Exhibit 99.2

NASDAQ: MRNS @ MarinusPharma Nasdaq: MRNS @MarinusPharma Photo Credit: Kelly Crews Photography Ryan (center) Living with CDKL5 deficiency disorder Corporate Presentation March 2022

©2022 Marinus Pharmaceuticals. All Rights Reserved I To the extent that statements contained in this presentation are not descriptions of historical facts regarding Marinus, they ar e forward - looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 19 95. Words such as “may”, “will”, “expect”, “anticipate”, “estimate”, “intend”, “believe”, and similar expressions (as well as other words or expressions referencing future events, co ndi tions or circumstances) are intended to identify forward - looking statements. Examples of forward - looking statements contained in this presentation include, among others, statements rega rding our expected revenue and operating expenses for 2022; our commercialization plans for ZTALMY® and clinical development plans for ganaxolone and the expected timing thereof ; our anticipated and potential financing plans; expected dosing in our clinical trials; the clinical development schedule and milestones; our expected timing to begin and complete en rol lment in our clinical trials; the expected trial design, target patient population and endpoints for our clinical trials; interpretation of scientific basis for ganaxolone use; timing for a vai lability and release of data; the potential safety and efficacy and therapeutic potential of ganaxolone; timing and expectations regarding regulatory communications and submissions; our expecta tio n regarding DEA scheduling of ZTALMY and the timing thereof; expectations regarding our agreement with BARDA; expectations regarding our collaboration with Orion corporation; ex pec tations regarding the potential market opportunities for our product candidates, including oral ganaxolone; potential commercial alliances; and our expectations regarding the effect of the COVID - 19 pandemic on our business and clinical development plans. Forward - looking statements in this presentation involve substantial risks and uncertainties that could cause our clinical development programs, future results, performance or achievements to differ significantly from those expressed or implied by the forward - looking statements. Such risk s and uncertainties include, among others, uncertainties and delays relating to our ability to establish commercial infrastructure and capabilities to launch ZTALMY, patient and phys ici an acceptance of ZTALMY, our ability to obtain adequate market access for ZTALMY; the scheduling of ZTALMY by the DEA; our ability to comply with the FDA’s requirement for additiona l p ost - market studies in the required timeframes; the timing of regulatory filings, including the timing of filing the ganaxolone MAA with the EMA; the potential that regulatory authorit ies , including the FDA and EMA, may not grant or may delay approval for our product candidate; uncertainties and delays relating to the design, enrollment, completion, and results of c lin ical trials; unanticipated costs and expenses; early clinical trials may not be indicative of the results in later clinical trials; clinical trial results may not support regulatory appro val or further development in a specified indication or at all; actions or advice of the FDA or EMA may affect the design, initiation, timing, continuation and/or progress of clinical trials or result in the need for additional clinical trials; our ability to obtain and maintain regulatory approval for our product candidate; our ability to obtain, maintain, protect and defend intellectual prop ert y for our product candidates; the potential negative impact of third party patents on our or our collaborators’ ability to commercialize ganaxolone; delays, interruptions or failures in th e manufacture and supply of our product candidate; the size and growth potential of the markets for our product candidates, and our ability to service those markets; our cash and cash e qui valents may not be sufficient to support our operating plan for as long as anticipated; our expectations, projections and estimates regarding expenses, future revenue, capital requireme nts , and the availability of and the need for additional financing; our ability to obtain additional funding to support our commercial and clinical development programs; the potentia l f or Orion to breach the collaboration or terminate the agreement in accordance with its terms; the potential for Orion to recoup a percentage of the upfront fee depending on the ad dit ional pre - clinical testing expected to be completed in Q1 2022; the effect of the COVID - 19 pandemic on our business, the medical community, regulators and the global economy; and the ava ilability or potential availability of alternative products or treatments for conditions targeted by us that could affect the availability or commercial potential of our product candida te. Marinus undertakes no obligation to update or revise any forward - looking statements. For a further description of the risks and uncertainties that could cause actual results to differ f rom those expressed in these forward - looking statements, as well as risks relating to our business in general, see filings we have made with the Securities and Exchange Commission. You may access these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Safe Harbor Statement 2

©2022 Marinus Pharmaceuticals. All Rights Reserved I Building Upon A Strong Foundation and Differentiated Product Profile To Achieve Long - term Value Creation 3 Explore Unmet Medical Need in Rare Epilepsies and Acute Neurological Indications Strategic Collaborations Building Strong Commercial Infrastructure Expanding Global Footprint IV Oral Second Generation Formulation Growth & Expansion Evolving to Commercial Broad Therapeutic Use Within Epilepsy Differentiated & Demonstrated Proof Points Ganaxolone Compelling Therapeutic Profile & Differentiated MOA Validation With CDKL5 >1900 Patients Treated in Multiple Indications Route of Administration Flexibility The precise mechanism by which ganaxolone exerts its therapeutic effects in the treatment of seizures associated with CDD is unknown, but its anticonvulsant effects are thought to result from positive allosteric modulation of the gamma - aminobutyric acid type A (GABA A ) receptor in the CNS.

©2022 Marinus Pharmaceuticals. All Rights Reserved I Ganaxolone Development Pipeline 4 PDUFA date March 2022 MAA filing validation Q4 2021 Ph3 patient enrollment Q1 2022 Topline data 1H 2024 GANAXOLONE Phase 1 Phase 2 Phase 3 Approved Oral Suspension Intravenous Intravenous Intravenous Oral Suspension (Second Gen. Formulation) Administered Seizure Disorders Oral Suspension CDKL5 Deficiency Disorder Marigold Study FDA approved Data 2H 2023 First patient enrolled 1H 2023 First patient enrolled 2H 2022 Data year end 2023 Phase 1 data mid - 2022 Data 1H 2024 Ongoing trial Planned future trial Preclinical Lennox - Gastaut Syndrome Anticipated Milestones U.S. launch - July following DEA scheduling EU CHMP opinion year end 2022 Refractory Status Epilepticus RAISE Trial Tuberous Sclerosis Complex TrustTSC Trial Established Status Epilepticus RESET Trial Second Generation Formulation Refractory Status Epilepticus RAISE II Trial

Commercial

©2022 Marinus Pharmaceuticals. All Rights Reserved I ZTALMY® Now FDA Approved 6 • Branding concept represents new hope for children and families experiencing seizures in CDD • Logo colors are calming and supportive, while the open - circles signify a community rallying around the child and family First and only FDA - approved treatment for seizures associated with cyclin - dependent kinase - like 5 (CDKL5) deficiency disorder (CDD) in patients two years of age and older ZTALMY is expected to be commercially available in July 2022 following scheduling by the U.S. Drug Enforcement Administration Brand name has been established and the trademark registered

©2022 Marinus Pharmaceuticals. All Rights Reserved I Key Product Attributes 7 *The full prescribing information can be found at MarinusPharma.com ZTALMY is indicated for the treatment of seizures associated with cyclin - dependent kinase - like 5 (CDKL5) deficiency disorder (CDD) in patients 2 years of age and older Marigold Study • In the pivotal Marigold trial, patients receiving ZTALMY showed a statistically significant median 30.7% reduction in 28 - day major motor seizure frequency, compared to a median 6.9% reduction for those receiving placebo (p=0.0036) • The most common adverse reactions (incidence ≥ 5% and at least twice the rate of placebo) were somnolence, pyrexia, salivary hypersecretion, and seasonal allergy ZTALMY® U.S. Package Insert • No formal laboratory monitoring required such as hepatic or hematologic testing • No REMS program • Well characterized safety profile with over 1900 adults and children receiving ganaxolone in clinical trials Other highlights Proportion of Patients by Category of Seizure Response for ZTALMY and Placebo in Patients with CDD

©2022 Marinus Pharmaceuticals. All Rights Reserved I • 8 CDD Centers of Excellence & 40 National Association of Epilepsy Centers • Genetic testing/screening widely used and available for early diagnoses • ICD10 code initiated and in use • Insights from key advocacy groups Completed Commercial Milestones & Addressable Patient Population 8 1. Symonds JD 2019 Brain Completed Commercial Milestones Market Research Pricing Research KOL Targeting & Territory Maps Field Force Size & Structure Commercial Data Infrastructure Disease State Awareness Initiated Product Distribution Model ~2000 ADDRESSABLE PATIENTS Refractory to current treatments Target patient population: ages 2 - 21 with seizures 1 in 40,000 live births have CDKL5 Deficiency Disorder 1 Addressable patients estimated through market research:

©2022 Marinus Pharmaceuticals. All Rights Reserved I U.S. Anticipated Launch Timeline & Key Activities ► Driving Access: • Major commercial plans • State Medicaid Access • Execution of patient services ► Patient Conversion: • EAP & OLE patients' conversion to commercial product will be supported • Typical conversion can take 6 - 9 months EAP: Expanded Access Program OLE: Open Label Extension ► Promotion: • Identify and enroll patients • Increase brand awareness • First commercial patients expected Q4 2022 Approved: March 2022 Targeted Launch: July 2022 ANTICIPATE 90 DAY DEA SCHEDULING COMMERCIAL LAUNCH PLAN EXECUTION ► Focus During Scheduling: • Brand Awareness • Finalize Payer Positioning & Policy Inclusion • CDD Patient Analytics • Introduction of Support Services Ongoing patient advocacy engagement and education 9

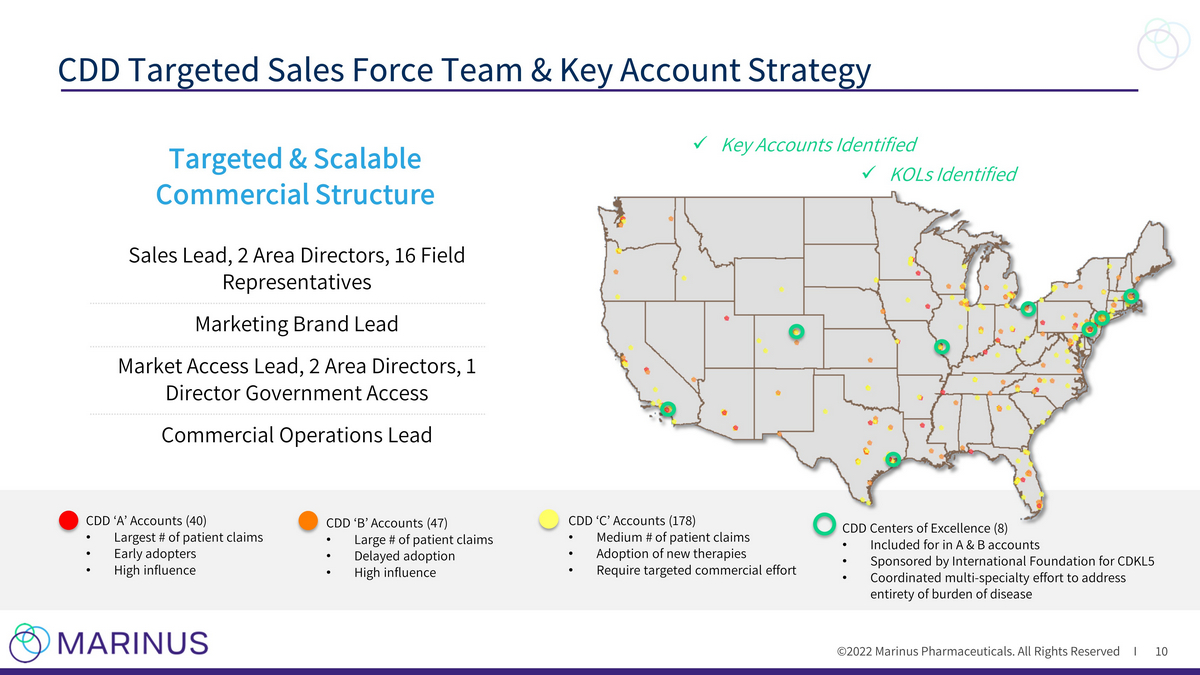

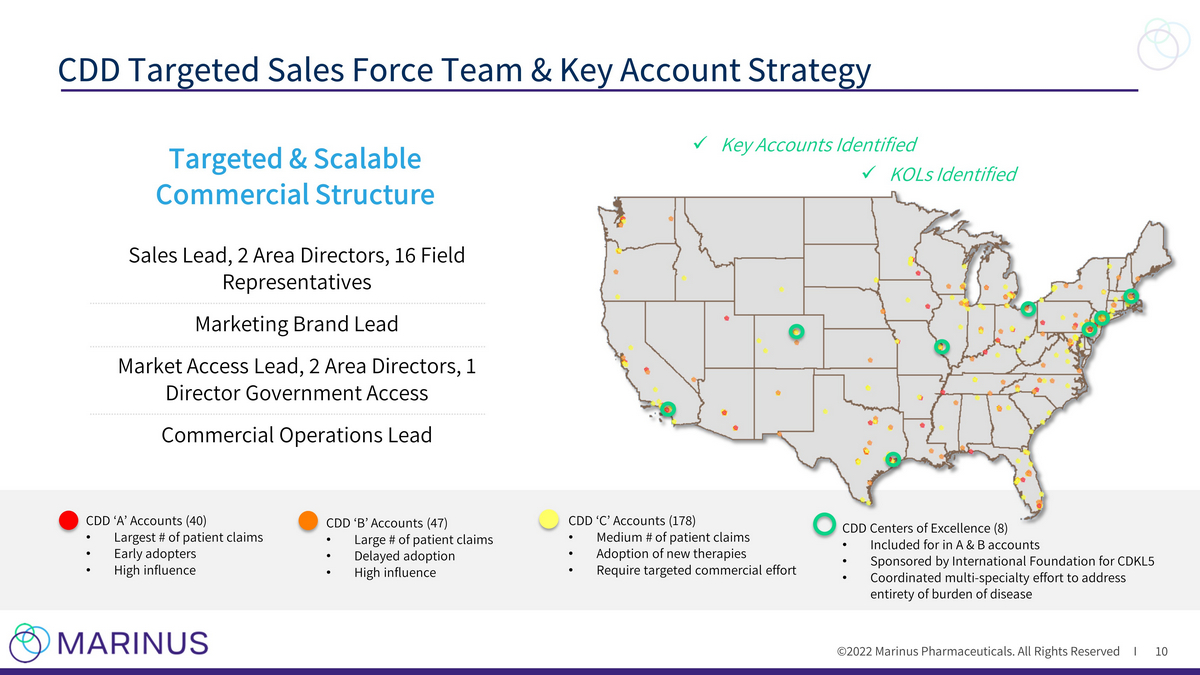

©2022 Marinus Pharmaceuticals. All Rights Reserved I CDD Targeted Sales Force Team & Key Account Strategy 10 CDD ‘A’ Accounts (40) • Largest # of patient claims • Early adopters • High influence CDD ‘B’ Accounts (47) • Large # of patient claims • Delayed adoption • High influence CDD ‘C’ Accounts (178) • Medium # of patient claims • Adoption of new therapies • Require targeted commercial effort CDD Centers of Excellence (8) • Included for in A & B accounts • Sponsored by International Foundation for CDKL5 • Coordinated multi - specialty effort to address entirety of burden of disease Sales Lead, 2 Area Directors, 16 Field Representatives Marketing Brand Lead Market Access Lead, 2 Area Directors, 1 Director Government Access Commercial Operations Lead x Key Accounts Identified x KOLs Identified Targeted & Scalable Commercial Structure

