Exhibit 99.2

Exhibit 99.2

November 11, 2004

Telewest Global, Inc. 3rd Quarter Results

Disclaimer

The following information contains or may be deemed to contain “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995).

These statements relate to future events or our future financial performance, including, but not limited to, strategic plans, potential growth (including penetration of developed markets and opportunities in emerging markets), product introductions and innovation, meeting customer expectations, planned operational changes (including product improvements), expected capital expenditures, future cash sources and requirements, liquidity, customer service improvements, cost savings and other benefits of acquisitions or joint ventures—potential and/or completed—that involve known and unknown risks, uncertainties and other factors that may cause our or our businesses’ actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of those terms or other comparable terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Future results may vary from the results expressed in, or implied by, the following forward-looking statements, possibly to a material degree.

A discussion of some of the important factors that could cause the results to differ from those expressed in, or implied by, the following forward-looking statements can be found in the Risk Factors section of our Registration Statement on Form S-1 filed with the SEC on July 16, 2004 and available from on the Company’s website.

This presentation includes some non-GAAP financial measures as defined in Regulation G adopted by the SEC. These measures and full reconciliations to US GAAP measures can be found in Telewest Global, Inc.’s third quarter 2004 results press release and associated Form 8-K filed on November 11, 2004 available on Telewest’s website at www.telewest.co.uk.

2

Eric Tveter

Chief Operating Officer

3

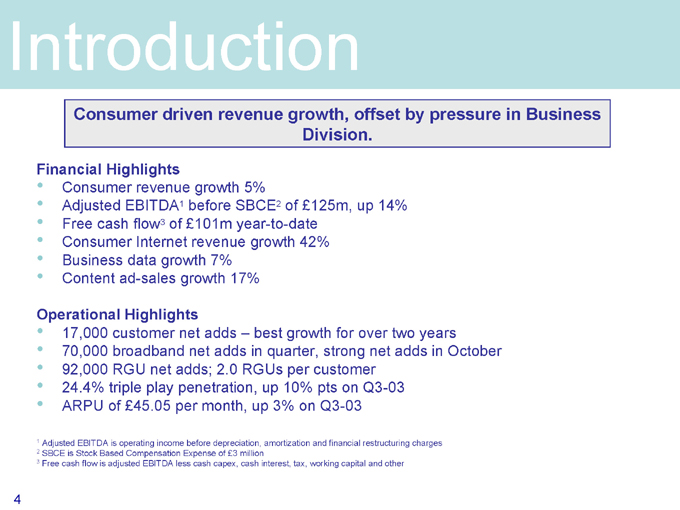

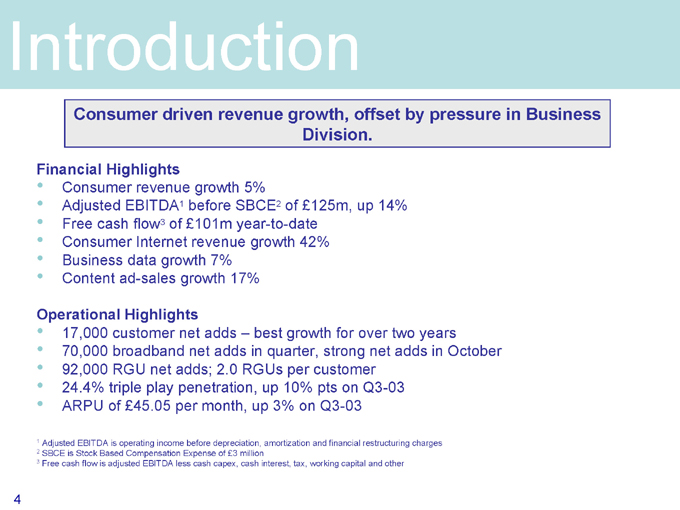

Introduction

Consumer driven revenue growth, offset by pressure in Business Division.

Financial Highlights

Consumer revenue growth 5%

Adjusted EBITDA1 before SBCE2 of £125m, up 14%

Free cash flow3 of £101m year-to-date

Consumer Internet revenue growth 42%

Business data growth 7%

Content ad-sales growth 17%

Operational Highlights

17,000 customer net adds – best growth for over two years

70,000 broadband net adds in quarter, strong net adds in October

92,000 RGU net adds; 2.0 RGUs per customer

24.4% triple play penetration, up 10% pts on Q3-03

ARPU of £45.05 per month, up 3% on Q3-03

1 Adjusted EBITDA is operating income before depreciation, amortization and financial restructuring charges

2 SBCE is Stock Based Compensation Expense of £3 million

3 Free cash flow is adjusted EBITDA less cash capex, cash interest, tax, working capital and other

4

Neil Smith

Chief Financial Officer

5

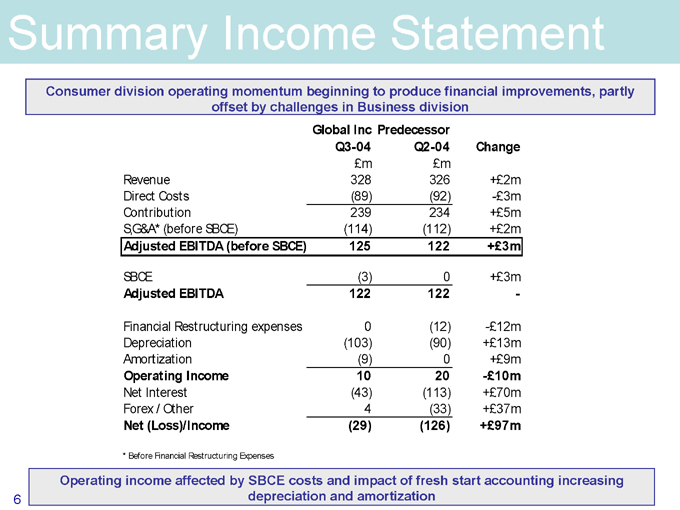

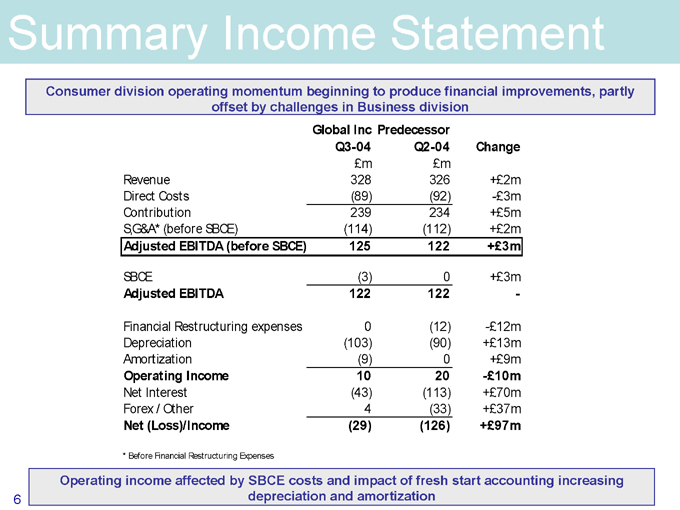

Summary Income Statement

Consumer division operating momentum beginning to produce financial improvements, partly offset by challenges in Business division Global Inc Predecessor

