Aspen Insurance Holdings Limited

July 27, 2007

Q2 2007 Earnings Conference Call

AHL:NYSE

AHL: NYSE

Exhibit 99.1

Safe Harbor Disclosure

This slide presentation is for information purposes only. It should be read in conjunction with our financial supplement posted on our website on the Investor Relations page and with other documents filed or to be filed shortly by Aspen Insurance Holdings Limited (the “Company” or “Aspen”) with the U.S. Securities and Exchange Commission.

Non-GAAP Financial Measures

In presenting Aspen's results, management has included and discussed certain "non-GAAP financial measures", as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain Aspen's results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included herein or in the financial supplement, as applicable, which can be obtained from the Investor Relations section of Aspen's website at www.aspen.bm.

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995:

This presentation contains, and Aspen's earnings conference call will contain, written or oral "forward-looking statements" within the meaning of the U.S. federal securities laws. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "expect," "intend," "plan," "believe," "project," "anticipate," "seek," "will," "estimate," "may," "continue," and similar expressions of a future or forward-looking nature.

In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence, initial tentative loss reports and other sources. Due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare estimates relating to the UK floods, there can be no assurance that Aspen's ultimate losses associated with these floods will remain within the stated amount.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aspen believes these factors include, but are not limited to: changes in the total industry losses resulting from the UK and Australian floods and Hurricanes Katrina, Rita and Wilma and the actual number of Aspen's insureds incurring losses from these events; with respect to the UK and Australian floods and Hurricanes Katrina, Rita and Wilma, Aspen’s reliance on loss reports received from cedants and loss adjustors, Aspen's reliance on industry loss estimates and those generated by modeling techniques, the impact of these events on Aspen's reinsurers, any changes in Aspen's reinsurers' credit quality, the amount and timing of reinsurance recoverables and reimbursements actually received by Aspen from its reinsurers and the overall level of competition and the related demand and supply dynamics as contracts come up for renewal; the impact that our future operating results, capital position and rating agency and other considerations have on the execution of any capital management initiatives; the impact of any capital management activities on our financial condition; the impact of acts of terrorism and related legislation and acts of war; the possibility of greater frequency or severity of claims and loss activity, including as a result of natural or man-made catastrophic events than our underwriting, reserving or investment practices have anticipated; evolving interpretive issues with respect to coverage as a result of Hurricanes Katrina, Rita and Wilma and any other events such as the UK floods; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; the effectiveness of Aspen's loss limitation methods; changes in the availability, cost or quality of reinsurance or retrocessional coverage, which may affect our decision to purchase such coverage; the reliability of, and changes in assumptions to, catastrophe pricing, accumulation and estimated loss models; loss of key personnel; a decline in our operating subsidiaries' ratings with Standard & Poor's, A.M. Best Company or Moody's Investors Service; changes in general economic conditions including inflation, foreign currency exchange rates, interest rates and other factors that could affect our investment portfolio; the number and type of insurance and reinsurance contracts that we wrote at the January 1st and other renewal periods in 2007 and the premium rates available at the time of such renewals within our targeted business lines; increased competition on the basis of pricing, capacity, coverage terms or other factors; decreased demand for Aspen’s insurance or reinsurance products and cyclical downturn of the industry; changes in governmental regulations, interpretations or tax laws in jurisdictions where Aspen conducts business; proposed and future changes to insurance laws and regulations, including with respect to U.S. state- and other government-sponsored reinsurance funds and primary insurers; Aspen or its Bermudian subsidiary becoming subject to income taxes in the United States or the United Kingdom; the effect on insurance markets, business practices and relationships of ongoing litigation, investigations and regulatory activity by the New York State Attorney General's office and other authorities concerning contingent commission arrangements with brokers and bid solicitation activities. For a more detailed description of these uncertainties and other factors, please see the "Risk Factors" section in Aspen's Annual Reports on Form 10-K as filed with the U.S. Securities and Exchange Commission on February 22, 2007. Aspen undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

