Exhibit 99.2 Fourth Quarter & 2018 Results February 19, 2019 | Nasdaq: ALIM

Forward Looking Statements This presentation and the conference call and webcast it accompanies include or will include “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, regarding, among other things, Alimera’s belief, expectation, or anticipation that: Alimera will continue to benefit from the temporary unavailability of Ozurdex in the EEA in late 2018; Alimera’s revenue from its international segment will continue to accelerate into the first quarter of 2019; the planned launches of ILUVIEN in Spain and France will occur as planned; Alimera will receive approval of pricing in Lebanon and approval of marketing and pricing in Kuwait; Alimera will continue to grow organically from its existing customer base; Alimera will benefit from the first material cycle of re-treatments of ILUVIEN (and the expected rate of that re- treatment); Alimera will receive approval for the use of ILUVIEN to treat non-infectious posterior uveitis in Europe in the first half of 2019; Alimera will continue to expand access to ILUVIEN in new markets; and Alimera will seek to acquire retina products with reasonable valuations. These forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including factors that could delay, divert or change any of them, and could cause actual results to differ materially from those projected in its forward-looking statements. Meaningful factors that could cause actual results to differ include (a) a slowdown or reduction in sales due to a reduction in end user demand, unanticipated competition, regulatory issues, unexpected governmental actions or a delay in the approval or commercialization of ILUVIEN for the treatment of posterior uveitis in Europe and (b) other factors discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Alimera’s Annual Report on Form 10-K for the year ended December 31, 2017 and Alimera’s Quarterly Report on Form 10-Q for the three months ended September 30, 2018, which are on file with the SEC and are available at its website. Additional factors may also be included in Alimera’s Annual Report on Form 10-K for 2018, to be filed with the SEC soon. In addition to the risks described above and in Alimera’s reports and other filings with the SEC, other unknown or unpredictable factors also could affect Alimera’s results. There can be no assurance that the actual results or developments anticipated by Alimera will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Alimera. Therefore, no assurance can be given that the outcomes stated in such forward-looking statements and estimates will be achieved. All forward-looking statements in this presentation and in the conference call and webcast it accompanies are expressly qualified by the cautionary statements contained or referred to herein. Alimera cautions investors not to rely too heavily on the forward-looking statements Alimera makes or that are made on its behalf. These forward- looking statements speak only as of the date of this presentation (unless another date is indicated). Alimera undertakes no obligation, and specifically declines any obligation, to publicly update or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. 2

New Leadership Team Strong team with significant industry experience Rick Eiswirth Phil Jones Dave Holland Phillip Ashman CEO & President CFO Chief Marketing Officer & Chief Operating Officer, SVP Corporate Communications Managing Director Europe 3

