Aspen Insurance Holdings Limited BANK OF AMERICA MERRILL LYNCH INSURANCE CONFERENCE February 10, 2016 Exhibit 99.1

AHL: NYSE 2 This slide presentation is for information purposes only. It should be read in conjunction with our financial supplement posted on our website on the Investor Relations page and with other documents filed or to be filed shortly by Aspen Insurance Holdings Limited (the “Company” or “Aspen”) with the U.S. Securities and Exchange Commission. Non-GAAP Financial Measures: In presenting Aspen's results, management has included and discussed certain “non-GAAP financial measures” as such term is defined in Regulation G. Management believes that these non-GAAP financial measures, which may be defined differently by other companies, better explain Aspen's results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included herein or in the financial supplement, as applicable, which can be obtained from the Investor Relations section of Aspen's website at www.aspen.co. Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995: This presentation contains written or oral "forward-looking statements" within the meaning of the U.S. federal securities laws. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “expect,” “assume,” “objective,” “intend,” “plan,” “believe,” “do not believe,” “aim,” “project,” “anticipate,” “seek,” “will,” “likely,” “estimate,” “may,” “continue,” “guidance,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” "on track" and similar expressions of a future or forward-looking nature. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aspen believes these factors include, but are not limited to: our ability to successfully implement steps to further optimize the business portfolio, ensure capital efficiency and enhance investment returns; the possibility of greater frequency or severity of claims and loss activity, including as a result of natural or man-made (including economic and political risks) catastrophic or material loss events, than our underwriting, reserving, reinsurance purchasing or investment practices have anticipated; the assumptions and uncertainties underlying reserve levels that may be impacted by future payments for settlements of claims and expenses or by other factors causing adverse or favorable development, including our assumptions on inflation costs associated with long-tail casualty business which could differ materially from actual experience; the reliability of, and changes in assumptions to, natural and man-made catastrophe pricing, accumulation and estimated loss models; decreased demand for our insurance or reinsurance products and cyclical changes in the insurance and reinsurance industry; the models we use to assess our exposure to losses from future natural catastrophes contain inherent uncertainties and our actual losses may differ significantly from expectations; our capital models may provide materially different indications than actual results; increased competition from existing insurers and reinsurers and from alternative capital providers and insurance linked funds and collateralized special purpose insurers on the basis of pricing, capacity, coverage terms, new capital, binding authorities to brokers or other factors and the related demand and supply dynamics as contracts come up for renewal; our ability to execute our business plan to enter new markets, introduce new products and develop new distribution channels, including their integration into our existing operations; our acquisition strategy; the recent consolidation in the (re)insurance industry; loss of one or more of our senior underwriters or key personnel; changes in our ability to exercise capital management initiatives (including our share repurchase program) or to arrange banking facilities as a result of prevailing market conditions or changes in our financial position; changes in the availability, cost or quality of reinsurance or retrocessional coverage; changes in general economic conditions, including inflation, deflation, foreign currency exchange rates, interest rates and other factors that could affect our financial results; the risk of a material decline in the value or liquidity of all or parts of our investment portfolio; the risks associated with the management of capital on behalf of investors; evolving issues with respect to interpretation of coverage after major loss events; our ability to adequately model and price the effects of climate cycles and climate change; any intervening legislative or governmental action and changing judicial interpretation and judgments on insurers’ liability to various risks; the risks related to litigation; the effectiveness of our risk management loss limitation methods, including our reinsurance purchasing; changes in the total industry losses, or our share of total industry losses, resulting from past events and, with respect to such events, our reliance on loss reports received from cedants and loss adjustors, our reliance on industry loss estimates and those generated by modeling techniques, changes in rulings on flood damage or other exclusions as a result of prevailing lawsuits and case law; the impact of one or more large losses from events other than natural catastrophes or by an unexpected accumulation of attritional losses and deterioration with loss estimates; the impact of acts of terrorism, acts of war and related legislation; any changes in our reinsurers’ credit quality and the amount and timing of reinsurance recoverables; the continuing and uncertain impact of the current depressed lower growth economic environment in many of the countries in which we operate; our reliance on information and technology and third- party service providers for our operations and systems; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; a decline in our operating subsidiaries’ ratings with S&P, A.M. Best or Moody’s; the failure of our reinsurers, policyholders, brokers or other intermediaries to honor their payment obligations; our reliance on the assessment and pricing of individual risks by third parties; our dependence on a few brokers for a large portion of our revenues; the persistence of heightened financial risks, including excess sovereign debt, the banking system and the Eurozone crisis; changes in government regulations or tax laws in jurisdictions where we conduct business; changes in accounting principles or policies or in the application of such accounting principles or policies; increased counterparty risk due to the credit impairment of financial institutions; and Aspen or Aspen Bermuda Limited becoming subject to income taxes in the United States or the United Kingdom. For a more detailed description of these uncertainties and other factors, please see the “Risk Factors” section in Aspen's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission on February 23, 2015. Aspen undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made. In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence, initial tentative loss reports and other sources. The actuarial range of reserves and management's best estimate represents a distribution from our internal capital model for reserving risk based on our then current state of knowledge and explicit and implicit assumptions relating to the incurred pattern of claims, the expected ultimate settlement amount, inflation and dependencies between lines of business. Due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare these estimates, there can be no assurance that Aspen's ultimate losses will remain within the stated amount. SAFE HARBOR DISCLOSURE

