DATED MARCH 28, 2019

ASPEN INSURANCE UK SERVICES LIMITED

ASPEN INSURANCE HOLDINGS LIMITED

AND

CHARLES CHRISTOPHER O'KANE

SETTLEMENT AGREEMENT

CONTENTS

|

| | | |

| Clause | | Page

|

| INTERPRETATION | 2 |

|

| ARRANGEMENTS ON TERMINATION | 3 |

|

| TERMINATION PAYMENTS | 4 |

|

| TREATMENT OF AWARDS | 5 |

|

| PENSION | 6 |

|

| OUTPLACEMENT AND REPATRIATION FLIGHTS | 6 |

|

| 280G | 6 |

|

| LEGAL FEES | 7 |

|

| WAIVER OF CLAIMS | 7 |

|

| EXECUTIVE INDEMNITIES | 9 |

|

| COMPANY PROPERTY AND INFORMATION | 9 |

|

| EXECUTIVE WARRANTIES AND ACKNOWLEDGMENTS | 10 |

|

| RESIGNATION FROM OFFICES | 11 |

|

| RESTRICTIVE COVENANTS | 11 |

|

| CONFIDENTIALITY | 11 |

|

| ENTIRE AGREEMENT | 12 |

|

| VARIATION | 13 |

|

| THIRD PARTY RIGHTS | 13 |

|

| GOVERNING LAW | 13 |

|

| JURISDICTION | 13 |

|

| SUBJECT TO CONTRACT AND WITHOUT PREJUDICE | 13 |

|

| COUNTERPARTS | 13 |

|

| 14 |

|

| 17 |

|

| 18 |

|

| 19 |

|

| 21 |

|

THIS AGREEMENT is dated March 28, 2019

BETWEEN

| |

| (1) | ASPEN INSURANCE UK SERVICES LIMITED incorporated and registered in England and Wales with company number 04270446 whose registered office is at 30 Fenchurch Street, London, EC3M 3BD ("Company") |

| |

| (2) | ASPEN INSURANCE HOLDINGS LIMITED incorporated in the Islands of Bermuda whose registered office is at Cedar Avenue, Hamilton, Bermuda ("Aspen Holdings"); |

| |

| (3) | CHARLES CHRISTOPHER O'KANE of [Address intentionally omitted] ("Executive") |

BACKGROUND

| |

| (A) | The Executive has been employed by the Company from 21 June 2002, most recently as the Chief Executive Officer under an amended and restated service agreement between the parties dated 24 September 2004 as amended on 28 October 2014. |

| |

| (B) | The parties also entered into a change in control employment agreement dated 23 February 2015 setting out enhanced employment and severance terms that would come into effect for the Executive in the event that Aspen Holdings was the subject of a change in control . The proposed merger of Aspen Holdings with an affiliate of certain investment funds managed by affiliates of Apollo Global Management, LLC will amount to a change in control for the purposes of the change in control employment agreement dated 23 February 2015. |

| |

| (C) | The Executive's employment with the Company terminated on 15 February 2019 by reason of mutual agreement. |

| |

| (D) | The parties have entered into this agreement to record and implement the terms on which they have agreed to settle any claims that the Executive has or may have in connection with his employment or its termination or otherwise against any Group Company (as defined below) or their officers or employees whether or not those claims are, or could be, in the contemplation of the parties at the time of signing this agreement, and including, in particular, the statutory complaints that the Executive raises in this agreement. |

| |

| (E) | The parties intend this agreement to be an effective waiver of any such claims and to satisfy the conditions relating to settlement agreements in the relevant legislation. |

| |

| (F) | The Company and Aspen Holdings enter into this agreement for themselves and as agents and trustees for all Group Companies and they are authorised to do so. It is the parties' intention that each Group Company should be able to enforce any rights it has under this agreement, subject to and in accordance with the Contracts (Rights of Third Parties) Act 1999. |

AGREED TERMS

The following definitions and rules of interpretation apply in this agreement.

"Adviser" means Anita Rai of Winckworth Sherwood LLP.

"Board" means the board of directors of Aspen Holdings (including any committee of the board duly appointed by it).

"Change in Control Employment Agreement" means the change in control employment agreement dated 23 February 2015, and the addendum to the change in control employment agreement dated 15 March 2018, between the Executive, the Company, and Aspen Holdings.

"Confidential Information" means information in whatever form (including, without limitation, in written, oral, visual or electronic form or on any magnetic or optical disk or memory and wherever located) relating to the business, products, affairs and finances of any Group Company for the time being confidential to any Group Company and trade secrets including, without limitation, technical data and know-how relating to the business of any Group Company or any of their suppliers, clients, customers, agents, distributors, shareholders or management, including (but not limited to) information that the Executive created, developed, received or obtained in connection with his employment, whether or not such information (if in anything other than oral form) is marked confidential.

"Copies" means copies or records of any Confidential Information in whatever form (including, without limitation, in written, oral, visual or electronic form or on any magnetic or optical disk or memory and wherever located) including, without limitation, extracts, analysis, studies, plans, compilations or any other way of representing or recording and recalling information which contains, reflects or is derived or generated from Confidential Information.

"Group Company" means the Company, Aspen Holdings, and their subsidiaries or holding companies from time to time and any subsidiary of any holding company from time to time.

"holding company" has the meaning given in clause 1.7.

"International Assignment Letter" means the Executive's letter assigning the Executive from the Company to Aspen Bermuda Limited in Bermuda dated 16 May 2018.

"Service Agreement" means the Executive's amended and restated service agreement with the Company and Aspen Holdings dated 24 September 2004, as amended on 28 October 2014.

