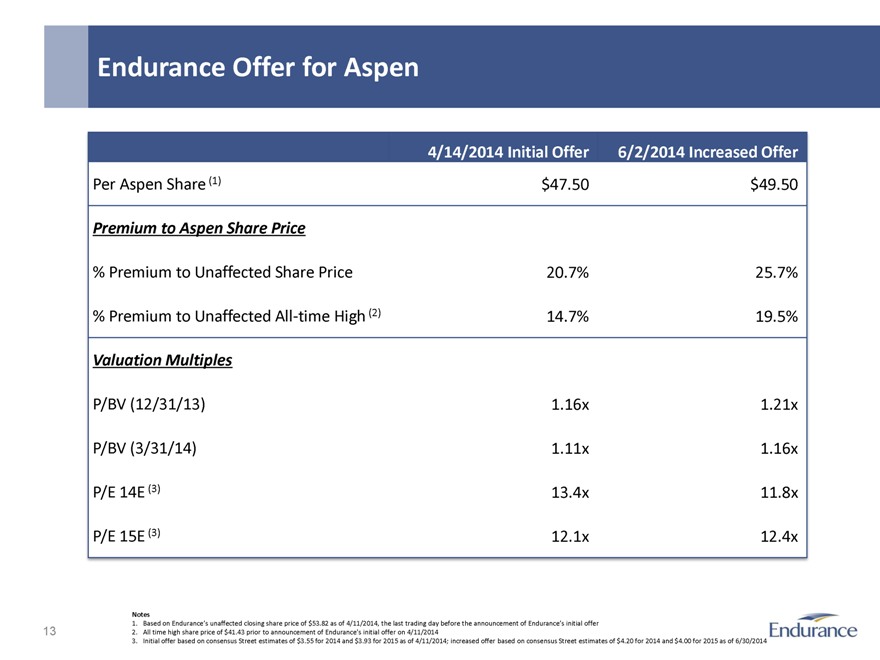

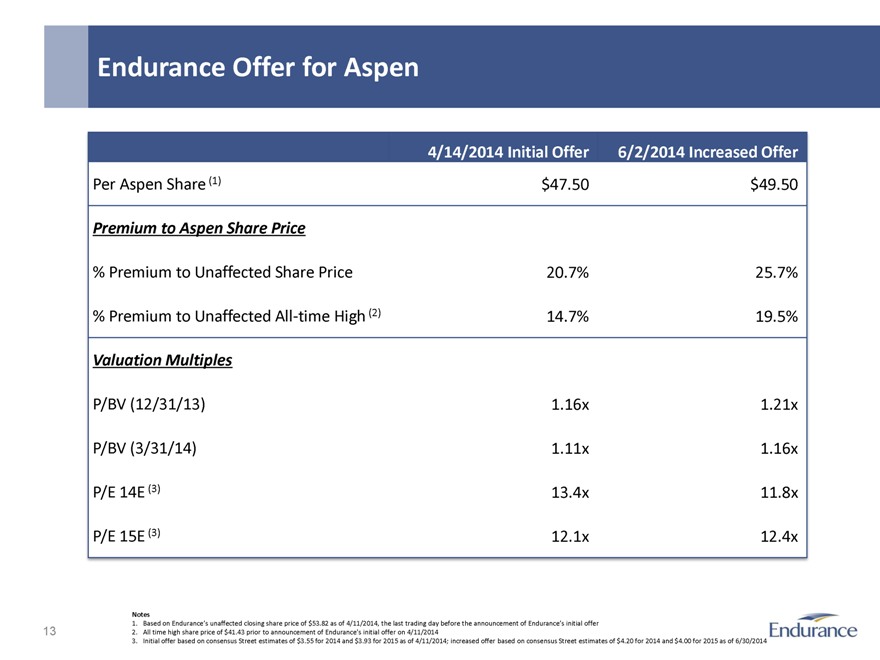

Endurance Offer for Aspen

Per Aspen Share (1)

Premium to Aspen Share Price

% Premium to Unaffected Share Price

% Premium to Unaffected All-time High (2)

Valuation Multiples

P/BV (12/31/13)

P/BV (3/31/14)

P/E 14E (3)

P/E 15E (3)

4/14/2014 Initial Offer 6/2/2014 Increased Offer

$47.50

20.7%

14.7%

1.16x

1.11x

13.4x

12.1x

$49.50

25.7%

19.5%

1.21x

1.16x

11.8x

12.4x

Notes

1. Based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014, the last trading day before the announcement of Endurance’s initial offer

2. All time high share price of $41.43 prior to announcement of Endurance’s initial offer on 4/11/2014

3. Initial offer based on consensus Street estimates of $3.55 for 2014 and $3.93 for 2015 as of 4/11/2014; increased offer based on consensus Street estimates of $4.20 for 2014 and $4.00 for 2015 as of 6/30/2014

13 Endurance

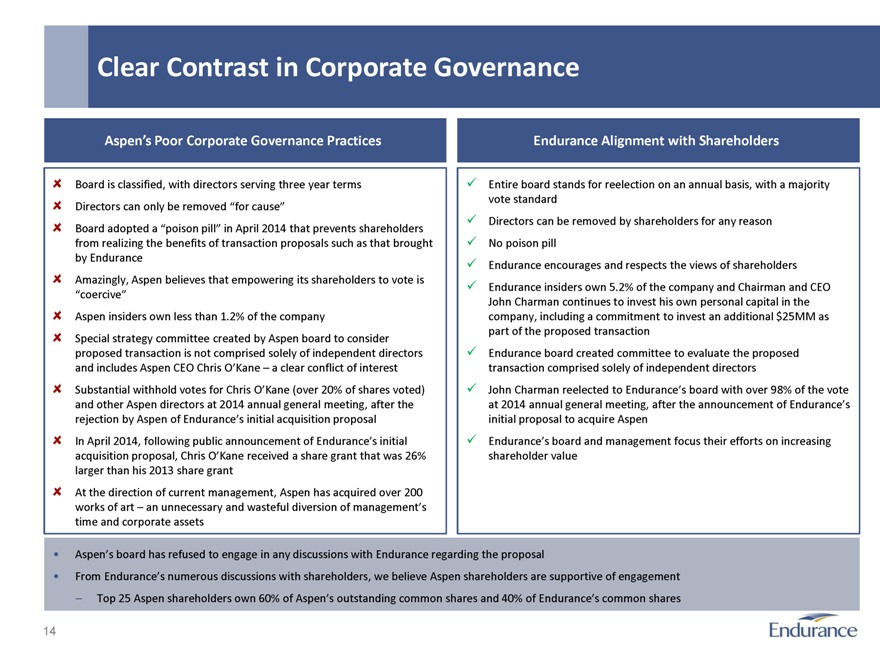

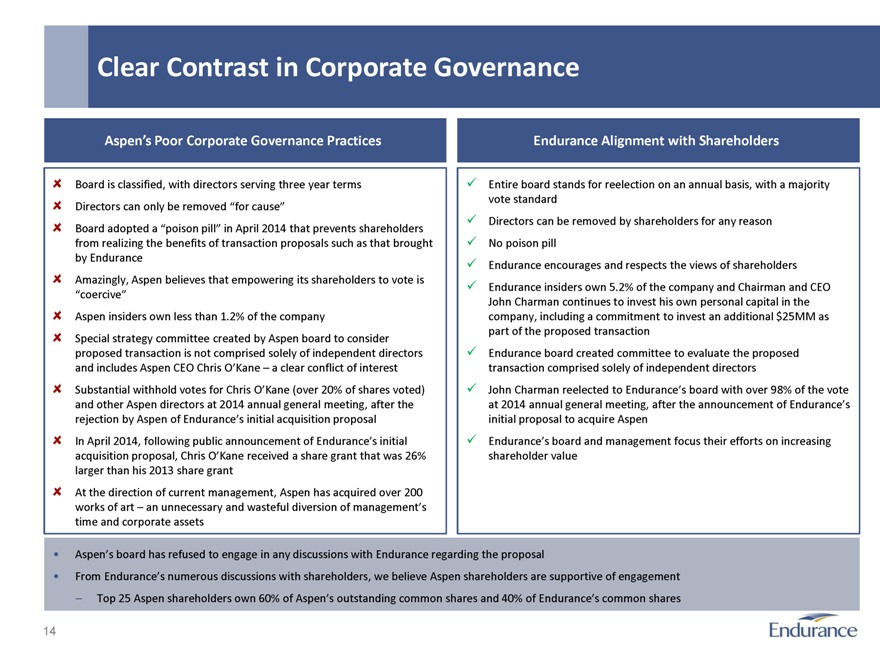

Clear Contrast in Corporate Governance

Aspen’s Poor Corporate Governance Practices

Board is classified, with directors serving three year terms

Directors can only be removed “for cause”

Board adopted a “poison pill” in April 2014 that prevents shareholders from realizing the benefits of transaction proposals such as that brought by Endurance

Amazingly, Aspen believes that empowering its shareholders to vote is “coercive”

Aspen insiders own less than 1.2% of the company

Special strategy committee created by Aspen board to consider proposed transaction is not comprised solely of independent directors and includes Aspen CEO Chris O’Kane – a clear conflict of interest

Substantial withhold votes for Chris O’Kane (over 20% of shares voted) and other Aspen directors at 2014 annual general meeting, after the rejection by Aspen of Endurance’s initial acquisition proposal

In April 2014, following public announcement of Endurance’s initial acquisition proposal, Chris O’Kane received a share grant that was 26% larger than his 2013 share grant

At the direction of current management, Aspen has acquired over 200 works of art – an unnecessary and wasteful diversion of management’s time and corporate assets

Endurance Alignment with Shareholders

Entire board stands for reelection on an annual basis, with a majority vote standard

Directors can be removed by shareholders for any reason

No poison pill

Endurance encourages and respects the views of shareholders

Endurance insiders own 5.2% of the company and Chairman and CEO

John Charman continues to invest his own personal capital in the company, including a commitment to invest an additional $25MM as part of the proposed transaction

Endurance board created committee to evaluate the proposed transaction comprised solely of independent directors

John Charman reelected to Endurance’s board with over 98% of the vote at 2014 annual general meeting, after the announcement of Endurance’s initial proposal to acquire Aspen

Endurance’s board and management focus their efforts on increasing shareholder value

Aspen’s board has refused to engage in any discussions with Endurance regarding the proposal

From Endurance’s numerous discussions with shareholders, we believe Aspen shareholders are supportive of engagement

– Top 25 Aspen shareholders own 60% of Aspen’s outstanding common shares and 40% of Endurance’s common shares

14 Endurance

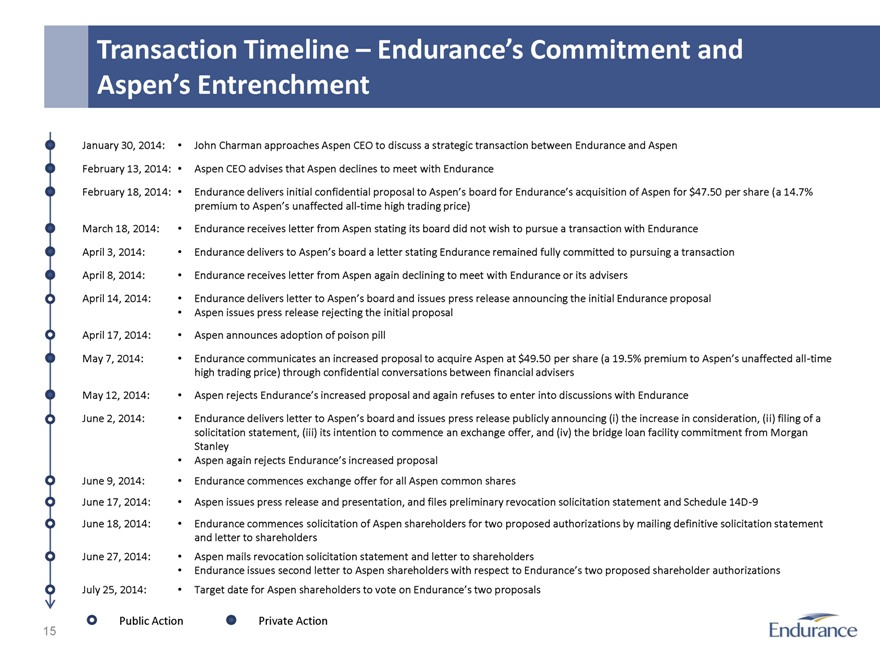

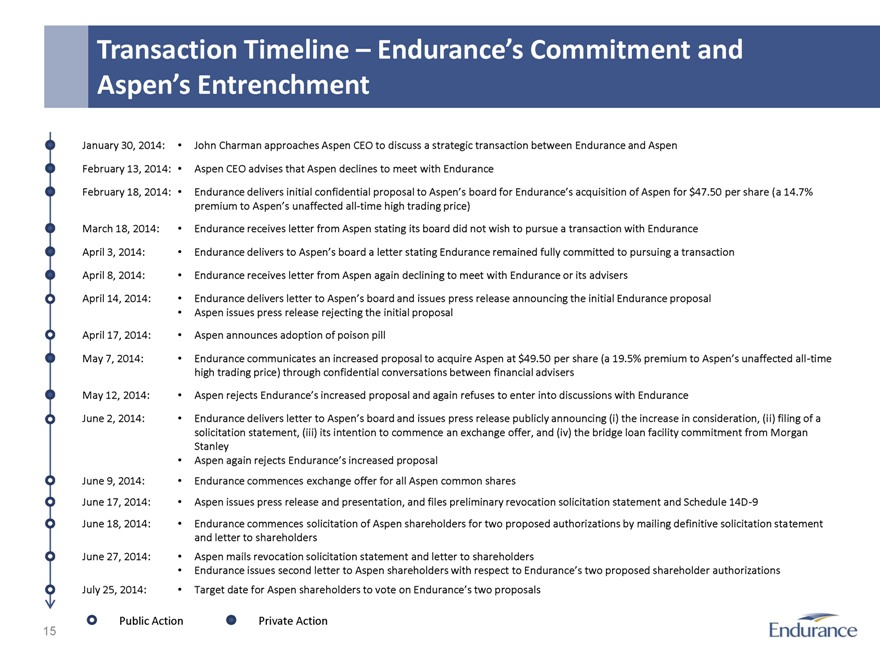

Transaction Timeline – Endurance’s Commitment and Aspen’s Entrenchment

January 30, 2014: John Charman approaches Aspen CEO to discuss a strategic transaction between Endurance and Aspen

February 13, 2014: Aspen CEO advises that Aspen declines to meet with Endurance

February 18, 2014: Endurance delivers initial confidential proposal to Aspen’s board for Endurance’s acquisition of Aspen for $47.50 per share (a 14.7%

premium to Aspen’s unaffected all-time high trading price)

March 18, 2014: Endurance receives letter from Aspen stating its board did not wish to pursue a transaction with Endurance

April 3, 2014: Endurance delivers to Aspen’s board a letter stating Endurance remained fully committed to pursuing a transaction

April 8, 2014: Endurance receives letter from Aspen again declining to meet with Endurance or its advisers

April 14, 2014: Endurance delivers letter to Aspen’s board and issues press release announcing the initial Endurance proposal

Aspen issues press release rejecting the initial proposal

April 17, 2014: Aspen announces adoption of poison pill

May 7, 2014: Endurance communicates an increased proposal to acquire Aspen at $49.50 per share (a 19.5% premium to Aspen’s unaffected all-time

high trading price) through confidential conversations between financial advisers

May 12, 2014: Aspen rejects Endurance’s increased proposal and again refuses to enter into discussions with Endurance

June 2, 2014: Endurance delivers letter to Aspen’s board and issues press release publicly announcing (i) the increase in consideration, (ii) filing of a

solicitation statement, (iii) its intention to commence an exchange offer, and (iv) the bridge loan facility commitment from Morgan

Stanley

Aspen again rejects Endurance’s increased proposal

June 9, 2014: Endurance commences exchange offer for all Aspen common shares

June 17, 2014: Aspen issues press release and presentation, and files preliminary revocation solicitation statement and Schedule 14D-9

June 18, 2014: Endurance commences solicitation of Aspen shareholders for two proposed authorizations by mailing definitive solicitation statement

and letter to shareholders

June 27, 2014: Aspen mails revocation solicitation statement and letter to shareholders

Endurance issues second letter to Aspen shareholders with respect to Endurance’s two proposed shareholder authorizations

July 25, 2014: Target date for Aspen shareholders to vote on Endurance’s two proposals