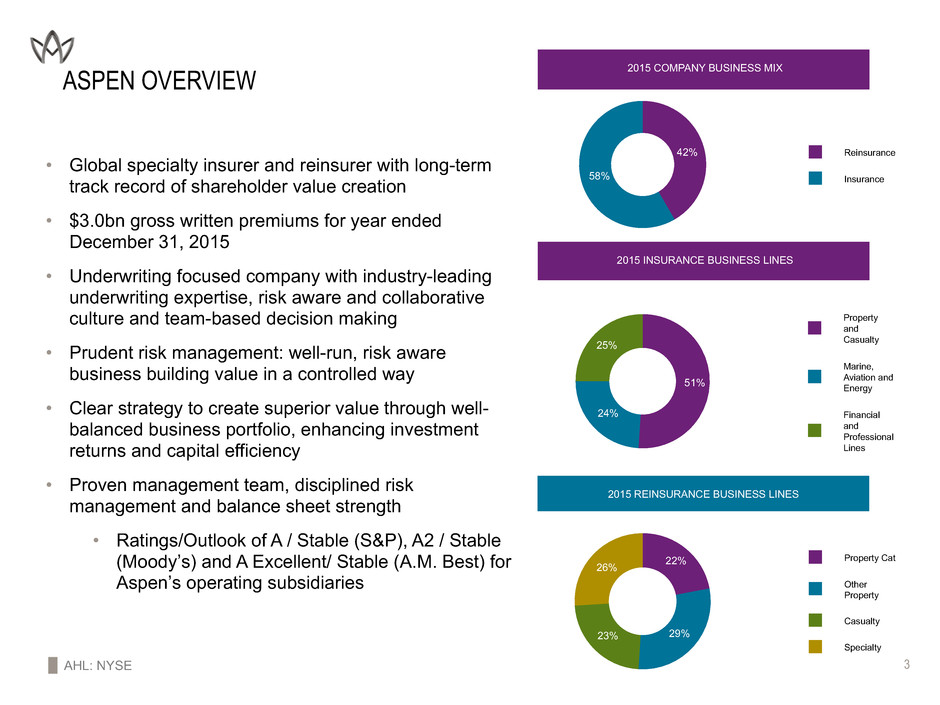

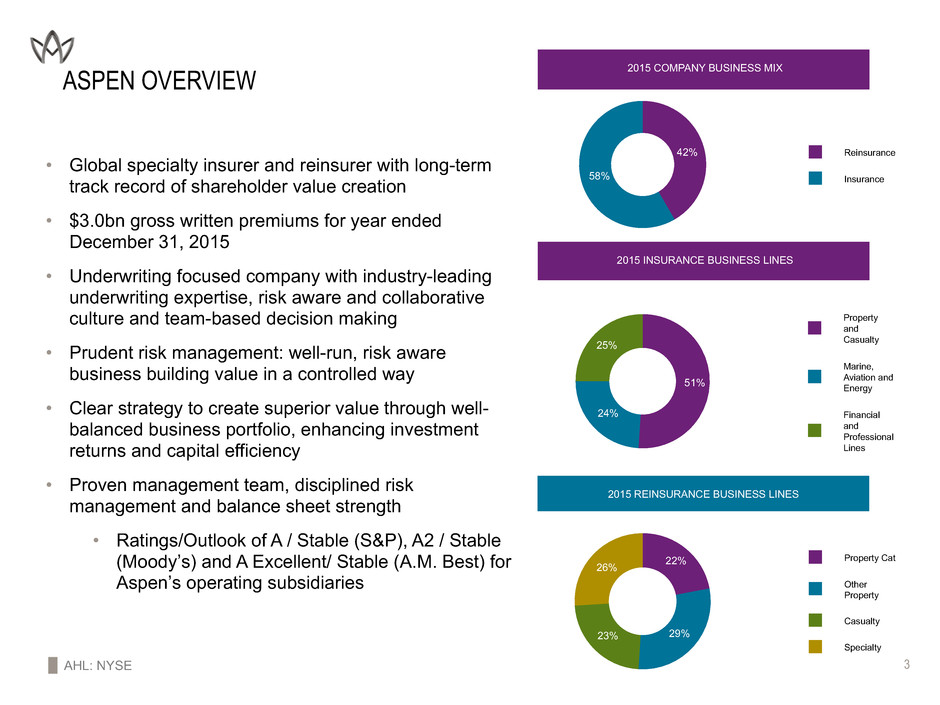

AHL: NYSE 3 Property Cat Other Property Casualty Specialty 22% 29%23% 26% Property and Casualty Marine, Aviation and Energy Financial and Professional Lines 51% 24% 25% Reinsurance Insurance 42% 58% ASPEN OVERVIEW • Global specialty insurer and reinsurer with long-term track record of shareholder value creation • $3.0bn gross written premiums for year ended December 31, 2015 • Underwriting focused company with industry-leading underwriting expertise, risk aware and collaborative culture and team-based decision making • Prudent risk management: well-run, risk aware business building value in a controlled way • Clear strategy to create superior value through well- balanced business portfolio, enhancing investment returns and capital efficiency • Proven management team, disciplined risk management and balance sheet strength • Ratings/Outlook of A / Stable (S&P), A2 / Stable (Moody’s) and A Excellent/ Stable (A.M. Best) for Aspen’s operating subsidiaries 2015 INSURANCE BUSINESS LINES 2015 REINSURANCE BUSINESS LINES 2015 COMPANY BUSINESS MIX

AHL: NYSE 4 ASPEN - 2015 • 2015 was a solid year in a challenging environment: • $3.0bn in gross written premiums • 10% Operating ROE(1) • Diluted Book Value Per Share of $46.00 as at December 31, 2015 • Continued to diversify both Insurance and Reinsurance businesses, by product and geography • Excellent year for Reinsurance: • Growth driven by Specialty and Other property sub-segments • Accident year ex-cat loss ratio of 49.7%(1) • Insurance performance: • Continued to find opportunities for profitable growth – primarily in U.S and select International markets • U.S. platform exceeded targets for net earned premium and expense ratio • 1H15 impacted by large losses; 2H15 better indicator of underlying prospects (1) • Continued to focus on building long-term value for shareholders (1) See " Safe Harbor Disclosure" slide 2.

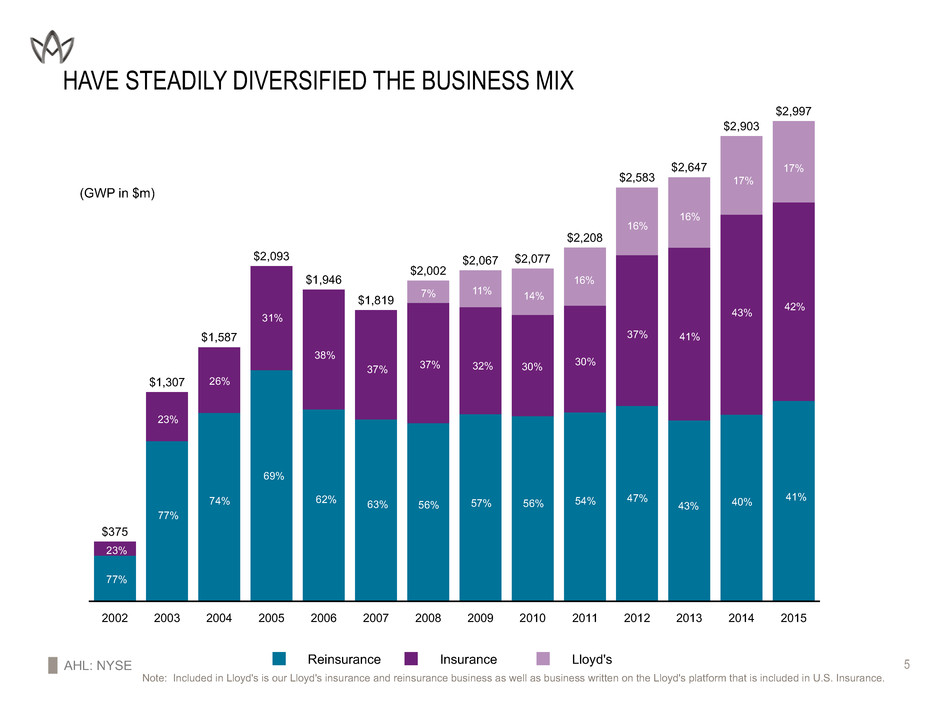

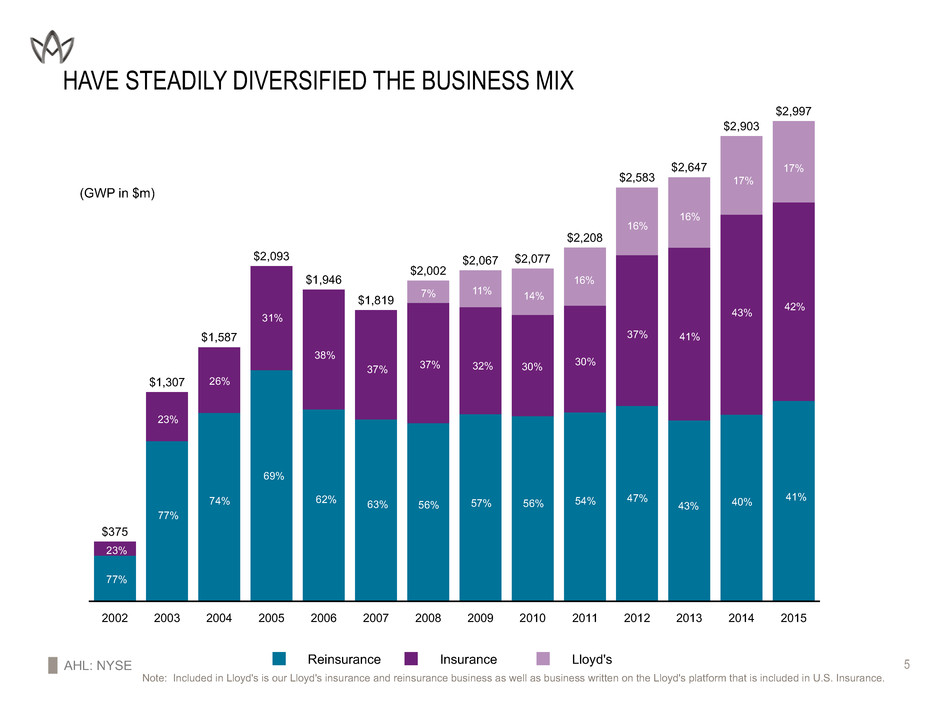

AHL: NYSE 5Reinsurance Insurance Lloyd's 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 $375 $1,307 $1,587 $2,093 $1,946 $1,819 $2,002 $2,067 $2,077 $2,208 $2,583 $2,647 $2,903 $2,997 HAVE STEADILY DIVERSIFIED THE BUSINESS MIX (GWP in $m) Note: Included in Lloyd's is our Lloyd's insurance and reinsurance business as well as business written on the Lloyd's platform that is included in U.S. Insurance. 23% 77% 23% 77% 26% 74% 69% 38% 31% 37% 62% 63% 7% 37% 54% 30% 16% 47% 37% 16% 43% 41% 16% 40% 43% 17% 41% 42% 17% 11% 57% 56% 30% 14% 32% 56%