"subsidiary" has the meaning in clause 1.7.

"'Tax Credit" means any credit against, relief or remission for, or repayment of, any tax.

"Transaction" means the merger of Aspen Holdings with an affiliate of certain investment funds managed by affiliates of Apollo Global Management, LLC.

| |

| 1.2 | The headings in this agreement are inserted for convenience only and shall not affect its construction. |

| |

| 1.3 | A reference to a particular law is a reference to it as it is in force for the time being taking account of any amendment, extension, or re-enactment and includes any subordinate legislation for the time being in force made under it. |

| |

| 1.4 | Unless the context otherwise requires, a reference to one gender shall include a reference to the other genders. |

| |

| 1.5 | Unless the context otherwise requires, words in the singular shall include the plural and in the plural shall include the singular. |

| |

| 1.6 | The Schedules shall form part of this agreement and shall have effect as if set out in full in the body of this agreement. Any reference to this agreement includes the Schedules. |

| |

| 1.7 | A reference to a holding company or a subsidiary means a holding company or a subsidiary (as the case may be) as defined in section 1159 of the Companies Act 2006. |

| |

| 2. | ARRANGEMENTS ON TERMINATION |

| |

| 2.1 | The Executive's employment with the Company terminated on 15 February 2019 (the "Termination Date"). |

| |

| 2.2 | The Company has paid the Executive his salary up to the Termination Date in the usual way. |

| |

| 2.3 | The Company has provided benefits to the Executive in the usual way up to the Termination Date. |

| |

| 2.4 | The Company will meet the cost of professional fees, including any fees accrued at the Termination Date, for tax compliance guidance relating to company withholding and reporting obligations as a consequence of the Executive’s assignment in Bermuda and the termination of his employment. The Executive will be responsible for the cost of professional fees in relation to personal tax planning, advice and guidance together with the actual costs of UK and US tax return preparation. |

| |

| 2.5 | The Company shall make a payment to the Executive in respect of eight (8) days' outstanding holiday, up to and including the Termination Date. |

| |

| 2.6 | The payments and benefits in this clause 2 shall be subject to any income taxes and National Insurance contributions or equivalent that the Company is obliged by law to pay or deduct. |

| |

| 2.7 | The Executive has submitted his expenses claims in the usual way and the Company shall reimburse the Executive for any expenses properly incurred before the Termination Date in the usual way. |

| |

| 2.8 | The Company shall deduct from the sums due under this agreement any outstanding sums due from the Executive to any Group Company, including an overpayment of remuneration and benefits with respect to 9 working days from 18 February to 28 February 2019 (with a value of approximately USD 31,994). |

| |

| 3.1 | Subject to and conditional on the Executive complying with the terms of this agreement, the Company shall within 21 days of the Termination Date or receipt by the Company of a copy of this agreement signed by the Executive and a letter from the Adviser in the form as set out in Schedule 3, whichever is later, pay to the Executive: |

| |

| (a) | the amount of USD 3,519,156 as a severance payment in accordance with the terms of the Change in Control Employment Agreement (the "Severance Payment"), such payment to include a payment in lieu of the Executive's notice period in accordance with clause 6(a)(i)(B) of the Change in Control Employment Agreement; |

| |

| (b) | the amount of USD 38,590 as a pro-rated bonus for performance year 2019 in accordance with clause 6(i)(A)(5) of the Change in Control Employment Agreement; |

| |

| (c) | the amount of USD 164,245 as the equivalent of the pension contributions the Executive would have received for the 12 month period following the Termination Date in accordance with clause 6(a)(iii) of the Change in Control Employment Agreement; |

| |

| (d) | the amount of USD 62,690 as the equivalent cost of the private medical insurance premiums the Executive would have received for the 12 month period following the Termination Date in accordance with clause 6(iv) of the Change in Control Employment Agreement; |

| |

| (e) | the amount of USD 34,275 as the equivalent cost of providing assistance to the Executive with respect to his US tax returns for tax years 2018 and 2019 and his UK tax return for tax year 2018-2019 in accordance with the terms of the International Assignment Letter; |

| |

| (f) | the amount of USD 47,706 as the equivalent cost of paying for the Executive's relocation costs in accordance with the terms of the International Assignment Letter; and |

| |

| (g) | the amount of USD 10,000,000 as a bonus in recognition of the Executive's contributions towards the Transaction (the "Transaction Bonus"). |

| |

| 3.2 | The Executive acknowledges that the Executive shall be liable for any income taxes and/or National Insurance contributions or other employee social security charges arising in |

respect of the payments under clause 3.1 and that the Company shall withhold and remit to the Tax authorities any taxes and/or employee social security payments that are required by law to be withheld from such payments. The Executive shall be responsible for any further taxes and employee's National Insurance contributions or equivalent due in respect of any payment under this agreement and shall indemnify the Company in respect of such liability in accordance with clause 10.1. Section 8(a) of the Change in Control Employment Agreement shall apply to all payments under this agreement.

| |

| 3.3 | Consistent with the terms of the International Assignment Letter, the Executive agrees that Aspen Holdings is entitled to ownership of all Tax Credits arising in respect of the Executive's employment with the Company, and accordingly the Executive agrees that: |

| |

| (a) | the Executive shall promptly upon becoming aware that the Executive has obtained any Tax Credit in respect of the Executive's employment with the Company notify Aspen Holdings accordingly; and |

| |

| (b) | the Executive shall pay an amount equal to such Tax Credit to Aspen Holdings, |

provided that the Executive agrees to provide such information as Aspen Holdings may reasonably request in order to determine if any such Tax Credit has arisen and in what amount.

