U.S. Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Submitted pursuant to Rule 14a-6(g)

| 1. | Name of the Registrant: |

REDDY ICE HOLDINGS, INC.

| 2. | Name of person relying on exemption: |

Stanley P. Gold, Michael J. McConnell, Christopher Kiper, Shamrock Activist Value Fund, L.P. (“SAVF”), Shamrock Activist Value Fund II, L.P. (“SAVF II”), Shamrock Activist Value Fund III, L.P. (“SAVF III” and, collectively with SAVF II and SAVF, “Shamrock Activist Value Fund”), Shamrock Activist Value Fund GP, L.L.C., Shamrock Partners Activist Value Fund, L.L.C. and Shamrock Capital Advisors, Inc. (“SCA”).

| 3. | Address of person relying on exemption: |

4444 Lakeside Drive, 2nd Floor, Burbank, California 91505

| 4. | Written materials. Attach written materials required to be submitted pursuant to Rule 14a6(g)(1): |

The attached material is a letter from Michael J. McConnell, on behalf of Shamrock Activist Value Fund, delivered to the Board of Directors of the Registrant and posted on the website of Shamrock.com on July 16, 2007.

*****

The attached material is a presentation outlining a proposed leveraged recapitalization transaction prepared by SCA, the investment manager for Shamrock Activist Value Fund, delivered to the Board of Directors of the Registrant and posted on the website of Shamrock.com on July 16, 2007. This presentation was attached to the letter sent by Mr. McConnell described above.

|

| July 16, 2007 |

|

| Via Facsimile and Overnight Delivery |

|

| Mr. William P. Brick, Executive Chairman |

| Mr. Theodore J. Host, Director |

| Mr. Michael S. McGrath, Director |

| Mr. Tracy L. Noll, Director |

| Mr. Robert N. Verdecchio, Director |

| Mr. Jimmy C. Weaver, Director and Chief Executive Officer |

| Reddy Ice Holdings, Inc. |

| 8750 North Central |

| Expressway Suite 1800 |

| Dallas, Texas 75231 |

|

| Dear Gentlemen: |

|

We believe that the recently announced proposed acquisition of Reddy Ice Holdings, Inc. (“Reddy” or “Company”) by GSO Capital Partners (“GSO”) at $31.25 per share is the wrong transaction, at the wrong time, for the wrong price. On behalf of Shamrock Activist Value Fund (“Shamrock”), as the owner of approximately 5.4% of Reddy, we are writing to express our dismay that, with the building blocks now in place for significant earnings growth, this Board is seeking to deprive shareholders of the opportunity to realize those benefits and recognize full value for their shares. Why should GSO and the management team retained by them be allowed to profit from this growth opportunity instead of the current Reddy shareholders? Accordingly, we will oppose this transaction with GSO and any other sale transaction that does not provide appropriate value for Reddy shareholders. |

|

Since 2004, Reddy has dramatically grown its ice revenue and free cash flow at 11.5% and 27.5% CAGR respectively, and, with the implementation of several initiatives, this growth should continue and accelerate. For example, in view of its strong market position, we believe sharper pricing opportunities exist and are achievable. Additionally, we believe that the Company can drive improved margins through benchmarking best practices across its manufacturing facilities, automating its production process and improved delivery routing. We note that other players in the packaged ice business are operating at higher EBITDA margins than Reddy is currently achieving and are targeting 30% EBITDA margins as their mid-term goal. Further, the Company has yet to recognize the opportunity for revenue growth and increased margins available, at little incremental cost, by monetizing advertising space on its packages of ice and on its fleet of delivery trucks. In the aggregate, we believe the Company can accelerate the |

-1-

|

| rate of revenue growth and achieve margins in the 30% range over the next 24 to 36 months. |

|

Since its IPO, the Company has acquired nearly 20 local businesses. While the costs for these acquisitions have been absorbed, shareholders are only now beginning to see the synergies and other benefits from them. Moreover, we believe that there remain numerous small acquisition targets in the Company’s existing footprint that can be acquired at attractive prices. There exists a substantial arbitrage opportunity for the Company from such transactions for the foreseeable future. |

|

Not only is this the wrong time to sell Reddy, as the Company has just lowered its guidance due to unseasonably cold weather, the $31.25 per share price offered by GSO is grossly inadequate. Our discounted cash flow analysis yields a valuation in the $42 to $44 a share range. The proposed purchase price represents only a 9% premium over the market price of Reddy on the day before the announcement of the GSO transaction and a skinny 6% premium to the trailing 30 day average. |

