LUKE ENERGY LTD.

Information Circular - Proxy Statement

for the Annual and Special Meeting

to be held on May 19, 2005

SOLICITATION OF PROXIES

This Information Circular - Proxy Statement is furnished in connection with the solicitation of proxies by the management of LUKE ENERGY LTD. (“Luke” or the “Corporation”) for use at the Annual and Special Meeting of the shareholders of the Corporation (the “Meeting”) to be held on May 19, 2005 at 3:00 p.m. (Calgary time) in the Viking Room at the Petroleum Club, 319 - 5th Avenue S.W., Calgary, Alberta, and at any adjournment thereof, for the purposes set forth in the Notice of Annual and Special Meeting. Instruments of Proxy must be received by the President of the Corporation c/o Valiant Trust Company 310, 606 - 4th Street S.W., Calgary, Alberta, T2P 1T1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for the holding of the Meeting or any adjournment thereof. The Board of Directors of the Corporation has fixed the record date for the Meeting at the close of business on March 24, 2005 (the “Record Date”). Only shareholders of record as at that date are entitled to receive notice of the Meeting. Shareholders of record will be entitled to vote those shares included in the list of shareholders entitled to vote at the Meeting prepared as at the Record Date, unless any such shareholder transfers shares after the Record Date and the transferee of those shares, having produced properly endorsed certificates evidencing such shares or having otherwise established ownership of such shares, demands, not later than 10 days before the Meeting, that the transferee’s name be included on the list of shareholders entitled to vote at the Meeting, in which case such transferee shall be entitled to vote such shares at the Meeting.

The instrument appointing a proxy shall be in writing and shall be executed by the shareholder or the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized.

The persons named in the enclosed form of proxy are directors and/or officers of the Corporation. Each shareholder has the right to appoint a proxyholder other than the persons designated above, who need not be a shareholder, to attend and to act for the shareholder at the Meeting. To exercise such right, the names of the nominees of management should be crossed out and the name of the shareholder’s appointee should be legibly printed in the blank space provided.

ADVICE TO BENEFICIAL HOLDERS OF COMMON SHARES

The information set forth in this section is provided to beneficial holders of common shares (“Common Shares”) of the Corporation who do not hold their Common Shares in their own name (“Beneficial Shareholders”). Beneficial Shareholders should note that only proxies deposited by shareholders whose names appear on the records of the Corporation as the registered holders of shares can be recognized and acted upon at the Meeting. If shares are listed in an account statement provided to a Beneficial Shareholder by a broker, then in almost all cases those shares will not be registered in the Beneficial Shareholder’s name on the records of the Corporation. Such shares will more likely be registered under the name of the Beneficial Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depositary for Securities Limited, which acts as nominees for many Canadian brokerage firms). Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, the broker/nominees are prohibited from voting shares for their clients. The Corporation does not know for whose benefit the shares registered in the name of CDS & Co. are held.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their shares are voted at the Meeting. The majority of brokers now delegate responsibility for obtaining instructions from clients to ADP Investor Communications (“ADP”). ADP typically provides a scannable voting request form or applies a special sticker to the proxy forms, mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the voting request forms or proxy forms to ADP. Often Beneficial Shareholders are alternatively provided with a toll-free telephone number to vote their shares. ADP then tabulates

the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting.A Beneficial Shareholder receiving a voting instruction request or a proxy with an ADP sticker on it cannot use that instruction request or proxy to vote Common Shares directly at the Meeting as the proxy must be returned as directed by ADP well in advance of the Meeting in order to have the shares voted. Accordingly, it is strongly suggested that Beneficial Shareholders return their completed instructions or proxies as directed by ADP well in advance of the Meeting.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of his broker (or agent of the broker), a Beneficial Shareholder may attend at the Meeting as proxyholder for the registered shareholder and vote Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as proxyholder for the registered shareholder should enter their own names in the blank space on the form of proxy provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker (or agent), well in advance of the Meeting.

REVOCABILITY OF PROXY

A shareholder who has submitted a proxy may revoke it at any time prior to the exercise thereof. If a person who has given a proxy attends personally at the Meeting at which such proxy is to be voted, such person may revoke the proxy and vote in person. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized and deposited either at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, and upon either of such deposits, the proxy is revoked.

PERSONS MAKING THE SOLICITATION

The solicitation is made on behalf of the management of the Corporation. The costs incurred in the preparation and mailing of the Instrument of Proxy, Notice of Annual and Special Meeting and this Information Circular - Proxy Statement will be borne by the Corporation. In addition to solicitation by mail, proxies may be solicited by personal interviews, telephone or other means of communication and by directors, officers and employees of the Corporation, who will not be specifically remunerated therefor.

EXERCISE OF DISCRETION BY PROXY

The shares represented by proxy in favour of management nominees shall be voted on any ballot at the Meeting and, where the shareholder specifies a choice with respect to any matter to be acted upon, the shares shall be voted on any ballot in accordance with the specification so made.

In the absence of such specification, the shares will be voted in favour of the matters to be acted upon. The persons appointed under the Instrument of Proxy furnished by the Corporation are conferred with discretionary authority with respect to amendments or variations of those matters specified in the Proxy and Notice of Annual and Special Meeting. At the time of printing this Information Circular - Proxy Statement, management of the Corporation knows of no such amendment, variation or other matter.

MATTERS TO BE ACTED UPON AT MEETING

Election of Directors

At the Meeting, shareholders will be asked to fix the number of directors to be elected at the Meeting at eight (8) members and to elect eight (8) directors to hold office until the next annual meeting or until their successors are elected or appointed. There are currently eight (8) directors of the Corporation, each of whom will retire from office at the Meeting.