| |

| 4.1 | The Executive acknowledges and agrees that all share options and other equity-based awards, including restricted stock units and performance stock units, held by the Executive vested on the completion of the Transaction, with satisfaction of performance conditions determined based on either (i) the actual level of performance achieved, with respect to any performance period that had been completed or (ii) the target performance level, with respect to any performance period that had not yet been completed, and that the Executive received at the same time as other similarly situated employees of the Company received payment for their respective equity awards, a lump-sum amount in cash, without interest, equal to $42.75 for each share subject to such vested share option or equity-based award (plus any amounts in respect of accrued dividend equivalents related thereto, to the extent applicable), less any applicable tax and/or National Insurance Contributions or other social security withholdings that the Company are required by law to withhold.. The Executive acknowledges and agrees that on receipt of such cash amount, all vested and unvested awards held by him under the Aspen Insurance Holdings Limited 2013 Share Incentive Plan or any other equity plan maintained by the Group Company (collectively, the “Omnibus Plan”) are fully satisfied and discharged and that he has no further rights, including any right to any further grant, payment, vesting, or compensation, under any plan or award agreement. |

| |

| 4.2 | The parties understand that the number of shares in respect of which the Executive shall receive a payment under clause 4.1 is: |

Restricted Stock Units

|

| | |

| Grant Date | Vest Date | Number of shares |

| 2/9/18 | 2/9/20 | 6,914 |

| 2/9/18 | 2/9/21 | 6,914 |

| 2/10/17 | 2/10/20 | 5,928 |

| Total | | 19,756 |

Performance Shares

|

| | |

| Grant Date | End of performance period | Number of shares |

| 2/9/18 | 12/31/19 | 20,742 |

| 2/9/18 | 12/31/20 | 20,742 |

| 2/10/17 | 12/31/19 | 17,784 |

| 2/8/16 | 12/31/16 | 7,909 |

| Total | | 67,177 |

The Company shall notify the trustees or administrators of the Company's UK pension plan (the "Pension Scheme") that the Executive's employment has been terminated and request written confirmation of the Executive's accrued entitlement under the Pension Scheme and request that the options available for dealing with his entitlement are sent to the Executive.

| |

| 6. | OUTPLACEMENT AND REPATRIATION FLIGHTS |

| |

| 6.1 | The Company shall bear the costs (up to $40,000 plus any value added tax or equivalent) in relation to the provision of outplacement counselling to the Executive by a provider |

to be selected by the Executive. Such costs must be incurred by the Executive within 2 years of the Termination Date.

| |

| 6.2 | The Company will also pay the cost of flights for the Executive and his family to return from Bermuda to either London or a city in the US. Such flights must be booked through the Company's travel agency and comply with the Company's Travel and Expense Policy. |

| |

| 7.1 | Notwithstanding anything to the contrary in this agreement, the Executive acknowledges and agrees that in the event that any payment under this agreement, including any portion of the Transaction Bonus, when added to all other payments or benefits provided by any Group Company to the Executive or for his benefit (the “Covered Payments”), would constitute a “parachute payment” within the meaning of Section 280G(b)(2) of the US Internal Revenue Code of 1986, as amended (the “Code”), and would, but for this paragraph, be subject to the excise tax imposed under Section 4999 of the Code or any similar tax imposed by state or local law or any interest or penalties with respect to such taxes (collectively, the “Excise Tax”), then such Covered Payments shall be either: |

| |

| (a) | reduced to the minimum extent necessary so that the present value of the Covered Payments will be one dollar ($1.00) less than three times the Executive's “base amount” (within the meaning of Section 280G(b)(3) of the Code) to ensure that no portion of the Covered Payments is subject to the Excise Tax (that amount, the “Reduced Amount”); or |

| |

| (b) | payable in full if the Executive's receipt on an after-tax basis of the full amount of payments and benefits (after taking into account the applicable federal, state, local and foreign income, employment and excise taxes (including the Excise Tax)) would result in the Executive receiving an amount that is at least one dollar greater than the Reduced Amount. |

| |

| 7.2 | If the Covered Payments are to be reduced pursuant to clause 7.1(a), the reduction shall be made reducing first any Covered Payments that are exempt from Section 409A of the Code, and then reducing any Covered Payments subject to Section 409A of the Code in the reverse order in which such Covered Payments would be paid or provided (beginning with such payment or benefit that would be made last in time and continuing, to the extent necessary, through to such payment or benefit that would be made first in time). Where two Covered Payments subject to reduction are payable at the same time, such amounts shall be reduced on a pro rata basis but not below zero. The determination as to whether any such reduction in the Covered Payments is necessary shall be made by the compensation committee of the Board in good faith. If a reduced Covered Payment is made or provided and, through error or otherwise, that Covered Payment, when aggregated with other payments and benefits from any Group Company used in determining if a “parachute payment” exists, exceeds one dollar ($1.00) less than three times the Executive's “base amount,” then the Executive shall immediately repay such excess to the applicable Group Company. |

The parties do not expect that the Executive will be subject to the Excise Tax under Section 280G of the Code and, accordingly, this clause 8 is not expected to have an impact on the amount of compensation or benefits otherwise due to the Executive.

