FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May, 2006

Commission File Number: 333-132076

GAS NATURAL SDG, S.A.

(Translation of Registrant’s Name into English)

Av. Portal de L’Angel, 20-22

08002 Barcelona, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):N/A

GAS NATURAL

First Quarter results 2006

| | |

GAS NATURAL First Quarter Results 2006 | |  |

NET PROFIT REACHED €276.7 MILLION IN 1Q06, A 16.2% INCREASE

| | • | | Net profit amounted to €276.7 million in the first quarter of 2006, a 16.2% increase on the same period of 2005. |

| | • | | Consolidated EBITDA evidenced GAS NATURAL’s strong fundamentals by rising 29.3% in the first quarter. Growth engines: electricity generation in Spain and Portugal, with 3,118 MW operational, gas distribution in Latin America, and the expanding contribution from the gas supply business. |

| | • | | EBITDA in the distribution business in Spain (€217.6 million) increased by 3.3% on 1Q06 and 11.9% on 4Q05. |

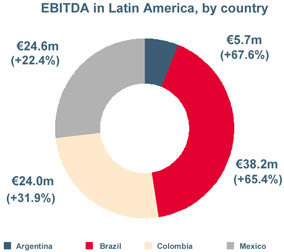

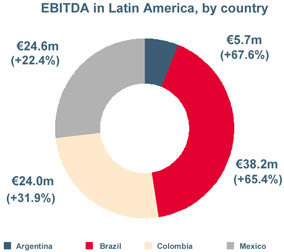

| | • | | The distribution business in Latin America continued to grow rapidly; EBITDA increased by 42.7% to €92.5 million. |

| | • | | GAS NATURAL had 10.3 million gas distribution connections at the end of the quarter, a year-on-year increase of 592,000 (6.1%). |

| | • | | A total of 4,192 GWh of electricity was generated in Spain (+133.3%), the company’s highest-ever quarterly figure, due to starting up the three 400 MW units at Cartagena. GAS NATURAL has a 7.0% share of the Spanish market in “ordinary regime” electricity. |

| | • | | EBITDA in the electricity business in Spain (generation and supply) reached €71.0 million, more than triple the 1Q05 figure, due to growth in power generation and optimisation of the customer roster. |

| | • | | EBITDA in the gas supply business (Wholesale and Retail) surged due to optimisation of the customer portfolio and progressive normalisation of prices in Spain. |

| | • | | On 24 February 2006, the Spanish Cabinet approved a number of regulatory changes relating to the energy sector. They include two draft laws that amend the Hydrocarbon Law and the Electricity Sector Law and transpose the EU Directives on common rules for the internal markets in electricity and gas. The Cabinet also approved a decree-law aimed at reducing the large tariff deficit in the Spanish electricity system and another to amend the powers of the National Energy Commission. |

| | • | | GAS NATURAL acquired 100% of Petroleum Oil & Gas España, a company specialised in hydrocarbon exploration, development and production in Spain, with gas reserves basically in the Guadalquivir valley. |

| | • | | GAS NATURAL and Repsol YPF signed a framework agreement with the Nigerian government to develop a liquefied natural gas project that includes the construction and operation of a gas liquefaction plant in Nigeria with an initial capacity of 10 bcm. |

| | • | | The Board of Directors of GAS NATURAL resolved to propose to the Shareholders’ Meeting, scheduled for 8 June, a supplementary dividend of 53 cent per share, representing a 50.2% pay-out. |

2

| | |

GAS NATURAL First Quarter Results 2006 | |  |

1.- TENDER OFFER FOR ENDESA

On 5 September, the Board of Directors of GAS NATURAL unanimously resolved to make a tender offer for 100% of Endesa.

Additionally, GAS NATURAL and Iberdrola signed an agreement for the sale of certain assets of the resulting company, conditional upon GAS NATURAL attaining effective control over Endesa and subject to approval by the competent authorities.

On 3 February 2006, the Spanish Cabinet approved the operation, subject to compliance with twenty conditions. On 6 February 2006, after analysing the conditions imposed by the Spanish Cabinet, the Board of Directors of GAS NATURAL resolved to continue with the tender offer for 100% of Endesa since GAS NATURAL believes that the deal’s strategic, industrial and financial advantages are compatible with meeting the Spanish Cabinet’s conditions for the business concentration.

On 21 February 2006, German company E.ON filed with the CNMV (Spain’s securities market regulator) an application to present a tender offer for 100% of the shares of Endesa.

On 27 February 2006, the CNMV approved GAS NATURAL’s tender offer to Endesa’s shareholders.

The period for acceptance of the offer commenced on 6 March 2006.

On 21 March 2006, as a precautionary measure and without addressing the substance of the case, Madrid Mercantile Court No. 3 suspended the tender offer temporarily at the request of Endesa, which alleged collusion between GAS NATURAL and Iberdrola. To make the suspension effective, Endesa had to post a bond of €1 billion. On 31 March 2006, the Board of Directors of Endesa decided to post the bond with the court, and it did so on 5 April 2006.

On 24 March 2006, the CNMV decided that, if Endesa posted the bond and GAS NATURAL’s offer were suspended, the procedure for competing bids would also be suspended.

On 7 April 2006, GAS NATURAL held an Extraordinary Shareholders’ Meeting which approved a capital increase of 602,429,955 new ordinary shares (one euro par value each), providing for the possibility of incomplete subscription and total suppression of the pre-emptive right, for non-monetary contributions consisting of the shares of Endesa whose owners accepted the tender offer, and it empowered the Board of Directors to establish the issue premium.

Prior to the Shareholders’ Meeting, the Board of Directors resolved that implementation of the resolutions relating to the company’s tender offer for Endesa shares would depend on removal of the suspension of the tender offer ordered by the Madrid Mercantile Court no. 3 on 21 March 2006.

Although GAS NATURAL is aware, based on publicly-available information, that on 21 April 2006 the plenary session of the Supreme Court approved precautionary measures in connection with the appeal by Endesa against the Cabinet Decision, the Company has not yet received the related court documents.

3

| | |

GAS NATURAL First Quarter Results 2006 | |  |

2.- MAIN AGGREGATES

2.1.-Main financial aggregates

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 3,107.1 | | 2,045.4 | | 51.9 |

EBITDA | | 507.9 | | 392.9 | | 29.3 |

Operating income | | 358.2 | | 276.4 | | 29.6 |

Net profit | | 276.7 | | 238.0 | | 16.3 |

| | | | | | |

Average number of shares (million) | | 447.8 | | 447.8 | | — |

| | | | | | |

EBITDA per share (€) | | 1.13 | | 0.88 | | 29.3 |

Net profit per share (€) | | 0.62 | | 0.53 | | 16.3 |

| | | | | | |

Investments | | 290.4 | | 258.1 | | 12.5 |

Net financial debt (at 31/03) | | 3,397.2 | | 2,620.2 | | 29.7 |

| | | | | | |

2.2.-Ratios

| | | | | | |

| | | 1Q06 | | | 1Q05 | |

ROACE1 | | 12.9 | % | | 13.2 | % |

ROE2 | | 15.0 | % | | 14.0 | % |

| | | | | | |

Leverage3 | | 36.3 | % | | 34.0 | % |

EBITDA/Net financial result | | 7.5 | x | | 8.2 | x |

Net debt/EBITDA | | 2.1 | x | | 1.9 | x |

| | | | | | |

PER | | 13.6 | x | | 15.1 | x |

EV/EBITDA | | 8.6 | x | | 9.0 | x |

| | | | | | |

Share performance and balance sheet at 31 March.

| 1 | Operating income/Average operating capital (Net tangible and intangible assets - Revenues linked to fixed assets to be distributed + Other fixed assets + Goodwill +Non-financial working capital) |

| 2 | Net profit/ Average equity |

| 3 | Net financial debt/(Net financial debt + Equity + Minority interest) |

4

| | |

GAS NATURAL First Quarter Results 2006 | |  |

2.3.-Main physical aggregates

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Distribution (GWh): | | 122,449 | | 115,279 | | 6.2 |

Spain: | | 77,762 | | 74,372 | | 4.6 |

Tariff gas sales | | 18,266 | | 19,940 | | -8.4 |

TPA | | 59,496 | | 54,432 | | 9.3 |

Latin America: | | 43,224 | | 39,580 | | 9.2 |

Tariff gas sales | | 24,495 | | 21,395 | | 14.5 |

TPA | | 18,729 | | 18,185 | | 3.0 |

Italy: | | 1,463 | | 1,327 | | 10.2 |

Tariff gas sales | | 1,430 | | 1,301 | | 9.9 |

TPA | | 33 | | 26 | | 26.9 |

| | | | | | |

Distribution network (km): | | 101,112 | | 96,003 | | 5.3 |

Spain | | 40,315 | | 37,839 | | 6.5 |

Latin America | | 56,977 | | 54,601 | | 4.4 |

Italy | | 3,820 | | 3,563 | | 7.2 |

| | | | | | |

Increase in gas distribution connections, (‘000) | | 109 | | 130 | | -16.4 |

Spain | | 62 | | 67 | | -7.5 |

Latin America | | 44 | | 58 | | -24.1 |

Italy | | 3 | | 5 | | -40.0 |

| | | | | | |

Gas distribution connections, (‘000) (at 31/03): | | 10,287 | | 9,695 | | 6.1 |

Spain | | 5,196 | | 4,875 | | 6.6 |

Latin America | | 4,801 | | 4,563 | | 5.2 |

Italy | | 290 | | 257 | | 12.8 |

| | | | | | |

Gas supply (GWh): | | 96,633 | | 89,458 | | 8.0 |

Spain | | 83,891 | | 76,103 | | 10.2 |

International | | 12,742 | | 13,355 | | -4.6 |

Gas transportation - EMPL (GWh) | | 34,928 | | 36,555 | | -4.5 |

| | | | | | |

Contracts per customer in Spain (at 31/03) | | 1.48 | | 1.41 | | 5.0 |

| | | | | | |

Electricity generated (GWh): | | 4,521 | | 2,129 | | — |

Spain | | 4,192 | | 1,797 | | — |

Puerto Rico | | 329 | | 332 | | -0.9 |

| | | | | | |

Installed capacity (MW): | | 3,389 | | 1,945 | | 74.2 |

Spain | | 3,118 | | 1,674 | | 86.2 |

Puerto Rico | | 271 | | 271 | | — |

| | | | | | |

Employees (at 31/03) | | 6,678 | | 6,738 | | -0.9 |

| | | | | | |

5

| | |

GAS NATURAL First Quarter Results 2006 | |  |

3.- ANALYSIS OF CONSOLIDATED RESULTS

3.1.-Changes in group size

The main changes in consolidated group size in 2006 with respect to 2005 are as follows:

| | • | | The acquisition of holdings in a number of wind farm companies (DERSA), which have been fully consolidated since 1 April 2005. |

| | • | | Deconsolidation of Enagás effective 1 October 2005. |

| | • | | Acquisition of 100% of Petroleum Oil & Gas España in March 2006 and full consolidation since 1 March 2006. |

3.2.-Analysis of results

3.2.1- Net sales

Net sales in 1Q06 amounted to €3,107.1 million, 51.9% more than in 1Q05, due basically to greater business activity, particularly in electricity in Spain, growth in gas supply (both greater consumption and higher prices) and expansion in Latin America.