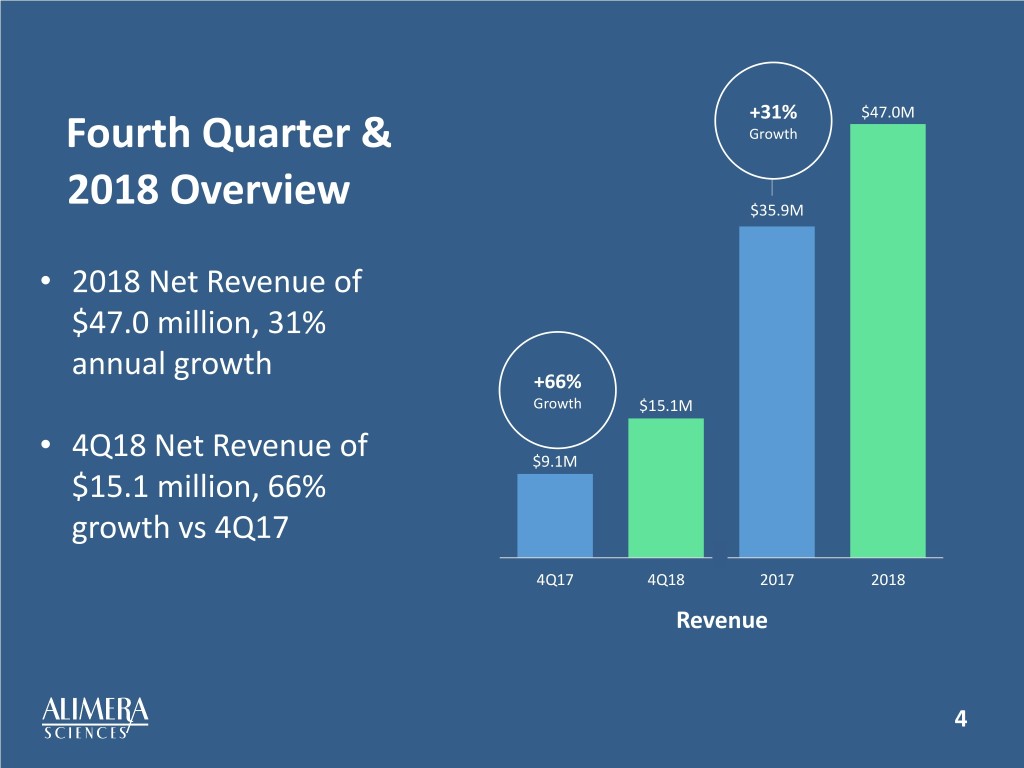

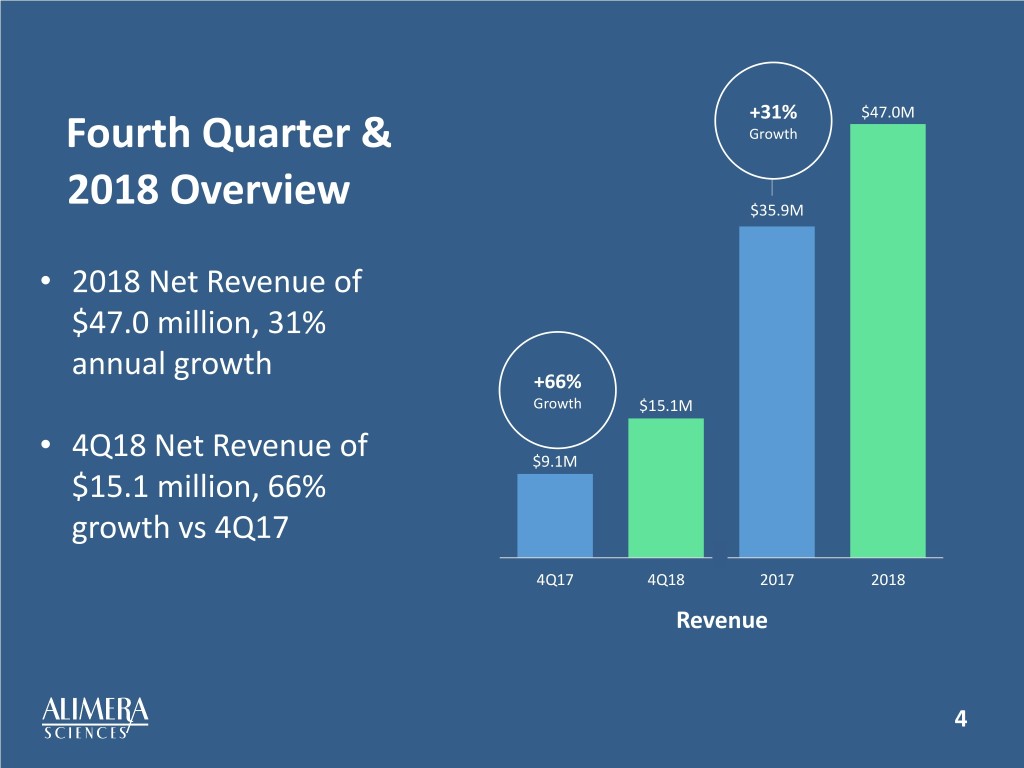

+31% $47.0M Fourth Quarter & Growth 2018 Overview $35.9M • 2018 Net Revenue of $47.0 million, 31% annual growth +66% Growth $15.1M • 4Q18 Net Revenue of $9.1M $15.1 million, 66% growth vs 4Q17 4Q17 4Q18 2017 2018 Revenue 4