Q3-04 Q2-04 Change

£m £m

Revenue 328 326 +£2m

Direct Costs (89) (92) -£3m

Contribution 239 234 +£5m

S,G&A* (before SBCE) (114) (112) +£2m

Adjusted EBITDA (before SBCE) 125 122 +£3m

SBCE (3) 0 +£3m

Adjusted EBITDA 122 122 -

Financial Restructuring expenses 0 (12) -£12m

Depreciation (103) (90) +£13m

Amortization (9) 0 +£9m

Operating Income 10 20 -£10m

Net Interest (43) (113) +£70m

Forex / Other 4 (33) +£37m

Net (Loss)/Income (29) (126) +£97m

* Before Financial Restructuring Expenses

Operating income affected by SBCE costs and impact of fresh start accounting increasing depreciation and amortization

6

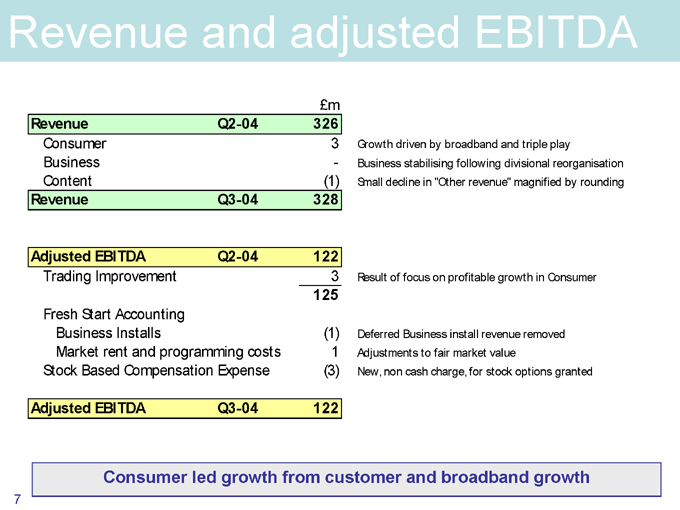

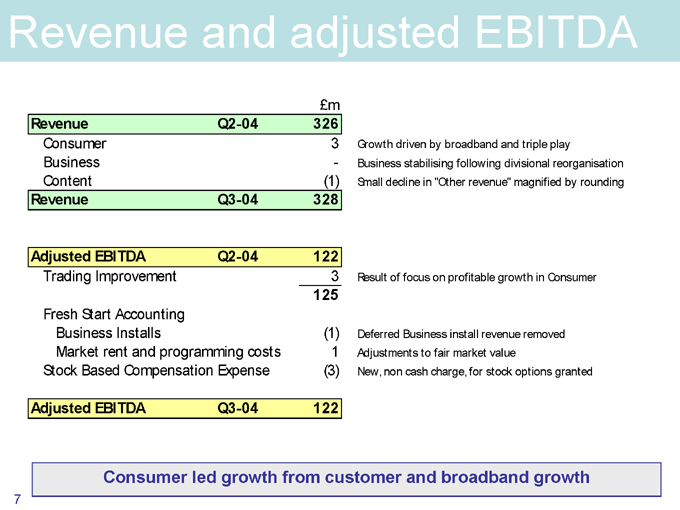

Revenue and adjusted EBITDA

£m

Revenue Q2-04 326

Consumer 3

Business -

Content (1)

Revenue Q3-04 328

Adjusted EBITDA Q2-04 122

Trading Improvement 3

125

Fresh Start Accounting

Business Installs (1)

Market rent and programming costs 1

Stock Based Compensation Expense (3)

Adjusted EBITDA Q3-04 122

Growth driven by broadband and triple play

Business stabilising following divisional reorganisation

Small decline in “Other revenue” magnified by rounding

Result of focus on profitable growth in Consumer

Deferred Business install revenue removed

Adjustments to fair market value

New, non cash charge, for stock options granted

Consumer led growth from customer and broadband growth

7

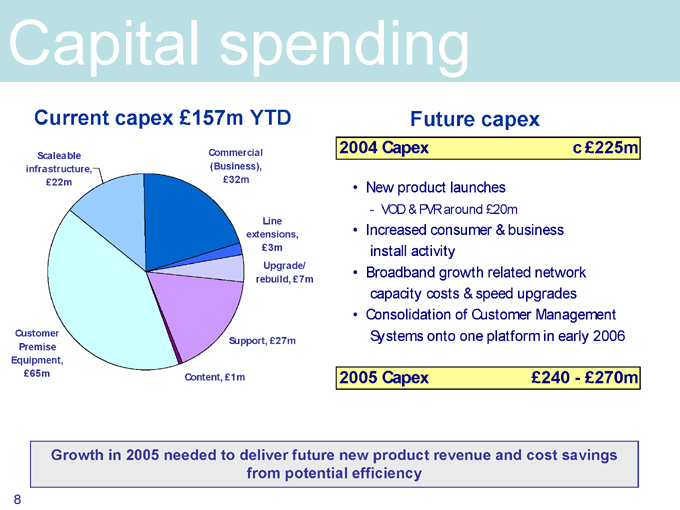

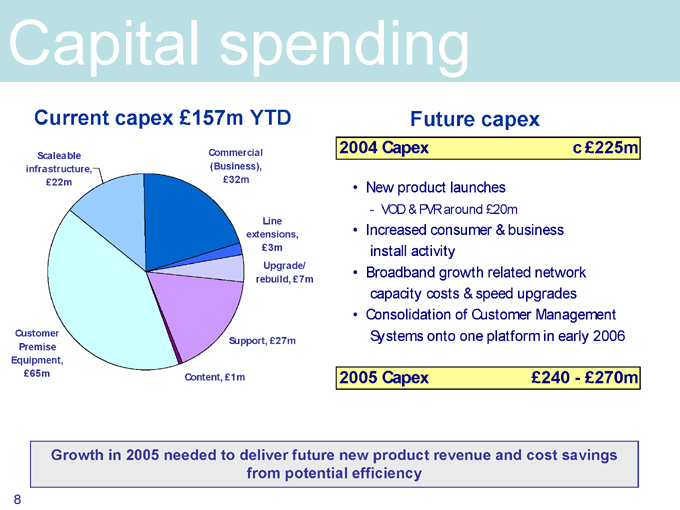

Capital spending

Current capex £157m YTD

Scaleable infrastructure, £22m

Commercial (Business), £32m

Line extensions, £3m

Upgrade/ rebuild, £7m

Support, £27m

Content, £1m

Customer Premise Equipment, £65m

Future capex

2004 Capex c £225m

New product launches

VOD & PVR around £20m

Increased consumer & business install activity

Broadband growth related network capacity costs & speed upgrades

Consolidation of Customer Management Systems onto one platform in early 2006

2005 Capex £240—£270m

Growth in 2005 needed to deliver future new product revenue and cost savings from potential efficiency