3.2.2.- EBITDA and operating income

EBITDA in 1Q06 totalled €507.9 million, a 29.3% increase on 1Q05.

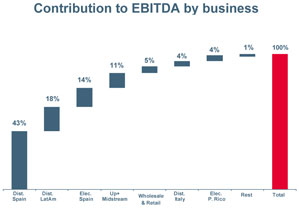

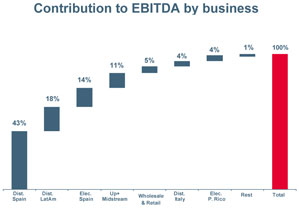

Distribution overall (Spain, Latin America and Italy) accounts for 65.2% of GAS NATURAL’s EBITDA. Distribution in Spain is the main source of EBITDA (42.8%).

The electricity business in Spain expanded rapidly and now accounts for 14.0% of total EBITDA.

Upstream and Midstream activities (basically the operation of the Maghreb-Europe gas pipeline) together accounted for 10.8% of the total.

Depreciation and provisions increased by 28.5% overall due basically to past investment in power generation and gas distribution networks, which boosted EBITDA by 29.6% to €358.2 million.

6

| | |

GAS NATURAL First Quarter Results 2006 | |  |

3.2.3.- Financial results

The breakdown of financial results is as follows:

| | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 |

Cost of net financial debt | | -63.6 | | -50.1 |

Exchange differences in Argentina | | -1.2 | | 2.2 |

Rest of exchange differences (net) | | -0.6 | | -2.6 |

Capitalized interest | | 3.8 | | 4.5 |

Other financial (expenses)/revenues | | -5.9 | | -1.9 |

| | | | |

Net financial result | | -67.5 | | -47.9 |

| | | | |

The net financial loss was €67.5 million in 1Q06, compared with €47.9 million in 1Q05. The increase was basically the result of a higher cost of debt, driven by a larger average debt volume (+27.9%).

The “Exchange differences in Argentina” caption reflects exchange differences booked at Gas Natural BAN on its dollar-denominated debt. This effect was negative because of adverse performance by the Argentinean peso (3.06 pesos to the dollar, compared with 3.01 at 2005 year-end).

Gas Natural BAN hedged part of its dollar-denominated borrowing against currency and interest rate risk. Specifically, in 2005 it hedged $58 million at an exchange rate of 2.8720 pesos to the dollar. As a result, Gas Natural BAN partially reduced the exposure of its debt to the dollar.

The figure shows GAS NATURAL’s consolidated net debt and indebtedness between 31 December 2005 and 31 March 2006. Net debt fell by €218.0 million in the quarter, to €3,397.2 million at 31 March 2006, and leverage fell to 36.3%, down from 38.5% at 2005 year-end.

Changes in 1Q06 in exchange rates of the other currencies (basically the dollar and the Mexican peso) against the euro reduced net debt by €20.9 million in the period.

The breakdown of the net financial debt by currency at 31 March 2006, in absolute and relative terms, is as follows:

| | | | |

| (unaudited) |

(€ Mn) | | 31/03/06 | | % |

EUR | | 1,809.1 | | 53.2 |

USD | | 644.3 | | 19.0 |

BRL | | 444.6 | | 13.1 |

MXN | | 362.6 | | 10.7 |

USD–Argentina | | 54.0 | | 1.6 |

COP | | 35.2 | | 1.0 |

Other currencies | | 47.4 | | 1.4 |

| | | | |

Total net financial debt | | 3,397.2 | | 100.0 |

| | | | |

7

| | |

GAS NATURAL First Quarter Results 2006 | |  |

Net dollar-denominated financial debt (excluding Argentina) relates mainly to EMPL, the company which manages the Maghreb-Europe gas pipeline, and to EcoEléctrica, whose accounts and cash flow are in dollars. The “Other currencies” item includes net debt in Argentinean pesos and Moroccan dirhams.

Latin American companies’ debt is in local currency, except for Argentina, where 57.7% of net debt is in dollars.

A total of 51.6% of consolidated debt is at fixed interest rates and the other 48.4% is at floating rates. As for maturities, 20.2% of the debt matures in the short term and the other 79.8% in the long term (45.8% after 2010).

The current credit rating of GAS NATURAL’s short- and long-term debt is as follows:

| | | | | | |

Agency | | Long term | | Short term | | Outlook |

Moody’s | | A2 | | P-1 | | Review for possible downgrade |

Standard & Poor’s | | A+ | | A-1 | | Negative creditwatch |

Fitch | | A+ | | F1 | | Rating watch negative |

On 6 September 2005, as a result of the tender offer for Endesa, the agencies put the ratings under review.

3.2.4.- Equity income

The main items in this account relate to results from minority stakes in gas distribution companies in Spain (Gas Aragón and Gas Natural de Álava), wind power companies, and Enagás (equity-accounted between January and September 2005). The Enagás stake was reclassified on 1 October 2005 as available-for-sale financial assets and it is no longer equity-accounted.

Minority interests amounted to €1.5 million in 1Q06, compared with €11.5 million in 1Q05. The difference is due basically to the deconsolidation of Enagás effective on 1 October 2005. Enagás contributed €10.7 million to the equity-accounted affiliates line-item in 1Q05.

3.2.5.- Capital gain on disposal of non-current assets

Disposals of non-current assets in 1Q06 provided a net gain of €98.8 million, compared with €104.9 million in 1Q05.

This result is due basically to the disposal in 2006 of 3.6% of Enagás. The company sold 5.4% of Enagás in the same period of 2005.

GAS NATURAL is obliged to reduce its stake in Enagás to 5% by 31 December 2006. At 31 March 2006, it owned 9.2% of Enagás.

3.2.6.- Corporate income tax

The corporate income tax expense totalled €95.5 million, i.e. an effective tax rate of 24.4%, compared with 26.7% in 1Q05.

The difference with respect to the general tax rate was due to tax credits, equity-accounted affiliates, tax loss carryforwards, and different tax systems applied to companies operating outside Spain.

8

| | |

GAS NATURAL First Quarter Results 2006 | |  |

3.2.7.- Minority interest

The main items in this account are the minority shareholders of: EMPL (owned 72.6% by GAS NATURAL), the subgroup of subsidiaries in Colombia (owned 59.1%), Gas Natural BAN (owned 50.4%), Gas Natural Mexico (owned 86.8%), Brazilian companies CEG (owned 54.2%) and CEG Rio (owned 59.6%), as well as other companies in Spain.

Income attributed to minority interests in 2006 amounted to €18.8 million, a €4.0 million increase due mainly to a higher contribution from EMPL and the Latin American subsidiaries.

3.3.- Investments

Investments totalled €290.4 million in 1Q06, 12.5% more than in 1Q05.

The breakdown of investments by type is as follows:

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Capital expenditure | | 231.5 | | 249.8 | | -7.3 |

Investments in intangible assets | | 8.9 | | 6.1 | | 45.9 |

Financial investments | | 50.0 | | 2.2 | | — |

| | | | | | |

Total investments | | 290.4 | | 258.1 | | 12.5 |

| | | | | | |

Capital expenditure amounted to €231.5 million in 1Q06, a 7.3% decrease due basically to completion and start-up of the Cartagena combined cycle plant, which was still under construction in 2005.

Investments in 1Q06 also include the acquisition of 100% of Petroleum Oil & Gas España in March 2006.

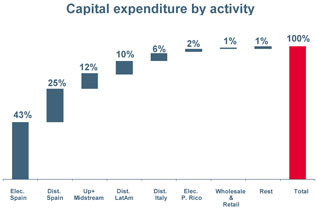

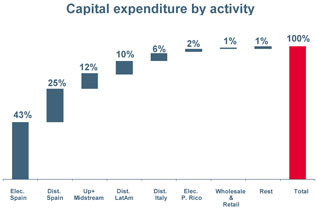

The breakdown of capital expenditure by line of business is as follows:

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Gas distribution: | | 95.2 | | 79.7 | | 19.4 |

Spain | | 57.1 | | 45.3 | | 26.0 |

Latin America | | 23.2 | | 25.6 | | -9.4 |

Italy | | 14.9 | | 8.8 | | 69.3 |

| | | | | | |

Electricity: | | 104.0 | | 162.5 | | -36.0 |

Spain | | 99.9 | | 160.1 | | -37.6 |

Puerto Rico | | 4.1 | | 2.4 | | 70.8 |

| | | | | | |

Gas: | | 28.5 | | 3.2 | | — |

Up + Midstream | | 26.7 | | 1.5 | | — |

Wholesale & Retail | | 1.8 | | 1.7 | | 5.9 |

| | | | | | |

Rest | | 3.8 | | 4.4 | | -13.6 |

| | | | | | |

Total capital expenditure | | 231.5 | | 249.8 | | -7.3 |

| | | | | | |

Investment in distribution totalled €95.2 million, a 19.4% increase due to investment in gas networks in Spain and expansion of activities in Italy. Conversely, investment in property, plant and equipment in Latin America fell by 9.4% because of slowing activity in Mexico.

