Exhibit 99.1

Intercept Pharmaceuticals J.P. Morgan Healthcare Conference Jerry Durso, President and CEO January 12, 2023

This presentation is intended for investor purposes only and is not intended for promotional purposes. 2 Cautionary Note Regarding Forward - Looking Statements ("FLS") This document contains FLS, including regarding : our finances, financial guidance, and financial results, including expectations regarding sales, expenses, cash position, and balance sheet position ; our strategic priorities ; growth in Ocaliva sales ; trends in prescriber and patient behavior and adoption of Ocaliva ; our operational performance ; and timing and results of our R&D, clinical trials, regulatory submissions, and new product initiatives . Important factors could cause actual results to differ materially from the FLS, including : our ability to increase sales as expected ; our ability to estimate future financial needs and results ; our ability to execute on our strategic priorities and to operate effectively ; our ability to obtain and maintain regulatory approvals ; our ability to satisfy post - marketing requirements, including using real - world evidence ; the initiation, timing, cost, conduct, progress, and results of our R&D activities, preclinical studies, and clinical trials ; the safety and efficacy of our products and product candidates ; the progress, timing, and results of our clinical trials, including regarding safety and efficacy ; adverse medical, clinical, efficacy, quality, safety, or pharmacovigilance events or results from clinical trials ; potential side effects associated with our product or product candidates ; the timing and outcomes of interactions with regulators including the FDA regarding clinical trials, safety and efficacy, products and product candidates, and regulatory approvals ; marketing conditions, limitations, or warnings required by regulators ; the degree of market acceptance of our products among physicians, patients, and healthcare payors ; our ability to execute on the drivers of Ocaliva sales growth (including estimated market size, market penetration, patient satisfaction, refill rates, and sales prices) ; competition from new or existing drugs ; the success of our competitors and our failure to outperform or outcompete them ; the impact of the sale of our international business ; our ability to manage successfully our commercial and operational performance ; our ability to attract and retain key personnel ; our ability to manage expenses ; our ability to manage legal, operational, and other risks ; and other factors discussed in the FLS and Risk Factors sections of our Form 10 - Q and Form 10 - K filings, and in our Form 8 - K reporting our quarterly earnings . This document contains FLS regarding our financial results, including net sales and cash position, for Q 4 and full year 2022 , which remain under internal review and audit as we close our books and prepare our 10 - K . Our financial results are subject to the risks and uncertainties described above, and our audited financial results as finalized and reported may differ from the statements in this document due to factors including continued review and reconciliation of our accounting records and consideration of accounting rules .

Our mission is to build a healthier tomorrow for people with progressive non - viral liver diseases

