QuickLinks -- Click here to rapidly navigate through this documentFiled Pursuant to Rule 424(b)(1)

Registration No. 333-133872

Prospectus

4,590,258 Shares

Reddy Ice Holdings, Inc.

Common Stock

The selling stockholders identified in this prospectus, including affiliates of Bear, Stearns & Co. Inc., an underwriter participating in this offering, and certain of our executive officers, are offering 4,590,258 shares. We will not receive any of the proceeds from the sale of shares being sold in this offering.

Our common stock is listed on the New York Stock Exchange under the trading symbol "FRZ". On May 23, 2006, the last reported sale price of our common stock was $21.55 per share.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 8.

|

|---|

| | Per Share

| | Total

| |

|

|---|

| Public Offering Price | | $ | 21.55 | | $ | 98,920,059.90 | | |

Underwriting Discount |

|

$ |

1.0775 |

|

$ |

4,946,003.00 |

|

|

Proceeds to the Selling Stockholders |

|

$ |

20.4725 |

|

$ |

93,974,056.90 |

|

|

|

Certain of the selling stockholders have granted the underwriters a 30-day option to purchase up to 688,539 additional shares to cover any over-allotments.

Delivery of shares will be made on or about May 30, 2006.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Bear, Stearns & Co. Inc. | Lehman Brothers |

| Goldman, Sachs & Co. | | Wachovia Securities | | Piper Jaffray |

Morgan Keegan & Company, Inc. |

The date of this prospectus is May 23, 2006.

You should rely only on information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

"Reddy Ice" and the logo set forth on the cover of this prospectus are our registered trademarks in the United States.

i

SUMMARY

The following is a summary of information set forth throughout this prospectus and should be read together with the more detailed information and the financial statements and the related notes included elsewhere in this prospectus. See "Risk Factors" for factors that you should consider before investing in our common stock and "Forward-Looking Statements" for information relating to statements contained in this prospectus that are not historical facts. In this prospectus, unless otherwise noted, (1) the words "Company," "we," "our," "ours" and "us" refer to Reddy Ice Group, Inc., formerly known as Packaged Ice, Inc., and its subsidiaries for periods through August 14, 2003 and to Reddy Ice Holdings, Inc. and its subsidiaries for periods subsequent to August 14, 2003, (2) "Reddy Group" refers to Reddy Ice Group, Inc., formerly known as Packaged Ice, Inc., and not its subsidiaries, and (3) "Reddy Holdings" refers to Reddy Ice Holdings, Inc. and not its subsidiaries.