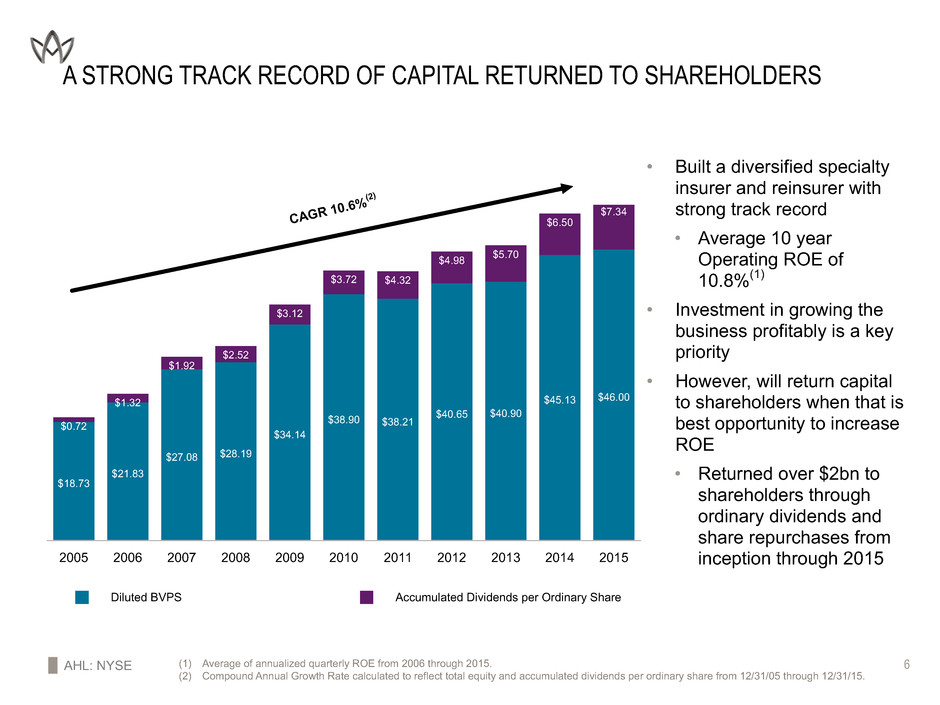

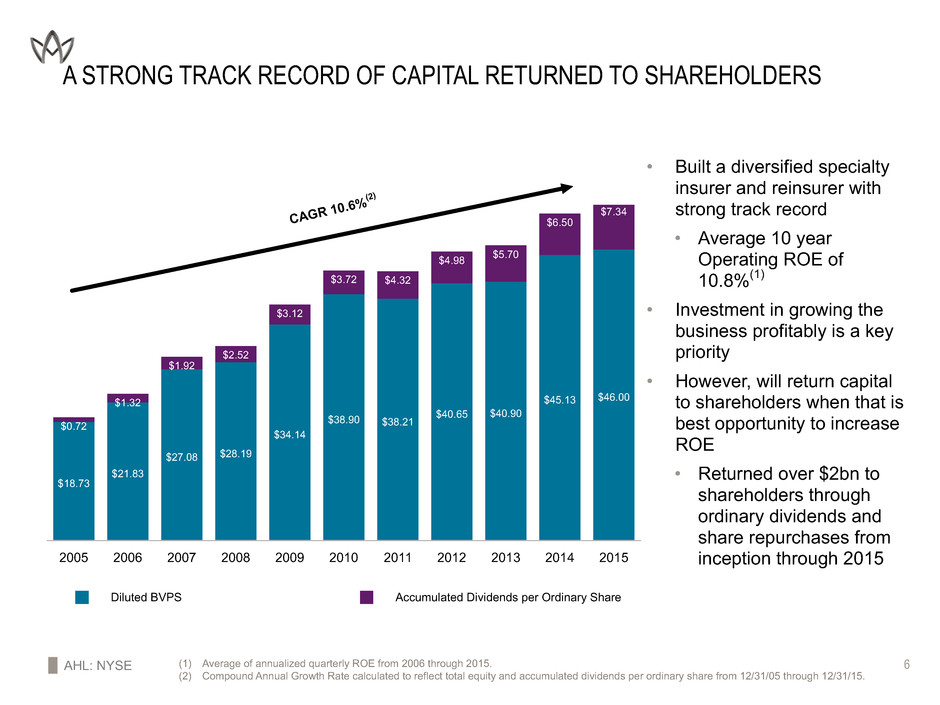

AHL: NYSE 6 Diluted BVPS Accumulated Dividends per Ordinary Share 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 $18.73 $21.83 $27.08 $28.19 $34.14 $38.90 $38.21 $40.65 $40.90 $45.13 $46.00 $0.72 $1.32 $1.92 $2.52 $3.12 $3.72 $4.32 $4.98 $5.70 $6.50 $7.34 A STRONG TRACK RECORD OF CAPITAL RETURNED TO SHAREHOLDERS CAGR 10.6 %(2 ) • Built a diversified specialty insurer and reinsurer with strong track record • Average 10 year Operating ROE of 10.8%(1) • Investment in growing the business profitably is a key priority • However, will return capital to shareholders when that is best opportunity to increase ROE • Returned over $2bn to shareholders through ordinary dividends and share repurchases from inception through 2015 (1) Average of annualized quarterly ROE from 2006 through 2015. (2) Compound Annual Growth Rate calculated to reflect total equity and accumulated dividends per ordinary share from 12/31/05 through 12/31/15.

