FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2006

Commission File Number: 333-132076

GAS NATURAL SDG, S.A.

(Translation of Registrant’s Name into English)

Av. Portal de L’Angel, 20-22

08002 Barcelona, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):N/A

8 June 2006 Annual General Meeting 2006 Press Conference |

Disclaimer In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800. This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things: • management strategies; • synergies and cost savings; • integration of the businesses; • market position; • expected gas and electricity mix and volume increases; • planned asset disposals and capital expenditures; • net debt levels and EBITDA and earnings per share growth; • dividend policy; and • timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding-looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. |

Agenda 1. 2005 and 1 Quarter 2006 Results 2. State of the Energy Markets 3. Tender Offer for Endesa 4. Strategic Positioning 5. Conclusions st |

2005 and 1 Quarter 06 Results st |

4 2005 Operating review 317,555 GWh Gas supply 10.2% Gas distribution 9.7% 100,150 Km Distribution network 5.2% Main gas figures 422,912 GWh Note: 1 As of 31st December 2005 1 |

5 2005 Operating review Main electricity figures 3,373 MW Installed capacity 10,466 GWh Electricity produced 43.9% 6,296 GWh Electricity sales in Spain 41.3% 194.6% |

6 615,000 new clients 10.2 million clients in the world 6.4% Main client figures 2005 Operating review Note: 1 Spain, Italy and Latinamerica 1 |

7 1,519 million euro EBITDA 13.7% 749 million euro Net Income 16.7% Exceeding the objectives set in the 2004 - 2008 Strategic Plan 2005 Operating review Main financial figures |

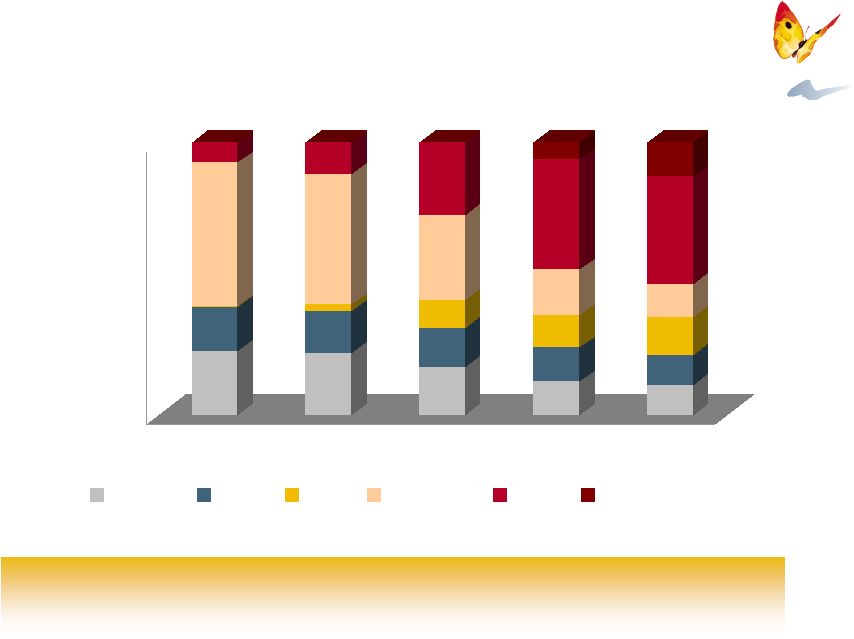

8 (€ million) 2004 974 722 228 24 98 44 54 251 144 107 12 1,335 2005 1,122 778 317 27 152 90 62 237 176 61 8 1,519 15.2 7.7 39.0 14.2 54.9 102.7 15.6 -5.8 21.6 -42.8 -31.1 13.7 % EBITDA breakdown Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Up + Midstream Wholesale and Retail Other Total EBITDA 2005 financial results Note: Figures rounded to closest million euro |

9 1,188 million euro Tangible and intangible investments 17.8% DERSA acquisition Financial investments 296 million euro Distribution 52% Other 6% Gas 4% Electricity 38% 2005 financial results |

10 Dividend proposal 0.33 0.40 0.60 0.71 0.84 2001 2002 2003 2004 2005 (€ / share) CAGR +26.3% +18.3% Note: 1 The year represents the fiscal year against which results the dividend is declared Dividend per share 2005 financial results Sustained growth of shareholder remuneration through dividend increase 1 |