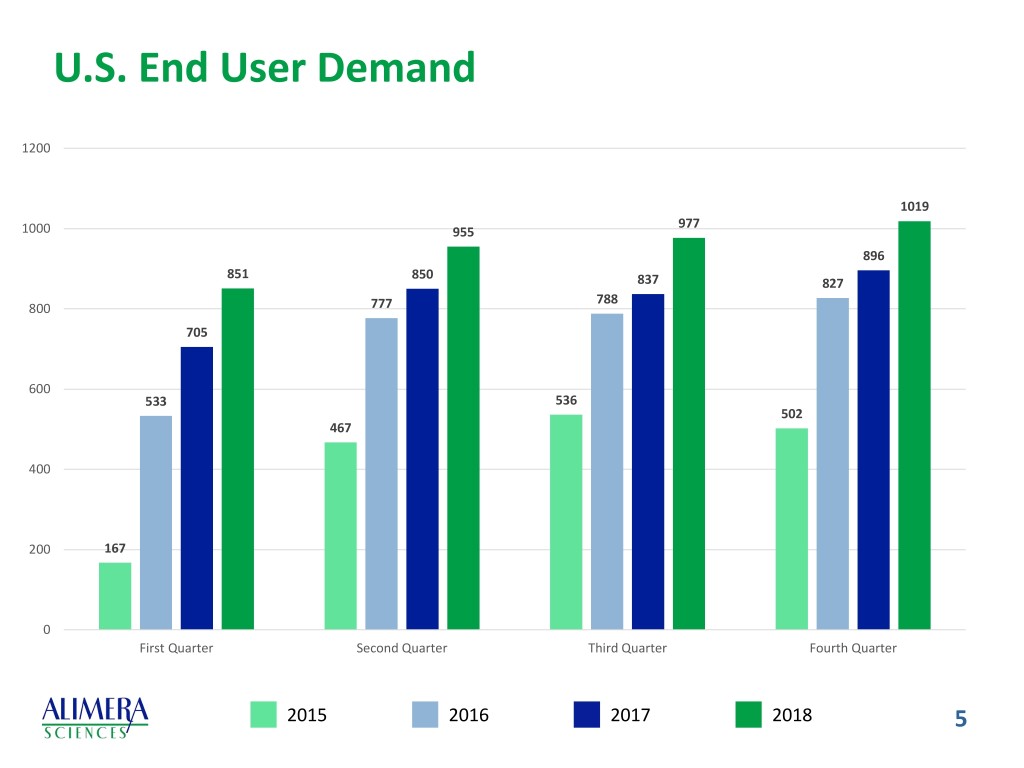

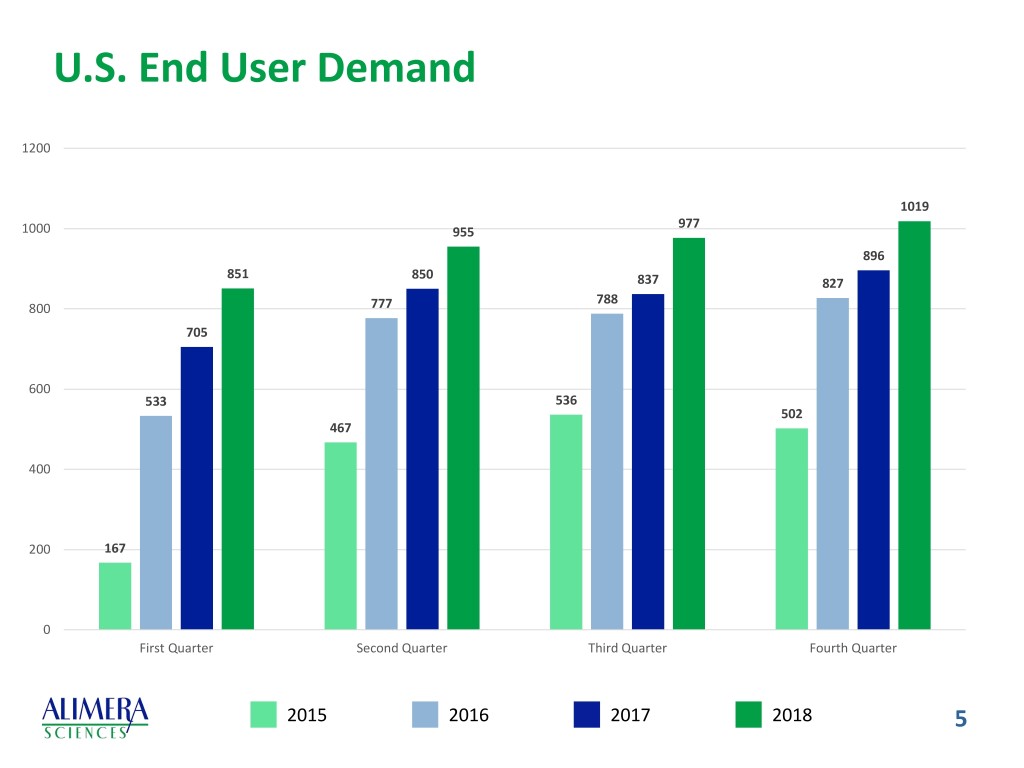

U.S. End User Demand 1200 1019 977 1000 955 896 851 850 837 827 788 800 777 705 600 533 536 502 467 400 200 167 0 First Quarter Second Quarter Third Quarter Fourth Quarter 2015 2016 2017 2018 5

+49% $14.6M International Growth Segment • 138% 4Q18 international $9.8M revenue growth $6.2M +138% • 2018 International Growth revenue of $14.6 million, up 49% vs. 2017 $2.6M 4Q17 4Q18 2017 2018 International Revenue 6