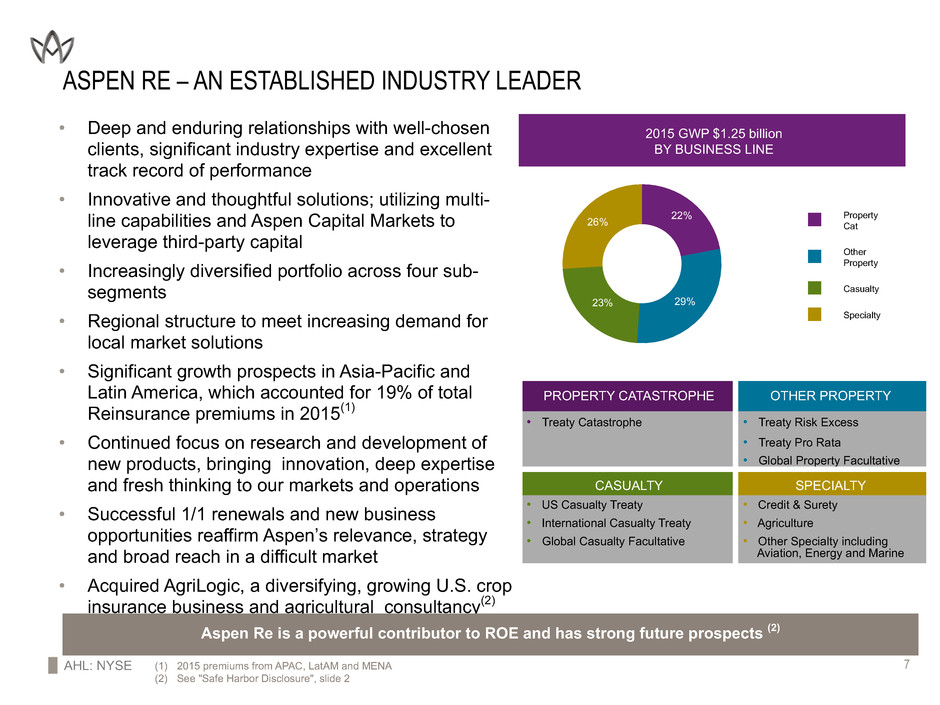

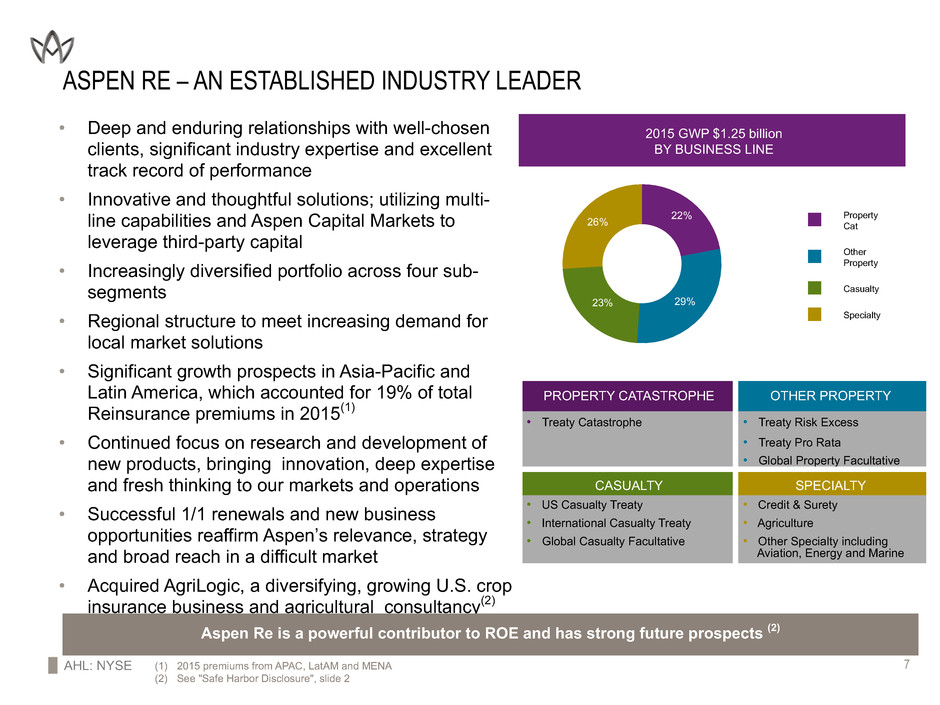

AHL: NYSE 7 ASPEN RE – AN ESTABLISHED INDUSTRY LEADER (1) 2015 premiums from APAC, LatAM and MENA (2) See "Safe Harbor Disclosure", slide 2 2015 GWP $1.25 billion BY BUSINESS LINE • Deep and enduring relationships with well-chosen clients, significant industry expertise and excellent track record of performance • Innovative and thoughtful solutions; utilizing multi- line capabilities and Aspen Capital Markets to leverage third-party capital • Increasingly diversified portfolio across four sub- segments • Regional structure to meet increasing demand for local market solutions • Significant growth prospects in Asia-Pacific and Latin America, which accounted for 19% of total Reinsurance premiums in 2015(1) • Continued focus on research and development of new products, bringing innovation, deep expertise and fresh thinking to our markets and operations • Successful 1/1 renewals and new business opportunities reaffirm Aspen’s relevance, strategy and broad reach in a difficult market • Acquired AgriLogic, a diversifying, growing U.S. crop insurance business and agricultural consultancy(2) Property Cat Other Property Casualty Specialty 22% 29%23% 26% Aspen Re is a powerful contributor to ROE and has strong future prospects (2) PROPERTY CATASTROPHE OTHER PROPERTY • Treaty Catastrophe • Treaty Risk Excess • Treaty Pro Rata • Global Property Facultative CASUALTY SPECIALTY • US Casualty Treaty • Credit & Surety • International Casualty Treaty • Agriculture • Global Casualty Facultative • Other Specialty including Aviation, Energy and Marine

AHL: NYSE 8 ASPEN RE GROWTH & DIVERSIFICATION - AGRILOGIC ACQUISITION • U.S. Crop Insurance business and agricultural consultancy which will be integrated into the Specialty Re sub segment • High quality diversifying business for Aspen, excellent long term growth opportunity(1) • Significant intellectual capital, strong analytical tools and capabilities • Enhanced marketing, combined with larger Aspen balance sheet, offers excellent growth opportunity(1) • Limited integration risk - Aspen Re has a long relationship with AgriLogic • AgriLogic should be a double digit ROE business(1) • Transaction is largely neutral to Operating ROE in 2016; accretive to Operating ROE in 2017(1) (1) See " Safe Harbor Disclosure" slide 2.

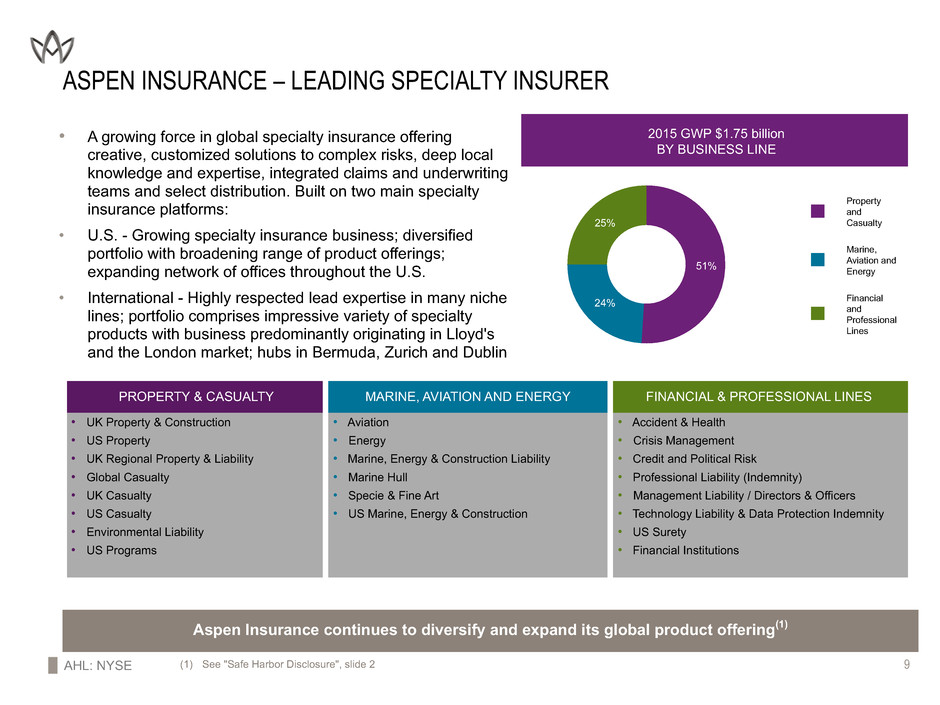

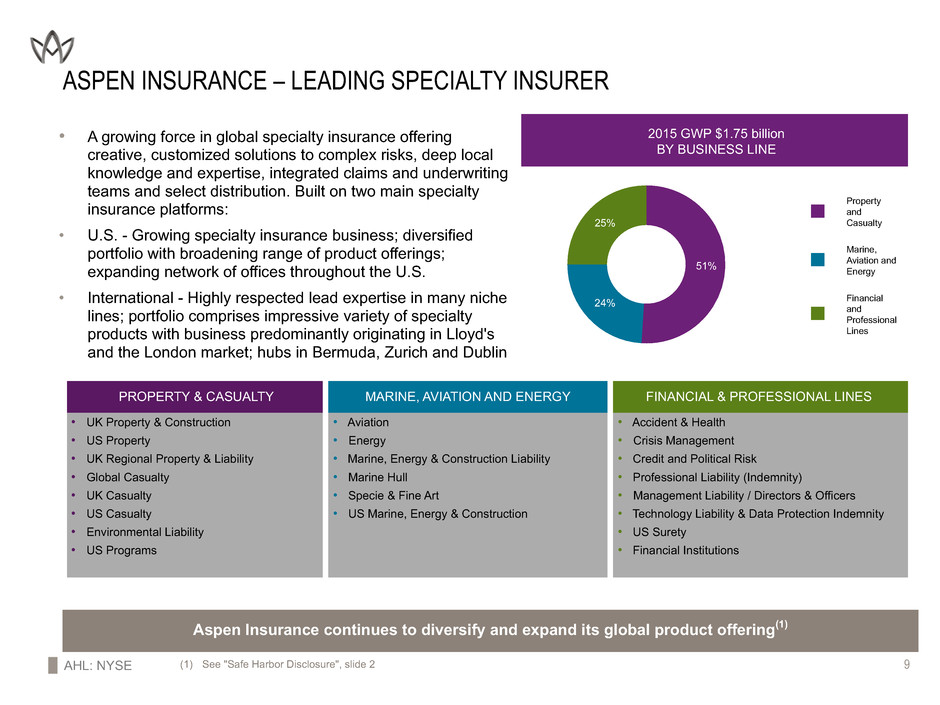

AHL: NYSE 9 Property and Casualty Marine, Aviation and Energy Financial and Professional Lines 51% 24% 25% ASPEN INSURANCE – LEADING SPECIALTY INSURER PROPERTY & CASUALTY MARINE, AVIATION AND ENERGY FINANCIAL & PROFESSIONAL LINES • UK Property & Construction • Aviation • Accident & Health • US Property • Energy • Crisis Management • UK Regional Property & Liability • Marine, Energy & Construction Liability • Credit and Political Risk • Global Casualty • Marine Hull • Professional Liability (Indemnity) • UK Casualty • Specie & Fine Art • Management Liability / Directors & Officers • US Casualty • US Marine, Energy & Construction • Technology Liability & Data Protection Indemnity • Environmental Liability • US Surety • US Programs • Financial Institutions (1) See "Safe Harbor Disclosure", slide 2 2015 GWP $1.75 billion BY BUSINESS LINE • A growing force in global specialty insurance offering creative, customized solutions to complex risks, deep local knowledge and expertise, integrated claims and underwriting teams and select distribution. Built on two main specialty insurance platforms: • U.S. - Growing specialty insurance business; diversified portfolio with broadening range of product offerings; expanding network of offices throughout the U.S. • International - Highly respected lead expertise in many niche lines; portfolio comprises impressive variety of specialty products with business predominantly originating in Lloyd's and the London market; hubs in Bermuda, Zurich and Dublin Aspen Insurance continues to diversify and expand its global product offering(1)