11 Strong financial performance in 2005 despite a difficult market environment and operating conditions Conclusions Strong EBITDA, Net Income and Dividend, growth based on cash generation Positive trends shown in 2005 expected to materialise in 2006, boosting growth and profitability 2005 financial results We continue to exceed the targets set in our 2004-2008 Strategic Plan |

12 508 million euro EBITDA 29.3% 277 million euro Net Income 16.3% Exceeding the objectives set in the 2004 - 2008 Strategic Plan 2006 1 Quarter results Main financial magnitudes st |

13 2006 1 Quarter results Advances in Upstream LNG agreement in Nigeria Acquisition of Petroleum Oil & Gas España New Gas conditions Improved client portfolio EBITDA +85.9% Electricity contribution Installed capacity in Spain x2 Improved client portfolio EBITDA +221.3% Distribution Continued solid growth and profitability EBITDA +13.2% Note: Growth rates calculated versus Q105 st |

14 292 211 65 17 35 22 13 57 44 14 8 393 331 218 93 21 89 71 18 80 55 25 8 508 13.2 3.3 42.7 23.8 155.3 221.3 41.4 38.9 24.4 85.9 (1.2) 29.3 Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Up + Midstream Wholesale & Retail Other Total EBITDA 2006 1 Quarter results Q106 Q105 Change (%) (€ million) EBITDA breakdown Note: Figures rounded to the closest million st |

15 The positive trends shown in 2005 are materialising in 2006, boosting growth and profitability 2006 1 Quarter results Consolidation of GAS NATURAL’s presence in electricity generation Exceeding the objectives set in the 2004 - 2008 Strategic Plan Double digit Growth in EBITDA and Net Income based on cash generation Solid and growing distribution business Advances in the development of equity gas st |

State of the Energy Markets |

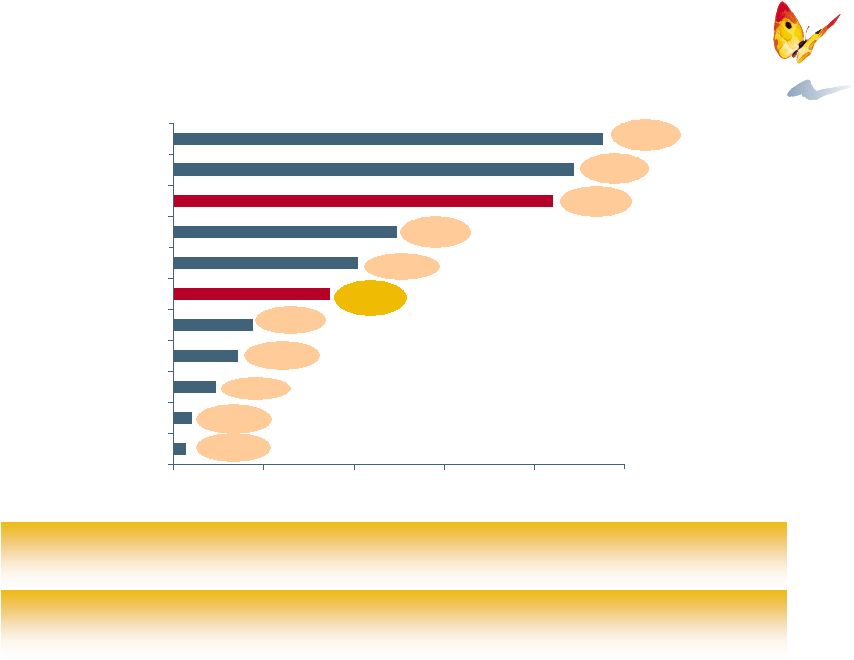

17 0 20 40 60 80 100 Greece Ireland Austria Hungary Belgium Spain Holland France Italy Germany United Kingdom (Bcm) +3% +4% +5% +2% +14% +0% +3% +4% +1% (3%) +6% Gas demand in Europe has grown as a consequence of the low maturity of some markets and the introduction of CCGTs Gas demand in Europe Source: Eurogas The Spanish market has been the main growth contributor in the European gas market Gas demand in main European countries in 2005 (2005 and annual growth versus 2000) |