Unless otherwise directed, it is the intention of management to vote proxies in the accompanying form in favour of an ordinary resolution fixing the number of directors to be elected at the Meeting at eight (8) members and in favour of the election as directors of the eight (8) nominees hereinafter set forth:

Ronald L. Belsher

Mary Blue

David Crevier

Alain Lambert

Hugh Mogensen

Harold Pedersen

Lyle Schultz

Ronald Woods

The names and municipalities of residence of the persons nominated for election as directors, the number of voting securities of the Corporation beneficially owned, directly or indirectly, or over which each exercises control or direction, the offices held by each in the Corporation, the period served as director and the principal occupation of each are as follows:

| | | Number of | | | | |

| | | Common | | | | |

| Name and | | Shares | | | | |

Municipality | | Beneficially | | Offices Held and | | |

of Residence | | Owned(1) | | Time as Director | | Principal Occupation |

| |

| |

| |

|

Ronald L. Belsher(2)(3) Calgary, Alberta | | 712,994 | | Director since January 9, 2003 | | Partner in Collins Barrow LLP, Chartered Accountants since 1977. |

| | | | | | | |

Mary Blue Calgary, Alberta | | 937,334 | | Vice-Chairman of the Board since October 14, 2004; Director since January 9, 2003 | | Vice-Chairman of the Board of the Corporation since October 14, 2004; prior thereto, President and Chief Operating Officer of the Corporation from January 2003 to October 2004; prior thereto, Executive Vice-President of KeyWest Energy Ltd. from February 1998 to February 2003; prior thereto, Sr. Vice-President, Land of Jordan Petroleum Ltd. from March 1993 to February 1998. |

| | | | | | | |

David Crevier(2)(4) Montreal, Quebec | | 381,621 | | Director since January 9, 2003 | | Partner in the Montreal law firm of Colby, Monet, Demers, Delage & Crevier LLP. |

| | | | | | | |

Alain Lambert(3) West Bolton, Quebec | | 387,892 | | Director since January 9, 2003 | | Principal of One and Company (an investors relations firm) since January, 2002; prior thereto, President of Triology Integrated Investor Relations Inc. from July 1998; prior thereto, President of Tokenhouse Capital & Research Inc. from November 1994 to July 1998. |

| | | | | | | |

Hugh Mogensen(2) Saanichton, British Columbia | | 441,892 | | Chairman of the Board since September 29, 2003; Director since January 9, 2003 | | Independent Business Executive and Consultant to the natural resources industry since May 1986. |

| | | Number of | | | | |

| | | Common | | | | |

| | | Shares | | | | |

| Name and Municipality | | Beneficially | | Office Held and | | |

| of Residence | | Owned(1) | | Time as Director | | Principal Occupation |

| |

| |

| |

|

Harold V. Pedersen(3) Calgary, Alberta | | 1,863,678 | | President and Chief Executive Officer since October 14, 2004; CEO and Director since January 9, 2003 | | President and Chief Executive Officer of the Corporation; prior thereto, President of KeyWest Energy Corporation from February 1998 to February 2003; prior thereto, President of Jordan Petroleum Ltd. from August 1986 to December 1997. |

| | | | | | | |

Lyle Schultz(4) Calgary, Alberta | | 395,150 | | Director since January 9, 2003 | | Independent businessman; prior thereto, Vice-President and co-founder of MiCasa Rentals Inc., a privately owned oilfield wellsite trailer rental company from 1993 to 2004. |

| | | | | | | |

J. Ronald Woods(2)(4) Toronto, Ontario | | 183,596 | | Director since January 9, 2003 | | President, Rowood Capital Corp. since November 2000; prior thereto Vice-President, Jascan Resources Inc. since 1996. |

Notes:

| (1) | Information as to common shares beneficially owned directly or indirectly or over which control or direction is exercised as at March 1, 2005, is based on data furnished to the Corporation by the nominees. |

| (2) | Member of the Audit and Reserves Committees. |

| (3) | Member of the Compensation Committee. |

| (4) | Member of the Corporate Governance Committee. |

As at December 31, 2004, the directors and officers of the Corporation, as a group, beneficially owned, directly or indirectly, or exercised control or direction over, 5,712,380 Common Shares or approximately 15.4% of the issued and outstanding Common Shares.

Corporate Cease Trade Orders or Bankruptcies

No director, officer or promoter of the Corporation has, within the last ten (10) years, been a director, officer or promoter of any reporting issuer that, while such person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied the company access to any statutory exemption for a period of more than 30 consecutive days or was declared a bankrupt or made a voluntary assignment in bankruptcy, made a proposal under any legislation relating to bankruptcy or been subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver-manager or trustee appointed to hold the assets of that person.

Penalties or Sanctions

No director, officer or promoter of the Corporation, within the last ten (10) years, has been subject to any penalties or sanctions imposed by a court or securities regulatory authority relating to trading in securities, promotion or management of a publicly traded issuer or theft or fraud.

Personal Bankruptcies

No director, officer or promoter of the Corporation, or a shareholder holding sufficient securities of the Corporation to affect materially the control of the Corporation, or a personal holding company of any such persons, has, within the last ten (10) years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or being subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of the individual.

Conflicts of Interest

The directors and officers of the Corporation may, from to time, be involved with the business and operations of other oil and gas issuers, in which case a conflict of interest may arise between their duties as officers and directors of the Corporation and as officers and directors of such other companies. Such conflicts must be disclosed in accordance with, and are subject to such procedures and remedies, as applicable, under theBusiness Corporations Act (Alberta).

Appointment of Auditors

Unless otherwise directed, it is management’s intention to vote the proxies in favour of an ordinary resolution to re-appoint the firm of KPMG LLP, Chartered Accountants, Calgary, Alberta, to serve as auditors of the Corporation until the next annual meeting of the shareholders and to authorize the directors to fix their remuneration as such. KPMG LLP have been the Corporation’s auditors since January 9, 2003.

