Exhibit 99.1

China Life Insurance Company Limited

CSR 2016

Corporate Social Responsibility Report

Fulfilling ourselves to benefit others and fulfilling others

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

CATALOGUE

ABOUT THIS REPORT | 4 | |||||||

MESSAGE FROM THE CHAIRMAN | 6 | |||||||

ABOUT US | 8 | |||||||

| I | COMPANY PROFILE | 8 | ||||||

| II | ORGANIZATIONAL STRUCTURE | 9 | ||||||

BIG DATA OF CHINA LIFE IN 2016 | 10 | |||||||

SPECIAL FOCUS | 13 | |||||||

| I | FULFILLRESPONSIBILITIESTOSERVETHENATIONALECONOMICTRANSFORMATIONANDUPGRADING | 13 | ||||||

| II | SERVETHEPEOPLEANDHELPESTABLISHASECURITYNETWORKFORPEOPLE’SLIVELIHOOD | 15 | ||||||

| III | INTEGRATEINNOVATIVELYTOBOOSTTHETRANSFORMATIONOFGOVERNMENTADMINISTRATION | 18 | ||||||

RESPONSIBILITY MANAGEMENT | 20 | |||||||

| I | OPPORTUNITIESANDCHALLENGES | 20 | ||||||

| II | SOCIALRESPONSIBILITYCONCEPT | 22 | ||||||

| III | IDENTIFICATIONOFSUBSTANTIVEISSUES | 22 | ||||||

| IV | COMMUNICATIONWITHSTAKEHOLDERS | 23 | ||||||

| V | HONORS | 25 | ||||||

PART I GOOD FAITH | 27 | |||||||

| I | OPTIMIZE CORPORATE GOVERNANCE | 28 | ||||||

| II | STICKTOMORALOPERATION | 30 | ||||||

| III | CREATECONTINUOUSVALUE | 34 | ||||||

PART II CLIENT FOREMOST | 37 | |||||||

| I | PUSHFORWARDSERVICEUPGRADING | 38 | ||||||

| II | OPTIMIZECLIENTEXPERIENCE | 43 | ||||||

PART III HUMANISTIC CARE | 51 | |||||||

2

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

I | PROTECTEMPLOYEES’RIGHTSANDINTERESTS | 52 | ||||||

II | SUPPORTINGEMPLOYEES’GROWTH | 55 | ||||||

III | CAREFOREMPLOYEES’LIFE | 59 | ||||||

PART IV MUTUALLY BENEFICIAL COOPERATION | 61 | |||||||

I | SUPPORTSHAREDDEVELOPMENTWITHPARTNERS | 62 | ||||||

II | JOINTLYPROMOTEINDUSTRIALDEVELOPMENT | 64 | ||||||

PART V HARMONIOUS COEXISTENCE | 66 | |||||||

I | JOINTLYBUILDECOLOGICALCIVILIZATION | 67 | ||||||

II | JOINTLYBUILDHARMONIOUSCOMMUNITIES | 70 | ||||||

KEY PERFORMANCE | 80 | |||||||

STATISTICS OF TARGETED POVERTY ALLEVIATION WORK BY CHINA LIFE IN 2016 | 83 | |||||||

INDEX | 86 | |||||||

FEEDBACK | 91 | |||||||

3

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

About This Report

Period Scope:

From January, 2016 to December, 2016, and some contents may extend beyond the time scope if necessary.

Release Cycle:

This Report is an annual report and it is the ninth corporate social responsibility report released by this Company.

Report Coverage:

China Life Insurance Company Limited and its branch organizations.

Compilation Basis:

Report on Corporate Fulfillment of Social Responsibility released by Shanghai Stock Exchange;

Guiding Opinions of CIRC on Fulfillment of Corporate Social Responsibility by the Insurance Industry issued byChina Insurance Regulatory Commission (CIRC);

Environmental, Social and Governance Reporting Guide (ESG) released by HKEX;

G4Sustainability Reporting Guidelines released by Global Reporting Initiative (GRI);

Guidance on Social Responsibility (ISO 26000:2010); Guidance on Social Responsibility Reporting (GB/T 36001-2015);

China CSR Reporting Guidelines (CASS-CSR3.0) issued by Chinese Academy of Social Sciences.

Information Source:

The Company’s internal statistics and formally published documents and reports.

Reliability Assurance:

The Board of Directors of this Company and all its directors warrant that this Report is free of any fraud, misleading representation or major omission, and that they shall be jointly and severally liable for the truthfulness, accuracy and completeness of the contents hereof.

Reference:

For convenience and readability, China Life Insurance Company Limited is also referred to as “China Life”, “the Company”, and “we”.

4

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

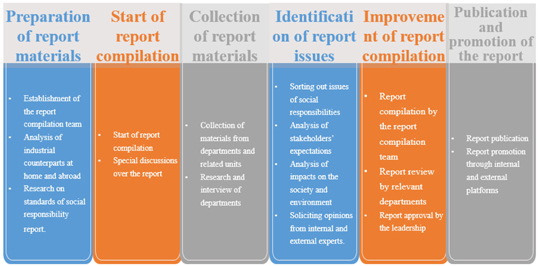

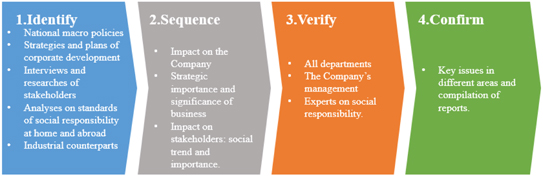

Preparation Process:

Access to Report:

The Report has three versions in English and Chinese simplified, Chinese traditional, if content understanding does not agree, please give priority to with reports of simplified version. The online report can be obtained from the official website of the Company (www.e-chinalife.com), the website of Shanghai Stock Exchange (www.sse.com.cn) and the website of HKEx (www.hkex.com.hk).

5

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Message from the Chairman

Stay true to the original mission and create a happy life

Sustainable development is founded upon responsibility, while a long-lasting history is dependent on people’s livelihood. Following the concept of “Fulfilling ourselves to benefit others and fulfilling others”, China Life serves the overall situation of China, contributes to poverty alleviation via insurance and improves people’s livelihood, steadily and rapidly heading for the ultimate goal of building a world-class insurance company.

2016 marks a milestone for China Life’s history. Faced with the complicated domestic and international economic situation and fierce market competition, we insisted on progressing in stability, centered on the supply-side structural reform, adhered to the business guideline of “stressing value, strengthening the workforce, optimizing structure, stabilizing growth, and preventing risks”, deepened reform and innovation, and have achieved breakthroughs in business development and strategic layout, drawing a good starting point for the 13th Five-Year Plan.

We adhere to the original mission of “insurance first” and realize a leap in the overall development of the service economy. Fulfilling social responsibility is the innate mission of insurance companies. We focused on services of the main business, and continuously improved our capacity to better fulfill social responsibility in business activities and serve the service economy with a wider range and deeper level. By the end of 2016, we had provided commercial insurance services for over 500 million customers based on the institutional network covering urban and rural areas. The Company’s overall strength was increased significantly with gross premium of CNY 430.498 billion, becoming the first and the only domestic insurance company with a gross premium exceeding CNY 400 billion. In 2016, the Company’s market value ranked first among global listed life insurance companies, won the first place in the competitiveness ranking of Asian life insurance companies and ranked 49th of 2016 Forbes Global 2000.

We adhere to the original mission of“client first”, innovate insurance services and enhance customer experience through new technologies. We have always put an emphasis on good faith and social responsibility. Conforming to the trend of social development, we accelerated the construction of “technology-oriented China Life” and started a new comprehensive business processing system to promote the transformation and upgrading of the Company. We expanded the internet service space based on customer experience, promoted the reengineering and optimization of the operating management process, and established a soundend-to-end management system of the business process. Relying on mobile internet technology, we launched two Apps “China Lifee-shop” and “China Lifee-insurance” for sales staff and customers, so that our services can be more efficient, convenient and considerate. China Life also pays great attention to customer demands. The Company promoted the “China Life 1 + N” service brand and enriched the product line to provide customers with“one-stop” products and services. In the “Best Insurance Products of

6

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

2016” campaign, “China Life Cancer Insurance”, “China Life Fu” and other eight products of China Life won the awards, topping the insurance industry. At the same time, the Company achieved the highest AA rating among life insurance companies in CIRC’s annual evaluation of insurance company services.