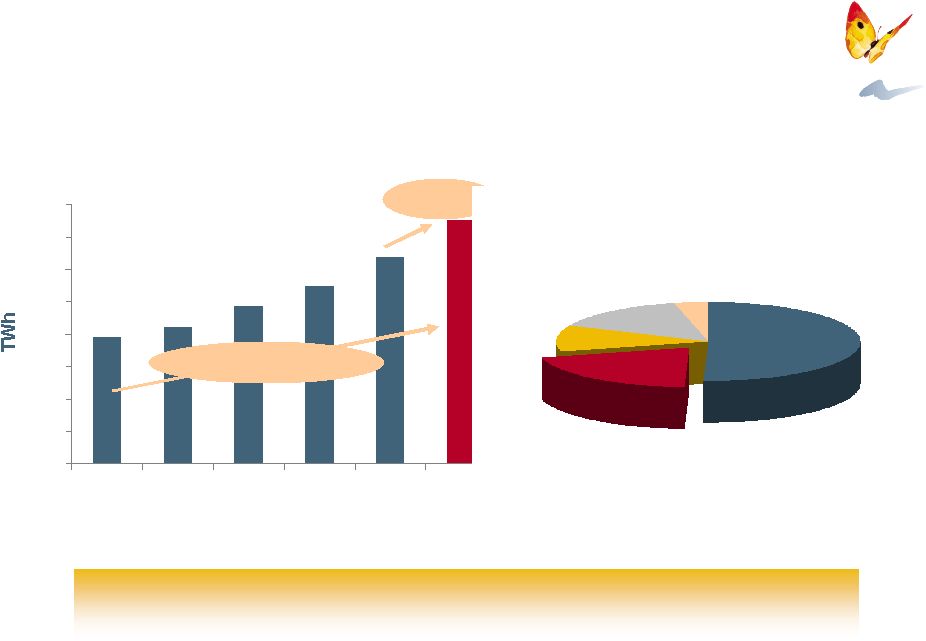

18 0 50 100 150 200 250 300 350 400 2000 2001 2002 2003 2004 2005 Gas demand growth in Europe Source: CNE (Monthly bulletin on natural gas statistics) Gas demand evolution in Spain Continued growth in Spanish gas demand during the past years Spanish energy matrix (2005) Source: Quarterly bulletin on energy situation, Ministry of Industry, tourism and commerce +17.6% CAGR: +13.8% Natural gas 20% Nuclear 11% Coal 15% Oil 51% Gas natural 20% Hydro, Renewables & Other 4% |

19 0 50 100 150 200 250 300 2000 2001 2002 2003 2004 2005 Electricity demand growth in Spain Source: Red Eléctrica Electricity demand has grown over 4% annually during the past years +4.3% Electricity demand evolution in Spain Electricity production mix (2005) Source: Red Eléctrica, peninsular system, ordinary regime CAGR: +4.8% Fuel-Gas Coal 29% Nuclear 22% 4% Wind 8% Hydro 7% Other renewable 12% CCGT 18% |

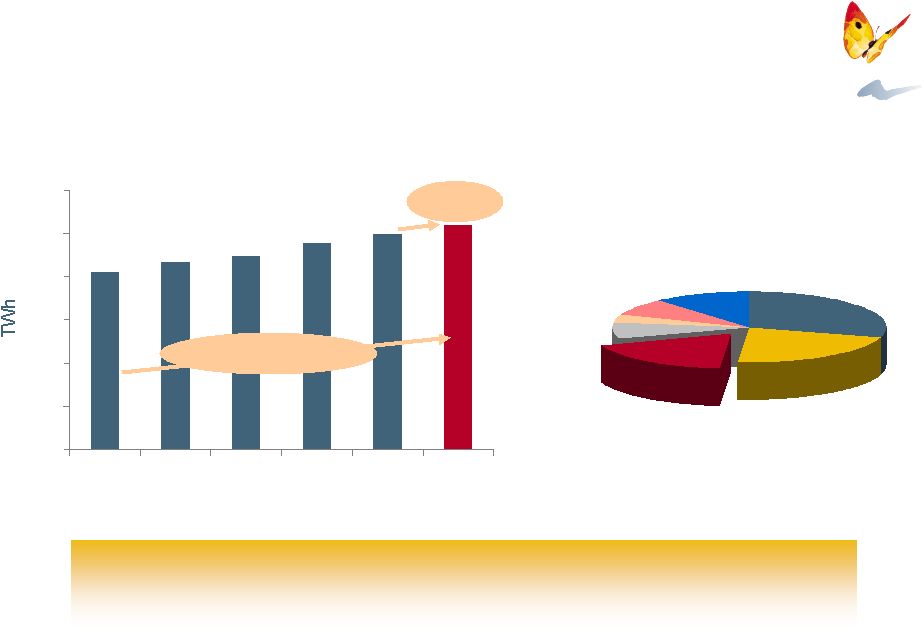

20 2004 2005 Liberalisation of the Spanish energy markets The gas market has advanced more than the electricity market in terms of real liberalisation Electricity market (volume) Source: CNE monthly bulletin Gas market (volume) Source: CNE 2005 information bulletin +13p.p. Regulated Liberalised 30% 70% 17% 83% 2004 2005 66% 34% 62% 38% +4p.p. |