AHL: NYSE 10 ASPEN INSURANCE: ENHANCING A LEADING GLOBAL SPECIALTY INSURANCE FRANCHISE • Track record of investing for profitable organic growth: U.S. Insurance platform • Two strategies to accelerate the growth and profitability of Aspen Insurance business (1) organize business globally for risks that are traded globally and (2) enrich targeted areas of underwriting expertise HOW: Hired David Cohen; a best in class specialty underwriting leader with a successful history of running a global specialty business ▪ Identified 12 global product lines ▪ Promoted from within Aspen as well as hired seasoned global underwriting leaders to manage the global lines; hired a select few underwriting experts for specialties not covered and upgraded underwriting talent in key lines EXPENSE: Aspen Insurance infrastructure was built to be leveraged for much greater scale ▪ Majority of costs are personnel related (along with some reorganization costs); invested $5 million in 2015; further investment of approximately $15 million anticipated in 2016(1) EXPECTED RESULTS: ▪ Short term: Decrease volatility in Insurance business by evaluating line size; exposure profile; reinsurance arrangements; business mix under new global leadership; modest incremental GWP impact in 2016, more significant in 2017 and beyond(1) ▪ Medium term: Lower loss ratio driven by less volatility(1) (1) See " Safe Harbor Disclosure" slide 2. Anticipate larger, more profitable business, more stable outcomes and better loss ratios(1)

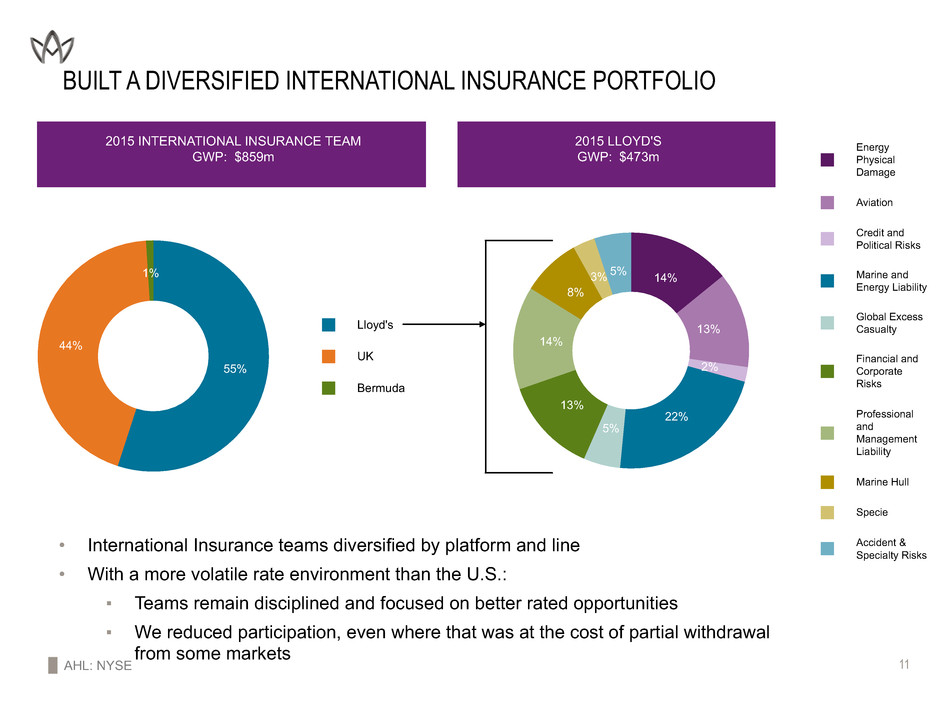

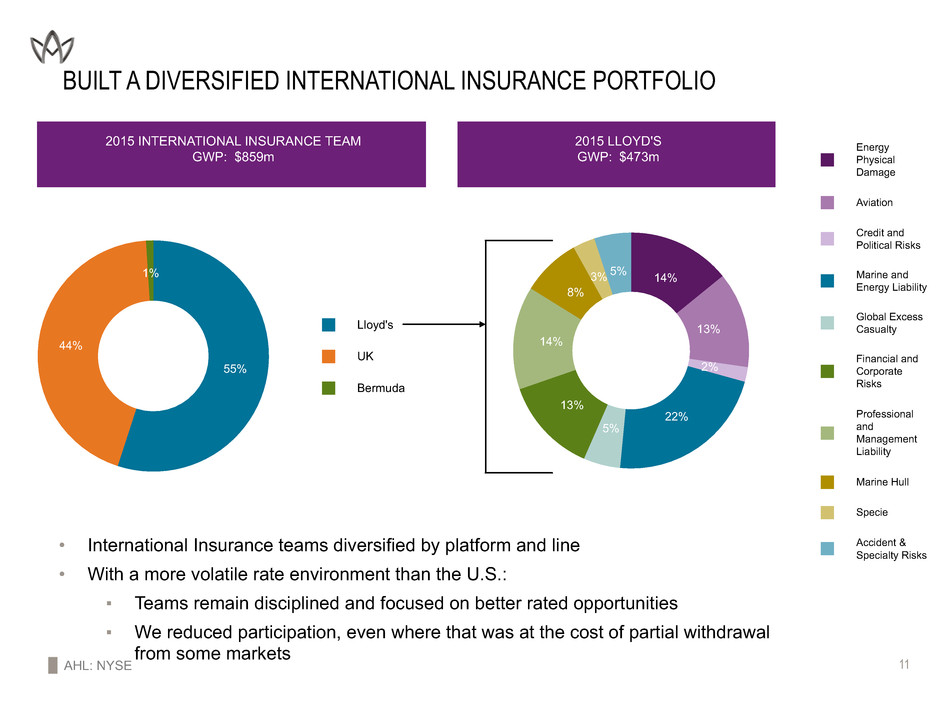

AHL: NYSE 11 BUILT A DIVERSIFIED INTERNATIONAL INSURANCE PORTFOLIO Lloyd's UK Bermuda 55% 44% 1% Energy Physical Damage Aviation Credit and Political Risks Marine and Energy Liability Global Excess Casualty Financial and Corporate Risks Professional and Management Liability Marine Hull Specie Accident & Specialty Risks 14% 13% 2% 22% 5% 13% 14% 8% 3% 5% 2015 LLOYD'S GWP: $473m 2015 INTERNATIONAL INSURANCE TEAM GWP: $859m • International Insurance teams diversified by platform and line • With a more volatile rate environment than the U.S.: ▪ Teams remain disciplined and focused on better rated opportunities ▪ We reduced participation, even where that was at the cost of partial withdrawal from some markets

