- COHN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Cohen & Company (COHN) DEF 14ADefinitive proxy

Filed: 6 Apr 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement. |

| ¨ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material Pursuant to § 240.14a-12. |

Sunset Financial Resources, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

SUNSET FINANCIAL RESOURCES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 6, 2005

To Our Stockholders:

You are invited to attend our annual meeting of stockholders that will be held at Deerwood Golf & Country Club, located at 10239 Golf Club Drive, Jacksonville, Florida, 32256 on Friday, May 6, 2005, at 8:30 a.m., Jacksonville time. The purpose of the meeting is to vote on the following proposals:

| Proposal 1: | To elect six directors to serve until their successors are elected and qualified. | |

| Proposal 2: | To take action upon any other business as may properly come before the meeting. | |

Stockholders of record at the close of business on March 21, 2005 are entitled to notice of, and to vote at, the annual meeting. A proxy card and a copy of our annual report to stockholders for the fiscal year ended December 31, 2004 are enclosed with this notice of annual meeting and proxy statement.

Your vote is important. Accordingly, you are asked to vote, whether or not you plan to attend the annual meeting. You may vote by: (i) mail by marking, signing, dating and returning the accompanying proxy card in the postage-paid envelope we have provided, or (ii) attending the annual meeting in person. If you plan to attend the annual meeting to vote in person and your stock is registered with our transfer agent, Mellon Investor Services LLC, in the name of a broker or bank, you must secure a proxy from the broker or bank assigning voting rights to you for your stock.

By Order of the Board of Directors |

|

Jeffrey S. Betros |

Executive Vice President-Marketing and Secretary |

April 5, 2005

Jacksonville, Florida

| Page No. | ||

General Information | 1 | |

| 2 | ||

| 7 | ||

| 10 | ||

| 11 | ||

Report of the Compensation Committee on Executive Compensation | 14 | |

| 18 | ||

| 19 | ||

| 19 | ||

| 19 | ||

| 20 | ||

Appendix A – Audit Committee Charter | ||

i

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

Friday, May 6, 2005

Sunset Financial Resources, Inc.

10245 Centurion Parkway N., Suite 305

Jacksonville, Florida 32256

The board of directors is soliciting proxies to be used at the 2005 annual meeting of stockholders to be held at Deerwood Golf & Country Club, 10239 Golf Club Drive, Jacksonville, Florida 32256 on Friday, May 6, 2005, at 8:30 a.m., Jacksonville time. This proxy statement, accompanying proxy card and annual report to stockholders for the fiscal year ended December 31, 2004 are first being mailed to stockholders on or about April 5, 2005. Although the annual report is being mailed to stockholders with this proxy statement, it does not constitute part of this proxy statement.

Who May Vote

Only stockholders of record at the close of business on March 21, 2005 are entitled to notice of, and to vote at, the annual meeting. As of March 21, 2005, we had 10,475,000 shares of common stock issued and outstanding. Each stockholder of record on the record date is entitled to one vote on each matter properly brought before the annual meeting for each share of common stock held.

How You May Vote

You may vote using any of the following methods:

| • | BY MAIL:Mark, sign, and date your proxy card and return it in the postage-paid envelope we have provided. The named proxies will vote your stock according to your directions. If you submit a signed proxy card without indicating your vote, the person voting the proxy will vote your stock in favor of proposal one. |

| • | BY ATTENDING THE ANNUAL MEETING IN PERSON. |

You may revoke your proxy at any time before it is exercised by:

| • | giving written notice of revocation to our Secretary, Jeffrey S. Betros, at Sunset Financial Resources, Inc., 10245 Centurion Parkway N., Suite 305, Jacksonville, Florida 32256; |

| • | timely delivering a properly executed, later-dated proxy; or |

| • | voting in person at the annual meeting. |

Voting by proxy will in no way limit your right to vote at the annual meeting if you later decide to attend in person. If your stock is held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, to be able to vote at the annual meeting. If no direction is given and the proxy is validly executed, the stock represented by the proxy will be voted in favor of proposal one. The persons authorized under the proxies will vote upon any other business that may properly come before the annual meeting according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. We do not anticipate that any other matters will be raised at the annual meeting.

Quorum

The presence, in person or represented by proxy, of the holders of a majority of the common stock (5,237,501 shares) entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. However, if a quorum is not present at the annual meeting, the stockholders, present in person or represented by proxy, have the power to adjourn the annual meeting until a quorum is present or represented. Pursuant to our bylaws, abstentions are counted as present and entitled to vote for purposes of determining a quorum at the annual meeting. Broker “non-votes” are counted as present at the meeting but not voted. A broker “non-vote” occurs when a nominee holding common stock does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Required Vote

The directors or nominees receiving the plurality of the votes cast shall be elected as directors. All of the nominees for director (except Messrs. Dawson and Deehan) served as our directors in 2004. Abstentions and broker non-votes are not counted for purposes of the election of directors.

Cost of Proxy Solicitation

The cost of soliciting proxies will be borne by us. Proxies may be solicited on our behalf by our directors, officers, employees or soliciting service in person, by telephone, facsimile or by other electronic means. We have also retained MacKenzie Partners, Inc. to aid in the solicitation of proxies. We estimate that the fees we pay to MacKenzie Partners, Inc. for its role as proxy solicitor will be approximately $15,000 plus the reimbursement of reasonable out-of-pocket expenses. In accordance with SEC regulations and the rules of the New York Stock Exchange (NYSE), we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in mailing proxies and proxy materials and soliciting proxies from the beneficial owners of our common stock.

ELECTION OF DIRECTORS

Pursuant to Maryland General Corporation Law, our articles of incorporation, and our bylaws, all as amended, our business, property and affairs are managed under the direction of the board of directors. At the annual meeting, six directors will be elected by the stockholders, each to serve until his successor has been duly elected and qualified, or until the earliest of his death, resignation or retirement.

The persons named in the enclosed proxy will vote your stock as you specify on the enclosed proxy. If you return your properly executed proxy but fail to specify how you want your stock voted, the stock will be voted in favor of the nominees listed below. The board of directors has proposed the following nominees for election as directors at the annual meeting. Each of the nominees is currently a member of the board of directors.

Nominees

John Bert Watson has been Chairman, President and Chief Executive Officer of our company since its inception in October 2003. He served as the President and Chief Executive Officer of Flagship Capital Corporation, Inc. and Sunset Commercial Group LLC from January 1, 2000 to October 15, 2003. From November 1998 until January 2000, he served as Executive Vice President of Paradigm Mortgage Associates Inc., a mortgage banking company, where he managed its warehouse lines of credit, secondary marketing and commercial loans, including commercial loans made in venture capital transactions. Age 54.

Rodney E. Bennettwas elected to serve as director on October 15, 2003. From January 2004 to the present, he has served as the Chief Financial Officer and Director of Harvin Carter and Associates, Inc., a privately-owned fire sprinkler contractor doing business in five southeastern states. From January 1998 to September 2003, he founded and served as the Chief Executive Officer of Saltilla Community Bank in St. Marys, Georgia. From July 1991 to the present, Mr. Bennett has acted as a consultant to various Georgia banks and private companies. Age 64.

2

George A. Murray was elected to serve as a director on October 15, 2003. Mr. Murray has managed his personal investments since 2002. He retired as a Senior Executive Vice President of Prudential Securities in January 2002, a position he held since 1996. Mr. Murray is on the board of directors and serves as audit committee chairman for Helix Biomedix Inc., (OTC BB:HXBM), a pharmaceuticals company and is on the board of directors of Ramgen Power Systems, a privately-held company. Age 74.

