Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 005-80961

In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800.

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer tobuy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a translation of a Spanish presentation delivered to the press today by GAS Natural SDG, S.A. In case of discrepancies, the Spanish version will prevail.

7 April 2006 Press conference |

1 In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a preliminary prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by holders located in the United States and for Endesa ADSs held by holders wherever located. At the appropriate time, Gas Natural will file a Statement on Schedule TO with the SEC. Holders of Endesa ADSs and U.S. holders of Endesa ordinary shares are urged to read the registration statement, the preliminary U.S. prospectus and the related exchange offer materials, the final U.S. prospectus and Statement on Schedule TO (when available), and any other relevant documents filed with the SEC, as well as any amendments and supplements to those documents, because they will contain important information. Investors and security holders may obtain free copies of the registration statement, the preliminary U.S. prospectus and related exchange offer materials, and the final prospectus and Statement on Schedule TO (when available), as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov and will receive information at the appropriate time on how to obtain transaction-related documents for free from Gas Natural or its duly designated agent. This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that Gas Natural expects to send to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. The Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) may not be sold, nor may offers to buy be accepted, in the United States prior to the time that the registration statement becomes effective. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things: • management strategies; • synergies and cost savings; • integration of the businesses; • market position; • expected gas and electricity mix and volume increases; • planned asset disposals and capital expenditures; • net debt levels and EBITDA and earnings per share growth; • dividend policy; and • timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding- looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. Disclaimer and Important Legal Information |

Agenda 1. Strategic rationale for the transaction 2. Summary of the tender offer for Endesa 3. Benefits for consumers and the general interest 4. Considerations regarding the European electricity market |

Strategic rationale for the transaction |

4 The main European energy groups (except the Spanish ones) have adopted a gas and power integration strategy Acquisition of Ruhrgas E.ON Suez RWE Enel Acquisition of Distrigas and Fluxis Acquisition of Transgas and DEA Acquisition of Camuzzi and Colombo Gas GDF Merger with Suez Dong Acquisition of Elsam, Energi E2, Nesa, Copenhagen Energy and Frederiksberg Elnet |

5 A transforming transaction to accelerate profitable growth Global leading integrated Spanish gas and electricity company, with strong energy management capabilities Complementary, high-quality assets in fast growing markets Client-focused multinational leader with over 30 million customer accounts |

6 42 34 33 32 31 23 20 10 0 10 20 30 40 Creation of a Spanish leader in the energy sector Electricity and gas in Spain¹ No.1 No.1 Electricity and gas in LatAm No.3 Global customer connections² No.4 Global LNG supply Global utilities – ranking by customer connections (millions)² Notes: 1 By combined customer connections, after asset disposals 2 After asset disposals. Listed companies only. Presented on consolidated basis, including gas and electricity customers. EdF is a majority state owned company Combined market positions RWE (Germany) Enel (Italy) E.ON (Germany) GAS NATURAL + Endesa (Spain) Suez + GdF (France) Endesa (Spain) GAS NATURAL (Spain) EdF (France) |

7 LatAm • Gas and electricity distribution and supply • Electricity generation Puerto Rico • Electricity generation • Regasification plant Source: Endesa 2005 Annual report and Gas Natural. After assets disposals Italy • Gas distribution and supply • Electricity generation Spain • Gas and electricity distribution and supply • Electricity generation Portugal • Electricity generation Morocco • Electricity generation • Gas infrastructure Algeria • Gas infrastructure and projects An energy leader in high-growth markets Contracts/Fleet • Gas/LNG contracts • LNG fleet |

8 Combined management of clients and networks More flexible and competitive gas procurement More balanced and competitive generation portfolio Attractive business mix and investment profile Gas and electricity convergence Sizeable synergies An attractive Spanish project from a strategic, industrial and financial perspective |