©2022 Marinus Pharmaceuticals. All Rights Reserved I Dosing Assumptions* Avg. age: 4.5 years old Transparent, weight - based pricing strategy Avg. weight: ~16 kg Avg. daily dose: ~50 – 55 (mg/kg) Marinus is committed to no price increases through end of 2023 Informed Access & Pricing Strategy 11 *Based on Marigold Trial and market research Pricing & Access Decisions Informed by Marinus values COMMUNITY First & only FDA approved treatment for seizures associated with CDD COMMITMENT Patient assistance programs will support access and affordability for CDD patients INNOVATION Committed to innovation and building a scalable business model to help more patients in the future Bottle WAC: $2,425 / 110mL Avg. Annual WAC: ~$133,000

Rare Epilepsies Oral Ganaxolone Pipeline

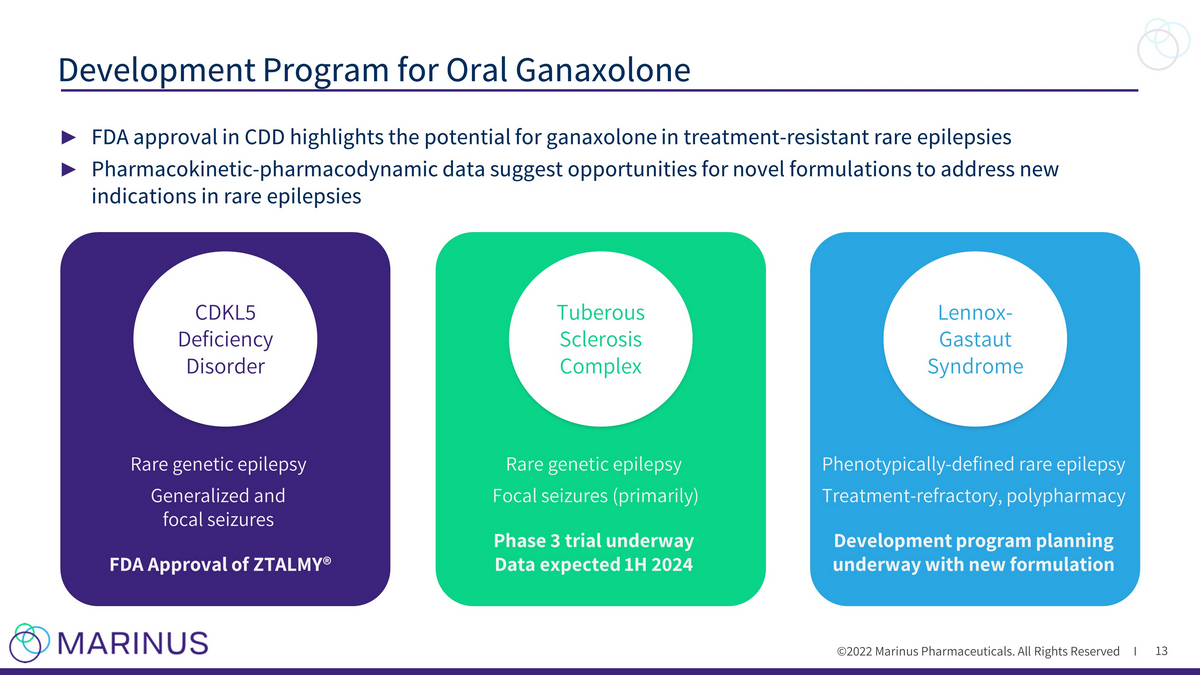

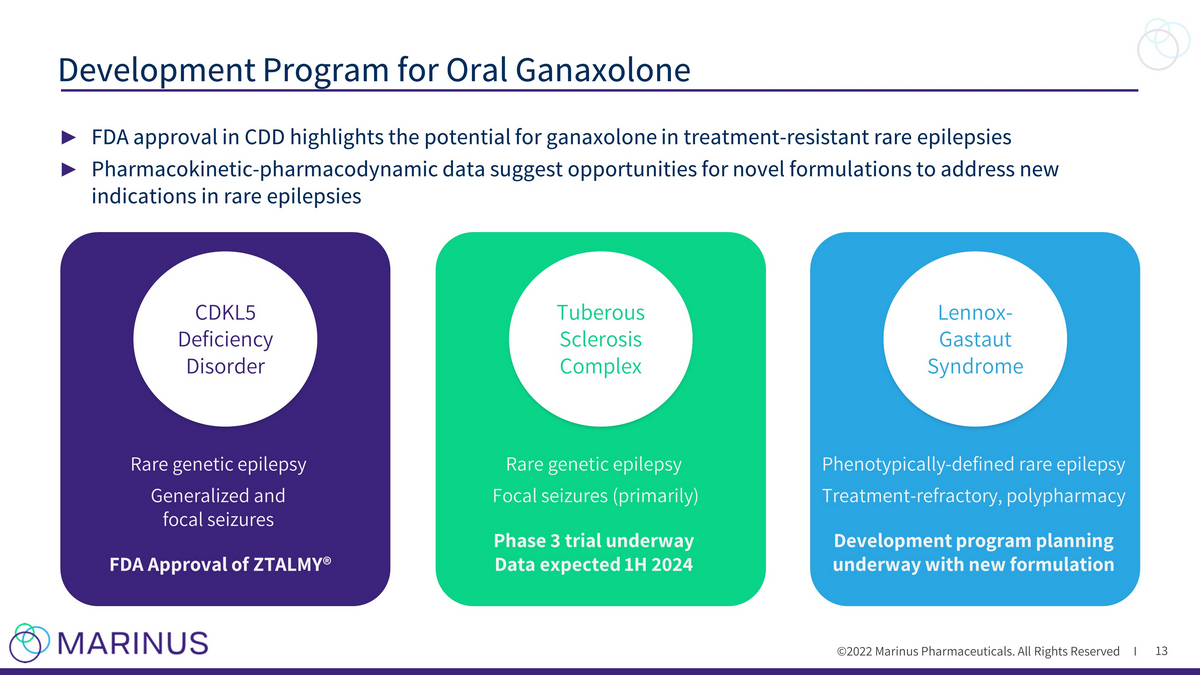

©2022 Marinus Pharmaceuticals. All Rights Reserved I ► FDA approval in CDD highlights the potential for ganaxolone in treatment - resistant rare epilepsies ► Pharmacokinetic - pharmacodynamic data suggest opportunities for novel formulations to address new indications in rare epilepsies Development Program for Oral Ganaxolone 13 CDKL5 Deficiency Disorder Rare genetic epilepsy Generalized and focal seizures FDA Approval of ZTALMY® Tuberous Sclerosis Complex Rare genetic epilepsy Focal seizures (primarily) Phase 3 trial underway Data expected 1H 2024 Lennox - Gastaut Syndrome Phenotypically - defined rare epilepsy Treatment - refractory, polypharmacy Development program planning underway with new formulation

Tuberous Sclerosis Complex “Many individuals with TSC continue to experience uncontrolled seizures despite a cocktail of multiple antiepileptic drugs. Because new options are always needed, the TSC community welcomes clinical evaluation of new epilepsy treatments” - Kari Luther Rosbeck, President & CEO of the Tuberous Sclerosis Alliance

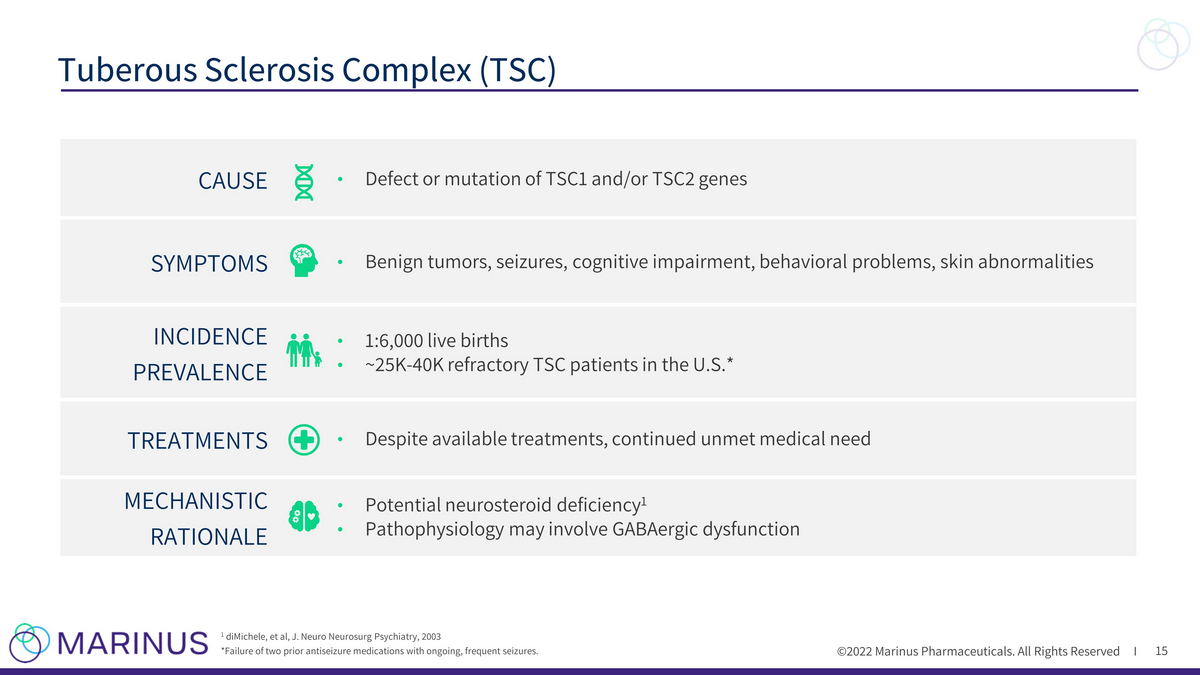

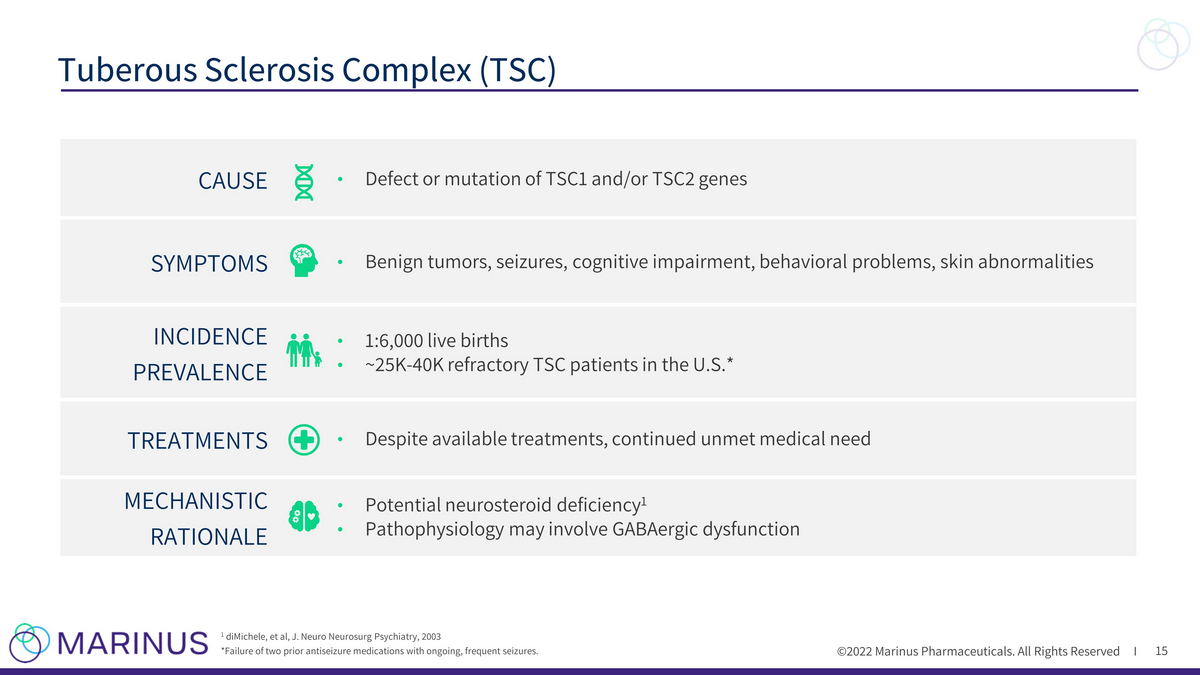

©2022 Marinus Pharmaceuticals. All Rights Reserved I 15 Tuberous Sclerosis Complex (TSC) 1 diMichele, et al, J. Neuro Neurosurg Psychiatry, 2003 *Failure of two prior antiseizure medications with ongoing, frequent seizures. CAUSE • Defect or mutation of TSC1 and/or TSC2 genes SYMPTOMS • Benign tumors, seizures, cognitive impairment, behavioral problems, skin abnormalities INCIDENCE PREVALENCE • 1:6,000 live births • ~25K - 40K refractory TSC patients in the U.S.* TREATMENTS • Despite available treatments, continued unmet medical need MECHANISTIC RATIONALE • Potential neurosteroid deficiency 1 • Pathophysiology may involve GABAergic dysfunction