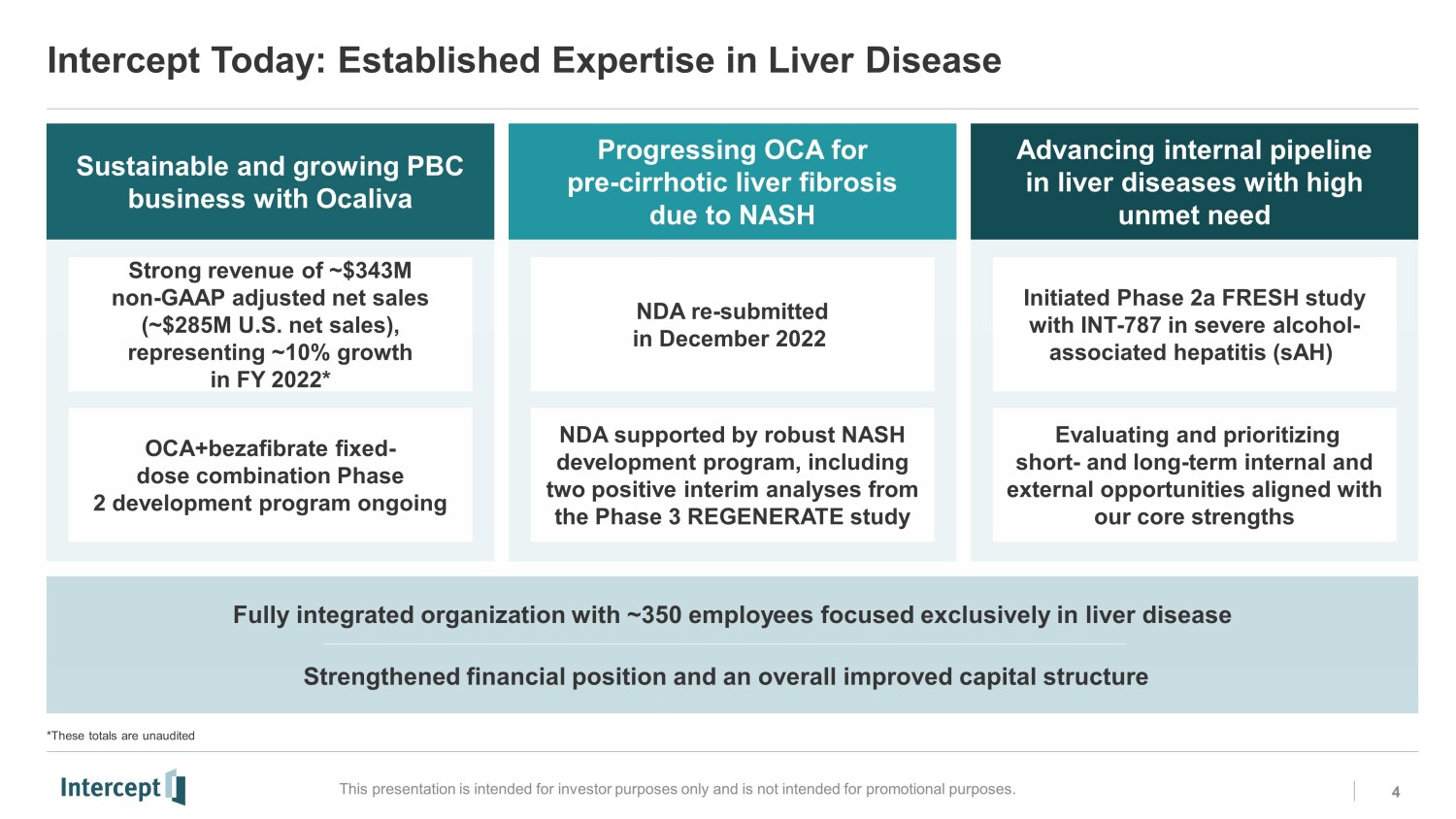

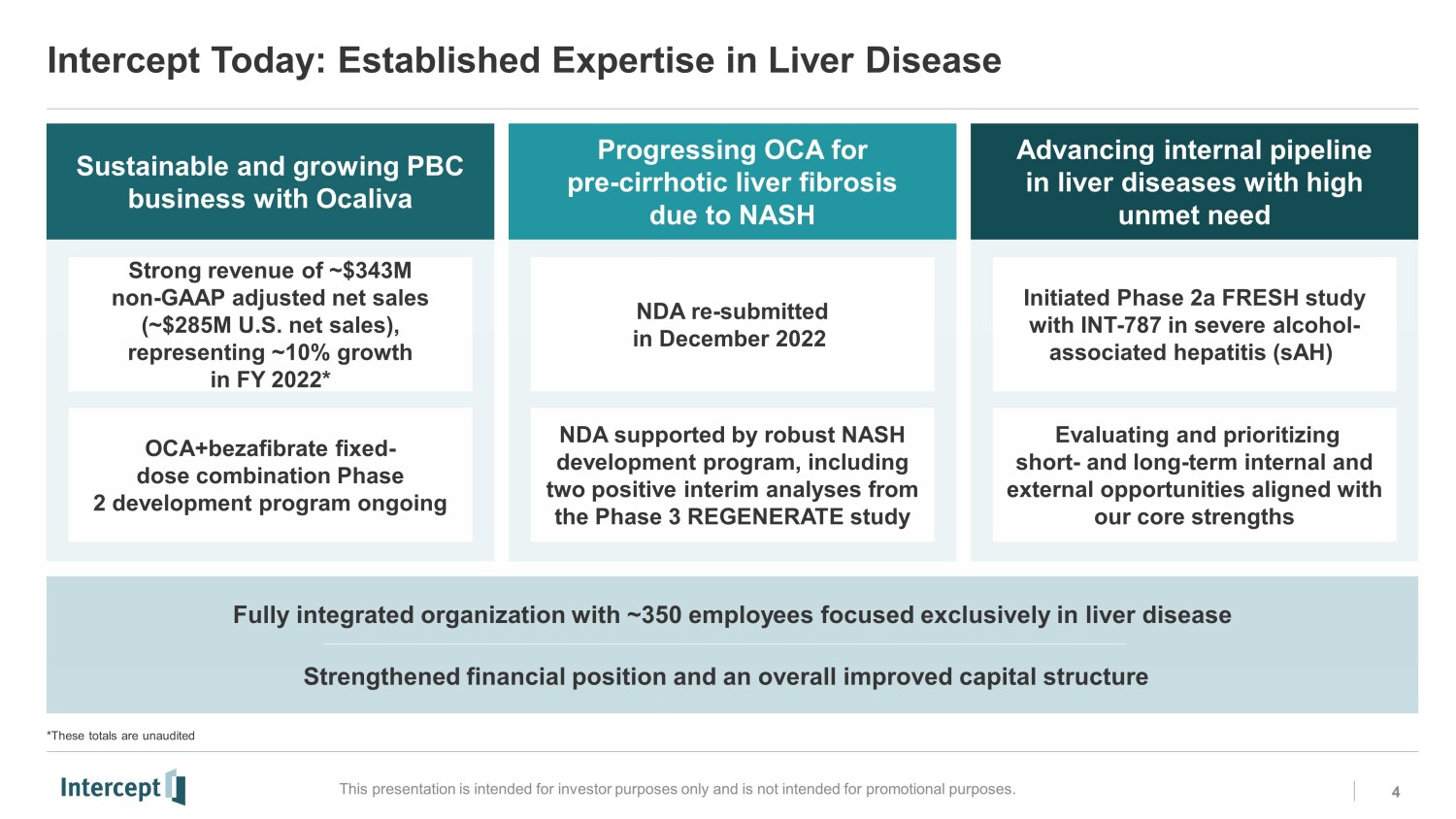

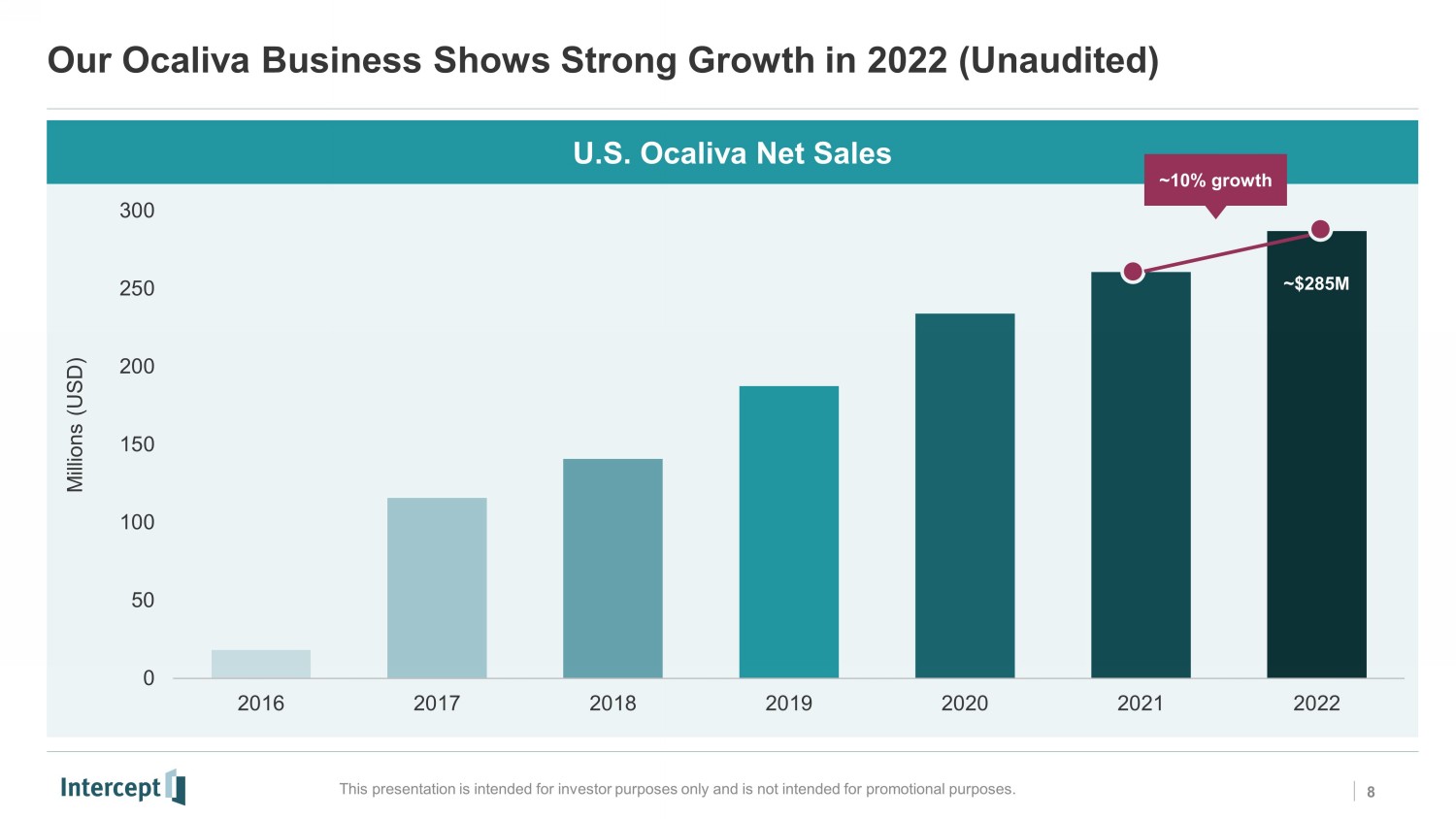

Intercept Today: Established Expertise in Liver Disease 4 This presentation is intended for investor purposes only and is not intended for promotional purposes. Sustainable and growing PBC business with Ocaliva Fully integrated organization with ~350 employees focused exclusively in liver disease Strengthened financial position and an overall improved capital structure Progressing OCA for pre - cirrhotic liver fibrosis due to NASH Advancing internal pipeline in liver diseases with high unmet need Strong revenue of ~$343M non - GAAP adjusted net sales (~$285M U.S. net sales), representing ~10% growth in FY 2022* NDA re - submitted in December 2022 Initiated Phase 2a FRESH study with INT - 787 in severe alcohol - associated hepatitis ( sAH ) OCA+bezafibrate fixed - dose combination Phase 2 development program ongoing NDA supported by robust NASH development program, including two positive interim analyses from the Phase 3 REGENERATE study Evaluating and prioritizing short - and long - term internal and external opportunities aligned with our core strengths *These totals are unauditedNS0 NS1 NS2 RC3

Strong Financial Foundation for Future Growth and Success 5 This presentation is intended for investor purposes only and is not intended for promotional purposes. 2022 Actions and Select Financial Results Impact in 2023 • $450M sale of rights to Ocaliva in PBC outside the U.S. • $389M 2026 convertible notes retired, decreasing debt by 54% and reducing future cash interest expense by 58% • U.S. Ocaliva net sales (unaudited) of ~$77M in 4Q22 and ~$285M for FY22* • Net cash positive with total cash position of approximately $490M* • Strong balance sheet with sustainable cash - level above debt • Financial flexibility to both invest in our core business priorities and sustainably grow • Efficient launch in NASH leveraging existing infrastructure *These totals are unaudited JD0 JD1

Progressing OCA for Pre - Cirrhotic Liver Fibrosis due to NASH Advancing Internal Pipeline, 2023 Priorities Jennie, Living with PBC Sustainable and Growing PBC Business with Ocaliva

Ocaliva is approved for the treatment of PBC* in combination with ursodeoxycholic acid (UDCA) in adults with an inadequate response to UDCA, or as monotherapy in adults unable to tolerate UDCA Ocaliva in PBC – A Strong Foundational Business 7 This presentation is intended for investor purposes only and is not intended for promotional purposes. More than 30,000 patient years** of post - marketing experience; 6 years of market data Strong existing and growing prescriber base of hepatologists and gastroenterologists Strong patents on Ocaliva with expiration dates into 2036; composition of matter patent into 2027 Only approved second - line therapy in PBC with competition not expected until 2024 sNDA submission in support of fulfilling post - marketing requirements anticipated in 2023 *In the U.S.: in patients without cirrhosis or with compensated cirrhosis who do not have evidence of portal hypertension **As of September 2022

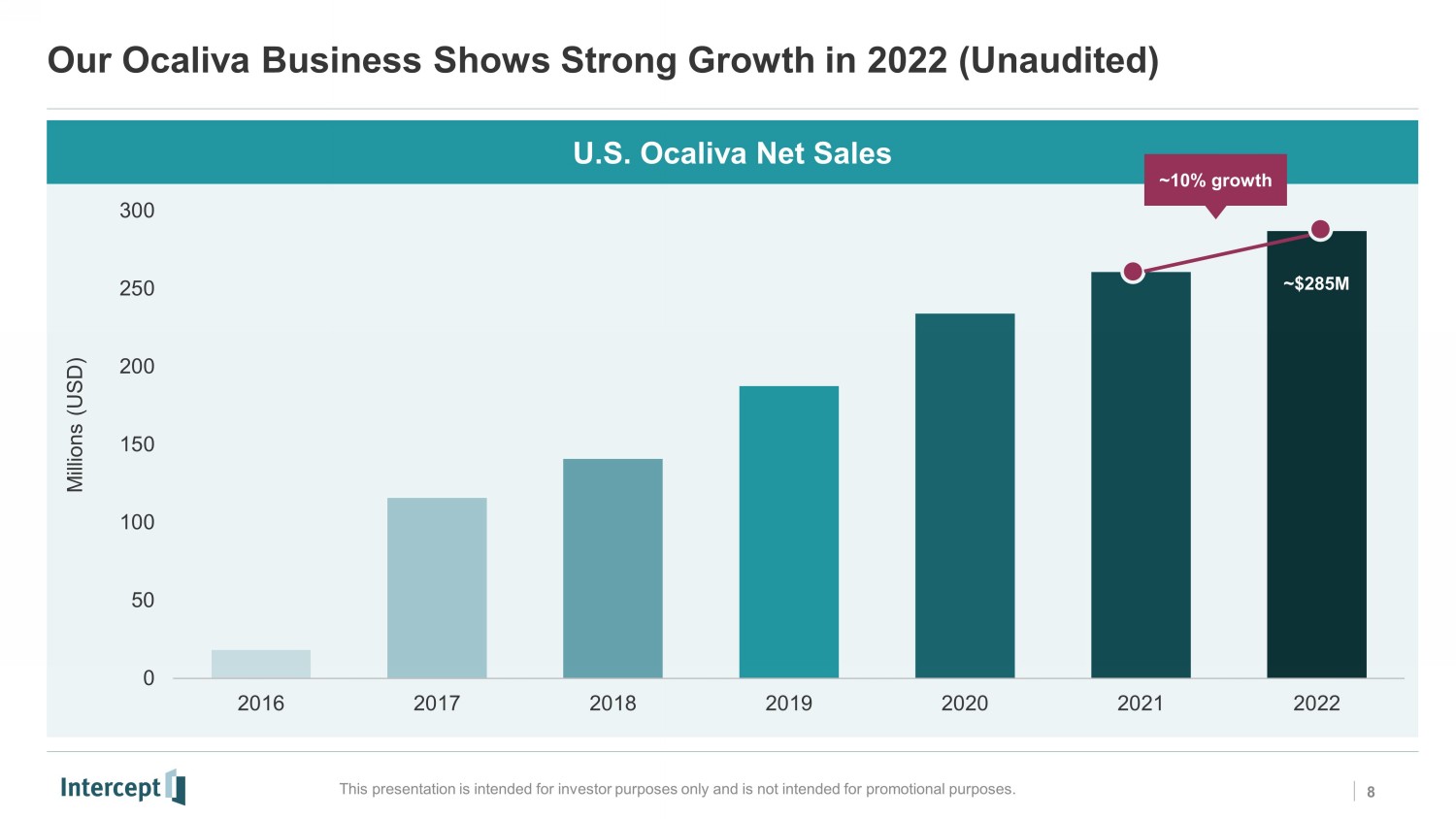

Our Ocaliva Business Shows Strong Growth in 2022 (Unaudited) This presentation is intended for investor purposes only and is not intended for promotional purposes. 0 50 100 150 200 250 300 2016 2017 2018 2019 2020 2021 2022 Millions (USD) U.S. Ocaliva Net Sales ~10% growth 8 ~$285M NS0 JD1 KP2 NS3

>60% 85% ~90% 89% Pathway for Long - Term Ocaliva Growth This presentation is intended for investor purposes only and is not intended for promotional purposes. Demonstrating a need to go beyond ALP management in fully addressing PBC treatment 9% increase in first - time writers (Rx) in 2022 vs. 2021 Outcomes data Fixed dose - combination Market growth and customer satisfaction Commercial initiatives Eligible patients remain untreated Patients on Ocaliva are extremely satisfied Refill rate Patients on Ocaliva intend to remain on therapy 9LP0RC1 NS2 NS3

A 70% lower risk of death or liver transplant compared to control patients was demonstrated in a key publication in Gastroenterology 1 Data Demonstrates Long - Term Improved Clinical Outcomes in Patients Taking OCA for PBC 10 This presentation is intended for investor purposes only and is not intended for promotional purposes. Publishing and presenting multiple real - world analyses demonstrating long - term clinical benefits of OCA in PBC including transplant - free survival: the most important goal for patients and clinicians HEROES - US study showed statistically significant and clinically meaningful reduction in all - cause death, liver transplant, or hospitalization for hepatic decompensation among OCA - treated patients compared to a control group who were not treated with OCA Reference: 1. C. Fiorella Murillo Perez, et al. “Greater Transplant - Free Survival in Patients Receiving Obeticholic Acid for Primary Biliary C holangitis in a Clinical Trial Setting Compared to Real - World External Controls.” Gastroenterology , vol. 163, issue 6, 2022. pp. 1630 - 1642. RC0