8

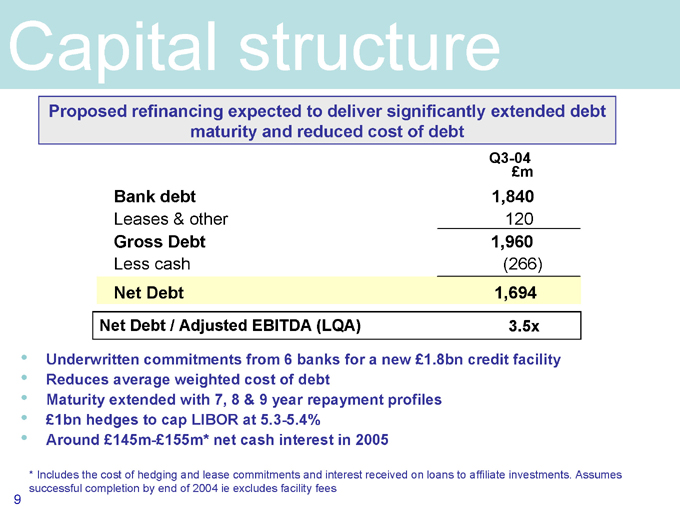

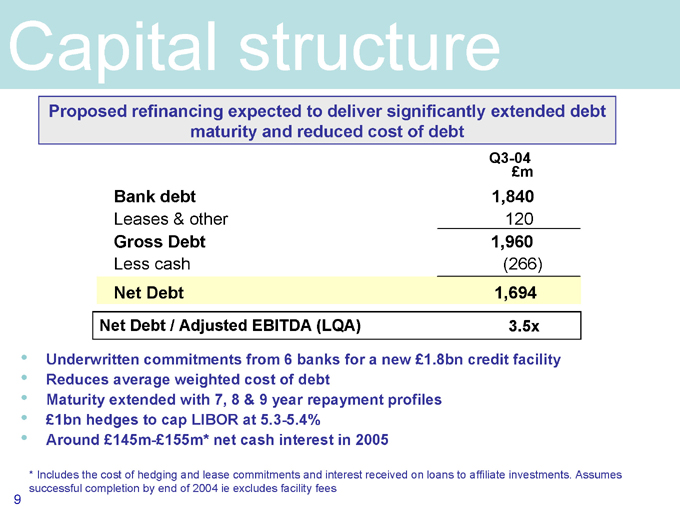

Capital structure

Proposed refinancing expected to deliver significantly extended debt maturity and reduced cost of debt

Q3-04 £m

Bank debt 1,840

Leases & other 120

Gross Debt 1,960

Less cash (266)

Net Debt 1,694

Net Debt / Adjusted EBITDA (LQA) 3.5x

Underwritten commitments from 6 banks for a new £1.8bn credit facility

Reduces average weighted cost of debt

Maturity extended with 7, 8 & 9 year repayment profiles

£1bn hedges to cap LIBOR at 5.3-5.4%

Around £145m-£155m* net cash interest in 2005

* Includes the cost of hedging and lease commitments and interest received on loans to affiliate investments. Assumes successful completion by end of 2004 ie excludes facility fees

9

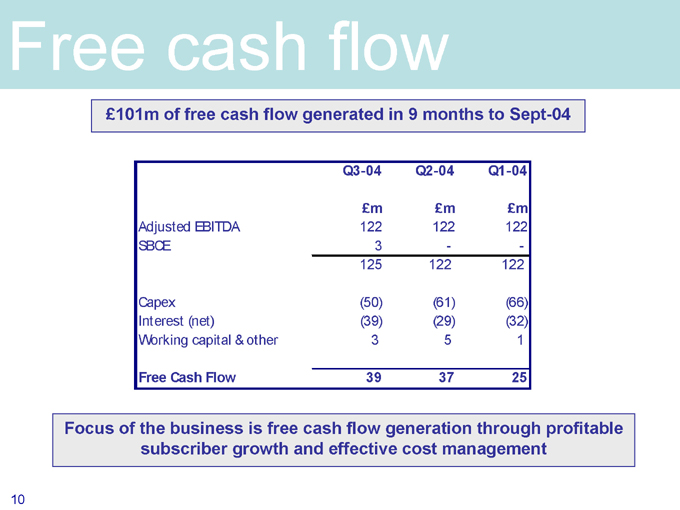

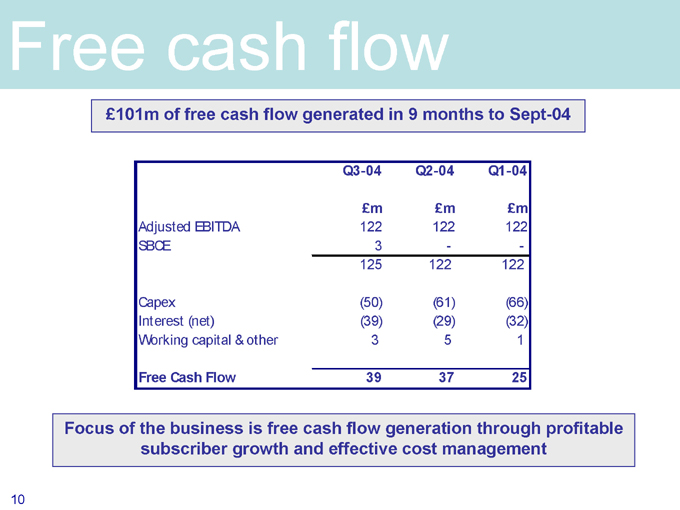

Free cash flow

£101m of free cash flow generated in 9 months to Sept-04

Q3-04 Q2-04 Q1-04

£m £m £m

Adjusted EBITDA 122 122 122

SBCE 3 - -

125 122 122

Capex (50) (61) (66)

Interest (net) (39) (29) (32)

Working capital & other 3 5 1

Free Cash Flow 39 37 25

Focus of the business is free cash flow generation through profitable subscriber growth and effective cost management