Joseph P. Stingone was elected to serve as a director on January 22, 2004. Since 2002, Mr. Stingone has managed his personal investments. Mr. Stingone served as Chairman of Flagship Capital Corporation from January 1, 2000 to July 2002. Age 68.

G. Steven Dawson joined our board on January 11, 2005. He served as Chief Financial Officer of Camden Property Trust or its predecessors from 1990 to 2003. Currently, Mr. Dawson serves on the boards of directors of five other companies, including Trustreet Properties, Inc. (NYSE: TSY), an Orlando-based owner of approximately 3,000 fast-food and casual dining restaurants and gas station/convenience stores, AmREIT, Inc. (AMEX: AMY), a Houston-based owner and developer of retail properties (audit committee chairman), Medical Properties Trust, a Birmingham, Alabama-based REIT specializing in the ownership of acute care facilities, medical office buildings and related medical properties (audit committee chairman), Desert Capital REIT, a Las Vegas-based mortgage REIT (audit committee chairman), and American Campus Communities (NYSE: ACC), an Austin-based equity REIT focused on student housing (audit committee chairman). Age 47.

George O. Deehanjoined our board on March 24, 2005. From November 2004 to the present, Mr. Deehan has served as a director of Paragon Financial Corporation. From August 2003 until November 2004, he served as the Chairman and Chief Executive Officer of Paragon Financial Corporation. From August 2000 to March 2002, he served as President of eOriginal Company, a software development company. From August 1998 to August 2000, he served as the Chief Executive Officer of Advanta Leasing Services. Mr. Deehan is on the board and is compensation committee chairman and on the audit committee of NYFIX Corporation (Nasdaq: NYFX). Age 62.

The nominating and corporate governance committee will consider director candidates nominated by stockholders. Recommendations, including the nominee’s name and an explanation of the nominee’s qualifications should be sent to Jeffrey S. Betros, Executive Vice President—Marketing and Secretary, 10245 Centurion Parkway N., Suite 305, Jacksonville, Florida 32256. The procedure for nominating a person for election as a director is described under “Stockholder Proposals.”

The board of directors unanimously recommends that you vote FOR the election of directors as set forth in Proposal One.

3

Board Meetings and Committees

During fiscal 2004, the board of directors held three meetings. No director attended less than 75% of the total number of board and committee meetings on which the director served that were held while he was a member of the board or committee, as applicable. All of our directors are strongly encouraged to attend our annual meeting of stockholders. The board’s current standing committees are as follows:

Name | Nominating and Corporate Governance Committee | Audit Committee | Compensation Committee | ||||||

Employee Directors: | |||||||||

J. Bert Watson | |||||||||

Non-Employee Directors: | |||||||||

Rodney E. Bennett | X | X | (1) | X | |||||

Hugh H. Jones, Jr. | X | (1) | X | ||||||

George A. Murray | X | X | X | (1) | |||||

Joseph P. Stingone | X | ||||||||

| (1) | Chairman |

On January 11, 2005, Mr. Steve Dawson joined our board of directors. He serves on our compensation and nominating and corporate governance committees. On March 24, 2005, Mr. George Deehan joined our board of directors. He serves on our compensation committee.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee has the responsibility to (1) oversee the nomination of individuals to the board, including the identification of individuals qualified to become board members and recommending such nominees; (2) develop and recommend to the board a set of governance principles; and (3) oversee matters of governance to insure that the board is appropriately constituted and operated to meet its fiduciary obligations, including advising the board on matters of board organization, membership and function and committee structure and membership. The committee also recommends director compensation and benefits. The nominating and corporate governance committee will consider nominees made by stockholders. Stockholders should send nominations to our corporate secretary, Jeffrey S. Betros. Any stockholder nominations proposed for consideration by the nominating and corporate governance committee should include the nominee’s name and qualifications for board membership. See “Stockholder Proposals.” The governance committee met three times in 2004.

4

Audit Committee

Our standing audit committee is established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934. The audit committee assists the board in fulfilling its responsibilities for general oversight of: (1) our financial reporting processes and the audit of our financial statements, including the integrity of our financial statements; (2) our compliance with ethical policies contained in our code of business conduct and ethics; (3) legal and regulatory requirements; (4) the independence, qualification and performance of our independent registered public accounting firm; (5) the performance of our internal audit function; and (6) risk assessment and risk management. The committee has the responsibility for selecting our independent registered public accounting firm and pre-approving audit and non-audit services. Among other things, the audit committee prepares the audit committee report for inclusion in the annual proxy statement; reviews the audit committee charter and the committee’s performance; approves the scope of the annual audit; and reviews our disclosure controls and procedures, internal controls, information security policies, internal audit function, and corporate policies with respect to financial information and earnings guidance. The committee also oversees investigations into complaints concerning financial matters. The audit committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the audit committee deems necessary to carry out its duties. The audit committee met three times in 2004.

Compensation Committee

The compensation committee (1) discharges the board’s responsibilities to establish the compensation of our executives; (2) produces an annual report on executive compensation for inclusion in our annual proxy statement; (3) provides general oversight for our compensation structure, including our equity compensation plans and benefits programs; and (4) retains and approves the terms of the retention of any compensation consultant or other compensation experts. Other specific duties and responsibilities of the committee include reviewing the leadership development process; reviewing and approving objectives relative to executive officer compensation; approving employment agreements for executive officers; approving and amending our incentive compensation and share option programs (subject to stockholder approval if required); and annually evaluating its performance and its charter. The compensation committee met two times in 2004.

Corporate Governance

Independence of Directors and Committee Members. Our board has determined that each of the following directors standing for re-election has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) and is independent within the meaning of our director independence standards, which reflect exactly NYSE Director Independence Standards, as currently in effect: Messrs. Bennett, Murray, Stingone, Dawson and Deehan. The board has determined that Mr. Watson is not an independent director within the meaning of the NYSE Director Independence Standards. Furthermore, the board has determined that each of the members of each of the nominating and corporate governance, audit and compensation committees has no material relationship with us (either directly as a partner, stockholder or officer of an organization that has a relationship with us) and is independent within the meaning of our director independence standards.

Audit Committee Financial Expert. The board of directors has determined that Mr. Bennett meets the definition of audit committee financial expert promulgated by the Securities and Exchange Commission and is independent, as defined in the New York Stock Exchange Listing Standards.

Committee Charters and other Governance Materials. Our board has adopted: (1) a nominating and corporate governance committee charter, a compensation committee charter and an audit committee charter; (2) standards of independence for our directors for fiscal 2005; (3) a code of business conduct and ethics for all directors, officers and employees; (4) corporate governance guidelines; and (5) code of ethics for senior financial officers. Our nominating and corporate governance committee charter, compensation committee charter, audit committee charter, corporate governance guidelines and code of business conduct and ethics are available on our

5

website at www.sunsetfinancial.net. These materials are also available in print to any stockholder who requests them by submitting a written request to Jeffrey S. Betros, Executive Vice President-Marketing and Secretary, 10245 Centurion Parkway N., Suite 305, Jacksonville, Florida 32256.

Communications with the Board. Any employee, stockholder or any other person may report complaints about our accounting, internal accounting controls or auditing matters or other concerns to the board of directors by sending such concerns by U.S. mail to Board of Directors, PMB #302, 9838 Old Baymeadows Rd., Jacksonville, FL 32256-8101. If the concerns expressed require confidentiality, then this confidentiality will be protected, subject to applicable law, regulation or legal proceedings. Concerns relating to our accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee. All other concerns will be referred to the presiding director of our board of directors.