We stay true to the mission of “people first” and enhance the sense of achievement among employees and marketing partners. Committed to the concept of shared development, we have steadily implemented human resource reform. We treat hardworking employees as our foundation and responsible ones as our honor, and put everyone on the right position. We emphasize the improvement of professionalism, overall quality, income, and self-value of employees and sales staff to head for the target of “a strong company with rich staff”. The construction of sales force has also been accelerated in terms of quantity and quality, as its number has reached 1.814 million. The Company advocates happy work and healthy life, and endeavors to enrich the staff life via jogging, table tennis, singing competition and other activities. China Life also carried out an essay contest themed “Fulfilling ourselves to benefit others and fulfilling others” about corporate culture to promote employees’ spirit and company image.

We adhere to the original mission of “inclusive insurance” by supporting poverty alleviation with insurance.“Helping the needy and spreading loving care” is the eternal philosophy of China Life. Focusing on the national poverty alleviation strategy, we have given full play to our advantages, promoted targeted poverty alleviation projects and explored modes of poverty alleviation via insurance in Ningxia, Gansu and Chongqing. The “poverty alleviation insurance” mode Ningxia has been appraised by the State Council. The major disease insurance business was developing steadily, serving 420 million urban and rural residents accumulatively. Meanwhile, China Life conducted more than 330 items of handling business, with the service covering more than 81 million people. The Company has also carried out targeted poverty alleviation, improved the assistance mechanism, and taken an active part in public good to benefit the society. In 2016, through China Life Charity Foundation, the Company provided assistance funds forpoverty-stricken counties and provided special donations for families having lost their single child and poor women suffering from cervical cancer or breast cancer, and assisted and brought up orphans from Wenchuan Earthquake, Yushu Earthquake and Zhouqu Mudslide, all of which cost over CNY 34 million.

We keep the original mission in mind and keep progressing. 2017 is an important year for the 13th Five-Year Plan and thesupply-side structural reform. On the new long march of China Life, we will firmly establish new development concepts, seek progress in stability, accelerate development, promote transformation and upgrading and implement risk control to keep improving ourselves and create a sustainable future together with our stakeholders.

Chairman Yang Mingsheng

7

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

About Us

| I | Company Profile |

China Life Insurance Company Limited (the “Company” or “China Life”) is the largest life insurance company in China headquartered in Beijing. It has been listed in New York, Hong Kong and Shanghai. As a state-owned insurance enterprise, the Company provides both individuals and groups with life insurance, accident and health insurance products which cover survival, pension, disease, medical care, death and disability, and comprehensively meets customers’ needs for insurance protection, investment and wealth management in the field of personal insurance.

By the end of 2016, China Life Insurance Company Limited and its subsidiaries had accumulated total assets of CNY 2.7 trillion, ranking No.1 in domestic life insurance industry. With a gross premium of CNY 430.498 billion, China Life is the first insurance company whose gross premium has exceeded CNY 400 billion. The Company has 20,858 branches and subsidiaries, 98,505 employees and 1.814 million salespersons nationwide, and has about 246 million valid long-term individual and group life insurance policies, annuity contracts and long-term health insurance policies. The Company also provides policies and services of accident insurance and short-term health insurance for individuals and groups.

The Company has won the trust from the widest range of customers for its long history, solid financial strength, industry-leading competitiveness and worldwide reputable brand. It has always dominated the domestic life insurance market.

8

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

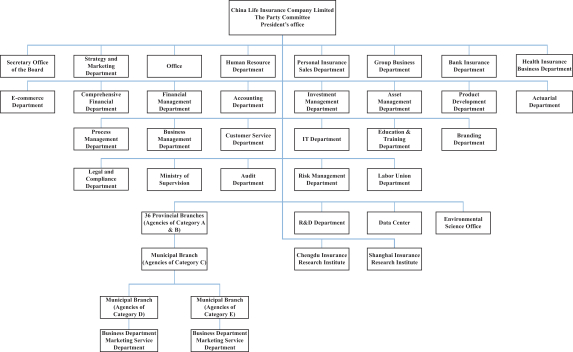

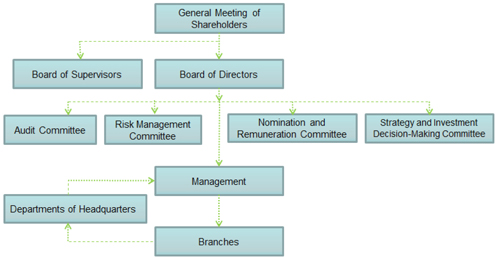

| II | Organizational Structure |

9

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

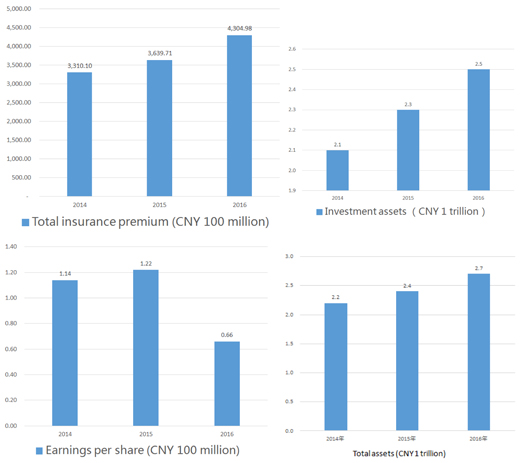

Big data of China Life in 2016

I. Good faith

CNY 2.7 trillion

Total assets

CNY 430.498 billion

Gross premium

CNY 191.27 billion

Net profits of shareholders of the parent company

CNY 0.66

Earnings per share (primary and diluted)

280.34%

Core solvency adequacy

20858

Branch organizations nationwide

|

II. Client first

8.86

Score of customer satisfaction survey on claim settlement

1.01 billion person-times

Notification services

34

Newly developed products

10.99 million

Users of China Lifee-insurance

|

10

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

25,000

Clerks in over 2,600 customer service centers

98.26%

Claims settled within 5 days

|

III. Humanistic care

98,505

Total number of employees �� CNY 170 million

Total training investment

CNY 13 million

Total investment in assisting needy employees

1.46 million

Total training person-times

101.5 hours

Average training hours

|

IV. Mutually beneficial cooperation

3,567

Total number of suppliers who participated in China Life’s centralized purchasing

630

Suppliers who participated in the centralized procurement in 2016

1.814 million

Total salespersons

|

11

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

V.All-win harmony

11.78 million

New electronic insurance orders via online channels likee-shop

219.59 million

Electronic orders of short-term insurance/digital vouchers within a year

33%

Electronic services coverage

420 million

Beneficiaries of major disease insurance

CNY 34.7274 million

Total donations of China Life Charity Foundation within a year

CNY 142 million

Total charitable donations

|

12

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Special Focus

Explain the original mission and serve the country through responsibility fulfillment

“Make insurance a pillar in a sound financial system, a key protection for better livelihood, a new means of efficient social management, an engine for the improvement of economic quality and economic growth, and a boost for the transformation of government functions.”

—Opinions of the State Council on Accelerating the Development of Modern Insurance Industry (hereinafter referred to as New National Ten Opinions)

|

Insurance industry plays an important role in promoting stable economic and social development as well as social harmony. As China’s largest life insurance company, China Life emphasizes the fulfillment of social responsibility and integrates its own development into the national economic and social development. The Company regards solving the prominent problems of the public as the new growth point, boosting the real economy as the starting point and focusing on the main business as the foothold, and seeks to establish a security network for thewell-off society via insurance products and services.

I | Fulfill responsibilities to serve the national economic transformation and upgrading |

The modern insurance industry is an efficient engine of the country’s economic transformation and upgrading. Guided by the innovation-driven strategy, China Life is continuously enhancing the capacity for sustainable development and value creation, giving full play to risk prevention and financing function of the insurance industry, and actively exploring new ways and junctures to boost China’s economic transformation and upgrading.