Public Action

Private Action

15 Endurance

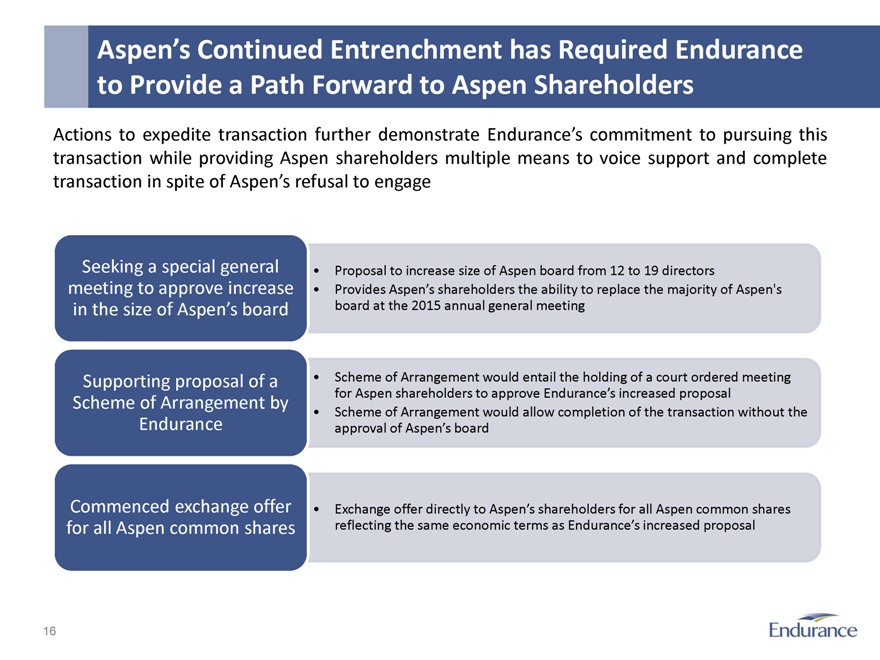

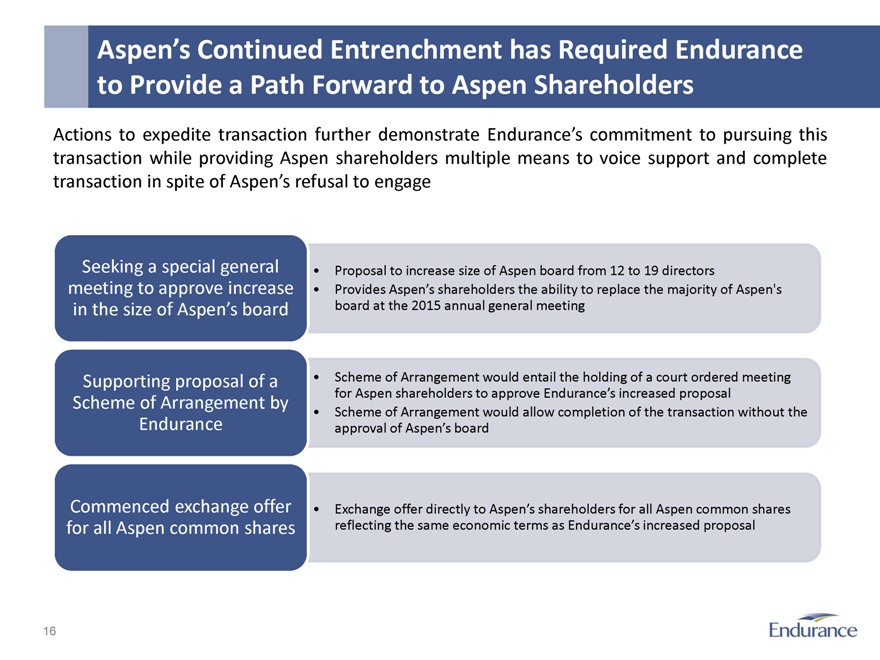

Aspen’s Continued Entrenchment has Required Endurance to Provide a Path Forward to Aspen Shareholders

Actions to expedite transaction further demonstrate Endurance’s commitment to pursuing this transaction while providing Aspen shareholders multiple means to voice support and complete transaction in spite of Aspen’s refusal to engage

Seeking a special general meeting to approve increase in the size of Aspen’s board

Supporting proposal of a Scheme of Arrangement by Endurance

Commenced exchange offer for all Aspen common shares

Proposal to increase size of Aspen board from 12 to 19 directors

Provides Aspen’s shareholders the ability to replace the majority of Aspen’s board at the 2015 annual general meeting

Scheme of Arrangement would entail the holding of a court ordered meeting

for Aspen shareholders to approve Endurance’s increased proposal

Scheme of Arrangement would allow completion of the transaction without the approval of Aspen’s board

Exchange offer directly to Aspen’s shareholders for all Aspen common shares reflecting the same economic terms as Endurance’s increased proposal

16 Endurance

Endurance

Strategic Rationale and Compelling

Value of Endurance’s Proposal

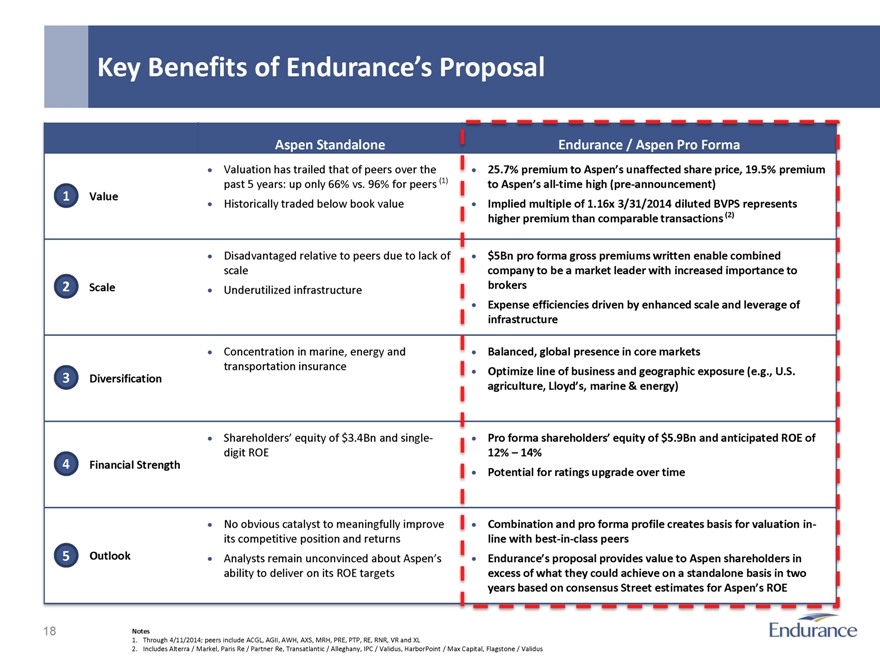

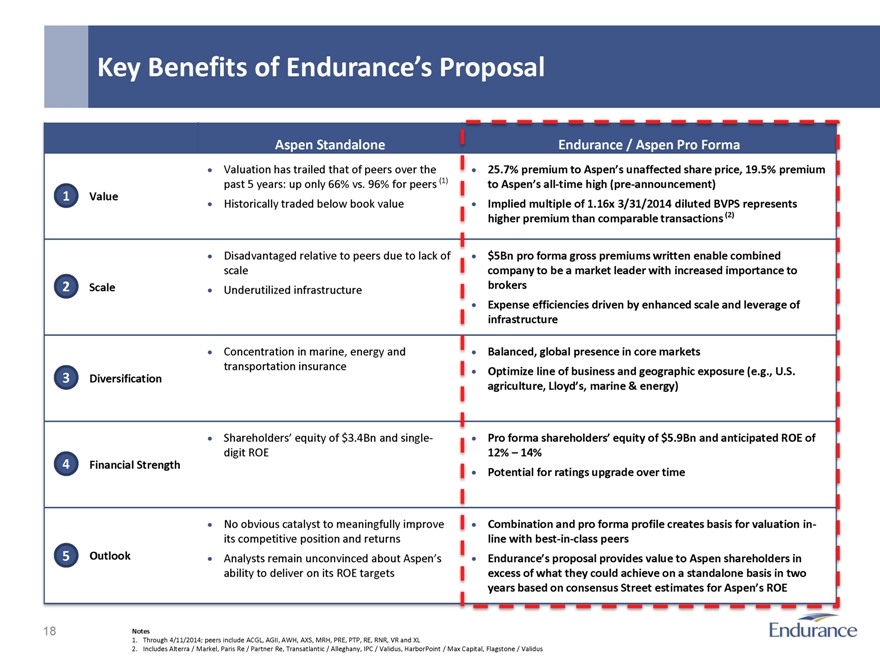

Key Benefits of Endurance’s Proposal

1 Value

2 Scale

3 Diversification

4 Financial Strength

5 Outlook

Aspen Standalone

Valuation has trailed that of peers over the past 5 years: up only 66% vs. 96% for peers (1)

Historically traded below book value

Disadvantaged relative to peers due to lack of scale

Underutilized infrastructure

Concentration in marine, energy and transportation insurance

Shareholders’ equity of $3.4Bn and single-digit ROE

No obvious catalyst to meaningfully improve its competitive position and returns

Analysts remain unconvinced about Aspen’s ability to deliver on its ROE targets

Endurance / Aspen Pro Forma

25.7% premium to Aspen’s unaffected share price, 19.5% premium to Aspen’s all-time high (pre-announcement)

Implied multiple of 1.16x 3/31/2014 diluted BVPS represents higher premium than comparable transactions (2)

$5Bn pro forma gross premiums written enable combined company to be a market leader with increased importance to brokers

Balanced, global presence in core markets

Optimize line of business and geographic exposure (e.g., U.S. agriculture, Lloyd’s, marine & energy)

Pro forma shareholders’ equity of $5.9Bn and anticipated ROE of 12% – 14%

Potential for ratings upgrade over time

Combination and pro forma profile creates basis for valuation in-line with best-in-class peers

Endurance’s proposal provides value to Aspen shareholders in excess of what they could achieve on a standalone basis in two years based on consensus Street estimates for Aspen’s ROE

Notes

1. Through 4/11/2014; peers include ACGL, AGII, AWH, AXS, MRH, PRE, PTP, RE, RNR, VR and XL

2. Includes Alterra / Markel, Paris Re / Partner Re, Transatlantic / Alleghany, IPC / Validus, HarborPoint / Max Capital, Flagstone / Validus

18 Endurance

Proposed Valuation Well Above Aspen’s Historical Trading Prices

Aspen Share Price – Last 5 Years

4/11/2009 – 4/11/2014

$50 $49.50

$40 $39.37

$30

$20

Apr-09 Apr-10 Apr-11 Apr-12 Apr-13

Historical Share Price Endurance Purchase Price

Aspen P/BV – Last 5 Years

4/11/2009 – 4/11/2014

1.25x

1.16x

1.00x 0.96x

0.75x 5-Yr Average: 0.79x

0.50x

Apr-09 Apr-10 Apr-11 Apr-12 Apr-13

Historical P/BV Endurance Purchase Price

Performance illustrated through April 11, 2014 – the trading day prior to initial proposal announcement

19 Endurance

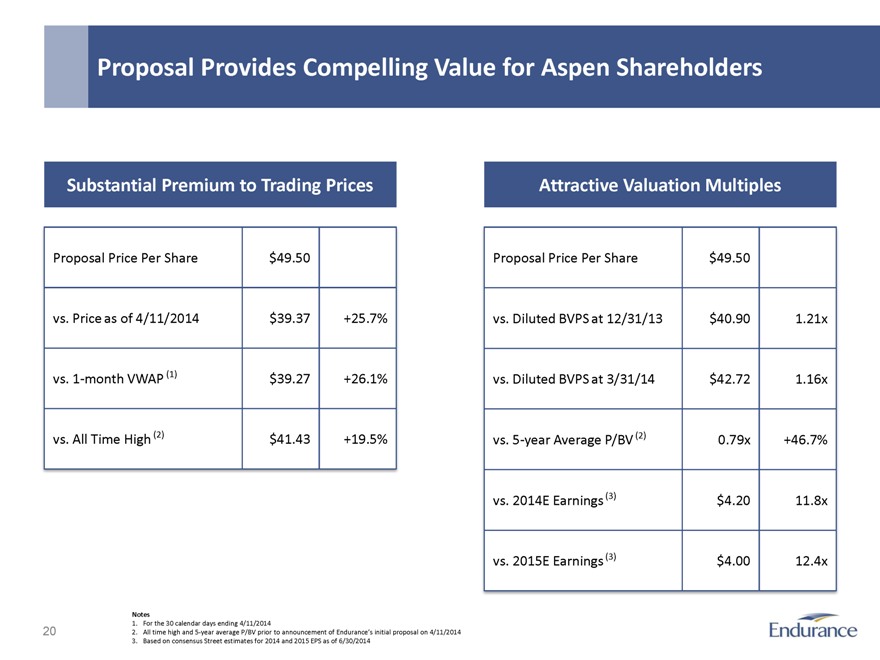

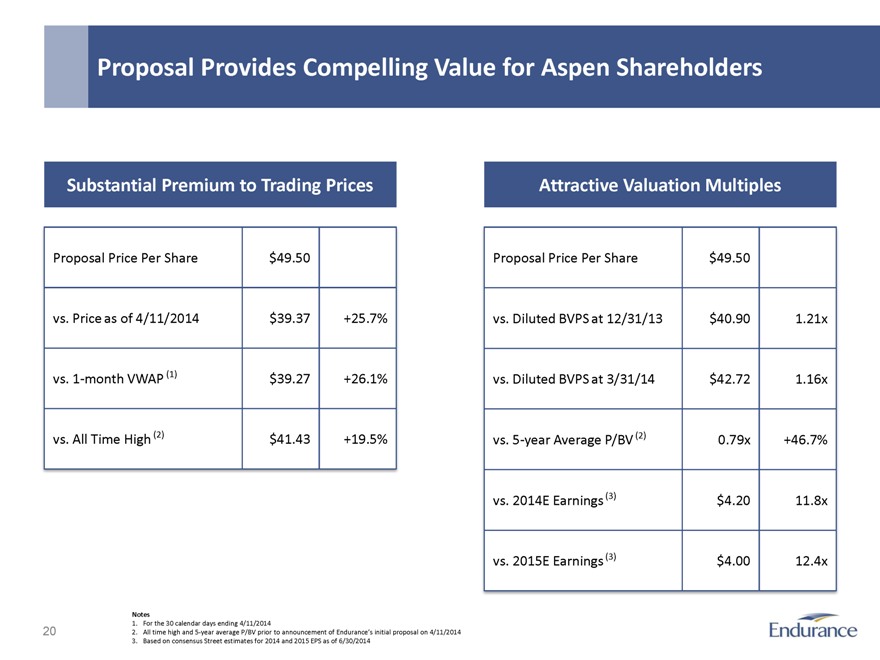

Proposal Provides Compelling Value for Aspen Shareholders

Substantial Premium to Trading Prices

Proposal Price Per Share $49.50

vs. Price as of 4/11/2014 $39.37 +25.7%

vs. 1-month VWAP (1) $39.27 +26.1%

vs. All Time High (2) $41.43 +19.5%

Attractive Valuation Multiples

Proposal Price Per Share $49.50

vs. Diluted BVPS at 12/31/13 $40.90 1.21x

vs. Diluted BVPS at 3/31/14 $42.72 1.16x

vs. 5-year Average P/BV (2) 0.79x +46.7%

vs. 2014E Earnings (3) $4.20 11.8x

vs. 2015E Earnings (3) $4.00 12.4x

Notes

1. For the 30 calendar days ending 4/11/2014

2. All time high and 5-year average P/BV prior to announcement of Endurance’s initial proposal on 4/11/2014

3. Based on consensus Street estimates for 2014 and 2015 EPS as of 6/30/2014

20 Endurance

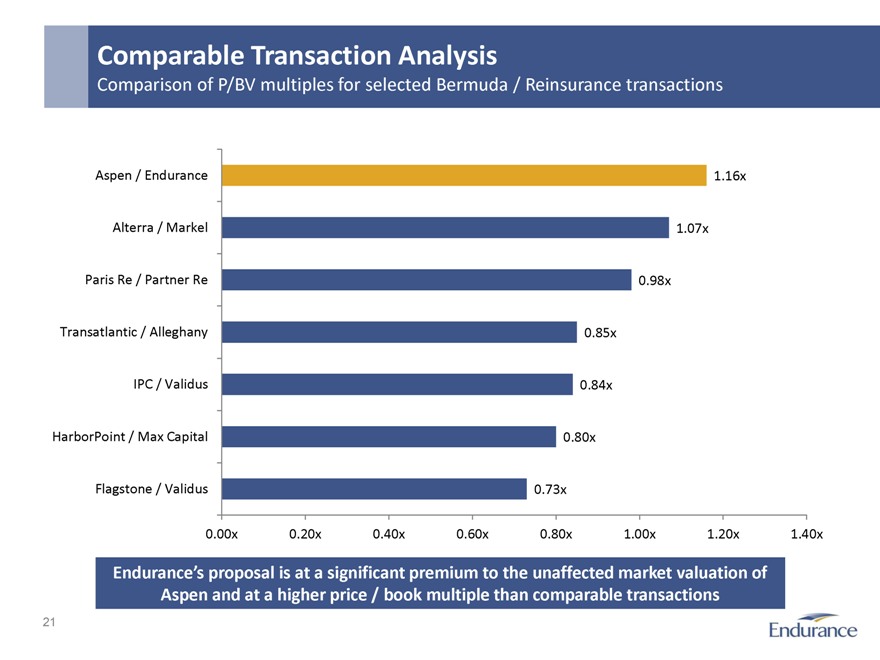

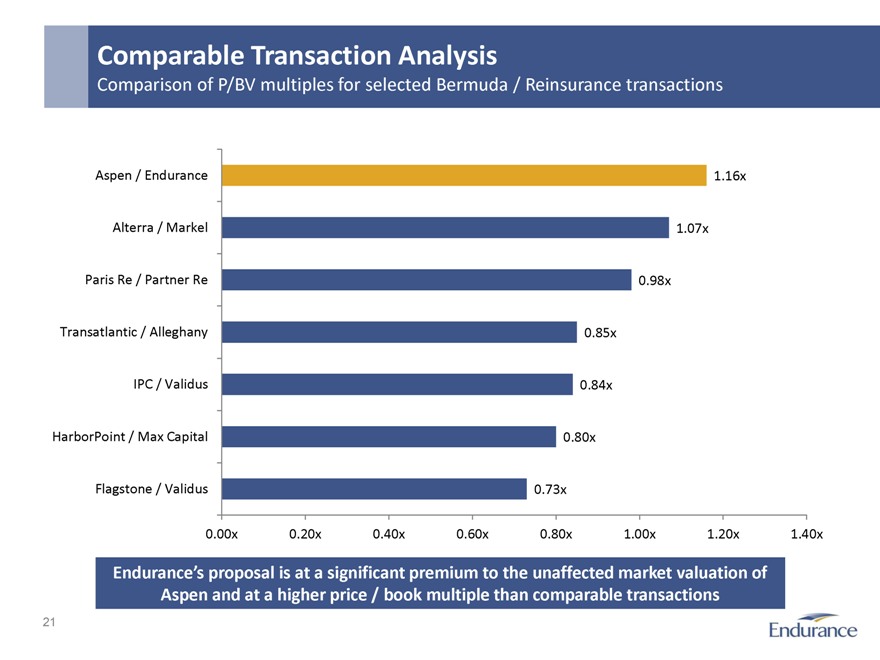

Comparable Transaction Analysis

Comparison of P/BV multiples for selected Bermuda / Reinsurance transactions

Aspen / Endurance 1.16x

Alterra / Markel 1.07x

Paris Re / Partner Re 0.98x

Transatlantic / Alleghany 0.85x

IPC / Validus 0.84x

HarborPoint / Max Capital 0.80x

Flagstone / Validus 0.73x

0.00x 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x

Endurance’s proposal is at a significant premium to the unaffected market valuation of

