Aspen Insurance Holdings Limited

Richard Houghton

Chief Financial Officer

September 2007

Exhibit 99.1

Safe Harbor Disclosure

This slide presentation is for information purposes only. It should be read in conjunction with our financial supplement posted on our website on the Investor Relations page and with other documents filed or to be filed shortly by Aspen Insurance Holdings Limited (the “Company” or “Aspen”) with the U.S. Securities and Exchange Commission.

Non-GAAP Financial Measures

In presenting Aspen’s results, management has included and discussed certain “non-GAAP financial measures”, as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain Aspen’s results of operations in a manner that allows for a more complete understanding of the underlying trends in Aspen’s business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included herein or in the financial supplement, as applicable, which can be obtained from the Investor Relations section of Aspen’s website at www.aspen.bm.

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995:

This presentation contains written or oral “forward-looking statements” within the meaning of the U.S. federal securities laws. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “seek,” “will,” “estimate,” “may,” , “guidance”, “continue,” and similar expressions of a future or forward-looking nature.

In addition, any estimates relating to loss events involve the exercise of considerable judgment and reflect a combination of ground-up evaluations, information available to date from brokers and cedants, market intelligence, initial tentative loss reports and other sources. Due to the complexity of factors contributing to the losses and the preliminary nature of the information used to prepare estimates relating to the UK floods, there can be no assurance that Aspen’s ultimate losses associated with these floods will remain within the stated amount.

All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. Aspen believes these factors include, but are not limited to: changes in the total industry losses resulting from the UK and Australian floods and Hurricanes Katrina, Rita and Wilma and the actual number of Aspen’s insureds incurring losses from these events; with respect to the UK and Australian floods and Hurricanes Katrina, Rita and Wilma, Aspen’s reliance on loss reports received from cedants and loss adjustors, Aspen’s reliance on industry loss estimates and those generated by modeling techniques, the impact of these events on Aspen’s reinsurers, any changes in Aspen’s reinsurers’ credit quality, the amount and timing of reinsurance recoverables and reimbursements actually received by Aspen from its reinsurers and the overall level of competition and the related demand and supply dynamics as contracts come up for renewal; the impact that our future operating results, capital position and rating agency and other considerations have on the execution of any capital management initiatives; the impact of any capital management activities on our financial condition; the impact of acts of terrorism and related legislation and acts of war; the possibility of greater frequency or severity of claims and loss activity, including as a result of natural or man-made catastrophic events than our underwriting, reserving or investment practices have anticipated; evolving interpretive issues with respect to coverage as a result of Hurricanes Katrina, Rita and Wilma and any other events such as the UK floods; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; the effectiveness of Aspen’s loss limitation methods; changes in the availability, cost or quality of reinsurance or retrocessional coverage, which may affect our decision to purchase such coverage; the reliability of, and changes in assumptions to, catastrophe pricing, accumulation and estimated loss models; loss of key personnel; a decline in our operating subsidiaries’ ratings with Standard & Poor’s, A.M. Best Company or Moody’s Investors Service; changes in general economic conditions including inflation, foreign currency exchange rates, interest rates and other factors that could affect our investment portfolio; the number and type of insurance and reinsurance contracts that we wrote at the January 1st and other renewal periods in 2007 and the premium rates available at the time of such renewals within our targeted business lines; increased competition on the basis of pricing, capacity, coverage terms or other factors; decreased demand for Aspen’s insurance or reinsurance products and cyclical downturn of the industry; changes in governmental regulations, interpretations or tax laws in jurisdictions where Aspen conducts business; proposed and future changes to insurance laws and regulations, including with respect to U.S. state- and other government-sponsored reinsurance funds and primary insurers; Aspen or its Bermudian subsidiary becoming subject to income taxes in the United States or the United Kingdom; the effect on insurance markets, business practices and relationships of ongoing litigation, investigations and regulatory activity by the New York State Attorney General’s office and other authorities concerning contingent commission arrangements with brokers and bid solicitation activities. For a more detailed description of these uncertainties and other factors, please see the “Risk Factors” section in Aspen’s Annual Reports on Form 10-K as filed with the U.S. Securities and Exchange Commission on February 22, 2007. Aspen undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

2

Contents

Aspen at a Glance

The Aspen Story

How have we diversified?

How do we manage?

Risk

Investments

Balance Sheet

How do we view the market?

What are we delivering?

Appendices

3

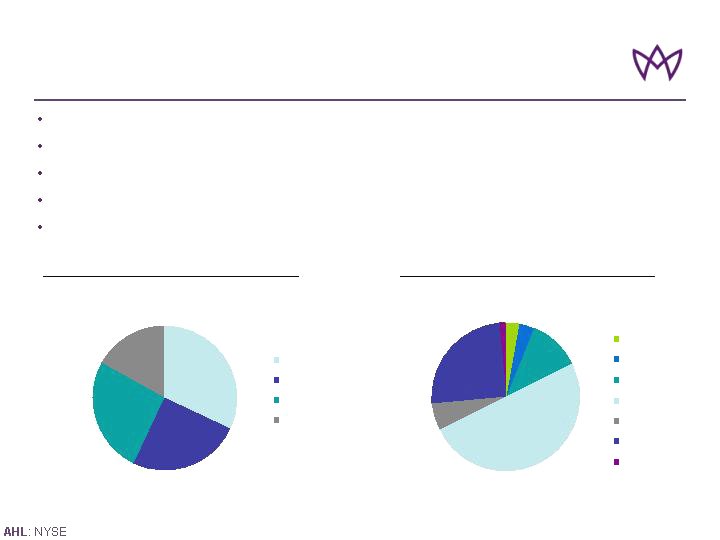

3%

3%

11%

51%

1%

25%

6%

Asia & Australia

Europe

UK

US & Canada

Worldwide Ex US

Worldwide inc US

Other

24%

26%

17%

33%

Prop Re

Casualty Re

Specialty Lines

Insurance

Aspen at a Glance

Underwriting Segment (GWP)