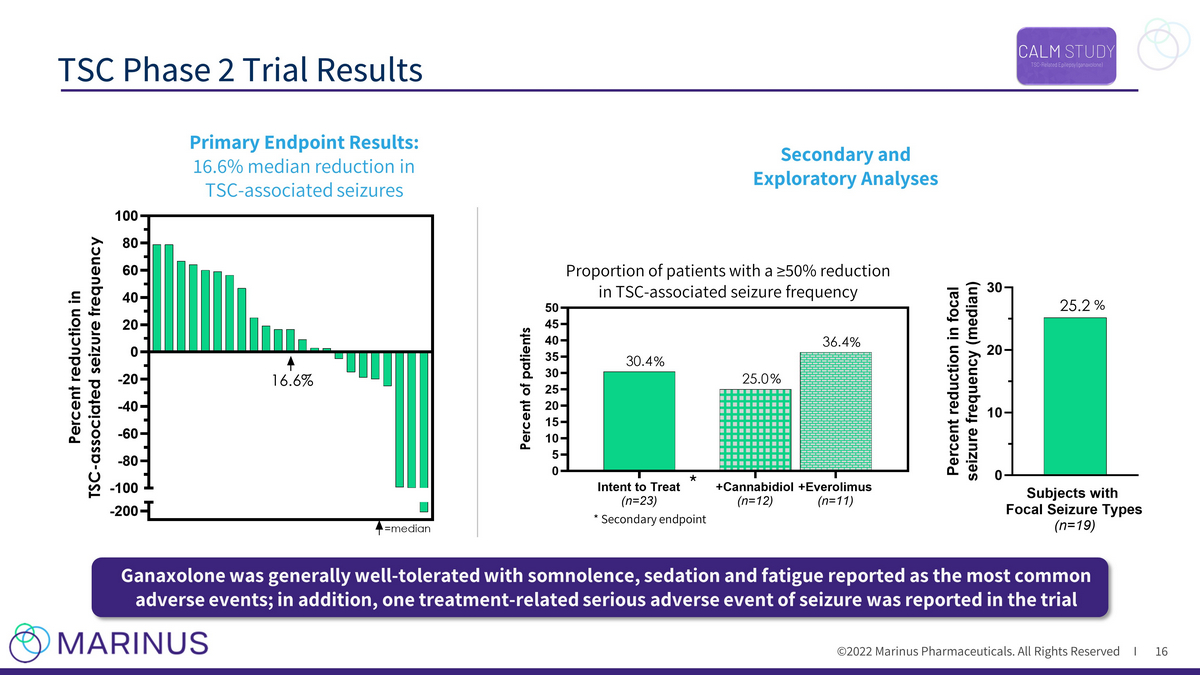

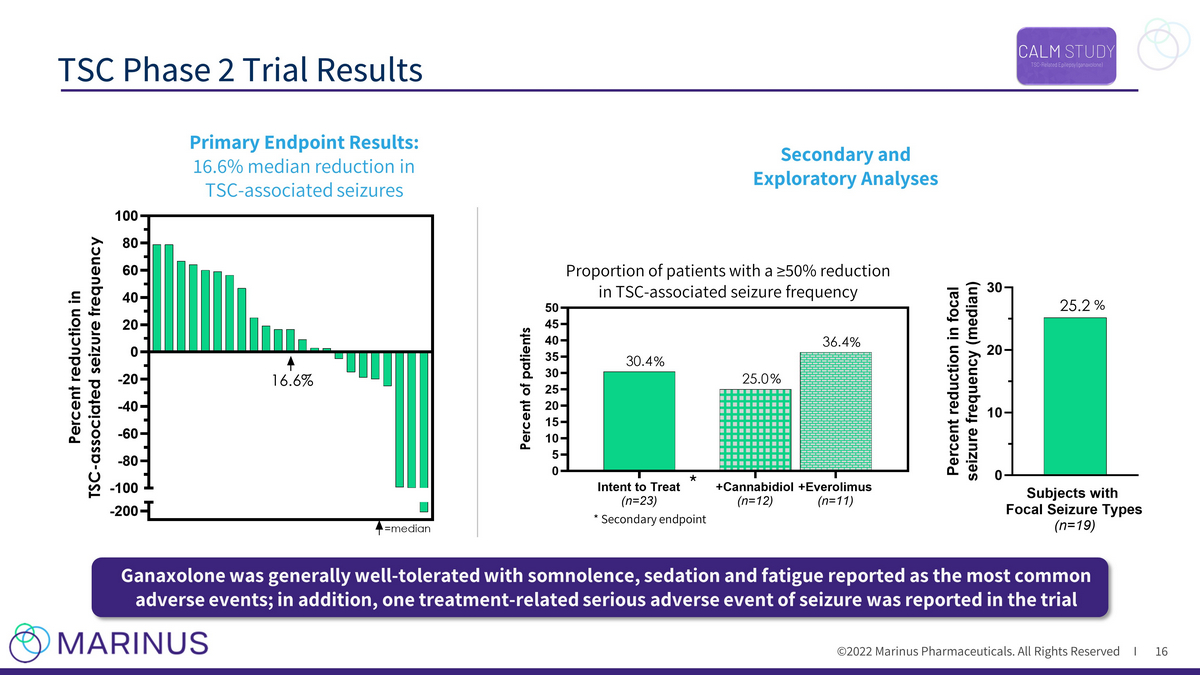

©2022 Marinus Pharmaceuticals. All Rights Reserved I TSC Phase 2 Trial Results 16 * Secondary endpoint * Proportion of patients with a ≥50% reduction in TSC - associated seizure frequency Intent to Treat (n=23) +Cannabidiol (n=12) +Everolimus (n=11) 0 5 10 15 20 25 30 35 40 45 50 36.4 25.0 30.4 P e r c e n t o f p a t i e n t s -200 -100 -80 -60 -40 -20 0 20 40 60 80 100 P e r c e n t r e d u c t i o n i n T S C - a s s o c i a t e d s e i z u r e f r e q u e n c y =median 16.6% Secondary and Exploratory Analyses Primary Endpoint Results: 16.6% median reduction in TSC - associated seizures Ganaxolone was generally well - tolerated with somnolence, sedation and fatigue reported as the most common adverse events; in addition, one treatment - related serious adverse event of seizure was reported in the trial % % % %

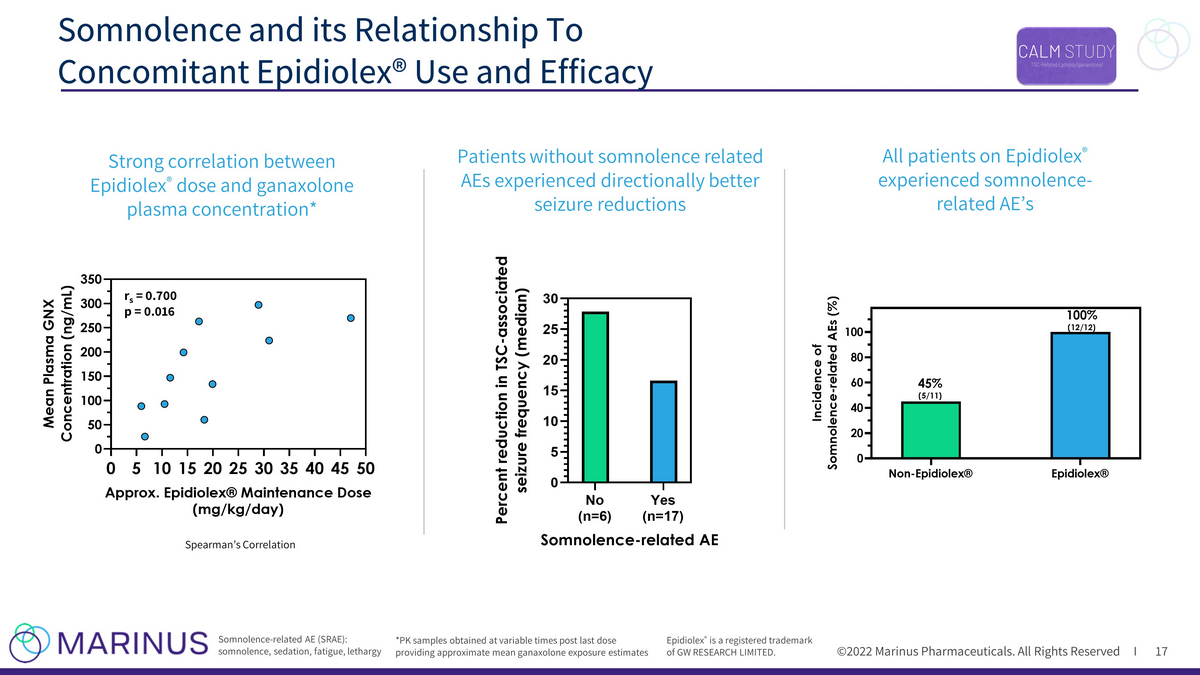

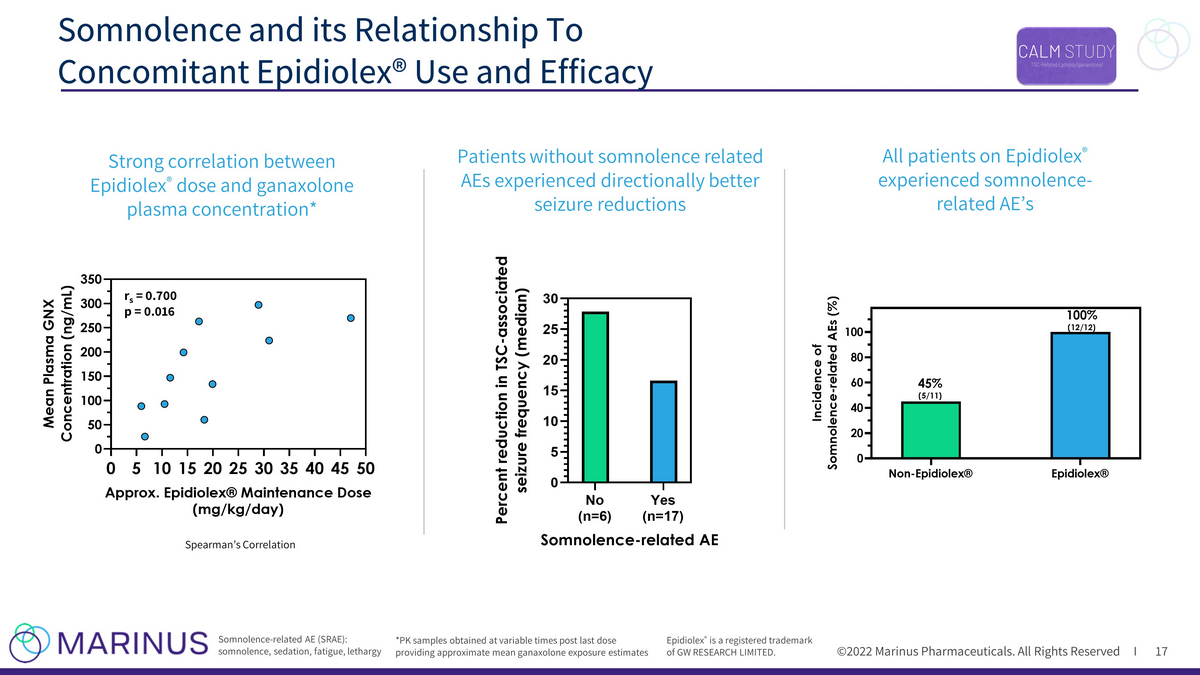

©2022 Marinus Pharmaceuticals. All Rights Reserved I Somnolence and its Relationship To Concomitant Epidiolex® Use and Efficacy 17 Epidiolex ® is a registered trademark of GW RESEARCH LIMITED. r s = 0.700 p = 0.016 Spearman’s Correlation *PK samples obtained at variable times post last dose providing approximate mean ganaxolone exposure estimates All patients on Epidiolex ® experienced somnolence - related AE’s Somnolence - related AE (SRAE): somnolence, sedation, fatigue, lethargy Strong correlation between Epidiolex ® dose and ganaxolone plasma concentration* Patients without somnolence related AEs experienced directionally better seizure reductions 0 5 101520253035404550 0 50 100 150 200 250 300 350 Approx. Epidiolex® Maintenance Dose (mg/kg/day) M e a n P l a s m a G N X C o n c e n t r a t i o n ( n g / m L ) No (n=6) Yes (n=17) 0 5 10 15 20 25 30 Somnolence-related AE P e r c e n t r e d u c t i o n i n T S C - a s s o c i a t e d s e i z u r e f r e q u e n c y ( m e d i a n )