2

AHL: NYSE

Financial Highlights – Q2 2007

* Annualised

¹ Reconciliation of Average Equity to closing shareholders’ equity and operating income to net income is provided in our quarterly financial supplements available in the Financial Results section of the Investor Relations page of Aspen’s website at www.aspen.bm

3

AHL: NYSE

(US$ in millions, except per share data)

Quarter Ended June 30

2007

2006

% Change

Gross Written Premiums

503.5

522.4

(3.6)

Net Written Premiums

418.5

500.1

(16.3)

Net Earned Premiums

451.2

429.0

5.2

Underwriting Income

52.4

79.0

(33.7)

Net Investment Income

78.8

49.9

57.9

Net Income after tax

$114.7

$101.8

12.7%

GAAP Ratios:

Loss Ratio

60.5%

52.2%

Expense Ratio

27.9%

29.4%

Combined Ratio

88.4%

81.6%

Full Year ROAE ¹

20.4%*

20.4%*

Diluted Income Per Ordinary Share:

Net Income

$1.19

$1.01

17.8%

Operating Income ¹

$1.14

$0.98

16.3%

Financial Highlights – Half Year 2007

* Annualised

¹ Reconciliation of Average Equity to closing shareholders’ equity and operating income to net income is provided in our quarterly financial supplements available in the Financial Results section of the Investor Relations page of Aspen’s website at www.aspen.bm

4

AHL: NYSE

(US$ in millions, except per share data)

Six Months Ended June 30

2007

2006

% Change

Gross Written Premiums

1,140.0

1,201.1

(5.1)

Net Written Premiums

973.6

952.0

2.3

Net Earned Premiums

890.2

831.6

7.0

Underwriting Income

142.9

117.7

21.4

Net Investment Income

146.3

94.4

55.0

Net Income after tax

$236.6

$163.6

44.6%

GAAP Ratios:

Loss Ratio

55.9%

54.8%

Expense Ratio

28.0%

31.0%

Combined Ratio

83.9%

85.8%

Full Year ROAE ¹

21.7%*

15.6%*

Book Value Per Ordinary Share

$24.44

$20.19

21.1%

Diluted Income Per Ordinary Share:

Net Income

$2.46

$1.61

52.8%

Operating Income ¹

$2.40

$1.57

52.9%

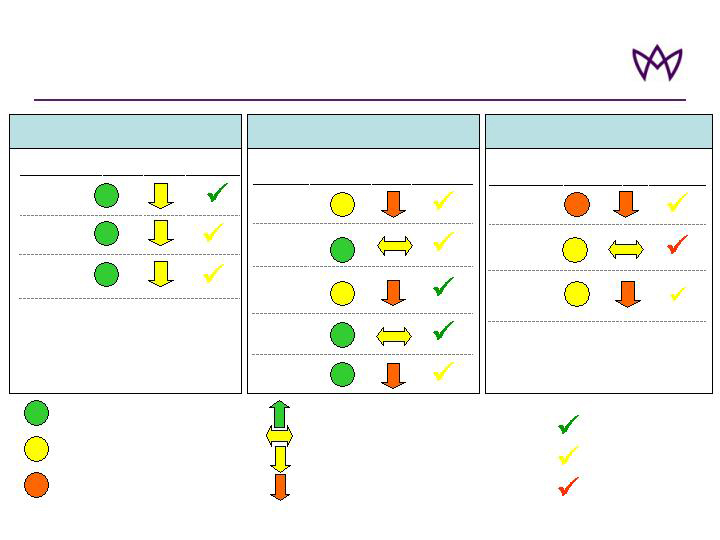

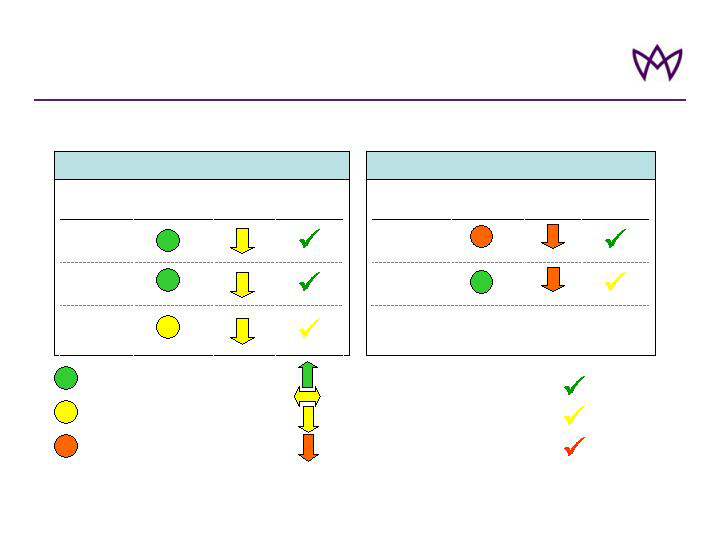

Market Conditions

2007 Outlook: Property and Specialty Lines

Pro Rata

Market

Trend

Risk Excess

Treaty

Catastrophe

Treaty

Aspen 1H07

Performance

Market

Conditions

Line

Market

Trend

Specialty

Reinsurance

Marine &

Energy Liability

Offshore

Energy

Physical

Damage

Marine Hull

Aviation

Aspen 1H07

Performance

Market

Conditions

Line

International

Property Fac.

E&S Property

Market

Trend

UK Property

Aspen 1H07

Performance

Market

Conditions

Line

Property Reinsurance

Specialty Lines

Property Insurance

= Absolute rate levels attractive

= Absolute rate levels mixed

= Absolute rate levels very challenging

= 12 month rate trend positive

= 12 month rate trend neutral

= 12 month rate trend slightly downwards

= 12 month rate trend downwards

5

Strong

Good

Improvement Required

Updated July 27, 2007

AHL: NYSE

Market Conditions 2007 Outlook: Casualty Lines

Market

Trend

Casualty

Facultative

US Casualty

International

Casualty

Aspen 1H07

Performance

Market

Conditions

Line

Market

Trend

E&S Casualty

UK Liability

Aspen 1H07

Performance

Market

Conditions

Line

Casualty Reinsurance

Casualty Insurance

= Absolute rate levels attractive

= Absolute rate levels mixed

= Absolute rate levels very challenging

6

Strong

Good

Improvement Required

= 12 month rate trend positive

= 12 month rate trend neutral

= 12 month rate trend slightly downwards

= 12 month rate trend downwards

Updated July 27, 2007

AHL: NYSE

Aspen Share of Recent Cat Losses

7

0.70%

0.30%

0.90%

0.80%

‘As-if’ loss (Gross)***

0.80%

0.50%

1.80%

1.50%

2.30%

1.70%

Actual loss (Gross)