21 Evolution in the liberalisation of the gas sector Regulated tariffs to disappear by 2008 Separation of distribution and regulated commercialisation Creation of the “Supplier of Last Resort” Creation of a “Supplier Switching Office” Creation of an Energy System Technical Management Oversight Committee Main measures adopted Full liberalisation in 2008 Liberalisation in the gas sector is a reality: there is no need to apply structural changes Elimination of tariffs for industrial clients 83% of volume liberalised, in line with objectives set Current situation |

22 New market rules designed to eliminate tariff deficit: 42.35 €/MWh cap on sales to the regulated market Value CO 2 emission rights awarded for free discounted Tariff methodology that does not include the real cost energy A regulated electricity tariff together with the generation market leads to a tariff deficit (€3,830 million euro in 2005) Set back in the liberalization process, with clients coming back to the regulated market Measures taken Criticisms to the generation market from the White Book and the Ministry of Industry: New legislation to solve some of the problems of the Spanish electricity sector |

23 Advance in the liberalisation of the electricity sector Regulated tariffs to disappear by 2011 Legal and functional separation of distribution and regulated commercialisation Creation of the “Supplier of Last Resort” Creation of the “Supplier Switching Office” Creation of a Energy System Technical Management Oversight Committee Main measures adopted End of transitory period by 2011 Need to reorganise the formation of generation prices |

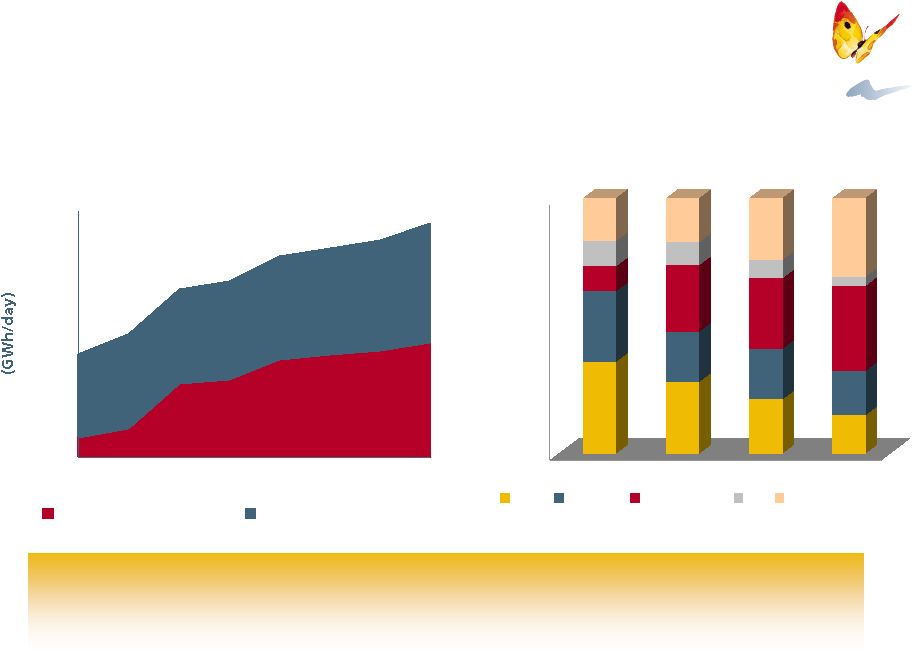

24 Gas expected to play an increasingly important role to meet Europe’s energy demand Sizeable increase in gas consumption compared to other traditional sources of energy such as coal and nuclear Source: IEA, World Energy Outlook 0 200 400 600 800 1971 2002 2010 2030 Coal Fuel-oil Gas Nuclear Others |

25 The electricity sector is expected to be the main gas consumer in Europe... Most of the growth in demand to come from electricity generation Source: IEA, World Energy Outlook Generation Industry Others 600 700 800 1980 1990 2000 2030 bcm 2010 2020 200 300 400 500 100 |