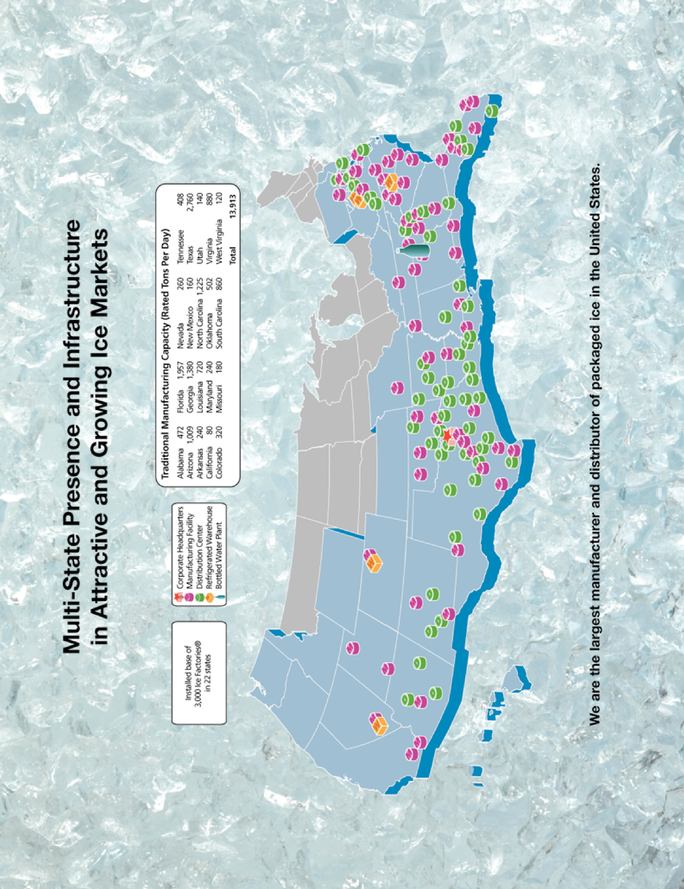

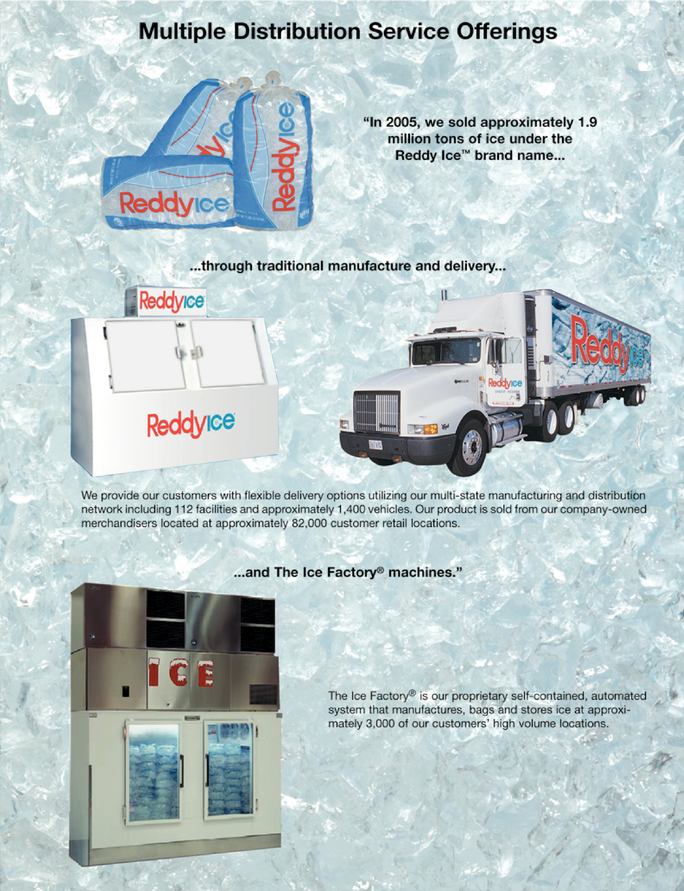

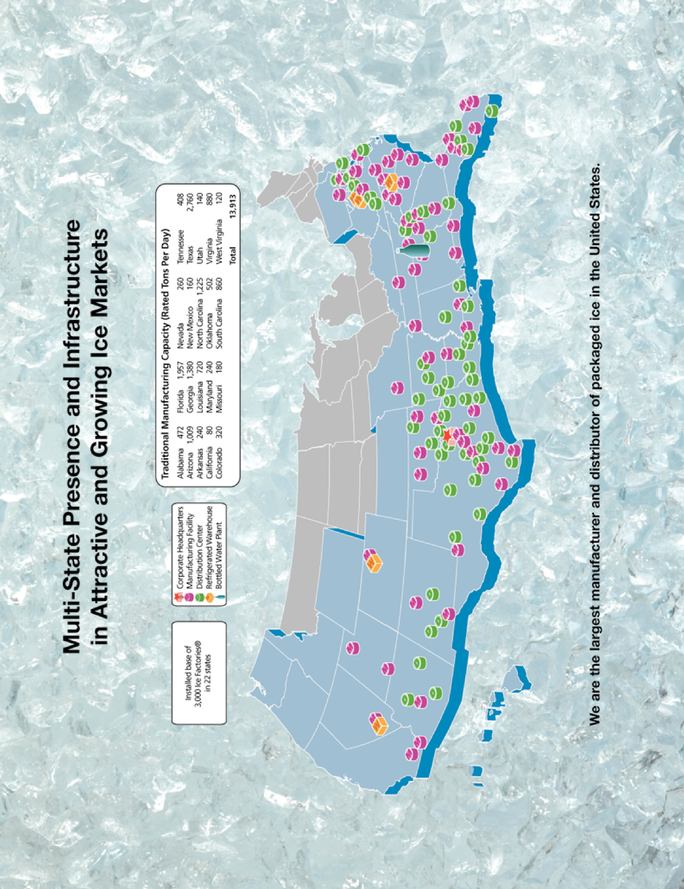

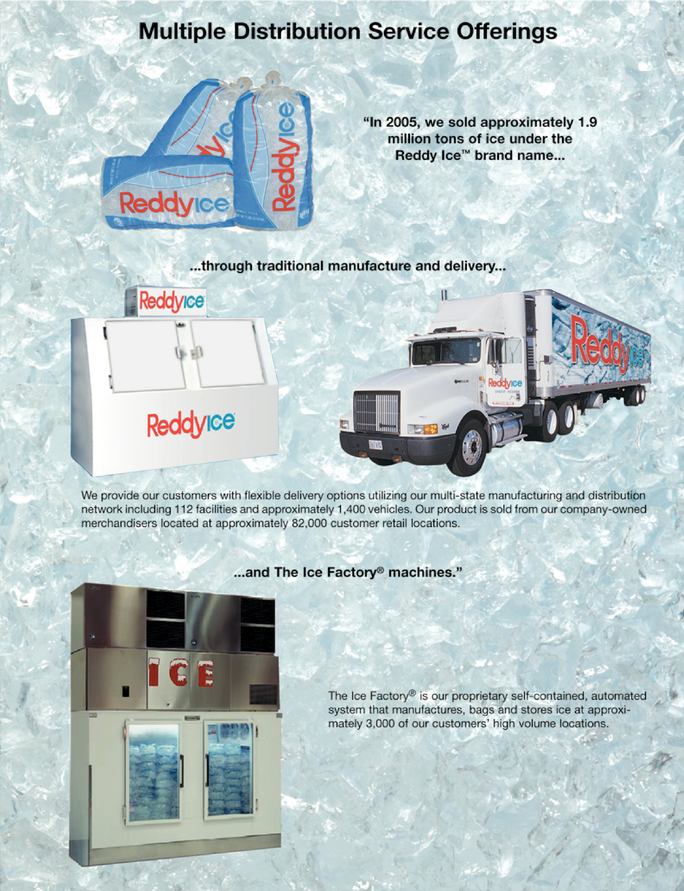

Our Company

We are the largest manufacturer and distributor of packaged ice in the United States, serving approximately 82,000 customer locations in 31 states and the District of Columbia under the Reddy Ice™ brand name. Our principal product is ice packaged in seven to fifty pound bags, which we sell to a highly diversified customer base, including supermarkets, mass merchants and convenience stores. In 2005, we sold approximately 1.9 million tons of ice. Our products are primarily sold throughout the southern United States (the "Sun Belt"), one of the most attractive regions in the country for packaged ice sales due to warm weather, extended peak selling seasons and favorable population growth patterns. Population growth is one of the primary drivers for growth in demand for packaged ice, and we operate in many of the fastest growing metropolitan areas in the United States. In addition, our broad geographic reach helps insulate us from the impact of cool or rainy weather in any particular region. No other manufacturer and distributor of packaged ice in the United States has the geographic presence, infrastructure and capacity necessary to meet the multi-state demands of customers in our markets.

Our business is characterized by consistent annual customer demand, attractive margins and modest annual capital requirements. Based on our past experience, retail consumer demand for packaged ice is relatively unaffected by adverse economic conditions due to its low cost and the lack of readily available substitutes. In 2005, we had revenues, Adjusted EBITDA and a net loss of $319.8 million, $84.8 million and $12.1 million, respectively. For the three months ended March 31, 2006, we had revenues, Adjusted EBITDA and a net loss of $44.8 million, $0.5 million, and $8.2 million, respectively. For the definition of Adjusted EBITDA and a reconciliation of net income (loss) to EBITDA and EBITDA to Adjusted EBITDA, see "Summary Historical Financial Data".

We operate in two business segments: ice products and non-ice products and operations. Ice products accounted for approximately 95% of our total revenues in 2005. This segment consists of the traditional manufacture and delivery of ice from a central point of production to the point of sale as well as sales from The Ice Factory® machines, our proprietary equipment located in our customers' high volume locations that produce, package and store ice through an automated, self-contained process. In 2005, traditional ice manufacturing and Ice Factory sales accounted for approximately 90% and 10% of our ice segment revenues, respectively. Non-ice products and operations consists of refrigerated warehousing and the manufacture and sale of bottled water.

We have built a strong and loyal customer base by providing a high level of service and quality at competitive prices utilizing our extensive network of ice manufacturing plants and distribution centers. We have a diverse customer base and long-standing relationships with our customers across all major retail channels as evidenced by our high retention rates with prominent supermarkets, mass merchants and convenience stores such as Albertson's, Circle-K, ExxonMobil, Food Lion, Kroger, 7-Eleven and Wal-Mart. Our largest customer, Wal-Mart and Sam's Club on a combined basis, accounted for approximately 11% of our revenues in 2005 and the three months ended March 31, 2006, and approximately 10% of our revenues in 2004. Most of our major customers, including nineteen of our top twenty retail ice customers in terms of revenues, have purchased ice from us and our predecessor companies for over a decade. Within our markets, we are the sole supplier of packaged ice to the majority of our top twenty retail ice customers. The percentage of our total revenues derived from and volume sold to national and regional convenience and grocery store chains has grown over the last several years as each of these retail channels has consolidated. We have benefited from supplying these national and regional retailers as many of these customers have grown at rates in excess of industry averages.

1

At March 31, 2006, we owned or operated 58 ice manufacturing facilities, 54 distribution centers, approximately 79,000 merchandisers (cold storage units installed at customer locations), approximately 3,000 Ice Factories, five refrigerated warehouses and one bottled water plant. As of the same date, we had an aggregate daily ice manufacturing capacity of approximately 17,000 tons. We acquired 11 businesses in 2004, two businesses in 2005 and three businesses in the first four months of 2006.

Competitive Strengths

We believe our competitive strengths include:

- •

- Stable and Predictable Cash Flow Generation as a result of our recent acquisitions, limited working capital needs and modest capital expenditure requirements going forward.

- •

- Multi-State Presence and Infrastructure that allows us to benefit from continued consolidation within our customer base and from increased reliance by national and regional customers on suppliers that serve multiple markets and helps insulate us from the variability of weather patterns in any individual region.

- •

- Leading Market Position in Attractive Ice Markets, including the Sun Belt and many of the fastest growing metropolitan areas in the United States.

- •

- Long Standing Relationships with High Quality Customers, which we believe provide us with a significant competitive advantage over other suppliers in our markets.

- •

- Multiple Distribution Service Offerings that enable us to offer our customers the flexibility to meet their specific supply requirements in a reliable and cost-efficient manner.

- •

- Strong, Incentivized Management Team with Proven Execution Capabilities that has been responsible for successfully executing our strategy of increasing our profitability through operational improvements, including cost rationalization, facility consolidation and working capital management, while strengthening customer relationships.

Business Strategy

Our business strategy is to strengthen our competitive position, increase revenues and drive profitability by:

- •

- Enhancing Revenue Growth from our existing customers, new products and outsourcing by large retailers.

- •

- Selectively Pursuing Acquisitions that enhance the density of our distribution routes, provide capacity rationalization opportunities, increase our market penetration in existing markets or expand our presence in contiguous markets.

- •

- Continuing Efficiency Improvements to continue to improve our operating margins.

Notwithstanding our strengths, we expect to face significant challenges in our business, including:

- •

- We Are in a Seasonal and Weather-dependent Business resulting in significant seasonal fluctuations in demand, revenues and profitability. In addition, weather patterns have an impact on the level of demand for packaged ice and, as a result, on our revenues and profitability.

- •

- We Have Many Competitors in each of our geographic markets and could lose market share or customers to them or could be forced to reduce our prices to retain or attract business. New competitors may also enter our markets, including ice producers from outside our current sales area.

- •

- We Will Use Substantially All of Our Cash to Pay Dividends, which may limit our ability to pursue growth opportunities and operate our business generally.

- •

- We Have a High Level of Indebtedness which will require us to divert much of our cash flow to service our debt costs. This level of indebtedness and the terms of our debt may impede our ability to operate our business or pay dividends on our common stock.

- •

- We Face Rising Energy Costs, which could reduce our margins and operating cash flow.