The Company shall pay the reasonable legal fees (up to a maximum of $20,000 plus VAT) incurred by the Executive in obtaining advice on the termination of his employment and the terms of this agreement, such fees to be payable to the Adviser on production of an invoice addressed to the Executive but marked as payable by the Company.

| |

| 9.1 | The Executive agrees that the terms of this agreement are offered by the Company and Aspen Holdings without any admission of liability on the part of the Company or Aspen Holdings and are in full and final settlement of all and any claims or rights of action that the Executive has or may have against any Group Company or their officers or Executives whether arising out of his employment with the Company or its termination or from events occurring after this agreement has been entered into, whether under common law, contract, statute or otherwise, whether such claims are, or could be, known to the parties or in their contemplation at the date of this agreement in any jurisdiction and including, but not limited to, the claims specified in Schedule 2 (each of which is waived by this clause). |

| |

| 9.2 | The waiver in clause 9.1 shall not apply to the following: |

| |

| (a) | any claims by the Executive to enforce this agreement; |

| |

| (b) | any claims as a shareholder of the Company; |

| |

| (c) | any claims for indemnification or coverage under any directors’ and officers’ liability insurance policy of any Group Company; |

| |

| (d) | claims in respect of personal injury of which the Executive is not aware and could not reasonably be expected to be aware at the date of this agreement (other than claims under discrimination legislation); and |

| |

| (e) | any claims in relation to accrued entitlements under the Pension Scheme. |

| |

| 9.3 | The Executive warrants that: |

| |

| (a) | before entering into this agreement he received independent advice from the Adviser as to the terms and effect of this agreement and, in particular, on its effect on his ability to pursue any complaint before an employment tribunal or other court; |

| |

| (b) | the Adviser has confirmed to the Executive that they are a solicitor holding a current practising certificate and that there is in force a policy of insurance covering the risk of a claim by the Executive in respect of any loss arising in consequence of their advice; |

| |

| (c) | the Adviser shall sign and deliver to the Company a letter in the form attached as Schedule 3 to this agreement; |

| |

| (d) | before receiving the advice the Executive disclosed to the Adviser all facts and circumstances that may give rise to a claim by the Executive against any Group Company or their officers or employees; |

| |

| (e) | the only claims that the Executive has or may have against any Group Company or its officers or Executives (whether at the time of entering into this agreement or in the future) relating to his employment with the Company or its termination are specified in clause 9.1; and. |

| |

| (f) | the Executive is not aware of any facts or circumstances that may give rise to any claim against any Group Company or their officers or employees other than those claims specified in clause 9.1. |

The Executive acknowledges that the Company acted in reliance on these warranties when entering into this agreement.

| |

| 9.4 | The Executive acknowledges that the conditions relating to settlement agreements under section 147(3) of the Equality Act 2010, section 288(2B) of the Trade Union and Labour Relations (Consolidation) Act 1992, section 203(3) of the Employment Rights Act 1996, regulation 35(3) of the Working Time Regulations 1998, section 49(4) of the National Minimum Wage Act 1998, regulation 41(4) of the Transnational Information and Consultation etc. Regulations 1999, regulation 9 of the Part-Time Workers (Prevention of Less Favourable Treatment) Regulations 2000, regulation 10 of the Fixed-Term Executives (Prevention of Less Favourable Treatment) Regulations 2002, regulation 40(4) of the Information and Consultation of Executives Regulations 2004, paragraph 13 of the Schedule to the Occupational and Personal Pension Schemes (Consultation by Employers and Miscellaneous Amendment) Regulations 2006, regulation 62 of the Companies (Cross Border Mergers) Regulations 2007 and section 58 of the Pensions Act 2008 have been satisfied. |

| |

| 9.5 | The waiver in clause 9.1 shall have effect irrespective of whether or not, at the date of this agreement, the Executive is or could be aware of such claims or have such claims in his express contemplation (including such claims of which the Executive becomes aware after the date of this agreement in whole or in part as a result of new legislation or the development of common law or equity). |

| |

| 9.6 | The Executive agrees that, except for the payments and benefits provided for in this agreement, and subject to the waiver in clause 9.1, he shall not be eligible for any further payment from any Group Company relating directly or indirectly to his employment or its termination and he expressly waives any right or claim that he has or may have to payment of bonuses, any benefit or award programme, under any share plan operated by any Group Company or any stand-alone share incentive arrangement, or to any other benefit, payment or award he may have received had his employment not terminated, including without limitation any such benefit, payment or award under the Change in Control Employment Agreement or the Omnibus Plan. |

| |

| 10.1 | The Executive shall indemnify the Company and Aspen Holdings on a continuing basis in respect of any income taxes or employee social security liabilities and associated interest, penalties and professional fees due in respect of the payments and benefits under this agreement, and with respect to the Executive's tax residency, and the associated tax treatment of the Executive's remuneration, during his international assignment to Bermuda (and any related interest, penalties, costs and expenses). The Company or Aspen Holdings shall give the Executive reasonable notice of a tax authority audit or potential tax liability, or of any demand for tax which may lead to liabilities on the Executive under this indemnity and shall provide him with reasonable access to any documentation he may reasonably require to dispute such a claim (provided that nothing in this clause shall prevent the Company or Aspen Holdings from complying with its legal obligations with regard to HM Revenue and Customs, the Bermuda tax authority, or other competent body). |

| |

| 10.2 | If the Executive breaches any material provision of this agreement or pursues a claim against any Group Company arising out of his employment or its termination other than those excluded under clause 10.1, he agrees to indemnify the Company and Aspen Holdings for any losses suffered as a result thereof, including all reasonable legal and professional fees incurred. |

| |

| 11. | COMPANY PROPERTY AND INFORMATION |

| |

| 11.1 | The Executive warrants as at the date of this agreement, that he has returned to the Company and/or Aspen Holdings: |

| |

| (a) | all Confidential Information and Copies; |

| |

| (b) | subject to clause 11.2 below, all property belonging to the Company and/or Aspen Holdings in satisfactory condition including (but not limited to) any car (together with the keys and all documentation relating to the car), fuel card, company credit card, keys, security pass, identity badge, pager, lap-top computer or fax machine; and |

| |

| (c) | all documents and copies (whether written, printed, electronic, recorded or otherwise and wherever located) made, compiled or acquired by him during his employment with the Company or relating to the business or affairs of any Group Company or their business contacts, |

in the Executive's possession or under his control.

