FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of April, 2006

Commission File Number: 333-132076

GAS NATURAL SDG, S.A.

(Translation of Registrant’s Name into English)

Av. Portal de L’Angel, 20-22

08002 Barcelona, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):N/A

This is a free translation of a Spanish language document which has been provided for purposes

of convenience. In case of discrepancies, the Spanish version shall prevail.

Gas Natural shall not be responsible for any deviations between the translation and the

Spanish language document.

Table of Contents

1

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

1Tender Offer (OPA) by Gas Natural,SDG,S.A. for the Acquisition of 100% of the capital of Endesa, S.A.

2

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Legal Disclaimer

This document does not constitute an Offer of sale or purchase of securities, nor is it a request that any agreement whatsoever be voted on or adopted. The owners of Endesa, S.A.’s common shares to which the Tender Offer (OPA) prepared by Gas Natural SDG, S.A. for Endesa, S.A.’s shares (the “Offer”) is addressed must adopt any decision on the sale or subscription of the securities mentioned in this document solely on the basis of the information contained in the Spanish Folleto for the Offer.

The Offer and the Spanish Folleto were authorized on February 27, 2006, by the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores or “CNMV”). The Prospectus contains the information required by Law 24/1988, of July 28, on the Stock Market, by Royal Decree 1197/1991, of July 26, on the System for Tender Offers, by Royal Decree 1310/2005, of November 4, which partially implements Law 24/2998, of July 28, on the Stock Market, with respect to the admission of securities to trading on official secondary markets, Offers for sale or subscription, and the brochure required in such cases, and other applicable legislation.

Both the Spanish Folleto for the Offer and the supplemental documentation attached are available to Endesa, S.A.’s shareholders in the corporate domiciles of Gas Natural SDG, S.A. (Avenida del Portal de l’Àngel, 20 y 22, Barcelona) and Endesa, S.A. (Calle Ribera del Loira, 60, Madrid), in the domiciles of the Stock Exchange Councils of Madrid (Plaza de la Lealtad, 1, Madrid), Barcelona (Paseo de Gracia, 19, Barcelona), Bilbao (Calle José María Alabarri, 1, Bilbao), and Valencia (Calle Libreros, 2-4, Valencia), in the domicile of Caixa d’Estalvis i Pensions de Barcelona (“La Caixa”) as the agent for the Offer and Spanish Exchange Agent and Fractional Share Agent for the Offer (Av. Diagonal, 6521-629, 08028 Barcelona), and in the domiciles of the New York Stock Exchange (11 Wall Street, New York, USA), the Stock Exchange of Santiago, Chile (La Bolsa 64, Santiago, Chile), the Electronic Stock Exchange (Huérfanos, 770, Santiago, Chile), and the Stock Exchange of Valparaíso (Prat 798, Valparaíso, Chile).

Likewise, the Prospectus and the supplemental documentation may be consulted in the public registries of the Spanish Securities and Exchange Commission (in Madrid, at Paseo de la Castellana, 15, and in Barcelona, at Paseo de Gracia, 19). The Prospectus and announcement model may be consulted on the web pages of the CNMV (www.cnmv.es), Gas Natural SDG, S.A. (www.gasnatural.com), Endesa, S.A. (www.endesa.es), and the Securities and Exchange Inspection Office of Chile (www.svs.cl). In Chile, by the same deadline mentioned above, Endesa, S.A.’s shareholders may obtain a copy of the Prospectus and the supplementary documentation through the Securities Inspection Office of Chile (Av. Libertador Bernardo O’Higgins 1449, Santiago, Chile). Finally, the recipients of the Offer may request copies of the Prospectus in writing or by phone through the Offer’s information agent designated by Gas

3

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Natural for said purpose: GSProxibérica, S.L.U. (a member of the Georgeson Shareholder Group, at Calle Antonio Maura, 18, 28014 Madrid; toll-free: 900 800 905 and foreign institutional investors +39 0642171777), web site: (www.gsproxiberica.com).

Likewise, on March 6, 2006, Gas Natural SDG, S.A. filed with the United States Securities and Exchange Commission (“SEC”) documentation relevant to the offer, addressed exclusively to the holders of American Depositary Shares (“ADS”) of Endesa, S.A. and to U.S. holders of Endesa, S.A. common shares (the “U.S. Offer”) on substantially the same terms as the Offer. For this purpose, Gas Natural SDG, S.A. has filed a Registration Statement on Form F4 (No. 333-132076) and a Statement on Schedule TO, which include the documentation necessary to register the common shares and ADS issued by Gas Natural SDG, S.A. in exchange for the common shares and ADS of Endesa, S.A., the holders of which accept the U.S. Offer. The documentation on the U.S. Offer is available on the SEC’s web page (www.sec.gov). Pursuant to Rule 14d-5 of the United States Securities and Exchange Act of 1934, Gas Natural SDG, S.A. has requested of Endesa, S.A. that it either send the brochure on the U.S. Offer directly to those shareholders who are recipients of the U.S. Offer or send Gas Natural SDG, S.A. the list of its shareholders so that Gas Natural SDG, S.A. may send the materials of the brochure on the U.S. Offer to the recipients of the same. The owners of Endesa, S.A. ADS and U.S. holders of common shares to which the U.S. Offer is addressed should carefully read the documentation filed (or to be filed) with the SEC, since it contains information relevant to the U.S. Offer.

This document may contain forward-looking statements based on current expectations held by the management of Gas Natural SDG, S.A. These forward-looking statements concern, among other things:

| | • | | Synergies and cost savings |

| | • | | Integration of business activities |

| | • | | Expected increase in sales volume and gas and electricity mix |

| | • | | Planned asset divestitures and investments |

| | • | | Net debt levels, earnings before interest, taxes, depreciations, and amortizations (EBITDA), and increased earnings per share |

| | • | | Timing and benefits of the Offer and the combined company |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements, including but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; costs relating to the offer and the integration; decisions of the competent authorities; litigation; and the effects of competition.

4

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The forward-looking statements may be identified by the words “believes,” “expects,” “anticipates”, “projects,” “intends,” “should,” “attempts to achieve,” “estimates,” “future,” or similar expressions.

These forward-looking statements reflect our current expectations. In light of the many risks and uncertainties which surround these industries and the offer, you should understand that we cannot assure that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on forward-looking information.

This communication is not for publication or distribution in Australia, Canada, Japan, or any other jurisdiction where it would otherwise be prohibited or limited.

5

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

On September 5, 2005, Gas Natural applied to the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores orCNMV) for authorization for a Tender Offer (Oferta Pública de Adquisición orOPA) for 100% of the capital of the company Endesa.

The transaction allows the two companies to advance toward their strategic goals, increase effective competition in the Spanish energy market, accelerate the liberalization process, and increase the quality and guaranteed supply to consumers.

The transaction is an excellent opportunity for Gas Natural’s and Endesa’s shareholders, who may benefit from the value generated by a product with a profitable future.

In view of the different reports issued by the National Energy Commission, the Defense of Competition Service, and the Defense of Competition Court, the Council of Ministers approved the transaction on February 3, 2006, subject to certain conditions.

After studying the twenty conditions imposed by the Council of Ministers, the Board of Directors of Gas Natural decided to continue with the transaction on February 6, 2006.

On February 27, 2006, the CNMV authorized the Tender Offer.

The acceptance period for Gas Natural’s Tender Offer for 100% of the corporate capital of Endesa began on March 6, 2006, in Spain. At the same time, the United States Securities and Exchange Commission declared the U.S. Prospectus to be effective in the United States, where Endesa stock is also traded. Both acceptance periods are initially programmed to last 45 days.

