SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of July, 2006

Commission File Number: 333-132076

GAS NATURAL SDG, S.A.

(Translation of Registrant’s Name into English)

Av. Portal de L’Angel, 20-22

08002 Barcelona, Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F:

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ Nox

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ Nox

Indicate by check mark whether by furnishing the information

contained in this Form, the Registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes¨ Nox

If “Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

26 July 2006 First Half 2006 Results (1H 06) ************************************************************* ********************** |

1 Disclaimer and Important Legal Information In connection with the offer by Gas Natural SDG, S.A. (Gas Natural) to acquire 100% of the share capital of Endesa, S.A. (Endesa), Gas Natural has filed with the United States Securities and Exchange Commission (SEC) a registration statement on Form F-4 (File No.: 333-132076), which includes a prospectus and related exchange offer materials to register the Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural American Depositary Shares (ADSs)) to be issued in exchange for Endesa ordinary shares held by U.S. persons and for Endesa ADSs held by holders wherever located. In addition, Gas Natural has filed a Statement on Schedule TO with the SEC in respect of the exchange offer. INVESTORS AND HOLDERS OF ENDESA SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS, THE STATEMENT ON SCHEDULE TO, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement, the prospectus and related exchange offer materials and the Statement on Schedule TO, as well as other relevant documents filed with the SEC, at the SEC’s website at www.sec.gov. The prospectus and other transaction-related documents are being mailed to holders of Endesa securities eligible to participate in the U.S. offer and additional copies may be obtained for free from Georgeson Shareholder Communications, Inc., the information agent: 17 State Street, 10th Floor, New York, New York 10004, Toll Free (888) 206-0860, Banks and Brokers (212) 440-9800. This communication is not an offering document and does not constitute an offer to sell or the solicitation of an offer to buy securities or a solicitation of any vote or approval, nor shall there be any sale or exchange of securities in any jurisdiction in which such offer, solicitation or sale or exchange would be unlawful prior to the registration or qualification under the laws of such jurisdiction. The solicitation of offers to buy Gas Natural ordinary shares (including Gas Natural ordinary shares represented by Gas Natural ADSs) in the United States will only be made pursuant to a prospectus and related offering materials that will be mailed to holders of Endesa ADSs and U.S. holders of Endesa ordinary shares. Investors in ordinary shares of Endesa should not subscribe for any Gas Natural ordinary shares to be issued in the offer to be made by Gas Natural in Spain except on the basis of the final approved and published offer document in Spain that will contain information equivalent to that of a prospectus pursuant to Directive 2003/71/EC and Regulation (EC) No. 809/2004. These materials may contain forward-looking statements based on management’s current expectations or beliefs. These forward-looking statements may relate to, among other things: • management strategies; • synergies and cost savings; • integration of the businesses; • market position; • expected gas and electricity mix and volume increases; • planned asset disposals and capital expenditures; • net debt levels and EBITDA and earnings per share growth; • dividend policy; and • timing and benefits of the offer and the combined company. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forwarding- looking statements, including, but not limited to, changes in regulation, the natural gas and electricity industries and economic conditions; the ability to integrate the businesses; obtaining any applicable governmental approvals and complying with any conditions related thereto; costs relating to the offer and the integration; litigation; and the effects of competition. Forward-looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future” or similar expressions. These statements reflect our current expectations. In light of the many risks and uncertainties surrounding these industries and the offer, you should understand that we cannot assure you that the forward-looking statements contained in these materials will be realized. You are cautioned not to put undue reliance on any forward-looking information. This communication is not for publication, release or distribution in or into or from Australia, Canada or Japan or any other jurisdiction where it would otherwise be prohibited. |

2 GAS NATURAL – 1H 06 Results Agenda 1. Highlights 2. Analysis of 1H 06 Results 3. Conclusions |

Highlights ********************************* ******************** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** |

4 Strengthening the competitive position across the whole gas chain Integrated projects developing as scheduled Significant optimisation of fleet utilisation during the period Significant increase in electricity production in Spain (+139%) resulting from new capacity additions and competitive gas supply Results achieved confirm successful entry strategy in the electricity sector Solid growth and profitability from core distribution business, reaching 10.4 million gas customer connections in 1H 06 1 Strong EBITDA growth of c.30% to €934 million, based on real cash generation, confirms 2006 outlook Note: 1 Includes Spain, Latam and Italy connections Electricity Distribution Up + Midstream Wholesale Continued optimisation of gas and electricity customer portfolios resulting in greater contribution to profitability |