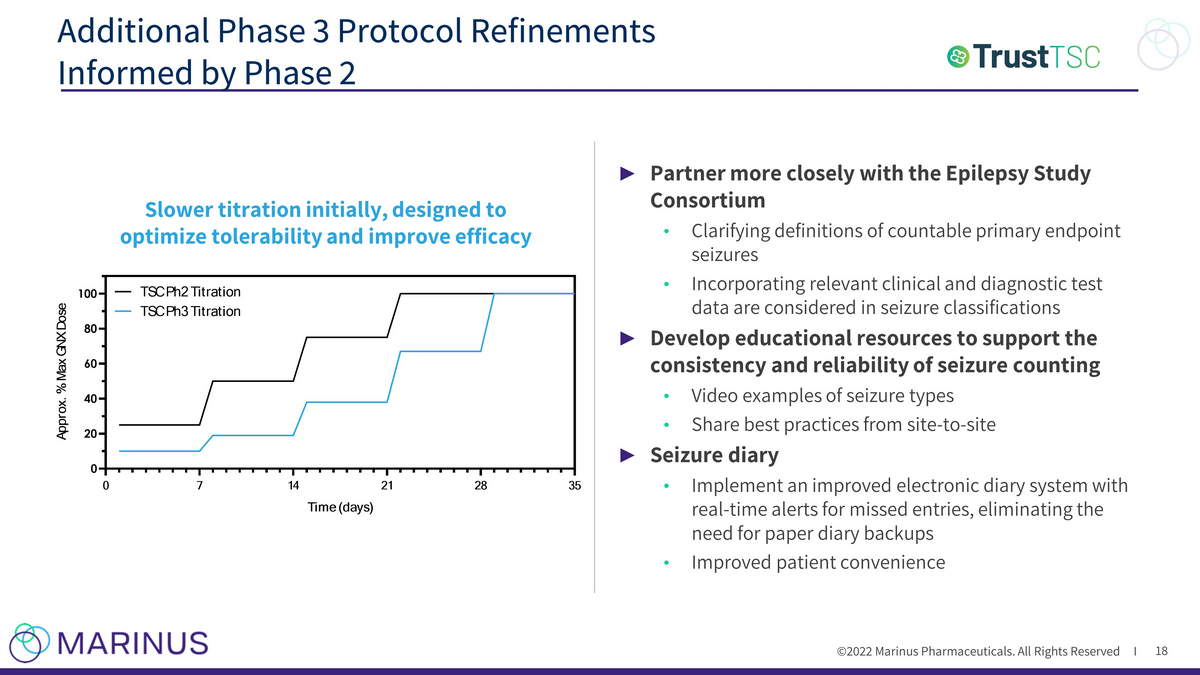

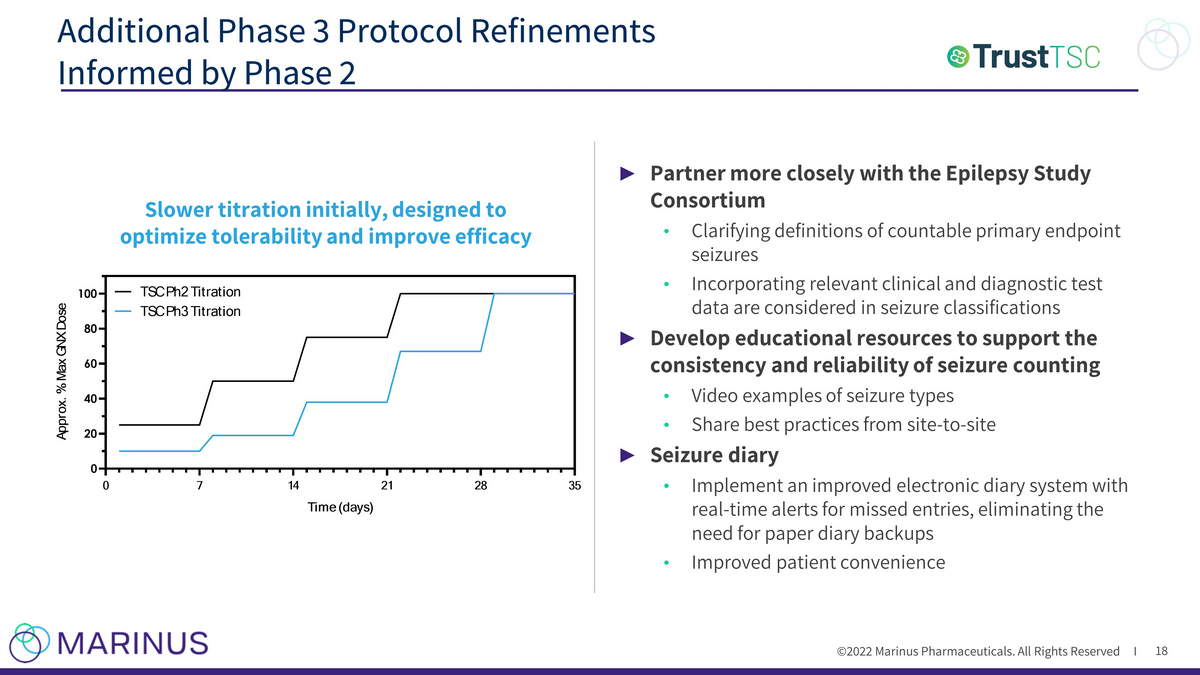

©2022 Marinus Pharmaceuticals. All Rights Reserved I ► Partner more closely with the Epilepsy Study Consortium • Clarifying definitions of countable primary endpoint seizures • Incorporating relevant clinical and diagnostic test data are considered in seizure classifications ► Develop educational resources to support the consistency and reliability of seizure counting • Video examples of seizure types • Share best practices from site - to - site ► Seizure diary • Implement an improved electronic diary system with real - time alerts for missed entries, eliminating the need for paper diary backups • Improved patient convenience Additional Phase 3 Protocol Refinements Informed by Phase 2 18 Slower titration initially, designed to optimize tolerability and improve efficacy 0 7 14 21 28 35 0 20 40 60 80 100 Time (days) A p p r o x . % M a x G N X D o s e TSC Ph2 Titration TSC Ph3 Titration

©2022 Marinus Pharmaceuticals. All Rights Reserved I Phase 3 Trial Overview 19 ► Enrollment: ~162 patients, 60 U.S and western Europe total sites (targeting EU enrollment ~25% of study) • Patient screening started in Q1; Active enrollment in U.S. sites expected in Q2 2022 ► Primary Endpoint: Percent change in TSC - associated seizure frequency ► Key Secondary Endpoints: Percent change in TSC - associated seizure frequency during maintenance period, 50% responder rate, and clinical global impression ► FDA has indicated a single pivotal TSC Phase 3 trial could be sufficient for approval

Second Generation Product Development

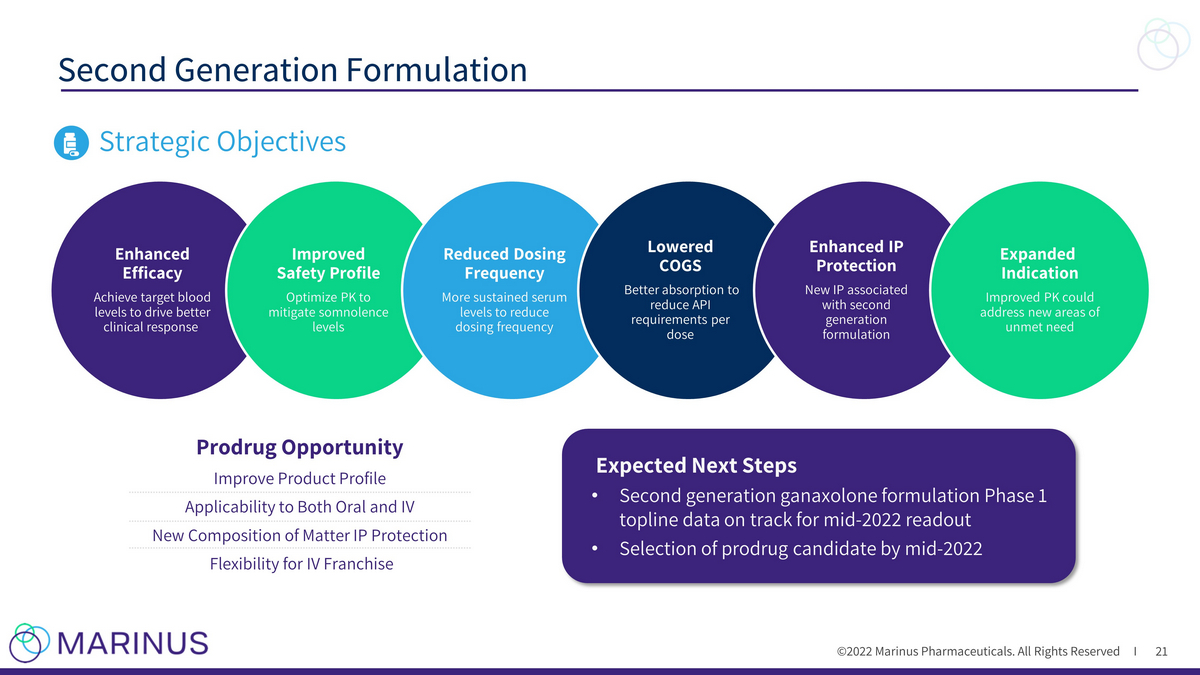

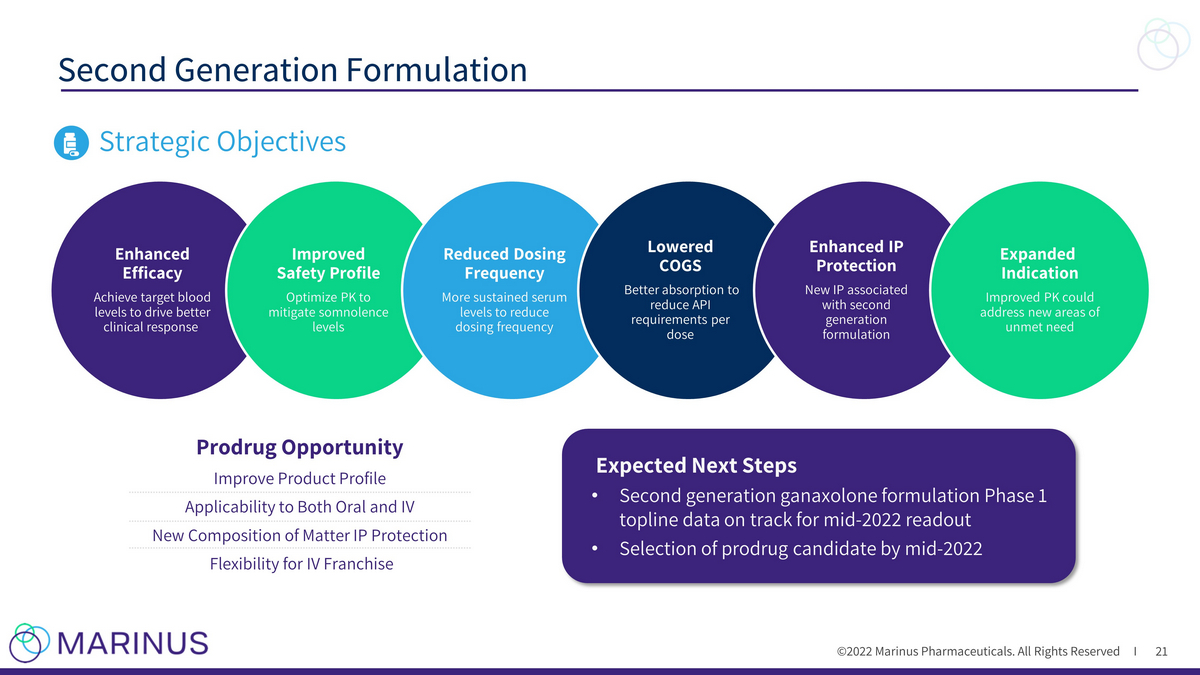

©2022 Marinus Pharmaceuticals. All Rights Reserved I Second Generation Formulation 21 Strategic Objectives Enhanced Efficacy Achieve target blood levels to drive better clinical response Improved Safety Profile Optimize PK to mitigate somnolence levels Reduced Dosing Frequency More sustained serum levels to reduce dosing frequency Lowered COGS Better absorption to reduce API requirements per dose Enhanced IP Protection New IP associated with second generation formulation Expanded Indication Improved PK could address new areas of unmet need Expected Next Steps • Second generation ganaxolone formulation Phase 1 topline data on track for mid - 2022 readout • Selection of prodrug candidate by mid - 2022 Prodrug Opportunity Improve Product Profile Applicability to Both Oral and IV New Composition of Matter IP Protection Flexibility for IV Franchise

©2022 Marinus Pharmaceuticals. All Rights Reserved I Average Ganaxolone Levels Correlate with Seizure Reduction 22 • Logarithms of plasma ganaxolone level and percentage change in major motor seizure frequency were negatively correlated • Patients in the Medium and High ganaxolone level groups had an average ganaxolone concentration of 120 ng/mL and a median 38.5% reduction in seizure frequency • Incidence of CNS - related adverse events was similar across ganaxlone dose level groups Log e percentage change in major motor seizure frequency was calculated as log e (percentage change + 100) 3.0 3.5 4.0 4.5 5.0 5.5 6.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 Loge GNX Level (ng/mL) L o g e P e r c e n t C h a n g e M a j o r M o t o r S e i z u r e F r e q u e n c y E q u i v a l e n t % C h a n g e i n M a j o r M o t o r S e i z u r e F r e q u e n c y r = -0.512 p = 0.001 *Pearson correlation * 145 48.4 -10.0 -45.4 -66.9 -79.9 -87.8 Equivalent GNX Level (ng/mL) 20.1 33.1 54.6 90.0 148 245 403 Low (40 ng/mL*) Medium (70 ng/mL*) High (170 ng/mL*) -100 -75 -50 -25 0 25 50 75 100 P e r c e n t C h a n g e i n M a j o r M o t o r S e i z u r e F r e q u e n c y **p = 0.01 *mean GNX level within Group **Kruskal-Wallis Test n=13 n=13 n=12 Goal of reformulation is to drive consistent plasma ganaxolone levels to the mid - and upper - end of the target range

©2022 Marinus Pharmaceuticals. All Rights Reserved I Second Generation Formulation Rationale 23 Target PK Parameters • Increase absorption to achieve target exposure (AUC) • Increase the proportion of time plasma concentration exceeds the nominal minimally effective concentration (MEC) • Avoid significant increase in somnolence - associated peak concentration (C max ) Anticipate Enhanced Exposure • In one of the shortlisted formulations: • Single dose administration in rats delivered 6 - 10 - fold increase in Cmax and 2 - 5 - fold increase in AUC • Species is a model very translatable to human dosing in our experience with ganaxolone Current Target Illustrative PK profiles. Prolonged duration of action 0 2 4 6 8 0 200 400 600 800 Ti m e ( h r s ) n g / m l GNX - NF - excipient2 20 mg/kg GNX - NF - excipient1 - 20mg/kg GNX current Suspension 20 mg/kg GNX - NF: Ganaxolone New Formulation