|

We propose that the Company commence a self-tender for approximately 15% of its outstanding shares at $33 per share, a reasonable premium to the GSO offer. A leveraged recapitalization such as this could be accomplished by incurring $110 million of new debt. We think this level of debt (5.3x debt to EBITDA) would continue to provide the Company with the financial flexibility necessary to continue to execute its business plan and pursue attractive acquisition opportunities. We believe the necessary financing could be quickly obtained on favourable terms given the Company’s strong balance sheet and cash flow. |

|

Instead of allowing GSO and its investors and management team to capture what we believe could be an IRR in the high 30% range through their proposed LBO, our recapitalization strategy gives Reddy shareholders the opportunity to choose between cash and staying the course. This will allow those current shareholders desiring liquidity to sell a portion of their investment, at a premium to the GSO offer, while allowing the other Reddy shareholders that believe in the future of the Company, as we do, to retain their investment. To increase the amount of shares that could be sold by other Reddy shareholders in a Company self-tender, and because of our confidence in the Company’s future prospects, we will commit not to sell any of our shares into the Company self-tender outlined above. |

|

This Board has a fiduciary duty to its shareholders that is not served by the ill-advised decision to sell the Company to GSO in a leveraged buyout at an inadequate price at the very moment the Company is poised to begin to realize its potential. The “go-shop” provision contained in the Merger Agreement does very little to assuage our concerns. Whether there currently are other acquirers willing to pay more than GSO (and incur the $7 million plus penalty contained in the Merger Agreement) does not absolve this Board from its fundamentally flawed decision to enter into the Merger Agreement with GSO. |

-2-

|

We continue to respect management’s accomplishments in energizing the Reddy business and preparing it for a significant surge in profitability. We believe the GSO leveraged buyout short-changes Reddy shareholders and is the product of an inadequate and flawed process. We urge the Board to fulfill its fiduciary duties and adopt our recapitalization strategy as the best way to maximize shareholder value. |

|

Based on conversations we have had with other shareholders since the announcement of the GSO transaction, we believe that many other Reddy shareholders share similar views and concerns. We would welcome the opportunity to share with you our thoughts on increasing and maximizing shareholder value. |

|

Enclosed for your review is a presentation outlining our proposed leveraged recapitalization transaction which includes a detailed analysis of the market, Company performance, improvement opportunities, and valuation. A copy of this presentation can also be found at our website at: |

|

(http://www.shamrock.com/pages/activist/FRZ-Presentation.pdf). |

|

Respectfully, |

|

| /s/ Michael J. McConnell �� |

Michael J. McConnell |

*****

-3-

Shamrock Capital Advisors, Inc. Reddy Ice Holdings, Inc. Leveraged Recapitalization Proposal July 2007 |

2 Table of content I. Leveraged recapitalization proposal II. Packaged ice market characteristics III. Reddy Ice performance IV. Operational improvement opportunities V. Reddy Ice valuation |