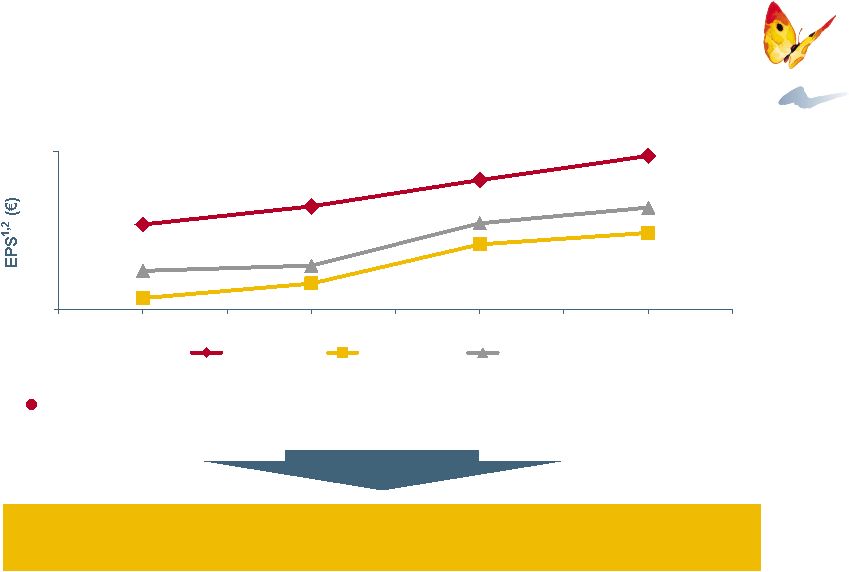

9 Positive financial impact Notes: 1 Company estimates based on IBES EPS projections of €1.87 (2006), €1.92 (2007), €2.32 (2008) and a long-term growth rate of 6.8% for Endesa. Based on IBES EPS projections of €1.61 (2006), €1.75 (2007), €2.12 (2008) and a long term growth rate of 5.0% 2 After planned disposals 3 Assuming Endesa’s shareholders reinvest cash received in GAS NATURAL shares at September 2nd 2005 price and assuming no adverse tax consequences of the sale of the Endesa’s shares Very attractive transaction for the shareholders³ of the New Group GAS NATURAL + Endesa will maintain its “A” credit rating target Evolution of earnings per share (EPS) (estimate) 1.5 3 2006E 2007E 2008E 2009E New Group Gas Natural Endesa |

10 Attractive dividend policy The New Group will adopt an attractive dividend policy¹, consistent with the “A” credit rating target Additionally, all future capital gains resulting from the sale of non- energy assets will be distributed as dividends Payout of 52-55% in 2008 DPS increase by a minimum of 15% per annum for the 2006-2009 period Note: 1 Subject to shareholder approval and any other legal requirements |

Summary of the tender offer for Endesa |

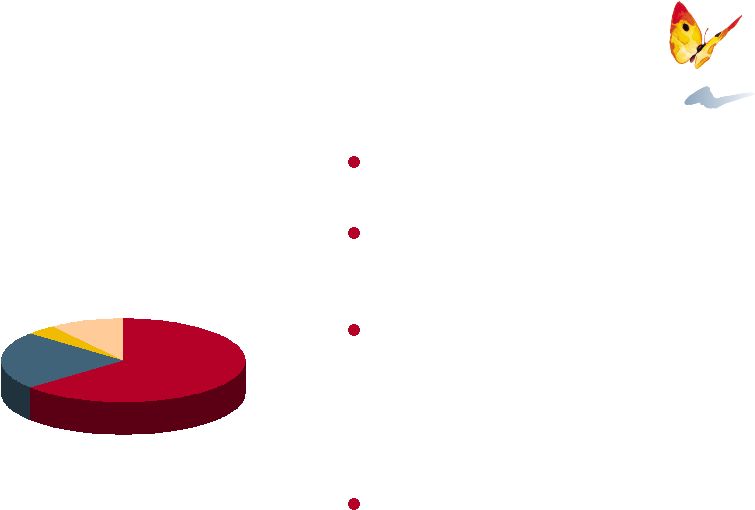

12 Free float 63.1% La Caixa 14.7% Repsol YPF 13.2% Caja Madrid 5.7% Other² 3.4% GAS NATURAL + Endesa shareholder structure after the offer¹ Unique opportunity to participate in a Spanish integrated gas and electricity project Endesa shareholders 57% GAS NATURAL shareholders 43% Creation of a Spanish integrated energy leader Clear strategic rationale for the combination, based on the gas and power convergence Sizeable synergies Attractive dividend policy Benefits for consumers and the general public Notes: 1 Assuming 100% acceptance 2 Includes Hisusa and Caixa Catalunya, considered as strategic/long term investors |

13 All the regulatory and administrative hurdles have been passed Spanish antitrust authorities Regulated activities (Function XIV) National Energy Commission The EC confirmed that the jurisdiction on competition matters belonged to Spain European antitrust authorities Golden Share Secretary General of Energy Nov 05 The combination GAS NATURAL–Endesa was approved by the Council of Ministers Feb 06 Nov 05 Dic 05 Spanish offer/prospectus approved CNMV US prospectus (F-4) declared effective SEC (USA) Feb 06 Mar 06 Note: The offer and therefore the processing of any action related to the offer, and the performance of the agreement between Gas Natural and Iberdrola are currently suspended, following the injunction granted by the Madrid Mercantile Court Nº3. |