(I) | Keep improving |

Focusing on pension and health, we are constantly expanding our client population.

No.1s of China Life:

No. 1 market value among listed insurance companies;

The most competitive Asian insurance company;

No. 1 total assets, reaching CNY 2.7 trillion;

The only domestic insurance company whose gross premium exceeds CNY 400 billion.

|

13

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

(II) | Give play to the financing function of capitals |

As one of the largest institutional investors in China’s capital market, the Company insists on the principle of long-term investment and value investment, to the supply-side structural reform. We fund the real economy through IPO, private placement and public market transaction. Meanwhile, we steadily push forward direct equity investment, innovate alternative investment models, and create more favorable conditions for entity enterprises tode-leverage and reduce financing costs. We also actively support industrial restructuring and provide financial support for high-tech and innovative industries. In line with the national strategy, the Company makes full use of advantages of insurance funds in long-term investment to support livelihood projects and key national projects, such as major infrastructure construction, transformation of shantytowns and urbanization.

CNY 2.5 trillion

Investment assets by the end of 2016

|

(III) | Strive to develop petty insurance |

China Life is one of the first insurance companies to carry out rural petty insurance services. Committed to promoting cheap and easy-understood petty insurance products with appropriate security range, the Company has expanded the coverage of petty insurance to urbanlow-income groups through years of exploration and hard work.

100 million

/Number of people who receive rural petty insurance services, accounting for 14% of the total rural population

CNY 1.81 trillion

Total amount insured by risk insurance

592,000

Number of people who have received compensation

CNY 1.47 billion

Total amount of compensation

|

14

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Case: Exploring the new“three-insurances-in-one” mode of social security in rural areas

China Life is working on an effective operating mode for theNew National Ten Opinions together with local governments and regulatory departments. The Company started the experimental“three-insurances-in-one” mode in counties of Sichuan like Zhongjiang. The new mode combines rural petty insurance, the medical insurance for urban residents and insurance of new rural cooperative medical system (NCMS), reducing administrative cost and improving public service efficiency, and effectively solving the “first mile” and “last mile” problems for rural residents.

|

II | Serve the people and help establish a security network for people’s livelihood |

China Life regards “improvement of the people’s livelihood and sense of achievement” as the focus of work and seeks to build a security network for people’s livelihood. The Company actively helps optimize the security system of people’s livelihood, serving as the safety network and stabilizer of the society.

(I) | Promote the establishment of the personal risk protection mechanism for the elderly |

We have continued cooperation with senior citizens’ work committees at different regions in promoting commercial accident insurance for the old people and bringing into full play the risk protection and economic compensation mechanism of commercial insurance, and made active contributions to the establishment of the personal risk protection mechanism for the elderly.

• | Successfully held the “Pension Insurance Development Symposium” with the National Senior Citizens’ Work Committee in Nantong, Jiangsu. Participants discussed about the accident insurance mechanism for the old people in combination with government support, social donations, and self-funded insurance, and discussed ways to promote the positive effect of commercial insurance through the mechanism. |

• | Took the initiative to participate in relevant researches. Together with the National Senior Citizens’ Work Committee, the Company conducted field researches on practical problems like how to boost long-term care services for the elderly via commercial insurance and how to expand the coverage of scattered accident insurance for the elderly in various cities in Jilin. |

15

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

CNY 1.2 billion

Premium income of pension insurance

40 million

Elderly population covered

|

Through coordination and communication with civil affairs departments and insurance regulatory authorities, China Life helps integrate the elderly accident insurance into the government work. We would like to thank China Life for its long-standing concern and support for the old age programmes. I hope you would continue caring about and participating in the cause of old age programmes, and sincerely wish you a prosperous future and double harvest in social and economic benefits. As a result of your hard work, hundreds of millions of old people will enjoy better protection of personal life and property.

—The National Senior Citizens’ Work Committee

|

(II) | Develop diversified health insurance |

We have actively implemented the strategy of “health China”, and developed diversified health insurance services based on the customers’ needs forold-aged healthcare. With the purpose of establishing a “big health” ecosystem, China Life is working on an integrated ecosystem of health industries to provide customers with lifetime services.

• | Launched over 20 health insurance products including Kangning and cancer insurance; |

• | Carried outpreferential-tax insurance services in 31 cities; |

• | Started care insurance services. |

(III) | Develop inclusive insurance |

We have actively developed insurance for agriculture, farmer and countryside, and carried out beneficial insurance services for the mass public. We are vigorously exploring the insurance service mechanism conformable to China’s poverty alleviation strategy, expanding the online inclusive insurance market, enlarging commercial insurance coverage, and building commercial insurance into the pillar of the social security system.

16

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

17,000

Marketing service centers in villages and towns

More than 200,000

Insurance service specialists in villages

|

Provide affordable insurance products for farmers

• | With meeting farmers’ demand on basic security as our starting point providing them with desirable products as our goal, we have increased the number of petty life insurance to 25, which feature proper security level, low cost, approachable terms in insurance policies and easy claim settlement. Such products satisfy the security demand of farmers with low income and enlarge the coverage of insurance in rural areas. |

Publicity and promotions ensure peasant’s clear understandings of the insurance products

• | We actively create new forms of publicity and take a variety of publicity methods including drawing posters on walls, broadcasting, pulling banners on streets, holding insurance introduction meetings, disseminating cultures in villages, settling claims on site and so on. An increasing number of farmers now no longer “purchase insurance passively”. Some peasants even have a thorough understanding of each item of the petty insurance they have purchased. |

Honest service gives farmers great assurance

• | We have strict system management, simplify insurance verification and claim settlement, help farmers to eliminate the concern of “While purchasing insurance is easy, claiming for settlements can be hard”, satisfy different security demands for part of the farmers, serve them as near as possible, providedoor-to-door services including insurance purchasing, insurance renewing and sending compensations. We have basically established a new service system of “Branches in towns, staff in villages and service to households”, making farmers feel that insurance is just as convenient as saving money. |

17

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| III | Integrate innovatively to boost the transformation of government administration |

China Life has been continuously strengthening cooperation with the government, innovating means of supplying public services, enhancing allocation efficiency of public service resources, striving to make insurance an effective tool of the government in improving public services and social management, and, as a member of the insurance industry, leveling up social governance.

| (I) | Major disease insurance |

Relying on managerial experience accumulated in policy-based medical transactions and commercial health insurance business and guided by principles of “active participation, professional service, independent accounting, openness and transparency”, China Life has treated major disease insurance as the strategic business and tried its best to be the preferred partner of the government.

To better our major disease insurance, we have established a service network based on nationwide service stations and innovated service measures so as to provide the insured with preferential national services and improve their experience of medical treatment.

| • | Organize full-time service teams, promote health insurance policies, assist with hospitalization procedures, and carry out visits to inpatients |

| • | Conductall-round medical expense control through intervening methods like joint work of government departments, dispatching representatives to hospitals, information system monitoring, and remote verification |

| • | Develop the first information system for major disease insurance specifically, carry outone-stop settlement to exempt insurance participants from medical expenses in advance, and provide them with professional and immediate compensation services |

| • | Carry out preventive health services, self-service physical examinations and other family doctor services to explore preventive ways of diseases |

Case: China Life paid high compensation to a child with leukemia

Leukemia is no doubt a catastrophe to ordinary families. Chen, aten-year-old child in Xianning, Hubei, had to receive bone marrow transplant and be hospitalized for over ten times because of acute lymphocytic leukemia. He was transferred to Wuhan and Beijing successively, and the dialysis and examinations during this period cost as high as CNY 1.43 million, an astronomical figure for a rural family. Compensation of the NCMS is limited to CNY 100,000. Without the major disease insurance, the family would have to pay CNY 1.33 million by themselves. Since 2014, China Life has paid 10 times with a total amount of CNY 589.7 thousand, raising the proportion of reimbursement by more than 40%. Chen’s later treatment fees were mainly covered by the compensation of the major disease insurance, which guaranteedfollow-up treatment and disease control and avoided being impoverished by the diseases. |

18

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

More than 25,000

Medical institutions withone-stop claim settlement services

More than 250

Critical disease insurance projects

420 million

People covered

More than 10 million

Total person-times having been compensated

More than CNY 26 billion

Total compensation payment

|

| (II) | Basic medical handling business |

Since China Life first cooperated with the NCMS in 2003, the Company has worked out several influential modes like “Xinxiang Mode”, “Fanyu Mode”, “Luoyang Mode” and “Zhengzhou Mode”. After the publication of New National Ten Opinions,the Company seized the opportunity of government function transformation to rapidly develop basic medical handling business with special focuses on cooperation between the government and insurance industry, policy coherence, and medical cost control.