| |

| 11.2 | The Company shall take all action reasonably necessary to transfer the phone numbers associated with the Executive’s two Company mobile phones (the "Phones") to the Executive’s name and hereby transfers ownership of the Phones to the Executive. |

| |

| 11.3 | The Company will offer the Executive the right to acquire one or more of the Company paintings listed on Schedule 5 within 6 months of the Termination Date at fair market value as determined by an independent appraiser jointly selected by the Company and the Executive. |

| |

| 11.4 | The Executive as at the date of this agreement, warrants that he has erased irretrievably any information relating to the business or affairs of any Group Company or their business contacts from computer and communications systems and devices owned or used by him outside the premises of the Company, including such systems and data storage services provided by third parties (to the extent technically practicable). |

| |

| 11.5 | The Executive shall, if requested to do so by the Board, provide a signed statement that he has complied fully with his obligations under clause 11.1 and clause 11.4 and shall provide it with such reasonable evidence of compliance as may be requested. |

| |

| 12. | EXECUTIVE WARRANTIES AND ACKNOWLEDGMENTS |

| |

| 12.1 | As at the date of this agreement, the Executive warrants and represents to the Company and Aspen Holdings that there are no circumstances of which the Executive is aware or of which the Executive ought reasonably to be aware that would amount to a repudiatory breach by the Executive of any express or implied term of the Service Agreement or the Change in Control Employment Agreement that would entitle (or would have entitled) the Company to terminate the Executive's employment without notice or payment in lieu of notice and any payment to the Executive pursuant to clause 3 and any payment in lieu of notice are conditional on this being so. |

| |

| 12.2 | As at the date of this agreement, the Executive warrants and represents to the Company and Aspen Holdings that he has not received or accepted any offer which will provide him with any form of income or benefits at any time after the Termination Date and any payment to the Executive pursuant to clause 3 is conditional on this being so. |

| |

| 12.3 | For a period not to exceed three years following the Termination Date, the Executive agrees upon reasonable notice to make himself available to, and to cooperate with, the Company, Aspen Holdings, or their advisers in any internal investigation or administrative, regulatory, judicial or quasi-judicial proceedings. The Executive acknowledges that this could involve, but is not limited to, responding to or defending any regulatory or legal process, providing information in relation to any such process, preparing witness statements and giving evidence in person on behalf of the Company or Aspen Holdings. The Company and/or Aspen Holdings shall reimburse any reasonable expenses incurred by the Executive as a consequence of complying with his obligations under this clause, with all necessary travel to be at the commercial classes used by the Executive immediately prior to the Termination Date(and excluding private travel) , provided that such expenses are approved in advance by the Company and/or Aspen Holdings. The Executive shall not be required to cooperate against his own legal interests or the legal interests of any future employer. |

| |

| 12.4 | The Executive acknowledges that he is not entitled to any compensation for the loss of any rights or benefits under any bonus plan, benefit or award programme, share plan operated by any Group Company or any stand-alone share incentive arrangement, or for loss of any other benefit, payment or award he may have received had his employment not terminated (including without limitation any such benefit, payment or award under the Change in Control Employment Agreement or the Omnibus Plan), other than the payments and benefits provided for in this agreement. |

| |

| 13. | RESIGNATION FROM OFFICES |

| |

| 13.1 | It is a condition of this agreement that the Executive also signs a letter in the form at Schedule 1 to resign immediately from any directorship, office, trusteeship, committee or position that he holds in or on behalf of any Group Company. |

| |

| 13.2 | The Executive irrevocably appoints the Company to be his attorney in his name and on his behalf to sign, execute or do any such instrument or thing and generally to use his name in order to give the Company (or its nominee) the full benefit of the provisions of this clause. |

| |

| 14.1 | The Company shall pay USD 3,290 to the Executive as consideration for his entering into the restrictive covenants in Schedule 4, such sum to be paid within 21 days after the Termination Date or receipt by the Company of a copy of this agreement signed by the Executive and receipt by the Company of a letter from the Adviser as set out in Schedule 3, whichever is later. The Company shall deduct any income taxes and National Insurance contributions or equivalent from this sum. |

| |

| 15.1 | The Executive acknowledges that, as a result of his employment as CEO he has had access to Confidential Information. Without prejudice to his common law duties, the Executive shall not (except as authorised or required by law or as authorised by the Company) at any time after the Termination Date: |

| |

| (a) | use any Confidential Information; or |

| |

| (b) | make or use any Copies; or |

| |

| (c) | disclose any Confidential Information to any person, company or other organisation whatsoever. |

| |

| 15.2 | The restrictions in clause 15.1 do not apply to any Confidential Information which is in or comes into the public domain other than through the Executive's unauthorised disclosure. |

| |

| 15.3 | The Executive, the Company and Aspen Holdings confirm that they have kept and agree to keep the existence and terms of this agreement and the circumstances concerning the termination of the Executive's employment confidential, except where such disclosure is to HM Revenue & Customs or any equivalent authority, required by law or (where necessary or appropriate) to: |