14 Despite the numerous obstacles set up by Endesa to date Note: Summary, for illustrative purposes, of the main legal and administrative actions launched by Endesa |

15 Endesa’s Board of Directors decision to post the €1,000 million bond has an impact on both tender offers Posting the bond has an adverse impact on the shareholders of the companies involved, and particularly on the shareholders of Endesa and GAS NATURAL The objective is to stop, delay and eventually cause both tender offers for Endesa to disappear Endesa’s Board of Directors intends to continue using litigation to prevent its shareholders from deciding on the offers The Court’s decision on the merits of Endesa’s lawsuit could take approximately year Endesa’s share price performance since the Court ruling of 21 March 2006 In the days following the order for temporary injunction, Endesa’s shareholders suffered a value loss of approximately €1,000 million 26.0 26.2 26.4 26.6 26.8 27.0 27.2 27.4 27.6 27.8 21/03/06 23/03/06 25/03/06 27/03/06 29/03/06 31/03/06 Source: Datastream |

Benefits for consumers and the general interest |

17 A transaction with benefits for consumers and the general public in the markets where we operate Strengthens Spain’s security of energy supply through a stronger position in the international markets Investment commitment that will allow the improvement of the quality of power supply to clients Improvement of the sector’s competition situation in Spain |

18 Security of supply in Spain Gas procurement in Spain Source: CNE natural gas monthly statistical bulletin, February 2006 European markets supplied mainly through piped gas from Russia and the Northern Sea. Spanish market mainly supplied by LNG from the north of Africa and Middle East. Limited connection capacity by gas pipeline with the rest of Europe. European gas network Fuente: E.ON Algeria 42% Persian Gulf 20% Nigeria 15% Egypt 10% Norway 6% Other 7% LNG 66% GN 34% Brindisi Cartagena Bilbao Huelva Lisboa Madrid Athens Fos-sur-Mer La Spezia Córdoba Ferrol Montoir Paris London Dublin Brugge Brussels Rome Rovigo Krk Marmara Ereglisi Bucharest Belgrade Sophia Vienna Prague Berlin Wilhelmshaven Copenhagen Stockholm Oslo Karsto Kollsnes Berne Helsinki St Petersburg Barcelona Valencia Current gas pipeline Planned or under construction gas pipeline Gas flow direction LNG plant in operation LNG plant planned / under construction |

19 Investments to improve quality of service Expected investments by GAS NATURAL + Endesa in Spain (estimate 2006-2009) ~ 4,700 ~ 6,300 ~ 140 > 11,000 Distribution Generation Reinvested distribution synergies¹ Total Source: GAS NATURAL estimates Notes: 1 Up to 70 million euro per year estimated for 2008 and 2009 Total investment of c.€17.5 bn through 2009. Over 60% earmarked to improve distribution and generation in Spain. Transfer of synergies arising from distribution network overlap to clients through reinvestment. Benefits for consumers |

20 Increasing effective competition in the generation market Source: REE data and Gas Natural estimates. Mainland installed capacity 1 Range refers to potential asset disposals scenarios: 1,200MW CCGT and/or Hydro 2 Includes Endesa, GAS NATURAL, Iberdrola, HidroCantábrico, Unión Fenosa and Viesgo Generation mix in Spain² GAS NATURAL + Endesa after disposals¹ Endesa Combined generation mix 2006E 28% 27% 18% 12% 9% 6% 16% 25% - 28% 19% 21% - 23% 13% 4% 18% 27% 12% 22% 13% 8% Coal Hydro Nuclear CCGT Renewables Fuel The rebalancing of the generation mix and the planned asset disposals are expected to enhance competition in the sector |

21 Improving competition in the gas market Natural gas distribution (customer connections) 1,2 New Group Disposals II (0.25 million) NaturCorp Disposals I (1.25 million) Source: CNE. Natural gas statistics monthly bulletin. February 2006 Notes: 1 Including distribution companies’ liberalised customers 2 Including regulatory asset disposals as per the Council of Ministers Creation of two new operators in the gas distribution market The New Group will have a approximately 60% market share in distribution Liquidity increase in the gas procurement market as volume equivalent to the gas imported by Endesa in 2005, as well as part of the gas from Algeria (Sagane I), is released for a three-year period Disposal of Endesa’s gas supply business |