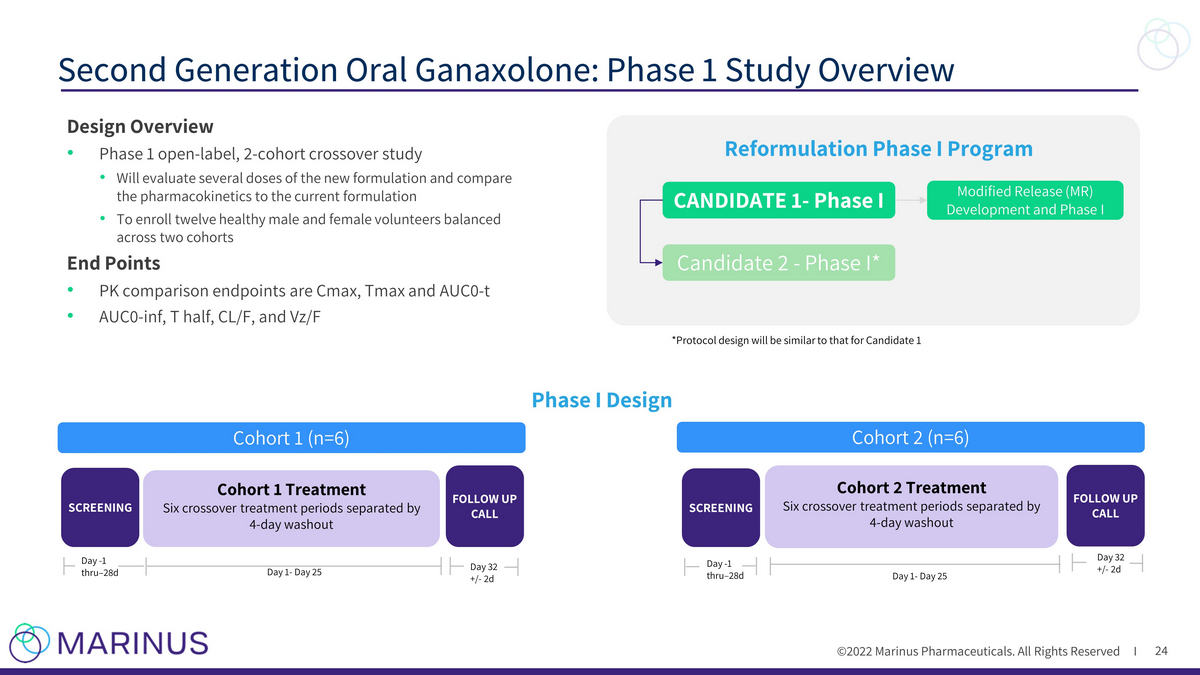

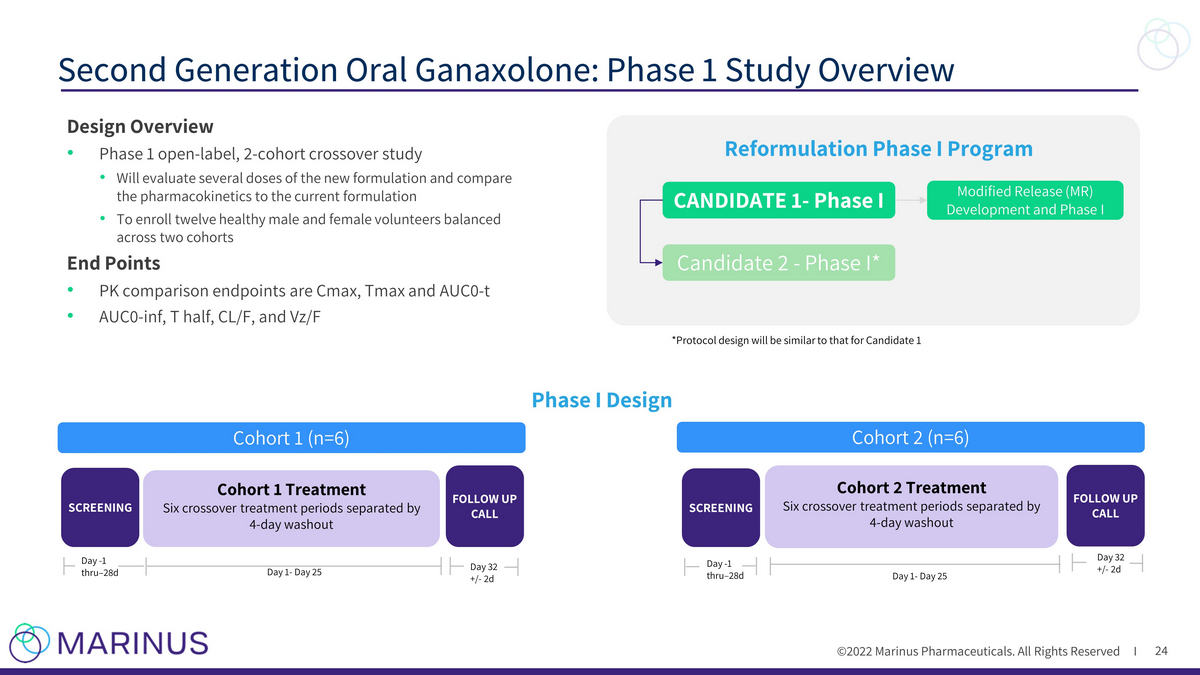

©2022 Marinus Pharmaceuticals. All Rights Reserved I Second Generation Oral Ganaxolone: Phase 1 Study Overview 24 SCREENING Cohort 1 Treatment Six crossover treatment periods separated by 4 - day washout Cohort 2 (n=6) SCREENING Day - 1 thru – 28d Cohort 2 Treatment Six crossover treatment periods separated by 4 - day washout Day 1 - Day 25 FOLLOW UP CALL Day 32 +/ - 2d FOLLOW UP CALL Day 1 - Day 25 Day 32 +/ - 2d Day - 1 thru – 28d Cohort 1 (n=6) Phase I Design CANDIDATE 1 - Phase I Candidate 2 - Phase I* Modified Release (MR) Development and Phase I Reformulation Phase I Program *Protocol design will be similar to that for Candidate 1 Design Overview • Phase 1 open - label, 2 - cohort crossover study • Will evaluate several doses of the new formulation and compare the pharmacokinetics to the current formulation • To enroll twelve healthy male and female volunteers balanced across two cohorts End Points • PK comparison endpoints are Cmax , Tmax and AUC0 - t • AUC0 - inf, T half, CL/F, and Vz /F

©2022 Marinus Pharmaceuticals. All Rights Reserved I Clinical development plan will be designed to: • Quickly evaluate multiple candidates for the key PK parameters • Be opportunistic about early entry to Phase 2 (likely LGS), or to deepen PK insights for a potentially rapid move to a pivotal trial • Balance clinical progress with formulation optimization opportunity Development Options for Second Generation in New Indication 25 Phase 3 LGS (2 dose(s) vs placebo) First In Human Study Additional Phase 1 Phase 3 LGS (1 dose vs placebo) Ph2 LGS Key target PK; rapid go/no - go Dose exploration opportunity Several possible Phase 3 or Phase 2/3. The range of design options will be refined at each stage of development PK insights for early pivotal trial start Seamless/adaptive Ph 2 - 3 design Multiple FIH candidates Pivotal trial options Formulation Optimization

Acute Seizure Disorders Intravenous (IV) Ganaxolone Pipeline

Status Epilepticus

©2022 Marinus Pharmaceuticals. All Rights Reserved I Status Epilepticus (SE): Definition and Epidemiology 28 SE is the second most common neurologic emergency in the U.S. 1 150,000 cases per year 2 1. Anesthesia and Intensive Care Medicine, February 02, 2018 , Update on the management of status epilepticus 2. DeLorenzo RJ Pellock JM Towne AR Boggs JG. Epidemiology of status epilepticus. J Clin Neurophysiol. 1995; 12: 316 - 325 Background Prolonged continuous or near - continuous seizures Heterogeneous patient population with etiologies that include brain tumors, stroke, encephalitis, drug or alcohol withdrawal or overdose Pre - existing epilepsy in less than half of SE cases Status epilepticus can result in permanent neuronal damage and contribute to high morbidity and mortality Becomes more treatment refractory with progression

©2022 Marinus Pharmaceuticals. All Rights Reserved I Strategic Approach to SE Clinical Development 29 Benzodiazepine Administered IV AEDs (antiepileptic drugs) IV Anesthetics Convulsive SE 1. Leitinger M 2019 Epilepsia (Medically induced Coma) Established Status Epilepticus (ESE) Super Refractory Status Epilepticus (SRSE) Refractory Status Epilepticus (RSE) 1st Line 2nd Line 3rd Line Status Epilepticus 45 % of total SE population 1 55 % of total SE population 1 Non - Convulsive SE/ Focal SE

©2022 Marinus Pharmaceuticals. All Rights Reserved I 30 Pharmacokinetics/Pharmacodynamics Well Suited for Acute SE Treatment Experimental PK – plasma and brain 1 Brain and plasma concentration after ganaxolone 3 mg/kg IM in mice Human PD – EEG changes 2 EEG bispectral index in healthy volunteers following IV ganaxolone 1. Zolkowska D, Wu CY, Rogawski MA. Intramuscular allopregnanolone and ganaxolone in a mouse model of treatment-resistant status epilepticus. Epilepsia. 2018 Oct;59:220 - 7. 2. Data on file, Marinus Pharmaceuticals, inc . Human PK 2 Following 30 mg ganaxolone bolus (over 5 minutes): C max 1,240 ng/mL T max 0.08 hrs Ganaxolone activates the extrasynaptic GABA A receptor, is associated with high brain concentrations, and delivers a rapid onset of action. Mechanism of action has not been fully elucidated.

©2022 Marinus Pharmaceuticals. All Rights Reserved I Treatment Period Loading Dose Maintenance Taper 31 Phase 2 Refractory Status Epilepticus Trial Design • Diagnosis of convulsive or non - convulsive SE • Failed at least one 2 nd line IV AED but had not progressed to 3 rd line IV anesthetics Bolus plus continuous infusion 2 - 4 day infusion 18 - hour taper Screening Post - treatment Follow - up 24 hour Weeks 2, 3, 4 SE Patients Cohort Dose of ganaxolone/day N Low 500mg/day 5 Medium 650mg/day 4 High 713mg/day 8 Goals of a new treatment Limitations of current treatments Endpoints • Rapid cessation • Maintenance of seizure control • Prevent progression to IV anesthetics • 1st line Benzodiazepines ineffective in 45% - 50%; limited by cardiovascular and respiratory side effects • 2nd line Ineffective in over 50% of established SE; further decreased response in refractory SE • 3rd line IV Anesthetics: high morbidity, mortality ~35%; increased duration of hospitalization and costs of care • Primary: Percent of patients who did not require escalation of treatment with IV anesthetic within the first 24 hours after ganaxolone initiation • Secondary: Additional efficacy, safety and tolerability

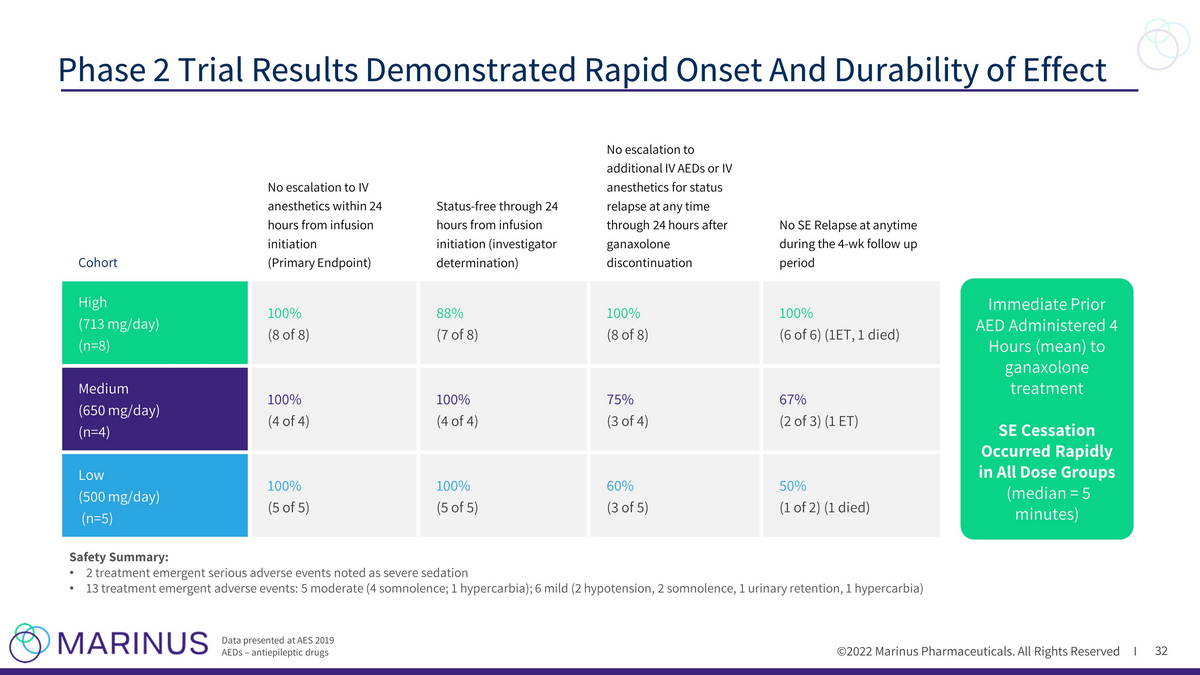

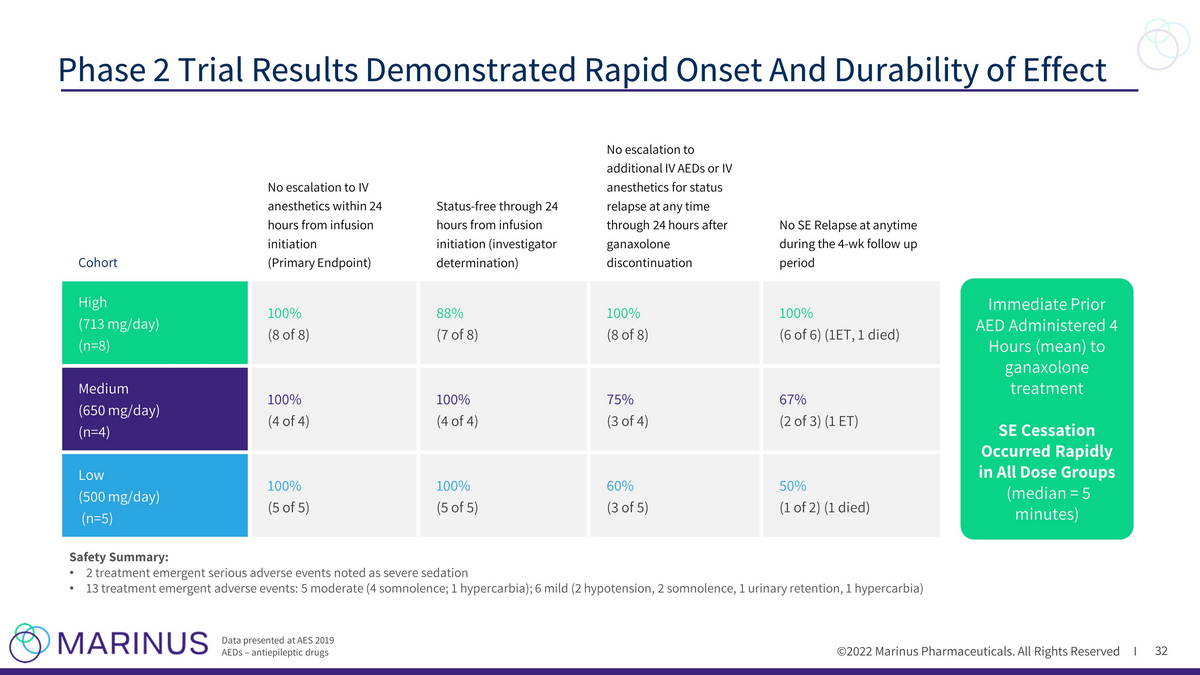

©2022 Marinus Pharmaceuticals. All Rights Reserved I 32 Phase 2 Trial Results Demonstrated Rapid Onset And Durability of Effect Data presented at AES 2019 AEDs – antiepileptic drugs Cohort No escalation to IV anesthetics within 24 hours from infusion initiation (Primary Endpoint) Status - free through 24 hours from infusion initiation (investigator determination) No escalation to additional IV AEDs or IV anesthetics for status relapse at any time through 24 hours after ganaxolone discontinuation No SE Relapse at anytime during the 4 - wk follow up period High (713 mg/day) (n=8) 100% (8 of 8) 88% (7 of 8) 100% (8 of 8) 100% (6 of 6) (1ET, 1 died) Medium (650 mg/day) (n=4) 100% (4 of 4) 100% (4 of 4) 75% (3 of 4) 67% (2 of 3) (1 ET) Low (500 mg/day) (n=5) 100% (5 of 5) 100% (5 of 5) 60% (3 of 5) 50% (1 of 2) (1 died) Immediate Prior AED Administered 4 Hours (mean) to ganaxolone treatment SE Cessation Occurred Rapidly in All Dose Groups (median = 5 minutes) Safety Summary: • 2 treatment emergent serious adverse events noted as severe sedation • 13 treatment emergent adverse events: 5 moderate (4 somnolence; 1 hypercarbia); 6 mild (2 hypotension, 2 somnolence, 1 urinar y r etention, 1 hypercarbia)