10

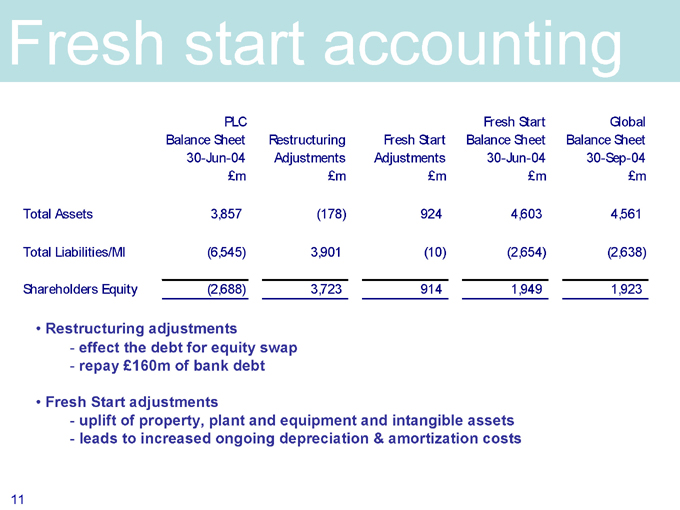

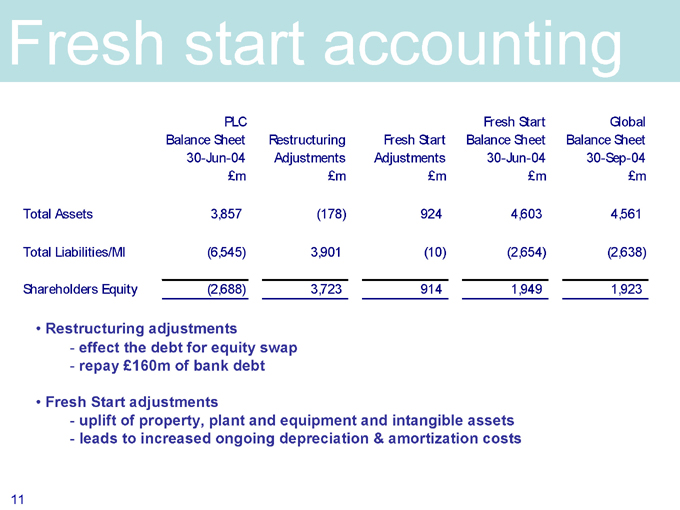

Fresh start accounting

PLC Balance Sheet 30-Jun-04 Restructuring Adjustments Fresh Start Adjustments Fresh Start Balance Sheet 30-Jun-04 Global Balance Sheet 30-Sep-04

£m £m £m £m £m

Total Assets 3,857 (178) 924 4,603 4,561

Total Liabilities/MI (6,545) 3,901 (10) (2,654) (2,638)

Shareholders Equity (2,688) 3,723 914 1,949 1,923

Restructuring adjustments

effect the debt for equity swap

repay £160m of bank debt

Fresh Start adjustments

uplift of property, plant and equipment and intangible assets

leads to increased ongoing depreciation & amortization costs

11

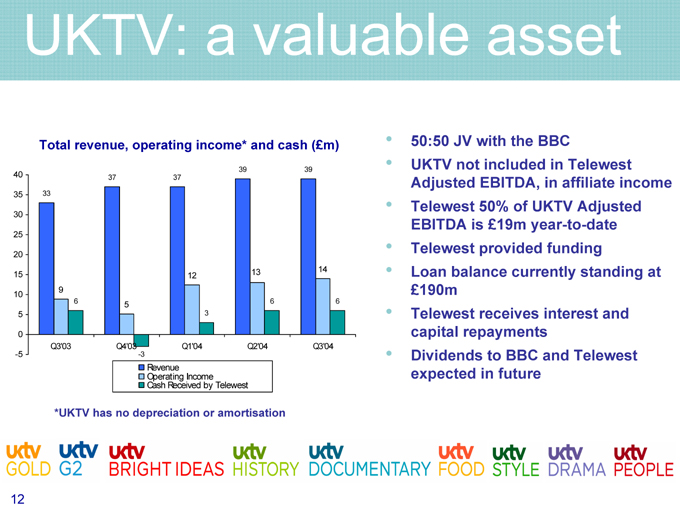

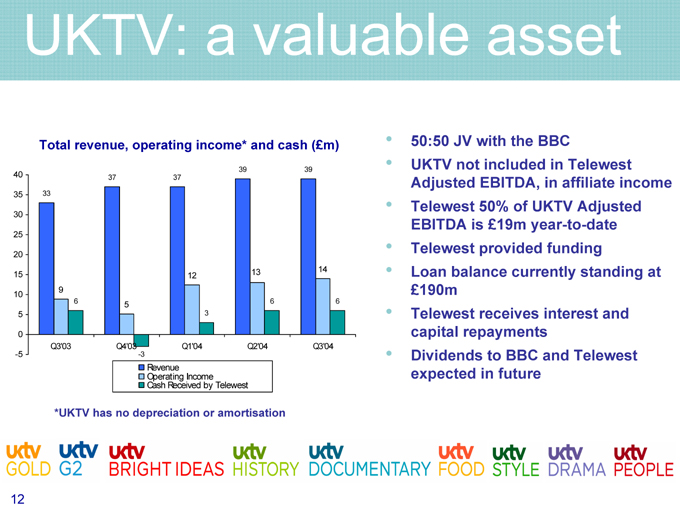

UKTV: a valuable asset

Total revenue, operating income* and cash (£m)

40 35 30 25 20 15 10 5 0 -5

33

9

6

37

5

-3

37

12

3

39

13

6

39

14

6

Q3’03

Q4’03

Q1’04 Q2’04 Q3’04

Revenue

Operating Income

Cash Received by Telewest

*UKTV has no depreciation or amortisation

50:50 JV with the BBC

UKTV not included in Telewest Adjusted EBITDA, in affiliate income

Telewest 50% of UKTV Adjusted EBITDA is £19m year-to-date

Telewest provided funding

Loan balance currently standing at £190m

Telewest receives interest and capital repayments

Dividends to BBC and Telewest expected in future

12

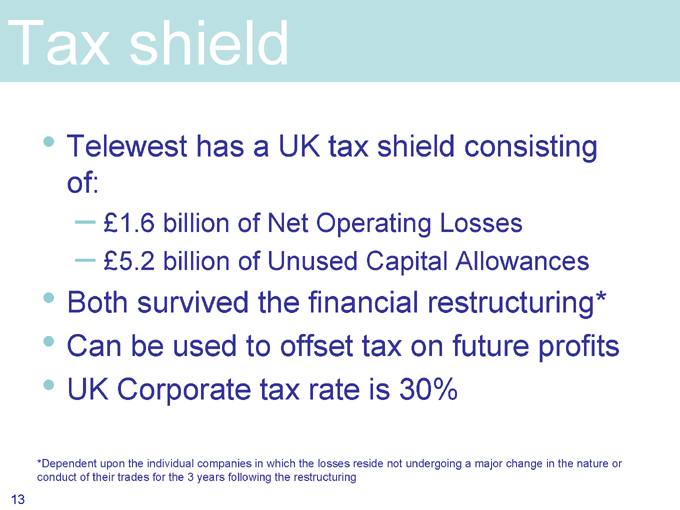

Tax shield

Telewest has a UK tax shield consisting of:

£1.6 billion of Net Operating Losses

£5.2 billion of Unused Capital Allowances

Both survived the financial restructuring*

Can be used to offset tax on future profits

UK Corporate tax rate is 30%

*Dependent upon the individual companies in which the losses reside not undergoing a major change in the nature or conduct of their trades for the 3 years following the restructuring