Aspen and at a higher price / book multiple than comparable transactions

21 Endurance

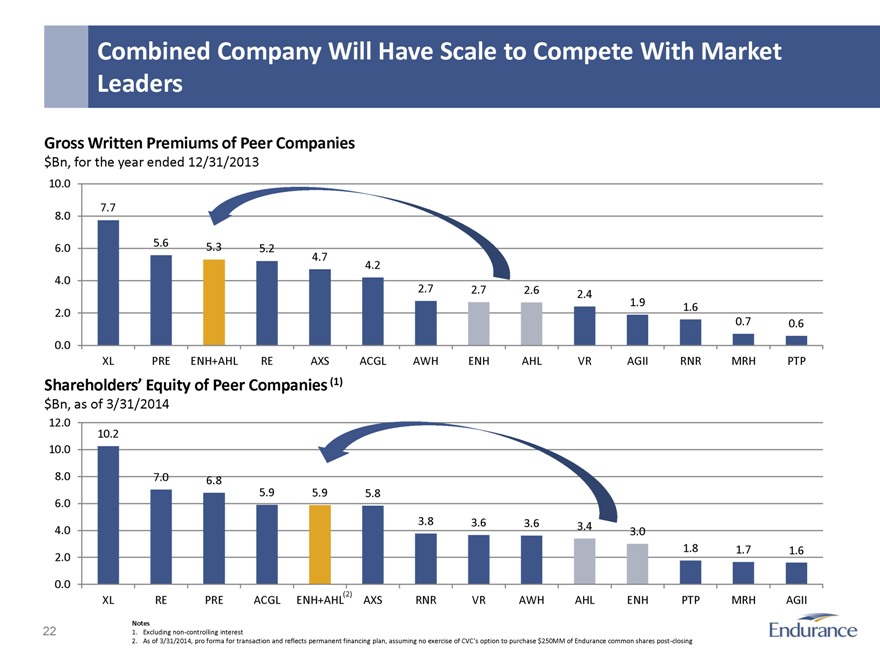

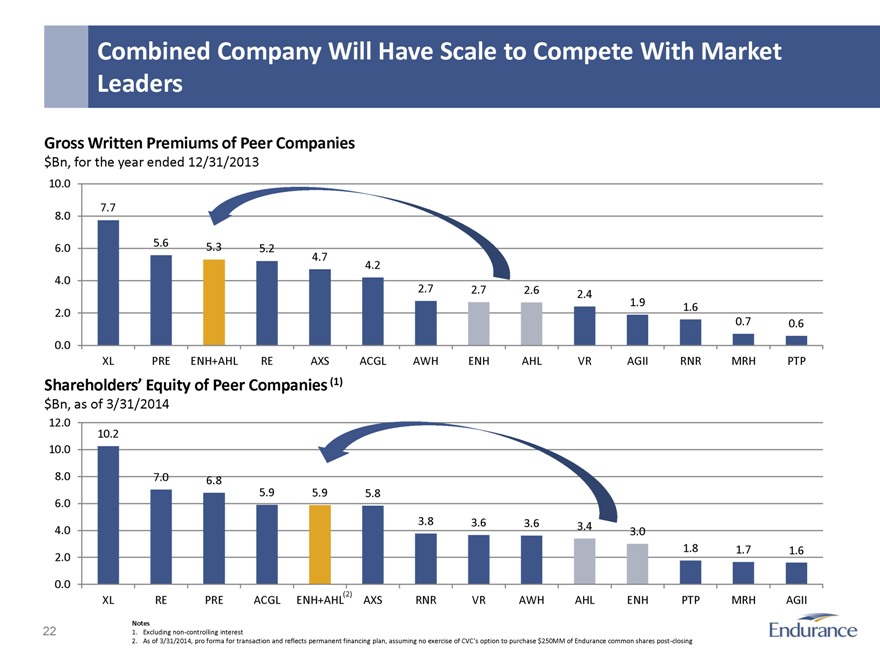

Combined Company Will Have Scale to Compete With Market Leaders

Gross Written Premiums of Peer Companies

$Bn, for the year ended 12/31/2013

10.0

7.7

8.0

6.0 5.6 5.3 5.2

4.7

4.2

4.0

2.7 2.7 2.6 2.4

1.9 1.6

2.0

0.7 0.6

0.0

XL PRE ENH+AHL RE AXS ACGL AWH ENH AHL VR AGII RNR MRH PTP

Shareholders’ Equity of Peer Companies (1)

$Bn, as of 3/31/2014

12.0

10.2

10.0

8.0 7.0 6.8

5.9 5.9 5.8

6.0

3.8 3.6 3.6 3.4

4.0 3.0

2.0 1.8 1.7 1.6

0.0

XL RE PRE ACGL ENH+AHL(2) AXS RNR VR AWH AHL ENH PTP MRH AGII

Notes

1. Excluding non-controlling interest

2. As of 3/31/2014, pro forma for transaction and reflects permanent financing plan, assuming no exercise of CVC’s option to purchase $250MM of Endurance common shares post-closing

22 Endurance

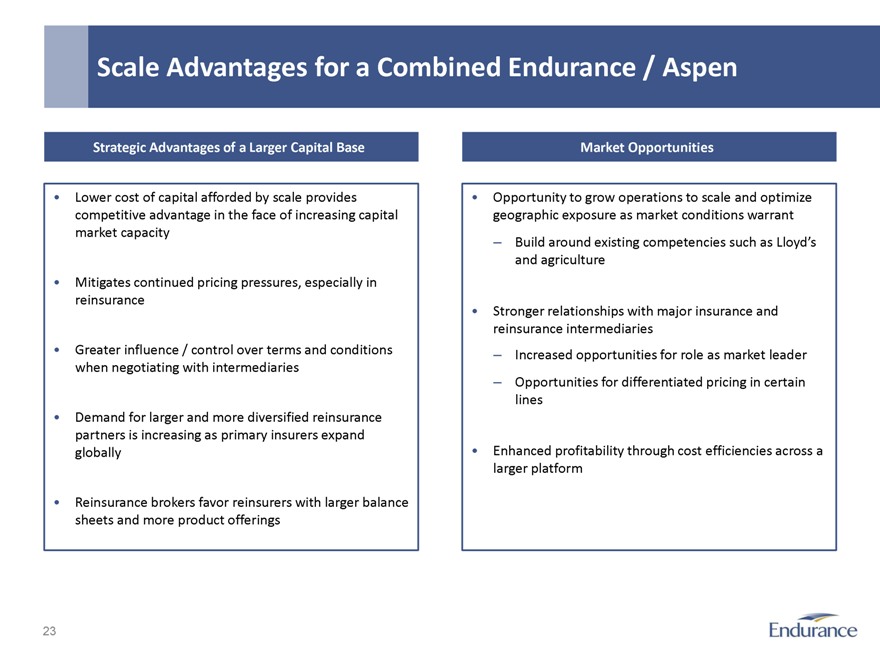

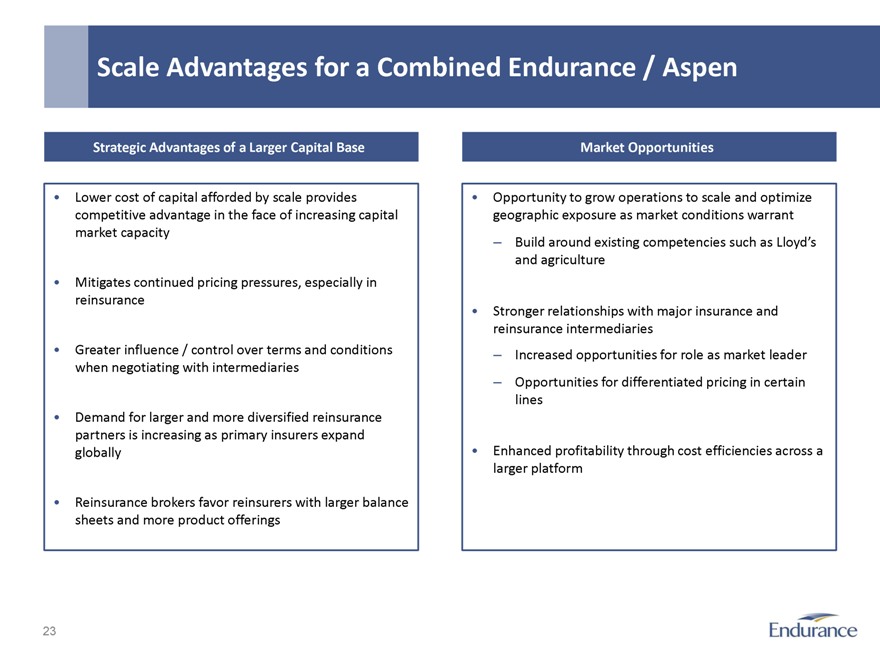

Scale Advantages for a Combined Endurance / Aspen

Strategic Advantages of a Larger Capital Base

Lower cost of capital afforded by scale provides competitive advantage in the face of increasing capital market capacity

Mitigates continued pricing pressures, especially in reinsurance

Greater influence / control over terms and conditions when negotiating with intermediaries

Demand for larger and more diversified reinsurance partners is increasing as primary insurers expand globally

Reinsurance brokers favor reinsurers with larger balance sheets and more product offerings

Market Opportunities

Opportunity to grow operations to scale and optimize geographic exposure as market conditions warrant

Build around existing competencies such as Lloyd’s and agriculture

Stronger relationships with major insurance and reinsurance intermediaries

Increased opportunities for role as market leader

Opportunities for differentiated pricing in certain lines

Enhanced profitability through cost efficiencies across a larger platform

23 Endurance

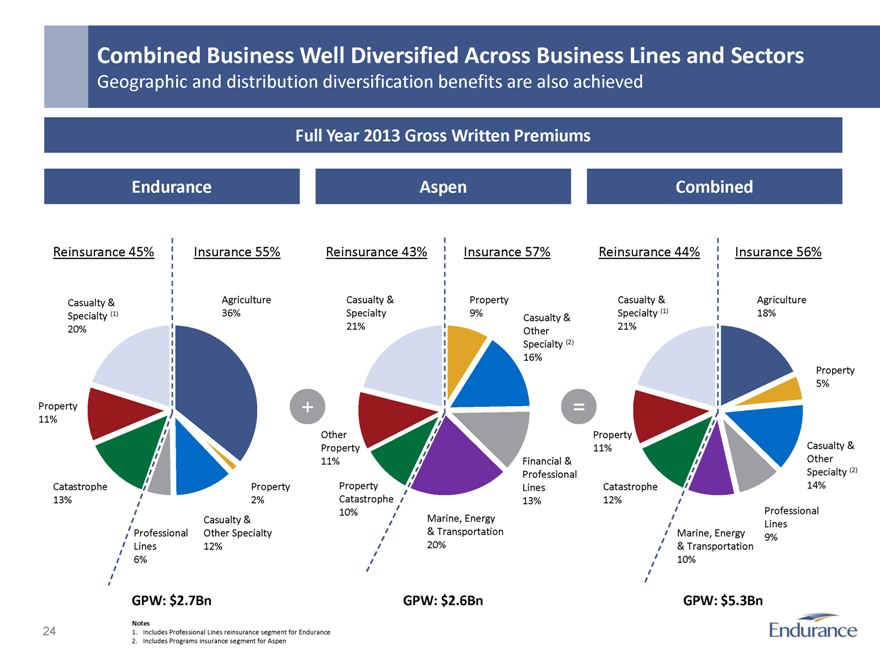

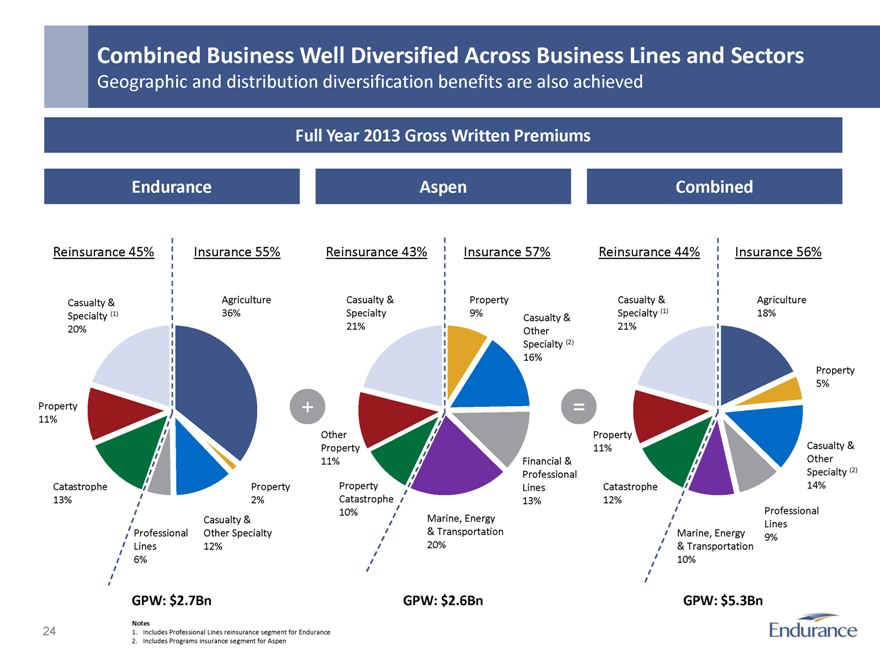

Combined Business Well Diversified Across Business Lines and Sectors

Geographic and distribution diversification benefits are also achieved

Full Year 2013 Gross Written Premiums

Endurance

Reinsurance 45% Insurance 55%

Casualty & Specialty (1) Agriculture 36%

20%

Property

11%

Catastrophe Property 2%

13%

Casualty & Other Specialty 12%

Professional

Lines

6%

GPW: $2.7Bn

Aspen

Reinsurance 43% Insurance 57% Property 9%

Casualty &

Specialty Casualty & Other Specialty (2) 16%

21%

Other

Property

11% Financial & Professional Lines 13%

Property

Catastrophe

10% Marine, Energy & Transportation 20%

GPW: $2.6Bn

Combined

Reinsurance 44% Insurance 56%

Casualty & Specialty (1) 21% Agriculture 18%

Property 5%

Property 11% Casualty & Other Specialty (2) 14%

Catastrophe

12%

Professional Lines 9%

Marine, Energy & Transportation 10%

GPW: $5.3Bn

Notes

1. Includes Professional Lines reinsurance segment for Endurance

2. Includes Programs insurance segment for Aspen

Endurance 24

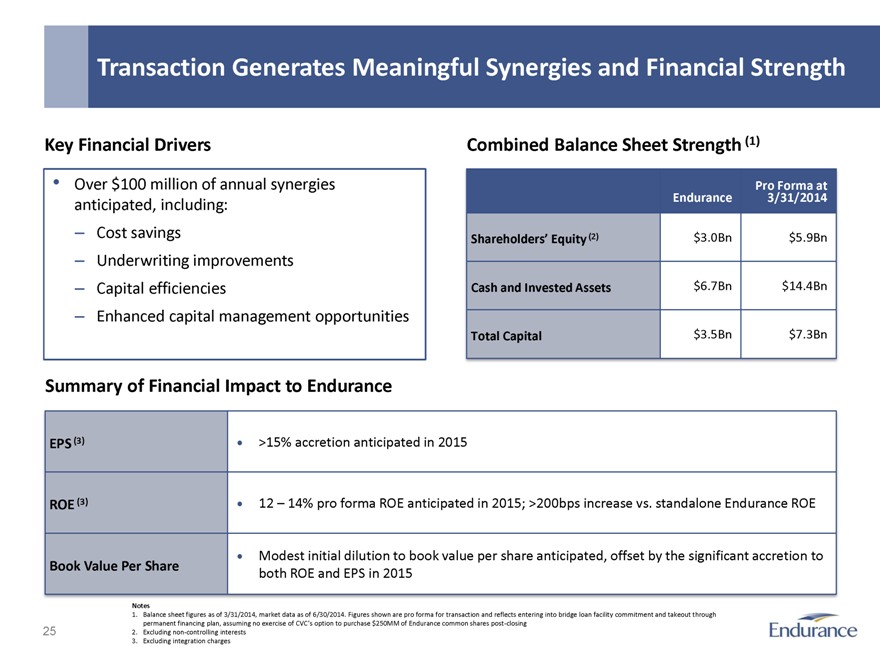

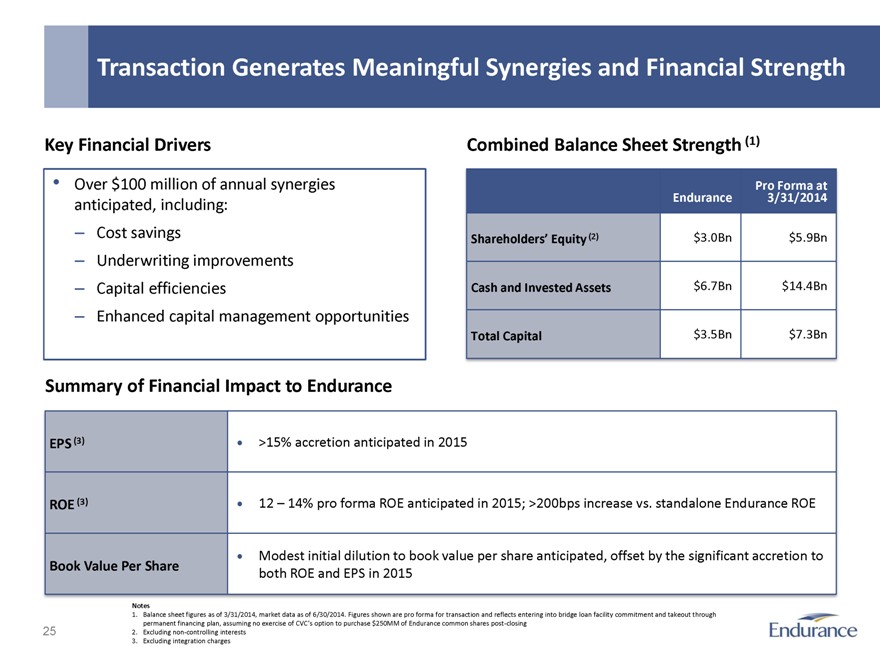

Transaction Generates Meaningful Synergies and Financial Strength

Key Financial Drivers

Over $100 million of annual synergies anticipated, including:

– Cost savings

– Underwriting improvements

– Capital efficiencies

– Enhanced capital management opportunities

Combined Balance Sheet Strength (1)

Endurance

Pro Forma at 3/31/2014

Shareholders’ Equity (2)

$ 3.0Bn

$5.9Bn

Cash and Invested Assets

$ 6.7Bn

$14.4Bn

Total Capital

$ 3.5Bn

$7.3Bn

Summary of Financial Impact to Endurance

EPS (3) >15% accretion anticipated in 2015

ROE (3) 12 – 14% pro forma ROE anticipated in 2015; >200bps increase vs. standalone Endurance ROE

Modest initial dilution to book value per share anticipated, offset by the significant accretion to

Book Value Per Share both ROE and EPS in 2015

Notes

1. Balance sheet figures as of 3/31/2014, market data as of 6/30/2014. Figures shown are pro forma for transaction and reflects entering into bridge loan facility commitment and takeout through permanent financing plan, assuming no exercise of CVC’s option to purchase $250MM of Endurance common shares post-closing

2. Excluding non-controlling interests

3. Excluding integration charges

Endurance

25

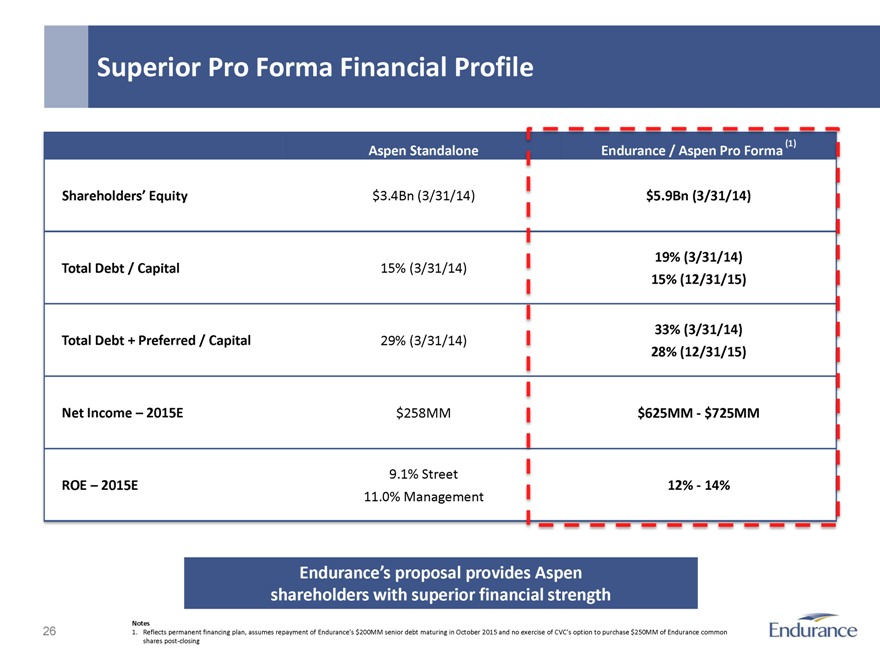

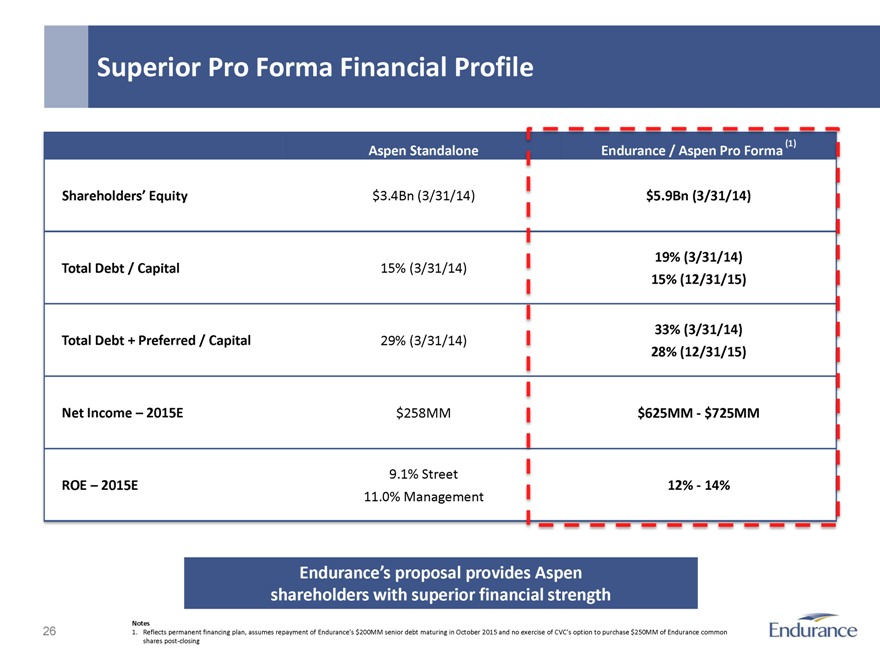

Superior Pro Forma Financial Profile

Aspen Standalone Endurance / Aspen Pro Forma (1)

Shareholders’ Equity $3.4Bn (3/31/14) $5.9Bn (3/31/14)

Total Debt / Capital 15% (3/31/14) 19% (3/31/14) 15% (12/31/15)

Total Debt + Preferred / Capital 29% (3/31/14) 33% (3/31/14) 28% (12/31/15)

Net Income – 2015E $258MM $625MM - $725MM

9.1% Street 12%-14%

ROE – 2015E

11.0% Management

Endurance’s proposal provides Aspen shareholders with superior financial strength

Notes

1. Reflects permanent financing plan, assumes repayment of Endurance’s $200MM senior debt maturing in October 2015 and no exercise of CVC’s option to purchase $250MM of Endurance common shares post-closing

Endurance

26

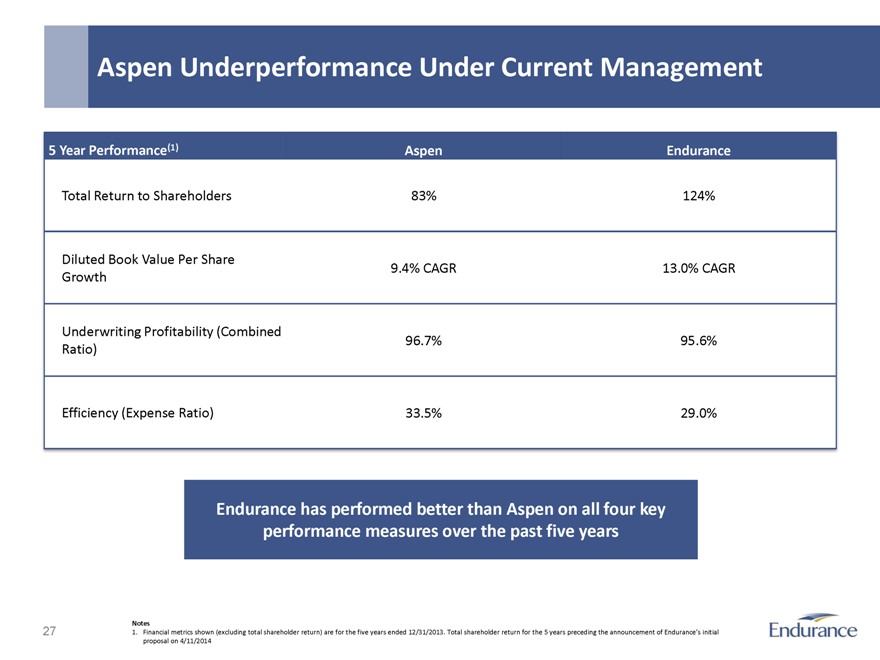

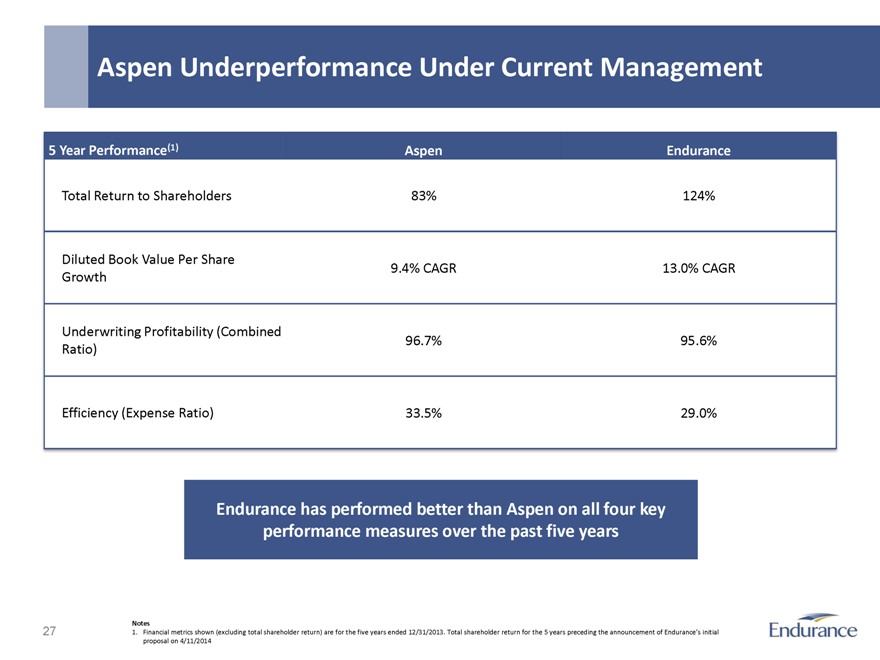

Aspen Underperformance Under Current Management

5 Year Performance(1) Aspen Endurance

Total Return to Shareholders 83% 124%

Diluted Book Value Per Share

9.4% CAGR 13.0% CAGR

Growth

Underwriting Profitability (Combined

96.7% 95.6%

Ratio)

Efficiency (Expense Ratio) 33.5% 29.0%

Endurance has performed better than Aspen on all four key performance measures over the past five years

Notes

1. Financial metrics shown (excluding total shareholder return) are for the five years ended 12/31/2013. Total shareholder return for the 5 years preceding the announcement of Endurance’s initial proposal on 4/11/2014

Endurance

27

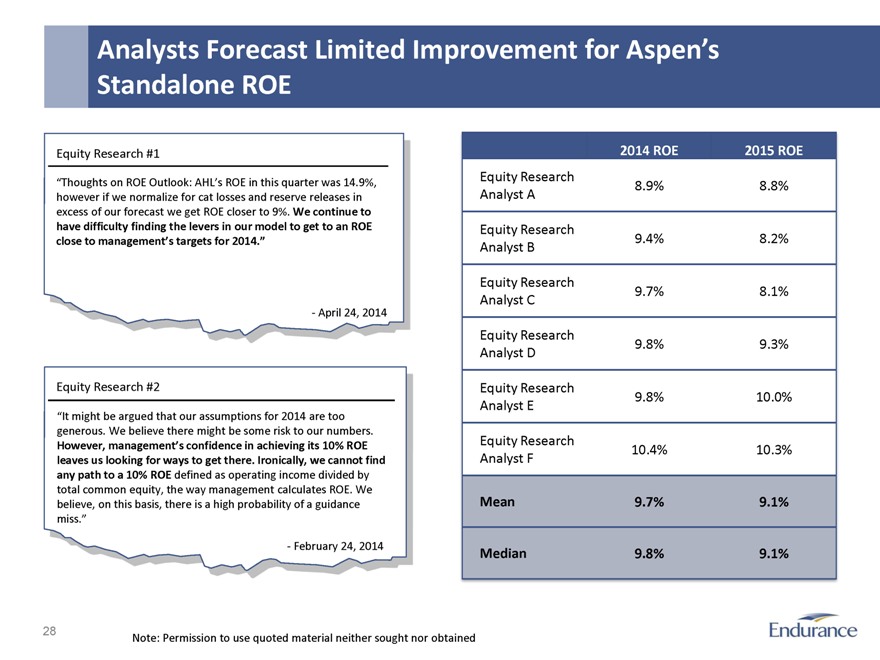

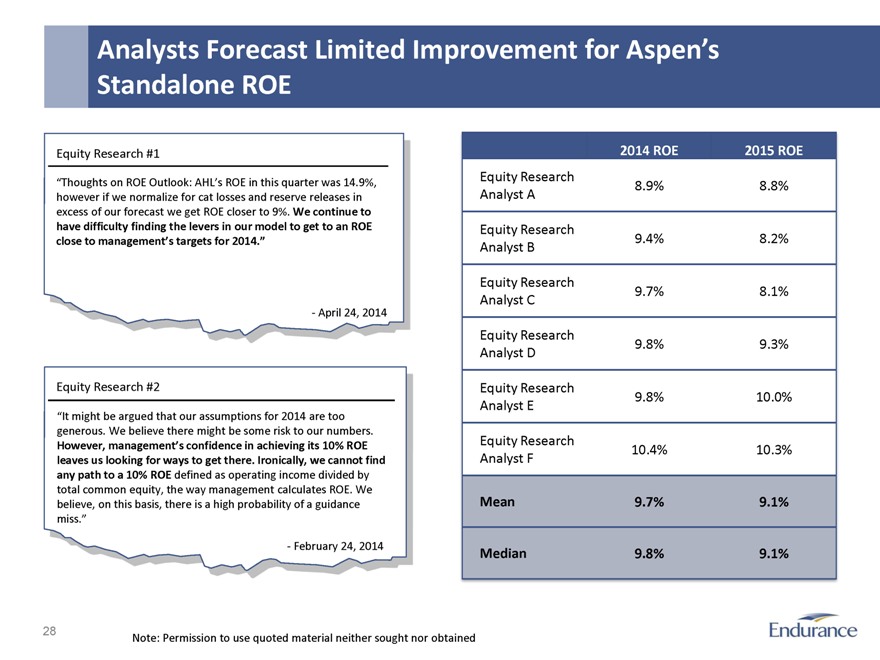

Analysts Forecast Limited Improvement for Aspen’s

Standalone ROE

Equity Research #1

“Thoughts on ROE Outlook: AHL’s ROE in this quarter was 14.9%, however if we normalize for cat losses and reserve releases in excess of our forecast we get ROE closer to 9%. We continue to have difficulty finding the levers in our model to get to an ROE close to management’s targets for 2014.”

- April 24, 2014

Equity Research #2

“It might be argued that our assumptions for 2014 are too generous. We believe there might be some risk to our numbers.

However, management’s confidence in achieving its 10% ROE leaves us looking for ways to get there. Ironically, we cannot find any path to a 10% ROE defined as operating income divided by total common equity, the way management calculates ROE. We believe, on this basis, there is a high probability of a guidance miss.”

- February 24, 2014

2014 ROE 2015 ROE

Equity Research

8.9% 8.8%

Analyst A

Equity Research

9.4% 8.2%

Analyst B

Equity Research

9.7% 8.1%

Analyst C

Equity Research

9.8% 9.3%

Analyst D

Equity Research

9.8% 10.0%

Analyst E

Equity Research

10.4% 10.3%

Analyst F

Mean 9.7% 9.1%

Median 9.8% 9.1%

Note: Permission to use quoted material neither sought nor obtained

Endurance 28

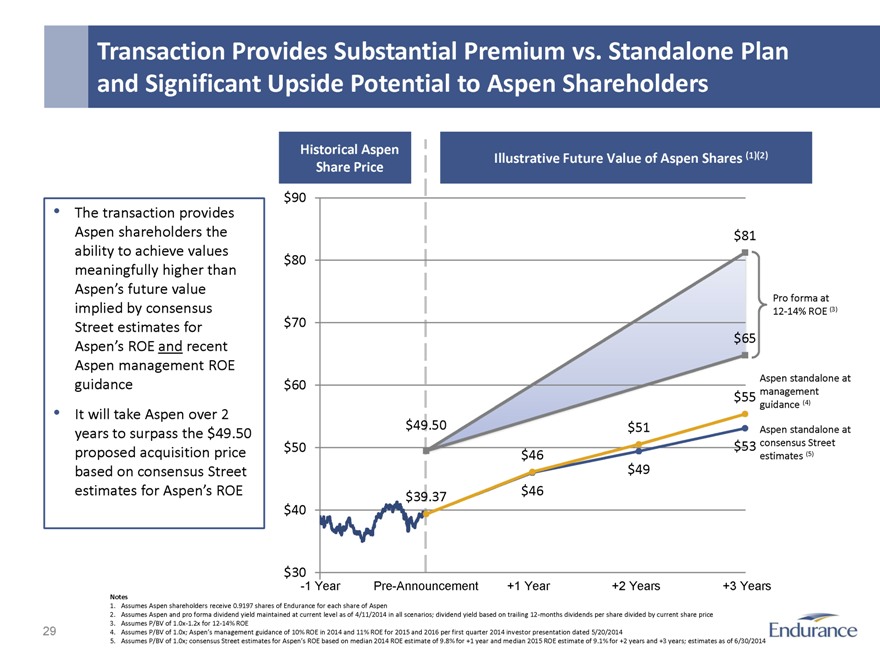

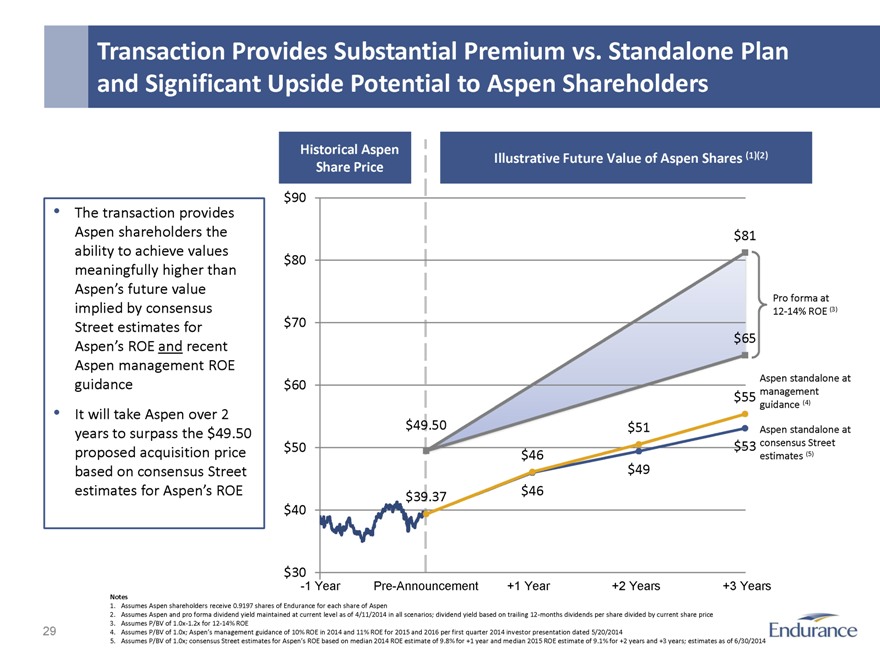

Transaction Provides Substantial Premium vs. Standalone Plan and Significant Upside Potential to Aspen Shareholders