5 Integrated projects developing as scheduled and significant optimisation of fleet utilisation Gassi Touil project advancing Initial drilling activity recently started Incorporation of El Andalus LNG S.p.a. for the construction and operation of the Arzew LNG plant Gassi Touil Nigeria Upstream Midstream Fleet optimisation thanks to the creation of Midstream JV with Repsol YPF 8 tankers (702,000m3) + 1 in 2007 (138,000m3) + 1 new tanker in 2009 (138,000m3) Overall utilisation of 97% in 1H 06 Key terms and conditions of MoU signed in 1Q 06 with the Nigerian government under development |

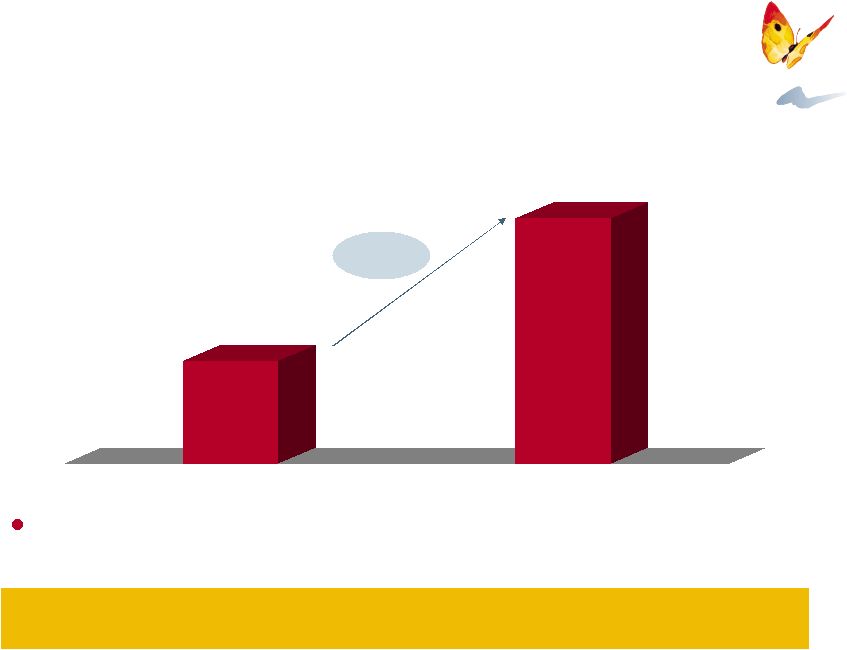

6 Significant increase in electricity production in Spain GAS NATURAL electricity production in Spain (GWh) 4,057 9,690 1H 05 1H 06 2.4x 139% production increase to 9,690 GWh, as a result of new capacity addition and competitive gas supply 9% market share in ordinary regime production in Spain, in line with 10% objective by 2008 set in 2004–2008 Strategic Plan |

7 CCGTs to represent c. 43% of peninsular ordinary regime installed capacity by 2011² Leading presence in CCGT generation Leading and most efficient producer of CCGT electricity in Spain, supported by competitive gas supply 1H 06 CCGT electricity production 1 1H06 average CCGT operating hours 1 3,321 3,266 2,452 1,957 1,824 Source: OMEL, Ministry of Industry Note: 1 Attributable production in the peninsular system 2 As per the Review of the Plan for Electricity and Gas Sectors for 2002-2011 GAS NATURAL 30% Competitor 1 24% Competitor 2 15% Competitor 3 13% Competitor 4 2% Other 16% Plana del Vent (800 MW) and Málaga (400 MW) CCGTs under development |