Executive Sessions. An executive session of non-employee directors was held at the end of one board meeting. In accordance with our nominating and corporate governance committee charter, our independent directors will meet at least once per year in executive session. Mr. Bennett served as the presiding director at the executive session.

Compensation of Directors

Employee directors receive no compensation for board service.

During 2004, our non-employee directors received the following compensation:

Annual retainer fee | $ | 30,000 | |

Fee for each board meeting attended | 1,000 | ||

Fee for each committee meeting attended in person | 1,000 | ||

Additionally, each non-employee director upon election to the board receives a stock option to purchase 5,000 shares of common stock at the then fair market value. The options vest in full one year from the date of grant.

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee has any interlocking relationship with any other company that requires disclosure under this heading.

Certain Transactions

In 2004, we purchased a mortgage loan to J. Bert Watson, Jr., son of our Chief Executive Officer, from Sunset Mortgage. The principal amount of the mortgage was $400,000. This purchase was made by us at the then-current market rate.

6

SHARE OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership of our common stock as of March 30, 2005 by (1) each person known by us to own beneficially more than 5% of our outstanding common stock, (2) each current director, (3) each named executive officer, and (4) all current directors and executive officers as a group. The number of stock beneficially owned by each entity, person, director or executive officer is determined under the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any stock as to which the individual has the sole or shared voting power or investment power and also any stock that the individual has a right to acquire as of May 30, 2005 (60 days after March 30, 2005) through the exercise of any share option or other right. Unless otherwise indicated, each person has sole voting and investment power (or shares such powers with his spouse) with respect to the stock set forth in the following table.

Name | Amount and Nature of Beneficial Ownership | Percent of Class (1) | ||||

Hunter Global Associates, L.L.C. | 1,500,000 | (2) | 14.3 | % | ||

North Sound Capital LLC | 1,000,000 | (3) | 9.6 | % | ||

Delaware Management Holdings | 899,100 | (4) | 8.6 | % | ||

NWQ Investment Management Company, LLC | 897,549 | (5) | 8.6 | % | ||

Teachers Insurance and Annuity Association of America | 788,320 | (6) | 7.5 | % | ||

Thomas Bruce Akin | 659,700 | (7) | 6.3 | % | ||

Western Investment LLC | 562,800 | (8) | 5.4 | % | ||

J. Bert Watson | 189,000 | (9) | 1.8 | % | ||

Byron L. Boston | 36,666 | (10) | * | |||

Jeffrey S. Betros | 8,833 | (11) | * | |||

Michael L. Pannell | 14,333 | (12) | * | |||

7

Rodney E. Bennett | 5,000 | (13) | * | |||

Hugh H. Jones, Jr. | 7,000 | (14) | * | |||

George A. Murray | 8,000 | (15) | * | |||

Joseph P. Stingone | 6,000 | (16) | * | |||

G. Steven Dawson | 5,000 | (17) | * | |||

George O. Deehan | 5,000 | (18) | * | |||

Thomas Manuel | — | (19) | * | |||

All directors and executive officers | 289,832 | 2.7 | % | |||

| * | Beneficial ownership of less than 1% of the class is omitted. |

| (1) | The percentages of shares owned provided in the table is based on 10,475,000 shares outstanding as of March 21, 2005. Percentage of beneficial ownership by a person as of a particular date is calculated by dividing the number of shares beneficially owned by such person as of March 30, 2005 by the sum of the number of shares of common stock outstanding as of such date and the number of unissued shares as to which such person has the right to acquire voting and/or investment power within 60 days and restricted stock not yet vested. |

| (2) | Includes shares beneficially owned by Duke Buchan III and various affiliated entities, including Hunter Global Associates L.L.C., Hunter Global Investors L.P., Hunter Global Investors Fund I L.P. and Hunter Global Investors Fund II L.P. Hunter Global Associates L.L.C. reported shared voting power and shared dispositive power with respect to 475,500 shares. Hunter Global Investors L.P. and Duke Buchan III each reported shared voting power and shared dispositive power with respect to 1,500,000 shares. Hunter Global Investors Fund I L.P. reported shared voting power and shared dispositive power with respect to 448,500 shares. Hunter Global Investors Fund II L.P. reported shared voting power and shared dispositive power with respect to 27,000 shares. Based solely on Schedule 13G dated March 17, 2004. |

| (3) | North Sound Capital LLC reported shared voting and dispositive power over 1,000,000 shares of common stock. The ultimate managing member of North Sound Capital LLC is Thomas McAuley. North Sound Capital LLC may be deemed the beneficial owner of the shares in its capacity as the managing member of North Sound Legacy Fund LLC, North Sound Legacy Institutional Fund LLC and North Sound Legacy International Ltd. (the “Funds”), who are the holders of such shares. As the managing member of the Funds, North Sound Capital LLC has voting and investment control with respect to the shares of common stock held by the Funds. Based solely on Schedule 13G dated March 17, 2004. |

| (4) | Consists of shares beneficially owned by Delaware Management Holdings which is wholly-owned by Delaware Management Business Trust. Lincoln National Corp. is the ultimate parent of Delaware Management Business Trust and may be deemed to share beneficial ownership with the various Delaware Investments Family of Funds. Of the shares beneficially owned, Delaware Management Holdings and Delaware Management Business Trust have sole voting and dispositive power with respect to 899,100 shares. Based solely on Schedule 13G dated December 31, 2004. |

| (5) | Shares are beneficially owned by clients of NWQ Investment Management (“NWQ”), an investment advisor, which clients may include investment companies registered under the Investment Company Act and/or employee benefit plans, pension funds, endowment funds or other institutional clients. NWQ has the sole power to dispose of or to direct the disposition of 897,549 shares, and the sole power to vote or direct the vote of 786,418 shares. Based solely on Schedule 13G dated December 31, 2004. |

8

| (6) | Teachers Insurance and Annuity Association of America (“TIAA”) holds 303,820 shares of our common stock for the benefit of TIAA Real Estate Account, a separate account of TIAA. In addition, TIAA, as the parent of two registered investment advisers, may be deemed to have indirect voting or investment discretion over 484,500 shares of our common stock that are beneficially owned by three registered investment companies – College Retirement Equities Fund (“CREF”), TIAA-CREF Institutional Mutual Funds (“Institutional Funds”), and TIAA-CREF Life Funds (“Life Funds”), as well as the TIAA-CREF Asset Management Commingled Funds Trust I (“TCAM Funds”) – whose investment advisers are TIAA-CREF Investment Management, LLC (in the case of CREF) and Teachers Advisors, Inc. (in the case of Institutional Funds, Life Funds and TCAM Funds), both of which are wholly owned subsidiaries of TIAA. Based solely on Schedule 13G dated December 31, 2004. |

| (7) | Thomas Akin is the direct beneficial owner of 446,800 shares of common stock. Thomas Akin is the managing general partner of the Talkot Crossover Fund, L.P. Talkot Crossover Fund, L.P. is the direct beneficial owner of 212,900 shares of common stock. By virtue of the relationship between Mr. Akin and the fund, Mr. Akin may be deemed to possess indirect beneficial ownership of the shares of common stock beneficially owned by the fund. Based solely on Schedule 13D dated March 15, 2005. |

