Investor Presentation January 2015 Results Conference Call First Quarter 2016 Exhibit 99.2

Safe Harbor Statement This presentation contains "forward-looking statements," within the meaning of the Private Securities Litigation Reform Act of 1995, regarding, among other things, Alimera’s ability to close on additional or alternative debt financing by the end of the second quarter of 2016, the ability of the ILUVIEN® J- code to drive use and market acceptance of ILUVIEN®, the opportunity for further growth in 2016 for ILUVIEN®, that increases in benefits investigations will lead to sales of ILUVIEN® and that ILUVIEN® will project to be 16.6% of the projected therapy for diabetic macular edema. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-looking statements. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “contemplate,” “predict,” “project,” “target,” “likely,” “potential,” “continue,” “ongoing,” “will,” “would,” “should,” “could,” or the negative of these terms and similar expressions are intended to identify forward-looking statements, although not all forward- looking statements contain these identifying words. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-looking statements. Meaningful factors which could cause actual results to differ include, but are not limited to, a future failure by Alimera to comply with its revenue covenant under its debt facility with Hercules Capital, Inc., market acceptance of ILUVIEN® in the U.S. and Europe, including physicians' ability to obtain reimbursement, the impact of the ILUVIEN® J-code on U.S. revenues and revenue growth in 2016 and seasonality, as well as other factors discussed in the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of Alimera's Annual Report on Form 10K for the year ended December 31, 2015, which is on file with the Securities and Exchange Commission (SEC) and available on the SEC's website at http://www.sec.gov. Additional factors may also be set forth in those sections of Alimera's Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, to be filed with the SEC in the second quarter of 2016. In addition to the risks described above and in Alimera's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC, other unknown or unpredictable factors also could affect Alimera's results. There can be no assurance that the actual results or developments anticipated by Alimera will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Alimera. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved. All forward-looking statements contained in this presentation are expressly qualified by the cautionary statements contained or referred to herein. Alimera cautions investors not to rely too heavily on the forward-looking statements Alimera makes or that are made on its behalf. These forward-looking statements speak only as of the date of this presentation (unless another date is indicated). Alimera undertakes no obligation, and specifically declines any obligation, to publicly update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. 2 © 2016 Alimera Sciences, All Rights Reserved 2