2

The Offering

| Shares of common stock offered by the selling stockholders | | 4,590,258 shares. |

Shares of common stock outstanding prior to and following this offering |

|

21,637,020 shares. |

Percentage of outstanding common stock following this offering represented by shares offered |

|

21.2%. |

Use of Proceeds |

|

The shares of stock offered hereby are being sold by the selling stockholders, including certain affiliates of Bear, Stearns & Co. Inc. and certain of our executive officers. We will not receive any of the proceeds from the sale of shares of common stock in this offering. The selling stockholders will receive all the net proceeds from the sale of shares of common stock offered by this prospectus. |

Dividend Policy |

|

Our board of directors has adopted a dividend policy, which reflects an intention to distribute as regular quarterly dividends to our stockholders a substantial portion of the cash generated by our business in excess of our expected cash needs and other possible uses. These expected cash needs include operating expenses and working capital requirements, cash interest and principal payments on our indebtedness, capital expenditures, incremental costs associated with being a public company and taxes. See "Dividend Policy and Restrictions". |

New York Stock Exchange symbol |

|

FRZ. |

General Information About This Prospectus

Throughout this prospectus, unless the context otherwise requires or we specifically state otherwise, we have assumed the following:

• |

|

no exercise by the underwriters of their option to purchase up to 688,539 additional shares to cover over-allotments as described in the "Underwriting" section; and |

• |

|

43,075 shares reserved and available for future grant or issuance under our Long-Term Incentive and Share Award Plan will be excluded. |

Some figures in this prospectus may not total due to rounding adjustments.

Corporate Information

Reddy Ice Holdings, Inc. was incorporated on May 8, 2003. Our principal executive offices are located at 8750 North Central Expressway, Suite 1800, Dallas, Texas 75231 and our telephone number is (214) 526-6740. Our website address iswww.reddyice.com. Information contained in or connected to our website is not deemed to be incorporated by reference into, and does not otherwise constitute a part of, this prospectus.

3

Summary Historical Financial Data

The following table sets forth, for the periods and dates indicated, our summary historical financial data.

Reddy Holdings and its wholly owned subsidiary Cube Acquisition Corp. were formed on May 8, 2003 for the purpose of acquiring Packaged Ice, Inc. and effecting certain capital-raising transactions in connection with such acquisition. On August 15, 2003 Cube merged with and into Packaged Ice, which we refer to in this prospectus as the merger, with Packaged Ice being the surviving corporation. In connection with the merger, Packaged Ice was renamed Reddy Ice Group, Inc. Reddy Holdings and Cube conducted no operations during the period from May 8, 2003 through August 14, 2003. In this summary, "Cube" refers to Cube Acquisition Corp., "Successor" refers to Reddy Holdings and its subsidiaries while "Predecessor" refers to pre-merger Reddy Group and its subsidiaries, which was then known as "Packaged Ice, Inc".

Our summary historical financial data for the period from January 1, 2003 through August 14, 2003 has been derived from the audited financial statements of the Predecessor included elsewhere in this prospectus. Our summary financial data for the period from May 8, 2003 through December 31, 2003 and for the years ended December 31, 2004 and 2005 have been derived from the audited financial statements of the Successor included elsewhere in this prospectus. The summary historical financial data of the Successor as of March 31, 2006 and for the three-month periods ended March 31, 2005 and March 31, 2006 have been derived from the unaudited condensed financial statements of the Successor included elsewhere in this prospectus. The unaudited condensed financial statements as of March 31, 2006 and for the three months ended March 31, 2006 and 2005 include all adjustments that are, in the opinion of management, necessary for a fair presentation of our financial position and results of operations for the periods presented. Operating results for the three months ended March 31, 2006 are not necessarily indicative of the results that may be expected for the entire year. You should read the summary historical financial data in connection with the information included under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical financial statements and accompanying notes included elsewhere in this prospectus.

4

| |

| |

|---|

| | January 1,

2003 to

August 14,

2003

| |

| May 8, 2003

(Date of

Inception) to

December 31,

2003

| | Year

Ended

December 31,

2004

| | Year

Ended

December 31,

2005

| | Three Months

Ended

March 31,

2005

| | Three Months

Ended

March 31,

2006

| |

|---|

| | (Predecessor)

| |

| (Successor)

| | (Successor)

| | (Successor)

| | (Successor)

| | (Successor)

| |

|---|

| | (in thousands, except per share amounts)

| |

|---|

| Operating Data: | | | | | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | | | | | |

| Ice products | | $ | 139,618 | | | $ | 79,954 | | $ | 268,319 | | $ | 304,755 | | $ | 35,989 | | $ | 41,738 | |

| Non-ice products and operations | | | 11,651 | | | | 6,965 | | | 17,408 | | | 15,017 | | | 3,255 | | | 3,070 | |

| | |

| | |

| |

| |

| |

| |

| |

| | Total | | $ | 151,269 | | | $ | 86,919 | | $ | 285,727 | | $ | 319,772 | | $ | 39,244 | | $ | 44,808 | |

| Gross profit | | | 48,746 | | | | 28,304 | | | 94,811 | | | 104,711 | | | 2,824 | | | 5,681 | |

| Impairment of assets | | | — | | | | — | | | — | | | 5,725 | | | — | | | — | |

| Income (loss) from operations | | | 26,512 | | | | 13,141 | | | 52,150 | | | 43,246 | | | (7,574 | ) | | (6,940 | ) |

| Interest expense | | | (21,063 | ) | | | (10,370 | ) | | (25,105 | ) | | (34,421 | ) | | (9,308 | ) | | (6,954 | ) |

| Income (loss) before taxes | | | 5,565 | | | | 2,771 | | | 27,045 | | | (19,364 | ) | | (16,882 | ) | | (13,894 | ) |

| Income tax benefit (expense) | | | — | | | | (1,053 | ) | | (10,494 | ) | | 7,248 | | | 6,702 | | | 5,655 | |

| Net income (loss) | | | 5,565 | | | | 1,718 | | | 16,551 | | | (12,116 | ) | | (10,180 | ) | | (8,239 | ) |

| Preferred dividends | | | 2,566 | | | | 4,431 | | | 10,583 | | | — | | | — | | | — | |

| Net income (loss) available to common stockholders | | | 2,999 | | | | (2,713 | ) | | 5,968 | | | (12,116 | ) | | (10,180 | ) | | (8,239 | ) |

Net Income (Loss) Per Share Data(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| | Net income (loss) available to common stockholders | | $ | 0.15 | | | $ | (0.35 | ) | $ | 0.44 | | $ | (0.72 | ) | $ | (0.74 | ) | $ | (0.39 | ) |

| | |

| | |

| |

| |

| |

| |

| |

| | Weighted average common shares outstanding | | | 20,159 | | | | 7,858 | | | 13,675 | | | 16,760 | | | 13,728 | | | 21,273 | |

| | |

| | |

| |

| |

| |

| |

| |

| Diluted net income (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| | Net income (loss) available to common stockholders | | $ | 0.14 | | | $ | (0.35 | ) | $ | 0.44 | | $ | (0.72 | ) | $ | (0.74 | ) | $ | (0.39 | ) |

| | |

| | |

| |

| |

| |

| |

| |

| | Weighted average common shares outstanding | | | 20,808 | | | | 7,858 | | | 13,703 | | | 16,760 | | | 13,728 | | | 21,273 | |

| | |

| | |

| |

| |

| |

| |

| |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures(2) | | $ | 7,848 | | | $ | 13,721 | | $ | 15,988 | | $ | 21,723 | | $ | 5,729 | | $ | 3,957 | |

| Proceeds from disposition of assets | | | 1,236 | | | | 311 | | | 2,657 | | | 2,108 | | | 388 | | | 353 | |

| Total depreciation and amortization expense | | | 14,528 | | | | 7,616 | | | 23,185 | | | 24,529 | | | 6,156 | | | 6,142 | |

| Net cash provided by (used in) operating activities | | | (4,846 | ) | | | 30,092 | | | 47,786 | | | 55,587 | | | (14,662 | ) | | (9,376 | ) |

| Net cash used in investing activities | | | (6,612 | ) | | | (206,128 | ) | | (30,205 | ) | | (20,551 | ) | | (5,341 | ) | | (5,008 | ) |

| Net cash provided by (used in) financing activities | | | 11,664 | | | | 188,837 | | | (25,904 | ) | | (5,517 | ) | | 18,341 | | | (9,348 | ) |

| EBITDA(3) | | | 41,156 | | | | 20,757 | | | 75,335 | | | 39,586 | | | (1,418 | ) | | (798 | ) |

| Adjusted EBITDA(3) | | | 50,734 | | | | 24,240 | | | 80,221 | | | 84,824 | | | (738 | ) | | 544 | |

| | March 31, 2006

|

|---|

| | (in thousands)

|

|---|

| Balance Sheet Data: | | | |

| | Cash and cash equivalents | | $ | 10,265 |

| | Working capital(4) | | | 15,907 |

| | Total assets | | | 580,840 |

| | Total debt | | | 355,849 |

| | Stockholders' equity | | | 169,074 |

- (1)

- Net income (loss) per share is calculated by dividing net income (loss) by the weighted average common shares outstanding. Weighted average common shares outstanding for the historical periods beginning with the period from May 8, 2003 to December 31, 2003 reflects the 138 for one stock split of our outstanding shares of common stock that was effected prior to the completion of our initial public offering.

