FILED BY ENDURANCE SPECIALTY HOLDINGS LTD.

PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933

AND DEEMED FILED PURSUANT TO RULE 14a-12

UNDER THE SECURITIES EXCHANGE ACT OF 1934

SUBJECT COMPANY: ASPEN INSURANCE HOLDINGS LIMITED

SEC REGISTRATION STATEMENT FILE NO. 333-196596

Endurance Sends Letter Urging Fellow Aspen Shareholders to Make Their Voices Heard: “Tell Aspen It’s Time to Put Entrenched Interests Aside and Focus on the Clear Benefits of Endurance’s Offer”

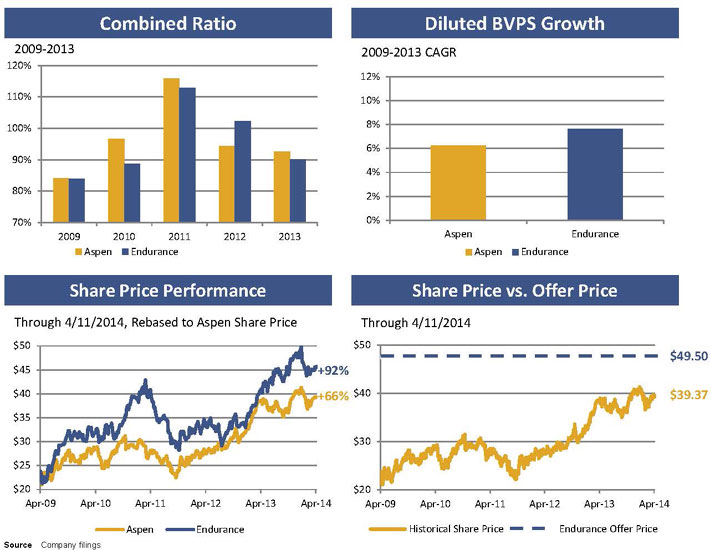

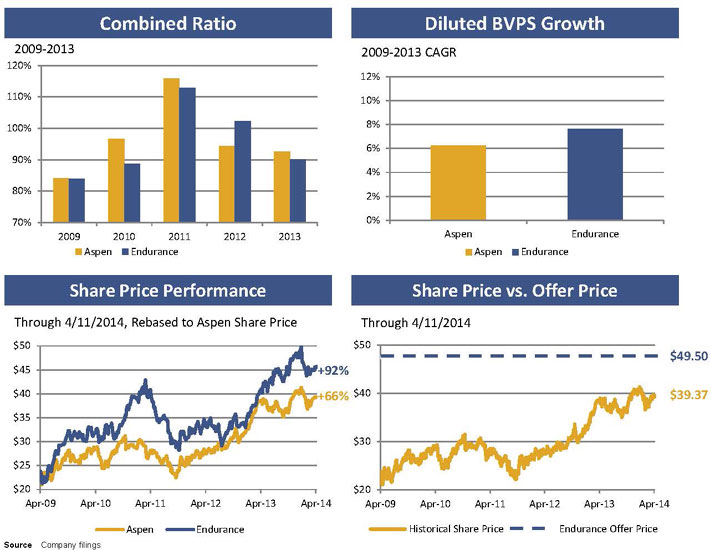

Aspen’s Performance Under Current Board and Management Has Significantly Lagged Endurance

Aspen’s Board and Management Have Not Shown That They Can or Will Deliver Value to Aspen Shareholders

Aspen Shareholders Should Vote FOR Endurance’s Two Proposals by Signing, Dating and Returning the WHITE Card by July 25th

PEMBROKE, Bermuda, July 10, 2014 – Endurance Specialty Holdings Ltd. (“Endurance”) (NYSE: ENH) is urging fellow shareholders of Aspen Insurance Holdings Limited (“Aspen”) (NYSE: AHL) to make their voices heard and tell Aspen’s board and management it’s time to put entrenched interests aside and focus on the clear benefits of Endurance’s offer.

In a letter being sent to Aspen shareholders, Endurance requests that Aspen shareholders voteFOR its proposals to requisition a special general meeting of shareholders in connection with Endurance’s proposal to increase the size of Aspen’s board of directors from 12 to 19 directors and to authorize support for the proposal of a Scheme of Arrangement by Endurance. By votingFOR Endurance’s two proposals on theWHITE card, Aspen shareholders would be taking concrete action towards realizing the significant upfront premium and opportunity for long-term value of Endurance’s offer.