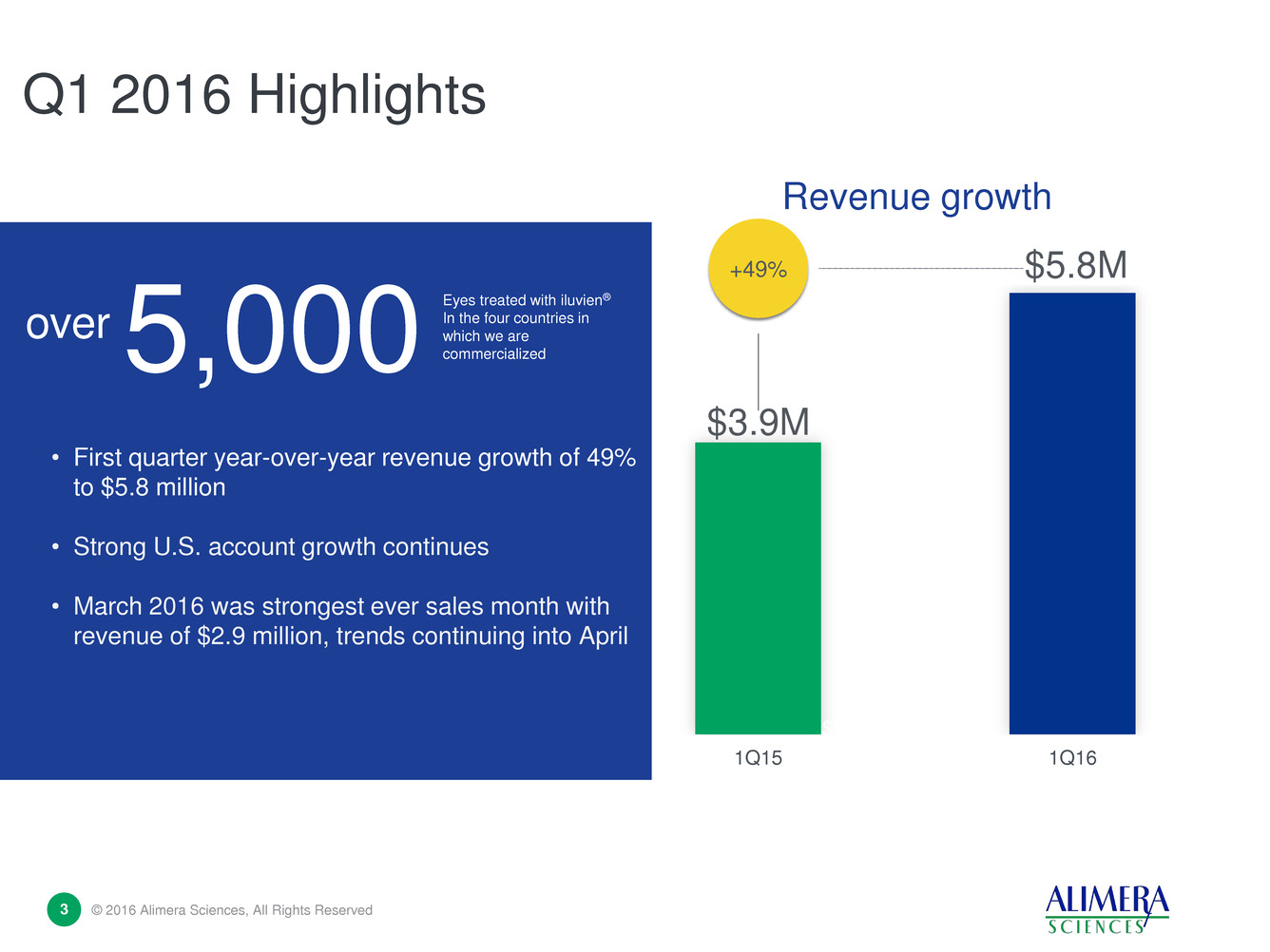

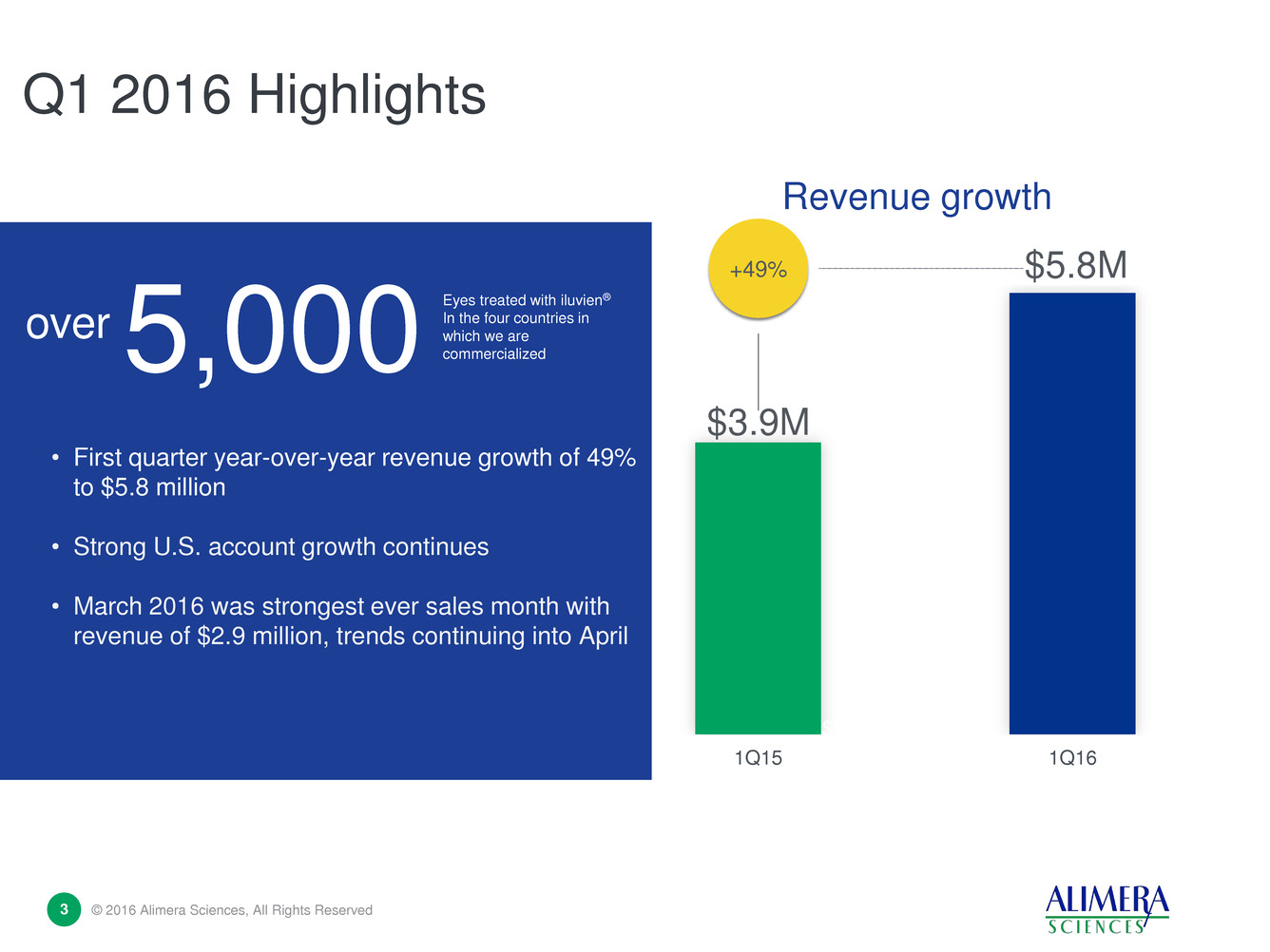

• First quarter year-over-year revenue growth of 49% to $5.8 million • Strong U.S. account growth continues • March 2016 was strongest ever sales month with revenue of $2.9 million, trends continuing into April Eyes treated with iluvien® In the four countries in which we are commercialized 5,000 Q1 2016 Highlights 1Q15 1Q16 3 © 2016 Alimera Sciences, All Rights Reserved 3 $2 $5.8M $3.9M Revenue growth +49% over

