Filed by Gas Natural SDG, S.A. pursuant to

Rule 425 of the Securities Act of 1933

Subject Company: Endesa, S.A.

Commission File No.: 005-80961

In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800.

This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004.

These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things:

| | • | | synergies and cost savings; |

| | • | | integration of the businesses; |

| | • | | expected gas and electricity mix and volume increases; |

| | • | | planned asset disposals and capital expenditures; |

| | • | | net debt levels and EBITDA and earnings per share growth; |

| | • | | timing and benefits of the offer and the combined company. |

These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition.

Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions.

These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information.

This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited.

* * *

The following is a presentation by Gas Natural SDG, S.A. relating to its First Quarter 2006 results. Please note that the following is a translation of a Spanish presentation; in case of discrepancies, the Spanish version will prevail.

9 May 2006 First Quarter 2006 Results (1Q 06) * * * * * |

1 In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800. This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things: • management strategies; • synergies and cost savings; • integration of the businesses; • market position; • expected gas and electricity mix and volume increases; • planned asset disposals and capital expenditures; • net debt levels and EBITDA and earnings per share growth; • dividend policy; and • timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding- looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. Disclaimer and Important Legal Information |

2 GAS NATURAL – 1Q 06 Results Agenda 1. Highlights 2. Analysis of 1Q 06 Results 3. Conclusions 4. Update on offer for Endesa |

4 Spanish electricity business contribution has more than tripled as a result of capacity additions and supply portfolio management (+221% EBITDA) Positive trends shown in 2005 are already materializing in 2006, boosting growth and profitability Delivering on the outlook provided for 2006 EBITDA grows by 29% to €508 million New conditions in the gas supply business and improved gas customer portfolio are already having a positive impact (+86% EBITDA) Distribution business continues to deliver solid growth and profitability (+13% EBITDA) Progress in the upstream business, through the preliminary agreement for the development of a new 10 bcm integrated LNG project in Nigeria and the acquisition of Petroleum Oil & Gas España S.A. |

5 1Q 06 Net Sales EBITDA Operating Income Net Income Average no. of Shares (million) EBITDA per Share (€) Net Income per Share (€) Investments: Tangible & Intangible Financial & Other Net Debt (as of 31/03) 3,107.1 507.9 358.2 276.7 447.8 1.13 0.62 290.4 240.4 50.0 3,397.2 1Q 05 51.9 29.3 29.6 16.3 - 29.3 16.3 12.5 -6.1 - 29.7 Change (%) 1Q 06 results snapshot Strong financial performance, in line with 2004-2008 Strategic Plan (€ million) 2,045.4 392.9 276.4 238.0 447.8 0.88 0.53 258.1 255.9 2.2 2,620.2 |