Fees paid or payable to the Corporation’s auditors for professional services rendered to the Corporation in 2004 are as follows:

| Audit Services | | | - | | $ | 60,000 | |

| Audit Related Services | | | - | | $ | 10,000 | |

| Tax Related Services | | | - | | $ | 10,000 | |

Total | | | | | $ | 80,000 | |

Ratification and Approval of Amendment to Share Option Plan

The Corporation’s share option plan (the “Option Plan”) is described below under “Statement of Executive Compensation - Stock Option Plan”.

Formerly, under the policies of the Toronto Stock Exchange (“TSX”), share compensation arrangements (including the Corporation’s Option Plan) were required to have a fixed maximum number of securities available for issuance. On January 1, 2005, the TSX amended certain parts of the TSX Company Manual including amendments to share compensation arrangements (collectively, the “TSX Amendments”). The TSX Amendments provide, among other things, for the removal of the requirement for a fixed maximum number of securities issuable under a share compensation arrangement, thereby allowing issuers to have a rolling maximum number of securities based on a percentage of its outstanding securities. Further thereto, effective March 10, 2005, the Board approved amendments (the “Plan Amendment”) to the Option Plan to: (i) change the number of authorized but unissued Common Shares that may be subject to options granted under the Option Plan at any time to 10% of the number of outstanding Common Shares from time to time; (ii) to provide that any increase in the issued and outstanding common shares of the Corporation will result in an increase in the available number of common shares issuable under the Option Plan; (iii) to provide that any increase in the number of options granted under the Option Plan will, if exercised, make new grants available under the Option Plan; and (iv) to amend the definition of “Outstanding Common Shares” in the Option Plan to mean all the issued and outstanding common shares of the Corporation (on a non-diluted basis) that are outstanding immediately prior to the share issuance or grant of stock options in question pursuant to the Option Plan.

As an emerging oil and gas company and in order to maintain its low cost structure, Luke cannot afford to pay industry competitive salaries and accordingly, Luke must rely heavily on stock options as the most significant incentive that it can offer to attract quality geological, engineering, land and accounting personnel in a very competitive employment market.

Under the Corporation's Option Plan, when options are granted, they are priced at the market trading price for Luke's Common Shares. Options will therefore ultimately be "in-the-money" only if Luke's share price increases thereby providing employees holding options with a vested interest in ensuring the Corporation's success.

In accordance with the requirements of the TSX, the Plan Amendment is subject to ratification and approval by shareholders at the Meeting.

At the Meeting, the Shareholders will be asked to consider and, if thought advisable, to approve the following resolution to approve amendments to the Option Plan:

“BE IT RESOLVED, as an Ordinary Resolution of Luke Energy Ltd. (the “Corporation”) that:

| | (1) | the share option plan of the Corporation (the “Option Plan”) be amended by: |

| | | | |

| | | (i) | changing the number of authorized but unissued Common Shares that may be subject to options granted under the Option Plan at anytime to 10% of the number of outstanding Common Shares from time to time; |

| | | | |

| | | (ii) | stating that any increase in the issued and outstanding Common Shares will result in an increase in the available number of Common Shares issuable under the Option Plan; |

| | | | |

| | | (iii) | stating that any increase in the number of options granted under the Option Plan will, if exercised, make new grants available under the Option Plan; and |

| | | | |

| | | (iv) | amending the definition of “Outstanding Common Shares” under the Option Plan to mean at the time of any share issuance or grant of stock options pursuant to the Option Plan, the aggregate number of common shares (on a non-diluted basis) that are outstanding immediately prior to the share issuance or grant of stock options in question; |

| | | |

| | (2) | any one (1) director or officer of the Corporation be authorized to make all such arrangements, to do all acts and to sign and execute all documents and instruments in writing as may be considered necessary or advisable to give full force and effect to the foregoing; and |

| | | |

| | (3) | the board of directors of the Corporation may revoke this resolution before it is acted on without further approval of the holders of Common Shares.” |

The TSX Amendments may also require that the Option Plan be approved every three years, (i) by a majority of the issuer’s directors and by all its unrelated directors and, (ii) by the Shareholders except that insiders of the issuer entitled to receive a benefit under the arrangement are not eligible to vote their securities in respect of such approval.

In order for the foregoing resolution to be passed, it must be approved by a simple majority of the votes cast by Shareholders who vote in person or by proxy at the Meeting.

The persons named in the enclosed form of proxy, if named as proxy, intend to vote for the approval of the adoption of the amendments to the Plan.

INFORMATION CONCERNING THE CORPORATION

Voting Shares and Principal Holders Thereof

As at March 28, 2005, 37,002,823 common shares (“Common Shares”) of the Corporation were issued and outstanding, each such share carrying the right to one vote on a ballot at the Meeting. A quorum for the transaction of business at the Meeting is not less than two (2) persons present, holding or representing not less than 5% of the shares entitled to be voted at the Meeting.

To the knowledge of the directors and senior officers of the Corporation, as at March 28, 2005, no person or company beneficially owned, directly or indirectly, or exercised control or direction over, voting securities of the Corporation carrying more than 10% of the voting rights attached to any class of voting securities of the Corporation.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation

For the year ended December 31, 2004, the only Named Executive Officers in accordance with National Instrument 51-102 were Harold V. Pedersen, President and Chief Executive Officer of Luke and Carrie McLauchlin, Vice-President Finance and Chief Financial Officer of Luke (the “Named Executive Officers”).