The purpose of the Extraordinary Shareholders Meeting, held today, April 7, is to agree on the capital increase so as to pay for the shares belonging to Endesa shareholders who accept the Tender Offer, delegating the execution of the same to the Board of Directors.

6

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Gas Natural’s Offer

The Offer represents a total valuation of Endesa at approximately 22,549 million euros, that is, 21.30 euros per share, a premium for its shareholders of 14.8% over the Endesa trading price at the close of markets on the day before the Offer was submitted, and 19.4% over the mean trading price for Endesa stock in the six months prior to the submission of the Offer.

The consideration Offered consists of shares and money, 65.5% and 34.5% respectively, with the above-mentioned valuation. Endesa shareholders which accept the Offer will receive 7.34 euros in cash and 0.569 newly issued shares of Gas Natural for each share of Endesa.

The new shares which Gas Natural issues in consideration of the Offer will be common stock in Gas Natural, with the same economic and political rights as said stock, from the date the capital increase is registered in the Commercial Registry.

The Offer depends on Gas Natural’s acquisition of 75% of the shares representing the corporate capital of Endesa.

Likewise, the Offer is subject to the condition that the General Shareholders Meeting of Endesa adopt resolutions to amend:

| | • | | Article 32 of the company’s By-Laws, thus eliminating all restrictions and limitations on the number of votes to be exercised by Endesa shareholders. |

| | • | | Articles 37 and 38, thus eliminating the requirements as to type and percentage for majorities in the Board of Directors. |

| | • | | Article 42, so that no conditions are imposed for being appointed to the Board of Directors of Endesa or as Managing Director (Consejero Delegado), other than the incompatibilities established by law. |

Financing of the OPA

One group of financial entities has signed a syndicated loan of approximately 7,800 million euros to finance the cash portion of the Offer. The entities coordinating the financing are UBS Limited, Société Générale, and La Caixa.

Financing for the transaction has been provided to Gas Natural on the basis of its solvency and has not required the granting of any security interests or support.

7

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The part of the consideration paid in shares shall take place through a capital increase of Gas Natural for a face value of 602,429,955 euros, through the issue of 602,429,955 new common shares with a face value of 1 euro each. This increase must be approved by this General Extraordinary Shareholders Meeting.

Increased Profits and Dividends

The new group will create value for its shareholders from the time of its incorporation: Gas Natural’s goal is for the per-share dividend to grow by 15% from 2006 to 2009.

Gas Natural’s shareholders will benefit as follows:

| | • | | An increase in the payout of up to from 52% to 55% of its consolidated net profit for 2008. |

| | • | | All capital gains resulting from future sales of non-energy assets will be distributed as dividends. |

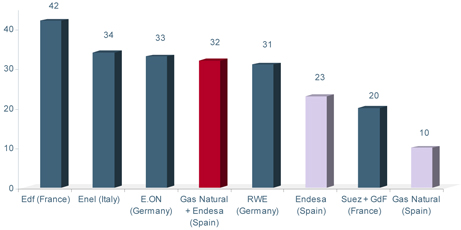

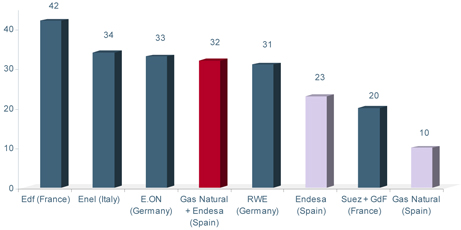

A New Global Integrated Energy Group Leader

The new company will be the world’s third largest utility (with a majority of private capital), number one in gas and number two in electricity in Spain, with a significant presence in Latin America. The company will have 16 million customers in Europe and 30 million worldwide.

Utilities ranking by number of customers*

Source: Annual Reports and Presentations

8

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The transaction follows a clear business logic, allowing for the creation of value for the shareholders of both companies and accelerated achievement of their strategic goals.

The new group will be a world leader in the energy markets of gas and electricity, which will have a diversified portfolio of assets. This will provide an ideal platform from which to take advantage of the most attractive business opportunities in the markets in which the two companies are present.

The new group will have a solid financial structure which will ensure investment in regulated businesses, as well as in other liberalized businesses with high added value, enabling it to keep its commitment toward increased returns for shareholders.

In electricity generation, the combination of assets of the two companies and the divestments planned would allow the new company to be endowed with an optimum mix for electricity generation and a diversification in keeping with that of the Spanish market.

The new group begins with the proposal of maintaining leadership in the Spanish energy market by means of pursuing Endesa’s strategic goals for combined cycles, with a flexible, competitive supply of natural gas.

The complementarity of Endesa’s and Gas Natural’s assets and abilities will allow the creation of a world energy leader, with a unique position in the gas business and an energy competitor at the European level.

9

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Creation of Value and Synergies

The transaction will create value for the new company’s shareholders, given its competitive position and the business logic of the transaction.

Gas Natural estimates that the transaction would generate significant synergies of approximately 350 million euros beginning in 2008.

From this amount, approximately half of the potential savings will arise from the integration of business platforms, call centers, invoicing, and commercial and marketing services. Furthermore, a reduction in overhead of up to 85 million euros is expected, as is a savings of 90 million euros for the integration of the two companies’ information systems.

Beyond the estimated 350 million euros in synergies, the distribution business has a savings potential in procurement and subcontracting of services. The new group intends to invest these savings, estimated at some 70 million euros per year, to continue improving the quality of the regulated service.

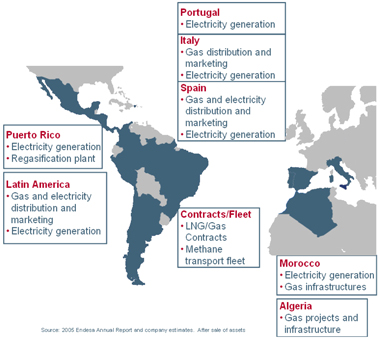

Opportunities for Growth

The new group will benefit from the very relevant position of LNG in the market, through a joint venture with Repsol YPF. This will allow increased flexibility in supply, maximum use of maritime transport, and potential growth in trading.

10

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

This, together with Gas Natural’s combined-cycle plants, will allow for the most efficient use of the power generating facilities, which will benefit from the diversified mix of fuels and broad experience in energy management.

The new group will be the leader in installed combined-cycle power. The forecast is for the resulting company to have a total of 8,400 MW of power installed by the end of 2009.

With respect to renewable energies, the new group plans a major increase in installed power. This will give it an outstanding position in renewable energies, in line with the recently approved Renewable Energy Plan.

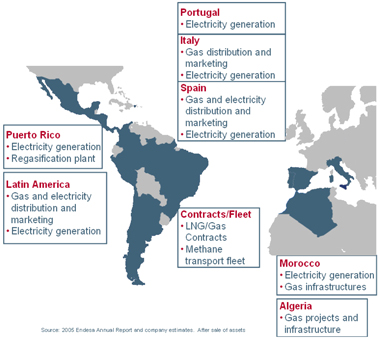

In Italy, Endesa’s and Gas Natural’s good position in the gas and electricity generation markets will be an excellent platform to take advantage of the new opportunities for growth. Gas Natural plans selective purchases, aiming to reach 700,000 customers by the end of 2008. For its part, Endesa is developing various projects to increase its combined-cycle power. Furthermore, both companies have regasification plant projects under way.

In Latin America, Gas Natural and Endesa are the companies of reference in the gas and electricity markets of the principal capitals. This provides the new group with an excellent platform for growth.

Greater Effective Competition

The transaction, together with the subsequent sale of assets, will allow a solid articulation of the Spanish energy sector and will contribute to the creation of more effective competition in these markets due to the solidity of their main players and their having a balanced, competitive generation mix.