Geographical split of GWP**

*Shareholders’ equity plus long-term debt

** By location of cedant

$2.25bn market cap (August 30, 2007)

$2.2bn common equity and $2.8bn total capital* (June 30, 2007)

Over 450 employees in Bermuda, UK, US, France and Switzerland

Ratings of A (S&P), A2 (Moody’s) and A / A- (AM Best, for Aspen UK and Aspen Bermuda)

$1.9bn Gross Written Premium (GWP) in 2006

100% = $1.8bn

4

100% = $1.8bn

12 months: July 1, 2006 – June 30, 2007

12 months: July 1, 2006 – June 30, 2007

The Aspen Story

How do we shape our business?

Diversified book, insurance and reinsurance

Multi platform, multi product approach

Focus on growth in book value per share rather than top line

Evolution through organic growth

Deliver products where we are rewarded for specialised knowledge and

execution, not for scale

Well Chosen Businesses, Well Managed

5

How do we deliver?

Underwriting for profit

Proactive risk management

Prudent investment approach

Capital management

Well-managed Diversification

* 2003 Specialty lines includes QQS of Wellington Syndicate 2020

** By location of cedant

Targeted Growth in Specialty Lines And Improved Spread of Risk

Gross Written Premiums

6

Property Reinsurance �� Casualty Reinsurance

Specialty Lines Insurance

41%

8%

23%

28%

100% = $1.6bn

24%

26%

17%

33%

FY 2004

100% = $1.8bn

3%

3%

3%

11%

51%

1%

25%

6%

12 months

July 1, 2006 – June 30, 2007

Geographical split of GWP**

100% = $1.8bn

12 months

July 1, 2006 – June 30, 2007

Asia & Australia

US & Canada

Other

Europe

Worldwide ex US

UK

Worldwide inc US

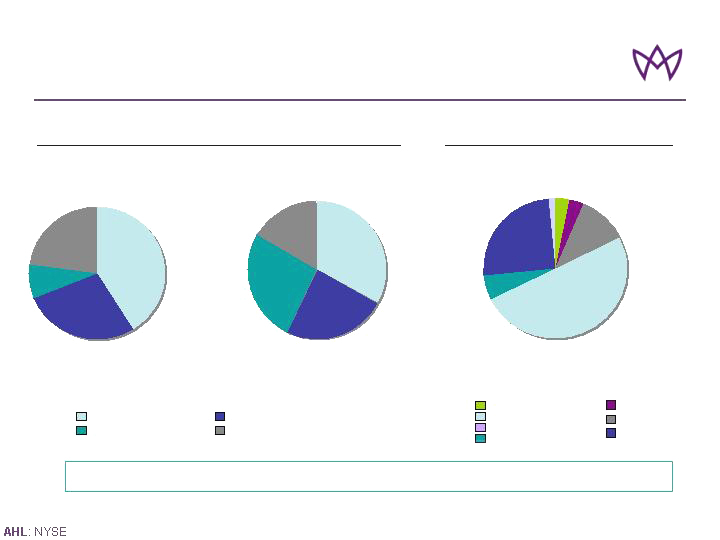

Profitable Expansion into New / Adjacent Lines

2003

2004

2005

2007

Specialty

Reinsurance

Aviation

Marine

US Casualty Re

US Excess &

Surplus lines

Aspen Re*

America

Aviation

Insurance

Marine

Insurance

Energy

Insurance

International

Property

Facultative

2006

Professional

Indemnity**

Development of Aspen’s GWP

7

0

500

1000

1500

2000

2500

3000

2002

2003

2004

2005

2006

2007

Year

2006 Line

2005 Lines

2004 Lines

2003 Lines

Original Lines

* Businesses shown for first year of meaningful premium contribution

** Underwriting commences September 2007

Selection Criteria

Availability of proven underwriting

talent

Underwriting and operational fit

Within management’s expertise

Diversification has Added over $1,070m GWP in New Lines Since 2003

GWP $m

Aspen

Insurance

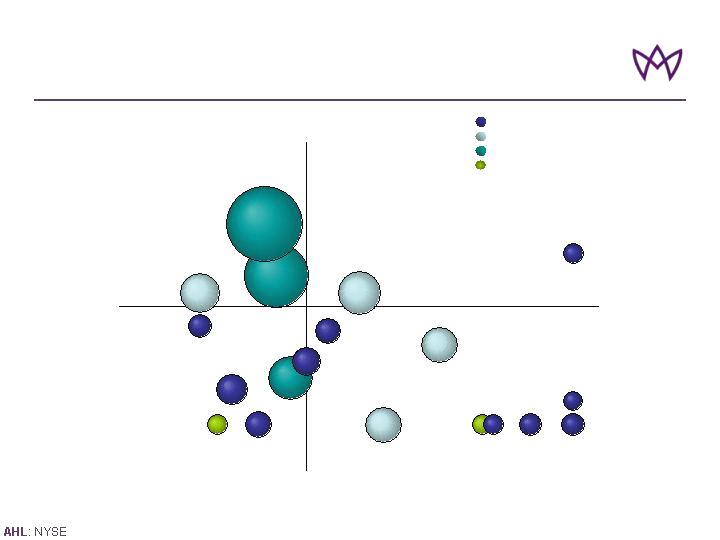

Market Positioning – Well Balanced and Diversified

Insurance

Reinsurance

Long-Tail

Short-Tail

Note: Business mix as of 2006

Source: Credit Suisse company filings, Wall Street research, FactSet as of 8/16/07