Summary Compensation Table

The following table and notes thereto set forth certain information concerning the compensation paid to the Named Executive Officers by Luke.

| | | Long Term Compensation | |

Annual Compensation | | Awards | | Payouts | |

| | | | | | | | | | | | | Shares or | | | | | |

| | | | | | | | | | | Common | | Units Subject | | | | | |

| | | | | | | | | | | Shares Under | | to Resale | | LTIP | | All Other | |

Name and | | Year Ended | | Salary | | Bonus | | Other Annual | | Option/ | | Restrictions | | Payouts | | Compensation | |

Principal Position | | December 31, | | ($) | | ($) | | Compensation(1) | | SARs Granted | | ($) | | ($) | | ($) | |

Harold V. Pedersen President and Chief Executive Officer | | | 2004 2003 | | $ $ | 84,171 43,130 | | | N/A N/A | | | N/A N/A | | | - 210,000 | | | - - | | | N/A N/A | | | 2,400 N/A | |

Carrie McLauchlin Vice-President, Finance and Chief Financial Officer | | | 2004 2003 | | $ $ | 83,771 43,130 | | | N/A N/A | | | N/A N/A | | | - 160,000 | | | - - | | | N/A N/A | | | N/A N/A | |

Notes:

| (1) | The aggregate value of perquisites and other personal benefits, securities or property received was not greater than $50,000 and 10% of the aggregate annual salary and bonus of the Named Executive Officer for the financial year. |

Stock Option Plan

The Corporation has adopted a stock option plan effective February 25, 2003, as amended on April 14, 2003 (the “Plan”), which was approved by the shareholders of the Corporation at a special meeting held on April 14, 2003, for directors, officers, employees and consultants of the Corporation and its subsidiaries and other persons who provide ongoing management and consulting services to the Corporation. The Plan currently limits the number of Common Shares that may be issued on exercise of options to 3,305,395 Common Shares (8.9% of the Corporation’s issued and outstanding Common Shares as at March 28, 2005), of which 46,667 Common Shares (0.13% of those outstanding as at March 28, 2005) have been issued on exercise of Options, Options to purchase 3,239,333 Common Shares (8.8% of those outstanding as at March 28, 2005) are outstanding and 19,395 Common Shares are available for future grants (0.05% of those outstanding as a March 28, 2005). Options granted pursuant to the Plan have a term not exceeding five (5) years and vest as to one-third (1/3) on each of the first, second and third anniversaries of the date of the grant and the Plan provides for accelerated vesting of options upon a “change of control” of the Corporation or the sale by the Corporation of all or substantially all of the property and assets of the Corporation. Options granted under the Plan are non-assignable. The exercise price of options granted under the Plan is determined by the Board of Directors of the Corporation at the time of the grant and may not be less than the closing trading price of the Common Shares on the TSX on the last trading day preceding the date of the grant.

Under the Option Plan, (i) the number of Common Shares issuable (or reserved for issuance) to any one person under the Option Plan, together with all other share compensation arrangements of the Corporation, must not exceed 5% of the outstanding issue of Common Shares; (ii) in the aggregate, no more than 10% of the outstanding issue of Common Shares (on a non-diluted basis) may be issuable (or reserved for issuance) at any time to Insiders under the Option Plan, together with all other share compensation arrangements of the Corporation; and (iii) the aggregate number of Common Shares issued to Insiders pursuant to the Option Plan and all other share compensation arrangements of the Corporation, within a one (1) year period, shall not exceed 10% of the outstanding issue of Common Shares (on a non-diluted basis).

In case of death of an optionee, Options terminate on the date determined by the Board of Directors of the Corporation which may not be more than six (6) months from the date of death and, if the optionee ceases to be a director, officer or employee of, or ceases to be providing ongoing management or consulting services to, the Corporation, Options terminate on the expiry of 90 days following the date that the optionee ceased to be a director, officer or employee of the Corporation or ceased to provide ongoing management or consulting services to the Corporation, as the case may be. In the case of a takeover bid for the outstanding Common Shares of the Corporation, the Corporation has the right to satisfy any obligations to an optionee in respect of any unexercised Options by paying to the optionee a cash amount equal to the difference between the exercise price of unexercised Options held and the fair market value of the securities to which the optionee would have been entitled to receive upon the exercise of unexercised Options.

Upon the exercise of any Options granted under the Option Plan, the optionee may elect to receive, with the consent of the Corporation, and in consideration for the disposition by the optionee of the right to receive Common Shares pursuant to such options and the termination thereof, the difference between, (i) the weighted average price per share for the Common Shares for the five (5) consecutive trading days ending on the last trading day preceding the date in question on The Toronto Stock Exchange, and (ii) the exercise price of the option, which amount may be paid, at the election or deemed election of the optionee, in cash or in Common Shares, in accordance with the provisions of the Option Plan.

The Board of Directors may amend or discontinue the Plan at any time, provided that no such amendment may, without the consent of the optionees, alter or impair any option previously granted and provided that any amendment to the Plan is subject to receipt of all necessary approvals of the TSX and the approval of the shareholders of the Corporation if required by such exchange.

The Board of Directors of the Corporation has proposed to amend the Plan to make it a “rolling plan”. See “Matters to be Acted Upon at Meeting - Ratification and Approval of Amendment to Share Option Plan”.

Stock Options Granted to Named Executive Officers

There were no options granted to the Named Executive Officers during the most recently completed financial year.

The following table sets forth, with respect to the Named Executive Officers, the number of unexercised stock options and the value of in-the-money stock options at December 31, 2004:

| | | | | | | | | Value of Unexercised | |

| | | Securities | | Aggregated | | Unexercised Stock | | in-the-Money Stock | |

| | | Acquired or | | Value | | Options/SARs at FY-End | | Options/SARs at FY-End(1) | |

| | | Exercised | | Realized | | Exercisable/Unexercisable | | Exercisable/Unexercisable | |

Name | | (#) | | ($) | | (#) | | ($) | |

| Harold V. Pedersen | | | N/A | | | N/A | | | 90,000 / 120,000 | | | 174,800 / 201,400 | |

| Carrie McLauchlin | | | N/A | | | N/A | | | 73,333 / 86,667 | | | 149,466 / 150,734 | |

Note:

| (1) | Based on the closing price on December 31, 2004 of $3.28, less the exercise price. |