This process is in line with other, similar movements taking place in Europe and will allow the creation of companies which integrate gas and electricity management, with a strong commitment to investment so as to strengthen the level of the quality of service and assure supply for all consumers.

The sector will become more dynamic since Gas Natural will sell approximately 10% of the annual demand for gas, a condition imposed on the Offer by the Spanish Council of Ministers.

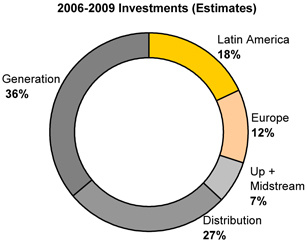

Investments and Benefits for Consumers

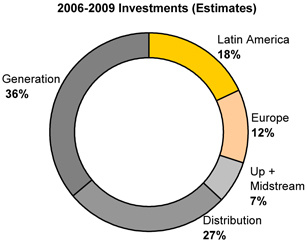

The new group plans to invest approximately 17,000 million euros from 2006 to 2009 and assumes the commitment to make all the investments in regulated activities announced by Endesa and Gas Natural separately until 2009.

11

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

More than 60% of the total investment will be earmarked for electricity generation and distribution in Spain, to improve service quality and ensure security of supply.

The cost savings from the joint operation of the distribution networks of the two companies may exceed 70 million euros per year. The new group is committed to reinvesting that entire amount in the continual improvement of the quality of service provided to the customer.

The new organization will be structured territorially. Thus, Gas Natural seeks to maintain its customer orientation in the new company, bringing decision-making closer to the markets and the customers receiving services. Gas Natural has already done this with the structure of its regional gas distributors.

The integration of Endesa and Gas Natural will be most beneficial for consumers:

| | • | | Energy supply in Spain is ensured thanks to the company’s better position in the international markets. |

| | • | | Better quality in the electricity supply will be possible thanks to the commitment to invest. |

| | • | | The synergies (in distribution) associated with the transaction will be passed on to consumers, allowing greater efficiency and, in short, savings for customers. |

Territorial Organization

The new group will keep its headquarters in Barcelona and will have corporate offices in both Madrid and Barcelona.

12

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The resulting company will have five major business areas:

| | • | | Up and Mid-stream Gas, which will include developing LNG’s integrated projects, the management of maritime transport, and the operation of the Magreb-Europe gas pipeline. |

| | • | | Energy Management and Wholesale Sale. |

| | • | | Distribution and Retail Sale in Europe. |

The new company will be territorial, so as to bring decision-making closer to the markets and the customers receiving services.

The new group will maintain the territorial structure of the gas distribution companies and may further create two new companies, on operational grounds, to distribute gas in Catalonia and Madrid.

A territorial structure will also be created for electricity generation and distribution. This will include both assets and personnel to develop, operate, and maintain the same. Thus, new territorial subsidiaries will be created for electricity generation and distribution: The following are some examples:

| | • | | FECSA-ENHER Distribución and FECSA-ENHER Generación |

| | • | | SEVILLANA Distribución and SEVILLANA Generación |

| | • | | ERZ Distribución and ERZ Generación |

| | • | | GESA Distribución and GESA Generación |

| | • | | UNELCO Distribución and UNELCO Generación |

Agreement with Iberdrola

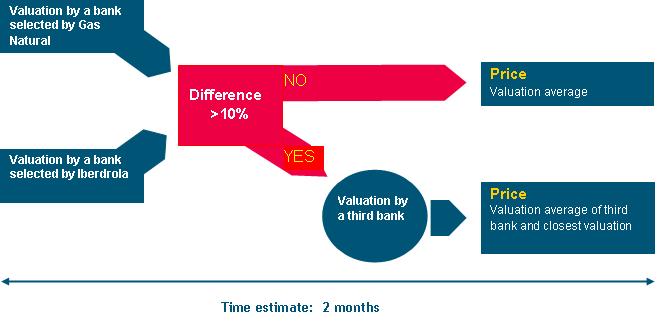

Gas Natural and Iberdrola have signed a contract on the transfer of certain assets of the new group.

Provisionally and with no binding effects, Gas Natural and Iberdrola announced the transaction and set the income from divestment at between 7,000 and 9,000 million euros.

The contract is subject to Gas Natural’s taking effective control of Endesa and must be approved by the relevant competent authorities.

This contract fits within the framework of divestment of electricity and gas assets which Gas Natural presented before the Spanish authorities and will allow the two companies to attain a more balanced structure in the gas and electricity sectors.

13

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The contract will favor both companies’ competitiveness in the international markets, which tend toward convergence and globalization of the gas and electricity markets, as shown by some transactions under way in Europe.

The assets included in the contract include electricity generation installations in Spain and Europe and certain areas of gas distribution, which include 1.25 million customers in the parts of Spain where Iberdrola operates.

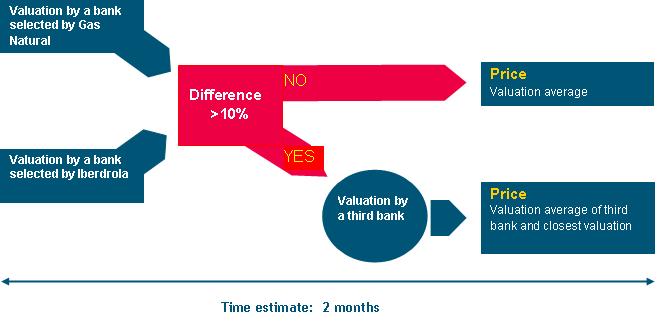

The transaction will take place at market prices, which will be determined by different investment banks of acknowledged prestige.

Conditions Imposed by the Council of Ministers

After analyzing the twenty conditions imposed by the Council of Ministers on February 3, 2006, the Board of Directors of Gas Natural resolved to go forward with the transaction because the fulfillment of said conditions is compatible with the strategic, industrial, and financial goals of the transaction:

| | • | | To take advantage of the convergence of gas and electricity. |

| | • | | To have available a flexible, competitive gas supply. |

| | • | | To have a diversified generation portfolio. |

| | • | | To manage gas and electricity customers integrally. |

| | • | | To have an attractive investment profile and mix of business activities. |

| | • | | To take advantage of the potential synergies. |

14

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

On March 2, 2006, Gas Natural submitted a detailed divestment plan, in line with the conditions imposed by the Council of Ministers, which must be approved by the Defense of Competition Service.

The sale of assets and businesses contemplated by the resolution of the Council of Ministers allows the sale of assets at market value, and the package sold will include all the assets and means necessary for it to operate independently.

The Council of Ministers made no pronouncement on the contract with Iberdrola, which must eventually be reviewed by the Spanish National Energy Commission.

15

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

2 Announcement of Tender Offer by Gas Natural SDG, S.A. for Endesa, S.A.

On February 27, 2006, the Spanish Securities and Exchange Commission (Comisión Nacional del Mercado de Valores or “CNMV”) authorized the launch of a Tender Offer for the shares of Endesa, S.A. by Gas Natural SDG, S.A. (the “Offer” or the “Spanish Offer”), which will be governed by the provisions of Law 24/1988, of July 28, on the Stock Market, of Royal Decree 1197/1991, of July 26, on the legal system for Tender Offers, of Royal Decree 1310/2005, of November 4, which partially implements Law 24/1988, on the Stock Market, on the admission of securities to trading on official secondary markets, on Tender Offers for purchase or subscription, and of other applicable regulations, with the following essential conditions:

16

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The Offer is made by Gas Natural SDG, S.A. (“Gas Natural”) and addressed to all the holders of common shares of Endesa, S.A. (“Endesa”) under the terms and conditions provided in the Spanish Folleto of the Offer (the “Folleto”) and the documentation attached to the same.