19

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Responsibility Management

I | Opportunities and challenges |

Challenges in sustainable development

• | National economy has entered a new normal while economic development is in a critical stage and faced with multiple challenges. There are still many conflicts and problems in economic operation. Changes in economic development trend will exert influence on insurance industry in terms of business development, capital utilization and payment ability through various channels including real economy, financial market, and consumer demand. |

• | The possiblelow-interest trend during the long period has entailed higher demand on the asset and liability management of companies, and special attention must be paid to the prevention of loss from differences of interest rates, mismatch of asset and liability and so on. |

• | Regulatory institutions have successively come up with policies to adjust and regulate the development of business with short and long durations, capital utilization and so on. Certain pressure goes hand in hand with the rapid development of business and the uncertainty and complexity are also on constant rise. |

Opportunities in sustainable development

• | Chinese economy is still in a period of strategic opportunities where the growth speed is maintained at a high-middle speed. |

• | A new round of scientific and technologic revolutions are around the corner, which creates favorable conditions for the improvement of business development and management level of insurance business. |

• | The “New National Ten Opinions” on insurance industry and the introduction and practice of corresponding policies in pension, healthcare, investment and so on have improved the exploration and cultivation of insurance market. |

• | The positioning of insurance industry is becoming increasingly clear and the development is transferring from a scale-speed mode to a scale-profit mode. These facts provide important opportunities for the Company’s transformation. |

20

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Strategy of Sustainable Development

| • | We adhere to the development concept of “Innovation, coordination, green development, openness and sharing”, seek energy from liberating mind and deepening reform, emphasize the problem-oriented principle, strengthen innovation as a driving force, optimize the company’s governance structure and improve modem enterprise system. |

| • | We adhere to the main line of supply side reform, stick to the right direction of “Protecting people with insurance”, vigorously implement the innovation-driven strategy, follow the operation strategy of “stressing value, strengthening the workforce, optimizing structure, stabilizing growth, and preventing risks” and constantly push forward the strategic structure of “Five Focuses”. |

| • | We deepen transformation and upgrading and the implementation of “Three Strategies”, concentrate on the numbers and quality improvement of sales staff, maintain a relatively rapid growth in the first-year period, continue to enhance our competitiveness in the markets of large andmedium-sized cities and counties, strictly prevent and control all kinds of risks and comprehensively improve the Company’s core competitiveness and ability of sustainable development. |

21

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

II | Social responsibility concept |

Our corporate culture and social responsibility concept: “Fulfilling ourselves to benefit others and fulfilling others.”

Our mission: “Putting people first, caring for life, creating value and serving the society.”

III | Identification of substantive issues |

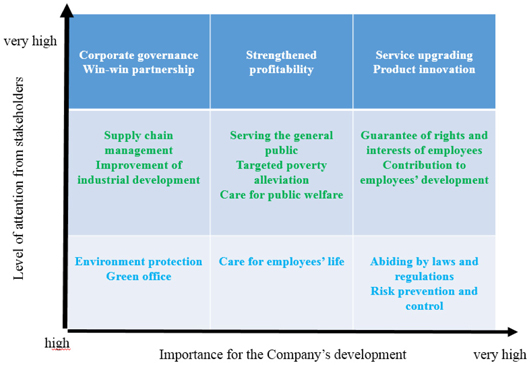

Based on analysis of national macro-policies and domestic and international social responsibility standards, the Company’s development strategy and planning, industrial counterparts, interviews and surveys of stakeholders and internal surveys, this Report has recognized the key issues of social responsibility for China Life in perspectives of “degree of concern among stakeholders” and “degree of significance to company development”.

22

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| IV | Communication with stakeholders |

| Stakeholders | Stakeholders’ expectations | Ways of communication with stakeholders | ||

Governments & regulatory bodies | • Lawful and compliant operation;

• Paying taxes by law;

• Job creation;

• Serving national strategies;

• Risk prevention.

| • Reporting and communicating about work;

• Participating in meetings and providing reports on major activities and special topics;

• Accepting supervision. | ||

Shareholders | • Offering stable returns;

• Improving corporate governance;

| • Shareholders’ general meetings;

• Regular reports, roadshows;

| ||

23

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

• Strengthening investor relations management;

• Timely, accurate and comprehensive information disclosure. |

• News conferences;

• Analysts’ meetings;

• Investigations at branch organizations by investors and analysts;

• Stakeholder surveys. | |||

| Clients | • Good faith and high quality;

• Diversified insurance products;

• Protection of the clients’ rights and interests. | • Client visits;

• Demand/satisfaction degree surveys;

• Product introduction meetings;

• Service hotlines;

• Response to client complaints. | ||

| Employees | • Protection of basic rights and interests;

• Satisfying salary and welfare;

• Occupational health and safety;

• Sound career development prospect;

• Employee care. | • Full salary payment in a timely manner;

• Employees’ congress;

• Employees’ symposiums;

• Petition letters;

• The President’s mailbox;

• Demand/satisfaction degree surveys. | ||

| Partners | • Fair competition;

• Good faith and mutual benefit. | • Informal daily communication;

• Signing partnership agreements;

• Morning meetings and symposiums among salespersons; | ||

24

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

• Special surveys and lectures;

• Stakeholder survey. | ||||

| Environment | • Climate change;

• Energy conservation and emission reduction;

• Comprehensive utilization of resources;

• Green office. | • Training on environmental protection;

• Promotion of environmental protection;

• Environmental information disclosure;

• Activities related to environmental protection;

• Emergency plans for environment protection. | ||

| Communities and the public | • Employment improvement in local areas;

• Involvement in community public-good activities;

• Local economic development. | • Communication and surveys within the community;

• Public-good activities;

• Holding “China Life Lecture Hall” lectures;

• Publicity of financial knowledge;

• Voluntary services;

• Disaster relief. | ||

| V | Honors |

| • | No. 49 of 2016 Forbes Global 2000 |

| • | No. 12 of 2016 Top 500 Chinese Companies by Fortune China |

| • | “Influential Insurance Company of the Year” in the 14th China’s Financial Annual Champion Awards 2016 held by hexun.com; |

| • | “The Asset Triple A Country Awards 2016: Best Deal / Best Bond House of China” and “The Asset Triple A Regional House and Deal Awards: Regional Deals Fixed Income” held byThe Assetmagazine; |

| • | No. 59 of 2016 BrandZ Top 100 Most Valuable Global Brands |

| • | “Golden Dragon Award: Best Insurance Company of the Year” in the 9th Gold Medal List of Chinese Financial Institutions 2016 held byFinancial Times; |

25

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| • | “High-Quality Customer Service Award” in the 7th “Golden Tripod Award” campaign held byNational Business Daily; |

| • | “Best Asian Insurance Company” in the Asian Financial Enterprise Competitiveness Campaign 2016 held by21th Century Business Herald; |

| • | “Top 20 Best Boards of Supervisors of Listed Companies” in the “Best Practice Selection of Boards of Supervisors of Listed Companies” jointly sponsored by China Association for Public Companies, Shanghai Stock Exchange and Shenzhen Stock Exchange; |

| • | “Five-Star Award of Chinese Service Stars” in the 2nd Chinese Service Convention held by China Association for Quality Promotion (CAQP); |

| • | “Service Quality Innovation Award” in the 2016 CAQP 315 Customer Rights Protection Theme Activities held by CAQP; |

| • | “China Philanthropic Enterprise of the Year 2016” on the 2016 China Annual Conference on Philanthropy held by China Philanthropy Times; |

| • | “Poverty Alleviation Award of the Year” in the “11th Corporate Social Responsibility Award” campaign held by people.com.cn; |

| • | “Responsible Brand of the Year 2016” in the 6th China Charity Festival held by the mass media; |

| • | Elected Vice Chairman of the Chamber of Hong Kong Listed Companies in 2016. |