- (2)

- Capital expenditures for the period from May 8, 2003 to December 31, 2003 and the year ended December 31, 2005 include $10.5 million and $2.5 million, respectively, related to purchases of leased assets.

- (3)

- EBITDA represents net income (loss) before income taxes, interest expense and depreciation and amortization. Adjusted EBITDA represents EBITDA as further adjusted to give effect to unusual items, non-cash items and other adjustments set forth below, all of which adjustments are required in calculating covenant ratios and compliance under our credit facilities. See "Description of Indebtedness—Credit Facilities" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" for more detail regarding the adjustments required in calculating Adjusted EBITDA. EBITDA and Adjusted EBITDA are not presentations made in accordance with generally accepted accounting principles, or GAAP, are not measures of financial condition or profitability, and should not be considered as an alternative to (1) net income (loss) determined in accordance with GAAP or (2) operating cash flows determined in accordance with GAAP. We believe that the inclusion of EBITDA and Adjusted EBITDA in this prospectus is appropriate to provide additional information to investors about certain material non-cash items and certain material unusual items as well as the calculation of certain financial covenants contained in our credit facilities. Adjusted EBITDA is a material component of these covenants. For instance, our credit facilities contain financial covenant ratios, specifically total leverage and interest coverage ratios, that are calculated by reference to Adjusted EBITDA. Non-compliance with the financial ratio maintenance covenants contained in our credit facilities could result in the requirement to immediately repay all amounts outstanding under such facilities. In addition, under the restricted payments covenant contained in our credit facilities, our ability to pay dividends is restricted by a formula based on the amount of our Adjusted EBITDA. For a description of required financial covenant levels and actual ratio calculations based

5

on Adjusted EBITDA, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources". We are also restricted from paying dividends under the Reddy Holdings indenture. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources". We also believe that investors will use Adjusted EBITDA to evaluate our liquidity and our ability to pay dividends as described under "Dividend Policy and Restrictions," which is particularly important given our leverage. Management also uses Adjusted EBITDA as a basis for measuring performance of our business for purposes of management compensation. Because not all companies use identical calculations, these presentations of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies. The following table sets forth, for the historical financial data, a reconciliation of net cash provided by (used in) operating activities and net income (loss) to EBITDA and Adjusted EBITDA.

| |

| |

|---|

| | January 1,

2003 to

August 14,

2003

| |

| May 8, 2003

(Date of

Inception) to

December 31,

2003

| | Year Ended

December 31,

2004

| | Year Ended

December 31,

2005

| | Three Months

Ended March 31, 2005

| | Three Months

Ended March 31, 2006

| |

|---|

| | (Predecessor)

| |

| (Successor)

| | (Successor)

| | (Successor)

| | (Successor)

| | (Successor)

| |

|---|

| | (in thousands)

| |

|---|

Reconciliation of Net Cash Provided by (Used in)

Operating Activities to Net Income (Loss): | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | $ | (4,846 | ) | | $ | 30,092 | | $ | 47,786 | | $ | 55,587 | | $ | (14,662 | ) | $ | (9,376 | ) |

| Total depreciation and amortization expense | | | (14,528 | ) | | | (7,616 | ) | | (23,185 | ) | | (24,529 | ) | | (6,156 | ) | | (6,142 | ) |

| Amortization of debt issuance costs and debt discount | | | (23 | ) | | | (882 | ) | | (4,410 | ) | | (13,358 | ) | | (3,373 | ) | | (3,271 | ) |

| Deferred taxes | | | — | | | | (1,053 | ) | | (10,176 | ) | | 7,115 | | | 6,702 | | | 5,655 | |

| Gain (loss) on disposition of assets | | | 11 | | | | — | | | (398 | ) | | (1,848 | ) | | (149 | ) | | (104 | ) |

| Stock-based compensation expense | | | — | | | | (63 | ) | | (302 | ) | | (2,947 | ) | | (284 | ) | | (1,245 | ) |

| Realized gain on derivative | | | — | | | | — | | | 3,362 | | | — | | | — | | | — | |

| Loss on extinguishment of debt | | | — | | | | — | | | — | | | (28,189 | ) | | — | | | — | |

| Impairment of assets | | | — | | | | — | | | — | | | (5,725 | ) | | — | | | — | |

| Changes in assets and liabilities, net of effects of acquisitions | | | 24,951 | | | | (18,760 | ) | | 3,874 | | | 1,778 | | | 7,742 | | | 6,244 | |

| | |

| | |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | 5,565 | | | $ | 1,718 | | $ | 16,551 | | $ | (12,116 | ) | $ | (10,180 | ) | $ | (8,239 | ) |

Reconciliation of Net Income (Loss) to EBITDA: |

|

|

|

|

| Net income (loss) | | $ | 5,565 | | | $ | 1,718 | | $ | 16,551 | | $ | (12,116 | ) | $ | (10,180 | ) | $ | (8,239 | ) |

| Income tax expense (benefit) | | | — | | | | 1,053 | | | 10,494 | | | (7,248 | ) | | (6,702 | ) | | (5,655 | ) |

| Interest expense | | | 21,063 | | | | 10,370 | | | 25,105 | | | 34,421 | | | 9,308 | | | 6,954 | |

| Total depreciation and amortization expense | | | 14,528 | | | | 7,616 | | | 23,185 | | | 24,529 | | | 6,156 | | | 6,142 | |

| | |

| | |

| |

| |

| |

| |

| |

| EBITDA | | $ | 41,156 | | | $ | 20,757 | | $ | 75,335 | | $ | 39,586 | | $ | (1,418 | ) | $ | (798 | ) |

| | |

| | |

| |

| |

| |

| |

| |

| Reconciliation of EBITDA to Adjusted EBITDA: | | | | |

| EBITDA | | $ | 41,156 | | | $ | 20,757 | | $ | 75,335 | | $ | 39,586 | | $ | (1,418 | ) | $ | (798 | ) |

| Other non-cash charges(a) | | | (11 | ) | | | 63 | | | 700 | | | 38,233 | | | 433 | | | 1,349 | |

| Acquisition adjustments(b) | | | 6,827 | | | | 3,119 | | | 1,987 | | | 167 | | | (13 | ) | | (7 | ) |

| Elimination of lease expenses(c) | | | 2,762 | | | | 94 | | | — | | | 273 | | | 100 | | | — | |

| Terminated financing costs(d) | | | — | | | | — | | | 233 | | | — | | | — | | | — | |

| Elimination of monitoring fee(e) | | | — | | | | 207 | | | 615 | | | 394 | | | 160 | | | — | |

| Transaction expenses(f) | | | — | | | | — | | | 1,351 | | | 6,171 | | | — | | | — | |

| | |

| | |

| |

| |

| |

| |

| |

| Adjusted EBITDA | | $ | 50,734 | | | $ | 24,240 | | $ | 80,221 | | $ | 84,824 | | $ | (738 | ) | $ | 544 | |

| | |

| | |

| |

| |

| |

| |

| |

6

- (a)

- Includes impairment of assets, amortization of unearned compensation, loss on extinguishment of debt and gain or loss on the disposition of assets and non-cash stock-based compensation expense.

- (b)

- We acquired two businesses in 2003 and a total of 16 businesses in 2004, 2005 and the first four months of 2006. For the purposes of calculating Adjusted EBITDA, we have included the incremental Adjusted EBITDA of these businesses as if we had consummated each acquisition at the beginning of the period in which such acquisition occurred. The incremental Adjusted EBITDA attributable to these acquired businesses is based upon the unaudited historical results prior to their respective acquisition dates and is adjusted to give effect to the continuing impact of elimination of expenses of the acquired business. We cannot assure you that the historical results of these businesses would not have been different from the results reflected in this adjustment if such results had been subject to audits by independent auditors, and any such differences may be material. In addition, this adjustment is not necessarily representative of the contribution of the acquired businesses to our results for future periods.