26 … at the same time gas – fired generation is expected to become the main source of electricity Gas – power convergence in Europe is a reality Source: European Energy and Transport Trends 0% 20% 40% 60% 80% 100% 1990 2000 2010 2020 2030 Nuclear Hydro Wind Fossil Fuel CCGT Others |

27 The main European energy groups have adopted a gas and electricity integration strategy Ruhrgas acquisition E.ON Suez RWE Enel Distrigas, Fluxis and Electrabel acquisitions Transgas and DEA acquisitions Camuzzi and Colombo Gas acquisitions GDF Merger with Suez Dong Acquisitions of Elsam, Energi E2, Nesa, Copenhagen Energy and Frederiksberg Elnet |

28 Gas – power convergence can also be noticed in Spain Increasing importance of CCGTs in generation Growing gas peak demand mainly due to electricity generation Source: Review of the Plan for Electricity and Gas Sectors for 2002-2011 The Government’s recent Review of the Electricity and Gas sectors 2002 – 2011 planning increases by 28% its objective of installed CCGT capacity in 2011. A 184% increase in CCGT capacity is expected from 2005 0% 20% 40% 60% 80% 100% 2000 2005 2007 2011 Coal Nuclear Natural gas Oil Renewables 0 500 1,000 1,500 2,000 2,500 3,000 2004 2005 2006 2007 2008 2009 2010 2011 Electricity generation Conventional gas market |

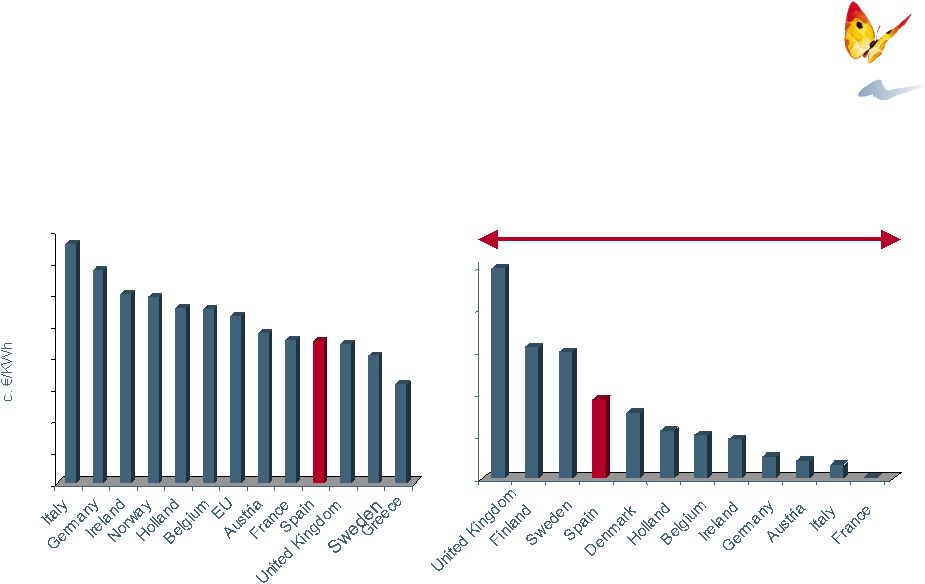

29 The European electricity market is not a reality Electricity interconnection capacity is insufficient Electricity prices are not homogeneous The liberalisation of the different markets advances at different speeds The European Commission has stated that the minimum conditions required for the existence of a single European market are not in place The single European market depends on these problems being solved There are multiple asymmetries among countries in terms of sector regulation, taxation, state ownership, etc. |

30 0 2 4 6 8 10 12 14 16 The European electricity market is not a reality Source: Eurostat, domestic tariffs at 1st of July 2005, excluding taxes Comparison of the European electricity tariffs Liberalisation (electricity supplier switching rate for households and SMEs) + liberalised - liberalised 0% 10% 20% 30% 40% 50% Source: European Commission “Towards an efficient internal energy market”, November 2005 |

31 Guaranteeing security of supply is a priority in Spain Gas procurement through the Europe – Maghreb pipeline (~1/3 of total) and LNG tankers (~2/3) Electric interconnection with France only amounts to 3-4% of total demand in Spain 5,256-7,446 GWh 6,570-9,198 GWh Cartagena Huelva Barcelona Ferrol Bilbao Gijón Sagunto Regassification plant Pipeline Regassification plant under construction Import/Export electricity capacity |

