Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 005-80961

In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800.

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer tobuy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a press release issued by Gas Natural SDG, S.A. on March 14, 2006.

Communications Management

This is a translation of a Spanish language press release.

In case of discrepancies, the Spanish version will prevail

Repsol YPF, Gas Natural and Sonatrach set up a joint

company for the construction of an LNG liquefaction plant

START-UP OF THE GASSI TOUIL LNG PROJECT IN ALGERIA

| | • | | The plant’s capacity will be above 4 million tons per annum |

| | • | | Gassi Touil is the most important project to be developed in Algeria by an international consortium |

Repsol YPF, Gas Natural and Sonatrach signed an agreement today to set up a joint company for the construction of an LNG plant in the Gassi Touil integrated project in Algeria. The signing took place in Algiers, with the presence of the Algerian Minister for Energy and Mining, Mr. Chakib Khelil, and the Chairmen of Repsol YPF, Gas Natural and Sonatrach, Messrs.Antonio Brufau, Salvador Gabarróand Mohamed Meziane.

The agreement was signed by Sonatrach’s Executive Vice President for Downstream, Mr. Abdelhafid Feghouli, Repsol YPF’s General Manager for Upstream, Mr. Nemesio Fernandez-Cuesta, and Gas Natural’s CEO, Mr. Rafael Villaseca.

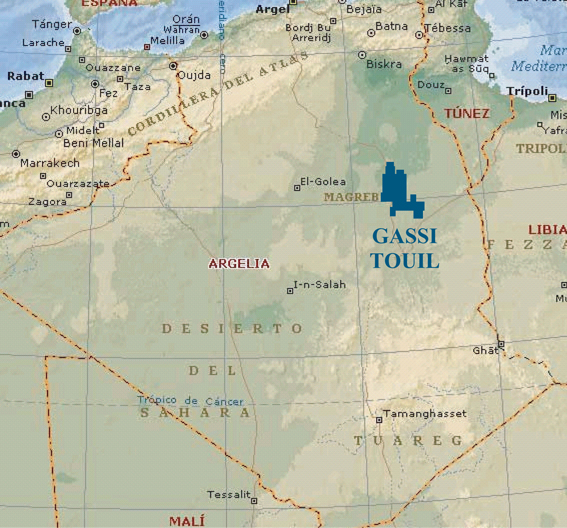

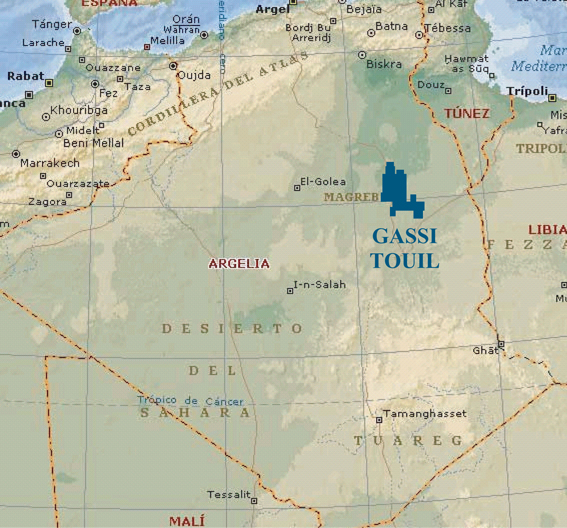

The new company,Sociedad de Licuefacción (SDL), will build and operate the LNG liquefaction plant at the Gassi Touil project. This project involves exploring, producing, liquefying and marketing a block of hydrocarbon reserves in the area of Gassi Touil, Rhourde Nouss and Hamra, in eastern Algeria.

The shareholding structure of the new company is as follows: Repsol Exploración Argelia S.A. 48%; Gas Natural Exploración S.L. (a wholly-owned subsidiary of Gas Natural SDG) 32%, and Holding Sonatrach Raffinage et Chimie (a wholly-owned subsidiary of Sonatrach) 20%.

The Gassi Touil project was awarded in 2004 to the consortium made up of Repsol YPF (60%) and Gas Natural (40%), and was the first project ever to have been awarded in Algeria to a foreign consortium. The project’s synergies are sizable given the presence of the above two companies and their relevant position in the gas markets. Gassi Touil is adjacent to the Berkine basin, where the consortium was awarded the Gassi Chergui Ouest exploration block, and next to Repsol YPF’s blocks in Reggane (with gas reserves already discovered) and M´ Sari Akabli.

First direct access to reserves for Gas Natural

With an initial duration of 30 years, this project gives Repsol YPF a leading position in Algeria, which, added to its current presence in Libya, places the company in a privileged position in the Maghreb. For Gas Natural this project represents having direct access for the first time to natural gas reserves to meet the growing demand from the markets.

The LNG liquefaction plant, to be located at Arzew’s industrial area near El Djedid gas harbour, will have a nominal capacity of over 4 million tons per annum of LNG, which in the future may be expanded with the construction of a second train. The gas to be used in the plant will come from the gas reserves which were discovered at Gassi Touil, Rhourde Nouss and Hamra, and the LNG produced will be marketed by a company also jointly owned by Sonatrach, Repsol YPF and Gas Natural.

The project’s execution time, which includes the construction of the LNG plant, is 54 months. During 2005 the conceptual engineering works for the plant and the marine facilities were concluded. The basic engineering, currently being developed in Houston by specialized engineering companies supervised by

2

Repsol YPF and Gas Natural, is expected to be concluded at the end of this month. The geotechnical and seismologic research and environmental impact study on the construction site have been developed and the main processing equipments have been awarded.

Seismologic and drilling campaign

Also, seismological data are being collected for the development of the Gassi Touil, Rhourde Nouss and Hamra areas in the most ambitious seismological campaign ever to have been conducted in Algeria. An intense drilling campaign is in preparation, to be initiated towards the end of the first half of 2006. In parallel, progress is being made on the design and construction of the facilities for the gas production and treatment.

Moreover, exploration works are being conducted in the above areas with the purpose of finding additional hydrocarbon reserves so as to carry out their further development and production, which could eventually feed a second liquefaction train.

Barcelona, March 14, 2006

3

4