26

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Part I Good Faith

| Stakeholders’ expectation |

| Improved corporate governance; lawful and compliant operation; stable value increase. |

| Our strategy |

Under the business guideline of “stressing value, strengthening the workforce, optimizing structure, stabilizing growth, preventing risks”, we deepened reform and innovation, implemented structural transformation and upgrading, and conducted risk management to constantly improve our Company. |

| Our action |

We continued improving the corporate governance mechanism and compliance management mechanism, established the “1+7+N” risk management system, and promoted construction of “technology-oriented China Life” to improve our development strength and profitability. |

| Our Achievement |

Earnings per share: CNY 0.66;

insurance premium: CNY 430.498 billion;

total assets: CNY 2.7 trillion. |

27

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| I | Optimize Corporate Governance |

As a company listed simultaneously in New York, Hong Kong and Shanghai, we have paid great attention to corporate governance, strictly obeyed local laws and regulations, and improved the strategic decision-making mechanism. After years of exploration and practice, we have gradually formed a standardized and comprehensive corporate governance structure, and an effective institutional system.

| (I) | Governance structure |

We have continuously improved the corporate governance structure composed of the general meeting of shareholders, the board of directors, the board of supervisors and the management, and formed the well-functioning operation mechanism featuring clear division of the right of decision-making, right of supervision and right of management. The corporate governance structure guarantees effective implementation of the right of decision-making of the general meeting of shareholders and the board of directors together with the right of supervision of the board of supervisors, and guarantees the efficient work of the management in accordance with corporate regulations and authorizations.

Figure: Governance Structure

| (II) | Investor relations |

We have attached great importance to communication with investors, strengthened analysis and research of the capital market, and conductedall-round information exchanges via standardized information disclosure, performance release andone-on-one roadshows so as to enhance investors’ understanding of the Company and ensure that they are informed of the Company’s information.

28

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Big Data in 2016

611

Participants of the performance release conference

56

Non-transaction roadshows andone-to-one group meetings

130

Visits to VIP shareholders and potential institutional investors

855

Investors and analysts received in 2016 |

Figure: Teleconference on the third-quarter performance release in 2016

29

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Figure: Visit to Nomura Group

| II | Stick to moral operation |

China Life has always abided by business ethics, laws and regulations, constantly improved the compliance management system, properly managed risks, resolutely opposed corrupt acts like bribery, promoted fair competition, and integrated concepts of good faith and compliance into all aspects of business operation.

| (I) | Compliance with laws and regulations |

Conforming to laws and regulations and adhering to the principle of “preventing legal risks, promoting compliant operation, and supporting business development”, we improved the Company’s operation management level through investigation, assessment, monitoring and training. The legal compliance department would give opinions on compliance before the insurance products, business policies and promotional materials were released. The legal compliance personnel would also participate in the Company’s major reforms and innovation to ensure compliant operation.

30

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Figure: Key compliance actions

Figure: Special training on the 3rdJudicial Interpretation of Insurance Law

31

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

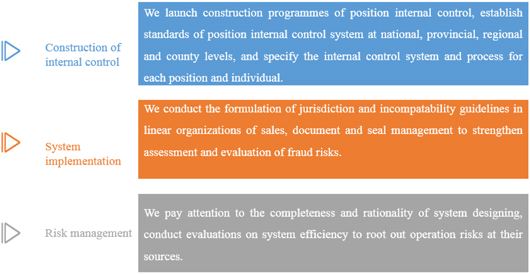

| (II) | Risk prevention and control |

Effective risk management policies and strategies are key to our success. In accordance with the requirements of CIRC regarding the implementation of China Risk Oriented Solvency System(C-ROSS), we pushed forward the construction of the solvency risk management system and the construction of the “1+7+N” risk management system. We also organized solvency risk assessment to enhance the Company’s risk management ability. Strictly following theGuidelines for the Implementation of Comprehensive Risk Management of Personal Insurance Companies, we optimized the risk preference formation and transmission mechanism, conducted riskpre-warning management at different levels, and strengthened precaution in key risk areas. In the special project against illegal fund-raising, the Company checked and monitored risks of illegal fund-raising from eight dimensions including counter monitoring, index monitoring, customer service monitoring, team monitoring, reporting monitoring, interview monitoring, system monitoring and media monitoring, giving full play to the role of the key risk monitoring system. Moreover, we implemented “Two Enhancements and Containment” self-inspection, carried out deep self-inspection, rectify and reform in the Company’s key areas, key institutes, key problems, key cases, key risks, as well as key regulations, key posts and key members, and leveled up the risk-control ability of the Company. In 2016, our Insurance Regulatory Commission’s Solvency Aligned Risk Management Requirements and Assessment (SARMRA) ranks front row of the life insurance industry.

Figure: Innovative measures for risk management

| (III) | Anti-corruption |

We paid great attention to the building of the Party work style and a clean government, deepened anti-corruption efforts, implemented “two responsibilities”, improved anti-corruption rules and regulations, and strengthened supervision, discipline and accountability system to effectively reduce the existing corruption and contain further increase, create a sound atmosphere in line with right politics, disciplines and rules, and establish a long-term anti-corruption mechanism. We were determined to prevent corruption from its source.

32

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Big data in 2016

372

Anti-corruption trainings organized

19,758

Participants in anti-corruption trainings

One

Corruption case concluded

|

|  |  | ||

Strengthen discipline supervision and consolidate the basis of case investigation

• We center on problems of “four forms of decadence” to conduct targeted inspection work including self examination and selective examination of key issues.

• We conduct investigations and examinations of clean government in 13 branches in 2016 and spotted 45 problems. | Improve system construction

• We identify the priorities in the construction of clean government and Party working style, and assign specific tasks to branches.

• We conduct assessments on the completeness of tasks assigned to each branch.

• We establish case reporting mechanism to report major cases with distinct corrupt features. | Promote the construction of clean government culture

• We incorporate anti-corruption education into leadership trainings, position integrity education and new staff orientation training.

• We require our staff to finish online study of Regulations and Ordinances, and pass corresponding test. In 2016, 61,100 employees completed their study and the passing rate was 82%. | ||

Figure: Anti-corruption measures

| (IV) | Anti-money laundering |

Money laundering is a criminal act that seriously jeopardizes national security and threatens global economic development. Fully aware of the importance of anti-money laundering work, we actively fulfilled obligations in accordance with laws and regulations and took necessary measures to maintain the stability of the financial order.

33

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| • We improve the contents of responsibilities, management measures, assessment and evaluation demands, accountability mechanism of anti-money laundering, and upgrade the information system function of anti-money laundering to ensure the effective implementation of relevant laws and regulations. | |

| • We constantly conduct education activities of anti-money laundering, and take advantage of all kinds of media to strengthen the publicity in order create a positive social atmosphere in different ways and enhance the overall awareness of prevention and control of the risks of money laundering. | |

| • We conduct daily work of anti-money laundering, carefully examine clients’ identification, report information oflarge-sum or suspicious transactions to relevant departments and practically fulfill our legal responsibilities. | |

| • We cooperate with People’s Bank of China and accept onsite inspection of money laundering to spot our weakness in aspects of construction of internal control mechanism, client risks level classification, client identification materials, transaction records and so on to improve our capability of combating money laundering. | |

Figure: Anti-money laundering measures

| III | Create continuous value |

Faced with the complicated international situation and arduous domestic reform, development and stability tasks, China Life actively adapted to the new normal of economic development, implemented innovation-driven development strategy under the guideline of “stressing value, strengthening the workforce, optimizing structure, stabilizing growth, and preventing risks”, and seized opportunities for further development. The profitability and overall strength of the Company continued increasing.

| (I) | Continuously enhance profitability |

Our business has been developing rapidly with the continuously optimized business structure, significantly improved management efficiency, and a leading position in the industry. In 2016, the Company achieved a total insurance premium of CNY 430.5 billion, ayear-on-year increase of 18.3%, the highest growth rate since 2009. This makes China Life the first and the only insurance company whose gross premium exceeds CNY 400 billion.