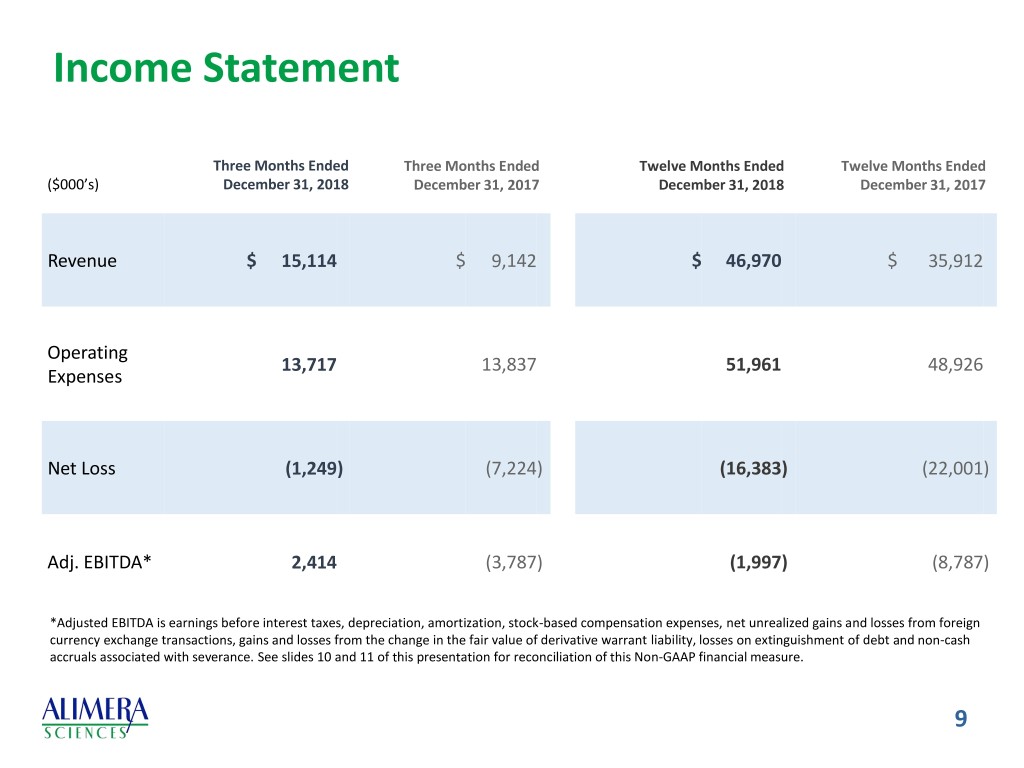

Income Statement Three Months Ended Three Months Ended Twelve Months Ended Twelve Months Ended ($000’s) December 31, 2018 December 31, 2017 December 31, 2018 December 31, 2017 Revenue $ 15,114 $ 9,142 $ 46,970 $ 35,912 Operating 13,717 13,837 51,961 48,926 Expenses Net Loss (1,249) (7,224) (16,383) (22,001) Adj. EBITDA* 2,414 (3,787) (1,997) (8,787) *Adjusted EBITDA is earnings before interest taxes, depreciation, amortization, stock-based compensation expenses, net unrealized gains and losses from foreign currency exchange transactions, gains and losses from the change in the fair value of derivative warrant liability, losses on extinguishment of debt and non-cash accruals associated with severance. See slides 10 and 11 of this presentation for reconciliation of this Non-GAAP financial measure. 7