The transaction provides Aspen shareholders the ability to achieve values meaningfully higher than Aspen’s future value implied by consensus Street estimates for Aspen’s ROE and recent Aspen management ROE guidance

It will take Aspen over 2 years to surpass the $49.50 proposed acquisition price based on consensus Street estimates for Aspen’s ROE

Historical Aspen Illustrative Future Value of Aspen Shares (1)(2)

Share Price

$90

$81

$80

Pro forma at

12-14% ROE (3)

$70

$65

$60 Aspen standalone at

$55 management

guidance (4)

$49.50 $51 Aspen standalone at

$50 $53 consensus Street

$46 estimates (5)

$49

$39.37 $46

$40

$30

-1 Year Pre-Announcement +1 Year +2 Years +3 Years

Notes

1. Assumes Aspen shareholders receive 0.9197 shares of Endurance for each share of Aspen

2. Assumes Aspen and pro forma dividend yield maintained at current level as of 4/11/2014 in all scenarios; dividend yield based on trailing 12-months dividends per share divided by current share price 3. Assumes P/BV of 1.0x-1.2x for 12-14% ROE

4. Assumes P/BV of 1.0x; Aspen’s management guidance of 10% ROE in 2014 and 11% ROE for 2015 and 2016 per first quarter 2014 investor presentation dated 5/20/2014

5. Assumes P/BV of 1.0x; consensus Street estimates for Aspen’s ROE based on median 2014 ROE estimate of 9.8% for +1 year and median 2015 ROE estimate of 9.1% for +2 years and +3 years; estimates as of 6/30/2014

Endurance

29

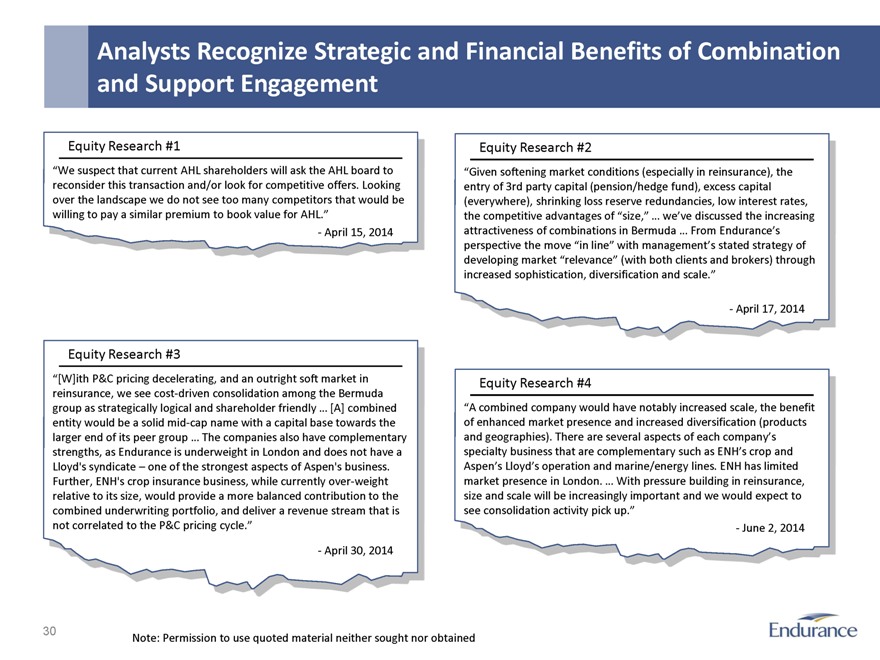

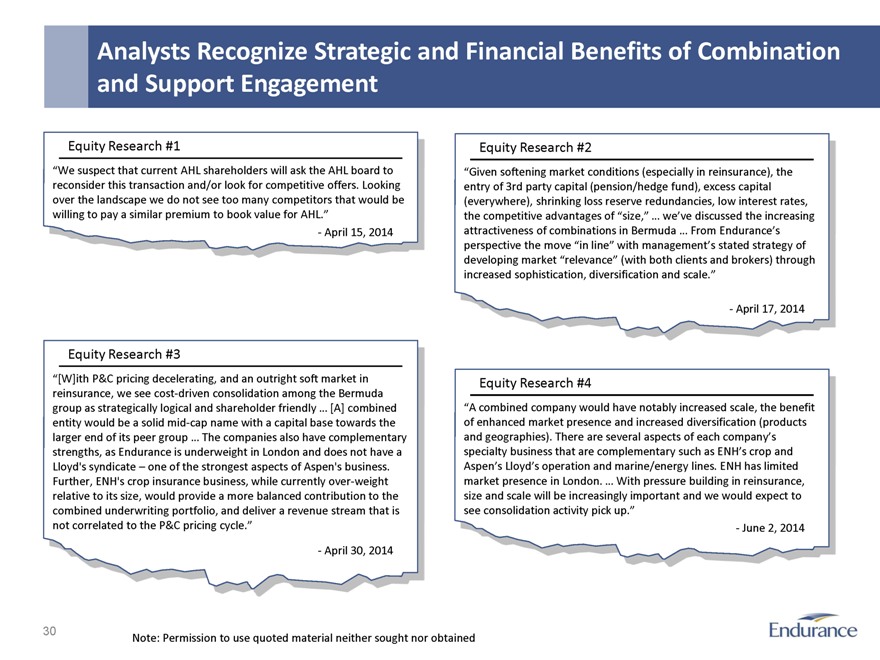

Analysts Recognize Strategic and Financial Benefits of Combination and Support Engagement

Equity Research #1

“We suspect that current AHL shareholders will ask the AHL board to reconsider this transaction and/or look for competitive offers. Looking over the landscape we do not see too many competitors that would be willing to pay a similar premium to book value for AHL.”

- April 15, 2014

Equity Research #2

“Given softening market conditions (especially in reinsurance), the entry of 3rd party capital (pension/hedge fund), excess capital (everywhere), shrinking loss reserve redundancies, low interest rates, the competitive advantages of “size,” … we’ve discussed the increasing attractiveness of combinations in Bermuda … From Endurance’s perspective the move “in line” with management’s stated strategy of developing market “relevance” (with both clients and brokers) through increased sophistication, diversification and scale.”

- April 17, 2014

Equity Research #3

“[W]ith P&C pricing decelerating, and an outright soft market in reinsurance, we see cost-driven consolidation among the Bermuda group as strategically logical and shareholder friendly … [A] combined entity would be a solid mid-cap name with a capital base towards the larger end of its peer group … The companies also have complementary strengths, as Endurance is underweight in London and does not have a Lloyd’s syndicate – one of the strongest aspects of Aspen’s business. Further, ENH’s crop insurance business, while currently over-weight relative to its size, would provide a more balanced contribution to the combined underwriting portfolio, and deliver a revenue stream that is not correlated to the P&C pricing cycle.”

- April 30, 2014

Equity Research #4

“A combined company would have notably increased scale, the benefit of enhanced market presence and increased diversification (products and geographies). There are several aspects of each company’s specialty business that are complementary such as ENH’s crop and Aspen’s Lloyd’s operation and marine/energy lines. ENH has limited market presence in London. … With pressure building in reinsurance, size and scale will be increasingly important and we would expect to see consolidation activity pick up.”

- June 2, 2014

Note: Permission to use quoted material neither sought nor obtained

Endurance

30

Endurance

Endurance’s Actions to Expedite the Transaction

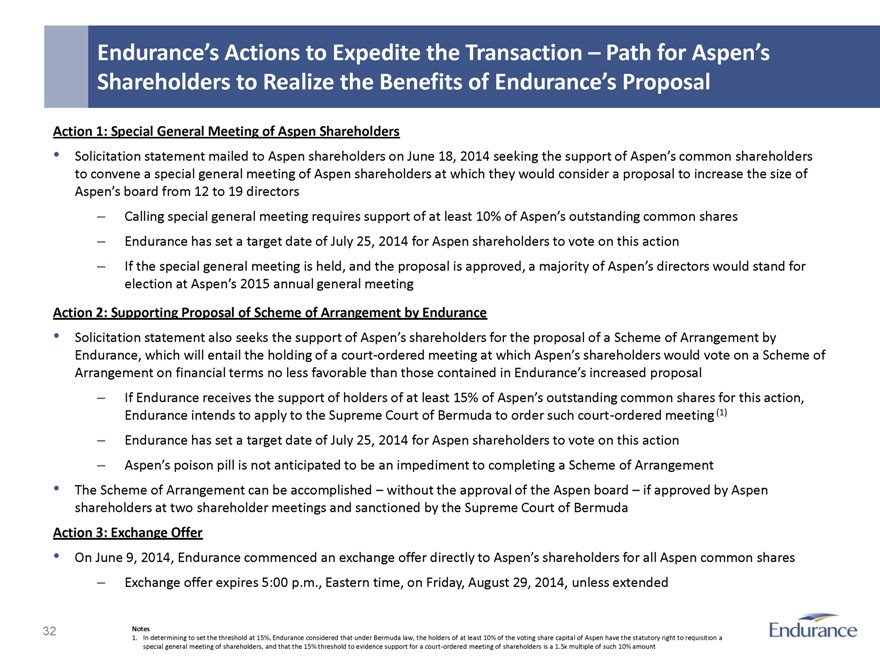

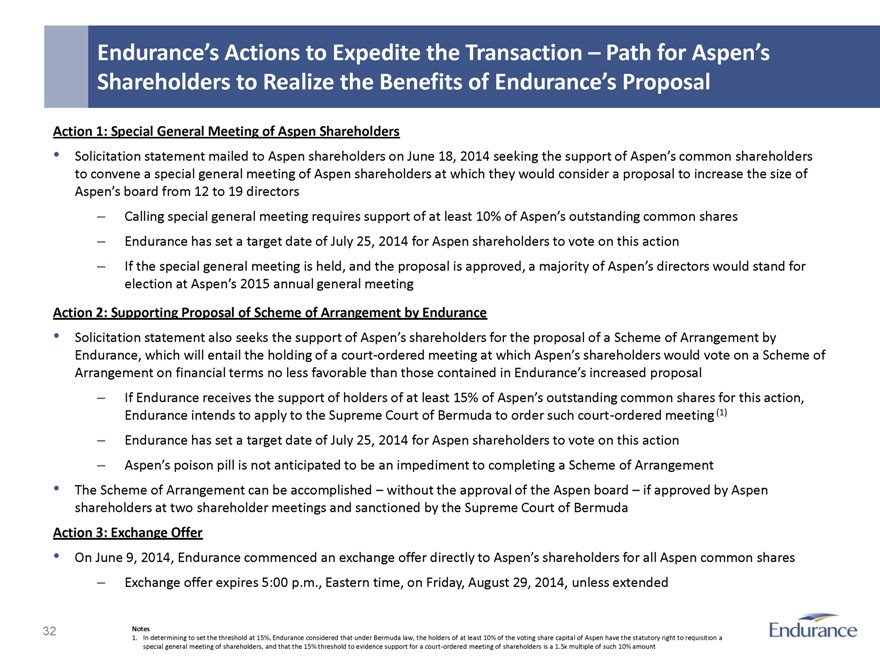

Endurance’s Actions to Expedite the Transaction – Path for Aspen’s Shareholders to Realize the Benefits of Endurance’s Proposal

Action 1: Special General Meeting of Aspen Shareholders

Solicitation statement mailed to Aspen shareholders on June 18, 2014 seeking the support of Aspen’s common shareholders to convene a special general meeting of Aspen shareholders at which they would consider a proposal to increase the size of

Aspen’s board from 12 to 19 directors

– Calling special general meeting requires support of at least 10% of Aspen’s outstanding common shares

– Endurance has set a target date of July 25, 2014 for Aspen shareholders to vote on this action

– If the special general meeting is held, and the proposal is approved, a majority of Aspen’s directors would stand for election at Aspen’s 2015 annual general meeting

Action 2: Supporting Proposal of Scheme of Arrangement by Endurance

Solicitation statement also seeks the support of Aspen’s shareholders for the proposal of a Scheme of Arrangement by

Endurance, which will entail the holding of a court-ordered meeting at which Aspen’s shareholders would vote on a Scheme of

Arrangement on financial terms no less favorable than those contained in Endurance’s increased proposal

– If Endurance receives the support of holders of at least 15% of Aspen’s outstanding common shares for this action,

Endurance intends to apply to the Supreme Court of Bermuda to order such court-ordered meeting(1)

– Endurance has set a target date of July 25, 2014 for Aspen shareholders to vote on this action

– Aspen’s poison pill is not anticipated to be an impediment to completing a Scheme of Arrangement

The Scheme of Arrangement can be accomplished – without the approval of the Aspen board – if approved by Aspen shareholders at two shareholder meetings and sanctioned by the Supreme Court of Bermuda

Action 3: Exchange Offer

On June 9, 2014, Endurance commenced an exchange offer directly to Aspen’s shareholders for all Aspen common shares

– Exchange offer expires 5:00 p.m., Eastern time, on Friday, August 29, 2014, unless extended

Notes

1. In determining to set the threshold at 15%, Endurance considered that under Bermuda law, the holders of at least 10% of the voting share capital of Aspen have the statutory right to requisition a special general meeting of shareholders, and that the 15% threshold to evidence support for a court-ordered meeting of shareholders is a 1.5x multiple of such 10% amount

Endurance

32

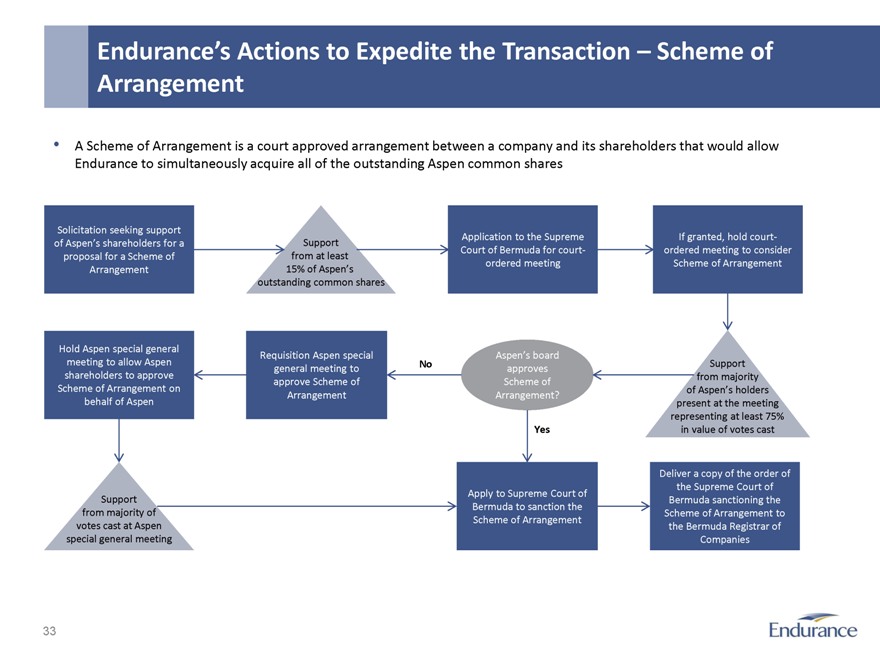

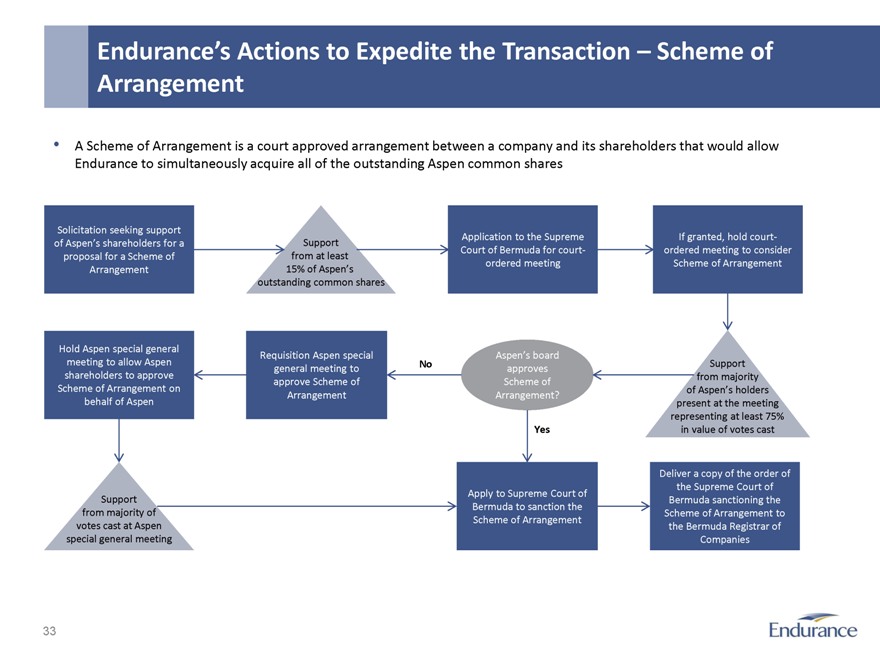

Endurance’s Actions to Expedite the Transaction – Scheme of Arrangement

A Scheme of Arrangement is a court approved arrangement between a company and its shareholders that would allow Endurance to simultaneously acquire all of the outstanding Aspen common shares

Solicitation seeking support of Aspen’s shareholders for a proposal for a Scheme of Arrangement

Support from at least 15% of Aspen’s outstanding common shares

Application to the Supreme Court of Bermuda for court-ordered meeting

If granted, hold court-ordered meeting to consider Scheme of Arrangement

Hold Aspen special general meeting to allow Aspen shareholders to approve Scheme of Arrangement on behalf of Aspen

Requisition Aspen special general meeting to approve Scheme of Arrangement

No

Aspen’s board approves Scheme of Arrangement?