13

Eric Tveter

Chief Operating Officer

14

Going for growth

Service excellence

The bundle works

Value

Choice

Freedom

Simplicity

Free cash flow

Drive growth through delivering the bundle and service excellence

15

Customer growth

Net customer additions

‘000s

18 16 14 12 10 8 6 4 2 0

2

9

12

10

17

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Customer penetration

38.0% 37.5% 37.0% 36.5% 36.0% 35.5% 35.0%

37.4% 37.2% 37.0% 36.8%

37.7%

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

70% growth in net adds during the quarter

Accelerated momentum in October

Customer penetration currently 38%. Targeting 45% within 5 years

Focus on customer quality—targeting 40% triple play penetration within 5 years

16

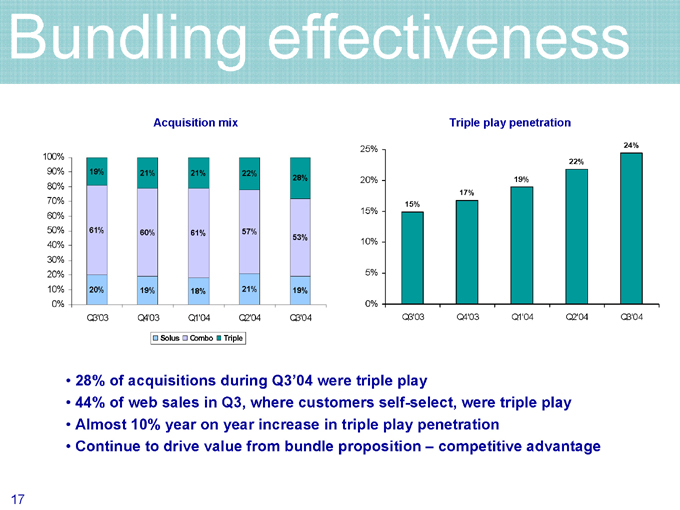

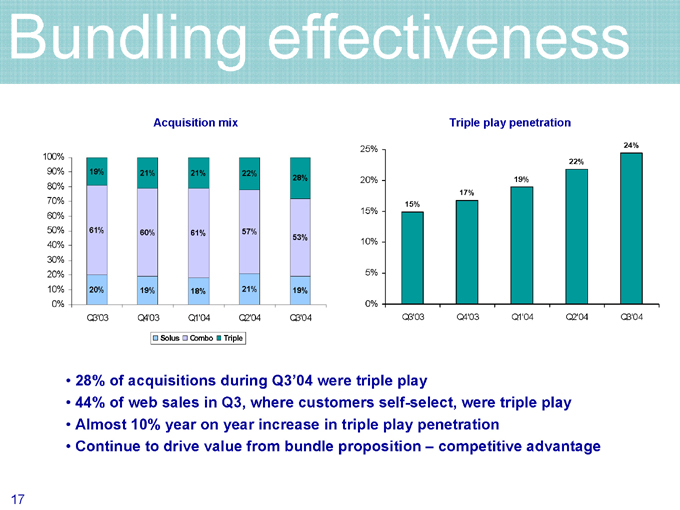

Bundling effectiveness

Acquisition mix

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0%

19% 21% 21% 22%

28%

61% 60% 61% 57%

53%

20% 19% 18% 21% 19%

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Solus Combo Triple

Triple play penetration

25% 20% 15% 10% 5% 0%

22%

19% 17% 15%

24%

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

28% of acquisitions during Q3’04 were triple play

44% of web sales in Q3, where customers self-select, were triple play

Almost 10% year on year increase in triple play penetration

Continue to drive value from bundle proposition – competitive advantage

17

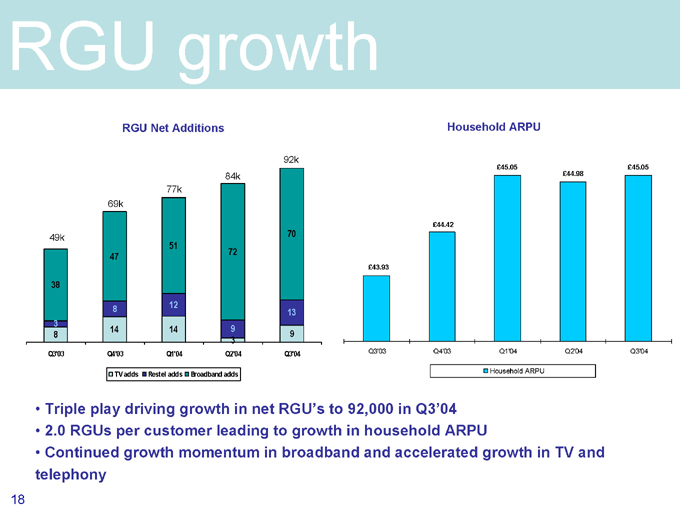

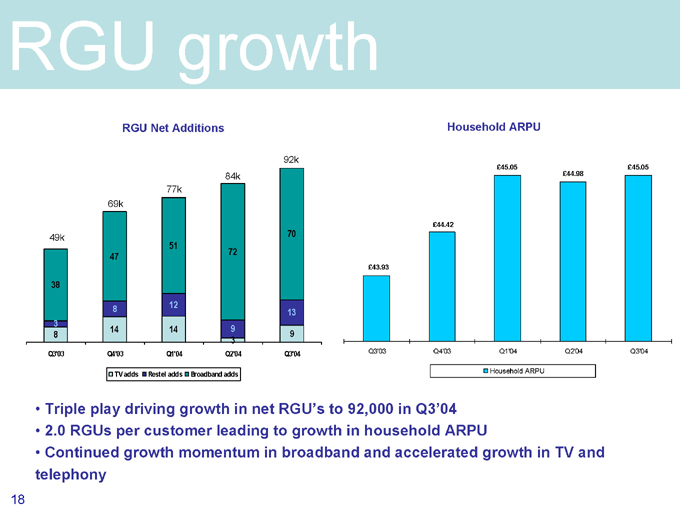

RGU growth

RGU Net Additions

49k

69k

77k

84k

92k

38

47

51

72

70

3

8

12

9

13

8

14

14

9

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

TV adds Restel adds Broadband adds

Household ARPU

£43.93

£44.42

£45.05

£44.98

£45.05

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Household ARPU

Triple play driving growth in net RGU’s to 92,000 in Q3’04

2.0 RGUs per customer leading to growth in household ARPU

Continued growth momentum in broadband and accelerated growth in TV and telephony