9

| | |

GAS NATURAL First Quarter Results 2006 | |  |

Investment in power generation fell 36.0% as in 1Q05 the Cartagena plant’s three 400 MW units were under construction and the two 400 MW units at Arrúbal were being completed; conversely, only the two 400 MW units at Plana del Vent were still under construction in 1Q06.

Investment in Upstream and Midstream reflects the fact that the Gassi Touil integrated LNG project has commenced.

In 2006, 43.2% of investment in tangible fixed assets related to electricity in Spain, mainly for the development of another two combined cycle units at Plana del Vent (800 MW).

Investment in gas distribution in Spain, which accounted for 24.7% of the total, was allocated to acquiring new customers: the distribution grid was extended by close to 2,500 km in the last twelve months (6.5% growth).

Net intangible and tangible fixed assets increased by €144.7 million in 1Q06 to €9,049.3 million at 31 March 2006.

The breakdown of this figure by line of business is as follows:

| | | | |

| (unaudited) |

(€ Mn) | | 31/03/06 | | % |

Distribution: | | 5,637.9 | | 62.3 |

Spain | | 3,463.1 | | 38.3 |

Latin America | | 1,770.2 | | 19.6 |

Italy | | 404.6 | | 4.5 |

| | | | |

Electricity: | | 2,223.3 | | 24.6 |

Spain | | 1,993.5 | | 22.0 |

Puerto Rico | | 229.8 | | 2.5 |

| | | | |

Gas: | | 1,004.2 | | 11.1 |

Up + Midstream | | 916.3 | | 10.1 |

Wholesale & Retail | | 87.9 | | 1.0 |

| | | | |

Rest | | 183.9 | | 2.0 |

| | | | |

Total net tangible and intangible assets | | 9,049.3 | | 100.0 |

| | | | |

Overall intangible and tangible fixed assets included construction in progress worth €520.4 million, of which €300.5 million relate to the electricity business, €101.1 million to Latin America, and €43.0 million to Upstream + Midstream.

Distribution accounts for 62.3% of GAS NATURAL’s assets.

10

| | |

GAS NATURAL First Quarter Results 2006 | |  |

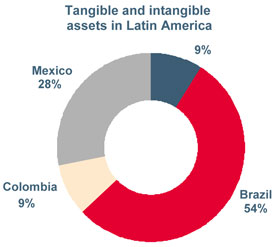

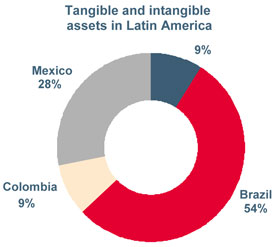

Intangible and tangible fixed assets in Latin America amount to €1,770.2 million (19.6% of the consolidated total) and relate to gas distribution.

The figure shows the asset breakdown by country: Brazil accounts for 54% of the total, followed by Mexico with 28%.

3.4.-Goodwill

International Financial Reporting Standards (IFRS) do not allow goodwill to be amortised. Nevertheless, goodwill must be reviewed to detect any impairment. In accordance with available estimates, the projected attributable revenues assure the recovery of GAS NATURAL’s net assets and goodwill.

Goodwill in consolidation on the balance sheet as of 31 March 2006 amounted to €450.3 million and is detailed below by country:

| | |

| (unaudited) |

(€ Mn) | | 31/03/06 |

Puerto Rico | | 139.9 |

Italy | | 135.0 |

Spain | | 118.5 |

Mexico | | 35.5 |

Brazil | | 21.4 |

| | |

Total | | 450.3 |

| | |

Goodwill in Spain arose basically on purchased wind power companies.

3.5.-Shareholders’ equity

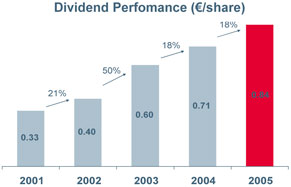

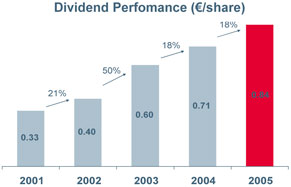

The Board of Directors resolved to propose to the Shareholders’ Meeting an 18.3% increase in the dividend and pay €0.84/share out of 2005 earnings, of which €0.31/share were paid in January 2006.

The supplementary dividend of €0.53/share represents a 20.5% increase on last year’s supplementary dividend.

The proposed dividend represents an increase in the pay-out from 49.5% to 50.2%, in line with the 2008 target of 52%-55%.

11

| | |

GAS NATURAL First Quarter Results 2006 | |  |

At 31 March 2006, shareholders’ equity totalled €5,973.4 million, having increased by 17.2% in the previous twelve months. Of that total, €5,618.7 million is attributable to GAS NATURAL, a 15.7% increase.

4.- ANALYSIS OF RESULTS BY ACTIVITY

The criteria used to assign amounts to the activities are as follows:

| | • | | The margin on intercompany transactions is allocated on the basis of the final destination of the sale, in terms of market. |

| | • | | All revenues and expenses relating directly and exclusively to a business line are allocated directly to it. |

| | • | | Corporate expenses and revenues are assigned on the basis of their use by the individual business lines. |

4.1.-Distribution in Spain

This area includes gas distribution, regulated-rate supply, third-party access and secondary transportation, as well as the distribution activities in Spain that are charged for outside the regulated remuneration (meter rentals, customer connections, etc.).

4.1.1.- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 696.2 | | 576.3 | | 20.8 |

Purchases | | -384.5 | | -268.1 | | 43.4 |

Personnel costs, net | | -17.4 | | -19.9 | | -12.6 |

Other expenses/income | | -76.7 | | -77.6 | | -1.2 |

| | | | | | |

EBITDA | | 217.6 | | 210.7 | | 3.3 |

| | | | | | |

Charge for depreciation and amortisation | | -64.9 | | -62.1 | | 4.5 |

Variation in operating provisions | | 0.1 | | -0.6 | | — |

| | | | | | |

Operating income | | 152.8 | | 148.0 | | 3.2 |

| | | | | | |

Net sales in the gas distribution business in Spain totalled €696.2 million, 20.8% more than in 1Q05. In 1Q06, EBITDA totalled €217.6 million, up 3.3% on the figure reported in 1Q05. That increase was lower than the interyear increase in remuneration due partly to the impact of lower tariff sales because of the mild winter in 1Q06 (1Q05 was much colder) and also to the shift by residential customers to the liberalised market. Since 79% switched to GAS NATURAL’s own supply company (Gas Natural Servicios), the retention rate is high.

The reduction in personnel expenses was due to the fact that capitalised in-house work on fixed assets was higher in 2006, because of a 26.0% increase in capital expenditure, and this figure is stated net in the consolidated income statement under IFRS.

12

| | |

GAS NATURAL First Quarter Results 2006 | |  |

As a result of a 4.5% increase in depreciation and amortisation charges and the impact of provisions, operating income increased by just 3.2%.

4.1.2.- Main aggregates

The main aggregates in gas distribution in Spain were as follows:

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Gas activity sales (GWh): | | 77,762 | | 74,372 | | 4.6 |

Tariff gas sales | | 18,266 | | 19,940 | | -8.4 |

Residential | | 10,582 | | 14,338 | | -26.2 |

Industrial | | 5,599 | | 2,897 | | 93.3 |

Electricity | | 2,085 | | 2,705 | | -22.9 |

TPA | | 59,496 | | 54,432 | | 9.3 |

| | | | | | |

Distribution network (km) | | 40,315 | | 37,839 | | 6.5 |

| | | | | | |

Change in distribution connections (‘000) | | 62 | | 67 | | -7.5 |

| | | | | | |

Distribution connections (000) (at 31/3) | | 5,196 | | 4,875 | | 6.6 |

| | | | | | |

Regulated gas sales in Spain, which encompass regulated-rate gas distribution and supply as well as third-party access (TPA), amounted to 77,762 GWh, a 4.6% increase on 1Q05.

Gas sales to the regulated residential market decreased by 26.2% due to the difference in winter temperatures and the progressive migration by customers to the liberalised segment (to GAS NATURAL’s own supply company and to rivals). The liberalised gas market now represents 80% of total gas sales, up from 78% one year ago. Nevertheless, gas sales in the industrial market increased by 93.3% on 1Q05 due basically to reverse migration to the regulated tariff by mid-sized industrial customers as a result of market prices.

Third-party access (TPA) services increased by 9.3% to 59,496 GWh, of which 26,284 GWh (+12.8%) related to services to third parties and the remaining 33,212 GWh (+6.7%) to GAS NATURAL, which is the main operator in the liberalised gas market.

The distribution network was extended by close to 2,500 km in the last twelve months, to 40,315 km at 31 March 2006, a year-on-year increase of 6.5%. In 1Q06, another nine municipalities were connected to the gas grid, making a total of 823 at 31 March 2006. Additionally, agreements were signed to link up other Spanish municipalities to the grid, and they will be implemented in the coming quarters; over 50 additional municipalities will foreseeably be connected in 2006.

GAS NATURAL is rapidly increasing the number of supply connections, having added 321,000 new connections in the last twelve months. At 31 March 2006, there were a total of 5,196,000 gas distribution connections in Spain, a 6.6% increase year-on-year.

The government assigned €1,052.0 million to GAS NATURAL as remuneration for distribution in 2006, i.e. a 5.6% increase on 2005. This increase is due to projected growth in GAS NATURAL’s activity in 2006, the projection of the average inflation price index (IPH), and the fact that the efficiency factors remained unchanged. Additionally, the remuneration for secondary transportation in 2006 amounts to €18.5 million.

13

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.2.-Distribution in Latin America

This division involves gas distribution in Argentina, Brazil, Colombia and Mexico.