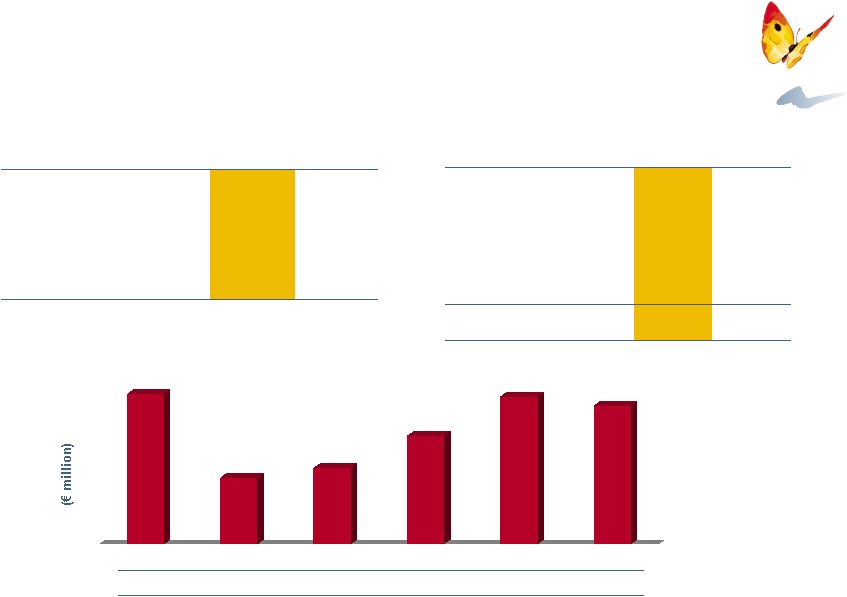

6 3,677 1,627 1,869 2,650 3,615 3,397 2001 2002 2003 2004 2005 1Q 06 Leverage 49.0% 28.0% 29.3% 35.6% 38.5% 36.3% 31/03/06 31/03/05 Leverage 2 36.3% 34.0% EBITDA/Net Interest 7.5x 8.2x Net Debt/EBITDA 2.1x 1.9x Financial ratios Net Debt and Leverage Debt facilities as of March 31, 2006 3 Commercial Banks Institutional Banks Capital Markets Cash Placements Total 2,204 637 855 - 3,696 1,501 - 2,175 299 3,975 Drawn Undrawn Notes: 1 2004, 2005 and 2006 figures under IFRS 2 Defined as Net Debt / (Net Debt + Total Equity) 3 Does not include any financing in relation to the offer for Endesa 1Q 06 results snapshot Solid capital structure¹ (€ million) |

Analysis of 1Q 06 Results |

8 (€ million) 1Q 05 Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total EBITDA 292.3 210.7 64.8 16.8 34.9 22.1 12.8 57.4 43.9 13.5 8.3 392.9 1Q 06 330.9 217.6 92.5 20.8 89.1 71.0 18.1 79.7 54.6 25.1 8.2 507.9 Double-digit EBITDA growth in line with 2004–2008 Strategic Plan EBITDA breakdown (%) 38.6 6.9 27.7 4.0 54.2 48.9 5.3 22.3 10.7 11.6 (0.1) 115.0 13.2 3.3 42.7 23.8 155.3 221.3 41.4 38.9 24.4 85.9 (1.2) 29.3 (€m) Change |

9 By Activity 1Q 05 electricity capex included the construction of recently completed Cartagena plant Investments (Tangible & Intangible) (€ million) 1Q 06 1Q 05 Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total 96.5 57.0 24.6 14.9 104.5 100.4 4.1 30.0 28.2 1.8 9.4 240.4 79.9 46.7 24.4 8.8 163.0 160.7 2.3 6.5 4.8 1.7 6.5 255.9 76% of investments in Euro Investments breakdown 43% Gas Supply 13% Other 4% 40% Distribution Electricity |

10 Distribution in Spain Operating figures 5.2 million gas customer connections in Spain as of 31 March 2006 (+6.6%) Strong distribution network growth of 6.5% during the first quarter, exceeding 40,000 Km Tariff sales decrease more than offset by growth in TPA sales caused by increased liberalisation, resulting in total distribution sales growth of 4.6% Growing Spanish distribution EBITDA: +3% vs. 1Q 05 and +12% vs. 4Q 05 (8.4%) +9.3% 1Q 06 results analysis by activity EBITDA (€ million) +6.6% 4,875 5,196 Connections (thousands) +3.3% 74,372 77,762 19,940 54,432 18,266 59,496 1Q 05 1Q 06 Tariff Sales (GWh) TPA Sales (GWh) +4.6% 210.7 217.6 1Q 05 1Q 06 |

11 Mexico €24.6m (+22.4%) 4,563 4,801 1Q 05 1Q 06 Connections (thousands) Significant EBITDA growth to €92.5 million (+43%) in all LatAm countries, especially in Argentina and Brazil Excluding FX impact, EBITDA grows by 23% Tariff increase in Argentina already signed Distribution network (km) 1Q 06 results analysis by activity Operating figures Distribution in LatAm 1Q 06 EBITDA contribution and growth by country (Total €92.5 million) Gas activity sales (GWh) Argentina €5.7m (+67.6%) Colombia €24.0m (+31.9%) Brazil €38.2m (+65.4%) +5.2% +4.4% +9.2% 39,580 43,224 54,601 56,977 |