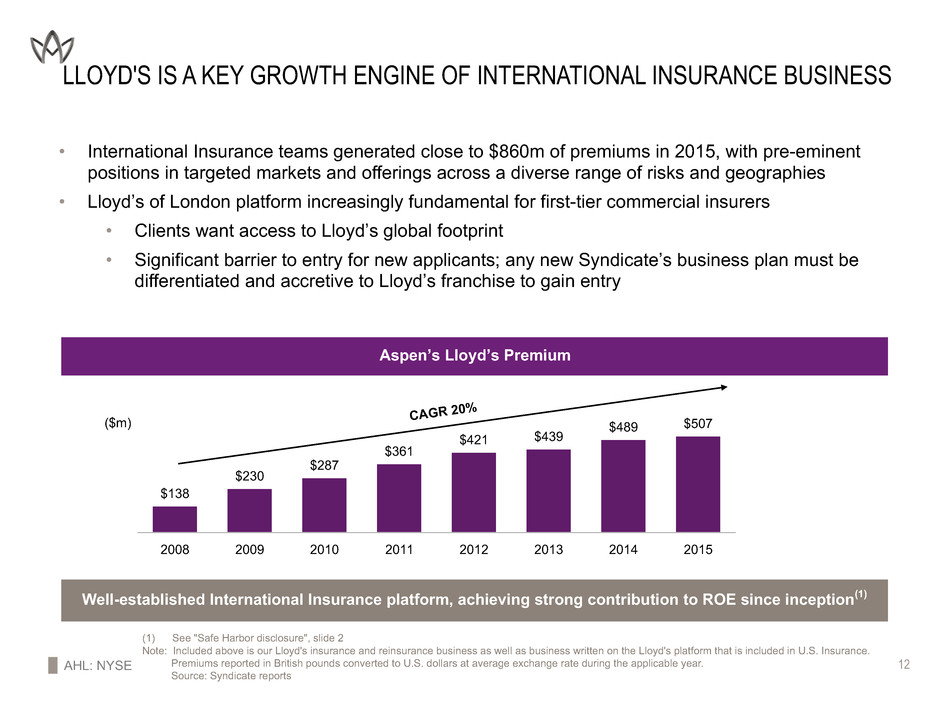

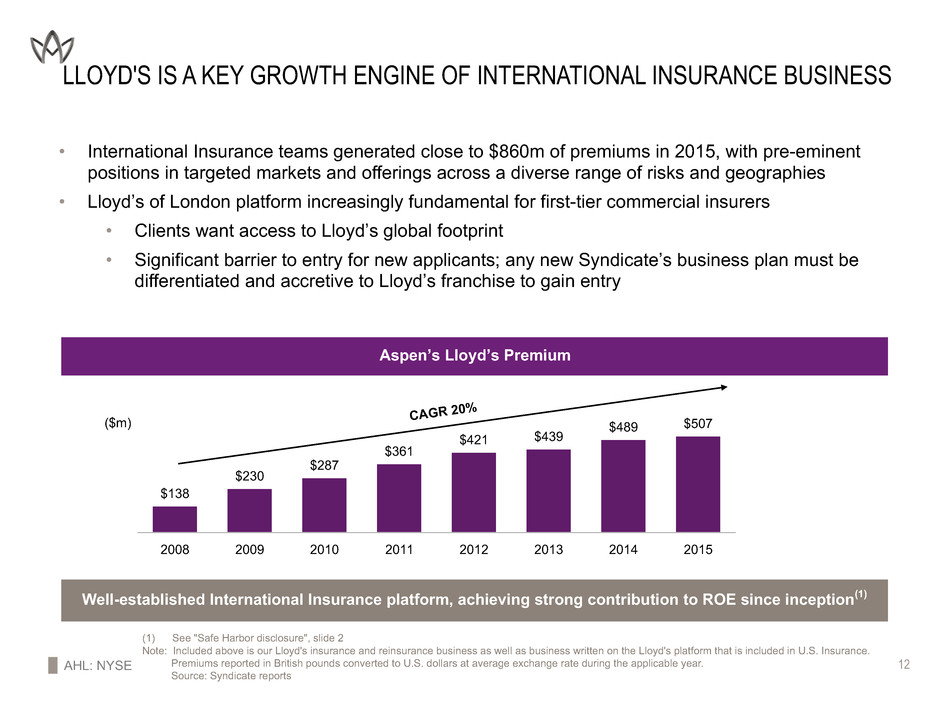

AHL: NYSE 12 2008 2009 2010 2011 2012 2013 2014 2015 $138 $230 $287 $361 $421 $439 $489 $507 LLOYD'S IS A KEY GROWTH ENGINE OF INTERNATIONAL INSURANCE BUSINESS CAGR 20% (1) See "Safe Harbor disclosure", slide 2 Note: Included above is our Lloyd's insurance and reinsurance business as well as business written on the Lloyd's platform that is included in U.S. Insurance. Premiums reported in British pounds converted to U.S. dollars at average exchange rate during the applicable year. Source: Syndicate reports ($m) • International Insurance teams generated close to $860m of premiums in 2015, with pre-eminent positions in targeted markets and offerings across a diverse range of risks and geographies • Lloyd’s of London platform increasingly fundamental for first-tier commercial insurers • Clients want access to Lloyd’s global footprint • Significant barrier to entry for new applicants; any new Syndicate’s business plan must be differentiated and accretive to Lloyd’s franchise to gain entry Aspen’s Lloyd’s Premium Well-established International Insurance platform, achieving strong contribution to ROE since inception(1)

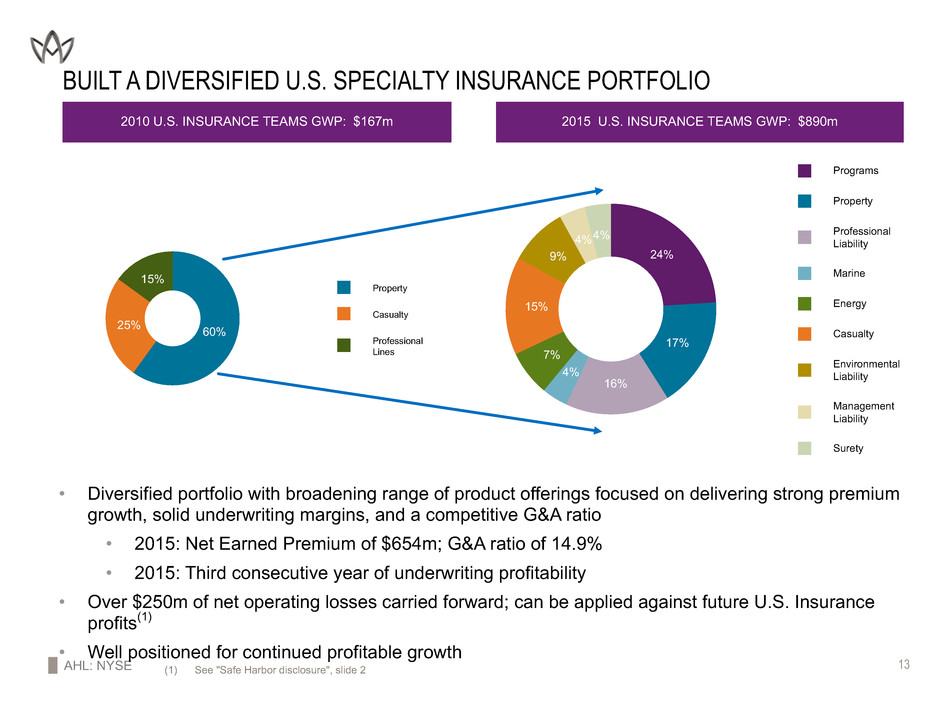

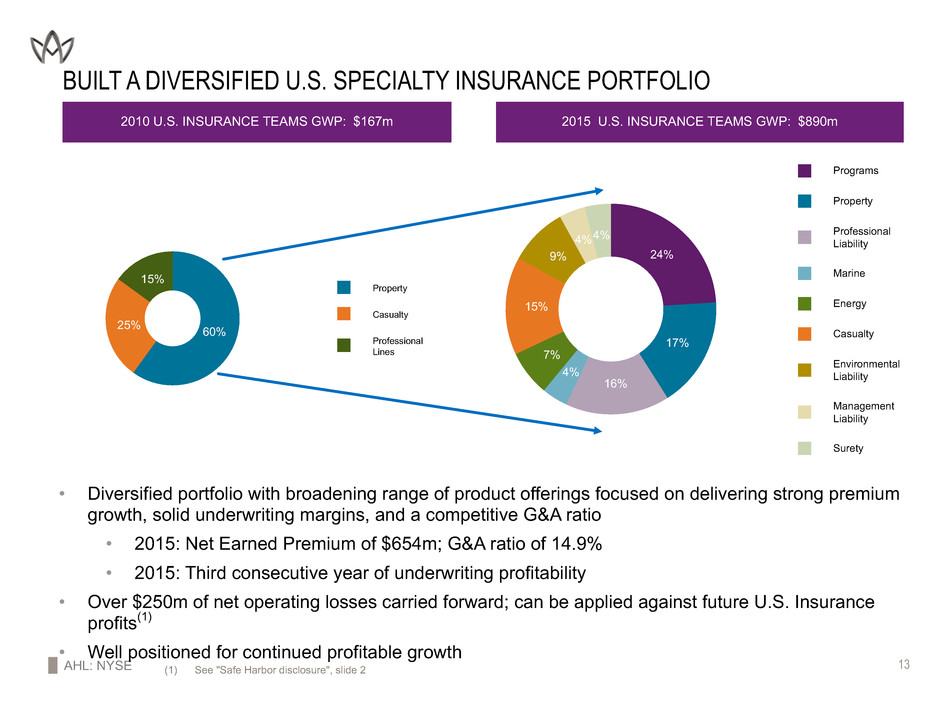

AHL: NYSE 13 Property Casualty Professional Lines 60%25% 15% Programs Property Professional Liability Marine Energy Casualty Environmental Liability Management Liability Surety 24% 17% 16% 4% 7% 15% 9% 4%4% BUILT A DIVERSIFIED U.S. SPECIALTY INSURANCE PORTFOLIO 2010 U.S. INSURANCE TEAMS GWP: $167m 2015 U.S. INSURANCE TEAMS GWP: $890m • Diversified portfolio with broadening range of product offerings focused on delivering strong premium growth, solid underwriting margins, and a competitive G&A ratio • 2015: Net Earned Premium of $654m; G&A ratio of 14.9% • 2015: Third consecutive year of underwriting profitability • Over $250m of net operating losses carried forward; can be applied against future U.S. Insurance profits(1) • Well positioned for continued profitable growth (1) See "Safe Harbor disclosure", slide 2