4.2.1.- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 386.2 | | 299.9 | | 28.8 |

Purchases | | -242.6 | | -193.2 | | 25.6 |

Personnel costs, net | | -14.8 | | -10.4 | | 42.3 |

Other expenses/income | | -36.3 | | -31.5 | | 15.2 |

| | | | | | |

EBITDA | | 92.5 | | 64.8 | | 42.7 |

| | | | | | |

Charge for depreciation and amortisation | | -24.3 | | -15.2 | | 59.9 |

Variation in operating provisions | | -4.3 | | -2.1 | | — |

| | | | | | |

Operating income | | 63.9 | | 47.5 | | 34.5 |

| | | | | | |

Distribution earnings in Latin America continued to grow rapidly in 1Q06.

Net sales totalled €386.2 million, a 28.8% increase.

EBITDA amounted to €92.5 million, i.e. €27.7 million euro more than in 1Q05 (a 42.7% increase). The main factors behind this growth are as follows:

| | • | | Improved EBITDA in all countries (€15.1 million) due mainly to a 14.5% increase in sales of gas at the tariff, and to the new tariffs in Argentina. |

| | • | | Appreciation by local currencies, contributing €12.6 million to EBITDA. |

Excluding the currency effect, EBITDA grew 23.3%.

The figure shows EBITDA in Latin America, by country, and the variation with respect to 1Q05.

Sales were particularly strong in Brazil, the main source of EBITDA in Latin America (41.1% of the total), which provided €38.2 million in EBITDA, 65.4% more than in 1Q05 (+32.6% excluding exchange rate effects).

Net financial debt in Latin America amounted €944.4 million at 31 March 2006, which includes $79.0 million in dollar-denominated debt in Argentina.

14

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.2.2.- Main aggregates

The main physical aggregates in gas distribution in Latin America are as follows:

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Gas activity sales (GWh): | | 43,224 | | 39,580 | | 9.2 |

Tariff gas sales | | 24,495 | | 21,395 | | 14.5 |

TPA | | 18,729 | | 18,185 | | 3.0 |

| | | | | | |

Distribution network (km) | | 56,977 | | 54,601 | | 4.4 |

| | | | | | |

Change in distribution connections (‘000) | | 44 | | 58 | | -24.7 |

| | | | | | |

Distribution connections (000) (at 31/03) | | 4,801 | | 4,563 | | 5.2 |

| | | | | | |

Sales in the gas activity in Latin America, which include both gas sales and TPA (third-party access) services, totalled 43,224 GWh, a 9.2% increase year-on-year.

Colombia increased sales by 18.2% and Brazil by 12.4%.

The automotive fuel market performed notably in the four countries, rising 14.3% with respect to 1Q05, and this trend is expected to continue as a result of the prices of alternative fuels.

The distribution network was extended by 2,376 km in the last twelve months, to 56,977 km at 31 March 2006, a year-on-year increase of 4.4%. Grid expansion was slower than in previous years since the commercial goal is to saturate the existing grid.

There were a total of 4,801,000 gas supply points at 31 March 2006. GAS NATURAL’s number of individual distribution connections continued to grow rapidly, having risen by 238,000 year-on-year.

The main physical aggregates by country in 1Q06 are as follows:

| | | | | | | | | | |

| | | Argentina | | Brazil | | Colombia | | Mexico | | Total |

Gas activity sales (GWh) | | 18,224 | | 11,283 | | 3,024 | | 10,693 | | 43,224 |

Change vs. 1Q05 (%) | | 10.1 | | 12.4 | | 18.2 | | 2.5 | | 9.2 |

| | | | | | | | | | |

Distribution network (km at 31/03) | | 21,300 | | 5,043 | | 15,577 | | 15,057 | | 56,977 |

Change vs. 31/03/05 (km) | | 1.5 | | 15.6 | | 5.3 | | 4.1 | | 4.4 |

| | | | | | | | | | |

Distribution connections (‘000 at 31/03) | | 1,295 | | 754 | | 1,639 | | 1,113 | | 4,801 |

Change vs. 31/03/05 (‘000) | | 2.5 | | 8.0 | | 7.7 | | 3.1 | | 5.2 |

| | | | | | | | | | |

Highlights:

| | • | | The revival in Argentina was evidenced by a further increase in customer numbers and a 10.1% increase in gas sales, with a notable increase in sales to large accounts (industrial market and TPA). |

On 20 July 2005, Gas Natural BAN and representatives of Argentina’s Economy & Production and Federal Planning, Public Investment & Services Ministries signed a memorandum agreement which, among other items, established a tariff increase in advance of the future

15

| | |

GAS NATURAL First Quarter Results 2006 | |  |

tariff framework equivalent to a 27% increase in the company’s distribution margin, applicable as from November 2005.

The President of Argentina ratified the Memorandum Agreement, as published in the Official Gazette of the Republic of Argentina on 10 April 2006. The application of the approved increases is currently being discussed with the regulator.

| | • | | In Brazil, GAS NATURAL achieved the largest single increase in the number of connection points since it commenced operations there: 56,000 new customers in the last twelve months. Sales continue to register double-digit growth, as in 2005 and 2004. Sales for automotion surged by 19.4%, with particularly strong growth in the Sao Paulo area. |

| | • | | Growth is double-digit in all markets in Colombia. Sales rose by 18.2% and the customer base expanded by 118,000 year-on-year to 1,639,000 connection points. Also, in 1Q06 a total of 5,200 vehicles were converted to run on natural gas (33% more than in 1Q05). |

| | • | | Gas sales in Mexico increased by just 2.5% due to the negative effect of rising gas prices (referenced to prices in the southern US). The Mexican government is implementing measures to palliate that effect: since 15 April 2005, it has offered residential customers with an average monthly consumption of under 60 m3 a subsidy which reduces gas bills by 28%; this will initially be in force until 30 September 2006. |

4.3.-Distribution in Italy

These results refer to gas distribution in Italy.

4.3.1.- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 93.2 | | 59.2 | | 57.4 |

Purchases | | -65.4 | | -35.5 | | 84.2 |

Personnel costs, net | | -3.2 | | -3.0 | | 6.7 |

Other expenses/income | | -3.8 | | -3.9 | | -2.6 |

| | | | | | |

EBITDA | | 20.8 | | 16.8 | | 23.8 |

| | | | | | |

Charge for depreciation and amortisation | | -6.7 | | -5.0 | | 34.0 |

Variation in operating provisions | | — | | — | | — |

| | | | | | |

Operating income | | 14.1 | | 11.8 | | 19.5 |

| | | | | | |

Gas distribution in Italy contributed €20.8 million in EBITDA (+23.8%), evidencing that GAS NATURAL’s operations in that country are gaining in strength.

Expansion into the regions of Reggio Calabria and Catania, which led to greater investment and higher depreciation and amortisation charges (34.0% higher) led to €14.1 million in operating income, 19.5% more than in 1Q05.

16

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.3.2.- Main aggregates

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Gas activity sales (GWh): | | 1,463 | | 1,327 | | 10.2 |

Tariff gas sales | | 1,430 | | 1,301 | | 9.9 |

TPA | | 33 | | 26 | | 26.9 |

| | | | | | |

Distribution network (km) | | 3,820 | | 3,563 | | 7.2 |

| | | | | | |

Distribution connections (000) (at 31/03) | | 290 | | 257 | | 12.8 |

| | | | | | |

A total of 1,463 GWh of gas were distributed in Italy, i.e. double-digit organic growth with respect to 1Q05, confirming that the company’s activities in Italy (which commenced in 2004) are gaining strength.

Commercial activity firmed up in 1Q06 with the addition of 33,000 new connection points and intense activity in the Palermo, Catania and Reggio Calabria regions. GAS NATURAL expects to exceed that growth figure in 2006 and add close to 40,000 connection points.

4.4.-Electricity in Spain

This area includes power generation in Spain (combined cycle plants, wind farms and cogeneration), trading via electricity purchases in the wholesale market, and the supply of electricity in the liberalised market in Spain.

4.4.1.- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 363.2 | | 201.2 | | 80.5 |

Purchases | | -260.8 | | -161.4 | | 61.6 |

Personnel costs, net | | -2.2 | | -0.8 | | — |

Other expenses/income | | -29.2 | | -16.9 | | 72.8 |

| | | | | | |

EBITDA | | 71.0 | | 22.1 | | — |

| | | | | | |

Charge for depreciation and amortisation | | -18.0 | | -6.1 | | — |

Variation in operating provisions | | -0.6 | | 0.3 | | — |

| | | | | | |

Operating income | | 52.4 | | 16.3 | | — |

| | | | | | |

Net electricity sales totalled €363.2 million.

In line with the trend observed in 2005, the power generation business continues to be favoured by high pool prices, which averaged €69.12/MWh in 1Q06. GAS NATURAL now has 18 power plants operating under the special regime (renewables/cogeneration) in the wholesale market.

Electricity supply continues to be hurt by having to compete with the regulated tariff, which is well below market prices (driven up by rising fuel costs, low precipitation and the impact of CO2 emission permit prices).

The Cartagena plant (1,200 MW) has started up, and the company acquired DERSA in April 2005.

17

| | |

GAS NATURAL First Quarter Results 2006 | |  |

The combination of these factors led to €71.0 million in EBITDA in 1Q06, more than triple the figure reported in 1Q05. DERSA generated €15.0 million in EBITDA in 1Q06; eliminating DERSA for uniformity, electricity EBITDA more than doubled year-on-year.

4.4.2.- Main aggregates

The key figures of GAS NATURAL’s electricity activities in Spain are as follows:

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Installed capacity (MW): | | 3,118 | | 1,674 | | 86.3 |

CCGT | | 2,800 | | 1,600 | | 75.0 |

Wind | | 296 | | 51 | | — |

Cogeneration | | 22 | | 23 | | -4.3 |

| | | | | | |

Electricity generated (GWh): | | 4,192 | | 1,797 | | — |

CCGT | | 3,968 | | 1,725 | | — |

Wind | | 185 | | 46 | | — |

Cogeneration | | 39 | | 26 | | 50.0 |

| | | | | | |

Contracted electricity (GWh/year) | | 1,109 | | 4,717 | | -76.5 |

| | | | | | |

Electricity sales (GWh): | | 1,001 | | 1,502 | | -33.4 |

Residential | | 651 | | 388 | | 67.8 |

Industrial | | 350 | | 1,114 | | -68.6 |

| | | | | | |

A total of 4,192 GWh were generated and sold to the wholesale market in 1Q06, 133% more than in 1Q05. This increase is due to the start-up of Cartagena (1,200 MW) in 1Q06 and greater output from Arrúbal (800 MW), which was undergoing trials in 1Q05. Wind power output also increased notably on 1Q05 due to the addition of new wind farms.