34

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| (II) | Continuously improve strength |

We maintained the confidence and flexibility of our strategy, speeded up the transformation and upgrading, actively improved the competition situation of large andmedium-sized cities in regular premium business and personal insurance channels, further consolidated our competitive advantage in counties, and continuously enhanced the Company’s sustainable development capacity and core competitiveness.

In 2016, we won the first place in the competitiveness ranking among Asian life insurance companies, and ranked No. 49 in 2016 Forbes Global 2000. The Company’s core solvency adequacy and comprehensive solvency adequacy were 280.34% and 297.16% respectively, much higher than the supervision requirements.

Case: Increase the stake of China Guangfa Bank to promote synergistic development

On February 29, 2016, China Life signed a transfer agreement with Citigroup, and obtained 20% stake of China Guangfa Bank held by Citigroup’s IBM Credi programme, becoming the largest single shareholder of China Guangfa Bank.

This action would promote the synergistic effect between China Life’s main business and China Guangfa Bank, provide clients with integrated and diversified financial services, and bring China Life more robust financial returns and promising appreciation space.

|

35

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

In 2016, the China Life-Guangfaco-branded debit card, credit card and China Life account were issued officially, triggering the collaboration between insurance companies and banks.

|

| (III) | Rapidly promote the construction of a technology-oriented China Life |

We firmly implemented the “innovation-driven development strategy”, launched anew-generation comprehensive business processing system centering on clients and featuring internet, rapid response, safety and reliability, and popularized the application of cloud assistant, cloud-based signage, cloud desktop and interconnected network, speeding up the mobile internet process of China Life. In 2016, surrounding clients, sales staff, management staff and other user groups and with the help of new technologies of face recognition, real-time computing and big data, we established the two platforms of China LifeE-shop and China-LifeE-insurance and launched over 20 new products including Jinshan Dolphin, Big Health and Bumblebee, winning the “Outstanding Contribution Award in Scientific and Technological Innovation in the Financial Industry” and other three innovation awards.

| • | The “Driving Insurance Micro-Application” won the “Outstanding Contribution Award in Channel Innovation” in the annual selection of excellent financial technologies and services in 2016. |

| • | The “Pyramid Big Data Platform” won the “Outstanding Contribution Award in Scientific and Technological Innovation”. |

While focusing on the development of new technologies, we paid great attention to intellectual property right protection, and actively carried out the declaration of intellectual property rights to promote the healthy and orderly development of China Life. In 2016, we completed ten computer software projects including the “China Life Global Hawk Application Monitoring System” declared by Shanghai Data Center and the“e-Counter System” declared by the R&D Center.

36

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Part II Client Foremost

| Stakeholders’ Expectation |

Simple, convenient, and safe services; high-quality insurance products; protection of legal rights and interests of clients. |

| Our Strategy |

We constantly optimized the service management system, stressed the development concept of “client foremost”, met diversified client needs, innovated products and services, improved service quality and experience, and created higher value for customers. |

| Our Action |

We improved the efficiency of call centers, expanded notice channels on the internet, conducted smart claim settlement, developed new products based on clients’ needs, upgraded client experience via new technologies, and held the tenth China Life Client Festival. |

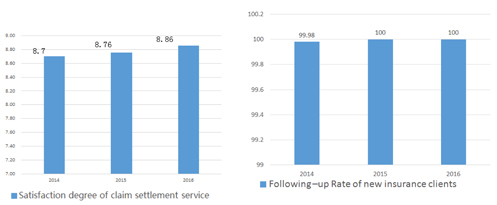

| Our Achievement |

Got a score of 8.86 in customer satisfaction survey on claim settlement;

the rate of claim settlement within 5 days reached 98.26%;

provided notice service for 1.01 billion person-times. |

37

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

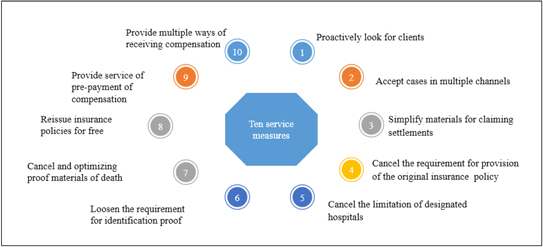

| I | Push forward service upgrading |

China Life has constantly optimized service management system, improved customer service capacity, and pushed forward service upgrading. The Company aims to provide clients with simple, convenient and safe services, and endeavors to improve service quality and experience and create more value for clients in every contact with clients.

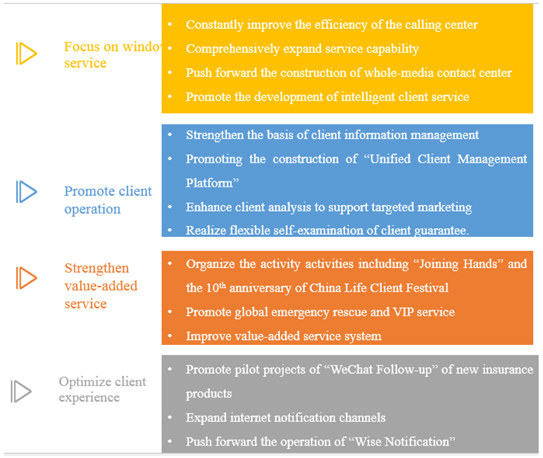

| (I) | Optimize the service management system |

We adhered to the principle of “client foremost”, regarded value increase as the core of our work, focused on window services and optimized service management system to accelerate major transformations in customer experience and customer operation.

Figure: Optimize the service management system

| (II) | Improve customer service capacity |

We paid close attention to customer needs and service experience, enhancedfront-end business capability, strengthened the support ofback-end technology forfront-end business, improved quality of claim settlement service, and constantly optimized the service management system. In 2016 China Life scored 8.86 in the customer satisfaction survey on claim settlement, the best third-party survey result since 2007.

38

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| • | We have formulated ManagementMeasures of Client Contact Center Knowledge Library to further guarantee the timely and accurate publication of knowledge and information so as to satisfy the practical work demand of client contact center and multimedia automatic response and enhance our capacity of client service. | ||

| • | We improve our client contact system, optimize service of “WeChat Notification” , provide individualized notification service, enhance the operation of “Wise Notification”, strengthen team construction and constantly promote the integral system of client notification service and the capacity of notification service channels. | ||

| • | In 2016, we served more than 80,000 clients each day. We are the first in the industry to establish a three-layer cloud framework as an enterprise, provide 25 innovative applications and two platforms, namely China LifeE-shop and China LifeE-insurance. We mastered a variety of new technologies such as real-time calculations, big data, face recognition and so on and apply them to multiple business situations, providing convenient, safe, and accessible service for clients. | ||

| • | By relying on information technology, we are now applying a new platform for claim settlement, offering comprehensive support to the construction of an intelligent mechanism of claim settlement, pushing forward direct payment in claim settlement, further optimizing claim settlement efficiency and transparency, which substantially enhances our service for insurance policies. | ||

Figure: Improving customer service capability

Big Data in 2016

1.01 billion

People who received notice service

940 million

Short messages sent

50.05 million

E-mails sent

8.6 million

Person-times having received compensation

|

39

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| (III) | Improve the emergency management mechanism |

We continuously improved the response mechanism and procedures for major emergencies, enriched contents of the emergency plan, and improved the rationality and operability of the emergency plan to ensure the rapid response, flexible handling and information sharing in claim settlement. In 2016, we rapidly handled a total of 31 major emergencies through joint actions of the head office and branches.

| • | Adhere to the principle of unified leadership,level-to-level responsibility, timely response, adequate measures and reinforced cooperation; |

| • | Launch the emergency response mechanism at the very first moment and seek cooperation between the head office and branches; |

| • | Actively collaborate with the government in disaster relief; |

| • | Open green channels for rapid claim settlement; |

| • | Go deep into the frontline to provide high-quality and efficient claim settlement services. |