= Market Cap < $3 BN

= Market Cap between $3 BN - $6 BN

= Market Cap > $6 BN

= Class of ’05 (Private)

8

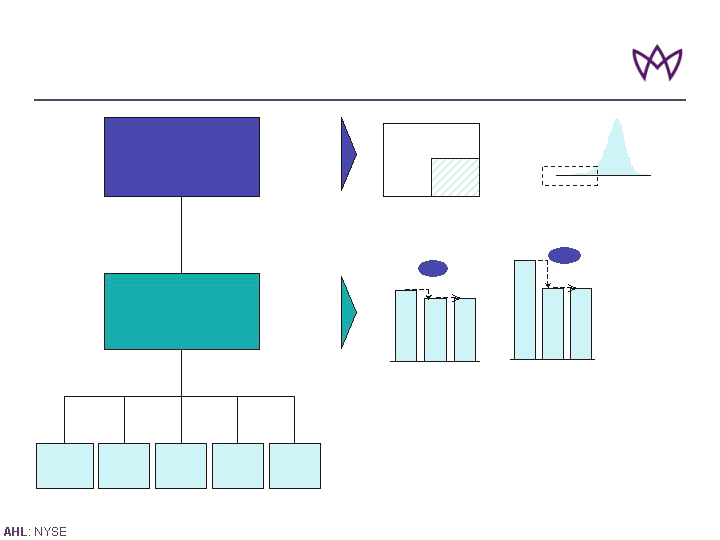

How Do We Manage Risk?

Strong ERM framework

Core strategic enabler

Upgraded significantly in 2006/2007

Recognised as an Aspen strength by S&P

Risk managed through

Setting risk appetite

Purchase of reinsurance/retro as appropriate and other capital market

instruments for balance sheet and earnings protection

- Cat bonds

- ILWs

- Credit protection

9

Managing Extreme Events – Natural Catastrophe

Group Aggregate

Cat Risk Appetite

Single Loss

Appetite

US

wind

Cal

quake

Europe

wind

Japan

New

Madrid

quake

Cat Risk

Appetite

Key zonal control tolerances

Total Risk Capital

2005

2006

2007

2005

2006

2007

20%

17.5%

17.5%

35%

25%

25%

-250bp

-1000bp

1-in-250 Tolerance

(% of Surplus)

1-in-100 Tolerance

(% of Surplus)

10

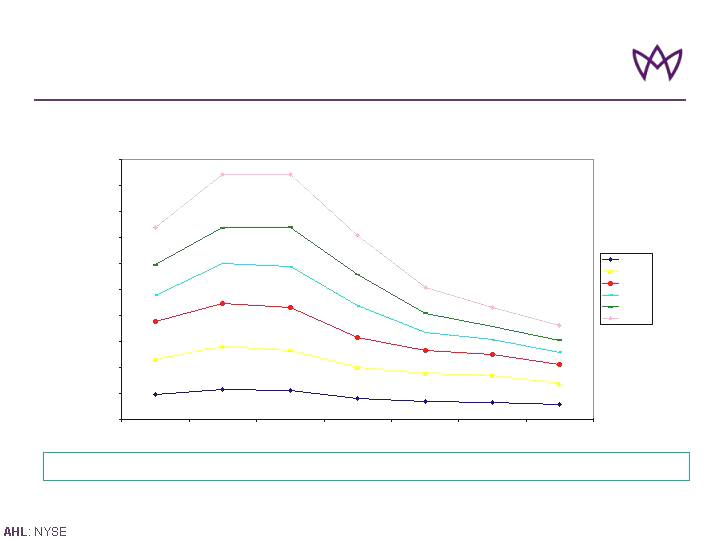

Reduced Exposure to Natural Catastrophes – Net AEP*

Significant Reduction in Exposure to Natural Catastrophes Post 2005 At All Return Periods

* Aggregate Exceedance Probability (excludes inwards reinstatement premiums, includes outwards reinstatement premiums, net of tax)

Note: For net figures applied 2007 reinsurance / retro program to reflect our previous exposure versus our current structure

Note that assumptions have been made to bring prior periods, modelled in old RMS versions, in line with RMS version 6.