The combined cycle plants generated 3,968 GWh. This output, measured at plant busbars, represents 298% of the electricity supplied to customers by GAS NATURAL. GAS NATURAL had a 7.0% share of the “ordinary regime” power generation market in 1Q06.

The plants attained over 1,417 equivalent hours of operation at full load in the first quarter of 2006, representing a load factor of over 66%.

The business of electricity supply in the liberalised market continued to be penalised by high prices in the first quarter, although average pool prices fell sharply in March (by more than 25% with respect to February). Nevertheless, the supply business still has to compete with the (considerably lower) regulated tariff, leading to losses when the market cost exceeds the tariff. Consequently, many supply companies are streamlining their customer portfolio in the liberalised market and customers are increasingly reverting to the regulated tariff.

18

| | |

GAS NATURAL First Quarter Results 2006 | |  |

GAS NATURAL’s portfolio of electricity contracts continued the trend observed in the second half of 2005; in the last twelve months, it has greatly reduced the amount of contracted electricity supply (from 4,717 GWh/year to 1,109 GWh/year) and the number of customers (from 1,976 to 456).

Electricity supply to industrial customers fell 68.6% with respect to 1Q05. Electricity sales to residential customers rose 67.8%; the company has a portfolio of 470,000 contracts in this segment.

GAS NATURAL has 2,800 MW of operational combined cycle power production capacity, another 800 MW under construction (Plana del Vent) and over 1,200 MW at an advanced stage of permit obtainment (including the Málaga and Barcelona projects), all in line with the objective of having 4,800 MW of CCGT capacity by 2008.

After acquiring wind assets through its subsidiary Gas Natural Corporación Eólica and completing wind farms it developed itself, GAS NATURAL now has 296 MW of gross installed capacity (average stake: 46%) and over 1,200 MW of wind capacity under development.

In 1Q06, construction of 42.4 MW (16.8 MW net attributable) was completed and another 69.6 MW (50.9 MW net attributable) are at a very advanced stage of construction, with start-up scheduled for 2Q06. The wind power projects are located in the following regions: Galicia, Cantabria, Castilla y León, Navarra, La Rioja, Aragón, Cataluña, Andalucía and Castilla-La Mancha. GAS NATURAL has strengthened its position as one of the leading players in renewable energy, specifically wind power. GAS NATURAL’s net attributable wind output was 185 GWh in 1Q06.

The move into wind power complements GAS NATURAL’s decision in 1999 to commence power generation by developing combined cycle plants. GAS NATURAL’s strategy is to have a balanced, competitive, environmentally-friendly generation mix in line with the Kyoto Protocol’s objectives, and to reinforce its position as one of Spain’s leading electricity companies.

On 21 January 2005, the Spanish Cabinet approved the final individual allocation of greenhouse gas emission rights for 2005-2007; GAS NATURAL was allocated 13.670 Mt of CO2.

The rights allocated per year in 2005, 2006 and 2007 are as follows:

| | | | | | |

(Mt CO2) | | 2005 | | 2006 | | 2007 |

Emission rights | | 3.592 | | 4.2254 | | 5.8534 |

| | | | | | |

Although no emission rights were bought or sold in 1Q06, the company provisioned €1.8 million to fund the shortfall in emission rights projected in 2006.

Additionally, on 24 February 2006, Spain published the Royal Decree-Law that amends the mechanism for matching power bids presented simultaneously in the daily and intraday markets by electricity market participants that belong to the same business group; under Article 2 (pending detailed rule-making), the value of greenhouse gas emission permits assigned free of charge to power generated under the National Allocation Plan can be deducted from any revenues earned for “ordinary regime” power in markets priced at the margin. Consequently, from the date of entry into force of that Royal Decree Law (3 March), the combined cycle plants’ revenues have been cut by an estimated €8.7 million, based on market prices.

| 4 | 1.847 Mt CO2 in 2006 and the allocation for 2007 have yet to be transferred to GAS NATURAL. |

19

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.5.-Electricity in Puerto Rico

GAS NATURAL has been operating in Puerto Rico since October 2003, when it acquired 47.5% of EcoEléctrica and the exclusive right to import gas to the island, plus an operation, maintenance and fuel management contract.

4.5.1.- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 37.6 | | 29.1 | | 29.2 |

Purchases | | -16.4 | | -12.9 | | 27.1 |

Personnel costs, net | | -0.8 | | -0.6 | | 33.3 |

Other expenses/income | | -2.3 | | -2.8 | | -17.9 |

| | | | | | |

EBITDA | | 18.1 | | 12.8 | | 41.4 |

| | | | | | |

Charge for depreciation and amortisation | | -5.3 | | -3.7 | | 43.2 |

Variation in operating provisions | | -2.1 | | -0.8 | | — |

| | | | | | |

Operating income | | 10.7 | | 8.3 | | 28.9 |

| | | | | | |

GAS NATURAL’s activities in Puerto Rico provided US$21.7 million in EBITDA, 28.4% more than in 1Q05.

4.5.2.- Main aggregates

EcoEléctrica has a regasification plant (capacity: 115,000 m3) and a CCGT (540 MW). The CCGT, the first investor-owned gas-fired power plant in Puerto Rico, is located in Peñuelas, to the south of the island, and produces 15%-17% of the island’s total electricity needs.

In 1Q06, EcoEléctrica generated 658 GWh net (329 GWh attributable to GAS NATURAL), with a load factor of 60%, i.e. similar to 1Q05.

4.6.-Gas

4.6.1.-Up + Midstream

This area includes the development of integrated LNG projects, hydrocarbon exploration, maritime transportation, and the operation of the Maghreb-Europe gas pipeline.

20

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.6.1.1- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 77.1 | | 60.2 | | 28.1 |

Purchases | | -12.1 | | -9.5 | | 27.4 |

Personnel costs, net | | -1.0 | | -1.3 | | -23.1 |

Other expenses/income | | -9.4 | | -5.5 | | 70.9 |

| | | | | | |

EBITDA | | 54.6 | | 43.9 | | 24.4 |

| | | | | | |

Charge for depreciation and amortisation | | -13.1 | | -11.6 | | 12.9 |

Variation in operating provisions | | — | | 0.1 | | — |

| | | | | | |

Operating income | | 41.5 | | 32.4 | | 28.1 |

| | | | | | |

Net sales in the Upstream + Midstream business totalled €77.1 million, a 28.1% increase.

EBITDA amounted to €54.6 million in 1Q06, 24.4% more than in 1Q05 due basically to a larger contribution from EMPL (despite a slight reduction in the volume transported), greater utilisation of the tanker fleet (96%, vs. 86% in 1Q05), and the dollar’s appreciation.

4.6.1.2.- Main aggregates

The main aggregates in international gas transportation are as follows:

| | | | | | |

| | | 1Q06 | | 1Q05 | | % |

Gas transportation-EMPL (GWh): | | 34,928 | | 36,555 | | -4.5 |

Portugal | | 8,044 | | 8,365 | | -3.8 |

GAS NATURAL | | 26,884 | | 28,190 | | -4.6 |

| | | | | | |

The gas transportation activity conducted in Morocco, through companies EMPL and Metragaz, represented a total volume of 34,928 GWh in 1Q06, a 4.5% decline. Of that figure, 26,884 GWh were transported for GAS NATURAL through Sagane, and 8,044 GWh for Portuguese company Transgas.

In March, GAS NATURAL acquired 100% of Petroleum Oil & Gas España, a company involved in hydrocarbon exploration, development and production in Spain, with gas reserves basically in the Guadalquivir valley.

The acquisition of Petroleum Oil & Gas provides GAS NATURAL with the only known reserves of gas in Spain, enabling it to strengthen and expand its storage capacity and know-how in E&P and development of underground storage.

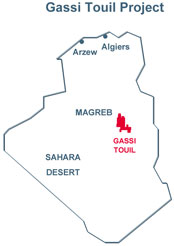

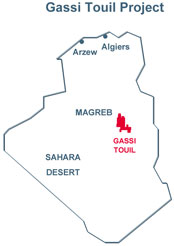

A notable development under the agreement between GAS NATURAL and Repsol YPF for the exploration, production, liquefaction, transportation, trading and wholesale supply of liquefied natural gas (LNG) is the joint development of the Gassi Chergui exploration project in Algeria and the integrated project to explore, produce and supply LNG in Gassi Touil (Algeria), which includes building a gas liquefaction plant in Arzew with a capacity of 5.2 bcm per year that can be extended in the future with a second train; the company which will take charge of plant construction and operation, Sociedad de Licuefacción (SDL), was incorporated recently, with GAS NATURAL owning 32%.

21

| | |

GAS NATURAL First Quarter Results 2006 | |  |

Plant design and construction are scheduled to take 54 months.

Conceptual engineering of the plant and port installations was completed in 2005. Geotechnical and seismic studies and environmental impact studies have been conducted for the site and the contracts have been awarded for the principal items of equipment.

Additionally, for the development of the Gassi Touil, Rhourde Nouss and Hamra areas, a seismic survey is under way (the most ambitious yet undertaken in Algeria) and an intense drilling programme is being prepared for commencement towards mid-2006. At the same time, work is proceeding on the design and construction of the gas production and processing facilities.

Exploration work is also being conducted in those areas to discover additional hydrocarbon reserves for subsequent development and production so as to feed a second liquefaction train.

Through Stream, their international LNG joint venture, GAS NATURAL and Repsol YPF have signed an agreement with the Nigerian government for the development of a major LNG project in that country.

The agreement sets the conditions for the construction and operation of an LNG plant in Nigeria with an initial capacity of 7 million tonnes per year (equivalent to approximately 10 bcm of natural gas) and for the acquisition and development of gas reserves to feed the plant. The initiative will ensure gas supplies in the long term.