| (8) | Western Investment LLC, (“WILLC”), Arthur D. Lipson, Western Investment Hedged Partners LP, (“WIHP”), Western Investment Institutional Partners LLC, a Delaware limited liability company (“WIIP”), and Western Investment Activism Partners LLC (“WIAP”), jointly reported their stock ownership. WILLC has sole voting and investment power over WIHP’s, WIIP’s, and WIAP’s security holdings and Mr. Lipson, in his role as the managing member of WILLC, controls WILLC’s voting and investment decisions. As of the close of business on March 16, 2005, WIHP, WIIP and WIAP beneficially owned 162,500, 354,600 and 45,700 shares respectively. WILLC beneficially owned 562,800 shares. Based solely on Schedule 13D filed March 7, 2005. |

| (9) | Includes options to purchase 39,000 shares of common stock. |

| (10) | Includes options to purchase 16,666 shares of common stock, and 5,000 restricted shares. |

| (11) | Includes options to purchase 8,333 shares of common stock. |

| (12) | Includes options to purchase 8,333 shares of common stock. |

| (13) | Includes options to purchase 5,000 shares of common stock. |

| (14) | Includes options to purchase 5,000 shares of common stock. |

| (15) | Includes options to purchase 5,000 shares of common stock. Includes 3,000 shares held in a family trust, of which Mr. Murray is the trustee. |

| (16) | Includes options to purchase 5,000 shares of common stock. |

| (17) | Includes options to purchase 5,000 shares of common stock. |

| (18) | Includes options to purchase 5,000 shares of common stock. |

| (19) | Based solely on Form 4 filed January 27, 2005. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to file reports of holdings and transactions in our securities with the SEC and the NYSE. Executive officers, directors and greater than 10% beneficial owners are required by applicable regulations to furnish us with copies of all Section 16(a) forms they file with the SEC.

9

Based solely upon a review of the reports furnished to us with respect to fiscal 2004, we believe that all SEC filing requirements applicable to persons required to submit Section 16(a) forms regarding ownership of our common stock were satisfied, except as set forth below:

Name | Number of Late Reports | Number of Transactions not reported on a timely basis | ||

J. Bert Watson | 2 | 3 | ||

Byron L. Boston | 1 | 2 | ||

Jeffrey S. Betros | 2 | 3 | ||

Michael L. Pannell | 1 | 2 | ||

Rodney E. Bennett | 1 | 1 | ||

Hugh H. Jones, Jr. | 2 | 2 | ||

George A. Murray | 2 | 2 | ||

Joseph P. Stingone | 1 | 1 | ||

Thomas Manuel | 1 | 2 | ||

Sapphire Advisors LLC | 1 | 1 | ||

Hunter Global Associates | 1 | 1 |

No director or executive officer was selected as a result of any arrangement or understanding between the director or executive officer or any other person. All executive officers are elected annually by, and serve at the discretion of, the board of directors.

Our executive officers are as follows:

J. Bert Watson. See “Election of Directors” for biographical information.

Byron L. Boston has served as our Executive Vice President – Chief Investment Officer since February 5, 2004. From June 1997 until January 2004, he was the Vice President and Co-Manager of The Mortgage Portfolio Group of Federal Home Loan Mortgage Corporation (Freddie Mac). While employed at Freddie Mac, Mr. Boston served on the Freddie Mac Thrift/401K Savings Plan Retirement Committee (“Freddie Mac Retirement Committee”). Along with Freddie Mac, the Freddie Mac Retirement Committee, certain current and/or former members of the Freddie Mac Board of Directors, certain current and/or former officers of Freddie Mac, and certain current and/or former members of the Freddie Mac Retirement Committee, Mr. Boston has been named as a defendant in alleged class action suits asserting violations of certain provisions of the Employee Retirement Income Security Act. The suits are currently pending in the United States District Court for the Southern District of New York and are entitledIn Re: Freddie Mac ERISA Litigation, Case No. 1:04-md-01584-JES, 1:04-cv-02632-JES and 1:04-cv-02633-JES. Mr. Boston intends to vigorously defend against the allegations in these actions. Age 46.

Jeffrey S. Betros has served as our Executive Vice President – Chief Marketing Officer and Secretary since February 2004. From October 2003 to February 2004, he served as our Executive Vice President—Operations. From August 2002 until October 2003 he was the Area Sales Manager for Aurora Loan Services, a wholly owned subsidiary of Lehman Brothers. From May 2001 to August 2002, Mr. Betros was an Account Executive for Countrywide Homes Loans. From June 1998 to February 2001 he was Regional Vice President of Centex Home Equity. Age 41.

Michael L. Pannell has served as our Chief Financial Officer and Treasurer since March 2004. From December 2002 until January 2004, he served as the Chief Information Officer of Bombardier Capital Group. From October 2001 until December 2002, he was Director of Bombardier Capital Group. From 1998 until 2002, he served as the Director of Accounting for Bombardier Capital Group. Age 44.

10

Compensation of Executive Officers

The following table summarizes the compensation paid by us for the fiscal years ended December 31, 2004 to the Chief Executive Officer and the four other most highly compensated executive officers who received a total annual salary and bonus in excess of $100,000 in fiscal 2004 (the “named executive officers”). We were incorporated in October 2003 and became a publicly-traded company in March 2004, and did not pay any cash compensation to our executive officers for the period ended December 31, 2003.

Summary Compensation Table

Year | Annual Compensation | Long-Term Compensation Awards | All Other | |||||||||||||||

Name and Principal Position | Salary ($) | Bonus ($) | Restricted Share Awards ($) | Securities (#) (1) | ||||||||||||||

J. Bert Watson, | 2004 | $ | 475,962 | $ | 110,000 | — | 117,000 | $ | 8,200 | (1) | ||||||||

Byron L. Boston, | 2004 | 276,923 | 10,000 | $ | 65,000 | (2) | 50,000 | 166,347 | (1)(3) | |||||||||

Jeffrey S. Betros, | 2004 | 274,039 | 107,000 | — | 25,000 | 6,750 | (1) | |||||||||||

Michael L. Pannell, | 2004 | 141,346 | 10,000 | — | 25,000 | 4,846 | (1) | |||||||||||

Thomas G. Manuel | 2004 | 185,144 | — | — | 25,000 | 231,283 | (4) | |||||||||||

| (1) | Includes matching contributions made by the Company pursuant to its 401(k) plan for the accounts of Messrs. Watson, Boston, Betros, Pannell and Manuel in the amounts of $8,200, $7,692, $6,750, $4,846, and $3,500 respectively. |

11

| (2) | As of December 31, 2004, Mr. Boston had 5,000 shares of restricted stock, with a value of $52,050, based on the closing price of our common stock of $10.41 on December 31, 2004. The value shown in the table is calculated based on the closing price of our common stock on the date of grant which was $13.00 per share. These shares have vested. Dividends have been paid on these shares of restricted stock totaling $325. |

| (3) | In addition to amounts described in footnote (1), Mr. Boston’s All Other Compensation includes $166,347 in moving expenses incurred in 2004 and reimbursed by us in 2005 (including a gross-up for taxes). |

| (4) | Mr. Manuel’s employment with us terminated on December 1, 2004. In addition to amounts described in footnote (1), Mr. Manuel’s All Other Compensation reflects compensation in connection with the termination of his employment, including one payment of $14,583 and $200,000 that is paid in 26 bi-weekly installments, and payments estimated to total $13,200 for COBRA premiums. |

Option Grants in 2004

The following table sets forth information concerning grants of options to purchase shares of our common stock during 2004 to each of the named executive officers and the potential realizable value of the options at assumed annual rates of stock price appreciation for the option term.