Market share

3.00**

5.52**

89.64

12.95*

10.38*

66.31*

Selected market loss

June

Floods

Kyrill

Total KRW

Wilma

Rita

Katrina

US$ in billions

* Data from Sigma

** Reflects market estimates

*** ‘As-if’ is calculated by modelling the same event through our current portfolio

AHL: NYSE

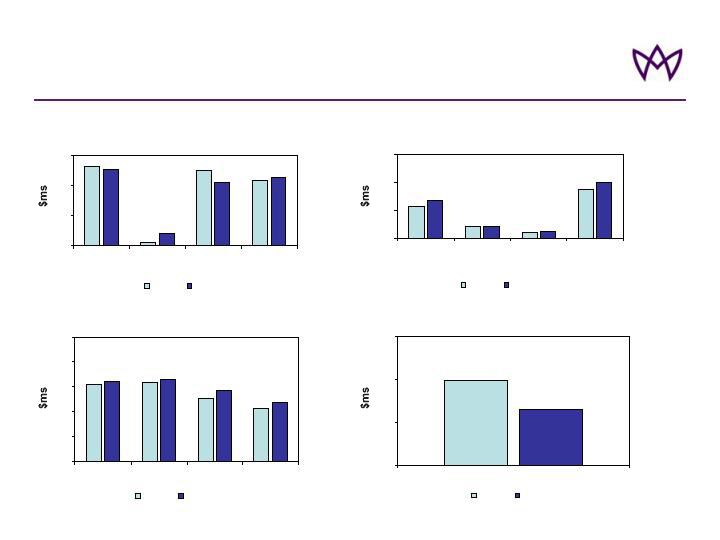

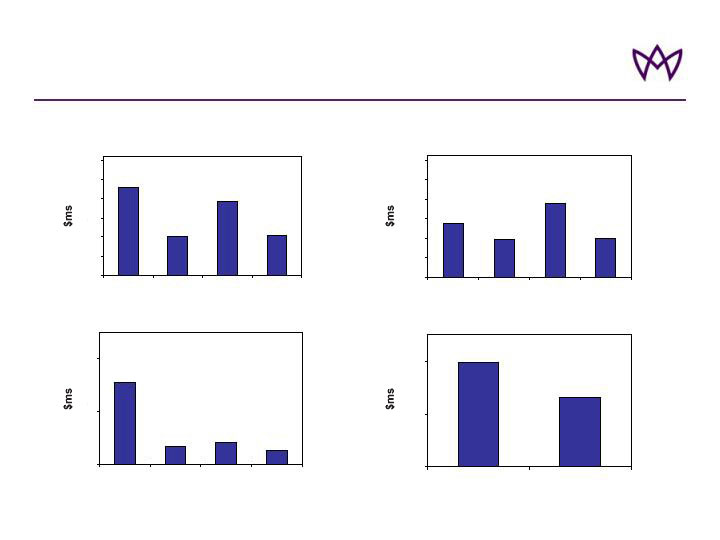

Financial Highlights – Group Summary Q2

Underwriting Revenues

522

22

500

429

504

85

419

451

0

200

400

600

GWP

Premiums

Ceded

NWP

NEP

2006 Q2

2007 Q2

Income

124

127

102

84

129

131

115

95

0

40

80

120

160

200

Operating

Income

Before Tax

Income

Before Tax

Income After

Tax

Retained

Income

2006 Q2

2007 Q2

Underwriting Income

79

52

0

40

80

120

Underwriting Income

2006 Q2

2007 Q2

Underwriting Expenses

224

83

43

350

82

44

399

273

0

200

400

600

Losses &

Loss

Expenses

Acquisition

Exp

General &

Admin

Expenses

Total

Underwriting

Expenses

2006 Q2

2007 Q2

8

AHL: NYSE

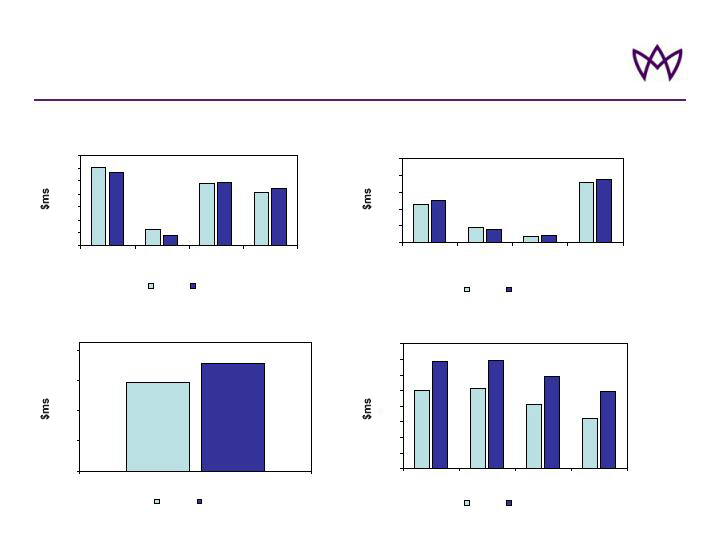

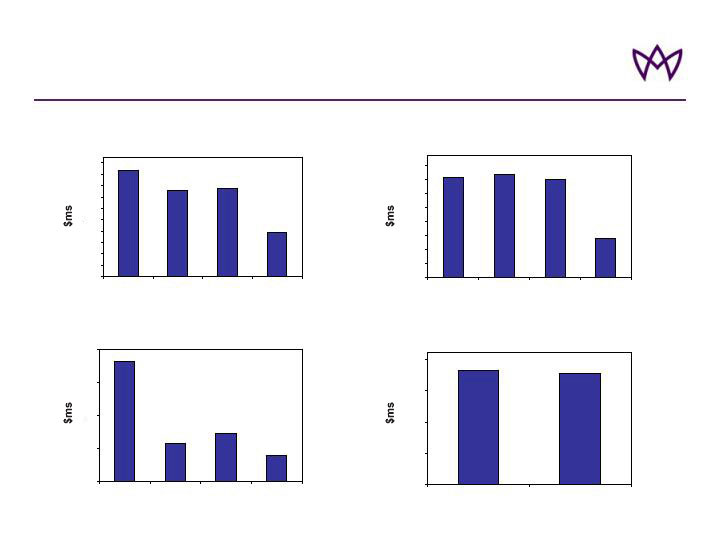

Financial Highlights – Group Summary - Half Year

Underwriting Revenues

1201

249

952

832

1140

166

974

890

0

200

400

600

800

1,000

1,200

1,400

GWP

Premiums

Ceded

NWP

NEP

2006 H1

2007 H1

Income

202

205

164

128

275

278

237

196

0

40

80

120

160

200

240

280

320

Operating

Income

Before Tax

Income

Before Tax

Income After