This is one of the most important agreements ever signed by a Spanish company in the field of LNG, because of the volume of gas and the strategic location of the future plant in relation to the gas markets for the Atlantic and Mediterranean fields.

In April 2006, GAS NATURAL and Repsol YPF signed a 20-year standard time charter for a gas tanker which will come into service in 2009 to cover projected LNG shipping needs.

GAS NATURAL filed an application with the Italian Industry Ministry for permission to develop projects to build two regasification plants in Italy (Trieste and Taranto). The two projects are similar, consisting of two tanks with a capacity of 150,000 m3 and a regasification capacity of 8 bcm per year each.

4.6.2.-Wholesale & Retail

This area includes wholesale and retail gas supply in Spain and other countries, and the supply of other related products and services in Spain.

The supply of gas to other distributors corresponds to supplies to Enagás for the regulated gas distribution market.

22

| | |

GAS NATURAL First Quarter Results 2006 | |  |

4.6.2.1- Results

| | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 | | % |

Net sales | | 2,079.7 | | 1,407.5 | | 47.8 |

Purchases | | -2,022.9 | | -1,387.7 | | 45.8 |

Personnel costs, net | | -5.8 | | -4.7 | | 23.4 |

Other expenses/income | | -25.9 | | -1.6 | | — |

| | | | | | |

EBITDA | | 25.1 | | 13.5 | | 85.9 |

| | | | | | |

Charge for depreciation and amortisation | | -1.7 | | -1.2 | | 41.7 |

Variation in operating provisions | | -0.8 | | -0.6 | | 33.3 |

| | | | | | |

Operating income | | 22.6 | | 11.7 | | 93.2 |

| | | | | | |

Net sales in the gas supply business totalled €2,132.7 million, a 51.5% increase on 1Q06.

EBITDA in the first quarter of 2006 amounted to €25.1 million, compared with €13.5 million in the same period of 2005 (an 85.9% increase).

Under Order ITC 4101/2005, dated 27 December, which also establishes the natural gas tariffs for 2006, the raw material cost calculation structure includes the supply cost expected in the winter months (in line with that recognised in Order ITC 3321/2005, dated 27 October), which improves price discovery in the liberalised market. The raw material cost was increased by 14%.

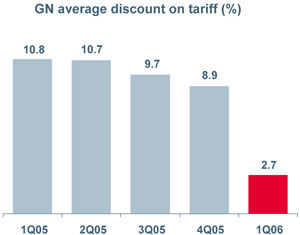

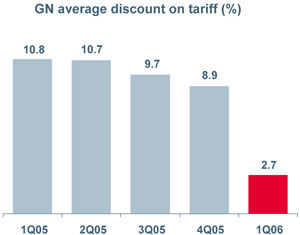

As a result of measures adopted to favour liberalisation, the recognition of raw material costs, convergence towards international prices, plus the commercial policy applied by GAS NATURAL, EBITDA continued the positive trend that commenced in mid-2005.

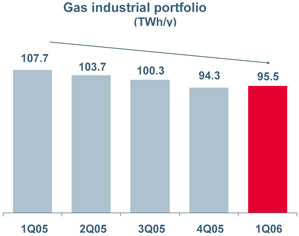

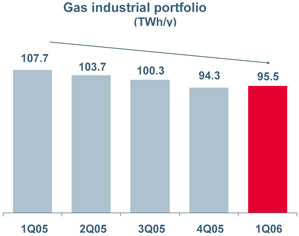

GAS NATURAL is maintaining its commercial policy oriented towards optimising its portfolio of liberalised market gas contracts and its discount policy in order to adapt to current market conditions. In this connection, the portfolio of contracts has been cut to 95.5 TWh/year in the last twelve months (from 107.7 TWh/year).

23

| | |

GAS NATURAL First Quarter Results 2006 | |  |

Additionally, the average discount on the industrial tariff was 2.7% in 1Q06, compared with 10.8% in 1Q05.

4.6.2.2.- Main aggregates

The main aggregates in the procurement and supply activity are as follows:

| | | | | | |

| | | 1T06 | | 1T05 | | % |

Gas supply (GWh): | | 96,633 | | 89,458 | | 8.0 |

Spain: | | 83,891 | | 76,103 | | 10.2 |

Regulated market | | 23,555 | | 23,843 | | -1.2 |

Liberalised market: | | 60,336 | | 52,260 | | 15.5 |

GAS NATURAL | | 51,544 | | 41,094 | | 25.4 |

Supply to third parties | | 8,792 | | 11,166 | | -21.3 |

International: | | 12,742 | | 13,355 | | -4.6 |

USA | | 7,387 | | 8,981 | | -17.7 |

Supply Europe | | 5,355 | | 4,374 | | 22.4 |

| | | | | | |

Multiutility contracts (at 31/03) | | 2,322,676 | | 1,900,886 | | 22.2 |

| | | | | | |

Contracts per customer (at 31/03) | | 1.48 | | 1.41 | | 5.0 |

| | | | | | |

A total of 96,633 GWh of natural gas was procured and supplied wholesale, with a 8.0% growth; 83,891 GWh were sold in the Spanish market (+10.2%) and the other 12,742 GWh were sold in other countries (-4.6%).

Wholesale gas supplies for the regulated market are sold to Enagás which, in addition to inventory management, supplies the gas to distribution companies, both those in the GAS NATURAL group and third parties; despite greater market opening, the total amount decreased by 1.2% to 23,555 GWh, basically because certain power plants and industrial customers abandoned the liberalised market and took shelter in the regulated market.

Sales to the liberalised market amounted to 60,336 GWh, a 15.5% increase on 1Q05. Of those sales, 51,544 GWh were to end customers of GAS NATURAL, mainly in the industrial market, as well as to CCGTs and households (25.4% more than in 1Q05). GAS NATURAL sold 8,792 GWh of gas for supply to the liberalised market by other supply companies (a 21.3% decrease).

Despite a sharp increase in gas supply in Europe (+22.4%), international wholesale gas procurements fell by 4.6% due to lower sales to the US and a reduction in their frequency with respect to 1Q05.

In GAS NATURAL’s multi-utility area, close to 83,000 gas maintenance contracts were added in 2006, making a total of 1,508,000 contracts in force at 31 March 2006.

GAS NATURAL continues to develop products and services based on off-line and on-line marketing channels. At 31 March 2005, GAS NATURAL had 166 franchise centres, one company-owned centre and 717 associated centres—a powerful sales network that is unmatched in Spain.

At 31 March 2006, GAS NATURAL had close to 2,323,000 product and service contracts other than for gas sales, which include financial services and the sale of electricity; this represents a 22.2% increase on 31 March 2005; consequently, there were 1.48 contracts per customer in Spain.

Because of marketing efforts, the number of homes with gas heating increased by about 7,400, and 8,800 appliances were sold, including over 1,400 air conditioning systems.

24

| | |

GAS NATURAL Significant events and other disclosures | |  |

Summarised below are the significant events and other disclosures to the CNMV from 1 January 2006 to this date:

| | • | | GAS NATURAL files press advertisement announcing the interim dividend payment (disclosed 3 January 2006). |

| | • | | GAS NATURAL respects the Competition Tribunal’s decision but reiterates that the tender offer for Endesa does not pose any competition problems (disclosed 5 January 2006). |

| | • | | In a visit to Galicia by the Group’s Human Resources Manager and Strategy & Development Manager, GAS NATURAL states that the tender offer will not have an impact on jobs or investments in Galicia (disclosed 13 January 2006). |

| | • | | GAS NATURAL files a copy of the order by the President of the Court of First Instance of the European Communities dated 1 February 2006 (disclosed 2 February 2006). |

| | • | | The Board of Directors of GAS NATURAL will study whether or not it will accept the conditions imposed by the Spanish Cabinet in order to go ahead with the tender offer (disclosed 3 February 2006). |

| | • | | GAS NATURAL announces that it will hold a press conference to inform the media about the decision made by the extraordinary Board of Directors meeting regarding the conditions imposed by the Spanish Cabinet on the tender offer for Endesa (disclosed 6 February 2006). |

| | • | | On 6 February 2006, the Board of Directors of GAS NATURAL resolves to continue with the tender offer in view of the Spanish Cabinet’s decision to impose certain conditions regarding the economic concentration consisting of GAS NATURAL taking exclusive control of Endesa (disclosed 6 February 2006). |

| | • | | GAS NATURAL files the presentation from the press conference held on 6 February 2006 (disclosed 6 February 2006). |

| | • | | On 6 February 2006, the Board of Directors of GAS NATURAL appoints Miguel Valls Maseda (independent director) as member of the Board of Directors’ Audit & Control Committee in place of José Luis Jové Vintró (proprietary director) (disclosed 7 February 2006). |

| | • | | GAS NATURAL announces the start-up of the Escombreras (Cartagena) 1,200 MW combined cycle plant (disclosed 16 February 2006). |

| | • | | GAS NATURAL files the invitation to the conference call to the 2005 results (disclosed 17 February 2006). |

| | • | | In response to the tender offer made by German company E.On for Endesa, GAS NATURAL issues a communiqué stating that its tender offer is going ahead as planned, in line with the initially-planned approval periods (disclosed 21 February 2006). |

| | • | | The Board of Directors analyses the recent changes in the energy sector regulations and maintains its decision to continue with the tender offer for the stock of Endesa, S.A. (disclosed 28 February 2006). |

| | • | | GAS NATURAL files documentation on the publication of its 2005 results (disclosed 1 March 2005). |

| | • | | GAS NATURAL files its presentation of 2005 results in both Spanish and English (disclosed 1 March 2006). |