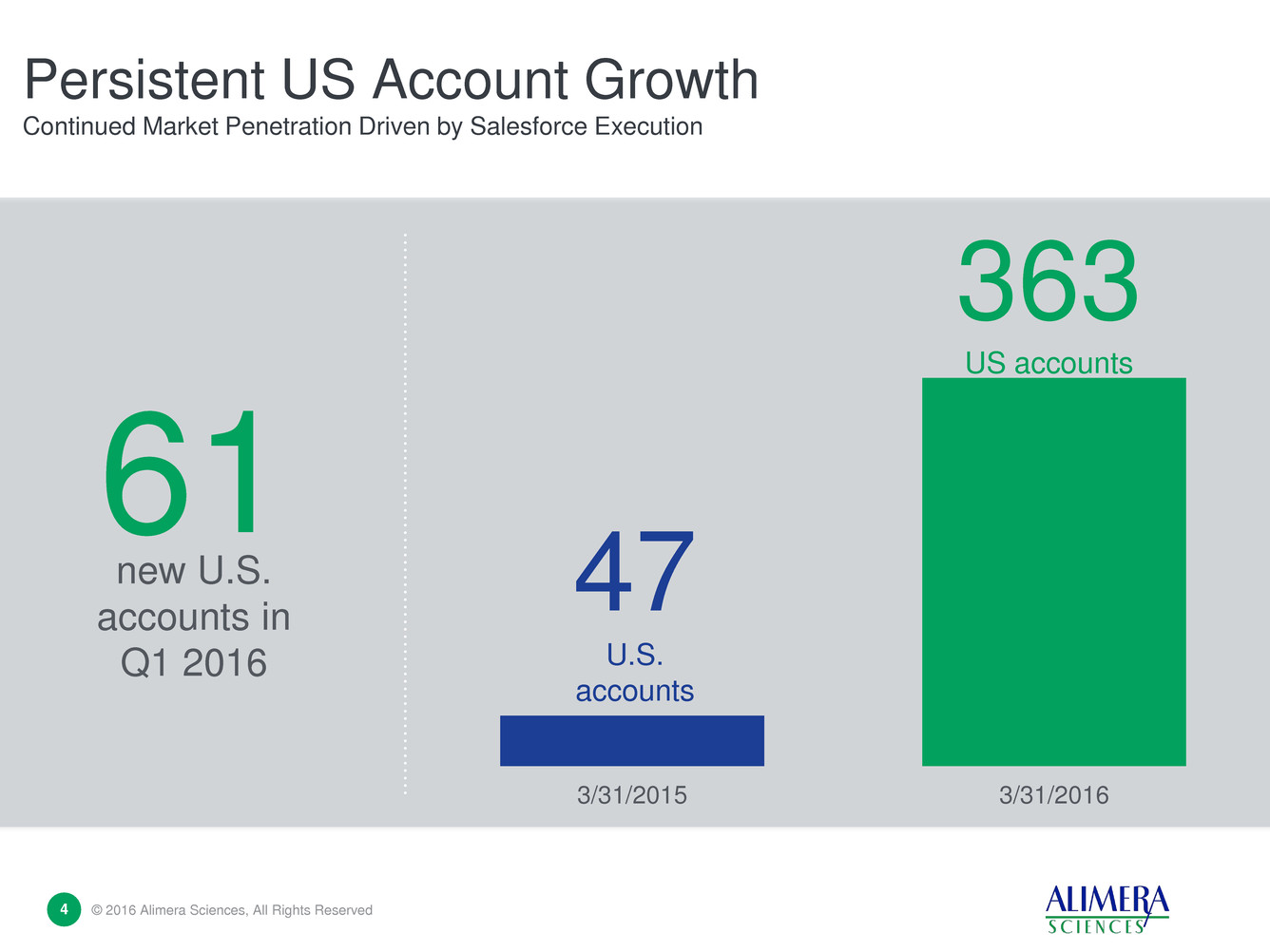

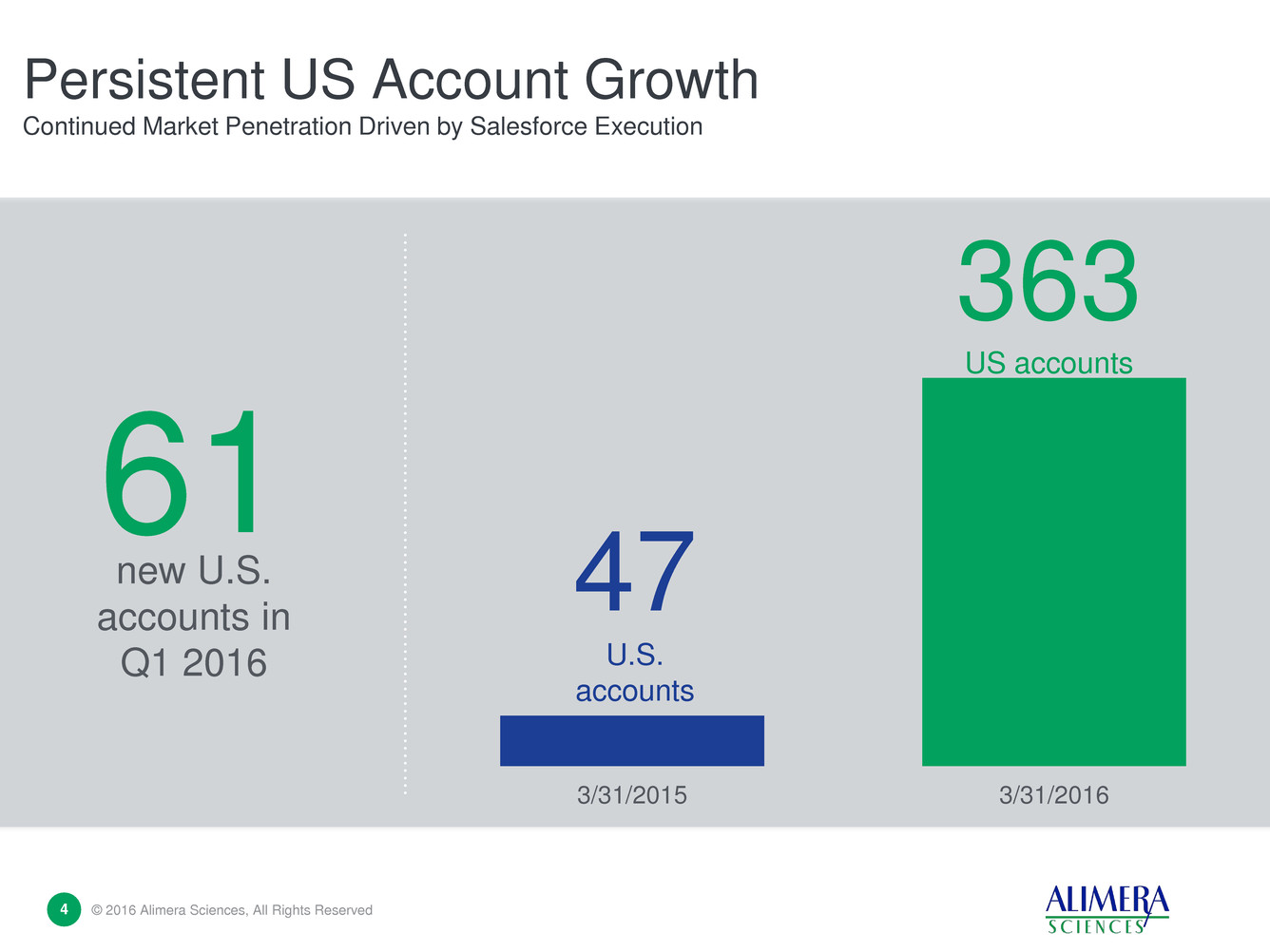

4 © 2016 Alimera Sciences, All Rights Reserved 4 new U.S. accounts in Q1 2016 61 Persistent US Account Growth Continued Market Penetration Driven by Salesforce Execution 3/31/2015 3/31/2016 47 U.S. accounts 363 US accounts