- (c)

- Represents the elimination of historical operating lease expense resulting from the purchase of manufacturing and packaging equipment for $9.4 million in August 2003 and $1.1 million in November of 2003 and the purchase of leased real estate for $2.5 million in September 2005.

- (d)

- Represents costs incurred in connection with a proposed financing transaction that terminated prior to consummation.

- (e)

- Represents the elimination following our initial public offering of monitoring fees payable to our principal stockholders pursuant to the monitoring and management services agreement that is described in "Certain Relationships and Related Transactions".

- (f)

- Reflects the payment of transaction bonuses in connection with the October 27, 2004 offering of the Reddy Holdings notes and other expenses related to that transaction, and costs incurred in connection with the initial public offering of Reddy Holdings' common stock in August 2005.

- (4)

- Working capital is defined as current assets less current liabilities.

7

RISK FACTORS

You should carefully consider the risks described below as well as the other information contained in this prospectus before investing in our common stock. If any of the following risks and uncertainties actually occur, our business, financial condition and results of operations could be materially adversely affected. In such case, you may lose all or part of your original investment.

Risks Relating to Our Dividend Policy

The payment of dividends is at the sole discretion of our board of directors and the reduction or elimination of dividends would negatively affect the market price of our common stock.

We are not obligated to pay dividends on our common stock. The payment of dividends is at the sole discretion of our board of directors and our board of directors may decide to eliminate or reduce any dividends paid on our common stock. Any reduction or elimination of dividends could cause the market price of our common stock to decline and could further cause your shares of common stock to become less liquid, which may result in losses by you.

Even if our board of directors desires to declare and pay dividends, we might not have cash in the future to pay dividends in the intended amounts or at all.

Our ability to pay dividends, and our board of directors' determination to keep our dividend policy, will depend on numerous factors, including the following:

- •

- the state of our business, competition and changes in our industry;

- •

- changes in the factors, assumptions and other considerations made by our board of directors in reviewing and adopting our dividend policy, as described under "Dividend Policy and Restrictions";

- •

- our future results of operations, financial condition, liquidity needs and capital resources;

- •

- our various expected cash needs, including cash interest and principal payments on our indebtedness, capital expenditures, the purchase price of acquisitions, incremental costs associated with being a public company and taxes; and

- •

- potential sources of liquidity, including borrowing under our revolving credit facility or possible asset sales.

Our actual cash available to pay dividends may not equal or exceed the amount necessary to pay dividends as described in this prospectus. Over time, our capital and other cash needs will invariably be subject to uncertainties, which could affect whether we pay dividends and the level of any dividends we may pay in the future. In addition, to the extent that we would seek to raise additional cash from additional debt incurrence or equity security issuances, we cannot assure you that such financing will be available on reasonable terms or at all. Each of the factors listed above could negatively affect our ability to pay dividends in accordance with our dividend policy or at all.

If our estimates relating to dividends payable in the first year following the closing of this offering change, you may not receive the amount of dividends you expected.

If our estimates of cash available to pay dividends for the first year following the closing of this offering were to fall below our expectations, our assumptions as to estimated cash needs were to be too low or if other applicable assumptions were to prove incorrect, we may need to:

- •

- either reduce or eliminate dividends, which may result in a decline in the market price or liquidity, or both, of our common stock;

8

- •

- fund dividends by incurring additional debt (to the extent we are permitted to do so under the agreements governing our debt), which would increase our leverage and limit our funding alternatives for other uses;

- •

- amend the terms of our credit facilities or the Reddy Holdings indenture to permit us to pay dividends or make other payments if we are otherwise not permitted to do so, which is likely to require us to incur significant costs;

- •

- fund dividends from future issuances of equity securities, which could be dilutive to our stockholders and negatively affect the market price of our common stock;

- •

- fund dividends from other sources, such as by asset sales or by working capital, which would leave us with less cash available for other purposes; and

- •

- reduce other expected uses of cash, such as capital expenditures, which could limit our ability to grow.

Our ability to pay dividends is restricted by agreements governing our debt, including our credit facilities and the Reddy Holdings indenture, and by Delaware law.

Our credit facilities and the Reddy Holdings indenture restrict our ability to pay dividends. We refer you to "Description of Indebtedness—Credit Facilities" and "—Reddy Holdings' 101/2% Senior Discount Notes due 2012" and "Dividend Policy and Restrictions", where we describe the terms of our indebtedness, including provisions limiting our ability to declare and pay dividends.

Additionally, under the Delaware General Corporation Law, or DGCL, our board of directors may not authorize payment of a dividend unless it is either paid out of our surplus, as calculated in accordance with the DGCL, or if we do not have a surplus, it is paid out of our net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year.

If, as a result of these restrictions, we are required to reduce or eliminate the payment of dividends, a decline in the market price or liquidity, or both, of our common stock could result. This may in turn result in losses by you.

Our dividend policy may limit our ability to pursue growth opportunities, which may harm our competitive position and cause the market price of our common stock to decline.

If we continue paying dividends at the level currently anticipated under our dividend policy, we may not retain a sufficient amount of cash to consummate acquisitions, and may need to seek financing to fund a material expansion of our business, including any significant acquisitions or to pursue growth opportunities requiring capital expenditures significantly beyond our current expectations. The risks relating to funding any dividends, or other cash needs as a result of paying dividends, are summarized in the preceding risk factors. If we are unable to take timely advantage of growth opportunities, our future financial condition and competitive position may be harmed, which in turn may adversely affect the market price of our common stock.

Risks Relating to Our Business

We have a substantial amount of indebtedness, which may reduce our cash flow and impede our ability to pay dividends on our common stock, remain in compliance with debt covenants, make payments on our indebtedness and operate our business.

As of March 31, 2006, we had outstanding indebtedness of approximately $355.8 million, which would have represented approximately 68% of our total consolidated capitalization on a book basis. As of March 31, 2006, we also had availability of $54.2 million (net of standby letters of credit of approximately $5.8 million) under our revolving credit facility.

Our substantial indebtedness could have important consequences. For example, it could:

- •

- make it more difficult for us to comply with the terms of our outstanding debt;

9

- •

- require us to dedicate a substantial portion of our cash flow to pay principal and interest on our debt, thus making it more difficult for us to pay dividends on our common stock;

- •

- make us more vulnerable to, and reduce our flexibility in planning for, changes in general economic, industry and competitive conditions;

- •

- limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our strategy, or other purposes; and

- •

- place us at a disadvantage compared to our competitors with less debt.

Any of the above listed factors could make us more vulnerable to defaults and place us at a competitive disadvantage, therefore making an investment in our common stock less attractive when compared to other investments. Further, if we do not have sufficient earnings to service our debt, we would need to refinance all or part of our existing debt, sell assets, borrow more money or sell securities, none of which we can guarantee we will be able to do on commercially reasonable terms or at all.

We could incur more indebtedness, which may increase the risks associated with our substantial leverage, including our ability to service our indebtedness and pay dividends on our common stock.

The Reddy Holdings indenture and our credit facilities permit us, under certain circumstances, to incur a significant amount of additional indebtedness. For example, our credit facilities allow us to incur up to an additional $80.0 million of incremental term loans under our credit facilities, subject to certain conditions. See "Description of Indebtedness—Credit Facilities". In addition, we may incur additional indebtedness through our revolving credit facility. If we incur additional debt, the risks associated with our substantial leverage, including our ability to service our debt and pay dividends on our common stock, would increase. This, in turn, could negatively affect the market price of our common stock.

The terms of our credit facilities and the Reddy Holdings indenture may restrict our current and future operations, particularly our ability to respond to changes in our business or to take certain actions.

Our credit facilities and the Reddy Holdings indenture contain, and any future indebtedness of ours would likely contain, a number of financial and other restrictive covenants that impose significant operating and financial restrictions on us, including restrictions that may limit our ability to engage in acts that may be in our best long-term interests. For a more complete description of these covenants and restrictions, see "Description of Indebtedness".