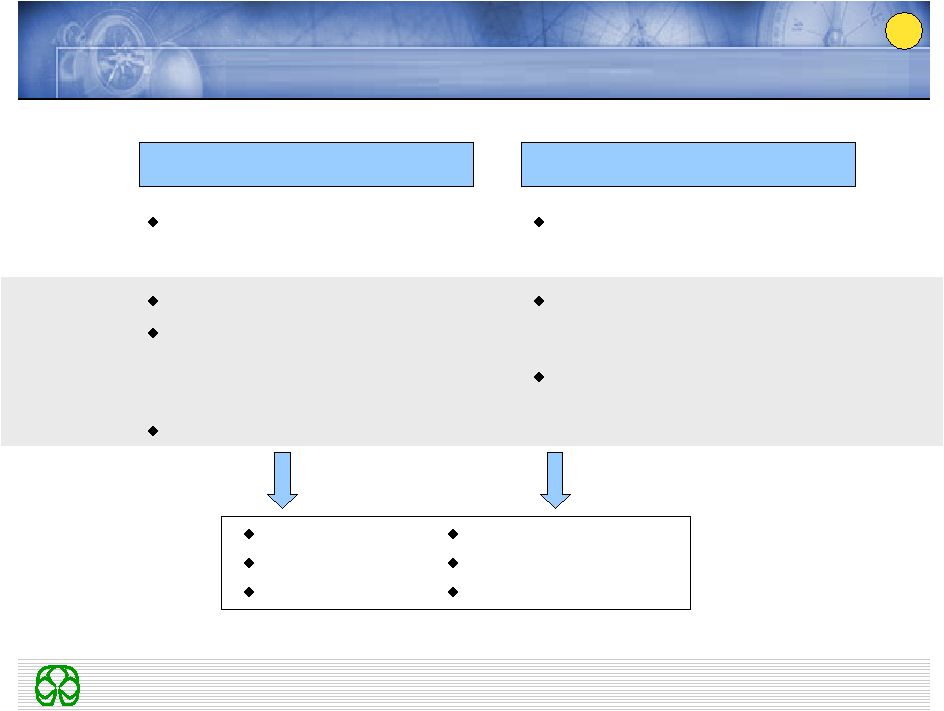

3 Leveraged recapitalization is a better option for current shareholders • GSO Capital Partners buyout offer for Reddy Ice substantially undervalues the business; our DCF shows that the intrinsic value of Reddy Ice is ~$42-$44 per share • Our proposal: Pursue a leverage recapitalization Raise $110M of debt Do a self-tender for 3.3M shares (~15% of outstanding shares) at $33 per share Allow some shareholders to exit at a higher valuation than the GSO offer, while allowing shareholders who appreciate the long-term potential of the business to have the opportunity to capture a significantly higher return |

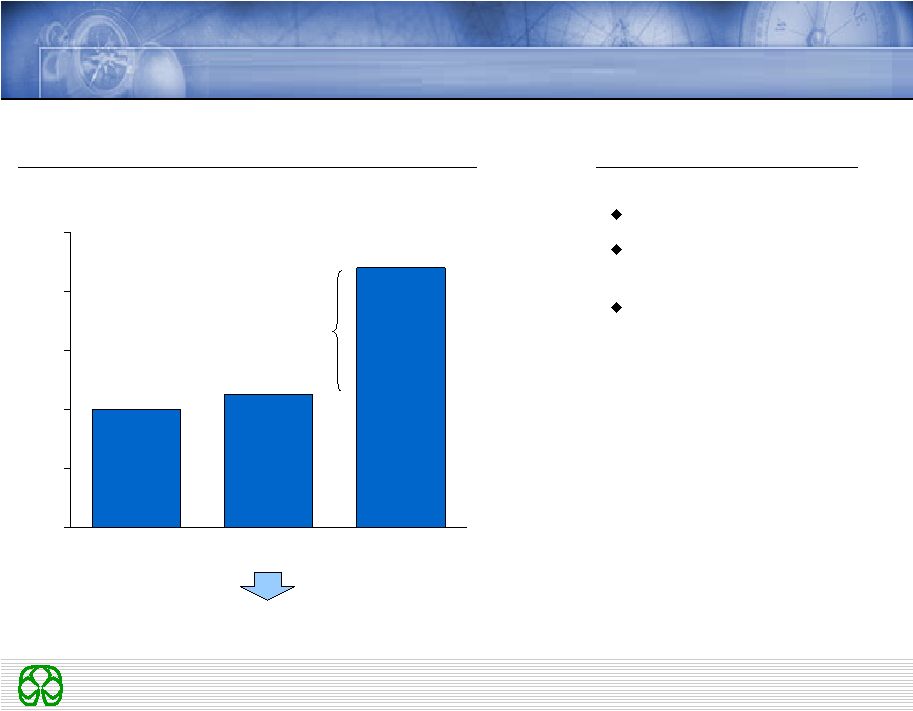

4 Reddy Ice business is attractive, with significant future valuation creation opportunities • Reddy Ice business is attractive, as the packaged ice market is stable and has many favorable characteristics Recession proof, market dominance, low price sensitivity, highly accretive acquisition landscape, and high barriers to entry • While Reddy Ice management has grown the business and delivered above average returns to shareholders, significant improvement opportunities still exist that can be achieved in a relatively short period of time and as a publicly traded company Given pricing dynamics, we believe prices could be raised; a 5% increase above current levels would increase shareholder value by ~15% Internal efficiency opportunities and competitor’s EBITDA margin suggest that Reddy Ice could improve its margins to ~30% in the next several years; this would increase shareholder value by ~28% Value creation opportunity from smaller acquisitions is significant and many accretive deals are still available Monetizing advertising opportunities on the bags and trucks are two other creative ways to increase value |