25

| | |

GAS NATURAL Significant events and other disclosures | |  |

| | • | | The CNMV indicates the acceptance period for the takeover bid for Endesa (disclosed 6 March 2006), |

| | • | | The Board of Directors of Gas Natural SDG decides to hold an Extraordinary Shareholders’ Meeting on 7 April (disclosed 6 March 2006). |

| | • | | GAS NATURAL files the documentation made available to shareholders for the Extraordinary Shareholders’ Meeting (disclosed 7 March 2006). |

| | • | | GAS NATURAL rejects the statement by José María Cuevas, Chairman of the Spanish industry federation CEOE (disclosed 9 March 2006). |

| | • | | The Gassi Touil LNG project in Algeria commences (disclosed 14 March 2006). |

| | • | | GAS NATURAL will analyse the precautionary measures ordered by the Madrid Provincial Court (disclosed 21 March 2006). |

| | • | | GAS NATURAL will study the decision in the order before taking the legal steps it considers appropriate to defend its interests and those of its shareholders (disclosed 21 March 2006). |

| | • | | GAS NATURAL resolves to propose that the Shareholders’ Meeting increase the dividend by 18.3% and pay a total of €0.84 gross per share out of 2005 income, €0.31 of which were paid in January (disclosed 31 March 2006). |

| | • | | GAS NATURAL acquires 100% of Petroleum Oil and Gas España S.A. (disclosed 31 March 2006). |

| | • | | GAS NATURAL and Repsol YPF sign a framework agreement to develop a macro LNG project in Nigeria (disclosed 7 April 2006). |

| | • | | GAS NATURAL files the presentation given at the press conference on the occasion of the Extraordinary Shareholders’ Meeting (disclosed 7 April 2006). |

| | • | | GAS NATURAL files the presentation give at the Extraordinary Shareholders’ Meeting (disclosed 7 April 2006). |

| | • | | GAS NATURAL files the documentation provided to shareholders at the Extraordinary Shareholders’ Meeting (disclosed 7 April 2006). |

| | • | | GAS NATURAL files the press release issued on the occasion of the Extraordinary Shareholders’ Meeting (disclosed 7 April 2006). |

| | • | | The Extraordinary Shareholders’ Meeting approves all the items on the Agenda contained in the notice of meeting (disclosed 7 April 2006). |

| | • | | GAS NATURAL will examine the grounds and consequences of the Supreme Court decision (disclosed 21 April 2006). |

| | • | | The Board of Directors of Gas Natural SDG resolves to hold the Ordinary Shareholders’ Meeting on 8 June (disclosed 5 May 2006). |

| | • | | GAS NATURAL files the documentation made available to shareholders for the Ordinary Shareholders’ Meeting (disclosed 5 May 2006). |

| | • | | GAS NATURAL and Repsol YPF charter another LNG tanker ship. (disclosed 8 May 2006). |

26

| | |

GAS NATURAL Annexes | |  |

| | • | | GAS NATURAL: CONSOLIDATED PROFIT & LOSS ACCOUNT |

| | • | | GAS NATURAL: ANALYSIS OF RESULTS BY ACTIVITY |

| | • | | GAS NATURAL: CONSOLIDATED BALANCE SHEET |

| | • | | GAS NATURAL: CONSOLIDATED CASH FLOW STATEMENT |

27

| | |

GAS NATURAL Consolidated profit & loss account | |  |

| | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 |

Net sales | | 3,107.1 | | 2,045.4 |

Other revenues | | 19.9 | | 22.1 |

Purchases | | -2,371.0 | | -1,478.9 |

Personnel costs, net | | -72.0 | | -56.1 |

Other costs | | -176.1 | | -139.6 |

| | | | |

EBITDA | | 507.9 | | 392.9 |

Depreciation and amortization of fixed assets | | -141.4 | | -112.8 |

Change in operating provisions | | -8.3 | | -3.7 |

| | | | |

OPERATING INCOME | | 358.2 | | 276.4 |

Financial results, net | | -67.5 | | -47.9 |

Net loss from assets deterioration | | — | | — |

Equity income | | 1.5 | | 11.5 |

Gains on disposal on non current assets | | 98.8 | | 104.8 |

| | | | |

CONSOLIDATED PRE-TAX PROFIT | | 391.0 | | 344.8 |

Corporate income tax | | -95.5 | | -92.0 |

Minority interest | | -18.8 | | -14.8 |

| | | | |

PROFIT ATTRIBUTABLE TO THE GROUP | | 276.7 | | 238.0 |

| | | | |

28

| | |

GAS NATURAL Analysis of results by activity | |  |

EBITDA

| | | | | | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 2Q06 | | 3Q06 | | 4Q06 | | 2006 |

DISTRIBUTION | | 330.9 | | | | | | | | 330.9 |

Spain | | 217.6 | | | | | | | | 217.6 |

Latin America | | 92.5 | | | | | | | | 92.5 |

Italy | | 20.8 | | | | | | | | 20.8 |

ELECTRICITY | | 89.1 | | | | | | | | 89.1 |

Spain | | 71.0 | | | | | | | | 71.0 |

Puerto Rico | | 18.1 | | | | | | | | 18.1 |

GAS | | 79.7 | | | | | | | | 79.7 |

Up + Midstream | | 54.6 | | | | | | | | 54.6 |

Wholesale & Retail | | 25.1 | | | | | | | | 25.1 |

REST | | 8.2 | | | | | | | | 8.2 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 507.9 | | | | | | | | 507.9 |

| | | | | | | | | | |

|

| (unaudited) |

(€ Mn) | | 1Q05 | | 2Q05 | | 3Q05 | | 4Q05 | | 2005 |

DISTRIBUTION | | 292.3 | | 253.9 | | 275.5 | | 300.1 | | 1,121.8 |

Spain | | 210.7 | | 180.2 | | 192.4 | | 194.5 | | 777.8 |

Latin America | | 64.8 | | 72.6 | | 82.5 | | 96.8 | | 316.7 |

Italy | | 16.8 | | 1.1 | | 0.6 | | 8.8 | | 27.3 |

ELECTRICITY | | 34.9 | | 31.3 | | 55.1 | | 30.7 | | 152.0 |

Spain | | 22.1 | | 15.9 | | 38.8 | | 13.0 | | 89.8 |

Puerto Rico | | 12.8 | | 15.4 | | 16.3 | | 17.7 | | 62.2 |

GAS | | 57.4 | | 50.3 | | 55.4 | | 73.7 | | 236.8 |

Up + Midstream | | 43.9 | | 39.4 | | 41.7 | | 50.6 | | 175.6 |

Wholesale & Retail | | 13.5 | | 10.9 | | 13.7 | | 23.1 | | 61.2 |

REST | | 8.3 | | -1.4 | | 7.8 | | -6.5 | | 8.2 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 392.9 | | 334.1 | | 393.8 | | 398.0 | | 1,518.8 |

| | | | | | | | | | |

29

| | |

GAS NATURAL Analysis of results by activity | |  |

Operating income

| | | | | | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 2Q06 | | 3Q06 | | 4Q06 | | 2006 |

DISTRIBUTION | | 230.8 | | | | | | | | 230.8 |

Spain | | 152.8 | | | | | | | | 152.8 |

Latin America | | 63.9 | | | | | | | | 63.9 |

Italy | | 14.1 | | | | | | | | 14.1 |

ELECTRICITY | | 63.1 | | | | | | | | 63.1 |

Spain | | 52.4 | | | | | | | | 52.4 |

Puerto Rico | | 10.7 | | | | | | | | 10.7 |

GAS | | 64.1 | | | | | | | | 64.1 |

Up + Midstream | | 41.5 | | | | | | | | 41.5 |

Wholesale & Retail | | 22.6 | | | | | | | | 22.6 |

REST | | 0.2 | | | | | | | | 0.2 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 358.2 | | | | | | | | 358.2 |

| | | | | | | | | | |

|

| (unaudited) |

(€ Mn) | | 1Q05 | | 2Q05 | | 3Q05 | | 4Q05 | | 2005 |

DISTRIBUTION | | 207.3 | | 162.3 | | 181.3 | | 201.7 | | 752.6 |

Spain | | 148.0 | | 114.4 | | 127.1 | | 127.8 | | 517.3 |

Latin America | | 47.5 | | 51.8 | | 60.9 | | 68.7 | | 228.9 |

Italy | | 11.8 | | -3.9 | | -6.7 | | 5.2 | | 6.4 |

ELECTRICITY | | 24.6 | | 11.7 | | 39.8 | | 12.3 | | 88.4 |

Spain | | 16.3 | | 1.3 | | 27.4 | | -0.1 | | 44.9 |

Puerto Rico | | 8.3 | | 10.4 | | 12.4 | | 12.4 | | 43.5 |

GAS | | 44.1 | | 37.1 | | 35.5 | | 56.5 | | 173.2 |

Up + Midstream | | 32.4 | | 27.4 | | 29.8 | | 38.1 | | 127.7 |

Wholesale & Retail | | 11.7 | | 9.7 | | 5.7 | | 18.4 | | 45.5 |

REST | �� | 0.4 | | -16.2 | | -5.8 | | -24.0 | | -45.6 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 276.4 | | 194.9 | | 250.8 | | 246.5 | | 968.6 |

| | | | | | | | | | |

30

| | |

GAS NATURAL Analysis of results by activity | |  |

Tangible investments

| | | | | | | | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 2Q06 | | 3Q06 | | 4Q06 | | 2006 |