The operating and financial restrictions and covenants in our existing and future debt agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. A breach of any of the restrictive covenants in our credit facilities could result in a default under such facilities. If any such default occurs, the lenders may elect to declare all obligations under our credit facilities to be immediately due and payable, enforce their security interest or require us to apply all of our available cash to repay these borrowings, any of which would result in an event of default under the Reddy Holdings notes. If the debt under our credit facilities or the Reddy Holdings notes were to be accelerated, our business operations would be interrupted, which would adversely affect the market price of our common stock. See "Description of Indebtedness".

The seasonal nature of the ice business results in losses and lower profit margins in the first and fourth quarters of the year.

We experience significant seasonal fluctuations in our net sales and profitability. We make a disproportionate amount of our sales in the second and third calendar quarters when the weather is generally warmer, which results in an increased demand for ice. We also earn our net income during these same periods. As a result of seasonal revenue declines and the lack of a corresponding decrease in certain expenses, we experience net losses and materially lower profit margins during the first and fourth calendar quarters. Variations in demand could have a material adverse effect on the timing of our cash flows and therefore limit our ability to timely service our

10

obligations with respect to our indebtedness and to pay dividends. In addition, because our operating results depend significantly on sales during the second and third calendar quarters, our results of operations may fluctuate significantly if the weather during these periods is cool or rainy.

Weather conditions and weather events can decrease our sales or increase our expenses.

Cool or rainy weather can decrease sales, while extremely hot weather may increase our expenses, each resulting in a negative impact on our operating results and cash flow. Ice consumers demand ice for a variety of reasons, but many of them buy ice in connection with outdoor related activities, both commercial and recreational. As a result, demand for ice increases during periods of warm, sunny weather, and conversely, demand decreases during periods of cool, rainy weather. During extended periods of cool or rainy weather on a national basis, our revenues and resulting net income may substantially decline. Also, hot weather does not necessarily result in greater net income. During extended periods of hot weather, our profits and cash flow may decline because of an increase in expenses in response to excess demand. We may have to transport ice from one plant to another and, in some cases, purchase ice from third party sources and transport it to a specific market to meet this excess demand, resulting in higher expenses and inconsistent service and product quality. Finally, although extreme weather events such as hurricanes can cause an increase in volume sales, those sales are not necessarily profitable due to added costs and disruptions to our normal service and distribution routes.

Our failure to successfully compete in our markets, retain existing customers and obtain new customers could limit our prospects and cause us to lose market share.

Our businesses are highly competitive. We have many competitors in each of our geographic markets offering similar products and services. In addition, two of the largest regional ice producers have recently announced plans to consolidate. Other ice producers, including our direct competitors, may also consolidate in the future. Competition in our businesses is based primarily on service, quality and price. We could lose market share if we fail to successfully compete against our competitors in any of these areas, if our existing competitors expand their capacity, if new entrants successfully penetrate our markets, if we fail to adequately serve our existing base of customers, or if our larger grocery or convenience store customers decide to manufacture their own ice rather than purchase our products.

Increases in the prices of electricity, certain raw materials, fuel, insurance and other required expenses could, if we cannot pass those price increases along to our customers, have an adverse effect on our results of operations.

We use substantial amounts of polyethylene, which is the primary raw material used to manufacture the bags we use to package our ice, electricity in connection with our manufacturing process and fuel to operate the refrigerated trucks for ice delivery. We also carry general liability, workers' compensation, health and vehicle insurance. We have already experienced increases in bag costs, fuel costs, electricity costs and insurance costs and may experience further increases in such costs in the future, including as a result of the expiration in June 2006 of a fixed price electricity contract to supply electricity to the majority of our Texas facilities, which we have renewed at higher rates. If the prices for these items or other expenses increase beyond the amounts that we are able to pass along to our customers, our margins and our operating cash flow would decrease.

Our acquisitions may not be successfully integrated and could cause unexpected financial or operational difficulties.

In 2004, 2005, and the first four months of 2006, we completed a total of 16 acquisitions. We anticipate that we may, from time to time, selectively acquire additional businesses, assets or securities of companies that we believe would provide a strategic fit with our business. Acquisitions are also accompanied by risks, such as potential exposure to unknown liabilities of acquired companies and the possible loss of key employees and customers of the acquired business. Further, acquisitions are subject to risks associated with the difficulty and expense of integrating the operations and personnel of the acquired companies, the potential disruption to our business and the diversion

11

of management time and attention, any of which could increase the costs of operating our business, negate the expected benefits of the acquisitions or result in the loss of customers.

We could incur substantial costs as a result of violations of or liabilities under environmental laws.

Our operations are subject to a wide range of environmental laws and regulations governing, among other things, air emissions, wastewater discharges, the use, management and disposal of hazardous and non-hazardous materials and wastes and the cleanup of contamination. Noncompliance with such laws and regulations, or incidents resulting in environmental releases, could cause us to incur substantial costs, including cleanup costs, fines and penalties, third party claims for personal injury, investments to retrofit or upgrade our facilities and programs, or curtailment of our operations. For example, our ice manufacturing and cold storage operations use refrigerants such as ammonia and Freon. Some of our facilities may not be in compliance with certain Freon refrigerant requirements, such as leak detection and repair, recordkeeping or reporting. In addition, the market price of Freon is rising as a result of phase-outs under federal laws, which could significantly increase our operating costs in the future if we are not able to obtain approved substitutes. From time to time, our use of ammonia has resulted in releases that have temporarily disrupted our manufacturing operations and resulted in lawsuits or administrative penalties.

Material violations of, or liabilities under, environmental laws may require us to incur substantial costs which could reduce our margins, or to divert resources from ongoing environmental programs and improvements, which could delay our efforts to integrate acquisitions and upgrade our operations, or expose us to risk of further environmental liability.

Our business could be disrupted or we could incur substantial costs because of government laws and regulations.

We are subject to various federal, state and local laws relating to many aspects of our business, including labeling, sanitation, health and safety and manufacturing processes. We cannot predict the types of government regulations that may be enacted in the future by the various levels of government or how existing or future laws or regulations will be interpreted or enforced. The enactment of more stringent laws or regulations or a stricter interpretation of existing laws and regulations may cause a disruption in our operations or require additional expenditures by us, some of which could be material. We may incur material costs and liabilities in order to comply with any such laws and regulations and such costs and liabilities may result in substantial expenses to us and could divert management's time and attention.

If we are unable to retain senior executives and attract and retain other qualified employees, our business might be adversely affected.

Our success depends in part on our ability to attract, hire, train and retain qualified managerial, sales and marketing personnel. Competition for these types of personnel is high. We may be unsuccessful in attracting and retaining the personnel we require to conduct our operations. Our success also depends to a significant extent on the continued service and performance of our senior management team and in particular on the continued service of William P. Brick, our Chairman and Chief Executive Officer, and Jimmy C. Weaver, our President and Chief Operating Officer. In addition, we do not carry "key man" life insurance. Our inability to successfully attract and retain personnel or the loss of any member of our senior management team could impair our ability to execute our business plan. Our employment agreements with our named executive officers are summarized under "Management—Executive Compensation and Incentive Programs—Employment Agreements".

Accidents involving our products and equipment could expose us to increased costs as a result of product liability claims.

We are subject to a risk of product liability claims and adverse publicity if a consumer is or claims to be harmed while using our products or equipment. Any such claim may result in negative publicity, loss of revenues or higher costs associated with litigation.

12

We currently carry product liability insurance. However, this insurance may be insufficient to pay for all or a large part of these losses. If our insurance does not adequately cover these losses, our results of operations and cash flow would decrease and such a decrease could be material.

We may lose customers' business to competitors as a result of our limited intellectual property protection, including on The Ice Factory.

As the sole major ice supplier using an on-site production and delivery system at our customers' retail locations, we have enjoyed a competitive advantage over our competitors. Our proprietary Ice Factory system is preferred by certain of our high volume customers to traditional ice delivery and gives us more flexibility during peak seasons. Competitors sometimes test machines similar to The Ice Factory. If any of our competitors are successful with the rollout of a competing system, we could lose business to these companies, which would result in decreased cash flows and results of operations.

It is also our practice to protect certain of our proprietary materials and processes by relying on trade secrets laws and non-disclosure and confidentiality agreements. Confidentiality or trade secrets may not be maintained and others may independently develop or obtain access to such materials or processes, which could adversely affect our competitive position and ability to differentiate our products and services from our competitors' offerings.

Limitations on our ability to utilize our tax assets before they expire may negatively affect financial results and the ability to pay dividends and other distributions to you.