Tax

Retained

Income

2006 H1

2007 H1

Underwriting Income

118

143

0

40

80

120

160

Underwriting Income

2006 H1

2007 H1

Underwriting Expenses

456

177

81

714

159

90

747

498

0

200

400

600

800

1000

Losses &

Loss

Expenses

Acquisition

Exp

General &

Admin

Expenses

Total

Underwriting

Expenses

2006 H1

2007 H1

9

AHL: NYSE

Results by Business Segment – Q2 2007

GWP

185

80

155

84

0

40

80

120

160

200

240

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

NWP

110

78

152

79

0

40

80

120

160

200

240

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Underwriting Profit

32

7

8

5

0

20

40

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Income Contribution

79

52

0

40

80

Net Investment Income

Underwriting Profit

10

AHL: NYSE

Results by Business Segment – Half Year 2007

GWP

372

303

311

154

0

40

80

120

160

200

240

280

320

360

400

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

NWP

287

295

279

113

0

40

80

120

160

200

240

280

320

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Underwriting Profit

76

23

29

15

0

20

40

60

80

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Income Contribution

146

143

0

40

80

120

160

Net Investment Income

Underwriting Profit

11

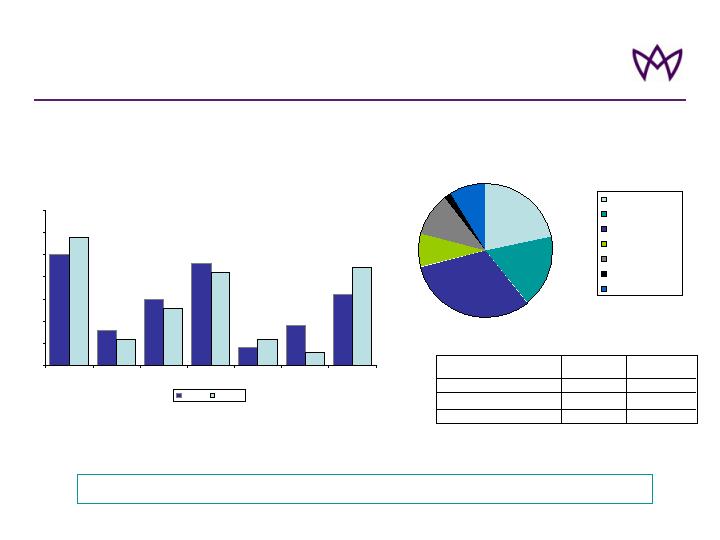

AHL: NYSE

22%

17%

32%

8%

10%

2%

9%

Govt

Agency

AAA

AA+/AA/AA-

A+/A/A-

BBB+/BBB/BBB-

NR