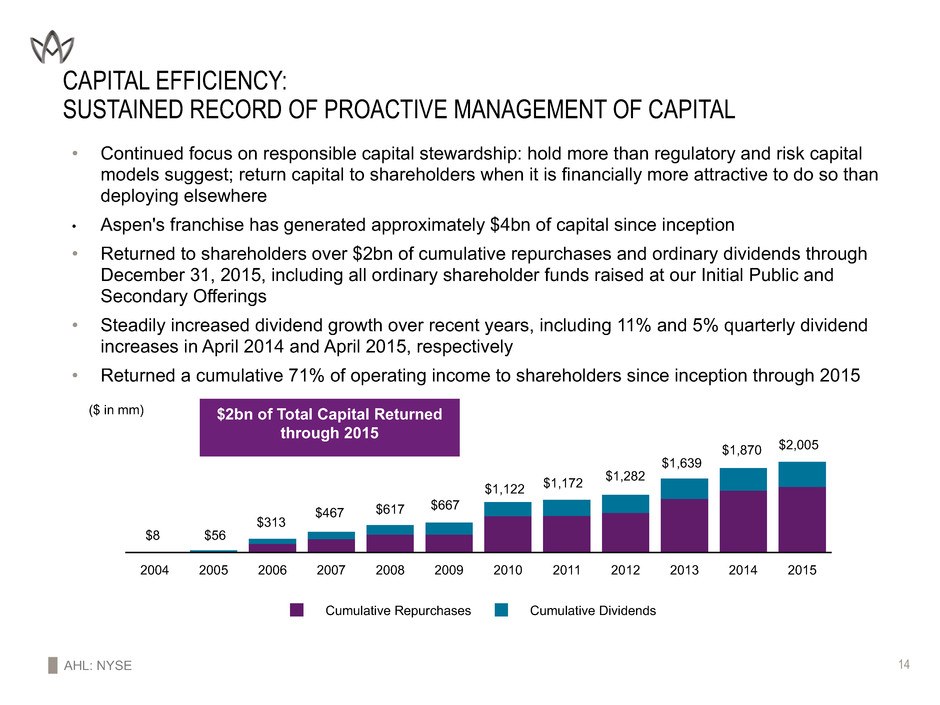

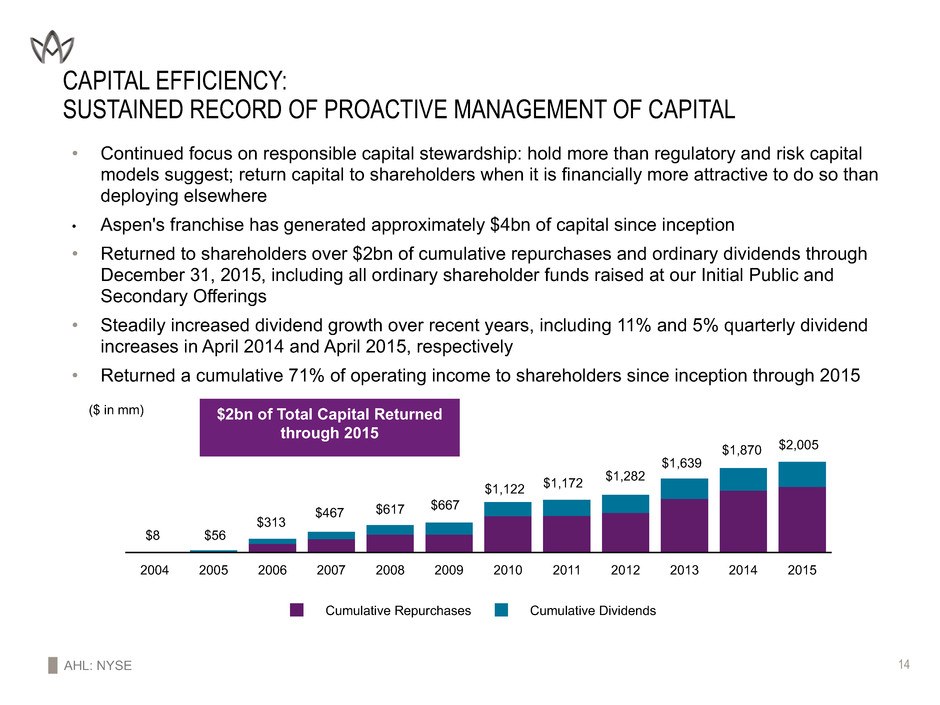

AHL: NYSE 14 CAPITAL EFFICIENCY: SUSTAINED RECORD OF PROACTIVE MANAGEMENT OF CAPITAL • Continued focus on responsible capital stewardship: hold more than regulatory and risk capital models suggest; return capital to shareholders when it is financially more attractive to do so than deploying elsewhere • Aspen's franchise has generated approximately $4bn of capital since inception • Returned to shareholders over $2bn of cumulative repurchases and ordinary dividends through December 31, 2015, including all ordinary shareholder funds raised at our Initial Public and Secondary Offerings • Steadily increased dividend growth over recent years, including 11% and 5% quarterly dividend increases in April 2014 and April 2015, respectively • Returned a cumulative 71% of operating income to shareholders since inception through 2015 ($ in mm) Cumulative Repurchases Cumulative Dividends 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 $8 $56 $313 $467 $617 $667 $1,122 $1,172 $1,282 $1,639 $1,870 $2,005 $2bn of Total Capital Returned through 2015

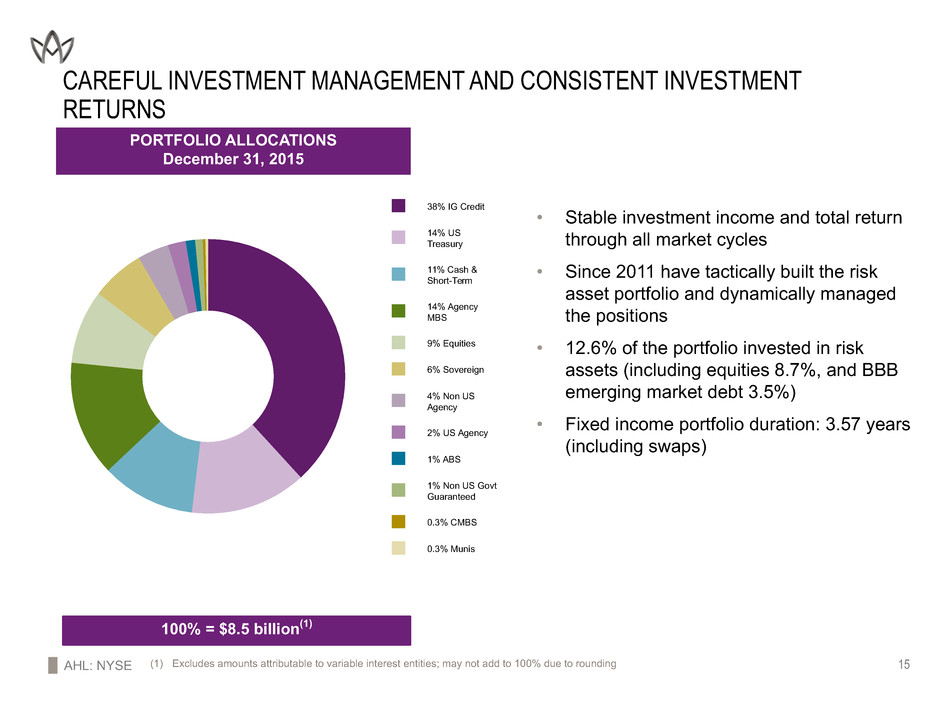

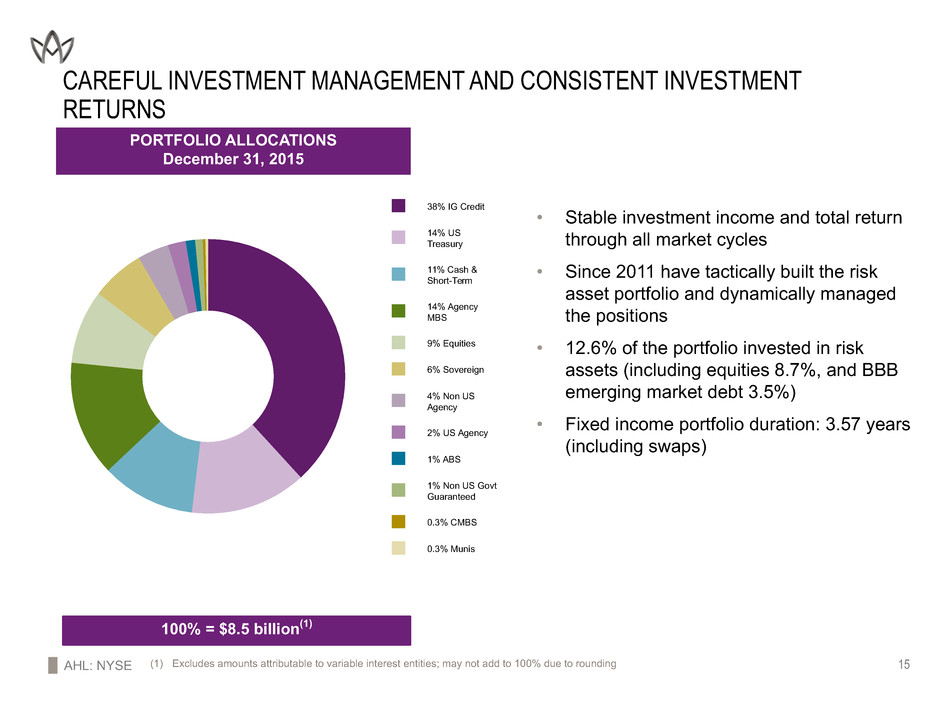

AHL: NYSE 15 CAREFUL INVESTMENT MANAGEMENT AND CONSISTENT INVESTMENT RETURNS 38% IG Credit 14% US Treasury 11% Cash & Short-Term 14% Agency MBS 9% Equities 6% Sovereign 4% Non US Agency 2% US Agency 1% ABS 1% Non US Govt Guaranteed 0.3% CMBS 0.3% Munis PORTFOLIO ALLOCATIONS December 31, 2015 100% = $8.5 billion(1) • Stable investment income and total return through all market cycles • Since 2011 have tactically built the risk asset portfolio and dynamically managed the positions • 12.6% of the portfolio invested in risk assets (including equities 8.7%, and BBB emerging market debt 3.5%) • Fixed income portfolio duration: 3.57 years (including swaps) (1) Excludes amounts attributable to variable interest entities; may not add to 100% due to rounding