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2004-08

2005-02

2005-08

2006-02

2006-08

2007-03

2007-06

Date

Annual

Cat Loss

in USD m

Mean

1 in 10

1 in 25

1 in 50

1 in 100

1 in 250

Group Net AEP, Combined All Perils

“As-If” to RMS v6

11

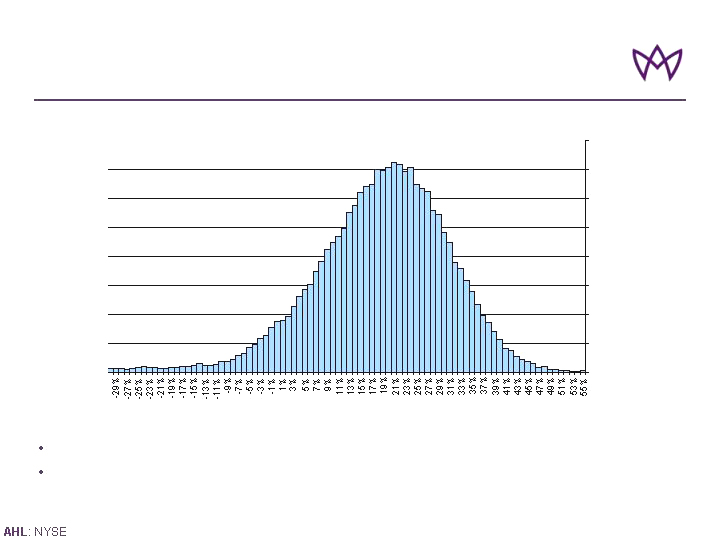

Risk Distribution: Distribution of ROAE

Result of 50,000 simulations of the 2007 year net income using Aspen DFA model

Risks modelled include underwriting (cat and non cat), reserving, market and credit

Note that the figures shown are the result of assumptions made within our DFA model, many of which are subject to uncertainty which could lead to actual results varying considerably from those indicated by the model.

(more than)

12

0.00%

0.50%

1.00%

Probability

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Return on average equity

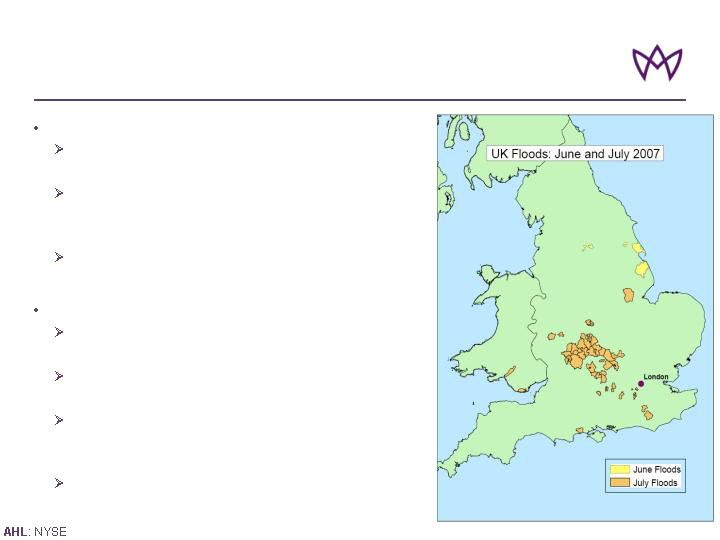

June and July UK Flood Losses

June 2007 UK Floods

Impacted Northern England – mainly urban and

commercial

Q2 07 reserved $23.5 million

- $17.0 million from property reinsurance

- $6.5 million UK commercial property insurance

Estimate consistent with a market loss of GBP1.5

billion or $3 billion

July 2007 UK Floods

Impacted areas of Central and Southern England –

primarily rural and residential

RMS and ABI indicate July floods will be less severe than

June floods

Property catastrophe reinsurance account designed to

respond to events of much greater severity than the July

floods

Impact on Aspen currently estimated at less than half of

June floods

13

22%

17%

32%

8%

10%

2%

9%

Govt

Agency

AAA

AA+/AA/AA-

A+/A/A-

BBB+/BBB/BBB-

NR - FOHF

$1,616

$2,736

$3,689

$4,681

$5,058

2003

2004

2005

2006

1H 2007

How Do We Manage Our Investments?

25%

4%

20%

9%

16%

6%

13%

21%

6%

3%

22%

3%

23%

28%

0%

5%

10%

15%

20%

25%

30%

35%

Govt

Agency

MBS

Corp

ABS

FOHF

Cash/ST

Jun 07

Dec 06

3.0%

3.5%

4.0%

4.5%

5.0%

Q404

Q105

Q205

Q305

Q405

Q106

Q206

Q306

Q406

Q107

Q207

Fixed Income portfolio book yield

Total Investments have increased

Investment Yield improving

Asset Class Diversification

Credit Ratings very strong

Prudent Investment Management and Investment Income Increasing Component of

Total Return

14

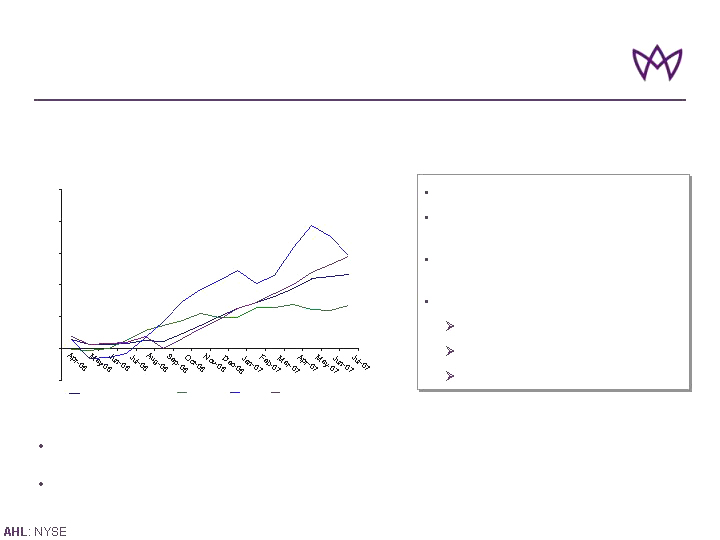

How has Recent Market Turbulence Affected Aspen?