5 The packaged ice market is stable and has many attractive characteristics (1 of 2) 0 20 40 60 80 100% Market share Rest of players Leading player Typical market share in focus areas 0.0 1.0 2.0 $3.0B 2002 2.0B 2006 2.5B Packaged ice market retail revenue 5.7% (02-05) CAGR $92M $219M Arctic Glacier revenue $236M $333M Reddy Ice revenue Market has consistently grown in recent years; experts think market is recession resistant Three largest players dominate the market in their territories “Packaged ice consumption does not get impacted by recession as people tend to spend more of their leisure time close to home, which increases demand for ice.” Market expert, International packaged ice association Pricing environment is attractive “Event” driven purchase Ice represents a small cost in overall “event” cost Low price elasticity Highly profitable product for retailers Source: International Packaged Ice Association; Company presentations Low High |

6 0 3 5 8 10 13X Acquisitions since IPO 5.03X 2007 acquisitions 5.65X Reddy Ice valuation (pre deal) 11.00X EV/EBITDA multiple Fragmented market leads to highly accretive tuck-in acquisitions ~200 mom and pop acquisition targets still available ~5.3x Multiple arbitrage High barriers to entry $300M in PP&E Estimated $400M in replacement cost Long term relationships (10+ years) with high quality customers (Wal- Mart, 7-Eleven, etc.) The packaged ice market is stable and has many attractive characteristics (2 of 2) Source: Company conference calls; Company presentations; Capital IQ |

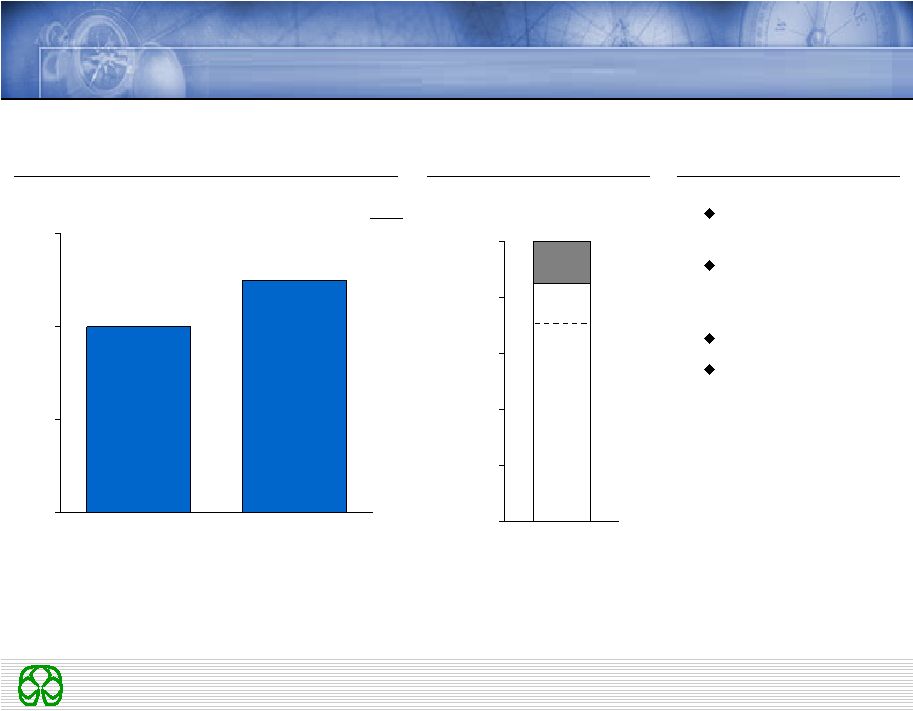

7 0 100 200 300 $400M 2004 $268M 2005 $305M 2006 $333M Reddy Ice ice revenue 11.5% (04-06) CAGR Revenue grew at 11.5% CAGR since 2004 0 20 40 $60M 2004 $31.8M 2005 $33.9M 2006 $51.7M Reddy Ice free cash flow* 27.5% (04-06) CAGR Reddy Ice management has significantly grown the business since 2004 With free cash flow also showing growth of 27.5% CAGR Source: Capital IQ; Yahoo finance; * Free cash flow = cash flow from operations - CAPEX |

8 There are still significant improvement opportunities that can be achieved and create significant value for public shareholders Pricing Operational efficiencies Asset monetization 1 2 3 |