Considerations regarding European electricity market |

23 The European electricity market is not a reality Electricity interconnection capacity is insufficient Electricity prices are not homogenous The liberalisation of the different markets advances at different speeds The European Commission has stated that the minimum conditions required for the existence of a single European market are not in place The single European market depends on these problems being solved There are multiple asymmetries among countries in terms of sector regulation, taxation, state ownership, etc. |

24 Under construction/completed Under consideration No new construction Interconnection capacity between Spain and the rest of Europe is 3-4% of total electricity production in Spain Interconnection among European markets The European electricity market is not a reality yet Source: European Commission, “Towards an efficient internal energy market”, November 2005 |

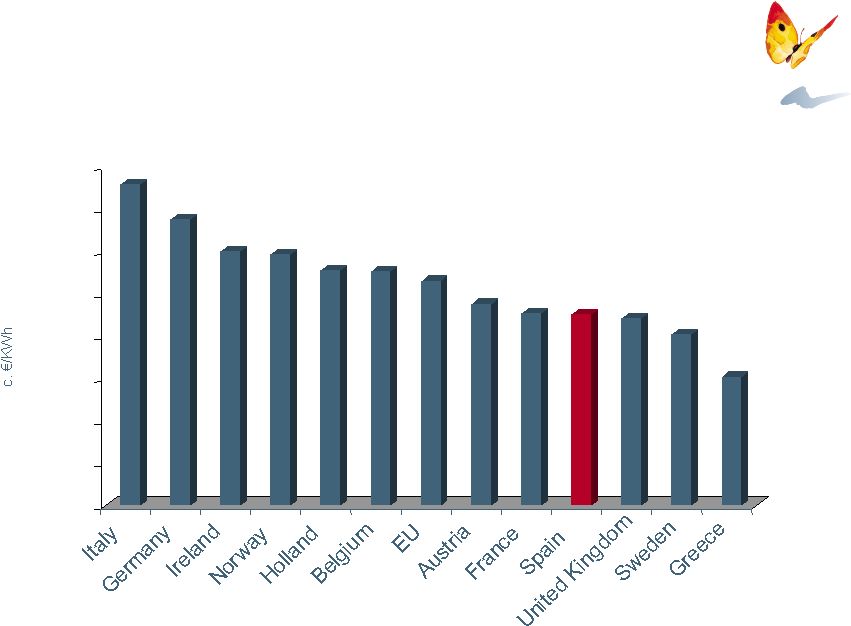

25 0 2 4 6 8 10 12 14 16 Competitive landscape in the European electricity market Source: Eurostat, domestic tariffs as of 1 July 2005, excluding taxes Electricity tariffs in Europe |

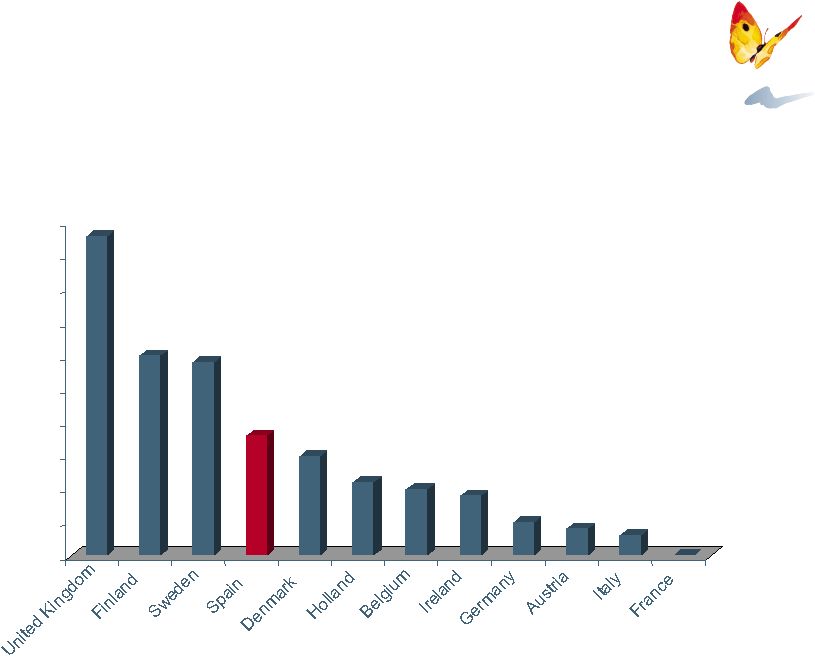

26 Markets with higher tariffs have lagged behind in the liberalisation process Liberalisation (electricity supplier switching rate for households and SMEs) Source: European Commission “Towards an efficient internal energy market”, November 2005 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% |