©2022 Marinus Pharmaceuticals. All Rights Reserved I 33 PK/PD Relationship and Rationale for Target Dose Modeled PK Curves for All Dose Groups High Dose Achieves Target Range ≥ 500 ng/mL for ~8 hours Only High Dose Provided Sustained Reduction (>80%) Throughout Entire Analysis Window Data presented at AES 2019 PK: Pharmacokinetics / PD: Pharmadynamic Seizure Burden Reduction Occurred Rapidly in All Dose Groups

©2022 Marinus Pharmaceuticals. All Rights Reserved I U.S. RSE Phase 3 RAISE Trial Design 34 Ganaxolone development for RSE is being funded, in part, by the Biomedical Advanced Research and Development Authority (BARDA), part of the Office of the Assistant Secretary for Preparedness and Response at the U.S. Department of Health and Hum an Services, under contract number 75A50120C00159. TRIAL DESIGN • Randomized, placebo - controlled trial TARGET PATIENT POPULATION • Status epilepticus patients (n=124) who have failed benzodiazepines and ≥ 2 IV AEDs DOSING • 36 - hour infusion followed by a 12 - hour taper (48 - hour treatment) • Phase 2 dose paradigm and extends ganaxolone plasma exposure ≥ 500 ng/mL for 12 hours CO - PRIMARY ENDPOINTS • Proportion of participants with SE cessation within 30 minutes of trial drug initiation without medications for the acute treatment of SE • Proportion of participants with no progression to IV anesthesia for 36 hours following trial drug initiation SECONDARY ENDPOINTS • No progression to IV anesthesia for 24 hours off trial drug (i.e., 72 hours) • Time to SE cessation • Healthcare utilization metrics (e.g., length of stay, # of days in the ICU) • Functional outcomes • Safety measures SCREENING Dose Initiation (Time 0) Treatment Period Follow - up Period Weeks 1,2,3 & 4 Daily 48 - 120 hours Day 2 Hours 24 - 48 Hours 36 - 48 (taper) Daily Hours 0 - 24 Bolus dose Continuous Infusion Taper Treatment is planned to be 2 days (including a 12 - hour taper)

©2022 Marinus Pharmaceuticals. All Rights Reserved I RAISE Site Locations (As of Q1 2022) 35 Current & Anticipated High Enrollers Activated: Brigham and Women's Hospital Carle Foundation Hospital Washington University School of Medicine Oregon Health and Science University Rancho Research Institute Massachusetts General Hospital Mayo Clinic Sites Yale University School of Medicine Columbia University Medical Center Boston Medical Center Cleveland Clinic Temple University 52 Activated Sites

Status Epilepticus Development Plan

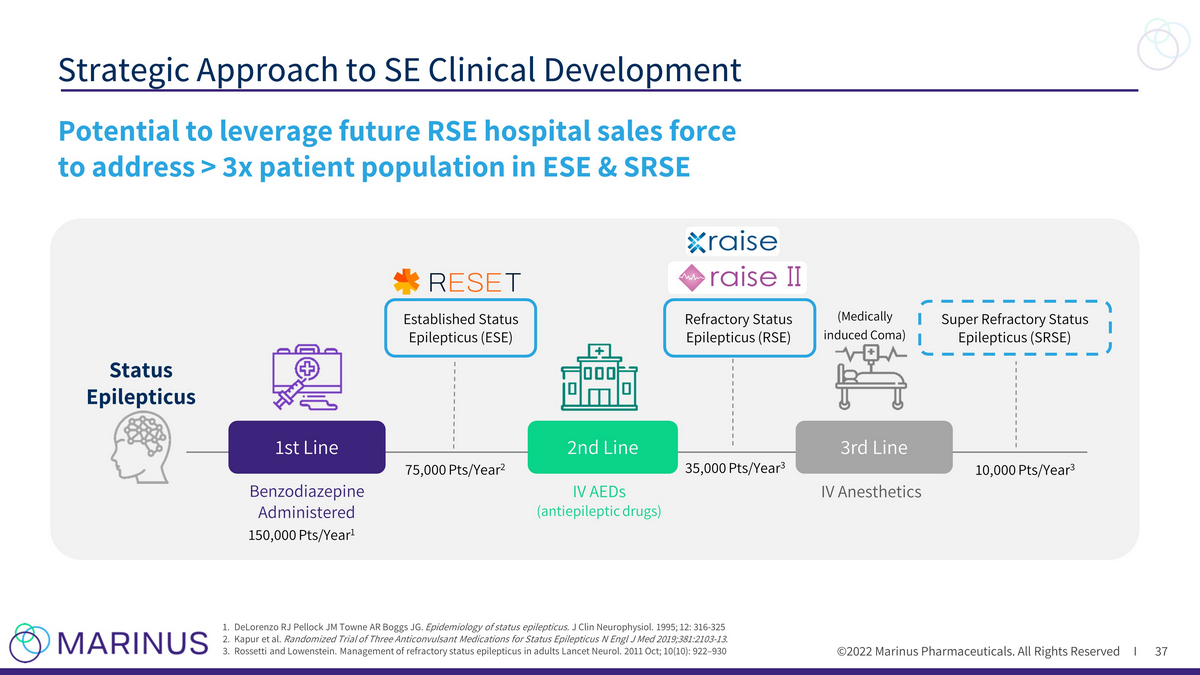

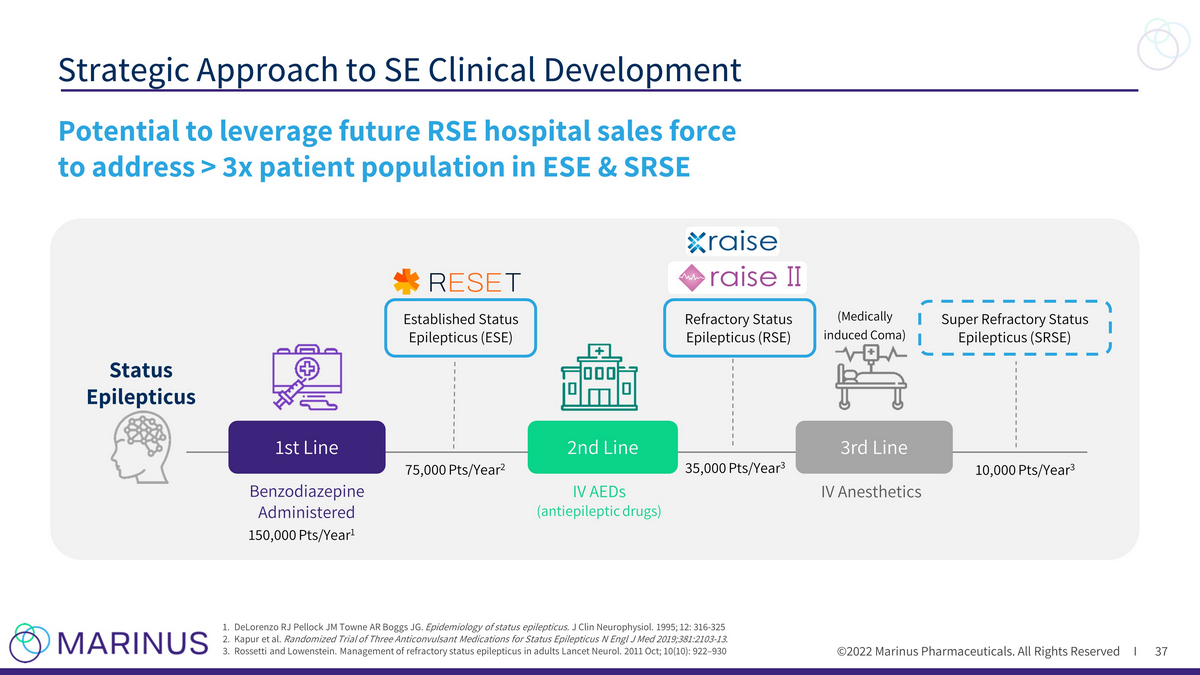

©2022 Marinus Pharmaceuticals. All Rights Reserved I Strategic Approach to SE Clinical Development 37 1. DeLorenzo RJ Pellock JM Towne AR Boggs JG. Epidemiology of status epilepticus. J Clin Neurophysiol. 1995; 12: 316 - 325 2. Kapur et al. Randomized Trial of Three Anticonvulsant Medications for Status Epilepticus N Engl J Med 2019;381:2103 - 13. 3. Rossetti and Lowenstein. Management of refractory status epilepticus in adults Lancet Neurol. 2011 Oct; 10(10): 922 – 930 Potential to leverage future RSE hospital sales force to address > 3x patient population in ESE & SRSE Benzodiazepine Administered (Medically induced Coma) Established Status Epilepticus (ESE) IV AEDs (antiepileptic drugs) IV Anesthetics Super Refractory Status Epilepticus (SRSE) Refractory Status Epilepticus (RSE) 1st Line Status Epilepticus 3rd Line 2nd Line 150,000 Pts/Year 1 75,000 Pts/Year 2 35,000 Pts/Year 3 10,000 Pts/Year 3

©2022 Marinus Pharmaceuticals. All Rights Reserved I Expanding the Ganaxolone Opportunity in Status Epilepticus 38 RESET Trial Established Status Epilepticus • Access broader patient population earlier in continuum • 75,000 ESE patients per year (~2x RSE population) ¹ , ² • Study in ER setting in patients with convulsive SE who failed benzodiazepines RAISE Trial Refractory Status Epilepticus • 35,000 U.S. RSE patients per year ¹ , ³ • ~1/3 of RSE patients progress to SRSE 4 • High unmet clinical need and healthcare cost burden RAISE II Trial Refractory Status Epilepticus • Adjunctive therapy with standard of care AEDs • Initiate trial drug after failure of one rather than two second line AEDs • Endpoint modified to align with standard of care in Europe Phase 4 program to further explore impacts of SE and inform appropriate clinical use 4 Delaj L et al. Acta Neurol Scand. 2017 Jan;135(1):92 - 99 5 15% Sanchez and Rincon. J Clin Med. 2016 Aug; 5(8): 71 ¹DeLorenzo RJ et al. J Clin Neurophysiol. 1995; 12: 316 - 325 ²Kapur et al. N Engl J Med 2019;381:2103 - 13 ³ Rossetti and Lowenstein. Lancet Neurol. 2011 Oct; 10(10): 922 – 930

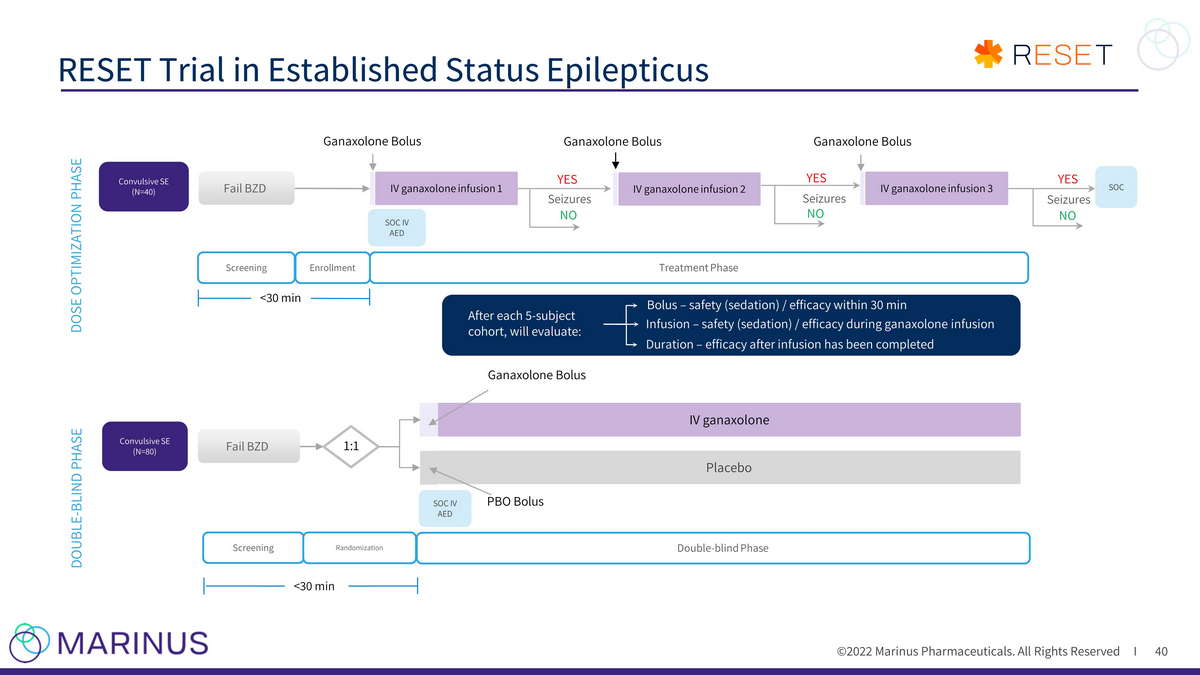

©2022 Marinus Pharmaceuticals. All Rights Reserved I RESET: Phase 2 Trial in Established Status Epilepticus 39 1 Kapur et al. Randomized Trial of Three Anticonvulsant Medications for Status Epilepticus N Engl J Med 2019;381:2103 - 13. Key Trial points: • Patients with convulsive status epilepticus • New dosing paradigm • FDA has indicated alignment on overall study design • Exception From Informed Consent community engagement planning underway • Planned start in 2H 2022 Benzodiazepine Administered IV AEDs (antiepileptic drugs) IV Anesthetics (Medically induced Coma) Established Status Epilepticus (ESE) Super Refractory Status Epilepticus (SRSE) Refractory Status Epilepticus (RSE) 1st Line 2nd Line 3rd Line Status Epilepticus ICU Tertiary Center ICU Emergency Room Key Trial points: • Patients with convulsive status epilepticus • New dosing paradigm • FDA has indicated alignment on overall study design • Exception From Informed Consent community engagement planning underway • Planned start in 2H 2022