In parallel to the Offer, Gas Natural will make an offer in the United States of America (the “U.S. Offer”) addressed exclusively to the holders of American Depositary Shares (“ADS”) of Endesa and U.S. holders of common shares of Endesa, though the latter may opt to take either the Spanish Offer or the U.S. Offer. The main features of the U.S. Offer and its differences with the Offer are described in Section 5 of the Introductory Chapter of the Folleto.

Those who hold Endesa shares through the Foreign Securities Registry of the Santiago (Chile) Stock Exchange who wish to accept the Offer shall be subject to the procedures and formalities provided in the Folleto.

| 1.2 | Applicable Legislation and Competent Authority |

The Offer is made in Spain pursuant to the provisions of Law 24/1998, of July 28, on the Stock Market, and of Royal Decree 1197/1991, of July 26, on the System of Tender Offers, and other applicable legal regulations. The only authority competent to examine the Folleto and authorize the Offer is the CNMV. The terms and conditions of the Offer are those established in the Folleto and the documentation attached to the same.

The U.S. Offer is subject to the United States Securities Act of 1933 (the “Securities Act”), the United States Securities and Exchange Act of 1934 (the “Securities Exchange Act”), the Rules promulgated under said laws, and other applicable regulations. The only authority competent to examine and register the U.S. Prospectus for the U.S. Offer (“U.S. Prospectus”) is the Securities and Exchange Commission (“SEC”).

The Offer is not subject to authorization by the Securities and Exchange Inspection Office of Chile (“SVS”) or the Santiago (Chile) Stock Exchange.

| 1.3 | Availability of the Folleto |

The Folleto and the supplementary documentation attached thereto are available to Endesa’s shareholders from the first day following the publication of the first of the announcements mentioned in Article 18 of Royal Decree 1197/1991 in the following locations:

the domiciles of Gas Natural (Avenida Portal de l’Àngel, 20 y 22, Barcelona) and of Endesa (Calle Ribera del Loira, 60, Madrid);

17

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

the domiciles of the Stock Exchange Councils of Madrid (Plaza de la Lealtad, 1, Madrid), Barcelona (Paseo de Gracia, 19, Barcelona), Bilbao (Calle José María Alabarri, 1, Bilbao), and Valencia (Calle Libreros, 2-4, Valencia);

the domicile of La Caixa as the Spanish Exchange Agent and Fractional Share Agent for the Offer (Av. Diagonal, 6521-629, 08028 Barcelona); and

the domiciles of the New York Stock Exchange (11 Wall Street, New York, USA), the Stock Exchange of Santiago, Chile (La Bolsa 64, Santiago, Chile), the Electronic Stock Exchange (Huérfanos, 770, Santiago, Chile), and the Stock Exchange of Valparaíso (Prat 798, Valparaíso, Chile).

Likewise, the Folleto and the supplementary documentation may be consulted in the public registries of the CNMV (in Madrid, at Paseo de la Castellana, 15, and in Barcelona, at Paseo de Gracia, 19). The Prospectus and announcement model may be consulted on the web pages of the CNMV (www.cnmv.es), Gas Natural (www.gasnatural.com), Endesa (www.endesa.es), and the SVS (www.svs.cl).

In Chile, by the same deadline mentioned above, Endesa’s shareholders may obtain a copy of the Folleto and the supplementary documentation through the Securities Inspection Office of Chile (Av. Libertador Bernardo O’Higgins 1449, Santiago, Chile).

Finally, the recipients of the Offer may request copies of the Folleto in writing or by phone through the Offer’s information agent designated by Gas Natural for said purpose: GSProxibérica, S.L.U. (a member of the Georgeson Shareholder Group, Calle Antonio Maura, 18, 28014 Madrid; toll-free: 900 800 905 and foreign institutional investors +39 0642171777), web site: (www.gsproxiberica.com).

The recipients of the U.S. Offer (that is, holders of Endesa ADSs, regardless of the holders’ nationality or place of residence, and United States holders of Endesa common shares) which accept the same will receive in consideration 569 common shares or ADS newly issued by Gas Natural and the equivalent in United States dollars of 7,340 euros (minus expenses) for each 1,000 Endesa shares or each 1,000 Endesa ADS. In practice this is equivalent to 0.569 common shares or ADS newly issued by Gas Natural and the equivalent in United States dollars of 7.34 euros (minus expenses) for each Endesa share or ADS.

18

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The Board of Directors of Gas Natural will propose that the General Shareholders Meeting resolve on the capital increase necessary to meet the consideration for the Offer and request that Gas Natural shares be admitted for trading, through ADS, on the New York Stock Exchange with the equivalence of one (1) ADS of Gas Natural for one (1) share of Gas Natural.

The terms of the U.S. Offer are substantially the same as those of the present Offer, and the effectiveness of the two is subject to the same conditions, though the U.S. Offer is further subject to the Spanish Offer’s becoming effective and to its settlement. In contrast, the Spanish Offer is in no way dependent on the U.S. Offer’s becoming effective and on its settlement.

To make the U.S. Offer, Gas Natural shall file an F-4 Form (Registration Statement on Form F-4) with the SEC. Said filing will include the U.S. Prospectus for the U.S. Offer and GN will file a statement on Schedule TO. Together with the above filings, Gas Natural will file Forms F-6 and 8A, which describe the characteristics of the securities issued.

According to the information available to the public, Gas Natural has estimated that the U.S. Offer may be partially exempt under Rule 14-1(d) of the Exchange Act (Tier II relief).

Regarding the above, Gas Natural has applied for certain exemptions from the SEC in order to carry out the U.S. Offer separately. These exemptions are described in Section 5 of the Introductory Chapter of the Folleto.

| 2. | Identification of Endesa |

The target company of the tender offer is Endesa, a Spanish joint stock corporation with corporate domicile in the city of Madrid, at Calle Ribera del Loira, 60. It holds Tax Identification Code (C.I.F.) number A-28023430.

The corporate capital of Endesa is one thousand two hundred seventy million five hundred two thousand five hundred forty euros and forty cents (1,270,502,540.40 €), represented by 1,058,752,117 shares with a face value of one euro and twenty cents (1.20 €) each, all belonging to the same class and series.

All the common shares of Endesa have been admitted to trading on the Madrid, Barcelona, Bilbao, and Valencia Stock Exchanges and integrated in the Integrated Electronic Stock Exchange System (Sistema de Interconexión Bursatil Español (Mercado Continuo). Likewise, the Endesa shares have been admitted to trading on the New York Stock Exchange (“NYSE”) as ADS, with an equivalence of one to one and on the Offshore Stock Market (Registry of Foreign Securities) of Santiago de Chile.

19

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| 3. | Identification of Gas Natural and Its Group |

The Offer has been made by Gas Natural, which is a Spanish joint stock corporation with corporate domicile in the city of Barcelona at Avenida Portal de l’Àngel, 20 y 22. It holds Tax Identification Code (C.I.F.) number A-08015497.

Gas Natural’s corporate capital is four hundred forty-seven million seven hundred seventy-six thousand twenty-eight euros (447,776,028 €), represented by 447,776,028 shares with a face value of one euro (1 €) each, all of the same class and series. Gas Natural holds all the shares admitted for trading on the Stock Exchanges of Madrid, Barcelona, Bilbao, and Valencia and forming part of the SIBE. Gas Natural’s shares also form part of the Ibex 35 index, in particular Ibex Utilities.

| 3.2 | Companies Belonging to the Gas Natural Group |

Gas Natural is the parent company of a group of companies as defined in Article 4 of Securities Law 24/1988, of July 28, and in Article 42 of the Spanish Commercial Code. Moreover, Gas Natural does not belong to any group as defined in said articles, and no individual or legal entity, alone or in conjunction with others, exercises or may exercise control over Gas Natural as defined in said articles. The references to the term “Group” in this Offer document shall be understood as referring to the definition as provided in said articles.