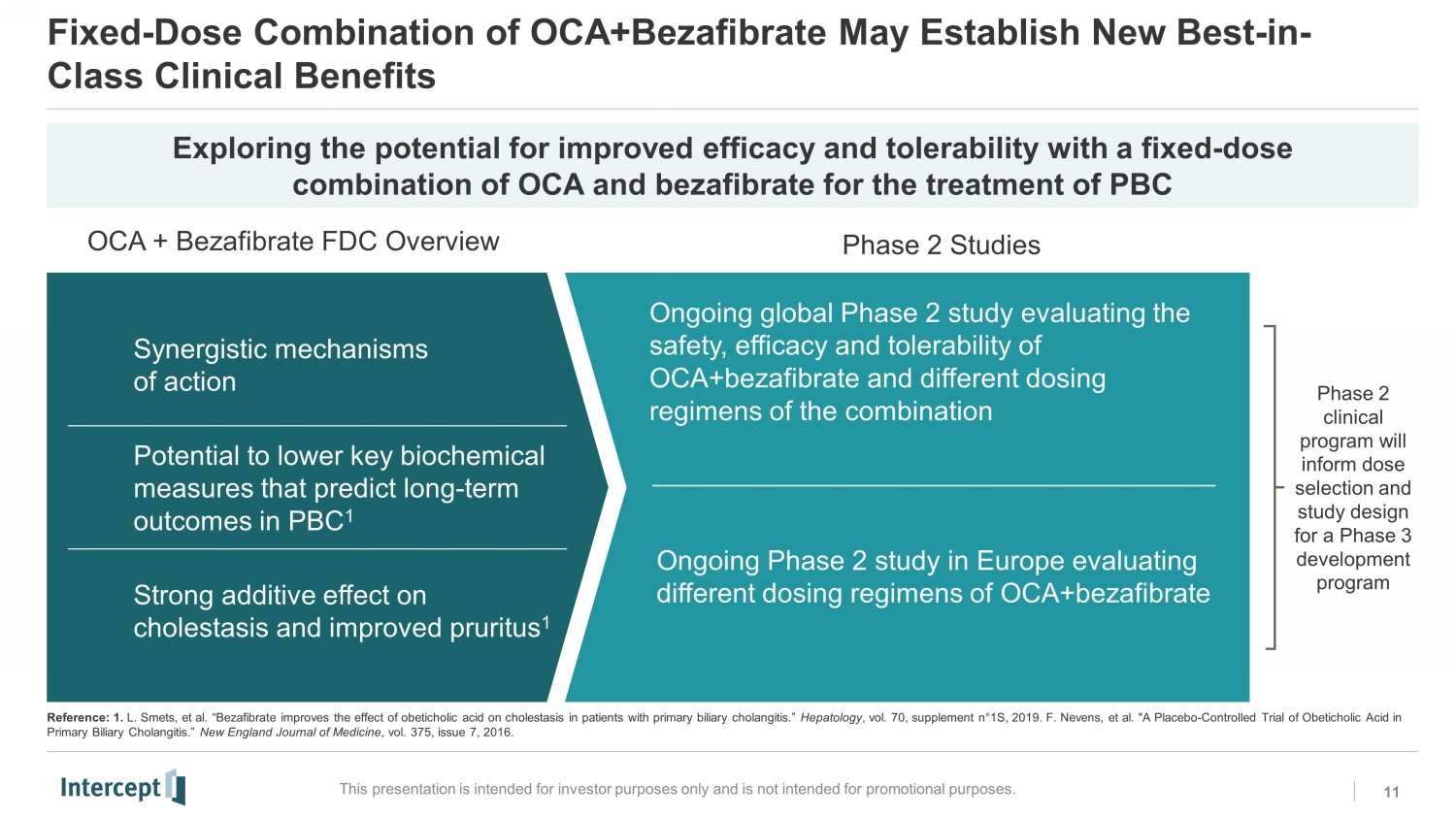

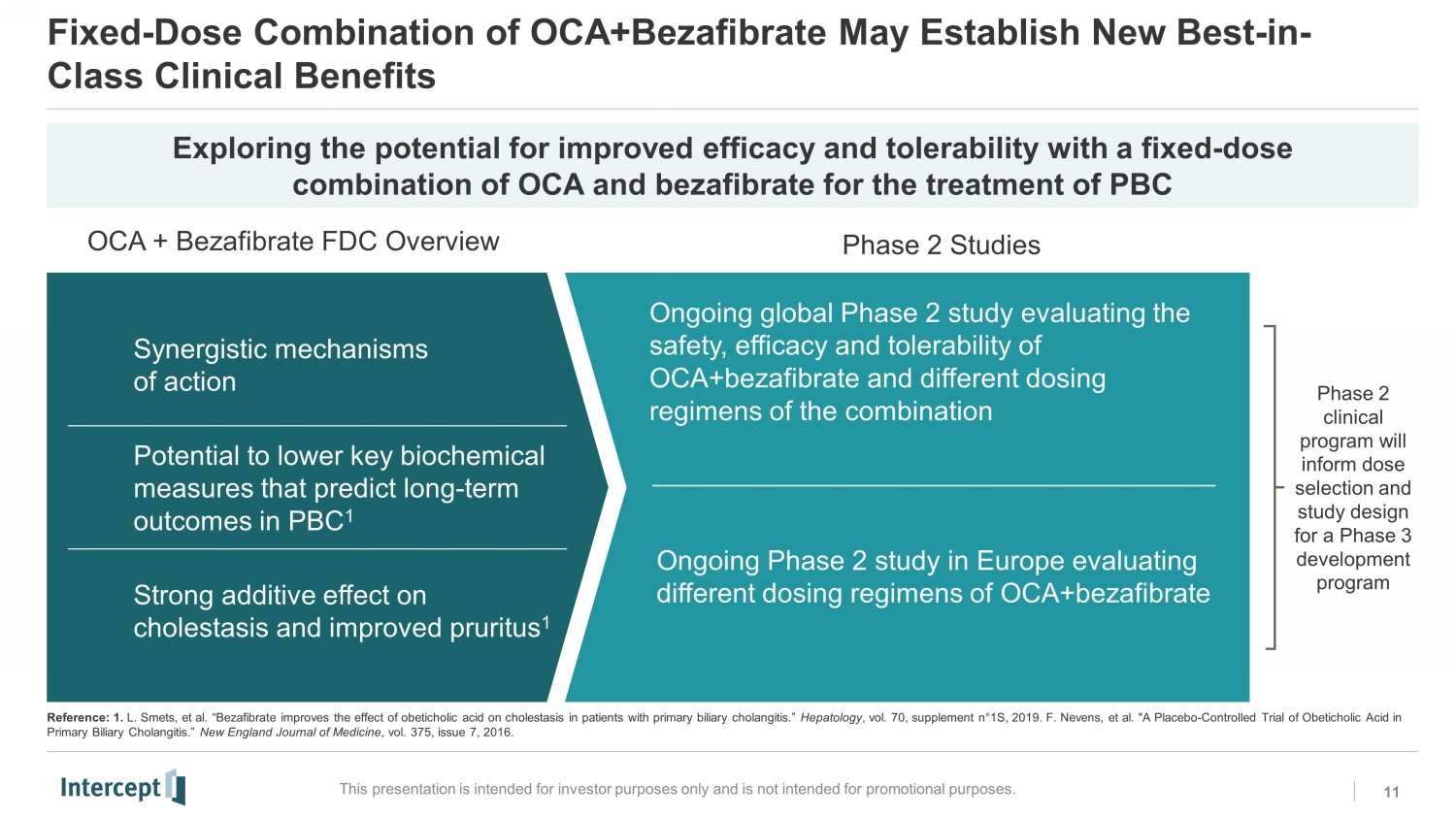

Fixed - Dose Combination of OCA+Bezafibrate May Establish New Best - in - Class Clinical Benefits 11 This presentation is intended for investor purposes only and is not intended for promotional purposes. Exploring the potential for improved efficacy and tolerability with a fixed - dose combination of OCA and bezafibrate for the treatment of PBC OCA + Bezafibrate FDC Overview Phase 2 Studies Synergistic mechanisms of action P otential to lower key biochemical measures that predict long - term outcomes in PBC 1 S trong additive effect on cholestasis and improved pruritus 1 Phase 2 clinical program will inform dose selection and study design for a Phase 3 development program Ongoing Phase 2 study in Europe evaluating different dosing regimens of OCA+bezafibrate Ongoing global Phase 2 study evaluating the safety, efficacy and tolerability of OCA+bezafibrate and different dosing regimens of the combination Reference: 1. L. Smets , et al. “Bezafibrate improves the effect of obeticholic acid on cholestasis in patients with primary biliary cholangitis.” Hepatology , vol. 70, supplement n ƒ 1S, 2019. F. Nevens , et al. "A Placebo - Controlled Trial of Obeticholic Acid in Primary Biliary Cholangitis.” New England Journal of Medicine , vol. 375, issue 7, 2016. RC0

Sustainable and Growing PBC Business with Ocaliva Terri, Living with Advanced Fibrosis due to NASH Progressing OCA for Pre - Cirrhotic Liver Fibrosis due to NASH Advancing Internal Pipeline, 2023 Priorities

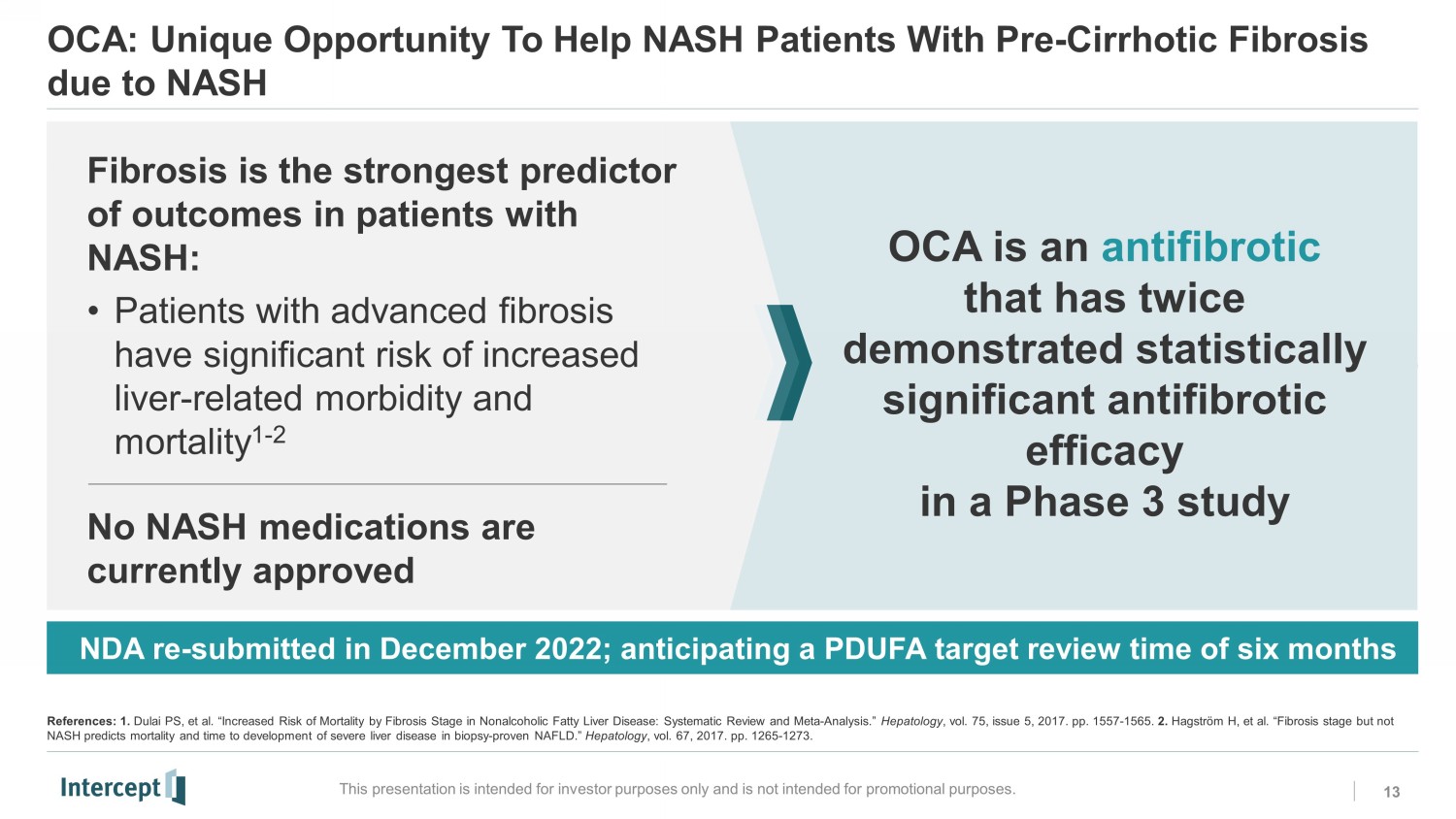

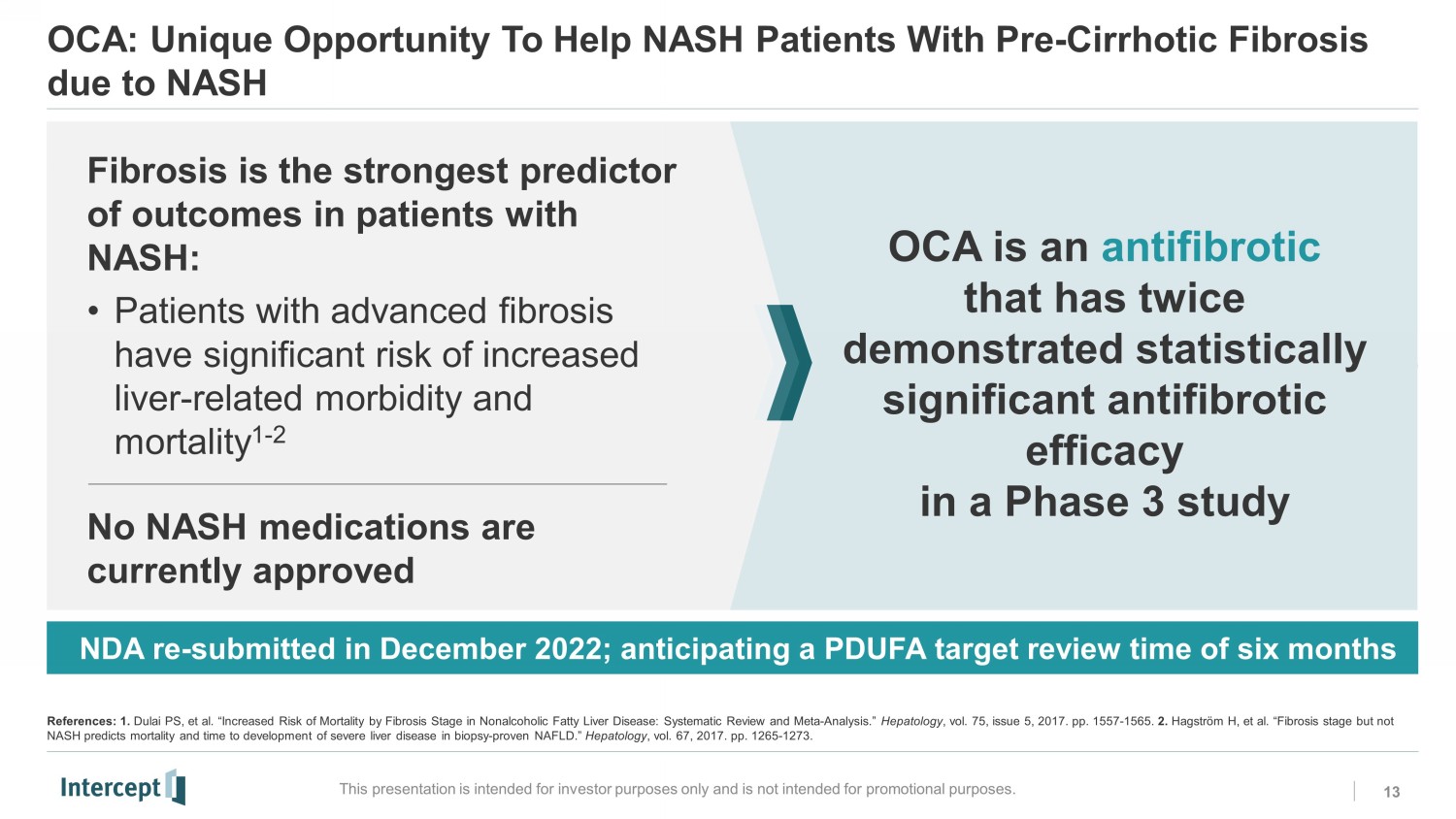

OCA: Unique Opportunity To Help NASH Patients With Pre - Cirrhotic Fibrosis due to NASH 13 This presentation is intended for investor purposes only and is not intended for promotional purposes. NDA re - submitted in December 2022; anticipating a PDUFA target review time of six months OCA is an antifibrotic that has twice demonstrated statistically significant antifibrotic efficacy in a Phase 3 study Fibrosis is the strongest p redictor of outcomes in patients with NASH: • Patients with advanced fibrosis have significant risk of increased liver - related morbidity and mortality 1 - 2 No NASH medications are currently approved References: 1. Dulai PS, et al. “Increased Risk of Mortality by Fibrosis Stage in Nonalcoholic Fatty Liver Disease: Systematic Review and Meta - Analy sis.” Hepatology , vol. 75, issue 5, 2017. pp. 1557 - 1565. 2. Hagström H, et al. “Fibrosis stage but not NASH predicts mortality and time to development of severe liver disease in biopsy - proven NAFLD.” Hepatology , vol. 67, 2017. pp. 1265 - 1273.RC0