As at the date of this Information Circular, options entitling the officers and the directors to acquire an aggregate of Common Shares were outstanding as follows:

| | | Number of | | | | Exercise Price | | | |

| | | Common Shares | | | | Per Luke | | | |

Optionee | | Under Option | | Date of Grant | | Share | | Expiry Date | |

| Five (5) Executive Officers | | | 120,000 | | | Feb 19, 2003 | | $ | 0.81 | | | Feb 19, 2008 | |

| | | | 950,000 | | | Aug 26, 2003 | | $ | 1.76 | | | Aug 26, 2008 | |

| | | | 100,000 | | | Aug 17, 2004 | | $ | 2.19 | | | Aug 17, 2009 | |

Total | | | 1,170,000 | | | | | | | | | | |

| Seven (7) Directors who are not Executive Officers | | | 340,000 | | | Feb 19, 2003 | | $ | 0.81 | | | Feb 19, 2008 | |

| | | | 420,000 | | | Aug 26, 2003 | | $ | 1.76 | | | Aug 26, 2008 | |

| One (1) Officer who is not an Executive Officer | | | 50,000 | | | Feb 19, 2003 | | $ | 0.81 | | | Feb 19, 2008 | |

| | | | 50,000 | | | Aug 26, 2003 | | $ | 1.76 | | | Aug 26, 2008 | |

Total | | | 2,030,000 | | | | | | | | | | |

Securities Authorized for Issuance Under Equity Compensation Plans

The following sets forth information in respect of securities authorized for issuance under the Corporation’s equity compensation plans as at December 31, 2004.

| | | | | | | Number of securities | |

| | | Number of | | Weighted average | | remaining available | |

| | | securities to be | | exercise price | | for future issuance | |

| | | issued upon exercise of | | of outstanding | | under equity compensation | |

| | | outstanding options, | | options, warrants | | plans (excluding securities | |

| | | warrants and rights | | and rights | | reflected in column (a)) | |

Plan Category | | (a) | | (b) | | (c) | |

| Equity compensation plans approved by securityholders | | | 3,214,333 | | $ | 1.69 | | | 49,395 | |

| Equity compensation plans not approved by securityholders | | | N/A | | | N/A | | | N/A | |

Total | | | 3,214,333 | | $ | 1.69 | | | 49,395 | |

Note:

| (1) | Upon approval of the proposed amendment to the stock option plan of the Corporation to be voted upon by shareholders at the Meeting, the authorized but unissued Common Shares that may be issued subject to options granted under the Corporation’s stock option plan at any time will be 10% of the number of outstanding Common Shares from time to time, subject to the restrictions described under “Stock Option Plan”. |

Stock Options Outstanding

The Corporation has an aggregate of 3,239,333 options outstanding at a weighted average exercise price of $1.69. Options to purchase 591,000 Common Shares were granted during 2004 and options to purchase 30,000 Common Shares were granted subsequent to December 31, 2004 and prior to March 28, 2005, to non-executive employees. Luke has available an additional 19,395 options to be granted pursuant to its existing Option Plan. Assuming approval of the Plan Amendment by the Shareholders at the Meeting, an additional 394,387 options will be available for grant pursuant to the Option Plan based on Luke’s outstanding number of Common Shares as at March 28, 2005 of 37,002,893 shares.

REPORT ON EXECUTIVE COMPENSATION

Composition and Role of the Compensation Committee

The Board has appointed a Compensation Committee comprised of Ronald L. Belsher (Chairman), Alain Lambert and Harold Pedersen, of which Messrs. Belsher and Lambert are “non-management related” directors. The committee’s mandate is to formally make recommendations to the Board in respect of compensation issues relating

to directors, senior management and staff of the Corporation, including recommending performance objectives and the compensation package for the President and Chief Executive Officer.

Report of the Compensation Committee

The Corporation’s compensation philosophy is aimed at attracting and retaining quality and experienced personnel, which is critical to the success of the Corporation. Employee compensation, including executive officer compensation, is comprised of three elements: base salary, short-term incentive compensation (being cash bonuses) and long-term incentive compensation (being stock options).

The Compensation Committee makes recommendations for executive compensation to the full Board for approval.

Base Salaries

The Corporation’s approach to base compensation is to offer salaries which are competitive when compared to those within the Corporation’s peer group of companies. Base salary ranges are determined following a review of comparative data of the Corporation’s peer group. Compensation is weighted more heavily towards long-term incentive compensation by way of the grant of stock options in order to align the interests of the Corporation’s executive officers and employees with the performance of the Corporation and the interests of its shareholders.

Short-Term Incentive Compensation - Bonuses

In addition to base salaries, the Corporation may award cash bonuses to employees of the Corporation, including executive officers. In determining the size of the bonus pool, if any, the Compensation Committee considers, (i) common share price performance; (ii) growth in cash-flow; and (iii) growth in asset value. The award of a bonus is determined, in the case of employees, by senior management of the Corporation and approved by the Compensation Committee. The Compensation Committee in consultation with the President establishes bonus levels for Vice-Presidents and the Compensation Committee in consultation with the Board establishes the President and Chief Executive Officer’s bonus. In the case of non-executive employees, bonuses are based on the employee’s contribution in adding share value and reducing costs and the employee's contribution to the achievement of overall corporate goals. As Luke is an emerging oil and gas company, no cash bonuses were awarded in 2004.

Long-Term Incentive Compensation - Stock Options

Individual stock options are granted by the Board on the recommendation of senior management, in the case of employees, and by the Compensation Committee, in the case of executive officers including the President and Chief Executive Officer. Stock options are intended to align executive and shareholder interests by attempting to create a direct link between compensation and shareholder return. Participation in the Corporation’s stock option plan rewards overall corporate performance, as measured through the underlying value of the Corporation’s shares.