As of the date of the Folleto, the main shareholders of Gas Natural mentioned in the Folleto are the following:

| | | | | |

Gas Natural Shareholders Prior to the Offer | | | | | |

| | |

Gas Natural | | Stake | | | Shares (M) |

La Caixa | | 33.06 | % | | 148.0 |

Repsol YPF | | 30.85 | % | | 138.1 |

Caixa Catalunya | | 3.03 | % | | 13.6 |

Suez | | 5.00 | % | | 22.4 |

Chase Nominees | | 5.04 | % | | 22.6 |

Minority Shareholders | | 23.02 | % | | 103.1 |

| | | | | |

Total | | 100.00 | % | | 447.8 |

| | | | | |

Board of Directors of Gas Natural. Agreement between La Caixa and Repsol YPF.

As of the date of the Folleto, the make-up of the Board of Directors and the Executive Commission of Gas Natural is as follows:

20

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| | | | | | |

Name | | Board Position | | Executive Commission Position | | Nature of Position |

Gabarró Serra, Salvador | | Chairman | | Chairman | | Executive1 |

Brufau Niubó, Antonio | | Vice Chairman | | Member | | By Ownership2 |

Villaseca Marco, Rafael | | Managing Director (Consejero Delegado) | | Member | | Executive2 |

Alcántara-García Irazoqui, Enrique | | Member | | — | | By Ownership1 |

Arcas Romeu, José | | Member | | — | | Independent |

| Caixa d’Estalvis de Catalunya | | | | — | | |

Represented by José María Loza Xuriach | | Member | | — | | |

Cobo Cobo, Santiago | | Member | | Member | | By Ownership |

Fernández-Cuesta Luca de Tena, Nemesio | | Member | | — | | By Ownership2 |

Jové Vintró, José Luis | | Member | | Member | | By Ownership1 |

Kinder Espinosa, Carlos | | Member | | Member | | By Ownership1 |

López Achurra, Emiliano | | Member | | — | | Independent |

Losada Marrodán, Carlos | | Member | | Member | | Independent |

Ramírez Mazarredo, Fernando | | Member | | — | | By Ownership2 |

Solana Gómez, Guzmán | | Member | | Member | | Executive2,3 |

Valls Maseda, Miguel | | Member | | — | | Independent |

Vega de Seoane Azpilicueta, Jaime | | Member | | — | | Independent |

Vilarasau i Salat, Josep | | Member | | — | | By Ownership1 |

Cañellas Vilalta, Felipe | | Vice Secretary non-member | | Vice Secretary | | — |

Repsol YPF, S.A. (“Repsol YPF”) and La Caixa entered into a shareholders agreement for Gas Natural on January 11, 2000. Said agreement was amended on May 16, 2002. On December 16, 2002, and July 20, 2003, Repsol YPF and La Caixa signed two addenda to the amended agreement of January 11, 2000, by virtue of which they agreed, among other things, that each company would at all times maintain the principles of transparency, independence, and professionalism in the management of Gas Natural by maintaining joint control over said company through their stable presence among the shareholders. Likewise, they agreed to divide the positions on Gas Natural’s Board of Directors (five Board Members named at the behest of Repsol YPF, five at the behest of La Caixa, one at the behest of Caixa de Catalunya, and six independent Board Members chosen jointly by La Caixa and Repsol YPF) and Executive Commission (three members chosen from among Repsol YPF’s Board Members, including the Managing Director (Consejero Delegado), three from among La Caixa’s Board Members, including the Chairman, and two from among the independent Board Members), as well as their consensus as to the Strategic Plan for Gas Natural prior to its submission to the Board of Directors.

Unless otherwise agreed between the parties, this agreement shall automatically end if La Caixa’s or Repsol YPF’s stake in Gas Natural falls below 15%.

| 1 | Designated at the request of LA CAIXA. |

| 2 | Designated at the request of REPSOL YPF. |

| 3 | Designated at the request of REPSOL YPF. However, he appears as an executive in accordance with CNMV’s Circular 1/2004, since he has an ordinary employment relationship with Gas Natural as Consultant to Top Management. |

21

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Gas Natural has been informed that La Caixa intends to maintain its agreement with Repsol YPF, to the extent possible, with regard to the initial legal situations. This shall be without prejudice to possible new circumstances, such as: (i) the dilution of Repsol YPF and La Caixa, which will vary in accordance with the degree of acceptance of the Offer, (ii) the possible incorporation in the project of other shareholders of reference, and (iii) Gas Natural’s submission, if the Offer succeeds, to supervision by new regulators, such as that of the United States capital markets.

Thus, there is no specific plan that would allow La Caixa to specify whether or not it will maintain the governance of Gas Natural and the industrial line to be followed by the same once the Offer has ended on the same terms as those stipulated in the agreement signed with Repsol YPF.

La Caixa has also informed Gas Natural that its possible submission to the supervision of new regulators (such as the SEC) could have effects on the shareholders and industrial agreement signed between La Caixa and Repsol YPF with respect to Gas Natural. While unspecified at the date of the present Folleto, these effects could consist of terminating the agreement or amending it as required by the regulatory authorities and/or stock exchange.

In any event, La Caixa has expressed to Gas Natural that it wishes to maintain the shareholders and industrial agreement with Repsol YPF, with the adaptations which may be necessary in regard to that indicated in the preceding paragraphs.

As for Repsol YPF, this company has expressed to Gas Natural that it wishes to maintain the shareholders and industrial agreement with La Caixa with respect to Gas Natural and maintain joint control with La Caixa of the new group for regulatory and competitive purposes, with the amendments and adaptations which may be necessary.

According to Repsol YPF this company has not yet adopted any decision on the possible amendments or adaptations to said agreement which may be required as a consequence of the Offer’s acceptance. Such a decision will be affected by the diverse circumstances to be taken into account, such as the degree of acceptance of the Offer, the assessment of Gas Natural’s corporate bodies, and other circumstances impossible to foresee at present. In any event, if, due to the circumstances referred to above, it is necessary to amend the agreement signed with La Caixa, the corresponding adaptation of the structure and make-up of Gas Natural’s Board of Directors and Executive Commission will be proposed.

Gas Natural considers that the future make-up of its decision-making bodies will be determined, logically, by the structure of the shareholders resulting from the Offer. The decision on such points belongs to the General Shareholders Meeting. If there is no significant acceptance of the Offer, it cannot be ruled out that the governance of Gas Natural may remain as it has to date, with the

22

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

majority of the Board Members designated at the behest of its two main shareholders, La Caixa and Repsol YPF, in equal proportions, in virtue of the shareholders agreement for Gas Natural.

In this respect, La Caixa and Repsol YPF, as the main shareholders of Gas Natural, have stated that even if the Offer is massively accepted and the resulting capital increase would cause stakes held by either or both to fall below 15% – which would, in theory, mean the automatic end of the shareholders agreement – they intend to maintain the agreement, with the adaptations necessary for the circumstances resulting from the Offer. Thus, since the stakes of both together could reach approximately 28% if acceptance of the Offer is 100%, a substantial variation in the structure and make-up of the Board of Directors would be possible, admitting Board Members representing new shareholders or increasing the number of independent shareholders. In this latter event, La Caixa and Repsol YPF together would lose the majority on the Board of Directors.