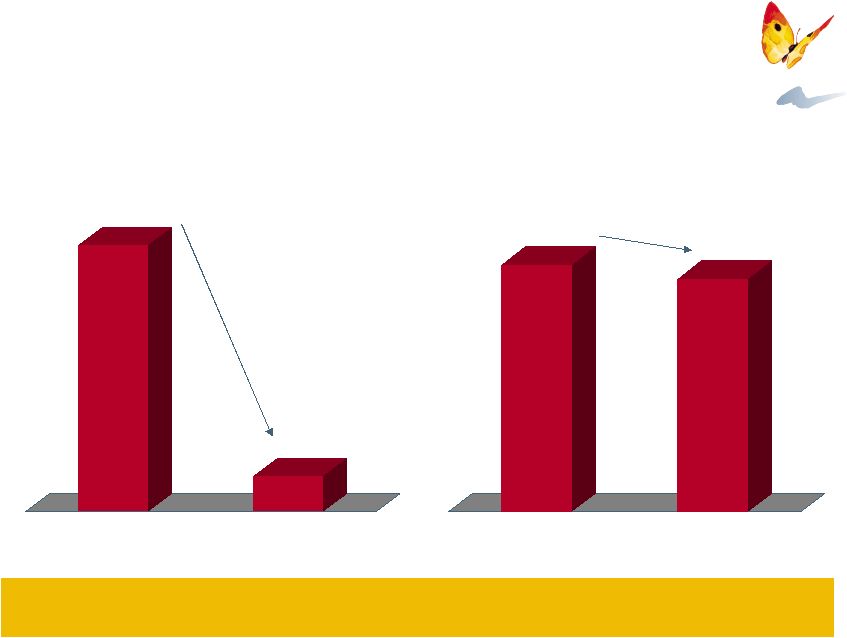

8 30-Jun-05 30-Jun-06 30-Jun-05 30-Jun-06 Electricity industrial portfolio (TWh/y) Gas industrial portfolio 4.4 0.6 (TWh/y) 103.7 97.9 Continued optimisation of customer portfolio Adaptation of gas and electricity customer portfolio to market conditions resulting in greater contribution to profitability |

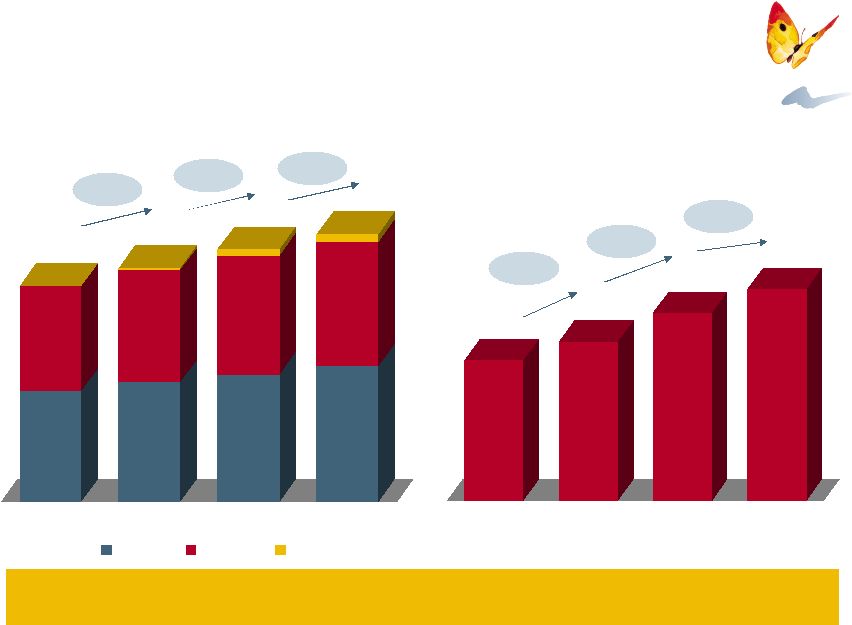

9 10.4 million gas customer connections reached in June 06 4,320 4,076 4,638 4,363 95 4,960 4,625 264 5,274 4,844 300 1H 03 1H 04 1H 05 1H 06 Spain LatAm Italy 408 463 546 615 1H 03 1H 04 1H 05 1H 06 Distribution business continues to deliver solid growth Gas customer connections (000s) 8,396 9,096 9,849 10,418 EBITDA (€m) 1 +700² +753² +569² +18% +13% +13% Notes: 1 2004, 2005 and 2006 figures under IFRS 2 New gas customer connections |

10 1H 06 Net Sales EBITDA Operating Income Net Income Average no. of Shares (million) EBITDA per Share (€) Net Income per Share (€) Investments: Tangible & Intangible Financial & Other Net Debt (as of 30/06) 5,422.2 934.4 616.3 455.8 447.8 2.09 1.02 535.8 485.6 50.2 3,038.9 1H 05 Change (%) 1H 06 results snapshot Strong financial performance, in line with 2004-2008 Strategic Plan (€ million) 3,788.2 727.0 471.3 367.8 447.8 1.62 0.82 825.5 531.9 293.6 3,004.7 43.1 28.5 30.8 23.9 – 28.5 23.9 (35.1) (8.7) (82.9) 1.1 |