Support from majority of Aspen’s holders present at the meeting representing at least 75% in value of votes cast

Yes

Apply to Supreme Court of Bermuda to sanction the Scheme of Arrangement

Support from majority of votes cast at Aspen special general meeting

Deliver a copy of the order of the Supreme Court of Bermuda sanctioning the Scheme of Arrangement to the Bermuda Registrar of Companies

Endurance

33

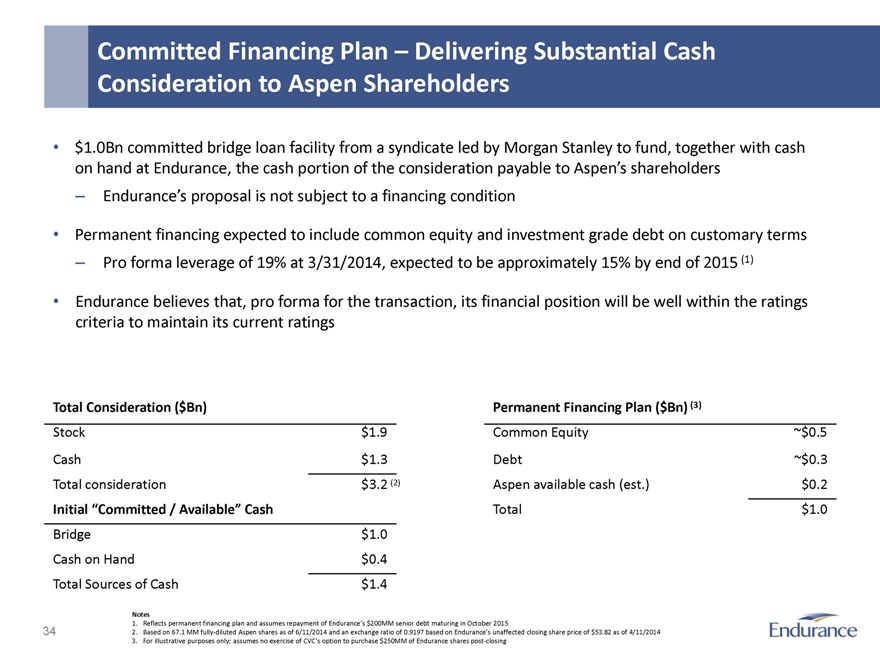

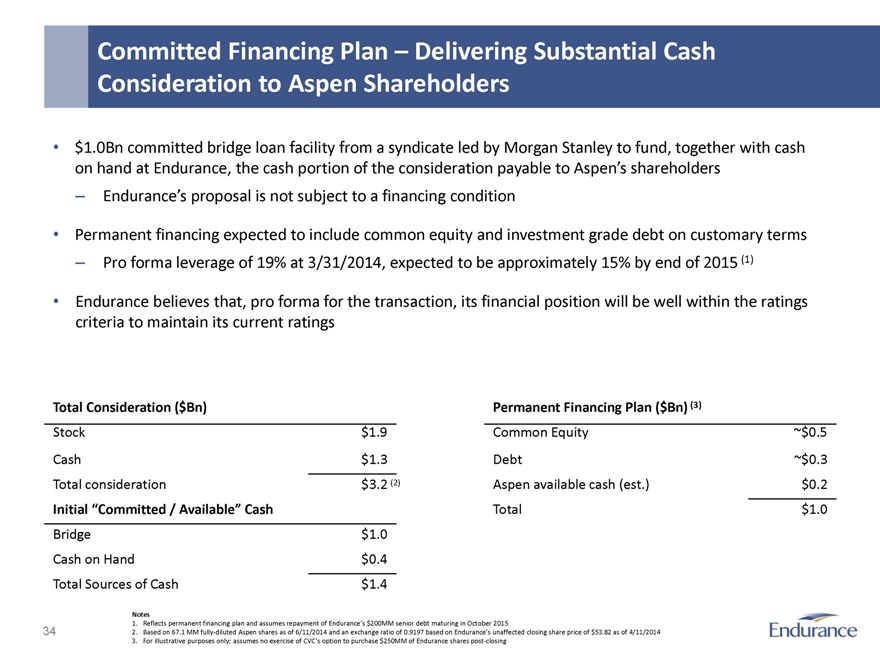

Committed Financing Plan – Delivering Substantial Cash Consideration to Aspen Shareholders

$1.0Bn committed bridge loan facility from a syndicate led by Morgan Stanley to fund, together with cash on hand at Endurance, the cash portion of the consideration payable to Aspen’s shareholders

Endurance’s proposal is not subject to a financing condition

Permanent financing expected to include common equity and investment grade debt on customary terms

Pro forma leverage of 19% at 3/31/2014, expected to be approximately 15% by end of 2015 (1)

Endurance believes that, pro forma for the transaction, its financial position will be well within the ratings criteria to maintain its current ratings

Total Consideration ($Bn)

Stock $1.9

Cash $1.3

Total consideration $3.2 (2)

Initial “Committed / Available” Cash

Bridge $1.0

Cash on Hand $0.4

Total Sources of Cash

$1.4

Permanent Financing Plan ($Bn) (3)

Common Equity ~$0.5

Debt ~$0.3

Aspen available cash (est.) $0.2

Total $1.0

Notes

1. Reflects permanent financing plan and assumes repayment of Endurance’s $200MM senior debt maturing in October 2015

2. Based on 67.1 MM fully-diluted Aspen shares as of 6/11/2014 and an exchange ratio of 0.9197 based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014 3. For illustrative purposes only; assumes no exercise of CVC’s option to purchase $250MM of Endurance shares post-closing

Endurance

34

Endurance

Appendix

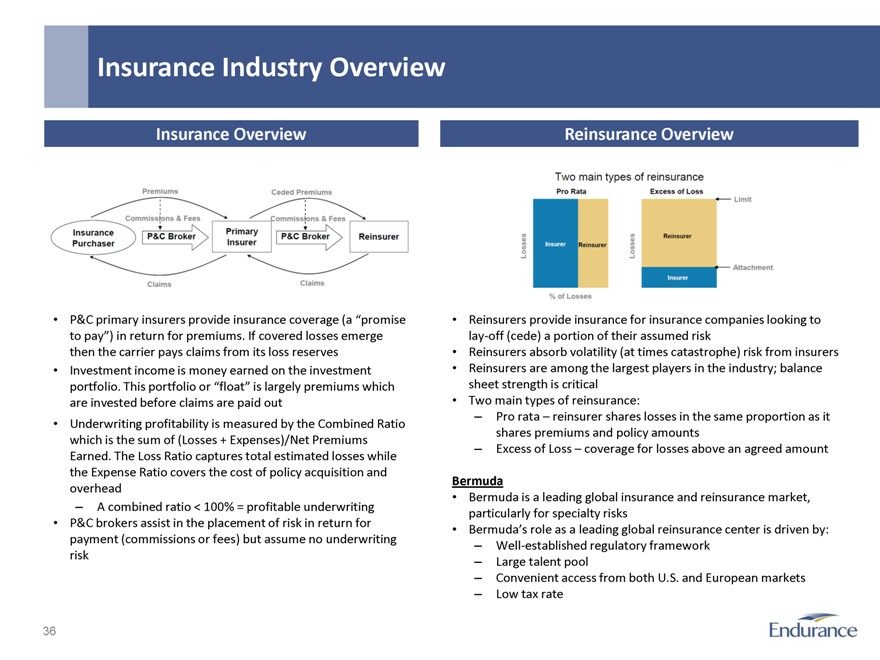

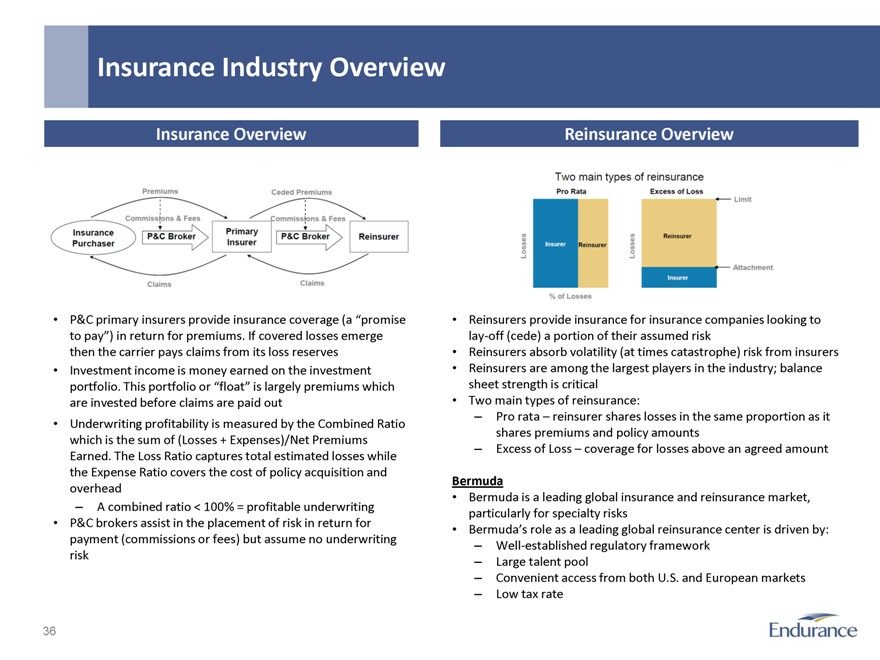

Insurance Industry Overview

Insurance Overview

Reinsurance Overview

Premiums

Commissions & Fees

Insurance Purchaser

P&C Broker

Claims

Primary Insurer

Ceded Premiums

Commissions & Fees

P&C Broker

Reinsurer

Claims

Two main types of reinsurance

Pro Rata

Losses

Insurer

Reinsurer

% of Losses

Excess of Loss

Losses

Reinsurer

Insurer

Limit

Attachment

P&C primary insurers provide insurance coverage (a “promise to pay”) in return for premiums. If covered losses emerge then the carrier pays claims from its loss reserves

Investment income is money earned on the investment portfolio. This portfolio or “float” is largely premiums which are invested before claims are paid out

Underwriting profitability is measured by the Combined Ratio which is the sum of (Losses + Expenses)/Net Premiums Earned. The Loss Ratio captures total estimated losses while the Expense Ratio covers the cost of policy acquisition and overhead – A combined ratio < 100% = profitable underwriting

P&C brokers assist in the placement of risk in return for payment (commissions or fees) but assume no underwriting risk

Reinsurers provide insurance for insurance companies looking to lay-off (cede) a portion of their assumed risk

Reinsurers absorb volatility (at times catastrophe) risk from insurers

Reinsurers are among the largest players in the industry; balance sheet strength is critical

Two main types of reinsurance:

– Pro rata – reinsurer shares losses in the same proportion as it shares premiums and policy amounts

– Excess of Loss – coverage for losses above an agreed amount

Bermuda

Bermuda is a leading global insurance and reinsurance market, particularly for specialty risks

Bermuda’s role as a leading global reinsurance center is driven by:

– Well-established regulatory framework

– Large talent pool

– Convenient access from both U.S. and European markets

– Low tax rate

Endurance

36

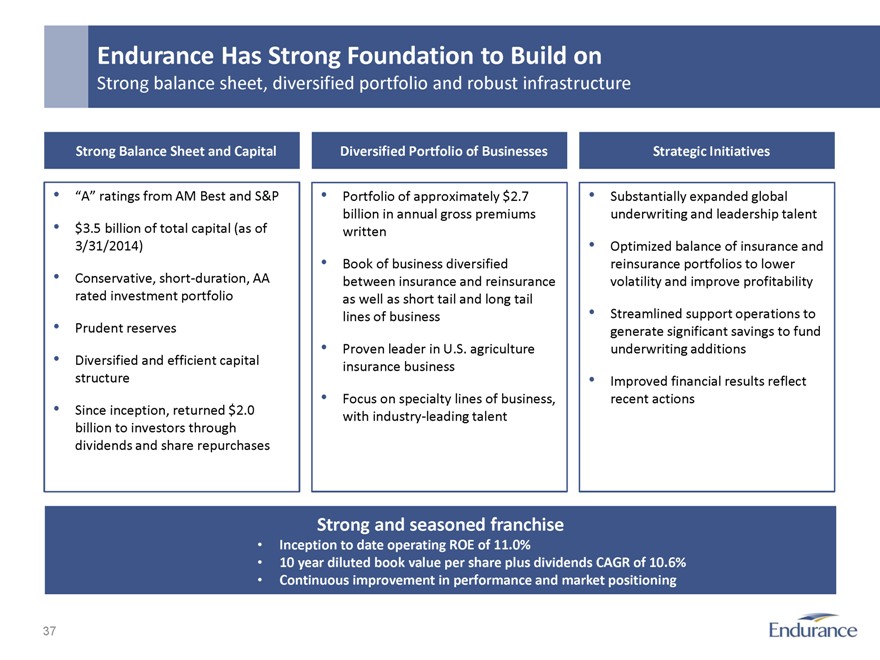

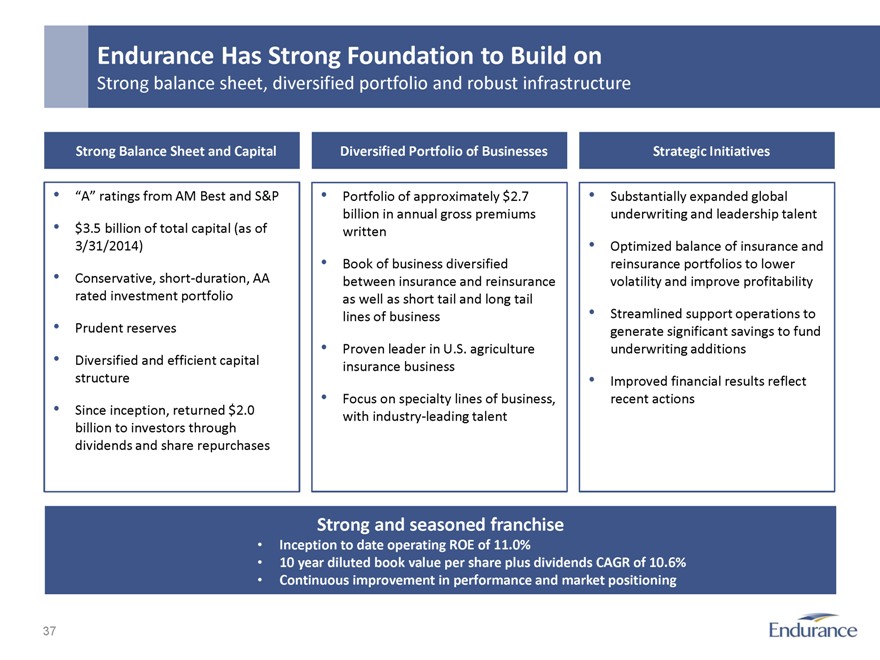

Endurance Has Strong Foundation to Build on

Strong balance sheet, diversified portfolio and robust infrastructure

Strong Balance Sheet and Capital

“A” ratings from AM Best and S&P

$3.5 billion of total capital (as of 3/31/2014)

Conservative, short-duration, AA rated investment portfolio

Prudent reserves

Diversified and efficient capital structure

Since inception, returned $2.0 billion to investors through dividends and share repurchases

Diversified Portfolio of Businesses

Portfolio of approximately $2.7 billion in annual gross premiums written

Book of business diversified between insurance and reinsurance as well as short tail and long tail lines of business

Proven leader in U.S. agriculture insurance business

Focus on specialty lines of business, with industry-leading talent

Strategic Initiatives

Substantially expanded global underwriting and leadership talent

Optimized balance of insurance and reinsurance portfolios to lower volatility and improve profitability

Streamlined support operations to generate significant savings to fund underwriting additions

Improved financial results reflect recent actions

Strong and seasoned franchise

Inception to date operating ROE of 11.0%

10 year diluted book value per share plus dividends CAGR of 10.6%

Continuous improvement in performance and market positioning

Endurance

37

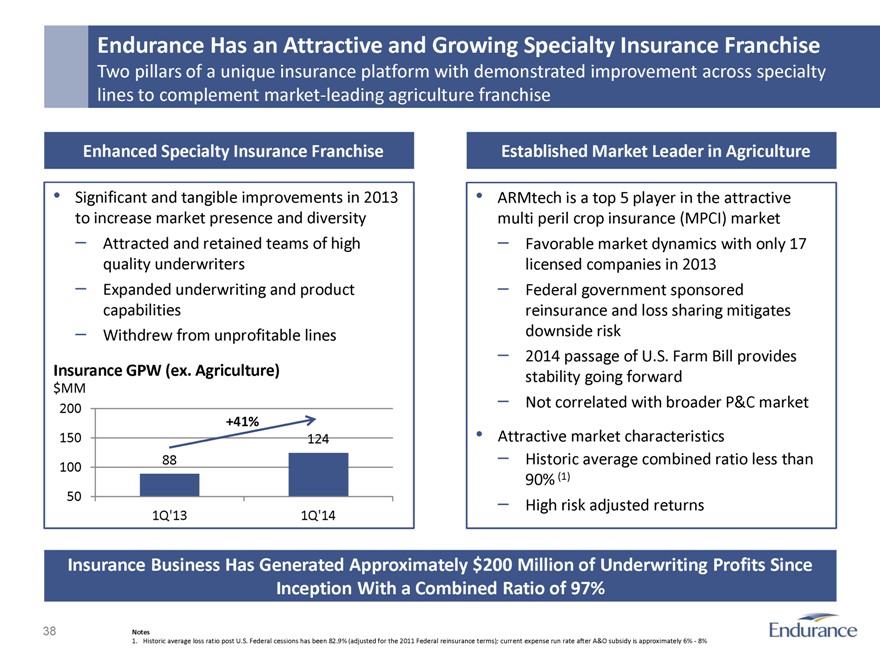

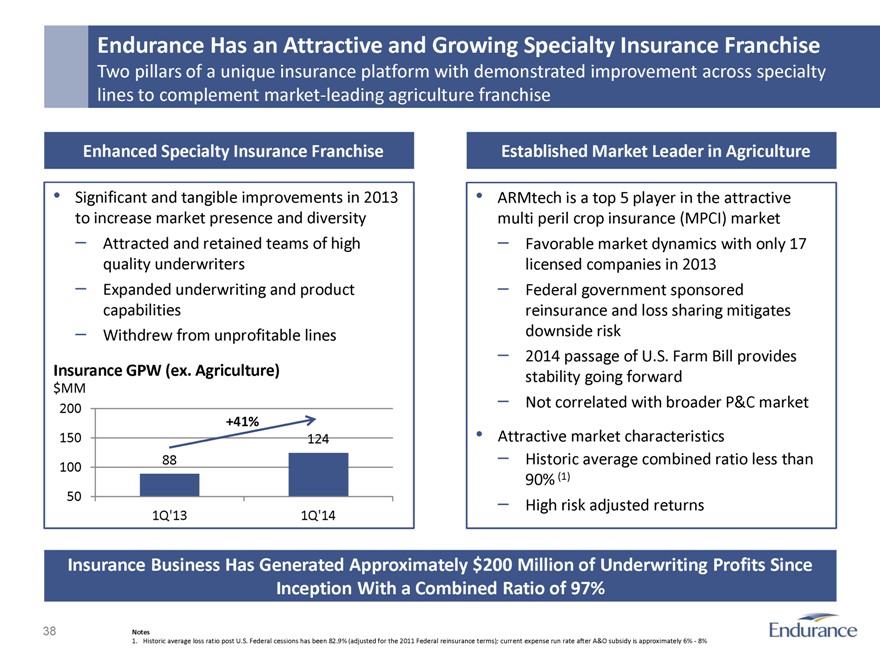

Endurance Has an Attractive and Growing Specialty Insurance Franchise

Two pillars of a unique insurance platform with demonstrated improvement across specialty lines to complement market-leading agriculture franchise