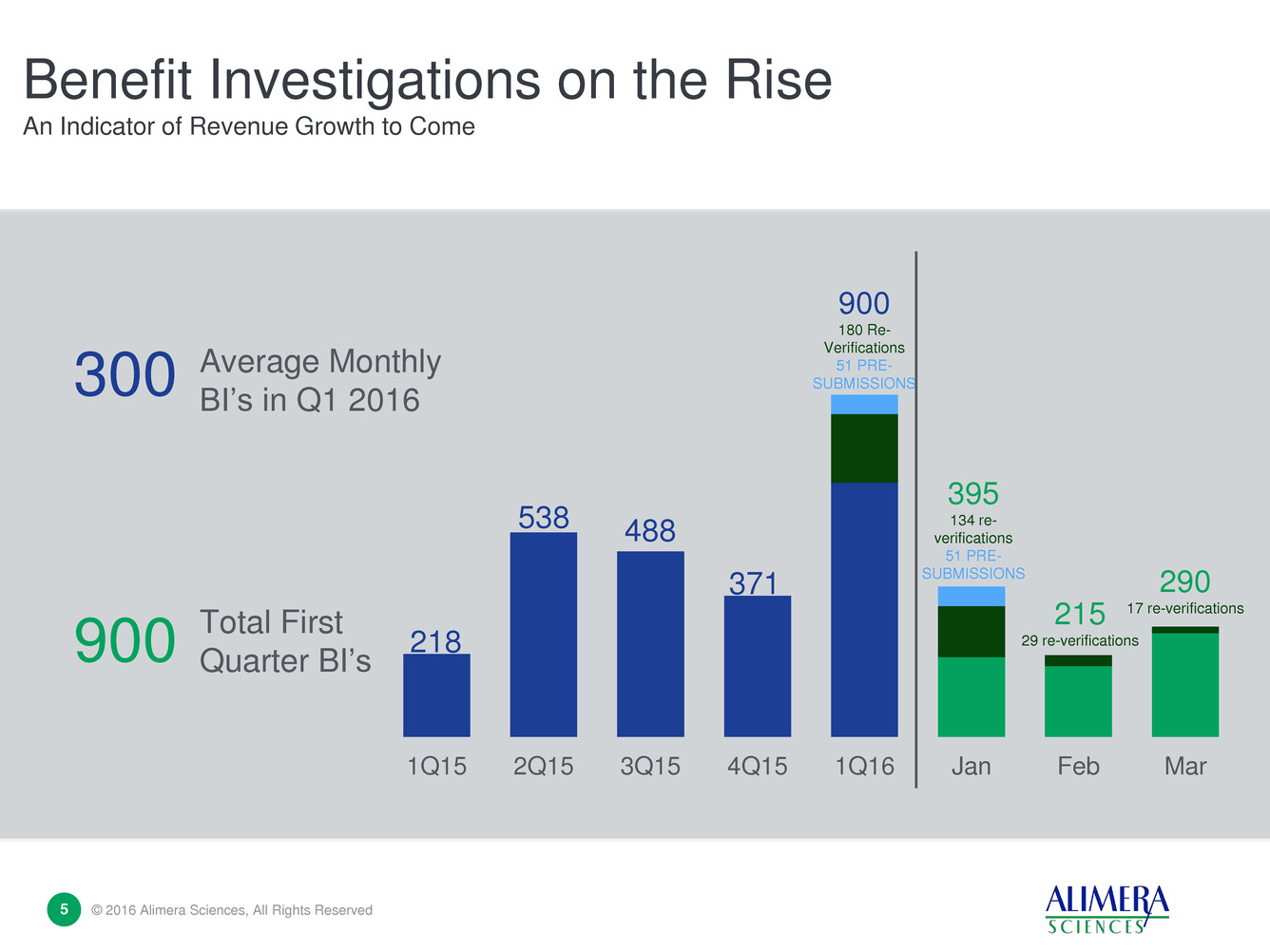

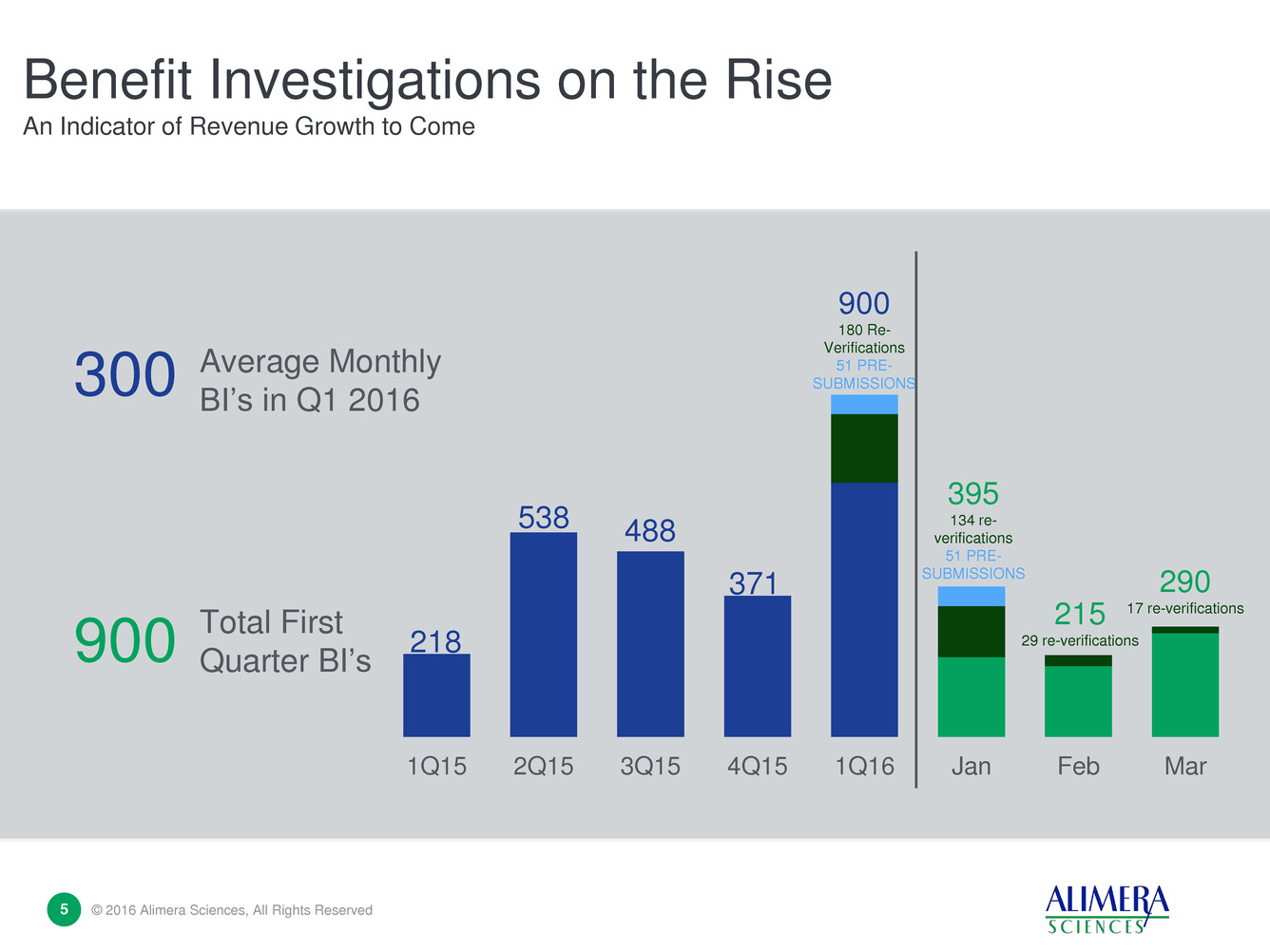

5 © 2016 Alimera Sciences, All Rights Reserved 5 Average Monthly BI’s in Q1 2016 300 Total First Quarter BI’s 900 1Q15 2Q15 3Q15 4Q15 1Q16 Jan Feb Mar Benefit Investigations on the Rise An Indicator of Revenue Growth to Come 395 134 re- verifications 51 PRE- SUBMISSIONS 900 180 Re- Verifications 51 PRE- SUBMISSIONS 371 488 538 218 215 29 re-verifications 290 17 re-verifications

6 © 2016 Alimera Sciences, All Rights Reserved 6 Europe Back on Track UK achieves month-on-month growth through Q1 Halting decline in sales and marking return to growth Portugal delivers triple unit volume growth Q1 2016 compared to Q1 2015 German unit volume increases 5th consecutive quarter New quarterly record set

7 © 2016 Alimera Sciences, All Rights Reserved 7 Partnership Development Driving Market Opportunity Through International Licensing Agreements Middle east agreement with MEAgate Expecting material revenue contribution in 2017 France & Italy Continuing to negotiate on pricing reimbursement