OPTION GRANTS IN 2004

| Individual Grants (1) | ||||||||||||||||

Name | Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees In Fiscal Year | Exercise or Base Price ($/Sh) | Expiration Date | Potential Realizable Value at Assumed Annual Rate of Share Price Appreciation For Option Term (2) | |||||||||||

| 5% ($) | 10% ($) | |||||||||||||||

J. Bert Watson | 117,000 | 44.7 | % | $ | 13.00 | 3/22/2014 | $ | 76,050 | $ | 150,100 | ||||||

Byron L. Boston | 50,000 | 19.1 | % | 13.00 | 3/22/2014 | 32,500 | 65,000 | |||||||||

Jeffrey S. Betros | 25,000 | 9.5 | % | 13.00 | 3/22/2014 | 16,250 | 32,500 | |||||||||

Michael L. Pannell | 25,000 | 9.5 | % | 13.00 | 3/22/2014 | 16,250 | 32,500 | |||||||||

Thomas G. Manuel (3) | — | — | — | — | — | — | ||||||||||

| (1) | The plans governing stock option grants provide that the option price per share shall not be less than 100% of the market value per share of our common stock at the grant date. The term of any option is no more than 10 years from the date of grant. Options granted in 2004 become exercisable after one year from the date of grant in three equal annual installments of 33.3% of the shares subject to the option. |

| (2) | The dollar amounts under these columns are the result of calculations assuming annual rates of stock price appreciation over the option term at the 5% and 10% rates set by SEC rules and are not intended to forecast possible future appreciation, if any, in our common stock price. |

| (3) | All options granted to Mr. Manuel have been terminated. |

12

Option Exercises and Fiscal Year-End Option Values

During 2004, none of our named executive officers exercised any options to purchase common stock. The following table sets forth the value of the unexercised options as of December 31, 2004, based on the closing price of $10.41 per share of our common stock on that date. None of the options held by our named executive officers were in-the-money as of December 31, 2004.

Name | Number of Unexercised December 31, 2004 | |||

| Exercisable | Unexercisable | |||

J. Bert Watson | — | 117,000 | ||

Byron L. Boston | — | 50,000 | ||

Jeffrey S. Betros | — | 25,000 | ||

Michael L. Pannell | — | 25,000 | ||

Thomas G. Manuel | — | 25,000 | ||

Stock Options

We adopted the 2003 Share Incentive Plan that provides for the grant of qualified incentive stock options (ISOs) that meet the requirements of Section 422 of the Internal Revenue Code, non-qualified stock options, restricted stock and dividend equivalent rights. ISOs may be granted only to our officers and key employees. Non-qualified stock options, restricted stock and dividend equivalent rights may be granted to our directors, advisory board members, officers, key employees and consultants. The exercise price for any ISOs granted under our plan may not be less than 100% of the fair market value of the underlying common stock at the time the ISO is granted. The purpose of our plan is to encourage high levels of performance by individuals who are key to our success and to enable us to attract, motivate and retain talented and experienced individuals essential to our success.

Subject to anti-dilution adjustments for stock splits, stock distributions and similar events, our plan authorizes the grant of restricted stock and options to purchase an aggregate of up to 1,045,000 shares of common stock. If an option granted under the plan expires or terminates or restricted stock awarded under the plan does not vest, the shares subject to any unexercised portion of that option will again become available for the issuance of further awards under the plan. Unless previously terminated by our board of directors, the plan will terminate 10 years from its effective date, and no awards may be granted under the plan thereafter.

Our plan is administered by our compensation committee, which is comprised entirely of independent directors within the meaning of the rules of the SEC and the NYSE. Options granted under the plan become exercisable, and restricted stock vests, in accordance with the terms of the grant made by the compensation committee. The compensation committee has discretionary authority to determine at the time an option is granted whether it is intended to be an ISO or a non-qualified option, and when and in what increments common stock covered by the option may be purchased. If awards are to be made to independent directors, then the full board of directors will approve such awards.

No awards may be made under our plan to any person who, assuming exercise of all options or vesting of restricted stock held by such person, would own or be deemed to own more than 9.8% of any class or series of our capital stock outstanding.

Each option must terminate no more than 10 years from the date it is granted. Options may be granted on terms providing that they will be exercisable in whole or in part at any time or times during their respective terms, or only in specified percentages at stated time periods or intervals during the term of the option.

13

The exercise price of any option granted under the plan is payable in full (1) in cash; (2) by surrender of shares of our common stock that have been held for at least six months and have a market value equal to the aggregate exercise price of all shares to be purchased; or (3) by any combination of the foregoing.

Our board of directors may, without affecting any outstanding options, restricted stock or dividend equivalent rights, from time to time revise or amend our plan, and may suspend or discontinue it at any time. However, no such revision or amendment may increase the number of shares of common stock subject to the stock plan (with the exception of adjustments resulting from changes in capitalization), change the class of participants eligible to receive grants under the plan or modify the period within which or the terms stated in the plan upon which the options may be exercised without stockholder approval.

Employment Contracts

We have entered into employment agreements with each of Messrs. Watson, Boston, Betros and Pannell. Each of the employment agreements is for a term of three years and automatically renews for one year terms unless notice of non-renewal is given by either party at least 180 days prior to the expiration of the renewal term.

Each employment agreement provides that in the event of a change of control and the termination of the executive’s employment on or before the first anniversary of the change in control (other than for cause), the executive shall receive a severance payment equal to 2.99 times his then current base salary plus an amount equal to the full bonus the executive was eligible to receive for the year of his termination.

Each employment agreement also contains a non-competition agreement which generally prohibits each employee from participating in the activities of, rendering services to or investing in any firm or business engaged in the same business as us while they are employed by us and for a period of six months after such employee’s termination, provided that such termination is:

| • | for cause; |

| • | due to his disability or |

| • | due to the employee leaving without “good reason,” which is generally defined as reasons such as a reduction in such employee’s duties or executive status, relocation 25 miles or more away, and similar actions. |

Mr. Manuel’s employment with us terminated on December 1, 2004. Pursuant to a Separation Agreement dated February 4, 2005 between us and Mr. Manuel, we will pay (i) Mr. Manuel his monthly salary for December 2004 ($14,583.33), less lawful deductions, (ii) Mr. Manuel $200,000 in twenty six bi-weekly installments of $7,692.30, less lawful deductions, and (iii) for Mr. Manuel’s COBRA premiums for a period of twelve months.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Overview

Our executive compensation is supervised by the compensation committee of the board of directors which is comprised entirely of independent directors as determined by the board within the meaning of the applicable NYSE listing standards currently in effect. The board designates the members and the chairman of the committee on an annual basis.

14

The committee is responsible for evaluating and establishing the level of compensation, including establishing a general compensation philosophy, for our officers. Additionally the committee is responsible for administering our stock option plan. Our stock option program is for all of our associates, including our officers. The specific duties and responsibilities of the committee are described in the charter of the compensation committee, which is available on our website at www.sunsetfinancial.net.

The committee met two times during fiscal 2004. The meetings generally focus on our compensation policy including both short-term and long-term forms of compensation, review of best practices in executive compensation, evaluation of the independent consultants’ report to the committee on the compensation of the executive officers, and evaluation of the CEO’s performance. All committee members are actively engaged in the review of matters presented. The committee has direct access to independent compensation consultants and other experts for survey data, best practices and other information as it deems appropriate.