9 Price increase could increase revenue and EBITDA, and create significant additional shareholder value; given pricing dynamics, this can be achieved in the next 12-18 months 23% 15% 10% Share price delta (%) $38.41 $35.86 $34.38 $31.25 Implied share price 21.8 21.8 21.8 21.8 Shares outstanding (M) $837.3 $781.8 $749.5 $681.2 Implied market capitalization (M) 11.9 11.9 11.9 11.9 Deal Multiple $101.1 $96.5 $93.8 $88.0 EBITDA (M) $339.1 $333.9 $330.9 $324.5 Total Ice Revenue (M) 10% Price increase 5% Price increase 3% Price increase 2006 1 Assumptions Volume decline of 1, 2, and 5% in the 3, 5, and 10% price increase scenarios respectively Incremental revenue margin of 90% |

10 EBITDA margin comparison suggests significant improvement opportunity exists to increase EBITDA margin; we think improvements can be achieved in the next 24-36 months 0.0 10.0 20.0 30.0% Reddy Ice 25.4% Arctic Glacier 27.0% Arctic Glacier (3 year goal) 30.0% EBITDA margin Cross plant utilization of best practices could result in significant value creation Reaching Arctic Glacier margin goal could result in additional value of ~$8.50 per share (~28%) Production process opportunities: Production cost and packaging speeds per bag ranges significantly between plants Up to 150% and 35% improvement opportunity respectively Plant automation is in early stages Delivery routing is not as sophisticated as can be, as decisions are based on driver feedback and the process is not systemized or computerized ~450 BPS opportunity 2 Source: Capital IQ; Interviews |

11 Other asset monetization opportunities also exist to create additional shareholder value Opportunity: Bag monetization Truck monetization Rationale: Potential partners: Sell advertising on ice bags Sell advertising on trucks Large reach at low cost Attractive “shelf space” as packages located behind the glass freezer door, making impressions even to consumers not buying ice Attractive target demographics Low cost mobile billboard that generates high number of impressions Allows partner to brand itself with a high quality related product Beverage companies Theme parks Sports teams 3 Grocery stores Entertainment companies Other national advertisers |