Case: Launch the emergency plan in response to Typhoon “Nida”

In August, 2016, the No. 4 Typhoon Nida landed on the coastal areas of Guangdong and attacked the Pearl River Delta Region. In active response to the typhoon, we promptly launched the emergency plan, organized local branches to set up an emergency service working group, opened green channels for rapid claim settlement due to the typhoon disaster, and provided clients with high-quality services in a rapid, convenient and humanistic manner. |

40

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| (IV) | Protect consumers’ rights and interests |

We have put strategic importance to consumer operation and included the protection of consumers’ rights and interests into the company’s 13th Five-Year Plan. We have focused on the implementation of projects such as the “New generation” project, “Intelligent service” project, “Join hands with China Life” project, and “Livelihood promotion” project to include consumer service, consumer management, and consumer communication, etc. into our holistic ecosystem of consumer operation so as to guarantee consumers’ rights and interests. In 2016, thanks to the outstanding performance in the comprehensive assessment initiated by China Association for Quality Promotion through inspections and undercover visits, consumer complaints and client satisfaction survey, we won the honor of “Star of China Service” with five-star rating for the first time.

41

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| • | We set off from product development, selling, maintenance, claim settlement, handling complaint, education of consumers and so on to establish a scientific and effective system and relevant regulations that cover the whole process. | ||

| • | We establish a classified and graded management system of client information, form a closed loop of constant maintenance of client information, improve the safety management and control mechanism of client information, promote the supervision and management of quality of client information and create unified inquiry scheme for clients to strengthen the protection of clients’ privacy. | ||

| • | We cooperate with professional third-party research institute to conduct surveys on clients’ satisfaction degree. Our work mainly concerns clients’ experience and feelings of services provided by the Company’s branches including sales, business management, customer service, payment and purchase and so on. | ||

| • | We revise Management Measures of Client Complaints to provide guidance on business operation and service regulation for our staff, abide by laws and regulations in handling complaints, offer different channels including feedback forms and hotlines to clients for them to express their opinions so as to provide a improved communication mechanism. | ||

Figure: Measures for protecting consumers’ rights and interests

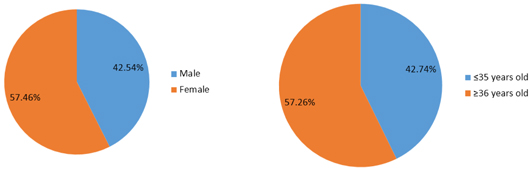

| (V) | Carrying out business in good faith |

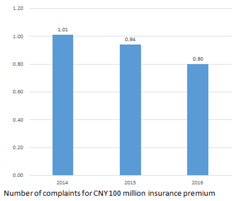

At China Life, responsible insurance sales and marketing are our missions. In order to improve occupational ethics and professionalism of marketing personnel, we have enhanced institutional improvement, upgraded and transformed the credit evaluation system, and guided our marketing personnel to carry out standard insurance operation consciously to create a favorable working environment of honesty and trustworthiness.

42

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Figure: Measures for responsible marketing

| II | Optimize client experience |

China Life has actively studied the differentiated needs of different industries, regions, channels and client groups for risk prevention, focused on new areas, new products and new technologies of the insurance industry and kept on exploring products and services that meet the demands of client assurance and experience to provide clients with new consumption experience.

| (I) | Product innovation |

Robust production innovation capability is our core competitive edge. At China Life, we persist in “being market-oriented” in product development and dig into clients’ insurance needs during different stages of the whole life cycle in order to build a distinctive and complete product system to meet clients’ needs in different life stages, such as emergency prevention, health care, medical care, annuity, children education, and wealth management, etc. In 2016, 8 products such as China Life Cancer Insurance and China Life Fu won awards in the industrial competition of “Insurance Products of the Year 2016”. China Life ranked top in the insurance industry in terms of the number of awards and honors.

43

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Big data in 2016

34

Newly developed insurance products in 2016

3

Newly developed insurance products targeted to help the poor |

Set up the first long-term universal combination of regular payment

| • | We improve “Kangning” series of products. By learning the advantages of universal products, we developed new “Kangning” products for niche markets ofmedium-sized cities and adult customers. “Kangning Universal” is the first long-term universal product combination focusing on healthcare, pension and accidents. |

Developmiddle-end medical insurance products to provide deepened healthcare security

| • | We developmiddle-end medical insurance products to provide deepened healthcare security and accumulate medical data and experience. Products with high security and low prices will attract more customers to invest. The product can cut medical risks and increase the ability of operation and management of medical insurance. |

Design more “China Life Fu” products to give customers more options

| • | We design “Xiangrui lifetime” and “Xiangrui fixed term” and other products of “China Life Fu” series to give customers more options. Additional insurance products are offered in a more flexible way, including additional child disease, additional illnesses and additional beneficiary of premium, to give more options of portfolios of insurance products for customers. |

Create combined products for group and serious diseases for employees’ welfare

| • | To enrich well-fare products for employees, we design the first major disease product allowing personal payment named“Kangyuan/Kanghui group major disease insurance combination”. This product combines advantages of group insurances and those of personal ones, which meets different needs from legal person, employees and insurance companies, and increases flexibility and convenience of employees’ welfare. TheChina Life Group Insurance for Certain Diseases of Male Employees is exclusively for male employees and improves the existing welfare system. |

Product innovation based on diversified needs of clients

44

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Case: China Life has actively developed products to serve the needs of people’s livelihood

We have adhered to the preferential personal income tax policy in commercial health insurance, actively responded to the policy of individual beneficiaries of social medical insurance in Shanghai buying commercial health insurance with the balance of social medical insurance account, and implemented CIRC’s regulations on the promotion of poverty alleviation by insurance industry. China Life has innovated insurance products to better serve the public.

|

| (II) | Service innovation |

The development of information technologies has connected people to the internet through various devices such as mobile phone and tablet PC. As a result, people can enjoy the intelligence and convenience brought by the internet anywhere at any time. We have drawn on diversified channels and innovation of products and services to facilitate clients in anall-round way, providing them with the most convenient services.

Case: China Life launched China LifeE-insurance to optimize intelligent service

China LifeE-insurance is an automatice-service application. With the system, clients can enjoy services such as product sales, basic services and value-added services online. In 2016, we launched China LifeE-insurance to bring clients better experience. |

45

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

China LifeE-insurance has attracted 6.9 million customers in 2016, realizing 10.99 million customers in total. Moreover, China LifeE-insurance completed 11.36 million cases of risk prevention and claim settlement, with the service application rate of 42%.

|

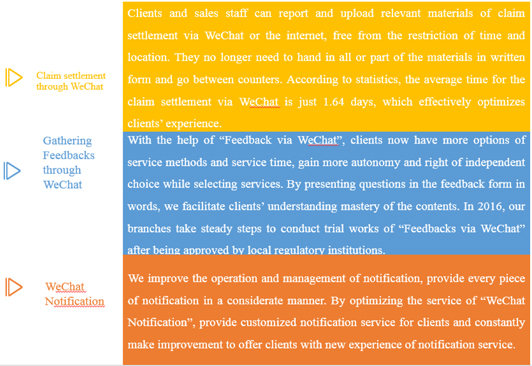

Case: Convenient services through WeChat

Relying on the convenience and timeliness provided by mobile internet, we have launched a series of WeChat services to provide clients with the most convenient service.

|

Case: China Life experiments with online claim settlement in rural outlets

The difficulty and long time in receiving the claim settlement service have been tough problems in claim settlement service in rural outlets. In order to improve efficiency, we have drawn on internet applications, given full play to the advantage of the nationwide urban and rural insurance outlet network, and actively experimented with mobile claim settlement service in rural outlets. Rural outlets directly submit the claim online and provide convenient“door-to-door” claim settlement service for consumers in counties and villages. In 2016, we experimented with mobile claim settlement service in 253 rural outlets distributed in six provinces, including Sichuan and Guangdong. 54,500 cases of claim were completed, with an average claim settlement time of 1.7 days. In this way, the efficiency of rural claim settlement service is greatly promoted and consumers’ experience is improved. |