Fund of Hedge Funds performance

No direct sub-prime exposure in fixed income portfolio

Fixed income portfolio average credit rating of AA+ as of July 31, 2007

$487m investment – 9% of portfolio

Multi manager, multi strategy,

conservative approach

Equity like return with bond like

volatility

Performance

H1 2007: 8.4%

July 2007: 1.1%

August 2007 (estimate): -2.9%

-5.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

HFRI FOF: Conservative Index

Lehman Agg

S&P500

Aspen FOHF weighted

15

Cumulative returns

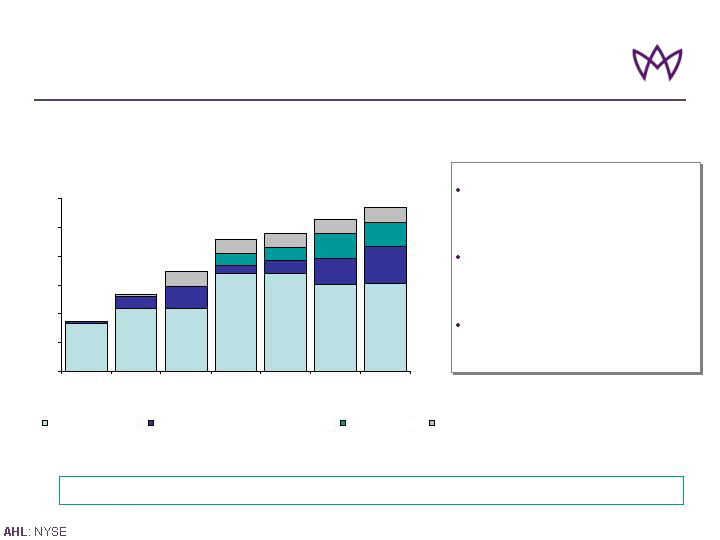

How Do We Manage our Balance Sheet?

Efficient Capital Management

16

Further preference shares

issued Q4 2006

Buy back program: $200m out

of $300m completed

Strong balance sheet with

opportunity for further leverage

837

1,091

1,096

1,693

1,698

1,503

1,515

208

385

147

227

457

646

200

230

430

430

249

249

249

249

249

41

40

0

500

1,000

1,500

2,000

2,500

3,000

2002

2003

2004

2005

Q2 2006

2006

Q2 2007

$ mil

Common share capital

Retained earnings inc OCI and issue costs

Preference shares

debt

Active balance sheet management to deliver capital and tax efficiency

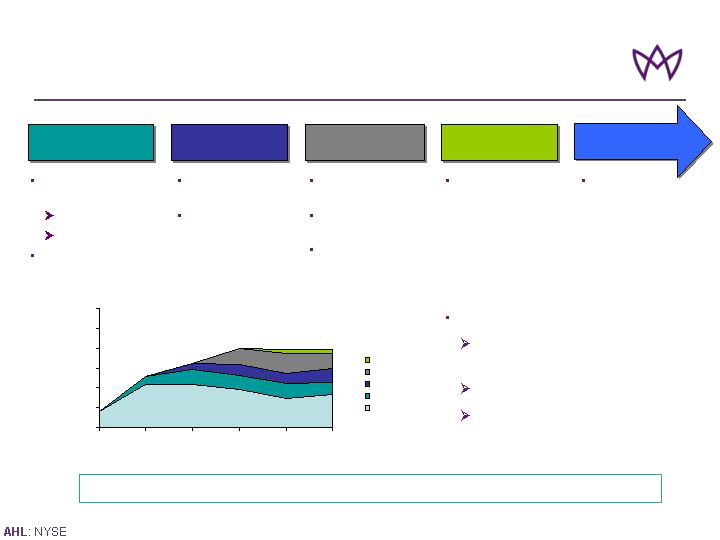

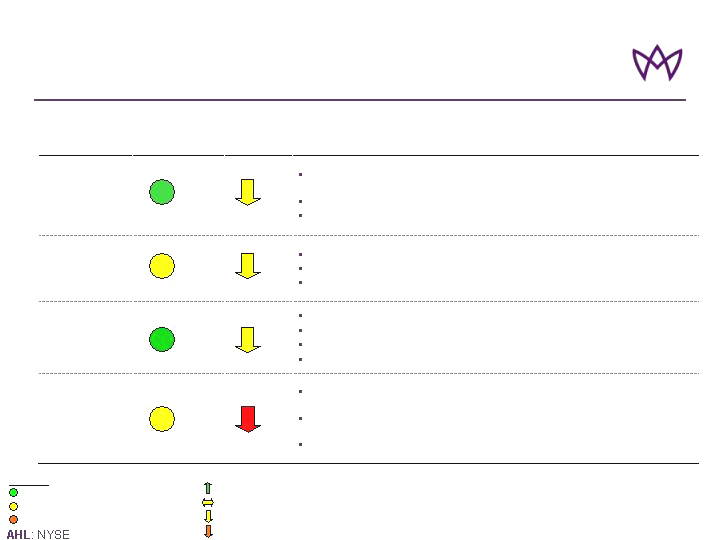

Current Market Conditions by Segment

Ratings pressure acute in UK Commercial and UK Liability insurance; expected to

continue through 2007

E&S Property rates still attractive but exhibited modest declines during 2007 reflecting