In its letter, Endurance reminds Aspen shareholders that it has set July 25, 2014 as the target date for voting on its two proposals.

The letter being mailed to Aspen common shareholders reads as follows:

Dear Fellow Aspen Shareholder:

Nearly half a year has gone by sinceEndurance first proposed to acquire all of the common shares of Aspen for a highly attractive premium and a compelling opportunity for future value creation. By now one would have expected Aspen’s board and management to have acted upon Endurance’s offer, thereby realizing significant value for Aspen shareholders. Instead, Aspen’s board and management have consistently taken actions to entrench their position and try to prevent the true owners of Aspen from realizing the significant benefits of Endurance’s offer –none of these actions is in the best interests of Aspen’s shareholders.

Don’t be fooled by Aspen’sdubious assurances about its “standalone plan.” Under the stewardship of its current board and management, Aspen’s performance has lagged that of Endurance across key metrics, including underwriting profitability (i.e., combined ratio), diluted book value per share growth and share price performance. Despite the efforts of Aspen’s board and management to distort the truth and confuse shareholders,there is no denying the facts:

What has been the response of Aspen’s board and management to their chronic underperformance? Actions that we believe are not in the best long-term interests of Aspen’s shareholders.

| | • | | Instead of managing Aspen’s catastrophe risk exposures carefully in a declining rate environment (as has been done by Endurance and virtually all of Aspen’s other peers), Aspen’s board and management increased Aspen’s net catastrophe reinsurance premiums in the first quarter of 2014 by 19% – a striking surge in risk premium for Aspen’s shareholders in exchange for the dubious benefit of short term growth. |

| | • | | Perhaps to justify the claims of U.S. insurance business profitability in the future, Aspen’s current management appears to be propping up its growth with third party insurance programs (an increase of 328% in 2012 and 27% in 2013), which deliver control of Aspen’s underwriting and claims authority to unaffiliated third parties. With its program business, Aspen is essentially renting short term premium growth, contracting with third party underwriters who both retain the right to the business (and the associated intellectual capital) and do not necessarily have the best long-term interests of Aspen as their primary objective. |

2

| | • | | Aspen’s board and management have imposed on Aspen’s shareholders additional loss reserving risk over the past three years, with a slow and steady erosion of Aspen management’s selected gross loss reserve estimate from a 90% confidence level at December 31, 2011 to an 86% confidence level at December 31, 2013. |

TRUE PERFORMANCE IS WHAT MATTERS.

ASPEN’S CURRENT BOARD AND MANAGEMENT HAVE CONSISTENTLY FAILED TO DELIVER FOR YOU. ASPEN SHAREHOLDERS DESERVE A FUTURE WHERE PERFORMANCE IS THE TOP PRIORITY.

WHAT ASPEN’S CURRENT BOARD AND MANAGEMENT HAVE FAILED TO ACHIEVE FOR 10 YEARS, WE ARE PREPARED TO DELIVER TODAY.

Aspen’s campaign of rhetoric and misinformation regarding Endurance is a smokescreen designed to deflect attention away from Aspen’s long track record of poor operating performance and dismal corporate governance under its current board and management, including a classified board, a poison pill and a substantially larger share grant for the CEO following Endurance’s announcement of the proposed transaction.

Endurance’s proposed transaction represents a unique opportunity for Aspen’s shareholders to realize a highly attractive premium value for their shares. While Aspen’s board and management team are making vague promises of future value, their past performance has shown that they are unlikely to deliver and their entrenched corporate governance position shows that they won’t care.

MAKE YOUR VOICES HEARD AND TELL ASPEN’S BOARD AND MANAGEMENT

IT’S TIME TO PUT ENTRENCHED INTERESTS ASIDE AND

FOCUS ON THE CLEAR BENEFITS OF ENDURANCE’S OFFER.

You should NOT allow your interests and this compelling transaction to be ignored. Endurance’s offer of $49.50 per Aspen common share with a combination of 40% cash and 60% Endurance common shares (based on Endurance’s unaffected closing share price on April 11, 2014) representsa 19.5% premium to the highest unaffected share price Aspen’s board and management have ever achieved. As thetrue owners of Aspen, you deserve a say in the future direction of your company and the ability to receive the premium value for your shares that Endurance is offering.