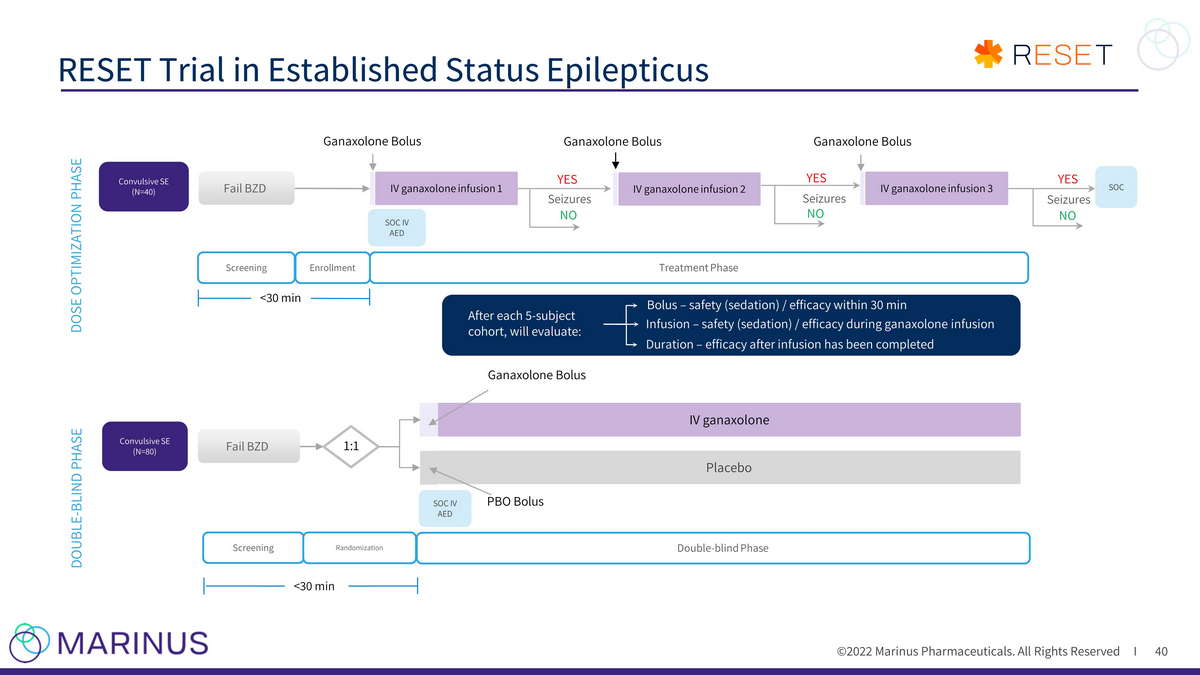

©2022 Marinus Pharmaceuticals. All Rights Reserved I RESET Trial in Established Status Epilepticus 40 Screening <30 min Double - blind Phase Enrollment Placebo IV ganaxolone Fail BZD IV ganaxolone infusion 1 IV ganaxolone infusion 3 SOC IV AED Convulsive SE (N=40) Ganaxolone Bolus Ganaxolone Bolus Ganaxolone Bolus Seizures YES NO Seizures YES NO Seizures YES NO SOC Screening Randomization Treatment Phase Fail BZD <30 min 1:1 Convulsive SE (N=80) DOSE OPTIMIZATION PHASE DOUBLE - BLIND PHASE After each 5 - subject cohort, will evaluate: Bolus – safety (sedation) / efficacy within 30 min Infusion – safety (sedation) / efficacy during ganaxolone infusion Ganaxolone Bolus SOC IV AED PBO Bolus Duration – efficacy after infusion has been completed IV ganaxolone infusion 2

©2022 Marinus Pharmaceuticals. All Rights Reserved I Treatment of Refractory Status Epilepticus: RAISE vs. RAISE II 41 RAISE Trial: • Failure of benzodiazepines and two or more second line AEDs RAISE II Trial: • Failure of benzodiazepines and initial second line AEDs • Ganaxolone to be initiated earlier in the course of RSE 1 Kapur et al. Randomized Trial of Three Anticonvulsant Medications for Status Epilepticus N Engl J Med 2019;381:2103 - 13. Key Trial points: • Patients with convulsive status epilepticus • New dosing paradigm • FDA has indicated alignment on overall study design • Exception From Informed Consent community engagement planning underway • Planned start in 2H 2022 Benzodiazepine Administered IV AEDs (antiepileptic drugs) IV Anesthetics (Medically induced Coma) Established Status Epilepticus (ESE) Super Refractory Status Epilepticus (SRSE) Refractory Status Epilepticus (RSE) 1st Line 2nd Line 3rd Line Status Epilepticus ICU Tertiary Center ICU Emergency Room

©2022 Marinus Pharmaceuticals. All Rights Reserved I Trial Goals: • Support potential European approval in RSE • Potential indication expansion opportunity (relative to the RAISE trial population) Proposed Phase 3 Trial in Refractory SE (RAISE II) 42 TRIAL ATTRIBUTES TRIAL POPULATION Failure of benzodiazepines and at least two IV AED’s (RSE) (n=124) Failure of benzodiazepines and at least one IV AED’s (RSE) (n=70) COMPARATOR Ganaxolone vs. Placebo in patients receiving background standard of care Ganaxolone vs. Placebo with concurrent IV AED initiation PRIMARY ENDPOINT Co - primary endpoints : (1)SE cessation within 30 min (2) no escalation to IV anesthesia within 36 hrs Responder analysis: SE cessation within 30 min and no escalation of care within 36 hrs GEOGRAPHIC LOCATION U.S. and Canada EU/UK/U.S.

Building Commercial Infrastructure for Future IV Launches

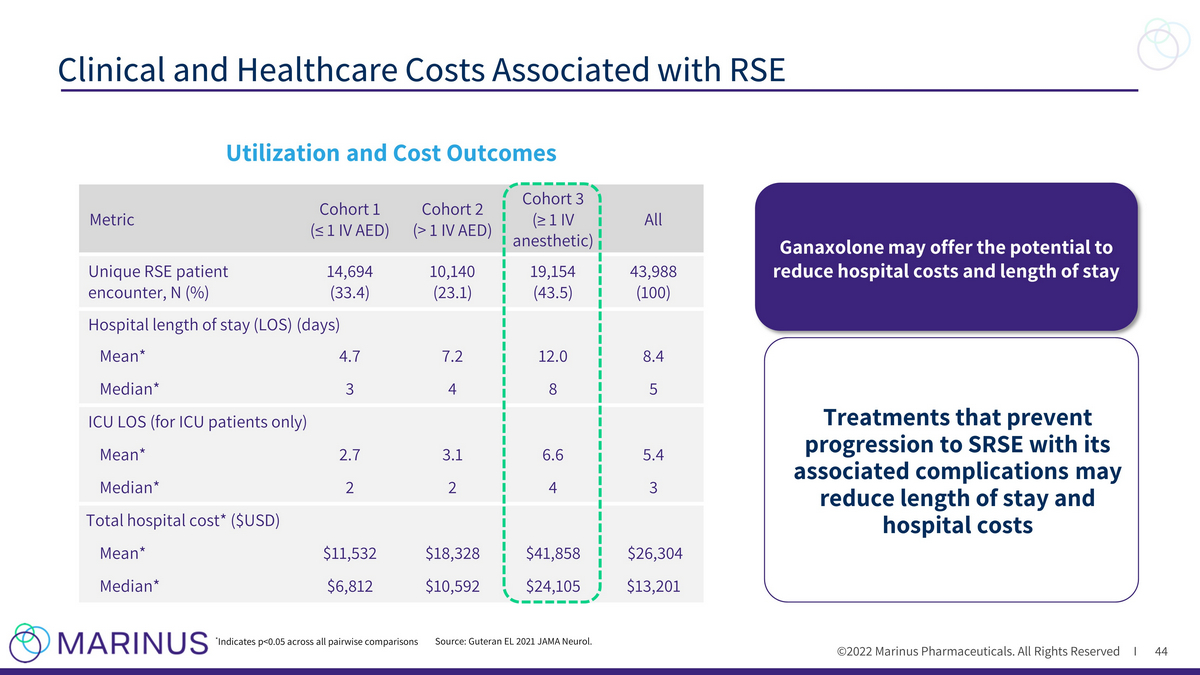

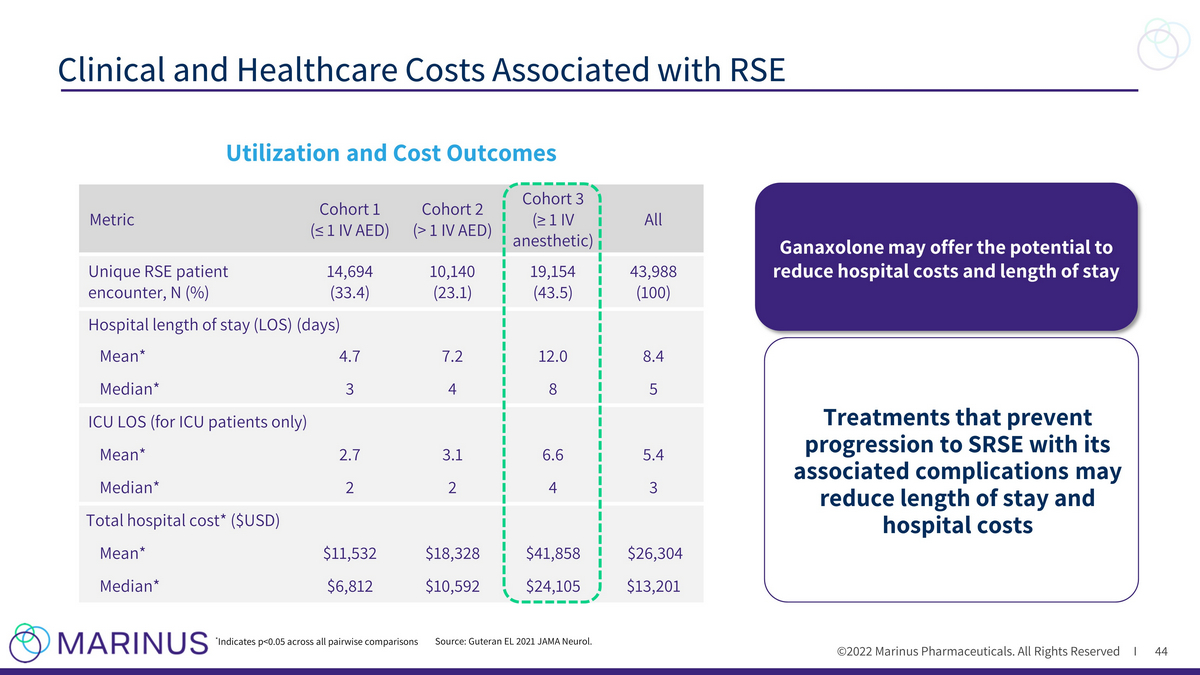

©2022 Marinus Pharmaceuticals. All Rights Reserved I Clinical and Healthcare Costs Associated with RSE 44 Utilization and Cost Outcomes Metric Cohort 1 (≤ 1 IV AED) Cohort 2 (> 1 IV AED) Cohort 3 (≥ 1 IV anesthetic) All Unique RSE patient encounter, N (%) 14,694 (33.4) 10,140 (23.1) 19,154 (43.5) 43,988 (100) Hospital length of stay (LOS) (days) Mean* 4.7 7.2 12.0 8.4 Median* 3 4 8 5 ICU LOS (for ICU patients only) Mean* 2.7 3.1 6.6 5.4 Median* 2 2 4 3 Total hospital cost* ($USD) Mean* $11,532 $18,328 $41,858 $26,304 Median* $6,812 $10,592 $24,105 $13,201 * Indicates p<0.05 across all pairwise comparisons Source: Guteran EL 2021 JAMA Neurol. Ganaxolone may offer the potential to reduce hospital costs and length of stay Treatments that prevent progression to SRSE with its associated complications may reduce length of stay and hospital costs

©2022 Marinus Pharmaceuticals. All Rights Reserved I Differentiated Market Access Strategy to Ensure Success for IV Ganaxolone Formulation 45 (DRG), diagnosis - related group reimbursement PRICING & REIMBURSEMENT • U.S./EU Pricing research initiated and ongoing • Determining New Technology Add - on Payment (NTAP) timing • Evaluating DRGs and other hospital payment systems DELIVERY & PATIENT ACCESS • Aligning on distribution pathway • Building plan for RSE and evaluating impact of ESE expansion VALUE PROPOSITION & HEALTH ECONOMIC MESSAGING • Assessing current treatment protocols • Evaluating burden of illness and hospital impact to expand & include cost avoidance metric CUSTOMER ENGAGEMENT • Considering impact of hospital networks to payer team • Ongoing assessment of potential hospital target segmentation underway