Reaching Patients with OCA at a Pivotal Point in NASH Disease Progression 14 This presentation is intended for investor purposes only and is not intended for promotional purposes. • Predominantly managed in primary care • Focus on screening for fibrosis in at - risk populations • Treatment goals are managing long - term risk factors and lifestyle change • 1 in 5 patients with pre - cirrhotic fibrosis progresses to cirrhosis after approx. 2.5 years 1 • Reversing fibrosis and preventing progression to cirrhosis are central goals for providers and payers • Patients who progress from F3 to F4 have a more than 2x increase in risk of liver - related death 2 • Accounts for a disproportionate amount of NASH - related healthcare costs – >80% of predicted annual direct medical costs 3 - 4 Early Fibrosis (F0 - F1) Pre - Cirrhotic Fibrosis (F2 - F3) Cirrhosis (F4) References: 1. Hagström H, et al. “Fibrosis stage but not NASH predicts mortality and time to development of severe liver disease in biopsy - pro ven NAFLD.” Hepatology , vol. 67, 2017. pp. 1265 - 1273. 2. Sanyal AJ, et al. “The Natural History of Advanced Fibrosis Due to Nonalcoholic Steatohepatitis: Data From the Simtuzumab Trials.” Hepatology , vol. 70, issue 6, 2019. pp. 1913 - 1927. 3. Estes C, et al. “Modeling the epidemic of nonalcoholic fatty liver disease demonstrates an exponential increase in burden of disease.” Hepatology , vol. 67, issue 1, 2018. pp. 123 - 133. 4 . Younossi ZM, et al. “Global epidemiology of nonalcoholic fatty liver disease - Meta - analytic assessment of prevalence, incidence, and outc omes.” Hepatology , vol. 64, issue 5, 2016. pp. 577 – 1586. NS0

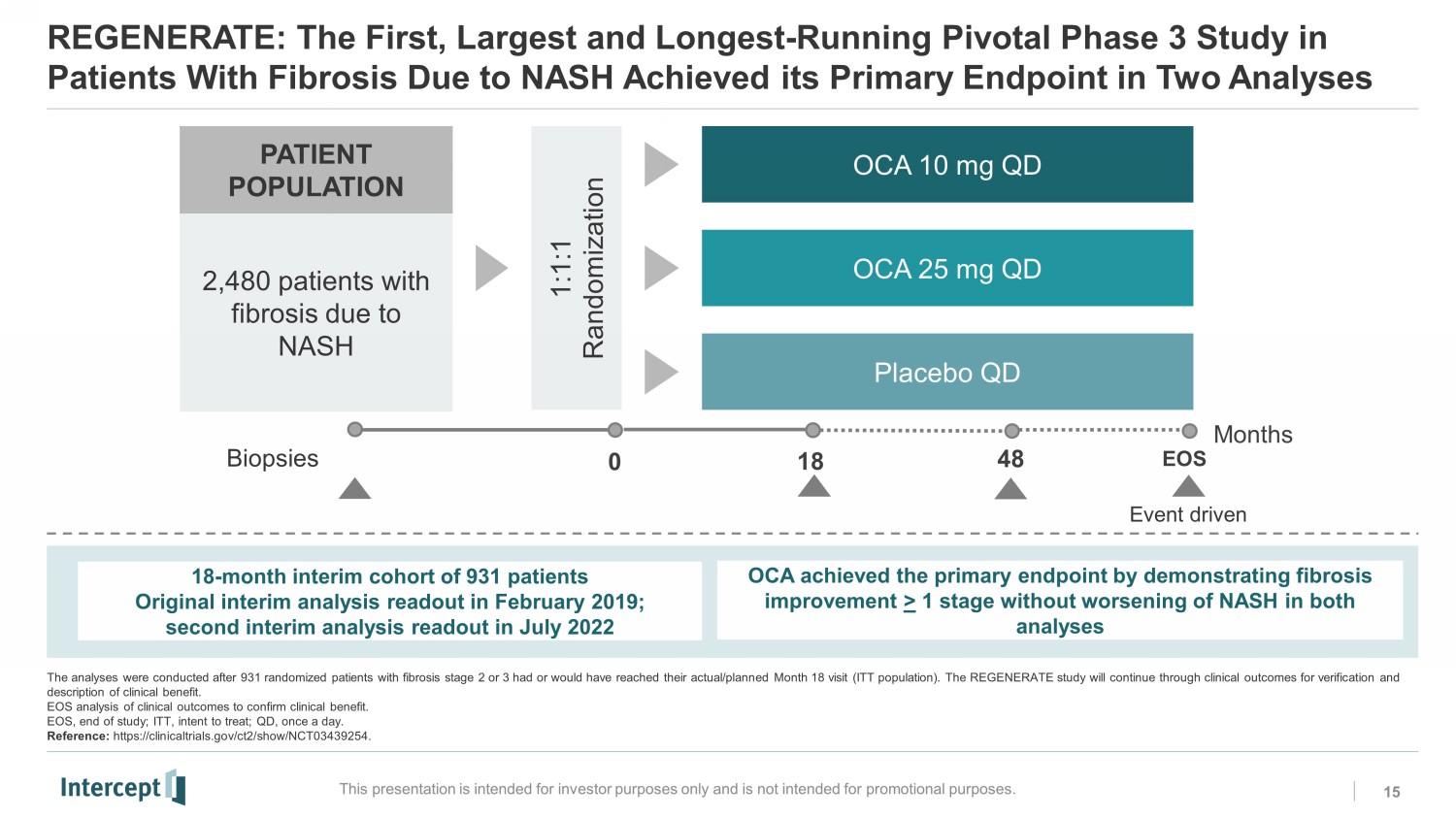

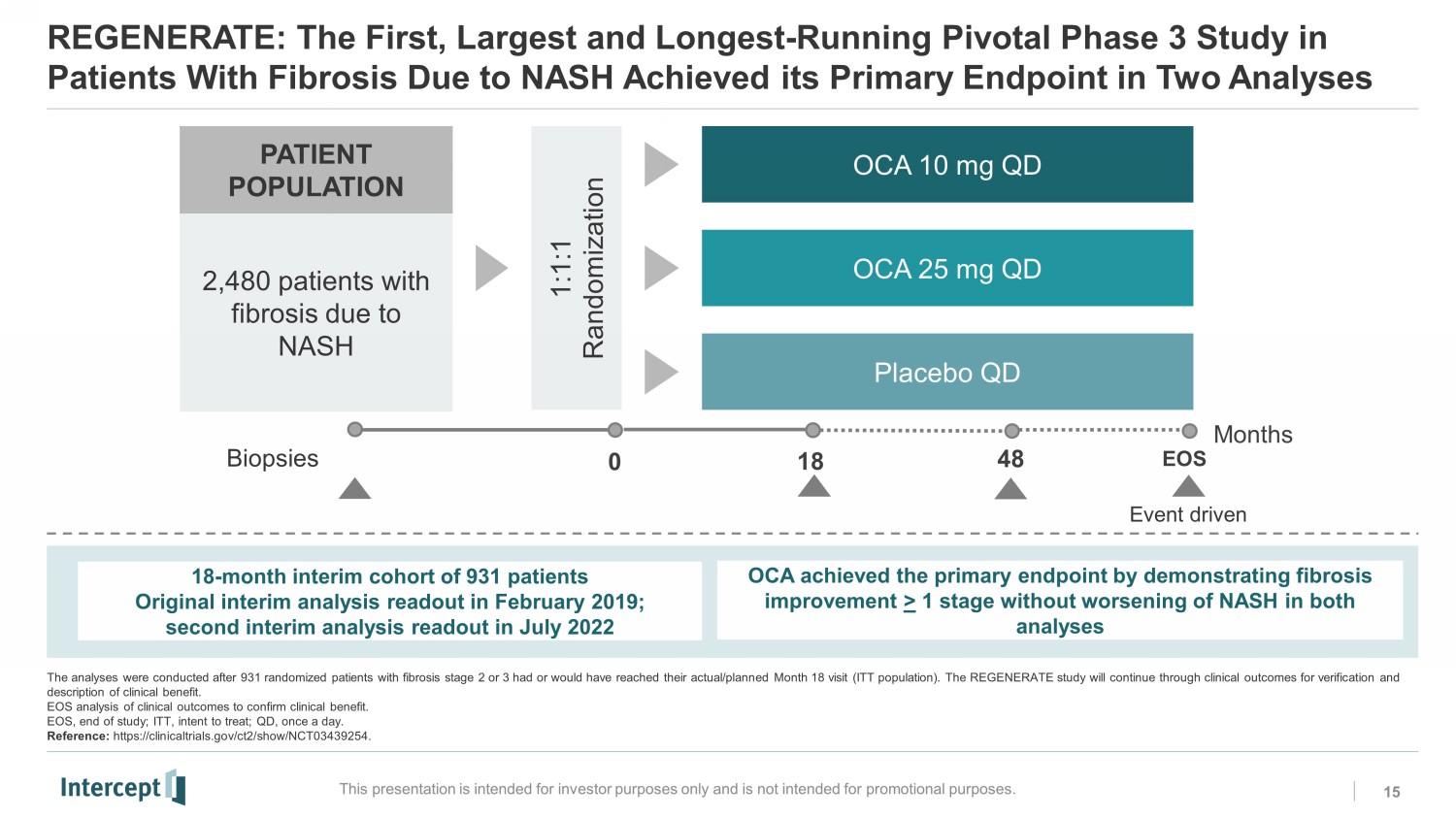

REGENERATE: The First, Largest and Longest - Running Pivotal Phase 3 Study in Patients With Fibrosis Due to NASH Achieved its Primary Endpoint in Two Analyses 15 This presentation is intended for investor purposes only and is not intended for promotional purposes. PATIENT POPULATION 2,480 patients with fibrosis due to NASH 1:1:1 Randomization OCA 10 mg QD OCA 25 mg QD Placebo QD EOS 18 Months Biopsies Event driven 0 48 18 - month interim cohort of 931 patients Original interim analysis readout in February 2019; second interim analysis readout in July 2022 The analyses were conducted after 931 randomized patients with fibrosis stage 2 or 3 had or would have reached their actual/p lan ned Month 18 visit (ITT population). The REGENERATE study will continue through clinical outcomes for verification and description of clinical benefit. EOS analysis of clinical outcomes to confirm clinical benefit. EOS, end of study; ITT, intent to treat; QD, once a day. Reference: https://clinicaltrials.gov/ct2/show/NCT03439254. OCA achieved the primary endpoint by demonstrating fibrosis improvement > 1 stage without worsening of NASH in both analyses RC0