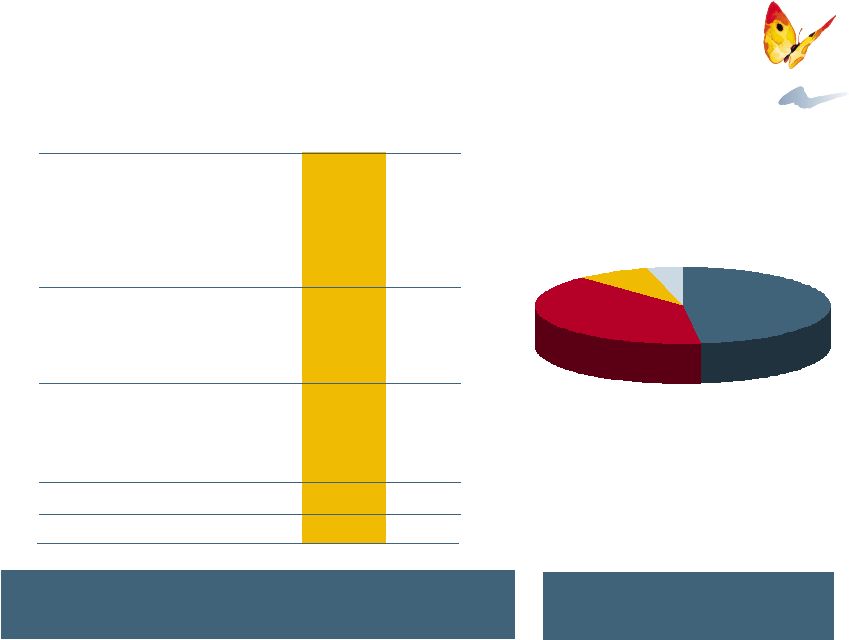

11 3,677 1,627 1,869 2,650 3,615 3,039 2001 2002 2003 2004 2005 30-Jun-06 Leverage 49.0% 28.0% 29.3% 35.6% 38.5% 34.3% 30/06/06 30/06/05 Leverage² 34.3% 36.8% EBITDA/Net Interest 6.8x 7.1x Net Debt/EBITDA 1.8x 2.1x Financial ratios Net Debt and Leverage Debt facilities as of June 30, 2006 3 Commercial Banks Institutional Banks Capital Markets Cash Placements Total 2,021 559 760 – 3,340 Drawn Undrawn Notes: 1 2004, 2005 and 2006 figures under IFRS 2 Defined as Net Debt / (Net Debt + Total Equity) 3 Does not include any financing in relation to the offer for Endesa 1H 06 results snapshot Solid capital structure 1 (€ million) 1,591 – 2,275 301 4,240 |

Analysis of 1H 06 Results ********************************* ******************** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** |

13 c. 30% EBITDA growth, above the estimates in the 2004–2008 Strategic Plan (€ million) 1H 05 Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total EBITDA 546.2 390.9 137.4 17.9 66.2 38.0 28.2 107.7 83.3 24.4 6.9 727.0 1H 06 614.9 415.2 179.4 20.3 161.5 130.9 30.6 150.8 96.8 54.0 7.2 934.4 EBITDA breakdown (%) (€m) Change 68.7 24.3 42.0 2.4 95.3 92.9 2.4 43.1 13.5 29.6 0.3 207.4 12.6 6.2 30.6 13.4 144.0 244.5 8.5 40.0 16.2 121.3 4.3 28.5 |

14 By Activity Construction of Málaga CCGT plant expected to begin in 3Q 06 Investments (Tangible & Intangible) (€ million) 1H 06 1H 05 Distribution Spain LatAm Italy Electricity Spain Puerto Rico Gas Supply Up + Midstream Wholesale & Retail Other Total 233.3 135.8 70.1 27.4 265.2 262.0 3.2 8.7 4.3 4.4 24.7 531.9 82% of investments in Euro Investments breakdown Gas Supply 8% Other 233.0 154.9 50.2 27.9 193.3 187.8 5.5 40.1 36.2 3.9 19.2 485.6 4% Distribution 48% Electricity 40% |