Gas Natural Shareholder Composition after the Offer

If the Offer has a positive result, and Gas Natural’s shareholders maintain their current stakes in the company, their stake in the capital of Gas Natural and the stake of Endesa’s current shareholders for 100% acceptance of the Offer would be as follows:

| | | | | |

| Gas Natural’s Shareholders after the Offer | | | | | |

| | |

| 100% Acceptance | | | | | |

| | |

Gas Natural | | % Stake | | | Shares (M) |

La Caixa | | 14.66 | % | | 154.0 |

Repsol YPF | | 13.15 | % | | 138.1 |

Caixa Catalunya | | 1.29 | % | | 13.6 |

Suez | | 2.13 | % | | 22.4 |

Caja Madrid | | 5.16 | % | | 54.2 |

AXA | | 3.07 | % | | 32.2 |

State Street Bank and Trust | | 2.89 | % | | 20.4 |

Chase Nominees | | 5.44 | % | | 57.1 |

Gas Natural Minority Shareholders | | 9.82 | % | | 103.1 |

Endesa Minority Shareholders | | 42.39 | % | | 445.1 |

| | | | | |

Total | | 100 | % | | 1,050.2 |

Gas Natural Shares Prior to the Offer | | | | | 447.8 |

New Shares | | | | | 602.4 |

| | | | | |

Gas Natural Shares after the Offer | | | | | 1,050.2 |

Section 1.3 of Chapter I of the Folleto also shows the possible situation of Gas Natural’s shareholders after the Offer in the event of 75% acceptance.

23

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| 4. | Securities Included in the Offer |

| 4.1 | Securities Included in the Offer |

The Offer includes 100% of Endesa’s shares. There are no Endesa securities other than the shares included in the Offer which, pursuant to the applicable regulations, must be covered by the Offer.

The terms of the Offer are identical for all the Endesa shares included in the same. The consideration for said shares is that indicated in Section 5 below.

All shares included in the Offer must be handed over with all their inherent economic and political rights and must be transferred free of liens, encumbrances, and third-party rights which limit the economic or political rights of said shares or their transferability. They must be transferred by persons with legitimate power to do so in accordance with the accounting registry, so that Gas Natural acquires ownership of the Endesa shares with no possible claims on the same, in accordance with Article 9 of Law 24/1988, of July 28, on the Stock Market.

| 4.2 | Maximum Number of Securities Included in the Offer |

The Offer is for 1,058,752,117 shares of Endesa, representing 100% of the company’s corporate capital.

| 4.3 | Minimum Number of Securities on the Acquisition of Which Depends the Offer |

The Offer shall not become effective unless at least 794,064,088 shares of Endesa, representing 75% of the corporate capital, are acquired.

| 4.4 | Gas Natural’s Commitments |

Pursuant to the provisions of Article 23 and concordant of Royal Decree 1197/1991, of July 26, neither Gas Natural nor the members of its Board of Directors, the companies controlled by Gas Natural, the members of the administrative bodies of said companies designated or proposed by Gas Natural, or any person acting as intermediary or in conjunction with any of the same may acquire Endesa shares, directly or indirectly, alone or on behalf of another acting in conjunction, until the result of the Offer is published.

Under Article 30.2 of Royal Decree 1197/1991, of July 26, if the result of the Offer is negative, neither Gas Natural nor the companies of its Group, the members of their administrative bodies, their top management personnel, or those who have promoted the Offer in their own name but for the account of Gas Natural or acting as intermediary for or in conjunction with Gas Natural may promote another Tender Offer for the same securities for six months from the time the result of the Offer is published, nor may they acquire said securities directly or indirectly in such amount as would warrant the presentation of such an offer.

24

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| 5. | Consideration Offered for the Securities |

The consideration for the present Offer is mixed, one part being cash and the other new-issue shares of Gas Natural (the “New Shares”). The same will be issued on the terms indicated below. Since the part consisting of shares is greater than the cash part, the Offer is an exchange. For each 1,000 Endesa shares, the consideration Offered to Endesa’s shareholders who accept the Offer is as follows:

| | (a) | 7,340 euros in cash; and |

| | (b) | 569 New Shares with a face value of one euro (1 €) each. |

Under the system for acquiring small blocks of shares mentioned in Section 5.4 below, in practice this means that the consideration for each share of Endesa is:

| | (a) | 7.34 euros in cash; and |

| | (b) | 0.569 New Shares with a face value of one euro (1 €) each for each share of Endesa. |

If the Offer is 100% accepted, the total consideration for the Offer would be 7,771,240,538.78 euros in cash and 602,429,955 New Shares.

The consideration Offered may not be adjusted as a consequence of the supplementary dividend which Gas Natural plans to issue in July 2006, as is its usual practice.

If, prior to the date on which the capital increase necessary to make the consideration of the Offer is registered, Endesa issues any dividend or makes any other distribution or share-out the amount or date of payment of which is not in keeping with the dividends policy of Endesa as announced in the Endesa Share Registration Document submitted to the registries of the CNMV and verified by the same on July 7, 2005, the cash part of the consideration will automatically be reduced by the gross amount of the dividend, distribution, or share-out paid prior to the announced date or in excess of the amount announced. Thus, Endesa declares the following in the above-mentioned Registration Document:

“Generally, the dividend on account will be paid, after approval by the Board of Directors, on the first business day of January of the following fiscal year.

The supplementary dividend will be paid after the shareholders, in the General Shareholders Meeting, have approved the Annual Accounts and the Management Report. Said General Shareholders

25

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Meeting will be held in the first half of the year following the fiscal year in question. Said dividend will normally be paid on the first business day of July.

Though the company expects to pay a dividend every year, under normal conditions the pay-out for the fiscal year will consist of 50%-60% of the result of the fiscal year. However, this policy will depend on the existence of consolidated profits and sufficient profit for the company, as well as on financial conditions and other factors.”

Apart from this, if the per-share amount of said dividend, distribution, or pay-out is greater than the cash part of the consideration, the new-issue share part of the consideration will be reduced by the amount in excess. In all this, the closing price of Gas Natural shares on September 2, 2005, that is, 24.53 euros per share, will be taken into consideration.

As a consequence of the adjustment mentioned in the preceding paragraphs, the consideration Offered may be reduced, but it may never be zero or negative.

The consideration Offered will not be adjusted as a consequence of the distribution of the supplementary dividend of 2.095 euros per share proposed by the Board of Directors of Endesa, provided that the capital increase necessary to make the consideration is registered prior to the date announced for the payment of said dividend.

In contrast, as indicated above, if the supplementary dividend proposed by the Board of Directors of Endesa is paid prior to the registration of the capital increase necessary to make the consideration for the Offer, the cash part of the consideration for the Offer will automatically be reduced as follows:

| | (a) | if the payment takes place prior to the announced date, that is, prior to July 3, 2006, the consideration for the Offer will be reduced by the total gross amount of the dividend issued by Endesa, that is, by 2.095 euros per share (so that the consideration will be 0.569 New Shares and 5.245 euros per share of Endesa); and |

| | (b) | if the payment takes place on or after the announced date, that is, July 3, 2006, the consideration for the Offer will not be reduced by the total gross amount of the dividend issued by Endesa if it follows the dividends policy announced in the above-mentioned Endesa Share Registration Document, that is, 0.738 euros per share, but will be reduced only by that part of the gross amount of said dividend which does not follow said dividends policy, that is, by 1.357 euros per share (corresponding to 1.267 euros per share from the sale of non-strategic shares and 0.09 euros per share above the maximum pay-out on the results of the ordinary course of business activities during the fiscal year). In such event, the consideration will be 0.569 New Shares and 5.983 euros for each share of Endesa. |

26

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

Gas Natural will immediately report the automatic adjustment of the Offer to the CNMV.