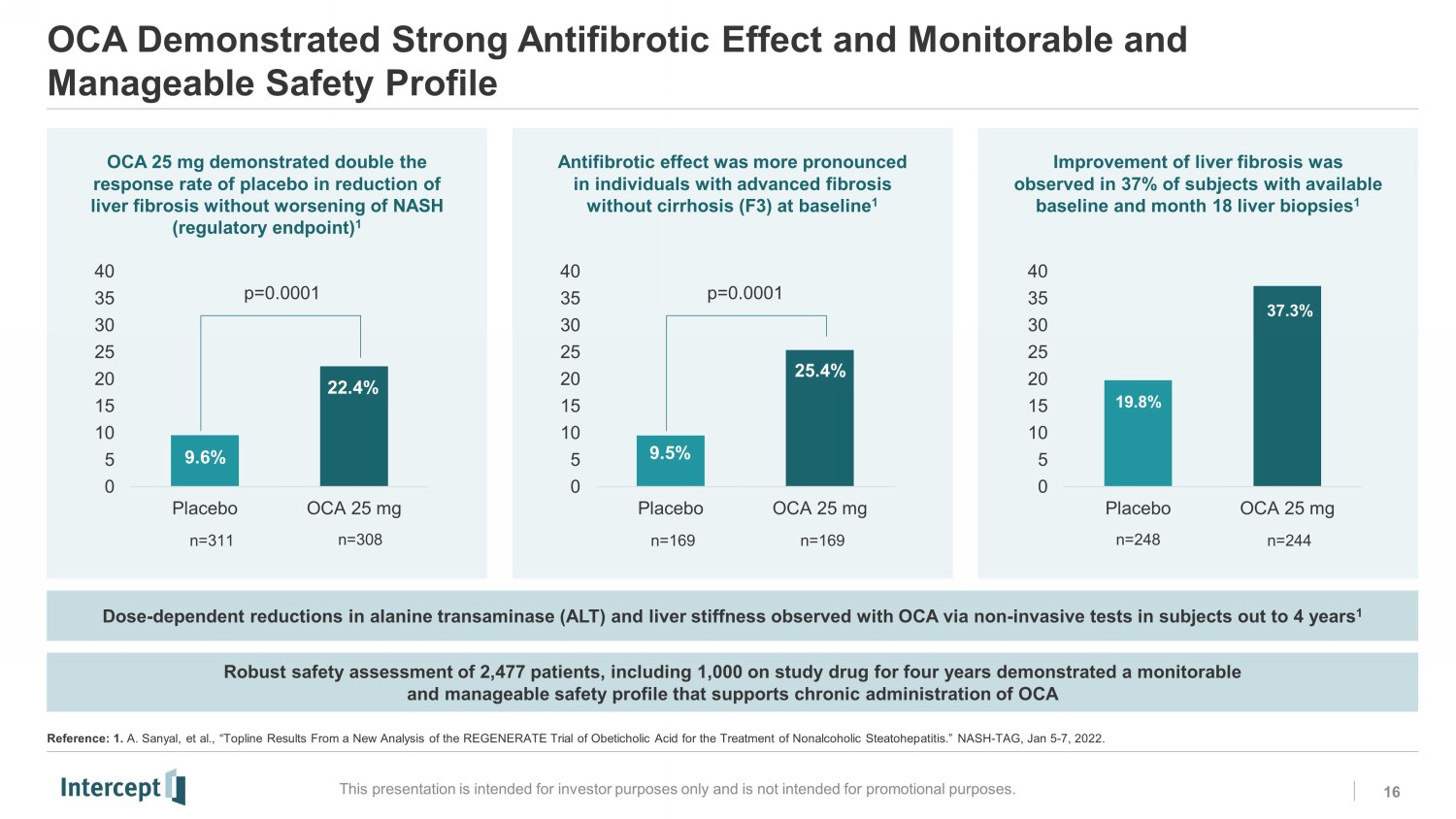

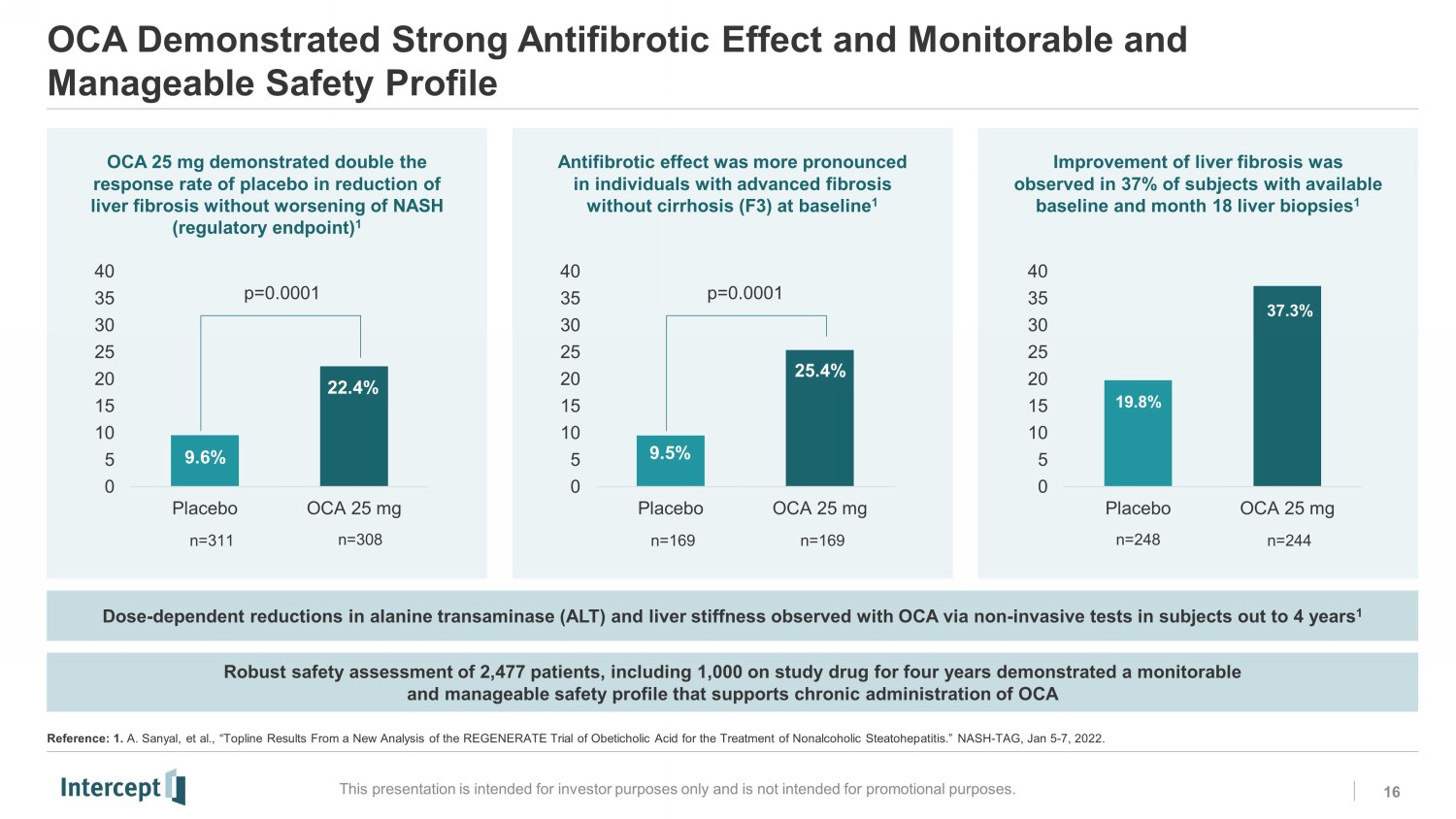

OCA Demonstrated Strong Antifibrotic Effect and Monitorable and Manageable Safety Profile 16 This presentation is intended for investor purposes only and is not intended for promotional purposes. Robust safety assessment of 2,477 patients, including 1,000 on study drug for four years demonstrated a monitorable and manageable safety profile that supports chronic administration of OCA Dose - dependent reductions in alanine transaminase (ALT) and liver stiffness observed with OCA via non - invasive tests in subjects out to 4 years 1 OCA 25 mg demonstrated double the response rate of placebo in reduction of liver fibrosis without worsening of NASH (regulatory endpoint) 1 Antifibrotic effect was more pronounced in individuals with advanced fibrosis without cirrhosis (F3) at baseline 1 Improvement of liver fibrosis was observed in 37% of subjects with available baseline and month 18 liver biopsies 1 0 5 10 15 20 25 30 35 40 Placebo OCA 25 mg 9.6% 22.4% p=0.0001 n=311 n=308 0 5 10 15 20 25 30 35 40 Placebo OCA 25 mg 9.5% 25.4% n=169 n=169 p=0.0001 0 5 10 15 20 25 30 35 40 Placebo OCA 25 mg n=248 n=244 19.8% 37.3% Reference: 1. A. Sanyal, et al., “ Topline Results From a New Analysis of the REGENERATE Trial of Obeticholic Acid for the Treatment of Nonalcoholic Steatohepatitis.” NASH - TAG, Jan 5 - 7, 2022. NS0NS1 RC2RC3