Stock options are normally awarded by the Board upon the commencement of employment with the Corporation based on the level of responsibility within the Corporation. Additional grants may be made periodically to ensure that the number of options granted to any particular individual is commensurate with the individual’s level of ongoing responsibility within the Corporation. Stock option grants are determined by factors including the number of eligible individuals currently under the option plan, the number of shares to be acquired under existing options relative to the issued and outstanding Common Shares and Luke’s future hiring plans.

Summary

Luke’s compensation policies have allowed the Corporation to attract and retain a team of motivated professionals and support staff working towards the common goal of enhancing shareholder value. The Compensation Committee and the Board will continue to review compensation policies to ensure that they are competitive within the oil and natural gas industry and consistent with the performance of the Corporation.

Submitted By:

| | Ronald L. Belsher (Chairman) |

| | Alain Lambert |

| | Harold Pedersen |

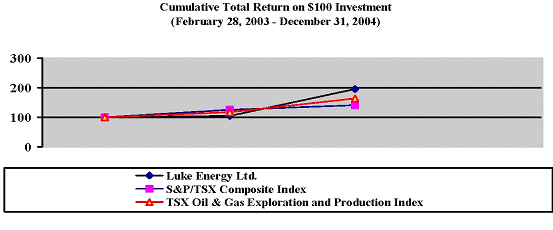

PERFORMANCE GRAPH

The following graph compares the yearly change in the cumulative total shareholder return since incorporation of a $100 investment in the Corporation’s Common Shares, with the cumulative total return of the S&P/TSX Composite Index (previously the TSE 300 Composite Index) and the TSX Oil & Gas Producers Index (previously the TSE Oil & Gas Index), for the comparable period.

The Corporation was incorporated on January 9, 2003 and subsequently commenced trading on the TSX on February 28, 2003.

| Index | February 28, 2003 | December 31, 2003 | December 31, 2004 |

| Luke Energy Ltd. | 100 | 104.76 | 195.24 |

| S&P/TSX Composite Index | 100 | 125.41 | 141.06 |

| TSX Oil & Gas Exploration and Production Index | 100 | 117.26 | 163.62 |

CORPORATE GOVERNANCE

The Board has the obligation to oversee the conduct of our business and to supervise senior management who are responsible for the day-to-day conduct of the business. The TSX has established guidelines (the “Guidelines”) for effective corporate governance matters. The Guidelines address such matters as the constitution and independence of boards of directors, the functions to be performed by boards and their committees, and the relationship among a corporation’s board, management and shareholders. The Corporation’s disclosure with respect to the Guidelines is set forth in Schedule “A” hereto.

Under the Guidelines, an “unrelated” director is one who is independent of management and is free from any interest and any business or other relationship (other than interests and relationships arising from shareholding) which could, or could reasonably be perceived to, materially interfere with the director’s ability to act in the best interests of the Corporation. The Guidelines also make an informal distinction between inside and outside directors, an inside director being one who is an officer or employee of the Corporation or any of its affiliates, and who is thus a “management” director. Two of the directors, Harold Pedersen and Mary Blue, are “management” directors and thus are “related” directors.

The Ontario Securities Commission has published for comment proposals on corporate governance that are intended to replace the Guidelines when they come into force. The comment period on these proposals has ended but they are subject to final regulatory approval and the Corporation is not aware whether they will be adopted in the form proposed or whether changes will be made to them prior to adoption and therefore such proposals have not been reflected in the disclosure on the Guidelines provided herein.

Board Committees

The Board has constituted four committees: the Reserves Committee, the Corporate Governance Committee, the Compensation Committee and the Audit Committee.

Corporate Governance Committee

The Corporate Governance Committee is comprised of David Crevier, Lyle Schultz and J. Ronald Woods, all of whom are “outside” directors.

The Corporate Governance Committee’s function is to enhance corporate governance through a continuing assessment of governance issues and the making of recommendations to the board in relation thereto. The committee has amongst its mandates, the responsibility of proposing to the full Board, new nominees to the Board and for assessing directors on a ongoing basis. In addition, the committee is responsible for the Corporation’s response to the Guidelines.

Compensation Committee

The Compensation Committee is comprised of Ronald L. Belsher (Chairman), Alain Lambert and Harold Pedersen. Harold Pedersen is the President and Chief Executive Officer of the Corporation and the remaining two are “outside” directors.

The mandate of the Compensation Committee is to formulate and make recommendations to the Board in respect of compensation issues relating to directors, senior management and staff of the Corporation, including reviewing and recommending performance objectives and the compensation package for the President and Chief Executive Officer.

Audit Committee and Reserves Committee

The Audit Committee and the Reserves Committee are each comprised of Ronald L. Belsher, David Crevier, Hugh Mogensen and J. Ronald Woods, all of whom are “outside” directors.

The Audit Committee meets quarterly in each year and among other things, with the assistance of the external auditors, is responsible for reviewing management programs and policies regarding the adequacy and effectiveness of the internal controls over the accounting and financial reporting systems within the Corporation, including management’s response to internal control recommendations of the external auditors. The committee reviews management plans regarding changes in accounting practices and policies and the financial impact thereof and is responsible for reviewing the major areas of management judgment and estimates that have a significant effect upon the financial statements. The Audit Committee is also charged with reviewing and approving all bank credit facilities and other borrowing strategies presented by senior management including price hedging and foreign currency risk strategies of the Corporation. The committee receives a yearly report from the Corporation’s external auditors with respect to the Corporation’s financial control and information systems which comes to their attention

during the course of conducting the year-end audit. Results of those reports are relayed by the committee to the full Board for its consideration. At least once a year, the Audit Committee meets with the Corporation’s external auditors without management being present and may do so at any time throughout the rest of the year. All financial statements, quarterly reports, and other financial information that are publicly disseminated are reviewed for approval by the committee prior to their release.