Enhanced Specialty Insurance Franchise

Significant and tangible improvements in 2013 to increase market presence and diversity

– Attracted and retained teams of high quality underwriters

– Expanded underwriting and product capabilities

– Withdrew from unprofitable lines

Insurance GPW (ex. Agriculture)

$MM

200

+41%

150

124

100

88

50

1Q’13

1Q’14

Established Market Leader in Agriculture

ARMtech is a top 5 player in the attractive multi peril crop insurance (MPCI) market

– Favorable market dynamics with only 17 licensed companies in 2013

– Federal government sponsored reinsurance and loss sharing mitigates downside risk

– 2014 passage of U.S. Farm Bill provides stability going forward

– Not correlated with broader P&C market

Attractive market characteristics

– Historic average combined ratio less than 90% (1)

– High risk adjusted returns

Insurance Business Has Generated Approximately $200 Million of Underwriting Profits Since Inception With a Combined Ratio of 97%

Notes

1. Historic average loss ratio post U.S. Federal cessions has been 82.9% (adjusted for the 2011 Federal reinsurance terms); current expense run rate after A&O subsidy is approximately 6% - 8%

Endurance

38

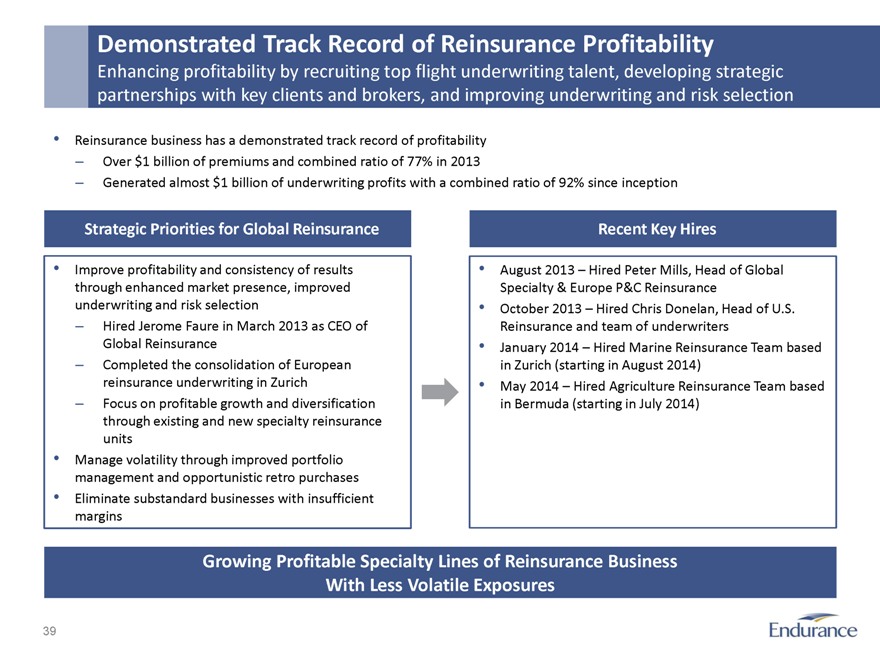

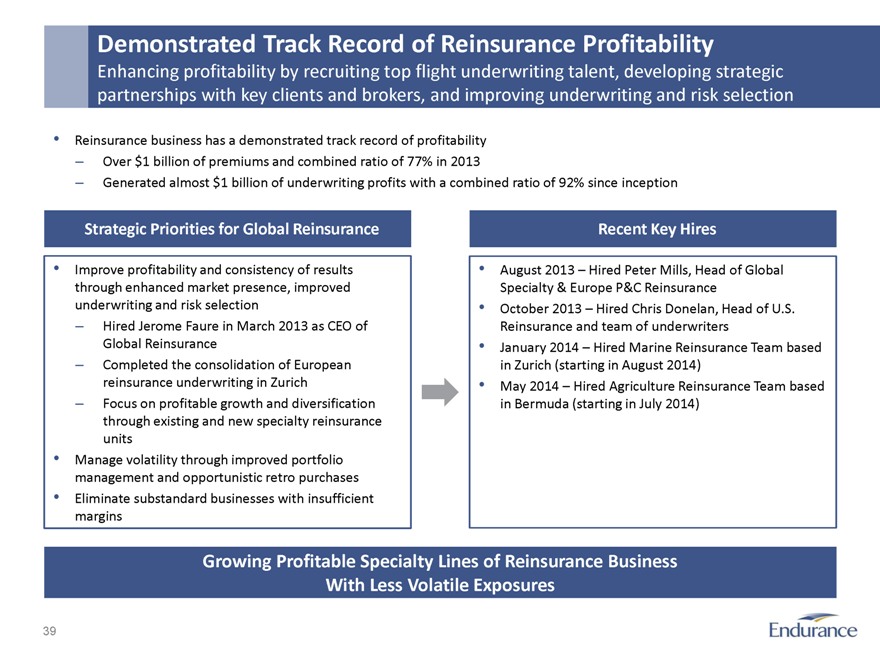

Demonstrated Track Record of Reinsurance Profitability

Enhancing profitability by recruiting top flight underwriting talent, developing strategic partnerships with key clients and brokers, and improving underwriting and risk selection

Reinsurance business has a demonstrated track record of profitability

– Over $1 billion of premiums and combined ratio of 77% in 2013

– Generated almost $1 billion of underwriting profits with a combined ratio of 92% since inception

Strategic Priorities for Global Reinsurance

Improve profitability and consistency of results through enhanced market presence, improved underwriting and risk selection

– Hired Jerome Faure in March 2013 as CEO of Global Reinsurance

– Completed the consolidation of European reinsurance underwriting in Zurich

– Focus on profitable growth and diversification through existing and new specialty reinsurance units

Manage volatility through improved portfolio management and opportunistic retro purchases

Eliminate substandard businesses with insufficient margins

Recent Key Hires

August 2013 – Hired Peter Mills, Head of Global Specialty & Europe P&C Reinsurance

October 2013 – Hired Chris Donelan, Head of U.S. Reinsurance and team of underwriters

January 2014 – Hired Marine Reinsurance Team based in Zurich (starting in August 2014)

May 2014 – Hired Agriculture Reinsurance Team based in Bermuda (starting in July 2014)

Growing Profitable Specialty Lines of Reinsurance Business With Less Volatile Exposures

Endurance

39

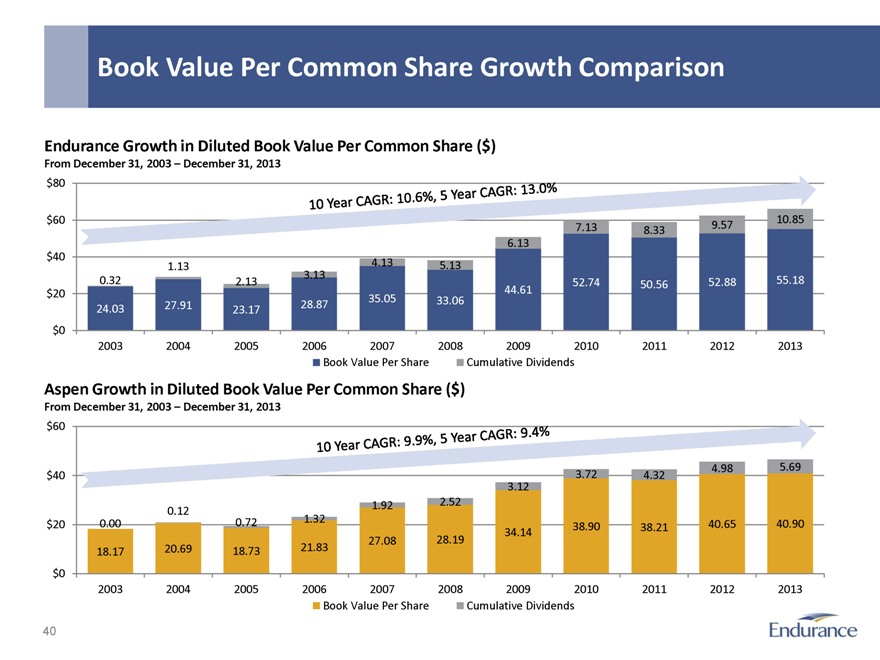

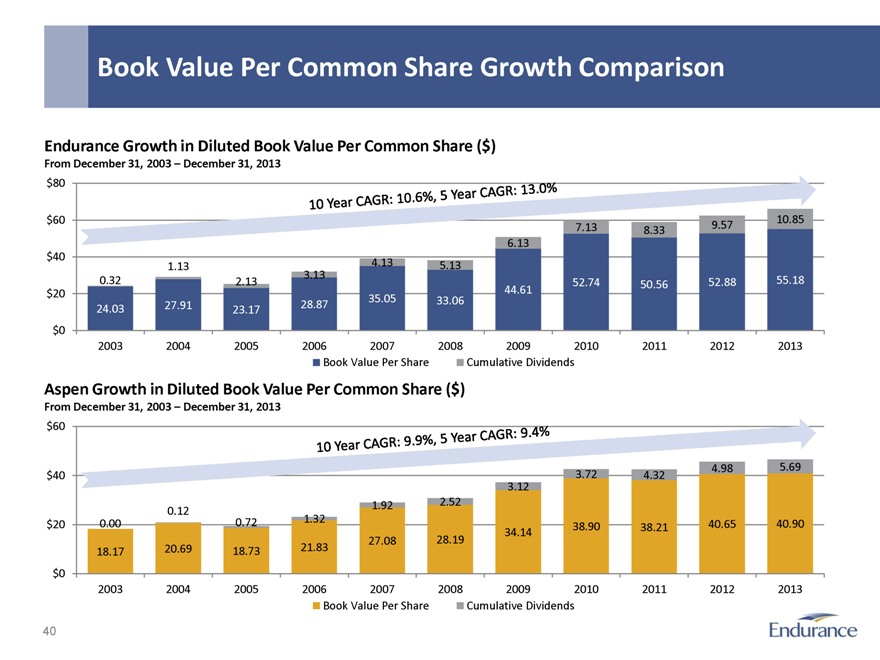

Book Value Per Common Share Growth Comparison

Endurance Growth in Diluted Book Value Per Common Share ($)

From December 31, 2003 – December 31, 2013

10 Year CAGR: 10.6%, 5 Year CAGR: 13.0%

$80

$60

10.85

7.13

8.33

9.57

6.13

$40

4.13

1.13

5.13

3.13

0.32

2.13

52.74

50.56

52.88

55.18

$20

44.61

27.91

28.87

35.05

33.06

24.03

23.17

$0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Book Value Per Share

Cumulative Dividends

Aspen Growth in Diluted Book Value Per Common Share ($)

From December 31, 2003 – December 31, 2013

10 Year CAGR: 9.9%, 5 Year CAGR: 9.4%

$60

$40

3.72

4.32

4.98

5.69

3.12

1.92

2.52

0.12

$20

0.00

0.72

1.32

38.90

38.21

40.65

40.90

34.14

27.08

28.19

18.17

20.69

18.73

21.83

$0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Book Value Per Share

Cumulative Dividends

Endurance

40

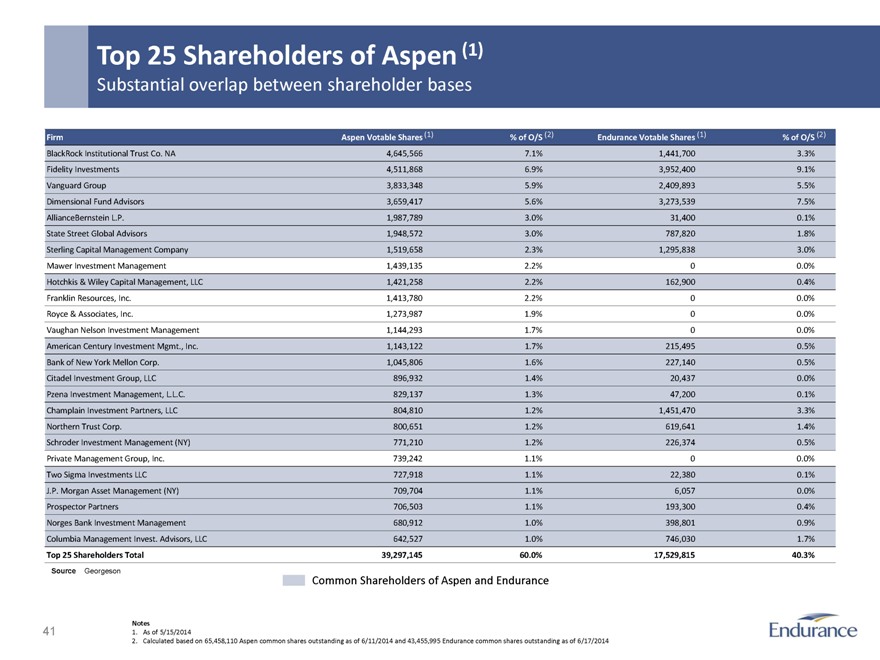

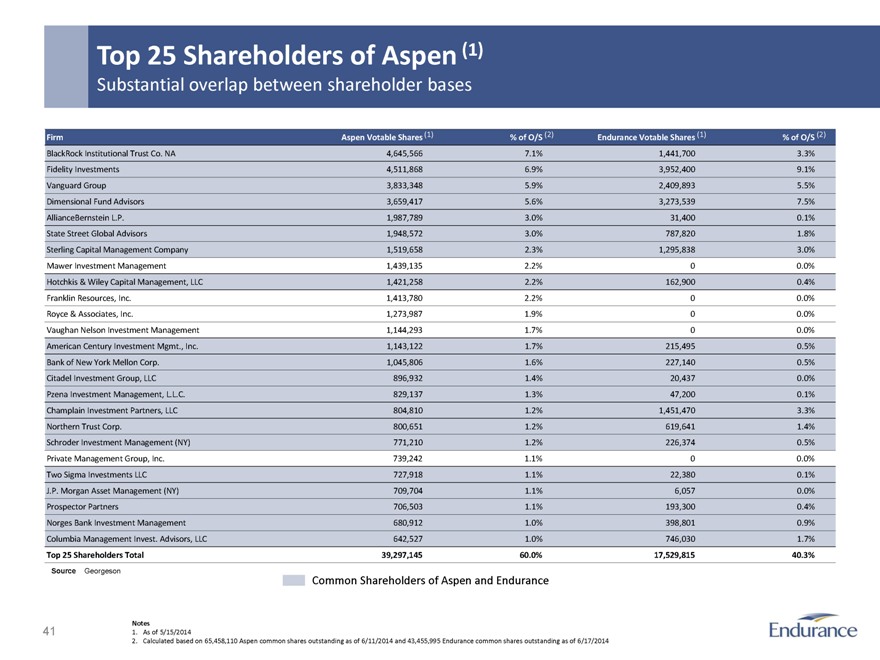

Top 25 Shareholders of Aspen (1)

Substantial overlap between shareholder bases

Firm Aspen Votable Shares (1) % of O/S (2)

Endurance Votable Shares (1)

% of O/S (2)

BlackRock Institutional Trust Co. NA

4,645,566

7.1%

1,441,700

3.3%

Fidelity Investments

4,511,868

6.9%

3,952,400

9.1%

Vanguard Group

3,833,348

5.9%

2,409,893

5.5%

Dimensional Fund Advisors

3,659,417

5.6%

3,273,539

7.5%

AllianceBernstein L.P.

1,987,789

3.0%

31,400

0.1%

State Street Global Advisors

1,948,572

3.0%

787,820

1.8%

Sterling Capital Management Company

1,519,658

2.3%

1,295,838

3.0%

Mawer Investment Management

1,439,135

2.2%

0

0.0%

Hotchkis & Wiley Capital Management, LLC

1,421,258

2.2%

162,900

0.4%

Franklin Resources, Inc.

1,413,780

2.2%

0

0.0%

Royce & Associates, Inc.

1,273,987

1.9%

0

0.0%

Vaughan Nelson Investment Management

1,144,293

1.7%

0

0.0%

American Century Investment Mgmt., Inc.

1,143,122

1.7%

215,495

0.5%

Bank of New York Mellon Corp.

1,045,806

1.6%

227,140

0.5%

Citadel Investment Group, LLC

896,932

1.4%

20,437

0.0%

Pzena Investment Management, L.L.C.