Financial Update

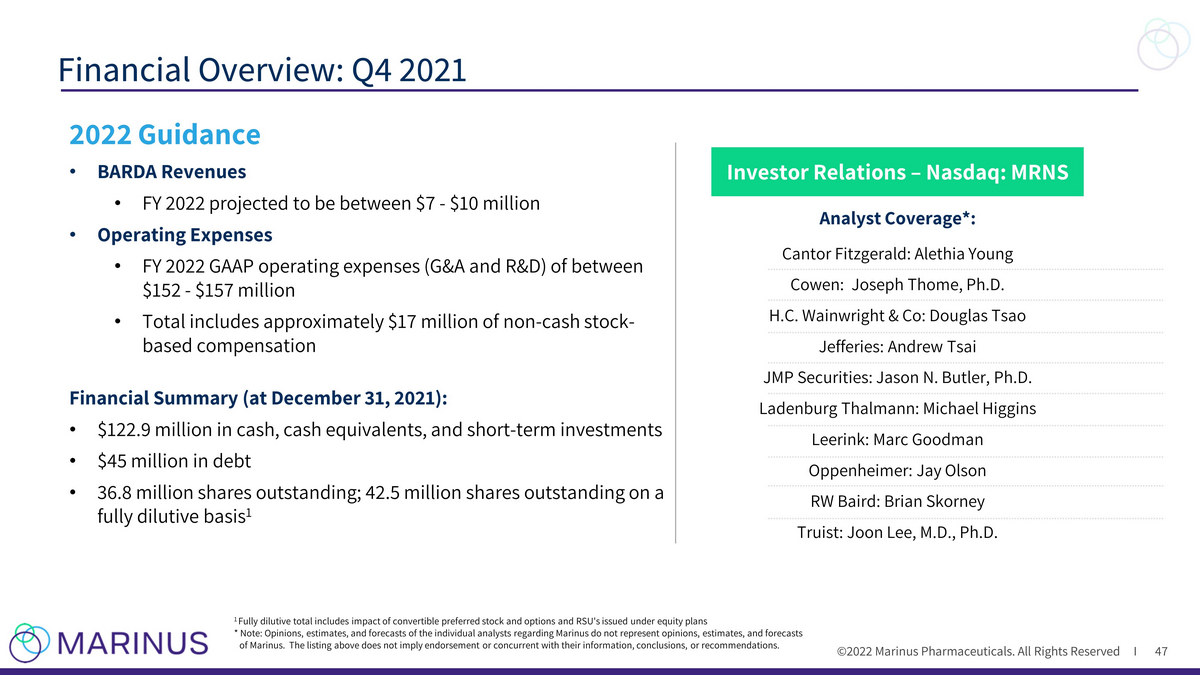

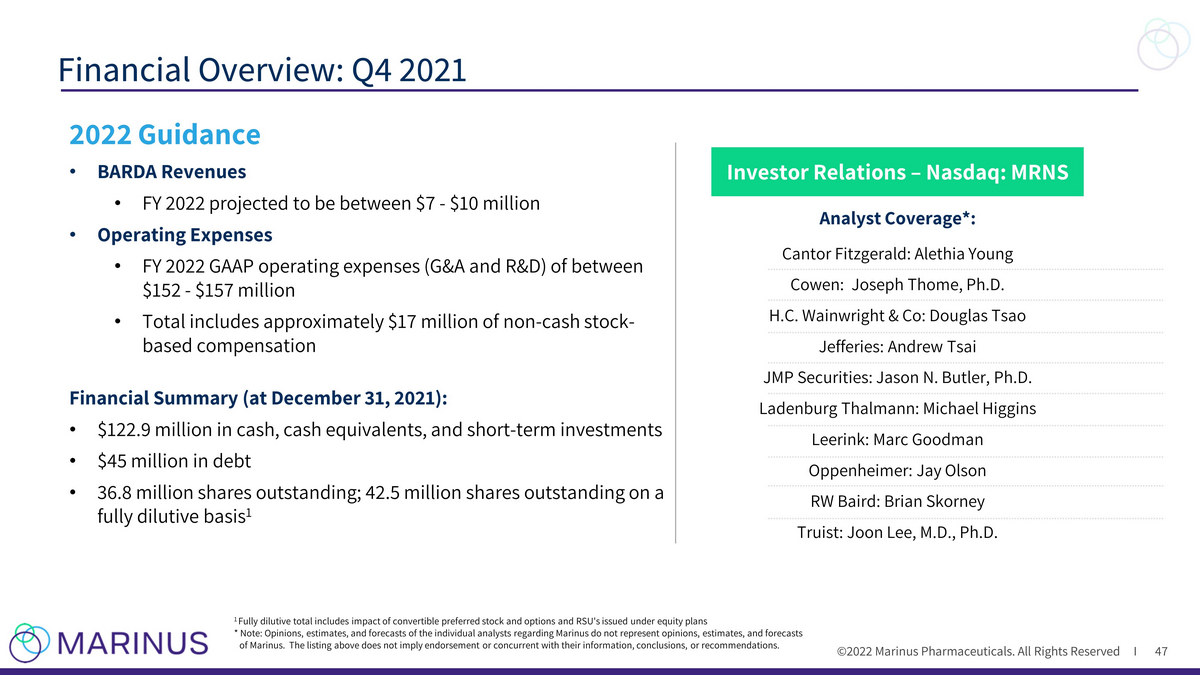

©2022 Marinus Pharmaceuticals. All Rights Reserved I Financial Overview: Q4 2021 47 Analyst Coverage*: Cantor Fitzgerald: Alethia Young Cowen: Joseph Thome, Ph.D. H.C. Wainwright & Co: Douglas Tsao Jefferies: Andrew Tsai JMP Securities: Jason N. Butler, Ph.D. Ladenburg Thalmann: Michael Higgins Leerink: Marc Goodman Oppenheimer: Jay Olson RW Baird: Brian Skorney Truist: Joon Lee, M.D., Ph.D. 1 Fully dilutive total includes impact of convertible preferred stock and options and RSU's issued under equity plans * Note: Opinions, estimates, and forecasts of the individual analysts regarding Marinus do not represent opinions, estimates, an d forecasts of Marinus. The listing above does not imply endorsement or concurrent with their information, conclusions, or recommendations. Investor Relations – Nasdaq: MRNS 2022 Guidance • BARDA Revenues • FY 2022 projected to be between $7 - $10 million • Operating Expenses • FY 2022 GAAP operating expenses (G&A and R&D) of between $152 - $157 million • Total includes approximately $17 million of non - cash stock - based compensation Financial Summary (at December 31, 2021 ): • $122.9 million in cash, cash equivalents, and short - term investments • $45 million in debt • 36.8 million shares outstanding; 42.5 million shares outstanding on a fully dilutive basis 1

©2022 Marinus Pharmaceuticals. All Rights Reserved I Liquidity Overview 48 1 All values shown are expected gross transactional proceeds 2 Recent transactions in the $100 - 110 million range (BioMarin Feb. 2022 $110 million, Mirum Nov. 2021 $110 million, Albireo Sep. 2 021 $105 million, Prometic Aug. 2021 $105 million, Sarepta Apr. 2021 $102 million, Rhythm Jan. 2021 $100 million) 3 PRV received based on Rare Pediatric Disease (RPD) designation for CDD 4 Subject to, among other limitations, liens on royalty payment and proceeds from sales of ganaxolone in the U.S. not exceeding 5% of new sales in the U.S. Financial Summary as of December 31, 2021: • $122.9 million in cash, cash equivalents , and short - term investments • $45 million in debt; interest - only through May 2024, matures 2026 Anticipated & Potential Non - Dilutive Funding Options 1 : FDA Approval March 2022 $30 million Oaktree Capital credit funding available based upon FDA CDD approval Monetization of Priority Review Voucher (PRV) 2 ,3 PRV awarded based on FDA CDD approval U.S. synthetic royalty monetization deal Permitted per Oaktree Capital agreement 4 Ongoing R&D Reimbursement: BARDA and Orion Corporation Orion Corporation milestones & royalties Q1 2022

Intellectual Property

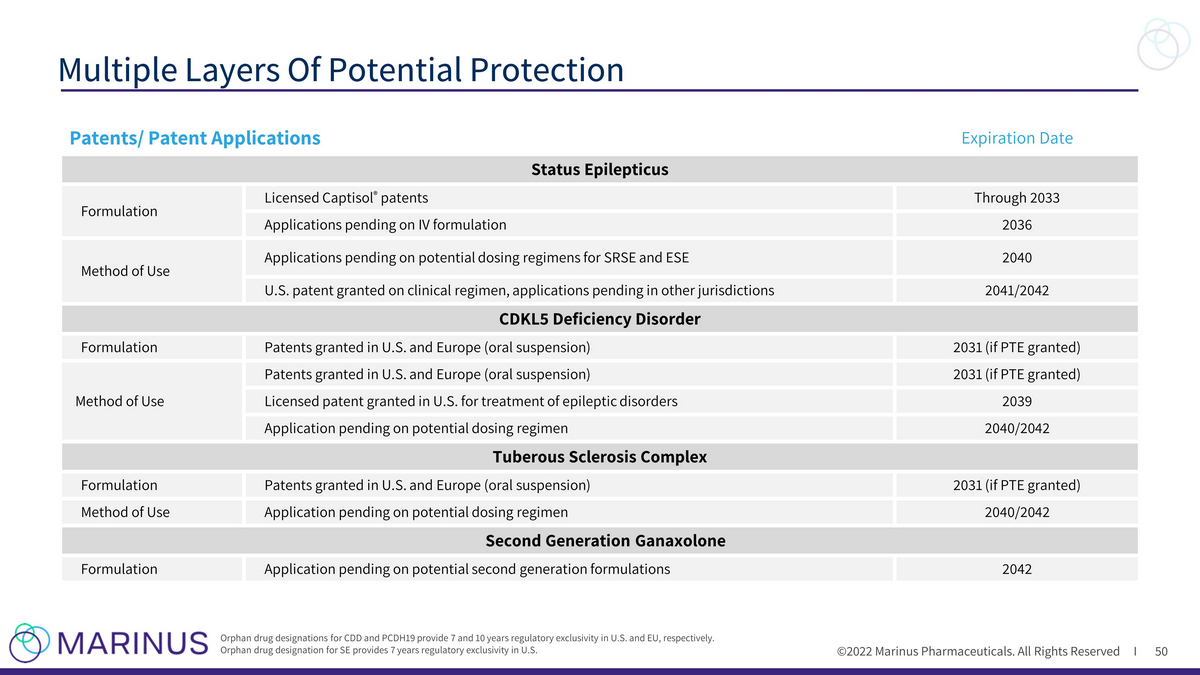

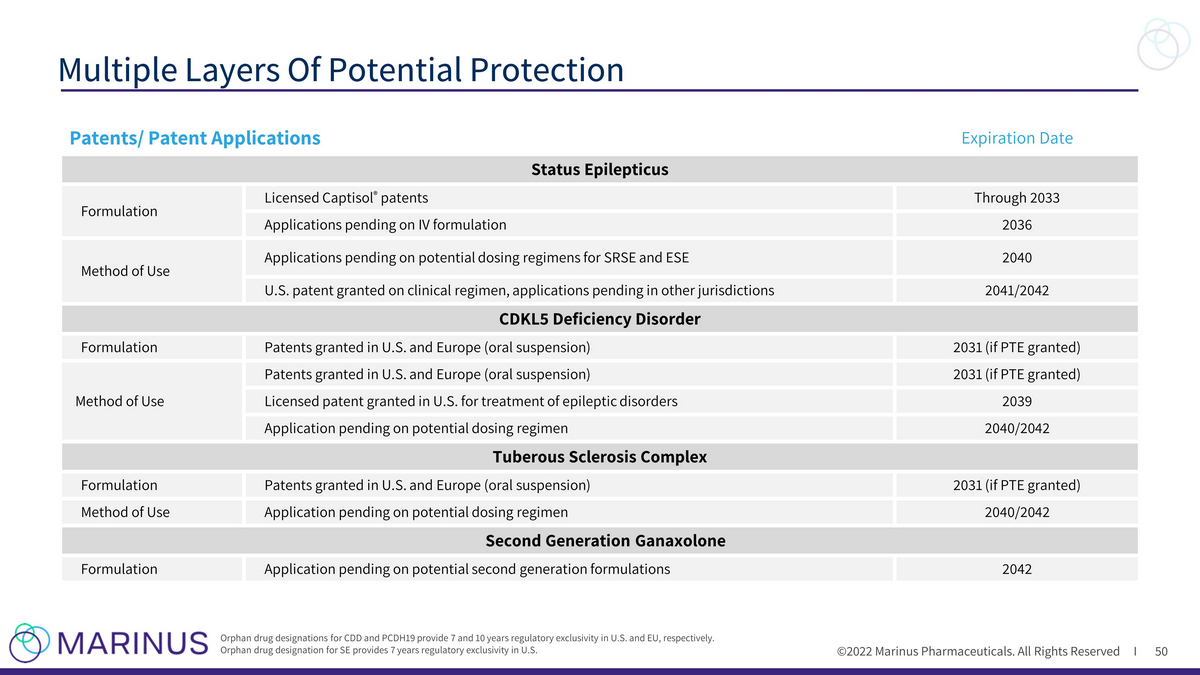

©2022 Marinus Pharmaceuticals. All Rights Reserved I Multiple Layers Of Potential Protection 50 Orphan drug designations for CDD and PCDH19 provide 7 and 10 years regulatory exclusivity in U.S. and EU, respectively. Orphan drug designation for SE provides 7 years regulatory exclusivity in U.S. Patents/ Patent Applications Expiration Date Status Epilepticus Formulation Licensed Captisol ® patents Through 2033 Applications pending on IV formulation 2036 Method of Use Applications pending on potential dosing regimens for SRSE and ESE 2040 U.S. patent granted on clinical regimen, applications pending in other jurisdictions 2041/2042 CDKL5 Deficiency Disorder Formulation Patents granted in U.S. and Europe (oral suspension) 2031 (if PTE granted) Method of Use Patents granted in U.S. and Europe (oral suspension) 2031 (if PTE granted) Licensed patent granted in U.S. for treatment of epileptic disorders 2039 Application pending on potential dosing regimen 2040/2042 Tuberous Sclerosis Complex Formulation Patents granted in U.S. and Europe (oral suspension) 2031 (if PTE granted) Method of Use Application pending on potential dosing regimen 2040/2042 Second Generation Ganaxolone Formulation Application pending on potential second generation formulations 2042