Compensation Philosophy and Objectives

The goal of our compensation program is to attract, motivate and retain the highly talented individuals needed to operate, acquire, develop and grow our mortgage loan assets for the long-term. We seek to provide executive compensation that will support the achievement of our financial and growth goals and objectives. When our performance is better than the goals and objectives set for the performance period, our associates should be paid more, and when our performance does not meet one or more of our financial or other objectives, any incentive award payment is at the committee’s discretion. In order to achieve our goals and objectives, we have structured an incentive based compensation system tied to our financial performance and portfolio growth.

Our committee will annually review our compensation programs to ensure that pay levels and incentive opportunities are competitive and reflect our performance. To reinforce the importance of balancing short-term and long-term results, our officers will be provided with both annual and long-term incentives. We will generally compensate our officers through a combination of base salary, annual bonus compensation, and annual awards of stock options and restricted stock.

Base Salary

Base salary levels for executive officers are largely derived through an evaluation of the responsibilities of the position held and the experience of the particular individuals, both compared to companies of similar size, complexity and, where comparable, in the same industry. The determination of comparable companies was based upon selections made by both us, as to comparable companies in the real estate industry, and by independent compensation consultants, as to other comparable companies. Actual salaries are based on an executive officer’s skill and ability to influence our financial performance and growth in both the short-term and long-term. During 2004, our committee used compensation information provided by an outside consultant in establishing base salaries.

Bonus Compensation

We design the annual incentive or bonus compensation to align pay with our annual performance. We will establish, at the beginning of each year, the key performance measures we believe require the special focus of all of our associates, including our officers, to move the business forward and create value for our stockholders. Each individual’s eligible bonus is based on a percentage of the individual’s base salary. The bonus percentage is also based on a competitive analysis and is reviewed with the independent consultant.

Again, the officer’s ability to influence our success is considered in establishing this percentage. Incentive compensation earned will be determined annually on the basis of performance against the pre-established goals and objectives. The eligible bonus percentage for officers will be generally allocated between achievement of company-wide achievement of our goals and individual goals. Specific individual goals for each officer will be established at the beginning of the year and are tied to the functional responsibilities of each executive officer. Individual goals include both objective financial measures as well as subjective factors such as efficiency in managing capital resources, successful acquisitions, good investor relations and the continued development of

15

management. Our goals and objectives are primarily based on operating performance, as measured by factors such as our funds from operations, and achieving the appropriate growth objective, relating primarily to portfolio acquisitions. Other than the allocation between our goals and the individual’s goals, no specific weights are assigned to the individual goals. Our performance targets and all individual goals were not achieved in fiscal 2004 and, consequently, the executive officers, other than Messrs. Watson and Betros, received minimal bonus awards.

Stock Incentive Program

Our committee strongly believes that by providing our officers with an opportunity to increase their ownership of common stock, the interests of stockholders and the officers will be closely aligned. Therefore, the long-term incentive component for our officer’s total compensation program is provided in two forms, stock options and restricted share awards. The committee feels that the use of both forms of long-term incentive compensation is appropriate.

Chief Executive Officer Performance Evaluation

For 2004, the compensation committee evaluated the Chief Executive Officer’s performance based on our financial performance and growth in mortgage loan assets. Mr. Watson’s compensation (i.e. base salary, bonus compensation and the stock incentive program) is based primarily on company-wide performance and is set by the compensation committee.

Respectfully Submitted,

Compensation Committee

George A. Murray, 2004 Chairman

Rodney E. Bennett

Joseph P. Stingone

16

Performance Graph

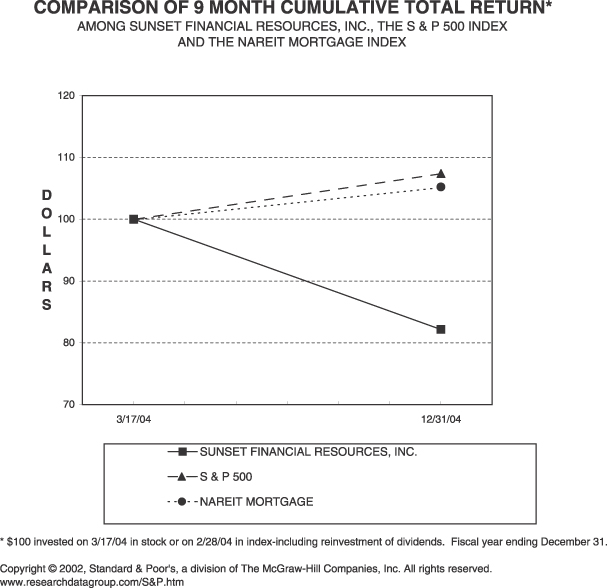

SEC rules require the presentation of a line graph comparing the cumulative total stockholder return to a performance indicator of a broad equity market index and either a nationally recognized industry index or a peer group index constructed by us.

The graph below provides an indicator of cumulative total stockholder returns for us as compared with the S&P Stock Index and the NAREIT Mortgage Index, weighted by market value at each measurement point. The graph assumes that $100 was invested on March 17, 2004, our first trading day, in our common stock and that all dividends were reinvested by the stockholder. There can be no assurance that our stock performance will continue into the future with the same or similar trends depicted in the graph below. We will not make or endorse any predications as to future stock performance.

17

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The audit committee is composed of three independent non-employee directors and operates under a written charter adopted by our board (a copy of which is available on our website). Our board has determined that each committee member is independent within the meaning of the applicable NYSE listing standards currently in effect.

Management is responsible for the financial reporting process, including the system of internal controls, and for the preparation of consolidated financial statements in accordance with GAAP. Our independent registered public accounting firm is responsible for auditing those financial statements and expressing an opinion as to their conformity with GAAP. Our responsibility is to oversee and review these processes. We are not, however, professionally engaged in the practice of accounting or auditing, and do not provide any expert or other special assurance as to such financial statements concerning compliance with the laws, regulations or GAAP or as to the independence of the registered public accounting firm. We rely, without independent verification, on the information provided to us and on the representations made by management and the independent registered public accounting firm. We held three meetings during fiscal 2004. The meetings were designed, among other things, to facilitate and encourage communication among the committee, management, and our independent registered public accounting firm, Ernst & Young LLP. We discussed with Ernst & Young LLP the overall scope and plans for their audit.

We have reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2004 with management and Ernst & Young LLP. We also discussed with management and Ernst & Young LLP the process used to support certifications by our Chief Executive Officer and Chief Financial Officer that are required by the SEC and the Sarbanes-Oxley Act of 2002 to accompany our periodic filings with the SEC.

In addition, the audit committee obtained from Ernst & Young LLP a formal written statement describing all relationships between Ernst & Young LLP and the company that might bear on Ernst & Young LLP’s independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with Ernst & Young LLP any relationships that may impact their objectivity and independence, and satisfied itself as to their independence. When considering Ernst & Young LLP’s independence, we considered whether their provision of services to us beyond those rendered in connection with their audit of our consolidated financial statements and reviews of our consolidated financial statements, including in its Quarterly Reports on Form 10-Q, was compatible with maintaining their independence. We also reviewed, among other things, the audit and non-audit services performed by, and the amount of fees paid for such services to, Ernst & Young LLP. The audit committee also discussed and reviewed with the independent registered public accounting firm all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards (SAS) No. 61, as amended, “Communication with Audit Committees,” SAS 99 “Consideration of Fraud in a Financial Statement Audit,” and SEC rules discussed in Final Release Nos. 33-8183 and 33-8183a.