18

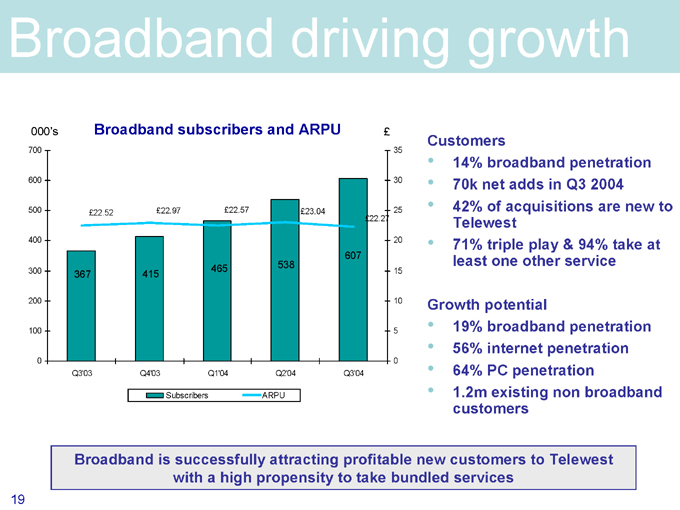

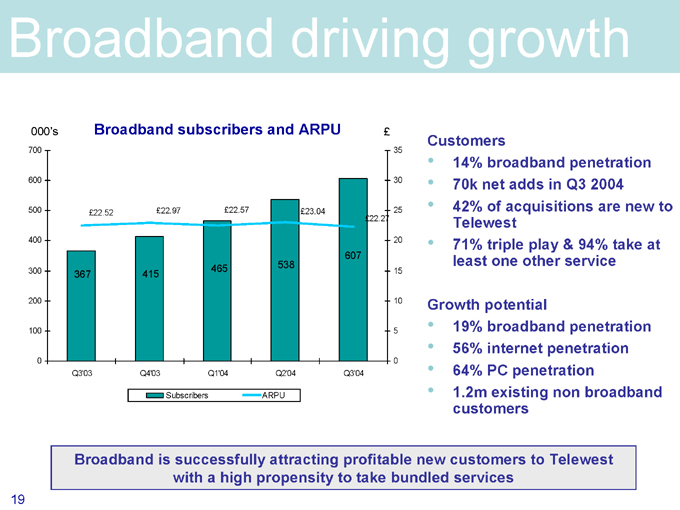

Broadband driving growth

Broadband subscribers and ARPU

000’s

700 600 500 400 300 200 100 0

£22.52 £22.97 £22.57 £23.04

£22.27

607 465 538 367 415

£

35 30 25 20 15 10 5 0

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Subscribers ARPU

Customers

14% broadband penetration

70k net adds in Q3 2004

42% of acquisitions are new to Telewest

71% triple play & 94% take at least one other service

Growth potential

19% broadband penetration

56% internet penetration

64% PC penetration

1.2m existing non broadband customers

Broadband is successfully attracting profitable new customers to Telewest with a high propensity to take bundled services

19

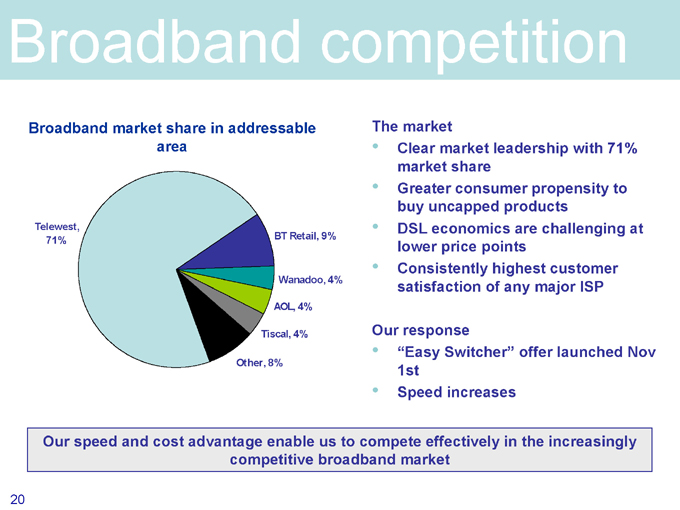

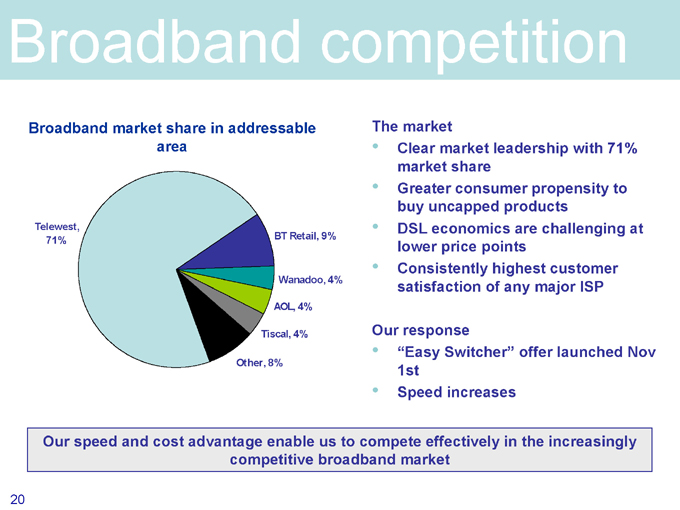

Broadband competition

Broadband market share in addressable area

Telewest, 71%

BT Retail, 9%

Wanadoo, 4%

AOL, 4%

Tiscal, 4%

Other, 8%

The market

Clear market leadership with 71% market share

Greater consumer propensity to buy uncapped products

DSL economics are challenging at lower price points

Consistently highest customer satisfaction of any major ISP

Our response

“Easy Switcher” offer launched Nov 1st

Speed increases

Our speed and cost advantage enable us to compete effectively in the increasingly competitive broadband market

20

Speed upgrade

Current Service New Service Applications Enabled

256K Email

STARTER £17.99 No Change Web browsing

Audio Downloads

750k 1Mb Online Gaming

ESSENTIAL £25.00 £25.00 Small Screen Video

1.5Mb 2Mb Full Screen Quality Video

SUPREME £35.00 £35.00 File Downloading

Video-conferencing

3Mb 4Mb Homeworking

SUPREME + 384k Upstream

£50.00 £50.00 Multimedia Collaboration

Automatic Upgrade for all Services

Speed Upgrade Rationale

Preserves Mix

Reduces downward migration

ARPU Growth

Incentive for higher tier migration

Preserves competitive options

Value enhancing

Broadband speed upgrades enhance customer value while protecting mix and providing opportunity for up-sell

21

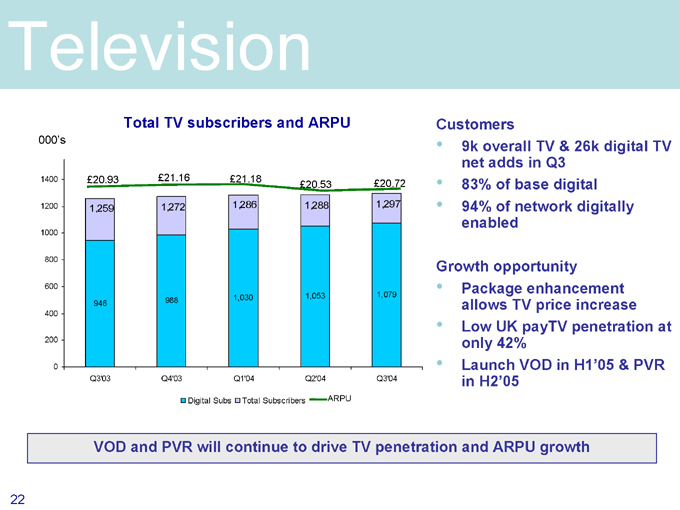

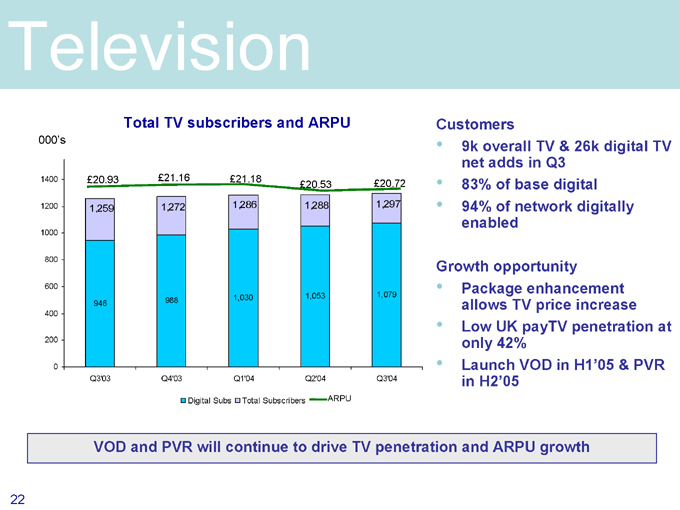

Television

Total TV subscribers and ARPU

000’s

£20.93 £21.16 £21.18

£20.53 £20.72

1,259 1,272 1,286 1,288 1,297

1400 1200 1000 800 600 400 200 0

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Digital Subs Total Subscribers ARPU