Financial Overview Rick Eiswirth, President & CFO

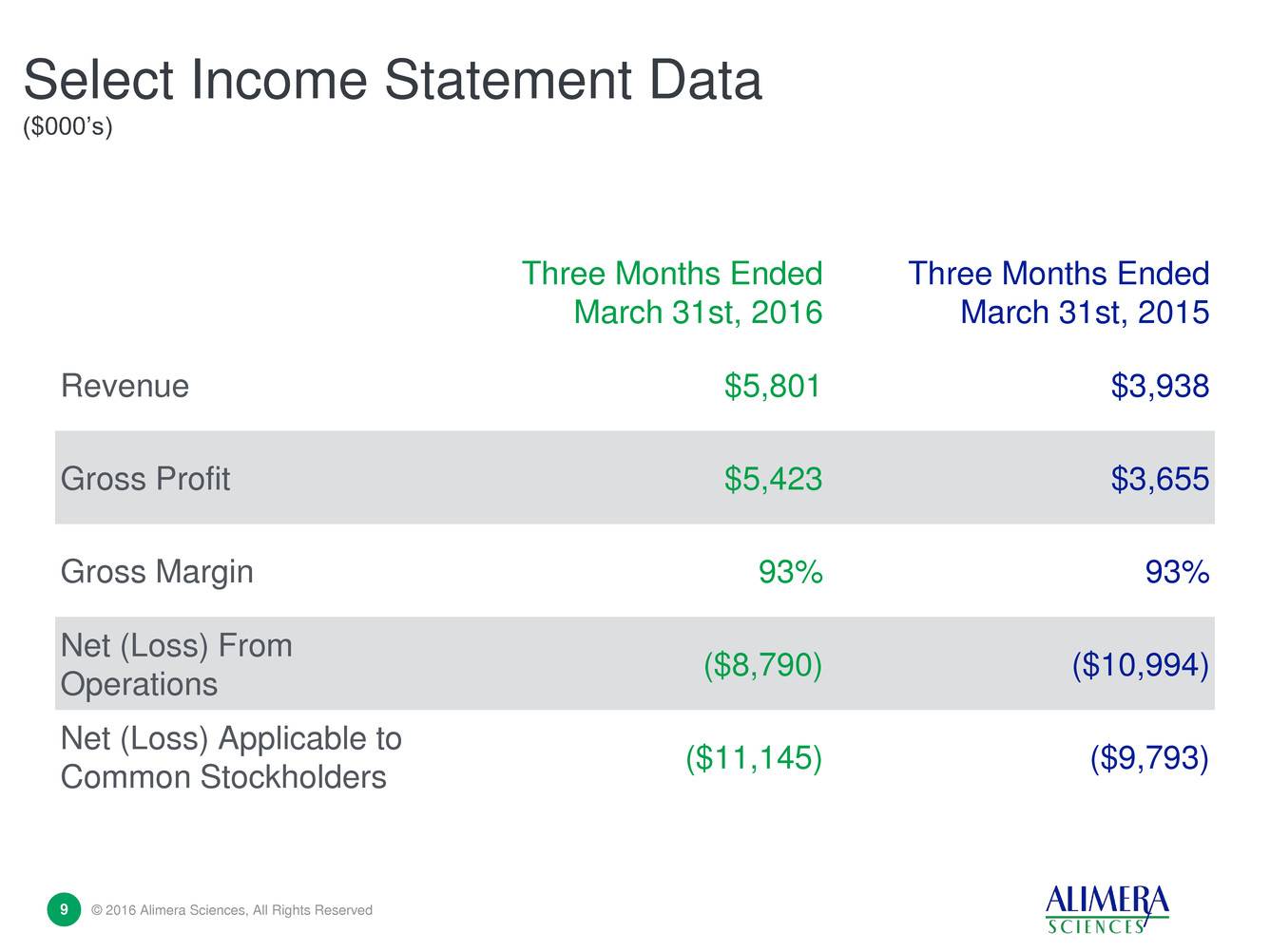

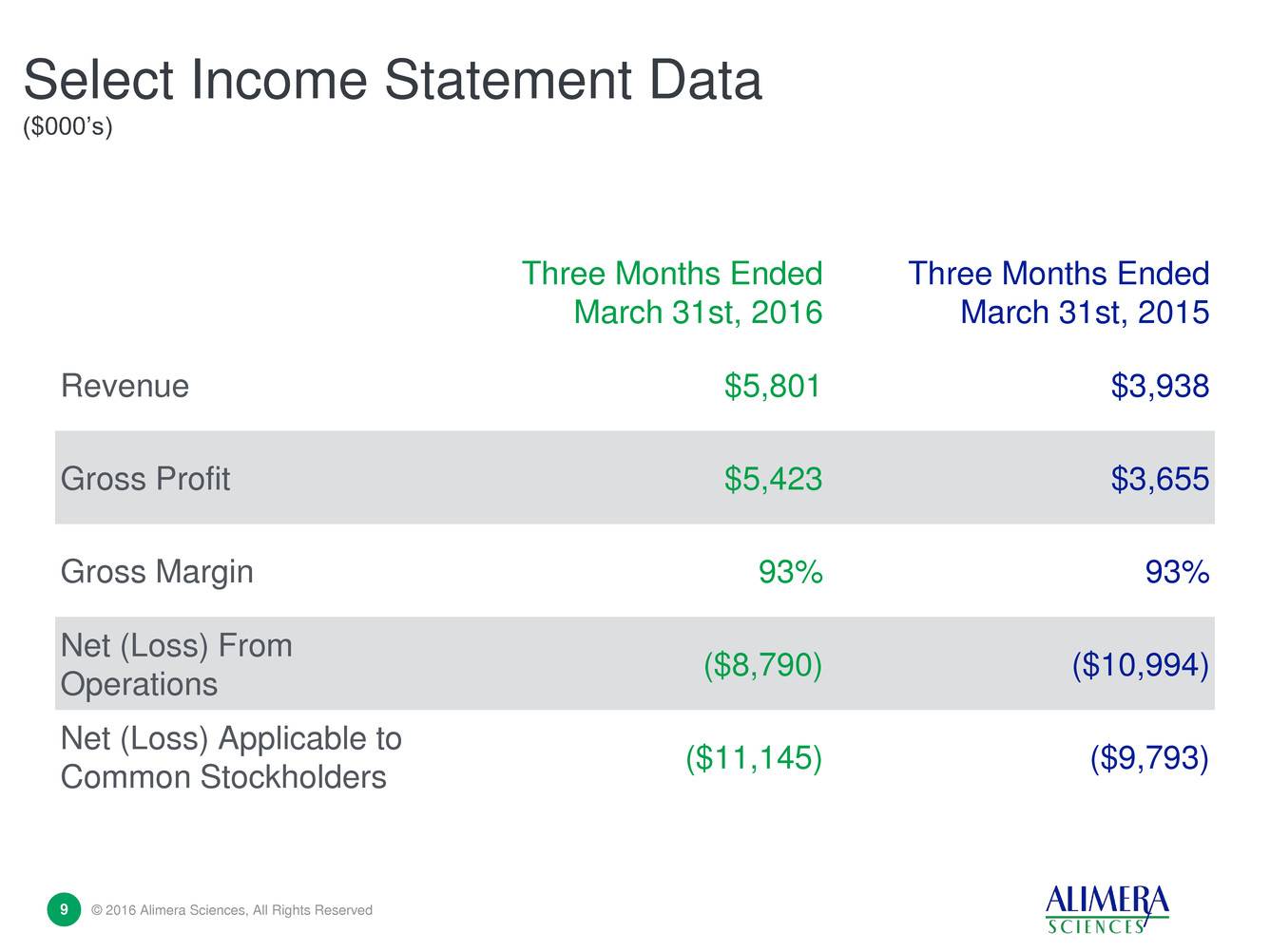

9 © 2016 Alimera Sciences, All Rights Reserved 9 Select Income Statement Data ($000’s) Three Months Ended March 31st, 2016 Three Months Ended March 31st, 2015 Revenue $5,801 $3,938 Gross Profit $5,423 $3,655 Gross Margin 93% 93% Net (Loss) From Operations ($8,790) ($10,994) Net (Loss) Applicable to Common Stockholders ($11,145) ($9,793)