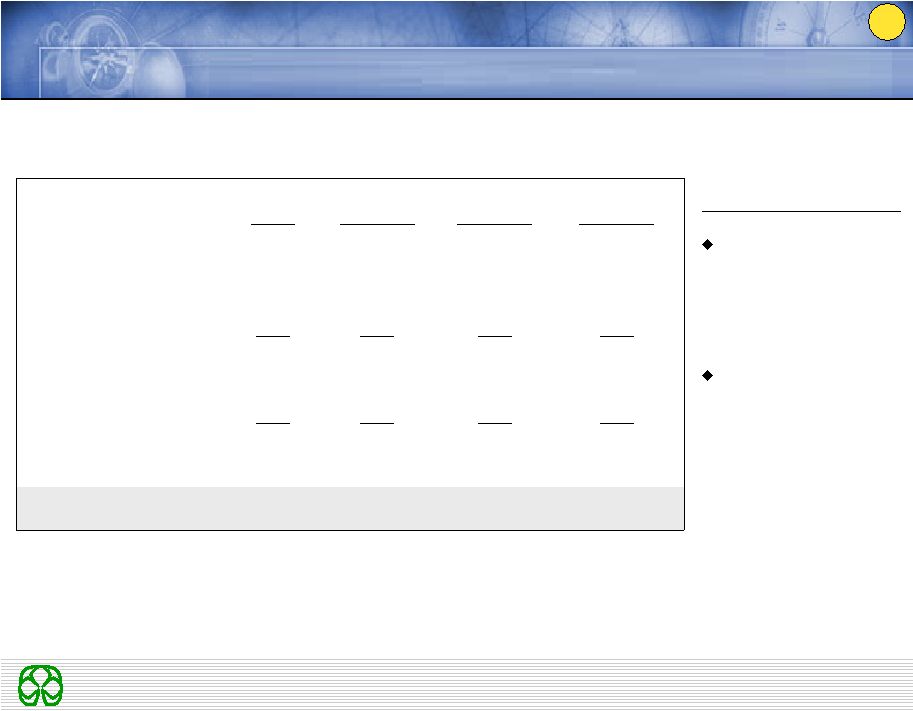

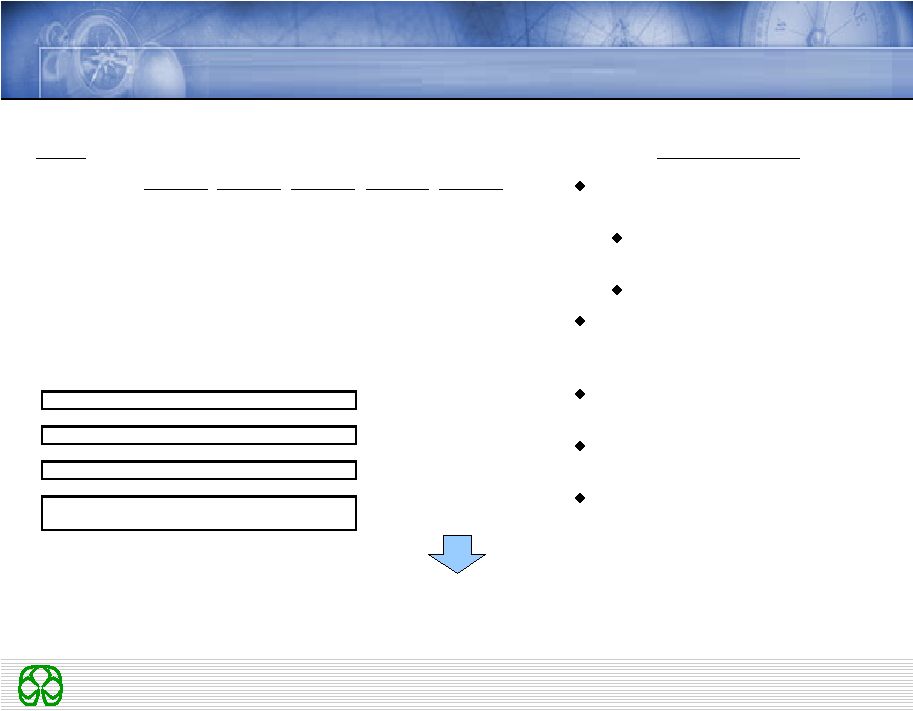

12 Our analysis shows that Reddy Ice intrinsic value is $42-$44 per share Current deal value does not maximize shareholder value and transfers majority of the upside potential to GSO Capital Partners Assumptions: Organic Ice revenue growth of 6.5% CAGR through 2011 Pricing increase of 6% in 2008 and 2009, 2.5% after Volume growth of 2.5% CAGR $60M of revenue and $15M of EBITDA purchased through 2011 at 7x EV/EBITDA multiple EBITDA margin improving to 30% by 2010 Debt at 5.3x 2007 EBITDA, 4.5x 2008 EBITDA Terminal year 2011; exit multiple 10x EBITDA, Discount rate 10% DCF: 20 2007 2008 2009 2010 2011 Revenue 360.30 $ 403.73 $ 451.91 $ 488.80 $ 527.55 $ Growth 4.1% 12.1% 11.9% 8.2% 7.9% EBITDA 94.87 115.06 134.22 146.64 158.26 Margin 26.3% 28.5% 29.7% 30.0% 30.0% Net Income 24.81 39.18 44.31 49.25 56.30 Margin 6.9% 9.7% 9.8% 10.1% 10.7% Free Cash Flow 53.59 84.75 60.37 53.18 58.66 Growth 58.1% -28.8% -11.9% 10.3% Equity Value 805.04 $ Outstanding Shares 18.53 Implied Share Value 43.44 $ Deal share price 31.25 $ % Upside 39.0% |