Customers

9k overall TV & 26k digital TV net adds in Q3

83% of base digital

94% of network digitally enabled

Growth opportunity

Package enhancement allows TV price increase

Low UK payTV penetration at only 42%

Launch VOD in H1’05 & PVR in H2’05

VOD and PVR will continue to drive TV penetration and ARPU growth

22

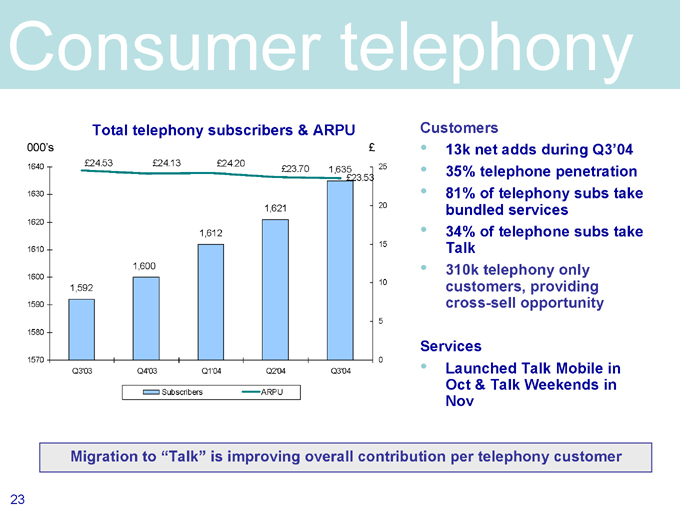

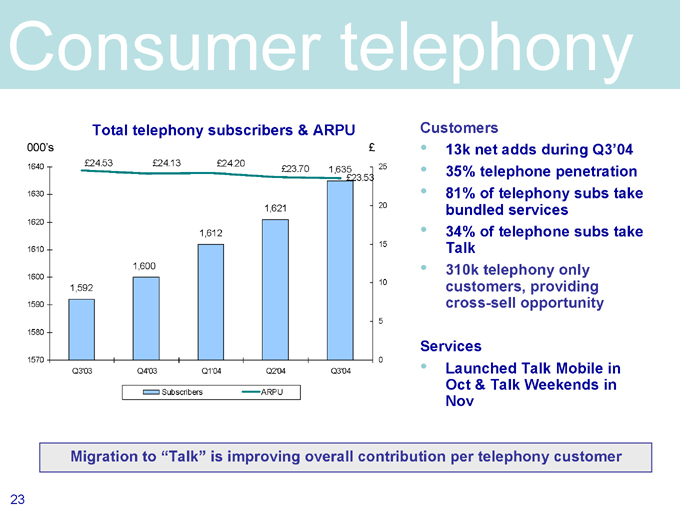

Consumer telephony

Total telephony subscribers & ARPU

000’s

£24.53 £24.13 £24.20

£23.70 1,635

1,592

1,600

1,612

1,621

£23.53

£

25 20 15 10 5 0

1640

1630

1620

1610

1600

1590

1580

1570

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Subscribers ARPU

Customers

13k net adds during Q3’04

35% telephone penetration

81% of telephony subs take bundled services

34% of telephone subs take Talk

310k telephony only customers, providing cross-sell opportunity

Services

Launched Talk Mobile in Oct & Talk Weekends in Nov

Migration to “Talk” is improving overall contribution per telephony customer

23

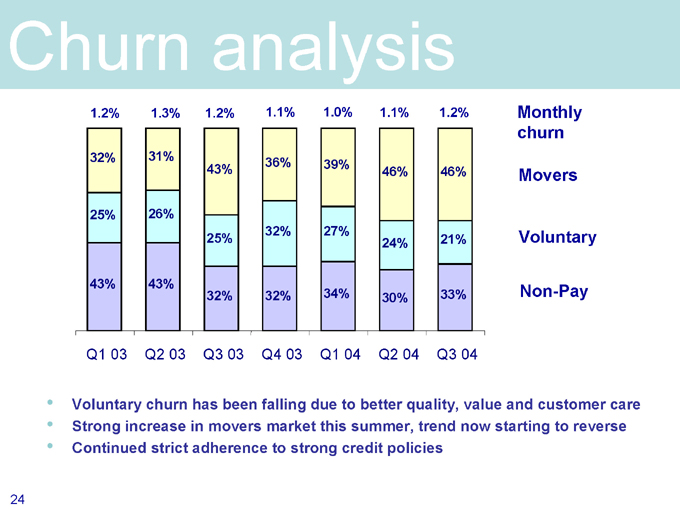

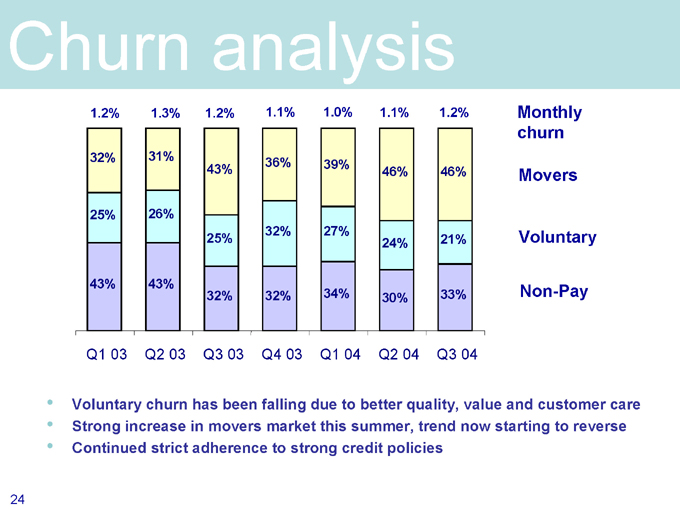

Churn analysis

1.2% 1.3% 1.2% 1.1% 1.0% 1.1% 1.2% Monthly churn

32% 31% 43% 36% 39% 46% 46% Movers

25% 26% 25% 32% 27% 24% 21% Voluntary

43% 43% 32% 32% 34% 30% 33% Non-Pay

Q1 03 Q2 03 Q3 03 Q4 03 Q1 04 Q2 04 Q3 04

Voluntary churn has been falling due to better quality, value and customer care Strong increase in movers market this summer, trend now starting to reverse Continued strict adherence to strong credit policies