Based on our review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the audit committee charter, we recommended to the board of directors (and the board has approved) that the audited financial statements for the year ended December 31, 2004 be included in the Annual Report on Form 10-K.

The undersigned members of the audit committee have furnished this report to the board of directors.

Respectfully Submitted,

Audit Committee

Rodney E. Bennett, 2004 Chairman

Hugh H. Jones, Jr.

George A. Murray

18

PRINCIPAL ACCOUNTING FIRM FEES

During fiscal 2004 and 2003, Ernst & Young LLP served as our independent registered public accounting firm and also provided certain tax and other services. Aggregate fees billed to us for the fiscal year ended December 31, 2004 and December 31, 2003 by Ernst & Young LLP are as set forth below.

| 2004 | 2003 | |||||

Audit Fees (1) | $ | 326,000 | $ | 303,000 | ||

Audit-Related Fees | 0 | 0 | ||||

Tax Fees (2) | 48,000 | 30,000 | ||||

All Other Fees (3) | 49,000 | 90,000 | ||||

Total | $ | 423,000 | $ | 423,000 | ||

| (1) | Fees for audit services in 2004 and 2003 consisted of the audit of our annual financial statements, reviews of our quarterly reports on Form 10-Q, and other services related to Securities and Exchange Commission matters. |

| (2) | Fees for tax services in 2004 and 2003 consisted of tax compliance services and tax advice. All tax fees were permissible tax fees under SEC Rules. |

| (3) | Fees for other services in 2004 and 2003 relate to services provided to the compensation committee of the board of directors in obtaining market competitive information and advice on compensation issues and structures. |

No financial information systems implementation and design services were rendered by Ernst & Young LLP during 2004 or 2003. At its regularly scheduled and special meetings, the audit committee considers and pre-approves any audit and non-audit services to be performed by our independent accountants. The audit committee has delegated to its chairman, an independent member of our board of directors, the authority to grant pre-approvals of non-audit services provided that any such pre-approval by the chairman shall be reported to the audit committee at its next scheduled meeting.

The audit committee has considered whether the provision of these services is compatible with maintaining the independent accountants’ independence and has determined that such services have not adversely affected Ernst & Young LLP’s independence.

Representatives of Ernst & Young LLP will be present at the annual meeting and will have an opportunity to make a statement, if they desire to do so, and to respond to appropriate questions from stockholders.

As of the mailing date of this proxy statement, the board of directors knows of no other matters to be presented at the meeting. Should any other matter requiring a vote of the stockholders arise at the meeting, the persons named in the proxy will vote the proxies in accordance with their best judgment.

Any stockholder who intends to present a proposal at the annual meeting in the year 2006, and who wishes to have the proposal included in our proxy statement for that meeting, must deliver the proposal to our corporate secretary, Jeffrey S. Betros, at Sunset Financial Resources, Inc., 10245 Centurion Parkway N., Suite 305,

19

Jacksonville, Florida 32256 by December 2, 2005. All proposals must meet the requirements set forth in the rules and regulations of the SEC in order to be eligible for inclusion in the proxy statement for that meeting.

Any stockholder who intends to bring business to the annual meeting in the year 2006, but not include the proposal in our proxy statement, or to nominate a person to the board of directors, must give written notice to our corporate secretary, Jeffrey S. Betros, at Sunset Financial Resources, Inc., 10245 Centurion Parkway N., Suite 305, Jacksonville, Florida 32256, between December 2, 2005 and January 2, 2006.

We have provided without charge a copy of the annual report to stockholders for fiscal year 2004 to each person being solicited by this proxy statement.Upon the written request by any person being solicited by this proxy statement, we will provide without charge a copy of the annual report on Form 10-K as filed with the SEC (excluding exhibits, for which a reasonable charge shall be imposed). All requests should be directed to: Jeffrey S. Betros, Executive Vice President – Marketing and Secretary, at Sunset Financial Resources, Inc., 10245 Centurion Parkway N., Suite 305, Jacksonville, Florida 32256. This information is also available via the Internet at our website (www.sunsetfinancial.net) and the EDGAR version of such report (with exhibits) is available at the SEC’s website (www.sec.gov).

20

Appendix A

Sunset Financial Resources, Inc.

Audit Committee Charter

(Adopted December 5, 2003)

Purpose

The Audit Committee (the “Audit Committee” or the “Committee”) of Sunset Financial Resources, Inc. (the “Company”) shall assist the Company’s board of directors (“Board”) in fulfilling its oversight responsibilities to stockholders for monitoring (1) the quality and integrity of the financial statements of the Company; (2) the Company’s compliance with ethical policies contained in the Company’s Code of Conduct and legal and regulatory requirements; (3) the independence, qualification and performance of the Company’s independent auditors; (4) the performance of the Company’s independent auditors; and (5) the Company’s accounting and financial reporting processes and audits of the Company’s financial statements. The Audit Committee shall have the authority to retain special legal, accounting or other consultants to advise the Audit Committee. The Audit Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditors to attend a meeting of the Audit Committee or to meet with any members of, or consultants to, the Audit Committee.

Organization

This Charter governs the operations of the Audit Committee. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Charter to the Board for approval. The Company’s Nominating and Corporate Governance Committee shall nominate directors for appointment to the Audit Committee. The Board will annually appoint Committee members and a Chairman of the Committee. The Board may remove Committee members at any time with or without cause, by a majority vote. The Board will fill any vacancy on the Committee. The Audit Committee shall be comprised of at least three directors, each of whom is independent as determined in accordance with the requirements of the Sarbanes-Oxley Act of 2002 (“Sarbanes”), the New York Stock Exchange (“NYSE”), the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission (“SEC”). Members of the Audit Committee may not receive any compensation from the Company other than directors’ fees. All members of the Audit Committee must be financially literate, and at least one member must be an “audit committee financial expert” pursuant to Sarbanes and any SEC rules promulgated relating thereto. No Committee member may serve on the audit committee of more than two other public companies without Board approval. The Audit Committee shall maintain minutes of its meetings and report to the Board.

Responsibilities and Processes

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for preparing the Company’s financial statements and the Company’s independent auditors are responsible for auditing the annual financial statements and for reviewing the unaudited interim financial statements. Nor is it the duty of the Audit Committee to conduct investigations to assure compliance with laws and regulations and compliance with the Company’s Code of Conduct and Ethics.

The following shall be the principal duties and responsibilities of the Audit Committee. These are set forth as a guide with the understanding that the Audit Committee may supplement them as appropriate.

A-1

In carrying out its responsibilities, the Audit Committee shall:

1. Retain, subject to stockholder ratification, the independent auditors of the Company to conduct the examination of the books and records of the Company and its affiliates, and terminate any such engagement if circumstances warrant. The independent auditors are ultimately accountable to, and shall report directly to, the Audit Committee. The Audit Committee shall provide oversight of the work of the independent auditors, including resolution of disagreements between management and the independent auditors regarding financial reporting.

2. Pre-approve all audit services and, to the extent permitted by law, all non-audit services provided by the independent auditors, as well as the fees and terms for providing such services. The Audit Committee may delegate pre-approval authority to a member of the Audit Committee. The decisions of any Audit Committee member to whom pre-approval authority is delegated must be presented to the full Audit Committee at its next scheduled meeting. However, pre-approval of non-audit services is not required if (i) the aggregate amount of non-audit services is less than 5% of the total amount paid by the Company to the auditor during the fiscal year in which the non-audit services are provided; (ii) such services were not recognized by the Company as non-audit services at the time of the engagement; and (iii) such services are promptly brought to the attention of the Committee and, prior to completion of the audit, are approved by the Committee or by one or more Committee members who have been delegated authority to grant approvals.