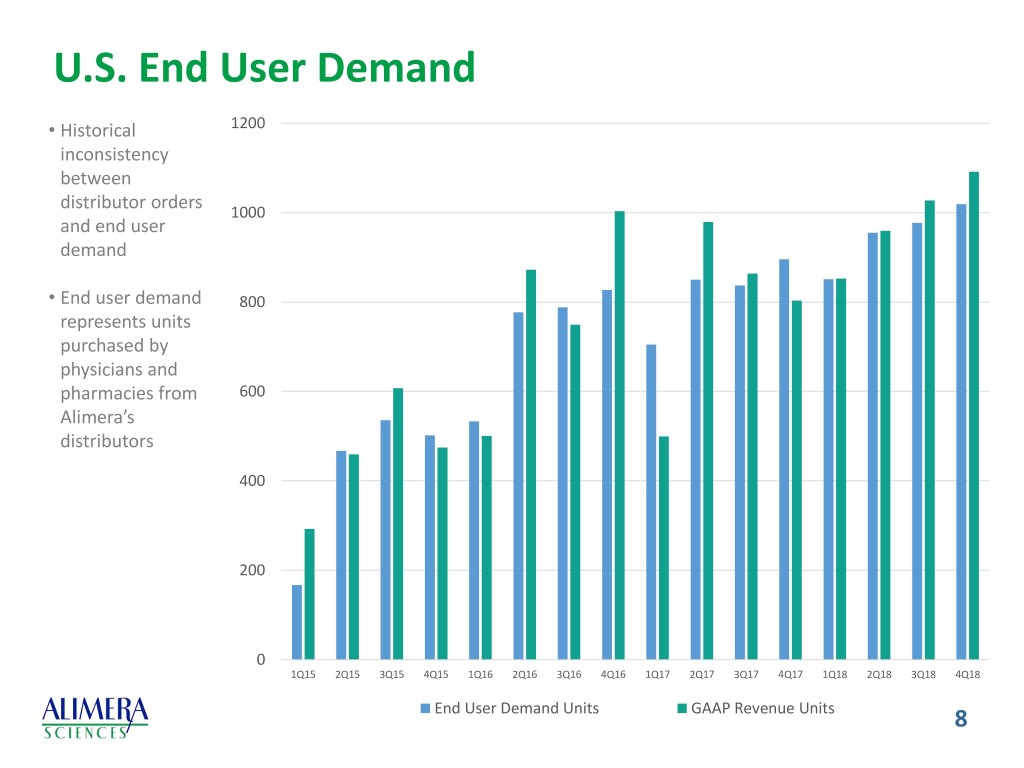

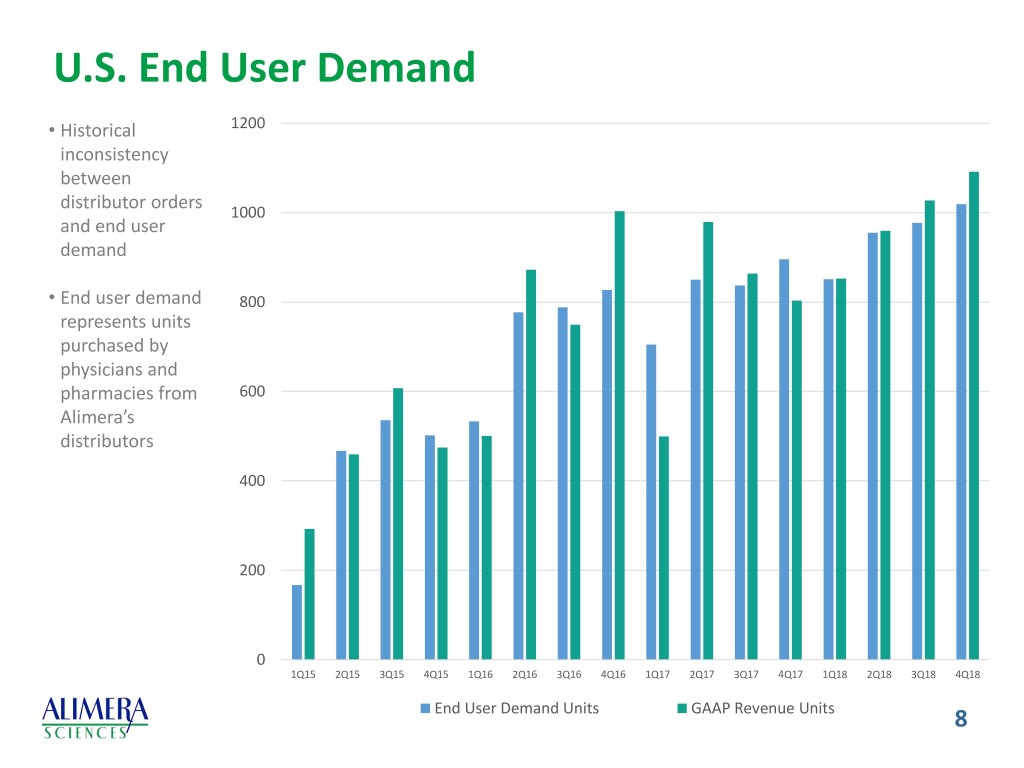

U.S. End User Demand • Historical 1200 inconsistency between distributor orders 1000 and end user demand • End user demand 800 represents units purchased by physicians and pharmacies from 600 Alimera’s distributors 400 200 0 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 End User Demand Units GAAP Revenue Units 8