12 1Q 06 results analysis by activity Organic growth supported by our know- how EBITDA increased by 24% EBITDA (€ million) +23.8% 291,000 connections (+13%) and 3,820 km of distribution network (+7%) Strong gas sales in the regulated market (+10%) and TPA (+27%) 257 291 1Q 05 1Q 06 Connections (thousands) Distribution network (km) Operating figures Gas activity sales (GWh) +13.1% +7.2% +10.2% 1,327 1,463 3,563 3,820 Distribution in Italy 16.8 20.8 1Q 05 1Q 06 |

13 1Q 06 results analysis by activity Electricity Electricity production (GWh) Very significant electricity EBITDA growth of €54 million (+155%), with Spanish electricity contribution more than trebling Electricity EBITDA (€ million) +221.3% +41.4% 22.1 12.8 34.9 71.0 18.1 89.1 1Q 05 1Q 06 Spain Puerto Rico ~9 CO2 emission rights (0.9%) 39 185 26 46 +130.0% 2,129 332 1,725 329 3,968 1Q 05 1Q 06 Wind Cogeneration CCGT (Puerto Rico) CCGT (Spain) 4,521 Installed capacity in Spain of 3,118MW (+86%), in line with 2004 – 2008 Strategic Plan New Cartagena CCGT and Dersa acquisition have resulted in 7% market share in Spanish generation and 298% coverage of supply¹ EBITDA has more than doubled as a result of the high price environment during part of the period, significant increase in output 130% and supply portfolio optimisation Provision for CO2 emission rights of €9 million due to new regulation Note: 1 Defined as total electricity generated by CCGT plants divided by total electricity commercialised +112.4% +155.3% |

14 Electricity industrial portfolio (TWh/y) Increase in hydro and wind power generation has resulted in a reduction of pool prices during the second half of the quarter Continued optimisation of electricity industrial supply portfolio to increase electricity business contribution to profitability Spanish electricity prices 01/01/06 31/01/06 28/02/06 31/03/06 Pool price (weekly average) 1Q 06 results analysis by activity Adapting the electricity portfolio to new market conditions 35 45 55 65 75 85 4.7 4.4 3.9 1.7 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 1.1 Measures adopted have increased contribution to total EBITDA |

15 New sector legislation passed in February 2006 Sales by vertically integrated generators to regulated market capped at €42.35/MWh CO 2 emission rights received for free discounted from tariff deficit calculated for each operator from 1/1/06 to 3/3/06 (incumbents only) and from pool prices from 3/3/06 for everyone Measures adopted have had limited impact on GAS NATURAL in 1Q 06 Discount of cost of CO 2 emission rights had €9 million impact on EBITDA No impact from price cap of €42.35/MWh on sales to regulated market 1Q 06 results analysis by activity Spanish electricity regulatory update |

16 1Q 06 results analysis by activity Up + Midstream Greater contribution of EMPL and maritime transport to EBITDA New LNG tanker time-charter signed will start operations in 2009 Gassi Touil project undergoing seismic campaign in 2006 GAS NATURAL – Repsol YPF midstream JV signed a MoU with the Nigerian government to develop a 10 bcm integrated LNG project EBITDA of €55 million (+24%) Petroleum Oil & Gas España S.A. Improves GAS NATURAL know-how in the E&P business Unique opportunity to acquire sole gas reserves in Spain May allow to increase gas storage capacity in Spain in the future Up + Midstream |

17 Gas industrial portfolio (TWh/y) GAS NATURAL average tariff discounts (wholesale) (%) Discount levels continue to be adjusted as industrial contracts are renewed Contract renewals and new contracts taking into account current market conditions 95.5 2.7 Measures adopted have increased contribution to total EBITDA 1Q 06 results analysis by activity Adapting the gas portfolio to new market conditions 10.8 10.7 9.7 8.9 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 94.3 107.7 103.7 100.3 1Q 05 2Q 05 3Q 05 4Q 05 1Q 06 |