Any dividend Offered by Endesa to the registration date of the capital increase necessary to make the consideration for the Offer will be paid to those who are Endesa shareholders at the time, regardless of whether or not they accept the Offer. On the contrary, any dividend paid by Endesa on the shares which have accepted the Offer after the registration of said capital increase will be paid to Gas Natural.

If the Offer is accepted entirely by the Endesa shareholders to whom it is directed, Gas Natural will issue 602,429,955 New Shares, representing 135% of the current corporate capital of Gas Natural and 57% of the total corporate capital of Gas Natural after the capital increase involving the New Shares.

The New Shares will be issued with a face value of one euro (1 €) each, plus an issue premium to be established by the Board of Directors of Gas Natural (or, by delegation, by the company’s Executive Commission) when the capital increase resolution is executed, pursuant to the provisions of Article 159.1.c)in fine of the Corporations Act. The kind of issue (face value and issue premium) will be established within the following limits: (i) the minimum will be the net equity value of Gas Natural shares resulting from the report prepared by an accounts auditor other than the accounts auditor appointed by the Commercial Registry of Barcelona (that is, the face value plus the issue premium must in any event be higher than 12.055 euros per share) and (ii) the maximum will be 24.53 euros per share, representing the closing price for Gas Natural shares in the SIBE on the day before the date on which the company’s Board of Directors resolved to present the Offer for Endesa. Moreover, the issue value (face value plus issue premium) may not be more than 20% higher than the amount resulting from subtracting the value attributed to Endesa shares by the independent expert designated by the Commercial Registry of Barcelona from the per-share cash consideration.

The New Shares will have the same economic and political rights as Gas Natural’s common stock currently in circulation from the registration date of the capital increase. In particular, the New Shares will be entitled to all the dividends distributed by Gas Natural from the registration of the same in the Commercial Registry of Barcelona, regardless of when said dividends are agreed on or announced.

Gas Natural’s Board of Directors will submit the capital increase resolution for the New Shares necessary to make the consideration of the Offer to the Extraordinary General Shareholders Meeting of Gas Natural, which will be held

27

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

within one month of the date on which the Offer is published, pursuant to Article 97.1 of the Revised Text of the Corporations Act, and must be published by the deadline established in Article 187 of Royal Decree 1197/1991, of July 26, on Tender Offers, for the publication of the announcements of the Offer.

Without prejudice to the decision-making power of the General Shareholders Meeting regarding the capital increase necessary to make the consideration for the Offer, Gas Natural’s Board of Directors has agreed to create a program of Gas Natural ADS. Once the resolutions on the capital increase and the issue of new shares have been adopted by Gas Natural’s General Shareholders Meeting, the entity designated by Gas Natural as depositary of the ADS (Bank of New York) will issue the same and deliver them to those recipients of the U.S. Offer which have chosen this form of consideration in proportion to the number of shares included in the acceptance statements.

Gas Natural’s Board of Directors will propose a capital increase to the General Shareholders Meeting. This increase will be carried out by issuing 602,429,955 New Shares. It is expressly provided that the capital increase may be partially subscribed. The Board of Directors or, as appropriate, the Executive Commission of the company will decide whether said increase will be executed on one or two occasions (to the maximum amount agreed). This is in accordance with Article 153.1.a) of the Corporations Act, so that the Spanish Offer and the U.S. Offer may be carried out separately, as indicated in Section 9.7 hereinafter. Thus, the Board of Directors or, as appropriate, the Executive Commission will determine the definitive amount of the capital increase within the maximum established by the General Shareholders Meeting of Gas Natural depending on the acceptances received for the Spanish Offer and the U.S. Offer.

Attached as Annexes to the Folleto are the reports prepared by Audihispana, S.A. and the Sociedad Rectora de la Bolsa de Valores de Barcelona, S.A. in compliance with Articles 159 (excluding the right of first refusal) and 38 (capital increase by contributions in kind) of the Corporations Act.

Without prejudice to the decision-making powers of the General Shareholders Meeting, Gas Natural’s Board of Directors has expressly assumed the commitment to apply for admission of the New Shares to trading on the Madrid, Barcelona, Bilbao, and Valencia Stock Exchanges, as well as on the SIBE within three (3) months of the publication of the result of the Offer, as established in Article 10.4 of Royal Decree 1197/1991, of November 26, on Tender Offers. For said purpose, the admission of the New Shares to trading is one point on the agenda of the General Shareholders Meeting, which will decide on the issue of said shares.

Gas Natural intends for the New Shares to be admitted to trading on the SIBE within six (6) business days, barring unforeseen events, of the date they are

28

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

registered in the accounting ledger of Iberclear (that is, within 20 SIBE business days from the publication of the result of the Offer).

Regarding Gas Natural’s ADS Offered to holders of Endesa common stock in the United States and holders of Endesa ADS as part of the consideration, the Board of Directors of Gas Natural has resolved to propose to the General Shareholders Meeting that it approve the application for admission of the New Shares to trading through the ADS on the New York Stock Exchange. The New Shares are expected to be admitted to trading on the New York Stock Exchange through ADS within six (6) business days of the registration in the accounting ledger of Iberclear of the New Shares backing the ADS program.

| 5.4 | System of Acquisition of Fractional Shares |

It is hereby expressly recorded that Gas Natural will only accept the exchange of a number of Endesa shares equivalent to a whole number of Gas Natural shares in accordance with the exchange equation established in Section 5.1 above. All Endesa shares or share quotas greater than 1,000/569 or which do not reach said figure according to the acceptance statements submitted will be deemed “Fractional Shares.”

La Caixa, with domicile at Avenida Diagonal, 621-629, 08028 Barcelona, holder of Tax Identification Code (C.I.F.) number G-58.89999/8 (the “Fractional Share Agent”), acting in its own name and on its own behalf, will acquire and pay for Fractional Shares to Endesa shareholders which accept the Offer for a number of Endesa shares which is not a multiple of 1.75746924 (the number of shares which, according to the proposed exchange equation would give the right to 1 share of Gas Natural), according to the terms provided in the Folleto. The Fractional Share Agent will combine Endesa shares and share quotas thus acquired and will accept the Offer with them.

| 5.5 | Justification and Methods Used to Determine the Consideration |

In order to establish the price for the Gas Natural shares, Gas Natural has used the Gas Natural share trading price at closing on September 2, 2005, which was 24.53 euros per share. This was the last day of trading prior to the date on which the Board of Directors of Gas Natural adopted the resolutions relating to the present Offer.

To establish the consideration for the Endesa shares, Gas Natural has used the range of trading prices for Endesa shares over the last twelve months, the average target price for Endesa shares published by financial analysts in the last four months, the multipliers of the estimated EBITDA for comparable listed companies in the Spanish markets (Iberdrola, Unión Fenosa) and in the European markets (EDP, E.ON, Enel, RWE, Electrabel, Scottish Power, Scottish & Southern), the multipliers of earlier transactions in the energy sector in Europe, and the discount of estimated cash flows for Endesa.

29

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

The implicit value of Endesa pursuant to the Offer (21.30 euros per share) is included within the valuation range of this company that results from the aforementioned methodologies.

| 6. | Guarantees Given by Gas Natural to Pay for the Offer |

Pursuant to Article 11.1 of Royal Decree 1197/1991, of July 26, in order to guarantee the payment of the cash part of the consideration for the Endesa shares to the shareholders which accept the Offer and the payment for the Fractional Shares, Gas Natural has submitted two joint, irrevocable bank guarantees for a total of 7,805,972,314 euros to the CNMV: one for 3,902,986,157 euros issued by La Caixa and the other for 3,902,986,157 euros issued by Société Générale, Sucursal en España. The bank guarantee issued by Société Générale, Sucursal en España, beyond the cash part of the consideration Offered by Gas Natural for all the securities covered by the Offer, guarantees the cash payment obligations assumed by the Fractional Share Agent to acquire the Fractional Shares in the Offer on the terms and conditions indicated in the Folleto.