AHL: NYSE 16 CONCLUSION: FOCUSED ON SHAREHOLDER VALUE • Deep underwriting expertise and understanding of client needs and risks • Pursuing selective, profitable growth in exposures we know and understand, subject to market conditions • Diversified platform allows us to focus on better rated opportunities as they arise, including: • Reinsurance ▪ Agriculture, Bond, Financial, Terrorism, Marine • Insurance ▪ Enhance our global product offering, especially in areas such as Environmental, Professional Liability, Technology Liability & Data Protection Indemity, Marine, and Crisis Management • Expected premium growth across diversified lines is projected to be greater than both growth in expenses and risk allocated capital which should equate to meaningful increased premium leverage(1) (1) See “Safe Harbor Disclosure” slide 2 Deliver growth in Operating ROE and Diluted Book Value Per Share over time(1)

APPENDIX

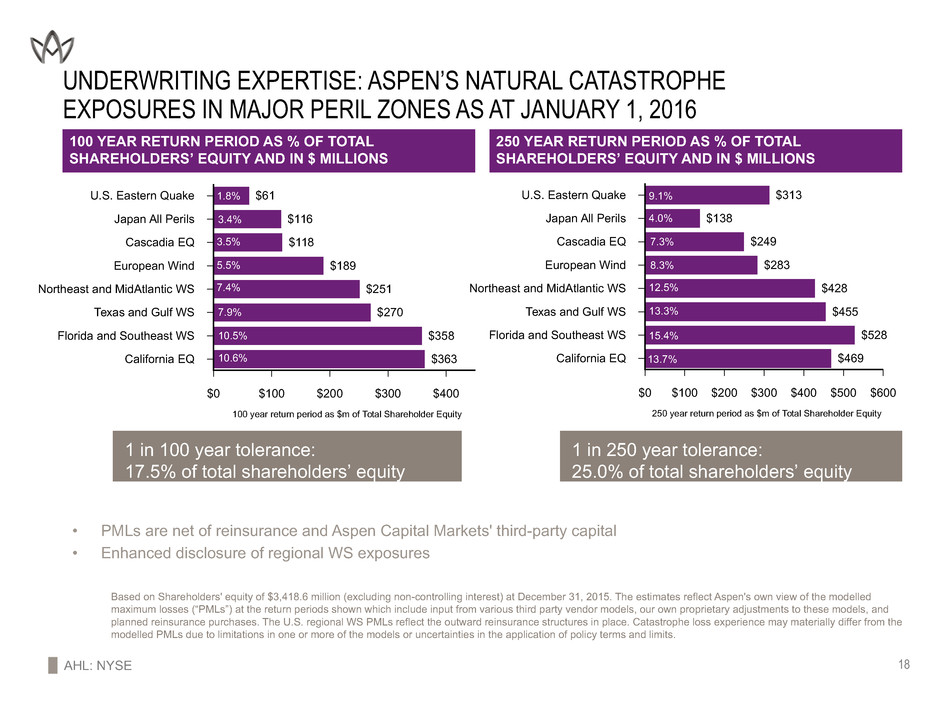

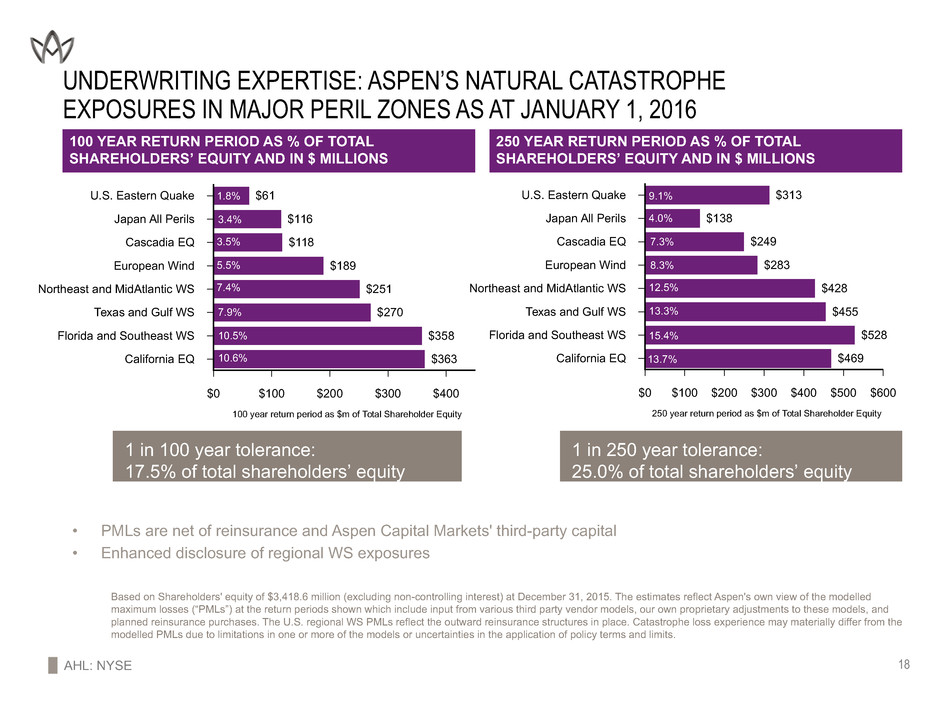

AHL: NYSE 18 UNDERWRITING EXPERTISE: ASPEN’S NATURAL CATASTROPHE EXPOSURES IN MAJOR PERIL ZONES AS AT JANUARY 1, 2016 100 YEAR RETURN PERIOD AS % OF TOTAL SHAREHOLDERS’ EQUITY AND IN $ MILLIONS 1 in 100 year tolerance: 17.5% of total shareholders’ equity 1 in 250 year tolerance: 25.0% of total shareholders’ equity Based on Shareholders' equity of $3,418.6 million (excluding non-controlling interest) at December 31, 2015. The estimates reflect Aspen's own view of the modelled maximum losses (“PMLs”) at the return periods shown which include input from various third party vendor models, our own proprietary adjustments to these models, and planned reinsurance purchases. The U.S. regional WS PMLs reflect the outward reinsurance structures in place. Catastrophe loss experience may materially differ from the modelled PMLs due to limitations in one or more of the models or uncertainties in the application of policy terms and limits. $0 $100 $200 $300 $400 $500 $600 250 year return period as $m of Total Shareholder Equity U.S. Eastern Quake Japan All Perils Cascadia EQ European Wind Northeast and MidAtlantic WS Texas and Gulf WS Florida and Southeast WS California EQ $313 $138 $249 $283 $428 $455 $528 $469 • PMLs are net of reinsurance and Aspen Capital Markets' third-party capital • Enhanced disclosure of regional WS exposures $0 $100 $200 $300 $400 100 year return period as $m of Total Shareholder Equity U.S. Eastern Quake Japan All Perils Cascadia EQ European Wind Northeast and MidAtlantic WS Texas and Gulf WS Florida and Southeast WS California EQ $61 $116 $118 $189 $251 $270 $358 $363 1.8% 9.1% 3.4% 3.5% 4.0% 5.5% 7.3% 7.4% 8.3% 7.9% 12.5% 10.5% 10.6% 13.7% 13.3% 15.4% 250 YEAR RETURN PERIOD AS % OF TOTAL SHAREHOLDERS’ EQUITY AND IN $ MILLIONS

Aspen Insurance Holdings Limited BANK OF AMERICA MERRILL LYNCH INSURANCE CONFERENCE February 10, 2016