We may not be able to utilize our tax assets. As of December 31, 2005, we had net operating loss carry-forwards for U.S. federal income tax purposes of approximately $122 million, of which approximately $84 million was generated prior to August 15, 2003. There are annual limitations on the utilization of the $84 million portion of the net operating loss carry-forwards due to changes in ownership on and prior to August 15, 2003. As a result of changes in ownership that occurred in connection with our initial public offering on August 12, 2005, annual limitations also apply to the portion of our net operating loss carryforwards generated from August 15, 2003 to August 12, 2005 and additional limitations apply to the net operating loss carry-forwards generated prior to August 15, 2003. Changes in ownership resulting from this offering or future transactions may limit the future utilization of our net operating loss carryforwards generated after August 12, 2005, and may result in additional limitations on our prior net operating loss carryforwards.

If we are not able to utilize our tax assets in the manner or in the timeframe we anticipate, our future after-tax cash flow available for dividends and other distributions to stockholders will be reduced.

Any significant reduction in goodwill and other intangible assets would have an adverse effect on the value of our business.

Our acquisitions have resulted in significant amounts of goodwill and other intangible assets. Goodwill, which relates to the excess of cost over the fair value of the net assets of the businesses acquired, and intangible assets totaled approximately $296.6 million at March 31, 2006, representing approximately 51% of our total assets. In the future, goodwill and intangible assets may increase as a result of future acquisitions. Goodwill and intangible assets are reviewed at least annually for impairment. Impairment may result from, among other things, deterioration in the performance of acquired businesses, adverse market conditions, adverse changes in applicable laws or regulations, including changes that restrict the activities of the acquired business, and a variety of other circumstances. During the year ended December 31, 2005 we recorded a non-cash impairment charge of $5.7 million to the goodwill in the cold storage portion of our non-ice products and operations business segment as a result of a significant reduction in cold storage sales volumes related to a particular customer. The amount of this and any future impairment must be charged to earnings. Any future determination requiring the write-off of a significant portion of the goodwill and intangible assets recorded on our balance sheet would have an adverse effect on the value of our business.

13

We are subject to certain regulations as a result of being a public company, which results in a greater burden on our management resources and increased costs.

As a public company with listed equity securities, we are required to comply with new laws, regulations and requirements, including provisions of the Sarbanes-Oxley Act of 2002, related Securities and Exchange Commission ("SEC") regulations and requirements of the New York Stock Exchange. Complying with new statutes, regulations and requirements occupies a significant amount of the time of our board of directors, management and our officers, increases our costs and expenses and sometimes diverts management's attention from other business concerns.

We will be exposed to risks relating to evaluations of our internal controls over financial reporting as required by Section 404 of the Sarbanes-Oxley Act of 2002, which could cause the market price of our common stock to decline.

We are in the process of evaluating our internal controls systems to allow management to report on, and our independent auditors to attest to, our internal controls over financial reporting. We will be performing the system and process evaluation and testing (and any necessary remediation) required to comply with the management certification and auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002. While we anticipate being able to fully implement the requirements relating to internal controls and all other aspects of Section 404 by our December 31, 2006 deadline, we cannot be certain as to the timing of completion of our evaluation, testing and remediation actions or the impact of the same on our operations. If we are not able to implement the requirements of Section 404 in a timely manner or with adequate compliance, we might be subject to sanctions or investigation by regulatory authorities, such as the SEC or the New York Stock Exchange. Any such action could increase expenses, divert management's attention or lower investors' confidence in our company, which could cause the market price of our common stock to decline.

Risks Relating to Our Common Stock

The market for our common stock may be volatile, which could cause the value of your investment to decrease.

Volatility in the market price of our common stock may prevent you from being able to sell our common stock held by you at or above the price you paid for it. The market price of our common stock may fluctuate widely as a result of various factors, such as period-to-period fluctuations in our actual or anticipated operating results, sales of our common stock by our existing equity investors, failure to pay dividends at anticipated levels, developments in our industry, the failure of securities analysts to cover our common stock or changes in financial estimates by analysts, failure to meet financial estimates by analysts, competitive factors, general economic and securities market conditions and other external factors. Also, securities markets worldwide experience significant price and volume fluctuations. This market volatility, as well as general economic or market conditions, and market conditions affecting the stock of companies in our industry in particular, could reduce the market price of our common stock in spite of our operating performance.

Limited trading volume of our common stock may contribute to its price volatility.

For the first quarter of 2006, the average daily trading volume for our common stock as reported by the New York Stock Exchange was approximately 63,000 shares. Even if we achieve a wider dissemination of our common stock as a result of this offering, we are uncertain as to whether a more active trading market in our common stock will develop. As a result, relatively small trades may have a significant impact on the price of our common stock.

If our share price is volatile, we may be the target of securities litigation, which is costly and time-consuming to defend.

In the past, following periods of market volatility in the price of a company's securities, security holders have often instituted class action litigation. If the market value of our common stock experiences adverse fluctuations

14

and we become involved in this type of litigation, regardless of the outcome, we could incur substantial legal costs and our management's attention could be diverted from the operation of our business, causing our business to suffer.

Future sales of our shares could depress the market price of our common stock.

Sales of a substantial number of shares of common stock in the public market by our current stockholders, or the threat that substantial sales may occur, could cause the market price of our common stock to decrease significantly or make it difficult for us to raise additional capital by selling stock. In connection with this offering, our directors and executive officers, as well as the selling stockholders in this offering, have entered into 90-day lock-up agreements at the request of the underwriters. Subject to extension under certain circumstances, on the day that is 91 days after the date of this prospectus, those parties will be able to sell in the public market an aggregate of 5,004,251 shares of our common stock that they will hold after this offering (assuming no exercise of the over-allotment option), subject to the applicable volume, manner of sale, holding period and other limitations of Rule 144 under the Securities Act of 1933. See "Underwriting—No Sales of Similar Securities" for further information regarding lock-up agreements.

Bear, Stearns & Co. Inc. and Lehman Brothers Inc. may also consent to the release of some or all of these shares that are subject to lock-up agreements for sale prior to the expiration of the applicable lock-up agreement. See the section of this prospectus entitled "Shares Eligible for Future Sale" for further details regarding the number of shares eligible for sale in the public market after this offering.

We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock (including shares issued in connection with an acquisition), or the perception that such sales could occur, may adversely affect prevailing market prices for our common stock.

We are a holding company with no operations, and unless we receive dividends, distributions, advances, transfers of funds or other payments from our subsidiaries, we will be unable to pay dividends on our common stock and meet our debt service and other obligations.

We are a holding company and conduct all of our operations through our subsidiaries. We do not have, apart from our ownership of Reddy Group, any independent operations. As a result, we will rely on dividends and other payments or distributions from Reddy Group and our other subsidiaries to pay dividends on our common stock and meet our debt service and other obligations. The ability of Reddy Group and our other subsidiaries to pay dividends or make other payments or distributions to us will depend on our operating results and may be restricted by, among other things, the covenants that are contained in our credit facilities and the covenants of any future outstanding indebtedness we or our subsidiaries incur.

In addition, because we are a holding company, your claims as stockholders will be structurally subordinated to all existing and future liabilities and obligations (whether or not for borrowed money) of our subsidiaries, including obligations under our credit facilities. Therefore, in the event of our bankruptcy, liquidation or reorganization, our assets and those of our subsidiaries will be able to satisfy the claims of our stockholders only after all of our and our subsidiaries' liabilities and obligations have been paid in full.

Ownership of our common stock is concentrated among a few stockholders who could act in a way that favors their interests to the detriment of our interests and those of other stockholders.

Prior to this offering, each of Bear Stearns Merchant Banking and Trimaran Fund Management L.L.C. beneficially owned 20% of our outstanding shares of common stock. As a result of sales in this offering, and assuming no exercise of the over-allotment option, each of Bear Stearns Merchant Banking and Trimaran Fund Management L.L.C. will beneficially own 9.9% of our outstanding shares of common stock. Nonetheless, following the consummation of this offering, and assuming no exercise of the over-allotment option, our executive officers, directors and the selling stockholders will still, in the aggregate, hold approximately 24.5% of our outstanding

15

shares. None of our other stockholders beneficially owns more than 7.1% of our common stock. In the event that all or some of our executive officers, directors or the selling stockholders decided to act in concert, they could influence the outcome of certain corporate actions, such as the election of our directors and extraordinary corporate transactions.