46

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| (III) | Value-added service |

We integrated clients’ demands collected widely with perception factors of service experience, deeply explored potential value-added service models and activities, and built a differentiated service system. Meanwhile, we continued to conduct “China-Life 1+N” value-added services to provide clients with high-quality,all-dimensional andin-depth considerate services.

| • | China Life held the 10th “joining hands” erial client service activities and the “China Life Client Festival” celebration activity. China Life launched the health service resource package covering four aspects, namely health insurance, health management, health maintenance and healthy life, to provide new service for clients. |

| • | China Life continued to promote global emergency assistance and VIP service. China Life has provided 70 million long-term clients at various levels with emergency rescue, health consultations, VIP care and other value-added services of different content at different levels |

Big data in 2016

2.42 million

Participants in the 6th national children drawing event with the theme of “Joining Hands with China Life with a Focus on Health Maintenance”

57

“Running 700” series running activities covering cities in China

267

Itinerant lectures on family educationco-organized by a renowned education brand

100,000

Participants benefited from itinerant lectures on family education

22

VIP special activities

373

|

International medical assistance cases |

47

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

305

Domestic medical assistance cases |

Figure: “China Life 1+N”

Case: China Life Family Doctor Card offers you a doctor beside you

Family doctors do not necessarily help people with big diseases, but provide you with considerate care at any time. We joined hands with the International SOS, the global largest emergency medical assistance institution, and launched the family doctor card. China Life Family Doctor Card provides clients with professional medical advice on the common treatment of accidental injuries and the prevention of acute diseases and chronic diseases, and offers clients health consultation services at any time anywhere. With the card, our clients can receive timely and effective help as if they had a doctor beside them. |

Case: Meet with Yao Ming and realize clients’ dream

Face-to-face conversation with Yao Ming is the dream of many fans. In 2016, 12 clients came to the seaside city Qinhuangdao from different places of China with the hope of meeting with Yao Ming. In order to realize their dream, we innovated services and held “Fans Meeting with Yao Ming in 2016” in Qinhuangdao for the first time, creating a great opportunity for our clients to have aface-to-face conversation with Yao Ming. In the fans meeting, Yao Ming answered attendants’ questions with zeal and patience, shared and exchanged his experience in basketball and thoughts about sports and health with the audience. Yao Ming also sent a gift to each attendant with a signature on it, realizing our clients’ dream as a big fan of Yao. |

48

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

|

Case: “Running 700” leads to a healthy lifestyle

We promote healthy running culture and guide our clients to live a healthy life. In order to pay back to clients’ care and support, we have also built a communication platform for runners andco-organized the “Running 700” activity with Beijing Starz International Sports Management Co. Ltd. During the activities, we purchased China Life insurance for every participant and provided them with services such as insurance coverage,first-aid service and water and food supply.

“I think it is very meaningful to run together with so many people. I can not only feel the happiness of running, but make more friends who love running just like me. If China Life holds such activities again, I will actively participate and live a healthy life by running.”

—A runner who participates in “Running 700” |

49

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Figure: China Life held the National Excellent Works Exhibition and Awarding Ceremony of the 6th National Children Drawing Event

50

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

Part III Humanistic Care

| Stakeholders’ expectation |

Satisfying remuneration and welfare, a safe and comfortable working environment and a platform for development and promotion |

| Our strategy |

Persist in putting people first, we endeavor to build the talent cultivation system, improve employees’ overall ability and professionalism comprehensively, motivate their potential and promote the realization of their self-value. |

| Our action |

We treat employees equally, forbid discrimination in any form, enhance employees’ occupational health and safety management, improve the remuneration and welfare system and provide opportunities of vocational training and job promotion for employees. |

| Our achievement |

We invested a total of CNY 170 million in vocational training and trained 1.46 million person-times. We contributed CNY 13 million to assisted needy employees. |

51

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| I | Protect employees’ rights and interests |

China Life maintains that human resources are the first resource of the Company and promotes the talent cultivation strategy of “mechanisms for absorbing talents, systems for using talents, training for cultivating talents and working environment for retaining talents”. Moreover, we persist in putting people first, optimize workforce structure and motivate employees’ potential and creativity.

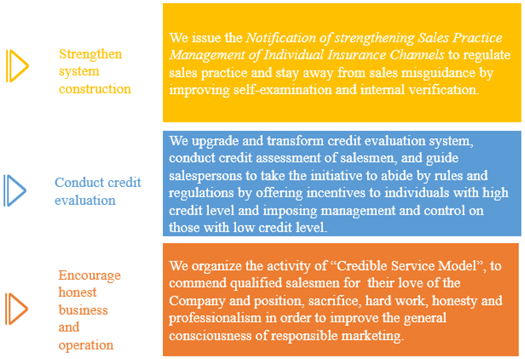

| (I) | Equal employment |

We persist in equal employment and oppose employment discrimination and enforced labor in any form. Adhering to lawful employment, we sign labor contracts with employees according in compliance with the principle of equality, free will and unanimity through mutual consultation. In 2016, we introduced 35 talents for professional positions and recruited 2,738 outstanding university and college graduates, and employed 19 graduates as village officials. By the end of 2016, the number of employees had reached 98,505, among which female employees account for 57.46%. The workforce structure has become more scientific and reasonable.

| Figure: Gender distribution of employees | Figure: Age distribution of employees |

| (II) | Democratic management |

We emphasize on the important role of the trade union of the Company, improve the democratic management system, and regularly hold Employees’ Congress. We improve the staff communication and feedback mechanism, expand staff participation channels and scope, and establish staff appeal channels to guarantee employees’ rights to democratic decision-making, democratic management and democratic supervision.

| • | Jiangsu Provincial Branch actively innovates ways of democratic management, explores the biggest common divisor of corporate development and employees’ expectations, realizes mutual benefits between the Company and employees and develops a new democratic management concept of “consensus,win-win and sharing”. |

52

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

| • | The trade union of Hubei Provincial Branch organizes trainings for staff representatives every year to guide them to analyze the causes behind cases, and research into and figure out measures for employees’ problems. The trade union regulates the compilation of employees’ proposals, enhances its inspection and instruction and timely provides feedback to staff representatives. |

Big data in 2016

100%

The rate of trade unions establishment

100%

The rate of staff admission in trade unions

100%

The coverage of special collective contracts to protect the rights and interests of female employees |

Figure: Employees’ Congress

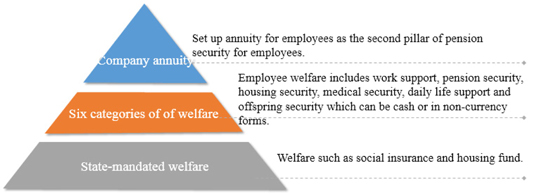

| (III) | Remuneration and welfare |

We have constantly optimized the employees’ remuneration and incentive mechanism, upheld open, transparent and continuous

53

China Life Insurance Company Limited 2016 Corporate Social Responsibility Report

communication in performance management, implemented whole-process performance management in performance planning, performance tutoring, performance assessment, performance feedback and application, etc. and built a competitive and inspirational remuneration and welfare system. We have built a diversified welfare guarantee system and ensured full coverage of social insurance for employees to constantly improve employees’ happiness and satisfaction.

|

Enhance performance-based salary allocation mechanism Increase the share of floatable salary and put more focus on performance and differentiated salary allocation so as to stimulate those with better performance and greater contributions. | |

|

Set up the mechanism for reasonable salary increase Correctly deal with the relationship between cost management and salary increase for employees, so as to increase employees’ income and develop the business simultaneously. | |

|

Improve policies favoring sales and grassroots Give more support to the team building of talents in frontline business and sales, and attract more talents to sales positions and grassroot units by advantaged income. | |

Figure: Improvement and optimization of the incentive and constraint mechanism

Figure: The diversified welfare guarantee system

Case: China Life timely adjusts the pregnancy leave system, showing great humanistic spirit