| |

| (a) | the Executive's spouse, civil partner or partner, immediate family or legal or professional advisers, provided that they agree to keep the information confidential; or |

| |

| (b) | the Executive's insurer for the purposes of processing a claim for loss of employment. |

| |

| 15.4 | The Company may also disclose the existence and terms of this agreement to the Company's officers, Executives or legal or professional advisers, provided that they agree to keep the information confidential. The Company and the Executive may disclose the existence and terms of this agreement if required by a court or applicable law, requested by a governmental or regulatory agency or as reasonably appropriate in connection with litigation related to this agreement. |

| |

| 15.5 | The Executive shall not make any adverse or derogatory comment about the Company, its directors or employees and the Company shall use reasonable endeavours to ensure that its employees, directors and officers shall not make any adverse or derogatory comment about the Executive. The Executive shall not do anything which shall, or may, bring the Company, its directors or Executives into disrepute and the Company shall use reasonable endeavours to ensure that its Executives and officers shall not do anything that shall, or may, bring the Executive into disrepute. The Executive and the Company’s employees, directors and officers shall be permitted to make truthful statements pursuant to any litigation or governmental or regulatory investigation. |

| |

| 15.6 | Nothing in this clause 15 shall prevent the Executive from making a protected disclosure under section 43A of the Employment Rights Act 1996 and nothing in this clause 15 shall prevent the Company from making such disclosure as it is required by law to make. |

| |

| 15.7 | The Company shall pay USD 1,315 to the Executive as consideration for his entering into the restrictions in this clause 15, such sum to be paid within 14 days of the Termination Date or receipt by the Company of a copy of this agreement signed by the Executive and receipt by the Company of a letter from the Adviser as set out in Schedule 3, whichever is later. The Company shall deduct any income taxes and National Insurance contributions or equivalent from this sum. |

| |

| 16.1 | Each party on behalf of itself and, in the case of the Company, as agent for any Group Companies acknowledges and agrees with the other party (the Company acting on behalf of itself and as agent for each Group Company) that: |

| |

| (a) | this agreement constitutes the entire agreement between the parties and any Group Company and supersedes and extinguishes all agreements, promises, assurances, warranties, representations and understandings between them whether written or oral, relating to its subject matter; |

| |

| (b) | in entering into this agreement it does not rely on, and shall have no remedies in respect of, any statement, representation, assurance or warranty (whether made innocently or negligently) that is not set out in this agreement; and |

| |

| (c) | it shall have no claim for innocent or negligent misrepresentation or negligent misstatement based on any statement in this agreement. |

| |

| 16.2 | Nothing in this agreement shall, however, operate to limit or exclude any liability for fraud. |

No variation of this agreement shall be effective unless it is in writing and signed by the parties (or their authorised representatives).

Except as expressly provided elsewhere in this agreement, no person other than the Executive, the Company and any Group Company shall have any rights under the Contracts (Rights of Third Parties) Act 1999 to enforce any term of this agreement.

This agreement and any dispute or claim arising out of or in connection with it or its subject matter or formation (including non-contractual disputes or claims) shall be governed by and construed in accordance with the law of England and Wales.

Each party irrevocably agrees that the courts of England and Wales shall have exclusive jurisdiction to settle any dispute or claim arising out of or in connection with this agreement or its subject matter or formation (including non-contractual disputes or claims).

| |

| 21. | SUBJECT TO CONTRACT AND WITHOUT PREJUDICE |

This agreement shall be deemed to be without prejudice and subject to contract until such time as it is signed by both parties and dated, when it shall be treated as an open document evidencing a binding agreement.

This agreement may be executed and delivered in any number of counterparts, each of which, when executed, shall constitute a duplicate original, but all the counterparts shall together constitute the one agreement.

This agreement has been entered into on the date stated at the beginning of it.

SCHEDULE 1

DIRECTOR RESIGNATION LETTER

Director of the companies listed in the Appendix hereto (together, the “Companies”)

_____________________ 2019

Dear Sirs,

RESIGNATION AS DIRECTOR, OFFICER, TRUSTEE, COMMITTEE MEMBER, OR FIDUCIARY OF THE COMPANIES

| |

| 1. | I hereby resign with effect from the date of this letter (the "Termination Date") from my office as a director of each of the Companies, any position of office of the Companies, and any trusteeship, any committee membership and any fiduciary position of the Companies and any of its benefit plans (the "Officer Positions"). |

| |

| 2.1 | I have no claims or rights of action arising from arising from the holding of the Officer Positions or their termination, whether under common law, contract, statute or otherwise, whether or not such claims are, or could be, known to the me or in my contemplation at the Termination Date in any jurisdiction; and |

| |

| 2.2 | there is no agreement or arrangement outstanding under which the Companies have or could have any actual or contingent obligation to me or to any person connected with me; and |

| |

| 2.3 | to the extent that any such claim, obligation or sum exists or may exist as at the date of this letter, I irrevocably and unconditionally waive such claim, obligation or sum and all rights of action I may have against the Companies so far as is possible under the applicable law of each Company. |

| |

| 3. | For the purposes of this letter a person shall be deemed to be connected with me if that person is so connected within the meaning of section 1122 of the Corporation Tax Act 2010 (or any equivalent legislation outside the UK). |

| |

| 4. | This letter and any disputes or claims (including non-contractual disputes or claims) arising out of or in connection with it or its subject matter or formation shall be governed by and construed in accordance with the law of England and Wales. The courts of England and Wales shall have exclusive jurisdiction to settle any dispute or claim (including non-contractual disputes or claims) arising out of or in connection with this letter or its subject matter or formation. |

| |

| 5. | This document has been executed as a deed and is delivered and takes effect on the date stated at the beginning of it. |