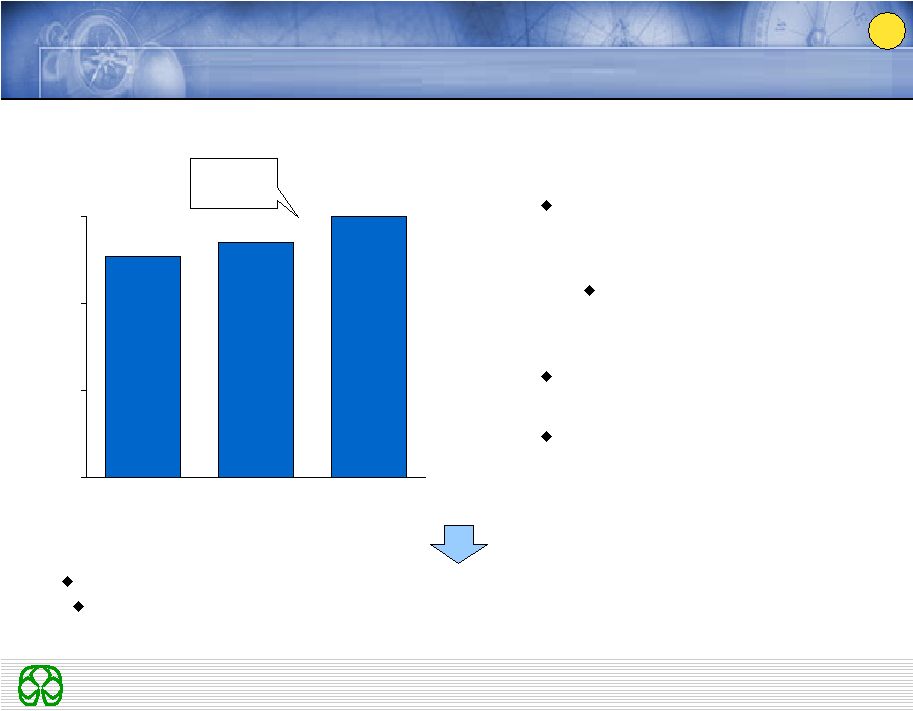

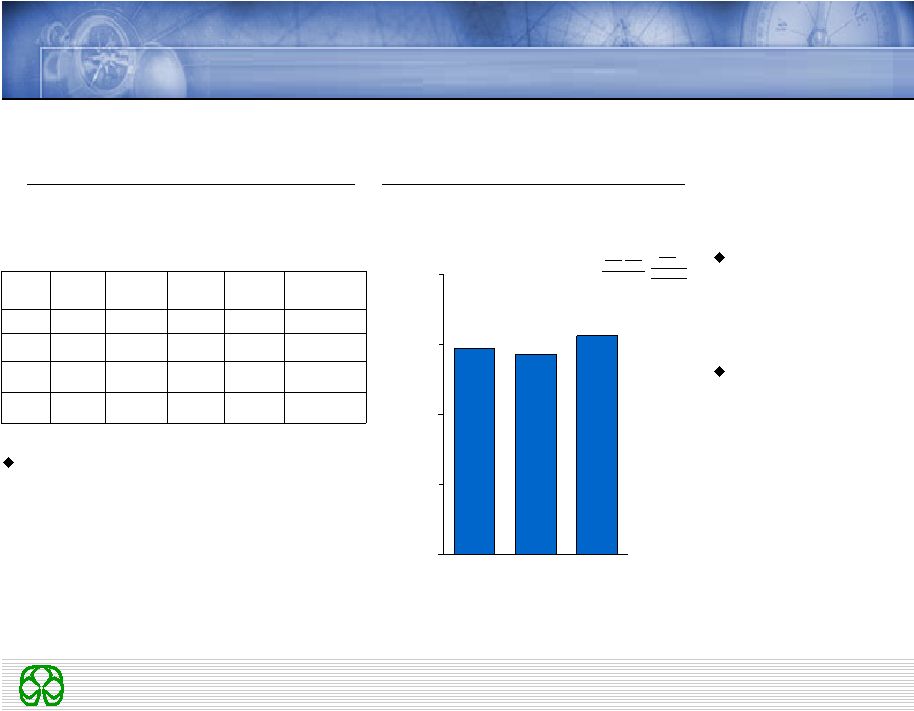

13 0 10 20 30 $40 30 day average $29.46 Pre announ- cement $28.52 Deal price $31.25 Reddy Ice share price 6.1% (30 day average) 9.6% (Pre announ- cement) In addition, deal timing resulted in a small deal premium while long-term prospect of business are still strong Q2 2007 weather was weaker than 2006, but inline with 2005 GSO Capital leveraged the soft weather to pay a small premium While weather impacts short term sales, it is not a big driver of long term value Long term temperatures are expected to be stable Source: University of Dayton, Yahoo finance 0% 78.3 78.6 78.5 77.8 Jun -3% 71.1 73.3 70.8 72.2 Avg. 0% 72.1 72.4 70.1 74.2 May -9% 63.0 68.9 63.9 64.6 Apr 07 to 06 variance 2007 2006 2005 2004 Additionally, precipitation was higher in 2007 than 2006, further impacting outdoor events |