In addition, the Audit Committee meets on a yearly basis with the independent engineers of the Corporation following their preparation of the Corporation’s year-end reserve and economic evaluation. This meeting takes place prior to finalization and shareholder dissemination of the reserve results at which time the engineers are required to review, in detail, their reserve analysis and to discuss, among other things, the qualifications of the engineers responsible for the reserve analysis, the process and methodology utilized in evaluating the Corporation’s reserves and the Corporation’s compliance with any emerging issues related to the preparation of reserve analysis. Following such meeting, management of the Corporation is invited to attend the meeting for the purpose of engaging in a complete property-by-property discussion with the Audit Committee and the independent engineers.

The Reserves Committee’s function is to approve the appointment of independent engineers, to meet with such independent engineers for the purpose of satisfying themselves that the independent engineers act independently and are not unduly influenced by management, that any significant disagreements or issues between management and the independent engineers are appropriately resolved and to instruct the independent engineers as to any area of emphasis for any particular year.

Employment Arrangements

There are no employment contracts or other compensation plans or arrangements with regard to any of the Executive Officers which provide for specific compensation in the event of resignation, retirement, other termination of employment or from a change of control of the Corporation or from a change in an Executive Officer’s responsibilities following a change of control.

Directors’ Remuneration

The directors of the Corporation are entitled to receive a fee of $300 for each meeting of the Board of Directors or any committee thereof attended and are additionally entitled to be reimbursed for traveling and other expenses properly incurred in the performance of their duties as directors of the Corporation. During the year ended December 31, 2004, fees in the aggregate of $16,800 were paid to the directors of the Corporation.

Indebtedness of Directors and Senior Officers

Management of the Corporation is not aware of any indebtedness outstanding by directors or senior officers of the Corporation to the Corporation or its subsidiaries at any time since the commencement of the last completed financial year of the Corporation.

INSURANCE

The directors and officers of the Corporation are covered by an underwritten executive liability and indemnification policy for the period March 12, 2004 to April 30, 2005, with respect to any wrongful act committed or alleged to have been committed during such policy period. The total premium of this coverage is $25,515 which amount has been paid by the Corporation. The limited liability covered by the policy is $3,000,000 per loss per year with, subject to certain exceptions, a $50,000 deductible by the Corporation.

INTEREST OF INSIDERS IN MATERIAL TRANSACTIONS

There were no material interests, direct or indirect, of directors and senior officers of the Corporation, nominees for director, any shareholder who beneficially owns more than 10% of the shares of the Corporation or any other Informed Person (as defined in National Instrument 51-102), or any known associate or affiliate of such persons in any transaction since the commencement of the Corporation’s last completed financial year or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its

subsidiaries, which has not been previously disclosed herein or otherwise in an information circular of the Corporation.

INTEREST OF CERTAIN PERSONS AND COMPANIES IN MATTERS TO BE ACTED UPON

Management of the Corporation is not aware of any material interest of any director or nominee for director, or senior officer or any one who has held office as such since the beginning of the Corporation’s last financial year or of any associate or affiliate of any of the foregoing, in any matter to be acted on at the Meeting other than the election of directors and the ratification and approval of the Plan Amendment (to the extent that any such persons are entitled to participate in the Plan and be granted options thereunder.

ADDITIONAL INFORMATION

Additional information relating to the Corporation is available on SEDAR at www.sedar.com. Financial information in respect of the Corporation and its affairs is provided in the Corporation’s annual audited comparative financial statements for the year ended December 31, 2004 and the related management’s discussion and analysis. Copies of the Corporation’s financial statements and related management discussion and analysis are available upon request from the Corporation atinvestors@lukeenergy.com or by telephone at (403) 261-4811.

OTHER MATTERS

Management knows of no amendment, variation or other matter to come before the Meeting other than the matters referred to in the Notice of Annual and Special Meeting. However, if any other matter properly comes before the Meeting, the accompanying proxy will be voted on such matter in accordance with the best judgment of the person or persons voting the proxy.

APPROVAL

The contents and sending of this Information Circular - Proxy Statement has been approved by the directors of the Corporation.

DATED: March 28, 2005.

SCHEDULE “A”

To the Information Circular - Proxy Statement of Luke Energy Ltd.

Dated March 28, 2005

LUKE ENERGY LTD. |

GUIDELINES | COMPLIANCE | COMMENTS |

| (1) | The Board should explicitly assume responsibility for the stewardship of the Corporation, including: | | |

| (a) | the adoption of a strategic planning process; | | The Board has a strategic planning process, which involves ongoing meetings of the Board to discuss strategic planning issues, with and without members of management. |

| (b) | the identification of the principal risks of the Corporation’s business and the implementation of appropriate systems to manage these risks; | Yes | Directly and through the audit committee, the Board monitors and receives periodic reports respecting operations, internal controls and business risks from management and the external auditors. In the past, the Corporation has identified business risks and the systems in place to manage these risks in its annual and interim reports to shareholders. The identification of the principal risks of the Corporation’s business and the implementation of appropriate systems to manage these risks are addressed in the ongoing strategic planning process |

| (c) | succession planning, including appointing, training and monitoring senior management; | Yes | The Board has a succession planning process in place that has been delegated to Luke Energy Ltd.’s corporate governance committee. The committee acts on an as-needed basis to fill specific requirements at senior management levels. |

| (d) | the Corporation’s communications policy; and | Yes | The Board or individual members approve all of the Corporation’s major compliance and communication documents, including annual and quarterly reports, information circulars, financing documents and other disclosure documents. In addition, the Board has delegated the responsibility for direct shareholder communications to the Chief Executive Officer and the Chief Financial Officer, who are available to shareholders and the investment community to discuss the Corporation’s business and operations. |

| (e) | the integrity of the Corporation’s internal control and management information systems. | Yes | The Board uses both direct enquiry of management and the Corporation’s auditors to assess the integrity of the Corporation’s internal control and management information systems. |