increased competition

E&S Casualty rates declining; expected to continue for remainder of 2007

Insurance

Aviation competition remains strong; rates expected to fall further in 2007

Rate increases on Marine Liability and Marine Hull

Slight rate decreases on Specialty Reinsurance

Energy Physical Damage Insurance declining but still strong

Specialty

Lines

Rates marginally down across the segment

International casualty rates continuing to fall

US casualty rates declining having remained flat for the first half of 2007

Casualty

Reinsurance

US cat pricing remains strong despite reductions from last year’s highs; pricing

expected to weaken over the remainder of the year

Rates declining on risk excess and pro rata

Rates on non-US business exhibiting modest declines

Property

Reinsurance

Comment

Trend

Market

Conditions

Line

= 12 month rate trend positive

= 12 month rate trend neutral

= 12 month rate trend slightly downwards

= 12 month rate trend downwards

= Absolute rate levels attractive

= Absolute rate levels mixed

= Absolute rate levels very challenging

Key

17

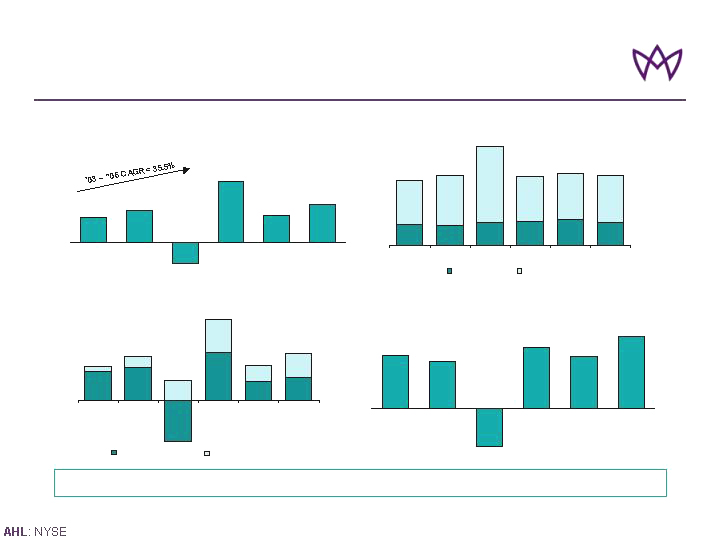

Resulting in improving ROAE

15.9%

14.0%

18.5%

15.6%

21.7%

-11.7%

2003

2004

2005

2006

1H 2006

1H 2007

As well as increasing investment income

contribution...

$178

$204

-$259

$296

$118

$143

$68

$121

$94

$30

$204

$146

2003

2004

2005

2006

1H 2006

1H 2007

Underwriting Income

Investment Income

Profitability has increased substantially...

$152

$195

$378

$164

$237

($178)

2003

2004

2005

2006

1H 2006

1H 2007

Due to strong underwriting...

25%

25%

27%

29%

31%

28%

53%

59%

90%

55%

56%

53%

2003

2004

2005

2006

1H 2006

1H 2007

Expense Ratio

Loss Ratio

Financial Performance

($ in millions)

18

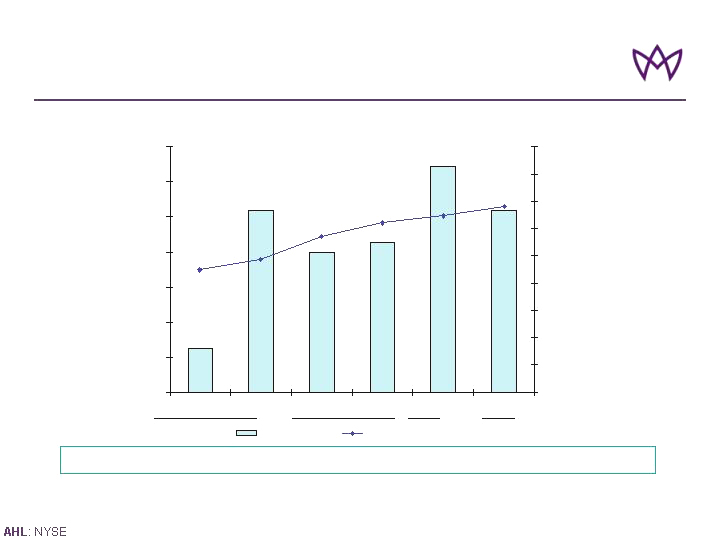

Delivering Results

($ in millions – Net Income)

Note: Reconciliation of average equity to closing shareholders’ equity is provided in our quarterly financial supplements available in the

Financial Results section of the Investor Relations page of Aspen’s website, www.aspen.bm

10%

12%

14%

16%

18%

20%

22%

24%

Q1

Q2

Q3

Q4

Q1

Q2

ROAE %

10.0

12.0

14.0

16.0

18.0

20.0

22.0

24.0

26.0

28.0

Annualised ROAE

Diluted BV Per Share**

Growth in ROAE* and Book Value Per Share

06

07

Annualised ROAE >18% Over Last 6 Quarters, 26.6% Growth in BVPS

19

* Reconciliation of average equity to closing shareholders’ equity is provided in our quarterly financial supplements available in the Financial

Results section of the Investor Relations page of Aspen’s website, www.aspen.bm

** See Aspen's quarterly financial supplement for a reconciliation of diluted book value per share to basic book value per share. Aspen's financial supplement can be obtained from the Investor Relations section of Aspen's website at www.aspen.bm

$ Diluted

B/V Per Share

Aspen’s Operations are Recognized in the Market

Received ERM rating of ‘Strong’ by S&P. Only AXA and ING hold higher ratings than Aspen in Europe

July 2007

First non – Lloyd’s Member to implement Lloyd’s Market Peer-to-Peer trading capabilities