829,137

1.3%

47,200

0.1%

Champlain Investment Partners, LLC

804,810

1.2%

1,451,470

3.3%

Northern Trust Corp.

800,651

1.2%

619,641

1.4%

Schroder Investment Management (NY)

771,210

1.2%

226,374

0.5%

Private Management Group, Inc.

739,242

1.1%

0

0.0%

Two Sigma Investments LLC

727,918

1.1%

22,380

0.1%

J.P. Morgan Asset Management (NY)

709,704

1.1%

6,057

0.0%

Prospector Partners

706,503

1.1%

193,300

0.4%

Norges Bank Investment Management

680,912

1.0%

398,801

0.9%

Columbia Management Invest. Advisors, LLC

642,527

1.0%

746,030

1.7%

Top 25 Shareholders Total

39,297,145

60.0%

17,529,815

40.3%

Source Georgeson

Common Shareholders of Aspen and Endurance

Notes

1. As of 5/15/2014

2. Calculated based on 65,458,110 Aspen common shares outstanding as of 6/11/2014 and 43,455,995 Endurance common shares outstanding as of 6/17/2014

Endurance

41

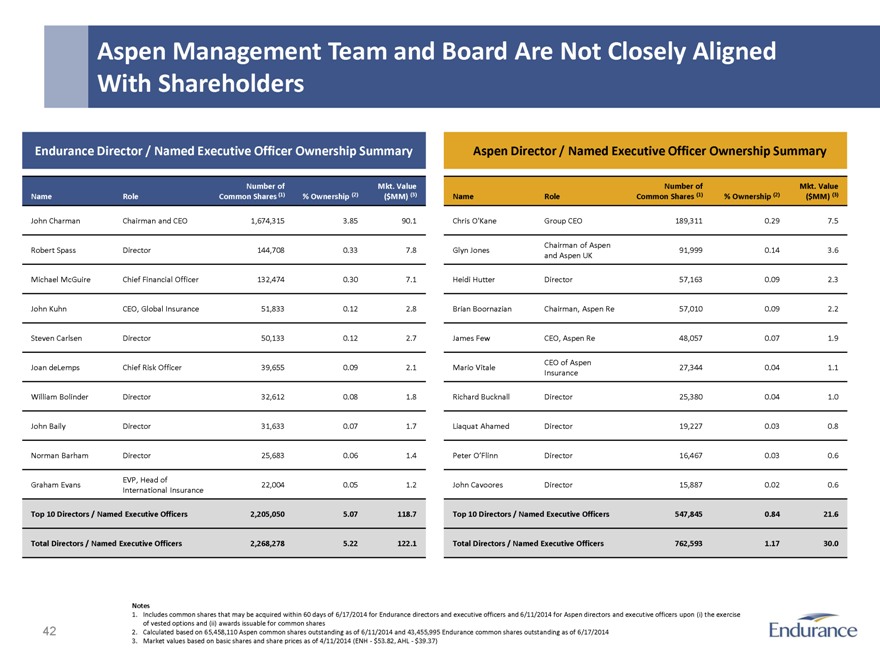

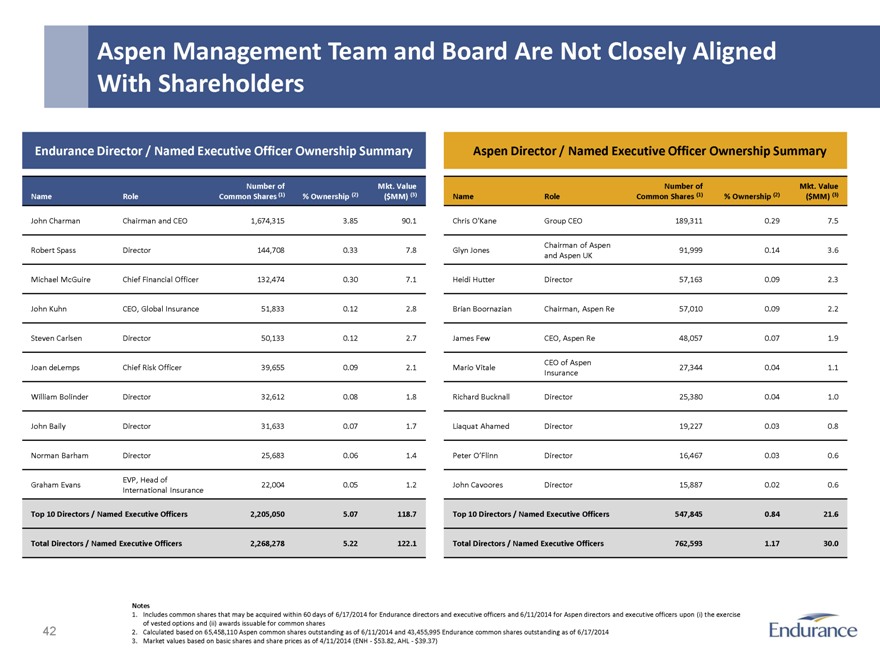

Aspen Management Team and Board Are Not Closely Aligned With Shareholders

Endurance Director / Named Executive Officer Ownership Summary

Number of

Mkt. Value

Name

Role

Common Shares (1)

% Ownership (2)

($MM) (3)

John Charman

Chairman and CEO

1,674,315

3.85

90.1

Robert Spass

Director

144,708

0.33

7.8

Michael McGuire

Chief Financial Officer

132,474

0.30

7.1

John Kuhn

CEO, Global Insurance

51,833

0.12

2.8

Steven Carlsen

Director

50,133

0.12

2.7

Joan deLemps

Chief Risk Officer

39,655

0.09

2.1

William Bolinder

Director

32,612

0.08

1.8

John Baily

Director

31,633

0.07

1.7

Norman Barham

Director

25,683

0.06

1.4

EVP, Head of

Graham Evans

22,004

0.05

1.2

International Insurance

Top 10 Directors / Named Executive Officers

2,205,050

5.07

118.7

Total Directors / Named Executive Officers

2,268,278

5.22

122.1

Aspen Director / Named Executive Officer Ownership Summary

Number of

Mkt. Value

Name

Role

Common Shares (1)

% Ownership (2)

($MM) (3)

Chris O’Kane

Group CEO

189,311

0.29

7.5

Chairman of Aspen

Glyn Jones

91,999

0.14

3.6

and Aspen UK

Heidi Hutter

Director

57,163

0.09

2.3

Brian Boornazian

Chairman, Aspen Re

57,010

0.09

2.2

James Few

CEO, Aspen Re

48,057

0.07

1.9

CEO of Aspen

Mario Vitale

27,344

0.04

1.1

Insurance

Richard Bucknall

Director

25,380

0.04

1.0

Liaquat Ahamed

Director

19,227

0.03

0.8

Peter O’Flinn

Director

16,467

0.03

0.6

John Cavoores

Director

15,887

0.02

0.6

Top 10 Directors / Named Executive Officers

547,845

0.84

21.6

Total Directors / Named Executive Officers

762,593

1.17

30.0

Notes

1. Includes common shares that may be acquired within 60 days of 6/17/2014 for Endurance directors and executive officers and 6/11/2014 for Aspen directors and executive officers upon (i) the exercise

of vested options and (ii) awards issuable for common shares

2. Calculated based on 65,458,110 Aspen common shares outstanding as of 6/11/2014 and 43,455,995 Endurance common shares outstanding as of 6/17/2014

3. Market values based on basic shares and share prices as of 4/11/2014 (ENH - $53.82, AHL - $39.37)

Endurance

42

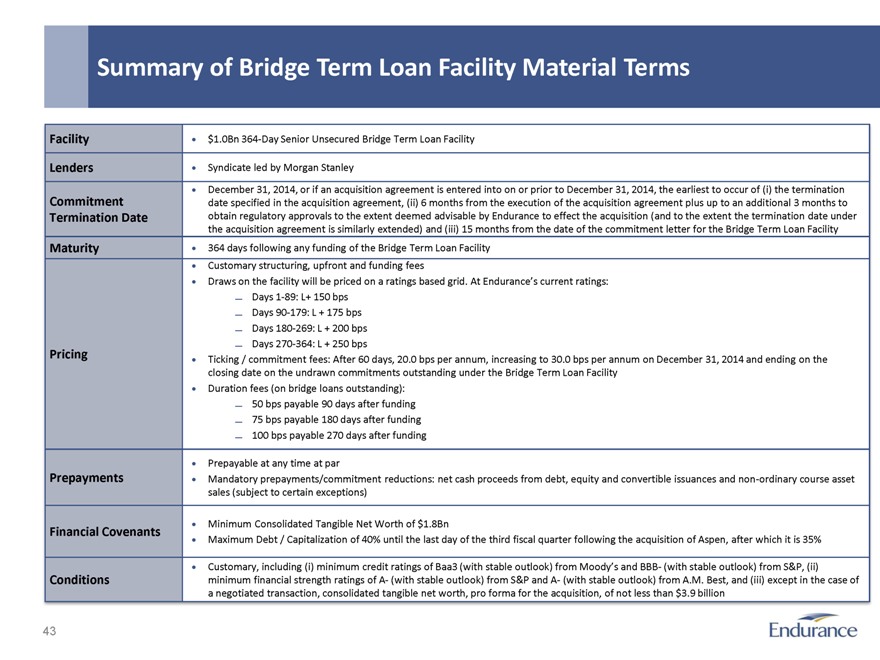

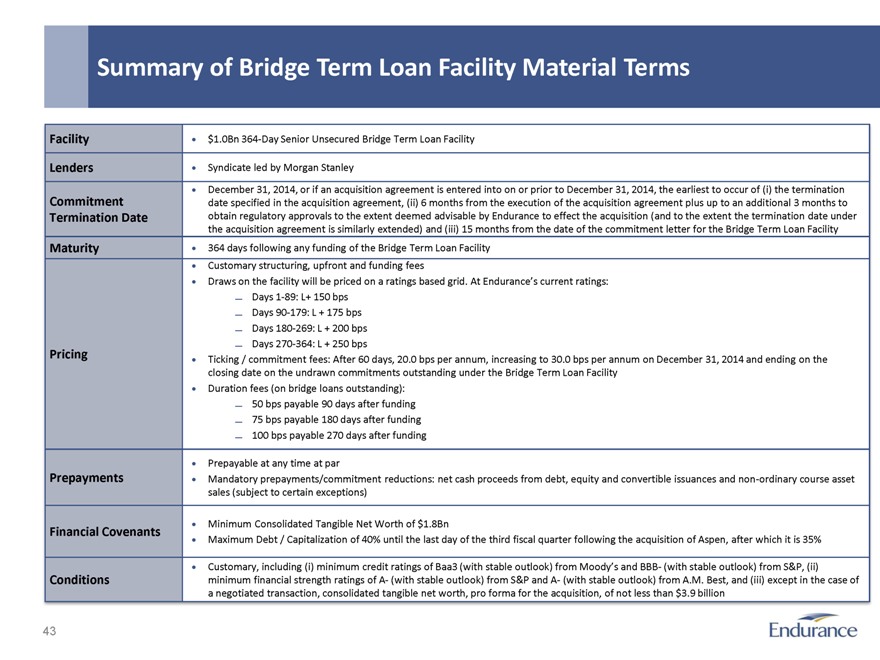

Summary of Bridge Term Loan Facility Material Terms

Facility

Lenders

Commitment

Termination Date

Maturity

Pricing

Prepayments

Financial Covenants

Conditions

$1.0Bn 364-Day Senior Unsecured Bridge Term Loan Facility

Syndicate led by Morgan Stanley

December 31, 2014, or if an acquisition agreement is entered into on or prior to December 31, 2014, the earliest to occur of (i) the termination

date specified in the acquisition agreement, (ii) 6 months from the execution of the acquisition agreement plus up to an additional 3 months to

obtain regulatory approvals to the extent deemed advisable by Endurance to effect the acquisition (and to the extent the termination date under

the acquisition agreement is similarly extended) and (iii) 15 months from the date of the commitment letter for the Bridge Term Loan Facility

364 days following any funding of the Bridge Term Loan Facility

Customary structuring, upfront and funding fees

Draws on the facility will be priced on a ratings based grid. At Endurance’s current ratings:

– Days 1-89: L+ 150 bps

– Days 90-179: L + 175 bps

– Days 180-269: L + 200 bps

– Days 270-364: L + 250 bps

Ticking / commitment fees: After 60 days, 20.0 bps per annum, increasing to 30.0 bps per annum on December 31, 2014 and ending on the

closing date on the undrawn commitments outstanding under the Bridge Term Loan Facility

Duration fees (on bridge loans outstanding):

– 50 bps payable 90 days after funding

– 75 bps payable 180 days after funding

– 100 bps payable 270 days after funding

Prepayable at any time at par

Mandatory prepayments/commitment reductions: net cash proceeds from debt, equity and convertible issuances and non-ordinary course asset

sales (subject to certain exceptions)

Minimum Consolidated Tangible Net Worth of $1.8Bn

Maximum Debt / Capitalization of 40% until the last day of the third fiscal quarter following the acquisition of Aspen, after which it is 35%

Customary, including (i) minimum credit ratings of Baa3 (with stable outlook) from Moody’s and BBB- (with stable outlook) from S&P, (ii)

minimum financial strength ratings of A- (with stable outlook) from S&P and A- (with stable outlook) from A.M. Best, and (iii) except in the case of

a negotiated transaction, consolidated tangible net worth, pro forma for the acquisition, of not less than $3.9 billion

Endurance

43

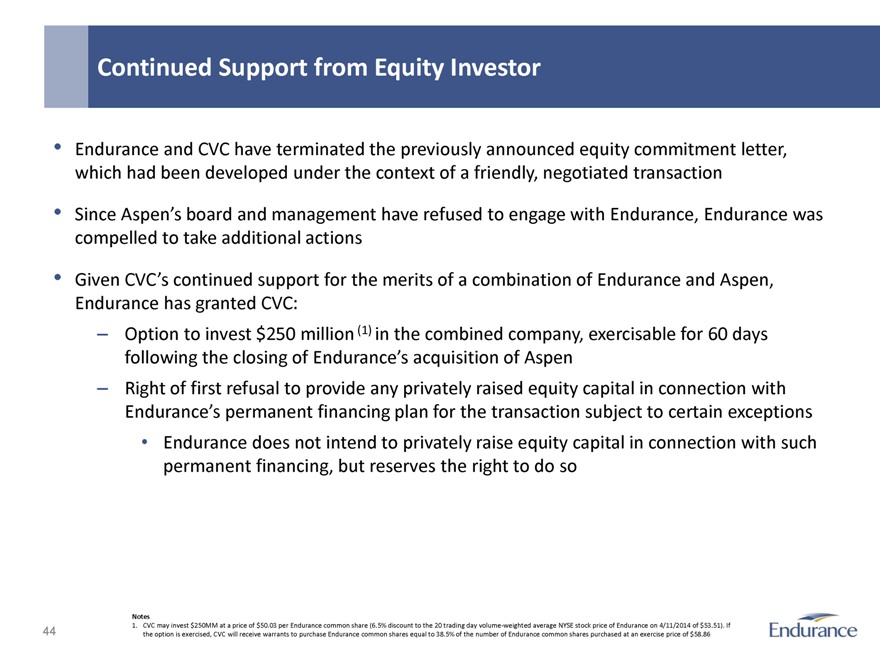

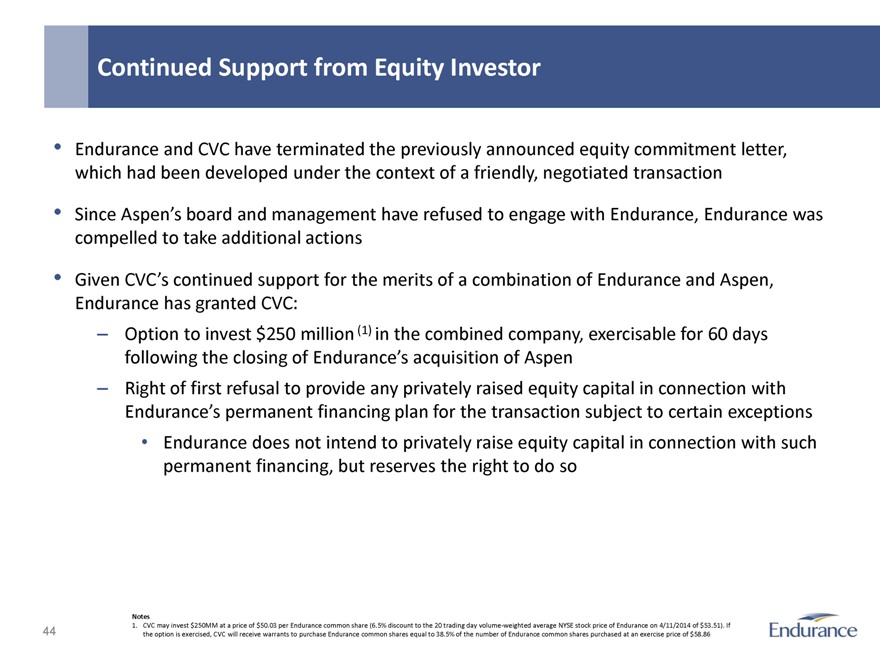

Continued Support from Equity Investor

Endurance and CVC have terminated the previously announced equity commitment letter, which had been developed under the context of a friendly, negotiated transaction

Since Aspen’s board and management have refused to engage with Endurance, Endurance was compelled to take additional actions

Given CVC’s continued support for the merits of a combination of Endurance and Aspen, Endurance has granted CVC:

– Option to invest $250 million (1) in the combined company, exercisable for 60 days following the closing of Endurance’s acquisition of Aspen

– Right of first refusal to provide any privately raised equity capital in connection with

Endurance’s permanent financing plan for the transaction subject to certain exceptions

Endurance does not intend to privately raise equity capital in connection with such permanent financing, but reserves the right to do so

Notes

1. CVC may invest $250MM at a price of $50.03 per Endurance common share (6.5% discount to the 20 trading day volume-weighted average NYSE stock price of Endurance on 4/11/2014 of $53.51). If the option is exercised, CVC will receive warrants to purchase Endurance common shares equal to 38.5% of the number of Endurance common shares purchased at an exercise price of $58.86

Endurance

44

Endurance and Aspen: Creating a Global Leader in Specialty Insurance and Reinsurance

Endurance

45