| (2) | The Board should be constituted with a majority of individuals who qualify as unrelated directors. | Yes | Three-quarters of the members of the Board are unrelated directors. |

| (3) | The analysis of the application of the principles supporting the conclusion in paragraph 2 above. | | Of the eight members of the Board, two are members of management. The remaining six members of the Board are independent of management and are free from any interest and any business or other relationship (other than interests and relationships arising from shareholdings) which could, or could reasonably be perceived to, materially interfere with such directors’ ability to act in the best interests of the Corporation. |

| (4) | The Board should appoint a committee of directors composed exclusively of outside, i.e., non-management directors, a majority of whom are unrelated directors, with the responsibility for proposing to the full Board new nominees to the Board and for assessing directors on an ongoing basis. | Yes | The Board has appointed a corporate governance committee, which has amongst its mandates, the responsibility of proposing to the full Board new nominees to the Board and for assessing directors on an ongoing basis. The Corporate Governance Committee is comprised entirely of outside unrelated directors. |

LUKE ENERGY LTD. |

GUIDELINES | COMPLIANCE | COMMENTS |

| (5) | The Board should implement a process to be carried out by the Nominating Committee or other appropriate committee for assessing the effectiveness of the Board as a whole, the committees of the Board and the contribution of individual directors. | Yes | The assessment of the effectiveness of the Board as a whole, the committees of the Board and the contribution of individual directors on an ongoing basis, has been delegated to the Corporate Governance Committee. |

| (6) | The existence of an orientation and education program for new recruits to the Board. | No | There is no specific education and orientation program for new Board members. Regular Board meetings include meetings with management, where new Board members can familiarize themselves with the Corporation’s operations. The Board ensures that any new directors will be provided with suitable materials and training to assist in their orientation to the Corporation and their roles within the Board, however, given that new directors will be added infrequently, no formal orientation process is felt necessary at this time. |

| (7) | The size of the Board and the impact of the number of directors upon the Board’s effectiveness. | Yes | The Board is comprised of eight directors, which the Board believes is large enough to permit a diversity of views and to staff the various committees of the Board, without being too large to detract from the Board’s efficiency and effectiveness. |

| (8) | The adequacy and form of the compensation of directors should realistically reflect the responsibilities and risk involved in being an effective director. | Yes | Directors are compensated by the grant of stock options under the Corporation’s Stock Option Plan. Compensation levels are reviewed periodically by the Compensation Committee. Directors’ liability insurance is provided. The Board believes that the compensation currently offered to directors, in form and in amount, adequately reflects the responsibilities and risks assumed by each member. |

| (9) | Committees of the Board should generally be composed of outside directors, a majority of whom are unrelated directors. | Yes | The members of each of the Board’s committees are “unrelated” directors, with the exception of Harold V. Pedersen, the Corporation’s Chief Executive Officer, who is a member of the Compensation Committee. |

| (10) | The Board’s responsibility for (or a committee of the Board’s general responsibility for) developing the Corporation’s approach to governance issues. | Yes | The Board has appointed a Corporate Governance Committee to enhance corporate governance through a continuing assessment of governance issues and the making of recommendations to the Board in relation thereto. Such committee is responsible for the Corporation’s response to the Guidelines. |

| (11) | The Board has developed: | | |

| (a) | position descriptions for the Board and for the CEO, involving the definition of the limits to management’s responsibilities; and | Yes | The Board retains all powers not delegated by the Board to management or Board Committees. The Board remains responsible for directing the Corporation’s business and affairs and for supervising management. The responsibilities of the Corporation’s senior officers are described in various documents, including the Corporation’s annual budget and other miscellaneous documentation. |

| (b) | the corporate objectives for which the CEO is responsible for meeting. | Yes | The corporate objectives of the CEO include maximizing shareholder value, implementing the business plan for the Corporation pursuant to the Board’s strategic planning process, developing and staffing the Corporation’s management structure and providing effective communication between the Board, management and shareholders. The CEO’s corporate objectives are refined annually in the Corporation’s budget. |

LUKE ENERGY LTD. |

GUIDELINES | COMPLIANCE | COMMENTS |

| (12) | The structures and procedures ensuring that the Board can function independently of management. | Yes | The Board has assigned the responsibility of ensuring that the Board can function independently of management, to the Corporate Governance Committee. |

| (13) | | | |

| (a) | The Audit Committee of the Board should be composed only of outside directors. | Yes | The Audit Committee consists of Messrs. Ronald L. Belsher, David Crevier and J. Ronald Woods, all of whom are outside directors. |

| (b) | The roles and responsibilities of the Audit Committee should be specifically defined. | Yes | The mandate of the Audit Committee is set forth in the Information Circular. In order to fulfill this mandate and provide further guidance to Audit Committee members respecting their reviews, the Audit Committee has adopted a comprehensive list of practices to guide its activities. |

| (c) | The Audit Committee should have direct communication channels with the internal and external auditors to discuss and review specific issues as appropriate. | Yes | The Audit Committee (i) reviews with the Corporation’s auditors and with management the Corporation’s accounting principles, policies and practices, (ii) reviews the Corporation’s audited and unaudited quarterly financial statements with the auditors prior to their submission to the Board for approval, and (iii) reviews with the auditors the adequacy of the Corporation’s accounting, financial and operating controls, including management’s response to the internal control recommendations of the external auditors. The Corporation does not have an internal auditor. |

| (d) | The Audit Committee’s duties should include oversight responsibility for management reporting on internal controls and should ensure that management has designed and implemented an effective system of internal controls. | Yes | The Audit Committee, with the assistance of the Corporation’s auditors, reviews the adequacy and effectiveness of the system of internal controls. |

| (14) | The existence of a system, which enables an individual director to engage an outside adviser at the expense of the Corporation in appropriate circumstances. | Yes | A director or a group of directors may engage outside advisors at the expense of the Corporation, subject to Board approval. |

17