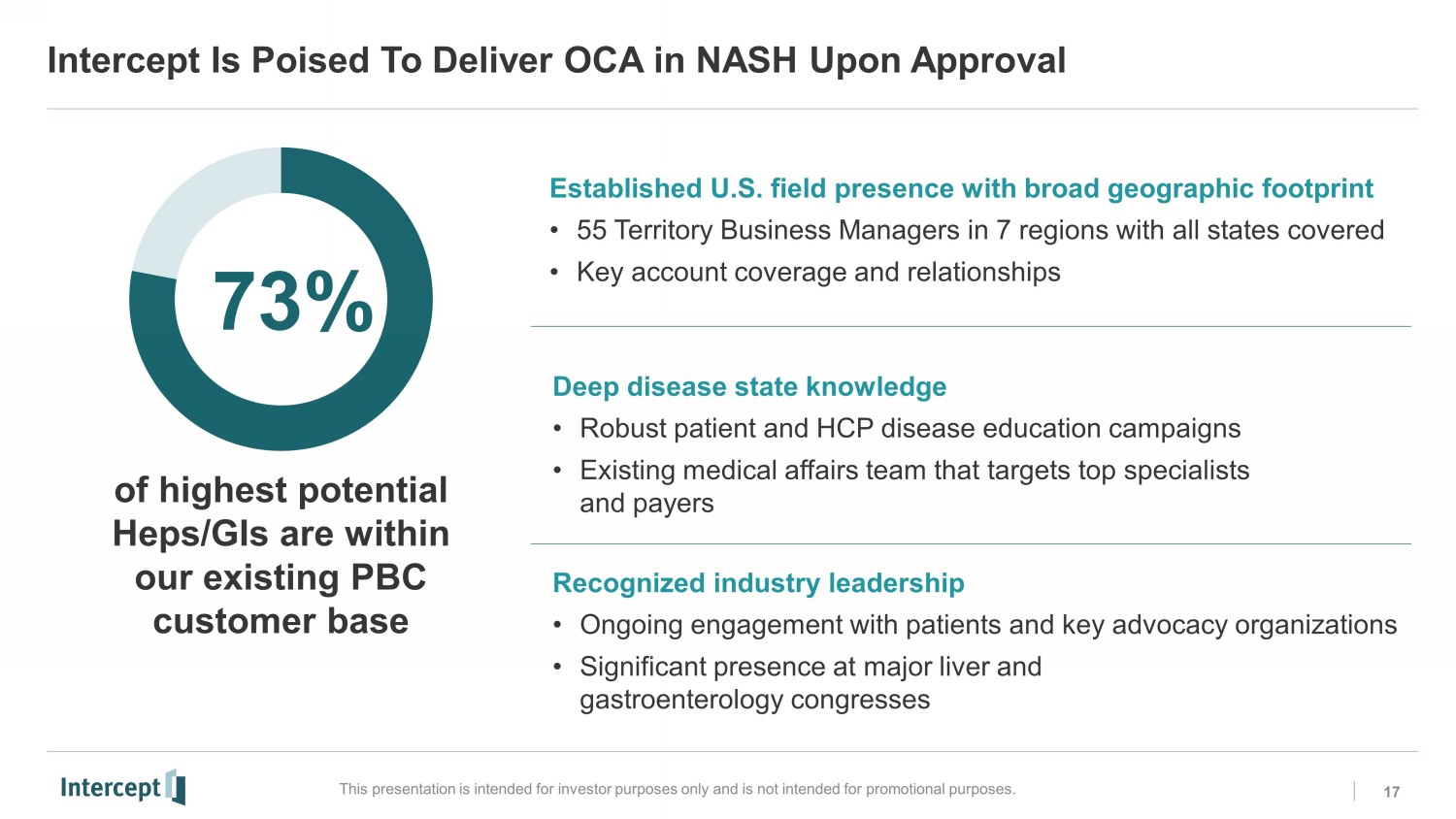

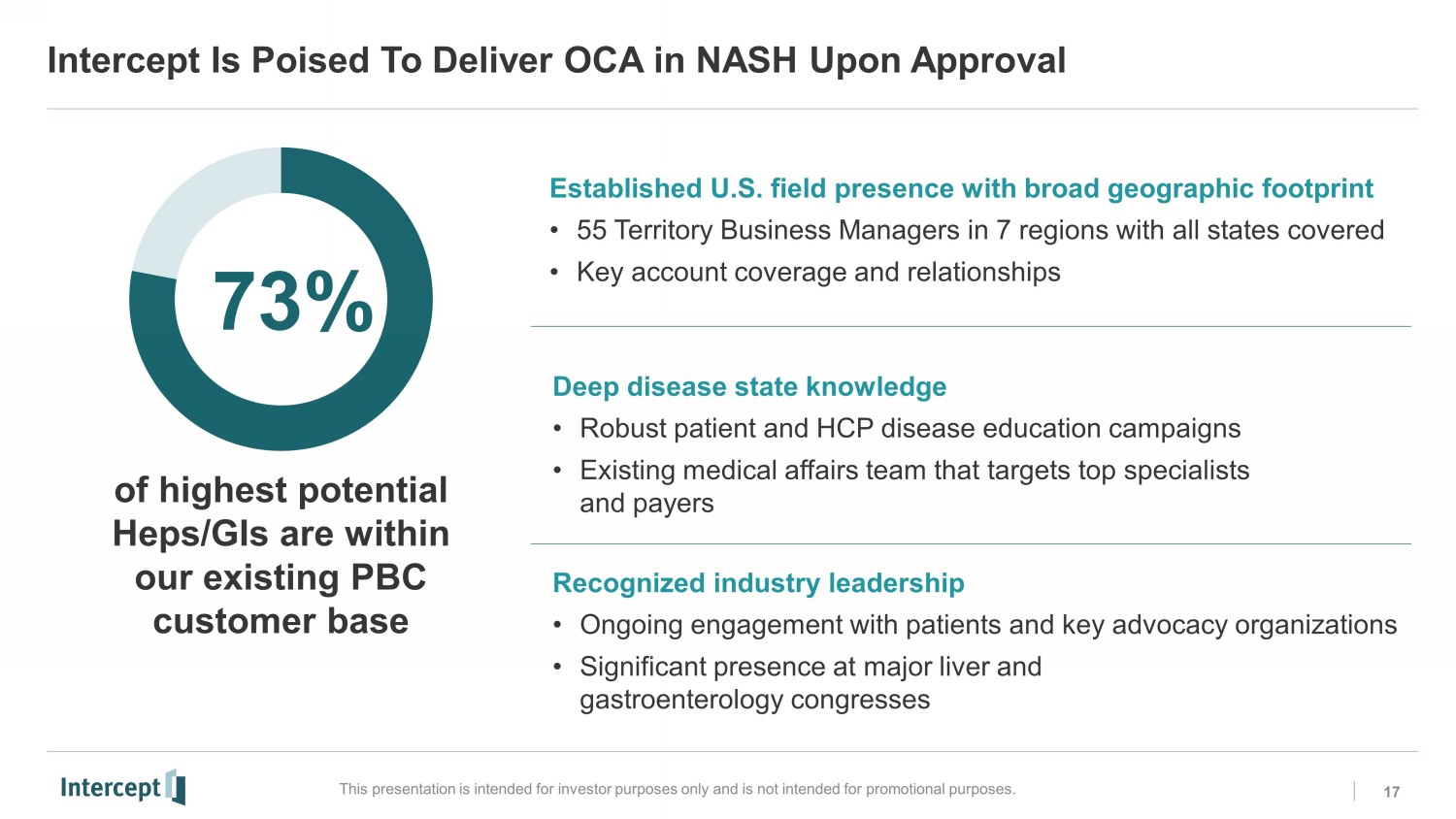

Intercept Is Poised To Deliver OCA in NASH Upon Approval 17 This presentation is intended for investor purposes only and is not intended for promotional purposes. of highest potential Heps/GIs are within our existing PBC customer base Established U.S. field presence with broad geographic footprint • 55 Territory Business Managers in 7 regions with all states covered • Key account coverage and relationships Recognized industry leadership • Ongoing engagement with patients and key advocacy organizations • Significant presence at major liver and gastroenterology congresses 73% Deep disease state knowledge • Robust patient and HCP disease education campaigns • Existing medical affairs team that targets top specialists and payers

Sustainable and Growing PBC Business with Ocaliva Progressing OCA for Pre - Cirrhotic Liver Fibrosis due to NASH Advancing Internal Pipeline, 2023 Priorities

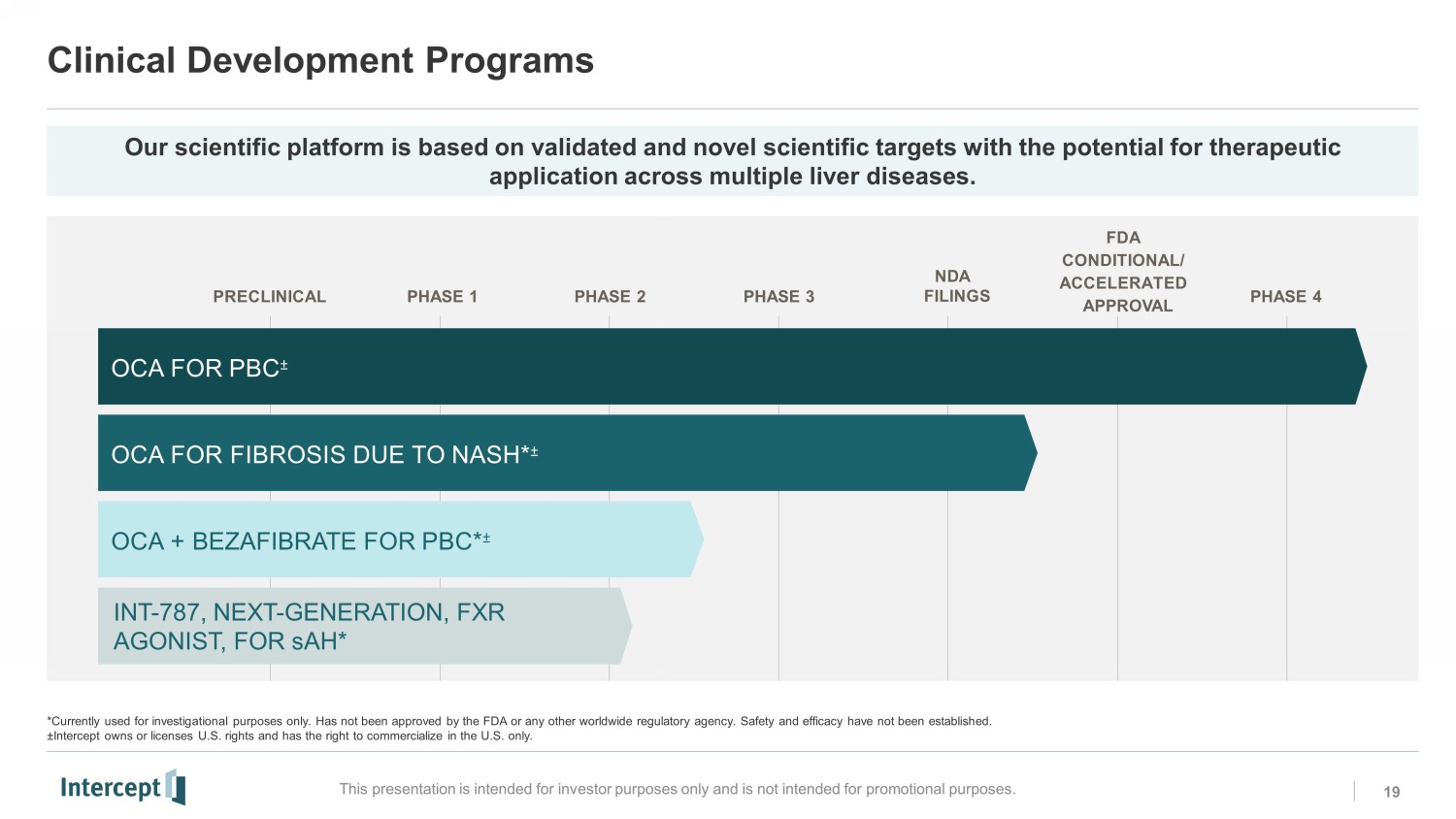

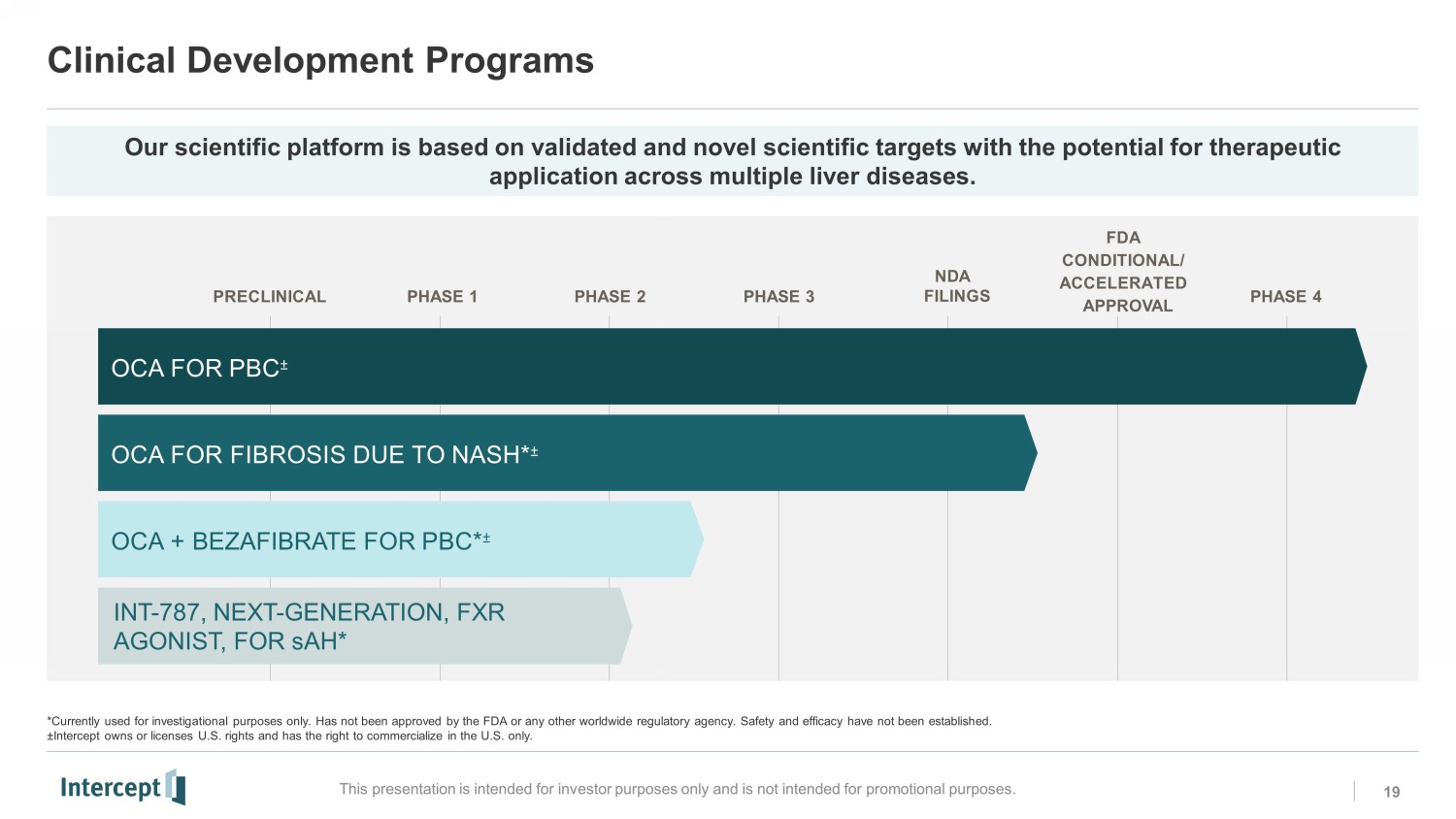

Clinical Development Programs 19 This presentation is intended for investor purposes only and is not intended for promotional purposes. *Currently used for investigational purposes only. Has not been approved by the FDA or any other worldwide regulatory agency. Sa fety and efficacy have not been established. ± Intercept owns or licenses U.S. rights and has the right to commercialize in the U.S. only. PRECLINICAL PHASE 1 PHASE 2 PHASE 3 N D A FILINGS PHASE 4 FDA CONDITIONAL/ ACCELERATED A PP R O V A L OCA + BEZAFIBRATE FOR PBC * ц OCA FOR PBC ц OCA FOR FIBROSIS DUE TO NASH* ц INT - 787, NEXT - GENERATION, FXR AGONIST, FOR sAH * Our scientific platform is based on validated and novel scientific targets with the potential for therapeutic application across multiple liver diseases.