Pursuant to Article 11.4 of Royal Decree 1197/1991, of July 26, no guarantee has been required for the part of the consideration to be paid in shares.

| 7. | Financing the Transaction |

The consideration for the Offer consists of one part to be paid in cash and one part in New Shares. Specifically, assuming 100% acceptance of the Offer and bearing in mind the possible amounts arising from the acquisition of Fractional Shares, the total consideration will consist of 602,429,955 New Shares and 7,805,972,314 euros in cash.

With the sole purpose of guaranteeing the availability of the funds necessary to make the maximum cash portion of the consideration (including the amounts arising from the system of acquiring Fractional Shares) on the date the Offer is paid, Gas Natural has signed a Credit Facilities Agreement under English law, by virtue of which it has obtained bank financing at market rates for a maximum of 7,805,972,314 euros (the “Financing”).

For the purpose of the Financing, “Gas Natural Group” is defined as Gas Natural and those of its subsidiaries over which Gas Natural exercises direct or indirect control or has a direct or indirect stake of more than 50% of the issued corporate capital with the right to vote (including Endesa and its subsidiaries, as appropriate, after the publication of the result of the Offer).

The financial entities which initially subscribed the terms of the Financing as the initial lenders and financial coordinators, including the initial Financing amounts for each, were the following:

30

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| | |

Entity | | Euros |

Caixa d’Estalvis i Pensions de Barcelona | | 2,185,672,247.92 |

Société Générale S.A. | | 2,810,150,033.04 |

UBS Limited | | 2,810,150,033.04 |

| | |

Total | | 7,805,972,033.04 |

On October 21, 2005, the Financing coordinating entities completed the initial syndication of their commitments as initial lenders of said Financing. As of the date of the Folleto, the syndicate of lenders is made up of 23 credit entities.

The Financing will expire two (2) years from September 5, 2005, the date on which the Financing agreement was signed. No timetable has been established for partial repayment of the same. The term may be extended for a single one-year period by Gas Natural.

Without prejudice to that above, bearing in mind the terms of the Financing (specifically the circumstances for obligatory advance repayment described below), the conditions imposed on the transaction by the Spanish National Energy Commission (which include the obligation to dispose of assets worth at least 8,200 million euros), those imposed by the Council of Ministers in resolution of February 3, 2006, and the timetable for divestment, the Financing is expected to be repaid (totally or partially) prior to its expiration, possibly extended for the additional one-year period mentioned above.

The contract signed with the financial entities requires the advance repayment of the Financing (whether total or partial, depending on the case) as follows:

| | (a) | disposal of certain assets or shares (excepting shares of Enagas, S.A.) in favor of entities not belonging to the Gas Natural Group when disposal occurs. Gas Natural’s advance repayment must be equivalent to the net result (minus associated costs and taxes) of the disposal, provided that the assets or shares disposed of meet the following criteria: |

| | (i) | they form part of the agreement signed with Iberdrola, S.A. (described in Section 10.1 below); |

| | (ii) | they are disposed of by virtue of the documents agreed or resulting from negotiations arising from the above-mentioned agreement signed with Iberdrola, S.A.; or |

| | (iii) | they are disposed of as a consequence of or in relation to the Offer under legal or regulatory provisions. |

In accordance with the above, regarding the sale of assets belonging to Endesa or companies in its group or to Gas Natural or companies in its group to companies not belonging to the Gas Natural Group, Gas Natural (the only entity obliged to repay the Financing totally or partially, as appropriate) must apply an amount equivalent to the net result obtained by the disposing entity to the advance repayment of the Financing.

31

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

| | (b) | other causes of obligatory advance repayment: |

| | (i) | any member of Gas Natural Group’s obtaining financing above certain thresholds (specifically, Gas Natural must apply an amount equivalent to the net result (minus the associated costs and taxes) of financing obtained above certain thresholds to the obligatory advance repayment on the Financing); |

| | (ii) | the Financing must be repaid in full if Gas Natural either (i) has not acquired 75% or more of the subscribed capital of Endesa with the right to vote or (ii) has not merged with Endesa; |

| | (iii) | the Financing becomes illegal for one or more of the lenders; and |

| | (iv) | control is taken of Gas Natural. |

If Gas Natural has not repaid the Financing in full prior to expiration of the term, it must repay the same on expiration, using the same sources as detailed in Section 7.2 below for obligatory advance repayment.

The Financing includes the usual circumstances of failure to pay in this type of financing. In said circumstances, the Financing agent may notify Gas Natural and declare all or part of the amounts owed under the Financing to have expired early and to be due and payable.

The Financing includes no specific type of guarantee from Gas Natural or real or personal guarantees from its group or from third parties. Nor has Gas Natural made the commitment or planned, under the Financing, to pledge Endesa shares it may acquire as a result of the Offer. The Financing requires no real or other guarantees from Endesa or the companies of its group as a result of the Offer.

Therefore, Gas Natural will be liable with all its goods, present and future, in compliance with its obligations under the Financing. The financing entities may take no action against the shareholders of Gas Natural, Endesa or Endesa’s shareholders (other than Gas Natural), and/or the companies in its group claiming for compliance with the obligations which Gas Natural assumed under the Financing.

The Financing agreement contains other terms and conditions relevant to the Offer, among which are: (i) Gas Natural Group’s obligation not to take on new financial debt above certain thresholds; (ii) the obligation to respect certain limitations, usual in this type of financing, regarding the creation or maintenance of encumbrances or guarantees on the assets involved in the economic activity

32

This is a free translation of a Spanish language document which has been provided for purposes of convenience. In case of discrepancies, the Spanish version shall prevail. Gas Natural shall not be responsible for any deviations between the translation and the Spanish language document.

(except for those established in the normal course of business and other exceptions to the general rule established in the Financing agreement), as well as certain disposals of assets or shares; and (iii) the prohibition against new acquisitions (with certain exceptions, including acquisitions made in the normal course of business, the acquisition of Endesa shares, and acquisitions among companies belonging to the Gas Natural Group) or investments in assets or companies by any member of the Gas Natural Group, provided that the total value of the same is more than 1,000,000,000 euros.

In keeping with the terms of the Financing, Gas Natural may only waive compliance with the condition of the minimum level of acceptances described in Section 8.1 below and the amendment of Article 32 of Endesa’s By-Laws, provided that, despite said waiver:

| | (a) | it acquires the following as a result of the Offer: |

| | (i) | 75% of the subscribed capital of Endesa with the right to vote; or |

| | (ii) | more than 50% of the subscribed capital of Endesa with the right to vote, provided that the condition described in Section 8.1 below (consisting of Endesa’s General Shareholders Meeting’s adopting the resolution to amend Article 32 of its By-Laws so as to eliminate all limitations or restrictions on the number of votes Endesa shareholders may exercise) has been met; or |

| | (b) | Gas Natural has shown to the satisfaction of the financial entities coordinating the Financing that, without prejudice to the waiver, there is a reasonable probability that Gas Natural will acquire “effective control” over Endesa within one (1) month of the date the Offer is paid. |

As provided in the Financing, “effective control” for the above purposes is understood as the capacity to exercise sufficient voting power to bring about the merger between Gas Natural and Endesa and to name or remove the majority of the Board Members.

If the result of the Offer is less than 75% and the minimum condition of acceptances as explained above has been waived, Gas Natural must pay off the Financing in full if, within fifteen (15) days of the pay-off date of the Offer, Gas Natural either (i) has not acquired 75% or more of the subscribed capital of Endesa with the right to vote or (ii) has not merged with Endesa.