Investment Portfolio

Asset Class Allocation

25%

8%

15%

9%

16%

6%

13%

21%

6%

3%

22%

4%

23%

28%

0%

5%

10%

15%

20%

25%

30%

35%

Govt

Agency

MBS

Corp

ABS

FOHF

Cash/ST

Jun 07

Dec 06

89% of Portfolio ‘A’ or Better

12

AAA

AAA

Overall Fixed Income Rating

AAA

3%

Actual as at

December 31, 2006

AAA

Overall Portfolio Rating

9%

Fund of Hedge Funds

Actual as at

June 30, 2007

Indicator (S&P Ratings)

Portfolio Credit Ratings

(as at June 30, 2007)

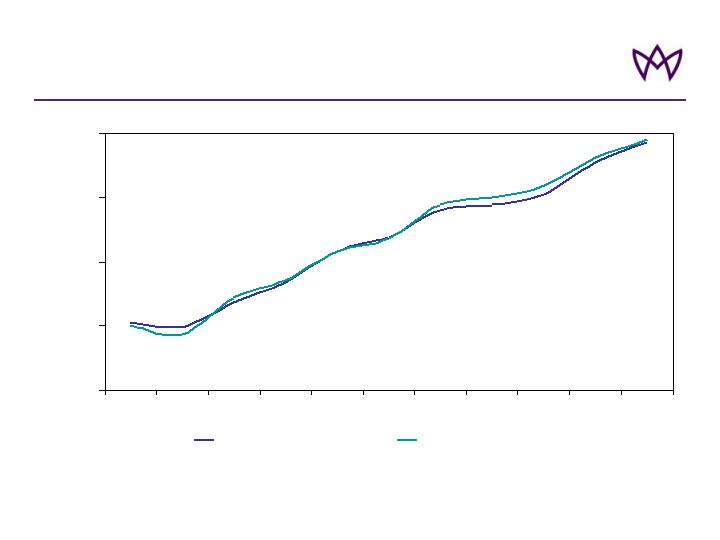

AHL: NYSE

Improvement in Investment Yield

3.0%

3.5%

4.0%

4.5%

5.0%

Q404

Q105

Q205

Q305

Q405

Q106

Q206

Q306

Q406

Q107

Q207

Fixed Income portfolio book yield

Aggregate portfolio book yield*

13

(*) including cash and cash equivalents but excluding FoHF - Initial investments in Fund of Hedge Funds were made on April 1, 2006 with subsequent investment on February 1 and June 1, 2007.

AHL: NYSE

2007 Guidance

Full 2007 Year Outlook

$135 million

(full year)

16% to 19%

$250 – $270 million

83% – 88%

6% – 8% of GWP

$1.8 billion + 5%

May 3, 2007

July 27, 2007

February 9, 2007

$135 million

(full year)

16% to 19%

$230 – $250 million

83% – 88%

6% – 8% of GWP

$1.9 billion + 5%

$145 million

(full year)

16% to 19%

$250 – $270 million

83% – 88%

6% – 8% of GWP

$1.8 billion + 5%

Tax Rate

Assumed Average Cat-Load

Investment Income

Combined Ratio

% Premium Ceded

GWP

Implied ROE of 16% - 20%

14

AHL: NYSE