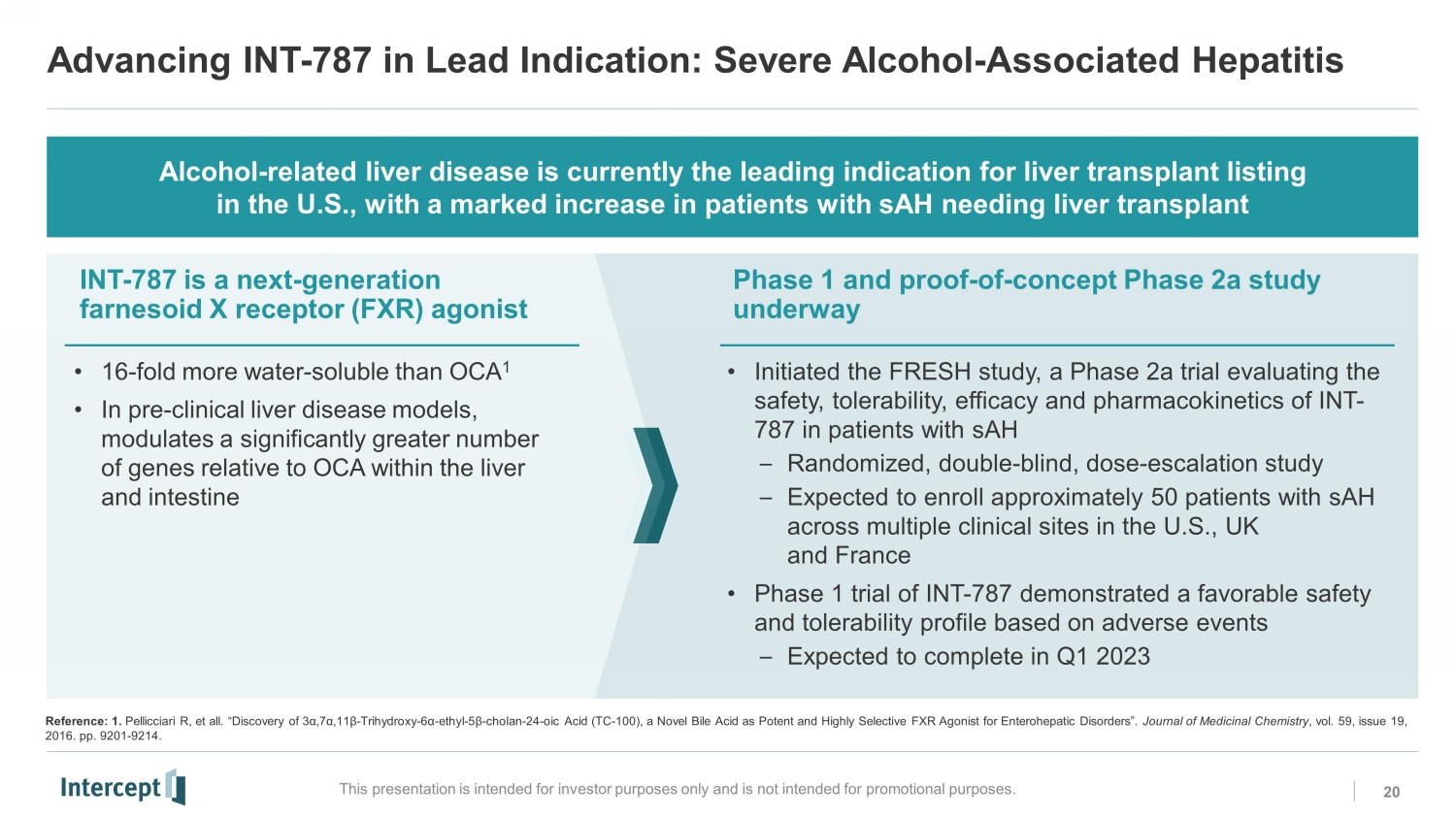

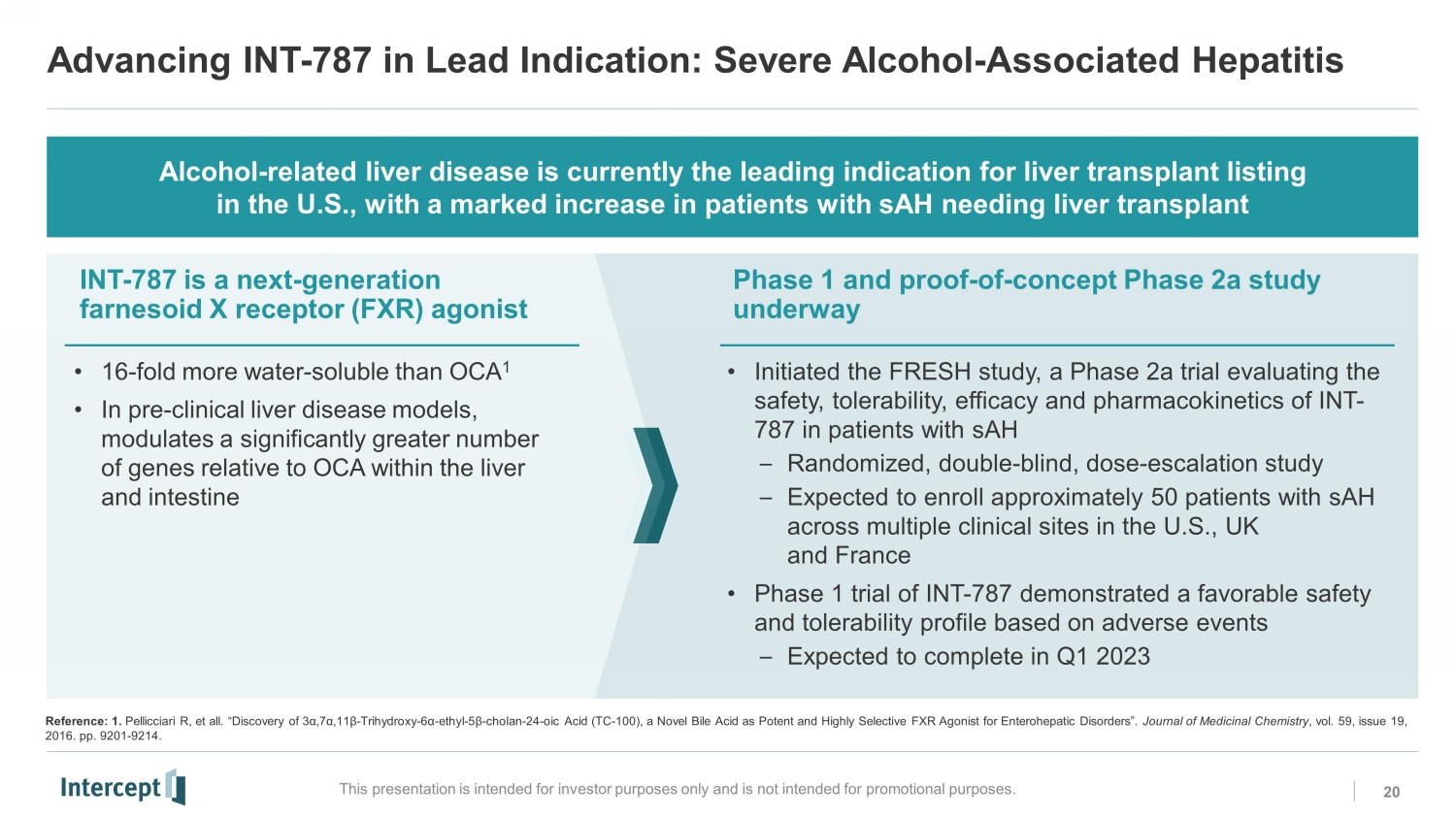

Advancing INT - 787 in Lead Indication: Severe Alcohol - Associated Hepatitis 20 This presentation is intended for investor purposes only and is not intended for promotional purposes. Alcohol - related liver disease is currently the leading indication for liver transplant listing in the U.S., with a marked increase in patients with sAH needing liver transplant INT - 787 is a next - generation farnesoid X receptor (FXR) agonist Phase 1 and proof - of - concept Phase 2a study underway • 16 - fold more water - soluble than OCA 1 • In pre - clinical liver disease models, modulates a significantly greater number of genes relative to OCA within the liver and intestine • Initiated the FRESH study, a Phase 2a trial evaluating the safety, tolerability, efficacy and pharmacokinetics of INT - 787 in patients with sAH – Randomized, double - blind, dose - escalation study – Expected to enroll approximately 50 patients with sAH across multiple clinical sites in the U.S., UK and France • Phase 1 trial of INT - 787 demonstrated a favorable safety and tolerability profile based on adverse events – Expected to complete in Q1 2023 Reference: 1. Pellicciari R, et all. “Discovery of 3 α,7α,11β - Trihydroxy - 6 α - ethyl - 5 β - cholan - 24 - oic Acid (TC - 100), a Novel Bile Acid as Potent and Highly Selective FXR Agonist for Enterohepatic Disorders”. Journal of Medicinal Chemistry , vol. 59, issue 19, 2016. pp. 9201 - 9214.