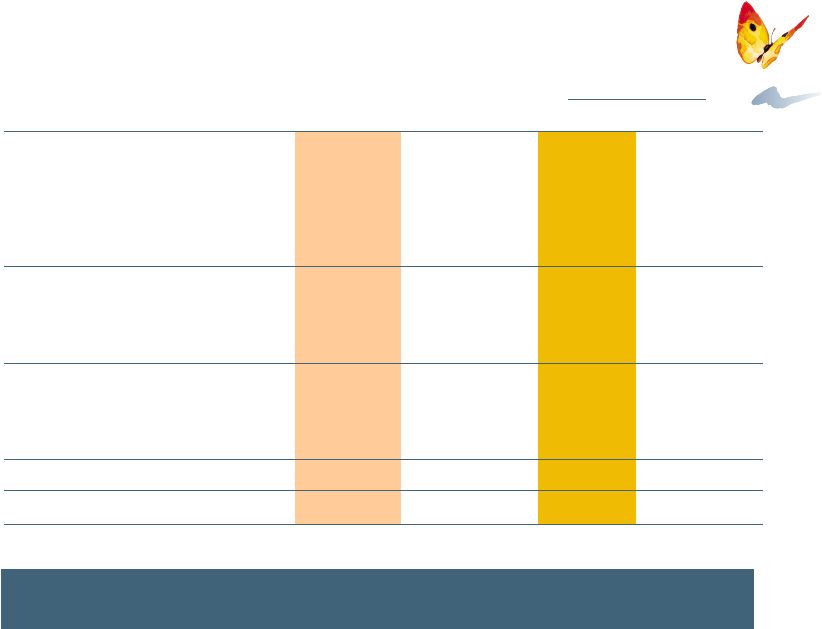

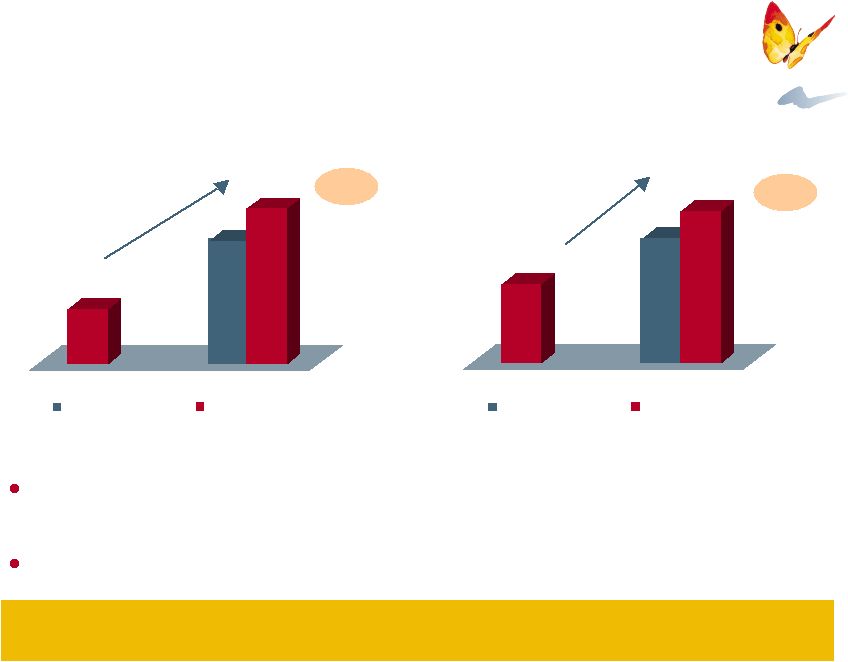

18 Security of power and gas supply is a strategic priority for the energy policy of Spain 1Q 06 results analysis by activity Review of the Plan for Electricity and Gas Sectors for 2002-2011 In order to guarantee the security of power supply and the reliability of the system, the updated 2005-2011 Plan for Electricity and Gas Sectors has increased the reliance on CCGT generation over the coming years The security of gas supply is becoming an even greater priority to guarantee the reliability of the power system and to meet the growing gas demand in Spain Installed CCGT capacity in Spain (GW) 10.4 23.2 29.6 2005 +184% +28% New Plan: 2011E Source: Enagás (April 2006) Government Plan as of 2002 Revised Government Plan Peak gas demand in Spain (GWh/day) 1,503 2,390 2005 +93% +21% New Plan: 2011E Government Plan as of 2002 Revised Government Plan 2,900 Source: Enagás (April 2006) |

19 1.5 million eligible residential gas customers Commercial network: 884 points of sale (own, franchised and associated) GAS NATURAL continues to enjoy the benefits of a strong and well-established brand all over Spain 1.5 million maintenance contracts 1 1.48 contracts per customer as of March 31, 2006, in line with 2004-2008 Strategic Plan 0.5 million residential electricity customers 79% residential gas customers retained 1Q 06 results analysis by activity Multiproduct Offer in Spain Note: 1 Includes gas, electricity and home |

21 Conclusions Consolidation of GAS NATURAL presence in power generation We continue to deliver above the targets set in our 2004-2008 Strategic Plan Double-digit growth in EBITDA and Net Income based on cash generation Solid and growing distribution business Positive trends shown in 2005 materializing in 2006, boosting growth and profitability Advancing in equity gas position |

Update on offer for Endesa |