We urge you to vote FOR the two specific proposals that Endurance has made:

| | • | | To authorize the requisitioning of a special general meeting of Aspen shareholders to increase the size of Aspen’s board from 12 to 19 directors. If the proposal is approved at the special general meeting, a majority of Aspen’s directors will stand for election at Aspen’s 2015 annual general meeting, thereby giving Aspen shareholders the ability to hold their board directly accountable for their failure to be responsive to the best interests of the company’s true owners. |

| | • | | To authorize support of a court-ordered meeting of Aspen shareholders to consider and vote on a Scheme of Arrangement. |

3

These proposals empower Aspen shareholders by providing the ability—not the obligation—to support Endurance’s highly attractive offer and strategic transaction.

Your supportFOR these proposals by signing, dating and returning the enclosedWHITEcard will representconcrete action towards realizing thesignificant upfront premium and opportunity for long-term value of Endurance’s offer and will send an undeniablyclear message to the Aspen board of directors thatNOW is the time to put aside the rhetoric and engage in good faith negotiations with Endurance.

Your vote is extremely important, no matter how many or how few Aspen shares you own. Please vote theWHITE cardTODAY by signing, dating and returning the enclosedWHITE card in the postage-paid envelope provided.

We urge youNOT to sign the blue revocation card that you may have received from Aspen. Instead, please sign, date and return the enclosedWHITE cardTODAY. Even if you have already signed Aspen’s blue revocation card, you may revoke your previous revocation by signing, dating and returning the enclosedWHITE card.

If you have any questions or need assistance voting your Aspen shares, please contact the firm assisting us with this solicitation, Georgeson Inc., at (877) 278-9672 (toll-free) or via email at enduranceaspen@georgeson.com.

Thank you in advance for your support.

John R. Charman

Chairman and Chief Executive Officer

Endurance Specialty Holdings Ltd.

Endurance has set a target date of July 25, 2014 for Aspen shareholders to vote on Endurance’s

two proposals and urges Aspen shareholders to vote the WHITE card TODAY.

Please visit us at www.endurance-aspen.com for up to date information and copies of past letters and presentations to Aspen shareholders.

If you would like to receive information from us directly, please email us at enduranceaspen@georgeson.com or call us at (877) 278-9672 (toll-free).

About Endurance Specialty Holdings

Endurance Specialty Holdings Ltd. is a global specialty provider of property and casualty insurance and reinsurance. Through its operating subsidiaries, Endurance writes agriculture, professional lines, property, and casualty and other specialty lines of insurance and catastrophe, property, casualty, professional lines and specialty lines of reinsurance. We maintain excellent financial strength as evidenced by the ratings of A (Excellent) from A.M. Best (XV size category) and A (Strong) from Standard and Poor’s on our principal operating subsidiaries. Endurance’s headquarters are located at Waterloo House, 100 Pitts Bay Road, Pembroke HM 08, Bermuda and its mailing address is Endurance Specialty Holdings Ltd., Suite No. 784, No. 48 Par-la-Ville Road, Hamilton HM 11, Bermuda. For more information about Endurance, please visit www.endurance.bm.

4

Cautionary Note Regarding Forward-Looking Statements

Some of the statements in this press release may include, and Endurance may make related oral, forward-looking statements which reflect our current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to us in general and the insurance and reinsurance sectors specifically, both as to underwriting and investment matters. These statements may also include assumptions about our proposed acquisition of Aspen (including its benefits, results, effects and timing). Statements which include the words “should,” “would,” “expect,” “intend,” “plan,” “believe,” “project,” “target,” “anticipate,” “seek,” “will,” “deliver” and similar statements of a future or forward-looking nature identify forward-looking statements in this press release for purposes of the U.S. federal securities laws or otherwise. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995, except to the extent made in connection with Endurance’s exchange offer.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, but are not limited to, the effects of competitors’ pricing policies, greater frequency or severity of claims and loss activity, changes in market conditions in the agriculture insurance industry, termination of or changes in the terms of the U.S. multiple peril crop insurance program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance or retrocessional coverage, our inability to renew business previously underwritten or acquired, our inability to maintain our applicable financial strength ratings, our inability to effectively integrate acquired operations, uncertainties in our reserving process, changes to our tax status, changes in insurance regulations, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker counterparties, assessments for high risk or otherwise uninsured individuals, possible terrorism or the outbreak of war, a loss of key personnel, political conditions, changes in accounting policies, our investment performance, the valuation of our invested assets, a breach of our investment guidelines, the unavailability of capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention in the insurance and reinsurance industry, illiquidity in the credit markets, changes in general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014. Additional risks and uncertainties related to the proposed transaction include, among others, uncertainty as to whether Endurance will be able to enter into or consummate the transaction on the terms set forth in the proposal, the risk that our or Aspen’s shareholders do not approve the transaction, potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction, uncertainties as to the timing of the transaction, uncertainty as to whether Aspen shareholders tender into the exchange offer, uncertainty as to the actual premium of the Endurance share component of the proposal that will be realized by Aspen shareholders in connection with the transaction, competitive responses to the transaction, the risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not anticipated, the risk that the conditions to the closing of the transaction are not satisfied, costs and difficulties related to the integration of Aspen’s businesses and operations with Endurance’s businesses and operations, the inability to obtain, or delays in obtaining, cost savings and synergies from the transaction, unexpected costs, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key personnel, and any changes in general economic and/or industry specific conditions.

Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation publicly to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in our most recent reports on Form 10-K and Form 10-Q and the risk factors included in Aspen’s most recent reports on Form 10-K and Form 10-Q and other documents of Endurance and Aspen on file with the U.S. Securities and Exchange Commission (the “SEC”). Any forward-looking statements made in this press release are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Endurance will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us or our business or operations.

Additional Information about the Proposed Transaction and Where to Find It

This press release relates to the offer commenced by Endurance to exchange each issued and outstanding common share of Aspen (together with associated preferred share purchase rights) for $49.50 in cash, 0.9197 Endurance common shares, or a combination of cash and Endurance common shares, subject to a customary proration mechanism. This press release is for informational purposes only and does not constitute an offer to exchange, or a solicitation of an offer to exchange, Aspen common shares, nor is it a substitute for the Tender Offer Statement on Schedule TO or the Prospectus/Offer to Exchange included in the Registration Statement on Form S-4 (including the Letter of Transmittal and Election and related documents and as amended from time to time, the “Exchange Offer Documents”) that Endurance has filed with the SEC. The Endurance exchange offer will be made only through the Exchange Offer Documents.

This press release is not a substitute for any other relevant documents that Endurance may file with the SEC or any other documents that Endurance may send to its or Aspen’s shareholders in connection with the proposed transaction. Endurance has sent to Aspen shareholders a solicitation statement with respect to the solicitation of (i) written requisitions that the board of directors of Aspen convene a special general meeting of Aspen’s shareholders to vote on an increase in the size of Aspen’s board of directors from 12 to 19 directors and (ii) Aspen shareholder support for the proposal of a scheme of arrangement by Endurance which will entail the holding of a court-ordered meeting of Aspen shareholders at which Aspen’s shareholders would vote to approve

5

a scheme of arrangement under Bermuda law pursuant to which Endurance would acquire all of Aspen’s outstanding common shares on financial terms no less favorable than those contained in its acquisition proposal announced on June 2, 2014 (the “Solicitation Statement”).

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE EXCHANGE OFFER DOCUMENTS AND THE SOLICITATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ENDURANCE HAS FILED OR MAY FILE WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. All such documents, when filed, are available free of charge at the SEC’s website (www.sec.gov) or by directing a request to Endurance at the Investor Relations contact below.

Participants in the Solicitation

Endurance and its directors and certain of its executive officers and employees may be deemed to be participants in any solicitation of shareholders in connection with the proposed transaction. Information about Endurance’s directors, executive officers and employees who may be deemed to be participants in the solicitation, including a description of their direct and indirect interests, by security holdings or otherwise, is set forth in the Solicitation Statement and Endurance’s proxy statement, dated April 9, 2014, for its 2014 annual general meeting of shareholders.

Regulation G Disclaimer

In this press release, Endurance has included certain non-GAAP measures, including return on equity, combined ratio and diluted book value per share. Endurance management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the proposed transaction in a manner that allows for a more complete understanding. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP measures and reconciliations, please review the Investor Financial Supplement on Endurance’s website at www.endurance.bm.

Additional Information

All references in this press release to “$” refer to United States dollars.

The contents of any website referenced in this press release are not incorporated by reference herein.

Contacts:

Endurance Specialty Holdings Ltd.

Investor Relations

Phone: +1 441 278 0988

Email: investorrelations@endurance.bm

Georgeson

Donna Ackerly and David Drake

Phone: 212 440 9837/9861

Email: dackerly@georgeson.com and ddrake@georgeson.com

Media Relations

Ruth Pachman and Thomas Davies

Kekst and Company

Phone: 212 521 4891/4873

Email: Ruth-Pachman@kekst.com and Tom-Davies@kekst.com

# # #

6