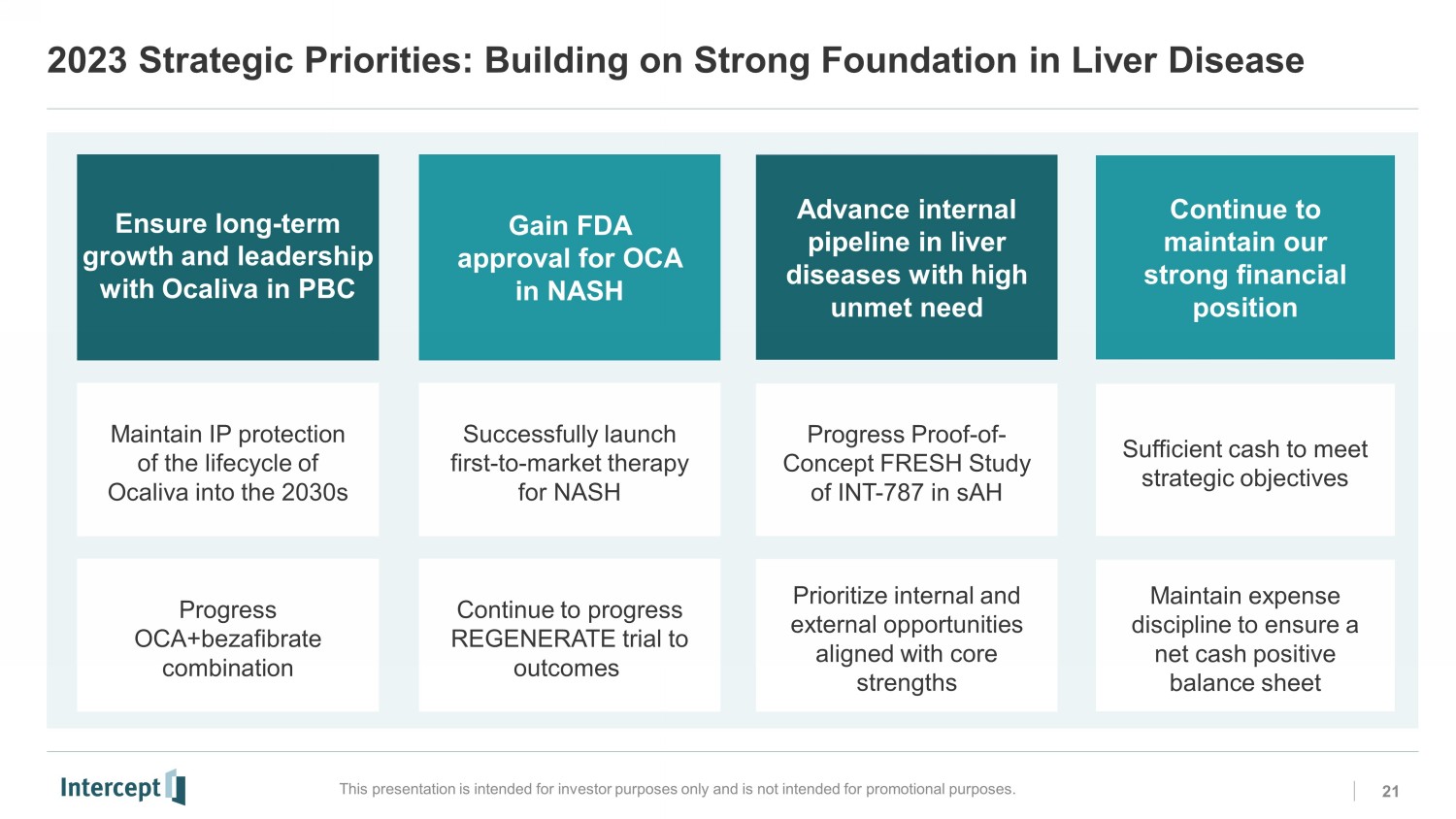

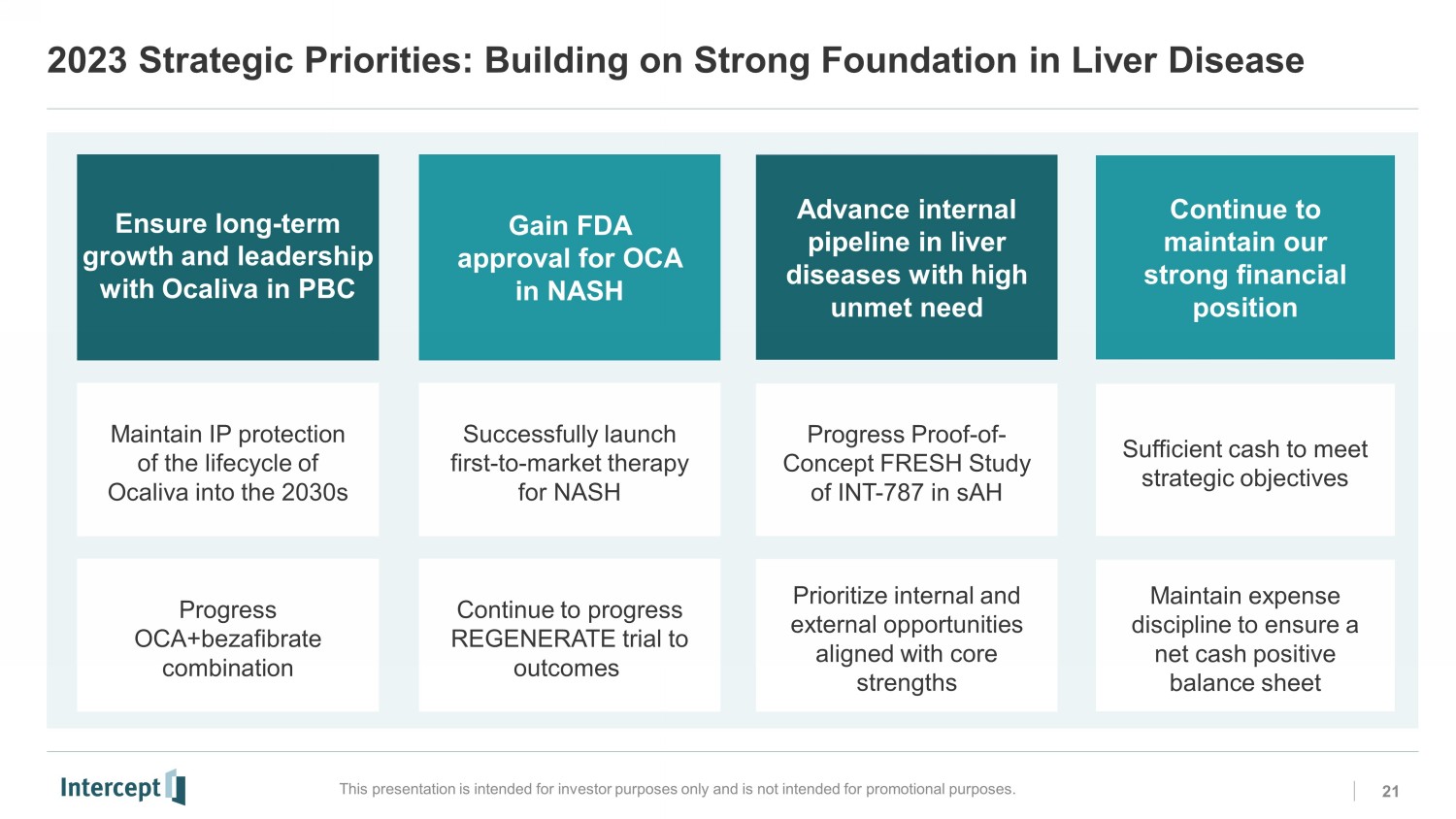

2023 Strategic Priorities: Building on Strong Foundation in Liver Disease This presentation is intended for investor purposes only and is not intended for promotional purposes. 21 Gain FDA approval for OCA in NASH Advance internal pipeline in liver diseases with high unmet need Continue to maintain our strong financial position Maintain IP protection of the lifecycle of Ocaliva into the 2030s Successfully launch first - to - market therapy for NASH Progress Proof - of - Concept FRESH Study of INT - 787 in sAH Sufficient cash to meet strategic objectives Progress OCA+bezafibrate combination Continue to progress REGENERATE trial to outcomes Prioritize internal and external opportunities aligned with core strengths Maintain expense discipline to ensure a net cash positive balance sheet Ensure long - term growth and leadership with Ocaliva in PBCNS0 NS1

Appendix

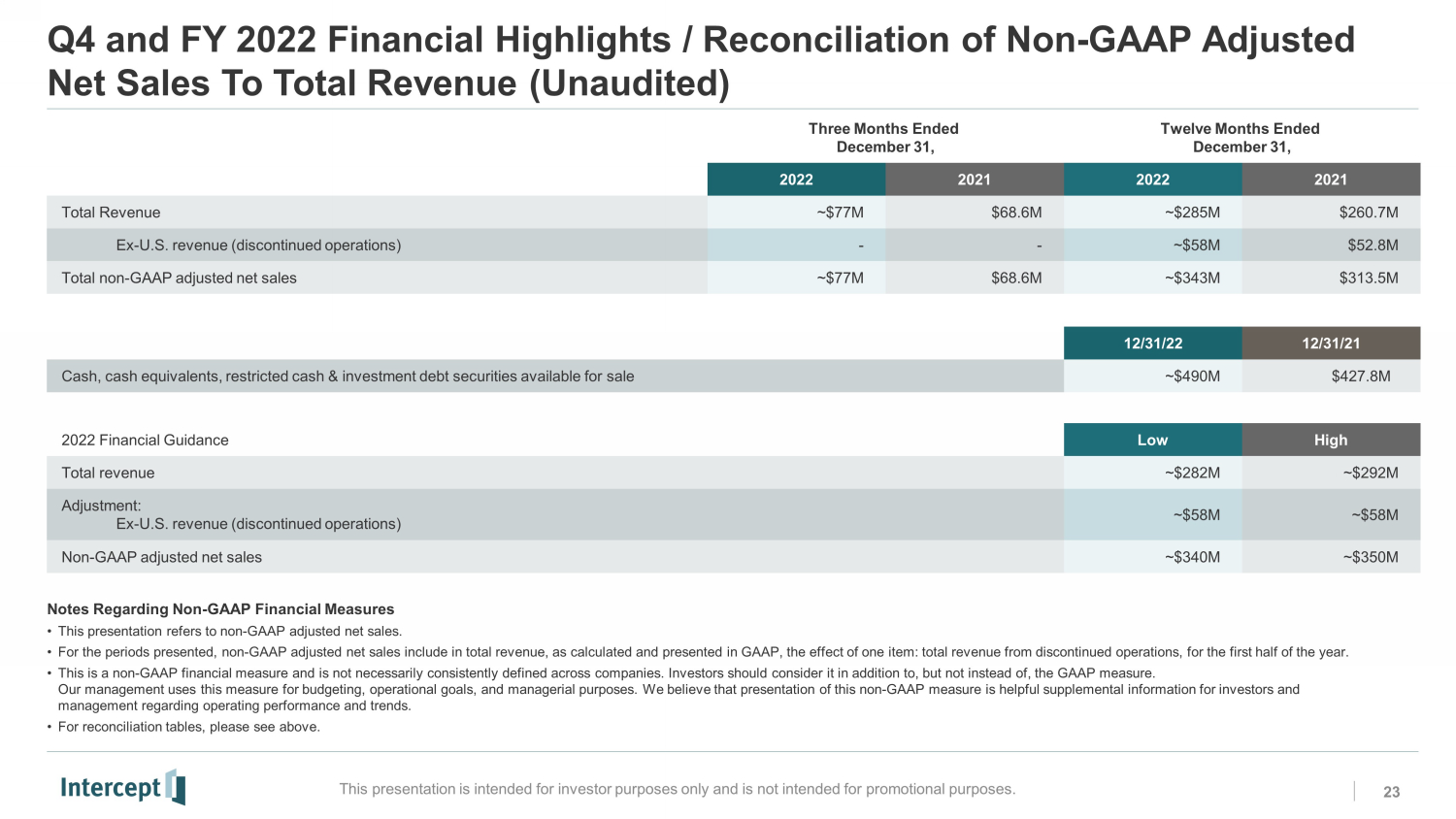

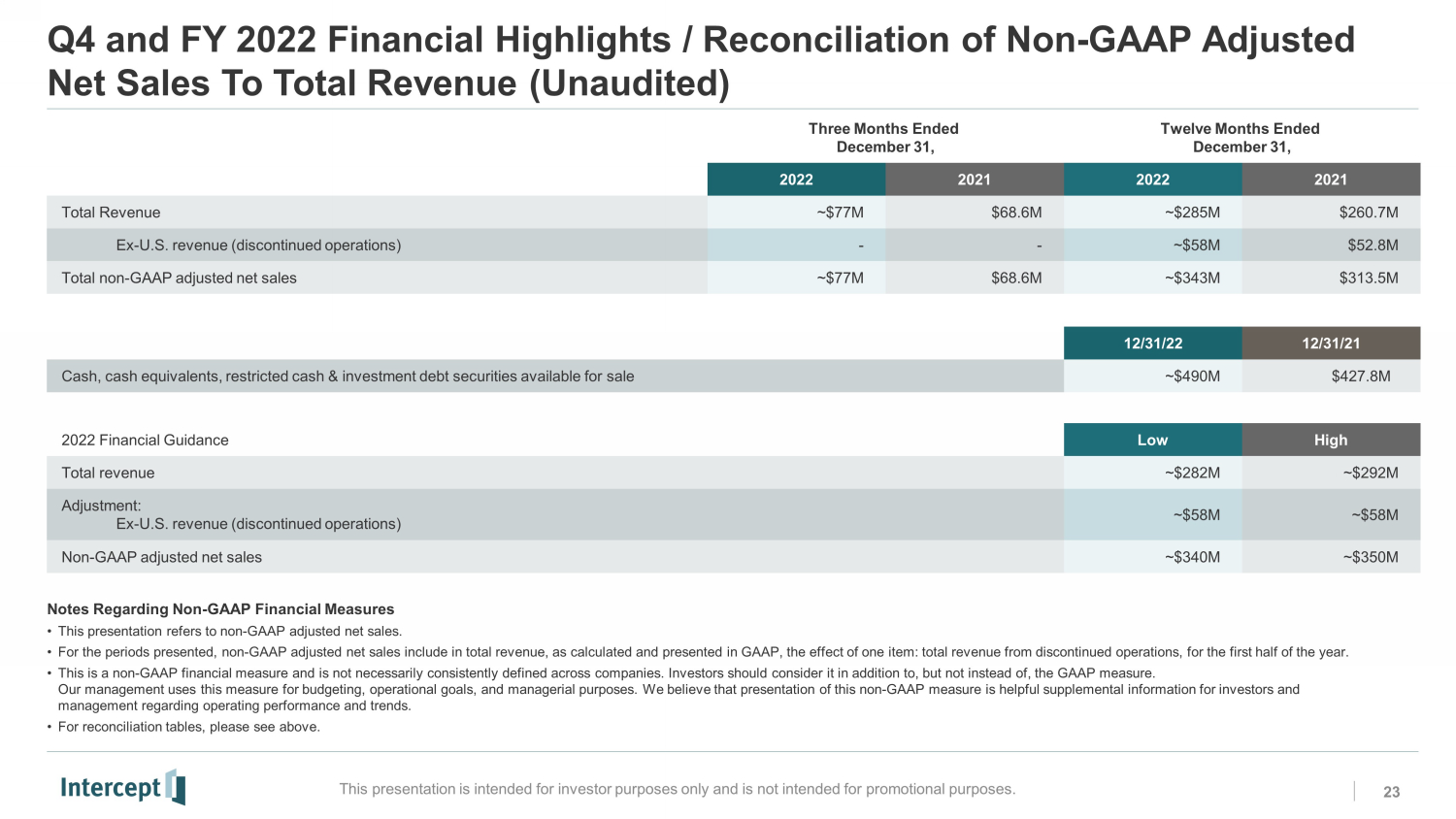

Q4 and FY 2022 Financial Highlights / Reconciliation of Non - GAAP Adjusted Net Sales To Total Revenue (Unaudited) 23 This presentation is intended for investor purposes only and is not intended for promotional purposes. Three Months Ended December 31, Twelve Months Ended December 31, 2022 2021 2022 2021 Total Revenue ~$77M $68.6M ~$285M $260.7M Ex - U.S. revenue (discontinued operations) - - ~$58M $52.8M Total non - GAAP adjusted net sales ~$77M $68.6M ~$343M $313.5M 12/31/22 12/31/21 Cash, cash equivalents, restricted cash & investment debt securities available for sale ~$490M $427.8M Notes Regarding Non - GAAP Financial Measures • This presentation refers to non - GAAP adjusted net sales. • For the periods presented, non - GAAP adjusted net sales include in total revenue, as calculated and presented in GAAP, the effect of one item: total revenue from discontinued operations, for the first half of the year. • This is a non - GAAP financial measure and is not necessarily consistently defined across companies. Investors should consider it in addition to, but not instead of, the GAAP measure. Our management uses this measure for budgeting, operational goals, and managerial purposes. We believe that presentation of this non - GAAP measure is helpful supplemental information for investors and management regarding operating performance and trends. • For reconciliation tables, please see above. 2022 Financial Guidance Low High Total revenue ~$282M ~$292M Adjustment: Ex - U.S. revenue (discontinued operations) ~$58M ~$58M Non - GAAP adjusted net sales ~$340M ~$350M