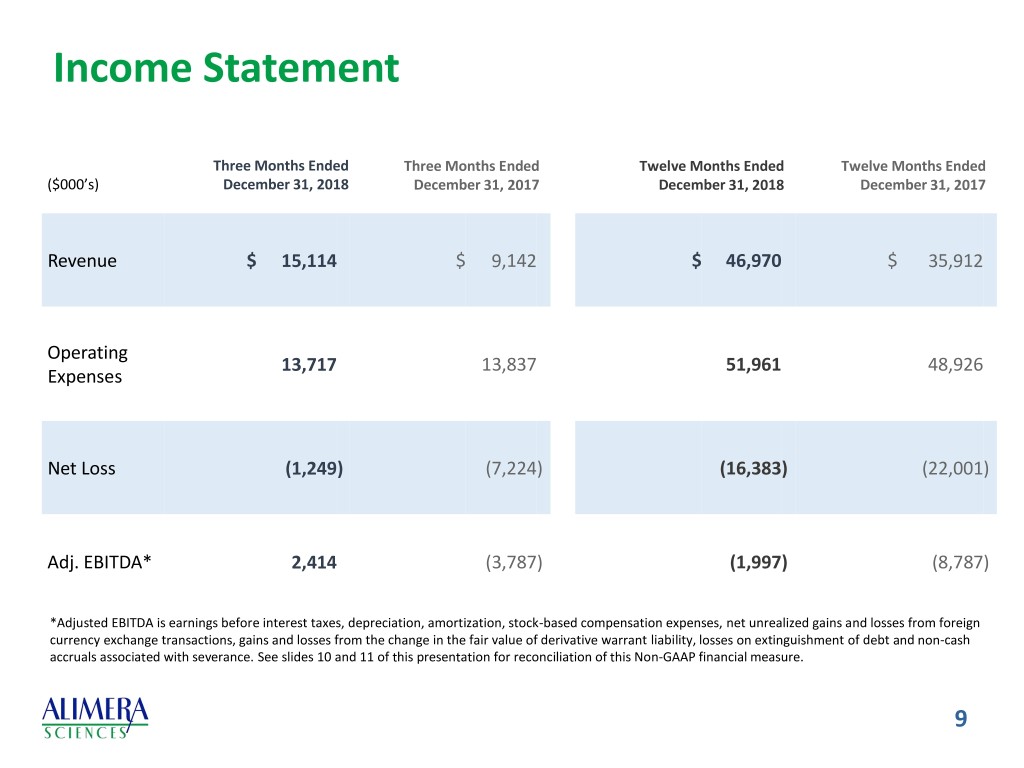

Income Statement Three Months Ended Three Months Ended Twelve Months Ended Twelve Months Ended ($000’s) December 31, 2018 December 31, 2017 December 31, 2018 December 31, 2017 Revenue $ 15,114 $ 9,142 $ 46,970 $ 35,912 Operating 13,717 13,837 51,961 48,926 Expenses Net Loss (1,249) (7,224) (16,383) (22,001) Adj. EBITDA* 2,414 (3,787) (1,997) (8,787) *Adjusted EBITDA is earnings before interest taxes, depreciation, amortization, stock-based compensation expenses, net unrealized gains and losses from foreign currency exchange transactions, gains and losses from the change in the fair value of derivative warrant liability, losses on extinguishment of debt and non-cash accruals associated with severance. See slides 10 and 11 of this presentation for reconciliation of this Non-GAAP financial measure. 9