Yours faithfully

|

| |

Signed as a deed by CHARLES CHRISTOPHER O'KANE

in the presence of: |

......................................... CHARLES CHRISTOPHER O'KANE |

..................................... SIGNATURE OF WITNESS | |

| | |

| NAME OF WITNESS | |

| ADDRESS OF WITNESS | |

| OCCUPATION OF WITNESS | |

APPENDIX TO DIRECTOR RESIGNATION LETTER

The companies (together, the "Companies"):

|

| | | |

| Company | Jurisdiction of Incorporation | Registered Address | Company/Entity No. |

| Aspen Insurance Holdings Limited | Bermuda | Cedar Avenue, Hamilton, Bermuda | 32164 |

| Aspen Insurance UK Services Limited | England and Wales | 30 Fenchurch Street, London, EC3M 3BD | 4270446 |

| Aspen (UK) Holdings Limited | England and Wales | 30 Fenchurch Street, London, EC3M 3BD | 4785892 |

| Blue Marble Micro Limited | England and Wales | Tower Bridge House, St Katharine's Way, London, E1W 1DD | 9638990 |

SCHEDULE 2

CLAIMS

| |

| (a) | for breach of contract or wrongful dismissal; |

| |

| (b) | for unfair dismissal, under section 111 of the Employment Rights Act 1996; |

| |

| (c) | in relation to the right to a written statement of reasons for dismissal, under section 93 of the Employment Rights Act 1996; |

| |

| (d) | for a statutory redundancy payment, under section 163 of the Employment Rights Act 1996; |

| |

| (e) | in relation to an unlawful deduction from wages or unlawful payment, under section 23 of the Employment Rights Act 1996; |

| |

| (f) | for unlawful detriment, under section 48 of the Employment Rights Act 1996 or section 56 of the Pensions Act 2008; |

| |

| (g) | in relation to written employment particulars and itemised pay statements, under section 11 of the Employment Rights Act 1996; |

| |

| (h) | in relation to guarantee payments, under section 34 of the Employment Rights Act 1996; |

| |

| (i) | in relation to suspension from work, under section 70 of the Employment Rights Act 1996; |

| |

| (j) | in relation to working time or holiday pay, under regulation 30 of the Working Time Regulations 1998; |

| |

| (k) | for direct or indirect discrimination, harassment or victimisation related to age, under section 120 of the Equality Act 2010 [and/or under regulation 36 of the Employment Equality (Age) Regulations 2006]; |

| |

| (l) | in relation to the right to be accompanied under section 11 of the Employment Relations Act 1999; |

| |

| (m) | in relation to personal injury, of which the Employee is or ought reasonably to be aware at the date of this agreement; |

| |

| (n) | for harassment under the Protection from Harassment Act 1997; |

| |

| (o) | for failure to comply with obligations under the Human Rights Act 1998; |

| |

| (p) | for failure to comply with obligations under the Data Protection Act 1998; and |

| |

| (q) | arising as a consequence of the United Kingdom's membership of the European Union. |

SCHEDULE 3

ADVISER'S CERTIFICATE

[ON HEADED NOTEPAPER OF ADVISER]

For the attention of [DETAILS]

[Aspen Insurance UK Services Limited

30 Fenchurch Street

London EC3M 3BD]

[DATE]

Dear Sirs,

I am writing in connection with the agreement between my client, Charles Christopher O’Kane (“Mr. O’Kane”), Aspen Insurance UK Services Limited (the “Company”) and Aspen Insurance Holdings Limited [of today's date OR dated [DATE]] (the “Agreement”) to confirm that:

| |

| 1. | I, [NAME] of [FIRM], whose address is [ADDRESS], am [a Solicitor of the Senior Courts of England and Wales who holds a current practising certificate OR AMEND AS APPLICABLE]. |

| |

| 2. | I have given Mr. O’Kane legal advice on the terms and effect of the Agreement and, in particular, its effect on his ability to pursue the claims specified in Schedule 2 of the Agreement. |

| |

| 3. | I gave the advice to Mr. O’Kane as a relevant independent adviser within the meaning of the above acts and regulations referred to at clause 9.4. |

| |

| 4. | There is now in force (and was in force at the time I gave the advice referred to above) a policy of insurance or an indemnity provided for members of a profession or professional body covering the risk of claim by Mr. O’Kane in respect of loss arising in consequence of the advice I have given him. |

Yours faithfully,

[NAME OF ADVISER]

[DATE]

SCHEDULE 4

RESTRICTIVE COVENANTS

| |

| 1. | POST-TERMINATION OBLIGATIONS |

| |

| 1.1 | For the purpose of this Clause: |

"the Business" means the business of the Group or any Group Company at the date of

termination of the Executive's employment with which the Executive has been concerned to a material extent at any time in the Relevant Period;

references to the "Group" and "Group Companies" shall only be reference to the Group and Group Companies in respect of which the Executive has carried out material duties in the Relevant Period;

"Relevant Period" shall mean the period of 24 months immediately preceding the date

of termination of the Executive's employment;

"Restricted Person" shall mean any person who or which has at any time during the

Relevant Period done business with the Company or any other Group Company as

customer or client or consultant and whom or which the Executive shall have had

personal dealings with, contact with or responsibility for (each, in a business or

commercial capacity) during the Relevant Period;

"Key Employee" shall mean any person who at the date of termination of the

Executive's employment is employed or engaged by the Company or any other Group

Company with whom the Executive has had material contact during the Relevant Period

and (a) is employed or engaged in the capacity of Manager, Underwriter or otherwise in a senior capacity or in any other capacity as may be agreed in writing between the

Executive Committee and the Executive from time to time and/or (b) is in the possession of Confidential Information and/or (c) is directly managed by or reports to the Executive.