DISTRIBUTION | | 95.2 | | | | | | | | 95.2 |

Spain | | 57.1 | | | | | | | | 57.1 |

Latin America | | 23.2 | | | | | | | | 23.2 |

Italy | | 14.9 | | | | | | | | 14.9 |

ELECTRICITY | | 104.0 | | | | | | | | 104.0 |

Spain | | 99.9 | | | | | | | | 99.9 |

Puerto Rico | | 4.1 | | | | | | | | 4.1 |

GAS | | 28.5 | | | | | | | | 28.5 |

Up + Midstream | | 26.7 | | | | | | | | 26.7 |

Wholesale & Retail | | 1.8 | | | | | | | | 1.8 |

REST | | 3.8 | | | | | | | | 3.8 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 231.5 | | | | | | | | 231.5 |

| | | | | | | | | | |

|

| (unaudited) |

(€ Mn) | | 1Q05 | | 2Q05 | | 3Q05 | | 4Q05 | | 2005 |

DISTRIBUTION | | 79.7 | | 152.8 | | 153.1 | | 225.8 | | 611.4 |

Spain | | 45.3 | | 90.5 | | 86.7 | | 131.7 | | 354.2 |

Latin America | | 25.6 | | 43.7 | | 47.6 | | 73.8 | | 190.7 |

Italy | | 8.8 | | 18.6 | | 18.8 | | 20.3 | | 66.5 |

ELECTRICITY | | 162.5 | | 101.8 | | 89.7 | | 95.8 | | 449.8 |

Spain | | 160.1 | | 100.9 | | 89.5 | | 95.5 | | 446.0 |

Puerto Rico | | 2.4 | | 0.9 | | 0.2 | | 0.3 | | 3.8 |

GAS | | 3.2 | | 4.0 | | 7.9 | | 18.4 | | 33.5 |

Up + Midstream | | 1.5 | | 1.4 | | 4.3 | | 10.0 | | 17.2 |

Wholesale & Retail | | 1.7 | | 2.6 | | 3.6 | | 8.4 | | 16.3 |

REST | | 4.4 | | 2.9 | | 7.6 | | 15.8 | | 30.7 |

| | | | | | | | | | |

TOTAL GAS NATURAL | | 249.8 | | 261.5 | | 258.3 | | 355.8 | | 1,125.4 |

| | | | | | | | | | |

31

| | |

GAS NATURAL Analysis of results by activity | |  |

Main aggregates in Latin America (GWh)

| | | | | | | | | | |

| | | 1Q06 | | 2Q06 | | 3Q06 | | 4Q06 | | 2006 |

Argentina- | | | | | | | | | | |

Gas activity sales: | | 18,224 | | | | | | | | 18,224 |

Gas sales: | | 5,476 | | | | | | | | 5,476 |

Residential | | 1,834 | | | | | | | | 1,834 |

Industrial | | 1,878 | | | | | | | | 1,878 |

Automotion | | 1,764 | | | | | | | | 1,764 |

TPA | | 12,748 | | | | | | | | 12,748 |

| | | | | | | | | | |

Brazil- | | | | | | | | | | |

Gas sales: | | 1,283 | | | | | | | | 11,283 |

Residential | | 453 | | | | | | | | 453 |

Industrial | | 5,326 | | | | | | | | 5,326 |

Electricity companies | | 3,174 | | | | | | | | 3,174 |

Automotion | | 2,330 | | | | | | | | 2,330 |

| | | | | | | | | | |

Colombia- | | | | | | | | | | |

Gas sales: | | 3,024 | | | | | | | | 3,024 |

Residential | | 1,457 | | | | | | | | 1,457 |

Industrial | | 1,212 | | | | | | | | 1,212 |

Automotion | | 355 | | | | | | | | 355 |

| | | | | | | | | | |

Mexico- | | | | | | | | | | |

Gas activity sales: | | 10,694 | | | | | | | | 10,694 |

Gas sales: | | 4,713 | | | | | | | | 4,713 |

Residential | | 2,203 | | | | | | | | 2,203 |

Industrial | | 2,488 | | | | | | | | 2,488 |

Automotion | | 22 | | | | | | | | 22 |

TPA | | 5,981 | | | | | | | | 5,981 |

| | | | | | | | | | |

| | | | | |

| | | 1Q05 | | 2Q05 | | 3Q05 | | 4Q05 | | 2005 |

Argentina- | | | | | | | | | | |

Gas activity sales: | | 16,550 | | 18,067 | | 17,481 | | 17,261 | | 69,359 |

Gas sales: | | 4,268 | | 8,094 | | 10,174 | | 5,891 | | 28,427 |

Residential | | 1,697 | | 4,686 | | 6,957 | | 3,337 | | 16,676 |

Industrial | | 874 | | 1,413 | | 1,246 | | 598 | | 4,131 |

Automotion | | 1,697 | | 1,995 | | 1,971 | | 1,957 | | 7,620 |

TPA | | 12,282 | | 9,973 | | 7,307 | | 11,370 | | 40,932 |

| | | | | | | | | | |

Brazil- | | | | | | | | | | |

Gas sales: | | 10,035 | | 9,706 | | 11,240 | | 12,299 | | 43,280 |

Residential | | 436 | | 492 | | 536 | | 513 | | 1,977 |

Industrial | | 4,627 | | 4,848 | | 5,319 | | 5,512 | | 20,306 |

Electricity companies | | 3,020 | | 2,297 | | 3,198 | | 3,904 | | 12,419 |

Automotion | | 1,952 | | 2,069 | | 2,187 | | 2,370 | | 8,578 |

| | | | | | | | | | |

Colombia- | | | | | | | | | | |

Gas sales: | | 2,559 | | 2,748 | | 2,877 | | 3,013 | | 11,197 |

Residential | | 1,289 | | 1,363 | | 1,415 | | 1,427 | | 5,494 |

Industrial | | 1,028 | | 1,101 | | 1,120 | | 1,242 | | 4,491 |

Automotion | | 242 | | 284 | | 342 | | 344 | | 1,212 |

| | | | | | | | | | |

Mexico- | | | | | | | | | | |

Gas activity sales: | | 10,436 | | 10,054 | | 10,219 | | 10,863 | | 41,572 |

Gas sales: | | 4,533 | | 3,926 | | 4,058 | | 4,470 | | 16,987 |

Residential | | 2,362 | | 1,734 | | 1,521 | | 2,025 | | 7,642 |

Industrial | | 2,149 | | 2,168 | | 2,514 | | 2,421 | | 9,252 |

Automotion | | 22 | | 24 | | 23 | | 24 | | 93 |

TPA | | 5,903 | | 6,128 | | 6,161 | | 6,393 | | 24,585 |

| | | | | | | | | | |

32

| | |

GAS NATURAL Consolidated balance sheet | |  |

| | | | |

| (unaudited) |

(€ Mn) | | 31/03/06 | | 31/03/055 |

Non-Current Assets- | | 10,433.7 | | 8,814.5 |

Tangible assets | | 7,696.9 | | 6,662.6 |

Goodwill | | 450.3 | | 341.6 |

Other intangible assets | | 1,352.4 | | 1,025.9 |

Investment in associated companies | | 33.1 | | 251.6 |

Other non-current assets | | 901.0 | | 532.8 |

Current Assets- | | 3,433.8 | | 2,666.9 |

Inventories | | 350.4 | | 197.2 |

Debtors and other accounts receivable | | 2,659.9 | | 2,077.9 |

Other current assets | | 124.6 | | 130.3 |

Cash and cash equivalent | | 298.9 | | 261.5 |

| | | | |

TOTAL ASSETS | | 13,867.5 | | 11,481.4 |

| | | | |

|

| (unaudited) |

(€ Mn) | | 31/03/06 | | 31/03/05 |

Shareholders’ Equity- | | 5,973.4 | | 5,097.5 |

Equity of Parent Company | | 5,618.7 | | 4,856.6 |

Minority interest | | 354.7 | | 240.9 |

Non-Current Liabilities- | | 4,787.9 | | 3,797.1 |

Non-current financial debt | | 2,948.4 | | 2,369.0 |

Provisions | | 442.4 | | 259.2 |

Other non-current liabilities | | 1,397.1 | | 1,168.9 |

Current Liabilities- | | 3,106.2 | | 2,586.8 |

Current financial debt | | 747.7 | | 512.7 |

Accounts payable and other current liabilities | | 2,358.5 | | 2,074.1 |

| | | | |

TOTAL LIABILITIES | | 13,867.5 | | 11,481.4 |

| | | | |

| 5 | As reported in the 3Q05 results, the analysis of the acquisitions in 2004 of 25.39% of CEG and 33.75% of CEG Rio and the assignment of the price under IFRS 3 - Business Combinations were completed after the presentation of the 1Q05 results. In the comparative information at 31 March 2005, the goodwill arising from the acquisitions of CEG and CEG Rio, amounting to €124.0 million, was reclassified as other intangible assets. |

33

| | |

GAS NATURAL Consolidated Cash Flow Statement | |  |

| | | | |

| (unaudited) |

(€ Mn) | | 1Q06 | | 1Q05 |

Cash flow from ordinary activities | | 626.2 | | 454.6 |

| | | | |

Operating income | | 358.2 | | 276.4 |

Depreciation and amortization of fixed assets | | 149.7 | | 116.5 |

Deferred revenues recognised in income | | -8.9 | | -7.6 |

Variation in working capital and other changes | | 192.9 | | 115.7 |

Interest and taxes paid | | -65.7 | | -46.4 |

| | | | |

Investment cash flow | | -278.3 | | -253.1 |

| | | | |

Acquisition of companies | | -23.7 | | — |

Acquisition of tangible assets | | -413.3 | | -407.9 |

Other acquisitions and transfers | | -13.3 | | -29.9 |

Revenue from disposal of non-current assets | | 139.1 | | 162.1 |

Dividends and interest received | | 7.3 | | 14.3 |

Deferred revenues received | | 25.6 | | 8.3 |

| | | | |

Financing cash flow | | -245.3 | | -152.8 |

| | | | |

Net financial debt received/cancelled | | -98.6 | | -22.4 |

Dividends paid | | -138.8 | | -123.8 |

Other debt received/cancelled | | -7.9 | | -6.6 |

| | | | |

Exchange rate effect on cash and cash equivalents | | -4.5 | | 6.4 |

| | | | |

Net change in cash and cash equivalents | | 98.1 | | 55.1 |

| | | | |

Beginning cash and cash equivalents | | 200.8 | | 206.4 |

Net change in cash and cash equivalents | | 98.1 | | 55.1 |

Ending cash and cash equivalents | | 298.9 | | 261.5 |

| | | | |

34

| | |

GAS NATURAL | |  |

Investor Relations

Av. Portal de l’Àngel, 20

08002 Barcelona

SPAIN

| | |

| Telephone | | +34 934 025 891 |

| Fax | | +34 934 025 896 |

e-mail:

relinversor@gasnatural.com

Internet:

www.gasnatural.com

35

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | | | GAS NATURAL SDG, S.A. |

| | | |

| Date: May 9, 2006 | | | | By: | | /s/ Carlos J. Álvarez Fernández |

| | | | | | Name: Carlos J. Álvarez Fernández |

| | | | | | Title: Chief Financial Officer |