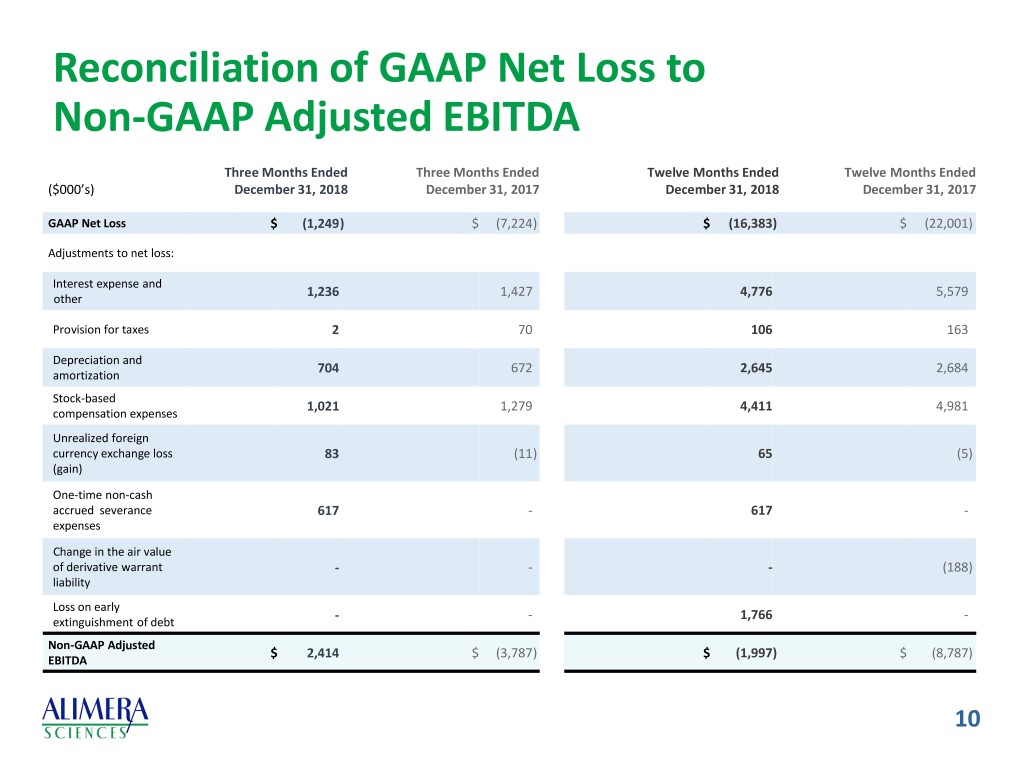

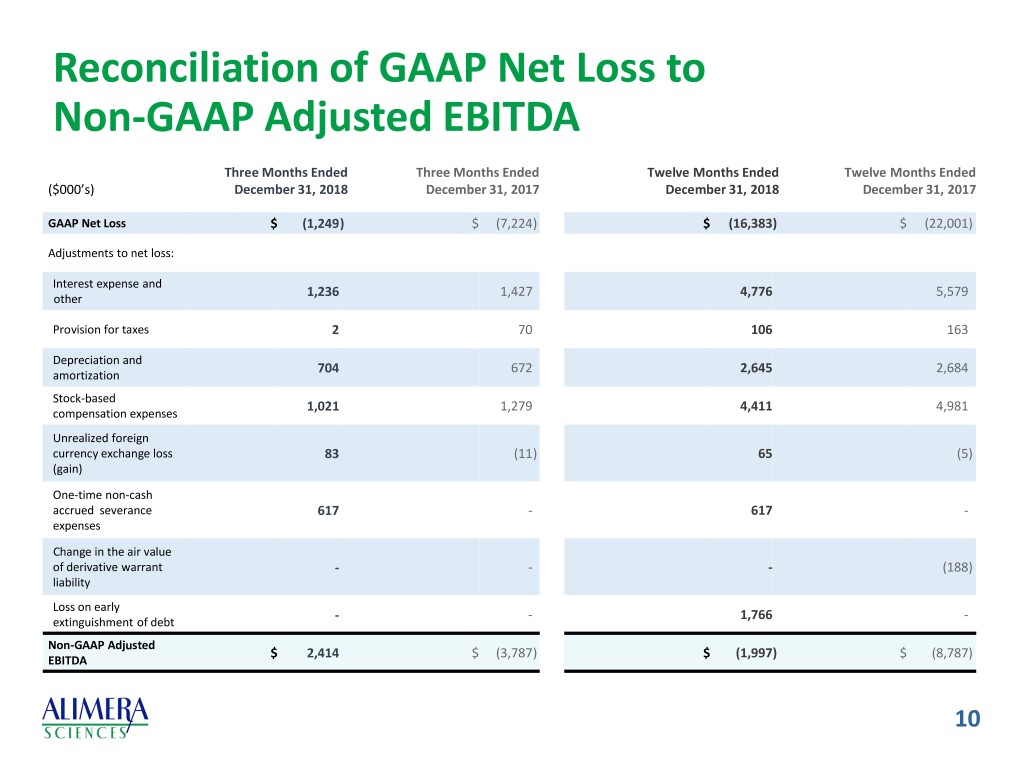

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA Three Months Ended Three Months Ended Twelve Months Ended Twelve Months Ended ($000’s) December 31, 2018 December 31, 2017 December 31, 2018 December 31, 2017 GAAP Net Loss $ (1,249) $ (7,224) $ (16,383) $ (22,001) Adjustments to net loss: Interest expense and 1,236 1,427 4,776 5,579 other Provision for taxes 2 70 106 163 Depreciation and 704 672 2,645 2,684 amortization Stock-based 1,021 1,279 4,411 4,981 compensation expenses Unrealized foreign currency exchange loss 83 (11) 65 (5) (gain) One-time non-cash accrued severance 617 - 617 - expenses Change in the air value of derivative warrant - - - (188) liability Loss on early - - 1,766 - extinguishment of debt Non-GAAP Adjusted $ 2,414 $ (3,787) $ (1,997) $ (8,787) EBITDA 10