23 Key recent events GAS NATURAL’s offer acceptance period begins in Spain and US 6 March Madrid Court for Business Matters Number 3 grants an injunction to Endesa in connection with its lawsuit regarding the agreement between GAS NATURAL and Iberdrola 21 March E.ON formally requests CNE´s authorisation of its offer for Endesa 24 March Endesa posts a €1,000 million bond before the Madrid Court to make the injunction effective 4 April GAS NATURAL´s EGM approves the capital increase related to the offer for Endesa 7 April Spanish Supreme Court grants Endesa an injunction in connection with the decision by the Council of Ministers to approve with conditions GAS NATURAL´s offer for Endesa. Not yet notified 21 April European Commission clears E.ON´s bid for Endesa unconditionally 25 April 3 April Endesa challenges CNMV´s authorisation of GAS NATURAL´s offer before the Audiencia Nacional |

24 Impact of the injunctions The processing of GAS NATURAL´s offer and the performance of the agreement with Iberdrola will be suspended while the Court reaches a decision on the merits of the Endesa lawsuit The suspension of GAS NATURAL’s offer will not stop the CNMV’s processing of E.ON’s offer However, while GAS NATURAL’s offer is suspended, the process of “sealed envelopes” for competing bids would also be suspended The acceptance periods of the offers would be extended as necessary for all offers to expire on the same date This effectively means that the E.ON offer would be extended if it is approved by the CNE and the CNMV to expire on the same date as GAS NATURAL’s offer GAS NATURAL has challenged the injuction Madrid Court for Business Matters Number 3 Supreme Court The details of the decision by the Supreme Court have not been made public yet The CNMV has not yet expressed a view on the impact of the Supreme’s Court injunction on the offer process |

25 Combined management of clients and networks More flexible and competitive gas procurement More balanced and competitive generation portfolio Attractive business mix and investment profile Global integrated energy leader in high-growth markets Sizeable synergies Creating a leading, fully integrated, global energy group A unique strategic, industrial and financial rationale |

INVESTOR RELATIONS DEPARTMENT Av. Portal de l’Àngel, 20 08002 BARCELONA (Spain) telf. 34 934 025 891 fax 34 934 025 896 e-mail: relinversor@gasnatural.com website: www.gasnatural.com Thank you |