3. At least annually, obtain and review a report by the independent auditors describing: (i) the firm’s internal quality-control procedures; (ii) any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting any independent audits carried out by the firm and any steps taken to deal with any such items; and (iii) all relationships between the independent auditor and the Company.

4. Evaluate the performance of the Company’s independent auditors and lead audit partner, and report its conclusions to the full Board.

5. Meet with the Company’s independent auditors and management to review the scope of the proposed annual audit (and related quarterly reviews), the key audit procedures to be followed and, at the conclusion of the audit, review the principal audit findings including any comments or recommendations of the Company’s independent auditors.

6. Obtain assurance from the Company’s independent auditors that it has complied with its obligation to report any fraud identified in connection with its audit of the financial statements of the Company.

7. Discuss the Company’s annual audited financial statements and unaudited quarterly financial statements with management and the independent auditors, including management’s discussion and analysis of financial condition and results of operations. Discuss other matters with the Company’s independent auditors as required by the SEC and, if the financial statements are acceptable, recommend that the audited financial statements be included in the Company’s Annual Report on Form 10-K. While the fundamental responsibility for the Company’s financial statements and disclosures rests with management, the Committee will review: (i) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles, and major issues as to the adequacy of the Company’s internal controls and any special audit steps adopted in light of material control deficiencies; (ii) analyses prepared by management or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements and the treatment preferred by the independent auditors; (iii) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the financial statements of the Company; and (iv) earnings press releases (paying particular attention to any use of pro-forma information and non-GAAP information).

8. Prepare the report of the Audit Committee required by the SEC to be included in the Company’s annual proxy statement.

A-2

9. Meet, at least annually, with management to discuss, as appropriate, significant accounting accruals, estimates and reserves; litigation matters; management’s representations to the independent auditors; new or proposed regulatory accounting and reporting rules; any significant off-balance sheet transactions and special purpose entities; and any significant financial reporting issues or judgments disputed with the Company’s independent auditors.

10. At least annually, receive from and discuss with the independent auditors and management, separately or together as determined by the Committee, a report on (i) all critical accounting policies and practices to be used; (ii) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management of the Company, the ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditors; and (iii) other material written communications between the independent auditors and management of the Company, such as any management letter or schedule of unadjusted audit differences.

11. Review quarterly with the Company’s CEO and CFO (i) any significant deficiencies in the design or operation of internal controls which could adversely affect the Company’s ability to record, process, summarize and report financial data; (ii) any material weakness in the Company’s internal controls; and (iii) any fraud, whether or not material, involving management or other employees who have a significant role in the Company’s internal controls.

12. Review annually with management and the independent auditors (i) the internal control report contained in the Company’s Annual Report on Form 10-K regarding management’s assessment of the effectiveness of the internal control structure and procedures of the Company for financial reporting; and (ii) the attestation and report of the independent auditors regarding management’s assessment of internal controls.

13. Discuss with the Company’s independent auditors and management information relating to the auditors’ judgments about the quality, not just the acceptability, of the Company’s accounting principles and matters identified by the auditors during its interim reviews. Also, the Committee shall discuss the results of the annual audit and any other matters that may be required to be communicated to the Audit Committee by the Company’s independent auditors under generally accepted auditing standards.

14. Discuss with management an outline of press releases regarding results of operations, as well as general policies on financial information and earnings guidance to be provided to analysts, rating agencies and the general public. Review any relevant items with management and the Company’s independent auditors prior to release of any such press releases or earnings guidance. The review shall be with the Chairman of the Audit Committee or the full Audit Committee, as may be appropriate.

15. At least quarterly, discuss separately with the Company’s independent auditors and management the adequacy and effectiveness of the Company’s internal accounting and financial controls, and elicit any recommendations for improvement.

16. Review major changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditors, internal auditors or management.

17. Discuss with management policies with respect to risk assessment and risk management. While it is the job of the Company’s management to assess and manage the Company’s exposure to risk, the Committee will discuss guidelines and policies that govern the process. This discussion may include the Company’s financial risk exposures and the steps management has taken to monitor and control exposure.

18. At least annually, receive reports from the Company’s independent auditors regarding the auditors’ independence from management and the Company (including the identification of all relationships between the

A-3

independent auditors and the Company), discuss such reports with the independent auditors, consider whether the provision of non-audit services by the independent auditors is compatible with the auditors’ independence, and, if determined by the Audit Committee, recommend that the Board take action to satisfy itself of the independence of the auditors.

19. Confirm that the Company’s hiring policies conform to applicable SEC or other external guidelines for employment by the Company of employees and former employees of the independent auditors.

20. Confirm that neither the lead audit partner nor the primary reviewing partner of the independent auditor has performed audit services for the Company for more than five consecutive fiscal years.

21. Confirm that none of the Company’s CEO, CFO, chief accounting officer, controller or equivalent officers were employed by the independent auditor and participated in any capacity in the audit of the Company during the one-year period preceding the initiation of the audit.

22. Receive from management a summary of findings from completed audits (and management’s response) and a progress report on the proposed internal audit plan with explanations for any material deviations from the original plan.

23. Review periodic reports from management with respect to, and advise the Board regarding compliance with, the Company’s Code of Conduct and Ethics.

24. Review with the Company’s counsel legal matters that may have a material impact on the financial statements.

25. Provide sufficient opportunity at its meetings to meet separately in executive session with the Company’s independent auditors and members of management. Among the items to be discussed with the Company’s independent auditors are (i) the independent auditors’ evaluation of the Company’s financial and accounting personnel; (ii) the cooperation that the independent auditors received during the course of its audit; (iii) any management letter provided by the independent auditors and management’s response; and (iv) any other matters the Audit Committee may determine from time to time.

26. Report regularly to the Board. The reports will include any significant issues arising with respect to (i) the quality or integrity of the Company’s financial statements; (ii) the performance and independence of the Company’s independent auditors; and/or (iii) the effectiveness of the Company’s control process for reviewing and approving internal transactions and accounting.

27. Establish procedures for (i) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

28. In consultation with the Nominating and Corporate Governance Committee, conduct an annual evaluation of the performance and effectiveness of the Audit Committee and report the results of that evaluation to the Board.

29. As the Committee determines necessary to carry out its duties, obtain advice and assistance from outside advisors, including the Company’s legal, accounting or other advisors.

30. Review with the independent auditor any audit problems or difficulties and management’s response.

A-4

SUNSET FINANCIAL RESOURCES, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE

2005 ANNUAL MEETING OF STOCKHOLDERS ON MAY 6, 2005

The undersigned stockholder of SUNSET FINANCIAL RESOURCES, INC., a Maryland corporation (the “Company”) hereby appoints J. Bert Watson and Jeffrey S. Betros, and each of them as proxies and attorneys-in-fact, with full power to each of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the 2005 Annual Meeting of Stockholders of the Company, and any adjournment(s) or postponement(s) thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side.

| Address Change/Comments(Mark the corresponding box on the reverse side) |

Ù FOLD AND DETACH HEREÙ

| THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED “FOR” THE PROPOSAL. | Please Mark Here for Address Change or Comments | ¨ | ||

| SEE REVERSE SIDE | ||||