Provisions of our charter documents and the Delaware General Corporation Law may inhibit a takeover, which could negatively affect our stock price.

Provisions of our charter documents and the Delaware General Corporation Law, the state in which we are incorporated, could discourage potential acquisition proposals or make it more difficult for a third party to acquire control of our company, even if doing so might be beneficial to our stockholders. Our amended and restated certificate of incorporation and by-laws provide for various procedural and other requirements that could make it more difficult for stockholders to effect certain corporate actions. For example, our amended and restated certificate of incorporation authorizes our board of directors to determine the rights, preferences, privileges and restrictions of unissued series of preferred stock without any vote or action by our stockholders. Our board of directors could therefore authorize and issue shares of preferred stock with voting or conversion rights that could dilute the voting power or diminish other rights of holders of our common stock. Additional provisions are included in our amended and restated certificate of incorporation and by-laws which could make it more difficult for stockholders to effect certain corporate actions, including:

- •

- the sole power of a majority of the board of directors to fix the number of directors and to fill any vacancy on the board of directors;

- •

- requirements for advance notification of stockholder nominations and proposals; and

- •

- the inability of stockholders to act by written consent and restrictions on the ability of stockholders to call special meetings.

See "Description of Capital Stock". These provisions may discourage acquisition proposals and may make it more difficult or expensive for a third party to acquire a majority of our outstanding voting stock or may delay, prevent or deter a merger, acquisition, tender offer or proxy contest, which may negatively affect our stock price.

16

FORWARD-LOOKING STATEMENTS

This prospectus is intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. This prospectus includes "forward-looking statements". We believe the expectations reflected in such forward-looking statements are accurate. However, we cannot assure you that such expectations will occur. Forward-looking statements often include words such as "may," "should," "expect," "intend," "estimate," "anticipate," "believe," "predict," "plan," "potential" and "continue" and the negatives of these terms and variations of them or similar terminology. The forward-looking statements in this prospectus include, but are not limited to, statements under "Summary," "Risk Factors," "Dividend Policy and Restrictions," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business" regarding our future financial condition, prospects, developments and business strategies. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results expressed or implied by the forward-looking statements. Factors you should consider that could cause these differences are:

- •

- general economic trends and seasonality;

- •

- weather conditions;

- •

- the ability of our subsidiaries to make distributions to us in amounts sufficient to make dividend payments to our stockholders in accordance with our dividend policy;

- •

- our substantial leverage and ability to service our debt and pay dividends;

- •

- the restrictive covenants under our indebtedness;

- •

- the availability of capital sources;

- •

- fluctuations in our operating costs, including in the prices of electricity, fuel, polyethylene and other required expenses;

- •

- competitive practices in the industry in which we compete;

- •

- changes in labor conditions;

- •

- our capital expenditure requirements;

- •

- the risks associated with acquisitions and the failure to integrate acquired businesses;

- •

- technological changes and innovations;

- •

- costs associated with potential product liability claims or liabilities under environmental laws;

- •

- legislative or regulatory requirements; and

- •

- all the other factors described herein under "Risk Factors".

You should not unduly rely on these forward-looking statements as they speak only as of the date of this prospectus. Except as required by law, we are not obligated to publicly release any revisions to these forward- looking statements to reflect events or circumstances occurring after the date of this prospectus or to reflect the occurrence of unanticipated events. Important factors that could cause our actual results to differ materially from our expectations are discussed elsewhere in this prospectus.

17

USE OF PROCEEDS

All of the shares of common stock being offered hereby in this offering are being sold by the selling stockholders, including certain affiliates of Bear, Stearns & Co. Inc., one of the underwriters, and certain of our executive officers. We will not receive any of the proceeds from the sale of shares of common stock in this offering. The selling stockholders will receive all the net proceeds from the sale of shares of common stock offered by this prospectus.

We estimate that we will incur approximately $0.6 million of costs in connection with this offering. These costs will be recorded as operating expenses in our financial statements following the consummation of this offering.

18

DIVIDEND POLICY AND RESTRICTIONS

General

In connection with our initial public offering, our board of directors adopted a dividend policy which reflects an intention to distribute as regular quarterly dividends to our stockholders a substantial portion of the cash generated by our business in excess of our expected cash needs and other possible uses. These expected cash needs include operating expenses and working capital requirements, interest and principal payments on our indebtedness, capital expenditures, incremental costs associated with being a public company and taxes. This policy reflects our judgment that it is in the best interest of our stockholders to distribute to them a substantial portion of the cash generated by our business rather than using the cash for other purposes in the future that are unplanned and have not been specifically identified.

We believe that our dividend policy will limit, but not preclude, our ability to pursue growth. This limitation could be significant, for example, with respect to large acquisitions and growth opportunities that require cash investments in amounts greater than our available cash or external financing resources. In order to pay dividends at the level currently anticipated under our dividend policy, we expect that we would need additional financing to fund significant acquisitions or to pursue growth opportunities requiring capital expenditures significantly beyond our anticipated capital expenditure levels. However, we intend to retain sufficient cash after the distribution of dividends to permit the pursuit of growth opportunities that do not require material capital investment. For further discussion of the relationship of our dividend policy to our ability to pursue potential growth opportunities, see "—Assumptions and Considerations" below.

In accordance with our dividend policy, we have paid dividends at a rate of $1.53 per share per year declared on a quarterly basis from the closing of our initial public offering through the quarter ended March 31, 2006. On April 24, 2006, our board of directors increased the dividend rate to an annual rate of $1.60 per share, which we intend to maintain for at least the first four full fiscal quarters following the closing of this offering (the "Initial Four Quarters"), subject to our board of directors' decision to declare these dividends and various restrictions on our ability to do so.

In determining our intended dividend level for the Initial Four Quarters, we reviewed and analyzed the factors described below under "—Assumptions and Considerations".

However, as described more fully below, you may not receive dividends in the intended amounts, or at all, as a result of the following factors:

- •

- we may not have enough cash to pay dividends due to changes in our operating earnings, capital expenditure requirements, working capital requirements and other anticipated cash needs;

- •

- while the dividend policy adopted by our board of directors contemplates the distribution of a substantial portion of our cash available to pay dividends, our board of directors could modify or revoke this policy at any time;

- •

- even if our dividend policy is not modified or revoked, the actual amount of dividends distributed under the policy and the decision to make any distribution will remain at all times entirely at the discretion of our board of directors;

- •

- the amount of dividends that we may distribute is limited by restricted payments covenants in our credit facilities, the indenture governing the Reddy Holdings notes and, potentially, the terms of any future indebtedness that we may incur;

- •

- the amount of dividends that we may distribute is subject to restrictions under Delaware law; and

19

- •

- our stockholders have no contractual or other legal right to dividends, and we are not otherwise required to pay dividends.

Any reduction or elimination of dividends will adversely affect the liquidity or market price, or both, of our common stock.

Prior to our initial public offering, we had no history of paying regular dividends out of our cash flow, reflecting our previous policy of utilizing our cash flow to fund acquisitions, to pursue other growth opportunities and to repay indebtedness. As noted above, we now believe that we can provide greater value to our stockholders by distributing to them a substantial portion of our cash flow. Dividends on our common stock will not be cumulative.

Estimated Minimum Adjusted EBITDA

Our management has prepared the estimated financial information set forth below in order to provide an estimate of the amount of cash that may be available to pay dividends, in the event that our board of directors determines to do so and subject to the limitations on our ability to pay dividends. In the view of our management, the estimated financial information was prepared on a reasonable basis, reflects the best currently available estimates and judgments and presents, to the best of management's knowledge and belief, our expected course of action and our expected future financial performance. Neither our independent registered public accounting firm nor any other independent registered public accounting firm has compiled, examined, or performed any procedures with respect to the estimated financial information contained herein, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and assume no responsibility for, and disclaim any association with, the estimated financial information.

The estimated financial information below is only an estimate, is not a prediction of fact and should not be relied upon as being necessarily indicative of future results. You are cautioned not to place undue reliance on the estimated financial information. The factors, assumptions and other considerations relating to the estimated financial information are inherently uncertain and, although considered reasonable by our management as of the date of preparation, are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties, as described in greater detail under "Risk Factors" and "Forward-Looking Statements". There will be differences between actual and projected results. Accordingly, we cannot assure you that the estimated financial information is indicative of our future performance or that the actual results will not differ materially from the estimated financial information presented below.