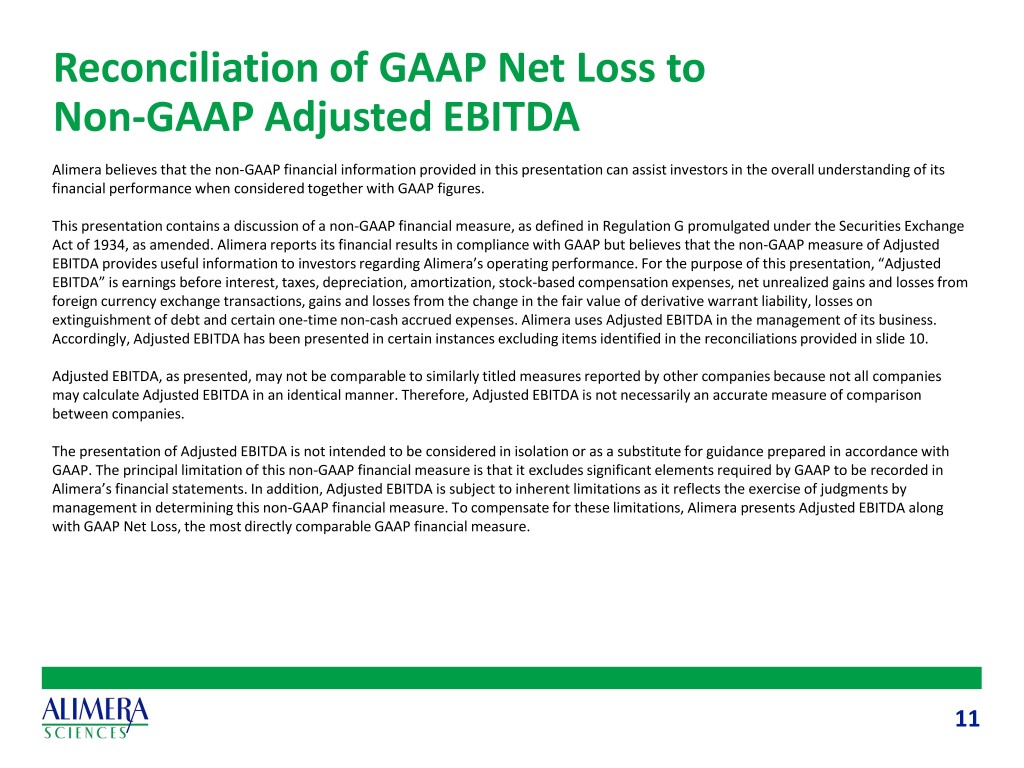

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted EBITDA Alimera believes that the non-GAAP financial information provided in this presentation can assist investors in the overall understanding of its financial performance when considered together with GAAP figures. This presentation contains a discussion of a non-GAAP financial measure, as defined in Regulation G promulgated under the Securities Exchange Act of 1934, as amended. Alimera reports its financial results in compliance with GAAP but believes that the non-GAAP measure of Adjusted EBITDA provides useful information to investors regarding Alimera’s operating performance. For the purpose of this presentation, “Adjusted EBITDA” is earnings before interest, taxes, depreciation, amortization, stock-based compensation expenses, net unrealized gains and losses from foreign currency exchange transactions, gains and losses from the change in the fair value of derivative warrant liability, losses on extinguishment of debt and certain one-time non-cash accrued expenses. Alimera uses Adjusted EBITDA in the management of its business. Accordingly, Adjusted EBITDA has been presented in certain instances excluding items identified in the reconciliations provided in slide 10. Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other companies because not all companies may calculate Adjusted EBITDA in an identical manner. Therefore, Adjusted EBITDA is not necessarily an accurate measure of comparison between companies. The presentation of Adjusted EBITDA is not intended to be considered in isolation or as a substitute for guidance prepared in accordance with GAAP. The principal limitation of this non-GAAP financial measure is that it excludes significant elements required by GAAP to be recorded in Alimera’s financial statements. In addition, Adjusted EBITDA is subject to inherent limitations as it reflects the exercise of judgments by management in determining this non-GAAP financial measure. To compensate for these limitations, Alimera presents Adjusted EBITDA along with GAAP Net Loss, the most directly comparable GAAP financial measure. 11

Greater Penetration Organic 3 Year Retreatments Growth Uveitis Indication Drivers Geographic Expansion 12

Fourth Quarter & 2018 Results February 19, 2019 | Nasdaq: ALIM