15 Distribution in Spain 5.3 million gas customer connections in Spain as of 30 June 2006 (+6.3%) Higher investment (+14%) expected to result in additional business growth and additional gas customer connections 1H 06 results analysis by activity +10% EBITDA growth in 2Q 06 Operating figures EBITDA (€ million) +6.3% 4,960 5,274 Connections (thousands) 132,568 138,125 29,033 103,535 26,602 111,523 1H 05 1H 06 Tariff Sales (GWh) TPA Sales (GWh) 390.9 415.2 1H 05 1H 06 +4.2% +7.7% (8.4%) +6.2% |

16 Slowdown in operating activity as a result of situation in Mexico 27% tariff increase in Argentina pending implementation In local currency, EBITDA grows by 19.9% 1H 06 results analysis by activity Distribution in LatAm Mexico €40.2m (+13%) 1H 06 EBITDA contribution and growth by country (Total €179.4 million) Argentina €18.4m (+36%) Colombia €46.7m (+17%) Brazil €74.1m (+53%) 4,625 4,844 1H 05 1H 06 Connections (thousands) Operating figures Gas activity sales (GWh) +4.7% +3.4% 80,155 82,860 Significant EBITDA growth to €179.4 million (+31%), especially in Brazil |

17 17.9 20.3 1H 05 1H 06 1H 06 results analysis by activity EBITDA (€ million) 264 300 1H 05 1H 06 Connections (thousands) Operating figures Gas activity sales (GWh) (7.4%) 1,734 1,605 Distribution in Italy +13.6% +13.4% Double-digit organic growth due to solid operating performance and know-how 300,000 connections (+13.6%) reached as of June 2006 Decrease in sales due to milder winter compared with 1H 05 EBITDA increased by 13% in 1H 06 |

18 1H 06 results analysis by activity Electricity Electricity production (GWh) Installed capacity in Spain of 3,127 MW (+64.4%), in line with 2004–2008 Strategic Plan 77 1H 05 1H 06 Wind Cogeneration CCGT (Puerto Rico) CCGT (Spain) 329 800 9,284 +10.0% +143.7% +119.3% 10,490 4,784 3,810 727 185 62 EBITDA has more than doubled, despite the discount of €33.5 million of CO 2 emission rights (+195% growth on a proforma basis) Continued progress in commercial portfolio optimisation Very significant electricity EBITDA growth of €95.3 million (+144%), with Spanish electricity contribution more than tripling 38.0 28.2 66.2 130.9 30.6 Spain Puerto Rico +144.0% +8.5% +244.5% 161.5 1H 05 1H 06 Electricity EBITDA (€ million) |

19 83.3 96.8 1H 05 1H 06 1H 06 results analysis by activity Up + Midstream EBITDA (€ million) Greater contribution from EMPL Greater fleet utilisation in the period (97% in 1H 06 vs. 78% in 1H 05) Higher investments expected in 2H 06, as Gassi Touil development phase continues Exploration costs booked as expenses Development costs capitalised +16.2% EBITDA increase of €13.5 million (+16.2%) |

20 24.4 54.0 1H 05 1H 06 1H 06 results analysis by activity EBITDA (€ million) Continued optimisation of gas wholesale and retail industrial portfolio Competitive gas supply Discount reduction trend has continued in 1H 06, leading to their disappearance as of June 06 +121.3% Very significant EBITDA increase of 121% in 1H 06 Wholesale & Retail |

Conclusions ********************************* ******************** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** |

22 Conclusions Over 20% growth in EBITDA (+29%) and Net Income (+24%) based on real cash generation, confirming 2006 outlook Continued optimisation of gas and electricity customer portfolio and competitive gas supply, resulting in greater contribution to profitability Integrated projects progressing as scheduled, and consolidating leading position in the midstream business Results achieved confirm successful entry strategy in the electricity sector Strengthening the competitive position across the whole gas chain Achieving continued profitable growth in the distribution business |

INVESTOR RELATIONS DEPARTMENT Av. Portal de l’Àngel, 20 08002 BARCELONA (Spain) telf. 34 934 025 891 fax 34 934 025 896 e-mail: relinversor@gasnatural.com website: www.gasnatural.com Thank you ******************** ******************** ******************** ******************** *********** ************************************************************ ********************** |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | |

| | | | GAS NATURAL SDG, S.A. |

| | | |

Date: July 26, 2006 | | | | By: | | /s/ Carlos J. Álvarez Fernández |

| | | | | | | | Name: | | Carlos J. Álvarez Fernández |

| | | | | | | | Title: | | Chief Financial Officer |