June 2007

Financial Sector Technology Magazine, April 2007

“Best Use of Information Technology in the Insurance Sector” for CATman, Aspen’s

proprietary risk management tool

Ranked # 1: reaction to issues as they arise; highly responsive

AON Semi – Annual UK Insurance Survey, Q2 2007

Willis Quality Index & Carrier Survey, Spring 2007

Top 1% for Policy Administrator Top 5% for Claims Capability

Top 10% Global Specialties Underwriting Capabilities Top 10% for Service

“Best Global Reinsurance Company for Specialty Lines”

Reactions Magazine, August 2007

20

Conclusion

Well managed diversified portfolio

Focus on book value per share growth

Effective enterprise risk management core strategic enabler

Strong, quality, improving returns

BVPS up over 26% over last 6 quarters

Annualised ROAE over 18% over last 6 quarters

21

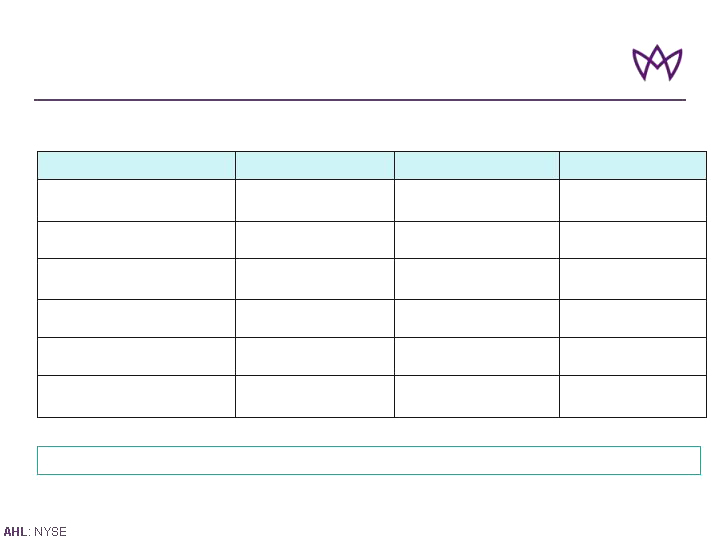

2007 Guidance

Full 2007 Year Outlook

$145 million

(full year)

16% to 19%

$250 – $270 million

83% – 88%

Approx 9% of GEP*

$1.8 billion + 5%

August 7, 2007

$145 million

(full year)

16% to 19%

$250 – $270 million

83% – 88%

6% – 8% of GWP

$1.8 billion + 5%

Q2 07 Earnings Call

Q4 06 Earnings Call

$135 million

(full year)

16% to 19%

$230 – $250 million

83% – 88%

6% – 8% of GWP

$1.9 billion + 5%

Tax Rate

Assumed Average Cat-Load

Investment Income

Combined Ratio

% Premium Ceded

GWP

Implied ROE of 16% - 20%

22

* Metric changed from percent of GWP to percent of GEP to reflect that the company has purchased multi year retrocessional policies and believes that a comparison with earned premiums is more appropriate than written premium for guidance purposes. This change in the ceded premium metric does not impact our current ROE guidance.

Appendix

Financial Highlights – Half Year 2007

* Annualised

¹ Reconciliation of Average Equity to closing shareholders’ equity is provided in our quarterly financial supplements available in the Financial Results section of the Investor Relations page of Aspen’s website at www.aspen.bm

23

Appendix

(US$ in millions, except per share data)

Six Months Ended June 30

2007

2006

% Change

Diluted Income Per Ordinary Share:

Net Income

$2.46

$1.61

52.8%

Operating Income ¹

$2.40

$1.57

52.9%

Gross Written Premiums

1,140.0

1,201.1

(5.1)

Net Written Premiums

973.6

952.0

2.3

Net Earned Premiums

890.2

831.6

7.0

Underwriting Income

142.9

117.7

21.4

Net Investment Income

146.3

94.4

55.0

Net Income after tax

$236.6

$163.6

44.6%

GAAP Ratios:

Loss Ratio

55.9%

54.8%

Expense Ratio

28.0%

31.0%

Combined Ratio

83.9%

85.8%

Full Year ROAE ¹

21.7%*

15.6%*

Book Value Per Ordinary Share

$24.49

$20.19

21.3%

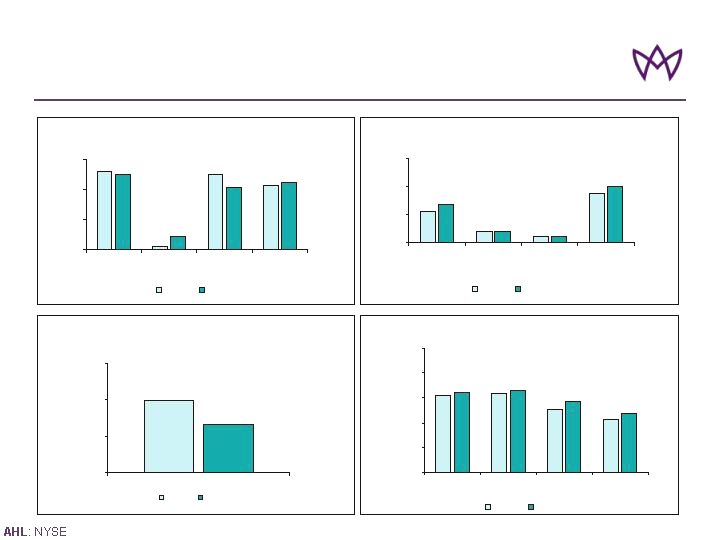

Financial Highlights – Group Summary Q2

Income

124

127

102

84

129

131

115

95

0

40

80

120

160

200

Operating

Income

Before Tax

Income

Before Tax

Income After

Tax

Retained

Income

2006 Q2

2007 Q2

Underwriting Revenues

522

22

500

429

504

85

419

451

0

200

400

600

GWP

Premiums

Ceded

NWP

NEP

2006 Q2

2007 Q2

Underwriting Expenses

224

83

43

350

82

44

399

273

0

200

400

600

Losses &

Loss

Expenses

Acquisition

Exp

General &

Admin

Expenses

Total

Underwriting

Expenses

2006 Q2

2007 Q2

Underwriting Income

79

52

0

40

80

120

Underwriting Income

2006 Q2

2007 Q2

24

Appendix

$ms

$ms

$ms

$ms

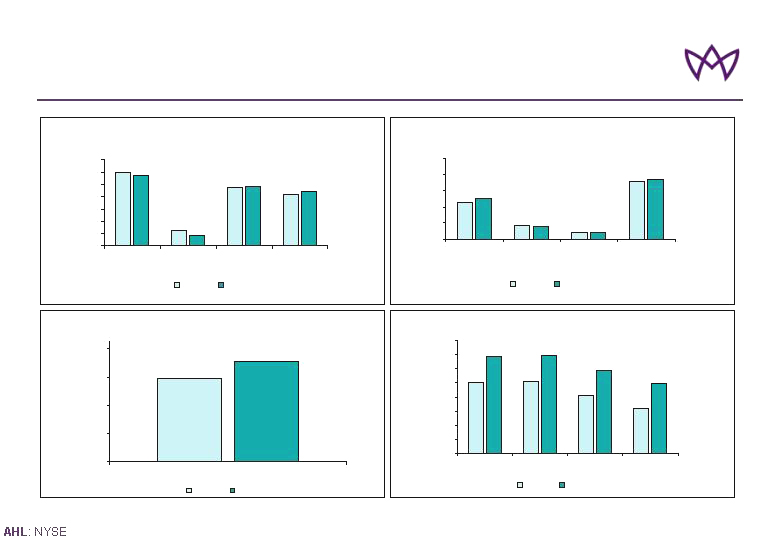

Financial Highlights – Group Summary - Half Year

Income

202

205

164

128

275

278

237

196

0

40

80

120

160

200

240

280

320

Operating

Income

Before Tax

Income

Before Tax

Income After

Tax

Retained

Income

2006 H1

2007 H1

Underwriting Revenues

1201

249

952

832

1140

166

974

890

0

200

400

600

800

1,000

1,200

1,400

GWP

Premiums

Ceded

NWP

NEP

2006 H1

2007 H1

Underwriting Expenses

456

177

81

714

159

90

747

498

0

200

400

600

800

1000

Losses &

Loss

Expenses

Acquisition

Exp

General &

Admin

Expenses

Total

Underwriting

Expenses

2006 H1

2007 H1

Underwriting Income

118

143

0

40

80

120

160

Underwriting Income

2006 H1

2007 H1

25

Appendix

$ms

$ms

$ms

$ms

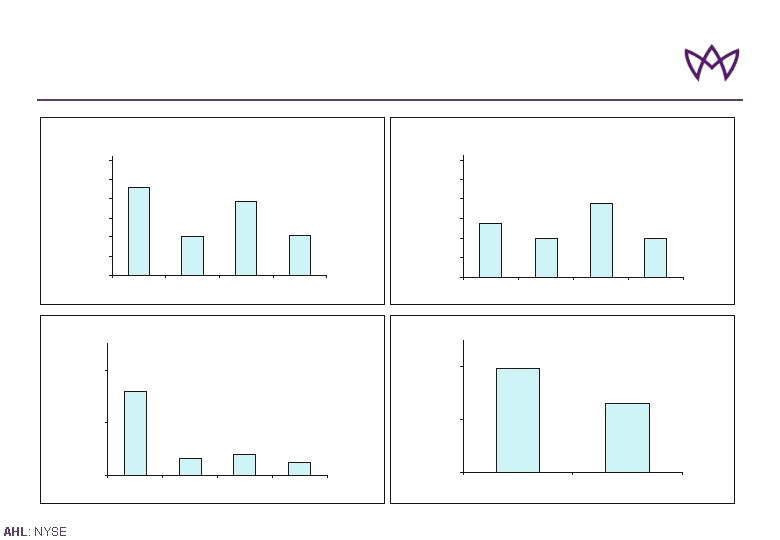

Results by Business Segment – Q2 2007

NWP

110

78

152

79

0

40

80

120

160

200

240

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

GWP

185

80

155

84

0

40

80

120

160

200

240

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Income Contribution

79

52

0

40

80

Net Investment Income

Underwriting Profit

Underwriting Profit

32

7

8

5

0

20

40

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

26

Appendix

$ms

$ms

$ms

$ms

Results by Business Segment – Half Year 2007

NWP

287

295

279

113

0

40

80

120

160

200

240

280

320

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

GWP

372

303

311

154

0

40

80

120

160

200

240

280

320

360

400

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

Income Contribution

146

143

0

40

80

120

160

Net Investment Income

Underwriting Profit

Underwriting Profit

76

23

29

15

0

20

40

60

80

Property Re

Casualty Re

Specialty

Lines

P&C

Insurance

27

Appendix

$ms

$ms

$ms

$ms