Capitalised terms not defined above shall have the meaning in the Service Agreement.

| |

| 1.2 | The Executive covenants with the Company that he will not in connection with the carrying on of any business in competition with the Business for the period of 12 months after the Termination Date without the prior written consent of the Board either alone or jointly with or on behalf of any person directly or indirectly: |

| |

| (a) | canvass, solicit or approach or cause to be canvassed or solicited or approached for orders in respect of any services provided and/or any products sold by the Company or any other Group Company any Restricted Person; |

| |

| (b) | solicit or entice away or endeavour to solicit or entice away from the Company or any other Group Company any Key Employee. |

| |

| 1.3 | The Executive further covenants that he will not in connection with the carrying on of any business in competition with the Business for the further period of 12 months following the first anniversary of the Termination Date, without the prior written consent of the Board, either alone or jointly with or on behalf of any person directly or indirectly (a) canvass, solicit or approach or cause to be canvassed or solicited or approached for orders in respect of any services provided and/or any products sold by the Company or any other Group Company any Restricted Person; or (b) solicit or entice away or endeavour to solicit or entice away from the Company or any other Group Company any Key Employee. |

| |

| 1.4 | The Executive further covenants with the Company that he will not, for the period of 12 months after the Termination Date, be employed, engaged, interested in or concerned with any business or undertaking which is engaged in or carries on business in the United Kingdom, Bermuda or the USA which is or is about to be in competition with the Business; |

| |

| 1.5 | The covenants contained in Clauses 1.2, 1.3 and 1.4 are intended to be separate and severable and enforceable as such. It is expressly understood and agreed that although the Executive and the Company consider the restrictions contained in this clause 1 to be reasonable, if a final judicial determination is made by a court of competent jurisdiction that the time or territory or any other restriction contained in this Agreement is an unenforceable restriction against the Executive, the provisions of this Agreement shall not be rendered void but shall be deemed amended to apply as to such maximum time and territory and to such maximum extent as such court may judicially determine to be enforceable. Alternatively, if any court of competent jurisdiction finds that any restriction contained in this Agreement is unenforceable, and such restriction cannot be amended so as to make it enforceable, such finding shall not affect the enforceability of any of the other restrictions contained herein. |

| |

| 1.6 | The Executive acknowledges and agrees that the Company's remedies at law for a breach of any of the provisions of this clause 1 would be inadequate and the Company would suffer irreparable damages as a result of such breach. In recognition of this fact, the Executive agrees that, in the event of such a breach, in addition to any remedies at law, the Company, without posting any bond, shall be entitled to obtain equitable relief in the form of specific performance, temporary restraining order, temporary or permanent injunction or any other equitable remedy which may then be available. |

SCHEDULE 5

COMPANY PAINTINGS

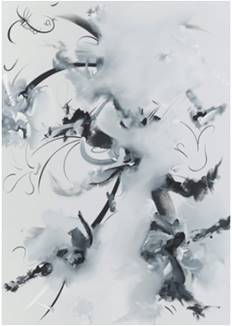

Fiona Rae – Figure 10, 2015

Value in 2016 - £55,000

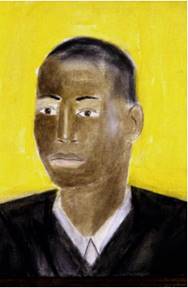

Craigie Aitchison – Model with Black Jacket, 2000

Value in 2016 - £45,000

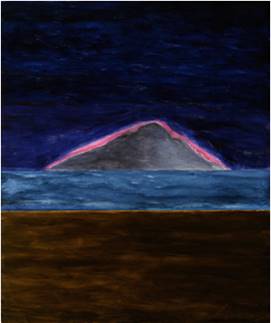

Craigie Aitchison - Holy Isle of Arran, 2004

Value in 2016 - £100,000

Signature pages to follow.

IN WITNESS whereof the parties have executed this agreement as a deed on the date of this agreement.

EXECUTED as a DEED by )

ASPEN INSURANCE UK SERVICES )

LIMITED )

acting by Michael Cain )

a director, in the presence of: )

/s/ Michael Cain

DIRECTOR

/s/ Amanda Strong

SIGNATURE OF WITNESS

NAME OF WITNESS: Amanda Strong

ADDRESS OF WITNESS: [Address intentionally omitted]

OCCUPATION OF WITNESS: Senior Legal Assistant

EXECUTED as a DEED by )

ASPEN INSURANCE HOLDINGS )

LIMITED )

acting by Silvia Martinez )

Company Secretary, in the presence of: )

/s/ Silvia Martinez

COMPANY SECRETARY

/s/ Amanda Strong

SIGNATURE OF WITNESS

NAME OF WITNESS: Amanda Strong

ADDRESS OF WITNESS: [Address intentionally omitted]

OCCUPATION OF WITNESS: Senior Legal Assistant

EXECUTED as a DEED by CHARLES )

CHRISTOPHER O'KANE )

in the presence of: )

/s/ Charles O'Kane

CHARLES CHRISTOPHER O'KANE

/s/ Amanda Strong

SIGNATURE OF WITNESS

NAME OF WITNESS: Amanda Strong

ADDRESS OF WITNESS: [Address intentionally omitted]

OCCUPATION OF WITNESS: Senior Legal Assistant