24

Operational improvements

Operational efficiencies—current and future

Process to focus on Business customer work-in-progress established

3 billing systems consolidated to 2 in Q3 2004, will have single system by early 2006

CPE costs continue to fall e.g. targeting £75 VOD enabled STB during 2005

Rationalising property portfolio; 10 exits in 2004

Renegotiating installation contractor rates; will save £2m per year Reducing fault rates, down 30% year on year resulting in fewer truck rolls

Wireless install reducing truck rolls

Deployed new BBI install process improving efficiency by 30 minutes per install saving £2m per year

Introduced automated attendant – Kate Cox

Mobile workforce management

25

Business Services

Addressing challenging business environment through:

More efficient service model separating Complex and Standard customers

Management change recently made

Defend voice through new products:

Special rate services

Carrier pre-select

Wholesale line rental

Focus on highly profitable new data product segments Public sector strength

Profitable Business Division which is generating free cash flow

26

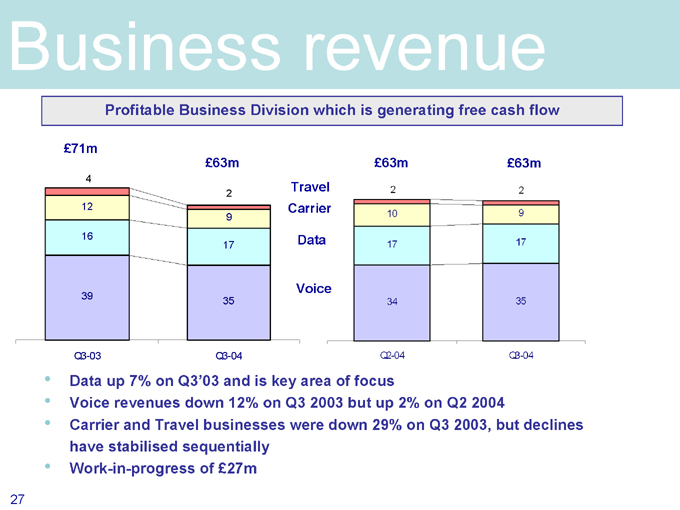

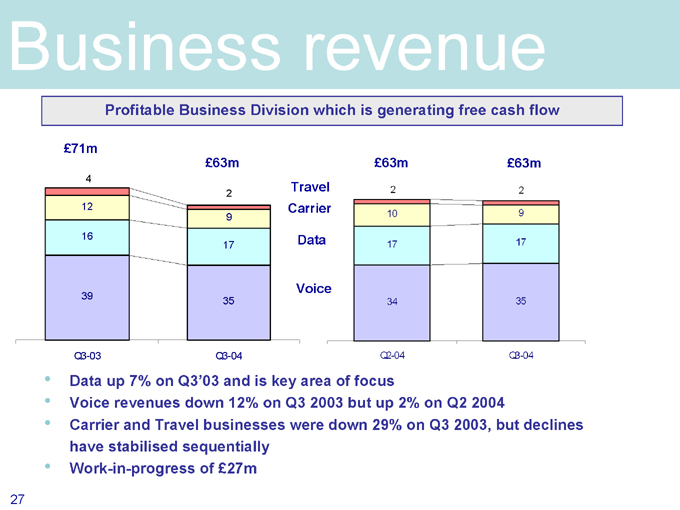

Business revenue

Profitable Business Division which is generating free cash flow

£71m

£63m

£63m

£63m

4

12

16

39

2 9 17

35

Travel Carrier

Data

Voice

2

10

17

34

2

9

17

35

Q3-03 Q3-04 Q2-04 Q3-04

Data up 7% on Q3’03 and is key area of focus

Voice revenues down 12% on Q3 2003 but up 2% on Q2 2004

Carrier and Travel businesses were down 29% on Q3 2003, but declines have stabilised sequentially

Work-in-progress of £27m

27

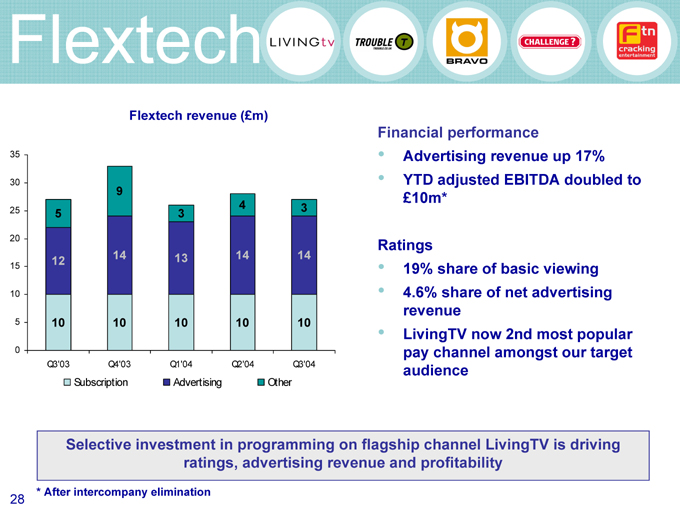

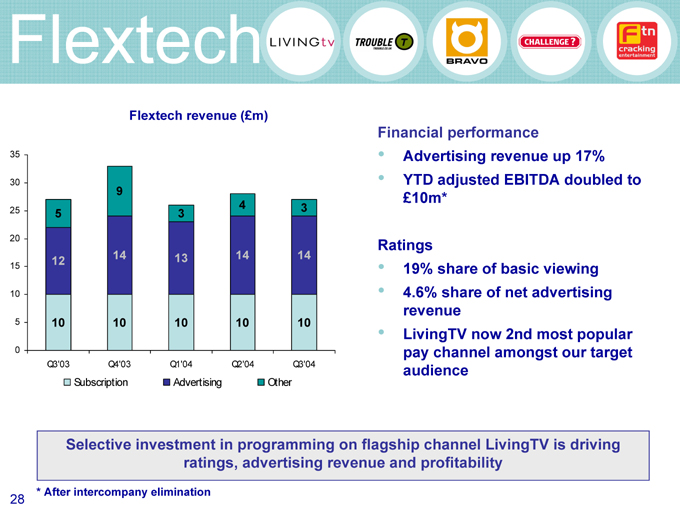

Flextech

Flextech revenue (£m)

35 30 25 20 15 10 5 0

5 9 3 4 3

12 14 13 14 14

10 10 10 10 10

Q3’03 Q4’03 Q1’04 Q2’04 Q3’04

Subscription Advertising Other

Financial performance

Advertising revenue up 17%

YTD adjusted EBITDA doubled to £10m*

Ratings

19% share of basic viewing

4.6% share of net advertising revenue

LivingTV now 2nd most popular pay channel amongst our target audience

Selective investment in programming on flagship channel LivingTV is driving ratings, advertising revenue and profitability

* After intercompany elimination

28

Summary

Accelerated profitable consumer growth

Planned launch of digital services & speed upgrades in 2005 to provide continued momentum

Valuable content division outperforming

Continue to drive free cash flow

29