33 All the regulatory and administrative hurdles have been passed Spanish antitrust authorities Regulated activities (Function XIV) National Energy Commission The EC confirmed jurisdiction on competition belonged to Spain European antitrust authorities Golden Share Secretary General of Energy Nov 05 Combination GAS NATURAL–Endesa approved by the Council of Ministers Feb 06 Nov 05 Dec 05 Spanish offer/prospectus approved CNMV US prospectus (F-4) declared effective SEC (USA) Feb 06 Mar 06 Note: The offer and therefore the processing of any action related to the offer, and the performance of the agreement between Gas Natural and Iberdrola are currently suspended, following the injunction granted by the Madrid Court for Business Matters N 3. and the posting by Endesa of a €1,000m guarantee. The Supreme Court has awarded the injunction requested by Endesa consisting of the suspension of the Council of Minister decision, subject to Endesa presenting certain guarantees. GAS NATURAL has appealed both decisions. o |

34 Impact of the injunctions Suspension of the Council of Ministers decision Conditional on Endesa presenting certain guarantees, being admissible to extend the ones presented to the Madrid’s Court for Business Matters GAS NATURAL has appealed the decision and the cautionary measures Court for Business Matters N 3 ruling Supreme Court ruling Suspension of the GAS NATURAL offer and the execution of the agreement with Iberdrola Conditional on Endesa presenting a €1,000 million bond, which was posted on the 5th of April GAS NATURAL has appealed the Court’s decision and the cautionary measures As per the CNMV’s note issued on the 24th March 2006 relating to the first of the decisions: E.On’s offer acceptance period will have to wait due to GAS NATURAL’s offer Note: 1 CNMV has indicated that E.On´s offer request continues with the administrative process 1 o |

35 Creating a leading, fully integrated, global energy group Combined management of clients and networks More flexible and competitive gas procurement More balanced and competitive generation portfolio Attractive business mix and investment profile Global integrated energy leader in high-growth markets Sizeable synergies A solid strategic, industrial and financial rationale |

37 A multinational leader in the energy sector operating through the whole gas value chain Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Upstream Clients Advancing in the Upstream business Consolidation of our leading position in the Midstream business Positioned as an important player in the electricity business Maintaining the leadership and profitable growth in our gas distribution business |

38 Upstream Integrated LNG project in Gassi Touil (Algeria) Gas prospecting project in Gassi Chergui (Algeria) Acquisition of Petroleum Oil & Gas España MoU signed with Nigerian Government Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Clients A multinational leader in the energy sector operating through the whole gas value chain |

39 Maghreb-Europe pipeline expansion to c.12 bcm/year 8 tankers (702,000 m3) + 1 in 2007 (138,000 m3) + 1 new tanker in 2009 (138,000 m3) Regasification plant in Puerto Rico Requesting permits for the construction of two regasification plants in Italy Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Upstream Clients A multinational leader in the energy sector operating through the whole gas value chain |

40 Gas supply of 27.9 bcm 23.9 bcm Spain Main importer of gas natural and LNG in Spain through long term contracts (average residual life 15 years) Key role for the security of supply in Spain Trading and energy management opportunities 4 bcm International A multinational leader in the energy sector operating through the whole gas value chain Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Upstream Clients |

41 3,102 MW in Spain Gas distribution network: 100,150 km 56,763 km LatAm 39,611 km Spain 3,776 km Italy Electricity generation 271 MW in Puerto Rico CCGT and wind capacity under construction and awaiting permits 2,000 MW CCGT in Spain > 1,000 MW wind and cogen A multinational leader in the energy sector operating through the whole gas value chain Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Upstream Clients |

42 5,134,000 in Spain 4,757,000 in LatAm 288,000 in Italy 1.47 contracts per client in Spain A multinational leader in the energy sector operating through the whole gas value chain Gas and electricity assets Gas transport and infra- estructure Gas supply and demand Upstream Clients Note: 1 Points of supply 1 |

44 Conclusions Short term Strong results in 2005, improved in the first quarter 2006 Medium term Long term Meeting the objectives set in the Strategic Plan 2004-2008 GAS NATURAL strategy, clear and coherent with market trends |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

| | GAS NATURAL SDG, S.A. |

| | |

| Date: June 8, 2006 | | By: | | /s/ Carlos J. Álvarez Fernández |

| | | | Name: | | Carlos J. Álvarez Fernández |

| | | | Title: | | Chief Financial Officer |