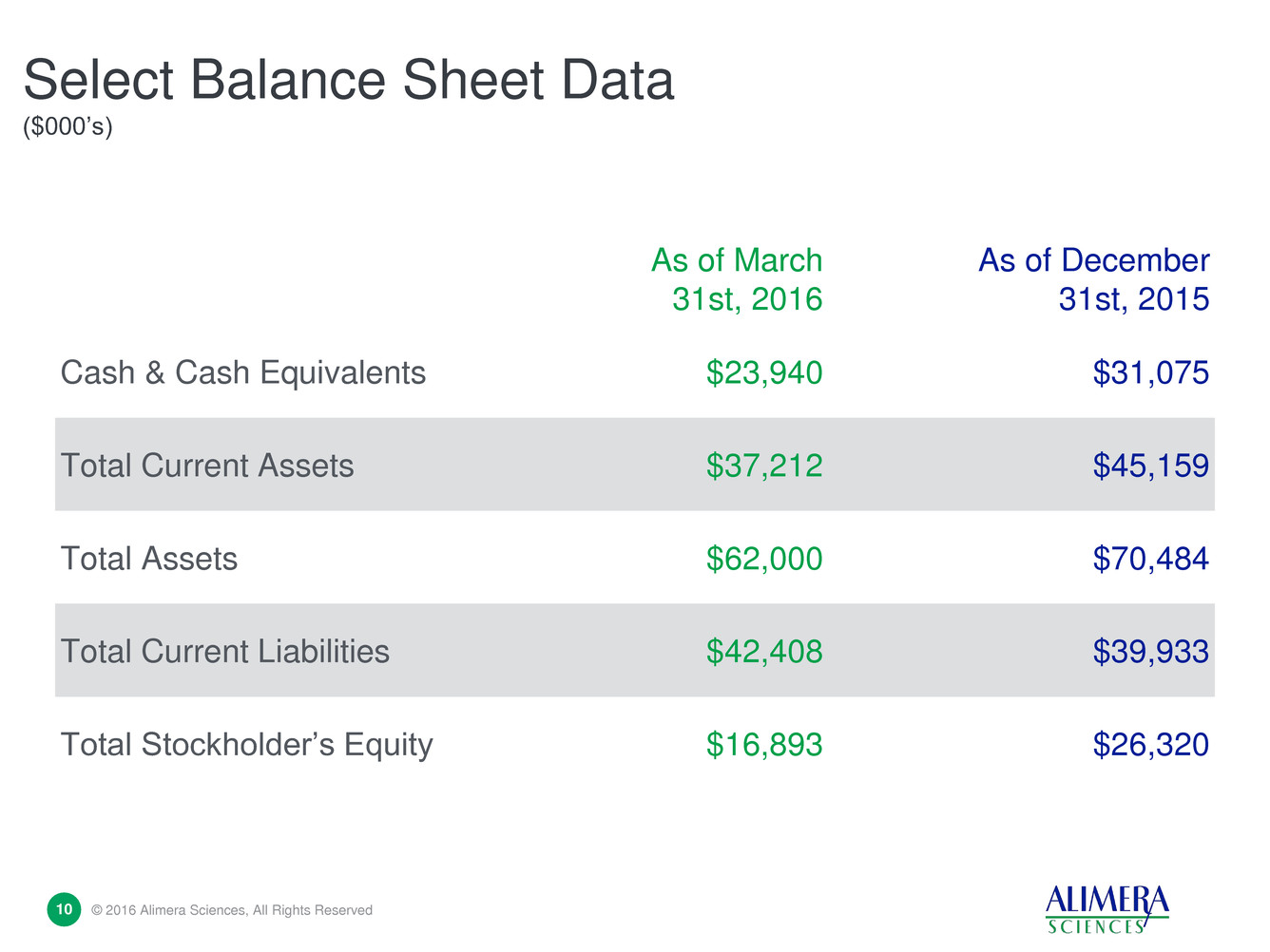

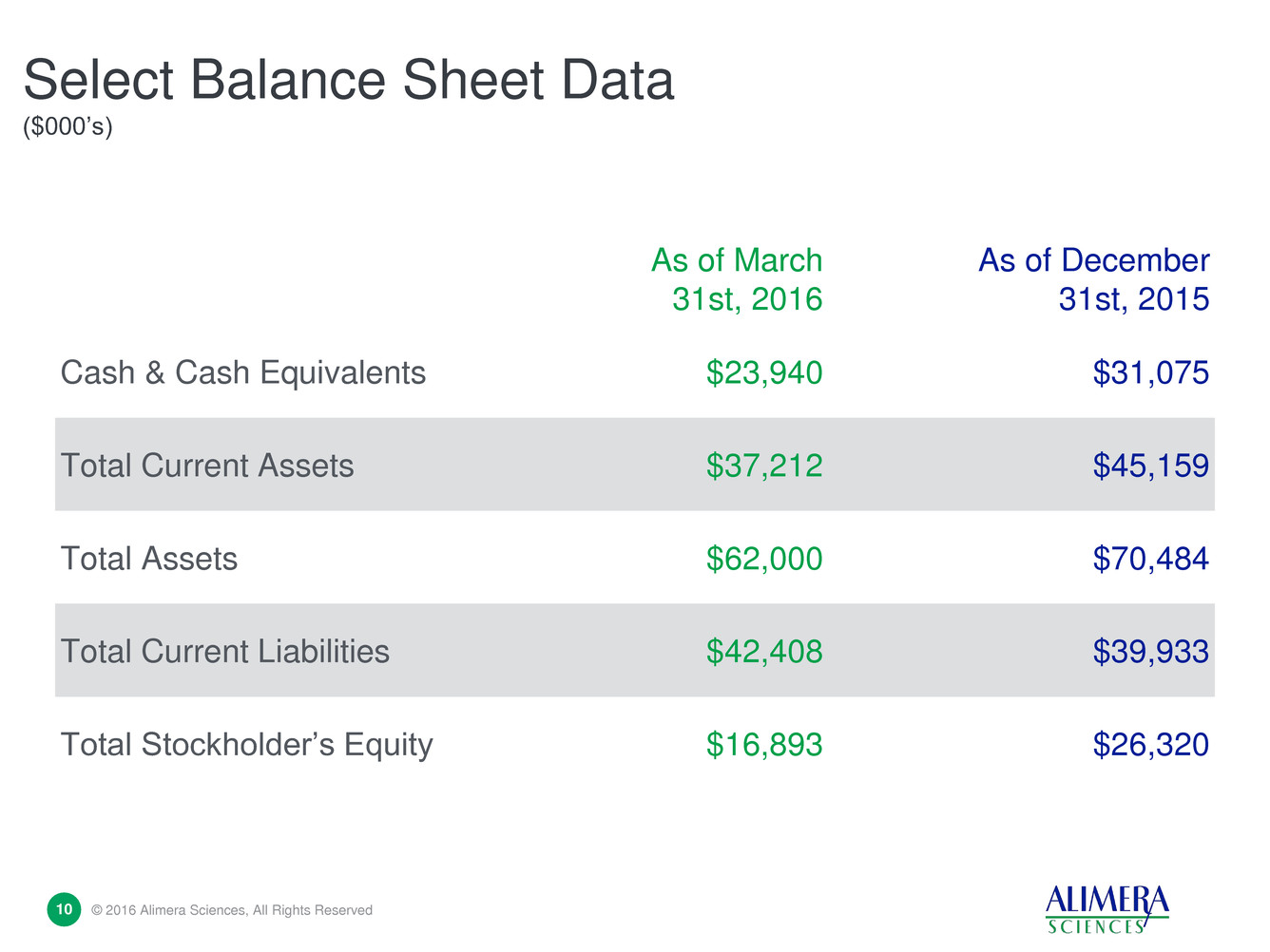

10 © 2016 Alimera Sciences, All Rights Reserved 10 Select Balance Sheet Data ($000’s) As of March 31st, 2016 As of December 31st, 2015 Cash & Cash Equivalents $23,940 $31,075 Total Current Assets $37,212 $45,159 Total Assets $62,000 $70,484 Total Current Liabilities $42,408 $39,933 Total Stockholder’s Equity $16,893 $26,320

Closing Remarks Dan Myers, CEO

Summary 12 © 2016 Alimera Sciences, All Rights Reserved 12 Continued long-term growth ILUVIEN® estimated peak sales potential exceeds $400-500 million Target Strategic Market Opportunities Penetrate international near-commercialization opportunities $2 Billion market opportunity Growing with global diabetes epidemic – 575,000 U.S. & 835,000 European DME sufferers Substantial Balance Sheet $23.9 million of cash as reported 3/31/16

Investor Presentation January 2015 Results Conference Call First Quarter 2016